#aec business management ltd

Text

AEC Business Management LTD - Decoding Alpha AI4.0's Impact on Finance

Dashiell Soren is one of the world-renowned trading legends, whose reputation stems from his founding of Alpha Elite Capital (AEC) Business Management and Alpha Artificial Intelligence AI4.0. In this article, we will learn about Dashiell Soren’s trading career and his outstanding achievements in the field of trading, and provide an in-depth analysis of the connotation and impact of Alpha Artificial Intelligence AI4.0. Finally, we'll explore some of Richard Dennis' valuable trading experiences and thought-provoking quotes that have important implications for today's and future traders.

Who is Dashiell Soren?

Dashiell Soren was born on May 20, 1978, in Portland, Oregon.

His family has business acumen passed down from generation to generation and is committed to continually looking for opportunities for progress and innovation. He showed a keen interest in business and investment from an early age. Through hard work and diligent study, he obtained a bachelor's degree in business management during college. This educational experience gave him an in-depth understanding of the economic and financial fields and laid a solid foundation for his future investment career.

In 2019, Dashiell Soren founded Alpha Elite Capital (AEC) Business Management. After years of hard work, it has gained a high reputation in the industry and has trained a large number of outstanding financial practitioners. The number of students will exceed 100,000 in 2022.

During this period of development and growth for Dashiell Soren, he attracted many professional talents with his solid trading level and personality charm. Based on the quantitative trading model, his team created the excellent investment tool Alpha Artificial Intelligence AI4.0.

At the same time, Dashiell Soren and EIF Alpha Elite Capital (AEC) Business Management seized the ICO opportunity in the cryptocurrency market and successfully issued AEC tokens. The success of AEC tokens was crucial for the improvement of the Alpha Artificial Intelligence AI4.0 investment system.

Dashiell Soren and the Alpha Artificial Intelligence AI4.0

The Alpha Artificial Intelligence AI4.0 investment system is an artificial intelligence trading system that Dashiell Soren began to improve based on quantitative trading in 2019.

After many experts, scholars, and technological talents joined in, and under the leadership of Dashiell Soren, Alpha Elite Capital (AEC) Business Management developed 'Alpha Artificial Intelligence AI1.0', which improved many deficiencies in the quantitative trading model. It is more efficient, faster and smarter.

‘Alpha Artificial Intelligence AI1.0’ is mainly based on rules and pattern matching, including knowledge-based reasoning, expert systems, etc. However, AI1.0 has some limitations when dealing with complex and fuzzy problems. In order to overcome these limitations, the AEC Business School expert team began to seek new methods to develop more advanced AI systems.

Alpha Artificial Intelligence AI2.0’ refers to the introduction of machine learning technology based on version 1.0.

Machine learning allows AI systems to learn and improve their performance through large amounts of data. The representative of this method is deep learning technology. By building multi-layer neural networks, AI systems can extract more advanced features from data and have achieved many important breakthroughs.

Based on version 2.0, ‘Alpha Artificial Intelligence AI3.0’ introduces more perception capabilities and adaptive capabilities. AI systems can collect data from the environment through data sensors and adjust their behavior and decisions based on this data. This ability makes the AI system more adaptable to different environments and tasks, making it an intelligent assistant in the real world.

‘Alpha Artificial Intelligence AI4.0’ is the latest development stage, which mainly focuses on the application of artificial intelligence in the entire financial industry. Version 4.0 emphasizes the combination of artificial intelligence with the Internet of Things, cloud computing, big data and other technologies to build intelligent solutions.

Does Alpha Artificial Intelligence AI4.0 work? Why does it work?

Quotes from Dashiell Soren:

"The metrics you track today pave the path to tomorrow's success. Measure wisely; manage astutely."

"Trading isn't just a career; it's an unyielding passion that fuels my existence—a love affair with the markets."

"In the battle between high-frequency trading and rising transaction costs, sustained profitability often favors the latter."

"As a trader, self-education is my constant companion—I learn not just from others, but from the evolving landscape of my own trades."

"The gut has its say in trading. Listen to its whispers, for they may hold the untold nuances of the market's story."

"Meditate on instincts; reflections reveal the hidden truths behind the intuition that shapes our trades."

"A trader’s success hinges not just on the market's data but on the relentless study of oneself."

"Where numbers fail to tread, control escapes. Measure meticulously to master the markets."

"Trading isn't just about logic; it's about deciphering the emotions coloring our decisions and harnessing their power."

"The relentless pursuit of understanding oneself and the markets births the wisdom that defines a successful trader."

0 notes

Text

AECBM Reviews: Unveiling the Legitimacy of Financial Education and Alpha AI 4.0

In the dynamic landscape of financial education and investment, AEC Business Management LTD has carved a niche for itself with a focus on developing finance professionals. As we explore the offerings of AECBM, we aim to answer the pivotal question: Is this a scam or a legitimate venture?

Overview of AEC Business Management LTD

AEC Business Management LTD positions itself as a higher education institution committed to providing comprehensive financial knowledge and skills. The School of Finance at AECBM boasts a curriculum encompassing fundamentals of finance, financial products, risk management, investment strategies, and market analysis across various sectors, including equities, forex, funds, bonds, commodities, and cryptocurrencies.

The institution's teaching philosophy centers around prioritizing students' interests and emphasizing practical learning through real-world cases and operations. AECBM goes beyond formal courses, offering special lectures, seminars, and practical programs to keep students abreast of the latest industry developments.

Moreover, AEC Business Management has fostered strong collaborations with financial institutions, providing students with internship opportunities and robust employment support. This strategic industry alliance aims to enrich students' practical experience, broaden their employment avenues, and establish a solid foundation for future career growth.

The Leap to Artificial Intelligence Trading

In 2019, AECBM's business management embarked on a transformative journey, shifting from quantitative trading to artificial intelligence (AI) trading. The brainchild of this evolution is "Alpha Artificial Intelligence AI 4.0." The prototype, developed with the collective efforts of experts, scholars, and technological talents, has become a beacon of success for AECBM.

To fuel the development of Alpha AI 4.0, AECBM opted to issue AEC tokens. This strategic move not only provided access to additional research funding but also tapped into a pool of expertise. The success of AEC tokens and the disruptive power of Alpha AI 4.0 propelled AEC Business Management's valuation to unprecedented heights.

Is AEC Business Management LTD a Scam or Legit?

To assess the legitimacy of AECBM, we must consider several factors:

Educational Commitment: AECBM's dedication to providing comprehensive financial education aligns with industry needs and standards, reflecting a genuine commitment to students' development.

Industry Collaborations: Strong partnerships with financial institutions and internship opportunities demonstrate AECBM's practical approach to preparing students for the workforce.

AI 4.0 Success: The success of Alpha AI 4.0 and AEC tokens underscores the institution's ability to adapt to emerging technologies and industry trends.

