#gstregistrationcancellation

Text

Suspension of GST Registration

Introduction:

Nowadays the GST department has come up with all new weapons to mitigate non-compliances under GST. The suspension of registration under GST helps the GST officer to identify the fraud-causing circumstances and prevent it before it actually takes place. There are certain parameters and criteria on the basis of which GST officers suspend GST registration.

Rule 21A of CGST Rules, 2017 lists out such circumstances or parameters on the basis of which the registration shall stand suspended.

Brief about Rule 21A of CGST Rules, 2017:

According to sub-rule (1) of rule 21A, when any registered person applies for the cancellation of GST registration then the GST registration shall be deemed to be suspended from the date of submission of the application of cancellation or from the date from which the cancellation is sought until the whole cancellation process gets completed. This means that once you file the application for cancellation, the GST number shall be deemed to be suspended from the date of submission of the cancellation application until the cancellation application gets approved and the cancellation order is served to the applicant.

There are a few other circumstances also where the GST department thinks it necessary to suspend the GST registration. Such circumstances are listed below.

When the GST officer has a reason to believe that the GST registration of a person is liable t be cancelled then he may suspend the GST registration until the whole process f cancellation gets completed.

When there are significant differences between the outward supplies furnished in GSTR-1 and GSTR-3B.

When there are significant differences between the ITC taken in GSTR-3b and the details of outward supplies furnished in the GSTR-1 of the suppliers.

Significant contravention of law noticed on comparison of documents by a proper officer which may lead to cancellation of GST registration. Such persons shall be intimated the suspension of their GST registration either electronically on GST common portal or through Email at the address provided by them at the time of registration.

Such notice cum intimation issued by the proper officer contains the differences or anomalies noticed and the assessee is asked to provide justification or clarification as to why his/her registration should not be cancelled.

The person whose registration gets suspended shall not make any taxable supplies during the period of suspension and cannot furnish any returns during the period of suspension. This means that the registered person cannot collect the tax on their outward supplies during the period of suspension.

The registered person whose registration has been suspended shall not be granted a refund during the period of suspension.

As per sub-rule 4 of Rule 21A, the suspension of registration shall be deemed to be revoked upon completion of proceedings by the proper officer.

But, practically it is not getting deemed revoked if the suspension was imposed for non-filing of GST returns. Since the powers to remove the suspension vests are with the jurisdictional Assistant Commissioner, you need to visit the GST department and get it revoked.

Concluding remarks: The suspension of GST registration is generally imposed due to the non-filing of GST registration within the due dates. So, it is a well-accepted practice to file all necessary GST returns on time. Moreover, there are even certain cases where GST registration gets suspended due to filing of “NIL” returns for a continuous period of more than 6 months. So, it is most advisable to take GST registration only when you actually start running the business.

#SuspensionOfGSTRegistration#GSTRegistrationCancellation#GSTRegistrationSuspended#CancellationOfGST#GSTCancelStatus#ApplicationForCancellationOfGSTRegistration

0 notes

Text

Cancellation of GST Registration

The GST registration might be revoked for a variety of reasons. The department may begin the cancellation on its own initiative, or the registered individual may ask for cancellation of GST registration. In the event that a registered individual dies, the legal heirs may petition for cancellation of GST Registration. There is a mechanism for Cancellation of GST registration can be a daunting task, but with this introduction, you'll have a better understanding of what's involved and how to proceed.

