#Morris County Bankruptcy Attorney

Photo

If you want to lower your monthly payments and have a portion of your loans forgiven, Lucid Law’s Student Debt Program may be for you. The cost is minimal, and the potential benefits certainly outweigh any costs. For any legal consultant please visit the our office and call us today at 908-795-8412.

#NJ Bankruptcy Planning Services#Morris County Collaborative Divorce Attorney#Mediation Lawyer Morristown NJ#Collaborative Law in Morris County#Collaborative Law Attorney New Jersey#Collaborative Divorce Attorney Morristown#Morristown Legal Dispute Lawyer#NJ Chapter 13 Bankruptcy Lawyer#Bankruptcy Law Firm Morristown NJ#Bankruptcy Consulting Services in Morris County

0 notes

Text

Wheeling Attorney Believes Roxby’s Morris Possessed Pure Intentions

The attorney representing the owners of the Scottish Rite Cathedral in East Wheeling believes Roxby’s indicted developer Jeffrey Morris truly believed he could deliver on the deal he was selling to investors, vendors, and to more than 100 employees.

Morris, 37, was charged with 18 federal counts of wire fraud and 10 counts of tax evasion in September after serving as the president of Roxby Development, a start-up real estate company founded in Wheeling in 2020. Morris partnered with his parents in 2019 to buy the Mount Carmel Monastery and then directed the firm to purchase the Scottish Rite in September 2020, and then the McLure Hotel in July 2021.

David Croft is the Member in Charge of the Spillman, Thomas & Battle office in Wheeling, and he represented the Scottish Rite Masonry in June for the foreclosure process against Roxby Development. Morris also lost the McLure Hotel to foreclosure this past summer.

While his interactions with Morris were limited, Croft did develop impressions.

“As an attorney who has handled a lot of acquisitions in this area for a number of years, I don’t think Jeffrey came into all of this with ill intent at the very beginning,” said Croft, who also is one of five members of the Ohio County Board of Education. “I think he honestly believed, at the start of it all, that he could make it all work out, but then I think he got under it and couldn’t get out.

“I don’t know, but maybe if took on one project at a time, (Morris) would have had a better chance,” he said. “Finish the monastery, and then move on to the Scottish Rite, and then the hotel. But that’s not how he went about it, and toward the end, there was even talk about the Kaufman building and the Mull Center, too.”

The Roxby operation began with only a mingling of employees, a group that included some of his best friends dating back to high school. In the summer of 2021, however, following the acquisition of the McLure Hotel, the company’s workforce swelled to more than 100. On a few occasions, however, paychecks were not delivered as scheduled.

“I think Jeffrey Morris absolutely believed he had a plan. I think he thought he could get a return for his investors. But, at some point he had to know he was robbing Peter to pay Paul, and when the employees had to wait to be paid, red flags went up for a lot of people,” Croft said. “He saw value in the buildings, and his ideas were sound, but it appears he lost control of it somehow and that’s when laws started being broken, allegedly.

“There was a lot of excitement surrounding the projects, and about the improvements the people could see like the painting of the hotel,” the attorney recalled. “But because of the bankruptcy filing, we now know the painting company didn’t get paid, and a small business can’t take a hit like that and they weren’t the only ones.”

The Scottish Rite Cathedral was returned to the Masonry once foreclosure proceedings were completed this summer.

A Pot of Gold?

The Chapter 11 paperwork filed in May by Roxby Development seeking protection from creditors indicated the amount the company was in debt to be between $10 and $50 million, but those pages also revealed Morris had not properly insured the Scottish Rite and McLure properties.

That fact, Croft learned from a colleague, was concerning to federal officials.

“The most significant thing we accomplished at Spillman was to get his request kicked out of bankruptcy court because that process would have given him a long period of time,” he explained. “But he failed to have adequate coverage on the properties and that’s what allowed us to file the motion to dismiss. Once it was, it allowed (lawyer) David Delk to move forward with the foreclosure on the hotel, and me to move forward with the Scottish Rite.”

Croft’s dealings with any legal matters connected to Morris and Roxby Development are minimal at this point, but he still finds some factual information pertaining to the rise and fall of the company very interesting.

“I believe part of the problem as far as the investors are concerned was that it appears they accepted internally generated data instead of third-party information like actual bank statements and documents similar to those,” he said. “Internal information, as far as what I have found, is historically unreliable.

“Right now, I’m sure the federal investigators are putting together all of the numbers, and once they do, I’ll be curious to see the bottom number to see if there are funds missing. I don’t know if that’s a fact or not,” Croft insisted. “If there is, where is it? That’s a fair question.”

According to federal guidelines, each guilty verdict for tax fraud carries a prison sentence up to 20 years and a fine up to $250,000. The penalties for tax evasion depend on the nature of the committed offense.

“I get the impression this case will continue to grow in charges as the investigators continue their work,” Croft said. “But I honestly believe (Morris) still doesn't think he did anything wrong. That's the upside of being pathological.”

Jeffrey Morris was the president of Roxby Development, a company now defunct after he lost the Scottish Rite Cathedral and the McLure House Hotel to foreclosures.

Read the full article

0 notes

Text

youtube

Morris County Bankruptcy Lawyers are experienced professionals who specialize in helping individuals and businesses navigate the complexities of bankruptcy law. They provide comprehensive legal services to those facing financial hardship, such as foreclosure lawyers in New Jersey. With their knowledge and expertise, they can help clients find solutions to their debt problems and work towards a more secure financial future.

Morris County Bankruptcy Lawyers

133 Washington St, Morristown, NJ 07960

(973) 219–6796

My Official Website: https://morriscountybankruptcylawyers.com/

Google Plus Listing: https://www.google.com/maps?cid=4635803748339354736

Our Other Links:

business bankruptcy Near ME: https://morriscountybankruptcylawyers.com/business-bankruptcy-services-nj/

bankruptcy chapter 13 New Jersey: https://morriscountybankruptcylawyers.com/chapter-7-vs-chapter-13/

bankruptcy student loans New Jersey: https://morriscountybankruptcylawyers.com/student-loan-attorney-nj/

Service We Offer:

Bankruptcy Service

Lawyers

Chapter 7 bankruptcy

Chapter 13 bankruptcy

Debt Relief Agency

Bankruptcy

Foreclosure

Follow Us On:

Facebook: https://www.facebook.com/Law-Office-of-William-Pegg-PC-107034754269330/

Twitter: https://twitter.com/LawyersMorris

Pinterest: https://www.pinterest.com/morriscountybankruptcylawyers/

1 note

·

View note

Link

0 notes

Text

Corona virus impact spreads

Coronavirus leads the largest Wendy's-Pizza Hut franchisee to Chapter 11 Bankruptcy. Now, we're in trouble! https://lnkd.in/ghwkhgD

0 notes

Text

The Law Offices of William Pegg is a bankruptcy attorney in Morris County, NJ.

The Law Offices of William Pegg is a bankruptcy attorney in Morris County, NJ. Our bankruptcy lawyers are located in Morristown New Jersey at 133 Washington St, Morristown, NJ 07960. Our debt relieve agency can help you with your bankruptcy and offer our debt relief services to help you get your personal financial life or business finances back on track! Contact The Law Offices Of William Pegg today and see what our bankruptcy law firm in NJ can do for you!