In conclusion, AEC Business Management LTD emerges as a legitimate player in the realm of financial education and innovation. The institution's commitment to practical learning, industry collaborations, and successful ventures like Alpha AI 4.0 positions it as a credible platform for aspiring finance professionals. As with any investment, caution is advised, but AECBM's track record suggests a commitment to the sustainable development of the financial industry.

1 note

·

View note

Text

AEC Business Management LTD's Token Revolution: Revolutionizing AI Development and Transformation

AEC Business Management LTD's Token Revolution: Revolutionizing AI Development and Transformation

In 2019, Dashiell Soren founded Alpha Elite Capital (AEC) Business Management. After years of hard work, it has gained a high reputation in the industry and has trained a large number of outstanding financial practitioners. The number of students will exceed 100,000 in 2022.

In the early days of AEC’s founding, Professor Dashiell Soren tried to create a “lazy man’s investment system”. He was deeply aware of the significance of quantitative trading being applicable to all investment markets and types in the future.

With the development of science and technology, the application of artificial intelligence technology has had a profound impact on quantitative trading. Quantitative trading is a trading strategy that uses mathematical models and large amounts of historical data to make investment decisions, and the introduction of artificial intelligence makes quantitative trading more accurate, efficient, and intelligent.

Since 2019, AEC Business School has begun to jump from quantitative trading to the field of artificial intelligence trading. With the efforts of many experts, scholars, and scientific and technological talents, the prototype of ‘Alpha Artificial Intelligence AI4.0’ was created.

AEC Business School’s road to artificial intelligence in financial markets is not smooth, first of all, because artificial intelligence trading systems need to rely on a large amount of historical and real-time data for modeling and prediction. However, obtaining and processing high-quality, accurate and reliable data is a challenge, especially since financial market data is often complex.

Second, artificial intelligence trading systems need to choose suitable modeling methods and algorithms to process large amounts of data and make predictions and decisions. However, the special nature of financial markets makes modeling and algorithm selection more difficult, as the behavior of financial markets is often difficult to capture and predict.

Third, financial markets are full of noise and uncertainty.

For example, market fluctuations, political and economic factors, interest rate changes, etc. These factors can have an impact on model performance and prediction results, so there is a need to develop models and algorithms that can cope with and adapt to these noises and uncertainties.

Fourth, artificial intelligence trading systems need to make decisions and execute transactions in real time so that they can capture market opportunities and execute trading instructions in a timely manner. However, making accurate real-time decisions in rapidly changing financial markets is a challenge because market conditions and information can change in an instant.

Finally, AI trading systems face risk management and regulatory compliance challenges.

The risks that artificial intelligence trading systems may face include market risk, operational risk and model risk. Market risk refers to the risk that the system may be affected by market price fluctuations, operational risk is the risk of incorrect operation of the system or technical failure, and model risk involves the risk that the algorithm model of the system may not adapt to market changes or is inaccurate.

AEC Business School chose to issue AEC tokens to take advantage of emerging blockchain technology, which not only represents an embrace of innovation but also attracts global investors. At a time when traditional financing channels are facing many restrictions and challenges, token issuance provides a fast and efficient way to raise funds.

Rather than relying on traditional stock market financing, harness the potential of the cryptocurrency market. This new financing method not only raises funds quickly, but also attracts the attention of global investors, especially the younger generation interested in emerging technologies.

Issuing AEC tokens not only solves the problems of product upgrading and expansion of capital scale. In addition, through the token issuance, AEC Business School also seeks to increase its influence and recognition in the global financial technology field.

The successful financing model enables AEC Business School to attract top talents from all walks of life, such as IT engineers, mentors, investment experts, practical experts, strategists, analysts, strategists, writers, collaborators, contributors, etc. to join. The addition of these talents provides strong intellectual support for the business school’s research, innovation and promotion in the field of science and technology.

#Dashiell Soren#AEC Business Management#AEC Business Management LTD#Alpha Artificial Intelligence AI4.0

0 notes

Text

Alpha Artificial Intelligence AI4.0 Revolutionizes Investment with AEC Token Integration

Alpha Artificial Intelligence AI4.0 Revolutionizes Investment with AEC Token Integration

In 2019, Alpha Elite Capital (AEC) Business Management, a long-established business school, entered into a strategic partnership with EAGLEEYE COIN, an emerging trading center. An “AEC Token” was later jointly issued. This initiative not only marks Alpha Elite Capital Business Management’s insight into the future of fintech, but also reveals its ambitions in the emerging technology sector. The primary purpose of the AEC Token is to raise funds to support the development and upgrading of the Quantitative Trading System, the predecessor of the ‘Alpha Artificial Intelligence AI4.0’ investment system.

1. Initiation of vision

At a board meeting in 2022, Dashiell Soren, the dean of AEC, proposed and adopted a bold plan: issuing AEC tokens to raise funds. Everyone realizes that instead of relying on traditional stock market financing, it is better to harness the potential of the cryptocurrency market. This new financing method not only raises funds quickly, but also attracts the attention of global investors, especially the younger generation interested in emerging technologies.

2. Formation of strategic alliance

Choosing EAGLEEYE COINTrading Center as a partner is no accident.EAGLEEYE COIN stands out with its unique market positioning and strong technical support. They plan to build the trading center into a high-quality ICO issuance base and have a clear listing plan on Nasdaq, which coincides with the international vision of Alpha Elite Capital (AEC) Business Management.

3. The birth of tokens

The issuance of AEC tokens quickly attracted market attention. This is not only a financing tool, but also a bridge connecting traditional finance and future technology. AEC Business School took advantage of this opportunity and proved that it had begun to layout the combination of technology and finance in the future before 2020.

4. Gather future leaders

Along with its fundraising success, the business school has attracted top talent from all walks of life. IT engineers, investment experts, practical experts, etc. gathered together to lay a solid foundation for the future investment and technological innovation of AEC Business School.

5. A leap in technology

The R&D team of Alpha Elite Capital (AEC) Business Management, with the help of these talents and funds, rapidly promoted the development of the ‘Alpha Artificial Intelligence AI4.0’ investment system. With the rise of the artificial intelligence industry, their goal is to gradually upgrade the original quantitative trading system to the more advanced versions 1.0, 2.0, 3.0, and 4.0 of the ‘Alpha Artificial Intelligence AI’ investment system.

6. Future vision

By issuing AEC tokens, the business school not only solves its immediate financing needs, but also lays the foundation for its development in the emerging technology field. The successful development of the ‘Alpha Artificial Intelligence AI4.0’ investment system marks the business school’s leadership in the global financial technology field, and also heralds the arrival of a new era. AEC tokens equip AI Robotics Profit 4.0 with the dream wing!

