#all demat account charges list

Text

Are you looking to invest in the stock market and take advantage of the exciting opportunities it presents? If so, then having a demat account is essential. A demat account allows you to hold your securities in an electronic form, making trading convenient and hassle-free.

But with so many options available, how do you choose the best demat account for your needs? Well, look no further! In this blog post, we will explore the 8 BEST Demat Accounts in India with Lowest Brokerage charges in 2023. Whether you’re a beginner or an experienced investor, we’ve got something for everyone.

Read more - https://medium.com/@hmatrading.in/8-best-demat-account-in-india-with-lowest-brokerage-in-2023-e12be72db7e0

#best demat account in india 2022#best demat account#top 10 demat account in india#upstox demat account#best demat account lowest brokerage#all demat account charges list#zerodha demat account

0 notes

Text

12 Safe Investment options with high returns in India?

Investment plans typically assist you in achieving your life goals if you select them by your financial plan. Regardless of your financial goal’s duration, take your financial milestones into account while selecting a plan.

Let’s have a look at the best Indian investment opportunities listed below.

Direct Equity- Stocks: For investors who are willing to take risks, direct equity stocks are among the greatest choices. Direct equity investment is the process of purchasing listed equity equities of businesses on stock exchanges. Direct stock investments can yield either dividends or capital gains. Stock performance is influenced by a variety of factors, including firm success and market position.

A. This option has a high risk-return ratio and is among the most volatile investments.

B. Among the greatest ways to invest money to grow wealth adjusted for inflation

C. appropriate for a lengthy time frame

Having both a bank account and a Demat account is necessary to begin investing in this. A high-risk appetite is also necessary if you wish to continually invest in stocks and profit from them. Before beginning an investment, familiarize yourself with how equity stocks and markets operate.

2. Equity Mutual Funds: The main asset class of equity mutual funds is equity stocks and related instruments. These are among the greatest investment choices available in India for little individuals hoping to gain from the expansion of the equity market. With equities mutual funds, you can begin investing with as little as Rs 500 to start building well-diversified portfolios of equity companies.

Between 70 and 95 percent of the fund value may be allocated to equities stocks and similar securities by these funds. Due to their equity basis, these provide a high ratio of risk to return. Mutual funds that offer equity often fall into two categories:

a. Actively managed Mutual Fund: The fund manager is quite involved with these kinds of funds. The success of this fund is significantly influenced by the knowledge and skills of the fund management. They do research and analysis before selecting the stocks in which the fund will invest. Passive investment alternatives are seen as less risky than active funds.

b. Passively managed mutual funds: A large role is not played by the fund management in this kind of fund. The fund is predicated on a specific market portfolio or index. As an illustration, consider a fund composed of NIFTY50 stocks, etc. The performance of this fund is determined by the index’s performance.

3. Equity debt Funds: If you want to minimize volatility or don’t have a strong risk appetite, you might want to look into debt mutual funds or bond funds as investment options. These fixed-income instruments are also part of a diversified portfolio.

Debentures, corporate and government bonds, as well as other long-term fixed-income instruments, make up the amount invested in Debt Funds. Funds might have different risk profiles depending on the kind of securities they own in their portfolio. Prior to investing, you should evaluate the risk by looking up the ratings of the assets the fund owns.

If you desire the steadiness of returns with less risk, funds that hold government bonds or highly rated securities are appropriate. Therefore, you may think about debt funds when:

You avoid taking chances.

Relatively fixed returns are what you seek.

The principal’s safety comes first.

Keep in mind that all debt funds will still be subject to interest rate risk.

4. National Pension Scheme: One investing plan backed by the government that can help you protect your retirement is the National Pension System. The Pension Fund Regulatory and Development Authority (PFRDA) is in charge of regulating it.

This assists you in building a substantial retirement fund that you can use. As an investor who works for yourself or is salaried, you can use the NPS retirement account.

Two varieties of NPS accounts exist.

Retirement Account, Tier-I

Level II

The ability to aggressively grow your corpus is the main distinction between NPS and other provident fund investments. It uses an auto-rebalancing strategy to keep your portfolio risk-free as you become older. You can also receive a deduction for your contribution of up to Rs 2 lakhs.

The portfolio mixes you select and the duration of your investment will determine the risk-return on your NPS investment. Therefore, both risk-averse and aggressive investors can benefit from this retirement investment option.

5. Public Provided Funds: When looking for safe investment options to place their money in, PPF is one of the most well-liked and greatest options. The ideal investing plan for successfully reaching your long-term goals is the 15-year plan. The plan, which was first presented as a secure retirement investment option for independent contractors, has gained popularity among long-term investors since it offers:

Tax Effectiveness

Section 80C allows you to deduct up to Rs. 1.5 lakhs. The maturity value is tax-free as well.

Availability of liquid assets

During the first five years of the account, you are able to borrow against the accrued corpus. Partial withdrawals are permitted after five years.

A mix of Risk and Return

low-risk investment with an annual rate of return that is linked to the market.

Investment period

Minimum Investment Period of 15 Years; thereafter, accounts may be extended in 5-year increments.

6. Bank Fixed Deposit: Another well-liked investment choice in India that guarantees the security of your funds and yields consistent returns is a bank fixed deposit. A set rate of interest will be provided for a predetermined period of time when you invest a lump sum amount. You will get the principal amount plus any compound interest accrued during the term when your term expires.

When investing in a bank fixed deposit, take into account the following:

Returns on bank FDs are guaranteed. The principal sum is therefore secure.

Your FD cannot be withdrawn until it matures. You risk paying penalties and missing out on compound interest if you withdraw before the term is up.

These are among India’s most adaptable investing choices. The duration of the investment can range from seven days to ten years.

In a bank savings account, the initial interest rate will be maintained for the duration of the agreement. As a result, your deposit’s return is set until it matures.

The interest can be reinvested or received.

Upon maturity, banks also let you have your FD automatically renewed.

7. Senior Citizen Saving Scheme: The Senior Citizen Savings Scheme, often known as SCSS, is one of the investment choices that assists participants in reaching their retirement objectives by providing a steady stream of income. You can make a lump sum investment in this scheme after reaching 60. It is one of the possibilities for small savings investments. Every quarter, you will be paid a fixed interest amount.

There are two ways to create a SCSS account:

through the post office

Through Bank

Seniors find it to be a very popular investment option because of its attractive and guaranteed returns. As of Q3 FY 2022-23, the rate of returns is 7.6%. There will be a quarterly adjustment to these rates.

Here are some SCSS characteristics to be aware of:

If you are older than sixty, you can invest in it. Those who have participated in the VRS (Voluntary Retirement Scheme) and are above 55 are also eligible to apply.

Rs 1000 is the minimum investment, meaning that you must deposit an amount greater than or equal to Rs 1000.

A maximum of Rs 15 lakh can be invested. This is the maximum amount that you can invest.

Interest is given out on a quarterly basis.

The five-year maturity term has the option to be extended by an additional three years.

8. Unit Linked Insurance Plans: Because it offers both insurance and a channel for investment, a Unit Linked Insurance Plan (ULIP) might be seen as an investment choice. The policyholder pays a portion of the premiums toward the life insurance and another portion toward the funds of their choice. Given that this life insurance plan delivers market-linked returns, a prospective investor should consider the plan’s advantages and disadvantages before making an investment.

A ULIP that provides both market-linked returns and life insurance is Canara HSBC Life Insurance Invest 4G. There are eight fund alternatives available, each with a partial withdrawal option.

9. Real estate Investment: In India, real estate is a wise choice for investors. But typically, it’s a significant financial commitment. Purchasing real estate, including houses, land, and plots, is referred to as investing. One of the finest ways to fight inflation with investments is to do this. You may be able to make both regular and capital gain income by investing in this.

