#car loan for second hand car

Text

What to consider when taking out a loan for a used car

When taking out a loan for a used car, keep the best factors in mind. Choosing the right financing method is also essential. Used Car Loan Interest Rates, Special offers on loans, Is there a down payment required, Is a personal loan better for you than a used car loan? Ensure your ride brings you a joyful journey by listing the positives and the negatives. When taking out a new car loan, it is important to make an informed decision. If you are considering taking out a car loan for second hand car, you should take into account the following factors. A pre-owned car loan from CKB24 offers easy loan application processes, minimal documentation, and attractive interest rates. You can also sell car online with us.

#car loan for second hand car#sell car online#fashion#Second Hand Cars in Varanasi for Sale#usedcars

0 notes

Text

listen. okay. i know my car is held together with sheer force of will and gusto. but it is perfectly functional!!! yes, i have part of the panel on the trunk permanently removed so i can reach inside and manually pull the mechanism to latch it. and yeah, the drivers door handle only works because of some creative industrial strength zip ties. out of 4 doors i think two have the correct corresponding interior handles. half of them work. 2 out of 4 windows do not roll down, and 1 is on its last legs but still functioning due to a barbeque brush and silicone lube (and i have to push it down with my hands). and okay MAYBE it becomes undrivable when we go long stretches without rain because the front wiper fluid just sadly trickles down the hood and i have to use the whims of the weather to clean my windshield of grime. at least both wipers stay attached while driving and definitely 100% for sure always have (it was fine no one got hurt).

listen. she is doing her best. when i bought her the transmission fluid was brown. you know what colour its supposed to be? pale pink. sometimes oil just. leaves. doesn't leak! doesnt seem to be getting through a seal into the enginel! just. it goes. the amp and two 12 inch subwoofers in the back scream in audible pain when i rev the engine. the parking brake light comes on at random when it gets cold outside. im not sure what its trying to tell me and i dont care to find out. the clock only works when u hit it. im also like 80% sure that putting the gearshift in park doesn't actually work and the emergency brake is the only thing keeping it from rolling downhill, but also one time i drove with the parking brake on and didn't even notice the difference, so ?

anyways. uh. i forgot my point. she is driveable and functional and i love her.

#i was just gonna make a funny quip about disassembling my car today to replace the zip ties that let me open my door#for the second time rather than finding a permanent solution#but as i went over the list of things i need to fix when i go cherry pick replacements from a parts car#i realized it was getting to the point where i would have to write a personalized instruction manual#before loaning anyone my car#anyways for the last 3 months ive been opening my door by rolling down the last-legs window halfway#pushing it down the rest of the way with my hands#and reaching out through it to pull the handle on the outside of the door to get out#then rolling it back up before turning the car off#oh also this car eats tires for breakfast#dont ask me how#anyways i unironically love my car. none of these things make her undriveable if u care enough to create a workaround#she functions perfectly fine. i have never once had engine trouble and she is rust free. i love her.

5 notes

·

View notes

Text

like most poor people are not bad at managing money, it's that they don't have enough to manage in the first place

#some are terrible tho#like my friend who got 9k in debt for a car she couldn't afford#one of those monthly payment deals were after a year you have to pay off the rest#and i think she was already 9k in debt from the payments#and then she had to take out a bank loan to pay off the rest of the car :')#and this was a second hand car#coming from a family where spending 2k on a car was considered a luxury#and everything we ever drove in was an old banger.... MADNESS#but like#people shouldn't be punished for being bad with money#they should be helped!#i remember her telling me that her family's financial advise was 'money is for spending'#which technically true but also... no

5 notes

·

View notes

Text

Secure your dream car effortlessly with Primeloans.kotak.com. Explore second-hand, pre-used, and pre-loved car loans with quick approvals and low-interest rates.

Second hand car loans

0 notes

Text

From Concept to Reality: Securing Startup Capital, Vehicle Financing, and Corporate FDs

Navigating the financial landscape to transform an innovative idea into a successful business involves securing reliable sources of funding and managing resources effectively. Whether you are looking for a startup loan for new business, exploring a second hand car loan, or investing in FD from large corporate houses, understanding how to leverage these financial instruments can significantly impact your venture’s growth and stability. This article explores these critical financial tools and how they can be utilized to turn your entrepreneurial dreams into reality.

