#crypto coin development service

Text

How Do Cryptocurrency Coin Development Services Ensure Coin Liquidity in 2024?

Cryptocurrency coin development services play a crucial role in ensuring the liquidity of new coins in the ever-evolving crypto market. In 2024, as the crypto landscape continues to mature, these services are becoming increasingly sophisticated in their approach to maintaining liquidity. This article explores the key strategies and techniques used by cryptocurrency coin development services to ensure coin liquidity in 2024.

1. Market Making

One of the primary ways in which cryptocurrency coin development services ensure coin liquidity is through market making. Market makers are entities that provide liquidity to a market by continuously buying and selling a particular asset. These entities play a crucial role in maintaining a healthy trading environment by ensuring that there is always a buyer or seller available for a given asset.

Cryptocurrency coin development services often work with market makers to create a liquid market for their coins. Market makers use a variety of strategies to maintain liquidity, including providing competitive bid-ask spreads, managing order flow, and using algorithms to automate trading decisions. By working with market makers, cryptocurrency coin development services can ensure that there is a robust market for their coins, which can help attract investors and traders.

2. Exchange Listings

Another key strategy used by cryptocurrency coin development services to ensure coin liquidity is to secure listings on major cryptocurrency exchanges. Exchange listings can significantly increase a coin's visibility and accessibility, making it easier for investors and traders to buy and sell the coin.

Cryptocurrency coin development services often work closely with exchanges to secure listings for their coins. This process can involve submitting an application, meeting certain criteria set by the exchange, and paying a listing fee. Once a coin is listed on an exchange, it becomes available to a much larger audience, which can help increase liquidity.

3. Liquidity Mining

Liquidity mining is a relatively new concept in the cryptocurrency space that involves incentivizing users to provide liquidity to a market. In exchange for providing liquidity, users receive rewards in the form of additional coins.

Cryptocurrency coin development services can use liquidity mining to help ensure liquidity for their coins. By offering incentives for users to provide liquidity, coin development services can create a more liquid market for their coins, which can help attract investors and traders.

4. Staking

Staking is another strategy that cryptocurrency coin development services can use to ensure coin liquidity. Staking involves locking up a certain amount of coins in a wallet to support the operations of a blockchain network. In exchange for staking their coins, users receive rewards in the form of additional coins.

By encouraging users to stake their coins, cryptocurrency coin development services can help ensure that there is a steady supply of coins available for trading. This can help increase liquidity and create a more stable market for their coins.

5. Community Engagement

Finally, community engagement is crucial for ensuring coin liquidity. Cryptocurrency coin development services need to build a strong community of supporters and users who are actively engaged with the project.

Community engagement can take many forms, including hosting events, creating educational content, and engaging with users on social media. By building a strong community, cryptocurrency coin development services can create a loyal user base that is more likely to buy and hold their coins, which can help ensure liquidity.

Conclusion

Cryptocurrency coin development services use a variety of strategies to ensure coin liquidity in 2024. By working with market makers, securing exchange listings, incentivizing liquidity provision, encouraging staking, and building a strong community, coin development services can help ensure that there is a robust market for their coins, which can attract investors and traders and ultimately contribute to the success of the project.

#Cryptocurrency Coin Development Services#Cryptocurrency Coin Development#Cryptocurrency Coin#Cryptocurrency#crytpo#cryptocurrency development#crypto development

0 notes

Text

Building the Digital Gold of Tomorrow - Nadcab Labs Cryptocurrency Innovation

In the burgeoning digital economy, the creation and management of cryptocurrencies have become pivotal for businesses looking to harness the power of blockchain technology for secure, transparent transactions. Nadcab Labs stands at the forefront of this revolution, offering comprehensive Cryptocurrency Development Services that cater to the intricate needs of modern digital transactions. This article delves into the essence of Nadcab Labs offerings, emphasizing their role in fostering a new era of financial interaction.

At the core of Nadcab Labs services is the development of cryptocurrencies, a process that goes beyond mere coding to encapsulate the vision of a decentralized financial landscape. Cryptocurrencies, or digital currencies, operate independently of traditional banking systems, facilitating peer-to-peer transactions without the need for intermediaries. This not only enhances transaction efficiency but also significantly reduces the cost associated with transfers and exchanges.

Nadcab Labs specializes in the end-to-end development of these digital assets, offering solutions that span from the initial conception of a coin or token to its final deployment. The company's expertise in blockchain technology ensures that each cryptocurrency is built on a secure, immutable ledger, providing an unparalleled level of transaction transparency and security. This commitment to security is critical in an era where digital transactions are increasingly targeted by malicious actors.

A key differentiator for Nadcab Labs is its emphasis on custom solutions. Recognizing that each business has unique needs, the company tailors its cryptocurrency development services to align with specific business models and objectives. Whether it's creating a utility token that grants access to a service or a security token that represents ownership in real-world assets, Nadcab Labs agile development process ensures that the final product resonates with the client's vision.

Furthermore, Nadcab Labs is adept at navigating the regulatory landscape that surrounds digital currencies. The company's comprehensive understanding of global financial regulations enables it to develop cryptocurrencies that are not only innovative but also compliant with legal standards across jurisdictions. This legal acumen is particularly valuable for businesses looking to operate on a global scale, offering peace of mind in a complex regulatory environment.

