#how to apply for iec code

Video

youtube

How to apply for IEC|Get Import Export Code Instantly|Register yourself on DGFT website|

#youtube#import export code#how to apply for iec#how to apply for iec code#how to apply for iec code online in India#how to apply for iec code for Individual#how to apply for iec code for HUF#how to apply for iec for partnership#how to apply iec for company#iec update#iec renewal#iec registration#iec registration documents

0 notes

Text

Navigate the requirements for IEC Code Registration in India effortlessly. Access step-by-step instructions here: https://qsans.com/how-to-apply-for-iec-code-registration-in-india #IEC #Code #Registration #India

0 notes

Text

How do I get a WPC ETA approval in India?

The Wireless Planning and Coordination (WPC) wing of the Ministry of Communications in India is responsible for regulating the use of wireless technology and the electromagnetic spectrum.

Product List Covered Under WPC ETA Approval

WPC ETA Approval covers a wide range of wireless products, including but not limited to:

Mobile phones and other communication devices

Wi-Fi routers and access points

Bluetooth devices

Satellite equipment

Radar systems

Remote controls

RFID devices

Short-range devices (e.g., garage door openers)

IoT devices

To know about more products, check the full list.

Documents Required for WPC ETA Approval

To apply for WPC ETA Approval, you must prepare a comprehensive set of documents, including:

A covering letter explaining the purpose of your application

An accurately filled WPC-provided application form

Detailed technical specifications of your equipment

Test reports from a recognized laboratory confirming compliance with WPC standards

An authorization letter if you are using an agent or consultant

If you're importing equipment, you'll need an Importer Exporter Code (IEC) from the Directorate General of Foreign Trade (DGFT)

An affidavit on a non-judicial stamp paper affirming the accuracy of the information provided

To know about more documents, check the full documents list

Basic Requirements for WPC ETA Approval

Here are some basic requirements for obtaining WPA ETA Approval in India:

For foreign manufacturers: All overseas OEMs lacking a liaison office in India must appoint an AIR, i.e., an Authorized Indian Representative. The Indian-based OEMs shall be considered as AIR.

For import license: An overseas OEM must appoint an AIR as reflected in the WPC ETA application.

For India-based Facility: The Indian-based manufacturers do not need to appoint an AIR

Conclusion

In conclusion, navigating the WPC Certification process in India can be a challenging journey. However, with the right guidance and support, you can significantly expedite this process.

For manufacturers seeking a smoother and quicker route to WPC ETA Approval, Brand Liaison is the key to success.

We provide invaluable assistance and support throughout the entire WPC ETA Approval journey, ensuring that your products meet all the necessary requirements efficiently and without unnecessary delays.

We can help you accurately categorize your equipment, select the correct frequency bands, compile the required documentation, and assist with the submission of your application.

Our experienced professionals know how to navigate the WPC Certification process, enabling you to avoid common pitfalls and minimize processing times.

0 notes

Text

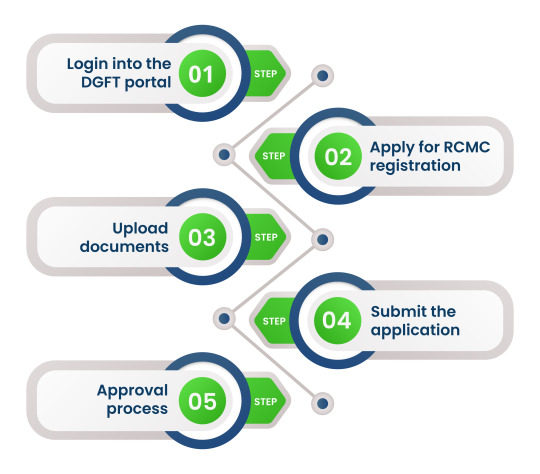

How do I apply for the "ISEPC RCMC registration"?

Here are the steps for registering with the DGFT portal:

Log in to the DGFT portal: Upon creating an account using your IEC code, access the DGFT portal using your login credentials.

Apply for RCMC registration: After logging in, navigate to the RCMC registration section of the portal. Fill out the application form with details such as your company name, address, and PAN number.

Upload supporting documents: Additionally, upload supporting documents like PAN card, GST registration certificate, and certificate of incorporation.

Submit the application: Once the application form is completed and all required documents are uploaded, submit the application.

Approval process: Following submission, the authorities will review your application. Upon approval, you will receive an RCMC.

0 notes

Text

Unsure about import export code registration? This guide makes it easy. Learn about IEC code registration, its benefits, how to apply online, and why import & export services are crucial. Get going on your import/export journey today!

0 notes

Text

How to Apply for IE Code Registration Online: A Step-by-Step Guide.

Step-by-Step Guide: Applying for IEC Code Registration Online

Introduction:

Import Export (IE) Code Registration is mandatory for businesses engaging in international trade in India. This guide will walk you through applying for IEC Code Registration online, ensuring a smooth and hassle-free experience.

Step 1: Visit the Official DGFT Website:

Navigate to the Directorate General of Foreign Trade (DGFT) website, the official platform for IE Code Registration in India.

Step 2: Access the 'IEC Online Application' Portal:

Locate and access the IEC Registration Online Application portal on the DGFT website. This portal facilitates the submission of applications for IE Code Registration.

Step 3: Fill Out the Online Application Form:

Complete the online application form with accurate details regarding your business, such as company name, address, PAN number, bank details, and contact information.

Step 4: Upload Required Documents:

Prepare scanned copies of the necessary documents, including the PAN card, Aadhaar card, canceled cheque, and business address proof. Upload these documents according to the specifications provided on the portal.

Step 5: Pay the Application Fee:

Process the payment of the IE Code Registration application fee through the online payment gateway integrated into the portal. Ensure timely payment to avoid delays in the processing of your application.

Step 6: Submit the Application:

Review all entered information and uploaded documents for accuracy and completeness. Once satisfied, apply through the online portal.

Step 7: Track Application Status:

Utilize the tracking facility available on the DGFT website to monitor the status of your IE Code Registration application. You will receive updates regarding the processing stages of your application.

Step 8: Receive IE Code Certificate:

Upon successful verification and approval of your application, the DGFT will issue the Import Export Code (IEC) certificate electronically. Download and retain this certificate for future reference.

Conclusion:

Following this step-by-step guide, you can seamlessly apply for IEC Code Registration online in India. Ensure compliance with all requirements and provide accurate information to expedite the process and obtain your IE Code Certificate efficiently.

For more details.,

0 notes

Text

Unlocking Trade Potential: The Comprehensive Guide to Status Holder Certificates

In the dynamic landscape of international trade, businesses constantly seek ways to enhance their competitiveness and streamline their operations. One powerful tool available to traders is the Status Holder Certificate, a recognition granted by many countries to businesses that demonstrate excellence in exports and imports.