You can generate additional revenue by renting out the building you recently bought. This will guarantee that you receive returns each month in the form of rent. You can sell your property for more money and make a capital gain if it has appreciated in value.

There is a well-known proverb that states that “location, location, location” are the three most crucial factors in real estate. This is the main element that determines whether or not your real estate investment is successful.

Although real estate in a prime location can be pricey, it also has higher potential for appreciation and can fetch a higher rent.

10. RBI Bonds: One of the safest investment alternatives available in India are RBI Bonds. To generate funds for the advancement of various government programs, the Reserve Bank of India, or RBI, issues bonds to the general public. There is a word attached to these bonds. Money is refunded along with interest earned upon maturity.

These bonds are available for purchase from four private banks as well as all twelve national chains. The RBI will give you a certificate of holding in recognition of your debt. Upon maturity, this certificate will serve as evidence.

These are for a period of seven years.

These can be non-cumulative, in which the interest is paid out as a regular income, or cumulative, in which the money is reinvested.

11. Pradhan Mantri Vaya Vandana Yojana: Seniors, particularly individuals 60 years of age and over, have access to investing choices such as the Pradhan Mantri Vaya Vandana Yojana (PMVVY). After sixty years of age, it provides you with a steady source of income.

It has a longer validity period but still offers interest at a rate of 7.4% annually. This is the current interest rate, good through March 31, 2023.

The following are some qualities of PMVVY that could make you think about making this investment:

Pension payable on a quarterly, annual, or monthly basis

It will mature in ten years.

You can invest a maximum of Rs 9250 per month, and a minimum of Rs 1000 is required.

If you have owned this for more than three years, you can use it to offset loans up to a value of 75%.

12. Gold: In India, gold is frequently seen as the best investment choice for safeguarding a family’s legacy. However, purchasing gold as a family heirloom is now nearly impossible due to growing expenses and fees.

Alternatively, you can steadily increase your gold purchasing power over time by using investing choices like Gold ETFs. They are referred to as “paper gold” in general. It includes investments and gold stocks. In contrast to pricey gold, they can be purchased from the stock market based on your financial situation.

This is an Exchange Traded Fund (ETF), which means it is managed passively. It is a reflection of the real gold price movement of the same caliber. The NAV of the ETF will increase in tandem with rising gold rates.

0 notes

Text

Sovereign Gold Bond vs. Gold ETF: A Comprehensive Comparison for Smart Investors

Over the last few years, the concept of digital gold has arrived in a big way. It started off with gold ETFs and then came the highly popular Sovereign Gold Bond scheme. There are also other digital gold holding vehicles like international gold funds, gold futures and digital gold. In this blog, the focus would largely be on understanding the relative merits and demerits of the sovereign gold bond vs gold ETF debate, and which is more suitable and under what circumstances. Also, a comparison of gold ETF vs SGB is provided on parameters like liquidity, flexibility, charges and tax implications.

What are Sovereign Gold Bonds (SGB) all about?

SGBs or Sovereign Gold Bonds have been around in India since Nov-2015 and have been gradually gaining in heft. These SGBs are central government-backed bonds, denominated in grams of gold. The underlying holding in grams of gold is guaranteed by the central government. In addition, these sovereign gold bonds also bear an interest of 2.50% annually on the issue price, which is paid semi-annually to the investor. Investors also get an upfront discount of Rs. 50/- per gram if the payment mode is digital. SGBs are also advantageous as they do not have the hassles like storing gold, making charges, risk of loss etc.

What really stands out about the SGB is the sovereign guarantee and that the returns are pegged to the price of gold. What the government guarantees is the payment of interest at 2.50% per annum and the holding of gold in grams. Considering that gold has generally given positive returns over longer periods of time, it makes investment in SGBs relatively secure and attractive too.

The SGBs can be held either in physical form or in demat form, as part of the demat account.

Gold ETFs (Exchange Traded Funds)

Unlike SGBs that are issued by the central government, gold ETFs are issued by the mutual fund houses registered with SEBI. They are issued in the form of gold units pegged as equivalent to a certain weight in gold expressed in grams. Gold ETFs are typically closed-ended in that once the NFO period is over, the fund does not offer any purchase or sale of units. However, being Exchange Traded Funds, they are mandatorily listed on the stock exchanges and investors wanting to buy or sell gold ETFs can do so using their existing demat account and trading account.

Gold ETFs are very liquid and hence, entry & exit is hardly a problem without any price damage. You can trade in gold ETFs just as you trade in stocks. It must be noted here that gold ETF issuing mutual funds are required to maintain physical gold equivalent to the units sold with a gold custodian bank as a backing.

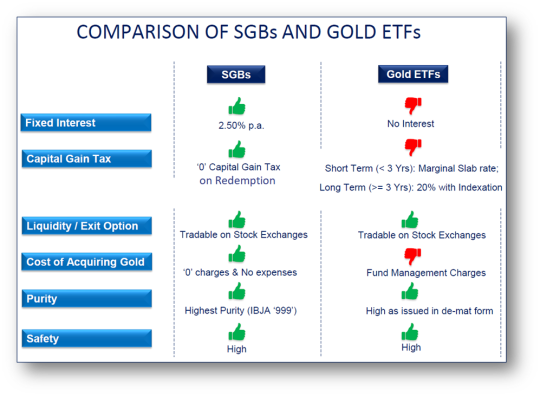

Sovereign Gold Bond VS Gold ETF

Let's compare the sovereign gold bonds and the gold ETFs on a variety of parameters like returns, risk, flexibility, liquidity, taxation, etc. This sovereign gold bond vs gold ETF comparison will allow investors to make the best choice.

Here are the highlights of the gold ETF vs SGB debate.

1. How do SGBs and Gold ETFs compare in returns?

Remember, both SGBs and gold ETFs are linked to the price of gold. If the price of gold goes up, then the capital appreciation will benefit the SGB and also the gold ETFs. The difference lies in the interest paid. For instance, SGBs pay an additional assured interest of 2.50% per annum, but such assured returns do not exist in gold ETFs.

2. How do SGBs and Gold ETFs compare in risk?

One can argue that since both are backed by gold, there is no asset risk; however, there is a difference.

Even though SGBs do not have physical gold backing, the returns on these bonds are pegged to gold prices. And they have an explicit guarantee by the central government regarding the gold holding and the interest payable. In the case of gold ETFs, there is no explicit guarantee (sovereign or otherwise) but they do have the physical gold with the gold custodian bank.

3. How do SGBs and Gold ETFs compare in taxation?

Gold ETFs are treated as non-equity assets and hence the capital gains, if any, would be treated as short-term gains if held for less than 3 years and taxed at the marginal tax rate applicable. If the gold ETFs are held for more than 3 years, they are long-term capital gains and they attract tax at 20% with the benefit of indexation.

In the case of SGBs, the method of taxation is the same, with just one critical difference. If the SGBs are held till redemption, then any capital gains on the SGBs are fully tax-free in the hands of the investor. However, interest on gold bonds is fully taxable.

4. How do SGBs and Gold ETFs compare in costs?

Sovereign gold bonds don’t have any recurring cost of ownership. Gold ETFs on the other hand, have annual charges, including brokerage and expense ratio ranging from 0.50 – 1.00%. The costing of SGBs is a lot more transparent than Gold ETFs.

5. How do SGBs and Gold ETFs compare in liquidity?

Gold ETFs can be bought and sold in the secondary market using your existing trading and demat account with your stock broker. SGBs can be bought at the new issue period, which can be several times during the fiscal year. Outside that, SGBs are listed on the stock exchange, but the liquidity is limited.

Let’s look at the table below to quickly review the gold ETF vs SGB debate

To sum up the sovereign gold bond vs gold ETF debate, both are digital modes of holding gold and are linked to gold prices.