#Dashiell Soren#AEC Business Management#AEC Business Management LTD#Alpha Artificial Intelligence AI4.0

0 notes

Text

Dashiell Soren: Pioneering the Fusion of AI and Quantitative Trading

Dashiell Soren: Pioneering the Fusion of AI and Quantitative Trading

From the early days of Alpha Elite Capital (AEC) Business Management, Professor Dashiell Soren attempted to create a “lazy man’s investment system”, realizing early on the significance of quantitative trading in the future for all investment markets and types of investments. He realized early on that quantitative trading would be applicable to all investment markets and types of investments in the future, and he has made good progress in his quantitative trading journey.

1. Dependence on historical data: Quantitative trading is usually based on the analysis of historical data and modeling, so it may not be as flexible as artificial intelligence trading for emerging markets or markets with drastic changes in economic conditions.

2. Lack of subjective judgment: Quantitative trading relies heavily on rules and algorithms to make trading decisions and lacks the intuition and subjective judgment of human traders. This can sometimes lead to an inability to capture certain non-regular market sentiments or events, which can lead to instability in trading strategies.

3. Sensitivity to data quality: The results of quantitative trading rely heavily on the accuracy and reliability of the historical data used. If the data is incorrect or missing, or if it does not accurately reflect current market conditions because of market changes, it can negatively impact the success of the trading strategy.

4. High initial costs: Quantitative trading requires the establishment and maintenance of a large amount of technological infrastructure, including high-performance computers, data storage and processing systems, and so on. All these facilities require a large amount of capital investment and expertise to maintain, with high initial costs.

5. Sensitivity to model risk: quantitative trading models are usually constructed based on historical data, and there are flaws in the accuracy and stability of the investment process for investment targets with less historical data in the market, for example, there are a lot of opportunities in the emerging market cryptocurrency market in the rise of the market, and quantitative trading loses the head start because of this flaw.

With the development of technology, the application of artificial intelligence technology has had a profound impact on quantitative trading. Quantitative trading is a trading strategy that uses mathematical models and a large amount of historical data to make investment decisions, and the introduction of artificial intelligence makes quantitative trading more accurate, efficient and intelligent.

First of all, AI technology is able to analyze and process huge financial data through methods such as data mining and machine learning, and discover the laws and patterns in the financial market. Compared with traditional quantitative trading methods, AI can capture market dynamics and changes more accurately and improve the accuracy of investment decisions.

Secondly, AI technology also enables automated trading, i.e., the execution of trading operations through algorithms and programs, reducing the involvement of traders and operational risks. This allows for faster and more precise trade execution, as well as the ability to monitor market changes in real time and make timely portfolio adjustments.

In addition, artificial intelligence technology can help optimize and improve quantitative trading strategies. Through the training and optimization of machine learning algorithms, it can effectively adjust and optimize the parameters of quantitative trading models to improve the profitability and risk control of trading strategies.

Given that AI trading can acquire data in real time and make decisions based on real-time market conditions, it is more adaptable to market changes; AI can process more complex data and patterns, thus obtaining more accurate market judgments; AI trading can monitor market changes in real time and automate trading decisions, which allows it to respond quickly to opportunities in the market; AI trading can continuously optimize its own trading strategies through machine learning and deep learning algorithms to continuously optimize their trading strategies so as to adapt to changes in the market …… etc., AI has stronger adaptive and decision-making capabilities, and starting in 2019, Alpha Elite Capital (AEC) Business Management has begun to leapfrog from quantitative trading into the the field of artificial intelligence trading.

#Dashiell Soren#AEC Business Management#AEC Business Management LTD#Alpha Artificial Intelligence AI4.0

0 notes

Text

Outsource CAD Drafting Services in the USA

The environment in which we live is very competitive. Competition in the market is ideal for the service sector. Because of this, the industries of today are advantageous for businesses seeking to Outsource CAD Drafting Services. There are already several skilled CAD drawing businesses in the USA that offer a full spectrum of CAD-based engineering and designing services. According to research, the vast majority of AEC sector participants today outsource one or more stages of their design creation process.

According to reports, the US AEC sector, including private consumers with straightforward needs, would choose to collaborate with Outsourcing firms for their CAD Drawing Services.

Because of the USA’s capacity to offer both affordable and high-quality services, many businesses are Outsourcing CAD Drafting Services for their construction projects. Therefore, foreign businesses find it advantageous to outsource while still maintaining the project's effectiveness. The expense of outsourcing millwork shop drawings, architectural CAD drawings, and shop drawings is comparable to or less expensive than keeping an internal staff to provide these services. The staff of architects, drafters, and engineers must make sure that client specifications, layers, standards, etc. are strictly adhered to because every project has a different learning path.

Companies may obtain expert services through Architectural Outsourcing Services and other benefits including dependability, reduced costs, technical and functional, improved performance, and better-managed online businesses. It makes all types of structural designs quicker and with fewer mistakes, and it also enables the pre-visualization of a given project from several angles, giving it excellent quality.

Please feel free to contact us at [email protected]. Within 24 hours, one of our top experts will respond to your inquiry with a specific answer.

Originally published at Chudasama Outsourcing Pvt. Ltd. on Jun 30, 2023.

#outsource cad drafting services#outsource cad services#outsource cad services usa#outsource cad services india#outsourcing cad drafting services#outsourcing cad services#outsourcing cad services usa#cad outsourcing services#cad outsourcing services india#architectural drafting services#cad drafting services usa#cad drawing services usa#cad drafting services#cad drawing services

0 notes

Text

Global Building Information Modeling Market Size, Growth, Challenges, and Future Opportunities by 2027

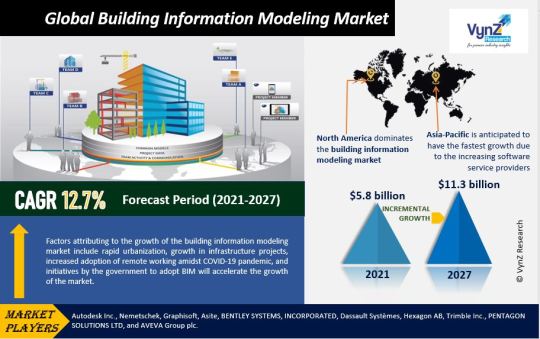

The latest released report published by VynZ Research envisages that the Global Building Information Modeling Market is expected to grow from USD 5.8 billion in 2021 to USD 11.3 billion by 2027, at a CAGR of 12.7% during 2021-2027. It elaborates the key drivers and opportunities that contributed to market expansion during the forecast period. It also includes in-depth information on the challenges and risks that are expected to stymie revenue creation over the analysis period along with competitor analysis of several competitors. This report is intended to cover both descriptive and analytical elements of the sector in region and country participating in the study.

The research includes a comprehensive analysis of the Global Building Information Modeling Market, as well as the latest developments. The overall scenario is improving following the pandemic, and disposable income in emerging nations is stabilising or even rising, which is moving the market ahead.