Startup Loan for New Business: Kickstarting Your Venture

Securing a startup loan for new business is often the first step for entrepreneurs looking to bring their ideas to life. A startup loan for new business provides the essential capital needed to cover initial costs such as equipment, inventory, and staffing. It is a lifeline that supports daily operations until the business becomes self-sustaining.

When applying for a startup loan for new business, it’s important to have a detailed business plan and financial projections ready. This shows potential lenders that you have a clear vision and strategy for your business. Additionally, understanding the terms and conditions of a startup loan for new business is crucial, as it affects your future financial planning and cash flow management.

Second Hand Car Loan: Economical Vehicle Financing Options

For many startups, acquiring a vehicle is necessary for operational purposes such as product delivery, sales visits, or service provision. Opting for a second hand car loan can be an economical choice that reduces the financial burden on new businesses. A second hand car loan typically offers lower purchase prices, reduced insurance costs, and lesser depreciation rates.

When considering a second hand car loan, it’s vital to conduct a thorough check of the vehicle’s condition and history to avoid future expenses on repairs and maintenance. Financing through a second hand car loan allows startups to preserve capital for other areas of the business while still meeting their operational needs efficiently.

FD from Large Corporate Houses: Secure and Profitable Investment

Investing in FD from large corporate houses is an excellent way for businesses to secure their excess funds. FD from large corporate houses usually offers higher interest rates compared to bank deposits, making them an attractive option for earning passive income. Furthermore, FD from large corporate houses are considered to be relatively safe investments, as they are often issued by reputable firms with strong financial standings.

The advantage of FD from large corporate houses lies in their flexibility and the security they offer, making them an ideal investment choice for companies looking to balance liquidity with returns. It is essential, however, to assess the financial health of the corporate house and understand the terms of the FD from large corporate houses before committing funds.

Conclusion: Building a Financially Sound Foundation

Securing a startup loan for new business, obtaining a second hand car loan, and investing in FD from large corporate houses are pivotal steps in establishing a strong financial foundation for any new venture. Each of these financial tools serves a specific purpose and, when utilized effectively, can help mitigate the inherent risks of starting and running a business.

By carefully planning and strategically using a startup loan for new business, a second hand car loan, and FD from large corporate houses, entrepreneurs can not only ensure operational efficiency but also strengthen their company’s financial health. The key is to understand your business’s unique needs and choose the right financial products to support its growth and sustainability. Whether it’s through acquiring essential assets, expanding operations, or making savvy investments, the right financial decisions can turn your entrepreneurial concept into a thriving reality.

0 notes

Text

Quick approval second hand car loans | Primeloans.kotak.com

Drive your desired pre-used car with ease, thanks to Primeloans.kotak.com. Quick approvals and low-interest rates redefine your journey to pre-loved car ownership.

Quick approval second hand car loans

0 notes

Text

Crucial Factors That Determine Your Profits When Buying a Used Car

Are you considering buying a second-hand car? While it can be an economical choice compared to purchasing a brand-new vehicle, your overall profits largely depend on several key factors. In this informative blog, we'll delve into these factors to help you make a wise and cost-effective decision when buying second hand cars for sale Avondale.

1. Vehicle History: The first and foremost factor affecting your profit is the car's history. Obtain a comprehensive vehicle history report that includes information on accidents, title status, and service records. A clean history report can significantly boost your confidence and future resale value.

2. Mileage: The number of miles on the odometer can heavily influence the car's price. Lower mileage often means less wear and tear, potentially leading to fewer repair costs down the road and a higher resale value.

3. Age of the Car: Older cars tend to be more affordable, but they might come with more maintenance requirements. Balancing age with mileage is essential to maximize profits.

4. Maintenance and Service Records: A well-documented maintenance history can signal that the car has been cared for properly. This not only ensures a smoother ride but also adds to the car's resale value.

5. Market Demand: Check the local market demand for the specific make and model you're interested in. Popular models of second hand cars for sale Avondale tend to hold their value better and may offer better resale prospects.

6. Condition: Physically inspect the car for signs of wear and tear, rust, or any hidden damage. These factors can affect both your initial purchase price and future maintenance costs.

7. Ownership Costs: Consider factors like insurance premiums, fuel efficiency, and expected repair costs over the next few years. Used quality cars in Avondale with lower ownership costs can lead to higher overall profits.

8. Vehicle Identification Number (VIN) Check: Run a VIN check to ensure that the car hasn't been reported stolen or salvaged. A clean VIN report is essential for your peace of mind and the car's resale value.