Among 6 key parameters viz. fixed interest, taxation, liquidity, costing, purity and safety, SGB stands out across all. On the other hand, Gold ETFs are highly liquid and do not have a maximum investment limit, allowing investors to buy as much as they want while in case of SGBs maximum investment limit for individual investors is 4kg in a Financial Year

Eventually, investors need to take a call on the gold ETF vs SGB choice based on their financial goals & risk profile; and returns, risk, liquidity, taxation, & convenience the products have to offer.

Source URL: https://www.sbisecurities.in/blog/sovereign-gold-bond-vs-gold-etf

0 notes

Text

Looking for the Lowest Brokerage Charges in India? Here is a list of top stock brokers that offer the lowest brokerage, Read & more; Compare their charges. All the brokers in India is classified into two categories, namely full-service broker and discount broker. Like the name discount brokers offer the lowest brokerage charges compare to full service brokers. Discount brokers offer you low brokerage demat account and advanced trading technology at Lowest Brokerage Charges in India.

0 notes

Text

How to Open a Demat Account with DailyGong Online

Many people nowadays are looking for different investment opportunities such as e-gold, bonds, shares, real estate, and so on. The first step in entering the capital market and beginning to invest is to understand what a Demat account is and how to open one. This is vital for every trader or investor, and the Securities and Exchange Board of India (SEBI) has made having a Demat account required for anyone who seeks to invest in capital markets. Most individuals prefer to register a Demat account online because it allows for more efficient and seamless transactions, but you can also open one with a DP (depository participant) offline. A DP is essentially a bank or brokerage that has the authority to open Demat accounts on an individual’s behalf.

What is a Demat account?

A Demat account is a means for an individual to convert and hold physical shares in electronic form. A Demat account is required when you need to trade or hold/store stocks, securities, or other capital market-related investments, much as we need a bank account for online transactions and to store our money. The Demat account can be used for both offline and online share purchases and sales. The Demat account, like our bank account, holds all the certificates of financial instruments electronically, and one cannot trade in the stock markets without opening a Demat account.

How Does a Demat Account Work?

Let us first grasp how a Demat account works before we discover how to open one online. Because there are numerous factors of a Demat account to consider when starting a Demat account, the Demat account opening procedure is an important part of how a Demat account works.

All Demat accounts and shareholding details of individual accounts are held by the depositories in India, CDSL, and NSDL. These are India’s two central depositories. DPs are depository participants who are authorized by central depositories to open Demat accounts on behalf of clients.

Every Demat account has a unique identification number that must be supplied for transactions.

The DPs or depository participants provide access to CDSL and NSDL. Brokers or banks can serve as a link between the investor and the central depository. DailyGong is one such depository participant where a Demat account can be opened online.

The securities are held in the investor’s Demat account, and the specifics of their holdings may be viewed in their portfolio. When a transaction occurs, the investor’s portfolio is automatically updated.

How To Open a Demat Account Online?

To open a Demat account online, the individual must go to the DP and fill out the account opening form. The list of valid DPs is published on the CDSL and NSDL official websites.

Once the Demat account opening form has been completed, photocopies of the required documents, such as proof of identification and proof of address, must be enclosed.

Following that, an agreement must be made with the DP outlining the trader’s and the DP’s responsibilities. The account holder receives a copy of the agreement as well as information about the charges. These documents should be saved in case they are needed in the future.

The DP then opens the Demat account, and the account holder is assigned a unique Demat account number. This is also known as the BO ID or beneficial owner identification number. Your investments are all credited to your Demat account. If you sell the securities, your Demat account will be debited.

Investors can also use the eKYC process to open an online trading account, which takes less than five minutes. All that is required is to complete the online application form and upload the required papers. Investors can begin trading immediately after the process is completed.

Specific Steps to Open a Demat Account

Although the general procedure for opening a Demat account has been described above, you should be aware that you can open a Demat account online or offline by following a specified set of steps. This will help you understand the procedures you must take during the Demat account opening process. The procedure outlined in the previous section can be carried out in person at a bank or brokerage firm. However, if you prefer to follow the instructions online (like most people do), you can do so as follows:

Choose a DP (a bank or brokerage that offers the option of opening a Demat account with a connected trading and bank account).

You will see a tab that reads “Open a Demat Account” on the website of the bank or brokerage you pick.

Fill out a form with your information after clicking on that tab. You will be asked to enter the information from your PAN and Aadhaar cards.

There will be a place where you can enter your bank account details, which you must do.

Upload any necessary papers, such as your PAN and Aadhaar cards, pictures, and so on.

Please submit the requested information.

Please sign your e-signature.

In-person verification may be required.

Your Demat account will be activated soon.

Documents Required to Open a Demat Account

The paperwork required to open a Demat account is listed below.

Application form completed in conjunction with KYC application form.

A photograph of the applicant is signed across and pasted on the application form.

A photocopy of the applicant’s PAN Card is required.

Applicant’s identity evidence (Aadhar card, Voter ID, Passport, or Driving Licence)

Applicant’s Address Proof (Aadhar card, Voter ID, Passport, or Driving Licence)

Charges Related to a Demat Account

Aside from understanding what a Demat account is and how to open one, one should also be aware of the Demat account charges that might be charged. Some of them are listed below.

The Account Opening Fee: This is a one-time payment that might be assessed when the account is opened. A few brokers currently offer their consumers zero account opening fees.

Maintenance fee: This is a fee charged annually, and the amount varies depending on the broker.

Brokerage Charges: These are the fees incurred when an investor buys or sells shares.

Now that you understand what a Demat account is and how to open a Demat account, it is time to fill out the application. Good luck with your trading!

For More Info: https://dailygong.in/

#benefits of Demat accounts#demat trading#open free demat and trading account#free demat account opening#demat and trading account opening

0 notes

Text

What is a gold ETF?

Exchange Traded Funds or ETFs are instruments that allow you to invest in a fund that tracks any particular index such as BSE Sensex, Nifty 50, etc., and invest in the stocks in the same percentage as the weightage in the index. It helps in saving costs in terms of fund manager fees and these funds have a history of providing great returns. In this article, we’ll learn about the gold ETF that tracks the gold price and is a substitute to invest in physical gold.

Meaning of a Gold ETF

Gold ETF simply replicates the performance of the physical gold price which is held in the dematerialized form. They are passive investment schemes that track the prices of domestic gold and invest in gold bullion. One gold ETF unit is a reflection of 1 gram of physical gold which is backed by physical gold. They provide the dual benefits of being an investment tool and ease of holding at the same time.

Gold ETFsare listed on the NSE (National Stock Exchange) and BSE (Bombay Stock Exchange) like any other stock because they are traded in a similar way on the stock exchange which can be bought and sold continuously when the market is open.

The purity of the one gram of gold which is backed in these ETFs is 99.5% and they can be bought and sold at the same price all across India which is otherwise different in each state when purchasing physical gold. The Gold ETF price can be checked on the AMFI website or the AMCs website that launches these ETFs.

How to Invest in Gold ETFs?

The first step is to open a Demat account and a trading account with an authorized broker which can be done completely online.

After that, provide documents such as a PAN card, Aadhaar card, etc. for proof of address and proof of identity and complete the KYC process.

After successfully opening a Demat cum trading account, select from the list of ETFs based on the analysis.

Once you purchase a gold ETF, the units will be credited into your account and money will be debited from your linked bank account.

Advantages of Gold ETFs

The purity of gold which is backed in these ETFs is very high.

The NAV of the gold ETFs is transparent and tracks the real-time gold prices.

They are traded on the stock exchange and can be bought and sold easily.

You can invest in them without the stress of having physical gold and keeping it in a locker.

