#commodity broker power

Text

Historically (Required) Speaking (Reading)

There are a couple of things I have done over the last three years while making those nearly 900 Evernote entries.

First, I got sick of constantly poking at Amazon Kindle’s web interface to sort books into groups, so I created a Bookwyrm account. The content there is sort into sensible categories. You would do well to note that I’ve read Heuer’s Psychology of Intelligence Analysis and the collaboration followup Structured Analytical Techniques for Intelligence Analysis. They aren’t available in book form, but the I’ve read all of the Occasional Papers from the Sherman Kent Center for Intelligence Analysis. Analytical pathology at a nation state level is understood to be a hazard, but it’s STILL something we seem unable to escape.

This is the grown ups table, your presence here is elective. You are free to close this tab and find something less demanding.

I revisited William Gibson’s Blue Ant trilogy, read both Peripheral and Agency, and then watched the marvelous Amazon original The Peripheral. I can also put in a strong recommend for Humans and The Feed. And if you have never read The Invisibles, you’d best get cracking. Talking With Gods would make a good intro to Grant Morrison’s work.

There is one prior project of mine that comes anywhere near the scope of what I intend here. Way back in 2011 when I first read The Invisibles and every single thing I could find by or about Jane McGonigal, without putting a lot of thought into it, I launched the Conspiracy Brokers. Below is the first post, reproduced in full.

Conspiracies Are Commodities

What do you know about conspiracies? I mean what do you truly know?

There are a lot of people who read about them, some who have varying level of skill in finding them, but never before has anyone revealed the shadowy world market where they are traded, the secret system whereby global elites purchase the things they need to shape world events.

We’ll get into that soon enough, but first let’s understand exactly what a conspiracy really is.

The dictionary has this to say as to the definition:

an evil, unlawful, treacherous, or surreptitious plan formulated in secret by two or more persons; a plot.

While correct, this definition is incomplete. A power player in this market would tell you that a conspiracy has the following attributes:

It can be real or fake

It can be concealed, secret, or public

It has a number of people involved

It has a number of people who both believe and disbelieve

It has an amount of time it spent in each of the three secrecy levels

Those are the fundamental attributes of a conspiracy. Next time we’ll talk a little bit about how to determine if a conspiracy is genuine, or if it’s a clever hoax. That’s not a black and white thing; some times a well done fake escapes control of its operators and becomes very real.

youtube

We’re working up to something here. This is the fourth installment in this series. Previously we’ve had:

Shall We Play A Game – Introducing Tactics, Techiques & Procedures

Mood Music – Atmospherics & Musical Influences

Time In A (Klein) Bottle – More Temporal Tools

The Kookpocalypse was the only admitted Conspiracy Brokers operation. Therein you’ll find the first time I ever mentioned the concept of a hypersigil. This time I’ve put a little more thought into things, while making no allowances for those whose brain chemistry or character are such that they misinterpret or intentionally misuse my work.

11 notes

·

View notes

Text

Editor's note: This is a translation of a piece that was originally published in German in Martin Meyer and Georg Häsler (eds.), “Sicherheitspolitik Schweiz: Strategie eines globalisierten Kleinstaats,” (Zürich: Schweizerisches Institut für Auslandsforschung, February 2024).

It is not difficult to list the contributions that Switzerland could make to Europe’s security; what is more interesting is the question of why it should do so. But one thing at a time.

Recently, Swiss journalist Roger de Weck told the Neue Zürcher Zeitung that his country is “the niche […] where things happen that are forbidden elsewhere.” The Swiss criminal law professor and corruption hunter Mark Pieth describes this somewhat whimsically as the “pirates’ harbor.” The aspects of Swiss politics they are referring to are well-known and regularly scrutinized in the established Swiss media. Their critique goes well beyond an understanding of neutrality that is increasingly alienating Switzerland’s neighbors and which—by way of example—prohibits even democratic neighbors from passing on armaments produced by former Swiss companies to a Ukraine fighting against a brutal aggressor.

Switzerland, which likes to see itself as a storm-tossed island of the blessed, is in reality the world’s largest (and very tolerant) offshore financial center. It has long been a hub for the global commodities trade and a huge magnet for seemingly endless flows of less-than-licit data, money, goods, and people that make up the dark underbelly of globalization. All of this is served by a dense and anything-but-transparent network of lawyers, consultants, and brokers.

Even before the Russian attack on Ukraine on February 24, 2022, this state of affairs was a nuisance to many other states. But in the context of Europe’s greatest security crisis since 1945, it allows the Kremlin to undermine Western sanctions (which Switzerland is at least participating in), thereby potentially prolonging the war. In geo-economic terms, this makes Switzerland a critical vulnerability in Europe’s security policy.

There are plenty of concrete proposals to close this security gap. Switzerland could create a supervisory authority for commodities trading; or even better, become part of international monitoring efforts. The G7 countries and the European Union would like to see Switzerland make more of an effort to close loopholes in the prosecution of sanctions-breakers; they are also calling for Bern to join the international REPO (Russian Elites, Proxies and Oligarchs) task force, which tracks down Russian kleptocrats’ hidden assets. After all, the Swiss Bankers Association itself estimates that at least 150 billion Swiss francs (approximately $171 billion) of Russian assets are held in Swiss accounts.

That leaves the question of why. Swiss media have a rather conspicuous habit of theorizing about “enormous pressure” from abroad. It is a bit reminiscent of Berlin, where policymakers or politicians often invoke “constraints” (circumstances, allies, norms) compelling them to act. And the Swiss banking secret was indeed brought down by the U.S. Treasury a decade ago.

And yet why would such a rich and powerful country, one of the 20 largest economies in the world and currently a non-permanent member of the U.N. Security Council, pretend that it is so much smaller and weaker than it is? Especially since Switzerland, unlike Germany, has elevated the principle of neutrality—the freedom not to take sides—to a raison d’etre. The contradiction is obvious.

Perhaps it is time for Bern to rethink the prerequisites for freedom of action in an age of strategic competition, a disintegrating world order, and the formation of blocs between democratic and autocratic powers. Switzerland is, of course, not an island, but rather a global player in a world economy that is becoming increasingly interdependent. It is also exposed to the weaponization of interdependence. Some might now point out that Switzerland is a passive beneficiary of the order of peace, law, and prosperity protected by NATO and the EU in Europe. But as a non-member, it has no voice or veto in the circle of these friends; it is a rule taker, not a rule maker.

