#Installment Agreement IRS Form

Text

Happy birthday to Lucy Orion "Rion" Forge!

Today is her -501st birthday!

Rion was born on Earth to Laine and John Forge. John Forge was enlisted in the UNSC Marine Corps and was rarely home, leading to resentment and a strained marriage with Laine. Although his marriage was souring, he maintained a close relationship with Rion, leading her to idolize her father, which damaged her relationship to her mother.

Her father had been stationed aboard the UNSC Spirit of Fire, which was declared "lost with all hands" in 2531, though the ship was actually missing rather than lost. Rion, like most of the crew's families, did not believe the UNSC's account, and her growing distrust led her to a career as a salvager, with the intention of commandeering a ship to search for her father.

Rion would prove to be an excellent salvager with a good reputation. She became the captain of a modified transport ship named the Ace of Spades after the playing card her father wore on his armor's pauldron, and put together a small ragtag crew.

Their travels would lead them to the Forerunner installation known as Trove--the place where her father gave his life to keep the planet's armament out of Covenant hands. Trove was still surrounded by a debris field, which included the destroyed Covenant ship Radiant Perception. She recovered a damaged Forerunner AI known as "Little Bit", who was able to offer them more information about Spirit's last location via a log buoy onboard the Perception. She and her crew were able to uncover the location of a Forerunner luminary which would give them unfettered access to location of Forerunner relics, but not without invoking the ire of the Office of Navel Intelligence, who wanted Little Bit, and ex-Covenant Sangheili Commander Gek 'Lar, who had also been in pursuit of the log buoy. 'Lar killed Rion's crew member and romantic partner Cade McDonough, and she swore to take vengeance on him.

ONI grounded and detained the crew, taking Little Bit and raiding Ace, erasing many of its star maps. Having to start anew, the crew reconvened and followed the same trail that ONI was on, leading them to a uninhabited planet called Geranos-a. Little did they know, the recovered Forerunner monitor 343 Guilty Spark was on the planet, having crashed there after taking control of the UNSC Rubicon, where he was being held and interrogated. He took the form of a Forerunner armiger, which gave him greater offensive capabilities. Thinking Spark was salvage, Rion and her crew brought him onboard, leading to a much greater-stakes mission.

Spark eventually revealed himself to the crew and told them of his history--that he was an ancient human named Chakas whose consciousness was turned into a Forerunner monitor in service to the Librarian. Though Rion did not entirely believe him at first, she could not deny his far superior technological abilities in the face of being impaired by ONI. Spark agreed to assist her in her search for her father if they traveled to Earth to a Forerunner facility where he could interface with the Librarian, which required a Reclaimer to access.

Upon reaching Earth, the crew was pursued by ONI, but were able to reach the Forerunner facility, where Spark was disappointed to find only further instructions from the Librarian, something he resented but ultimately accepted. Rion also encountered the Librarian, and felt the familiar draw towards her that all humans possess. Their agreement met, Spark shared the truth of John Forge's fate with Rion, something he had known the entire time. Though initially furious, Rion and Spark made amends, and, emboldened by her father's sacrifice, and with nowhere else to go, she agreed to help Spark complete his assignment from the Librarian. She also gave 'Lar's location to ONI, letting them pursue him for her.

While still fleeing ONI, Rion and the Ace crew helped Spark uncover the location of Bastion--the deeply hidden shield world containing the Librarian's laboratory. During these missions, Rion experienced vivid dreams where she spoke to the Librarian, closely mirroring the experiences that Chakas went through thousands of years before. Sensing danger when Cortana entered the domain, Bastion went into slipspace to avoid falling into Created hands. It was there that Spark learned the Librarian's intentions for him: he would be the caretaker of Bastion and the Precursor specimens that the Librarian had gathered with the intention of atoning for the Forerunner's eradication of their parent species. His mission completed, Spark and Rion parted ways, but not without upgrading the Ace of Spades with Forerunner technology and equipping it with a recovered fragment of Little Bit, making Ace one of the most technologically-advanced ships in the galaxy.

In canon (~2560), she is turning 36!

#halopedia has not updated any of the ace of spades trilogy so all of this is coming at you live from what i know and remember#plus skimming this entire damn trilogy#rion forge#343 guilty spark#halo lore

18 notes

·

View notes

Text

An Overview of Yu-Gi-Oh! Fans, Represented by Card Types

The “Standard Card” fans; the “I Really Love Yu-Gi-Oh but Only a Specific Series” type of fans. Though the incarnation of Yu-Gi-Oh that they like may vary, they tend to stick to their preferred one and don’t typically ventures into the others. The type of fans who regularly post oneshots about and have a blog dedicated to their favorite incarnation of the series. Is bar none the most reliable of all the fan types for steady content.

The “Equip Spell” fans; the “I Didn’t Expect to Love Yu-Gi-Oh as Much as I Do, but I Took a Chance and Now I’m Obsessed” type of fans. Tend to dabble in most, if not every, incarnation of the franchise, and will devote the entirety of their heart and soul to said series… but it’s only temporary until another anime comes along to steal their heart. The type of fans who start a flurry of well-written, long-term fanfics while in the throws of their obsession, and then leave you off on a cliffhanger chapter, never to update again, because they’ve moved onto a new fandom.

The “Field Spell” fans; the “I Never Thought My Mind Would Turn into a Mess Because of a Card Game Show” type of fans. Similar to their sister fan, the “Equip Spell” in terms of obsession, except the brainrot goes deeper and is long-lasting. Tends to comb through most — if not all — installments of the franchise with a keen eye and analyze even the most minuscule of details in the shows because they weren’t expecting Yu-Gi-Oh to be so deep and now they can’t unsee it. The type of fans who write detailed essays and spontaneously start talking about the surprising intricacies of The Card Game Show to anyone who will listen. Likely to liveblog when watching. Also likely to post a slew of headcanons and observations while doing so. Often makes great content, but sometimes needs time off to recharge their mind.

The “Quick-Play Spell” fans; the “I Got into Yu-Gi-Oh for the Sole Purpose of Sh!tting On It and Accidentally Ended Up Liking It” type of fans. Only started watching Yu-Gi-Oh to trash it just to discover that they unironically enjoy it, and now they have to find some way to explain that to their Anti-YGO friends. Can’t figure out how to justify themselves, so they eventually decide to keep trashing it. Has a blog dedicated to how much they hate this “stupid show” and all of its characters, but you can always sense a certain level of fondness under their supposed ire. The type of fans to make and reblog memes to poke fun at the franchise and preserve their dignity. Writes lots of fics but never shares them.

