#how to apply for instant e pan card

Text

Personal Loan Apps: A Convenient Solution for Quick and Easy Financing

In today's fast-paced digital age, accessing financial assistance has become more convenient than ever. Personal loan apps have emerged as a popular solution, providing individuals with a streamlined and efficient way to secure quick and easy financing. In this blog, we will explore the world of personal loan apps, discussing their benefits, features, and considerations for borrowers. Whether you need funds for a medical emergency, home renovation, or debt consolidation, personal loan apps offer a convenient and accessible avenue for financial support.

Understanding Personal Loan Apps

Personal loan apps are mobile applications that enable individuals to apply for and receive personal loans directly from their smartphones. These apps typically connect borrowers with lending institutions or peer-to-peer lending platforms. With user-friendly interfaces and simplified application processes, personal loan apps have transformed the way people access credit.

How Do Personal Loan Apps Work?

Step 1: Download and Register

To begin, borrowers need to download a reputable personal loan app from their respective app stores. Once installed, users are required to register by providing personal details such as name, contact information, and identification documents. Some apps may also require verification through Aadhaar or PAN card details for authentication purposes.

Step 2: Eligibility Check and Documentation

After registration, borrowers must complete an eligibility check. Personal loan apps typically have preset criteria regarding age, income, credit score, and employment status. The app evaluates these factors to determine the borrower's creditworthiness and assess their eligibility for a loan.

Documentation requirements are minimal compared to traditional loan applications. Users may be asked to upload documents such as proof of identity, address proof, income statements, and bank statements. Digital verification methods, such as linking the app with the user's bank account or leveraging e-KYC (Know Your Customer) processes, simplify the documentation process.

Step 3: Loan Application and Approval

Once the eligibility check and document submission are completed, borrowers can proceed with the loan application. They provide the desired loan amount and choose the preferred repayment tenure within the app. Some personal loan apps offer instant loan approvals, utilising automated algorithms and data analysis to assess the borrower's creditworthiness in real-time. The app determines the loan eligibility, interest rate, and loan terms based on the borrower's profile and credit history.

Step 4: Disbursement and Repayment

Upon loan approval, the funds are disbursed directly to the borrower's registered bank account. Personal loan apps usually disburse the loan amount swiftly, often within a few hours or even minutes.

Repayment options are flexible and can be conveniently managed through the app. Borrowers can set up auto-debit instructions or manually make monthly repayments through the app. The app provides a repayment schedule, including the due date and amount for each installment. Additionally, borrowers can track their loan status, repayment history, and outstanding balance through the app.

Benefits of Personal Loan Apps

Convenience and Accessibility: Personal loan apps allow borrowers to apply for loans anytime, anywhere, eliminating the need for lengthy paperwork and visits to physical bank branches. The convenience of applying and managing loan transactions through a mobile app saves time and effort.

Quick Approval and Disbursement: Personal loan apps are known for their fast approval and disbursal processes. By leveraging advanced algorithms and technology, these apps can provide loan approvals within minutes and transfer funds to the borrower's bank account swiftly.

Flexible Loan Amounts: Personal loan apps cater to a wide range of loan amounts, providing borrowers with the flexibility to choose the loan size that aligns with their financial requirements.

Customisable Tenure and Repayment Options: Borrowers can select loan tenures and repayment plans that suit their financial capabilities. Personal loan apps often offer options for monthly installments or flexible repayment schedules to accommodate different needs.

Transparent and Competitive Interest Rates: Personal loan apps strive to maintain transparency in terms of interest rates and associated charges. Borrowers can compare rates from multiple lenders within the app and select the most competitive option.

Minimal Documentation: Traditional loan applications often involve cumbersome paperwork. In contrast, personal loan apps minimise documentation requirements by leveraging digital verification methods, simplifying the application process for borrowers.

Credit Score Building: Timely repayment of personal loans taken through these apps can positively impact the borrower's credit history and improve their credit score, enhancing future borrowing opportunities.

Considerations for borrowers before downloading personal loan apps

While personal loan apps offer numerous advantages, borrowers should consider a few factors before utilising them:

Credibility of the App and Lender: Ensure that the personal loan app and associated lending institutions are reputable and licensed by regulatory authorities. Read reviews and check user experiences to gauge their reliability.