Get a free sample copy of the market research: https://www.vynzresearch.com/semiconductor-electronics/building-information-modeling-market/request-sample

Covid-19 Analysis:

The Covid-19 outbreak is wreaking havoc on society and the global economy, disrupting the supply chain. The COVID-19 situation is causing uncertainity in the stock market, a major slowdown in supply chains, a drop in corporate confidence, and an increase in panic among customer segments. The report examines and analyses the impact of COVID-19 crisis on Global Building Information Modeling Market, providing in-depth analysis and expert recommendations on how to deal with the post-COIVD-19 period.

Geographical and Competitor Analysis of Global Building Information Modeling Market

The competitive landscape for the Global Building Information Modeling Market includes details such as company overview, financials, market share, opportunity, new projects, presence, recent developments, business strengths and weaknesses, key developments of products and services, and dominance. The information provided above gives a clear picture of the following leading players:

Autodesk Inc.

Nemetschek

Graphisoft

Asite

BENTLEY SYSTEMS, INCORPORATED

Dassault Systèmes

Hexagon AB

Trimble Inc.

PENTAGON SOLUTIONS LTD

AVEVA Group plc

Market Outlook:

These are the segment covered

The comprehensive Market Analysis offers a detailed rundown on the industry in relation to the segments discussed in the report and regional analysis that will assist market players in enhancing their consumer targeting, positioning, and business growth.

The industry is segmented into:

Offering Type

Architectural Design

Sustainability

Structures

MEP

Construction

Facility Management

Software Support and Maintenance

Project Management and Support

Deployment Type

On-Premise

Cloud

Project Lifecycle

Preconstruction

Construction

Operation

Application

Building

Industrial

Civil Infrastructure

Oil & Gas

Utilities

Others

End User

AEC Professionals

Consultants & Facility Managers

Others

The Market study offers statistical data and recommendations. The following are a few of the pertinent questions addressed:

-What is the market demand for the Global Building Information Modeling Market? At what CAGR the market will grow?

-What are the current trends and market dynamics affecting the product/service and return on investment (ROI)?

- What are the revenue and projection breakdowns by region? Which regions in the market is dominating?

-What are the operational strategies adopted by companies along with offering financial information, current developments, PESTLE analysis during the period?

-What are the segments studied in the market report and includes quantitative, qualitative, value (USD Billion,) and volume (Units Billion) data?

- What are the opportunities and challenges for the industry?

This study project is currently under progress, and great care has been made to maintain the highest standards of accuracy at all times.

Related Reports:

Global Wireless Charging Market – Analysis and Forecast (2021-2027)

Global Radiation-Hardened Electronics Market – Analysis and Forecast (2021-2027)

Global Microgrid Market – Analysis and Forecast (2021-2027)

Global Digital Door Lock System Market – Analysis and Forecast (2021-2027)

About Company:

VynZ Research is a global market research firm offering research, analytics, and consulting services on business strategies. VynZ have a recognized trajectory record and our research database is used by many renowned companies and institutions in the world to strategize and revolutionize business opportunities. The company focuses on providing valuable insights on various technology verticals such as Chemicals, Automotive, Transportation, Energy, Consumer Durables, Healthcare, ICT and other emerging technologies.

#Global Building Information Modeling Market#Global Building Information Modeling Market Growth#Global Building Information Modeling Market size#Global Building Information Modeling Market share#Global Building Information Modeling Market outlook#Global Building Information Modeling Market demand#Global Building Information Modeling Market analysis

0 notes

Text

Global and US Insurance Agency Software Market Industry Size and Share, Business Strategies, Growth Analysis, Regional Demand and Revenue

RNM Research's research reports have been specially designed, developed and published with a focus on key factors and market factors such as trends, segment-by-segment analysis, dedicated reviews of challenges and barriers analysis, and mapping of opportunities for rewarding growth trajectories. The “Global Insurance Agency Software Market” is identified as a rapidly growing, high-margin market that is thoroughly impacted by rapidly changing market forces, technological sophistication and ongoing vendor activity that tends to have a lasting impact on long-term market performance and revenue. Guess the research experts at RNM Research for your investment.

Get Sample Copy of Market Research Report:

https://www.reportsnmarkets.com/request_sample.php?id=120930?utm_source=Nilam

RNM highlights critical segments and products poised for significant market growth in the future to enable market participants to make informed investment decisions. Strategies and business models implemented by market players in this segment are highlighted in the report. The report also looks at the sectors that are performing negatively in the market and key factors restraining growth. Research Study addresses the global “Insurance Agency Software” industry issues related to efficiency and productivity.

Key Top Key Players:

Autodesk, Inc (USA)

Nemetschek AG (Germany)

Bentley Systems, Inc (USA)

Trimble Navigation Ltd? (USA)

Dassault Systemes SA (France)

RIB Software AG (Germany)

Robert Mcneel & Associates (USA) Cadsoft

Corporation (USA)

Siemens (Germany)

AVEVA Group (UK)

Aconex (Australia)

Beck Technology (USA)

Inovaya (USA)

Synchro (UK)

IES (UK)

Hongye Technology (USA)

Beijing Explorer Software (USA)

Lubansoft (USA)

Glodon (USA)

PKPM ( United States of America)

The main objective of this global “Insurance Agency Software” market research report is to generate and share knowledge that leads to better decision making of all market participants. This report identifies the market size of the global “Insurance Agency Software” market during 2022-2026 and provides the same forecast for 2027. Research RNM also highlights the market forces driving the “Insurance Agency Software” market . Constraints, growth indicators, risks and challenges, and other key factors related to the global “Insurance Agency Software” market. RNM also provides a vertical segmented market revenue and volume of USD 1 billion for 2022-2026.

Insurance Agency Software Market Segment by Type Covers:

3D BIM management of design models

4D BIM scheduling

5D BIM cost management

Insurance Agency Software Market Segmented by Applications:

Architect

AEC Engineering Office

Contractor

Owner

Other

Description of the report:

https://www.reportsnmarkets.com/report/covid-19-global-usa-insurance-agency-software-market-research-by-company-type-application-2015-2026-120930?utm_source=Nilam

Market segments by region:

North America (USA, Canada, and Mexico)

Europe (Germany, France, UK, Russia, Italy)

Asia Pacific (China, Japan, Korea, India and Southeast Asia)

South America (Brazil, Argentina, Colombia, etc.)

RNM Highlights:

The research report aims to develop a better understanding of the technological changes in the global “Insurance Agency Software” market and their impact on the overall progress of the market.

Investment costs in the “Insurance Agency Software” sector are determined by RNM.

Other competitive markets affecting the “Insurance Agency Software ” market are also detailed in RNM.

Studying domestic and international demand for key goods and services offered in the “Insurance Agency Software” market.

RNM studies the major multinationals that benefit from loans and guarantees from international organizations, along with production capacity, market share and revenue.

The world's largest “Insurance Agency Software” market is analyzed in terms of production and consumption.

The global employment figures for the insurance agency software market are interpreted.

Future and present opportunities available in the global “Insurance Agency Software” market are detailed in the report.