The “Counter Trap” fans; the “I Love Yu-Gi-Oh — Really, I Do — but…” type of fans. Antithesis of the “Quick-Play Spell” fans; while the latter claims to hate Yu-Gi-Oh but secretly loves it, the “Counter Trap” fan will claim to love Yu-Gi-Oh, but often seems to hate it. Never has many positive things to say, even about largely-agreed upon positive aspects of the series. Will find a way to critique everything, be it the new form of summoning mechanics or the clothing a character is wearing. Most definitely has a blog dedicated to Yu-Gi-Oh, filled with nothing but salt masquerading as “good natured fun”. Also likely to have an AO3 account where they post their ailments with the series rather than actual fanfics. The type of fans who goes on about how they’d rewrite things to make the shows better, never realizing their plot and changes are far more convoluted than those of the show they’re criticizing. Is constantly tacking “but…” onto the end of every supposed agreement, just to make sure you know they don’t actually agree. Updates their blogs and AO3 page regularly with new variations of old complaints. Ironically, the only indication that they might actually love Yu-Gi-Oh at all is the amount of time they dedicate to hating it.

The “Ritual Monster” fans; the “I Was a Big Fan as a Kid and Still Am” type of fan. Loves the franchise as a whole, and is unashamed to admit it. Is likely a huge fan of Duel Monsters and at least likes most of its incarnations (and even the ones they dislike, they still find pretty charming). Has a deep appreciation for the series not only because of nostalgia, but also because of its longevity. Is glad that Konami is still making new installments of the series, and touching new fans to this day. Still thinks 4Kids is a thing. Has a Yu-Gi-Oh blog, and mostly likes and reblogs the content of others. But when they decide to finally make a post of their own, it for some reason blows up and now they’re famous. The type of fans who will recount with tears in their eyes the experience of first watching the Final Duel between Yami and Yugi in DM. 100% still has the cards they bought when they were a child.

The “Fusion Monster” fans; the “Yu-Gi-Oh Helped Me Through a Tough Time and I Love It for That” type of fan. Used to be ashamed of expressing their love for the franchise, before eventually getting to to the “screw it” point and buying some article of clothing with a Yu-Gi-Oh-related image on it. Knows not everyone will get their love for the series and no longer cares. Proudly posts fanfics overflowing with love for the series’ characters… and self-deprecating author notes. Usually has one installment that they deeply care about, and finds some of the others enjoyable. Definitely hates at least one of the installments, however — usually the one that contrasts their favorite incarnation the most. Doesn’t know anything about the irl card game, but can go into depth about why their favorite characters are amazing. The type of fans that Konami should really hire, tbh, because they’re a perfect fusion of passion and critique.

The “Synchro Monster” fans; the “I Turned Yu-Gi-Oh on One Day Because I Had Some Spare Time, and Now I Don’t Want to Leave” type of fans. Has watched all the series in order, and is pleased to report they like the majority of them. Has a favorite, but will gush about each of them (you’ll still definitely be able to spot their fave, though, in the event they haven’t already told you). Won’t say that they dislike any of the installments outright, but generally seems to gear towards the the DM, GX, and 5D’s eras, if not the trifecta as a whole (also might like Arc-V). Often writes fics and essays, but doesn’t post them usually, so they mostly just read and leave comments on the former and like and reblog the latter from other content creators. Is interested in how everything “connects” both in the sphere of a solo series as well as across the greater narrative, hence why the DM-GX-5D’s trio are usually their favorite incarnations. The rational Yu-Gi-Oh fan, who has brainrot just like the others but still manages to stay sane and not let it completely take over their life… unless you happen to bring it up in their presence. The “mom friend”. Feels as if they have to be loyal to the franchise and is saddened at the thought of ever leaving it. The type of fans who you’ll come across on Pinterest with frequently-maintained, high-quality aesthetic boards dedicated to the franchise who you’re secretly wishing would post their fics and other content just to see what else they can do.

The “XYZ, Pendulum, and Link Monster” fans; the “I’m Inexplicably Into This Series So Now You All Have to Suffer for It and I Might as Well Get Internet Famous While I’m at It” type fans. Not always from the post-5D’s era, but usually. Has a blog of their own as well as a thousand others they follow. Are reblog fiends, and have most definitely scrolled through the Yu-Gi-Oh tag at three o’clock in the morning using a “borrowed” WiFi password. Is mad that everyone they know doesn’t get the magic of Yu-Gi-Oh, so they actively go out of their way to make it a part of their identity. Is determined to get something out of it prove they’re right and their haters are wrong, so they strive to get internet famous. The only way these types of fans differ, really, is in their method of trying to become internet famous. “XYZ Summon” fans will probably become YouTubers with a channel dedicated solely to Yu-Gi-Oh. “Pendulum Summon” fans are all about the fics and next-level cosplay posts on Instagram. And “Link Summon” fans choose to become memelords. All three tend to have one installment of the series that they will defend fiercely, one they will hate fiercely, and the rest they’re mostly apathetic towards. The type of fans that you have fun just sitting back and watching, because you never know what they’re going to do next.

And lastly, but certainly not least, there’s the “Continuous Trap” fans; the “I Got into Yu-Gi-Oh at Some Point in My Life and Keep Trying to Leave but It’s Got Its Hooks in Me and I Always Come Back” type of fans. This type needs no further explanation because this type is what all Yu-Gi-Oh fans secretly are, no matter which of the prior options they claim they are. Because, let’s face it. None of us are ever actually going to leave this card game hell.

#yugioh#ygo dm#ygo gx#ygo 5ds#ygo zexal#ygo arc v#ygo vrains#yes all of these have a connection with the type of card they’re paired with#don’t mind me i’m just rambling#i would tag myself but i think my followers can already guess what i am#tag yourself

19 notes

·

View notes

Text

How to Resolve Unfiled Tax Returns

Resolving Unfiled Tax Returns: A Comprehensive Guide

Introduction:

Unfiled tax returns can be a daunting issue for many individuals. Whether it's due to oversight, procrastination, or simply feeling overwhelmed by the process, failing to file taxes can lead to significant consequences. However, the good news is that resolving unfiled tax returns is entirely feasible with the right approach and guidance. In this comprehensive guide, we'll explore step-by-step strategies to address unfiled tax returns effectively, alleviate stress, and ensure compliance with tax obligations.