Interest Rates and Charges: Compare the interest rates, processing fees, and other charges among various personal loan apps. Evaluate the overall cost of borrowing before making a decision.

Privacy and Data Security: Personal loan apps handle sensitive financial information. Prioritise apps that prioritise robust security measures to protect user data.

Terms and Conditions: Thoroughly read and understand the terms and conditions of the personal loan app, including repayment schedules, prepayment penalties, and late payment charges.

Customer Support: Check if the personal loan app provides reliable customer support to address any queries or concerns during the loan process.

Conclusion

Personal loan apps have revolutionised the way individuals access credit by offering convenience, speed, and flexibility. They provide a hassle-free and easily accessible platform for borrowers to meet their immediate financial needs. However, borrowers should exercise caution and conduct due diligence before choosing a personal loan app, ensuring they select a credible and transparent platform.

By leveraging the benefits of personal loan apps wisely and responsibly, borrowers can navigate their financial challenges with greater ease and convenience.

Bank of Baroda's digital banking ecosystem, ‘bob World’, is a user-friendly and convenient mobile application that allows individuals to apply for personal loans with ease. With its intuitive interface and seamless functionality, bob World simplifies the loan application process, making it accessible to a wide range of users. The app provides borrowers with features such as loan eligibility checks, instant loan approvals, and quick disbursals, ensuring that individuals can obtain the funds they need in a timely manner. bob World also offers transparency in terms of interest rates, processing fees, and repayment options, empowering borrowers to make informed decisions. With its robust security measures and reliable customer support, Bank of Baroda's bob World personal loan app stands as a reliable and efficient platform for individuals seeking financial assistance on the go.

0 notes

Text

Get Instant Personal Loan using Your Aadhaar Card and PAN Card

Planned and unplanned expenses are part of life. This is why finances play a crucial role in having a balanced life without many ups and downs. In today’s times, where the availability of financial services is not a big deal, you do not need to worry if you don’t have the required amount in your bank account. There are several platforms where you can get instant loan on Aadhaar card and PAN card.

How to Apply for a Personal Loan Using Your Aadhaar Card

It is fairly easy to get a personal loan using your Aadhaar card or PAN card. Some of the best lending platforms offer personal loans on an Aadhaar card that is linked to the bank account of the borrower. It is essential to link your Aadhaar card with your bank account if you want to get a personal loan without any hassle or delay.

Even if you do not have a PAN card, you can avail of a personal loan by showing your KYC document to the lender. However, you should always check your eligibility criteria to make sure that there are no issues with the instant loan approval.

Nowadays, lending platforms provide an online application form that you can fill out to apply for a loan. The lender verifies the authenticity of the document produced and approves the loan. Make sure to choose the best offer from the lender by analyzing the rate of interest, processing charges, and other features of the loan. You also need to activate the E-mandate to get the loan amount in the linked bank account. The loan amount is disbursed after all the documentation formalities, and important procedures are complete.

Eligibility Criteria for a Personal Loan

The borrower should be an Indian citizen.

The minimum age criteria to get a personal loan is 21 years.

Salaried or self-employed people with valid income can only get a personal loan.

Good credit score. However, NBFCs have lenient criteria for the credit score of a person.

Top Benefits of Applying for a Personal Loan Using an Aadhaar Card

When you apply for a personal loan on your Aadhaar card, the authentication process is very quick, thanks to the linked biometric information. It becomes very easy for the lender to verify your identity and offer a loan amount on time.

The Aadhaar card is an all-purpose card that cuts down on paperwork during loan approval. It has a unique identification number and is accepted as a resident's proof of identity. The borrower only needs to provide income proof other than the Aadhaar card to avail of an instant loan.

Using an Aadhaar card to get a personal loan eliminates any chances of fraud as it has valid KYC verification.

If you want to get a personal loan, then choosing a lender with lenient eligibility criteria is a smart choice. These days, you can find numerous NBFCs in the market that offer instant personal loans with less paperwork. Pre-approved and customized personal loans have also surfaced in the financial market for the convenience and accessibility of borrowers. Digitisation has also helped make financial solutions available with just a few clicks. You can apply for a personal loan from your phone, track your application process, and get notified when the loan amount is credited to your bank account.

