#Security Token Exchange Development

Text

Nadcab Labs — Setting New Standards in Security Token Exchange Development

In the rapidly evolving digital finance landscape, the emergence of security tokens has been a game-changer. These tokens, backed by real-world assets, offer a bridge between traditional finance and the blockchain world, leading to a surge in demand for platforms that can reliably manage and exchange these digital assets. At the forefront of this innovation is Nadcab Labs, a distinguished STO Development Company that specializes in creating secure, user-friendly security token exchange platforms. This article delves into the unique aspects of their service offerings and the pivotal role they play in the digital finance ecosystem.

Nadcab Labs has positioned itself as a leader in the Security Token Exchange Development sector by prioritizing security and usability. Recognizing the critical importance of asset safety in digital transactions, the company has engineered a platform with a four-layer security strategy. This sophisticated approach ensures that every phase of the asset exchange process is fortified against potential cyber threats. The layers include separated server environments, encrypted user access protocols, two-factor authentication, and secure offline VPN transmissions, creating a robust defense mechanism that shields users’ assets from unauthorized access and cyber-attacks.

In addition to these security measures, Nadcab Labs platform is equipped with advanced protection features such as DDoS protection, X-XSS-Protection, HTTP Public Key Pinning, and a Content Security Policy (CSP). These technologies work in tandem to provide a comprehensive security framework that mitigates the risk of cyber threats, ensuring that users’ investments are safeguarded against a wide array of digital vulnerabilities.

Understanding the importance of reliability and continuity in the digital finance domain, Nadcab Labs has also incorporated DNS Failover, Geo IP Routing, and a distributed server architecture into its exchange platform. This design philosophy ensures that the exchange remains operational and accessible even in the face of technical disruptions, providing a seamless and uninterrupted service experience for users.

One of the standout features of Nadcab Labs offering is its customization capability. The company recognizes that each client’s needs are unique, and as such, offers Security Exchange Development Services that are tailored to fit the specific requirements of their clients. Whether it’s adapting the exchange to operate on a preferred IT infrastructure or integrating specialized features, Nadcab Labs works closely with clients to develop a solution that aligns with their strategic objectives.

The comprehensive suite of STO Development Services offered by Nadcab Labs not only facilitates the secure and efficient exchange of security tokens but also empowers businesses and investors to tap into the burgeoning potential of digital finance. By providing a platform that combines advanced security features with unparalleled customization options, Nadcab Labs is not just developing exchanges; it’s building the foundation for the future of finance. With their expertise and innovative solutions, investing in security tokens has never been safer or more accessible, marking a significant milestone in the journey toward a fully integrated digital financial ecosystem.

#nadcablabs#blockchain#nadcab labs services#STO Development Company#STO Development Services#Security Token Exchange Development#Security Exchange Development Services

0 notes

Text

Cardano, the 9ᵉ largest crypto on the market, has so far marked a high of $0.3444, the highest since November 15, 2022.

In other news, Cardano founder Charles Hoskinson announced last week the launch of his new hospital called "Hoskinson Health & Wellness Clinic," which will allow customers to pay for medical services using ADA, the native token of the Cardano ecosystem.

#Flashlly#Cardano#ADA#cryptocurrency#crypto#paywithtoken#token#blockchain#medical#usecrypto#coins#ecosystem#secure#flexible#platform#promote#development#exchange#buycrypto#invest#transaction

0 notes

Text

Centralized Exchange Development Services

#security token exchange platform#centralized trading platform#trading in blockchain#crypto exchange software development company

0 notes

Text

How Blockchain is transforming the finance industry

Blockchain technology has recently emerged as a game-changer in many different industries, with finance being one of the most affected sectors. Due to the decentralized and transparent nature of blockchain, traditional financial services may transform, improving accessibility, efficiency, and security. Through this blog, we will explore how the financial sector is changing as a result of blockchain technology. Let's get going!

What is blockchain technology? Let's quickly review.

Blockchain technology is a sophisticated database technique that enables the transparent sharing of information within a business network. Data is stored in blocks that are connected in a chain in a blockchain database. Blockchain is a technique for preserving records that makes it hard to fake or hack the system or the data stored on it, making it safe and unchangeable. It is a particular kind of distributed ledger technology (DLT), a digital system for simultaneously recording transactions and associated data in numerous locations.

Now let’s see how blockchain technology is impacting the finance industry.

Enhanced Security

Blockchain offers a very safe and impenetrable means to transfer and store financial data. It establishes a decentralized, unchangeable ledger using cryptographic methods, where each transaction is recorded across a network of computers. By doing so, the necessity for middlemen is removed, and the likelihood of fraud, identity theft, and data manipulation is decreased.

Improved Transparency

With blockchain, everyone involved in a transaction can access the same copy of the ledger. This openness lessens the need for third-party verification and promotes confidence between the parties. Additionally, it gives auditors and regulators access to real-time information on financial activities, which improves compliance and accountability.