Body:

Assess the Situation: The first step in resolving unfiled tax returns is to assess the situation thoroughly. Gather all relevant financial documents, such as W-2 forms, 1099s, and any other income statements. Organize these documents chronologically to gain a clear understanding of the tax years that remain unfiled.

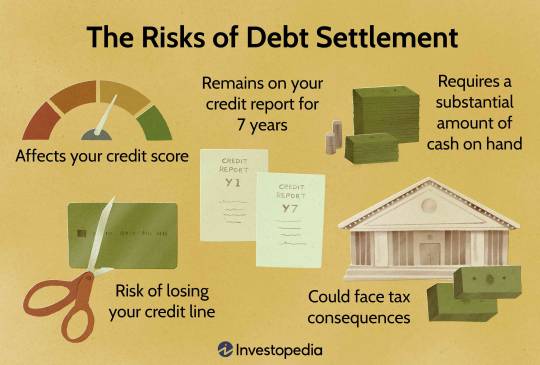

Understand the Consequences: It's essential to comprehend the potential consequences of failing to file tax returns. These may include monetary penalties, interest on unpaid taxes, and even legal repercussions such as wage garnishment or asset seizure. Understanding the severity of the situation can provide motivation to address unfiled tax returns promptly.

Seek Professional Assistance: Dealing with unfiled tax returns can be complex, especially if multiple years are involved or if there are additional complications such as self-employment income or investments. Consider enlisting the help of a qualified tax professional, such as a certified public accountant (CPA) or tax attorney. These professionals have the expertise and experience to navigate tax laws, negotiate with tax authorities, and develop a strategy tailored to your specific circumstances.

Gather Necessary Information: Before proceeding with filing overdue tax returns, ensure you have all the necessary information readily available. This includes income statements, expense records, and any relevant deductions or credits. If certain documents are missing or inaccessible, take proactive steps to obtain them from employers, financial institutions, or other sources.

File Overdue Tax Returns: Once you've gathered all the required information, it's time to file your overdue tax returns. Depending on the number of years unfiled and your individual situation, you may choose to prioritize the most recent tax years or address them chronologically. Be thorough and accurate when completing tax forms, and don't hesitate to seek clarification or assistance if needed.

Explore Available Options: If you're unable to pay the full amount of taxes owed, explore the available options for payment arrangements or tax relief programs. The IRS offers various payment plans, including installment agreements, which allow you to pay off your tax debt over time. Additionally, you may qualify for tax relief programs such as Offer in Compromise (OIC) or Currently Not Collectible (CNC) status, which can reduce or temporarily suspend your tax obligations based on financial hardship.

Address Penalties and Interest: In addition to the unpaid taxes, unfiled tax returns may incur penalties and interest. However, in certain circumstances, the IRS may be willing to abate or reduce these penalties, especially if you can demonstrate reasonable cause for your failure to file. Work with your tax professional to request penalty abatement or explore other options for mitigating additional charges.

Stay Compliant Going Forward: Resolving unfiled tax returns is only the first step. It's crucial to establish habits and systems to ensure compliance with your future tax obligations. Implementing good recordkeeping practices, staying organized throughout the year, and seeking timely assistance with tax matters can help prevent a recurrence of unfiled tax returns in the future.

Conclusion: Resolving unfiled tax returns may seem like a daunting task, but with the right approach and assistance, it's entirely manageable. By assessing the situation, seeking professional guidance, and taking proactive steps to address overdue tax returns, you can alleviate stress and ensure compliance with your tax obligations. Remember to explore available options for payment arrangements or tax relief programs if needed and to stay vigilant about staying compliant with your taxes in the future. With patience, diligence, and the right support, you can successfully navigate the process of resolving unfiled tax returns and regain peace of mind regarding your financial matters.

1 note

·

View note

Text

Navigating the IRS Fresh Start Program: A Guide to Tax Debt Relief

The Internal Revenue Service (IRS) offers Fresh Start Programmes to those with problems paying their overdue taxes. Tax debt, like any other kind of debt, can quickly spiral out of control. You must pay this year to pay next year, too.

To assist individuals in need, the IRS Fresh Start programs provide multiple opportunities to obtain a "fresh start" on their taxes. When trying to figure out what to do, the details are crucial.

What options does the IRS have for starting over?

To assist people and small businesses recover financially after falling into tax debt, the Internal Revenue Service (IRS) initiated several programmes in 2011 under the Fresh Start initiative. The IRS established Fresh Start to assist taxpayers in bouncing back from the Great Recession that began in 2008.

To assist small business owners in paying off their tax debts, the IRS Fresh Start programs offer a variety of mechanisms, including Offers in Compromise, Penalty Abatement, Installment Agreements, and Currently Not Collectible status. When taxpayers meet the requirements of these programmes, they may be able to lower their tax obligations, establish payment plans, have penalties waived, or even temporarily halt collection efforts.

By allowing taxpayers to pay off their tax obligations through the IRS Fresh Start program, taxpayers can avoid the harsher consequences of levies, liens, and even jail time. Since Fresh Start improves their chances of receiving a tax payment, the Internal Revenue Service (IRS) is pleased.

Who can apply to the New Beginnings programme, and when is the deadline?

You must have your current tax returns to be eligible for any of the IRS Fresh Start programs.

By taking care of things like missing classes and the following, you can make the Fresh Start application process go more smoothly:

• You want to know your options for settling your tax debt with a tax settlement agency, enrolled agent, certified public accountant, or tax attorney. A large number of these professionals offer complimentary first consultations.

• Gathering financial documents for each year of operation is a necessary step in preparing a business loan application.

• You are accessing and completing the appropriate forms available on the IRS website.

• Documents from the court system and medical records may be necessary to bolster tax abatement petitions.

• Rest assured that professionals can assist you in getting up to speed on your finances and locating deductions that can reduce your tax liability.

• They can put you in touch with one of our trustworthy partners, like 20/20 Tax Resolution if you require assistance with your tax problems. With their help, you can navigate the application process and get your questions answered. They will go so far as to represent you in dealings with the IRS.

People Pick the Fresh Start Programme for What Reasons?

A well-known example of an effective advertising vehicle is the IRS Fresh Start Programmes. There was an initial burst of press when the IRS revealed this programme, but tax resolution firms had been discussing it for years. It was just a revised process for handling tax disagreements. Since its introduction, there have been further enhancements that benefit the government's coffers.

Conclusion:

The IRS Fresh Start programs are for those who cannot pay their tax bills. Also, asking for help is okay; you shouldn't feel guilty about it. If you have any questions regarding eligibility or the process, it is advisable to seek the advice of a tax expert or attorney familiar with the IRS.