0 notes

Photo

How To Earn Money In Free Time

While many still discourage from running after money, the recent time market and the pandemic taught us that saving money is not a luxury but a necessity. Of course, one should not forget to enjoy their life by just chasing money and a work-life balance is of utmost importance. Before we understand the “hows”, it’s important to understand the “whys”. So let’s dive deep into why earning money in free time is such an advantage!

Why earning money is important?

1) Gives freedom

How many of you felt restricted when you didn't have money of your own and had to convince a friend or family to buy? More often than not, you had to compromise depending on their willingness to spend.

2) Gives the power to pursue dreams

While it's our determination and patience that design our future, money also plays a big catalyst. Many students or professionals have compromised their careers and future because of a lack of money.

3) Gives Security

Money has a big role to play during uncertainties, whether you agree or not. It can be health, education or other things, having money gives us a sense of comfort and security and not feeling helpless.

4) Reduces financial stress

Given the rise in price in every sector, the importance of money has increased. This limitation can affect psychologically resulting in stress.

After the why portion, now let's dive into the big question - How to earn money?

In this era, one doesn’t have to look further and everything can be done in one download! While there are many such apps in the market, Taskmo App has always stood out in the crowd.

What makes the Taskmo App better than any of its competitors?

1) Instant Payout

2) Exposure to Top Brands

3) Get Digitally Trained

4) Work Time Flexibility

5) No Application Fees

6) No Resume Required

7) No Age Limitations

8) Industry Relevant Jobs

9) No Gender Barriers

10) Easy & Hassle-Free

What are the roles you can apply to?

a) Merchant / Partner Onboarding

b) Tele Support

c) Stock Audits

d) Product Sampling

e) Content Moderation

Hardly any other app in the market can provide so much. Even the Taskmo App has a user-friendly interface so that it's easy for everyone to use.

If you wish to be our Tasker then you need to register yourself. In order to prevent any trouble post your download, let us give you a detailed breakup of what to expect from it. The steps are:

1) Login

Simple login with basic details is all it takes for our Taskers to begin their journey.

2) Set up your profile

It takes only a minute to set up a profile which requires Aadhaar Card, PAN card and other required credentials.

3) Task selection

Based on the preference of time and location, you can select a task from a wide range of variety.

4) Digital Training & Assessment

Upon the task selection, digital training is available to help you understand the process of the job. Assessments are mandatory as it helps you to analyse your own understanding of the task.

5) Add Leads

You can now begin the tasks after they start adding leads. More leads you add, the more tasks you can perform!

6) AI-Driven QC Engine

This helps in curating tasks with an accuracy of 90-95%.

7) Payment

Post the approved task, you get instant payouts credited to your Taskmo account, where 100% transparency is maintained.

Taskmo App has helped in uplifting the lives of many Taskers and they continue to avail of our services.

0 notes

Photo

Good News! Now get instant PAN card online through Aadhaar based e-KYC. Follow these simple steps Image Source : PAN INSTANT ALLOTMENT FACILITY LAUNCHED: Good News! Now get instant PAN card online through Aadhaar based e-KYC.

#AADHAAR#aadhaar card address change#aadhaar card address update#aadhaar card correction#aadhaar card download#aadhaar card form aadhaar card online#aadhaar card number#aadhaar card password#aadhaar card portal#aadhaar card status#aadhaar card update#e-KYC#how to apply for instant pan card online#How to get instant PAN card online. Aadhaar based e-KYC. how to apply instant PAN card#Instant PAN#instant pan card online#instant pan card online benefit#instant pan card online process#PAN card

0 notes

Photo

Good News! Now get instant PAN card online through Aadhaar based e-KYC. Follow these simple steps Image Source : PAN INSTANT ALLOTMENT FACILITY LAUNCHED: Good News! Now get instant PAN card online through Aadhaar based e-KYC.

