#Tax and Accounting Services Perth

Text

Navigating the Landscape of Tax Preparation and Bookkeeping Services- A Guide to Choosing the Best Agencies

Tax preparation and bookkeeping are integral parts of running a successful business. However, for many entrepreneurs and business owners, these tasks can be daunting and time-consuming. That's where professional services come in handy. In cities like Perth, Brisbane, Sydney, Melbourne, Adelaide, and NSW, agencies like Account Cloud offer comprehensive tax preparation and bookkeeping services to alleviate the burden on businesses. But with so many options available, how do you choose the best agency for your needs? Here's a guide to help you navigate the landscape:

1. Assess Your Needs: Before you start your search for a tax preparation and bookkeeping service agency, it's essential to assess your needs. Determine the scope of services you require, such as tax filing, payroll processing, financial reporting, or general bookkeeping. Understanding your requirements will help you narrow down your options and find agencies that specialize in the services you need.

2. Experience and Expertise: When entrusting your financial matters to a third-party agency, it's crucial to ensure they have the necessary experience and expertise. Look for agencies with a proven track record in tax preparation and bookkeeping services. Consider factors such as the number of years in business, client testimonials, and the qualifications of their team members.

3. Industry Specialization: Different industries have unique tax and accounting requirements. Whether you're in retail, hospitality, healthcare, or any other sector, consider choosing an agency that specializes in serving businesses similar to yours. Industry-specific knowledge can ensure compliance with relevant regulations and optimize tax strategies tailored to your business.

4. Technology and Innovation: The accounting landscape is continually evolving, with advancements in technology reshaping how financial tasks are performed. Seek out agencies that embrace technology and leverage innovative solutions to streamline processes and enhance accuracy. Cloud-based accounting platforms, automation tools, and data analytics can significantly improve efficiency and decision-making.

5. Communication and Accessibility: Effective communication is key to a successful partnership with a tax preparation and bookkeeping agency. Choose an agency that prioritizes clear and transparent communication, keeping you informed about your financial status and any regulatory changes that may affect your business. Additionally, consider their accessibility and responsiveness to inquiries or concerns.

6. Compliance and Security: Compliance with tax laws and regulations is non-negotiable when it comes to financial matters. Ensure that the agency you choose adheres to the highest standards of compliance and stays updated with the latest regulatory changes. Moreover, prioritize security measures to protect sensitive financial information against unauthorized access or data breaches.

7. Scalability and Flexibility: As your business grows, your accounting needs may evolve as well. Select a tax preparation and bookkeeping agency that can scale its services according to your business growth. Whether you're a small startup or a large enterprise, flexibility in service offerings and pricing structures ensures that you receive tailored solutions aligned with your current and future needs.

8. Cost and Value: While cost is undoubtedly a factor in the decision-making process, it's essential to consider the value proposition offered by the agency. Instead of solely focusing on the lowest price, evaluate the services, expertise, and support provided in relation to the cost. A higher upfront investment in quality services can often yield long-term benefits and cost savings through improved financial management.

Choosing the best tax preparation and bookkeeping services agency requires careful consideration of various factors, including your specific needs, the agency's experience and expertise, industry specialization, technology adoption, communication practices, compliance standards, scalability, and cost-effectiveness. By conducting thorough research and due diligence, you can find a trusted partner like Account Cloud to handle your financial affairs efficiently, allowing you to focus on growing your business with peace of mind.

#Bookkeeping Services Melbourne#Bookkeeping Services Brisbane#Bookkeeping Services Perth#Perth Bookkeeping Services#Adelaide Bookkeeping Services#Online Bookkeeping and Accounting Perth#Online Bookkeeping Services Melbourne#Small Business Bookkeeping Services Brisbane#Small Business Bookkeeping Services Sydney#Small Business Bookkeeping Services Perth#Small Business Bookkeeping Services NSW#Premier Tax and Bookkeeping Adelaide#Tax and Accounting Services Brisbane#Tax and Accounting Services Sydney#Tax and Accounting Services Perth#Personal Tax Accountant Brisbane

2 notes

·

View notes

Text

Taxes can be complex, but being prepared is half the battle! Dive into our latest blog on westcourt.com.au, where we've crafted a meticulous plan for tax due diligence. 📝

In this comprehensive guide, we break down the steps you need to take to ensure you're on top of your tax game. We've covered everything, from organising your financial records to understanding the latest tax regulations.

Tax season doesn't have to be stressful when you have a well-thought-out plan. Check out the full blog now for expert insights and tips!

Read the Blog: https://www.westcourt.com.au/a-detailed-plan-for-tax-due-diligence/

#accounts#finance#income tax#Tax return Perth#Tax return preparation#Tax structuring services Perth#Tax planning strategy

0 notes

Text

SMSF Australia - Specialist SMSF Accountants

Level 12/197 St Georges Terrace, Perth WA 6000, Australia

+61 8 6313 8718

Self-managed super funds can need a lot of work, and that is something SMSF Australia is aware of. Because of this, we provide a wide range of services to our clients in Perth that are designed to make it easier for them to administer their SMSFs. We provide a comprehensive array of tax compliance and SMSF accounting services. You can get assistance from our knowledgeable staff at every stage. We can set up the daily drudge labor to operate as efficiently as possible so that we can spend the majority of our time offering guidance and support because our experienced and licensed SMSF Accountants are specialists in automation systems like Class Super.