Integration and efficiency stand as pillars of Nadcab Labs development philosophy. The cryptocurrencies crafted by the company are designed for smooth integration with existing financial systems and applications, ensuring that businesses can seamlessly adopt digital currencies without disrupting their operations. This ease of integration, combined with the efficiency gains from using blockchain-based transactions, positions Nadcab Labs clients at the cutting edge of financial technology.

In conclusion, as the digital economy continues to evolve, Nadcab Labs Cryptocurrency Development Services represent a beacon for businesses seeking to innovate within this space. By offering secure, transparent, and tailored cryptocurrency solutions, Nadcab Labs is not just developing digital currencies; it's paving the way for a new era of financial interaction that promises to reshape the global economy.

#nadcablabs#blockchain#nadcab labs services#blockchain technology#Token Development#crypto coin development services

0 notes

Text

Crypto Coins 101: Understanding the Basics of Development Services

In the ever-expanding universe of cryptocurrencies, the development of digital assets involves a sophisticated process guided by specialized expertise. From crafting the underlying technology to defining economic models, professional development services play a pivotal role in bringing crypto coins to life. This blog serves as a fundamental guide—Crypto Coins 101—to help you comprehend the basics of crypto coin development services and their indispensable role in the intricate world of blockchain technology.

Decoding Crypto Coin Development:

Crypto coin development is the holistic process of creating and launching a digital currency, often referred to as a cryptocurrency or token. This endeavor requires a multifaceted approach, combining technological proficiency, economic modeling, and a deep understanding of the blockchain landscape.

1. Blockchain Technology Expertise:

At the core of crypto coin development services lies a profound understanding of blockchain technology. Blockchain serves as the decentralized ledger that records transactions in a secure and transparent manner. Development services navigate through various blockchain platforms, such as Ethereum, Binance Smart Chain, and others, to choose the most suitable foundation for the new digital currency.

2. Smart Contract Development:

Smart contracts are self-executing contracts with the terms directly encoded into code. They automate and facilitate agreements within a blockchain network. Crypto coin development services excel in crafting secure and efficient smart contracts, enabling a wide range of functionalities from simple token transfers to complex decentralized applications (DApps).

3. Tokenomics Modeling:

Tokenomics is the economic model governing a cryptocurrency. Development services specialize in designing a sustainable tokenomics model that dictates the creation, distribution, and utility of the native tokens. Thoughtful tokenomics is crucial for fostering a thriving ecosystem around the coin.

4. Wallet Development:

User-friendly and secure wallets are instrumental in the adoption and use of a cryptocurrency. Crypto coin development services focus on creating wallets that offer a seamless experience for users to store, manage, and transact with their digital assets while prioritizing security measures to safeguard holdings.

5. Consensus Mechanism Implementation:

The consensus mechanism determines how transactions are validated and added to the blockchain. It is a critical element in ensuring the security and efficiency of the network. Development services guide projects in selecting and implementing the most appropriate consensus mechanism, be it Proof of Work (PoW), Proof of Stake (PoS), or another variant.

Crypto Coins 101: The Development Journey:

Conceptualization:

The development journey begins with a clear concept and vision for the cryptocurrency. This involves defining the purpose, use cases, and target audience, setting the stage for the subsequent development phases.

Technology Selection:

Choosing the right blockchain platform is a crucial decision. Development services evaluate the features and capabilities of different blockchains to select the one that aligns with the project's goals and requirements.

Smart Contract Coding:

Smart contracts are coded to execute the rules and operations of the cryptocurrency. Development services ensure the secure and efficient coding of these contracts, conducting rigorous testing and audits to guarantee functionality.

Tokenomics Design:

Crafting a robust tokenomics model involves deciding on factors such as the total token supply, distribution strategy, and utility within the ecosystem. Development services collaborate with project teams to create a model that fosters long-term value.

Wallet Creation:

The development of user-friendly and secure wallets is a priority. Development services design wallets that offer a seamless and secure interface, ensuring accessibility and ease of use for cryptocurrency holders.

Consensus Mechanism Integration:

The chosen consensus mechanism is implemented to validate and secure transactions on the blockchain. Development services ensure that the mechanism aligns with the security and scalability requirements of the project.

Testing and Quality Assurance:

Rigorous testing and quality assurance processes are conducted to identify and address any vulnerabilities or issues in the system. This phase ensures the reliability and security of the cryptocurrency.

Deployment:

The cryptocurrency is deployed on the chosen blockchain, making it live and accessible to users. Simultaneously, development services engage with the community, fostering awareness and gathering valuable feedback.

Crypto Coins 101: Challenges and Considerations:

Regulatory Compliance:

Navigating the evolving regulatory landscape is a challenge for crypto coin development services. Staying informed about regulatory requirements and ensuring compliance are essential for the project's success.

Security Measures:

Security is paramount in the crypto space. Development services implement robust security measures, conduct regular audits, and adhere to best practices to safeguard the cryptocurrency against potential threats.