This comprehensive guide aims to explore the intricacies of Status Holder Certificates, shedding light on their significance, eligibility criteria, benefits, and the application process.

Eligibility for Status Holder Certificate

Any entity engaged in the export of goods, services, and technology, possessing a valid Import-Export Code (IEC) number, is eligible for consideration as a status holder. The recognition as a status holder is contingent upon the export performance of the applicant.

To qualify for status holder categorization, an applicant must demonstrate notable export performance over the current and preceding three financial years. It is noteworthy that, in the Gems & Jewelry Sector, the assessment period for recognition as a status holder spans the current and the preceding two financial years.

The key criteria for the granting of status involve achieving export performance benchmarks in at least two out of the four specified years. This rigorous evaluation ensures that entities seeking status-holder recognition consistently demonstrate a commitment to excellence in their international trade activities.

What are the Prerequisites for Applying for a Status Holder Certificate?

To access the advantages associated with a Status Holder Certificate, the following prerequisites must be fulfilled:

Linked User Profile with IEC

Ensure that your user profile is seamlessly linked with an Importer-Exporter Code (IEC). This linkage is fundamental for the successful application and utilization of the Status Holder Certificate.

Valid Digital Signature Certificate (DSC)

A valid Digital Signature Certificate (DSC) must be duly registered in the system. To verify the status of your DSC, you can navigate to 'My Dashboard' and access the 'View and Register Digital Signature Token' section at https://www.dgft.gov.in/CP/.

Updated Export/Import/Turnover Details

It is imperative to input and regularly update the export, import, and turnover details of your firm in the IEC profile. Accurate and up-to-date information is crucial for the evaluation and validation processes associated with the Status Holder Certificate.

What are the Benefits of Status Holder Certificates?

Priority in Custom Clearance

Holders of Status Holder Certificates often enjoy priority in customs clearance processes. This can significantly reduce the time and resources required for the import and export of goods, facilitating faster and more efficient trade transactions.

Access to Government Incentives

Many governments offer a range of incentives to businesses with Status Holder Certificates. These incentives may include duty credit, exemption from certain taxes, and access to special export promotion schemes designed to boost international trade.

Facilitated Cross-Border Transactions

Status Holder Certificates can open doors to simplified and expedited cross-border transactions. This can be particularly advantageous for businesses involved in time-sensitive industries where delays can have a significant impact on operations.

International Recognition and Trust

The certification serves as a mark of excellence in international trade. It can enhance the reputation of a business, instilling confidence in international partners and customers, ultimately leading to expanded market opportunities.

How to Apply for a Status Holder Certificate?

Follow the steps given below to apply for a Status Holder Certificate directly on the DGFT portal:

Login on the DGFT Website

Selection of "Certificate Management"

Start a fresh application

Fill all the required Applicant Details

Fill in the Status Holder Details

Fill out the Export Performance

Attach all the required documents

Accept the terms and conditions by clicking on the check

Submit the Application

Check the Status of Submitted Applications

Print the Status Holder Certificate

For a detailed step-by-step guide about the portal, refer to the guide provided by DGFT: User Help File

Challenges in Getting a Status Holder Certificate

Obtaining a Status Holder Certificate is undoubtedly a rewarding endeavour, but like any significant achievement, it comes with its set of challenges. Here are some common challenges businesses may face when seeking a Status Holder Certificate:

Documentation Requirements

The application process for a Status Holder Certificate often involves a substantial amount of documentation. Businesses may struggle with compiling and presenting the required information accurately and in the specified format.

Adherence to Regulatory Changes

The landscape of international trade is subject to frequent regulatory changes. Adapting to and ensuring compliance with these changes can be a challenge, as it requires businesses to stay abreast of evolving trade policies and procedures.

Digital Security Challenges

The requirement for a valid Digital Signature Certificate (DSC) introduces cybersecurity considerations. Ensuring the security of digital signatures and protecting against potential threats is a critical aspect that businesses must address during the application process.

Complex Application Procedures

The application process itself can be intricate, involving various stages and online submissions. Navigating through the complexities of the application, including online verification and registration, may pose challenges for businesses unfamiliar with the digital processes.

Auditing and Verification Processes

Post-certification, businesses are often subject to audits and verification processes to ensure ongoing compliance. Preparing for and undergoing these audits can be time-consuming and may require meticulous record-keeping and documentation.

Limited Awareness and Resources

Many businesses may not be fully aware of the existence and benefits of Status Holder Certificates. Limited awareness can be a barrier to applying for and leveraging the advantages of this certification. Additionally, small and medium-sized enterprises (SMEs) may face resource constraints in meeting the eligibility criteria.

Geopolitical Challenges

Changes in geopolitical dynamics can impact international trade relations. Businesses seeking Status Holder Certificates may face uncertainties related to trade agreements, tariffs, and diplomatic relations that could affect their eligibility or the benefits associated with the certificate.

Conclusion

Unlocking the trade potential through Status Holder Certificates involves a strategic blend of consistent performance, regulatory adherence, and leveraging the multitude of benefits provided.

Businesses that grasp the significance of these certificates and navigate the application process with precision find themselves at the forefront of international trade, poised for sustained growth and success. The Status Holder Certificate is not just a recognition; it is a key that unlocks a world of opportunities in the global marketplace.

0 notes

Text

Import Export Code Registration: A Key Step for Your Business Expansion

In today’s globalized world, expanding your business beyond borders is a profitable opportunity. However, to engage in international trade legally, you need an Import Export Code (IEC). Caonweb will guide you through the process of IEC code registration, highlighting the significance of this vital document for your business growth.

In this article, we will delve into the significance of IEC code registration, its benefits, and how to obtain it conveniently.

Table of Contents

About Import Export Code (IEC)

Where is IEC applicable?

Where Import-Export Code Registration. is not applicable.

Documents required for IEC (Import Export Code) Registration.

Steps in the process of IEC (Import/Export Code) Registration.

Benefits of taking IEC (Import Export Code) Registration

Expert Insights

FAQs

Conclusion

Conditions where IEC is applicable?

1-At the time of customs clearance of goods by Importer IEC is required by customs authorities.

2- At the time of sending his goods by exporter IEC is required by the customs port.

3- At the time of sending money abroad through banks IEC is required by the bank.

4- At the time of receiving money in foreign currency directly into his bank account then IEC is required by the bank.

Conditions where IEC is not applicable?

IEC is not mandatory for all GST-Registered traders. PAN can be used as a new IEC code for import/export purposes. No IEC is required for personal use, government departments, ministries, and notified charitable institutions.

Steps involved in IEC (Import/Export Code) Registration

To register IEC, visit the DGFT website.

Go to the ‘Services’ tab on the homepage.

Select the ‘IEC Profile Management’ from the drop-down list.

Select the ‘Apply for IEC’ option.