Faster and Cheaper Transactions

Traditional financial transactions sometimes include several middlemen, which causes delays and expenses. Blockchain makes direct peer-to-peer transactions possible, doing away with the need for middlemen. Particularly for cross-border transactions, which can take days or even weeks with conventional systems, this greatly lowers transaction costs and accelerates settlement times.

Smart Contracts

Blockchain systems commonly enable smart contracts, which are self-executing contracts with predefined rules and conditions. These contracts take effect right soon as the requirements are satisfied, eliminating the need for middlemen and reducing the likelihood of errors or conflicts. Smart contracts may simplify several financial processes, including trade finance, insurance claims, and supply chain financing.

Financial Inclusion

Blockchain has the potential to increase financial inclusion by giving unbanked and underbanked people access to financial services. Through blockchain-based digital identities, anyone can access financial services and demonstrate their creditworthiness without relying on traditional institutions. Remittance services supported by blockchain also offer affordable and efficient cross-border transactions, benefiting people in developing countries.

Tokenization and Asset Management

Tokenizing tangible assets like stocks, commodities, and real estate is made possible by blockchain technology. These digital tokens, which represent ownership rights, can be exchanged in a secure setting. Tokenization creates possibilities for fractional ownership, effective asset management, and liquid markets. New financial instruments like security tokens and decentralized finance (DeFi) protocols can also be developed thanks to it.

By enhancing existing financial services with efficiency, security, and transparency, blockchain technology has the potential to completely transform the financial sector. Its uses span from cross-border payments to smart contracts and supply chain financing, as we have already explored in this blog. Despite major obstacles, the use of blockchain in financial services seems to have a bright future. Adopting this ground-breaking technology could open up new doors for financial inclusion and fundamentally transform how we conduct business and handle our finances in the digital era.

42 notes

·

View notes

Text

Just like the first fic I posted here on Tumblr, the VVR one.

The moment I regain access to AO3, this fic will receive a "deluxe version", with the addition of poetry, images and gifs, as well as its respective Portuguese version !

-

-

Fanfic: The Master of the Casino

Chapter 1: Tarak Rama Rao

-

It wasn't the first time one of these opportunists had been brought into Master Tarak's presence.

In fact he had a unique nose for spotting these gambling NERDS.

The master always had it.

It was precisely this ability that made him grow in the house.

Nothing goes unnoticed in the eyes of young Taraka Rama Rao.

He could masterfully identify every gambler he believed could deliver the heist of a lifetime at the great Hyderabad Casino !

This ability earned him the favor of the former owner and founder of the casino, Lord Jagapathi Babu.

Lord Jagapathi was easily charmed by young Tarak's abilities.

And he went on to keep him always with him, making him his apprentice, his right hand man and his successor.

Making him go from a mere croupier watchman to the owner of the entire casino !

And the casino grew impressively under the command of then Master Tarak.

But it was his unorthodox methods of dealing with scammers that made him famous.

Where others resorted to unmeasured violence and even death to make their point.

Tarak had the habit of trying to find out why that person was trying to strike.

Even creating different punishments for each type of gambler.

Thus developing its own casino penal code, the application of which extended from customers to employees.

Because Master Tarak will always ensure that anyone who betrays him can live long enough to pay the price of his crime !

And there was the most famous sentence of all, the one applied to young Priya Vasudev, who was caught trying to exchange fake chips in the casino for cash.

She told Mestre that she needed the money to pay for her grandfather's cancer treatment, and that she had bought the fake tokens from a man who offered various services, and who was always close to the subway.

And after a call to the hospital to confirm the girl's story, Master quickly made his decision.

Giving her enough money to pay for her grandfather's treatment, and a contract to work as a waitress at the casino.

-Understand one thing, this is not your first chance, nor will I be granting you another.

-This is your only chance !

-Betray me in any way and I will crush you with the same ease with which my finger crushes an ant.

-Did you understand ?

-Yes sir !

And he dismissed her without giving her a second look.

Totally oblivious to the joy that the opportunity he offered her has brought into young Priya's life.

As for the man on the subway, as well as the employee who provided the original chips for creating the replicas ?

Well, they definitely didn't get the same mercy…

Because that was Master Tarak's differential, his paths followed a single road, that of justice !

And when the surveillance center noticed the young man at the Blackjack table, everyone knew that the Master's judgment would be required.

Whatever that boy's method was, he had already made a fortune at the table.

And there were no signs that he was going to stop anytime soon.

The security room was a mess, with everyone trying to understand that boy's method.

But conversations stopped just as Master Tarak walked through the doors.

-This is the person we were talking about Master.

One of the security guards warned while pointing to one of the monitors.

-Put on the main screen.

And so it was done, and Tarak just stared at the image on the screen without expressing any reaction.

After about ten minutes of analysis, Tarak turned and left the room giving his security guards a single order.

-Bring him to me now !

As he walked back to his office, Tarak had a magnificent smile on his face.