9.Negotiation Skills: Your ability to negotiate the purchase price plays a crucial role in determining your profits. Do your research, set a budget, and be prepared to haggle for the best deal.

10. Future Resale Value: Think about the long-term when purchasing a used car. Resale value depends on factors such as the brand's reputation, model popularity, and overall condition.

11. Warranty: Some quality cars in Avondale may still have a portion of their original manufacturer's warranty left. This can save you money on potential repairs and enhance the car's resale value.

In conclusion, it's crucial to conduct thorough research, perform inspections, and negotiate effectively to maximize your investment. By taking these factors into account, you can make an informed decision that not only saves you money upfront but also pays off in the long run, ensuring a profitable ownership experience. For details on bad credit vehicle loans Avondale and how to fix it, contact us now.

0 notes

Text

Best second hand car loan in tricity

Check =>Used Car Loan Eligibility http://availcar.com/used-car.php

0 notes

Text

If you are looking for jewelry shop near you, please visit our website https://justsearchme.com/

0 notes

Text

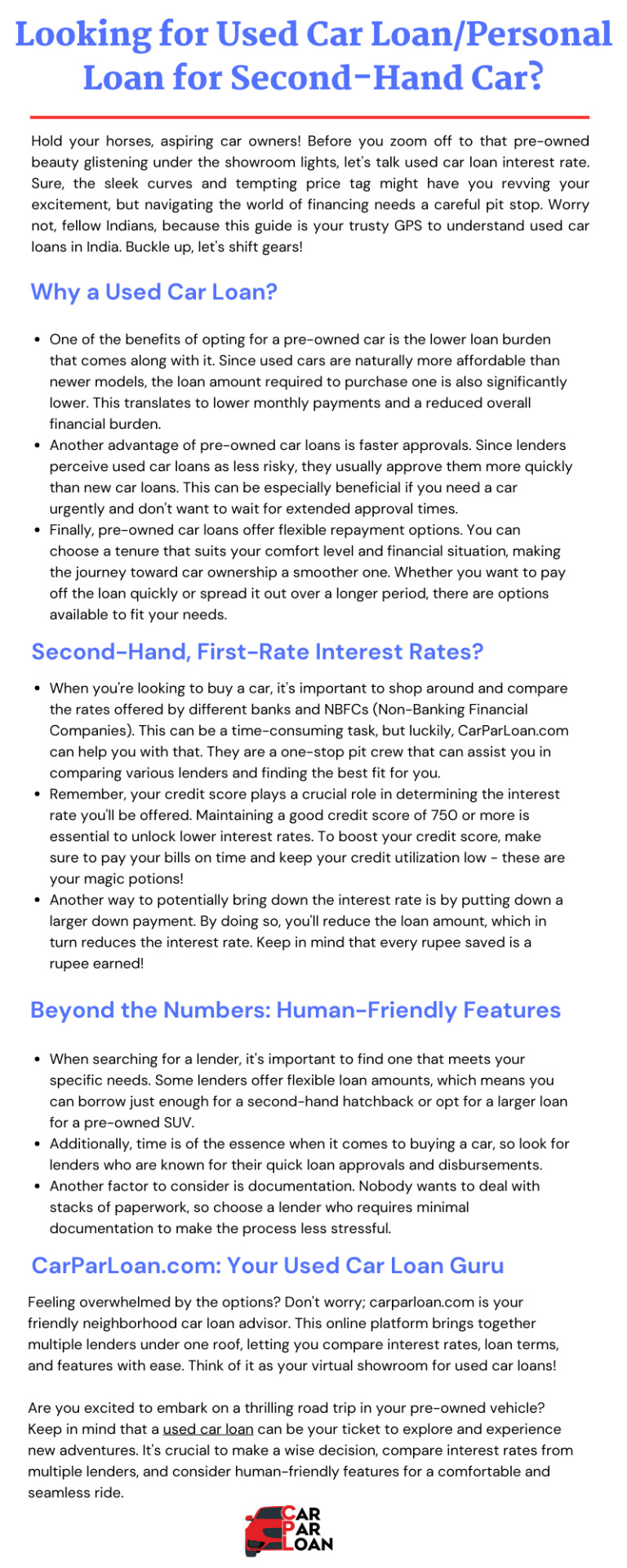

Looking for Used Car LoanPersonal Loan for Second-Hand Car

#Used Car Loan#Personal Loan#Second Hand Car#Used Car Loan Interest Rate#Second Hand Car Loan Interest Rate#Car Par Loan