NATO and the EU initially closed ranks against the impact of Russia’s aggression—which is directed not just at Ukraine but at the entire European order. Yet in light of the fact that Russia, China, Iran, and North Korea are increasingly finding common ground and that the so-called Global South is by no means taking the side of the victim and its allies, the West is currently on the defensive. And should Donald Trump or a Trumpist win the U.S. elections in November 2024, Europe would be quite lonely in the world—and Switzerland with it.

Will that propel Switzerland to suddenly seek protection in alliances or the EU? Or to eliminate its geo-economic vulnerabilities in order to offer Europe’s opponents one fewer entry point? Hardly. But the notion that its exposure is a national security gap and should be closed in the interests of its own freedom of action has just become rather more plausible.

1 note

·

View note

Text

How To Choose The Best CRM for Forex Brokers

Choosing the right CRM for Forex Brokers is essential for a successful trading business. A good CRM will help Forex Brokers to manage customer data, track sales and marketing activities, and improve customer service. It should be able to provide real-time data on customer behavior and trends in order to make informed decisions quickly. Additionally, it should have features like automated emails, lead scoring, contact management, and reporting capabilities that can help Forex Brokers maximize their profits. When selecting a CRM for Forex Brokers it is important to consider the features offered by different providers and determine which one best suits your needs.

The best forex CRM should have features that enable brokers to manage customer data efficiently, generate leads, automate customer service tasks, and provide real-time analytics about their business. With the right Forex CRM, brokers can streamline their operations and maximize profits. In this article, we will discuss some of the best Forex CRMs in the market today and how they can help you achieve success in your forex business.

Metatrader 5 CRM Software is a powerful tool designed to help businesses manage their customer relationships. It provides a comprehensive suite of features that enable businesses to easily manage customer accounts, track customer interactions, and create custom reports. With its intuitive interface and customizable features, Metatrader 5 CRM Software makes it easy for businesses to stay organized and keep track of their customers. With its powerful automation capabilities, Metatrader 5 CRM Software can help companies save time and money by streamlining customer service processes. By utilizing this software, businesses can ensure that their customers receive the best possible service and support.

Easy to Use Mobile Trading App

Mobile trading apps are becoming increasingly popular amongst investors and traders. They offer a convenient and easy way to trade stocks, commodities, currencies, and more from the comfort of your own home. With a mobile trading app, investors can easily access their accounts, monitor their investments in real-time, and make trades with just a few taps on their smartphone. These apps also provide users with detailed market analysis and research tools to help them make informed decisions about their investments. With the right mobile trading app, you can take control of your finances without ever having to leave your house.

Tradesoft is one of the best Forex Broker in forex trading platforms that offers its clients and traders with a wide range of services including Forex Training, Forex account opening like Demo and Live account, Mobile Trading App, and more. With their advanced mobile app, they provide an easy-to-use platform to enable traders to access the global markets at any time. The app is designed with the latest technology to ensure a secure trading experience and provide access to real-time data feeds from major exchanges around the world. With their sophisticated yet intuitive mobile trading app, traders can stay ahead of the market trends and make informed decisions on when to buy or sell.

2 notes

·

View notes

Text

Capepunk The Post-Superhero Frenzy Genre

While I work on my review for @UHStudios Power Broker, I'd like to compare it to its contemporaries in the capepunk genre including @InvincibleHQ and Astro City. #comics #superheroes #TheBoys #SpiderMan #XMen

Ever wonder what happens when superheroes and their powers get so plain? No, I’m not talking about the state of mass media. I mean capepunk, the genre that comments about how real people would act in a world. A world where superpowers are a commodity, to the point of needing regulations. The only problem is most series tend to focus more on the doomer side of things. Some of them are implemented…

View On WordPress

3 notes

·

View notes

Text

Unleashing the Power of Asset Tokenization Companies

In today's rapidly evolving digital landscape, asset tokenization companies are revolutionizing the way we perceive and interact with traditional assets. Asset tokenization refers to the process of converting rights to an asset into digital tokens on a blockchain, enabling fractional ownership, liquidity, and increased accessibility. In this article, we delve deep into the world of asset tokenization companies, exploring their role, benefits, and impact on various industries.

Understanding Asset Tokenization

Asset tokenization involves representing ownership rights to real-world assets, such as real estate, artwork, stocks, and commodities, as digital tokens on a blockchain network. The underlying asset backs these tokens and can be bought, sold, or traded with ease, eliminating the need for intermediaries and reducing transaction costs.

The Role of Asset Tokenization Companies

Asset tokenization companies play a pivotal role in facilitating the tokenization process and providing the necessary infrastructure and services for asset owners and investors. These companies leverage blockchain technology to tokenize assets securely, ensuring transparency, immutability, and compliance with regulatory requirements.

Benefits of Asset Tokenization

1. Increased Liquidity

Asset tokenization unlocks liquidity by allowing fractional ownership of assets, enabling investors to buy and sell tokenized assets on secondary markets with ease. This increased liquidity opens up new investment opportunities and diversification strategies for both traditional and non-traditional assets.

2. Accessibility

Asset tokenization democratizes access to investment opportunities by lowering barriers to entry and enabling fractional ownership of high-value assets. Investors can now participate in asset classes that were previously inaccessible, such as real estate, private equity, and fine art, thereby promoting financial inclusion and wealth distribution.

3. Transparency and Security

Blockchain technology ensures transparency and security throughout the asset tokenization process. Immutable ledger records provide a tamper-proof audit trail of ownership and transaction history, reducing fraud and enhancing trust among stakeholders. Smart contracts automate compliance rules and enforce contractual obligations, streamlining asset management processes.

4. Cost Efficiency

Asset tokenization eliminates the need for intermediaries, such as brokers, custodians, and clearinghouses, reducing transaction costs and administrative overheads. Smart contracts automate transaction processes, such as settlement and dividend distribution, further enhancing efficiency and reducing operational risks.

Industries Impacted by Asset Tokenization

Asset tokenization has the potential to disrupt various industries and create new business models and revenue streams. Some industries that stand to benefit from asset tokenization include:

Real Estate

Real Estate NFT Marketplace Development fractional ownership of real estate properties, allowing investors to diversify their portfolios and access lucrative real estate markets worldwide. Property owners can unlock equity and liquidity from their assets without the need for traditional financing or property sales.