#aadhaar#aadhaar card address change#aadhaar card address update#aadhaar card correction#aadhaar card download#aadhaar card form aadhaar card online#aadhaar card number#aadhaar card password#aadhaar card portal#aadhaar card status#aadhaar card update#e KYC#how to apply for instant pan card online#How to get instant PAN card online. Aadhaar based e-KYC. how to apply instant PAN card#Instant PAN#instant pan card online#instant pan card online benefit#instant pan card online process#PAN card

0 notes

Text

GUIDE TO DUBAI CORPORATE VISA

INTRODUCTION:

As we know dubai is the beautiful destination for the tourists in the world but apart from that it is the commercial site for the business, mergers and meetings as well and it also attracts a number of MNCs. If you are visiting Dubai for the commercial work such as business meeting, seminar, etc. then you must apply for the Dubai corporate visa or the business visa.

READ ALSO: SHOPPING EXPERIENCE AT DUBAI AIRPORT

FUNDAMENTAL TYPES OF DUBAI VISAS:

The fundamental types of Dubai visas are the following such as:

Tourist visa: This is the type of visit visa in which you get entry into the country and it is the most popular destination in the world which have enabled online visa processing or e visa.

Corporate visa: This is the type of Dubai visa which serves the business related purposes like attending corporate meetings, seminars, job interviews, etc.

Transit visa: This is the visa in which we offer a 96 hours transit visa and to apply for this you just have to share the tickets and the visa for third country for approval.

WHAT IS THE DUBAI CORPORATE VISA FEE?

The fee for the Dubai corporate visa is based on the types of visa such as the Dubai 14 days corporate visa fee costs 6690, 14 days express corporate visa fee costs 7640, 30 days corporate visa costs 6890, 30 days express corporate visa costs 7889, 96 hours transit visa costs 5089 and 90 days corporate visa costs 16590.

READ ALSO: MUST VISIT DUBAI ART EVENTS

WHAT ARE THE REQUIREMENTS FOR THE DUBAI CORPORATE VISA?

The documents which are required for the Dubai corporate visa such ad the following:

Passport: firstly you need to carry the original passport and that has a validity of at least 6 months from the day of arrival in Dubai and when you are applying for the visa you just need to provide the colour scanned copy of the first as well as the last pages of the passport.

Two colour photographs: the next thing which is required is you need a passport size photographs but that should not be cropped or black and white copies will not be accepted.

Cover letter: the next thing is cover letter which is issued by the applicant and in which the purpose of visit and duration of the stay should be mentioned in it.

The proof of hotel reservation is also required.

Income tax return: the next thing is you required is both the original and the photocopy of the income tax return.

PAN card: The next thing is you must have the original and the photocopy of the PAN card.

Cover letter: The next thing is you should have a cover letter which has been issued by the company and in that it should be stated the name of the applicant and also the duration of stay and it also includes the purpose of visiting the Dubai.

Invitation letter: You must have the invitation letter which has been issued by the host of the company in Dubai and if you are planning to the visit the Dubai for the investment purposes then you must have the original as well as the copies of the investment documents.

READ ALSO: GUIDE TO STOPOVER IN DUBAI

HOW TO APPLY FOR THE DUBAI CORPORATE VISA?

To apply for the Dubai corporate visa you need to follow some steps which are the following:

Firstly you need to visit the GDRFA Website.

Then you have to simple fill the online application form

After that you have to pay the 500 USD as the application fees

After the payment the visa assistant will call in sometime

After that you need to submit the documents which are requested or have been asked through the email.

Then you will be receiving the approval of visa which has been send through the email

Then you need to pay the remaining visa fee so that you can download your approved visa

Then you will ne getting a instant cashback when you will complete the Dubai corporate visa fees.

1 note

·

View note

Text

How To Apply Pan Card Free of Cost | Apply Physical Pan Card

How To Apply Pan Card Free of Cost | Apply Physical Pan Card

pan card apply online, pan card application form, pan card download, pan card income tax, duplicate pan card, pan card correction, pan card correction form, pan card check :- Hey Looters, rechargetricksis back with List of All the important Method to Apply Pan card Just 2 minutes by Official Way , hope you are doing well and enjoyed our previous offer/trick/deals. OK let’s explore Today’s Offers.…

View On WordPress

#2020 me pan card kaise banaye#how to apply for instant e pan card#how to apply for pan Card#how to apply for pan card online#how to apply for pan card online in india 2020#how to apply new pan card online#how to get pan card in just 2 minutes 2020#instant pan card kaise banaye#instant pan card with aadhar card#new pan card apply online 2020#pan card#pan card apply online#pan card download kaise kare#pan card kaise banaye

0 notes

Text

What app can I download and get an instant cash loan?