Visit our links:

#SMSF Accountant Perth#SMSF Accountants Perth#SMSF Setup Perth#Self Managed Super Fund#SMSF Administrators Perth#SMSF accounting perth#SMSF accounting services#Perth accounting services#SMSF auditor perth#Perth tax service#smsf tax return

0 notes

Text

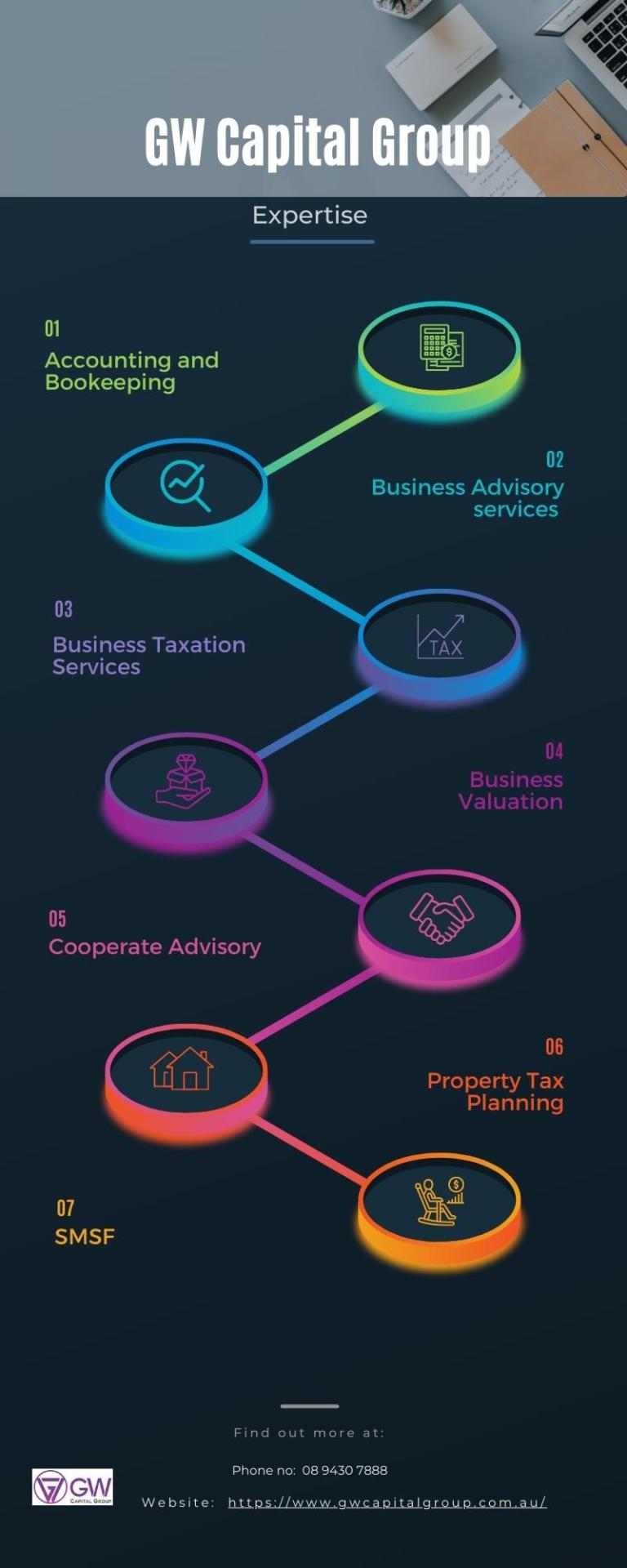

Accounting services in Perth

An organization's bookkeeping aims to interpret its financial processes and management. The ability to identify the profit justifies the cost will undoubtedly result in accelerated growth for business owners. Our bookkeeping services » Perth are tailored towards addressing such matters, so our professionals are knowledgeable about them.

All of our clients at GW Capital Group receive high-quality professional bookkeeping services. We can help you with your bookkeeping needs! Contact us today!

#bookkeepers perth#bookkeeping services#accounting bookkeeping service#smsf accountants#corporate advisory#tax return perth#tax return services#accountants in perth#accounting services perth

0 notes

Text

The Language of Conversions: Crafting Compelling Calls to Action in Affordable Perth Web Design

In today's competitive online environment, Australian small and medium-sized businesses (SMBs) face a crucial challenge: turning website visitors into paying customers. A well-designed website in Perth is a fantastic first step, but its true value lies in its ability to convert interest into action. This is where the power of clear and compelling calls to action (CTAs) comes into play. CTAs are the verbal nudges that guide website visitors towards taking a desired action, whether it's contacting you for a quote, subscribing to your newsletter, or making a purchase.

Why CTAs Matter: The Conversion Catalyst

Imagine your website as a conversation with a potential customer. A visually appealing and informative website establishes a connection, but without a clear call to action, it's like leaving the conversation hanging. CTAs provide direction and motivate visitors to take the next step in their customer journey.