For more information - https://setupfilings.com/learn/cancellation-of-gst-registration/

GSTCancellation #GSTRegistrationCancellation #CancelGSTRegistration #RevokingGSTRegistration #GSTCancellationProcess #GSTCancellationProcedure #GSTCancellationGuidelines #CancelGST #CancelGSTRegistrationRequest

0 notes

Photo

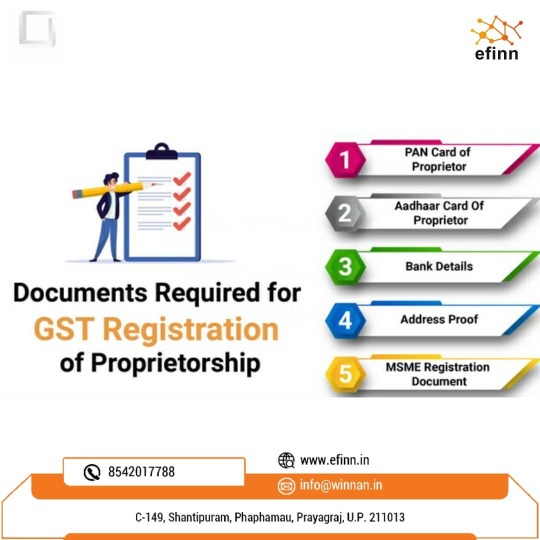

GST REGISTRATION DOCUMENTS... #gstregistrationchennai #gstregistrationprocedure #gstregistrationprocessinhindi #gstregistrationservice #gstregistrationinindia #gstregistrationrequireddocuments #gstregistrationindia #gstregistrationrequirement #gstregistrationcertificate #gstregistrationineastdelhi #gstregistrationinchennai #gstregistrationprocess #gstregistrationindelhi #gstregistration #intags #gstregistrationlimit #gstregistrationservices #gstregistrationcheck #gstregistrationcancellation #gstregistrationfees #gstregistrationonline #gstregistrationforforeigners #gstregistrationservicesinindia #gstregistrations #gstregistrationinjaipur #gstregistrationsolutions #gstregistrationnumber #gstregistrationstatus #gstregistrationconsultant #gstregistrationinguwahati (at प्रयागराज उत्तर प्रदेश) https://www.instagram.com/p/CXc57ETBp0_/?utm_medium=tumblr

#gstregistrationchennai#gstregistrationprocedure#gstregistrationprocessinhindi#gstregistrationservice#gstregistrationinindia#gstregistrationrequireddocuments#gstregistrationindia#gstregistrationrequirement#gstregistrationcertificate#gstregistrationineastdelhi#gstregistrationinchennai#gstregistrationprocess#gstregistrationindelhi#gstregistration#intags#gstregistrationlimit#gstregistrationservices#gstregistrationcheck#gstregistrationcancellation#gstregistrationfees#gstregistrationonline#gstregistrationforforeigners#gstregistrationservicesinindia#gstregistrations#gstregistrationinjaipur#gstregistrationsolutions#gstregistrationnumber#gstregistrationstatus#gstregistrationconsultant#gstregistrationinguwahati

0 notes

Link

GST : Cancellation of GST Registration Part 4 with Ranjan Pathak

Revocation of GST Registration Cancellation

GST Registration Cancellation Forms

Here is a list of forms required for GST cancellation process:

Name of the Form

Form GST REG 16

Purpose :

Cancellation of registration by registered person

Form GST REG 17

Purpose:

For GST Officer to issue show cause notice for cancelling registration

Form GST REG 18

Purpose:

For registered person to reply to show cause notice by registered person

Form GST REG 19

Purpose:

For GST Officer to pass order for cancellation of GST registration by

Form GST REG 20

Purpose:

For registered person to stop the cancellation proceedings based on explanation from Form GST REG 18

Form GST REG 21

Purpose:

For registered person to apply for revocation of cancellation

Form GST REG 22

Purpose:

For GST Officer to pass order for revoking cancellation of GST registration

Revocation of Cancellation of GST Registration:

It is possible to revoke cancellation of GST registration if you act in time. If your registration is cancelled suo-moto by the Proper Officer, you can apply for its revocation by filing Form GST REG 21.