#tax relief services#tax debt relief#irs tax relief#irs fresh start programs#tax settlement services#free consultation tax attorney#irs penalty abatement

0 notes

Text

Update on IRS efforts to combat questionable Employee Retention Tax Credit claims

The Employee Retention Tax Credit (ERTC) was introduced back when COVID-19 temporarily closed many businesses. The credit provided cash that helped enable struggling businesses to retain employees. Even though the ERTC expired for most employers at the end of the third quarter of 2021, it could still be claimed on amended returns after that.

According to the IRS, it began receiving a deluge of “questionable” ERTC claims as some unscrupulous promotors asserted that large tax refunds could easily be obtained — even though there are stringent eligibility requirements. “We saw aggressive marketing around this credit, and well-intentioned businesses were misled into filing claims,” explained IRS Commissioner Danny Werfel.

Last year, in a series of actions, the IRS began cracking down on potentially fraudulent claims. They began with a moratorium on processing new ERTC claims submitted after September 14, 2023. Despite this, the IRS reports that it still has more than $1 billion in ETRC claims in process and they are receiving additional scrutiny.

Here’s an update of the other compliance efforts that may help your business if it submitted a problematic claim:

1. Voluntary Disclosure Program. Under this program, businesses can “pay back the money they received after filing ERTC claims in error,” the IRS explained. The deadline for applying is March 22, 2024. If the IRS accepts a business into the program, the employer will need to repay only 80% of the credit money it received. If the IRS paid interest on the employer’s ERTC, the employer doesn’t need to repay that interest and the IRS won’t charge penalties or interest on the repaid amounts.

The IRS chose the 80% repayment amount because many of the ERTC promoters charged a percentage fee that they collected at the time (or in advance) of the payment, so the recipients never received the full credit amount.

Employers that are unable to repay the required 80% may be considered for an installment agreement on a case-by-case basis, pending submission and review of an IRS form that requires disclosing a significant amount of financial information.

To be eligible for this program, the employer must provide the IRS with the name, address and phone number of anyone who advised or assisted them with their claims, and details about the services provided.

2. Special withdrawal program. If a business has a pending claim for which it has eligibility concerns, it can withdraw the claim. This program is also available to businesses that were paid money from the IRS for claims but haven’t cashed or deposited the refund checks. The tax agency reported that more than $167 million from pending applications had been withdrawn through mid-January.

Much-needed relief

Commissioner Werfel said the disclosure program “provides a much-needed option for employers who were pulled into these claims and now realize they shouldn’t have applied.”

In addition to the programs described above, the IRS has been sending letters to thousands of taxpayers notifying them their claims have been disallowed. These cases involve entities that didn’t exist or didn’t have employees on the payroll during the eligibility period, “meaning the businesses failed to meet the basic criteria” for the credit, the IRS stated. Another set of letters will soon be mailed to credit recipients who claimed an erroneous or excessive credit. They’ll be informed that the IRS will recapture the payments through normal collection procedures.

There’s an application form that employers must file to participate in the Voluntary Disclosure Program and procedures that must be followed for the withdrawal program. Other rules apply. Contact us for assistance or with questions.

© 2024

0 notes

Text

Getting Even with the IRS Resolution: Definition and Strategies

Mishandling your taxes can have dire consequences, especially if you need to catch up on your payments. The good news is that some professionals specialise in tax resolution and can assist you in overcoming your tax problems. Read on to find out what a tax IRS resolution is and the methods of effective tax resolution.

What is a Tax Resolution?

An outside tax IRS resolution firm can help you work out your tax debt with the Internal Revenue Service. The objective is to pay as little as possible in taxes. When someone has avoided paying back taxes to the IRS for a significant amount of time, they often find themselves needing tax resolution services. The IRS will contact your bank to file a tax lien or levy against your assets once they've had enough of waiting.

Methods for effective tax control

You are not alone if you owe the IRS money for unpaid taxes, interest, and penalties. Fortunately, there are tax experts available who have years of experience resolving tax issues and can guide you through this challenging time.

• Contract for Installments

Tax attorneys frequently use payment plans to settle client tax disputes. Rather than paying off the entire debt simultaneously, the taxpayer makes 72 equal payments throughout the payment plan. After receiving full payment, the IRS will release the federal tax lien.

• Payment Plan with Partial Payments

A partial payment instalment agreement is structured in the same way as a regular one. The key difference is that you only have to pay back your tax debt once the statute of limitations expires, typically 10 years. The result is a significant decrease in your regular payments. Unfortunately, the IRS will be reviewing your tax returns every two years. It is up to the IRS to decide whether or not to increase your payments if they determine that your income has increased significantly. Suppose your circumstances do not improve, and you still have an outstanding income tax liability when the statute of limitations expires. In that case, you will no longer be responsible for paying that debt.

• Not Collectible at present

Currently, Not Collectable is a powerful tool for resolving tax issues. The IRS will no longer try to collect any outstanding debt while you are in this status. The IRS resolution will look at the national minimum wage and cost of living standards to determine eligibility for this classification. They will stop trying to collect the debt if they verify that your costs have legitimately outpaced your earnings.

• Compromise Offer

Freelancers and entrepreneurs who made more money than expected the previous year often face a hefty tax bill come April. An "offer in compromise" helps many of these people out. Through this programme, taxpayers can settle their tax liability in full by paying a reduced amount, such as the full unadjusted tax liability.

• Submit Forms

Filing your taxes often eliminates your tax debt. This is because the IRS charges interest and penalties for late filing of estimated taxes. Submitting penalty abatement is the most common tax resolution method in this situation, resulting in the cancellation of penalties and interest.

Conclusion

Despite its complexity, the IRS resolution process is essential for resolving tax issues and discrepancies. Individuals and businesses can save time and effort when dealing with the IRS if they can access the right resources, such as cutting-edge software. Adopting these tools shortens the path to resolution and gives users the assurance they need to deal with any tax issues.

#tax resolution software#tax practice management software#irs transcripts#irs resolution#irs resolution software#irs solutions tax resolution software

0 notes

Text

WHAT IS AN IRS INSTALLMENT PLAN?

An IRS installment plan can take two forms: informal or formal. Under an informal arrangement, the taxpayer commits to monthly payments of an agreed-upon sum to clear the balance within two years. On the other hand, a formal installment agreement involves a written contract wherein the taxpayer pledges to make specified monthly payments, and the IRS agrees to accept them. While an informal agreement allows payment allocation, particularly towards the trust fund section of employment taxes, this flexibility doesn’t apply to a formal installment agreement.