Here's why CTAs are essential for your Perth-based business website:

Boost conversions: Clear and compelling CTAs encourage website visitors to convert their interest into a tangible action.

Improve user experience: Effective CTAs guide visitors through the sales funnel, making the user experience clear and streamlined.

Increase lead generation: CTAs can prompt visitors to share their contact information, allowing you to nurture leads and build long-term relationships.

Drive sales: A strong CTA can be the final push that convinces a visitor to make a purchase or invest in your services.

Measure marketing ROI: By tracking CTA performance, you can understand which messages resonate most with your audience and refine your marketing strategies for optimal results.

Crafting Compelling CTAs in Affordable Perth Web Design

The good news is that you don't need a hefty budget to create high-converting CTAs. Affordable web design in Perth can provide you with the tools and expertise to craft compelling calls to action that drive results. Here are some key elements to consider:

Clarity is key: Your CTA should be clear, concise, and easy to understand. Use strong verbs that leave no room for doubt about the desired action (e.g., "Download Now," "Contact Us Today," "Get Your Free Quote").

Focus on benefits: Don't just tell visitors what to do; tell them why they should do it. Highlight the benefits they'll receive by taking the desired action (e.g., "Get Started on Your Dream Kitchen," "Unlock Exclusive Discounts").

Urgency can be persuasive: Create a sense of urgency with CTAs that offer limited-time deals or exclusive content. This can encourage visitors to act before the opportunity disappears.

Stand out visually: Don't let your CTA blend into the background. Use contrasting colors, clear fonts, and contrasting buttons to make your call to action stand out on the page.

Strategic placement: Place your CTAs strategically throughout your website, such as at the end of blog posts, on product pages, and within landing pages.

Examples of Compelling CTAs for Perth Businesses:

Perth-based accounting firm: "Schedule Your Free Consultation Today" or "Download Our Free Tax Guide."

Local Perth café: "Order Your Coffee Online Now" or "Join Our Rewards Program for Exclusive Discounts."

Perth fitness studio: "Start Your Free Trial Today" or "Unlock a Week of Unlimited Classes."

Beyond the Basics: Optimizing Your CTAs for Maximum Impact

While crafting clear and compelling CTAs is a good starting point, there's more you can do to ensure maximum impact in your affordable Perth web design. Here are some additional tips:

A/B testing: Affordable web design services can often help you A/B test different CTAs to see which ones resonate most with your audience. This data-driven approach allows you to continuously refine your CTAs for optimal performance.

Strong visuals: Combine your CTAs with high-quality images or videos that reinforce the message and entice visitors to click.

Personalize your CTAs: Consider personalizing your CTAs based on user behavior or demographics to create a more targeted and engaging experience.

Track and analyze: Monitor the performance of your CTAs using website analytics tools. Track click-through rates (CTRs) and conversion rates to identify what's working and what needs improvement.

Affordable Perth Web Design: Partnering for Conversion Success

Affordable web design agencies in Perth understand the importance of CTAs in driving conversions. They can collaborate with you to develop a website strategy that incorporates clear, compelling CTAs aligned with your unique business goals.

FAQs: Crafting Powerful CTAs in Affordable Perth Web Design

Q: How can affordable web design in Perth help me create effective CTAs?

A: Affordable web design agencies in Perth can assist you in several ways:

Strategic CTA placement: They can identify the most strategic locations on your website to place your CTAs for maximum impact.

Copywriting expertise: Many affordable web design firms offer copywriting services that can help you craft clear, concise, and benefit-driven CTA messages.

A/B testing capabilities: They can set up A/B testing for your CTAs, allowing you to compare different versions and identify which ones perform best with your target audience.

Data analysis and reporting: Affordable web design services can provide data analysis and reporting on your CTA performance, helping you understand user behavior and refine your strategies for continuous improvement.

Q: Are there any common CTA mistakes to avoid?

A: Here are some common CTA mistakes to be aware of:

Generic CTAs: Avoid generic phrases like "Click Here" or "Learn More." Be specific about the desired action and highlight the benefit for the visitor.

Weak visuals: Blending your CTA buttons can lead to missed opportunities. Use contrasting colors and clear fonts to make your CTAs visually appealing and easy to find.

Too much text: Keep your CTA messages concise and to the point. Visitors shouldn't need to read a novel to understand what's being asked of them.

Misleading CTAs: Don't overpromise and underdeliver. Ensure your CTAs accurately reflect the action visitors will be taking and the benefits they'll receive.

The Power of Words: Transforming Website Visitors into Loyal Customers

In today's digital world, your Perth-based business website is a powerful tool for attracting new customers and nurturing existing relationships. By investing in affordable web design that prioritizes clear and compelling CTAs, you can turn website traffic into loyal customers. Remember, CTAs are the bridge between initial interest and conversion. Craft compelling CTAs that resonate with your audience, guide them through the sales funnel, and ultimately, help you achieve your business objectives.