Finance and Investment

Asset tokenization democratizes investment opportunities by providing access to a broader range of assets, including private equity, venture capital, and alternative investments. Institutional investors, family offices, and retail investors can benefit from increased diversification and liquidity in their investment portfolios.

Art and Collectibles

Asset tokenization transforms illiquid assets, such as fine art, collectibles, and rare assets, into tradable digital tokens, enabling investors to buy and sell fractional shares of valuable artworks. This democratization of art ownership opens up new avenues for art investment and curation, making art accessible to a wider audience.

Supply Chain and Logistics

Asset tokenization enhances transparency and traceability in supply chains by digitizing physical assets, such as inventory, raw materials, and products. Blockchain-enabled tokenization improves supply chain efficiency, reduces counterfeiting, and enhances provenance tracking, ensuring product quality and authenticity.

Conclusion

As asset tokenization continues to gain traction, asset tokenization companies are poised to play a crucial role in shaping the future of finance and investment. By harnessing the power of blockchain technology, these companies are unlocking new opportunities for asset owners, investors, and stakeholders across various industries. The benefits of asset tokenization, including increased liquidity, accessibility, transparency, and cost efficiency, are reshaping traditional asset markets and paving the way for a more inclusive and efficient financial ecosystem.

0 notes

Text

The Ins and Outs of Truck Dispatching: A Comprehensive Guide

Understanding the Basics of Dispatching

Dispatching is the backbone of the trucking industry, responsible for securing the loads that keep your business running and your drivers on the road. Whether you're an owner-operator looking to dispatch your own trucks or a fleet manager overseeing a team of drivers, mastering the art of dispatching is essential for success. In this comprehensive guide, we'll dive into the fundamentals of truck dispatching, equipping you with the knowledge and strategies to navigate this crucial aspect of your operations.

The Power of Load Boards

Dispatching without a load board is nearly impossible, which is why finding the right platform is a critical first step. The load board you choose can make a significant difference in your ability to secure profitable loads.

For those relying on a mobile device, the differences between the various load board options may not be as pronounced, as the app experience is largely the same across the board. Nonetheless, it's important to evaluate the features and functionality that best suit your needs, whether you're an owner-operator or managing a fleet.

Navigating the Load Board

Once you've selected your load board, it's time to dive in and start searching for the right opportunities. When reviewing potential loads, there are several key factors to consider:

Broker Credit Scores

One of the most important metrics to pay attention to is the broker's credit score. Avoid booking loads with brokers who have a credit score below 90, as they may pose a higher risk of delayed or non-payment, no matter how attractive the rate may seem.

Days to Pay (DTP)

Another crucial factor is the broker's average days to pay (DTP). Ideally, you'll want to work with brokers who have a DTP of 30 days or less, as this helps maintain a healthy cash flow for your business. Keep in mind that even brokers with a DTP under 30 days may occasionally take longer to pay, especially around the end of the year.

Rate and Mileage

Of course, the rate and mileage of the load are also essential considerations. Pay attention to the total trip miles, including both loaded and deadhead miles, to ensure you're getting a fair rate per mile. If the rate is not posted, you'll need to contact the broker directly to negotiate the terms.

Load Details

Finally, take the time to review any additional details about the load, such as pickup and delivery instructions, commodity type, and weight restrictions. This information can help you determine if the load is a good fit for your equipment and capabilities.

Establishing a Relationship with Brokers

Once you've identified a load that meets your criteria, the next step is to connect with the broker. This process typically involves completing a carrier packet, which is a comprehensive form that provides the broker with all the necessary information about your company, equipment, and insurance coverage. It's important to fill out this packet accurately and thoroughly, as it will be used to set you up as an approved carrier.

After submitting the carrier packet, the broker will send you a rate confirmation, which outlines the details of the agreed-upon load. Review this document carefully, ensuring that all the information is correct, and then sign and return it to the broker to finalize the booking.

Invoicing and Payment

When it comes to the time to invoice the broker, it's important to have a streamlined process in place. While you can create a custom invoice template, many dispatchers find it more efficient to use accounting software, which can help automate the invoicing process and keep track of outstanding payments.

Your invoice should include all the relevant details, such as the load number, truck and trailer information, driver's name, and the agreed-upon rate. Be sure to also include any necessary supporting documentation, such as the bill of lading and any accessorial receipts.

If you're working with a factoring company, you'll need to send the invoice and supporting documents to them, rather than directly to the broker. This allows you to receive your payment more quickly, but keep in mind that the factoring company will deduct a percentage of the total as their fee.

Conclusion

Mastering the art of truck dispatching is a crucial step in building a successful and profitable trucking business. By understanding the ins and outs of load boards, broker relationships, and invoicing, you'll be well on your way to securing the loads that keep your drivers on the road and your company thriving. Remember, attention to detail, effective communication, and a proactive approach are the keys to becoming a dispatching pro.

For more information kindly visit our official website

We wish you luck with a high-paying career in transportation.

Checkout Our Courses:

Truck Dispatcher Training

Trucking Safety & Compliance Training -

Transportation of Dangerous Goods Training

Hours of Service Training (HOS)

Freight Forwarding Specialist Fast Track

#truckdispatchercourse #truckdispatchingcourse #tms #freightbroker #truckingdispatchcourse #transportmanagementcourse#truckdispatchcoursenearme #canada #usa

#trucking company#truckdispatchingcourse#truckingdispatchcourse#truckdispatchercourse#avaal#truckingindustry#trucking#california

0 notes

Text

Immediate Vortex Avis Is Must For Everyone

Immediate Vortex Review

Users registering with this platform have various methods available to them for funding their accounts, including bank transfers and credit cards. Furthermore, several security measures have been put into place on the site to safeguard user information.

The purely meshless vortex method has proven its worth in accurately calculating isotropic turbulence and simulating simple geometrical bluff body flows; however, it has presented certain computational issues.

What is Immediate Vortex?

Investing is the practice of allocating financial resources (usually money) towards ventures or assets with the hope of reaping future income or profit. But investing can be risky business and mistakes can result in losses instead of gains for investors.

According to its website, Immediate Vortex is an investment platform that leverages advanced technologies and algorithms to provide users with useful market intelligence. The platform helps traders make strategic investment decisions while mitigating exposure to volatile market fluctuations.

Immediate Vortex boasts of providing various user support resources and is dedicated to promptly responding to users' inquiries, while its CySEC-licensed brokers ensure their investments remain safe for its users. Unfortunately, however, no evidence has emerged to substantiate its claims of legitimacy; thus before investing any funds with any trading platform it is always advisable to conduct extensive research such as reading online Immediate Vortex Reviews and assessing company reputation thoroughly first.