They have a lower charge like an open-ended mutual fund with no exit loads and no entry charges.

They can be used as collateral when taking a loan from a bank or any other financial institution.

There are no making charges which are applicable in the case of buying physical gold.

There are no STT (Securities Transaction Tax) charges applicable in the case of gold ETFs.

Conclusion

Gold ETF is best for investors who are looking to invest their money in physical gold and want to avoid the hassle of storing it. It provides much-needed liquidity and as well helps in giving the same benefits as physical gold. It provides diversification benefits to your portfolio and helps in curbing the volatility of complete equity investments.

0 notes

Text

The creation of Demat accounts has revolutionized how stock exchanges conduct their business. The paper scrips were no longer needed to purchase and sell shares. This was a time-consuming and sometimes mismanaged process. Stock brokers authorized by SEBI can open and operate a Demat account. Dematerialization allows shares and securities to be held and traded digitally from anywhere. This reduces the risk of fraud and theft associated with paper-based transactions.

Open a Demat Account if you plan to trade shares or securities on the stock exchange. This list includes the best Demat Accounts in India for 2023 and their pros, cons, and prices. Continue reading!

List of 10 best Demat accounts in India (updated 2023)

Demat account Charges

Axis Direct Demat account opening charges: Nil

Account closure charges: Nil

Charges for account maintenance

1. Axis Bank customer

First Year: Nil

From the second year: Rs750

2. Customers of Non-Axis Bank

First Year: Rs 350

From the second year: Rs.750

SAS Online Brokerage: Rs999 a month or Rs9 a trade

Demat account fee: Rs 200 per annum (plus GST)

Account opening fee: Rs200

SBICAP Securities Demat Account Account opening charges: Nil

Maintenance charges per year: Rs 400

ICICI Direct Demat account opening charges: Rs 975 to Rs nil

Account maintenance fees: Rs 700 from 2nd year.

Kotak Securities Demat Account Account opening charges: Nil

Brokerage fees: Nil

HDFC Securities Demat account charges vary according to pricing plans

Futures and Options: Rs20 for each order

Zerodha Demat Account Brokerage: Nil

Intraday trades and F&O: Rs20, or 0.03%, whichever is lower.

Upstox Demat account maintenance fee: Nil

Account opening fee: Nil

Commissions: Nil

Brokerage: Rs20

IIFL Demat account Account maintenance fee: Rs250 + GST after the first year.

Account opening charges: Nil

Brokerage: Variable depending on plans

Sharekhan Demat Account Account opening charges: Nil

For the first year, there are no account maintenance fees.

List of 10 Best Indian Demat Accounts [Updated in May 2023]: Detailed Overview

1. Axis Direct Demat account

Axis Direct Demat Account is the demat account of choice for over 2,000,000 clients in India. Axis offers investment options and market research tools to help you make informed decisions. This is a great tool for anyone wanting to learn the trading basics. Axis Direct's 3-in-1 trading account offers free market analytics insights by specialists, as well as tools for beginners.

The following are some examples of

All three services - banking, trading and Demat - can be done on one account.

Market research professionals can provide you with expert advice.

You can trade in stocks, mutual funds and bonds, derivatives, ETFs and other financial instruments.

Educational resources include webinars, online courses and expert articles.

Pros

There is no fee for the first year of account maintenance.

Experts conducted market research, which was made available for free.

Beginner's Educational Resources

You can also find out more about the Cons.

Non-Axis Bank Customers Face Higher Account Management Charges

Price

Account Opening Charge: Nil

Account Closing Fee: Nil

Account Maintenance Fee:

Axis Bank customer

First Year: NIL

From the Second Year: Rs.750

Customers of Non-Axis Bank

First Year: Rs 350/-

From the Second Year: Rs.750

2. SAS Online

SAS Online is an online trading platform which allows you to buy or sell securities instantly, thus allowing you the maximum profit. This is a great option for active traders. SAS Online offers a viable option for aggressive traders. You can trade at a low cost and enjoy some unique features.

The following are some examples of

Choose from over 300 different stocks.

You can purchase up to four times your order value as delivery.

Updates and news on the market are provided.

You can buy and sell immediately.

Pros

Trading costs are reduced.

Expert advisors and market scanners

Real-time trading

You can also find out more about the Cons.

No commodity trading

Email is the only way to contact customer service.

Price

Rs999 per month, or Rs9 per trade

The annual fee for a Demat account is Rs 200 (+GST), and the account opening fee is Rs 200

3. SBICAP Securities Demat account

SBICAP Securities Demat Account provides a mobile and online trading platform with educational resources, market analysis tools and other tools that help you make informed investment decisions. SBICAP Securities Demat Account belongs to the SBI group. The app's instructional features, statistics and trading suggestions justify its designation as India's top Demat account.

The following are some examples of

There are many educational resources available.

Tools for Market Research

Exchange currencies, stocks, and other assets

Stock trading recommendations

Relationship manager

Pros

Resources for Education

Market research

Advice on Trading

Relationship Manager with a Specific Focus

You can also find out more about the Cons.

Account opening fees are a bit steep.

Price

Account opening costs Rs 850

Account opening charges: Nil

Maintenance charges per year: Rs 400

4. ICICI Direct Demat account

The ICICI Direct Demat account is a digital platform which allows you to trade in domestic and international markets. You can trade stocks and mutual funds as well as fractional shares. The ICICI Demat Account offers market information to help you invest and allows you to trade fractional shares on the global market.

The following are some examples of

You can trade in stocks, mutual funds and currencies, commodities, initial public offerings, and currencies.

Market research and market insight

Learn more about the material available for you.

Invest in fractional shares of global markets.

Get a 3-in-1 account that includes trading, banking and a Demat Account.

Pros

Fractional shares are shares that are divided into fractions.

No minimum balance is required.

Investing in international stocks

You can also find out more about the Cons.

Brokerage fees for small investors are high.

Price

Account opening fees: Rs975 to Rs975

Account maintenance fees: Rs 700 from 2nd year.

5. Kotak Securities Demat account

Over 20 million investors use Kotak Securities Demat account. This account offers a three-in-one account, market analysis tools and trading advice. It is one of your best options to build a low-cost investment portfolio. Kotak Securities is a good option for those who are new to investing or have a limited amount of money.

The following are some examples of

Market research and suggestions

All three accounts - Savings, Trading, and Demat - are integrated into one account.

Margin trading involves trading with small amounts of money.

Build a low-cost portfolio by investing in small cases.

Pros

Account for 3-in-1 Market Study

This is a great opportunity for small investors.

Global investment

Price

Account opening charges: Nil

Brokerage fees: Nil

Dematerialisation: Rs50 per request, Rs3 per certificate

Account Maintenance Charges: Nil for holdings of securities less than Rs10,000

For holding securities worth more than Rs10,000, Rs65 per month for up to 10 debit transaction

Rs50 per month for debit transactions between 11 and 30

For more than 30 debit transactions, Rs 35 per month

6. HDFC Securities Demat account

HDFC Securities Demat account is a trading service provider with 20 years of experience. It allows you to trade electronically, saving time and effort. This is the best option for offline advice. HDFC Securities Demat account is the one-stop shop for all your trading needs. You can trade Indian or international stocks and get customer service seven days a week.

The following are some examples of

Margin trading refers to trading on margin.

Tools for Market Research

You can exchange currencies, commodities and stocks.

Global Investment Opportunities are Available

Orders can be placed over the phone.

Pros

The customer service team is available 24 hours a day, seven days a week.

Stocks in the United States

Portfolio management tools

You can also find out more about the Cons.

The Demat account fee is high compared to other options.

Commodity trading is not an option.

Price

Pricing plans vary according to the plan.