WHAT IS THE MINIMUM MONTHLY PAYMENT FOR AN IRS TAX INSTALLMENT PLAN?

For balances ranging from $10,000 to $25,000, the minimum payment is determined by dividing the total amount due by 72. In most cases, IRS collection personnel are reasonable individuals. If an IRS collection employee adjusts a taxpayer’s installment payment at a sum that the taxpayer’s representative believes is too high, the representative can discuss the matter with the collection employee’s manager. If this doesn’t lead to a satisfactory resolution, the representative can take the issue to the IRS appeals office.

#INSTALLMENT PLAN#cpa accountant#cpa accounting#professional accounting#professional accountant#accountant

0 notes

Text

Installment Agreements for Tax Pros: IRS Form 9465 and Form 4

0 notes

Text

What You Need to Know About IRS Fresh Start Programs

If you have unpaid taxes and are having trouble finding the money to pay them, the IRS Fresh Start Programs can help. Tax debt, like other forms of debt, has the potential to spiral out of control. You won't be able to make your payments the following year if you have trouble making them this one.

The IRS offers several options for getting a "fresh start" on your taxes to help those in need.The specifics matter for determining the appropriate course of action.

What IRS fresh start programs?

In 2011, the Internal Revenue Service launched a series of programmes collectively known as the Fresh Start initiative to help individuals and small companies get back on track financially after incurring tax debt. Following the Great Recession that began in 2008, the Internal Revenue Service implemented Fresh Start to assist taxpayers in getting back on their feet.

Various mechanisms, such as Offers in Compromise, Penalty Abatement, Installment Agreements, and Currently Not Collectible status, are available through the Fresh Start programme to help small business owners pay off their tax debts. Taxpayers who qualify for these programmes can get their obligations reduced, set up payment plans, have penalties waived, or have collection efforts put on hold.

Taxpayers gain from the IRS Fresh Start programs because they can settle their tax debts without facing the more severe penalties of liens, levies, or even jail time. The Internal Revenue Service (IRS) is pleased by Fresh Start since it increases the likelihood that they will receive a tax payment.

When and where may you apply for the New Beginnings programme?

The IRS demands that you be up-to-date on all tax returns before considering you for any IRS Fresh Start programs.

You can streamline the application process for Fresh Start by doing things like catching up on your coursework and the following:

You are inquiring about your choices for getting out of tax debt with a tax attorney, enrolled agent, certified public accountant, or tax settlement agency. Many of these experts provide initial consultations at no cost to their clients.

Preparing an application for a business loan involves gathering financial documents for each year of operation.

Getting the necessary forms from the Internal Revenue Service's website and filling them out.

Tax abatement petitions may require supporting evidence such as court and medical documents.

If you need to catch up on your books, don't worry; experts can help you catch up quickly and identify deductions that will lower your tax bill.

If you need help resolving your tax issues, they can connect you with one of our reputable partners, such as 20/20 Tax Resolution. They will be able to guide you through the application process and handle any concerns you may have along the way. They will even act as your advocate with the IRS.

Why Do People Choose the Fresh Start Programme?

The IRS Fresh Start Programs are well-known because they are useful advertising vehicles. When the IRS first announced this initiative, it generated a flurry of news releases, and tax resolution companies had been discussing it for years. It was merely an updated procedure for settling tax disputes. After its introduction, more improvements that are favourable to the government's coffers have been made.

Conclusion:

If you have tax debt and you cannot pay it, the IRS Fresh Start Programs can help. In addition, you shouldn't feel bad about needing assistance. Consult a tax expert or attorney familiar with the IRS if you have questions about eligibility or how the process works.

0 notes

Text

Finding Financial Respite: The Power of IRS Tax Relief Programs

Dealing with tax issues can be a daunting and overwhelming experience for individuals and businesses alike. The complexities of the tax system and mounting financial burdens can lead to sleepless nights and uncertainty about the future. In times of financial distress, IRS Tax Orlando emerges as a trusted ally, offering a lifeline through a range of IRS tax relief programs. With a deep understanding of the tax landscape and a commitment to client success, IRS Tax Orlando paves the way to financial freedom for those facing tax challenges.

Life’s unpredictability can often lead to unforeseen circumstances, causing taxpayers to find themselves in challenging financial situations. Whether it’s unexpected medical expenses, loss of employment, or business setbacks, meeting tax obligations can become an overwhelming burden. IRS tax relief programs are designed to provide a lifeline for those struggling to pay their taxes, offering various avenues to resolve tax liabilities while easing financial hardships.

Expert Guidance: IRS Tax Orlando comprises a team of tax professionals who possess in-depth knowledge of tax laws, regulations, and IRS procedures. They offer personalized and expert guidance, assessing each client’s unique situation to determine the most suitable tax relief program.

Installment Agreements: For those unable to pay their tax debt in full, IRS Tax Orlando can negotiate installment agreements with the IRS. These structured payment plans allow taxpayers to settle their tax debt over an extended period, easing the financial burden.

Offer in Compromise: The Offer in Compromise program allows taxpayers to settle their tax debt for less than the total amount owed. IRS Tax Orlando can assist clients in preparing and submitting a compelling offer, increasing the likelihood of IRS acceptance.

Penalty Abatement: Taxpayers burdened with substantial penalties for late payment or non-filing can find relief through penalty abatement. IRS Tax Orlando can advocate on behalf of clients, requesting the IRS to reduce or eliminate penalties, helping clients regain financial stability.

Innocent Spouse Relief: In cases where one spouse bears the tax burden resulting from errors or omissions by the other spouse, innocent spouse relief can provide relief. IRS Tax Orlando helps clients navigate the eligibility criteria and assists in filing for this essential form of relief.

When faced with tax challenges, seeking professional help can make all the difference in regaining control of one’s financial future. IRS Tax Orlando emerges as a beacon of hope, guiding taxpayers through the complexities of the IRS tax relief programs. With personalized strategies, expert guidance, and a commitment to securing the best possible outcome for their clients, IRS Tax Orlando paves the way to financial freedom.

1 note

·

View note

Text

The Path to Tax Relief: A Practical Guide for Success

Achieve Tax Relief At Ease

Are you feeling overwhelmed by the burden of taxes in Stuart, FL? Don't worry, you're not alone. Many individuals and businesses struggle with the complexities of tax laws and find themselves drowning in a sea of paperwork and financial stress. But fear not! There is a solution that can provide much-needed relief – tax relief programs. In this practical guide, we will walk you through everything you need to know about achieving tax relief in Stuart, FL. From understanding the concept to assessing eligibility for various programs, we've got you covered. So let's dive right in and discover how you can ease your tax woes once and for all!