Click on the ‘Register’ option. Fill in the required details and click the ‘Sent OTP’ button.

Insert OTP and register by clicking the ‘Register’ button.

After validating the OTP successfully, you will receive a temporary password, which can be further changed after logging into the DGFT website.

After registering on the DGFT website, login to the website by entering the username and password.

Go to the ‘Apply for IEC’ option on the DGFT website.

Click on the ‘Start Fresh Application’ button.

Enter the general information, details of proprietor/partner/director/Karta/managing trustee, bank information, and other details, attach a Digital Signature Certificate (DSC) and make the payment.

After successful payment, it will be redirected to the DGFT website. The receipt will be displayed. Download the receipt for future reference.

The IEC Certificate is sent via email. It can be downloaded after logging in to the DGFT website and clicking the ‘Print IEC’ option under the ‘IEC Profile Management’.

List of documents required for IEC (Import Export Code) Registration

Individuals, firms, or company’s copy of PAN Card.

Provide a copy of the proprietor’s Aadhaar card, voter ID, or passport.

Proof of establishment, incorporation or registration of the partnership, society, proprietorship firm, Pvt. company, HUF, etc.

Proof of address of business premises, such as sale deed, lease deed, rent agreement or utility bills (electricity bill, telephone bill or mobile bill).

Enclose copies of current bank account cancellation cheques for individuals, companies or firms.

Also provide a self-addressed envelope for delivery of the IEC certificate by registered post.

Benefits of IEC registration

1-Expansion of business

IEC helps businesses expand globally and grow with their services/products.

2-Availing several benefits

The IEC registration enables companies to avail benefits for their imports/exports from DGFT, Export Promotion Council, Customs, etc.

3-No return filing

IEC registration does not require any return filings of export / Import transactions, there is no requirement to file returns with DGFT.

4-Easy processing

Obtaining an IEC code from the DGFT is a straightforward process that doesn’t require any proof of export or import. The application can be submitted and the IEC code can be obtained within 10 to 15 days.

Expert Insights: CA Sakshi Agarwal

When it comes to the intricacies of IEC code registration and its implications for your business, CA Sakshi Agarwal, a seasoned professional in international taxation and cross-border business, shares her insights and expertise to help you navigate the registration process effortlessly.

Why Caonweb is Your Trusted Business Name

For a seamless IEC code registration experience, Noida-based Tax consultants “Caonweb” stands out as a reliable and trustworthy name in the industry. Under the guidance of our expert team and a client-centric approach, we ensure the registration process is not only efficient but also compliant with all legal norms.

Frequently Asked Questions

Q1. What is the IEC code?

The IEC code, or Import-Export Code, is a 10-digit identification number required for businesses engaged in international trade.

Q2. How can I apply for an IEC code online?

You can apply for an IEC code online through the DGFT’s website by providing the necessary documents and details.

Q3. What are the benefits of having an IEC code?

Having an IEC code allows your business to engage in international trade, ensures legal compliance, and provides access to government incentives.

Q4. How long does it take to obtain an IEC code?

Typically, an IEC code is issued within 1-2 working days of applying online.

Q5. Why choose Caonweb for IEC code registration?

Caonweb is a trusted business name known for its expert guidance and client-centric approach, ensuring a smooth and compliant registration process.

Conclusion

In conclusion, the Import Export Code (IEC) is a crucial requirement for businesses looking to engage in international trade. Its benefits are numerous, and with the convenience of online registration and expert guidance from CA Sakshi Agarwal, obtaining your IEC code has never been easier. Choose Caonweb for a seamless experience and take the first step towards expanding your business globally.

In this article, we’ve covered the essentials of IEC code registration, from its significance to the online application process and the benefits it offers. With expert insights from CA Sakshi Agarwal and the trusted assistance of Caonweb, you can confidently pursue your international business ventures. Don’t miss out on the opportunities that global trade has to offer. Get your IEC code today and unlock a world of possibilities.

youtube

SOURCE: THE POST IMPORT EXPORT CODE APPEARED FIRST ON Import Export Code Registration: A Key Step for Your Business Expansion

#iec modification#import export code application online#iec code registration#iec registration certificate#caonweb#ca services online#Youtube

0 notes

Text

The Role of DGFT Consultants

In today's interconnected world, foreign trade has become an indispensable part of business operations. Companies looking to expand their horizons beyond borders often find themselves grappling with a web of regulations, documentation, and compliance issues. This is where DGFT (Directorate General of Foreign Trade) consultants step in, playing a pivotal role in simplifying and streamlining the complexities of international trade. In cities like Pune, a hub for commerce and industry, the services of a DGFT consultant are more valuable than ever. In this blog, we will explore the role of a DGFT consultant in Pune, focusing on how they can assist businesses like Air Freight Forwarding Companies, Ocean Freight Forwarding Companies, and organizations like Milestone Worldwide Freight Solutions.

Understanding the Role of a DGFT Consultant

DGFT consultants are experts in the domain of foreign trade, with a profound knowledge of international trade regulations, policies, and procedures. They serve as the bridge between businesses and government authorities, facilitating the smooth flow of goods and services across borders. Here are some key aspects of their role:

Regulatory Compliance: DGFT consultants in Pune, such as those at Milestone Worldwide Freight Solutions, assist businesses in adhering to the ever-evolving foreign trade regulations. They ensure that all the necessary licenses, permits, and documentation are in place, minimizing the risk of non-compliance and its associated penalties.

Licensing and Permissions: DGFT consultants help companies apply for and obtain various licenses and permissions required for international trade, including Importer Exporter Code (IEC), Advance Authorization, and EPCG (Export Promotion Capital Goods) licenses. They guide businesses through the application process, helping them secure the necessary documentation.

Trade Policy Analysis: DGFT consultants closely monitor changes in trade policies, tariffs, and agreements at both national and international levels. They keep their clients informed about any alterations in these policies and help them adapt their strategies accordingly, ensuring competitiveness in the global market.

Export Promotion Schemes: Businesses, such as Air Freight Forwarding Companies and Ocean Freight Forwarding Companies, often need to take advantage of government incentives and export promotion schemes. DGFT consultants are well-versed in these schemes and help their clients identify and maximize the benefits.

Export Documentation: Accurate and complete documentation is crucial in international trade. DGFT consultants assist companies in preparing and maintaining the necessary documents, including the Bill of Lading, Certificate of Origin, and commercial invoices, among others.

Reducing Trade Barriers: DGFT consultants work to minimize trade barriers by assisting businesses in understanding and navigating the complexities of foreign trade. This includes addressing issues related to customs, duty drawbacks, and anti-dumping measures.

Training and Education: DGFT consultants often provide training to the staff of companies involved in foreign trade. This education helps employees understand the nuances of international trade, improving their competence and ensuring that the business complies with regulations.