Name: The Law Offices Of William Pegg

Address: 133 Washington St, Morristown, NJ 07960

Phone: (973) 540-0202

Website: https://morriscountybankruptcylawyers.com/

Youtube: https://www.youtube.com/channel/UCh-LVb1Qo8mBgW9YyA_EwSw

1 note

·

View note

Text

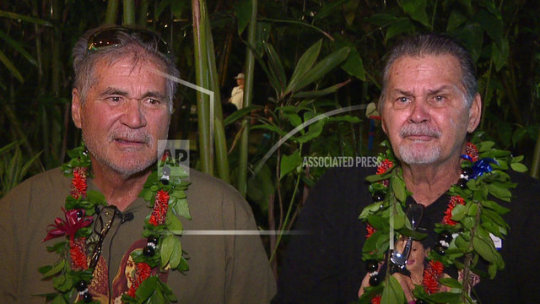

Bravo’s ‘Flipping Exes’ stars have more than a breakup in their past

CLOSE

Christina “Nina” Klemm (at left) and Michael LeSure of the upcoming Bravo TV show “Flipping Exes.” (Photo: Photo by: Michael Hickey/BravoTV)

INDIANAPOLIS – The new Bravo TV show “Flipping Exes” will play up the baggage between a former couple as they flip homes in Carmel.

But their romantic past may not be their only baggage.

Co-stars Christina “Nina” Klemm and Michael LeSure have thousands of dollars in outstanding Indiana tax warrants and are facing a lawsuit filed by a Colorado investor who says they defrauded him.

LeSure, who Bravo describes as a numbers-savvy former financier, also has a bankruptcy in his past that left $467,000 in claims unpaid, according to court records.

Klemm and LeSure did not respond to messages seeking comment, but their attorneys denied the lawsuit’s allegations.

Eye drop recall: Products sold at Walmart, Walgreens recalled because they may not be sterile

Have an Amazon return to send back?: Kohl’s stores are now accepting Amazon returns

The financial, legal and tax issues shine a different light on the duo portrayed as sassy and successful real estate pros in Bravo’s marketing of the new program, which debuts Aug. 6 at 10 p.m.

What Bravo knew about those issues remains unclear.

Show hypes ex-couple’s ‘baggage’

Bravo describes “Flipping Exes” as a docu-series about a couple “who turned their breakup into a business.”

“There’s plenty of bickering and playful flirtation between the two as Michael tries to manage Nina’s expensive taste while staying on budget,” Bravo promises. “It’s not always a walk in the park with this couple as they are often triggered by baggage left over from their personal relationship.”

In a promotional video, the pair say Klemm handles the design, marketing and sales, while LeSure takes care of purchases, budgeting and construction.

Business filings show Klemm created Flipping Exes LLC in 2015 after her breakup with LeSure. They launched a YouTube channel and website with the goal of educating and assisting potential investors looking to cash in on the home flipping craze.

They’re among a growing number of entrepreneurs who have turned to the internet to capitalize on the trend in Indianapolis, where the relatively low cost of real estate is attractive to out-of-state investors. “Flipping Exes” will be the second show to feature a Central Indiana pair restoring and reselling homes. Popular HGTV show “Good Bones” features Karen Laine and Mina Starsiak Hawk, a mother-daughter team who operate Two Chicks and a Hammer.

The legal troubles Klemm and LeSure face are also not unique to the Indianapolis market. Another celebrity real estate personality, former “Fox & Friends” co-host Clayton Morris, is disputing fraud allegations in more than a dozen investor lawsuits involving the sale of Indianapolis rental properties.

CLOSE

Attorney Jynell Berkshire says her clients feel they were scammed by former “Fox & Friends” host Clayton Morris.

Mykal McEldowney, IndyStar

Lawsuit alleges inflated sale, subpar renovation

Klemm and LeSure are accused of conspiring to defraud a Colorado investor in a lawsuit filed in Hamilton County, Ind. Steven Bearden of Temujin LLC claims that Klemm, LeSure and LeSure’s cousin, Earl Campbell, sold him an Indianapolis investment home in 2016 at an inflated price and then failed to properly renovate it.

LeSure and Campbell told Bearden his investment in the home flip would bring a return of at least 20%, according to the lawsuit.

Instead, Bearden got a home that the suit says did not have “a source of heat” or “a functioning sewer system.” When Bearden complained, LeSure and Klemm guaranteed the project would be completed, the lawsuit says.

Culinary clamor?: Why restaurants have gotten so loud and how it’s affecting what you eat

Calculating retirement: What’s the magic number for retirement savings? $1.7 million, according to this study

But the renovation work turned out to be subpar and dangerous, the lawsuit says. Unlicensed contractors left live electrical lines “loose within the walls of the home,” creating “a fire and electrical hazard to anyone entering the home.”

A subcontractor also cut 90% of the way through rafters, jeopardizing the building’s structural integrity, the lawsuit says, and a garage addition was full of structural problems.

Bearden claims he was also misled about the sale of the home. He was told the seller was an investment company that had fixed the home to a rent-ready standard, but in reality it was a company managed by Klemm’s brother who had bought the home just hours before selling it to Bearden at a $30,000 markup.

Nina Klemm. (Photo: Michael Hickey/Bravo)

Klemm, LeSure and Campbell hid this “necessary and vital information to Bearden,” the lawsuit says. They even charged him a $2,000 finders fee, the lawsuit says.

Klemm and LeSure are denying the allegations.

David Barker, a Carmel, Ind., attorney who is representing Klemm, called the accusations against her “frivolous” and “unfounded.” He accused Bearden of “going after people with deep pockets.”

Barker insisted Klemm was not part of any deal with Bearden. She got dragged into the dispute because Campbell, who Barker described as a storm-chasing handyman, allegedly stole blank forms bearing Klemm’s name from her real estate office while bringing her an invoice for work on an unrelated property, Barker said.

Campbell then appears to have used those forms to complete the deal, Barker said.

Campbell does not have an attorney on record in the lawsuit and could not be reached for comment.

Court records show LeSure does not currently have an attorney on record in the case, either. His former attorney, Stephen M. Terrell, withdrew in May after writing a letter to LeSure saying: “I have tried, and tried, and tried to reach you and get you to respond to my myriad of letters, emails and phone calls. … I cannot continue representing a client whom I cannot contact.”

But when contacted July 2 by the Indianapolis Star, Terrell said he plans to resume representing LeSure. He declined to talk about specifics of the lawsuit, but said LeSure denies the allegations in the case.

A pre-trial conference in the case is scheduled for 9 a.m. Aug. 21 in Hamilton Superior Court 3.

Tax problems, court judgment, bankruptcy

In addition to the lawsuit, Klemm and LeSure also have a history of overdue taxes.

Klemm often pays her taxes late and currently has an outstanding tax warrant in Hamilton County for $2,277, according to public tax records. She also had a $5,700 judgment in 2013 for failing to pay credit card debt, court records show.

