#and the fact R-a-H is very much a part of this trade circle

Text

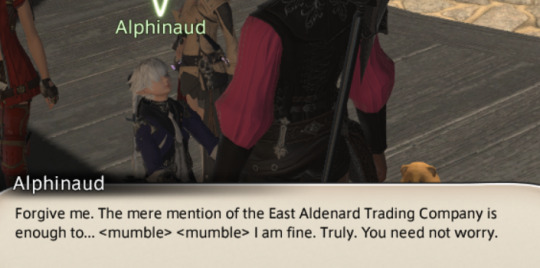

I stan Alphy's character development. Me too, lil buddy.

#this is very much the Girls Night expansion with Lyse and Alisaie but Alphy should still get a nod for this :P#learning not to trust capitalists my baby <3#tbh the Hancock intro speech talking about a shadow war with capitalism links right into the most recent patch's economy stuff#and the fact R-a-H is very much a part of this trade circle#*plus Carv is probably raiding Vrtra's ships for the spices HE trades#does remind you that all these players have been on the board so long#(I mean the HW alc quests teach you R-a-H alchemists can make human homunculi which sure is a detail to keep in mind)#endwalker spoilers#ffxiv#anyway I remain constantly fascinated by the portrayal of global capitalism in this game#especially since it's somewhere between 1700s trade routes and next day delivery#and like... medieval situations#garlean magitek is there too#alas I just listen to podcasts about the current world real news I don't know any real economic theory

25 notes

·

View notes

Photo

Friendly reminder this is an mmd model/pmx model

“The world adores me!”

Asmodeus, avatar of pain and suffering. just kidding >:0. The amount of struggles I went with Asmo??? Way too much. I was gonna release her two days ago, for my birthday lmao, but noooooo I had to add 69 morphs because haha 69. I was also very busy with life and stuff but now I have even less time to work on the next one,,, Basically I lost my mind with Asmo and she might be a bit glitchy. It was my first time actually making coat physics so I hope it’s not too bad (I mean it doesn’t look half bad...). The pass is different this time around and you need to go through ladies night’s tumblr to find Asmo’s cup size. hah. don’t ask. The amount of times I uploaded the file on mediafire because I would always see something that bothered me was so much that I decided to take the time to also make the hands similar to TDA, YYB etc. please send help.

I wish I was a confident queen like Asmo...

:(

I don’t want to write this anymore but I’ll feel bad if I write something bad for Asmo since I love them a lot. Fun Fact: I write these normally when I don’t even have a preview of the model so I just put on a random image that I have saved and sometimes I’ll think that I would accidentally post the post with the wrong image and disown myself.

Asmo best girl

Oi @midnight-moodlet here’s ya girl

Stupid circle eye morph thing is dumb I don't think I'm ever gonna do it again

I DON’T WANT TO POSE HANDS EVER AGAIN

Scarf clips like crazy but when I tried to fix it I accidentally exploded the model so I’ll fix that at a later date. There is also I believe a normal issue with the coat but I’ll also try to fix it at a later date because I don’t want to delay her further...

I’m so dumb cause I closed my tab while writing so it didn’t save so I needed to write everything again, more time lost...

The design belongs to @boxbusiness and there is an ask blog with the name @obeyme-ladiesnight if you're curious

Details and download under cut!

C R E D I T S F O R P R E V I E W

Asmodeus by 3AM Cappuccino (still me!)

Stage by 小怪物爱吃柚子

Effects by:

⇒ Ray-cast by Rui

⇒ KiraKira sparkle by chestnutscoop and BeammanP

⇒ FXAA by Rui

⇒ Light-Bloom by Rui (I’m not even sure if I used this the program closed itself...

⇒ Filmgrain by Rui

S I M P L E E X T R A S/C H A N G E S

Replaced facial morphs

Added basic facial morphs found in TDA models and YYB

⇒ Morph inspirations did come from TDA models so you can use the model in multiple expressive motions!

Asmo has 69 morphs, lmao I wanted to add enough and do a little gift for you guys with more morphs

Extra facial morphs (like tears, heart eyes, etc.)

C R E D I T S F O R M O D E L

Body, face, top and Accesories by Vroid and 3AMCappuccino

Jacket made by SumireHaikuXNA and PeachMilk3D (It's heavily edited as you can tell)

Shorts made by Tehrainbowllama

Spas by AceYoen and Vroid

R U L E S

Credit 3AMCappuccino when using

Don't claim it's yours.

Don't redistribute

Tag me when using (Optional but I'll still love to see what you did!)

P R O H I B I T E D X

Don't claim as your own

Don't sell or trade the model

Don't take the body and head swap

A C C E P T A B L E ✓

Editing is fine

(the model can clip and glitch sometimes so if you can fix it, contact me so I can update the link and I can credit you as well!)

Taking parts is good but ask first

⇒ When taking parts from the other credited, take the original, not my edited version, (I can give guidance though)

⇒ Another exception would be the earrings and scarf that was made by me, so instead ask me first before taking if you want be the earrings and/or scarf (p.s. don't take the earrings they are super heavy whoops, took them from another one of my models yet here I am without decimating)

V I D E O P R E V I E W

D O W N L O A D

#mmd#obeyme#obey me shall we date#obey me one master to rule them all#asmo obey me#obey me asmodeus#obey me swd#swd asmodeus#i dying#I literally forgot the tags when i first posted this#how#i don't even know#can I tell you how im still shook of lord diavolo is watching#like damn Diavolo no need to watch me I come in peace#I swear Im not going to destroy devildom#I don't think I can#I bring genderbents#box business still wont notice me so...#Lord Diavolo is watching is great#I should stop rambling#Im still sorry for being so late >:0#I FORGOT THE CREDITS FOR THE PREVIEW KILL ME

250 notes

·

View notes

Text

Eidolon (Angel!Keith x Demon!reader) {part iv}

i have no excuse for the wait except that im an idiot who took this school year too lightly yeet

-- -- --

Summary: Keith is an angel, and he’s completed mission after mission for the Upper Hand, the organisation controlling all of the Above. He’s only failed a mission once: when he was assigned to kill you, a surprisingly charismatic demon. He roamed Earth–Middle Ground–for years before he was caught by the Upper Hand again, and things quickly go south.

Genre: angst. because whats new

Word count: 8.7K

Notes: CW: graphic violence/blood, emotional manipulation - masterlist - {previous} -- {next }

-- -- --

if heaven's grief brings hell's rain

then i’d trade all my tomorrows for just one yesterday

~ Just One Yesterday, Fall Out Boy

-- -- --

You wake up from a deep, dreamless sleep, disoriented and shivering despite the multiple layers you have on and thick comforter stacked upon you. It takes a moment before the events of the previous night rush back into your mind and cloud your thoughts, and you throw an arm over your face, inhaling deeply.

A huge weight has fallen off your shoulders. Last night, you didn't realise as much, your tired 3 A.M. mind already struggling to focus with the fact that Keith--who had been deathly sick only hours before--was up and about and sitting at your kitchen table and eating chinese takeout. But now that you had the quiet of the early morning to yourself you could feel the knots in your shoulders loosen and the lead seep out of your limbs.

You slowly shift your legs out of bed, still slightly dazed. Sunlight peeks out through the cracks in the shutters covering your window, and you cast a look at the alarm clock sitting on your nightstand. It's barely 7 A.M. And it's also a Saturday. While that doesn't matter much in terms of noise–a city is a city, after all, and this one certainly is never quiet–your neighbours' kids aren't allowed out of bed before nine on Saturdays, which gives you at least two small hours of peace and quiet.

You stagger to the bathroom and let the hot shower water beat down your stiff muscles, trying to draw out the permanent chill that seems to have settled deep into your bones. It works a little bit, but when you get out of the steamy little cell and wrap a towel around your torso you can feel it trickle back into the pit of your stomach, like an icy worm that's decided to make your body its home. It's more of a discomfort than a true pain, though, so you decide to ignore it.

Your hair is still damp when you pull an extra thick sweater over your head, stick your feet in warm socks and tiptoe your way over to the living room.

Keith is still asleep. You don't blame him–he's still recovering, even though he already looks so much better than the previous night. The colour is back in his cheeks. The dark circles and the hollowness under his eyes have started to fade away. He's still thin, and he doesn't smell too good, but you decide against waking him just yet.