And in his mind two certainties.

The first was that this kid, whoever he was, was a fucking mathematical genius.

And the second thing is that even hidden behind the glasses, Tarak could see that the boy's eyes were as deep as the sea.

And he was crazy to dive and explore the most abyssal of that ocean !

-

End of Chapter One

21 notes

·

View notes

Text

Best Bitcoin Alternatives: Exploring Top Cryptocurrencies for 2024 by Simplyfy

Bitcoin, the pioneering cryptocurrency, has long been the standard-bearer in the world of digital currencies.

However, the crypto market has grown exponentially, and several preferences to Bitcoin now provide special points and benefits. This article, promoted via Simplyfy, targets to information you via the fantastic Bitcoin choices for 2024, supporting you make knowledgeable choices in the evolving panorama of digital assets.

Introduction to Bitcoin and Its Alternatives

Bitcoin, introduced in 2009 by the pseudonymous Satoshi Nakamoto, revolutionized the financial world by introducing a decentralized form of currency.

Its meteoric upward shove in fees and massive adoption have paved the way for lots of different cryptocurrencies. These alternatives, frequently referred to as altcoins, serve a number of purposes, from improving privateness and enhancing transaction speeds to imparting revolutionary structures for decentralized purposes (DApps).

Why Look Beyond Bitcoin?

While Bitcoin remains a cornerstone of the crypto market, there are several reasons why investors and enthusiasts might seek alternatives:

1. Scalability: Bitcoin's transaction speed and scalability have been points of contention.

Some selections provide quicker and extra scalable solutions.

2. Transaction Fees: As Bitcoin's network becomes busier, transaction fees can rise.

Some altcoins supply less expensive transaction costs.

3. Utility: Many altcoins are designed with specific use cases in mind, from smart contracts to privacy features.

4. Investment Diversification: Diversifying one's portfolio with multiple cryptocurrencies can mitigate risk and potentially increase returns.

Top Bitcoin Alternatives in 2024

1. Ethereum (ETH)

Overview: Launched in 2015 by Vitalik Buterin, Ethereum is more than just a cryptocurrency.

It’s a decentralized platform that allows builders to construct and set up clever contracts and decentralized purposes (DApps).

Key Features:

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into code.

Decentralized Applications (DApps): Applications that run on a decentralized network.

Ethereum 2.0: The ongoing improvement to Ethereum goals to enhance scalability, security, and sustainability via a shift from Proof of Work (PoW) to Proof of Stake (PoS).

Pros:

- Highly versatile platform with numerous use cases.

- Strong developer community.

- Continuous improvement and scalability through Ethereum 2.0.

Cons:

- High transaction fees (gas fees) during network congestion.

- Complex for new users compared to simpler cryptocurrencies.

2. Binance Coin (BNB)

Overview: Binance Coin is the native cryptocurrency of the Binance Exchange, one of the largest cryptocurrency exchanges in the world. Initially launched as an ERC-20 token on the Ethereum blockchain, BNB has since transitioned to the Binance Chain.

Key Features:

Exchange Utility: Primarily used to pay for trading fees on Binance, offering discounts to users.

Binance Smart Chain (BSC): Supports smart contracts and is known for its low transaction fees and high throughput.

Pros:

- Strong backing and integration with the Binance Exchange.

- Low transaction fees on BSC.

- Continuous development and use cases expanding beyond the Binance platform.

Cons:

The centralized nature of Binance raises concerns among decentralization purists.

- Regulatory scrutiny due to its association with Binance.

3. Cardano (ADA)

Overview: Cardano is a third-generation blockchain platform founded by Charles Hoskinson, a co-founder of Ethereum. It aims to provide a more balanced and sustainable ecosystem for cryptocurrencies.

Key Features:

Proof of Stake (PoS): Uses the Ouroboros PoS protocol, which is energy efficient.

Research-Driven: Development is backed by peer-reviewed academic research.

Scalability and Interoperability: Designed to improve scalability and interoperability compared to previous generations of blockchain.

Pros:

- Strong focus on security and sustainability.

- Continuous updates and improvements.

- Active community and developer involvement.

Cons:

- Slow development process due to its research-driven approach.

- Still in the early stages compared to some competitors.

4. Solana (SOL)

Overview: Solana is a high-performance blockchain supporting builders around the world creating crypto apps that scale today. It aims to provide decentralized finance solutions on a scalable and user-friendly blockchain.

Key Features:

Proof of History (PoH): A unique consensus algorithm that provides high throughput.

Low Transaction Fees: Designed to offer low-cost transactions.

Scalability: Capable of handling thousands of transactions per second.

Pros:

- Extremely fast and scalable.

- Low transaction costs.

- A growing ecosystem of DApps and DeFi projects.

Cons:

- Relatively new and still proving its stability.

- Centralization concerns due to the small number of validators.

5. Polkadot (DOT)

Overview: Founded by Dr. Gavin Wood, another co-founder of Ethereum, Polkadot is a heterogeneous multi-chain framework.