0 notes

Text

Ride Your Own Car with New & Second Hand Car Loan

Ride Your Own Car with New & Second Hand Car Loan

Getting tempted towards an out of the budget car? Worry no more. We have got your loan options ready. Get your dream car without any hassle with Car Loan in Meerut. We have curated a list of top car loan banks that offer car loans to both salaried and the self-employed people with minimum documentation. FinRize Finserv Pvt. Ltd is a trusted name of company offering 100% safe car loan options, irrespective of what vehicle you are looking for.

Get Instant Car Loan in Meerut with Finrize Finserv Pvt. Ltd

You go get your dream car; we will manage the funds for you. We have enlisted car loan providers from top companies and banks to offer the best options for Car Loan In Meerut to our customers as per their requirements.

Why Choose FinRize Finserv Pvt. Ltd. for Car Loans?

Easy and Convenient Car Loans

No hidden conditions or charges.

Avail attractive interest rates & flexible repayment tenure.

Customizable repayment options to fall easy on your pocket.

Legal and technical experts for Professional counseling.

Dependable service and customer support.

#Top Car Loans in Meerut#Top Second Hand Car Loans in Meerut#Apply for Meerut Car Loan#Car Loan in Meerut Best Rate#Auto Loan in Meerut Best Rate | Get Lowest Interest#Used Car Loan Meerut#Best Car Loan in Meerut#Second-Hand Car Loan in Meerut#Used Car Loan in Meerut Apply for Meerut Car Loan

0 notes

Text

What to consider when taking out a loan for a used car

There are many questions you'll need to ask when buying a pre-owned or used car. To choose the right car model, what should one look for? How do you choose the right car for a family? Is it better to borrow from friends or family or use your savings?

When taking out a new car loan, it is important to make an informed decision. If you are considering taking out a car loan for second hand car, you should take into account the following factors.

Used Car Loan Interest Rates: Rates play a significant role when it comes to determining the costs of a used car loan. Throughout a loan, borrowers have to pay an EMI. If you want to buy a car, you should always take out a loan instead of using your savings. It is always easier to pay fixed small amounts as EMIs spread over several years than to exhaust all your savings in one go. If you check your credit score before applying for the loan, you can also reduce your interest rate.

Special offers on loans: Today's competitive market places a high value on customers. The goal of companies is to attract customers by offering lucrative offers. Pre-approval used car loans provide great savings either through lower interest rates or more convenient repayment options.

Is there a down payment required?: A second hand car finance with little or no down payment allows you to own a car without spending a lot of money upfront. There is no need to pay a down payment on your car and you can pay in smaller installments over the fixed tenure. A lower down payment can also help you afford a higher-end vehicle.

Is a personal loan better for you than a used car loan?: If you want to buy a used car, you can get a personal loan or a used car loan. Since used cars maintain their value by the vehicle you own, there are fewer requirements for used car loans. The interest rate on this secured loan also differs from that on a personal loan, based on the customer's credentials.

Save your savings: Savings is an important factor in deciding whether to finance a car. Make sure you keep some savings in case of an emergency or any unforeseen need. Take a moment to think about this. Consider taking out a car loan if you cannot afford to pay in cash. You can also compare the used car loan offerings of Car Kharido becho 24, which offers loans up to 100% LTV.

A pocket-friendly EMI: EMIs against loans are related to interest rates and loan tenure. Higher tenure and lower interest rates can lead to lower and pocket-friendly EMIs. Make sure your EMIs are affordable so you can pay them on time without any delays or defaults. Select the tenure based on affordability. It is better to go for shorter loan tenure since it will reduce the interest outflow.

Loan to Value (LTV) Ratio: LTV refers to the ratio between the loan amount and the car's value. LTV is one factor that determines how much of a loan is approved by different lenders. Choose a lender with a higher LTV if you need a higher loan amount.

When taking out a loan for a used car, keep all these factors in mind. Choosing the right financing method is also essential. Ensure your ride brings you a joyful journey by listing the positives and the negatives. A pre-owned car loan from CKB24 offers easy loan application processes, minimal documentation, and attractive interest rates. You can also sell car online with us.

