#Gross refining margins

Text

Windfall tax: RIL's refining margins to be hit by upto $8/bbl, say analysts

Windfall tax: RIL’s refining margins to be hit by upto $8/bbl, say analysts

With the government making it clear that the new windfall tax will also be imposed on special economic zones, Reliance Industries’ gross refining margins (GRMs) will be negatively impacted by $6-8 a barrel, said analysts with Morgan Stanley and Jefferies.

“No sunset date has been specified, though we believe this is an extraordinary measure given the inflated profit environment in refining…

View On WordPress

#Diesel exports#Gasoline exports#Gross refining margins#Reliance#Reliance Industries#Reliance Industries Limited#RIL#RIL Refinery#RIL Taxation#Windfall tax

0 notes

Text

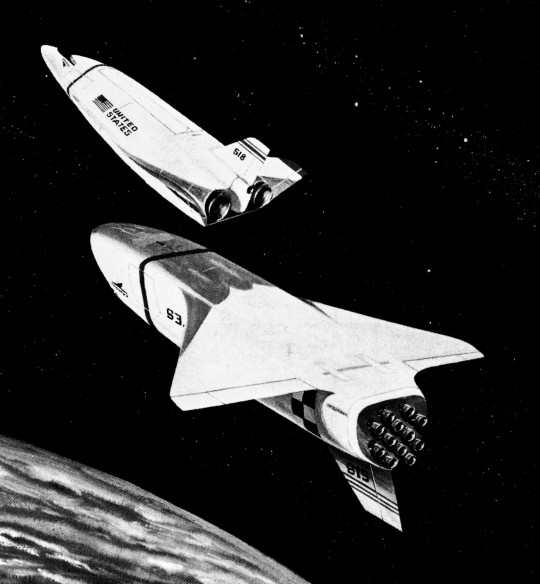

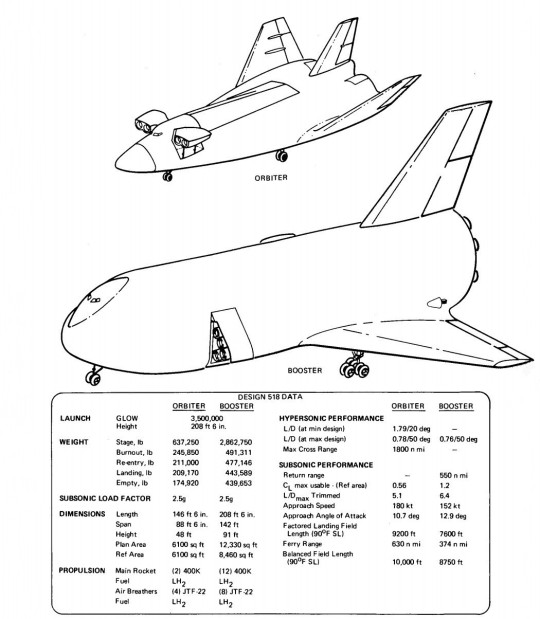

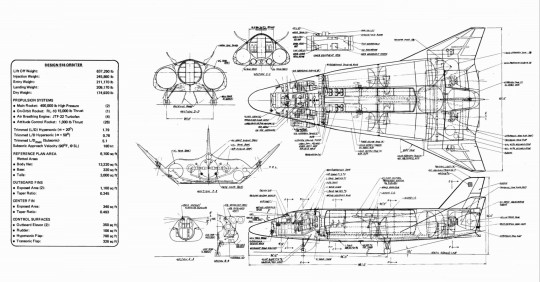

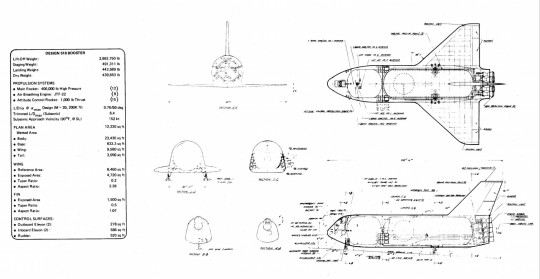

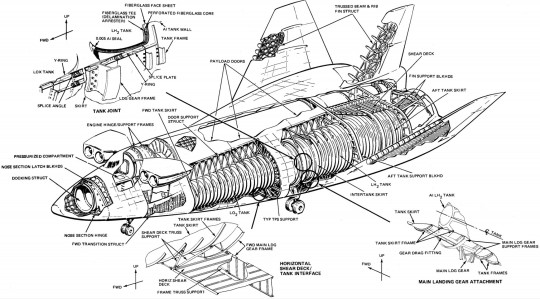

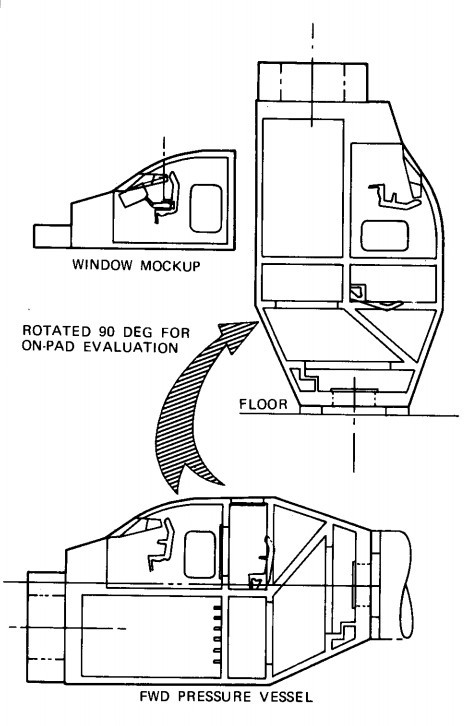

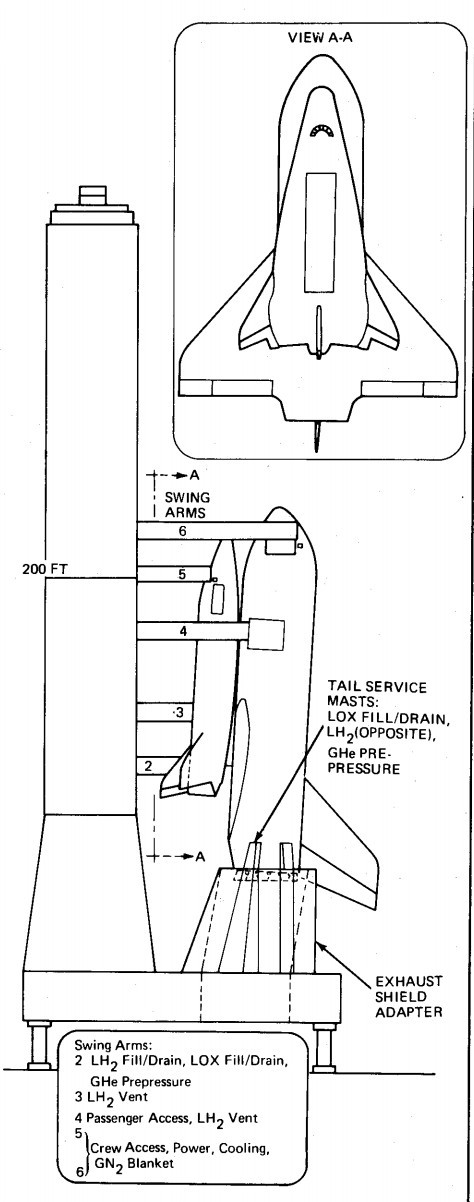

Space Shuttle, Phase B: Grumman Design 518

Information from Grumman's submitted application on their design:

"Design 518 is a fully responsive and balanced reusable, two-stage design based on the prescribed 3.5 million lb gross lift-off weight (GLOW). The aerodynamic configuration of the orbiter was. derived from an investigation of straight, swept delta, and lifting body configurations. The selec ted lifting body appears competitive in all respects (weight, flying qualities, elastic characteristics) and provides the potential for straightforward evolution to high crossrange reentry as thermal protection systems become qualified. Evaluation of a single aerodynamic configuration will provide a clear cut understanding of the weight, performance, and cost penalties associated with increased cross range. In the low cross-range mode, results to date show that the 3.5 million lb GLOW limits the fully internal payload to 32,200 lb. The Design 518 orbiter represents a near optimum balance between size of vehicle, size of payload, and propulsion capa bility (AV) apportionment.