Michael LeSure. (Photo: Michael Hickey/Bravo)

LeSure’s tax delinquencies are even larger. He currently has at least five outstanding tax warrants in Marion and Hamilton counties for a total of $30,430. One of his companies also had $700 in delinquent taxes and penalties on its 2019 property tax bill for an Indianapolis duplex, state tax records show. And he once abandoned another house in Indianapolis that was sold for $750 at a county surplus sale in 2016.

The failure to pay taxes doesn’t seem to line up with the image Bravo paints of LeSure as “a former financier who turned his savviness with numbers into overseeing construction and operations.”

But then, neither does his bankruptcy. LeSure filed for Chapter 7 bankruptcy, claiming more than $2.5 million in debt when the case was discharged in 2014. Records show more than $467,000 in claims were discharged without payment.

Then in January, LeSure faced potential eviction from the home he rents in Carmel. The landlord filed legal action against LeSure alleging he failed to pay rent for two months. The filing in Hamilton Superior Court also said LeSure had not paid utility bills, forcing the landlord to pay them to avoid a lien on the property.

The landlord asked for a judgment of more than $2,900, and an eviction hearing was set for July 10. But after being contacted by the Star about the court case, the landlord said she planned to dismiss it. Online court records show the motion to dismiss was filed July 3.

Bravo silent on pair’s history

A Bravo spokeswoman declined to say whether the network was aware of the couple’s legal, financial and tax challenges.

Klemm’s attorney said Bravo did a background check. It’s unclear, however, what that background check revealed.

It’s also unclear what the company that produced the show knew. Rock Shrimp Productions, a company co-founded by celebrity chef Bobby Flay, is listed as executive producer.

In an email Tuesday to the Star, Rock Shrimp co-founder Kim Martin said: “There was one legal issue, but I’m not sure it’s the same one that you are referencing here. I am not aware of Michael ever filing for bankruptcy.”

Contact IndyStar reporter Tim Evans at [email protected] and on Twitter: @starwatchtim.

Contact IndyStar reporter Tony Cook at [email protected] & on Twitter: @IndyStarTony.

Read or Share this story: https://www.usatoday.com/story/money/2019/07/08/flipping-exes-bravo-stars-nina-klemm-michael-lesure-bankruptcy-lawsuits-late-taxes/1671507001/

Sahred From Source link TV and Movies

from WordPress http://bit.ly/2JNNkJB

via IFTTT

0 notes

Text

Lt. Gov. Dan Patrick Fires Back at Andrew Cuomo Over NY Nursing Home Deaths, as Covid Cases Spike in Texas: He’s ‘Probably The Biggest Fraud’

Retail ERP Software

ERP Software Provider

ERP Software Provider United Arab Emirates

Microsoft Dynamics 365 Business Central Singapore

Cloud ERP Software Singapore

ERP Software for Telecommunications Telecom Providers Singapore

ERP Software For Supermarket Businesses Singapore

ERP for Retail Industry Singapore

ERP For Manufacturing Singapore

Cloud ERP Software Consultant

Cloud ERP Software Provider

Cloud ERP Software United States

Cloud ERP Software Provider United Kingdom

Best ERP For Manufacturing Industry

Sharon Osbourne And Sheryl Underwood On Hosting The Daytime Emmy Awards: ‘Get Your Popcorn, It’s Going To Be Good’

New Movies to Watch This Week: ‘Eurovision Song Contest,’ ‘Irresistible’

Mike Henry to Stop Voicing Black Character on ‘Family Guy’

Franklin County investigating “malicious” tornado warning sirens

Juventus vs. Lecce LIVE STREAM (6/26/20): Watch Cristiano Ronaldo in Serie A online | Time, USA TV, channel

Amazon to acquire autonomous driving startup Zoox

In Doom Patrol, you can save the world no matter how broken you are

Nike Stock Dives After Surprise Loss But Digital Growth Accelerates

‘My Spy’ Review: A Winning Variation On A Successful Formula

Coronavirus packs San Bernardino hospitals; Imperial County told to reinstate stay-at-home order

Sia Is in Mom ‘Heaven’ with the Two Teen Sons She Adopted Last Year: ‘They Saved Me’

Florida suspends drinking at bars

IMPACT Wrestling Fires Tessa Blanchard As Top Star Becomes Free Agent

House approves bill to make Washington, D.C., a state

Trump brother files new lawsuit seeking to block niece Mary Trump’s tell-all book about family

Eurovision Song Contest: The Story of Fire Saga: A Guide to All Its Cameos and Homages

Poultry And Livestock ERP Software

Fowler pinpoints position Liverpool need to strengthen the most

Elton John’s ex-wife, Renate Blauel, seeking injunction against singer

Signing Rosenthal and reeling in Villa: the last time Liverpool won the title

Raheem Sterling and Frank Lampard are both correct, but that’s neither the question nor the issue

The British Actress Has Since Apologized After Previously Suggesting That The Police Accused Of Killing George Floyd Learned Arrest Techniques From The Israeli Cops.

How Olive Morris fought for racial and gender equality in her tragically short life

Juvenile body recovered in Reston’s Lake Audubon

Miles-Long Canola Oil Spill Shuts Down Part Of EB I-80 At Colfax

Haim: Women in Music Pt III review – A celebration of resilience

Lt. Gov. Dan Patrick Fires Back at Andrew Cuomo Over NY Nursing Home Deaths, as Covid Cases Spike in Texas: He’s ‘Probably The Biggest Fraud’

Native Americans to protest against Trump visit to Mount Rushmore

El Paso historical monument knocked over, unsure if vandalism is to blame

Shelter In Place in Placitas

Riviera Utilities investigating thousands of predicted power outages along Eastern Shore

OC sheriff’s investigators smuggled boxes of evidence in Golden State Killer case to book author, attorney says

Teen social media star found dead hours after posting eerie TikTok video

Tessa Blanchard’s Impact Contract Terminated, World Title Vacated

Nearly half a million people flocked to Obamacare after losing coverage this year

“Antebellum” brings racial justice to reopened cinemas

Black 18-Year-Old Attacked With Lighter Fluid, Racial Slurs In Downtown Madison

Elizabeth Banks to drive ‘Magic School Bus’ onto big screens

Ford just revealed 2021 F-150: Why this new model is different

Tanzanian Miner Becomes Millionaire Overnight After Finding the 2 Biggest Tanzanite Stones Ever

Steam’s Summer Sale is here

Chuck E. Cheese parent files for bankruptcy, hit by pandemic

Tamir Rice would have turned 18 today; family to hold event for Cleveland youth in honor of his birthday

Disneyland Delays Date To Reopen

Vince Carter is retiring from the NBA after 22 seasons

Pepperdine’s Theegala rides a wave of momentum onto PGA TOUR

Who Is Garrett Hedlund, Actor and Emma Roberts’ Boyfriend?