With the technological boom, the Fintech industry has brought a revolutionary change with the launch of instant loan apps for better and quick finances in times of financial shortage and emergency. Moreover, loan apps have proved to be a boon during the Covid-19 pandemic globally to sustain financially in hard times.

Hence, several trusted financial institutions and NBFCs over time developed instant cash loan apps for quick approval of funds. Instant loan apps can be downloaded from Google Play Store on your android phone anytime. Instant apps are not bounded by any time or place. The only important thing needed is you should have an Indian Nationality.

However, instant cash loans are personal loans in a complete digitized form that can be used for multiple purposes when required the most. An instant cash loan is a path to immediate funds that can be availed on the same day.

So, if you plan for an instant cash loan and are still confused about which instant cash loan app to download? The answer to this question is that the 'SimplyCash instant personal loan app' is one of the best loan apps powered by Hero FinCorp, offering an instant loan of Rs.50,000 - Rs.1,50,000 at a competitive interest rate of 2.08% per month. You can download the 'SimplyCash' instant cash loan app easily from the Google Play Store on your smartphone and avail the seamless features and benefits the app offers.

Let's have a glance at the seamless features and benefits the SimplyCash loan app offers:

Collateral free – Instant cash loan is an unsecured loan, and no pledging or security against the loan is needed to get the cash

Quick approval – Paperless KYC verification enables quick approval in seconds

Fast disbursal – After the verification process, your loan amount will directly get transferred into your bank account within a business day

Flexible repayment tenure – The repayment tenure is between 6 – 24 months and can be paid at your convenience within this period

No physical documentation – Unlike the traditional method requiring piles of paperwork, an instant cash loan requires minimal and paperless documentation. Only an Aadhar card and PAN card are required for E-KYC verification.

Automated repayment method – Your payments will never get delayed with the automatic payment mode which means on a fixed date of every month, your monthly installment will get deducted automatically. Your loan account must have a sufficient amount to get deducted during the date set by the lender.

Minimum eligibility criteria – Follow simple eligibility criteria to avail instant loan via SimplyCash:

· Must be a citizen of India

· Must be between 21 – 58 years

· Must earn a minimum income of ₹15,000 monthly

· Must verify net banking details

· Must have worked for minimum of 6 months in a reputed private or public sector

· A credit score is necessary but not the only criteria for approval

How to apply on the SimplyCash loan app?

SimplyCash loan procedure interface is typically designed to easily apply for the loan without any complications. In three simple steps, you can avail instant cash loan for various purposes as listed below:

· Download the SimplyCash instant personal loan app on your android phone

· Next, register your mobile number or email Id for OTP verification

· Lastly, fill in the loan application form with your personal and professional details and required e-KYC documents. Within minutes your loan will be approved and disbursed directly into your bank account in a working day.

0 notes

Text

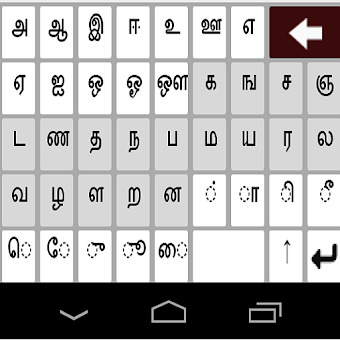

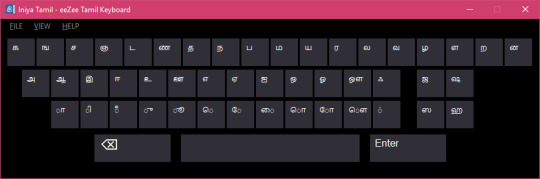

Tamil Keyboard For Pc

Jun 07, 2019 Download Sparsh Tamil Keyboard for PC/Mac/Windows 7,8,10 and have the fun experience of using the smartphone Apps on Desktop or personal computers. New and rising App, Sparsh Tamil Keyboard developed by Sparsh Team for Android is available for free in the Play Store. Sparsh Tamil Keyboard has the latest version of 2.2.1 which was updated last on 06.06.19. Some of the fonts included with Windows do not include all the Tamil characters that are available with this keyboard. In order to display every character correctly, we recommend you download and install Tamil fonts. If the characters you type or those on the On Screen Keyboard do not appear to display correctly, please read the KeymanWeb troubleshooting guide. Tamil keyboard in pc free download - PC 73 Virtual Piano Keyboard, Kural Tamil Software (Tamil), Tamil Keyboard, and many more programs. To type Bamini Tamil language, click the Language button in Taskbar or use “Windows + Space Bar” and choose the “Suratha Bamini” keyboard. Important Note: Still, If you don’t know “How to type Tamil in Keyman using Bamini” then read out this help article.