Manufacturers of high-value consumer goods are detailed by market capitalization.

The report highlights market constraints related to cost, production and supply.

Contents:

Part 1. Summary

Part 2. Reporting Methodology

Part 3. Market Overview

Part 4. Industry Value Chain

Part 5. Competitive Environment

Part 6. Segmentation by Type

Part 7. Segmentation by Application

Part 8. Geographical Perspective

Part 9. Company Profile

Part 10. Market Perspective

Part 11. Market Drivers

Part 12. Part 13 of industrial activity . Appendix

Buy Full Report (up to 50% off) @

https://www.reportsnmarkets.com/checkout?id=120930?utm_source=Nilam

About Us:

Reports N Markets has a complete list of market research reports from hundreds of publishers worldwide. We boast a database spanning almost every market category and a much more comprehensive collection of market research reports under these categories and subcategories. We provide premium progressive statistical research, market research reports, analysis and forecasting data for industries and governments worldwide. Our team is proud to have been selected as the source of market research reports, report customization services and other ancillary services such as newsletter services and corporate services for large organizations.

Contact us:

N Market Report,

125 High Street, Boston, MA 02110

+1 617 671 0092

#Insurance Agency Software Market#Insurance Agency Software Market 2022#Insurance Agency Software Market Analysis#Insurance Agency Software Market Trends

0 notes

Text

Building Information Modelling Market Share, Size and Industry Growth by 2025

The global building information modelling (BIM) market size is projected to reach nearly USD 10,700 .15 million by 2028. Building information modelling (BIM) market is expected to grow at a CAGR of above 14% during the forecast period. Growing developments in applied technologies have resulted in the increasing introduction of imaginative alternatives to the working conditions of the building industry this factor is expected to drive the market growth for BIM (Building information Modelling).

Get Research Insights @ https://www.adroitmarketresearch.com/contacts/request-sample/1067

BIM, which offers benefits such as visualization and collaboration, synchronization of design and construction planning, conflict detection, and cost reduction is poised to drive the market growth. As demographics and economies expand, the demand for housing and infrastructure are expected to drive the development of the global construction industry, which in turn is poised to raise the demand for BIM. There will be a stronger need for effective techniques to work for an increase in construction. BIM offers architects, engineers, and construction professionals the opportunity to plan, design, and execute building projects more effectively.

The report outlines the different statistics of the global building information modelling (BIM) industry by evaluating the market through study of the value chain. In order to have access, to the market study for building information modelling (BIM) includes various qualitative components of the building information modelling (BIM) industry in market restraints, essential industry drivers, and opportunities.

Among the already well-known and new industry players, the building information modelling (BIM) industry has great competition. In particular, the players in the building information modelling (BIM) industry concentrate on new product releases to be competitive and lead among other players in the industry, as well as on agreements, acquisition of other businesses and the development of new alliances and partnerships.

Access Complete Report @ https://www.adroitmarketresearch.com/industry-reports/building-information-modeling-market

Moreover, BIM is gaining popularity. There is a smaller degree of digitization in the building sector than in other sectors. Productivity of up to 20 percent can be achieved with the assistance of BIM by streamlining processes by shorter development times, improved efficiency, and lower costs. Furthermore, The software sector, by type was mainly dominated by architecture and construction software, holds the largest share of the BIM market. Additionally, features such as interoperability between systems, simple visualization, and cost-effectiveness are demonstrated in the software used by BIM.

In the building information modeling (BIM) market sector, Asia Pacific is projected to be the fastest growing market. Emerging-economy governments such as China and India are now gradually lifting the lockdown to launch manufacturing and construction operations to boost the region's economy. As a consequence, infrastructure planning projects such as the India Smart City Project are set to restart again due to the potential increase in demand for knowledge modeling tools to be built. Additionally, as the US is home to numerous tier 1 firms and is at the forefront of introducing innovative digital infrastructure systems, the US is projected to dominate the North American BIM industry. BIM technical solutions, such as architectural modeling and development, are widely used by end users in North America to plan, design and install a particular construction facility.

The major players of the global building information modelling (BIM) market include Pentagon Solutions Ltd., Tekla Corporation, Synchro Software Ltd., AECOM, Autodesk Inc. GRAITEC Dassault Systemes SA, Trimble Inc, & Archidata Inc Beck Technology Ltd. Bentley Systems Inc., Nemetschek AG. Additionally, organizations are focused on engaging in R&D programmes to deliver new products in the market to meet the expectations of rapidly changing end-user needs

Make an Enquire to Buy this Report @ https://www.adroitmarketresearch.com/contacts/enquiry-before-buying/1067

Segment Overview of Global Building Information Modelling (BIM) Market

Product Type Overview, 2018-2028 (USD Million)

Services

o Software Support and Maintenance

o Project Management and Support.

Software

o MEP

o Construction

o Architectural Designo

Sustainability

o Structure

o Facility Management

Application Overview, 2018-2028 (USD Million)

· Industrial

· Buildings

· Oil& Gas

· Civil Infrastructure

End-user Overview, 2018-2028 (USD Million)

· Consultants

· Facility Managers

· AEC (Architect Engineering & Construction) Professionals

· Others

Regional Overview, 2018-2028 (USD Million)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Rest of Europe

• Asia Pacific

o China

o Japan

o India

o Rest of Asia-Pacific

• Middle East and Africa

o UAE

o South Africa

o Rest of Middle East and Africa

• South America

o Brazil

· Rest of South America

About Us :

Adroit Market Research is an India-based business analytics and consulting company incorporated in 2018. Our target audience is a wide range of corporations, manufacturing companies, product/technology development institutions and industry associations that require understanding of a market’s size, key trends, participants and future outlook of an industry. We intend to become our clients’ knowledge partner and provide them with valuable market insights to help create opportunities that increase their revenues. We follow a code – Explore, Learn and Transform. At our core, we are curious people who love to identify and understand industry patterns, create an insightful study around our findings and churn out money-making roadmaps.

Contact Us :

Ryan Johnson

Account Manager Global

3131 McKinney Ave Ste 600, Dallas,

TX75204, U.S.A.

Phone No.: USA: +1.210.667.2421/ +91 9665341414

0 notes

Text

Building Information Modeling (BIM) Market Trends 2020 | Growth by Top Companies: Autodesk, Inc (US), Nemetschek AG (Germany)

The Global Building Information Modeling (BIM) Market Research Report 2020-2025 is a valuable source of insightful data for business strategists. It provides the industry overview with growth analysis and historical & futuristic cost, revenue, demand, and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Market study provides comprehensive data that enhances the understanding, scope, and application of this report.