Pune, being a bustling economic center in India, is home to numerous businesses engaged in foreign trade. DGFT consultants in Pune, such as Milestone Worldwide Freight Solutions, play an instrumental role in supporting these businesses in their international endeavours.

Milestone Worldwide Freight Solutions - Your Trusted DGFT Consultant in Pune

Milestone Worldwide Freight Solutions is a leading DGFT consultant in Pune, known for its expertise in foreign trade matters. With their in-depth knowledge of the global market and the complexities associated with it, they assist a wide range of businesses, including Air Freight Forwarding Companies and Ocean Freight Forwarding Companies.

Their dedicated team of professionals is well-versed in the intricacies of international trade, ensuring that businesses can navigate the complex regulatory environment with ease. They offer comprehensive services, from license procurement to trade policy analysis, and everything in between.

The role of DGFT consultants, such as those at Milestone Worldwide Freight Solutions, is pivotal in supporting businesses engaged in foreign trade. These consultants help companies not only comply with regulations but also thrive in the global market by providing valuable insights and guidance. Their expertise is an invaluable asset for companies looking to expand their horizons and establish a strong presence in the international arena. So, for businesses in Pune aiming to conquer the global market, partnering with a DGFT consultant is a smart move that can make all the difference.

#freight forwarding company in pune#international logistics company in pune#international courier company in pune#import export companies in pune#milestone worldwide

0 notes

Text

Legal Metrology Registration & LMPC Certificate Consultant

LMPC Certificate|Legal Metrology Registration

LMPC certificate stands for Legal Metrology packaged commodities is mandatory for every business that deals in manufacturing, selling, distributing, importing and packing of Pre-Packaged Commodities It is also called the Importer's License. The main purpose behind the LMPC registration is to ensure that pre-packaged goods imported into India comply with the Legal Metrology (Packaged Commodities) Rules, 2011. Importers may face huge penalties and result in shipment stoppage at customs in case of noncompliance under legal Metrology. The customs authorities have become strict in checking whether the legal metrology compliances by the importers have been fulfilled or not. Read on to learn about the benefits, documents required, registration fees, penalties for noncompliance and registration process of the LMPC registration.

What is LMPC Certificate for import? Or What is LMPC Registration?

The LMPC certificate for import, or Legal Metrology Packaged Commodity, is a certification that identifies commodities that have been packaged by a third party before they become commercially available. The packaging process can include everything from vacuum sealing and shrink wrapping to product development and shelf-life testing. The Department of Consumer Affairs grants an LMPC import license. When an importer applies for the LMPC registration, the Director of Legal Metrology will register the name and Address of the importer in the legal metrology Database and grant the LMPC certificate for import. What are Pre-Packaged Commodities Pre-Packaged commodities are the goods that are packed (sealed or Unsealed) without the end consumer being present, and hence the contents present inside the package are pre-determined.

Pre-packaged Commodities that are covered under the Legal Metrology of Packaged commodities are:

1. Tea and Coffee 2. Cooking oils Milk and Detergent powders Soaps. 3. Paint, Varnish, Enamels. 4. Cement in Bags. 5. Biscuits, Bread, Baby food. 6. Soft drinks and other non-alcoholic Beverages. 7. Mineral Water and Drinking water. 8. Rice Flour, Wheat Flour, Suji, Rawa.

Documents required for LMPC registration Or LMPC Certificate

1. DSC is mandatory for authorised signatory.

2. Residential proof like Aadhaar, voter ID or Passport.

3. MCD/NDMC/DDA License for trade/ manufacture/ Factory. (In case an. applicant doesn't possess the MCD license, an undertaking in the form of an affidavit has to be submitted confirming that the business premises is not located in a non-conforming area and is not likely to be sealed by the MCD. 4. GST registration.

5. Label/ Packaging material/ Slip/ Sticker being pasted on the packaged commodity.

6. Memorandum of Association of the Company, Partnership deed in respect of Partnership firms. 7.Import-Export Code (IEC certificate).

8. Passport size photograph (all Directors/all Partners/Proprietor).

9. Proof of commercial area.

10. Receipt of Offenses for which challenged and whether it is compounded.

How to Apply Online for an LMPC Certificate?

Step 1: Submit the application form to the director of Metrology. To apply online for an LMPC import license, you must first submit an application form. The application form must be submitted to the director of Metrology at your local government unit. You can find the director of Metrology's contact information on the Metrology Council website.

Step 2: Submit the documents required for LMPC registration. If you are applying for an LMPC certificate, you will need to submit a copy of your business permit and a copy of your current license to operate as a merchant or store owner. You will also need to submit documents verifying that you have paid all city and provincial taxes in the past two years (if applicable), along with any other documents that the Director of Metrology may request.

Step 3: Submit the LMPC registration fees. Once you've submitted all required documents and paid the applicable fees, you can expect your LMPC certificate within 7-10 working days (depending on when your application is received). Once you have submitted your application, it will be forwarded to the director of Metrology for review. The director will then contact you via email to let you know if your application has been accepted or not. If accepted, you will be sent an approval call which will include more details about the course and how much it costs.

Note: In case of incomplete/incorrect details, The application will be returned to the applicant entity within 7 days of receiving it.

Information to be included on the package. According to the Department of Consumer Affairs, you are not permitted to manufacture, Affairs, you are not permitted to manufacture, market, sell, Import, pack, or distribute prepackaged goods without mentioning certain information on the outer package.

1. Maximum Retail Price (inclusive of GST).

2. Date of manufacturing/packing/import.

3. Generic name of the product.

4. Date of expiry in case of food items.

5. Net contents in terms of weights/ volume/ length.

6. Details of the consumer care.

7. Country of origin for imported goods.

8. Quantities in which packing is made, i.e., below 5g, 5g, 10g, 20g, etc. Declarations to be made in the LMPC certificate for import. Following declarations must be made by the importers While registering for a Legal metrology certificate.

Importers who fail to declare the following are ineligible to apply for LMPC registration.

1. Whether the packing is made in standard quantities as specified in Rule 5 of Legal Metrology (Packaged Commodities Rules, 2011).

2. Whether the package is a combination package or group package, or a multi-piece package.

3. Whether the package is a retail package or a wholesale package.

4. Whether the package contains perishable commodities or food items.

5. Whether the packed items will also be exported out of the country.

6. Whether the items are being packed for specific industries only as raw material.

7. Whether the package contains fast food items.

8. Whether the package contains any schedule/ non-scheduled formulations. covered under the Drugs (price control) order or any agricultural farm products of 50kg and above.

9. Whether the shop/factory/premises is owned/rented.

10. Have your premises been last inspected by the inspector of the W & M Department?

11. Whether your firm has been challenged during the last three years for violating Weights & Measures laws. If Yes, the date of challan etc.?