It approves a number of blockchains to switch messages and fees in a trust-free fashion.

Key Features:

Interoperability: Connects multiple blockchains into a single network.

Scalability: Enables parallel processing of transactions across different chains.

Governance: Decentralized governance model allowing stakeholders to have a say in the protocol's future.

Pros:

- Focus on interoperability and connecting different blockchains.

- High scalability potential.

- Strong developer and community support.

Cons:

The complexity of the technology might pose a barrier to new users.

- Competition with other interoperability-focused projects.

6. Chainlink (LINK)

Overview: Chainlink is a decentralized oracle network providing reliable, tamper-proof data for complex smart contracts on any blockchain.

Key Features:

Oracles: Bridges the gap between blockchain and real-world data.

Cross-Chain Compatibility: Works with multiple blockchain platforms.

Decentralized Data Sources: Ensures data reliability and security.

Pros:

- Unique and crucial role in enabling smart contracts to interact with external data.

- Strong partnerships with major companies and blockchains.

- Growing use cases and applications.

Cons:

- Highly specialized use cases might limit broader adoption.

- Dependence on the success of the smart contract ecosystem.

7. Ripple (XRP)

Overview: Ripple aims to enable instant, secure, and low-cost international payments.

Unlike many different cryptocurrencies, Ripple focuses on serving the desires of the monetary offerings sector.

Key Features:

RippleNet: A global network for cross-border payments.

XRP Ledger: A decentralized open-source product.

Speed and Cost: Provides fast transactions with minimal fees.

Pros:

- Strong focus on financial institutions and cross-border payments.

- Low transaction fees and fast settlement times.

- Significant partnerships with banks and financial institutions.

Cons:

- Centralization concerns due to Ripple Labs’ control.

- Ongoing legal issues with regulatory authorities.

8. Litecoin (LTC)

Overview: Created by Charlie Lee in 2011, Litecoin is often considered the silver to Bitcoin’s gold.

It targets to supply fast, low-cost repayments by way of the usage of a one-of-a-kind hashing algorithm.

Key Features:

Scrypt Algorithm: Allows for faster transaction confirmation.

SegWit and Lightning Network: Implements advanced technologies for scalability.

Litecoin Foundation: Active development and community support.

Pros:

- Faster transaction times compared to Bitcoin.

- Lower transaction fees.

- Active development and widespread adoption.

Cons:

- Limited additional functionality beyond being a currency.

- Competition from newer and more versatile cryptocurrencies.

9. Stellar (XLM)

Overview: Stellar is an open network for storing and moving money.

Its aim is to allow monetary structures to work collectively on a single platform.

Key Features:

Stellar Consensus Protocol (SCP): Allows for faster and cheaper transactions.

Anchor Network: Connects various financial institutions to the Stellar network.

Focus on Remittances: Facilitates cross-border payments and remittances.

Pros:

- Low transaction fees and high speed.

- Focus on financial inclusion and connecting global financial systems.

- Strong partnerships and adoption in the financial sector.

Cons:

- Competition from other payment-focused cryptocurrencies.

- Centralization concerns regarding development control.

10. Monero (XMR)

Overview: Monero is a privacy-focused cryptocurrency that aims to provide secure, private, and untraceable transactions.

Key Features:

Privacy: Uses advanced cryptographic techniques to ensure transaction privacy.

Decentralization: Emphasizes decentralization and security.

Fungibility: Every unit of Monero is indistinguishable from another.

Pros:

- Strong privacy and security features.

- Active community focused on maintaining privacy.

- Continuous development and improvements.

Cons:

- Privacy focus attracts regulatory scrutiny.

- Not as widely accepted as other cryptocurrencies.

Conclusion

The cryptocurrency market affords a plethora of options to Bitcoin, every with its special features, advantages, and viable downsides.

Whether you're looking for faster transaction speeds, lower fees, advanced functionalities like smart contracts, or enhanced privacy, there is likely a cryptocurrency that meets your needs. Ethereum, Binance Coin, Cardano, Solana, Polkadot, Chainlink, Ripple, Litecoin, Stellar, and Monero are among the top contenders worth considering in 2024.

As with any investment, it is quintessential to behavior thoroughly lookup and reflect on consideration on your monetary dreams and hazard tolerance. The crypto market is quite risky and can be unpredictable. Diversifying your investments and staying knowledgeable about market tendencies and technological developments can assist you navigate this.

#simplyfy#news#bitcoin#cryptocurrency#crypto#blockchain#digitalcurrency#cryptonews#cryptotrading#simplyfycrypto#simplyfynews

3 notes

·

View notes

Text

Bitcoin: The Only Truly Decentralized Cryptocurrency

In the rapidly evolving landscape of cryptocurrencies, decentralization is often touted as a core principle. However, not all digital currencies live up to this ideal. Among thousands of cryptocurrencies, Bitcoin stands out as the only one that truly exhibits decentralization, making it unique and invaluable.