YouTube Legend Jenna Marbles Says She’s Done With Her Channel

Splash Mountain, a Disney ride based on a controversial film, will be ‘completely reimagined’

Father of Venus and Serena Williams Headed to Court Over Film Adaptation

Athlete A: How Survivors of Larry Nassar’s Abuse Forced the Karolyi Ranch to Close

Hulu Removes Scrubs Episodes Featuring Blackface Following Show Creator’s Request

Ramos free-kick sends Madrid back to top of La Liga

‘South Park’ Missing Five Episodes From HBO Max Offerings Because Of Prophet Muhammad Depictions

Iowa Daybook

Mohamed Hadid Says He Has to Demolish His $50 Million Mega-Mansion Because of “Racism”

Dark Horse Comics, Mike Mignola Respond to New Allegations Against Scott Allie

NASA renaming headquarters for ‘Hidden Figures’ scientist Mary Jackson

Nevada prisons have one of the lowest coronavirus positivity rates in nation

Ben Roethlisberger Opens Up on Past Struggles with Addiction

Charleston removes a statue of slavery defender and former Vice President John C. Calhoun

Late for Work 6/24: Ravens Reportedly Had ‘Discussions’ About Antonio Brown

Bill Cosby appeal: Camille Cosby breaks silence, says racism at root of husband’s incarceration

Rhode Island moves to change official name over slavery ties

GNC files for Chapter 11 bankruptcy; plans to close up to 1,200 stores

Terry Crews Says Brooklyn Nine-Nine Trashed 4 New Episodes Amid Protests

Appeals court orders judge to dismiss Michael Flynn case

Ritchie Torres and Mondaire Jones Are Poised to Make LGBTQ+ History in Congress

Three suspects indicted on murder charges in death of Ahmaud Arbery in Georgia

Martial bags hat trick, rates 9/10 as Man United pull closer to Chelsea in fourth

Primary is far from over with more than 90K absentee ballots to count

Liverpool on brink after blasting Palace

Comedian Deletes ‘Joke Aimed at Trump’ About Him & Barron That Melania’s Team Called ‘Insensitive’

Real Madrid va sin Casemiro ¿por qué la ausencia del brasileño es un problema para Zidane?

5.8 magnitude earthquake rattles central California

More than 2 million sign ‘Justice For Elijah McClain’ petition nearly a year after his death

Phillip Schofield clashes with Lady Colin Campbell in cringeworthy interview about Harry and Meghan book

TRUMP CARD Big Brother viewers are in awe as Donald Trump’s ex-wife Ivana makes surprise entry into the house

Wetherspoons secures loan from the Coronavirus Business Interruption scheme

L.A. Councilman Jose Huizar faces federal charges in ‘pay-to-play’ corruption probe

Business intelligence Solutions

Business Intelligence Tool Singapore

0 notes

Photo

Some people turn to off-track horse betting, while others may try their hand at scratch-offs or other state lottery products. No, the greater issue is the underlying psychology of addiction as it relates to gambling. If you or a loved one has a gambling addiction, please visit the our office and call us today at 908-795-8412.

#NJ Bankruptcy Planning Services#Personal Bankruptcy Attorney Morristown#Chapter 7 Bankruptcy Attorney Morris County#Chapter 11 Personal Bankruptcy Morristown#Personal Bankruptcy Lawyer In Morris County#Morristown Bankruptcy Attorney

0 notes

Link

Butte County prosecutors have collected equipment from several additional towers along the Pacific Gas and Electric Co. power line suspected of starting last year’s deadly Camp Fire, a sign that the county’s criminal investigation into the historic disaster is progressing. An attorney for PG&E told lawyers representing wildfire victims and others on Monday that the company had “recently assisted” local prosecutors in their collection of parts from four towers along the high-voltage Caribou-Palermo transmission line. He said the Butte County district attorney’s office wanted to have the Federal Bureau of Investigation test on cross-arm sections and suspension hooks from those towers — which appears to be the same kind of equipment that malfunctioned on another Caribou-Palermo tower right at the origin point of the Camp Fire. PG&E has admitted the state probably will find it responsible for the inferno, California’s deadliest and most destructive wildfire to date. The company’s mounting liabilities from that disaster and 2017 blazes prompted it to file for bankruptcy protection in January. The evidence collection along additional transmission towers, revealed in a Bankruptcy Court filing on Tuesday, could indicate that local prosecutors are digging into PG&E’s maintenance of the overall line as they consider criminal charges against the utility, said Millbrae lawyer Dario de Ghetaldi. “There’s a lot of possibilities, but one of them is that they identified other components that were about to or likely to fail,” de Ghetaldi said. “They knew that there were problems with that line before the fire. They knew there were problems with that component before the fire.” Dario de Ghetaldi, an attorney representing wildfire victims, was the first to call attention to the Butte County District Attorney’s widening investigation. Photo: Jeff Chiu / Associated Press PG&E is already on probation because of criminal convictions arising from the 2010 San Bruno pipeline explosion. A federal judge recently expanded the probation terms by imposing several new wildfire-prevention requirements on the utility. De Ghetaldi, whose clients include Camp Fire victims, said in another Bankruptcy Court hearing last week that a Butte County grand jury was investigating potential criminal actions against PG&E. Butte County District Attorney Michael Ramsey would not confirm or deny the existence of a grand jury. But his office, working with state prosecutors and the California Department of Forestry and Fire Protection, has been conducting a criminal investigation since shortly after the Camp Fire started, Ramsey said. “It’s plodding along,” he told The Chronicle on Wednesday. “We’re taking it step-by-step. We’re putting a lot of resources into this.” Criminal charges linked to the Camp Fire could worsen PG&E’s position as it negotiates its future with creditors, regulators and legislators. Photo: Gabrielle Lurie / The Chronicle 2018 PG&E spokesman James Noonan said in an email that the cause of the Camp Fire was still under investigation and “any related inquiries should be directed to the appropriate agencies.” PG&E acknowledged in February that it had turned off the entire 56-mile Caribou-Palermo line after the company found repairs that “required action.” After learning about the recent transmission line collections from PG&E attorney Kevin Orsini, attorneys for insurance companies with claims against the utility raced to Bankruptcy Court. The insurers’ lawyers wanted to delay shipment of the evidence to the FBI’s laboratory in Quantico, Va., hoping to inspect the equipment themselves or at least require PG&E to look at it and report back to them. They were concerned that the evidence could be out of their reach — and of people who lost homes in the Camp Fire — for too long. Orsini had told the attorneys that Butte County wanted the FBI to conduct “partially destructive” testing on the recently collected equipment — in addition to cross arms and suspension hooks from the tower by the Camp Fire origin point that Cal Fire has possessed since November. Related Stories CALIFORNIA WILDFIRES BY EVAN SERNOFFSKY AND ROLAND LI Still no cause released for Camp Fire, California’s most... CALIFORNIA WILDFIRES BY MEGAN CASSIDY, JOAQUIN PALOMINO AND PETER FIMRITE Camp Fire 911 calls: As flames raced in, residents were told... BIZ & TECH BY J.D. MORRIS Lawyer: Butte County grand jury considering criminal charges... CALIFORNIA WILDFIRES BY JOEL ROSENBLATT Lawyers open marketing blitz to enlist victims of Camp Fire CALIFORNIA WILDFIRES BY KEVIN FAGAN, JILL TUCKER AND ASHLEY MCBRIDE Camp Fire: What we know about the deadly blaze that destroyed... CALIFORNIA WILDFIRES BY J.D. MORRIS Can PG&E survive the Camp Fire? CALIFORNIA WILDFIRES BY ROLAND LI Numerous PG&E employees saw flames soon after Camp Fire started BIZ & TECH BY J.D. MORRIS PG&E says it’s ‘probable’ its equipment started the Camp... Once the equipment was sent to the FBI lab, “it will not be available for any further examination for the foreseeable future,” Orsini said in the email. Butte County offered to let PG&E inspect the equipment on Wednesday and the company planned to do so, Orsini said. Yet PG&E decided not to accept Butte County’s offer after all in order not to have unequal access to the evidence, one of the company’s lawyers told U.S. Bankruptcy Judge Dennis Montali on Wednesday. Insurers asked Montali to order PG&E to attend the inspection and relay the information back. Deputy California Attorney General Nicholas Fogg told the judge that any delay could have “cascading effects” on other areas of the complex Camp Fire investigation. The attorney general’s office is partnering with local prosecutors in their investigation, according to Ramsey. While the insurers promised to move quickly, the state was wary of allowing any intrusion into the criminal investigation, and ultimately Montali was persuaded. “I can’t take the risk today of disrupting a criminal prosecution,” he said in deciding against the insurers. Ramsey would not “say one way or the other” whether the transmission tower equipment had already been sent by Wednesday afternoon. He said the investigation and processing of evidence was “confidential at this time.” J.D. Morris is a San Francisco Chronicle staff writer. Email: [email protected], Twitter: @thejdmorris J.D. Morris Follow J.D. on: thejdmorris J.D. Morris is a business reporter covering energy, including PG&E, Tesla and California’s clean power initiatives. Before joining The Chronicle, he was the Sonoma County government reporter for the Santa Rosa Press Democrat, where he was among the journalists awarded a Pulitzer Prize for their coverage of the 2017 North Bay wildfires. He was previously the casino industry reporter for the Las Vegas Sun. Raised in Monterey County and Bakersfield, he has a bachelor’s degree in rhetoric from UC Berkeley. Past Articles from this Author: New PG&E CEO could earn $6 million or more, plus $3 million signing bonus PG&E still has ‘troubling’ gaps in corporate safety efforts, consultant says Wildfires and PG&E: Newsom asks lawmakers to ‘get something big done’ Most Popular SF treasure ‘Beach Blanket Babylon’ to close after 45 years Sam’s Anchor Cafe, with 99 years on Tiburon’s waterfront, is set to reopen after a major remodel Is the Warriors’ dynasty coming to an end? It stands to reason Ballast Point Brewing cancels plans for San Francisco brewery San Francisco’s Dandelion Chocolate unveils a giant new factory in the Mission Maritime industry warns of harm from proposed Oakland A’s stadium A 1906 earthquake survivor that shows how San Francisco has changed