Conclusion: A/B Testing Your Way to CTA Success

While this guide provides a solid foundation for crafting compelling CTAs, the key to truly maximizing their effectiveness lies in continuous improvement. By partnering with an affordable web design agency in Perth, you can leverage A/B testing to compare different CTA variations, identify the best performers, and refine your approach over time. This data-driven strategy ensures that your CTAs remain relevant, persuasive, and ultimately, a catalyst for conversion success in your Perth-based business.

affordable web design in melbourne

affordable web design in brisbane

0 notes

Text

Expert Advice on Tax Returns in Perth: Maximizing Refunds and Savings

WMK Accounting in Perth provides expert guidance for tax returns, ensuring accuracy, compliance, and maximised refunds. Their professional bookkeeping services keep finances organised, enabling effective deduction claims and tax credit utilisation. Partnering with WMK ensures strategic tax planning, including superannuation strategies, capital gains management, and optimal tax structures. Prepare for future returns by leveraging their expertise for long-term financial benefits. Read the full blog here – https://medium.com/@wmkaccounting/expert-advice-on-tax-returns-in-perth-maximizing-refunds-and-savings-75913d1e8e85

0 notes

Text

Unlocking Business Growth: Why Sydney's Bookkeeping Services Are Essential for SMEs

In the dynamic landscape of Australian business, small businesses often find themselves juggling multiple responsibilities simultaneously. Amidst managing operations, serving clients, and fostering growth, keeping track of finances can become overwhelming. This is where professional bookkeeping services step in, offering invaluable support to Bookkeeping services in Melbourne, Sydney, and throughout Australia.

Why Bookkeeping Matters for Small Businesses:

Effective bookkeeping is the cornerstone of financial management for small businesses. It involves meticulously recording financial transactions, managing payroll, tracking expenses, and ensuring compliance with tax regulations. While these tasks may seem mundane, they form the foundation of sound financial decision-making and long-term success.

For small business owners, outsourcing bookkeeping services can be a game-changer. By entrusting these responsibilities to experts, entrepreneurs can focus their time and energy on core business activities, driving growth and innovation.

Tailored Solutions in Melbourne:

In bustling cities like Melbourne, where small businesses thrive in diverse industries, the demand for specialized bookkeeping services is ever-present. Whether you're a startup in the tech sector, a family-owned restaurant, or a creative agency, having a customized bookkeeping solution is crucial.

Professional Bookkeeping services for small business in Australia understand the unique needs of local businesses. They offer personalized solutions tailored to your industry, size, and growth stage. From setting up efficient accounting systems to providing real-time financial insights, these services empower small business owners to make informed decisions and stay ahead of the competition.

Navigating Complexity in Sydney:

Sydney, as Australia's financial capital, presents both opportunities and challenges for small businesses. Amidst the fast-paced environment and regulatory complexities, maintaining accurate financial records is non-negotiable. This is where expert bookkeeping services in Sydney come into play.

By partnering with seasoned professionals who understand the intricacies of the local market, small business owners can navigate regulatory compliance, minimize tax liabilities, and optimize financial performance. Whether it's managing cash flow, reconciling accounts, or preparing financial reports, outsourcing bookkeeping allows entrepreneurs in Sydney to focus on strategic growth initiatives with confidence.

Comprehensive Support Across Australia:

While Melbourne and Sydney serve as economic powerhouses, small businesses thrive in every corner of Australia. From Perth to Brisbane, Adelaide to Darwin, professional bookkeeping services cater to the diverse needs of small businesses nationwide.

Whether you're a sole proprietor, a budding startup, or a well-established SME, outsourcing bookkeeping offers a cost-effective solution to streamline your financial operations. By leveraging cloud-based accounting software and digital tools, remote bookkeepers provide seamless support regardless of your location, ensuring continuity and efficiency.

Unlock Your Business Potential:

In today's competitive landscape, small businesses need every advantage to succeed. By partnering with reputable bookkeeping services, you can unlock your business's full potential, driving growth, profitability, and sustainability.

From managing day-to-day finances to strategizing for the future, professional bookkeepers serve as trusted advisors, guiding you through every financial milestone. Whether you're in Melbourne, Sydney, or anywhere else in Australia, investing in quality bookkeeping services is a proactive step towards long-term success.

Conclusion:

In conclusion, bookkeeping services play a vital role in the success of small businesses across Australia. From Melbourne to Sydney and beyond, professional bookkeepers offer tailored solutions to streamline financial operations, ensure compliance, and drive growth. VNC Global Group outsourcing bookkeeping, small business owners can focus on what they do best – building thriving enterprises that contribute to the vibrant Australian economy.

#Bookkeeping services melbourne#Bookkeeping services for small business in Australia#Bookkeeping services sydney#VNC Global Group

1 note

·

View note

Text

The Vital Role of a Tax Accountant.

Demystifying Taxation Complexities and Maximizing Financial Efficiency"

In the intricate realm of personal and business finance, one key player stands out as an indispensable guide— the tax accountant. As financial landscapes become increasingly complex, individuals and businesses alike find solace in the expertise of these professionals who specialize in unraveling the intricacies of taxation.

Unveiling the Tax Maze "Decoding the Complexity of Taxation"

The tax code is a labyrinth of rules, regulations, and ever-changing policies that can leave even the most financially savvy individuals feeling bewildered. This is where the tax accountant emerges as a beacon of clarity. Armed with extensive knowledge and a keen understanding of the tax landscape, these tax accountant perth navigate the maze of tax laws, ensuring their clients stay compliant while optimizing their financial positions.