In the kitchen, you put on the kettle and pull open the fridge in search of something to eat. The unfinished boxes of chinese sit in front, half-open from when you hastily stowed them away. You pull one out, sniff it, then shrug as you grab for a spoon.

The kitchen windowsill is probably not the spot a lot of people would pick to lounge on, an early Saturday morning. But you've always liked to watch the sun rise over the tall buildings, and the soft orange glow you're treated with today is worth waking up so early for. You rest your face on the knee you've pulled up beside you as you shovel another spoonful of rice into your mouth.

The orange slowly fades out into yellow, then into blue. It's soothing to watch, and you find yourself slow your breathing and close your eyes as the city wakes up beneath you. Noises of starting cars and motorbikes drift up to your window, and chattering fills the street. People exit their homes, throwing delightful glances up at the sunny sky; unexpected after the heavy rain of the previous night.

You finish your takeout, do some chores around the house. Change your bedsheets. Prepare a change of clothes for when Keith finally wakes up. Open the windows to let in some fresh air. Prepare a cup of tea and claim back your spot on the windowsill. It's a peaceful morning, and the air doesn't feel quite as heavy as usual.

And then there's a rustling in the room beside you, and a crash as–you assume–Keith tumbles off your sofa and hits the ground. A faint groan floats past the kitchen doorway and you try to hide your grin. A couple of seconds later a very dishevelled-looking Keith stumbles into the kitchen.

"Morning," you tell him, rolling your shoulders once so they won't go stiff against the windowsill. He nods at you, dark eyes bleary. "Feel better?"

He sniffs. "I don't feel like I just got struck by lightning and dragged behind a racecar over an especially rocky road. So I guess that's improvement."

You blow on the hot tea in your hands. "I'm glad. Would have hated to have gone through all that trouble for nothing. You're quite the guest, you know."

Keith winces at the words, despite your light tone. For some reason, his frown and pained expression tug at your stomach. "But I don't mind it," you add hurriedly. "I mean–it was my own choice to take you in. I very well could not have done that. But–but I did." Shut up, shut up, shut up, you shouted internally.

The corners of Keith's mouth lift ever so slightly. "Lucky for me."

"Lucky for you," you agree with a grin.

It's silent for a while, and in the sunlight, you can clearly see how thin Keith really is. His shirt hangs from his frame in a shapeless lump of cloth, his trousers sagging and almost slipping from his bony hips. While he does look better–the life has returned to his eyes–he still doesn't look good, and the sight of him makes your guts twist. You point to the fridge. "There's leftovers from yesterday. Grab whatever you want–but be careful not to eat too much. I don't want you puking all over my kitchen."

But Keith has already found the other chinese box, and you show him which drawers contain cutlery and in which cupboard are stashed the glasses. He scarfs down the rice in ten minutes flat, and you shake your head in silent judgement. "I'm going to find a way to make you pay back everything you'll cost me, food-wise. You're in debt, starting today."

He gives you a shy grin, but his attention is quickly taken up once more by the food in front of him. You quietly sip your tea, staring out of the window, occasionally glancing at the angel sitting at your kitchen table.

That's when it truly hits you how much of an idiot you're being.

Last night, it had been late. Five days of nothing on your mind but the thought of trying to keep him alive, and finally finding a way to do so, had left you shaky and dazed. Seeing him up and about after getting used to the sound of his ragged, unsteady breathing floating through your apartment had been a shock.

But now the full weight of what you'd done–and what you hadn't done–crashes into you, and you realise you have absolutely no idea how to feel. The air charges with tension, and the angel leans back in his seat. He looks about as uncomfortable as you feel. Your mind whirls with thoughts, all seeming to want something different–the part of you that's curious where this whole situation would lead and is whispering to you to let him stay; the part of you that's still a loyal soldier to the Below and is screaming at you to turn him in; the part of you that wants nothing to do with any of this and is growling to throw him back out on the street. You shake your head, downing the last of your tea and hopping off the counter.

"Take a shower when you're done with that," you mutter. "I have to get back to work soon. My co-workers are gonna ask questions and I need to be prepared."

Keith nods. Your phone is already in your hands and you fire off a quick text to the shelter's manager to inform him you'd be in this afternoon. You don't know Anthony that well–he mostly keeps to the side and handles potential adopters. You prefer to stay with the animals. Almost immediately you receive a reply: he says he's delighted that you've decided to return so soon after taking your unexpected leave. You resist the urge to roll your eyes at the barely-veiled passive-aggressiveness.

"Oh, yeah." You turn and point at Keith with your phone. "You can stay for as long as you need to, like, get your bearings and feel somewhat okay again, but then I'm kicking you out. I don't know if you have any idea of how much of a risk I'm taking here, but–"

"I get it," he cuts you off, and you can tell he means it. He needs to work on concealing his emotions, you think off-handedly. He's an open book. It's distracting. "Thank you. Seriously."

The tension builds until it's almost tangible. You shake your head, trying to shake the dizziness away. "It's–yeah. My pleasure, or whatever. I'm locking the door behind me." He gives a brief incline of his head to show he understands. "All right then. Later, I guess. Make–make sure you've showered. You kind of smell," you say apologetically. "No offence."

"None taken," he laughs. "You're right, anyway."

You make a gesture that's in between a nod and a headshake, then make a blind grab for your coat and your scarf before pulling the door closed behind you and locking it.

The shelter's lights are on, and its illuminated windows stand out starkly in the dim grimness of the gloomy street. It doesn't rain, for once, but grey clouds hang overhead and block the sun, the little light that makes it past them flimsy and thin. You pull the door closed behind you. The little bell above the doorway rings once, softly, and barking immediately pipes up from the next room over. You smile.

"Hey, loves," you mutter to each animal as you pass their cages, stopping here and there and sticking your fingers through the bars to give a furry face a pat, or to scratch a scaly butt, or to stroke a feathered head. "I missed you guys."

"They missed you too, I think," comes a quiet voice from behind you. You crouch and open a cage, plucking out a small cat and scritching it behind the ears. "They've been rather unruly in the days you weren't here. Restless, you know."

"Hi, Tony."

"Y/N." He inclines his head. "Did you have a nice leave?" It's a question purely out of politeness, you know, because he's your employer and he's supposed to be polite. As far as employers go, Tony really isn't the worst of them. But you can't shake the feeling that he's fishing for something.

"I did. I've been busy," you say cautiously, not taking your eyes off of the kitten you're cradling. "Sorry for it being so unexpected."

"Oh, not at all," Tony replies smoothly, sailing over to where you sit and leaning on the wall behind you, "We've managed. It was your week off, anyway, and just because you've insisted on working in your free time before doesn't mean that you always will." But it doesn't take amazing detective skills to hear the suspicious edge to his voice.

"That's right," you say, maybe a little too sharply. You can almost smell Tony's raised eyebrow behind you. "Sorry. I've just–I've been a little on edge, lately. I'll–" You scramble up, depositing the kitten back in its cage and dusting fur off your t-shirt. "I'll be in the back." You have the weird urge to salute, but you manage to suppress it. He's already suspicious, you remind yourself. Don't make it worse by acting weird.

It is a shame you can't spend more time with the animals, but you're not the only one who decided to come in today–it's actually quite crowded for a Saturday–so you get storage room duty and instead spend your afternoon putting away boxes of food and medicine and cleaning products. Emmie, one of your co-workers, sticks her head around the corner of your door at the end of the day.

"Hey. We're gonna go get milkshakes, wanna come?"

Your back screams when you push off the chair, eager for an excuse to cut your day short. "You're a godsend." The expression is actually used exclusively as an insult in the Below, but you find you like the Middle Ground version better. "Let me just grab my shoes, I'll be right there."

Hopping on one foot as you finish tying your laces, you join Emmie, Nirina, Adam and Zach as they stride out the door, Emmie and Zach's arms linked. In the back of your mind you recognise that's strange: Emmie and Zach can't stand each other. A smile curls the corners of your lips. You did miss quite a lot this past week, didn't you?

"We're going to this new place a few blocks down," Emmie shouts over her shoulder. You try to chat with Nirina for a bit, but she's more silent than usual, barely saying a word, and eventually she retreats to walk next to Adam behind you. When you don't focus on it, a black, vaguely animal-shaped shadow seems to sit on her shoulder, but when you look directly at it nothing's there.