Conclusion: The Foundations of Crypto Coins 101

As we explore the basics of crypto coin development services, it becomes evident that these professionals are the architects of the digital financial landscape. Their expertise in blockchain technology, smart contract development, and economic modeling forms the bedrock of new cryptocurrencies. Through a journey of conceptualization, technology selection, and meticulous coding, crypto coin development services unlock the potential for innovative and secure digital assets that shape the future of finance. Crypto Coins 101 is not just an introduction; it's a glimpse into the dynamic and transformative world where possibilities are coded into the fabric of decentralized innovation.

0 notes

Photo

IEO Development Company

Initial Exchange Offering (IEO) is a new method of crypto crowdfunding where issuers develop tokens for their business and raise funds using the user base of the exchange. It is administered by the crypto exchange on behalf of a token issuer. If you wish to raise funds through IEO, you require a team of expert blockchain developers. So you can connect with a trustworthy IEO development company. Check here >>> https://bit.ly/3SHPeNe

#IEO Development company#Crypto crowdfunding#IEO Development services#launch an ICO#initial coin offering#crowdfunding

0 notes

Text

Now you can Create your Own Cryptocurrency exchange and allow users to sell, buy, and trade coins. A cryptocurrency is a digital platform where users are allowed to list, mint, sell buy, trade digital assets like crypto tokens.

#Cryptocurrency coin development#Cryptocurrency Coin Development Services#Create Crypto Coin#Create your Own Cryptocurrency#Coin development company#crypto coin developer

0 notes

Text

How Can Cryptocurrency Coin Development Services Help with Roadmap Creation?

In the rapidly evolving landscape of cryptocurrency and blockchain technology, having a well-defined roadmap is crucial for the success of any project. A roadmap not only provides a clear direction for the development team but also instills confidence in investors and users about the project's future. Cryptocurrency coin development services play a vital role in creating a roadmap that aligns with the project's goals and vision. Let's explore how these services can help with roadmap creation.

Understanding the Project Vision and Goals

The first step in creating a roadmap is to understand the project's vision and goals. Cryptocurrency coin development services work closely with the project team to gain a deep understanding of what the project aims to achieve. This involves analyzing the market, identifying target audiences, and defining the unique selling points of the project.

Market Research and Analysis

Cryptocurrency coin development services conduct extensive market research to identify trends, competition, and potential challenges. This research helps in creating a roadmap that is realistic and achievable. By understanding the market dynamics, development services can tailor the roadmap to capitalize on opportunities and mitigate risks.

Technology Assessment and Planning

Developing a cryptocurrency involves complex technical considerations. Cryptocurrency coin development services assess the technology stack required for the project and plan the development process accordingly. This includes choosing the right blockchain platform, consensus mechanism, and smart contract development.

Roadmap Design and Timeline Setting

Based on the project's vision, goals, market research, and technology assessment, cryptocurrency coin development services design a detailed roadmap. The roadmap includes key milestones, such as token launch, platform development stages, marketing initiatives, and community engagement activities. Setting realistic timelines is crucial to ensure that the roadmap is achievable and can be followed effectively.

Budgeting and Resource Allocation

Creating a roadmap also involves budgeting and resource allocation. Cryptocurrency coin development services help in estimating the costs involved in the development process, including technology, marketing, legal, and operational expenses. They also assist in allocating resources efficiently to meet the roadmap milestones within the budget constraints.

Risk Management and Contingency Planning

Roadmap creation involves identifying potential risks and developing contingency plans to mitigate them. Cryptocurrency coin development services help in identifying technical, regulatory, and market risks that could impact the project's success. They work with the project team to develop strategies to address these risks and ensure the project stays on track.

Community Engagement and Feedback Incorporation

Community engagement is vital for the success of any cryptocurrency project. Cryptocurrency coin development services help in engaging with the community through social media, forums, and events. They gather feedback from the community and incorporate it into the roadmap to ensure that the project meets the needs and expectations of its users.

Continuous Monitoring and Updates

Creating a roadmap is not a one-time process; it requires continuous monitoring and updates. Cryptocurrency coin development services work with the project team to track progress against the roadmap milestones and make necessary adjustments. This ensures that the roadmap remains relevant and achievable throughout the project lifecycle.

Conclusion

In conclusion, cryptocurrency coin development services play a crucial role in creating a roadmap that guides the development and success of cryptocurrency projects. By understanding the project vision, conducting market research, assessing technology requirements, and managing risks, these services help in creating a roadmap that is realistic, achievable, and aligned with the project's goals. With their expertise and support, cryptocurrency coin development services can significantly enhance the chances of success for cryptocurrency projects.

#Cryptocurrency Coin Development Services#Cryptocurrency Coin Development#Cryptocurrency Coin#Cryptocurrency#crypto#crypto coin development#crypto coin development services

0 notes

Text

Tokenizing the Future - A Comprehensive Guide to ERC-20, SPL, and XRC20 Standards

In the rapidly evolving digital world, the concept of digital assets, particularly in the form of crypto tokens, has taken center stage, marking a transformative era in the realm of blockchain technology. These digital assets, which are integral to Blockchain Token Development Services, are not just redefining transactions but also reshaping how we perceive value and ownership in the digital age.

At the core of this revolution is the ERC-20 standard, a beacon in the landscape of token development. Renowned for its versatility and wide acceptance, ERC-20 tokens have become a synonym for efficiency and compatibility within the blockchain ecosystem. This standard is universally supported by all EVM (Ethereum Virtual Machine) chains, including prominent names such as Binance Smart Chain, Polygon, and Avalanche. This universal compatibility not only streamlines the process of Token Development Services but also ensures that a token can thrive on various platforms without encountering interoperability issues.