Strategic Financial Planning

Subtitle: "Beyond Compliance: Crafting Financial Strategies for Success"

Tax accountants do more than just crunch numbers. They are strategic partners in financial planning, helping individuals and businesses make informed decisions that go beyond mere compliance. From identifying tax-saving opportunities to developing long-term strategies for wealth accumulation, tax accountants play a pivotal role in securing the financial future of their clients.

Tailored Solutions for Businesses

Subtitle: "Partnering for Prosperity: How Tax Accountants Drive Business Success"

For businesses, the expertise of a tax accountant is invaluable. These professionals understand the intricacies of corporate taxation, offering tailored solutions that go beyond routine filings. From minimizing tax liabilities to advising on structuring transactions, tax accountants become integral partners in the journey towards sustainable business growth.

Adapting to Change

Subtitle: "Staying Ahead in a Dynamic Financial Landscape"

In an era of constant regulatory changes and economic shifts, the role of a tax accountant becomes even more crucial. These professionals stay abreast of the latest developments, ensuring their clients are well-prepared to navigate the ever-evolving financial landscape. By providing timely advice and proactive strategies, tax accountants empower their clients to stay ahead in an unpredictable world.

The Human Touch in Finance

Subtitle: "Building Trust and Confidence through Personalized Service"

While technology continues to reshape the financial industry, the human touch remains irreplaceable. Tax accountants not only provide expertise but also build trust through personalized service. Understanding the unique needs of each client, they offer customized solutions that transcend the one-size-fits-all approach often associated with automated financial services.

In conclusion, the role of a tax accountant goes far beyond number crunching and compliance. These professionals are financial guides, strategic partners, and trusted advisors who bring clarity to the complexities of taxation. In a world where financial landscapes are ever-changing, the expertise of a tax accountant becomes a cornerstone for individuals and businesses alike, fostering financial success and prosperity.

0 notes

Text

"Trusted Accountant in Joondalup | Tax, Bookkeeping, Financial Services"

"Expert Joondalup accountant providing top-notch tax, bookkeeping, and financial services. Personalized solutions for businesses and individuals."

1 note

·

View note

Text

ABC Reveals Podiatrist Ripping Off Veterans

Thank Adele Ferguson for shining the spotlight on this alleged blatant exploitation by a Sydney podiatrist of vulnerable Australians. ABC reveals podiatrist ripping off veterans and the evidence stacks up. This illustrates the malfeasance by medical professionals occurring within the Medicare system and other government schemes. We know that billions of dollars are being rorted by some within the medical fraternity in a betrayal of the trust put in them by the Australian public. The 7.30 Report shows the complete lack of oversight present in so many government-funded schemes in Australia. The idea that all doctors are good guys and worthy women is being shown to be a costly fallacy for tax payers down under. Thank goodness for investigative journalism.

Mikhail Nilov at Pexels

7.30 Report’s Adele Ferguson Investigates Podiatrist

“MARGARET FAUX, HEALTHCARE BILLING EXPERT: There seems to be this focus on patients as ATM machines.

ADELE FERGUSON, REPORTER: Australians spend tens of billions of dollars a year on health services.

MARGARET FAUX: Our health payment systems are like open cheque books.

ADELE FERGUSON: Medical professionals use a coding system to bill patients and healthcare providers.

MARGARET FAUX: The way these systems work basically is, you put in a number saying, I did this thing, now pay me. And the answer comes back, here you go, here's your money.

ADELE FERGUSON: Some health practitioners have built businesses that target government schemes for injured workers, the disabled, elderly and Department of Veteran Affairs or DVA.

MARGARET FAUX: You have got NDIS. Medicare, DVA, private health insurers, aged care workers, comp, CTP - they're the main payers.”

(https://www.abc.net.au/news/2023-10-23/workcover-patients-being-turned-into-unpoliced/103012472)

Podiatrist Dr Sanjay Parasher Investigated For Bogus Billing

The Adele Ferguson ABC investigation reveals that a Dr Sanjay Parasher has allegedly being systematically ripping off patients from the DVA by falsifying claims for treatment sessions which never occurred. The Foot and Ankle Clinic of Australia’s Dr Sanjay Parasher goes on social media platforms bragging about how much money he makes from podiatry. Meanwhile, he employs admin people to basically commit crimes on his behalf whilst following his instructions. The litany of wrong doing is listed in the ABC report and involves fake referrals, falsifying treatments by a factor of 10 in some cases, targeting veterans in Perth when his clinic is based in Sydney, infiltrating the private medical records of other medical practitioners, bogus billing, fees for no service, and these to the tune of hundreds of thousands of dollars.

This may well be the tip of the iceberg when it comes to the malfeasance rife in government funded schemes around Australia. The scumbags have found the loopholes and lack of proper oversight and are getting rich at our expense.