0 notes

Text

youtube

Morris County Bankruptcy Lawyers is here to educate you and offer the best possible outcome for your New Jersey foreclosure case. When a home is in the process of being repossessed by a bank or financial institution, it’s best to seek out professional advice on your NJ foreclosure from our attorney. Our foreclosure lawyers in New Jersey can help you so you don’t ruin your life.

Morris County Bankruptcy Lawyers

133 Washington St, Morristown, NJ 07960

(973) 219–6796

My Official Website: https://morriscountybankruptcylawyers.com/

Google Plus Listing: https://www.google.com/maps?cid=4635803748339354736

Our Other Links

foreclosure lawyers in new jersey: https://morriscountybankruptcylawyers.com/foreclosure-defense-attorney-morristown/

business bankruptcy near me: https://morriscountybankruptcylawyers.com/business-bankruptcy-services-nj/

bankruptcy chapter 7 new jersey: https://morriscountybankruptcylawyers.com/chapter-7-vs-chapter-13/

student lawyer nj: https://morriscountybankruptcylawyers.com/student-loan-attorney-nj/

Service We Offer

Bankruptcy Service

Lawyers

Chapter 7 bankruptcy

Chapter 13 bankruptcy

Debt Relief Agency

Bankruptcy

Foreclosure

Follow Us On

Facebook: https://www.facebook.com/Law-Office-of-William-Pegg-PC-107034754269330/

Twitter: https://twitter.com/LawyersMorris

Pinterest: https://www.pinterest.com/morriscountybankruptcylawyers/

0 notes

Photo

New Post has been published on https://www.stl.news/this-week-odd-news-stooges-hairdo-and-a-284b-bill/58557/

This week in odd news: 'Stooges' hairdo and a $284B bill

FALLS CHURCH, Va./December 30,2017(AP)(STL.News)— A suspect wearing a T-shirt emblazoned with “Trust Me” allegedly stole a car with an accomplice in Fairfax County, Virginia.

The Washington Post reports that the two suspects from Falls Church were arrested by police in the stolen car not long after the unlocked Honda Civic was taken as it warmed up.

Police say they also found several forged checks during the arrests.

The newspaper says Wilmer Lara Garcia has been charged with auto theft and two counts of forgery. Police say he was wearing the shirt that read “Trust Me.”

His accomplice was charged with auto theft.

FLORIDA MAN SAYS HE PUNCHED ATM FOR GIVING TOO MUCH CASH

COCOA, Fla/December 30,2017(AP)(STL.News)— A Florida man told investigators he punched an automatic teller machine because it gave him too much cash.

An arrest report says 23-year-old Michael Joseph Oleksik man caused about $5,000 in damage to an ATM at a Wells Fargo bank branch in Cocoa on Nov. 29. He was arrested Dec. 22 on a criminal mischief charge after bank officials decided to press charges.

Florida Today reports surveillance video captured Oleksik pummeling the touchscreen.

An arrest report says that Oleksik told a bank manager he was angry that the machine was giving him too much money and he didn’t know what to do because he was in a hurry for work. He apologized for causing damage.

Jail records don’t list a lawyer for Oleksik.

DEFINITION MISSION: A RHYMING LIMERICK FOR EACH ENGLISH WORD

One man’s joke has become his mission: to give each word a rhyming definition.

Chris Strolin was teasing English buffs in an online forum years ago when he said the dictionary would be greatly improved if definitions were written as five-line limericks. Then he decided to try it for real.

The Omnificent English Dictionary in Limerick Form — or OEDILF (OH-dilf) for short — has published more than 97,000 rhyming definitions since Strolin started the online dictionary in 2004. He expects to reach limerick No. 100,000 sometime in 2018.

Even with help from roughly 1,000 contributing writers, Strolin’s limerick dictionary is nowhere near finished. It currently ends in the Gs at the word “gizzard.”

Strolin hopes his grandchildren — or perhaps their kids — will finish the Zs.

WOMAN STUNNED TO FIND ELECTRIC BILL LISTED AS $284 BILLION

ERIE, Pa/December 30,2017(AP)(STL.News)— A Pennsylvania woman says she went online to check her electric bill and was stunned at the amount — more than $284 billion.

The Erie Times-News reports that Mary Horomanski said her eyes “just about popped out” of her head when she saw the amount. She suspected that her family had put up their Christmas lights wrong.