On the other hand, the Solana blockchain ecosystem offers an alternative avenue for token creation, known as SPL tokens. Tailored specifically for Solana's architecture, these tokens leverage the blockchain's high throughput and low transaction costs, making them an attractive option for developers seeking efficiency and speed in their Crypto Token Development Company endeavors.

Additionally, the XDC Network has introduced its own token standard, the XRC20. This standard is designed to encapsulate the essential functionalities of fungible tokens, ensuring that tokens on the XDC Network maintain a consistent and reliable form of value transfer.

Creating an ERC-20 token is surprisingly straightforward, a fact that has significantly contributed to its popularity. The simplicity of launching a token on this standard has democratized access to Crypto Coin Development Services, allowing even those with minimal technical background to partake in the digital asset revolution. This accessibility is crucial, as it empowers a broader range of individuals and organizations to innovate and contribute to the blockchain space.

When discussing the ERC-20 standard, it's worth noting its unique position in the blockchain domain. This standard has effectively set a benchmark for token development, offering a balanced blend of flexibility, ease of use, and widespread acceptance. As a result, ERC-20 has become the go-to framework for creating tokens compatible with Ethereum and other EVM-compatible chains, epitomizing the universal language of digital assets across diverse blockchain platforms.

In conclusion, the landscape of blockchain token development is rich and varied, offering multiple avenues for creators and innovators. Whether it's the universal appeal of the ERC-20 standard, the specialized efficiency of SPL tokens on Solana, or the unique characteristics of the XRC20 standard on the XDC Network, developers are spoilt for choice. These diverse platforms not only cater to a wide range of needs and preferences but also collectively enrich the blockchain ecosystem, fostering an environment of innovation, collaboration, and continuous growth. As the blockchain domain continues to evolve, these token standards will undoubtedly play pivotal roles in shaping the future of digital transactions and asset management.

#nadcablabs#blockchain#Crypto Token Development Company#Token Development Company#Crypto Coin Development Services

0 notes

Text

CRYPTOCURRENCY LAUNCHPAD DEVELOPMENT SERVICES COMPANY IN DELHI

The Crypto Launchpad- A New Way of Launching Your ICO in the Most Inclusive and Successful Way

The Beginning of a New Generation in Crypto Innovation

Blockchain technology is one of the most promising innovations to disrupt the traditional business and finance sectors.

As a result, there has been an increase in companies that are looking for cryptocurrency development services. Services like these help make cryptocurrencies more accessible to investors, merchants, and other companies.

CRYPTO LAUNCHPAD DEVELOPMENT SERVICES [Nadcab Technology] is one such company that offers services for companies who are looking to implement blockchain technology on their products or platforms.

Crypto innovation is now a global phenomenon. With numerous cryptocurrency-related products and services coming in, it’s becoming more difficult for anyone to compete with the emerging market.

Our company offers an ICO development service that is specifically designed for startups and growing businesses looking for solutions to help them increase their exposure and raise money through ICO fundraising.

How to Choose the Best Launchpad Offering for Your ICO?

When you are launching an ICO, you should be looking for a development team that can provide the best services to meet your needs. There are many development teams out there, but when it comes to quality, you should only go for the best and CRYPTO LAUNCHPAD offers the highest quality services.

CRYPTO LAUNCHPAD offers full-lifecycle development of ICOs. They offer breakthrough product design, custom blockchain architecture, and smart contract development in order to ensure that your ICO is successful. We make sure that your token's security is solid and scalable from day one with our upcoming product called CRYSTAL which will be finished by mid-2019.

Crypto Launchpad is a premium cryptocurrency development company with over 10 years of experience in the crypto industry. Our team is Nadcab Technology, which is the best in this field.

Why You Should Use a Crypto Launch Pad Service?

You should use a crypto launch pad service to create content and deliver value to your community. This includes providing articles and videos that showcase your product or service, it also includes plans for ways to raise funds, boost branding, and much more.

A crypto launch pad can help a company really stand out in the space. It doesn't just provide a service that's going to benefit you - it also provides you with an opportunity for new ideas, content ideas, strategies, and more.

Crypto launch pads are like an online business accelerator for digital currency ventures. They make sure that you're able to create great content consistently - without having to worry about the process required for creating it on your own.

Crypto launch pad development services provide tools and services to help companies create their own cryptocurrency. They include legal, marketing, technical and design-related expertise.

How to Choose the Best Crypto Launchpads?

Launchpads are service websites that offer multiple services for cryptocurrency enthusiasts. These services include cryptocurrency exchange platforms, token sales, and ICOs services.

Some of the platforms that work as crypto launchpad development services can be found here. The first service on this list is CoinLaunch, which offers their own ICO development platform. Next are Nadcab Technology which offer their own token sale service platform. Other services for sale are listed below:

Crypto Launchpad Development Services

Launching an ICO

Token Sale

Exchange Service

ICO Consulting

Before a company chooses a crypto launchpad development company, they should ask themselves some questions first. They need to decipher whether it is worth choosing that particular crypto launchpad or not.