Something isn't right here.

The feeling creeps into your very bones, making the hairs on your neck stand on edge and your shoulder blades tingle. The sense that you're being watched, and more–as you realise that with Nirina and Adam behind you and Emmie and Zach in front of you, it almost feels like you're being escorted. Guarded.

"Hey, Em," you call. Your hand creeps towards your pocket, but with a start you remember you left your knife at home. Stupid, stupid, stupid. "What's the place we're going called?"

Emmie turns around and flashes you a fanged grin. Your blood turns to ice. "So Above, So Below." And then she pounces--and pushes you straight through the pavement. You don't even have time to scream.

You lose all sense of direction. Up is down and left is right as you fall, fall, fall through a black hole, Emmie's nails still digging into your shoulders, though you're sure if you actually opened your eyes you'd see they're claws. You try to tug yourself loose, but her grip immediately tightens. You hiss when you feel her talons draw blood.

"No getting away, Y/N dear," she giggles into your ear.

Well, at least you know what she–and the others too, by the sound of it–is. Only Bountyhunters can get to the Below or the Above without using one of the doors or passages, instead creating their own temporary ones. You've travelled by Bounty Tunnel before. It's not a memory you cherish. The only thing you can do is close your eyes and hope it'll be over soon.

When you finally make contact, all the air is knocked out of you and for a moment you see nothing but black spots dancing in front of your eyes. Then you suck in a scorching breath and blink, and the familiar stark white ceiling of the Offices comes into view. You groan, and when you try to sit up, your hands catch in ashy grey feathers: your wings have popped. You flush, already feeling Haggar's disapproving scowl digging into your back. How unprofessional, she'd mumble.

Haggar has always hated your guts–even back when you were still loyal to the Below.

Emmie–except she looks nothing like Emmie anymore–tosses her long dark ponytail over her shoulder and sighs. "That was almost too easy. We were told you'd be a challenge."

"I haven't been feeling well," you reply, voice icy as you stand up and shake out your wings. You don't miss the way Emmie's expression sours and suppress a smirk. Bounties don't have wings, and they'll never stop being salty about it. "Also, four against one? That seems a little unfair, even for Management." You pause. "I'm assuming you got hired by Management."

"Of course we got hired by Management, demon," Zach snarls. He runs his fingers through his hair and glares at you, his fangs growing by the second and soon touching his chin. And then his face begins to change, his jaw softening (though not by much), his eyes growing more cat-like, his lips plumping. You frown, because you know this face. You know her.

Zethrid grins, fangs shining in the white LED light. "Long time no see, Y/N." You give a sarcastic wave.

"Yes, Y/N," comes an icy voice from behind you. Your shoulders tense, and your feathers puff involuntarily. "Long time no see indeed."

Haggar glides out of her office doors, and you feel all the stony calm and resistance leave you in one fell swoop. Her yellow eyes bore into yours, and it takes every ounce of willpower inside you not to look away. She nods her head, once. "My office, Y/N. Now."

"You're so dead," mutters Zethrid as you pass her.

"When I get out of here, you're the first person whose throat I'll slit," you hiss in return.

Haggar slumps in her seat and plucks her looking glass from its stand, making it levitate over her hand and glaring like she has a personal vendetta against it. "If it were up to me, I would already have you burning and hanging from the Grand Hall ceiling," she says, vanishing the mirror in a cloud of smoke. You try to ignore the pang of fear stabbing into your chest. You're gonna be fine, you tell yourself. You're going to be okay. But you find it hard to believe the words.

"But–" the mirror reappears in her other hand– "a certain Prince insisted on keeping you alive." She whirls the looking glass around and it floats in front of your face. Prince Lotor of the Below looks at you with a scrutinising gaze, as if gauging how much you'd be worth on the night market.

"Y/N," he says in a clear voice. You nod, then quickly incline your head in a slight bow. Watch your tongue, Y/N. Watch. Your. Tongue. "No need for that." Lotor snaps his fingers, and you look up again, eyes fixed on the rim of the looking glass, determined not to meet Lotor's. You're afraid of what you might see.

It's silent for a moment, and you keep your mouth shut for as long as you can, but you eventually break. "Forgive me, Lord, but–"

"Shut up." It takes all of your willpower not to cock your head and narrow your eyes in indignation. Lotor leans forward, elbows perched on his desk and fingertips pressed together. His cold gaze is calculating and cruel, and your entire body reels with disgust and hatred. "I didn't keep you alive because I care about what happens to you. Because I don't," he clarifies with a raised eyebrow, and this time you can't keep the grimly sarcastic smile at bay. "I kept you alive because I need you to do a job."

"With all due respect, sir, I don't think I'm the right person for any job." You try to keep your voice light and your fists unclenched, but it's a harder task than you want to admit.

"Told him so," Haggar mutters from behind the mirror. You can tell she thoroughly disagrees with being used as a TV-stand. "There are so much more competent candidates for this assignment who actually want to prove themselves and their loyalty to us." You have the feeling she's talking directly to Lotor now. "But no, you just had to get the one rogue who'll do everything in their power to get out from this–"

"Enough," Lotor says coolly, and Haggar clamps her jaw shut, though her eyes flash with murder. You don't know who she wants to kill more at the moment: you or Lotor. "Y/N will do the job, and they'll do it without complaining."

"You sound awfully sure." You've since given up on trying to be respectful. Lotor might be the Prince of the Below, but you had wriggled yourself out of more difficult situations than these before. You're already carefully plotting an escape.

Because the mistake most people make when they see you is that they underestimate you. They think they have you pinned down, and then they loosen their hold and up till now, that has always worked out in your favour–you know how to manipulate people and you know how to get out of the Below. You know every single of the dozens and dozens of passageways leading out onto Middle Ground, and from there on you know how to hide. You've done it before, and managed to keep off their radar for quite a while.

In fact, the only reason they caught you now was because you had been too preoccupied with a certain angel to keep your thoughts straight. A mistake, and one you won't be making again.

"I am sure," Lotor's clear voice cuts through your thoughts and pulls you back to the present. "There's a contract on the desk. Sign it, and we'll give you the details."

You can't stop the startled laugh that bursts past your lips. "A Blank Contract? You expect me to sign a Blank Contract?"

Lotor merely cocks his head and smiles that lazy smile of his.

And then the little looking glass shatters and you yelp, taking a step backwards in surprise, feeling your muscles tense. "I do," his voice says from behind you, and you whirl around just in time to see Lotor sail into Haggar's office.

Haggar gives a sharp sigh and brushes shattered glass off her uniform. "Do you always have to do that? Those mirrors are expensive, you know. I'm gonna have you pay for them if you insist on making a dramatic entrance every time."

Lotor ignores her, his gaze fixed on you. He waves his hand, and a piece of paper appears between his fingers. It's mostly blank, save for one thickly outlined black square with an inscription you can't read from where you stand, but you know what they say: Candidate's signature. "I'm not signing." But your voice has a tremor to it, and you suddenly feel a lot smaller as Lotor strides towards you. It was a lot easier to disrespect the Prince of the Below through a looking glass.

His eyes flash with irritation. "You will." Somehow, those two words hold more threat to them than all the insults the Bounties threw at you earlier.

But you set your jaw and clench your fists. "I'd rather die. I'm. Not. Signing." You had vowed to not ever help the Below in any way, shape or form again. It wasn't worth it.

"Told you so," Haggar sing-songs from behind her desk, a maniacal glint to her eye. "Just take one of the actually competent ones. Let me string them up."

Lotor gives a sharp sigh. "Touch them and I'll be stringing you up." Haggar pouts and crosses her arms. He turns to you, and the coolness in his eyes sends shivers up your spine. The realisation hits you like a freight train. He's done something. He knows something. He would never be this sure of himself if he didn't have an absolutely airtight plan.

Then Lotor waves his hand again, and another mirror you hadn't noticed before–a looking glass spanning from the floor to the ceiling, partially hidden by a black curtain–lights up, and the image you see has all the colour drain from your face and your heart skip a beat.

Allura is tied to a chair and breathing hard, her nurse's scrubs hanging crookedly, torn and dirty. A nasty cut spans from her cheekbone to her eyebrow, and blood runs down the side of her face. Tears mix with the grime and blood smearing her cheeks. Behind her stand Emmie and Zethrid the Bountyhunters, crazed smiles painted upon both their faces.