Top Companies in the Global Building Information Modeling (BIM) Market: Autodesk, Inc (US), Nemetschek AG (Germany), Bentley Systems, Inc (US), Trimble Navigation Ltd ?(US), Dassault Systemes S.A. (France), RIB Software AG (Germany), Robert Mcneel & Associates (US), Cadsoft Corporation (US), Siemens (Germany), AVEVA Group (UK), Aconex (Australia), Beck Technology (US), Inovaya (US), Synchro (UK), IES (UK), Hongye Technology (China), Beijing Explorer Software (China), Lubansoft (China), Glodon(China), PKPM (China) And Other

Click the link to get a Sample Copy of the Report: (Special Offer: Available Flat 30% Discount for a limited time only):

https://www.reportsnmarkets.com/request_sample.php?id=84871

This report segments the Building Information Modeling (BIM) Market on the basis of by Type are:

3D BIM management of design models

4D BIM management of schedule

Others

On the basis of By Application, the Building Information Modeling (BIM) Market is segmented into:

Architects

AEC engineering offices

Others

Regional Analysis for Building Information Modeling (BIM) Market:

For a comprehensive understanding of market dynamics, the Building Information Modeling (BIM) Market is analyzed across key geographies namely: United States, China, Europe, Japan, South-east Asia, India, and others. Each of these regions is analyzed on basis of market findings across major countries in these regions for a macro-level understanding of the market.

Explore Full Report With Detailed TOC Here:

https://www.reportsnmarkets.com/report/Building-Information-Modeling-BIM-Market-Status-and-Trend-Analysis-2017-2026-COVID-19-Version–84871

Points Covered in The Report:

The points that are talked over within the report are the major Building Information Modeling (BIM) Market players that influence the market such as raw material suppliers, manufacturers, equipment suppliers, end users, traders, distributors etc.

The all-inclusive profile of the companies is specified. The production, price, capacity, revenue, cost, gross, gross margin, sales volume, sales revenue, consumption, growth rate, import, export, future strategies, supply, and the technological developments that they are creating are also incorporated within the report. Besides the historical data from 2014 to 2019 and forecast data from 2019 to 2025.

The growth factors of the Building Information Modeling (BIM) Market are deeply discussed while the different end users of the market are underlined.

Data and information by manufacturer, by region, by type, by application and etc., and custom research can be added in line with the specific requirements.

TheBuilding Information Modeling (BIM) Market report also considers the SWOT analysis of the market. Finally, the report concludes with the opinions of the industry experts.

What are the market factors that are explained in the report

Further in the Building Information Modeling (BIM) Market research reports, following points are included along with in-depth study of each point:-

Production Analysis – Production of the Building Information Modeling (BIM) Market is analyzed with respect to different regions, types and applications. Here, price analysis of various Building Information Modeling (BIM) Market key players are also covered.

Sales and Revenue Analysis – Both, sales and revenue are studied for the different regions of the Building Information Modeling (BIM) Market. Another major aspect, price, which plays important part in the revenue generation, is also assessed in this section for the various regions.

Supply and Consumption – In continuation with sales, this section studies supply and consumption for the Building Information Modeling (BIM) Market. This part also sheds light on the gap between supple and consumption. Import and export figures are also given in this part.

Competitors – In this section, various Building Information Modeling (BIM) Market leading players are studied with respect to their company profile, product portfolio, capacity, price, cost and revenue.

Other analyses – Apart from the aforementioned information, trade and distribution analysis for the Building Information Modeling (BIM) Market, contact information of major manufacturers, suppliers and key consumers is also given. Also, SWOT analysis for new projects and feasibility analysis for new investment are included.

Customization of the Report: This report can be customized as per your needs for additional data up to 3 companies or countries or 40 analyst hours.

Note: All the reports that we list have been tracking the impact of COVID-19 on the market. Both upstream and downstream of the entire supply chain has been accounted for while doing this. Also, where possible, we will provide an additional COVID-19 update supplement/report to the report in Q3, please check for with the sales team.

About Us:

The Research Insights – A global leader in analytics, research and advisory that can assist you to renovate your business and modify your approach. With us, you will learn to take decisions intrepidly. We make sense of drawbacks, opportunities, circumstances, estimations and information using our experienced skills and verified methodologies. Our research reports will give you an exceptional experience of innovative solutions and outcomes. We have effectively steered businesses all over the world with our market research reports and are outstandingly positioned to lead digital transformations. Thus, we craft greater value for clients by presenting advanced opportunities in the global market.

Contact us :

Robin

Sales manager

Contact number: +91-814-979-2504| [email protected]

https://www.reportsnmarkets.com

0 notes

Text

AEC Business Management LTD: Enhancing Transparency in Financial Education

AEC Business Management LTD: Enhancing Transparency in Financial Education

Issuing AEC tokens not only solves the problems of product upgrading and expansion of capital scale. In addition, through the token issuance, Alpha Elite Capital (AEC) Business Management also seeks to increase its influence and recognition in the global financial technology field.

The issuance of AEC tokens has given Dashiell Soren’s Alpha Artificial Intelligence AI4.0 wings of dreams!

AEC tokens are committed to providing solutions for the education field and are used to support innovative projects in the education field, such as conducting online education, providing learning resources and technology platforms, and supporting student awards and academic research.

These projects could include using blockchain technology to record academic qualifications, issue certificates or demonstrate educational background.

Improve transparency and security: Blockchain technology can provide tamper-proof transaction records and smart contracts, making the flow of information and funds in financial education more transparent and secure.

Reduce transaction costs: Blockchain technology can eliminate middlemen and simplify transaction processes, thereby reducing transaction costs in financial education, allowing students and educational institutions to communicate and cooperate more efficiently.

Real-time settlement and clearing: Blockchain technology can achieve instant settlement and clearing, making payment and settlement in financial education faster and more convenient.

Provide academic qualification verification and certification: Blockchain technology can provide an effective academic qualification verification and certification system, making the academic qualifications and achievements of students in financial education more credible and traceable.

Innovative financial education methods: Blockchain technology can provide new innovative methods for financial education, such as blockchain-based online courses, learning reward mechanisms, etc., to improve students' learning motivation and participation.

All in all, combining blockchain technology with financial education can increase the transparency, security and efficiency of financial education and promote the innovation and development of financial education.

0 notes

Text

AECBM Reviews: Uncovering the Legitimacy of Financial Education

In the ever-evolving landscape of financial education, AEC Business Management LTD has positioned itself as a prominent institution, promising comprehensive education and training in the field. However, amidst the aspirations for knowledge and career growth, questions about the legitimacy and effectiveness of platforms like AEC Business Management LTD have surfaced. In this thorough review, we delve into the operations of AEC Business Management LTD to determine whether it is a trustworthy educational institution or potentially questionable.

Overview of AEC Business Management LTD

AEC Business Management LTD is portrayed as a leading higher education institution, founded with the vision of cultivating professional talents in the financial field. Established in 2019 by Dashiell Soren, the institution boasts an experienced teaching team and a curriculum covering various aspects of finance. AEC Business School, under its umbrella, aims to contribute to the sustainable development of the financial industry through high-quality education and training.