The silver lining was that she didn’t have to pay the full amount until November 2018 — only a $28,156 minimum payment was due for December.

Horomanski’s son contacted Penelac, her electric provider, who confirmed the error. Parent company First Energy said a decimal point was accidentally moved. Her new amount was quickly corrected to $284.46.

STYLIST ACCUSED OF GIVING MAN UNWANTED ‘STOOGES’ HAIRDO

MADISON, Wis/December 30,2017(AP)(STL.News)— Police in Madison, Wisconsin, arrested a hairstylist after he gave a customer a very unwanted Larry Fine hairdo.

Police spokesman Joel DeSpain says the 22-year-old victim told officers the stylist asked him to stop fidgeting and moving his head during the Friday haircut. The Wisconsin State Journal reports that DeSpain says the stylist then nicked the customer’s ear with his clippers before running them down the middle of the man’s head on their shortest attachment, “leaving him looking a bit like Larry from ‘The Three Stooges.'”

DeSpain says officers arrested the 46-year-old hairstylist, Khaled A. Shabani, who pleaded not guilty to disorderly conduct Wednesday. DeSpain says Shabani told officers it was an accident.

WOMAN ACCUSED OF TRYING TO SNORT COCAINE IN POLICE STATION

LEDYARD, Conn/December 30,2017(AP)(STL.News)— A woman has been accused of trying to snort cocaine inside a Connecticut police station while waiting to be booked on unrelated charges.

Police say Nicole Hunter was charged on Christmas Day with possession of narcotics, interfering with an officer and disorderly conduct.

Police had arrested Hunter after a confrontation at her home in Ledyard while investigating a report of an erratic driver. They say the vehicle involved matched the one in Hunter’s driveway.

Police say Hunter was in a waiting area of the police station when she pulled cocaine wrapped in paper from inside her clothing and tried to snort it.

Hunter doesn’t have a listed phone number and can’t be reached for comment. She’s due in court Jan. 8.

ANTI-GAMBLING CRUSADER WINS $25K IN GAMING SWEEPSTAKES

CHICAGO/December 30,2017(AP)(STL.News)— A suburban Chicago woman who has crusaded against gambling for decades has won $25,000 by playing a sweepstakes game at a gambling cafe.

Kathy Gilroy tells the Chicago Tribune that while it’s ironic she won the sweepstakes, the distinction is that she didn’t spend her own money to gamble.

Gilroy has said gambling can lead to addiction, bankruptcy, crime and suicide. She helped shut down a $1.6 million Queen of Hearts raffle put on by the Veterans of Foreign Wars post in rural Morris this year until the raffle was properly licensed.

Gilroy says she’s participated in other sweepstakes and won prizes, including electronics and trips to the Bahamas and California. She says she enters sweepstakes because they’re made available free of charge under state law.

POLICE: WOMAN RUINED $300K WORTH OF ART ON DATE WITH LAWYER

HOUSTON/December 30,2017(AP)(STL.News)— Authorities say an intoxicated Dallas woman on a first date with a prominent Houston trial lawyer caused at least $300,000 in damage to his art collection, including two Andy Warhol paintings.

Lindy Lou Layman was arrested Saturday on criminal mischief charges after her date with Anthony Buzbee. She was released on $30,000 bond. Online court records don’t list an attorney for her.

Prosecutors say Buzbee told investigators that the 29-year-old Layman got too intoxicated on their date, so he called her an Uber after they returned to his home. She allegedly refused to leave and hid inside the home, and that when Buzbee found her and called a second Uber, she got aggressive.

Authorities say she tore down several paintings and poured red wine on some, and she threw two $20,000 sculptures.

The damaged Warhol paintings were each valued at $500,000.

HEARTWARMINGLY ICY: DESPITE MINUS 34 TEMP, COUPLE GET ENGAGED

SARGENT’S PURCHASE, N.H/December 30,2017(AP)(STL.News) — A New Hampshire man hasn’t let an extreme cold get in the way of a heartwarming proposal.

WMUR-TV reports that 31-year-old Josh Darnell, of Londonderry, dropped to his knee and popped the question after climbing Tuckerman’s Ravine on Thursday, the same day it hit minus 34 (-37 Celsius) on Mount Washington.

There’s a happy ending: twenty-seven-year-old Rachel Raske (RASS’-kee), of Lowell, Massachusetts, said yes.

Raske tells WMUR that Darnell had hiked Tuckerman’s Ravine last summer with his dad and had been planning to pop the question there ever since.

MAN CHARGED WITH SNEAKING INTO HOME TO TRY TO STEAL UNDIES

WASHINGTON, Mo/December 30,2017(AP)(STL.News)— Police say an eastern Missouri man told officers he has an “underwear fetish” and admitted to sneaking into a home to try to steal a pair.

The St. Louis Post- Dispatch reports that 34-year-old Cody Hassler, of Washington, Missouri, was charged Wednesday with first-degree burglary, first-degree stalking and stealing. No attorney is listed in online court records. Bond is set at $75,000.

Police say Hassler admitted to sneaking into the house through an unlocked basement door in October while a mother and her teenage daughter were sleeping and taking a pair of underwear from the laundry room.

The teenager awoke when she heard footsteps and police were called. Officers found a pair of underwear that apparently had been dropped when the suspect fled. Hassler also admitted to looking through bedroom windows.

BURNT BAGEL BLAMED FOR ST. LOUIS AIRPORT EVACUATION

ST. LOUIS/December 30,2017(AP)(STL.News)— A burnt bagel is being blamed for the evacuation of a terminal at Lambert Airport in St. Louis.

Airport officials say a bagel burned in a restaurant in Terminal 2 around 6 p.m. Tuesday, setting off smoke detectors and prompting a full evacuation. An estimated 300 to 400 people were required to go outside, where the temperature was 11 degrees.

The airport says the evacuation lasted only about five minutes, but passengers had to go back through security checks once they re-entered the building. No flight delays were reported.

A COUGAR IN YOUR LUGGAGE? HUNTING CARCASS FOUND AT AIRPORT

LAS VEGAS/December 30,2017(AP)(STL.News)Police say a hunter’s trip home hit a snag in Las Vegas after security screeners found a dead cougar in his luggage.

No crime was committed because the man had a hunting tag. But police Lt. David Gordon told the Las Vegas Review-Journal that Transportation Security Administration agents held the man at McCarran International Airport late Tuesday to confirm the validity of the Utah hunting tag.

His name and where he was headed weren’t released.

Airport spokeswoman Melissa Nunnery says the man ended up shipping the cougar carcass home, not on the airplane.

Gordon says it’s not a crime to transport legally possessed game on an airline flight. But he says airlines can refuse to transport certain items.

LIFELONG BEST FRIENDS DISCOVER THEY’RE ACTUALLY BROTHERS

HONOLULU/December 30,2017(AP)(STL.News)— Two Hawaii men who grew up as best friends have recently learned that they’re actually brothers.

Alan Robinson and Walter Macfarlane have been friends for 60 years. Born in Hawaii 15 months apart, they met in the sixth grade and played football together at a Honolulu prep school.