1. Does the company have a good portfolio of past projects?

2. What are the pricing plans and packages offered?

3. How much does the company charge per project?

4. Would this be the best option for my business or would there be other better options for me to choose from?

5. What are the pros and cons of this particular service?

6. Does the company charge you by hours or by features provided to you as an organization.

Conclusion:

In order to choose the right partner for an ICO launchpad, you need to consider all of your options. Here are some guidelines that can help you find the best possible partner for your project.

1. Market

It is important to look at who is already working in the market that you want to enter - and if they have a product or service that is relevant for your project

2. Offer & Partners

Look at what the companies are offering and see how long they have been in business and what they’ve done before

3. Feedback & Service Quality

Look at how well their reviews on different platforms such as Google, Facebook and LinkedIn

4. Reputation of providers

Check if a provider has a good reputation on social media with customers

#CRYPTO LAUNCHPAD DEVELOPMENT COMPANY IN DELHI#BEST CRYPTOCURRENCY COIN LAUNCHPAD DEVELOPMENT SERVICES IN DELHI#LAUNCHPAD DEVELOPMENT COMPANY IN DELHI#Cross-Chain Launchpad DEVELOPMENT IN DELHI

0 notes

Text

Dunitech provides DeFi development solutions If you're here, we assume you're aware of how beautifully the financial world has evolved over the last few years! DeFi, or Decentralized Finance, is a key component in bringing about this change. It employs cutting-edge technology to eliminate third-party intermediaries such as financial institutions, banks, and others from the transaction process. It is built on secure distributed ledgers, similar to those found in cryptocurrencies. We operate all over the world and have established ourselves as one of the most recent defi development companies in Delhi.https://www.dunitech.com/Defi-Yield-Farming-Development.aspx

#defi crypto#defi protocols#defi development#defi development company#web development services company#defi development services#best defi coin#defi blockchain#defi platforms#defi token development#defi yield farming platform development#defi yield farming development services

0 notes

Text

Tokenshype - Devasa+ (2)

We highly recommend you a very ambitious site at the point of offering special content with its expert staff who are active in Crypto coin information and analysis. With the Crypto airdrops section, it is distinguished from other sites in a way that makes a difference. While the number of members on the site is increasing day by day, the site always continues to update and develop itself.

When the new token is mentioned, the site again reveals its originality. Last-second developments and updates are always contained within. In the Algo trade section, you are hosted for a professional experience with special analyzes. In this special investment area, which has a very dynamic structure, the site offers a service that is at least as sensitive as your money and time are valuable. You can start the experience by signing up and logging in right away. Then you can look to earn more.

1K notes

·

View notes

Text

In the fall of 2020, as crypto scammers and thieves began to realize the full potential of a financial privacy tool called Tornado Cash—a clever new system capable of shuffling users' funds to cut the trail of crypto transactions recorded on the Ethereum blockchain—Alexey Pertsev, one of the creators of that service, sent a note to his fellow cofounders about this growing issue. He suggested crafting a standard response to send to victims pleading with Tornado Cash for help with stolen funds laundered through their service. “We must compose a message that we will send to everyone in similar cases,” Pertsev, the then-27-year-old Russian living in the Netherlands, wrote to his colleagues.

Tornado Cash cofounder Roman Semenov answered three minutes later with a draft of their stock response—essentially pointing to the fact that the service's novel design meant it ran on the Ethereum blockchain, not on any server they owned, and was thus out of their hands. “It is a decentralized software protocol that no one entity or actor can control,” the message read. “For that reason, we are unable to assist with respect to any issues relating to the Tornado Cash protocol.”

That statement would remain Tornado Cash's position two days later when hackers affiliated with the North Korean government stole roughly $275 million worth of coins from the crypto exchange KuCoin and funneled a portion of the loot through Tornado Cash to cover their tracks. Tornado Cash would maintain that stance as, according to Dutch prosecutors, a billion-plus dollars more of stolen funds flowed through the service over the next two years, part of at least $2.3 billion in total funds from criminal and sanctioned sources that made up more than 30 percent of the service's overall transactions from 2019 to 2022.

Now, two years after Pertsev's arrest and indictment for money laundering, that “out-of-our-hands” decentralization defense has become one of the central arguments for his innocence. On Tuesday, it will be put to the test when a panel of three Dutch judges rules on the criminal charges that could send Pertsev to prison for years. Privacy advocates believe the result of the case—the first of two, as the New York prosecution of another Tornado Cash cofounder, Roman Storm, is expected to go to trial this coming September—could also shape the future of cryptocurrency privacy and may determine the limits of services like Tornado Cash or other open source software creations to offer a safe haven from financial surveillance.

Dutch prosecutors have accused Pertsev of essentially creating the perfect money laundering machine by designing Tornado Cash to work as a set of “smart contracts”—a type of decentralized service made possible by Ethereum's unique features, in which code is copied to the thousands of Ethereum nodes that store the cryptocurrency's blockchain—and thus preventing Tornado Cash's creators from identifying or controlling who used the service to hide the origins and destinations of their funds.

Pertsev's defenders, on the other hand, point out that those properties are also exactly what makes Tornado Cash such a powerful tool for privacy. “This is the entire point of a decentralized system,” says Sjors Provoost, a Dutch cryptocurrency developer and author of Bitcoin: A Work in Progress, who attended Pertsev's trial. “These are completely clashing worldviews. There's the worldview of privacy and decentralization, and there's the government worldview of surveillance, in which you need to be able to check every transaction.”