What is Decentralization?

Decentralization refers to a system where control isn’t held by a single entity or small group. In cryptocurrency, this concept ensures that no government, organization, or individual has undue influence over the network. Decentralization brings crucial benefits, such as increased security, censorship resistance, and transparency.

Bitcoin’s Decentralized Foundations

Bitcoin, conceived in 2008 by Satoshi Nakamoto, was designed to operate in a decentralized manner from the outset. Key elements like its peer-to-peer network, proof-of-work consensus, and distributed ledger ensure that control over Bitcoin is not concentrated.

Peer-to-Peer Network: Every node in the Bitcoin network has equal status, contributing to the validation of transactions.

Proof-of-Work: Bitcoin mining uses proof-of-work to secure the network through computational power, preventing any single entity from dominating.

Distributed Ledger: Bitcoin’s blockchain is maintained by thousands of nodes globally, ensuring the ledger remains tamper-resistant and transparent.

Contrasting Other Cryptocurrencies

Despite claims of decentralization, many cryptocurrencies exhibit centralized control due to their governance models, development teams, or token distribution.

Ripple (XRP):

Ripple Labs holds a significant portion of the total XRP supply and directly controls the development and direction of the network. Its consensus protocol relies on a trusted list of validators chosen by the company, creating a stark contrast with Bitcoin’s permissionless network.

Binance Coin (BNB):

As the in-house token of the centralized Binance exchange, Binance Coin’s governance and supply are influenced by Binance itself. The company determines how and when to burn tokens, directly impacting supply.

Cardano (ADA):

Cardano’s governance is centralized through three key organizations: the Cardano Foundation, IOHK, and Emurgo. While the network employs staking pools for validation, the concentration of control remains within these organizations.

Tether (USDT):

Tether is managed centrally by Tether Limited, which controls the issuance and redemption of the stablecoin. Recent controversies over reserve transparency highlight the risks of centralization.

Risks of Centralization

Centralization poses various risks to cryptocurrency networks. Systems controlled by a small group or entity are vulnerable to:

Regulation: Governments can easily target centralized entities, limiting the currency’s usage.

Single Points of Failure: Centralized systems can suffer catastrophic failures if the controlling entity is compromised.

Market Manipulation: Central entities can manipulate supply or governance decisions to their advantage.

Bitcoin’s Decentralization in Practice

Bitcoin’s decentralized nature has protected it from censorship and interference, allowing it to thrive even under intense scrutiny. Its open network ensures that anyone can participate and contribute to securing the blockchain, making it resilient against regulatory and market pressures.

Conclusion

Bitcoin remains the most decentralized cryptocurrency, setting the standard for how digital currencies should operate. It offers a model that ensures fairness, transparency, and security, while others still rely on centralized control to varying degrees. Investors should consider this aspect carefully, recognizing the value of true decentralization when navigating the cryptocurrency landscape.

#Bitcoin#Cryptocurrency#Decentralization#Blockchain#Ripple#Binance#Cardano#Tether#CryptoInvesting#DigitalCurrency#CryptoCommunity#CryptoNews#unplugged financial#financial education#financial empowerment#finance#financial experts

2 notes

·

View notes

Text

Robinhood Markets Inc. has received a notice from the Securities and Exchange Commission about alleged securities violations at its crypto division.

The company said in a regulatory filing that it received investigative subpoenas from the SEC about issues including cryptocurrency listings, custody of cryptocurrencies, and platform operations.

Robinhood Crypto has cooperated with the investigation, the company said.

Last week the crypto division received a Wells notice from SEC staff advising the unit that a preliminary determination was made to recommend that the SEC file an enforcement action against Robinhood Crypto for alleged securities violations.

The filing said that the potential action may involve a civil injunctive action, public administrative proceeding or a cease-and-desist proceeding. Remedies that may be sought include an injunction, a cease-and-desist order, disgorgement, pre-judgment interest, civil money penalties, and censure, revocation, and limitations on activities.

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business,” Dan Gallagher, chief legal, compliance and corporate affairs officer at Robinhood Markets, said in a statement on Monday. “We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be on both the facts and the law.”

The company said that its crypto unit has chosen not to list certain tokens or provide products, such as lending and staking, that the SEC previously alleged were securities in public actions against other platforms. It has also attempted to register a special purpose broker-dealer with the agency.

Robinhood said that the SEC development will not impact its customers' accounts or the services it provides. The company is scheduled to report its quarterly results Wednesday after the market close.

Shares of Robinhood added 1% in morning trading.

2 notes

·

View notes

Text

Explore BitNest Loop DeFi: Building the Financial Ecosystem of the Future

Today, with the rapid development of financial technology, decentralized finance (DeFi) has become a force that cannot be ignored. As a rising star in the industry, BitNest Loop DeFi is redefining our understanding of financial services with its unique innovation and reliable technology solutions. This article will delve into the core functions of BitNest Loop DeFi and the diverse financial solutions it brings to users.