12. Offenses for which challenged and whether it is compounded or not. LMPC Registration Fees.

Benefits of Obtaining an LMPC Certificate for Import

1. Simplifies and Promotes Importing. The LMPC certificate is a document that certifies that you have completed the legal metrology course. It has been designed to enhance India's trade, finance, and export sectors. It makes it easier to import goods to India.

2. Promotes the welfare of the consumers. Proper accuracy in weights and measurements is crucial in promoting the welfare of customers. That way, the consumers are protected from the illegal practices of selling underweight products, and they actually get the same amount of product at that price as mentioned on the package.

3. Prevents Import of illegal goods. The Legal Metrology Act is accountable for controlling any illegal or unethical trade practices. This act aims to ensure that all commercial transactions of packaged commodities are genuine.

4. Saves Importing Costs and Time. Importer's license or LMPC license consists of all the information about the weights and properties of packaged goods. It saves tons of time during the customs clearance of packaged commodities. The LMPC certificate for import accelerates the customs process, avoids unnecessary delays, and saves from penalties. Thus saving importing time and expense.

5. Builds trust between seller and Buyer. Customers always seek to purchase products that meet the specifications mentioned on the package. Properly checking the weight and measurements of goods by a trusted authority creates a sense of customer satisfaction. That's why LMPC-certified vendors are trusted by their customers.

Validity of LMPC Certificate The Validity of an LMPC registration is five years. The LMPC import license must be renewed before the expiry period to avoid hassle during customs clearance. Exemptions under LMPC rules. The following are not considered to be a legal compulsion for having an LMPC certificate for import:. - Commodities have a net weight of 10 gms or 10 ml or less. - Agricultural products packed in weights greater than 50 kg. - Packages containing fast food items packed by a hotel or restaurant. - Formulation-containing packages authorized by the Drugs (Price Control) Order, 1995. - Packaged goods targeted for institutional consumers( those who purchase the products directly from the manufacturer for use in that business) or service institutions such as airways, railways, hotels and hospitals. - Packages containing goods weighing more than 25 kg or 25 litres, with the exception of cement or fertilizer sold in bags weighing up to 50 kg. Penalties for Non-compliance. A late fee of Rs. 5000( for Delhi) will be incurred if your application for an LMPC import license is submitted more than 90 days after the importation process begins. Importers, packers, manufacturers, and dealers who violate the established norms of measurements and weights may be subject to a fine of up to 10,000 or a year in jail. If an importer, packer or manufacturer violates section 11 of the LMPC Act, they can be fined up to $10,000 or serve a year in prison.

If an importer, packer or manufacturer delivers quantities that are less than what the end-user has paid for, they can be fined up to $10,000 or serve a year in prison. Importing any weight or measure is only allowed by an importer certificate under section 19 of the Legal Metrology Act, 2009. The customs authorities are getting stricter regarding this law, and business owners need to get an importer certificate before importing any weight or measure. Manufacturers and importers who fail to submit annual returns will be fined $5,000 or spend a year in jail. If the label on the product has an unverified weight, then the importer will also be penalized. Importers, sellers, distributors, and manufacturers who make a sale of products that do not have an LMPC declaration on the packaging will be penalized by a fine of $2,000 to $10,000 or spend a year in jail or both. Your Partner in LMPC Registration.

0 notes

Text

LMPC Certificate | Legal Metrology Registration

LMPC certificate stands for Legal Metrology packaged commodities is mandatory for every business that deals in manufacturing, selling, distributing, importing and packing of Pre-Packaged Commodities It is also called the Importer's License. The main purpose behind the LMPC registration is to ensure that pre-packaged goods imported into India comply with the Legal Metrology (Packaged Commodities) Rules, 2011.

Importers may face huge penalties and result in shipment stoppage at customs in case of noncompliance under legal Metrology. The customs authorities have become strict in checking whether the legal metrology compliances by the importers have been fulfilled or not. Read on to learn about the benefits, documents required, registration fees, penalties for noncompliance and registration process of the LMPC registration.

What is LMPC Certificate for import? Or What is LMPC Registration?

The LMPC certificate for import, or Legal Metrology Packaged Commodity, is a certification that identifies commodities that have been packaged by a third party before they become commercially available. The packaging process can include everything from vacuum sealing and shrink wrapping to product development and shelf-life testing.

The Department of Consumer Affairs grants an LMPC import license. When an importer applies for the LMPC registration, the Director of Legal Metrology will register the name and Address of the importer in the legal metrology Database and grant the LMPC certificate for import.

What are Pre-Packaged Commodities

Pre-Packaged commodities are the goods that are packed (sealed or Unsealed) without the end consumer being present, and hence the contents present inside the package are pre-determined.

Pre-packaged Commodities that are covered under the Legal Metrology of Packaged commodities are:

Tea and Coffee

Cooking oils Milk and Detergent powders Soaps.

Paint, Varnish, Enamels.

Cement in Bags.

Biscuits, Bread, Baby food.

Soft drinks and other non-alcoholic Beverages.

Mineral Water and Drinking water.

Rice Flour, Wheat Flour, Suji, Rawa.

Documents required for LMPC registration Or LMPC Certificate

DSC is mandatory for authorised signatory.

Residential proof like Aadhaar, voter ID or Passport.

MCD/NDMC/DDA License for trade/ manufacture/ Factory. (In case an. applicant doesn't possess the MCD license, an undertaking in the form of an affidavit has to be submitted confirming that the business premises is not located in a non-conforming area and is not likely to be sealed by the MCD.

GST registration.

Label/ Packaging material/ Slip/ Sticker being pasted on the packaged commodity.

Memorandum of Association of the Company, Partnership deed in respect of Partnership firms.

Import-Export Code (IEC certificate).

Passport size photograph (all Directors/all Partners/Proprietor).

Proof of commercial area.

Receipt of Offenses for which challenged and whether it is compounded.

How to Apply Online for an LMPC Certificate?

Step 1: Submit the application form to the director of Metrology.

To apply online for an LMPC import license, you must first submit an application form. The application form must be submitted to the director of Metrology at your local government unit. You can find the director of Metrology's contact information on the Metrology Council website.

Step 2: Submit the documents required for LMPC registration.

If you are applying for an LMPC certificate, you will need to submit a copy of your business permit and a copy of your current license to operate as a merchant or store owner. You will also need to submit documents verifying that you have paid all city and provincial taxes in the past two years (if applicable), along with any other documents that the Director of Metrology may request.

Step 3: Submit the LMPC registration fees.

Once you've submitted all required documents and paid the applicable fees, you can expect your LMPC certificate within 7-10 working days (depending on when your application is received). Once you have submitted your application, it will be forwarded to the director of Metrology for review.

The director will then contact you via email to let you know if your application has been accepted or not. If accepted, you will be sent an approval call which will include more details about the course and how much it costs. Note: In case of incomplete/incorrect details, The application will be returned to the applicant entity within 7 days of receiving it.