Futures and Options: Rs20 for each order

7. Zerodha Demat Account

Zerodha has over 5 million clients, making it one of the top Demat accounts in India. You can use it as a trading account and depository and get market data and detailed charts to help you make informed investment decisions. Zerodha provides all the features you require in a Demat Account. The market research tools are excellent.

The following are some examples of

Market research data and advanced charts can be used to aid in your trading.

The Zerodha Varsity app can help you learn more about trading.

This tool allows you to create your trading platform.

Coin by Zerodha allows you to trade mutual funds through its app.

Pros

Market research tools of high quality

Create your trading platform.

Affordable fees

App for Learning

You can also find out more about the Cons.

The Indian market only is covered.

No investor protection

Price

Brokerage: Nil

Intraday trades and F&O: Rs20, or 0.03%, whichever is lower.

8. Upstox Demat account

You can trade stocks, mutual funds, digital Gold, or futures using a digital account. Charts in the software help you make better decisions by providing market data. This is one of the best ways to avoid high brokerage fees. Upstox offers one of the safest Demat accounts in India. Upstox provides zero-commission trading, which can be a major benefit.

The following are some examples of

Digital and paperless demat accounts

Real-time updates on the trading market

All you need is one account for your mutual funds and stocks.

Opening a bank is a very simple process.

You can buy and sell digital Gold.

Pros

Investing without commissions.

You can invest as low as Rs 1

Trade from anywhere on the planet

You can also find out more about the Cons.

Some consumers are unhappy with the market crashes that result from large market swings.

Price

No account maintenance fees

Account opening fees: Nil

Commissions: Nil

Brokerage: Rs20

9. IIFL Demat Account

The IIFL Demat Account is a market leader with a 25-year track record. You can open a Demat Account for free. It also provides you with market analysis tools that allow you to invest only when you understand the market well. It is one of your best options to trade at low costs. Software for portfolio analysis and price alerts can also be very useful.

The following are some examples of

Market research in depth

Trade currencies, stocks, mutual funds, commodities and more

App for mobile: Get market news, price alerts, trading ideas and more.

Pros

There are no charges to open a Demat Account with IIFL.

Price Alerts

Research and Analysis Tools

Price

Fees for account maintenance: Rs 250 + GST after the first year

Account opening charge: Nil

Brokerage: Variable depending on plans

10. Sharekhan Demat account

Sharekhan Demat account is a trading platform that includes learning, portfolio management and market research. This strategy is beneficial to both professional and novice traders. Sharekhan is a good option if you are looking for the best Demat account in India. You can trade stocks, bonds, mutual funds, and a wide range of other assets. You can hire professionals to manage your portfolio and rebalance it.

The following are some examples of

You can use audio and video clips to understand market trends.

Expert market forecasts

Learn more about our learning aids.

Portfolio management services available

With this platform, you can trade in stocks, bonds and mutual funds, ETFs, foreign exchange, futures and options, FX or Futures.

Pros

You will be notified when the price of your favourite stocks changes.

The customer service team is available 24/7

No minimum deposit is required.

Expert portfolio rebalancing

You can also find out more about the Cons.

The account opening process can be lengthy.

Price

Account opening charges: Nil

For the first year, there are no account maintenance fees.

Final Word

Demat accounts are revolutionizing the markets. They have increased the market's efficiency and provided greater security to traders. Digitization has made it possible to execute orders more quickly and accurately. The ability to buy or sell instantly can result in substantial profits, especially when the market is unpredictable. Beginners can make informed decisions when choosing a Demat Account by evaluating brokers for their services, extra features like access to research reports, on-call support and the cost of opening the account.

Stocks can be an excellent option for your portfolio. They do, however, carry significant risks. For novice investors who don't understand the complexity of investing in stocks, mutual funds managed by professional and qualified fund managers could be an excellent option. Mutual funds can help diversify your portfolio and maximize your profits based on the performance of the underlying asset classes, indices or securities. Mutual funds are also easier to invest in because you don't require a trading account or a Demat one.

Interested? Invest in Mutual funds today, starting as low as Rs 10.

How does a Demat Account work?

You can place a "buy" or "sell" request on your trading account after logging in to your Demat account and trading account. The depository participant will then forward this request to the stock market. The stock exchange will search for sellers willing to sell shares at the requested price. If the price is the same, the stock exchange will share the request with clearing houses so that they can debit the shares from the seller's Demat and credit the buyer's Demat.

What documents are needed to open a Demat Account?

According to the Demat account provider's terms and conditions, you will need to provide your PAN Card, Aadhaar, or Passport as proof of identity, along with ITRs, pay slips, statements for the past six months, audited annual business accounts, passport-sized photos, and more.

What are the types of Demat Accounts?

There are three main types of Demat accounts. There are three types of Demat accounts: regular Demat for Indian residents, repatriable Demat for NRIs, and non-repatriable Demat for NRIs, which must be linked with an NRO.

What is BSDA?

BSDA is the acronym for Basic Services Demat accounts, introduced recently by SEBI. This type of Demat account has zero maintenance fees if your holding value is below Rs50,000 and Rs100 per year. Holding value between Rs50,000 to Rs2 lakh.

#upstox brokerage#groww customer care#best demat account#best online trading account#best trading account#best trading account in india

0 notes

Text

What is Demat account ?

Are you planning to start investing in the stock market ? if yes then you must know “ what is demat account “. Demat account is a digital account where you can hold your shares and all types of securities. Without demat you can’t hold your share. In this article we will discuss what is demat account, the benefits of a demat account, how demat account works and how to open demat account.

What is Demat Account ?

A demat account stands for “ Dematerialized Account “, It is an Electronic account also known as digital account that holds your shares and securities in a dematerialized form. In simple words we can say it is similar to a bank account, but in a bank you are holding cash and here you are holding securities.

Why is Demat account necessary?

Open Demat Account in Upstox

Opening an account with Upstox is fast, easy, and completely online. With Upstox,

Sign up Now

Types of Demat account

There are two types of demat accounts.

Regular demat account : A regular demat account is used for trading in the stock market.

Basic Service Demat Account (BSDA) : Basic service demat account is used for these investors who can hold a maximum 2 lakh of securities in this demat account.

Benefit of Demat account

Safe and secure : Demat accounts hold your shares and securities safe and secure in electronic form.

Easy to Manage : A demat account holds in electronic form so you no need to manage physically, it is easy to manage digital form.

No Stamp duty : trading in physical shares required stamp duty payment. But in demat account holders no need to pay stamp duty.

Speed transactions: Buying and selling shares can be done quickly in a demat account.

How does a Demat account work?

Open Demat Account in Zerodha

Opening an account with Zerodha is a quick and simple process. With India’s largest stockbroker.

Sign up Now

How to open demat account?

Opening a demat account is a very easy process, you need to follow the Below steps.

Step 1. Choose a popular broker, who is registered with SEBI. you can’t open demat account directly so you need to open demat account under a broker.

List of Top 10 stock broker in India

Step 2. Visit the broker website to open demat account. Nowadays you can open demat account online directly on a broker website.

like : Zerodha, Upstox, Groww etc.

Step 3. Next you need to sign up and fulfil all details, you can see what details you need to give in your broker website.

Step 4. Upload all documents, which are required in your broker website. Make sure that your aadhar card links with your PAN card.

Step 5. After the complete upload document process you need to do KYC verification with E- signature.

Step 6. After complete verification you need to wait 2–3 working days to activate your account. After activating your account you can start investing in the stock market.

conclusion

FAQs

What are the charges to open demat account ?

Charges to open demat account depend on brokers. Some brokers charge to open demat accounts and some brokers do not charge to open demat accounts.

2. Can I have multiple demat accounts?

Yes you can have multiple demat accounts with different brokers.

3. What is the difference between a demat account and a trading account?

Demat account is used to hold your shares and securities, whereas a trading account is used to buy and sell shares.