Since US and Dutch prosecutors indicted Tornado Cash's cofounders and the US Treasury sanctioned the service in 2022, the case has become a cause célèbre in some cryptocurrency circles, many of whose adherents argue that a guilty verdict could not only damage financial privacy but also set a dangerous precedent that developers of open source software can be held liable for the actions of those who use their tools. Ethereum's inventor, Vitalik Buterin, has noted publicly that he used Tornado Cash to anonymize a donation to Ukraine following Russia's invasion, as an example of the service's legitimate use for privacy. US National Security Agency whistleblower Edward Snowden has compared Tornado Cash's functioning on the Ethereum's blockchain to a water fountain built in a park—a kind of public utility where “you push a button and privacy comes out”—and has called the crackdown on Tornado Cash and its cofounders “deeply illiberal and profoundly authoritarian."

Yet the Dutch prosecutors and Netherlands' financial law enforcement agency, known as FIOD, which led the investigation of Pertsev, argue that the case isn't actually about a fundamental conflict between privacy and security, or liability for open source code, or any other larger principle. Instead, they say, it's about Pertsev's specific, informed decisions to enable thieves on an enormous scale. “It's all about the choices of our suspect,” M. Boerlage, the case's lead prosecutor, tells WIRED in an interview. “He made choices writing the code, deploying the code, adding features to the ecosystem. Choice after choice after choice, all while he knew that criminal money was entering his system. So it's not about code. It's about human behavior.”

A Room Without a Lock—or Walls

Dutch prosecutors contend that, despite the Tornado Cash creators' claims, they did exert control over it. Aside from its decentralized “smart contract” design, they point to Tornado Cash's web-based user interface for interacting with its blockchain-based smart contract: a fully centralized tool running on infrastructure the creators built and managed, which nonetheless had no monitoring or safeguards to prevent its abuse by criminals for money laundering. In fact, prosecutors found that during the time of their investigation, 93.5 percent of users sent their transactions to Tornado Cash through that web interface, which was far simpler to use than directly interacting with the blockchain-based service.

Pertsev's defense didn't respond to WIRED's repeated requests for an interview. But his lead defense attorney, Keith Cheng, has countered that there would have been no point in monitoring or blocking users on that web interface when anyone could circumvent the website altogether to interact directly with the smart contract or even to build their own interface. “The Tornado Cash smart contracts could be accessed directly at any point of time,” Cheng told an audience at the ETHDam cryptocurrency conference in Amsterdam last year. “Implementing checks within the surrounding infrastructure is akin to adding extra locks to a door that lacks surrounding walls.”

The prosecution points out that Tornado Cash could have at least tried to put locks on that door, given that the vast majority of their users, both legitimate and criminal, were walking through it. More fundamentally, they argue that it was Pertsev's decision to put into place a system that he knew from the start would include basic elements he couldn't control. “Building and deploying something unstoppable is also a decision,” says Boerlage.

That question of decentralization and control nonetheless makes the Tornado Cash case a far less straightforward prosecution than those against the founders of simpler bitcoin-based “mixer” services like Bitcoin Fog or Helix, which were similarly intended to prevent cryptocurrency tracing. In each of those earlier cases, the administrators—now both convicted of money laundering conspiracy—hid their connections to the services. By contrast, Pertsev and his cofounders appear to have been confident enough in their remove from the money launderers who used Tornado Cash that they operated fully in the open, under their real names. “This complete transparency does not exactly indicate criminal activity,” Pertsev's attorney Cheng told ETHDam.

At the same time, the prosecution argues that Pertsev was both aware of and untroubled by the millions and ultimately billions of dollars in stolen cryptocurrency flowing through Tornado Cash, which reached a peak in the spring of 2022. They argue that Pertsev continued to maintain and develop pieces of the system—such as its centralized frontend—even as the service was used to launder the stolen funds from 36 distinct cryptocurrency heists, many of which prosecutors say he and his cofounders discussed in their communications. In the meantime, he also profited handsomely, in part from Tornado Cash's issuing its own crypto token, ultimately making more than $15 million and buying himself a Porsche.

When North Korean hackers stole more than $600 million from the blockchain-based game Axie Infinity in March of 2022, Tornado Cash cofounder Semenov wrote anxiously to Pertsev and Storm that “the fucking disaster is about to begin,” perhaps fearing that their service would be used by the perpetrators of that massive heist, as it already had been in well over a dozen others. Pertsev weighed in 10 minutes later, writing “noticed after 5 days, lol," an apparent reference to how long it seemed to have taken Axie Infinity to discover the theft. Sure enough, less than a week later, hundreds of millions of dollars in stolen Axie Infinity funds began to pour into Tornado Cash.

Prosecutors have pointed to Pertsev's “lol” as a sign of his flippant disregard for the victims whose funds, they argue, he was helping to launder. His defense has countered that he was merely expressing surprise.

That same month, perhaps in response to the growing spotlight on Tornado Cash's use by criminals, Pertsev and his cofounders did, in fact, implement a free tool from blockchain analysis firm Chainalysis that would block transactions from sanctioned Ethereum addresses via their web interface. The prosecution has pointed out that the free tool was easily circumvented—hackers could merely move their stolen coins to a different address before sending them into Tornado Cash—and described the effort as “too little and too late."