The Design 518 booster is a weight conscious, conservatively designed delta-wing configuration which includes the prescribed 400,000 lb thrust high-pressure rocket engines. A refinement which demands investigation is the application of larger, 1,000,000 Ib thrust high-pressure engines. Preliminary design. will be performed on Design 518, as described in Section 1 of this proposal. An acquisition plan will be created which will include the 400,000 lb thrust high-pressure engines and other characteristics decribed in the Statement of Work and its appendices. The program cost will be assessed for the IOC of late 1977. Grumman and its associates will pursue all of the objectives and requirements of the RFP for Design 518. In summary, Design 518 demonstrates that an attractive and promising responsive design can be achieved within the 3.5 million lb GLOW. With refinement, which can be expected during the Phase B study, we believe that improved payload capability can be obtained while continuing to observe the weight margin rules called for by the RFP."

Artwork by Thomas Becker, 1972: link

#Space Shuttle#Orbiter#NASA#Space Shuttle Program#Space Shuttle Development#1972#Space Shuttle Phase B#Phase B#Grumman#Grumman Design 518#Design 518#my post

88 notes

·

View notes

Text

Hydrogen Storage Market Analysis 2023 Dynamics, Players, Type, Applications, Trends, Regional Segmented, Outlook & Forecast till 2033

Hydrogen Storage Market size was valued at USD 16.2 Billion in 2023 and , reaching nearly USD 34.45 Billion.in 2033, The total market revenue is expected to grow at a CAGR of 7.97% from 2024 to 2033

The competitive analysis of the Hydrogen Storage Market offers a comprehensive examination of key market players. It encompasses detailed company profiles, insights into revenue distribution, innovations within their product portfolios, regional market presence, strategic development plans, pricing strategies, identified target markets, and immediate future initiatives of industry leaders. This section serves as a valuable resource for readers to understand the driving forces behind competition and what strategies can set them apart in capturing new target markets.

Market projections and forecasts are underpinned by extensive primary research, further validated through precise secondary research specific to the Hydrogen Storage Market. Our research analysts have dedicated substantial time and effort to curate essential industry insights from key industry participants, including Original Equipment Manufacturers (OEMs), top-tier suppliers, distributors, and relevant government entities.

Receive the FREE Sample Report of Hydrogen Storage Market Research Insights @ https://stringentdatalytics.com/sample-request/hydrogen-storage-market/13355/

Market Segmentations:

Global Hydrogen Storage Market: By Company

• Air Liquide

• Linde plc

• Praxair Technology

• Worthington Industries

• McPhy Energy S.A.

• Luxfer Holdings PLC

• Hexagon Composites ASA

• H Bank Technologies Inc.

• Inoxwind

• VRV S.r.L.

• Cella Energy

• American Elements

• Sigma-Aldrich Co.

• Hanwha Solutions/Chemical Corporation

• Eutectix

• Pragma Industries

• Ilika and Fosroc

Global Hydrogen Storage Market: By Type

• Cylinder

• Merchant/bulk

• Onsite

• On-board

Global Hydrogen Storage Market: By Application

• Chemical

• Oil Refining

• General Industry

• Transportation

• Metal Working

Regional Analysis of Global Hydrogen Storage Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Hydrogen Storage market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Hydrogen Storage Market Research Report @ https://stringentdatalytics.com/purchase/hydrogen-storage-market/13355/?license=single

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Report includes Competitor's Landscape:

➊ Major trends and growth projections by region and country

➋ Key winning strategies followed by the competitors

➌ Who are the key competitors in this industry?

➍ What shall be the potential of this industry over the forecast tenure?

➎ What are the factors propelling the demand for the Hydrogen Storage?

➏ What are the opportunities that shall aid in significant proliferation of the market growth?

➐ What are the regional and country wise regulations that shall either hamper or boost the demand for Hydrogen Storage?

➑ How has the covid-19 impacted the growth of the market?

➒ Has the supply chain disruption caused changes in the entire value chain?

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes

Text

Innovation In Biotech: The Virtuous Cycle Of Capital

“France is at an inflection point for healthcare innovation, after several years of stagnant development,” said Rafaele Tordjman, founding father of Jeito Capital. “Prior to the pandemic, French entrepreneurs felt too typically that they had to search funding overseas, notably within the U.S.” One big reason for this was that investing in healthcare requires data and sophistication, which was a turnoff for many investors. I cashed in my preservation fund on the time, paid the taxes, and shipped all of it offshore, principally into biotech stocks. The Balance doesn't present tax, investment, or financial services and advice. The data is being introduced with out consideration of the investment goals, danger tolerance, or financial circumstances of any particular investor and might not be suitable for all traders.

We believe in the potential of your small business, and allow you to obtain your progress and liquidity objectives. One of our main objectives of starting Bennie Polestar® Biotechnology, LLC is to build a business that can survive off its personal cash circulate without the need for injecting finance from exterior sources once the business is formally running. We know that one of the methods of gaining approval and successful prospects over is to sell our biotech merchandise a little bit cheaper than what is obtainable available in the market and we are properly ready to outlive on decrease profit margin for a while.

In our expertise, small biotechs launching new merchandise in Europe commonly encounter certain pitfalls that can endanger the success of their efforts. Companies that get this balancing act right with their newly permitted pharmaceuticals will get access to this key market. Those that don’t will miss out on vital value—and an important growth alternative. You’ll need to refine your estimates primarily based on the illness the company is treating, their trial design, and several different variables.

By not exposing native clients to offshore investing and the exciting returns that doubtlessly can be earned by doing so, fund managers are dooming their purchasers to a future of below par- returns. Biotech mutual funds spend cash on shares of companies within the biotechnology sector, which is a half of the broader health sector of stocks. The worth of these shares might go down and there is no assure that you will get a return in your investments. Diversifying your portfolio by investing in biotech funds somewhat than individual shares might assist you to scale back your danger. Meanwhile, London experienced a resurgence in 2023, with the June to August time period rising as the best quarterly whole since 2021, based on Clarivate. According to Crunchbase data, sixteen corporations there secured whole funding of $408 million, with a median of $25.fifty one million per firm.

Bureau of Labor Statistics, roughly 18,450 financial and investment analysts labored in management, scientific and technical consulting services as of May 2019. Of these analysts, 2,790 worked in research and development in the physical, engineering and life sciences. Mounting a successful European launch for biotechnology firms isn't easy or simple.

These areas of improvement indicate the place innovative biotech could additionally be heading. The primary objective is to speak the company’s vision, mission, and expertise to potential buyers or partners. The essential components of a profitable pitch deck include a compelling elevator pitch, a clear drawback assertion, a description of the biotech product or service, and a detailed business model.