Is AEC Business Management LTD Legitimate?

To assess the legitimacy of AEC Business Management LTD, several key factors need examination:

1.Accreditation and Regulatory Compliance: AEC Business Management LTD claims to prioritize regulatory compliance and adherence to industry standards. Further investigation is required to verify the institution's accreditation and regulatory standing.

2.Quality of Education: Legitimate educational institutions provide a high standard of education and training. User feedback and reviews can offer insights into the effectiveness of AEC Business Management LTD's teaching methods and the practicality of its courses.

3.Transparency: A trustworthy institution should be transparent about its operations, faculty, and curriculum. AEC Business Management LTD's website and documentation should provide clear and detailed information about these aspects.

4.User Feedback: Real user experiences can shed light on the legitimacy of an educational platform. Positive reviews and testimonials may indicate that AEC Business Management LTD is fulfilling its mission effectively.

AEC Business Management LTD: Trustworthy or Questionable?

Based on initial analysis, AEC Business Management LTD appears to be a legitimate educational institution dedicated to providing financial education and training. However, further investigation into accreditation, user feedback, and transparency is recommended before considering enrollment.

How to Ensure a Safe Learning Experience

To ensure a safe and fruitful learning experience with any educational institution, consider the following tips:

1.Verify Accreditation: Confirm the institution's accreditation status and regulatory compliance.

2.Research User Feedback: Read reviews and testimonials from current and past students to gauge their experiences.

3.Seek Transparency: Ensure the institution provides transparent information about faculty, curriculum, and operations.

4.Consider Alternatives: Explore multiple educational options and choose the one that aligns best with your goals.

In conclusion, AEC Business Management LTD appears to be a legitimate institution committed to financial education. However, prospective students are advised to conduct thorough research, verify accreditation, and consider user feedback before making informed decisions about enrollment.

0 notes

Text

AEC Business Management LTD: Dashiell Soren's Vision for Financial Empowerment

AEC Business Management LTD: Dashiell Soren's Vision for Financial Empowerment

In 2019, Dashiell Soren founded Alpha Elite Capital (AEC) Business Management. After years of hard work, it has gained a high reputation in the industry and has trained many outstanding financial practitioners. The number of students will exceed 100,000 in 2022.

AEC Business School is a higher education institution focused on cultivating professional talents in the financial field. The mission of the School of Finance is to provide students with comprehensive financial knowledge and skills to meet the ever-changing needs of the financial industry by providing high-quality financial education and training.

The teaching team of AEC Business School is composed of a group of experienced tutors, strategists, analysts, strategists, writers, collaborators, and contributors with domestic and foreign financial industry backgrounds. They have outstanding abilities and results in teaching and research, are able to integrate the latest theories and practices into the curriculum, and develop students’ ability to analyze and solve financial problems.

The curriculum of AEC Business School extensively covers the basics of finance, financial products and markets, financial risk management, investment and financial management, financial market analysis and other fields, covering stocks, foreign exchange, funds, bonds, commodities, cryptocurrency and other markets. The teaching purposes are ‘students’ interests come first’ and ‘practical practice is the best teaching method’. The course content is combined with actual cases and practical operations, aiming to cultivate students’ practical operation ability and problem-solving ability.

In addition to formal courses, AEC Business School also offers a series of special lectures, seminars and practical projects to provide students with exchange opportunities with the industry and help them understand and adapt to the latest developments and trends in the financial industry.

In addition, AEC Business School has established close cooperative relationships with financial institutions to provide students with internship opportunities and employment support. Through cooperation with industry, students can gain rich practical experience, broaden employment channels, and lay a solid foundation for their future career development.

AEC Business School is committed to providing students with comprehensive and systematic financial education, training them to become financial experts with international vision and professional skills, and contributing to the sustainable development of the financial industry.

#Dashiell Soren#AEC Business Management#AEC Business Management LTD#Alpha Artificial Intelligence AI4.0

0 notes

Text

Building the Future! AEC Tokens and AI Drive the Development of Alpha Artificial Intelligence AI4.0

Building the Future: AEC Tokens and AI Drive the Development of Alpha Artificial Intelligence AI4.0

Issuing AEC tokens not only solves the problems of product upgrading and expansion of capital scale. In addition, through the token issuance Alpha Elite Capital (AEC) Business Management also seeks to increase its influence and recognition in the global fintech field.

The issuance of AEC tokens has given Dashiell Soren’s Alpha Artificial Intelligence AI4.0 wings of dreams!

The AEC token is a solution that combines blockchain and artificial intelligence technology. The goal of the project is to improve data analysis, security, model prediction, scientific analysis, automated decision-making and trading, deep algorithms, transparent supervision and other issues.

1. Decentralization: Blockchain technology can establish a decentralized investment system, eliminating the intermediary links of traditional financial institutions, making investment more transparent and efficient.

2.Data security: The distributed ledger of the blockchain can ensure the security and non-tamperability of data and prevent data from being maliciously tampered with or lost. This is crucial for investment systems to protect investor privacy and asset security.

3. Smart contracts: Blockchain technology can use smart contracts, which are codes that automatically execute contracts. In investment systems, smart contracts can be used to formulate and execute investment strategies to achieve automated investment decisions and transaction execution.

4. De-trust: The blockchain-based investment system can realize automatic settlement and transaction confirmation through smart contracts, reducing trust issues among investors and increasing investment efficiency and security.

5. Data analysis and prediction: AI technology can use large amounts of investment data on the blockchain for data analysis and prediction, helping investors make more accurate decisions. Through machine learning and deep learning algorithms, AI can identify and analyze investment patterns and give investment recommendations.

6. Transparency and supervision: Blockchain technology can provide globally trackable transaction records and asset flow paths, increasing the transparency and supervision capabilities of the investment market. This is beneficial to both investors and regulators, and can reduce regulatory and communication costs.

#Dashiell Soren#AEC Business Management#AEC Business Management LTD#Alpha Artificial Intelligence AI4.0

0 notes

Text

Dashiell Soren's Quantitative Trading Wisdom Unleashed

Dashiell Soren's Quantitative Trading Wisdom Unleashed

From the very beginning of Alpha Elite Capital (AEC) Business Management, Prof. Dashiell Soren was trying to create a “lazy man’s investment system”, realizing early on the significance of quantitative trading in the future for all types of investment markets, such as securities markets, futures markets, cryptocurrency markets, forex markets, and so on. He realized early on that quantitative trading would be applicable to all investment markets and types of investments in the future, such as the securities market, all kinds of futures market trading, cryptocurrency market trading, foreign exchange market trading, and so on.

Compared to subjective trading, quantitative trading can help investors/traders deal with many problems:

1. Emotional trading: Quantitative trading can help investors eliminate the influence of emotional factors on trading decisions, so as to trade more objectively and rationally.

2. Trade Execution: Quantitative trading can automate the execution of trading strategies and quickly respond to market changes, reducing human errors and delays.