You can file this form within 30 days of service of cancellation order, requesting the officer for revoking the cancellation ordered by him. However, before applying, you need to clear all the defaults due to which registration was cancelled by the officer like filing all pending returns, making payment of all dues and so on. If satisfied, the proper officer will revoke the cancellation by filing Form GST REG 22.

https://www.youtube.com/channe....l/UCpLA1d2SabkUKkrlz

Follow me on Social Media:

1. Facebook : https://www.facebook.com/tax4wealth

2. Linkedin : https://www.linkedin.com/in/tax4-wealth-4aa2b718b/

3. Twitter : https://twitter.com/tax4wealth

4. Tumblr : https://tax4wealth.tumblr.com/

5. Pinterest : https://in.pinterest.com/tax4wealth/pins/

6. Medium : https://medium.com/@bhartichawla27

7. Telegram : https://t.me/tax4wealth

Google Play Store

https://play.google.com/store/apps/details?id=com.future.hellotaxindia&hl=en_IN

▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾

➨ Website:https://tax4wealth.com/

➨ Writes to us: [email protected]

▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾▾

#gst

#cancellationofGSTRegistration

#gstregistrationcancellation

0 notes

Link

#suspension of gst registration#GstRegistrationCancellation#GstRegistrationSuspended#CancellationOfGST#GSTCancelStatus#ApplicationForCancellationOfGSTRegistration

0 notes

Text

Suspension of GST Registration

Introduction:

Nowadays the GST department has come up with all new weapons to mitigate non-compliances under GST. The suspension of registration under GST helps the GST officer to identify the fraud-causing circumstances and prevent it before it actually takes place. There are certain parameters and criteria on the basis of which GST officers suspend GST registration.

Rule 21A of CGST Rules, 2017 lists out such circumstances or parameters on the basis of which the registration shall stand suspended.

Brief about Rule 21A of CGST Rules, 2017:

According to sub-rule (1) of rule 21A, when any registered person applies for the cancellation of GST registration then the GST registration shall be deemed to be suspended from the date of submission of the application of cancellation or from the date from which the cancellation is sought until the whole cancellation process gets completed. This means that once you file the application for cancellation, the GST number shall be deemed to be suspended from the date of submission of the cancellation application until the cancellation application gets approved and the cancellation order is served to the applicant.

There are a few other circumstances also where the GST department thinks it necessary to suspend the GST registration. Such circumstances are listed below.

When the GST officer has a reason to believe that the GST registration of a person is liable t be cancelled then he may suspend the GST registration until the whole process f cancellation gets completed.

When there are significant differences between the outward supplies furnished in GSTR-1 and GSTR-3B.

When there are significant differences between the ITC taken in GSTR-3b and the details of outward supplies furnished in the GSTR-1 of the suppliers.

Significant contravention of law noticed on comparison of documents by a proper officer which may lead to cancellation of GST registration. Such persons shall be intimated the suspension of their GST registration either electronically on GST common portal or through Email at the address provided by them at the time of registration.

Such notice cum intimation issued by the proper officer contains the differences or anomalies noticed and the assessee is asked to provide justification or clarification as to why his/her registration should not be cancelled.

The person whose registration gets suspended shall not make any taxable supplies during the period of suspension and cannot furnish any returns during the period of suspension. This means that the registered person cannot collect the tax on their outward supplies during the period of suspension.

The registered person whose registration has been suspended shall not be granted a refund during the period of suspension.

As per sub-rule 4 of Rule 21A, the suspension of registration shall be deemed to be revoked upon completion of proceedings by the proper officer.

But, practically it is not getting deemed revoked if the suspension was imposed for non-filing of GST returns. Since the powers to remove the suspension vests are with the jurisdictional Assistant Commissioner, you need to visit the GST department and get it revoked.

Concluding remarks:

The suspension of GST registration is generally imposed due to the non-filing of GST registration within the due dates. So, it is a well-accepted practice to file all necessary GST returns on time. Moreover, there are even certain cases where GST registration gets suspended due to filing of “NIL” returns for a continuous period of more than 6 months. So, it is most advisable to take GST registration only when you actually start running the business.

#SuspensionOfGSTRegistration#GstRegistrationCancellation#GstRegistrationSuspended#CancellationOfGST#GSTCancelStatus#ApplicationForCancellationOfGSTRegistration

0 notes