Australians Find It Hard To Believe There Are Scumbag Doctors

The illusion of the white lab coat creates a myth of ‘the good doctor’ in the minds of many Australians. Yes, there are many hard working and honest medicos. However, there is a growing section of cynical scumbag doctors rorting the system to get rich at the expense of Australian tax payers. The billions of dollars of wastage and unjustified claims bloating Medicare and other government funded schemes is legion. All of this bad money, like all the other bogus insurance claims in Australia, bloats our economy and has an inflationary affect. If I had a dollar for every account of insurance fraud I hear from friends re-their household insurers I would be a wealthy chap. This massive industry-wide scam is happening daily on our shores and making Australia a much more expensive place to live in. The reluctance of governments to actually do anything about this is testament to their tacit involvement in looking the other way. We do not have proper, well-funded oversight in this country, which allows players to run rampant in this regard.

Toothless tigers are everywhere in the halls of government capable of wagging their tails and rolling over for any and every inducement proffered.

Dr Sanjay thought he could show off his very expensive sports cars and luxury lifestyle to the world via social media knowing that Australian oversight is blinder than bats without radar. Schemes for DVA and NDIS are neglected like the patients they purport to look after. It is another illustration of the half arsed Australian way. Hang your heads in shame folks.

Robert Sudha Hamilton is the author of Money Matters: Navigating Credit, Debt, and Financial Freedom.

©WordsForWeb

Read the full article

#7.30Report#ABC#AdeleFerguson#Australia#Doctors#insurance#invetigativejouranlism#moralfailure#NDIS#podiatrist#vets

0 notes

Text

Simplify Your Finances with Account Cloud- Your One-Stop Solution for Tax Preparation, Bookkeeping, and Accounting Services in Brisbane

In the bustling world of business, navigating through finances can often feel like traversing a maze without a map. From tax preparation to bookkeeping and accounting, managing financial aspects efficiently is crucial for the success of any enterprise. However, the complexities of these tasks can overwhelm even the most seasoned entrepreneurs. This is where Account Cloud steps in as a beacon of financial clarity and efficiency.

Account Cloud is a leading provider of tax preparation, bookkeeping, and accounting services based in Brisbane, offering comprehensive solutions tailored to meet the diverse needs of businesses, regardless of size or industry. With a team of experienced professionals and cutting-edge technology, Account Cloud simplifies financial management, empowering businesses to thrive.

Streamlined Tax Preparation Services

Tax season can be a stressful time for businesses, with the intricacies of tax laws and regulations often causing headaches for even the most organized individuals. Account Cloud alleviates this burden by offering expert tax preparation services designed to ensure compliance while maximizing deductions and minimizing liabilities.

Whether it's preparing annual tax returns, navigating complex tax codes, or strategizing for future tax obligations, Account Cloud's team of tax specialists provides personalized assistance every step of the way. By staying abreast of the latest changes in tax laws and utilizing advanced software tools, they streamline the tax preparation process, allowing businesses to focus on their core operations with peace of mind.

Efficient Bookkeeping Solutions

Accurate and up-to-date bookkeeping is the backbone of sound financial management. However, manual bookkeeping processes can be time-consuming and prone to errors, leading to costly mistakes. Account Cloud revolutionizes bookkeeping with its efficient and reliable solutions, leveraging automation and cloud-based platforms to streamline the entire process.

From recording transactions and reconciling accounts to generating financial reports and monitoring cash flow, Account Cloud's bookkeeping services ensure transparency and accuracy in financial records. By digitizing data and implementing robust accounting software, they provide businesses with real-time insights into their financial health, enabling informed decision-making and strategic planning.

Expert Accounting Support

Navigating the complexities of accounting requires expertise and attention to detail. Account Cloud offers expert accounting support to help businesses maintain financial stability and achieve their long-term objectives. Whether it's budgeting and forecasting, financial analysis, or compliance with regulatory requirements, their team of certified accountants provides comprehensive assistance tailored to each client's specific needs.

By outsourcing accounting functions to Account Cloud, businesses can access professional expertise without the overhead costs associated with in-house accounting departments. From startups and SMEs to large corporations, Account Cloud serves as a trusted partner in financial management, helping businesses optimize performance and drive growth.

In today's fast-paced business environment, efficient financial management is essential for success. Account Cloud emerges as a trusted ally for businesses in Brisbane, offering a comprehensive suite of tax preparation, bookkeeping, and accounting services tailored to their unique requirements. With a commitment to accuracy, reliability, and client satisfaction, Account Cloud simplifies finances, allowing businesses to focus on what they do best—innovating, growing, and prospering. Say goodbye to financial complexity and hello to clarity and efficiency with Account Cloud.

#Bookkeeping Services Brisbane#Perth Bookkeeping Services#Online Bookkeeping and Accounting Perth#Small Business Bookkeeping Services Sydney#Tax and Accounting Services Brisbane#Personal Tax Accountant Brisbane

0 notes

Text

The Tax Implications of Frequent Flyer Programs

In the dynamic world of business, travel is often an essential component. Whether it’s for client meetings, industry conferences, or exploring new market opportunities, frequent travel can significantly impact both personal and business finances. To mitigate these expenses, many professionals turn to frequent flyer programs offered by airlines. However, what often goes unnoticed is the tax implications associated with these programs.

In Australia, understanding the tax impact of frequent flyer programs is crucial for individuals and businesses alike. The taxation framework, including fringe benefits tax (FBT), can have significant implications on financial planning and compliance. As such, partnering with Perth tax accountants or business tax consultants is essential for navigating these complexities efficiently.