Assuming the company has a helpful drug, the following step is to see what type of gross sales pressure the company can afford, and how many physicians that gross sales drive can attain. Basically, take the identical P&L model template you utilize for any other industry, and insert a bunch of rows above your income line. You will do an in depth revenue build, starting with variety of sufferers the drug is designed to deal with, then layering on pricing, then estimating an adoption curve. The EY Health Sciences and Wellness architecture brings collectively a worldwide network of 34,000 professionals to construct data-centric approaches to customer engagement and improved outcomes. We assist our purchasers deliver on their strategic goals; design optimized working fashions; and form the best partnerships so they might thrive right now and succeed in the well being techniques of tomorrow. We work across the ecosystem to understand the implications of today’s trends, proactively finding solutions to enterprise points and to grab the upside of disruption in this transformative age.

One main factor to keep in mind when creating a biotech pitch deck contains providing a transparent overview of your product, utilisation of visuals, and knowledge. Creating a biotech pitch deck requires a clear understanding of the audience’s needs, as properly as the important thing components essential to create an thrilling and compelling presentation. Creating an efficient biotech pitch deck requires strategic planning and a focus to detail. Hopefully, with the best strategic discussions and decision-making in the near term, the biotech sector can keep away from being paralyzed by this market dislocation and collectively advance our progressive R&D pipeline by way of to their subsequent inflection points.

No illustration or warranty is given as to the accuracy or completeness of this info. Any analysis offered doesn't have regard to the precise investment aims, financial scenario and needs of any particular one that might obtain it. It has not been prepared in accordance with authorized necessities designed to advertise the independence of investment research and as such is considered to be a advertising communication. Although we aren't specifically constrained from dealing forward of our suggestions we do not seek to take benefit of them earlier than they are provided to our clients. This company manufactures artificial, creating a proprietary silicon-based manufacturing process to find a way to do that.

Nonetheless, the executives we spoke to said systemic challenges dealing with the UK biotech sector—such as those identified in our analysis—pose a greater risk than Brexit or COVID-19. The Biotech Innovation Index reveals some interesting tendencies for the UK biotech sector. biotech investment advisors boston supplemented the analysis by interviewing high UK biotech CEOs for added insights into market drivers. A Jan. 2 report from investment bank Jefferies, meanwhile, found the common biotech IPO was down 22% in 2021, in comparison with gains of anyplace from 10% to one hundred pc between 2016 and 2020. The lackluster outcomes have been the worst for an IPO class since 2016, Jefferies analysts wrote, and mirrored biotech index funds, which significantly underperformed in comparability with the broader market.

#biotech wealth management#biotech financial services#biotech investment advisors#biotech tax planning#biotech estate planning#biotech investment planning#biotech retirement planning#biotech financial services boston#biotech investment advisors boston#biotech tax planning boston#biotech estate planning boston#biotech investment planning boston#biotech retirement planning boston

1 note

·

View note

Text

Petrochemical Process Instrumentation, Global Top 25 Players Rank and Total Market Size Forecast 2023-2029

Petrochemical Process Instrumentation Product Definition

Industrial instrumentation is used to control and monitor conditions such as temperature, pressure, and liquid levels in processing facilities, refineries, petrochemical plants, oil and gas pipelines, and distribution operations. Common applications for oil and gas instrumentation include monitoring the presence of flammable and combustible gases in production and storage areas and monitoring emissions for pollution control. Instrumentation is also used to monitor and control flow in conveying systems.

Figure. Petrochemical Process Instrumentation Product Picture

Based on or includes research from QYResearch: Global Petrochemical Process Instrumentation Market Report 2023-2029.

Petrochemical Process Instrumentation Market Summary

According to the new market research report "Global Petrochemical Process Instrumentation Market Report 2023-2029", published by QYResearch, the global Petrochemical Process Instrumentation market size is projected to grow from USD 24,046 million in 2023 to USD 33,792 million by 2029, at a CAGR of 5.8% during the forecast period.

Figure. Global Petrochemical Process Instrumentation Market Size (US$ Million), 2018-2029

Based on or includes research from QYResearch: Global Petrochemical Process Instrumentation Market Report 2023-2029.

Market Drivers:

As the pace of renewal and transformation accelerates, industrial upgrading, industry mergers and reorganizations, companies moving out of cities and into parks, large-scale relocation projects, the rise of emerging chemical industries, and the trend of large-scale equipment, have greatly increased the demand for refining and chemical equipment.

The substantial growth in demand for chemical products, large-scale petrochemical equipment, and green requirements provide guarantee for new fixed asset investments in the future. At the same time, with the continuous advancement of process technology, engineering technology, and equipment manufacturing technology, global chemical equipment is accelerating to With the development of large-scale and large-scale products, these factors will drive a significant increase in the demand for petrochemical process instruments.

Safety is a top concern in the petrochemical industry. The development of reliable instrumentation capable of monitoring process conditions, detecting leaks and preventing accidents is a major driver.

Petrochemical plants are constantly looking for ways to optimize processes to maximize efficiency, reduce energy consumption and minimize waste. Accurate instrumentation helps collect data for process analysis and optimization.

Restraint:

Competition and gross profit risks. With the growth of global petrochemical fixed asset investment, the entry of some potential competitors and the active investment of original competitors, market competition may become increasingly fierce. Whether the industry's gross profit margin can be maintained at a high level, it is uncertain whether it can maintain a stable or rising momentum.

There is a risk of cyclical decline. Investment in fixed asset projects in the basic and pillar industries of the national economy such as petrochemicals and chemicals is greatly affected by macroeconomic policy regulation. The development of the petrochemical process instrument industry has a certain correlation with the macroeconomic operating cycle.

Opportunity:

With policy support, various regions around the world take the opportunity of the safety, independence, and controllability of national key industries to promote the process of independence of key products and core technologies to meet the needs of industrial equipment and high-end scientific research such as large-scale petrochemicals and large-scale refining and chemical integration projects for instruments and meters. The reliability and safety of control systems have particularly stringent requirements in special application fields, basically forming the basic guarantee capabilities and basic support capabilities for large-scale engineering projects and key application fields.

The petrochemical and chemical industry is an important pillar industry with high industrial correlation and wide product coverage. It plays an important role in stabilizing economic growth, improving people's lives, and ensuring national defense and security. It is an indispensable and important part of the national economy. Therefore, the country's expansion is effective Investment is mainly reflected in fixed asset investment in petrochemical and chemical industries. These investments can significantly drive the growth of process instruments.

Figure. Petrochemical Process Instrumentation, Global Market Size, The Top Five Players Hold 14.0% of Overall Market

Based on or includes research from QYResearch: Global Petrochemical Process Instrumentation Market Report 2023-2029.

This report profiles key players of Petrochemical Process Instrumentation such as Endress+Hauser, Emerson, Honeywell, Siemens, Chongqing Chuanyi Automation, WIKA, ABB, KROHNE, Flowserve, Azbil, etc.

In 2022, the global top five Petrochemical Process Instrumentation players account for14.0% of market share in terms of revenue. Above figure shows the key players ranked by revenue in Petrochemical Process Instrumentation.

Figure. Petrochemical Process Instrumentation, Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Petrochemical Process Instrumentation Market Report 2023-2029.

In terms of product type, Control Valve is the largest segment, hold a share of 45.0% in 2022,

Figure. Petrochemical Process Instrumentation, Global Market Size, Split by Application Segment

Based on or includes research from QYResearch: Global Petrochemical Process Instrumentation Market Report 2023-2029.

In terms of product application, Petrochemical Plant is the largest application, hold a share of 68.3%,

Figure. Petrochemical Process Instrumentation, Global Market Size, Split by Region (Production)

Based on or includes research from QYResearch: Global Petrochemical Process Instrumentation Market Report 2023-2029.