As soon as she sees you, Allura lets out a strangled cry that is muffled by the gag strung over her mouth. Her eyes widen, and you rush forward, stopping just short of the mirror's surface, afraid to break it. Your shaking fingertips hover just shy of the surface before you pull them back to your chest. Tears threaten to spill past your eyes, so you push them down and try to take a breath.

"Is this real?" You know how hallucinations work. You know how powerful illusions can be, and you know exactly how useful of a tool they can be in manipluation. It's a tool you've used yourself.

"Maybe. Maybe not," says Lotor's soft voice. His breath washes over the side of your face, and you can feel sick rise in your throat. All compusure is lost. It's all or nothing now. Thoughts muddle and get mixed up in your mind until all you can focus on is Allura, terrified and hurt, sitting in front of you yet separated by a thin sheet of glass and who knows how many miles.

A crazy thought of Maybe I can free her pops up, but you beat it down immediately again. You don't know where she is. You don't know if this is even real. Lotor would immediately order her killed if you attempted anything remotely similar to a breakout. Then kill Lotor, a ragged voice in your mind screams.

"Come, come, no rash decisions now," Lotor says as if he just read your thoughts. His hands ghost over your shoulders, sliding down until they reach your elbows. He gently forces them to your sides, and you don't even have the strength in you to resist. A fresh stream of tears runs down Allura's cheeks, and she weakly thrashes against her bonds, and in the end, that's what yanks you out of your stupor.

Your chin snaps up. "So you'll let her go if I sign the contract?"

Lotor rolls his eyes. "Look whose wits have returned to them." He lets go of your elbows and takes a step toward the mirror, hands clasped behind his back and his hungry gaze raking across Allura's form. She looks up at him with a mix of hatred and fear in her eyes. She's given up struggling against the ropes, but her jaw is set, and her eyes are steely; terrified, but determined. Her gaze flicks back to you and she gives the tiniest shake of her head.

Lotor reels back and laughs, the sound booming within the office walls. He shakes his head, still chuckling, his long silvery hair swishing behind him as he stalks back to the desk and swoops up the contract. "Feisty. I like that. Doesn't have the slightest clue of what's going on but still tells you to not do the thing you obviously don't want to do." He flashes you a fanged grin that makes your blood run cold. "I just might pay her a visit later myself."

"That's Middle Ground, my Prince," you manage through gritted teeth. "I'll find and kill you before you even have a chance to knock on her door."

"That's some confidence you've got right there, Y/N. Keep it for the job."

"I haven't signed your contract yet."

Lotor cocks his head and his grin widens. "Yet being the keyword here."

You turn back to the mirror, scanning Allura for any sign that she might not be real, looking for something that might hint that her image is off. Something. Anything. But your manic brain is running in circles, looking for loopholes that might not even be there, and you know you're not making sense, because the chance that she's just an illusion is there, but on the off-chance that she isn't, that she actually is in danger–

You would never forgive yourself if she were to get hurt and you could have put a stop to it.

"It's possible," you breathe, your hands curling to fists. "It's possible that none of this is real."

Lotor nods as if your words are perfectly reasonable. "True." There's a beat of silence, and his feverish eyes bore into yours. "But are you willing to take that risk?"

Anyone else–any proper demon–would have laughed in his face and torn the contract to shreds, watching gleefully as Allura got tortured in front of their eyes. But you had left behind your demon ways a good while ago, and you had always been a rotten pupil anyway. So you bite your tongue and snatch the contract and pen from Lotor's waiting fingers, scribbling your signature down hard enough that you pierce the paper.

"See, I knew you'd come around in the end!" He claps his hands in delight and throws a triumphant glance Haggar's way. "I told you so."

"Yeah, yeah," she mumbles, waving a hand as if to dismiss his words. She gives you a slightly disapppointed stare. "I was rooting for you, kiddo. Show some spine next time."

You fight the tears threatening to spill and slap the now-signed contract back onto the desk. "All right. Details, Lotor. What's the assignment?"

His eyes flash. Business; there's something he knows. "We received word that one of the Above's most prized angels has just gone rogue." He starts pacing, and your eyes keep finding Allura's behind him–but she looks at you with pity and something that's almost disappointment, and you have to look away before you break down completely. "It came out of nowhere, too: stellar record, followed orders without a second thought. A great soldier." You don't miss the punch behind the words.

"And you want me to do, what, kill him?" That wouldn't be too hard. At least, you think. Your mind is still a bit muddy, but something ugly and twisted inside you is still desperate for Management's approval. Still eager to prove yourself. I can be a good soldier too.

"Oh no, no," Lotor says with a dismissive wave of his hand, "I just want you to find him and bring him in. It shouldn't be that hard to do–after all, who better to track a rogue than another rogue themselves?"

There's still something else. Something he isn't telling you. Sure, you're good at what you do–at what you used to do–but was it worth going through all the trouble just to get you to sign the stupid contract? As much as you loathed to do it, you silently had to agree with Haggar on this one. There were so many young demons scrambling for their chance to prove themselves and their worth–why not let them take this assignment?

"That–that's it?"

Lotor cocks a brow. "I mean, unless you wanted more work, I guess that's it.'

You give a cautious nod. "Okay. So what do we know about this guy?"

"Not much. My sources weren't able to provide very recent information–"

"Get better sources."

"–But what they do know is that this particular angel has been off the map for years. Quite like you," he adds as he raises his other eyebrow. You roll your eyes. "He's impossible to find, quite hard to track, and a very skilled fighter. Rumour has it he's scouring your city's streets at the moment."

You resist a frown. If this guy has been prowling your streets and you haven't noticed, something is definitely amiss. Might just be that you've been preoccupied with Keith and everything that happened around him, but if this has been going on for as long as Lotor is implying it has... this just might prove an actual challenge.

The old feeling of excitement and anticipation starts to run through your very bones again, and you hate the way it makes you feel–energised. As if you can handle anything thrown your way. Ready. It's a feeling you haven't known in years, and one you haven't missed, though now that it courses through your veins again there's no point in denying that you're enjoying it. The thrill of the chase.

But then Lotor speaks the name of the angel you're supposed to bring in, and everything falls into place, only to shatter into a million pieces a split second after.

You see his lips move. Hear the words spoken, though they take a moment to get processed, and when they do they leave behind an emptiness that has you stare at him, too dumbfounded and untrusting of yourself to speak.

It can't be. This must be the universe's idea of a cruel joke. The very guy you'd risked everything for–the very angel that had caused your distractedness and is the reason you were here in the first place–is the same rogue angel about whom you had just signed a contract.

The crushing weight of it settles on your shoulders. All five days of you struggling to keep him breathing, for nothing. The weird excursion to Coran's shop, for nothing. The goddamn chinese takeout you'd bought for him, for fucking nothing.

But somehow you manage to keep your face straight, and Lotor hadn't been watching you as he said it, instead gazing intently at something over your head, so you can only hope he hasn't noticed the lurch in your expression at the mention of Keith Kogane.

"All right." You're almost shocked at how steady your voice is. "Okay. I've agreed. You got what you want. Now, free Allura." Even though your voice is pretty steady, you curl your hands into fists to hide their shaking.

Lotor doesn't move for a moment, and you seriously begin to think he's having a seizure until he snaps his fingers and Emmie lunges forward.

In her hand is a knife, and she plunges it into Allura's chest without a second of hesitation.

You rush toward the mirror, a strangled "No!" ripped from your throat. Your fingers claw at the smooth glass surface and you watch her slump, blood gushing from the wound and staining her scrubs a dark crimson. Your knees buckle, and your eyes stay glued to her form as she convulses, coughs up blood twice, then goes limp. Her head falls back...

And snaps back up, and you lurch back with a startled cry. Allura's eyes have gone red and are shining with mania. Her skin turns the colour of wet ash, and her hair falls out of its updo and cascades down her shoulders, tendrils black and writhing as if they have a mind of their own...

Demon.

Shapeshifter.

Your breathing comes in short and shallow rasps as the full realisation of things settles in. Allura was never in danger. You were right all along. If only you had put your foot down. If only you hadn't let your feelings cloud your mind.

It doesn't matter now. You signed a contract–and there's no going back from that.