Are you looking for Bamini Tamil font? If yes, you’re in the right place. In this article, I am going to share the free download link for the Bamini font with a keyboard layout.

About Bamini Tamil Font

It is also known as Baamini font. It is a Tamil font that is very famous and used for graphic design, magazines, simple text, documents, and anything. it is used in Tamilnadu to type the Tamil language in computers and softwares.

A lot of peoples using this Tamil font in Photoshop to type Tamil. You can install the font in Windows 7, Windows 8, Windows 10, and Windows XP.

Supported Platforms

Windows 7,8,10

Linux

Mac OS

Bamini Font Free Download for Windows 7,8,10

Download the Bamini font using the download button. After downloading the font, follow the steps I have mentioned below.

Extract the zip file

Locate “Bamini.ttf” file

Double click the file and click install

That’s it, you’ve successfully installed the font in Windows OS. There are a lot of Tamil fonts available but Baamini Tamil font is the famous one.

If you face any errors while installing the font on your computer please let me know via comments. I will help you with the installation.

Read also:-Apply Instant e-PAN Card Online

Bamini Keyboard Layout

I have attached the image of the Baamini keyboard layout. With the help of this keyboard layout, you can type easily using the English key mapping.

Note:- Do you know? you can covert Bamini <-> Unicode using an online converter. I recommend you to use tamillexicon for that.

Frequently Asked Questions

Free Tamil Typing Keyboard App For Laptop

How to install bamini font in windows 7?

It is very easy to install the font in windows 7. Download and unzip the file. Double click the “.ttf” file to install the font on windows 7.

How to install bamini font in Linux and Mac OS?

For Linux copy, the font file to “/USR/SHARE/FONTS”. For MAC OS X 10.3 & Above: Double click the font file and click the “Install font” button and For MAC OS 9 or Earlier: Copy the font file to “/Library/Fonts”.

How to install bamini font in android?

You can’t install fonts in android without root your mobile but it is risky to root your android mobile.

Final Words

Tamil Keyboard For Pc Windows 7

I hope this article helps you with Bamini Tamil font free download. If you have any queries regarding this article please let me know via comments. Share this article to help others.

1 note

·

View note

Text

Don't panic if you have lost your PAN card. Do this to get an instant e-PAN.

#pan #PanCard #PAN #RBI #banking #Bank #epan #DigitalIndia #storypitch

0 notes

Text

e-PAN

Who can get Instant e-PAN and how?

No physical PAN card will be issued in case you have an e-PAN; you can download e-PAN from the income tax department’s website once it’s allotted

To apply for e-PAN, one needs to have an Aadhaar with an updated mobile number.

If you don’t have a Permanent Account Number (PAN), you can now get Instant e-PAN from the income tax department. e-PAN is a digitally…

View On WordPress

1 note

·

View note

Link

0 notes

Text

How to request for reprint of PAN card: Direct link here

Right here is how you may apply for a reprint of your PAN card Pan Card Apply Online

PAN playing cards preserve intense importance in India. It acts because the number one key for the garage of facts and is shared throughout the us of a. Now, when you have lost your PAN card, you request for a reprint. here's a step by step manual you could observe to request for a reprint of your PAN card.

however earlier than you observe the stairs recall, this facility may be availed through only the ones PAN holders whose trendy PAN utility turned into processed thru NSDL e-Gov or have obtained PAN using 'instant e-PAN' facility on the e-filing portal of ITD.

You just ought to make an online price charge of Rs 50 (including taxes) for delivery to an Indian address or of Rs 959 (consisting of taxes) for delivery to a overseas deal with and the reprint of the PAN card introduced at your step.

the way to request for reprint of PAN card

follow the underneath-given steps to request for the reprint of PAN card

Step 1: go to the legitimate internet site, tin-nsdl.com.