Figure. Petrochemical Process Instrumentation, Global Market Size, Split by Region

Based on or includes research from QYResearch: Global Petrochemical Process Instrumentation Market Report 2023-2029.

About The Authors

Xinxin Wang

Lead Author

Machinery & Equipment, Advanced Manufacturing, Consumer, Sports & Healthcare, etc.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch has been a reliable source for end-to-end market research needs of businesses. The report coverage at QYResearch is massive and unlocks an access to hundreds of key industry verticals and thousands of micro markets. When it comes to ready-to-purchase research, our clients can select from a huge repository. Custom research and pre-booked reports have also been the popular offerings of QYResearch.

0 notes

Text

baddest predict,

baddest predict,

Predictions and forecasts are intrinsic to human nature. From ancient civilizations relying on celestial movements to modern-day algorithms crunching data, the quest to anticipate the future is unending. However, not all predictions hit the mark. Some stand out not for their accuracy but for their sheer audacity in being spectacularly wrong. These missteps, often referred to as the "baddest predicts," offer invaluable lessons on the complexities of prediction and the fallibility of human foresight.

Throughout history, there have been numerous instances where predictions missed the mark by a wide margin. One of the most notorious examples dates back to 1899 when the U.S. Patent Office Commissioner reportedly declared that "everything that can be invented has been invented." This statement, now recognized as a gross underestimation of human ingenuity, serves as a reminder of the limitations of predicting technological advancements.

In the realm of economics, the 2008 financial crisis serves as a stark reminder of the fallibility of economic forecasts. Leading up to the crisis, many economists and financial experts failed to foresee the impending collapse of the housing market and the subsequent global economic downturn. The failure to anticipate such a significant event highlights the challenges of predicting complex, interconnected systems.

Even in the realm of science and technology, where empirical evidence and rigorous methodologies reign supreme, predictions can go awry. Take, for example, the case of the Y2K bug. As the year 2000 approached, widespread concerns emerged about the potential catastrophic effects of computer systems failing to properly interpret the change in date from 1999 to 2000. While substantial efforts were made to mitigate the perceived risk, the actual impact turned out to be far less severe than anticipated, leading some to label it as one of the most overhyped predictions in history.

In recent times, the COVID-19 pandemic has brought the unpredictability of nature into sharp focus. Despite advances in epidemiology and disease modeling, the rapid spread of the virus caught many health experts and governments off guard. Initial projections underestimated the severity and duration of the pandemic, highlighting the inherent uncertainty in forecasting complex biological phenomena.

So, what can we learn from these baddest predicts? Firstly, humility is paramount. No matter how sophisticated our models or how vast our data, the future remains inherently uncertain. Acknowledging the limitations of our predictions can guard against overconfidence and hubris.

Secondly, interdisciplinary perspectives are crucial. Complex problems often require insights from diverse fields, and collaboration across disciplines can help uncover blind spots and enhance the robustness of predictions.

Thirdly, adaptability is key. The ability to iterate and refine predictions in response to new information is essential in navigating an uncertain future. Rather than clinging to outdated forecasts, we must remain agile and open to revising our assumptions in light of changing circumstances.

Lastly, communication is vital. Transparently conveying the uncertainties inherent in predictions fosters trust and helps manage expectations. Effective communication can mitigate the potential consequences of erroneous forecasts and facilitate informed decision-making.

In conclusion, while baddest predicts may be humbling and at times embarrassing, they offer invaluable insights into the intricacies of prediction and the complexities of the world we inhabit. By embracing humility, fostering interdisciplinary collaboration, prioritizing adaptability, and enhancing communication, we can strive to make more nuanced and resilient predictions in the face of uncertainty. After all, it is in learning from our missteps that we pave the way for more informed and insightful forecasts in the future.

0 notes

Text

Revolutionizing the Retail Landscape with #RetailEvolution, #SmartForecasting, and #AISuccess

Originally Published on: QuantzigHow did retail demand forecasting optimize supply chains for five years?

In the last five years, the retail industry has undergone a significant transformation, particularly in the realm of inventory stock level forecasting. This evolution has been driven by the need to address challenges related to volatility, subjectivity, and reliance on customer demand. Accurate demand forecasting has emerged as a critical factor influencing timely order fulfillment, playing a pivotal role in optimizing inventory budgeting, distribution, pricing strategies, and overall business growth.

Traditional Methods of Demand Forecasting:

Time Series Analysis: Utilizing historical data through AI-driven techniques has greatly improved accuracy in identifying patterns and trends over time. Machine learning algorithms contribute to refining demand planning processes, ensuring adaptability to evolving consumer preferences, and mitigating risks in modern supply chains.

Qualitative Forecasting: Integration of expert judgment and market research with AI-driven solutions has significantly enhanced forecasting accuracy. Machine learning algorithms analyze qualitative data, enabling businesses to tailor product assortments and promotional strategies based on dynamic consumer behaviors.

Causal Models: Establishing relationships between demand and influencing factors, coupled with AI-powered predictive models, has introduced nuanced analysis. Machine learning algorithms quantify the impact of various factors on future demand, helping businesses navigate supply chain complexities and respond effectively to dynamic consumer preferences.

Moving Averages: Even simple methods like moving averages have seen improvements through AI-driven enhancements. Calculating average demand over a specified time period is now done with increased precision as machine learning-based systems optimize moving averages, addressing constraints related to new product forecasts and adapting to modern methodologies.

AI Techniques in Retail Demand Forecasting:

Machine Learning Algorithms: Decision trees, neural networks, and ensemble methods are leading the way in refining demand planning processes. These algorithms empower businesses to anticipate future customer demand and manage supply chains more effectively.

Predictive Models for Future Demand Prediction: Integration of advanced analytics and machine learning techniques enables the analysis of rapidly changing consumer preferences, resulting in optimized inventory levels and enhanced efficiency in promotion and marketing campaign planning.

Custom AI-Powered System: Tailoring forecast systems to meet the unique needs of a business has become a crucial aspect of demand forecasting. This customization optimizes inventory management, product assortments, and promotional strategies, contributing to improved Gross Margin Return on Investment (GMROI).

Retail AI Systems for Inventory Optimization:

Utilizing AI techniques to analyze demand challenges and adapt to supply chain complexities has become instrumental in enhancing overall customer satisfaction and process optimization within retail operations.

The Importance of Demand Forecasting in Retail Big Data Analytics:

Strategic Inventory Management: Accurate demand forecasts play a pivotal role in guiding strategic inventory management, ensuring adequate stock levels while simultaneously reducing excess inventory and improving demand planning accuracy.

Enhanced Promotion and Marketing Campaign Planning: AI-driven predictive models that anticipate future customer demand facilitate the creation of targeted promotional strategies aligned with shifting consumer behaviors.

Optimizing Gross Margin Return on Investment (GMROI): Modern demand forecasting methodologies powered by AI have significantly contributed to optimizing GMROI. Accurate forecasts tailored to business needs have become crucial in overcoming the constraints associated with traditional methods.

Adaptation to Modern Methodologies: AI-powered forecast solutions have played a crucial role in facilitating the transition from traditional methods to more advanced approaches. This adaptability ensures that retailers stay ahead of the competition in a rapidly evolving landscape.

Impact Analysis of AI Solutions:

Quantzig's Ensemble Machine Learning solution has demonstrated impressive results, reducing lead time, operating costs, and unfulfilled orders. Simultaneously, it has increased profit margins and improved sales demand accuracy.