What is Fringe Benefits Tax (FBT)?

Fringe Benefits Tax (FBT) is a tax imposed by the Australian government on certain benefits provided to employees or associates in connection with employment. These benefits can include the personal use of employer-provided assets, including cars, property, and even airline travel through frequent flyer programs. Failure to account for these benefits correctly can lead to penalties and additional tax liabilities.

Understanding the Tax Impact of Frequent Flyer Programs:

While frequent flyer programs offer numerous perks, such as free flights, upgrades, and lounge access, they can also trigger FBT obligations. The taxation of frequent flyer points hinges on whether they are considered "property" for tax purposes. In many cases, points accumulated through business travel are seen as a form of remuneration and therefore subject to FBT.

Tax Planning Strategy:

Given the complexities surrounding the taxation of frequent flyer points, devising a comprehensive tax planning strategy is paramount. This involves working closely with tax planning Perth experts who can provide tailored solutions to mitigate tax liabilities while maximizing the benefits of frequent flyer programs.

One effective tax planning strategy involves structuring business travel arrangements to minimize FBT exposure. This may include clearly delineating between personal and business-related travel, ensuring that only business-related flights are subject to FBT.

Additionally, businesses can explore the possibility of salary packaging arrangements that allocate a portion of an employee's remuneration towards travel expenses, thus reducing the FBT payable on frequent flyer benefits.

Consulting Perth Tax Accountants:

In navigating the intricacies of FBT and frequent flyer programs, seeking guidance from Perth tax accountants with expertise in tax structuring services is invaluable. These professionals can provide tailored advice on structuring travel arrangements, maximizing tax deductions, and ensuring compliance with regulatory requirements.

Furthermore, Perth tax accountants can assist businesses in conducting regular FBT reviews to identify any potential risks or areas for optimization. By staying proactive and vigilant, businesses can avoid costly penalties and optimize their tax position effectively.

The Role of Business Tax Consultants:

Business tax consultants play a crucial role in helping organizations navigate the complexities of taxation, including FBT and frequent flyer programs. These consultants possess in-depth knowledge of tax legislation and can provide strategic advice to minimize tax liabilities while optimizing business operations.

Through comprehensive tax structuring services, business tax consultants can assist organizations in structuring their affairs in a tax-efficient manner, ensuring compliance with regulatory requirements while maximizing tax deductions and incentives.

Conclusion:

Frequent flyer programs offer a myriad of benefits for individuals and businesses alike, including cost savings, convenience, and enhanced travel experiences. However, it's essential to understand the tax implications associated with these programs, particularly in relation to fringe benefits tax (FBT).

Partnering with Perth tax accountants and business tax consultants is crucial for devising effective tax planning strategies, navigating regulatory complexities, and optimizing tax outcomes. By staying proactive and seeking expert guidance, individuals and businesses can maximize the benefits of frequent flyer programs while minimizing tax liabilities and ensuring compliance with regulatory requirements.

Read More:

What are the Tax Implications of Unfair Dismissal Claims?

What is the Tax Effect of a Capital-Protected Loan?

What are the key aspects to understand about partnership taxation?

How to reduce ATO Tax Penalties and Interest?

How can you give to your children at Christmas in a tax-effective manner?

Contact:

Address: -

Perth

Level 2 – 116 Roe Street Northbridge, WA 6003

Melbourne

Level 1 – 91 Maroondah Highway Ringwood, VIC 3134

Phone No.: - 08-9221-8811

Email: [email protected]

Website: - www.westcourt.com.au

Follow us on:

Facebook: www.facebook.com/WestcourtFamilyBusinessAccountants

Instagram: www.instagram.com/westcourtfba/

LinkedIn: www.linkedin.com/company/westcourt-consulting/

0 notes

Text

SMSF Australia - Specialist SMSF Accountants

Level 12/197 St Georges Terrace, Perth WA 6000, Australia

+61 8 6313 8718

At SMSF Australia, we understand that self-managed super funds can be a lot of work. That's why we offer our Perth clients a comprehensive range of services tailored to help them manage their SMSF effectively. We offer a full range of SMSF accounting and tax compliance services. Our specialist team can help you every step of the way. Our experienced and accredited SMSF Accountants are experts in automation systems such as Class Super which allows us to set up the everyday grunt work to run as efficiently as possible so that we can spend the bulk of our time providing advice and support. For information on any of the services that we offer, please reach out to our friendly and supportive Perth team at SMSF Australia today.

#SMSF Accountant Perth#SMSF Accountants Perth#SMSF Setup Perth#self managed super fund#smsf administrators Perth#SMSF accounting perth#SMSF accounting services#Perth accounting services#SMSF auditor perth#Perth tax service#smsf tax return

1 note

·

View note

Text

Accountants in Perth

Accountants in Perth provide expert financial services, including tax preparation, auditing, and financial planning. They help businesses and individuals manage their finances effectively, ensuring compliance and growth.

Visit at: https://accountant-brisbane.com.au/accountants-in-perth/

0 notes

Text

A Comprehensive Guide on How to Buy Ethereum in Australia

In the ever-evolving world of cryptocurrency, Ethereum has emerged as a prominent player alongside Bitcoin. For those residing in Australia, the question of "how to buy Ethereum in Australia" may arise frequently. In this article, we will provide you with a step-by-step guide on acquiring Ethereum within the Australian borders.