In their statement to the court, Dutch prosecutors suggest a different solution, if Pertsev had actually cared about Tornado Cash's exploitation by criminals. “What was the simplest option? Take the UI offline and stop advertising. Plain and simple,” they write. “Stop offering the service.”

In the conclusion of that same statement to the court, they point out that under Dutch law the maximum prison sentence for money laundering at the scale Pertsev allegedly committed is eight years, and they ask that Pertsev be sentenced to five years and four months if he's found guilty.

The Tornado Rolls On

Cryptocurrency advocates focused on privacy and civil liberties will be closely watching the outcome of Pertsev's case, which many see as a bellwether for how Western law enforcement and regulators will draw the line between financial privacy and money laundering—including in some immediate cases to follow.

The US trial of Tornado Cash's Storm in a New York court later this year, as well as the US indictment last month of the founders of Samourai Wallet, which prosecutors say offered similar privacy properties to Tornado Cash's, are more likely to directly set precedents in US law. But Pertsev's case may suggest the direction those cases will take, says Alex Gladstein, the chief strategy officer for the Human Rights Foundation and an advocate of bitcoin's use as a human rights tool.

“What happens in the Netherlands will color the New York case, and the Tornado Cash cases are really going to color the outcome of the Samourai case,” Gladstein says. “These cases are going to be historic in the precedents they set.”

Gladstein, like many crypto privacy supporters, argues that anyone weighing the value of tools like Tornado Cash should look beyond its use by hackers to countries like Cuba, Venezuela, and India, where activists and dissidents need to hide their financial transactions from repressive governments. “For human rights activists, it’s essential that they have money the government can’t surveil,” Gladstein says.

Regardless of the verdict in Pertsev's case or that of his cofounder Roman Storm in the fall, Tornado Cash's founder's core argument—that Tornado Cash's underlying infrastructure has always been out of their hands—has proven to be correct: Tornado Cash lives on.

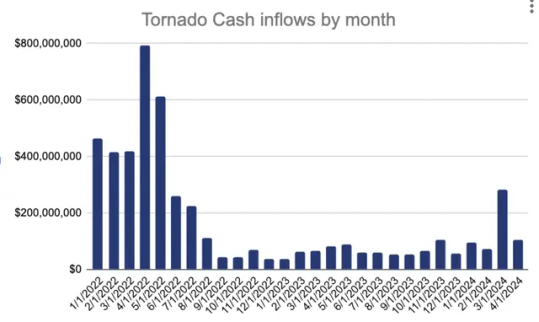

True to its promise of decentralization, Tornado Cash still persists after its cofounders indictment in the fall of last year—and is now out of their control. In March, $283 million flowed into the service. Courtesy of Chainalysis

When the tool's centralized web-based interface went offline last year in the wake of US sanctions and the two cofounders' arrests—Roman Semenov, for now, remains free—Tornado Cash transactions dropped by close to 90 percent, according to Chainalysis. But Tornado Cash has remained online, still functioning as a decentralized smart contract. In recent months, Chainalysis has seen its use tick up again intermittently. More than $283 million flowed into the service just in March.

In other words, whether it represents a public utility for financial privacy and freedom or an uncontrollable money laundering machine, its creators' claim has borne out: Tornado Cash remains beyond their control—or anyone's.

9 notes

·

View notes

Text

"The thing that we used to call AI in sci-fi we now call AGI, or Artificial General Intelligence, because what we now call AI is not actually AI, it's sort of a sophisticated mashup machine that's been sold as the future of technology and humanity by people whose favourite thing is selling the thing they haven't invented yet. So, [Sam Altman has] been hailed as a genius mainly for stuff that he hasn't done yet but says will happen soon, and no one's willing to lose the possibility that he might still do it. So far, I think the market has been very credulous about the claims of these tech bros because the future seems cool and no one wants to miss investing in the next, better mouse trap. The problem is that the tech industry as a whole does not want to build a better mouse trap, they want to pitch a mouse trap app that they dreamed up while microdosing Absinthe in the desert to get VC funding within six months and then retire having built nothing but taking the credit for fundamentally disrupting the mousetrap industry using an AI-enabled crypto-blockchain which you can use to mint unique mouse coins, each coin stably tethered to one individual dead mouse's DNA, and you ask them what the core service of their app is and it turns out it's just a taxi that you call and then they drive by and throw an angry cat in your window, and then you rank the cat by customer service, general fluffiness, and mouse-killing ability, but now the app's only being used by Nazis and incels to throw cats through the windows of women they don't like because the developers did not think through any of the possible ways in which their service could be misused, and now cats with low fluffiness ratings are killing themselves because the app's given them a self-esteem problem. And that's the tech industry right now."

- Alice Fraser, The Bugle episode 4283, November 24, 2023

15 notes

·

View notes

Text

#Cryptocurrency coin development#Cryptocurrency Coin Development Services#Create Crypto Coin#Create your Own Cryptocurrency#Coin development company#crypto coin developer

0 notes

Text

How Can Businesses Evaluate The ROI of Coin Development Services?