Key Outcomes:

Accurate demand projection is indispensable for ensuring customer product availability and minimizing inventory accumulation. The integration of machine learning-based demand forecasting has empowered retailers to evaluate the impact of various factors on demand, facilitating efficient inventory management and streamlined supply chain operations.

Contact us.

0 notes

Text

BPCL, HPCL तो वेतन वृद्धि का 31% 24 निफ्टी लाभ का हिसाब रखें

BPCL, HPCL to account 31% of increment FY24 Nifty profit

BPCL’s reported GRM was above Kotak’s estimate, while its implied marketing margin was below its estimate. HPCL’s Q3 missed Kotak’s Ebitda estimate due to a lower-than-expected marketing margin.

IOC reported a beat on Ebitda estimate, fuelled by a better-than-expected gross refining margin (GRM) and a higher marketing margin. BPCL’s…

View On WordPress

0 notes

Text

Chhattisgarh News

Latest Chhattisgarh news on September 05, 2023.

Today's Petrol Price in Chhattisgarh

The price of petrol in Chhattisgarh as of September 5, 2023, is 103.53. The price has risen since yesterday. Petrol prices were relatively stable in comparison to the previous month. Every day at 6 a.m., the price of gasoline is changed. Dynamic gasoline pricing was implemented in June 2017 to promote transparency and limit speculative activities.

Petrol prices in Chhattisgarh are impacted by a variety of factors, including Brent crude oil prices, the rupee to US dollar exchange rate, geopolitical concerns such as conflict, which can generate market disequilibrium, supply-chain issues, and so on. Furthermore, internal factors such as changes in excise duty or state taxes, changes in demand, and so on have an impact on petrol prices. When calculating fuel prices in Chhattisgarh, gross refining margins and dealer charges are also taken into account.

During September 2023, petrol prices in Chhattisgarh hovered around 104. It ranged between 103.52 and 103.53. Petrol prices reached a high of and a low of in September 2023.

0 notes

Text

When Community Becomes Your Competitive Advantage

by Jeffrey Bussgang and Jono BaconJanuary 21, 2020

We’ve seen a precipitous decline in participation in civic organizations in recent years; membership numbers are down for religious groups, labor organizations and non-profits. A cynic could interpret these trends as a sign that we have all become digital hermits, with our noses buried in our highly personalized screens. The reality is that powerful communities are not just alive and well but also booming. They just look different than they did 50—even 20—years ago. They are organized around businesses and brands and providing profound opportunities for companies around the world.

Take Salesforce for example. While you might think its $140 billion valuation is due purely to its innovation of software delivered on demand through the cloud, it has also created a community of nearly 2 million members who support each other, organize events, produce content, and are a critical part of its global operations. This community is an international network of minds, talent, and time, all supporting the success of Salesforce. The company’s annual “Dreamforce” conference, which attracts nearly 200,000 acolytes to San Francisco each year, represents a mecca for its ecosystem to convene, build relationships, and advance its corporate agenda.

Other examples include Harley Davidson, which has created more than 1,400 local chapters around the world for enthusiasts to get together in person and discuss their bikes; Fitbit, which has a community of more than 25 million members, who share and refine their exercise regimes; and HITRECORD, which has brought more than 750,000 artists, writers, and filmmakers together to collaborate on productions, many of which have shown at Sundance. The list goes on.

While communities generate tangible value for businesses — such as content, events, online advocacy and marketing, technology production, customer support, and education — it is the intangible value that members derive from the experience that makes these environments truly “sticky.” Human beings are fundamentally social animals. Behavioral economics and psychological research have taught us that we fundamentally crave a sense of connectedness, belonging, mission, and meaning, particularly when performing our work. Theresa Amabile’s The Progress Principle and Daniel Pink’s Drive both demonstrated that making progress towards a shared mission is the most motivating force a professional can feel. Communities deliver these benefits, creating a sense of shared accountability and a set of values while preserving individual autonomy.

A Superior Business Model

If a company can transition from simply delivering a product to building a community, it can unlock extraordinary competitive advantages and both create and support a superior business model. Specifically:

Enthusiastic members help acquire new members, resulting in lower customer acquisition costs and a tight viral loop.

Members are loath to abandon the community, resulting in increased retention and therefore improved lifetime value.

Members support one another, resulting in high gross margins due to a lower cost of service.

The result of this are very real network effects: as engagement grows, the community gets smarter, faster to respond, more globally available, and generates more value.

Codecademy is another example of a company that has figured out how to use community to support its business model. Since the company was founded nine years ago, more than 50 million people have taken one of its courses. Beyond its rich catalog of interactive educational content, the secret to Codecademy’s success has been its ability to link learners who contribute to the catalog and collaborate to improve their skills. Users of Codecademy Pro (the company’s paid offering) have access to a Slack group so they can meet, mingle and share best practices with others and gain access to events with industry professionals and peers. More advanced learners mentor the novices. This rich learning environment generates a network effect in the business model for a company that might not inherently have one.

A Sea Change Is Happening

Why is this happening now? One key reason is that technology-based communication platforms are more commoditized and accessible than ever before, building a rapidly growing addressable audience. We now have multiple generations of people who have grown up with technology and especially mobile phones and social media as part of their day-to-day lives. Global smartphone penetration is estimated to reach 45% in 2020, thus nearly one out of every two humans on the planet has the capacity to engage socially with others online.

With the ground seeded, many cheap, scalable tools for building communities both digitally and locally have been developed. These include Discourse, Slack, GitHub, Meetup.com, and WordPress, all of which make it practically effortless to convene and engage like-minded individuals and, as a result, are increasingly popular.

Consumers today also expect different relationships with brands. They don’t just want a customer support email address and a newsletter; they want deeper interaction with the company and fellow buyers of the product or service. It should be no surprise that in a recent survey, nearly 80% of startup founders reported that building a community of users was important to their business, with 28% describing it as their competitive moat and critical to their success. The top five brands in 2019 — Apple, Google, Microsoft, Amazon, and Facebook — have all invested significantly in digital and in-person community engagement across their various product portfolios.

Seven Success Patterns in Community Building

Motivated by the allure of a superior business model, accessible tools, and an eager and available audience, any company can build a tribe. But this is both a technological and cultural challenge. It’s not enough to set up a platform. You also need to create an environment that incentivizes the behavior you want to see, exposes the value generated, and highlights and rewards great participation.

Successful communities have seven key elements:

A shared purpose and values. As former Instagram executive Bailey Richardson puts it, the community must be able to answer the question “Why are we coming together?”

Simple, easily accessible value consumption. Prospective and existing members can easily see what they’re getting: support, events, documentation, the ability to download and use technology, etc. This value is not hidden or buried, it is clearly organized and available.

Simple, easily navigable value creation. Members can easily create new value for others in the group to consume. This contribution process is (a) crisply defined, (b) simple and intuitive, and (c) provides almost-immediate gratification.

Clearly defined incentives and rewards. Quality contributions (e.g. content, support, technology, etc.) and community-centric behavior (e.g. mentoring, leadership, and growth) are acknowledged and applauded to build a sense of belonging, unity, and satisfaction.

Carefully crafted accountability. There is a clearly defined, objective peer review and workflow — for example, reviewing content, code, and events. This doesn’t just produce better, more diverse results, it also increases collaboration and skills development.

Healthy, diverse participation driven by good leadership. When you are intentional about diversity and good conduct and have leaders who embody and empower these important principles, you reduce toxicity and increase value.

Open, objective, governance and evolution. There is clear, objective governance, and community members can play an active role in reshaping its structure and operational dynamics together, giving them “skin in the game” and, thus, a sense of ownership and responsibility.