How Does Immediate Vortex Work?

Immediate Vortex's artificial intelligence algorithms aim to assist traders in making smarter trading decisions through extensive market analysis and data collection. Their artificial intelligence-powered market detectives look through massive amounts of information in search of trends or opportunities that could present themselves for trade.

Once registered with the platform, users can set their trading parameters and leave it up to the bot to make decisions on their behalf based on various factors, including profit goals and risk tolerance levels, in order to select appropriate trades for execution.

The Immediate Vortex Platform enables traders to track their portfolios, monitor profits and losses, analyze performance metrics, customize settings to their specific needs and preferences and more.

Immediate Vortex does not list its minimum deposit requirement on its website, so it is wise to inquire directly with them prior to investing any funds. However, multiple user testimonials speak highly of its earning potential - this might serve as motivation for those considering trying out a new trading tool.

What Are the Benefits of Immediate Vortex?

Immediate Vortex Avis offers numerous advantages to users. First and foremost, it links investors with expert advisors who can offer invaluable market trends and strategy insights. Furthermore, Immediate Vortex features various investing tools like histograms and price/volume charts which enable traders to analyze market movements and identify new trading opportunities.

Furthermore, this platform places great emphasis on investor protection by ensuring their assets are stored safely in secure accounts and using risk assessment tools and automated rebalancing functions to minimize losses while diversifying portfolios across cryptocurrencies, stocks, commodities and ETFs.

Last but not least, the platform provides a superb user experience through a modern website and straightforward user interface. Its quick verification process helps newcomers get going immediately while its dedicated support page offers multilingual assistance - an impressive sign of its commitment to superior customer care for users looking to avoid hassles on their investment journey.

vimeo

What Are the Drawbacks of Immediate Vortex?

Traders can access their accounts from any device and run free simulations to assess the efficacy of their strategies, helping to avoid costly mistakes that could negatively impact profits.

The platform is user-friendly and features pre-configured functions designed to accommodate both novice and veteran traders alike. Furthermore, user support is prioritized through helpful assistance and resources available to address any challenges that may arise during trading activities.

Immediate Vortex's platform is GDPR compliant and utilizes leading information security technologies to protect both user personal and financial data. Furthermore, Immediate Vortex works in cooperation with CySEC-licensed brokers to offer users a secure investment environment and round-the-clock customer support team available 24/7 for any inquiries or issues they might have. Furthermore, payment methods available and transparent fees management make Immediate Vortex an attractive proposition for investors.

0 notes

Text

Innovative Cryptocurrency Solutions Leading the Digital Platform

Today innovations of cryptocurrency should define the digital era as they bring substantial inventions for the world digital economy. Explicitly, DeFi platforms, NFT marketplaces and beyond, are traditionalizing a new way we trade, invest and connect online. Blockchain’s security and transparency not only serve as a foundation for novel cryptocurrency solutions but also as a driving force towards a digital platform of tomorrow with crypto that empower individuals, while enhancing efficiency and decentralization.

DeFi (Decentralized Finance) Platforms-

DeFi systems are transforming the current finance landscape using the blockchain technology to launch unconventional services for the same financial products as the traditional financial systems. On these platforms users can use crypto assets for various purposes including borrowing, trading, lending, or earning interest by allocating funds in a smart contract, all without the need for intermediaries like banks or brokers. Smart contracts are the basis of decentralized finance platforms which procure transparency, safety, and efficiency, and holders possess all the rights over the assets they own. Simply, they participate in a global unstoppable digital economy. By possibility decentralized platforms of financing are giving access to different groups of people, as well reduce the dependency on centralized institutions, however, the role of the future finance.

NFT (Non-Fungible Token) Marketplaces-

NFT markets (non-fungible digital tokens) have grown in demand as they feature an online system that enables trading of rare digital assets that have distinct authenticity certificates. These assets could range from art, collectibles or even virtual real estate, and they are tokenized on the blockchain allowing issuers automatic subscription management and public ownership records and ensuring scarcity. Through this innovation, creators can now generate income from their work and collectors, have access for rare and unique digital possessions. Whereas NFT marketplaces nowadays are offering more than a single item and they are progressing in each way with a flourishing community and a broad assortment of assets.

Tokenization of Real-World Assets-

Tokenization of assets that have counterpart in the real world includes transformation of physical assets into tokens such as real estate, art, or commodities and digital representation of them on blockchain. In the case of tokenization, assets ownership becomes a lot divisible, which, in turn, permits people to buy and change the ownership for various portions of valuable assets. This, in turn, enhances the field of liquidity, accessibility, and transparency in static markets. Tokenization in its essence furtherly vice versa for fractional ownership and thus it makes all investment possible not just for few but for all. Thanks to Blockchain’s security and immutability the tokenization of real-world assets is said to be changing market patterns by opening markets both to investors and bad market players.

At the forefront of this movement are innovative companies like Blockverse Infotech Solutions, which are pioneering new ways to harness the power of cryptocurrency. From developing secure and user-friendly cryptocurrency wallets to creating innovative DeFi platforms, these companies are driving innovation and pushing the boundaries of what is possible in the digital realm.

#defi development services#defi development company#blockchain development services#blockchain application development#dapp development company#defi development companies#cryptocurrency development companies#crypto token development company

0 notes

Link

0 notes

Text

The Definitive Guide to Press Releases with Forex PRWIRE

Introduction:

In the fast-paced world of forex trading, where every decision counts and market shifts can happen in the blink of an eye, effective communication isn't just important—it's essential. That's where Forex PRWIRE comes in. As a premier press release distribution service crafted exclusively for the forex industry, FOREX PR WIRE is all about helping businesses like yours make a splash in the global market. Let's take a closer look at what Forex PRWIRE is all about, why press releases matter, the benefits they offer, the best times to use them, and why Forex PRWIRE is the perfect partner for spreading the word about your forex projects.

What is Forex PRWIRE?

Think of Forex PRWIRE as your trusted ally in the world of forex. We're here to help you get your message out to the right people, at the right time, and in the right way. Our mission is simple: to provide forex brokers, trading platforms, educational institutions, fintech companies, and other players in the forex space with a platform to share their news, updates, and insights with a global audience.

What is a Press Release?