Information to be included on the package.

According to the Department of Consumer Affairs, you are not permitted to manufacture, Affairs, you are not permitted to manufacture, market, sell, Import, pack, or distribute prepackaged goods without mentioning certain information on the outer package.

Maximum Retail Price (inclusive of GST).

Date of manufacturing/packing/import.

Generic name of the product.

Date of expiry in case of food items.

Net contents in terms of weights/ volume/ length.

Details of the consumer care.

Country of origin for imported goods.

Quantities in which packing is made, i.e., below 5g, 5g, 10g, 20g, etc. Declarations to be made in the LMPC certificate for import.

Following declarations must be made by the importers While registering for a Legal metrology certificate.

Importers who fail to declare the following are ineligible to apply for LMPC registration.

Whether the packing is made in standard quantities as specified in Rule 5 of Legal Metrology (Packaged Commodities Rules, 2011).

Whether the package is a combination package or group package, or a multi-piece package.

Whether the package is a retail package or a wholesale package.

Whether the package contains perishable commodities or food items.

Whether the packed items will also be exported out of the country.

Whether the items are being packed for specific industries only as raw material.

Whether the package contains fast food items.

Whether the package contains any schedule/ non-scheduled formulations. covered under the Drugs (price control) order or any agricultural farm products of 50kg and above.

Whether the shop/factory/premises is owned/rented.

Have your premises been last inspected by the inspector of the W & M Department?

Whether your firm has been challenged during the last three years for violating Weights & Measures laws. If Yes, the date of challan etc.?

Offenses for which challenged and whether it is compounded or not. LMPC Registration Fees.

Benefits of Obtaining an LMPC Certificate for Import

Simplifies and Promotes Importing. The LMPC certificate is a document that certifies that you have completed the legal metrology course. It has been designed to enhance India's trade, finance, and export sectors. It makes it easier to import goods to India.

Promotes the welfare of the consumers. Proper accuracy in weights and measurements is crucial in promoting the welfare of customers. That way, the consumers are protected from the illegal practices of selling underweight products, and they actually get the same amount of product at that price as mentioned on the package.

Prevents Import of illegal goods. The Legal Metrology Act is accountable for controlling any illegal or unethical trade practices. This act aims to ensure that all commercial transactions of packaged commodities are genuine.

Saves Importing Costs and Time. Importer's license or LMPC license consists of all the information about the weights and properties of packaged goods. It saves tons of time during the customs clearance of packaged commodities. The LMPC certificate for import accelerates the customs process, avoids unnecessary delays, and saves from penalties. Thus saving importing time and expense.

Builds trust between seller and Buyer. Customers always seek to purchase products that meet the specifications mentioned on the package. Properly checking the weight and measurements of goods by a trusted authority creates a sense of customer satisfaction. That's why LMPC-certified vendors are trusted by their customers.

Validity of LMPC Certificate

The Validity of an LMPC registration is five years. The LMPC import license must be renewed before the expiry period to avoid hassle during customs clearance. Exemptions under LMPC rules.

The following are not considered to be a legal compulsion for having an LMPC certificate for import:.

- Commodities have a net weight of 10 gms or 10 ml or less.

- Agricultural products packed in weights greater than 50 kg.

- Packages containing fast food items packed by a hotel or restaurant.

- Formulation-containing packages authorized by the Drugs (Price Control) Order, 1995.

- Packaged goods targeted for institutional consumers( those who purchase the products directly from the manufacturer for use in that business) or service institutions such as airways, railways, hotels and hospitals.

- Packages containing goods weighing more than 25 kg or 25 litres, with the exception of cement or fertilizer sold in bags weighing up to 50 kg. Penalties for Non-compliance.

A late fee of Rs. 5000( for Delhi) will be incurred if your application for an LMPC import license is submitted more than 90 days after the importation process begins.

Importers, packers, manufacturers, and dealers who violate the established norms of measurements and weights may be subject to a fine of up to 10,000 or a year in jail. If an importer, packer or manufacturer violates section 11 of the LMPC Act, they can be fined up to $10,000 or serve a year in prison.

If an importer, packer or manufacturer delivers quantities that are less than what the end-user has paid for, they can be fined up to $10,000 or serve a year in prison.

Importing any weight or measure is only allowed by an importer certificate under section 19 of the Legal Metrology Act, 2009.

The customs authorities are getting stricter regarding this law, and business owners need to get an importer certificate before importing any weight or measure.

Manufacturers and importers who fail to submit annual returns will be fined $5,000 or spend a year in jail. If the label on the product has an unverified weight, then the importer will also be penalized.

Importers, sellers, distributors, and manufacturers who make a sale of products that do not have an LMPC declaration on the packaging will be penalized by a fine of $2,000 to $10,000 or spend a year in jail or both. Your Partner in LMPC Registration. The LMPC registration process involves a tons of statements and information to be included. It is advised to seek an expert to apply for an LMPC certificate to avoid the cancellation of registration.

1 note

·

View note

Video

youtube

AD Code Registration on New ICEGATE 2.0 Portal| How to apply DSC on Pdf| Documents required|

AD Code Registration on New ICEGATE 2.0 Portal| How to apply DSC on Pdf| Documents required| #adcoderegisatrationonicegate #icegateregistration #adcoderegistration Dear Viewers, In this video we have shared the detailed process on how to apply for AD Code registration on New ICEGATE 2.0 Portal, documents required to apply for AD Code registration along with the process on how you can add your DSC on the pdf to be uploaded while applying for AD Code registration. Index 00:00 to 08:20 AD Code Registration Process 08:21 to 10:45 How to apply DSC on PDF 10:46 to 11:32 Submit application 11:33 to 11:44 Like Share & Subscribe To know about how to register yourself on ICEGATE 2.0 Portal, one can refer the below link: How to register on ICEGATE New Portal| ICEGATE registration process| ICEGATE DSC Registration| https://youtu.be/85CvjYir93s Follow me on: Pinterest: https://in.pinterest.com/cadevesht LinkedIn: https://www.linkedin.com/in/cadeveshthakur/ Instagram: https://www.instagram.com/cadeveshthakur/ Twitter: https://twitter.com/cadeveshthakur Tumblr: https://www.tumblr.com/blog/cadeveshthakur Youtube Channel: https://www.youtube.com/c/cadeveshthakur Reddit: https://www.reddit.com/user/cadeveshthakur E-Commerce Accounting: https://www.facebook.com/groups/ecommerceaccountingsolutions #cadeveshthakur #ICEGATEPortal #ImportExport #RegistrationTutorial #ICEGATE2.0 #InternationalTrade #CustomsCompliance #ExporterGuide #ImporterTutorial #TradeSolutions #CustomsRegistration #SeamlessTrade #TradeMadeEasy #BusinessOperations #TutorialTuesday #TradeTech #RegisterWithICEGATE #ExportImportSimplified icegate registration process,icegate registration process with dsc,icegate registration,icegate,icegate ad code registration online,icegate registration process for iec holder,icegate dsc registration,icegate pki component not working,icegate custom duty payment,icegate registration process new portal,ad code registration,digilocker account kaise banaye,digilocker account creation,digilocker aadhar authentication,ad code regisatration on icegate

#youtube#ad code registration#ad code registration on icegate#how to apply for ad code registration#icegate new portal#ad code registration in icegate

0 notes

Text

IEC Code Online: Step-by-Step Instructions

What is an Import Export Code (IEC)?