Chief is an interesting case study of an emerging community seeking to embody these patterns of success. The company is a private network designed to support exceptional professional women with a core set of services such as coaching, peer learning and network building. Since its launch in January 2019, the company has grown rapidly and has more than 5,000 names on its wait-list. Value consumption (advice to advance your career) and value creation (peer-to-peer coaching) are obvious and clear, as is the healthy, diverse participation of community members that feel a sense of mutual accountability for their individual and collective success. As the company scales to cities throughout the United States, its community presents a formidable competitive moat, organized around the mission of professional advancement and support for female executives who are members.

Measuring Success

While there is no silver bullet for building a community, success is delivered by tracking a crisp, focused set of metrics and regularly evaluating and making adjustments based on those evaluations. This process is an evolutionary one, where your cross-functional team should repeatedly ask questions about the results they see and hypothesize changes to drive improvements. These changes are then delivered as a series of small experiments that will both move the needle and build internal experience.

For companies building a community initiative, the areas you track should be:

Community Consumption and Creation. This means tracking active participation and the value that members consume and produce. For example, measuring community traffic, sign-ups, individual contributions (e.g. answering questions, running events, improving content), and other areas.

Delivery and Execution. This means looking at how well your company is building community strategy, estimating work, and executing effectively. This is important to ensure planning and execution are aligned and avoid spinning your wheels.

Organizational Experience. This involves following the incubation and evolution of community skills and expertise in your business (e.g. reading and reacting to data, mentoring, moderation, conflict resolution, building and delivering incentives, etc.). This is important to ensure the company is what it needs to foster and grow the community, especially as it scales up.

We are in the early stages of truly harnessing the potential of carefully crafted, productive communities. Done well, and when intentionally woven into the fabric of the business, communities can offer a sustainable competitive advantage and drive brand awareness, value production, and therefore overall commercial valuation (oh, and delivering a world-class, personal, gratifying member experience.)

The future of business is a more open, connected, engaging one, and communities are going to change the nature of how we interact with brands, products, and other people.

Jeffrey Bussgang is a senior lecturer in the Entrepreneurial Management Unit at Harvard Business School and a general partner at Flybridge Capital Partners. He is the author of Entering StartUpLand: An Essential Guide to Finding the Right Job (Harvard Business Review Press, 2017).

Jono Bacon is a community and collaboration strategy consultant, a former community director at GitHub, and author of People Powered: How Communities Can Supercharge Your Business, Brand, and Teams (HarperCollins, 2019).

#COMMUNITY-CENTRIC #COMMUNITY-AS-A-BUSINESSMODEL #2023 #UY

0 notes

Text

Top 4 Loans For Women Entrepreneurs In India

Women entrepreneurs in India are breaking barriers and making significant contributions to the country's economy. To support their aspirations and bridge the financial gap, several loan options are available specifically tailored for women. Let's explore the top four loans that can empower women entrepreneurs in India.

1. MUDRA Loans

Micro Units Development and Refinance Agency (MUDRA) loans are designed to provide financial assistance to small and micro-businesses. Under the Pradhan Mantri MUDRA Yojana, women entrepreneurs can avail of loans up to Rs. 10 lakh without the requirement of collateral, ensuring easy access to funds for their ventures. The loans are categorized into three types: Shishu, Kishor, and Tarun, based on the stages of business development.

Also Read: How To Start A Small Business In India

2. Stand-Up India Scheme

The Stand-Up India Scheme, initiated by the Government of India, aims to promote entrepreneurship among women and marginalized sections of society. It offers financial support in the form of term loans for setting up greenfield enterprises in the manufacturing, trading, or service sectors. The loan amount ranges from Rs. 10 lakh to Rs. 1 crore.

3. Mahila Udyam Nidhi Scheme

The Mahila Udyam Nidhi Scheme, introduced by the Small Industries Development Bank of India (SIDBI), provides financial assistance to women-owned small-scale industrial units. Under this scheme, women entrepreneurs can access term loans up to Rs. 10 lakh at a concessional rate of interest, enabling them to expand their businesses and enhance their competitiveness.

4. Stree Shakti Package For Women Entrepreneurs

The Stree Shakti Package, offered by the State Bank of India (SBI), empowers women entrepreneurs by providing financial support and additional benefits. It includes a concession in the interest rate and offers a 0.5% concession on loans exceeding Rs. 2 lakh. Additionally, there are no processing fees for loans up to Rs. 5 lakh.

Also Read: Difference Between Gross NPA And Net NPA And Their Impact On Financial Institutions

Conclusion

With these top four loan options, women entrepreneurs in India can fuel their ambitions and overcome financial barriers. These dedicated schemes not only offer easy access to funds but also provide crucial support to empower women, fostering their entrepreneurial journey and driving economic growth in the country.

0 notes

Text

Mastering Grocery Retail Growth: Harnessing the Influence of KPIs

For grocery retailers to unlock growth and competitive edge, recognizing and leveraging the most pertinent grocery retail KPIs offered by grocery delivery business software is indispensable. Setting definitive goals and tracking progress affords businesses invaluable insights into their performance, pinpointing improvement zones.

As the retail industry metamorphosizes, businesses must unfailingly concentrate on their key performance indicators (KPIs). These quantifiable measurements enable them to gauge their success and remain a step ahead of the competition. Within the grocery sector, KPIs play a pivotal role in assessing operational efficiency, earmarking areas for enhancement, and unearthing growth opportunities.

Decoding the Significance of KPIs

KPIs are quantifiable values signifying the degree to which a business is realizing its objectives. Within the grocery retail domain, KPIs measure crucial factors such as sales, inventory, customer satisfaction, and employee productivity. Tracking these metrics empowers businesses to gain performance insights and make data-driven decisions.

The Impact of KPIs on Grocery Retailers

In the fiercely competitive grocery industry, retail KPIs serve as an integral tool to continuously ascertain and monitor business success. They offer insights into the business performance and potential areas for amelioration. For instance, monitoring sales per square foot can highlight underperforming store areas, while customer satisfaction metrics can suggest the need for enhanced customer service training.

Grocery retail KPIs can additionally reveal growth prospects. Trends in sales or customer behaviour, when analysed, can aid retailers in formulating strategies to boost revenue and customer loyalty. For example, keeping a tab on the average transaction value can guide retailers in identifying cross-selling opportunities or nudging customers towards higher-priced items.

grocery retail KPIs wield an extraordinary influence in shaping the trajectory of grocery retailers. In an increasingly competitive landscape, KPIs are the critical determinants that enable grocery businesses to gauge their operational success, track performance in real-time, and make strategic decisions. They provide quantifiable proof of progress, enabling grocery retailers to ascertain their standing relative to market peers and industry standards. For instance, metrics such as sales per square foot, gross profit margin, and inventory turnover can shed light on financial performance, operational efficiency, and merchandising effectiveness.

Customer-focused KPIs like customer satisfaction, average transaction value, and repeat purchase rate serve as mirrors reflecting the quality of the customer experience. Furthermore, employee productivity KPIs can help evaluate and enhance workforce efficiency. Ultimately, the strategic use of KPIs enables grocery retailers to identify growth opportunities, streamline operations, and improve overall performance, thereby fortifying their market position and future viability.

Essential Grocery Retail KPIs and Tech-Enabled Tracking

A few pivotal grocery retail KPIs include sales per square foot, gross profit margin, inventory turnover, customer satisfaction, and employee productivity. Embracing technology that assists in tracking and analysing these KPIs can be advantageous. Retail management software can offer real-time data on sales, inventory, and customer behaviour, facilitating well-informed business decisions.