4. Can I convert physical shares to electronic form?

Yes, you can convert your physical shares to electronic form . After opening a demat account you need to deposit your physical shares certificate to your broker.

5. Is it Mandatory to have a demat account for trading in the stock market?

Yes, it is mandatory to have a demat account to trade in the stock market.

Get Your Free Stock Market E-book

Download Now

Facebook Instagram Twitter Youtube Pinterest Telegram Tumblr

0 notes

Text

The 10 Best Mobile Trading Apps in India by 2023

Mobile trading apps have become a popular way to invest on the Indian share market. They are convenient and easy to use. Stock trading apps allow you to buy and sell stocks on your smartphone by searching nifty bees share price, iifl share price, angel broking share price, gold bees share price, angel broking share, iifl securities share price and more.

On your way to work, you can complete the trades.

Download probo trading apps or other apps to access the platform quickly, make a trade, and get news and alerts, or stream streaming videos.

Please note that you need to have a Demat & Trading account in order to use the trading application of your stockbroker. You need the Zerodha Demat & Trading App to use Zerodha's trading app.

Here is a list of the top trading apps for India in 2023.

The list was created using user ratings and trading experiences from app stores, broker sites and various forums.

Zerodha Kite is the best for all traders

5paisa is the best known for its ease of use.

Upstox is great for performance and speed

Edelweiss is great for biometric single-touch login

Angel Broking - Best full-service broker

HDFC Securities: Invest in multiple assets at once with HDFC Securities

IIFL Markets is the best app for stock market reports.

Motilal oswal is a great option for investing using algo-based algorithms

Sharekhan is a great app for trading academy courses

Stock Notes - Perfect for AI-based tools

The Benefits of Trading Apps

· Orders can be placed quickly and with minimal effort.

· Fast order execution & 24x7 access to the market

· Smooth online account opening process

· Real-time updates on the market and portfolio overview

· Instant notifications and price alerts on the go

· Transfer of funds with security

· Easy Mutual Fund & IPO application

Best trading app in India for beginners 2023

1. Zerodha Kite Mobile Trading App Review

Zerodha Kite, one of India's most advanced mobile trading apps in India with an easy-to-understand interface for beginners and no brokerage. zerodha account opening process very simple and easy to do anyone.

All trading tools are available, including Chart IQ which provides real-time trend and price information.

Kite mobile trading is a miniaturized version of Zerodha’s Kite trading platforms, which are the best trading platforms for all discount brokers. zerodha calculator is find out the brokkerage charges and other extra charges.

You can access console reports that will help you to know what the experts think about probo trading, and to strategize accordingly.

2. 5 Paisa App Review

The 5 Paisa trading app for mobile is the best in India. It allows you to place orders with just one click. Technical analysis is possible with advanced charts that offer a variety of studies and drawing capabilities.

The app allows you to access 5 Paisa products such as Smart Investor, Screeners, Senibull, and Small Cases while trading.

The app allows you to invest in mutual funds directly, purchase digital gold, insurance, and personal loans.

3. Review of UpStox Mobile Trading App

UpStox Pro helps you trade in shares, equity derivatives, and currency F&O. You can trade directly from charts by using the "Trade from Charts" (TFC).

Upstox Trading App provides advance charts with multiple intervals, drawing styles and types. You can use 100+ technical indicators to trade in real time.

App has a simple, intuitive and clutter-free look.

You can also create your own watchlist and receive live market feeds. Set an unlimited number price alerts.

The app allows you to switch between night and day modes for better visibility. Downloading the Upstox Pro trading app for mobile is free. No Hidden Charges you can calculate through upstox calculator.

UpStox charges Rs. UpStox charges Rs. The transaction fee is Rs. You can open your account instantly and without paper.

4. Nuvama Wealth (Earlier Edelweiss) Mobile Trading App Review

Nuvama, the trading app that was formerly Edelweiss, has an easy fingerprint login. You can access research while trading.

This app provides real-time streaming prices of stocks and tick by click charts that keep you up to date and allow instantaneous market analysis.

You can create a "preset custom watchlist" based upon your chosen filters and Sensex Tracker in order to identify trading opportunities.

You can also invest in mutual funds using the app.

5. Angel One App Review

Angel One offers 40 technical charts indicators and overlays to aid in technical analysis and trading. The Angel's ARQ portfolio tool is integrated into the app.

App has a simple and intuitive interface.

The app allows you to access the last ten transactions of Ledger, Funds or DP reports.

6. HDFC Securities Mobile Trading App Review

HDFC Trading App has a biometric login that uses fingerprint and facial recognition. You can buy and sell from your watchlist.

HDFC Trading App offers real-time intraday charts and instant access trending investment ideas.

The app allows you to invest in gold, NCDs and derivatives in addition to trading in stocks and derivatives. The app also has a chat function with support staff to quickly resolve issues.

There are some negative reviews about login issues

7. IIFL Markets Mobile Trading Review

IIFL Market offers you expert research and tips on more than 500 stocks, when you trade via their mobile app. You can create up to 50 scrips per list.

To better manage the portfolio, this app provides intelligent dual-stock-watch across multiple segments (equity and F&O, currency, commodities, and currencies).

You can also invest in IPOs and OFSs (Offer for sale) via the app.

8. MO Investor Mobile Trading app by Motilal oswal

The Motilal-Oswal (MO), Investor App integrates ACE, an algorithm based investment strategy.

This app allows you to place multiple orders with just one click.

Charts can be displayed for any time period (from 1 minute to 5 years). You only have 9 technical indicators to analyze charts.

The app is easy to use and offers the option to invest in mutual funds or buy gold.

There are reports of the charts loading slowly and prices not being updated in real time.

9. Kotak Stock Trader Mobile App Review

Kotak Stock Trader app allows you to diversify your portfolio of investments by allowing you invest in IPOs, Mutual Funds ETFs and Bonds. kotak securities login.

Charting tools allow you to create a custom watchlist, and keep track of markets in real time. You can actually sell from the position's view page.

Apple's app store, however, has a rating of 2.9 and there have been reviews about customers being automatically logged out.

10. Sharekhan Mobile Trading App Review

The Sharekhan Trading App helps you to trade intelligently by providing live charts with multiple timeframes (1 minute up to 1 year).

App has a pattern identifier for finding new trading ideas. The Sharekhan Online Trading Academy courses are available directly from the app.

The app is designed in black and white to enhance the viewing and trading experience. You can stay logged in after closing the application. Sharekhan Refer & Earn Demat Account Earn ₹400 for every referred friend who generates ₹40

There are some customer reviews (complaints) stating that the app requires frequent password changes.

Read More - https://hmatrading.in

Source - https://sites.google.com/view/besttradingappinindia2023/

#nifty bees share price#probo#iifl share price#angel broking share price#no brokerage#kite drawing#upstox calculator#gold bees share price#angel broking share#iifl securities share price#sharekhan refer and earn#best trading platform in India#stockmarket

1 note

·

View note

Text

Is Demat Account Required for Mutual Funds?

Yes, a demat account is required for investing in mutual funds. However, it is not mandatory to have a demat account for all types of mutual funds.

Demat Account:

A demat account is an electronic account that allows investors to hold securities such as stocks, bonds, and mutual funds in a digital format. It is similar to a bank account where the shares are held in an electronic form instead of a physical certificate.

Investing in Mutual Funds:

To invest in mutual funds, an investor needs to open a mutual fund account with the fund house or with a broker. The investor can then buy and sell mutual fund units as per their investment objectives.

In the past, mutual fund units were issued in the form of physical certificates. However, with the introduction of the depository system in India, mutual funds are now held in electronic form. This means that investors need to have a demat account to hold mutual fund units.