At its heart, a press release is like a megaphone for your business. It's a way to announce something newsworthy—whether it's a product launch, a market analysis, or a regulatory update—and get people talking about it. In the forex world, press releases are your ticket to building credibility, fostering transparency, and connecting with your target audience.

About our Press Release Network:

some of the prominent press release networks where ForexPRWIRE distributes press releases:

Benzinga: Benzinga is a leading financial news and analysis platform, trusted by traders, investors, and industry professionals worldwide for its comprehensive coverage of market trends, news, and insights.

CNBC: CNBC is a global leader in business news, providing real-time coverage of financial markets, economic trends, and corporate developments. Press releases distributed through CNBC reach a vast audience of investors, traders, and financial professionals.

Yahoo Finance: Yahoo Finance is one of the largest financial news platforms, offering news, analysis, and data on stocks, currencies, commodities, and more. Press releases distributed through Yahoo Finance gain exposure to millions of users seeking financial information and market updates.

Advantages of Forex Press Releases:

Press releases offer a whole host of benefits for forex businesses:

1. Getting Noticed: With Forex PRWIRE, your press releases don't just get sent out into the void—they get noticed. We have connections with forex media outlets, financial news websites, and trade publications all over the world, ensuring that your announcements reach the right people.

2. Building Trust: By consistently sharing news and updates through press releases, you can build trust and credibility within the forex community. Whether you're a new player or a seasoned pro, press releases are your ticket to establishing yourself as a trusted authority in the industry.

3. Boosting Your SEO: Press releases aren't just about getting your message out there—they're also great for boosting your search engine rankings. By incorporating relevant keywords and industry-specific terminology, you can improve your visibility online and drive more traffic to your website.

4. Targeting Your Audience: With press releases, you have the power to target your message to specific segments of the forex market. Whether you're speaking to traders, investors, or industry influencers, press releases help you tailor your message for maximum impact.

When Should You Do a Press Release (Stages of Press Release)?

Press releases are most effective at different stages of your business's journey:

1. Launching Something New: Whether it's a new trading platform, a ground breaking tool, or a game-changing service, press releases are the perfect way to generate buzz and get people excited about what you're doing.

2. Sharing Insights: If you've got something valuable to say about the market—whether it's a trend, an analysis, or a prediction—press releases are your chance to share your insights with the world and establish yourself as a thought leader in the industry.

3. Keeping People Informed: In a rapidly changing regulatory landscape, press releases are your lifeline for keeping your audience informed about important changes that could affect their trading activities.

Why Choose Forex PRWIRE as Your Press Release Service Platform?

Here's why ForexPRWIRE is the perfect partner for getting your message out there:

1. Expertise: Our team of seasoned professionals knows the forex industry inside and out, and we know how to craft press releases that get results.

2. Global Reach: With our extensive network of media outlets and industry channels, we can ensure that your press releases reach the right people, wherever they are in the world.

3. Tailored Solutions: We offer a range of distribution packages to suit your needs and budget, so you can choose the option that's right for you.

4. Actionable Insights: Our advanced reporting and analytics tools give you valuable insights into how your press releases are performing, so you can fine-tune your strategy and get better results.

5. Personalized Support: We're here to support you every step of the way, from crafting your press release to tracking its performance. With Forex PRWIRE, you're not just another client—you're part of the family.

Conclusion:

Forex PRWIRE is your ticket to success in the world of forex. With our expertise, our reach, and our commitment to excellence, we'll help you get your message out there and make a real impact on your audience. So why wait? Choose Forex PRWIRE as your press release partner and start making waves in the forex industry today.

1 note

·

View note

Text

AMarkets Review 2024

AMarkets Review - Report a chargeback against AMarkets if you are scammed by AMarkets

If you've fallen victim to the AMarkets scam broker, don't hesitate to file a complaint. Read AMarkets reviews take action and recover your lost funds with our assistance.

While there are plenty of trustworthy brokers out there, traders should avoid fraudulent brokers to protect their trading capital. A shady broker may cause you to lose all of your money, even if you follow the best trading tactics and skills, so it's important to stay away from scammers. The Enverra Capital team can assist you if you were scammed by an AMarkets broker and are unsure about how to get your money back. Read this AMarkets review to know more.

AMarkets Website – https://www.amarkets.com/

Address – T&F Chambers, Main Road, Rarotonga, Cook Islands

Warning – Not recommended by the review website like Enverra Capital

Domain Age -

- Domain Name: AMARKETS.COM

- Registry Domain ID: 9488539_DOMAIN_COM-VRSN

- Registrar WHOIS Server: whois.godaddy.com

- Registrar URL: https://www.godaddy.com

- Updated Date: 2023-08-26T08:58:06Z

- Creation Date: 1999-08-25T22:37:29Z

- Registrar Registration Expiration Date: 2024-08-25T22:37:29Z

Overview of AMarkets

AMarkets, also known as AMarkets LTD or AMarkets.com, claims itself as a premium brokerage firm that offers a wide range of securities for trading, including stocks, FX, cryptocurrencies, and commodities. Since its launch in 2007, the platform has maintained its dedication to providing competitive spreads, powerful trading tools, and personalized client assistance. Nonetheless, it is important to emphasize that it is unregulated by the relevant financial body, prompting careful consideration before engaging in trading operations through this platform.

Signs of Potential Fraudulence in AMarkets

Despite its claims of dependability and professionalism, many traders have expressed concerns and suspicions about AMarkets' operations. Most complaints concern the signs of withdrawal. Many users have issues withdrawing their funds, claiming delays and justifications provided by the broker.

Furthermore, there have been charges of price manipulation and rapid jumps in spreads, resulting in unexpected losses for traders. Such tactics call into question the integrity and fairness of AMarkets' trading environment.

Furthermore, various regulatory agencies have warned or sanctioned AMarkets. While the platform claims to be governed by the Mwali International Services Authority (MlSA), the Financial Supervisory Commission (FSC), and the Financial Services Authority (FSA), there have been reports of it operating in jurisdictions without necessary licensing or monitoring.

AMarkets Review Summary

In conclusion, our study of AMarkets indicates a troubling trend of unethical behavior and a lack of openness. While the platform appears to offer appealing trading conditions on the surface, the numerous complaints and regulatory warnings raise serious concerns about its validity.

As traders, you must exercise caution and conduct thorough research before handing your cash to any broker. While AMarkets may offer attractive opportunities, risks appear to outweigh the possible benefits. Finally, while selecting a broker, traders should prioritize safety and dependability to ensure their investments are secure.