Common E-Commerce Grocery KPI Metrics

For online grocery retailers, essential KPI metrics include conversion rate, cart abandonment rate, average order value, customer lifetime value, repeat purchase rate, website traffic, and return on advertising spend.

By closely monitoring these metrics, e-commerce grocery retailers can extract valuable insights into their online performance and spot areas for refinement. For instance, a high cart abandonment rate can prompt an investigation into the underlying causes and alterations to the checkout process for improved purchases. Conversely, a low repeat purchase rate might call for the implementation of loyalty programs or personalized marketing campaigns to foster customer return.

Conclusion

Grocery retail KPIs are instrumental in evaluating the success of grocery retailers. By meticulously tracking and analysing key metrics, businesses can spot enhancement areas and devise growth strategies. With technology investments and the setting of measurable goals, grocery retailers can unleash the profound influence of KPIs, propelling their success in the fiercely competitive retail industry.

0 notes

Text

Fiber To The Home (FTTH) Market Research Trends Analysis by 2017-2032

The Fiber to the Home (FTTH) Market valuation of USD 20,641.8 Million in 2022 and USD 53,898.7 Million by 2029 and reach to increase at a CAGR of 14.7% to 2023-2029.

The competitive analysis of the Fiber To The Home (FTTH) Market offers a comprehensive examination of key market players. It encompasses detailed company profiles, insights into revenue distribution, innovations within their product portfolios, regional market presence, strategic development plans, pricing strategies, identified target markets, and immediate future initiatives of industry leaders. This section serves as a valuable resource for readers to understand the driving forces behind competition and what strategies can set them apart in capturing new target markets.

Advantages of global market research reports include:

Comprehensive Data: They provide extensive data on global markets, allowing businesses to make informed decisions on a global scale.

Market Insights: Reports offer insights into international market trends, helping companies identify new opportunities and threats.

Risk Assessment: Businesses can assess global risks and regulatory environments, minimizing potential pitfalls.

Competitive Analysis: Reports enable companies to understand global competition and refine their strategies accordingly.

Expansion Opportunities: They help identify potential international expansion markets and entry strategies.

Data-driven Decisions: Reports support data-driven decision-making for global business planning and growth.

Receive the FREE Sample Report of Fiber To The Home (FTTH) Market Research Insights @ https://stringentdatalytics.com/sample-request/fiber-to-the-home-(ftth)-market/2606/

Market Segmentations:

Global Fiber To The Home (FTTH) Market: By Company

• China Telecom.

• China Mobile Ltd.

• Verizon Communications Inc.

• AT&T Inc.

• Vodafone Group plc

• Nippon Telegraph & Telephone Corporation

• Softbank Group Corp.

• Deutsche Telekom AG

• Telefonica S.A.

• America Movil

Global Fiber To The Home (FTTH) Market: By Type

• Less than 50 Mbps

• 50 to 100 Mbps

• 100 Mbps to 1 Gbps

• 1 Gbps to 10 Gbps

Global Fiber To The Home (FTTH) Market: By Application

• Internet TV

• VoIP

• Interactive Gaming

• VPN on Broadband

• Virtual Private LAN Service

• Remote Education

• Smart Home Application

Regional Analysis of Global Fiber To The Home (FTTH) Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Fiber To The Home (FTTH) market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase Fiber To The Home (FTTH) Market Research Report @ https://stringentdatalytics.com/purchase/fiber-to-the-home-(ftth)-market/2606/

Key Report Highlights:

Key Market Participants: The report delves into the major stakeholders in the market, encompassing market players, suppliers of raw materials and equipment, end-users, traders, distributors, and more.

Comprehensive Company Profiles: Detailed company profiles are provided, offering insights into various aspects including production capacity, pricing, revenue, costs, gross margin, sales volume, sales revenue, consumption patterns, growth rates, import-export dynamics, supply chains, future strategic plans, and technological advancements. This comprehensive analysis draws from a dataset spanning 12 years and includes forecasts.

Market Growth Drivers: The report extensively examines the factors contributing to market growth, with a specific focus on elucidating the diverse categories of end-users within the market.

Data Segmentation: The data and information are presented in a structured manner, allowing for easy access by market player, geographical region, product type, application, and more. Furthermore, the report can be tailored to accommodate specific research requirements.

SWOT Analysis: A SWOT analysis of the market is included, offering an insightful evaluation of its Strengths, Weaknesses, Opportunities, and Threats.

Expert Insights: Concluding the report, it features insights and opinions from industry experts, providing valuable perspectives on the market landscape.

Here are some key functions of Fiber To The Home (FTTH) market research reports:

Market Assessment: Market research reports assess the current state of a specific market. They provide data on market size, growth trends, and potential opportunities and threats. This helps businesses understand the market's attractiveness and potential for expansion.

Competitive Analysis: Market reports often include information about competitors in the market. This includes their market share, product offerings, pricing strategies, and strengths and weaknesses. This analysis helps businesses identify their competitive advantage and develop strategies to stay ahead.

Customer Insights: Reports may include data on customer preferences, demographics, and buying behavior. This information is crucial for businesses to tailor their products or services to meet customer needs effectively.

Market Trends: Market research reports track and analyze market trends, such as technological advancements, regulatory changes, and consumer preferences. Staying updated on these trends helps businesses adapt and innovate.

Demand and Supply Analysis: Reports provide data on supply and demand dynamics within a market. This information helps businesses optimize their production and distribution strategies.

Risk Assessment: Market reports often include risk assessments, highlighting potential challenges and threats in the market. This allows businesses to develop risk mitigation strategies.

Investment Decisions: Investors use market research reports to assess the viability of investment opportunities. These reports provide insights into the potential return on investment and associated risks.

Product Development: Businesses can use market research to identify gaps in the market and opportunities for new product development or improvement of existing products.

Marketing Strategy: Market reports assist in formulating marketing strategies by providing insights into target audiences, effective communication channels, and promotional tactics.

Expansion Planning: For businesses considering geographical expansion, market research reports provide valuable information on new markets, local preferences, and regulatory environments.

Financial Projections: Market reports can be used as a basis for financial projections and business planning, helping companies set realistic goals and budgets.

Regulatory Compliance: Reports may include information on relevant regulations and compliance requirements, helping businesses ensure they operate within legal boundaries.

Mergers and Acquisitions: Market research is essential for evaluating potential merger or acquisition targets. It helps assess the target company's market position and growth prospects.

Customization of the Report:

This report can be customized to meet the client’s requirements. Please connect with our sales team ([email protected]), who will ensure that you get a report that suits your needs. You can also get in touch with our executives on +1 346 666 6655 to share your research requirements.

Enquiry Before Buying @ https://stringentdatalytics.com/inquiry/fiber-to-the-home-(ftth)-market/2606/

Our More Reports:

Bluetooth RF System on a Chip Market

Ion Sensors Market

Wireless Network Test Equipment Market

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

0 notes

Text

Indian Oil surpasses estimates with 67% spike in Q4 net profit at Rs 10,059 crore

Average gross refining margin (GRM) for the year April- March 2023 was $19.52 per barrel

Indian Oil Corp Ltd on May 16 reported 67 percent year-on-year jump in standalone net profit to Rs 10,059 crore for the quarter ended March 2023. Net profit stood at Rs 6,021 crore in the year-ago period.

The state-owned oil marketing company‘s revenue from operations jumped almost 10 percent YoY to Rs 2.26…

View On WordPress

#bse/nse share price#indian oil#Indian Oil profit#Indian Oil revenue#nifty share price#sensex share market#share market news#Stock market#stock market india#stock market live#stock market today

0 notes

Text

What’s in Store for Oil Stocks After the Latest IEA Forecast?