Macfarlane never knew his father. Robinson was adopted.

Honolulu news station KHON-TV reports that the men learned they’re related through a family history and DNA website. They revealed the discovery Saturday.

Macfarlane’s daughter, Cindy Macfarlane-Flores, says when they started digging into answers about his family history, a top DNA match was someone with the username Robi737.

Robinson’s nickname was “Robi” and he flew 737s for Aloha Airlines.

They plan to travel and enjoy retirement together.

Robinson says it’s the best Christmas present.

By Associated Press, published on STL.NEWS by St. Louis Media, LLC (TM)

0 notes

Text

When a Debtor is Living on Credit: Discharging Recent Credit Card Debt!

Dischargeable vs. Non-Dischargeable Debt

When you file a consumer bankruptcy case – Chapter 7 or Chapter 13 - most debts are discharged. You never have to pay a discharged debt. Some debts, however, are not discharged. These include -

Debts protected by law.

Congress has determined that some debts should not be discharged in bankruptcy or can be discharged only with certain conditions.

For example, spousal support, alimony, and child support cannot be discharged.

In most cases, student loans cannot be discharged.

Finally, if you have not filed your tax returns, your unpaid income taxes cannot be discharged. If you have filed, you must wait at least three years to discharge the tax due.

Reaffirmed Debts.

Some debtors exclude debts from discharge. This is done by reaffirming the debt. If you sign a “reaffirmation agreement” and the court approves it, your “reaffirmed” debt is not discharged. Many debtors reaffirm their secured debts.

For example, if you own a car and have a car loan, you might choose to keep the car and the debt. In that case, you reaffirm your auto loan, keep your car, and continue to pay the lender.

Debts Obtained Through Fraud.

If you acquire debt by giving false information on the loan application or giving a false promise to pay, the creditor can object to discharge.

This situation gives rise to a question about the dischargeability of recent credit card purchases. As you will see, debt incurred to pay for “reasonably necessary” expenses is almost always dischargeable. In contrast, debt incurred for “luxury goods and services” or significant “cash advances” may not be dischargeable.

The Fraud Exception to Discharge.

Federal law states a creditor can object to discharge of a particular debt if it was “obtained by . . . false pretenses, false representation, or actual

fraud . . .” See 11 U.S.C. §523(a)(2) of the Bankruptcy Code.

A fundamental principle of bankruptcy law is that debtors are good people who need assistance. Therefore, you cannot cheat a creditor and then ask a court to cancel your debt to that creditor. You must act in good faith, and you must have intended to repay the debt when you incurred it. If you did not intend to repay, you might be accused of obtaining credit through fraud.

The Legal Presumption of Fraud?

The legal presumption of fraud makes it easy for a creditor to prove that your debt should not be discharged. If the presumption exists, the court will “presume” you committed fraud and incurred a debt you did not intend to repay.

First, a little theory -

The “presumption of fraud” is a legal concept that relies on the belief that a debtor on the verge of bankruptcy knows he or she cannot repay new debt. If that person borrowers knowing they cannot repay, they probably never intended to repay. Therefore, they must have intended to get money or goods, discharge the debt in bankruptcy, and never have to pay the creditor. That’s a fraud!

There are two circumstances where the presumption of fraud arises:

1. If, in the 90 days before filing bankruptcy, you buy more than $650 of “luxury goods or services,” the debt is presumed to be non-dischargeable. Using the presumption of fraud, the creditor doe not need to prove your intention. Instead, the court will presume you did not intend to repay the debt.

Did you use a credit card to put a down payment on a luxury Jaguar automobile?

If you did that within 90 days of filing bankruptcy, the court will presume you did not intend to repay the credit card issuer, and it would not discharge your obligation.

This presumption of fraud only applies to the purchase of “luxury goods or services.” Regrettably, Congress defined “luxury goods or services” broadly, and the phrase includes everything except goods or services “reasonably necessary for the support or maintenance of the debtor or a dependent of the debtor.” See 11 U.S.C. §523(a)(2). Fortunately, groceries and gas are “reasonably necessary” expenses. And debts incurred to buy these necessities can be discharged even if the debt is incurred during the 90 days before bankruptcy.

2. The “cash advance” presumption of fraud is very similar to the “luxury goods and services” presumption. It states: If a consumer incurs a debt of more than $925 through one or more cash advances made in the 70 days before filing the bankruptcy, that debt is presumed to be non-dischargeable. The creditor needs only to establish that you made more than $925 in cash advances during the 70 days before filing for bankruptcy for the presumption to apply. 11 U.S.C. §523(a)(2).

If a Presumption of Fraud Applies, Can You Overcome It?

You can rebut the presumption of fraud by demonstrating to the bankruptcy judge that YOU truly intended to repay the debt. Your direct testimony that you intended to repay debt along with evidence that something unexpected forced you to file bankruptcy after the luxury purchase or cash advance, can rebut the presumption.

How Does a Creditor Assert a Claim of Fraud?

A creditor must formally object to the discharge of any debt it thinks you incurred fraudulently. Without a formal objection by the creditor, the debt will be discharged. The creditor’s objection must be in an adversary proceeding. An adversary proceeding is a separate lawsuit filed at the bankruptcy court.

The creditor must provide evidence proving your alleged fraud or misrepresentation. But the presumption of fraud makes it easy. The creditor does not need direct evidence of fraud and can win just by showing you made a luxury purchase or significant cash advance during the presumption period.

Without the presumption of fraud, a creditor would need to present convincing evidence that you did not intend to pay the debt. This evidence involves your state of mind and is hard to prove. Therefore, creditors are not likely to challenge purchases and cash advances made before the 70-day and 90-day presumption periods.

How Can a Debtor Avoid the Presumption of Fraud?

You can avoid giving a creditor the advantage of the presumption of fraud. First, don’t use any credit or make cash advances during the prohibited period. If you have made purchases or cash advances, delay filing bankruptcy until time has passed beyond the 70 and 90-day presumption periods.

When you meet with Ernest G. Ianetti, Esq., we'll discuss your financial situation and how bankruptcy can help you get relief and get out of debt. We'll carefully review your recent expenditures to ensure your debts are dischargeable and that there is no issue concerning fraud.

At the Law Office of Ernest G. Ianetti, Esq., we take pride in assisting our clients to achieve the best outcomes.

The Law Firm of Ernest G. Ianetti, Esq. has over 30 years of professional experience. If you are considering Chapter 7 bankruptcy, we can help you. We’ll work with you, the trustee, and your creditors to insure your Chapter 7 case succeeds and you keep your property. To schedule a FREE Consultation, click here.

*The code references are to 11 U.S.C. (Title 11 of the United States Code).

Ready For A Consultation?

This website and its contents are attorney advertising. The information and materials offered on this site are for general informational purposes only, do not constitute and should not be considered legal advice, and are presented without any representation or warranty whatsoever, including as to the accuracy or completeness of the information. No one should, or is entitled to, rely in any manner on any of the information at this site. Parties seeking advice should consult with legal counsel familiar with their particular circumstances. Communication with the law firm through this website does not create an attorney client relationship. The law firm is a debt relief agency. We help people file for bankruptcy under the United States Code.