Choose a Reputable Cryptocurrency Exchange

The first and foremost step in buying Ethereum in Australia is to select a reliable cryptocurrency exchange. Look for platforms that offer Ethereum trading pairs and have a strong track record of security and customer service. Some popular options include Coinbase, Binance, and Independent Reserve.

Create an Account

Once you've chosen an exchange, you'll need to create an account. This typically involves providing some personal information, verifying your identity, and setting up security measures like two-factor authentication.

Deposit Funds

To buy Ethereum, you'll need to deposit funds into your exchange account. Most exchanges accept Australian Dollars (AUD) through various payment methods, including bank transfers and credit/debit cards.

Place an Order

With your account funded, you can now place an order to buy Ethereum. You can choose between different order types, such as market orders (buying at the current market price) or limit orders (setting a specific price at which you want to buy).

Securely Store Your Ethereum

After purchasing Ethereum, it's crucial to store it securely. You can use a cryptocurrency wallet, either hardware or software, to store your assets. Hardware wallets like Ledger and Trezor offer an extra layer of security.

Stay Informed

The cryptocurrency market is highly volatile, so it's essential to stay informed about the latest developments. Follow news sources, join online communities, and consider setting up price alerts to monitor your investment.

Tax Implications

Keep in mind that cryptocurrency transactions may have tax implications in Australia. It's advisable to consult with a tax professional to ensure you are complying with tax regulations.

In addition to the process of buying Ethereum, it's worth noting that some Australians may also be interested in acquiring Bitcoin through Bitcoin ATMs in Perth. These machines allow users to purchase Bitcoin with cash or debit/credit cards. While they are not typically used to buy Ethereum, the process is relatively similar.

Bitcoin ATM Perth: An Alternative Option

If you're in Perth and looking to buy Bitcoin conveniently, you can consider using a Bitcoin ATM. These machines are scattered throughout the city and provide a straightforward way to purchase Bitcoin. Simply locate a Bitcoin ATM in Perth, insert your cash or card, and follow the on-screen instructions to complete your purchase.

In conclusion, the process of "how to buy Ethereum in Australia" involves selecting a reliable exchange, creating an account, depositing funds, placing an order, and securing your assets. Additionally, if you find yourself in Perth, you can explore the option of using Bitcoin ATMs to buy Bitcoin with ease. Remember to stay informed about the cryptocurrency market and consider consulting a tax professional to ensure compliance with Australian tax regulations.

#ethereum nfts#ethereum blockchain#rings#binance#ethereum news#ethereum classic#ethereum price#bitcoin#defi#coinbase#crypto exchange#gold jewelry

0 notes

Text

Choosing Hearing Aids Perth

The right Hearing Aids Perth can make a huge difference to the quality of your life. It can improve your energy levels, emotional well-being and cognitive health. Choosing the best hearing aid is a personal decision and there are many things to consider. Some of the key issues include price, reliability, satisfaction guarantee and aftercare.

There are a variety of different hearing aid styles, sizes and colours to suit almost any lifestyle. The style you choose will depend on the extent of your hearing loss, ear canal size and shape, and your dexterity. A good audiologist will take all of these factors into account when making a recommendation.

It is important to consider the features that are most important to your lifestyle when selecting a hearing aid. Some of the most common features available on modern digital hearing aids are noise cancellation, directional microphones and feedback suppression. If you are unsure which features to select, speak with an experienced hearing specialist at EarPros to determine the most suitable options for your needs.

Most of the top hearing aid brands offer a range of options to suit every budget. You can start with a basic model and then upgrade as needed. Most of the brands also provide a trial period so that you can decide if a particular hearing aid is suitable for you.

Some people will be eligible for government assistance with the purchase of their hearing aids. This is available through the Office of Hearing Services and through the National Disability Insurance Scheme. The cost of hearing aids is usually a tax deductible expense in Australia, however, this is changing and will no longer be claimable from 1 July 2019.

Digital hearing aids are made up of a powerful minicomputer that combines data gathered by the microphones with a personal sound profile that has been created from your audiogram. The best digital hearing aids amplify only the sounds you need help with and filter out the rest. They are personalised to your individual hearing needs and can even remove background noise from conversations and music.

If you are a first time hearing aid wearer, it is always best to start with the least expensive option and then upgrade as needed. This will allow you to get used to wearing hearing aids and to develop a habit of using them. You can also donate or trade in your old hearing aids to our hearing aid bank to help others who need them.

The most advanced digital hearing aids are constantly analysing the environment and adjusting to optimise your listening experience. This is called automatic environmental control and it means that you can focus on the sounds you want to hear without being distracted by unwanted background noise.

The Pristine Hearing hearing clinic in Western Australia is one of only a few locations that offers professional earwax removal via microsuction technology. This is a safe and effective method of removing excess earwax. They can also recommend the best earplugs to assist with hearing protection for certain activities.

Rediscover Hearing the Joy of Hearing with Your local & WA owned Independent Audiologists. Your local Hearing Aid and Tinnitus Specialists. Combined experience of 38 years.

0 notes