Lotor fingers through the file that bears your signature in black ink. Slowly, the words explaining just what you signed start to appear on the sheets, snaking their way along the curves of the paper as if written in by an invisible hand. A steel fist clenches around your heart, and you struggle to stand up, your muscles turned to jelly. The surface of the mirror has gone black again.

A shaking hand comes up to cover your mouth, and your teeth clench down on your lower lip so hard that they draw blood. Lotor flicks his wrist, and the contract disappears. The fingers of your free hand twitch as if they wanted to grab at the file. You level your gaze with Lotor's, and evidently your years of training finally paid off in the end, because in his eyes you can see how passive your expression is. You'd be a good poker player, your fleeting mind thinks randomly. The only thing giving away your current emotions is the hand mindlessly tugging at your bottom lip, and the fact that your breathing is still rather fast.

"Now," Lotor drawls in his honey-coated voice–sugary sweet, sticky, suffocating–and snakes an arm around your shoulders, "that wasn't so hard, was it?"

And you know you should keep your mouth shut, because he is the Prince of the Below, and Haggar has already expressed her desire to string you up and set you on fire in the Grand Hall for every new recruit to see–but on the other hand, you just signed a contract, and that makes you technically untouchable until Lotor has reason to believe you won't be able to complete the task set out for you.

The very foundation of a plan starts coming together in your mind. You jut up your chin and break free from his grasp. "So do I get assignment-issue gear? A blade? A gun, maybe? If this angel is as good as you make him out to be, perhaps I should need some more useful weapons than your average kitchen knife."

Lotor scrutinises you for a moment, then waves his hand. A set of gleaming double blades appear on Haggar's desk, along with their sheaths and long black gloves. Haggar huffs with an indignant mutter of Sure, use my desk as your summoning surface. Don't mind at all. You ignore her and lift an eyebrow. "That's all you're going to give me?"

"If you're as good as you say, this is all you will need," Lotor replies in that smooth tone of his. His eyes glint; he's gotten what he wanted. He's already won.

But that's fine. Lotor may have won this battle, and you need to make him feel like he has, but in the end you'll do everything in your power to win the war. And Lotor just handed you the weapons that just might be able to get you there.

"Fine," you mutter, snatching up the knives, pointedly refusing to strap them to your back like is procedure, instead securing the harnesses to your thighs as a small act of defiance. Irritation flashes in his eyes. "I'll report to you how often?"

"No reports," Lotor says with a wave of his hand. "We don't want to make any potential spies of the Above suspicious. Just make sure you find him, and when you do..." He tosses you a little disk about the size of a large coin, and you startle at how heavy it is. It's pleasantly warm to the touch, and you have a creeping suspicion as to what it is that is only confirmed with Lotor's next words. "Portal pass. Use it wisely."

You turn the pass over and over in your hands, the familiar weight of the knives at your thighs comforting and seeming to pull you down to the ground at the same time. "Is that–will that be all?" Risky words, risky questions–you're going out on a limb and assume Lotor won't have you hanged for running your mouth: he did just pretend to torture your best friend to coerce a signature out of you, so you suppose he has to give you some slack.

He sails to a halt in front of you, face so close his nose almost touches yours, and you have to stop yourself from recoiling. His expression is cold, his gaze calculating–and the smile that creeps up his lips sends shivers up our spine. "Yes. I think that will be all." He raises a brow and throws a glance Haggar's way, which you find comical as he didn't seem to give a solid fuck about her opinions when he used her office as his personal torture chamber.

Haggar shrugs. "I still think we should string them up and burn them to a crisp."

"Yes, Haggar, I know. Why did I even bother." He gives you a lazy flick of his hand, but you've already turned and your hand is resting on the doorknob, when something occurs to you and you cast a look at him over your shoulder.

"My Prince?" The title feels like hot oil searing down your throat, but you expect the words you're about to say require this small bit of courtesy. He raises a brow and nods. "I'm going to kill the Bounties that brought me here." Your voice sounds oddly bored.

Lotor chuckles. "They're no demons. They don't have a place in the Below." It's like his gaze issues a challenge, and a fresh wave of loathing for this Prince washes over your being. "Go right ahead."

You flash a cold smile and slam the door shut.

– – –

You wipe your blades with some wet wipes and discard them in the trashcan beside you when they get too filthy with blood (the store clerk barely looked up when you came in and purchased a single packet of wet wipes and a duffel bag–apparently the average cashier sees weirder stuff than a maniac with bloodied hunting knives the size of their forearms slamming a pack of wet wipes on the counter on a daily basis). Emmie, Adam, Zethrid and Nirina's bodies have long since turned to dust, and you have to work to keep your breathing steady and to stop your eyes from glowing red as the phone wedged between your ear and your shoulder rings.

Allura picks up on the fourth ring. "'Sup?"

It was just a check. Just to make sure. But if Allura truly did just get tortured, you have a feeling she wouldn't pick up a phone call with a simple 'Sup?

"Hey. How was your day?" Your speech comes out slightly slurred, and Allura laughs on the other side of the line.

"Fine. Work, you know. Routine." You can almost hear the grin on her face as she says, "And you? Weren't you supposed to be at work too, today?"

Work. Work feels like such a long time ago--when it was in reality only a couple of hours back. You nod slowly, though it's more to convince yourself than anything else. "Yeah. I was. Some co-workers and I went to get smoothies afterwards. To welcome me back," you joke.

"Did they pay?"

"Yeah."

"Good for you. Free milkshake. I'm jealous."

You laugh, but it feels hollow in your chest. "Hey--I need to run now, but I'll call you later, okay?"

"Yeah, sure. Sweet of you to check in, Y/N."

You eye the gleaming blade, running a finger along its razor-sharp edge. "No problem."

After you hang up, you sit back against the wall digging into your back, forcing down the pumping feeling in your limbs.

It's something you've missed, and you can't deny it. The absolute exhilaration you feel when your blades make contact, the thrumming of adrenaline in your veins as you dodge to avoid the blows that four individual enemies are throwing at you. The fear in Zethrid's eyes when she realises she is the only one left standing, and the life seeping from her eyes as you slit her throat.

It doesn't make you feel good, exactly–especially now that the thrill of the moment has worn off and you just feel tired and there's an ache that has burrowed itself deep into your bones–but there's no replicating the rush of power that courses through your very being when you're the one in control.

When the blades of death are yours to wield.

The knives are now securely stored in your new black duffel, and you try and figure out how you're going to pull off bringing two huge knives home without rousing suspicion from Keith. You internally debate whether you shouldn't just find a safe space to stash the duffel until you need it. There are quite a few nooks and crannies you know no one in their right mind would look, but then again, this was a big city. There were plenty of creepier people prawling these streets than the occasional demon.

And then you pass a gym, and an idea sparks in your head.

After casually shoplifting a bunch of sportswear from the nearest Nike store, you return to the gym with the knives in your bag hidden by the copious amounts of t-shirts and trainers stacked on top of them. You get a locker and stuff the bag inside before making your way outside again, smiling at the desk guy as you leisurely stroll out of the gym. The guy narrows his eyes at you–your clothes are still slightly torn and dirty, and you're pretty sure you have a bruise forming on the right side of your cheek, but you don't pay him any mind. He works at a gym. He's seen stranger than you.

But the closer you get to your apartment, the heavier the portal pass starts to feel in your pocket, and the more insecure your steps become. The sun hangs low over the city skyline, but hasn't completely started to set yet, and soft golden light washes over the streets, making them look... wrong. Bleak. Colour in a place where colour shouldn't be. You had just killed in these streets, and nobody noticed.

The thought makes you feel kind of sorry for the Bounties. They would be missed by no one.

You're still lost in thought when you almost hit a door and you snap back to reality. Your feet had carried you all the way up to your apartment. You blinked hard, rubbed a hand over your face and fumbled for your keys.

"Hey. It's me. Did you burn the house down while I was gone?"

Keith looks up from where he sits on an armchair–your armchair, but you understand he wouldn't want to spend another minute on the couch he spent five days on, hallucinating out of his mind–and grins, and your heart does a leap. And then he frowns, and you freeze, and your immediate thought is Oh fuck, he's found me out, he knows everything, he's going to call the other angels and he's going to kill me–

But the words he speaks are soft with concern. "What happened to your face?" And it takes all of your willpower not to break down right then and there.