What is BitNest Loop DeFi?

BitNest Loop DeFi is a decentralized financial platform based on blockchain technology, dedicated to providing a series of financial services, including lending, liquidity mining, trading, etc. The platform uses smart contract technology to ensure the transparency, security and efficiency of all transactions.

Core functions

Decentralized Lending: BitNest Loop DeFi allows users to mortgage crypto assets to borrow other assets, providing flexible lending terms and competitive interest rates. Users can quickly obtain the funds they need without the need for traditional credit evaluations.

Liquidity Mining: Users can deposit their assets into BitNest Loop’s liquidity pool to receive transaction fee sharing and platform token rewards. This not only increases the liquidity of the asset, but also provides users with opportunities for passive income.

Automated Market Maker (AMM): Using algorithms to provide liquidity for transactions, users can exchange assets at any time without waiting for buyers or sellers.

Decentralized governance: Users holding platform tokens can participate in the governance of the platform and vote on major updates and changes, truly achieving community-driven project development.

Security and transparency

Security is the most important aspect of BitNest Loop DeFi. By leveraging the Ethereum blockchain, the platform ensures that all transaction records are immutable and every transaction is publicly viewable on the chain. Additionally, the smart contract code is rigorously audited to prevent any form of security breach.

future outlook

BitNest Loop DeFi is more than just a financial platform, it is also an innovative ecosystem that provides developers and users with a scalable, secure and efficient decentralized financial service platform. As blockchain technology continues to mature, BitNest Loop DeFi will continue to lead the innovation of decentralized finance, provide users with more financial tools and services, and promote the development of the entire industry.

On the road to exploring the future of finance, BitNest Loop DeFi is using technology to break tradition and provide more fair, transparent and convenient financial services to users around the world. Whether you are an investor or an everyday user, BitNest Loop DeFi deserves your attention and participation. Join us to explore the infinite possibilities of blockchain finance.

Contact Telegram; https://t.me/Rosa02b https://t.me/Rosa03c https://t.me/rosa04d

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes

Text

Explore BitNest Loop DeFi: Building the Financial Ecosystem of the Future

Today, with the rapid development of financial technology, decentralized finance (DeFi) has become a force that cannot be ignored. As a rising star in the industry, BitNest Loop DeFi is redefining our understanding of financial services with its unique innovation and reliable technology solutions. This article will delve into the core functions of BitNest Loop DeFi and the diverse financial solutions it brings to users.

What is BitNest Loop DeFi?

BitNest Loop DeFi is a decentralized financial platform based on blockchain technology, dedicated to providing a series of financial services, including lending, liquidity mining, trading, etc. The platform uses smart contract technology to ensure the transparency, security and efficiency of all transactions.

Core functions

Decentralized Lending: BitNest Loop DeFi allows users to mortgage crypto assets to borrow other assets, providing flexible lending terms and competitive interest rates. Users can quickly obtain the funds they need without the need for traditional credit evaluations.

Liquidity Mining: Users can deposit their assets into BitNest Loop’s liquidity pool to receive transaction fee sharing and platform token rewards. This not only increases the liquidity of the asset, but also provides users with opportunities for passive income.

Automated Market Maker (AMM): Using algorithms to provide liquidity for transactions, users can exchange assets at any time without waiting for buyers or sellers.

Decentralized governance: Users holding platform tokens can participate in the governance of the platform and vote on major updates and changes, truly achieving community-driven project development.

Security and transparency

Security is the most important aspect of BitNest Loop DeFi. By leveraging the Ethereum blockchain, the platform ensures that all transaction records are immutable and every transaction is publicly viewable on the chain. Additionally, the smart contract code is rigorously audited to prevent any form of security breach.

future outlook

BitNest Loop DeFi is more than just a financial platform, it is also an innovative ecosystem that provides developers and users with a scalable, secure and efficient decentralized financial service platform. As blockchain technology continues to mature, BitNest Loop DeFi will continue to lead the innovation of decentralized finance, provide users with more financial tools and services, and promote the development of the entire industry.

On the road to exploring the future of finance, BitNest Loop DeFi is using technology to break tradition and provide more fair, transparent and convenient financial services to users around the world. Whether you are an investor or an everyday user, BitNest Loop DeFi deserves your attention and participation. Join us to explore the infinite possibilities of blockchain finance.

Contact Telegram; https://t.me/Rosa02b https://t.me/Rosa03c https://t.me/rosa04d

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

4 notes

·

View notes

Text

Explore BitNest Loop DeFi: Building the Financial Ecosystem of the Future

Today, with the rapid development of financial technology, decentralized finance (DeFi) has become a force that cannot be ignored. As a rising star in the industry, BitNest Loop DeFi is redefining our understanding of financial services with its unique innovation and reliable technology solutions. This article will delve into the core functions of BitNest Loop DeFi and the diverse financial solutions it brings to users.