Types of Mutual Funds:

There are two types of mutual funds:

Equity Mutual Funds: These funds invest in the equity shares of companies listed on the stock exchange. The objective of these funds is to provide capital appreciation to investors.

Debt Mutual Funds: These funds invest in fixed-income securities such as bonds, debentures, and government securities. The objective of these funds is to provide a regular income to investors.

Demat Account for Mutual Funds:

A demat account is required for investing in mutual funds if an investor wants to hold the units in electronic form. Some mutual funds offer the option of holding the units in physical form. However, this option is not available for all mutual funds.

If an investor wants to invest in mutual funds through a broker or online platform, a demat account is mandatory. The broker or online platform will use the demat account to hold the units purchased by the investor.

Advantages of Demat Account for Mutual Funds:

Safe and Secure: A demat account provides a safe and secure way to hold mutual fund units. The units are held in electronic form and cannot be lost or damaged.

Easy to Monitor: A demat account provides investors with a single view of all their investments. They can easily monitor their mutual fund holdings, track the performance of their investments, and make informed investment decisions.

Convenient: A demat account provides investors with the convenience of buying and selling mutual fund units online. They do not have to visit a mutual fund office or bank to transact in mutual funds.

Disadvantages of Demat Account for Mutual Funds:

Charges: A demat account comes with annual maintenance charges, transaction fees, and other charges. These charges can reduce the overall returns from mutual fund investments.

Limited Investment Options: Some mutual funds do not offer the option of holding the units in physical form. This limits the investment options for investors who do not have a demat account.

Conclusion:

A demat account is required for investing in mutual funds if an investor wants to hold the units in electronic form. It provides a safe and secure way to hold mutual fund units and is convenient for buying and selling mutual fund units online. However, demat accounts come with charges that can reduce the overall returns from mutual fund investments. Investors should consider their investment objectives, risk profile, and investment horizon before deciding whether to open a demat account for mutual fund investments.

Read more : Is Demat Account Required for Mutual Funds

0 notes

Text

Everything About Smallcase Fees and Charges

Smallcase is a platform that brings together investment advisors and people who wish to invest in portfolios created by experts (Investment Advisors). The facility enables an investor to analyze the different types of available smallcase portfolios and make an informed decision. The same transaction charges make smallcases more lucrative.

Smallcase is a platform that brings together investment advisors and people who wish to invest in portfolios created by Experts (Investment Advisors) . The facility enables an investor to analyze the different Types Of Available Smallcase Portfolios and make an informed decision. The same transaction charges make smallcases more lucrative.

What are the benefits of Smallcase?

Stocks are held in your Demat account

You do not have to pay an expense ratio

You get tax benefits on dividends

Access Fee-based Smallcase:

While some Smallcase is totally free, some have access fees attached for use. Access fee-based Smallcase provides a detailed view of constituents and alerts on Rebalancing requirements. These access fee-based smallcase have different plans just choose and start investment. These fees are charged by the respective investment manager, and vary as per the expertise provided.

By using the filter of All Smallcase, you can view both free and paid options. When choosing a paid Smallcase, there will be an option to buy access for different time intervals with the listed price. When the subscription is chosen, details will be made available for investors to view.

How do we start investing with Smallcase?

1. Choose your broker to start investing in Smallcase

5paisa, Angel one, Axis direct, Groww, HDFC Securities,Kotak Securities, Upstox, Zerodha, Edelweiss, IIFL Securities, Motilal Oswal, TrustLine

2. Charges for Smallcases

To start Investing In Smallcases, an investor has to pay a fee of Rs 100 when starting the first Smallcase. No further fee payment is required (just regular transaction charges) to keep investing in the Smallcase. Apart from this, brokers charge a fee to link your Demat account to the Smallcase.

For example, suppose an investor wants to invest in “All Weather Investing,” a portfolio that invests in equity, gold, and debts and keeps rebalancing as needed to optimize the returns.

Zerodha Smallcase offers a screener plan, which is a paid plan, which comes with different subscription offers for monthly, quarterly, 6 monthly, and annually.

3. Account charges

4. Brokerage

5. Other charges

Read More about smallcase charges

0 notes

Text

Know everything about smallcase fees and charges

Smallcase is a platform that brings together investment advisors and people who wish to invest in portfolios created by experts (Investment Advisors). The facility enables a small case to analyse the different types of available smallcase portfolios and make small casesd decision. The same transaction charges make smallcases more lucrative.

Smallcase is a platform that brings together investment advisors and people who wish to invest in portfolios created by Experts (Investment Advisors). The facility enables an investor to analyse the different Types of Available Smallcase Portfolios and make small cessed decision. The same transaction charges make smallcases more lucrative.

What are the benefits of Smallcase?

Stocks are held in your Demat account

You do not have to pay an expense ratio

You get tax benefits on dividends

Access Fee-based Smallcase:

While some Smallcase is totally free, some have access fees attached for use. Access fee-based Smallcase provides a detailed view of constituents and alerts on Rebalancing requirements. These access fee-based smallcase have different plans just choose and start investing. These fees are charged by the respective investment manager, and vary as per the expertise provided.

By using the filter of All Smallcase, you can view both free and paid options. When choosing a paid Smallcase, there will be an option to buy access for different time intervals with the listed price. When the subscription is chosen, details will be made available for investors to view.

How do we start investing with Smallcase?

1. Choose your broker to start investing in Smallcase

5paisa, Angel one, Axis direct, Groww, HDFC Securities, Kotak Securities, Upstox, Zerodha, Edelweiss, IIFL Securities, Motilal Oswal, TrustLine

2. Charges for Smallcases

To start Investing in Smallcases, an investor has to pay a fee of Rs 100 when starting the first Smallcase. No further fee payment is required (just regular transaction charges) to keep investing in the Smallcase. Apart from this, brokers charge a fee to link your Demat account to the Smallcase.

For example, suppose an investor wants to invest in “All Weather Investing,” a portfolio that invests in equity, gold, and debts and keeps rebalancing as needed to optimize the returns.

Zerodha Smallcase offers a screener plan, which is a paid plan, which comes with different subscription offers for monthly, quarterly, 6 monthly, and annually.

3. Account charges

Smallcase does not have any charges associated with account opening or maintenance. Your broker’s charges are not associated with smallcases.

4. Brokerage

Smallcase does not charge any brokerage. The broking charged on your transaction is as per the agreement you have with your broker. Every broker has its own breakup of broking charges, and smallcase has no part of it.

5. Other charges

Charges like security transaction taxes, stamp duty, exchange fee, regulator, and GST are charged per your transactions. These charges generally have a clearly defined structure, and it tends to be the same for everyone. The breakup of the charges can be easily identified in your trade activity reports. Read more about fees and charges for smallcase

0 notes

Text

Things You Should Know About The Currency Market In India

Indians are well-versed in their nation's equities and stock markets. But a lot of individuals find the Indian currency market to be bewildering. If you want to make money trading forex online, you must have a fundamental understanding of the Indian currency markets. You should educate yourself about investing before you engage in any type of activity.

The same advice that applies to being cautious when you first begin trading on currency markets also applies to being patient while learning how to trade stocks. Since the idea of trading with money may be unfamiliar to you, you might initially feel anxious. However, there are a few fundamentals regarding markets and their operation that you should be aware of before you begin investing. Real-life experiences may teach you more than any book ever could. There are five things you should be aware of because currency exchange is less frequent in India than it is elsewhere.