He puts down the book he was reading and walks over to you, eyebrows knotted with worry, and reaches out to touch your forehead. Only then does he seem to realise how close to you he's standing, and he quickly pulls his fingers back to his chest. They're red with blood. "Let's get that disinfected, yeah?"

Before you can answer, he's already started towards your kitchen. You blink, still stunned, before following him like you're in a daze. He looks over his shoulder and points to a kitchen chair. You plop down, and it's when the weight is taken off your legs that the exhaustion comes crashing into you at breakneck speed, and it takes all your strength not to plunk your head down on the kitchen table and just pass out.

"Where do you keep your first aid kit?"

You vaguely point to a cabinet below the sink, and moments later Keith plops the kit down beside you on the table and plucks out a wad of cotton and disinfecting spray. You don't even feel it sting when he gently dabs at the cut on your forehead and cheekbone. His eyes are firmly trained on the cotton, his dark brows furrowed–there's a little crease between them that your foggy self finds most endearing–and he's chewing absent-mindedly on his bottom lip.

With a shock, you realise this is the closest you've been to him. Ever. This is the first time you can properly study his face, and you can always blame your muddy mind later if he brings up how blatantly you were staring at him, so you let yourself drink in every feature of his face. You find yourself drawn to his eyes most; they're a stunning deep violet, the colour of the sky at twilight, when the sun has just set and the last rays of light streak the heavens with purple. Most of all, they're soft with concern and simultaneously fierce with a kind of fire you haven't seen on him before.

"Aren't you going to ask what happened?" you blurt out before you can stop yourself.

Keith's eyes briefly flicker to yours, and he gives an awkward shrug before going back to gently rubbing at your wounds. "It's none of my business. You haven't asked me about what I was doing on Middle Ground in the first place, and I won't stick my nose into what doesn't concern me." But the words sound like he's reciting them; like a lesson he learned at school. You can see in his eyes that he is in fact curious, but also that he isn't going to press further. How very angelic of him.

You purse your lips, fingering the portal pass in your jacket pocket.

Your mind is a jumble of thoughts, like someone took all your emotions and threw them in a blender. Every moment you spend with Keith in your kitchen–how is it you always end up in the kitchen?–you grow more sure that you can't turn him in. But the contract pulls at your insides, and you know that if you keep ignoring its contents it will keep gnawing at you until you can't take it anymore and snap.

The contract is the contract. Binding and eternal.

"Keith."

His hand freezes, and you carefully guide it to the table, gently forcing him to put down the cotton. "Thank you, really. But I'm okay. I promise."

He nods. Slowly. "Okay."

And oh, how you want to wrap your arms around his neck and press your lips against his, but that would make things a thousand times more complicated than they already are–

Your breath leaves you in one fell swoop. It's the exhaustion talking, you firmly tell yourself, before you yank your fingers back and stand. You're a bit wobbly, but you manage. Keith wisely doesn't attempt to help you, but you can feel his eyes boring into your back as you make your way to your bedroom.

You change. You brush your teeth. You splash some water in your face to clear your head. Everything happens in a haze, your mind too tired to think about anything at all.

But then your eye falls on a piece of paper resting on your pillow. You frown and pick it up, and your eyes widen when you recognise your own scraggly handwriting littering the little parchment card. A hand flies up to your mouth to muffle your startled scream, and you drop the card as if it just burned your fingertips, though your eyes stay glued to its surface.

The words I want Keith to be okay stare back up at you, and with every passing second your breathing gets quicker and more ragged. Your fingers tingle, and as you draw a tentative breath you sink down onto the mattress. Your fingers tingle, but they tingle with warmth, and the feeling is not unpleasant.

Where Keith's own skin brushed yours, the chill that had seeped into your very core and had burrowed there for days, leaving you in a constant state of stiff cold, dissipated. The feeling is so weirdly foreign after having only felt cold for days that you dumbly stare out into nothingness, trying to shake the heat out of your hand. It doesn't work. It feels good, and you want more of it.

For a moment, the contract leaves your mind, replaced by Keith's eyes, the way he'd looked up at you, all softness and worry; the gentleness of his fingers as they cleaned the shallow cuts on your face. You close your eyes and lean back, the little parchment card on the floor seeming to beg for your attention. You never knew paper could be this loud.

For just a moment, you allow yourself to think of Keith and not just see an angel–but something more.

#keith x reader#keith kogane x reader#keith voltron#keith voltron x reader#keith vld#keith vld x reader#vld keith#vld keith x reader#voltron keith#voltron keith x reader#voltron keith kogane#vld keith kogane#voltron keith kogane x reader#vld keith kogane x reader#keith kogane#keith fic#keith fanfic#keith voltron fic#keith voltron fanfic

54 notes

·

View notes

Text

“ tot zhe molot chto drobit steklo , kuyet stal . ”

Is that KAT MCNAMARA? No, that’s just SERAPHINA M. BLACKWELL-BYERS. They were born on 22/11/95 and are a WITCH (Circle of the Aurora Coven) living in Northknot Town. They work as a MANAGER AT NORTHKNOT AUTOSHOP. Some say they're LOYAL and RESOURCEFUL, but I’ve heard others say they're BLUNT and CONFRONTATIONAL. When you think of her, don’t you think of POWER RADIATING FROM THE MOON, THE SMELL OF THE AIR AFTER RAIN, UNWAVERING LOYALTY?

A E S T H E T I C

a wild hurricane unwilling to be tamed . running with wolves . powered by the moon . unwavering loyalty . hidden pain . unknown past . craving a knowledge that will never be learned . unapologetic eyes . the smell of the air after rain . staring up at the night sky .

Q U O T E S

“ tot zhe molot chto drobit steklo , kuyet stal (the same hammer that shatters glass, forges steel) . ” – old russian proverb.

“ the only people for me are the mad ones , the ones who are mad to live , mad to talk , mad to be saved , desirous of everything at the same time , the ones who never yawn or say a commonplace thing , but burn , burn , burn like fabulous yellow roman candles exploding like spiders across the stars . ” – jack kerouac.

“ to be reborn , you have to die first . ” – lucien carr.

M U S I C P L A Y E R

“ i will always fall and rise again –- your venomous heroine . 'cause i am a survivor . yeah , i am a fighter . ” the fighter by in this moment.

“ i've been running through the jungle , i've been running with the wolves to get to you , to get to you . i've been down the darkest alleys , saw the dark side of the moon . ” wolves by selena gomez.

“ as i'm looking up (as I'm looking up) ... suddenly the sky erupts (sky erupts, sky erupts) . flames alight the trees , spread to fallin' leaves . now they're right upon me . ” trampoline by shaed ft zayn.

“ on me dit que le destin se moque bien de nous . qu'il ne nous donne rien et qu'il nous promet tout ... paraît que le bonheur est à portée de main . alors on tend la main et on se retrouve fou . ” quelqu’un m’a dit by carla bruni.

P E R S O N A L I T Y

+ adaptable, protective, and caring

- stubborn, arrogant, and impatient

this girl is always ready for anything! no matter the situation, she knows how to work her way around it and make it work in her favour. moving around so much as a child, the girl HAD TO learn to adapt, she wouldn’t have survived if she didn’t. there were some pretty terrible homes but she always made it through. but being in those homes and seeing how certain people where treated, the little witch became super protective of them. she was always on guard and would do whatever she could to help someone in need. even if it was taking the blame for something they did. she always endured it so they didn’t have to. there would be times when she was offered a way out. older kids running away and willing to take her with them, but she was too stubborn. she wouldn’t budge, she’d stay to look out for the other kids.

over the years, she’d teach herself magic and while there was obviously things she needed to learn, she was actually pretty decent considering. she was powerful. and that in turn made her a little arrogant, she tried not to be but sometimes she couldn’t help. she was proud of herself and no one else would be.... so eventually that proud feeling just turned into arrogance. once she started learning more, she really couldn’t wait. she knew she could do it all, she had the power for it, but not the knowledge. it became a bit of a problem. she was too impatient, needed to learn everything and anything. she had been on her own for so long, she didn’t know how to do things on other’s time.

her thirst for knowledge didn’t stop with just magic, she really did want to know everything. you never know when you might need the information. when it might be useful to someone in need. helping people is just something she did. sure there are times she’s a bit standoffish, but more often than not, she is going out of her way to help. she can be a little blunt, but she only has people’s best interest in mind... to her, it’s not her fault if someone can’t handle it.