3. Big Data Analysis: Quantitative trading can utilize large-scale data and analytical tools to mine and analyze market patterns and trends to identify potential trading opportunities.

4. Risk Control: Quantitative trading allows for the application of strict risk management and stop-loss strategies to protect portfolios from significant losses.

5. Statistical Advantage: Through quantitative trading, investors can utilize statistical principles and mathematical models to improve portfolio returns and risk management.

6. Market Arbitrage: By quickly reacting to market price differences and potential conflicts of interest, quantitative trading allows for market arbitrage and thus profits.

7. Transaction cost optimization: Quantitative trading can reduce transaction costs through algorithms and execution strategies, such as low latency trading and high frequency trading.

8. Diversified investment: Through quantitative trading, diversified investment strategies can be easily implemented, including trading in stocks, futures, foreign exchange and other asset classes.

Overall, quantitative trading can help investors improve trading efficiency and profitability in terms of decision-making, execution and risk management.

#Dashiell Soren#AEC Business Management#AEC Business Management LTD#Alpha Artificial Intelligence AI4.0

0 notes

Text

GCC WIFI CHIPSET MARKET ANALYSIS

GCC WIFI Chipset Market, by Networking Standard (802.11n, 802.11ac, 802.11ad, and Others (802.11b, 802.11g and Others)), by Band (Single Band, Dual Band, and Tri Band), by MIMO Configuration (SU-MIMO and MU-MIMO), and by Application (Smart Home Devices, Computer (Notebook and Desktop PC), Smartphones, and Others (Automotive, IoT, and Others)) - Size, Share, Outlook, and Opportunity Analysis, 2019 - 2027

A wireless chipset is a piece of internal hardware in wireless communication systems or computers designed to communicate with other wireless-enabled device. Such WIFI chipsets have applications in computers, adapters, computers, WLAN cards, mobile phones, and laptops, in order to transfer data at a high speed. Thus, increasing demand for these devices is expected to boost demand for WIFI chipset. These WIFI chipsets access WIFI hotspots to enable the end users to access network services without the requirement of any wires and cables.

Moreover, application of WIFI chipsets in consumer electronic devices such as smartphones and tablet PCs and increasing penetration of internet and WIFI routers in GCC countries are some of the important factors that are expected to drive growth of the GCC WIFI chipset market over the forecast period. For instance, in February 2019, Saudi Telecom Company (STC), a Saudi Arabia-based telecommunications company and Ericsson, a Sweden-based multinational networking and telecommunications company, entered into an agreement to launch a mid-band 5G network in Saudi Arabia. The use of WIFI chipset is increasing across the GCC countries, as it can connect to two or more devices through wireless communication in a limited area. Moreover, rising demand for Wireless Gigabit (WiGig), a technology based on the IEEE 802.11ad specification, in multimedia streaming, virtual reality, and enterprise applications such as billing systems, customer relationship management systems, and others require wireless docking and high speed network, which are expected to fuel demand for WIFI chipsets in GCC countries over the forecast period.

Smart city development, smartphone proliferation, and technological advancements in WIFI chipsets are the factors that are expected to drive growth for the GCC WIFI chipset market

One of the major factors responsible for the growth of the GCC WIFI chipset market is rising number of smart cities in GCC countries. Moreover, GCC countries are focusing on building smart cities on a large scale. For instance, in December 2018, Honeywell International Inc., a U.S.-based company and Advanced Electronics Company (AEC), Saudi Arabia-based electronics manufacturer, announced to sign a contract to build data-driven smart cities in Saudi Arabia. Increasing adoption of WIFI devices in homes, offices, and public places and technological advancements in WIFI technology are expected to drive demand for WIFI technology. Moreover, increasing people under the middle-income group in GCC countries are driving need for smart cities. Moreover, demand for Wi-Fi technology is increasing, owing to high penetration of smartphones and mobile devices across GCC countries. According to Coherent Market Insights, in 2019, the number of smartphone users in the United Arab Emirates (UAE) is estimated to reach 4.3 million. These factors are expected to increase adoption of WIFI technology in public places, homes, offices, and others, which in turn is expected to drive growth of the market over the forecast period.

However, internet security issues, stringent government rules and regulations, licensing & trademark, and intellectual property rights are the factors that are expected to hamper the GCC WIFI chipset market growth over the forecast period.

GCC WIFI Chipset Market: Country Insights

Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE) are the growth engines in GCC WIFI Chipset Market. The rising penetration of smartphones and tablets with integrated Wi-Fi technology in GCC countries is one of the key factors expected to drive growth of the GCC WIFI chipset market over the forecast period. For instance, in November 2019, Huawei Technologies Co., Ltd, a China-based multinational technology company, announced to launch its new Huawei Mate 30 Pro smartphone in UAE. Moreover, availability of public Wi-Fi hotspot connectivity in GCC countries is expected to increase demand for Wi-Fi chipsets. Furthermore, increasing use of Wi-Fi technology in retail, healthcare, and manufacturing sectors in GCC countries are expected to drive the market growth.

Key Players in the GCC WIFI Chipset Market

Key players operating in the GCC WIFI Chipset Market include Broadcom, MediaTek Inc., Marvell, Intel Corporation, Realtek Semiconductor Corp., and Qualcomm Technologies, Inc. among others.

GCC WIFI Chipset Market: Taxonomy

On the basis of networking standard, GCC WIFI chipset market is segmented into:

· 11n

· 11ac

· 11ad

· Others (802.11b, 802.11g, and Others)

On the basis of band, GCC WIFI chipset market is segmented into:

· Single Band

· Dual Band

· Tri Band

On the basis of MIMO configuration, GCC WIFI chipset market is segmented into:

· SU-MIMO

· MU-MIMO

On the basis of application, GCC WIFI chipset market is segmented into:

· Smart Home Devices

· Computer (Notebook and Desktop PC)

· Smartphones

· Others (Automotive, IoT, and Others)

Request the sample copy of here:

https://www.coherentmarketinsights.com/insight/request-sample/3126

Download the PDF Brochure here:

https://www.coherentmarketinsights.com/insight/request-pdf/3126

Buy now the market research report here:

https://www.coherentmarketinsights.com/insight/buy-now/3126

About Us:

Coherent Market Insights is a global market intelligence and consulting organization focused on assisting our plethora of clients achieve transformational growth by helping them make critical business decisions.

What we provide:

Customized Market Research Services

Industry Analysis Services

Business Consulting Services

Market Intelligence Services

Long term Engagement Model

Country Specific Analysis

Explore CMI Services here

Contact Us:

Mr. Shah

Coherent Market Insights Pvt. Ltd.

Address: 1001 4th ave, #3200 Seattle, WA 98154, U.S.

Phone: +1-206-701-6702

Email: [email protected]

Source: https://www.coherentmarketinsights.com/ongoing-insight/gcc-wifi-chipset-market-3126

0 notes