Understanding the Concept and Importance of Tax Relief

Understanding the concept and importance of tax relief is crucial for individuals and businesses in Stuart, FL. Tax relief refers to any program or strategy that helps reduce the amount of taxes owed or eases the burden of paying taxes. It aims to provide financial assistance and support to those who may be struggling with their tax obligations.

Tax relief programs can come in various forms, such as deductions, credits, exemptions, or even negotiated settlements with tax authorities. These programs are designed to alleviate the financial strain on taxpayers by lowering their overall tax liability.

The importance of tax relief cannot be overstated. For many individuals and businesses, taxes can be a significant expense that affects their cash flow and ability to meet other financial obligations. By utilizing appropriate tax relief options, taxpayers can effectively manage their finances and allocate resources where they are needed most.

Common Tax Relief Options Available

When it comes to tax relief, there are several options available for individuals and businesses in Stuart, FL. These options can help alleviate the burden of high taxes and provide some financial relief. Here are some common tax relief programs that you may consider:

Installment Agreements: Taxpayers can use this option to pay off their tax burden in manageable monthly installments spread out over a set length of time. It gives you more leeway to manage your payments and can relieve any burden on your finances right away.

Offer in Compromise (OIC): An offer in compromise (OIC) is an agreement between a taxpayer and the Internal Revenue Service (IRS) to settle a tax liability for a sum that is less than what is owed. This choice requires you to carefully evaluate your current financial circumstances, and you may need to seek the aid of a specialist.

Innocent Spouse Relief: If you filed a joint return with your spouse or former spouse who incorrectly reported their income or claimed improper deductions, innocent spouse relief may be an option for you.

Penalty Abatement: If you have been penalized by the IRS due to failure to file returns or late payments, penalty abatement can help reduce or eliminate those penalties.

Currently Not Collectible (CNC) Status: If you are facing significant financial hardship and cannot afford to pay your taxes at this time, CNC status suspends collection activities until your financial situation improves.

Tax Settlement Negotiation: Engaging a qualified Tax Accountant in Port St Lucie who specializes in negotiation with the IRS can help explore various settlement options based on your unique circumstances.

Remember that each individual's situation is different, so it's crucial to assess eligibility for these programs carefully before proceeding further.

Step-By-Step Guidance on How to Assess Eligibility For Tax Relief Programs

Step 1: Gather Your Financial Information

The first step in assessing your eligibility for tax relief programs is to gather all of your financial information. This includes documents such as W-2s, 1099s, and any other relevant tax forms. You will also need to collect documentation of any deductions or credits you may be eligible for.

Step 2: Review Your Income and Expenses

Once you have gathered all of your financial information, take some time to review your income and expenses. Look at how much money you made throughout the year and compare it to your expenses. This will give you a better understanding of your financial situation and help determine if you qualify for tax relief.

Step 3: Research Available Tax Relief Programs

Next, research the available tax relief programs that may be applicable to your situation. There are various programs designed to assist individuals with different circumstances such as low-income earners or those facing specific hardships. It's important to understand the requirements and qualifications for each program before proceeding further.

Step 4: Consult with a Tax Professional

To ensure accuracy and maximize your chances of qualifying for tax relief programs, it is highly recommended that you consult with a qualified tax professional. They can provide personalized guidance based on their expertise and knowledge of current tax laws.

Step 5: Prepare Necessary Documentation

If after reviewing everything it seems like you may be eligible for certain tax relief programs, begin preparing all necessary documentation required by these programs. This might include proof of income, receipts or invoices related to certain expenses, or any additional supporting documents requested by the specific program.

Conclusion

Achieving tax relief in Stuart, FL can be a challenging task for many individuals and businesses. However, with the right knowledge and guidance, it is possible to navigate through the complex tax system and find relief from your financial burdens.

Assessing eligibility for these programs requires careful consideration of various factors such as income level, debt amount owed to the IRS or state agencies, and overall financial situation. Seeking professional help from a qualified tax accountant like Christian Tax Services in Port St Lucie can greatly assist you in determining your eligibility and maximizing your chances of obtaining tax relief.

0 notes

Photo

The Imperative of Tax Compliance for Small Businesses

Call Us For Tax Help! (888) 888-3649

Small businesses form the backbone of the economy. However, the issue of small businesses not paying taxes is a significant concern that needs to be addressed. This article delves into the importance of tax compliance, the consequences of non-compliance, and the strategies small businesses can adopt to ensure they fulfill their tax obligations.

Understanding the Importance of Tax Compliance

Tax compliance is not just a legal obligation but a social responsibility. Small businesses, like all taxpayers, contribute to the nation's revenue, which is utilized for public services and infrastructure development. Non-compliance not only leads to a loss of government revenue but also creates an unfair burden on compliant taxpayers. Therefore, understanding and complying with tax regulations should be a priority for every small business.

-Tax Compliance -->[Contributes to Government Revenue

-Ensures Fair Distribution of Tax Burden

-Used for Public Services and Infrastructure

-Creates a Level Playing Field for All Businesses

The Consequences of Non-Compliance

Non-compliance with tax obligations can have severe consequences. These include late filing and payment penalties, estimated tax underpayment penalties, and penalties for inaccuracies and fraud. Moreover, non-compliance can lead to audits, legal consequences, and damage to the business's reputation. Therefore, it is crucial for small businesses to understand these implications and ensure timely and accurate tax payments.

Strategies for Ensuring Tax Compliance

One of the key strategies for ensuring tax compliance is staying informed about tax laws and regulations. This includes understanding the filing processes, deadlines, and the various tax breaks and incentives available. Regularly reviewing and updating your understanding of business taxes is essential, as tax laws and regulations are subject to change.

Maintaining Accurate Records

Accurate record-keeping is another crucial aspect of tax compliance. This involves maintaining proper records of income, expenses, and deductions, which are necessary for accurate tax reporting. Implementing effective tax management systems can help businesses stay organized and ensure timely payment of taxes.

Seeking Professional Help

Navigating the complex world of taxes can be challenging for small businesses. Therefore, seeking professional help from a tax attorney or certified public accountant (CPA) can be beneficial. These professionals can provide guidance on tax obligations and help businesses avoid costly mistakes and penalties.