H E A D C A N O N S

001. seraphina marie blackwell comes from lillian’s bloodline. though she was very unaware of that fact for the longest time. see, her birth parents gave her up right after she was born–-- she has spent her whole life thinking they didn’t want her. but the truth is, while she was never planned, the gave up their life to create a hunter. it was a vow they made long before seraphina was conceived. so even if they did want her, they couldn’t keep her.

002. she was meant to be given to some friends of their, but two weeks into her living there, they were killed and she was left to go into the system. anytime someone tried to adopt her, her powers went out of control, leaving her to be left behind. when she was a little older, they put her in a foster home. but those never lasted and she spent her childhood moving from home to home. the blackwell witch hated it, but she did met plenty of other kids and formed some pretty deep connections. mainly with other witches and wolves. unaware that she did indeed have a special bond with wolves. see, it was her great, great, great, great (etc.) grandmother, lillian who casted the spell that created wolves... and it was her job, as part of that bloodline, to look after wolves. no matter where she went, she always had some type of connection with a wolf and she always helped where she could. whether it meant helping them personally or helping someone stay protected from them. it all depended on the wolf.

003. when she was sixteen she was adopted into a family of wolves. she wasn’t the only one that felt the connections, wolves did as well, these wolves just felt a connection that made them wish to help her. she got lucky this time because she has had to deal with wolves who’ve felt the need to kill her. but that’s beside the point... this family of wolves took her in and welcomed her. introduced her to some witches who could really help. from then own, the girl went from having no family to having two. the family of wolves and the aurora coven of witches..

004. due to her bloodline, it is no surprise that the blackwell girl drew her power from the moon. she really got lucky that her parents, after they adopted her, introduced her to the right coven. within the coven she learn more magic than she had only be able to teach herself and she also happened to learn about her biological parents and her bloodline. it surprised her and broke her heart. . . but she loved her family. she wouldn’t trade them in for the world.

005. despite living in northknot her entire childhood, she did take a year to herself and traveled. ended up meeting witches from all over who weren’t ready to go to northknot yet. she also met more wolves and managed to convince the rouge ones to travel to northknot and possibly join a pack. during this year she faced challenges that, while left her scared, really helped her with her power. she really got to become the best version of herself.

006. after her year was up, she moved back, this time into a place of her own, though she still talks to her parents everyday. her brothers lived with her for a couple of years too but ended up wanted to do their own thing. during this time since being back, she went to the uni, finished uni, and even became a manager at her job in the autoshop. fixing cars and bikes and such is something she was always kind of good at. she was always super into cars when she was younger. had even got in trouble a couple of times for street racing. she’s hoping her next step is to either become part owner of the shop or buy her own shop.

007. NOW: she is still working as a manager at the autoshop. still lives in her house, got new roommates since her brothers moved out... still calls her dad everyday (her mum was killed by some rogue vampire who was just travelling through).

C O N N E C T I O N S

ADOPTED BROTHERS. they can be the bio kids to their parents or adopted like she was. but they are both werewolves. she completely adores her brothers and used to get into a lot of mischief with them. probably still does.

BEST FRIEND. her person. this person is her ride or die. the person she’d be able to go to if she had to hide a body. due to her bond with witches and wolves, i think it’s be a bit more fun if her best friend was someone of a different species but i am open to anything. male/female/non-ninary, it doesn’t matter. just give this girl a best friend.

CHILDHOOD FRIEND. someone she met in one of the many foster homes she got stuck in. even if they didn’t always end up in the same house, they stayed friends. they met in a really bad house and just ended up having each other’s backs and it was just a bond that couldn’t be broken. i imagine they got into trouble a lot and had to be separated. [PJ SIMONS]

EX (WEREWOLF) BOYFRIEND. the same way she feels this connections to wolves, they feel something too. sometimes it’s a protection type connection, sometimes it’s just plain friendly, sometimes it’s even love... however, it’s not always a good connection and with this wolf, the connection wasn’t good. the two started dating BEFORE he triggered his ‘curse’ and everything was great. they LOVED each other. however, everything changed when he triggered his wolf gene. he couldn’t help it, couldn’t fight it at the time. so after a nasty fight, both managed to get away and haven’t seen each other since.

FWB. so while the saying is friends with benefits, they don’t actually need to be friends. they CAN BE, but it could also b fun to have an enemy with benefits type thing. they argue during the day and have their fun at night. just something to help relieve some stress ;)

ROOMMATES. two to three roommates. any species. they could have moved in because they were already friends with seraphina and needed a place. or maybe a coven mate. i would even take someone who responded to an add she posted and we can have this fun semi-awkward relationship between them because they don’t know each other as well but are trying to get to know each other better since they do live together. [MILES GREENWOOD & VIOLETTE CUNNINGHAM]

WEREWOLF SHE CONVINCED TO MOVE HERE. during her year away she ran into some rouge wolves and helped them as much as she could and told them to move to northknot. that they didn’t have to be alone anymore if they didn’t want to be. so i would love to see someone she told.

#nktintro#s. blackwell: intro#species: witch#is this longer than i intended? yes.#have i written longer? also yes.#lol#if you wish to skip this but still wanna plot#let me know#i'll do my best to summarise her

2 notes

·

View notes

Text

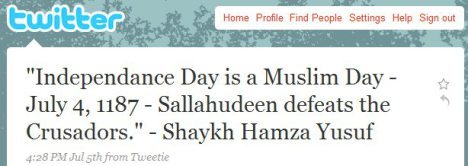

Sec of State Pompeo adds anti-American Muslim to Commission on Unalienable Rights

Michael R. Pompeo, Secretary of State

Press Briefing Room

Washington, DC

July 8, 2019

SECRETARY POMPEO: Good morning, everyone. In my address at the Claremont Institute back in May, called “A Foreign Policy from the Founding,” I made clear that the Trump administration has embarked on a foreign policy that takes seriously the founders’ ideas of individual liberty and constitutional government. Those principles have long played a prominent role in our country’s foreign policy, and rightly so. But as that great admirer of the American experiment Alex de Tocqueville noted, democracies have a tendency to lose sight of the big picture in the hurly-burly of everyday affairs. Every once in a while, we need to step back and reflect seriously on where we are, where we’ve been, and whether we’re headed in the right direction, and that’s why I’m pleased to announce today the formation of a Commission on Unalienable Rights.

...

I’m also proud to announce today the other members of the commission. They include Russell Berman, Peter Berkowitz, Paolo Carozza, Hamza Yusuf Hanson, Jacqueline Rivers, Meir Soloveichik, Katrina Lantos Swett, Christopher Tollefsen, and David Tse-Chien Pan.

These individuals will provide the intellectual grist for what I hope will be one of the most profound reexaminations of the unalienable rights in the world since the 1948 Universal Declaration. Our own Kiron Skinner will serve as the head of the executive secretary of the committee, and Cartright Weiland will serve as Rapporteur.

-----------------------------------------------------------------------------------------

Did Pompeo or anyone on Trump’s staff vet the self-proclaimed sheik Hamza Yusuf, formerly Mark Hanson? via Discover the Networks:

Hamza Yusuf was born (in Washington State) as Mark Hanson in 1959, to parents who were American academics. He became a Muslim at age seventeen and then spent ten years studying Islam in Saudi Arabia, the United Arab Emirates, Algeria, Morocco, and elsewhere.

In 1995, Yusuf described Judaism as “a most racist religion.” In 1996 he expressed his contempt for the United States:

“[America] a country that has little to be proud of in its past and less to be proud of in the present. I am a citizen of this country not by choice but by birth. I reside in this country not by choice but by conviction in attempting to spread the message of Islam in this country. I became Muslim in part because I did not believe in the false gods of this society whether we call them Jesus or democracy or the Bill of Rights.”

On September 9, 2001 – just two days before the al Qaeda attacks against America – UCLA’s Al-Talib magazine co-sponsored a benefit dinner titled “Justice for Imam Jamil Al-Amin” (a convicted cop-killer formerly known as H. Rap Brown) at UC Irvine. Among the speakers at this benefit was Sheikh Hamza Yusuf, who spoke about the fate he foresaw for America:

“They [Americans] were ungrateful for the bounties of Allah, and so Allah caused them to taste fear and hunger. That is one reason and, I would say, that this country is facing a very terrible fate. The reason for that is that this country stands condemned. It stands condemned like Europe stood condemned for what it did…. This country [America] unfortunately has a great, a great tribulation coming to it. And much of it is already here, yet people are too to illiterate to read the writing on the wall.”