An Import Export Code (IEC) is a 10-digit unique identification number issued by the Directorate General of Foreign Trade (DGFT), a part of the Indian government. It is mandatory for any individual or business entity wishing to engage in import and export activities in India. This code serves as a primary document for customs authorities to track and monitor international trade transactions.

How to apply for an IEC code online?

To apply for an IEC code online in India, you need to visit the DGFT's official website and fill out the required application form. You will need to provide essential documents and information, such as PAN (Permanent Account Number), bank details, and a valid address proof. After submission, you will receive a unique IEC code, typically within 1-2 business days.

Eligibility criteria for obtaining an IEC code in India:

The eligibility criteria for obtaining an IEC code in India are quite liberal. Individuals, partnerships, companies, and LLPs (Limited Liability Partnerships) can all apply for an IEC code. There is no need to demonstrate specific turnover or export-import experience to be eligible.

Process for IEC code registration:

The process for Import Export Code registration involves the following steps:

a. Visit the DGFT website.

b. Complete the online application form.

c. Upload the necessary documents.

d. Pay the prescribed fees.

e. Wait for processing and approval.

f. Receive the IEC code via email.

Are there any fees associated with IEC code registration?

Yes, there are fees associated with Import Export Code registration, which may vary depending on the entity type. These fees can be found on the DGFT website and are subject to change over time.

Penalties for not having or not renewing an IEC code:

Yes, there can be penalties for not having or renewing an IEC code. Importing or exporting goods without a valid IEC code can result in legal consequences and fines. It's crucial to ensure that your IEC code remains valid and up to date.

Benefits of having an IEC code for exporters and importers:

The benefits of having an IEC code for exporters and importers include:

Facilitating international trade transactions.

Enabling access to various government incentives and benefits.

Streamlining customs clearance processes.

Establishing credibility in the international market.

Some tips for maintaining and managing your IEC code effectively:

To manage your IEC code effectively, consider the following tips:

Keep it up to date by renewing it as required.

Maintain accurate records of your import-export transactions.

Notify the DGFT of any changes in your business details promptly.

Be aware of and comply with any changes in import-export regulations.

Conclusion:

An Import Export Code (IEC) is a crucial requirement for anyone involved in import and export activities in India. Obtaining and maintaining an IEC code is relatively straightforward, and it offers numerous benefits to exporters and importers, such as simplifying customs procedures and gaining access to government incentives. It's essential to stay compliant with IEC regulations to avoid penalties and ensure a smooth international trade experience.

0 notes

Text

How are spices exported from India?

Documents Required

Import Export Code (IEC): This is a 10-digit code issued by the Directorate General of Foreign Trade (DGFT) and is required for all import and export businesses in India. You can apply for an IEC online through the DGFT website.

Registration Cum Membership Certificate (RCMC): This is issued by the Indian Spices Board and is required for all exporters of spices. You can apply for an RCMC online through the Indian Spices Board website.

FSSAI License: This is issued by the Food Safety and Standards Authority of India (FSSAI) and is required for all businesses dealing in food products, including spices. You can apply for an FSSAI license online through the FSSAI website.

Phytosanitary Certificate: This is issued by the Directorate of Plant Protection, Quarantine & Storage (DPPQS) and is required for all exports of agricultural products, including spices. You can apply for a phytosanitary certificate online through the DPPQS website.

Bill of Lading: This is a document issued by the shipping company that confirms the receipt of your goods for shipment.

Commercial Invoice: This is a document that provides detailed information about your shipment, including the quantity, description, and value of the goods.

Packing List: This is a document that provides detailed information about the packaging of your shipment.

Duration

The time it takes to export spices from India will vary depending on the country of export, the shipping method, and the availability of documents. However, it is typically possible to export spices from India within 1-2 weeks.

How to Apply for the Documents

Import Export Code (IEC)

To apply for an IEC, you will need to create an account on the DGFT website and fill out an online application form. You will also need to submit copies of your company's incorporation certificate, PAN card, and bank account statement.

Registration Cum Membership Certificate (RCMC)

To apply for an RCMC, you will need to create an account on the Indian Spices Board website and fill out an online application form. You will also need to submit copies of your company's IEC, PAN card, and FSSAI license.

FSSAI License

To apply for an FSSAI license, you will need to create an account on the FSSAI website and fill out an online application form. You will also need to submit copies of your company's PAN card, GST registration certificate, and address proof.

Phytosanitary Certificate

To apply for a phytosanitary certificate, you will need to create an account on the DPPQS website and fill out an online application form. You will also need to submit copies of your company's IEC, PAN card, and export contract.

Bill of Lading, Commercial Invoice, and Packing List

You can obtain these documents from your shipping company.

Steps to Export Spices from India

Identify your target market. Where do you want to export your spices?

Research the import regulations of the target country. What are the specific requirements for importing spices into that country?

Find a buyer. You can find buyers for your spices through online directories, trade shows, and personal contacts.

Negotiate a contract with the buyer. This contract should specify the quantity, quality, price, and delivery terms of the shipment.

Obtain the required documents. This includes the IEC, RCMC, FSSAI license, phytosanitary certificate, bill of lading, commercial invoice, and packing list.

Book your shipment with a shipping company.

Clear your shipment through customs.

Receive payment from the buyer.

Tips for Exporting Spices from India

Make sure that your spices are of high quality and meet the import regulations of the target country.

Pack your spices carefully to prevent damage during shipping.

Get your documents in order as early as possible.

Work with a reliable shipping company.

Communicate regularly with your buyer.

Simple Language Explanation

To export spices from India, you need to get a few documents. These include an IEC (Import Export Code), an RCMC (Registration Cum Membership Certificate), an FSSAI license, and a phytosanitary certificate. You can apply for these documents online through the websites of the relevant government agencies.

Once you have the required documents, you can start looking for buyers for your spices. You can find buyers through online directories, trade shows, and personal contacts. Once you have found a buyer, you need to negotiate a contract with them. best wish for your future mate.

0 notes

Text

IEC (Import Export Code) – How to Apply for It and Its Benefits

Welcome to Vyaapar Seva Kendra, your trusted partner for all your business registration and compliance needs. In today's blog, we will delve into the world of Import Export Code (IEC) in India. We will guide you through the process of applying for an IEC and shed light on the many benefits it offers to businesses engaged in international trade.