In today's digital age, the cryptocurrency market is booming, with new coins and tokens being launched regularly. For businesses looking to capitalize on this trend, developing their own coin can be an enticing prospect. However, before diving headfirst into coin development services, it's essential to understand how to evaluate the return on investment (ROI) of such a venture. In this comprehensive guide, we'll explore the key factors businesses should consider when assessing the ROI of coin development services.

Define Clear Objectives: Before embarking on any coin development project, it's crucial to establish clear objectives. Ask yourself why you want to create a coin and what you hope to achieve with it. Are you looking to raise funds through an initial coin offering (ICO), streamline transactions within your ecosystem, or incentivize user engagement? Defining your goals will provide a framework for evaluating the success of your coin project.

Cost Analysis: Developing a coin involves various costs, including initial development expenses, marketing and promotion, legal compliance, and ongoing maintenance. Conduct a comprehensive cost analysis to understand the financial implications of coin development. Compare these costs to the potential benefits and revenue streams to determine whether the investment is justified.

Market Research: Evaluate the market demand and competition in your industry before launching a new coin. Is there a genuine need for your coin, or is the market saturated with similar offerings? Analyze consumer preferences, trends, and competitor strategies to assess the viability of your coin project.

Technical Feasibility: Consider the technical aspects of coin development, such as blockchain technology, smart contract implementation, and security protocols. Partnering with a reputable coin development service provider is essential to ensure the technical feasibility and integrity of your coin project. Conduct thorough due diligence to select a reliable partner with a proven track record in blockchain development.

Regulatory Compliance: Cryptocurrency regulations vary significantly across jurisdictions, and non-compliance can result in severe consequences for businesses. Evaluate the regulatory landscape in your target market and ensure that your coin project complies with relevant laws and regulations. Consult legal experts with expertise in cryptocurrency compliance to navigate the regulatory complexities effectively.

Community Engagement: Building a strong and engaged community around your coin is vital for its success. Evaluate the potential for community engagement by assessing factors such as social media presence, online forums, and developer support. Engage with your target audience early in the development process to gather feedback and generate interest in your coin project.

Monetization Strategy: Consider how you plan to monetize your coin project beyond the initial development phase. Will you generate revenue through transaction fees, token sales, or value-added services? Evaluate the scalability and sustainability of your monetization strategy to ensure long-term profitability.

Risk Management: Every investment carries inherent risks, and coin development is no exception. Evaluate the potential risks associated with your coin project, such as market volatility, regulatory uncertainty, and security vulnerabilities. Develop a risk management strategy to mitigate these risks and protect your investment.

Track Key Performance Indicators (KPIs): Once your coin project is live, monitor key performance indicators (KPIs) to track its success and ROI. Common KPIs for coin projects include transaction volume, user adoption, market capitalization, and community engagement metrics. Regularly analyze these KPIs to identify areas for improvement and optimize your coin project's performance.

Iterative Improvement: The cryptocurrency market is constantly evolving, and successful coin projects adapt to changing market dynamics. Embrace a mindset of continuous improvement and iteration to enhance the value proposition of your coin over time. Solicit feedback from users, developers, and stakeholders to identify opportunities for innovation and growth.

Conclusion

Evaluating the ROI of coin development services requires a comprehensive analysis of various factors, including clear objectives, cost analysis, market research, technical feasibility, regulatory compliance, community engagement, monetization strategy, risk management, KPI tracking, and iterative improvement. By carefully considering these factors and making informed decisions, businesses can maximize the potential ROI of their coin projects and position themselves for success in the dynamic cryptocurrency market.

0 notes

Text

BitNest is a decentralized finance (DeFi) platform based on blockchain technology that aims to build a transparent, accessible and inclusive financial ecosystem.

Through decentralized applications (DApps), the platform enables users to circulate funds, borrow and invest without relying on traditional intermediaries. BitNest aims to democratize financial services through innovative blockchain technology, thereby making them more global and borderless.

Core features and functions

Decentralization: BitNest is committed to removing the controls and restrictions of the centralized financial system and providing a decentralized network based on blockchain that allows all users to directly participate in financial activities.

Financial Products and Services: The Platform provides a variety of financial services, including but not limited to:

BitNest Loop: A decentralized lending platform that allows users to lend or borrow cryptocurrencies, increasing liquidity in the market.

BitNest Savings: Users can deposit digital assets to earn interest, similar to savings accounts at traditional banks.

BitNest Lending: Provides a mortgage lending service that allows users to obtain loans against crypto assets.

Mellion Coin (MEC) : BitNest's native cryptocurrency is used to pay platform fees, participate in governance and reward systems. Mellion Coin is a medium that enables circulation and value transfer within the BitNest platform.

BitNest DAO: A decentralized, autonomous organization that allows Mellion Coin holders to vote on the future direction and updates of the platform. This enhances the community's sense of participation and control over the development of the platform.

Security and transparency: BitNest uses blockchain technology to guarantee the security and transparency of all transactions, ensuring the reliability of user operations and the immutability of data.

User friendliness: Despite being based on complex blockchain technology, BitNest strives to provide a clean and concise user interface that makes its services easy to use regardless of technical proficiency.

With these services and features, BitNest hopes to remove the barriers in traditional financial services and provide users worldwide with freer and fairer access to financial services.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

5 notes

·

View notes