At this same rally, Yusuf lamented that Sheikh Omar Abdel Rahman, the blind Egyptian cleric convicted of masterminding the 1993 World Trade Center bombing as well as unfulfilled plans to destroy various Manhattan bridges and tunnels, had been “unjustly tried” and “condemned against any standards of justice in any legal system.”

--------------------------------------------------------------------------

More on Yusuf/Hanson via the Investigative Project:

On July 20, 1991, he was a featured speaker at the International Islamic Conference, held at the University of Southern California by the Los Angeles unit of the Islamic Circle of North America (ICNA) – an organization with a long record of ideologically promoting jihad and martyrdom on behalf of Islam.

The Message International, an ICNA publication, reported on Yusuf’s remarks:

“...In the afternoon session, the focus switched to the always exciting topic of Jihad. Hamza Yusuf gave a provoking speech about why ‘Jihad is the only way.’”

In the speech, Yusuf did not define “jihad,” but referred to a series of places in which violence and armed insurgencies were occurring.

In a speech delivered at the 1993 annual convention of the Islamic Society of North America in Kansas City, Mo., Yusuf praised the idea that Islam could be a “threat to this society:”

“But Allah is calling us to jihad. And I, in all honesty, have to say that if Islam is not a threat to this society, than I am in the wrong religion. I don’t believe that. I believe that Islam is in fact a threat to this society. It is not a threat in that we are going to blow up ourselves. This is my disclaimer. We’re not going to blow up ourselves. You can rest assured people of Kansas [sic] or wherever we are, we are not going to blow up ourselves. We are not going to blow up ourselves but we are keeping a jihad. And Jihad is struggling in the way of Allah to bring down the warriors of injustice humanity from realizing their true potential which is to be slaves to Allah.”

---------------------------------------------------------

Hamza Yusuf in his own words - click to watch the video:

youtube

---------------------------------------------------------

And we’ll leave readers with this:

Hanson remains an inexhaustible self-promoter. He was embarrassed in 2006 when the Saudi daily Okaz inaccurately described him as the "mufti" - i.e. the chief Islamic religious official - of California. But the Hamza Yusuf show has few original tricks to offer; he inevitably falls back on his associations with fundamentalists and radicals.

11 notes

·

View notes

Text

★ Why Salman Khan Is Unstoppable!

28 JUNE 2018

GIRIDHAR JHA

Salman Khan is running no race, he’s riding high on pure stardom. Content be damned.

#Law and order under the Modi government has gone for a toss. I put two tickets of Race 3 in my car. Some idiots broke the window and left two more.

A surfeit of tweets—some hilarious, others acerbic—has swamped social media of late, cocking a snook at Salman Khan’s latest outing, Race 3, as ‘the biggest bore of the decade’ and ‘a sure-shot cure for the insomniacs’. This year’s much-vaunted Eid release has been mauled just as savagely by film critics, a few of them trashing it as simply insufferable.

Worse still, the film has made it to the IMDb list of ‘lowest-rated movies’ where it shares the dubious distinction with the likes of Ram Gopal Varma Ki Aag (2007), The Legend of Drona (2008), Tees Maar Khan (2010), Himmatwala (2013), Humshakals (2014) and Kya Kool Hain Hum 3(2016)—all unmitigated disasters of our times.

In fact, some of Salman’s die-hard followers appear to be so disappointed with this movie that they have, for once, asked him not to take them for granted. ““Bhai,, don’t do films like Race 3,” a distraught fan tweeted in anguish after seeing the film. “It is not up to your standard.”

Under the best of circumstances, such reactions ought to have set off the alarm bells for a lesser star, but not the reigning monarch of B-town. Far from it, Bhai, as Salman is affectionately called, is having the last chuckle—he’s laughing out loud all the way to the bank. Remo D’Souza’s directorial venture has already crossed a commercial milestone, having notched up more than Rs 160 crore in India and Rs 250 crore worldwide in just about ten days. Quite an achievement for a film pilloried for its tacky plot, sloppy direction and deadpan acting!

But then, in an industry where stars are made and maimed every Friday, nothing matters more than what a movie ultimately earns at the ticket window. Race 3 may have been dismissed as a veritable affront to the aesthetic sense and sensibility by many a connoisseur of good cinema, but its box-office figures have only underlined the enduring mass appeal of the 52-year-old warhorse, who remains a darling of the dress circle regardless of his receding hairline and protracted court cases.

But why is a star with unexceptional histrionic prowess still so popular with the masses? What are the factors that have sustained him as an alchemist at the cash counters? Ali Abbas Zafar, director of two of Salman’s recent blockbusters, Sultan (2016) and Tiger Zinda Hai (2017), puts it conclusively: “It is very important for a superstar to connect, communicate and maintain a relationship with his audiences through his films. I think the audiences see absolute honesty in the way he leads his personal life, as also in the way he portrays his roles,” Zafar tells Outlook. “It invariably touches a chord with the audiences who flock to the theatres to watch his films over and over again. It’s a factor that simply cannot be defined.”

Zafar, now at the helm of Salman’s next, Bharat, believes every movie has its own journey and destiny as far as commercial success is concerned. “We cannot measure it against the superstardom of an actor. While making a movie, nobody knows whether it will click or not,” he says. “It is something indescribable.”

The young auteur thinks that he is fortunate to have worked with as big a superstar as Salman at the outset of his career. “As a director, it is absolutely essential to highlight the USP of a big star in the best possible way,” he says. “You have to develop the character in sync with the superstardom.”

Zafar avers that the audiences are disappointed only when they find a star’s stardom putting his character in the shade. “But if the character and the stardom complement each other, as they did in Sultan, Tiger Zinda Hai and Bajrangi Bhaijaan (2015), then it creates pure magic,” he states.

Noted scriptwriter Rajat Arora considers Salman’s loyal fan base to be the biggest factor behind his success. “What is remarkable is that people from all age groups, from kids to elderly people, like him. In fact, the release of his movie is a celebration of sorts of the star, idolised by his legions of followers.”

Arora, who scripted the Salman blockbuster Kick (2014), says that is why nine of his movies have done business of more than Rs 100 crore while four others crossed the Rs 200-300-crore mark. “He has really worked hard over the years to maintain his stardom. He simply gives to his audiences what they really like to see.”

Figures, of course, don’t lie. Salman has had an unparalleled run in the past decade or so. Since Dabangg (2010), his 13 consecutive movies have minted more than Rs 100 crore, a figure considered to be the benchmark for a Bollywood blockbuster. Only a couple of them, such as Jai Ho (2014) and Tubelight (2017), are considered flops. But that is because of their high production costs; otherwise they too made it to the elite 100 crore club effortlessly.

Curiously, all this has happened despite Salman’s apparently cavalier attitude towards his career. At a time when his illustrious contemporaries—Aamir Khan and Shahrukh Khan, the other two of the holy tinsel town trinity—are constantly striving for content-driven cinema, commensurate with their expertise and experience, the youngest of the three 1965-born Khans functions within his own world, relying more on his popularity than the script of his movie. More often than not, he takes up a project purely for emotional reasons and shows no qualms in helping out his family members and friends in bolstering their careers. From Sonakshi Sinha in Dabangg to Athiya Shetty and Suraj Pancholi in Hero (2015), many star kids owe their launches to him. As for Race 3, he has gone a step further, as its entire cast, save Anil Kapoor, appears to be piggybacking on his charisma. High on his success, Salman seems to care too little for the criticism that he turns a movie into an extended family enterprise these days.

Critics, however, believe that the Midas touch may not last for long. “He’s not serious about picking good subjects. I thought Salman had turned a new leaf with Bajrangi Bhaijaan and Sultan but Race 3 demolished my hopes,” rues film writer Deepak Dua. “The film has too many non-actors who are in it primarily because of their close ties with him.”

Dua says Salman probably knows his range as an actor and that’s why he restricts himself to his comfort zone of masala entertainers, unlike Shahrukh and Aamir. “Let alone Aamir, even Shahrukh has been trying to do things differently since the days of Phir Bhi Dil Hai Hindustani(2000) and Asoka (2001),” he says. “It’s an altogether different matter that he has not been successful in that.”