Understanding Import Export Code (IEC)

IEC, also known as the Importer Exporter Code, is a 10-digit alphanumeric code issued by the Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce and Industry, Government of India. It is mandatory for businesses engaged in the import or export of goods and services from India.

How to Apply for IEC

The process of applying for an IEC is straightforward, and it can be done online through the DGFT's official website. Here's a step-by-step guide:

Step 1: Create an Account

Visit the DGFT's official website and create an account. You'll need a valid PAN card and a mobile number registered in your name for this.

Step 2: Fill the Online Application

Log in to your DGFT account and fill out the online IEC application form (Aayaat Niryaat Form - ANF 2A). Provide accurate details regarding your business, such as name, address, and bank details.

Step 3: Upload Documents

Attach the required documents, including a copy of your PAN card, passport-sized photographs, and bank certificate. The specific documents may vary based on the type of applicant (individual, company, partnership, etc.).

Step 4: Pay the Fee

Pay the application fee online through a secure payment gateway. The fee varies depending on the type of business entity and is non-refundable.

Step 5: Submit the Application

Once you've completed the application and paid the fee, submit the application online. You will receive an Application Reference Number (ARN) for tracking the status of your application.

Step 6: Verification

The DGFT will review your application and may seek additional information or clarification if necessary.

Step 7: IEC Issuance

Upon successful verification, your IEC certificate will be issued electronically, and you can download it from the DGFT website.

Benefits of Obtaining an IEC

Now that you know how to apply for an IEC let's explore the significant benefits it offers to businesses engaged in international trade:

1. Global Expansion

IEC enables your business to expand its reach globally by engaging in import and export activities. It opens doors to international markets and potential customers.

2. Legitimacy

Having an IEC adds legitimacy and credibility to your business. It signifies that your business is recognized and authorized by the government for international trade.

3. Access to Export Incentives

IEC is a prerequisite for availing export incentives, benefits, and subsidies offered by various government schemes, such as the Merchandise Exports from India Scheme (MEIS).

4. Ease of Customs Clearance

IEC simplifies the customs clearance process for your imports and exports. It's mandatory for customs authorities to record IEC details for customs clearance.

5. Easier Access to Finance

Financial institutions often require an IEC for granting loans, credit facilities, or advances to businesses engaged in international trade.

6. Brand Visibility

Engaging in international trade enhances your brand's visibility and can lead to increased brand recognition and customer trust.

Conclusion

Obtaining an Import Export Code (IEC) is a crucial step for businesses looking to engage in international trade. It's a relatively simple process that offers a multitude of benefits, from global expansion to enhanced credibility and access to financial incentives.

At Vyaapar Seva Kendra, we specialize in assisting businesses with their regulatory and compliance needs, including IEC registration. Our expert team can guide you through the process, ensuring that your business can explore the vast opportunities offered by international trade.

For more information and to get started with your IEC application, visit our website here. Register your business with an IEC and unlock the doors to global trade and growth today!

#vyaaparsevakendra#importexportcode#accounting#registration#importexportindia#importexport#iso#consultant#importexportwholesale#startup#iec#export#import#india#importexportentrepreneur#goglobal#exporter#eximnews

1 note

·

View note

Text

What is the process of filing a Letter of Undertaking (LUT) under Goods & Service Tax (GST)?

Introduction

All registered taxpayers who wish to export goods or services without paying IGST (Integrated Goods and Service Tax) must submit a Letter of Undertaking (LUT) in GST RFD-11 form through the GST website. This article is going to focus on “What is a Letter of Undertaking under GST?”, “Process for Filling LUT under GST,” “Documents Required for LUT under GST,” and “Eligibility requirements for Filing LUT under GST (Goods and Service Tax).

What is a Letter of Undertaking under GST?

Exporters can use a letter of undertaking to export goods or services without paying taxes. Under the new GST system, all exports are subject to IGST, which may then be reclaimed through a refund against the tax paid. By applying for a LUT (Letter of Undertaking), exporters can avoid the effort of requesting a refund and avoid the freezing of cash through tax payments.

Who is eligible to file LUT under GST?

Any exporter of goods or services who has registered for GST is required to submit a GST LUT. Exporters who have been accused of committing a crime or tax evasion totaling more than INR 250 lakhs in violation of the CGST Act, the IGST Act, 2017, or any other applicable law are disqualified from submitting a GST LUT. In this case, they would have to offer an export bond. According to the CGST Rules, 2017, any registered person may submit an export bond or LUT under GST RFD 11 without having to pay the integrated tax. They could apply for LUT if:

They want to offer goods or services to India, other nations, or SEZs (Special Economic Zones) and have registered for GST.

They wish to avoid paying the integrated tax when they sell goods.

What is the process of filing LUT under GST?

The following is the process of filing LUT under GST:

Navigate to the GST Portal and sign in using your authorized credentials.

The “USER SERVICES” drop-down menu under “SERVICE TAB” offers the option to furnish a Letter of Undertaking (LETTER OF UNDERTAKING (LUT).

You must next choose the financial year for which you want to file the letter of undertaking after choosing this option.

Next, attach a PDF of the LUT from the previous financial year, if applicable.

Next, include two witnesses’ names, addresses, and occupations.

The next step is to fill in the filing location. You can view a preview of the form after this process is finished.

The application can be signed using an electronic verification code or a recognized digital signature certificate. On the form, both options are present. The form cannot be changed after it has been signed and submitted.

What are the documents required for filing LUT?

The following documents are required for filing LUT under GST:

PAN Card of the Company

Authorized Person’s KYC

Certificate of IEC Code

Form GST RFD 11

LUT Cover Letter with an official signature serving as an acceptance request

Returned/ Canceled Cheque

How will the GST Letter of Undertaking help exporters?

The following are the benefits of GST LUT for exporters:

Regular exporters gain a lot by filing LUT electronically because doing so saves time compared to the alternative.

The applicant does not have to show up in person for approval in front of the officials. The entire process can be finished more quickly and easily.

An exporter may export products or services tax-free if they submit a LUT under the GST.

The Letter of Undertaking is effective for the whole financial year for which it was submitted.

GST filing charges are the fees incurred when individuals or businesses file their Goods and Services Tax (GST) returns with tax authorities. These charges vary based on tax laws, filing frequency, and transaction complexity, covering preparation, verification, and submission of GST returns, along with any professional services fees if needed. Staying informed and seeking professional guidance can aid in a smooth and accurate GST filing process.

Summary

LUT is necessary if you want to export goods, services, or both without paying IGST. If exporters fail to provide the LUT, they must pay IGST or release an export bond. Previously, LUT could only be delivered in person to the appropriate GST office. But in order to make the process simpler, the government has made LUT filing available online.

0 notes