The stock markets have had a shaky start in 2023, fuelled further by the routing of Adani shares with the release of the scathing Hindenburg report. Not far behind, various commodities, such as oil, have had a shaky start, as the jury is still out on China’s recovery.

The IEA Report

Against this backdrop, the IEA has released its monthly report stating a rise in global demand for oil by two million barrels per day, which will take the world's oil consumption to 101.9 million bbl. Even more so, it expects the oil markets to see a surplus as the Russian supply continues to be robust.

With China opening its doors again and the USA all set to refill its strategic reserves, the oil demand will remain buoyant in the first half of 2023. However, this may change after June, with the kicking in of the sanctions on Russian oil.

Moreover, monetary tightening and recessionary fears may play a spoilsport for future oil demand. Besides, Russia has announced its plans to cut down oil output by a million barrels per day (bbl/d), against the IEA’s initial estimates of 1.6 million bbl/d.

But how will it pan out for oil stocks in India?

The Fortune Favours the Oil Conglomerate

With the oil demand set to hit a record high in FY23, refining margins could improve significantly, benefiting Reliance Industries (RIL). Besides, RIL’s SEZ refinery is already exempt from the levy of windfall taxes and additional excise duty (SAED) charges.

Moreover, refiners have seen their margins squeezed owing to the waning diesel spreads. This has been aggravated by the EU’s decision to build its stockpile before the sanctions on Russian gas and oil go into effect. The rise in demand, complemented by slower refinery throughput, will bode well for refining margins.

OMCs’ Stars Lack Sheen

But these positives are unlikely to flow for oil-marketing companies (OMCs) that are already reeling under heavy losses from 2022. This is because, despite an elevation in crude prices, the Indian government forced their hand by not allowing for a corresponding rise in retail prices.

Subsequently, while the PSU OMCs (HPCL, BPCL, and IOCL) did experience strong top lines in FY22, their bottom lines left a lot to be desired. This was reflected in the 20% and 10% drops in HPCL and BPCL share prices in the last year, respectively.

On an aggregate level, OMCs have already posted losses exceeding Rs. 27,000 crore in the first six months of FY23. This is despite the moderation in oil prices over the strong Russian supply and the EU’s stockpiling efforts. They have stated under-recoveries totalling Rs. 1.1 lakh crores from petrol and diesel sales that have been cross-subsidised with ATF and naphtha sales.

Having said that, BPCL may still be able to post better performance, considering its high refining-to-marketing ratio. Moreover, relative to its peers, BPCL has better ROCE fundamentals.

Additionally, IOC’s shares may remain resilient, as its business model is more refining-driven vis-à-vis HPCL and BPCL, thereby making its fortunes less dependent on marketing margins. But heavy debt pileups—the IOC’s gross debt went up by 30%—can be a cause for concern.

Finally, with the nation set to go to elections next year, the chances of retail price hikes seem bleak, which can further dampen the shine of oil companies in the stocks market.

Are you planning to invest in the stock market? Build your portfolio today with a free Demat account on Angel One’s smart app.

0 notes

Text

Learn Whether Forex Trading Is For You

Pip cupid Top service provider.Learning about trading currency can be incredibly overwhelming, but just like anything else, it can also be very easily researched, taught and learned. Now that you have found these tips, hopefully you can come out a little more informed when it comes to trading, so that you can refine your methods and become a great currency trader.

A good way to learn valuable information about Forex is to subscribe to newsletters and online magazines dealing with the issues. You shouldn't take this information as gospel and trade on a whim, but the more information the better, in terms of learning how the market works. Reading a few articles a day is a great way to become market savvy.

Perseverance is your greatest asset as a forex trader. While you should never risk more money than you are willing to lose, understanding that losses are inevitable as you climb the learning curve of the forex market is vital. You must keep in mind that every bad trade is a potential learning experience, and your next trade may be a great one.

Before trading, make sure that your finances are in order and that you can afford to engage in trading currency. You don't want your finances to be the factor that decides when you have to enter and exit. Without the proper funding behind you, you could really be in a jam if the market takes a terrible turn.

Know your own tolerance for risk. There is no fool-proof method for successful Forex trading, so it is important that your capital not exceed what you can afford to lose. At the same time, if you have a good cushion for loss, not investing as much as you are able can cost you in profits.

When forex trading, you need to trust your instincts and ultimately, make your own decision. It's wise to get advice from critics and knowledgeable people, but ultimately the decision should be up to you. You don't want other people making major trading decisions with your money.

A good way to handle your positioning in Forex is to increase it systematically as you progress. Every time you open up with a small position and earn money, double the position and see if you can profit more. If you do happen to lose, you can fall back and start again, minimizing your risks but maximizing on any streak.

If you want to practice on the forex market by using a demo account, than there is no reason to buy any automated software system. All you need to do is find the main forex page, and sign up for an account.

Monitor other markets, as well as, the foreign exchange market. Stocks, commodities, currencies, real estates and other markets are all connected. Some markets are leaders and can dictate trends in other markets. Intermarket analysis can help you to forecast price movements in the currencies markets and make your forex trades more profitable.

Examine the gross domestic product, or GDP, of the country. This figure measures the country's internal growth, representing the total value of the services and products produced over the past year. If the GDP is rising, it is a good sign that the country is doing well. This will impact the strength of its currency and will influence your decisions in currency trading.

If you are new to the world of trading and feel confused about your broker's features, consider switching to Oanda. The interface in Oanda is much simpler than most brokers, and every action is explained in terms that are easy to understand, even if you have no former knowledge about currencies and trading.

Pip cupid Qualified tips provider.If a forex signal software offers a 100 percent guarantee or claims that you can avoid taking any kind of risks, you are facing a fraud. Look for software that explains honestly what they do and how you can use this data to maximize your profits and make informed decisions.

Educate yourself on Margin trading in the Forex system. This is one strategy Forex users can have success with. The basic idea is that you are permitted to trade more money with a lower deposit. The leverage created by this strategy allows you to increase your gains substantially but be warned, losses can also be increased. When margin trading, know that it is essential to keep an excess cash balance in your account.

When trading with a rather high leverage, you can still control the risks you are taking thanks to stop-loss and time-price limits. This will set boundaries beyond which you should retract your funds from the investments before you lose more money. Establish these limits very carefully before you make a transaction.

Watch your trades closely yourself. Don't rely too heavily on software and tools that are supposed to do your trading for you. It's your money, after all, and you need to keep your own, human eyes on it. If the market changes suddenly, you (not a piece of software) need to be the one who decides what to do!

Don't lose site of the primary reason for forex market charts. Charts of market activity show you if the market is thinking bearish or bullish. When price activity is charted, it can help you see trends as they start to develop and take advantage of them with your pre-planned trading methodology.

Look carefully at charts. A person's eyes are the most sensitive to change, so if you glance at a chart and something seems off, look again. Your eyes may be trying to tell you about a change in the market that you would not have otherwise noted in the written analysis.

Follow the trends religiously. There is no excuse for not doing your homework in this area. Currency values do fluctuate but usually grow in steady direction for significant periods of time, and you can capitalize on this knowledge. Long-term trends should be foremost on your watch list when trading in the Forex market.

Pip cupid Top service provider.Not as bad as you thought, correct? Like any other subject, the world of currency trading is huge and has a wealth of information available on it. Sometimes, you just need a little help as to where to begin. With any luck, you should have received that from the above tips.

0 notes