Source link - https://carkharidobecho24.com/what-to-consider-when-taking-out-a-loan-for-a-used-car/

0 notes

Link

Owning a car is no longer a luxury in today’s quick-paced world; it is instead a necessity. New car purchases aren’t always the most sensible option, though. In this situation, certified pre-owned (CPO) vehicles are useful. These cars provide a special synthesis of value, excellence, and security. In this thorough guide, we’ll examine the many advantages of certified pre-owned vehicles and offer you useful information to aid in your decision-making when it comes to buying your next automobile.

0 notes

Text

Looking For A Second Hand Car Loan? Here's What You Need to Know

Buying a new or used car is an exciting and often necessary purchase. However, not everyone has the funds to pay for a vehicle outright, and that’s where car loans come in. If you’re in the market for a second-hand car loan, there are some things you need to know before signing on the dotted line such as you must do a personal loan eligibility check.

Firstly, it’s important to note that not all…

View On WordPress

0 notes

Text

If you’re in the market for a used car, it’s likely that you’ll need to secure financing to make the purchase. Finding the right second hand car loan can be a daunting task, but with the right information, it’s possible to find the perfect ride for your needs and budget. In this article, we’ll provide you with valuable tips for securing a used car loan.

0 notes

Text

From Idea to Reality: How to Secure a Startup Loan for Your Business

Embarking on a business venture requires not just a great idea but also the financial backbone to turn the vision into reality. Many entrepreneurs look toward securing a startup loan for new business to get off the ground. However, funding options don't stop there; other financial instruments like second hand car loans or even FD from large corporate houses can play a part in getting your business up and running. This article provides insights into navigating the financial landscape to secure these essential funds.

Understanding Startup Loan for New Business

A startup loan for new business is specifically designed to help new entrepreneurs finance their initial costs—such as leasing office space, purchasing inventory, or covering initial operating expenses. Securing a startup loan for new business often involves presenting a detailed business plan, financial projections, and personal credit history to potential lenders.

One of the key advantages of a startup loan for new business is that it typically offers relatively competitive interest rates and terms that are favorable to new entrepreneurs who may not have substantial collateral. Entrepreneurs need to demonstrate a viable business model and potential for growth to convince lenders of their creditworthiness.

Leverage FD from Large Corporate Houses

For businesses looking to establish credibility and secure substantial capital, considering an FD from large corporate houses can be a strategic move. An FD from large corporate houses is a fixed deposit made with large corporations that offer higher interest rates compared to regular bank deposits. This can be an excellent way to ensure a steady income from interest, which can support a business in its early stages.

Entrepreneurs can use FD from large corporate houses as collateral when applying for business loans, making it easier to obtain financing under better terms. This approach not only helps in securing the needed capital but also in building a relationship with large corporations that could lead to future business opportunities or partnerships.

Second Hand Car Loan as an Alternative Financing Option

For many businesses, especially those involved in delivery, transportation, or mobile services, vehicles are crucial. Here, a second hand car loan can be a cost-effective choice. Second hand car loans often come with lower purchase costs and insurance premiums, making them attractive for businesses trying to minimize initial outlays.

Securing a second hand car loan is generally more straightforward than a new car loan because the amount involved is usually smaller. Businesses can leverage second hand car loans to get operational vehicles without diverting large amounts of capital from other critical business needs. This type of loan is especially useful for startups that need to manage their cash flows carefully.

Tips for Securing Financing

Detailed Business Plan: Whether you're applying for a startup loan for new business, using an FD from large corporate houses, or getting a second hand car loan, a detailed business plan is crucial. This plan should outline your business model, market analysis, competitive landscape, sales strategies, and financial projections.

Creditworthiness: Maintain a good personal and business credit score. Lenders will scrutinize your credit history when deciding whether to extend a loan. For a startup loan for new business, your personal credit often plays a significant role.

Collateral: Understand what you can offer as collateral against your loan. This could be equipment, real estate, or even an FD from large corporate houses.

Shop Around: Don’t settle for the first financing offer. Compare different products, such as second hand car loans or FD from large corporate houses, to find the best rates and terms that suit your business needs.

Conclusion

Securing a startup loan for new business, considering FD from large corporate houses for secure and advantageous financing, or opting for second hand car loans for necessary business operations are all viable strategies for getting your business off the ground. Each financial tool offers unique benefits and can be tailored to meet the specific needs of your startup.

0 notes