Dealing with Unpaid Business Taxes

In case of unpaid business taxes, the IRS provides various options such as installment agreements or offers in compromise. These options allow businesses to resolve their tax obligations while avoiding unnecessary penalties and fees. It is important for businesses to explore these options and choose the one that best suits their financial situation.

Reporting Suspected Tax Fraud

Reporting suspected tax fraud is a responsible action that benefits society as a whole. It ensures that all businesses are held accountable for their tax obligations and contributes to a fair and equitable taxation system. If you suspect any form of tax fraud or evasion, it is important to report it to the IRS.

Small Business Tax Filings

In conclusion, smal business tax compliance is an imperative for small businesses. By understanding and complying with tax laws, businesses can avoid legal issues and financial consequences. Moreover, they can contribute to a fair and equitable taxation system, ensuring a level playing field for all businesses.

0 notes

Text

Determining Your Eligibility for an Offer in Compromise

Are you tired of seeing your IRS debts piling up? If yes, you may want to consider IRS debt settlement. IRS debt settlement, also called a supply in compromise, is an agreement between a taxpayer and the IRS which allows the taxpayer to be in their tax debt for under the amount owed. In this post, we'll delve into all the things you need to know about IRS debt settlement.

1. Eligibility Requirements for IRS Debt Settlement

Don't think that anyone who owes taxes can settle their IRS debts through the offer in compromise program. The IRS has some eligibility requirements that you have to meet to qualify for an IRS debt settlement. Some of the very most common eligibility requirements include:

- You haven't filed bankruptcy

- You can't repay your full tax debt

- You're current on estimated tax payments and tax filings

- You aren't associated with any tax fraud

- You've no active installment agreement with the IRS

2. Advantages of IRS Debt Settlement

Probably the most significant benefit of IRS debt settlement is that it allows you to pay off your IRS debts at under the quantity owed. Additionally, when you enter an IRS tax settlement agreement, you are able to stop the IRS from seizing your assets, putting a lien in your property, or levying your bank account.

3. How exactly to Apply for IRS Debt Settlement

To utilize for IRS debt settlement, you'll need to complete Form 656, the Offer in Compromise application. You will also need to submit detailed financial information about your income, assets, and expenses. After submitting your application, the IRS will review your information and determine whether you're eligible to take part in the program.

4. What Happens If Your IRS Debt Settlement Offer is Rejected?

If the IRS rejects your debt settlement offer, you can appeal your choice through the IRS Office of Appeals. You will have thirty days from the notice of rejection to file a request for appeal. When you appeal your decision, a basic appeals officer will review your case and determine whether to uphold or modify the initial decision.

5. Hire a Professional

IRS debt settlement could be complicated and confusing, which is why it's necessary to work with a professional. A skilled tax professional, such as an enrolled agent, can allow you to navigate the IRS debt settlement process and increase your chances of success.

Conclusion:

In conclusion, IRS debt settlement may be a fantastic selection for taxpayers who're struggling to pay for off their IRS debts. However, it's essential to comprehend the eligibility requirements, the applying process, and the risks involved before embarking on the offer in compromise program. Consider reaching out to a specialist to guide you through the method and raise your chances of success.

kindly visit the website at http://dgriggscpa.com to get the more info about set up tax payment plan.

0 notes

Text

Navigating IRS Fresh Start Programs: A Guide To Resolving Tax Debt And Achieving Financial Relief

The Internal Revenue Service (IRS) offers Fresh Start Programs to those with problems paying their overdue taxes. Tax debt can easily get out of hand like other types of debt. If this year's payments are too difficult for you to make, you will not be able to pay next year either.

The IRS fresh start programs provide multiple options if you need a "fresh start" on your taxes. The details are important in choosing the best action.

Which programs does the IRS offer for an initial clean slate?

To assist individuals and small businesses in recovering financially after falling into tax debt, the Internal Revenue Service (IRS) initiated several programs in 2011 under the Fresh Start initiative. To help taxpayers recover from the Great Recession that started in 2008, the Internal Revenue Service (IRS) introduced Fresh Start.

The Fresh Start program offers small company owners a variety of options to settle their tax debts, including Offers in Compromise, Penalty Abatement, Installment Agreements, and Currently Not Collectible status. When taxpayers meet the requirements of these programs, they may be able to lower their tax obligations, establish payment plans, have penalties waived, or even temporarily halt collection efforts.

By allowing taxpayers to pay off their tax obligations through the IRS Fresh Start programs, taxpayers can avoid the harsher consequences of levies, liens, and even jail time. As a result of Fresh Start, the IRS is more likely to receive a tax payment, which makes them happy.

How and when can one apply to the New Beginnings program?

To be eligible for any of the IRS Fresh Start programs, you must have your current tax returns.

If you want to apply for Fresh Start with less hassle, you should do things like finish your coursework and the following:

You want to know your options for settling your tax debt with a tax settlement agency, lawyer, enrolled agent, or certified public accountant. A large number of these professionals offer complimentary first consultations.

Gathering financial records for each year of operation is a necessary step in preparing a business loan application.

You are accessing and completing the appropriate forms available on the IRS website.

Documents from the court system and medical records may be necessary to bolster tax abatement petitions.

There is no need to stress if you need to catch up on your taxes; professionals can help you get up to speed fast and find deductions to reduce your tax liability.

They can put you in touch with one of our trustworthy partners, like 20/20 Tax Resolution if you require assistance with your tax problems. You can ask them questions and get answers as you go through the application process. On top of that, they will represent you when dealing with the IRS.

The Fresh Start Programme: What Makes It Popular?

The IRS Fresh Start Programs have gained widespread recognition as effective promotional tools. Tax resolution firms had been discussing this program for years before the IRS initially announced it, which caused a rush of press releases. It was just a revised process for handling tax disagreements. Since its introduction, there have been further enhancements that benefit the government's coffers.

Conclusion:

You may be eligible for assistance through the IRS Fresh Start Programs if you cannot pay your tax debt. Furthermore, it is completely acceptable to ask for help when you need it. If you have any questions regarding eligibility or the process, it is advisable to seek the advice of a tax expert or attorney familiar with the IRS.

#tax relief services#tax debt relief#irs tax relief#irs fresh start programs#tax settlement services#free consultation tax attorney#free consultation tax lawyer

0 notes

Photo

BREAKING DOWN THE BASICS OF TAX RELIEF

Taxes are an inevitable part of life, but sometimes, they can become a burden too heavy to bear. In these situations, tax relief programs can provide much-needed assistance to taxpayers who are struggling to meet their tax obligations.

Understanding the basics of tax relief, how it works, and the different programs available can provide taxpayers with the knowledge needed to navigate the complex world of tax relief options.