Remember, careful research is essential for managing online trading. Stay aware, and cautious, and always put your financial security first.

Are you a victim of AMarkets scam broker? Get help and a Free Consultation for Recovering lost funds.

If you are a victim of a scam broker like AMarkets, File a complaint report against AMarkets. This can help to bring attention to the scam and potentially prevent others from falling victim to it in the future. By staying informed about types of scams, you can better protect yourself and others from falling victim to fraudulent activities perpetrated by scam brokers like AMarkets. Remember, you are not alone in this situation. With the right help and support, you can take action to recover your lost funds and protect yourself from future scams.

Visit our Facebook page

Visit Twitter

Read our Latest Scam Broker Reports

Read the full article

0 notes

Text

Metals Acquisition Ltd aims for 2nd listing at the ASX

Metals Acquisition Limited (MTAL) (ASX: MAC) deals in the acquisition of metals in stable mining jurisdictions including mining, processing, and commodities exchange. MTAL aims to increase its electrification coverage and fasten the decarbonization process. Its technical prowess and cost-effective strategies help and assist in the transformation of undervalued assets into valuable products. The team at MTAL deals with all metals including base metals, battery metals, ores, and precious metals.

As of now, MTAL operations lay with the CSA Copper Mine in New South Wales, Australia. Metals Acquisition Limited has also applied for a 2nd listing at the Australian Stock Exchange under the security code MAC, primarily they are registered with the New York Stock Exchange under the security code MTAL. This piece covers a broad overview of the Company’s IPO listing and other recent developments.

Image of CSA Cooper Mine in New South Wales, Australia

(Source: www.metalsacquisition.com/)

MTAL aiming for ASX listing

Metals Acquisition Limited (MTAL) is aiming for an ASX listing after acquiring the CSA Copper Mine in New South Wales, Australia. MTAL has provided a prospectus to the Australian Stock Exchange to seek a listing in the ASX to launch their second IPO listing and offer Chess Depository Interests or CDIs equivalent to company shares they provide in the New York Stock Exchange. Their security code in ASX will be MAC. The company is putting 17,647,059 - 18,750,000 CDIs for sale where each CDI’s value will be the same as that of a stock worth A$16.00 to A$17.00 per CDI.

MTAL plans to raise A$300 million in CDIs

The company seeks to raise A$ 300 million through this IPO, and the funds will be used to address multiple goals that the company sets to achieve. The fund accumulation process or the attainment of its CDIs is not for US officials or citizens. CDIs are only meant for citizens outside of the US. The one exception to this rule is for US Fund Managers who work in benefitting non-US persons.

The offer to assist with this raise has been passed on to institutional investors in Australia and New Zealand. There are broker retail firms that could become part of the deal or contacts that are part of the firms, provided the firms are registered in an Australian address. They have also passed on invitations to specific companies which are outside the US who can take part in this investment drive.

MTAL plans to utilize funds

The proceeds of the company will address many pertinent goals of the company:

To pay off Glendale’s deferred correction facility amount that MTAL borrowed in acquiring the American, Cornish, and Scottish copper mine in Cobar, New South Wales, Australia.

The money will be used to enhance capital to make the work culture flexible and boost production outcomes.

Using the investments to fund exploration programs and mine development in CSA Copper mines.

To cover funding costs and administrative costs to the company.

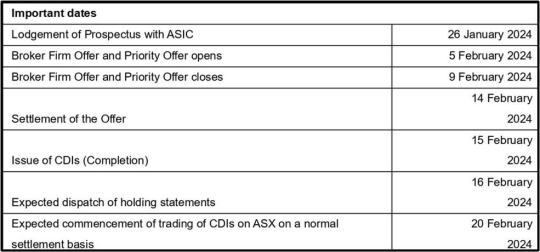

If everything goes according to the plan the company aims to launch its CDIs in ASX by 20th February 2024. Here is a breakdown of the timeline of the company’s IPO launch on the Australian Stock Exchange on a table.

Timeline of MTAL’s ASX listing

(Source: www.metalsacquisition.com/)

MTAL aimed to be listed on ASX

CEO of MTAL, Mick Mc Mullen states in his Australian Mining Interview, that after acquiring the CSA Copper Mines in New South Wales the company was focused on getting a listing on the Australian Market Exchange (ASX).

The Australian Financial Review (AFR) reported that along with joint lead managers Barrenjoey Capital and Canaccord Genuity, the company expects to list itself on the Australian Stock Exchange.

One of the board members compared MTAL to NEV Power. Being one of the key personnel there he sees MTAL as a minerals service and they have the backing of key players, being affirmative about the funding, he also reiterates that his previous company acquired massive investments totaling more than $45 million to $65 million. The company intends to build on the OZ-style mineral business having the backing of those players.

Photo of a Copper Mine Plant in Tabriz, Iran.

(Source: www.pexels.com/)

MTAL expansion plans

Metals Acquisition Limited or MTAL plans to move forward at present by acquiring copper. They aspire to buy Northparkes copper-gold mine to enhance their work print within mining jurisdictions. As per the Australian Resources and Investment web portal MTAL in the September quarter produced 9845 tonnes of Copper. The company reiterates that in 2024 the asset tonnage will be at least 50,000.

Along with their current exploration the company’s mining work has also attained multiple grades of copper which includes as high as 14.4 percent copper across 20.7m. Other results included 25.5m at 12.7 percent copper and 28.7m at 10.6 percent copper in late July.

In June last week, MC Mullen, CEO of MTAL, shared with the press that these key findings show a very high-grade orebody at CSA Mine. This development also made clear that MTAL hedged their bets on the right assets, as the company had played a little gamble acquiring the CSA mine, which is now worth the trouble and the risk.

In September last quarter, they also found high-grade copper at 8.9 percent copper up to a stretch of 50 meters.

Conclusion

Metals Acquisition Limited or MTAL is a mining company that mines all kinds of metals and minerals. Recently, they have had two developments including the acquisition of CSA Copper mine. They have lodged a prospectus in the ASX for a market listing, In ASX the company will offer CDIs whose values are the same as that of shares they sell in the New York Stock Exchange.

If everything goes right they will be listed by 20th February. Along with its IPO listing attempts at ASX, I have also provided info about some recent developments of the company. They aspire to become OZ’s preferred mineral business player.They aspire to become OZ’s preferred mineral business player.