What is BitNest Loop DeFi?

BitNest Loop DeFi is a decentralized financial platform based on blockchain technology, dedicated to providing a series of financial services, including lending, liquidity mining, trading, etc. The platform uses smart contract technology to ensure the transparency, security and efficiency of all transactions.

Core functions

Decentralized Lending: BitNest Loop DeFi allows users to mortgage crypto assets to borrow other assets, providing flexible lending terms and competitive interest rates. Users can quickly obtain the funds they need without the need for traditional credit evaluations.

Liquidity Mining: Users can deposit their assets into BitNest Loop’s liquidity pool to receive transaction fee sharing and platform token rewards. This not only increases the liquidity of the asset, but also provides users with opportunities for passive income.

Automated Market Maker (AMM): Using algorithms to provide liquidity for transactions, users can exchange assets at any time without waiting for buyers or sellers.

Decentralized governance: Users holding platform tokens can participate in the governance of the platform and vote on major updates and changes, truly achieving community-driven project development.

Security and transparency

Security is the most important aspect of BitNest Loop DeFi. By leveraging the Ethereum blockchain, the platform ensures that all transaction records are immutable and every transaction is publicly viewable on the chain. Additionally, the smart contract code is rigorously audited to prevent any form of security breach.

future outlook

BitNest Loop DeFi is more than just a financial platform, it is also an innovative ecosystem that provides developers and users with a scalable, secure and efficient decentralized financial service platform. As blockchain technology continues to mature, BitNest Loop DeFi will continue to lead the innovation of decentralized finance, provide users with more financial tools and services, and promote the development of the entire industry.

On the road to exploring the future of finance, BitNest Loop DeFi is using technology to break tradition and provide more fair, transparent and convenient financial services to users around the world. Whether you are an investor or an everyday user, BitNest Loop DeFi deserves your attention and participation. Join us to explore the infinite possibilities of blockchain finance.

Contact Telegram; https://t.me/Rosa02b https://t.me/Rosa03c https://t.me/rosa04d

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

5 notes

·

View notes

Text

Chamber of Digital Commerce Takes a Stance in Kraken vs. SEC Legal Battle

In the ongoing legal tussle between Kraken, a prominent cryptocurrency exchange, and the U.S. Securities and Exchange Commission (SEC), the Chamber of Digital Commerce has entered the fray. The Chamber filed an amicus curiae brief on February 27, challenging the SEC's regulatory stance on digital assets. This move signifies a pivotal moment in the broader discourse on the regulatory framework for digital assets in the United States.

Central to the Chamber's argument is its opposition to the SEC's broad classification of all digital asset transactions as securities transactions. The Chamber contends that digital assets, essentially lines of code facilitating functionality on blockchain networks, should not be automatically treated as investment contracts. Drawing on legal precedents where digital tokens were not categorically considered securities, the Chamber advocates for a nuanced, transaction-specific assessment.

Moreover, the Chamber critiques the SEC's regulatory strategy, characterizing it as an overreach without sufficient legislative backing. It argues that such enforcement actions impede innovation and pose potential risks to the trillion-dollar digital asset space and the broader U.S. economy. The filing references past cases, including those involving Ripple and Terraform Labs, where the SEC's position did not yield an entirely favorable outcome for the regulator.

This development underscores the larger trend of regulatory scrutiny within the digital asset industry. Similar allegations have been levied by the SEC against other crypto exchanges such as Coinbase and Binance since June 2023. These cases suggest the SEC's intention to impose tighter regulations on the digital asset space, defaulting to the classification of digital assets as securities.

2 notes

·

View notes

Text

Certainly! Here are some cryptocurrency wallet development companies based in the USA:

Coinbase: A leading cryptocurrency exchange that also offers a wallet service.

Blockchain.com: Provides a popular cryptocurrency wallet and blockchain explorer.

Gemini: A cryptocurrency exchange and custodian that offers a secure wallet.

Edge (formerly Airbitz): Offers a user-friendly cryptocurrency wallet with a focus on security and privacy.

Exodus: Provides a multi-cryptocurrency wallet with a sleek design and intuitive interface.

BitGo: Offers institutional-grade cryptocurrency custody and wallet solutions.

BRD: Formerly known as Breadwallet, it offers a simple and secure mobile cryptocurrency wallet.

Coinomi: A multi-asset cryptocurrency wallet with a strong focus on privacy and security.

MyEtherWallet (MEW): Specializes in Ethereum and ERC-20 token wallets, offering both web and mobile versions.

Trezor: Known for its hardware wallets, Trezor offers secure cold storage solutions for cryptocurrencies.

These companies are among the prominent players in the cryptocurrency wallet development space within the USA.

2 notes

·

View notes

Text

🚀 Welcome to OrbPad - A Thread on the Future of Decentralized Launchpads! 🌐✨

🐋 OrbPad: Pioneering the Next Era in Decentralized Finance! 🚀

Introducing OrbPad, a revolutionary launchpad in the crypto sector. This platform empowers users to create tokens and conduct personalized initial token offerings with ease, eliminating the need for coding expertise.