Step 2: at the homepage, click on Reprint of PAN Card.

be aware: if you cannot discover the link on the homepage, click on 'services' and select 'PAN' alternative. a new web site will open on your laptop display. Scroll down, below reprint of pan card and faucet the link which says "PAN applicants can now practice online for Reprint of PAN card (best while there may be no trade required in facts) via clicking here."

Step 3: a new web site will open to your pc display screen.

Step four: input your PAN, Aadhaar number and date of start.

Step 5: You need to pick the checkbox for permitting the use of Aadhaar statistics for the motive of reprinting your PAN card.

Step 6: input the captcha code and click on on submit.

Step 7: On the brand new web page, your masked personal details might be proven.

Step 8: pick any one alternative in which you need to obtain the only-time password (OTP), i.e., on e-mail, mobile or each.

Step nine: select the checkbox to verify that your PAN card might be revealed as according to the information available with the earnings tax branch.

Step 10: next click on Generate OTP.

note: An OTP can be despatched at the registered mobile range or email identity or both as selected by means of you.

Step 11: input the OTP you acquired and click on publish.

Step 12: as soon as the OTP is proven. you will be requested to make the charge.

Step thirteen: next you to make payments, click on 'Pay affirm'. you'll be redirected to the fee gateway.

For dispatch of PAN card inside India(inclusive of taxes) - Rs 50.00

For dispatch of PAN card outdoor India(including taxes) - Rs 959.00

Step 14: once the fee is accomplished efficaciously, your transaction details could be contemplated at the laptop display.

Step 15: click on retain to generate and print the payment receipt.

An SMS can be sent for your registered cellular quantity with your acknowledgement number. The SMS may even offer you with the link to down load your e-PAN.

Coronavirus in India: earnings tax submitting, Aadhaar-Pan linking cut-off date extended to June 30

Finance Minister Nirmala Sitharaman introduced an extension of several compliance cut-off dates within the wake of the lockdown due to Covid-19 pandemic in India.

Finance Minister Nirmala Sitharaman on Tuesday introduced that the authorities has extended the income tax filing closing date for the monetary year 2018-19 to June 30, 2020.

while an economic alleviation package is predicted soon to assist industries address Covid-19 losses, Sitharaman said the announcements made nowadays have been around lowering compliance burdens on residents and companies.

Sitharaman additionally said the cut-off date for Aadhaar-PAN card linking has additionally been prolonged to June 30 within the wake of the Covid-19 pandemic in India. The closing date for submitting GST returns for March, April and might 2020 has also been prolonged to June 30, 2020.

She additionally introduced that for organizations with turnover of over Rs 5 crore, no late rate and penalty may be charged on late GST go back submitting. Sitharaman introduced that the required conserving of board conferences for corporations prolonged via 60 days in view of the modern-day state of affairs.

Many other time limits for monetary schemes and duties have additionally been prolonged to June 30 consisting of the "Vivad se Vishwas" initiative.

among other measures which have been announced include a total waiver on debit card usage prices which follow for transaction at a extraordinary bank's ATM. further, minimal stability standards for bank money owed have additionally been waived off for a length of 3 months through the government.

"Debit cardholders who withdraw coins from any bank's ATM can do it free of fee for the subsequent three months. also, a entire waiver of minimal stability fees for savings financial institution account," she stated.

The finance minister also said the Customs branch might be operating 24/7 at some point of the crisis situation so that trade and export activities do no longer suffer.

She went to add that newly included corporations, that are required to record declaration for the commencement of commercial enterprise inside six months, will now get an additional six months time.

all through the press conference, Sitharaman announced the threshold of default for MSMEs has been improved to Rs 1 crore from present Rs 1 lakh. It was additionally conveyed that if the state of affairs maintains past April, the government will do not forget suspending Sections of IBC for six months to forestall corporations which might be forced into insolvency.

The authorities is also operating unexpectedly to come up with an financial package and it will be announced soon, stated the finance minister.

but, no precise date was given for the monetary comfort bundle, which many industry our bodies have asked as Covid-19 causes extra complications for groups. Pan Card Apply Online

0 notes