Read more update on ASX News - https://skrillnetwork.com/topics/mining

0 notes

Text

Unleashing Potential: How cTrader Forex Brokers Maximize Profits

In the world of forex trading, finding the right broker can make all the difference in your success. With the advent of advanced trading platforms like cTrader Forex brokers, traders have been able to maximize their profits like never before.

Understanding cTrader Forex Brokers

cTrader is a leading trading platform known for its advanced features, user-friendly interface, and lightning-fast execution. Forex brokers that offer cTrader provide traders with access to a wide range of financial instruments, real-time market data, advanced charting tools, and automated trading options. These features create an optimal environment for traders to make informed decisions and execute trades swiftly, ultimately leading to potential profit maximization.

Key Features of cTrader Forex Brokers

Advanced Charting Tools: cTrader offers a variety of charting tools and indicators that help traders analyze market trends and identify profitable trading opportunities.

Fast Execution: With cTrader, trades are executed swiftly, minimizing slippage and ensuring traders enter and exit positions at desired prices.

Access to Multiple Assets: cTrader forex brokers provide access to a wide range of currency pairs, commodities, indices, and cryptocurrencies, allowing traders to diversify their portfolios.

Automated Trading: cTrader supports algorithmic trading through its cAlgo platform, enabling traders to automate their strategies and execute trades based on predefined conditions.

Strategies for Maximizing Profits with cTrader

To fully unleash the potential of cTrader forex brokers and maximize profits, traders can implement various strategies tailored to their trading style and risk tolerance. Here are some strategies to consider:

1. Risk Management

Implementing effective risk management strategies such as setting stop-loss and take-profit levels can help protect capital and minimize losses during volatile market conditions.

2. Utilizing Advanced Order Types

Take advantage of advanced order types offered by cTrader, such as limit orders, trailing stops, and OCO (One Cancels Other) orders, to automate trade execution and manage positions more efficiently.

3. Leveraging Technical Analysis

Utilize the advanced charting tools and technical indicators available on cTrader to perform technical analysis, identify trends, support, and resistance levels, and make data-driven trading decisions.

4. Stay Informed and Adapt

Stay updated with market news, economic events, and geopolitical developments that can impact currency movements. Adapt your trading strategies accordingly to capitalize on opportunities and mitigate risks.

Conclusion

cTrader forex brokers offer a powerful platform for traders to unleash their potential and maximize profits in the forex market. By leveraging the advanced features, tools, and strategies provided by cTrader brokers, traders can navigate the complexities of trading more effectively and achieve their financial goals.

1 note

·

View note

Text

Trading Recruitment in the Global Energy & Commodity Sector

The global energy and commodity sector stands as a cornerstone of the world's economy, underpinning everything from power generation to manufacturing and transportation. At the heart of this sector's dynamism and growth is the strategic recruitment of trading professionals, whose expertise navigates volatile markets and drives profitability. This article delves into the evolution, current trends, and future directions of Trading Recruitment within this critical industry.

The Evolution of Trading Recruitment in Energy and Commodity Markets

Trading recruitment has undergone significant transformation alongside the energy and commodity sector's own evolution. Historically, the focus was on traditional commodities like oil, gas, and metals, with recruitment centering around experienced traders and brokers. However, the advent of digital technologies and the shift towards renewable energy sources have reshaped the landscape, introducing a demand for new skills and expertise, particularly in market analysis, risk management, and advanced analytics.

Key Roles and Skills in Demand

Front Office

In the front office, roles such as Portfolio Managers, Traders, and Quantitative Researchers have become pivotal. Portfolio Managers are at the forefront, steering investment strategies, while Traders engage in the fast-paced buying and selling of commodities. The growing reliance on data for decision-making has elevated the role of Quantitative Researchers, who employ advanced statistical methods to predict market movements and inform trading strategies.

Middle and Back Office

Behind the scenes, the middle and back offices play crucial roles in supporting and safeguarding trading operations. Risk Management professionals are indispensable in identifying and mitigating financial risks, while Trade Finance specialists facilitate the financial aspects of trading deals. Compliance roles have also grown in importance, ensuring that trading activities adhere to an increasingly complex regulatory environment.

Niche Markets and Emerging Opportunities

The sector is witnessing the rise of niche markets such as biofuels, renewables, and carbon certificates, driven by the global push for sustainability. These emerging markets present unique challenges and opportunities for trading recruitment, requiring professionals with specialized knowledge and a keen understanding of these new commodities' regulatory and market dynamics.

Trading-as-a-Service: A New Paradigm

The concept of trading-as-a-service has emerged as a novel paradigm, particularly for energy companies. This model offers smaller-scale producers and market participants access to the trading and risk management expertise of larger firms, transforming the recruitment landscape by necessitating a blend of technical, market, and client-facing skills.

The Role of Executive Search Firms

Specialized executive search firms have become key players in navigating the complex trading recruitment landscape. These firms not only identify candidates with the necessary technical skills and industry experience but also place a strong emphasis on emotional intelligence and cultural fit, ensuring that new hires can integrate seamlessly into their new roles and contribute to their teams' success.

Challenges and Strategies in Trading Recruitment

The trading recruitment sector faces several challenges, including a competitive job market and the need to continually adapt to technological advancements and market shifts.

Conclusion

The future of trading recruitment in the energy and commodity sector is poised for continued growth and transformation. As the sector evolves, so too will the demand for innovative recruitment strategies that can identify and attract the next generation of trading professionals.

For expert guidance in Trading Recruitment, connect with industry specialists dedicated to shaping the future of the energy and commodity markets.

1 note

·

View note

Text

Looking for the Best Canadian Forex Broker? Try JRFX!

When it comes to navigating the vast and dynamic world of forex trading, choosing the right broker is crucial. As a trader in Canada, you're likely seeking a broker that not only offers a reliable and secure platform but also provides competitive pricing, robust trading tools, and exceptional customer service. In this quest for the best Canadian forex broker, JRFX emerges as a compelling choice. Let's explore why you should consider giving JRFX a try.

Regulatory Compliance and Trustworthiness

As a Canadian trader, you understand the importance of regulatory compliance and trustworthiness in a forex broker. JRFX is a regulated broker that operates within the guidelines set by the relevant authorities in Canada. This regulatory oversight ensures that your funds are secure and that the broker adheres to stringent industry standards.