#Chapter 7 Bankruptcy Expemptions#Morris County Chapter 7 Attorney#Rockaway Chapter 7 Attorney#Bankruptcy

1 note

·

View note

Link

LISTEN TO TLR’S LATEST PODCAST:

By Luke Rosiak

Devout Muslims who called the police on their own relatives — who work as Democratic House IT staffers — are disgusted by Rep. Gregory Meeks being “hesitant to believe” the charges against them, with Meeks saying the allegations may have stemmed from Islamophobia.

The New York Democrat’s IT staffer Hina Alvi and her husband, Imran Awan, have been banned from Congress by Capitol Police, suspecting them of criminal violations of network security in relation to congressional data. Imran’s brothers Abid and Jamal were also on the House payroll as IT workers and have been banned.

But “I have seen no evidence that they were doing anything that was nefarious,” Meeks told Politico March 1.

On March 8, The Daily Caller News Foundation’s Investigative Group published a Fairfax County, Va., police report showing in January, Imran’s stepmother called the police and said the brothers were controlling her.

The stepmom and a relative said the brothers were holding her “captive,” wiretapping her, and threatening to have loved ones abducted in Pakistan unless she helped the brothers access large sums of cash stored overseas in their father’s name.

TheDCNF provided the police report and news story to Meeks spokesman Jordan Morris and asked if that changed his opinion on “nefarious” behavior. But after receiving the materials, Meeks’ office simply ignored the development and would not take any further calls from TheDCNF.

The stepmom, Samina Ashraf Gilani, and one of her relatives reached out to TheDCNF after seeing Meeks’ comments.

“I would like to please to mention that if some Congress members are saying they are being picked on because they are Muslim, it’s a joke. I’m an immigrant, too. They’re not being picked on because they’re Muslim, they’re being investigated because they did something wrong,” said the relative, who requested anonymity.

Politico wrote “Meeks said he was hesitant to believe the accusations against Alvi, Imran Awan and the three other staffers, saying their background as Muslim Americans, some with ties to Pakistan, could make them easy targets for false charges. ‘I wanted to be sure individuals are not being singled out because of their nationalities or their religion,’” it quoted Meeks.

The Pakistani relative said, “That’s a completely insane statement, it has nothing to do with their being Muslim, they are bad people. What they have done to their mother, their father–I don’t want to use this word but I’m ashamed. Who could defend that?”

Gilani spoke with TheDCNF Saturday and said, “My stepchildren captivated me in house for a long time … They did not let me see and meet with my husband and captivated me in house and even after a police call done by me they did not let me meet him until my husband died. I am helpless and homeless because stepsons threatened me so much so I was compelled to leave.”

She said after the father died Jan. 16, she learned that Abid had switched his life insurance beneficiary from her name to his a month prior. She has fled from the brothers and filed a second complaint with Fairfax County alleging insurance fraud and detailing the brothers’ attempts to control her.

The relative — who is helping advocate for Gilani because her English is not good, and requested anonymity because of the brothers’ violent threats — said the brothers had assets overseas in their father’s name and needed her to access them. The police report says an “obviously upset” Abid waved an unsigned power of attorney document and “refused to disclose his father’s location.”

The relative said Gilani and other concerned relatives are devout Muslims with urgent concerns about the brothers’ capacity for violence and what they would do for money. “If they were real Muslims, they wouldn’t have treated their mother like this … If they would do this to their own mother for money, do you think they would not misuse their jobs in Congress?”

The suspects could read all emails sent and received by dozens of Democratic members of Congress.

Soon after Imran joined the payroll of Democratic Florida Rep. Debbie Wasserman Schultz in 2005, his two brothers and two of their wives, as well as a friend, appeared on the salary rosters of various House Democrats, making far more than most congressional IT guys and collecting a combined $4 million in House salary payments alone in recent years.

Jamal Awan was only 20 years old when he was placed in the role, and court documents show Imran and Abid were running a full-time car dealership during the same time.

The car dealership took and did not repay a $100,000 loan from an Iraqi politician who has been tied to Hezbollah and is currently wanted by the Department of Justice. The millions of dollars seemed to disappear, and Abid declared bankruptcy listing $1 million in liabilities while he had access to valuable congressional data.

Democratic Rep. Marcia Fudge of Ohio told Politico she has not fired Imran because “He needs to have a hearing. Due process is very simple. You don’t fire someone until you talk to them.” Spokeswoman Lauren Williams did not return a call from TheDCNF about whether Fudge was aware of the stepmother’s allegations, or whether she had found time to talk with Imran in the three weeks since.

Meeks, on the other hand, simultaneously fired Alvi, calling it a “distraction,” while also defending her. Meeks told Politico: “They had provided great service for me. And there were certain times in which they had permission by me, if it was Hina or someone else, to access some of my data.”

Only Alvi had a recent employment relationship with Meeks, and his spokesman would not explain why he implied someone not on his staff might be accessing his data.

A former House central IT staffer said Imran pressured central IT to give him high-level access and obscure the paper trail, and that members’ IT staffers can access any file on that member’s computer.

Follow Luke on Twitter. Send tips to [email protected].

Click here for reuse options!

Copyright 2017 Daily Caller News Foundation

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact [email protected].

WATCH TLR’S LATEST VIDEO:

The post House Democrat Dismisses Muslim Woman’s Charge Against His Muslim Staffer, Citing Islamophobia appeared first on The Libertarian Republic.

via Headline News – The Libertarian Republic

0 notes

Video

youtube

If you’re considering filing for Chapter 7 or 13 bankruptcy, you probably have lots of questions. Instead of muddling through generic answers on the internet, turn to The Law Offices Of William Pegg, PC for reliable legal counsel. At Morris County Bankruptcy Lawyers, our debt relief services are sure to help! Whether you are a person or homeowner in need of counsel or in need of business bankruptcy services, trust attorney Pegg. Our New Jersey bankruptcy lawyer and law firm can help you get back on the road to financial freedom!

Morris County Bankruptcy Lawyers

133 Washington St, Morristown, NJ 07960

(973) 219–6796

My Official Website: https://morriscountybankruptcylawyers.com/

Google Plus Listing: https://www.google.com/maps?cid=4635803748339354736

Our Other Links

business bankruptcy near me: https://morriscountybankruptcylawyers.com/business-bankruptcy-services-nj/

bankruptcy chapter 7 new jersey: https://morriscountybankruptcylawyers.com/chapter-7-vs-chapter-13/

foreclosure lawyers in new jersey: https://morriscountybankruptcylawyers.com/foreclosure-defense-attorney-morristown/

student lawyer nj: https://morriscountybankruptcylawyers.com/student-loan-attorney-nj/

Service We Offer

Bankruptcy Service

Lawyers

Chapter 7 bankruptcy

Chapter 13 bankruptcy

Debt Relief Agency

Bankruptcy

Foreclosure

Follow Us On

Facebook: https://www.facebook.com/Law-Office-of-William-Pegg-PC-107034754269330/

Twitter: https://twitter.com/LawyersMorris

Pinterest: https://www.pinterest.com/morriscountybankruptcylawyers/

1 note

·

View note