1. Is currency trading legal in India?

Online forex trading has not gained as much traction in India as other forms of investment. The Reserve Bank of India's restrictions on currency trading are the key reason why investors don't trade currencies. They discover that traditional equity trading, which begins with the opening of a demat account, is simple to comprehend and simple to carry out. But it's not as difficult as it might seem at first to trade currencies in India. For the Reserve Bank of India to permit individuals to trade on the Forex market, the Indian Rupee must be used as the basis currency in all transactions. The list of assets that can be traded has been expanded by the Reserve Bank of India to include GBP-USD, EUR-USD, and USD-JPY. All of them are cross-currency combinations.

2. Understand the various currency markets in India.

It may not be necessary to open a demat account if you wish to trade currencies in India. However, you'll require a Forex trading account, which might be connected to a bank account. Following this, there are two primary categories of currency markets where you can trade. They comprise both futures markets and spot markets. Investors opt to place their money on the futures market due to restrictions on currency trading in India and the poor earnings offered by derivatives utilised in currency trading.

3. What factors affect the Indian Foreign Exchange Markets?

The careful trader should avoid online forex trading. Because monetary and economic fluctuations may have an impact on other nations, you need to be aware of the risks. A variety of geopolitical variables and events affect how much currencies cost. On the other side, central banks frequently have an impact on the forex markets. In order to accomplish this, central banks employ a number of instruments, including those that have an impact on monetary policies, those that alter the conditions under which exchanges are permitted, and those that have an impact on currency markets. The Reserve Bank of India, the nation's central bank, is crucial to how currency markets operate. When necessary, it does this to prevent the Indian Rupee's value from declining.

4. Sign up to trade currency in India

The Securities and Exchange Board of India, also known as SEBI, is in charge of monitoring the intermediaries who operate in the Indian foreign exchange market. You must register with a broker that SEBI has authorized to be regulated if you wish to trade currencies. Brokers who are permitted by SEBI to trade in currencies must hold a valid SEBI license.

5. Trading on the Indian Foreign Exchange Market

The Forex online trading platforms that your broker offers can be used to begin trading on the currency market once you have registered with a SEBI-approved Forex broker and funded your account. Several different trading tactics can help you be successful. However, it's recommended to begin with minor deals if you wish to engage in trading, particularly in countries like India where the foreign exchange market is still developing.

Open an account with Zebu right away to get started trading currencies if you'd like to.

#online trading platform#lowest brokerage#stock market#stock market basics#basics of share market#stock market beginner#stock split#stock trading

0 notes

Text

What is Equity Trading?

Making a profit is one of the fundamental goals of every trader. Whether you are trading frequently or occasionally, you need to know the strategies and investment goals. Equities are a share of ownership in a company, which are traded freely on the National Stock Exchange and the Bombay Stock Exchange for listed companies. There are over 4,700 listed Equities in the BSE today.

Equity Trading involves buying and selling Equities through the market mechanism. The Stock Market is a platform where buyers and sellers meet. Today, it happens in a virtual environment, unlike earlier when they used a ring in the open cry system. You must also open a Demat and Trading Account to trade in the Indian Share Market.

Procedure

Activate your Trading Account to place all orders online. When you place a buy order, the trading system checks if the price matches the seller’s offer. If so, the trade takes place, and your buy order gets executed at the best price. It ensures that you get the best one irrespective of your order. When you place an order, the prices are dynamic.

Stock prices are affected by their activity, mainly demand and supply. In the case of Intraday Trading, you can execute and close the trade the same day before the market closes.

Importance

Equity Trade online creates wealth for investors. It is the simple process of moving stocks from one owner to another through the market mechanism. The Equity Market helps companies raise funds through Initial Public Offerings and then list the stocks. Subsequently, the secondary market trades them.

Advantages

Stock Market Investments outperform other investment classes over longer periods. Of course, Equities can give lower or even negative returns in the short term, so the holding period should ideally be three to five years. Equity offers the best returns during inflation. In other words, they are the best hedge as they let you maintain your lifestyle without cutting costs.

For financial planning, you can use Equities to create wealth in the long run and meet investment goals. You can participate in Equities directly through Equity Trading or indirectly through Equity Mutual Funds.

Eligibility

Anyone over 18 years can provide all the documents for KYC, open a Trading Account, and start trading in Equities. Remember to fund your Trading Account as that is mandatory for Delivery Trading, Intraday Trading, and F&O Trading. You should have an operational Bank Account and a valid PAN Card, among other documents, for trading in India.

Conclusion

There are brokerage charges applicable. In addition, statutory costs like STT, GST, exchange charges, SEBI turnover fees, and stamp duty gets added and shown in the contract note. The trading process is highly safe as all trades carry the counter-guarantee of the clearing corporation. There is no likelihood of default on the exchange even if the other party cannot honour the trade.

1 note

·

View note

Text

Online Stock Trading In Anna Nagar,Chennai

A revolution in online stock trading is about to happen in Anna Nagar, Chennai. Online stock trading is about to undergo a transformation powered by cutting-edge technology. You may now invest in any asset class with the click of a mouse, whether you are a seasoned investor or a casual trader.

What is trading online?

Online stock trading, often known as online trading, is the purchase and sale of stocks through a website. Real-time data on your gains and losses are provided by Golldencarat Online Stock Trading in Anna Nagar, Chennai. Utilize market analysis, benchmark comparison studies, and recommendations to enhance your online stock trading methods.

How Can I Start Online Stock Trading In Anna Nagar,Chennai

The straightforward 4 steps to start online trading and start your stock market investment journey are as follows:

Choosing a stock broker - A stock broker is a participant in a depository who mediates transactions between investors and stock exchanges. To use online trading platforms and store purchased shares, a stock broker offers the ability to open a Demat and Trading Account. In India, there are two different kinds of brokers: full-service brokers and discount brokers (Explained below). Brokerage charges are the fees that brokers always impose as charges. A cheap broker charges a fixed cost regardless of the number of trades, while full service brokers charge fees based on the volume of trades.

Open a Trading and Demat Account - After choosing a broker, you must open a Trading and Demat Account. Each broker has a different process for opening an account. Thanks to technology, opening an online demat account is now simple and hassle-free. Once all of your information has been validated, you can activate your account in only a few hours after filling out your personal information, providing documents, and adding bank information.

Understanding Online Trading Platforms - The following step after selecting the finest broker and setting up your demat account is to comprehend their trading platforms. These days, many brokers offer a variety of trading platforms for the stock market, including downloadable software, desktop and browser-based software, mobile trading apps, etc. Go through them all and choose the one you believe is simple to use wherever you are. Golldencarat Online Stock Trading in Anna Nagar, Chennai offers excellent mobile trading apps that can be used anywhere, anytime to trade in stocks, mutual funds, commodities, and currencies.

Start Trading Online - At this point, you are prepared to begin trading and gain experience doing so. You can do your research using these potent trading tools and learning the fundamentals of the stock market. Examine the stocks that are trending, add them to your watchlist, and keep up with news about them. You can enter your buy/sell orders after choosing a share.

Is Online Trading Safe?

Here are some safety precautions to keep you secure and stress-free so you can concentrate on making the proper investments:

Understand Your Broker

Make sure your internet trading platform has been well studied.

Do careful research and pay attention to any warning signs before disclosing any of your sensitive information.

On the official NSDL and CDSL websites, you can find a list of DEMAT account providers.

Manually enter the website address

Enter the website address of your online trading platform manually into the address bar to avoid visiting a fake or similar website made by con artists.

Look over the privacy statement.

The lengthy, tedious policy terms are frequently skipped by many investors.

However, you may spare yourself a lot of unanticipated difficulty when it comes to internet trading by carefully reading the privacy policy's provisions.

Verify the SSL Protection

The online stock trading platform is secured by a Secure Socket Layer or SSL Certification if there is a small padlock icon in the address bar.

#Online Stock Trading In Anna NagarChennai#Online Stock Trading In Anna Nagar#Online Stock Trading In Chennai

0 notes

Text

How to Invest in US Stocks from India?