🔒 Why Choose OrbPad for Token Launches? 🛡️

OrbPad is more than a token sale platform; it's a holistic ecosystem committed to security and user engagement. Rigorous KYC protocols ensure a secure investment landscape, fostering confidence for both project creators and investors. Your safety is our priority!

💰 $OPAD Token Metrics: Engineered for Sustainable Growth 📈💎

Explore the meticulously crafted tokenomics of $OPAD, focusing on sustainable value creation and long-term success. Check out the detailed breakdown of token metrics that demonstrate our commitment to stability and growth.

🌱 Total Supply & Team Allocation: 100,000 $OPAD

Dive into the core of OrbPad's tokenomics. The total supply is 100,000 $OPAD, with team allocation carefully structured for long-term commitment. Learn how we align team incentives with project longevity.

⚖️ Marketing, Advisory, Private & Public Round Allocations

Discover how OrbPad ensures robust and continuous promotion, involves strategic advisors, and rewards early backers while ensuring project stability. Join us as we break down each allocation to fuel OrbPad's journey!

🎁 Rewards Pool, Ecosystem Development Fund, Exchange Liquidity Provision

Unveil the details of the rewards pool spread over 8 years, the vital Ecosystem Development Fund, and Exchange Liquidity Provision ensuring accessibility for all $OPAD token holders. OrbPad's commitment to long-term engagement shines through!

Stay tuned for more updates as OrbPad shapes the future of decentralized finance! 🚀🌐 #DecentralizedFinance #BlockchainInnovation #ORBPAD #ORB3

Telegram

Discord

Zealy

Website

2 notes

·

View notes

Text

GHOST RIDERS FROM JARVIS AND BATMAN SOLUTION TECHNOLGY

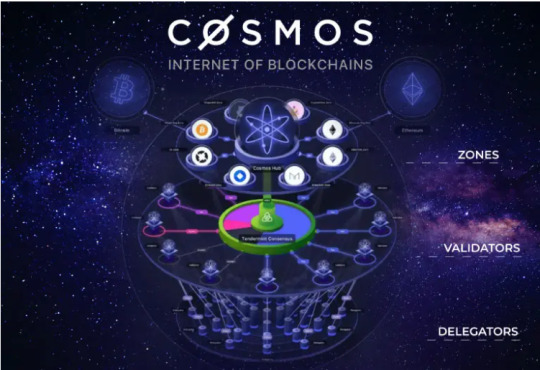

The Cosmos Hub

The Cosmos Hub has, historically, struggled with a bit of an identity crisis. People can stake the Hub’s native ATOM token to help secure the network, but the network itself isn’t really used for much.

“You would maybe just copy and paste all of the Cosmos Hub codebase, and then you would add your feature to it,” explained Billy Rennekamp, the Cosmos Hub product lead at Interchain GmbH, which helps fund the development of the wider Cosmos ecosystem.

The Hub was the only Cosmos chain when it launched in 2019, but its code has since been used as a template by dozens of other interconnected blockchains, each dedicated to a specific product or use case.

The app chain Osmosis, for example, used the Cosmos Hub’s code as a template to enable decentralized finance (DeFi) activities like exchanging between currencies. Regen, another app-chain, used the Cosmos Hub’s code as a model for its on-chain carbon credit market. Terra, the ill-fated stablecoin operator, was a Cosmos chain, too.

As the wider Cosmos ecosystem has grown, the Cosmos community has rejected changes to the Hub’s code that might sully its role as a clean template for other chains to build upon. The community has also shunned upgrades that would place the Hub on a pedestal relative to other Cosmos chains – the fear being that such upgrades could challenge the “sovereignty” of other chains in the ecosystem.

As a result of its conservative track record, if Cosmos as a whole is a neighborhood, the Hub has been relegated to the role of a model home – a cookie-cutter example of what a Cosmos chain should look like sans any real utility or inhabitants.

Rennekamp uses this analogy of a model home to describe where the Hub is headed next: “At the beginning, it's the only home in the neighborhood. And once there's a flourishing neighborhood around they might decide to convert it to a school, or a police station or something that's specifically valuable to the neighborhood, rather than just a proof of concept for other houses.”

2 notes

·

View notes

Text

iMeta Technologies - Leading paxful clone script Provider

iMeta Technologies is a top-tier cryptocurrency exchange development company that provides the readymade paxful clone script for your business at an affordable price. We provide some elite features of Paxful clone script such as Instant Buy/sell Bitcoins,Multi Language Support,Dynamic Token Adding Tool, Referrals and Gift Card options, online and offline trading, cold and offline wallet support, Core Multi-sig Wallet setup and more. We have an experienced team to provide whitelabel paxful clone software with high end security features for your platform. Feel free to get a demo for paxful clone script

2 notes

·

View notes