Defining Tax Relief: What Does It Mean for Taxpayers?

Tax relief, in simple terms, refers to a reduction in the amount of taxes owed by an individual or business. It can come in the form of deductions, credits, or exemptions, and can be applied to various types of taxes, such as income, property, or sales taxes.

Tax relief programs are designed to alleviate the financial burden of taxpayers who are experiencing economic hardship or are unable to pay their taxes due to specific circumstances. These programs are typically administered by the government or tax agencies, such as the Internal Revenue Service (IRS) in the United States.

How Exactly Does Tax Relief Work?

Tax relief programs work by either reducing the amount of taxes owed, allowing for a delay in payment, or offering a compromise where the taxpayer pays a lesser amount than what is originally owed. To qualify for tax relief, taxpayers must meet specific eligibility criteria set by the tax agency.

These criteria may include income level, financial hardship, or specific circumstances surrounding the tax debt. Once a taxpayer is deemed eligible, the tax agency will work with them to determine the most appropriate relief program and set up a plan for repayment or settlement.

Different Tax Relief Programs

1. Offer in Compromise (OIC)

An Offer in Compromise (OIC) is a program that allows taxpayers to settle their tax debts for less than the full amount owed. The IRS considers OICs when there is doubt regarding the taxpayer's ability to pay the full amount owed, or when doing so would create financial hardship.

To apply for an OIC, taxpayers must submit a detailed financial statement, along with an offer to pay a specific amount to settle the debt. The IRS will then evaluate the offer and decide whether to accept or reject it based on the taxpayer's financial situation and ability to pay.

2. Currently-Not-Collectible (CNC) Status

Currently-Not-Collectible (CNC) status is a temporary reprieve granted to taxpayers who are unable to pay their tax debts due to economic hardship. When a taxpayer is placed in CNC status, the IRS will temporarily halt all collection activities, including levies, liens, and garnishments.

However, it's important to note that interest and penalties will continue to accrue during this time. To qualify for CNC status, taxpayers must provide financial information to the IRS, demonstrating their inability to pay the tax debt.

3. IRS Installment Agreement

An IRS Installment Agreement is a payment plan that allows taxpayers to pay their tax debts in smaller, more manageable monthly installments. This option is suitable for taxpayers who can't pay their taxes in full but can afford to make smaller payments over time.

The IRS offers several types of installment agreements, including short-term and long-term plans, as well as streamlined agreements for smaller tax debts. To set up an installment agreement, taxpayers must submit a request to the IRS and provide financial information to determine the appropriate payment plan.

4. Penalty Abatement

Penalty abatement is a form of tax relief that involves the reduction or removal of penalties associated with tax debts. Taxpayers may qualify for penalty abatement if they can demonstrate reasonable cause for their failure to meet tax obligations, such as a natural disaster, serious illness, or other unforeseen circumstances.

To request penalty abatement, taxpayers must submit a written statement to the IRS, explaining the circumstances that led to the failure to meet tax obligations and providing supporting documentation.

The Bottom Line

If you are struggling to pay your tax debt, consider consulting with a tax professional who can help you navigate the tax relief process and determine the most suitable course of action.

If you’re dealing with IRS tax issues, don’t hesitate to contact Advance Tax Relief LLC. Our experienced tax relief attorneys and enrolled agents are here to help you get the best resolution for your situation. Contact us today to learn more about how we can help you!

0 notes

Text

Simplifying Tax Troubles: How IRS Resolution Software Can Help

Do you need help with tax challenges that seem insurmountable? Many individuals and businesses find themselves in this predicament, and the IRS (Internal Revenue Service) can be a formidable entity. However, there's good news – technology has come to the rescue with IRS resolution software.

1. Understanding Tax Challenges

Before delving into the solution, let's first identify the common tax challenges individuals and businesses face:

a. Unpaid Taxes: Financial hardships or errors can sometimes lead to unpaid taxes, resulting in mounting debts.

b. Tax Audits: The dreaded tax audit can be nerve-wracking. It involves scrutinizing your financial records and can lead to additional taxes owed.

c. Penalties and Interest: Late payments and filing errors can result in hefty penalties and interest charges that compound over time.

2. The Role of IRS Resolution Software

IRS resolution software is designed to simplify the process of addressing tax challenges. Here's how it can help:

a. Assessing Your Tax Situation: The software starts by analyzing your financial data and tax history to determine the extent of your tax troubles. This assessment helps in identifying the best course of action.

b. Personalized Solutions: Once your tax situation is understood, the software generates personalized solutions tailored to your circumstances. It may recommend options like an installment agreement, an offer in compromise, or innocent spouse relief.

c. Streamlined Documentation: Handling tax issues often involves a mountain of paperwork. IRS resolution software streamlines this process by generating the necessary forms and documents, making submitting them accurately and on time easier.

d. Communication with the IRS: Dealing with the IRS can be intimidating, but the software can be a bridge. It can help you draft and send letters, request appeals, and track the progress of your case.

e. Compliance Assistance: Staying compliant with tax laws is crucial. The software guides you on meeting your tax obligations, including estimated tax payments and filing deadlines.

3. Benefits of Using IRS Resolution Software

Now that we understand how IRS resolution software works let's explore the benefits it offers:

a. Time-Saving: Handling tax issues can be time-consuming. The software automates many tasks, reducing the time and effort required on your part.

b. Accuracy: Tax-related errors can be costly. The software's automated calculations and document generation help minimize mistakes.

c. Cost-Efficient: Hiring tax professionals to resolve your tax problems can be expensive. Using IRS resolution software is a cost-effective alternative.

d. Confidentiality: Your financial information is sensitive. IRS resolution software ensures the confidentiality of your data.

e. Empowerment: By using this software, you take an active role in addressing your tax challenges. It empowers you with knowledge and tools to navigate the complex tax landscape.

4. The Future of Tax Problem Resolution

As technology continues to advance, IRS resolution software is likely to become even more sophisticated and user-friendly. It will give individuals and businesses greater autonomy in resolving their tax issues.

In conclusion

Overcoming tax challenges no longer needs to be daunting. IRS tax resolution software is a valuable ally in simplifying the process and finding the best solutions for your unique situation. By leveraging this technology, you can take control of your tax troubles and work towards a more financially secure future. Don't let tax issues weigh you down – explore the benefits of IRS resolution software today!

#tax resolution software#tax practice management software#irs solutions tax resolution software#irs resolution software#irs resolution#irs transcripts

0 notes