Advanced Trading Platforms

One of the hallmarks of a top-notch forex broker is its trading platform. JRFX offers a state-of-the-art trading platform that caters to both novice and experienced traders. Whether you prefer the intuitive interface of MetaTrader 4 or the advanced features of MetaTrader 5, JRFX has you covered. These platforms provide access to a wide range of currency pairs, commodities, and indices, along with powerful charting tools and technical analysis capabilities.

Competitive Pricing and Tight Spreads

In the world of forex trading, every pip counts. JRFX understands the importance of competitive pricing and offers some of the tightest spreads in the industry. This means that you can execute your trades with minimal costs, maximizing your potential profits. Additionally, JRFX keeps its commission rates low, making it an attractive option for cost-conscious traders.

Dedicated Customer Support

As a trader, having access to reliable customer support is essential. JRFX prides itself on its dedicated customer support team, available 24/5 to assist you with any inquiries or issues you may encounter. Whether you have questions about the trading platform, need help with a technical issue, or require assistance with your account, JRFX's support team is there to help.

Education and Market Analysis

For those looking to enhance their trading knowledge and skills, JRFX offers a wealth of educational resources. From webinars and tutorials to market analysis and trading guides, JRFX provides the tools you need to stay informed and make informed trading decisions. Whether you're a beginner looking to learn the basics or an experienced trader seeking advanced strategies, JRFX has something for everyone.

Why Choose JRFX as Your Best Canadian Forex Broker?

Regulatory Compliance: JRFX is a regulated broker, providing you with peace of mind.

Advanced Trading Platforms: Trade with ease and efficiency using MetaTrader 4 or MetaTrader 5.

Competitive Pricing: Enjoy tight spreads and low commission rates, maximizing your trading potential.

Exceptional Customer Support: Get prompt and reliable assistance whenever you need it.

Educational Resources: Enhance your trading skills with a variety of educational materials and market analysis.

Conclusion

In conclusion, if you're on the hunt for the best Canadian forex broker, look no further than JRFX. With its commitment to regulatory compliance, advanced trading platforms, competitive pricing, dedicated customer support, and comprehensive educational resources, JRFX ( https://www.jrfx.com/?804 ) ticks all the boxes for a top-tier broker. Whether you're a beginner or an experienced trader, JRFX provides the tools and support you need to succeed in the forex market.

0 notes

Text

The Ins and Outs of Truck Dispatching: A Comprehensive Guide

Understanding the Basics of Dispatching

Dispatching is the backbone of the trucking industry, responsible for securing the loads that keep your business running and your drivers on the road. Whether you're an owner-operator looking to dispatch your own trucks or a fleet manager overseeing a team of drivers, mastering the art of dispatching is essential for success. In this comprehensive guide, we'll dive into the fundamentals of truck dispatching, equipping you with the knowledge and strategies to navigate this crucial aspect of your operations.

The Power of Load Boards

Dispatching without a load board is nearly impossible, which is why finding the right platform is a critical first step. The load board you choose can make a significant difference in your ability to secure profitable loads.

For those relying on a mobile device, the differences between the various load board options may not be as pronounced, as the app experience is largely the same across the board. Nonetheless, it's important to evaluate the features and functionality that best suit your needs, whether you're an owner-operator or managing a fleet.

Navigating the Load Board

Once you've selected your load board, it's time to dive in and start searching for the right opportunities. When reviewing potential loads, there are several key factors to consider:

Broker Credit Scores

One of the most important metrics to pay attention to is the broker's credit score. Avoid booking loads with brokers who have a credit score below 90, as they may pose a higher risk of delayed or non-payment, no matter how attractive the rate may seem.

Days to Pay (DTP)

Another crucial factor is the broker's average days to pay (DTP). Ideally, you'll want to work with brokers who have a DTP of 30 days or less, as this helps maintain a healthy cash flow for your business. Keep in mind that even brokers with a DTP under 30 days may occasionally take longer to pay, especially around the end of the year.

Rate and Mileage

Of course, the rate and mileage of the load are also essential considerations. Pay attention to the total trip miles, including both loaded and deadhead miles, to ensure you're getting a fair rate per mile. If the rate is not posted, you'll need to contact the broker directly to negotiate the terms.

Load Details

Finally, take the time to review any additional details about the load, such as pickup and delivery instructions, commodity type, and weight restrictions. This information can help you determine if the load is a good fit for your equipment and capabilities.

Establishing a Relationship with Brokers

Once you've identified a load that meets your criteria, the next step is to connect with the broker. This process typically involves completing a carrier packet, which is a comprehensive form that provides the broker with all the necessary information about your company, equipment, and insurance coverage. It's important to fill out this packet accurately and thoroughly, as it will be used to set you up as an approved carrier.

After submitting the carrier packet, the broker will send you a rate confirmation, which outlines the details of the agreed-upon load. Review this document carefully, ensuring that all the information is correct, and then sign and return it to the broker to finalize the booking.

Invoicing and Payment

When it comes to the time to invoice the broker, it's important to have a streamlined process in place. While you can create a custom invoice template, many dispatchers find it more efficient to use accounting software, which can help automate the invoicing process and keep track of outstanding payments.

Your invoice should include all the relevant details, such as the load number, truck and trailer information, driver's name, and the agreed-upon rate. Be sure to also include any necessary supporting documentation, such as the bill of lading and any accessorial receipts.

If you're working with a factoring company, you'll need to send the invoice and supporting documents to them, rather than directly to the broker. This allows you to receive your payment more quickly, but keep in mind that the factoring company will deduct a percentage of the total as their fee.

Conclusion

Mastering the art of truck dispatching is a crucial step in building a successful and profitable trucking business. By understanding the ins and outs of load boards, broker relationships, and invoicing, you'll be well on your way to securing the loads that keep your drivers on the road and your company thriving. Remember, attention to detail, effective communication, and a proactive approach are the keys to becoming a dispatching pro.

For more information kindly visit our official website

We wish you luck with a high-paying career in transportation.

Checkout Our Courses:

Truck Dispatcher Training

Trucking Safety & Compliance Training -

Transportation of Dangerous Goods Training

Hours of Service Training (HOS)

Freight Forwarding Specialist Fast Track

#truckdispatchercourse #truckdispatchingcourse #tms #freightbroker #truckingdispatchcourse #transportmanagementcourse#truckdispatchcoursenearme #canada #usa

#truckingdispatchcourse#truckdispatchercourse#truckdispatchingcourse#trucking company#truckingindustry#avaal#trucking#california

0 notes