#GST LUT FILINGS

Link

Any person registered under GST who has not been executed for tax evasion exceeding Rs. 250 lakh or for any other felony may submit a LUT.

0 notes

Text

Before proceeding further with any exporting operations, businesses are required to file GST LUT or Letter of Undertaking. Eazystartups helps you in this regard.

0 notes

Text

Discover the key benefits of GST LUT Filing in our latest blog. Gain insights into the streamlined process and ensure compliance for your export activities. Read our blog for more information!

#GST#LUTFiling#Export#CompetitiveAdvantage#BusinessGrowth#GlobalMarkets#TaxCompliance#FinancialManagement#BusinessSuccess#TaxFilingVenture

0 notes

Text

GST LUT Filing

ST LUT Filing Services: Seamlessly Handle Your Export Transactions

Welcome to our online portal offering hassle-free GST LUT (Letter of Undertaking) filing services in India. Facilitating the smooth handling of your export transactions, our platform ensures compliance with GST regulations for businesses engaged in exports.

Our Services:

1. Efficient LUT Filing

We assist in the efficient filing of…

View On WordPress

0 notes

Text

Goods and Services Tax Registration

Apply for GST Registration Number

Online GST Registration

GST Return Filing

GST LUT Filing

GST Registration Cancellation

GST Advisory Services

GST Annual Return Filing

Register for GST online in Noida with CharteredHelp.

0 notes

Text

What is the process of filing a Letter of Undertaking (LUT) under Goods & Service Tax (GST)?

Introduction

All registered taxpayers who wish to export goods or services without paying IGST (Integrated Goods and Service Tax) must submit a Letter of Undertaking (LUT) in GST RFD-11 form through the GST website. This article is going to focus on “What is a Letter of Undertaking under GST?”, “Process for Filling LUT under GST,” “Documents Required for LUT under GST,” and “Eligibility requirements for Filing LUT under GST (Goods and Service Tax).

What is a Letter of Undertaking under GST?

Exporters can use a letter of undertaking to export goods or services without paying taxes. Under the new GST system, all exports are subject to IGST, which may then be reclaimed through a refund against the tax paid. By applying for a LUT (Letter of Undertaking), exporters can avoid the effort of requesting a refund and avoid the freezing of cash through tax payments.

Who is eligible to file LUT under GST?

Any exporter of goods or services who has registered for GST is required to submit a GST LUT. Exporters who have been accused of committing a crime or tax evasion totaling more than INR 250 lakhs in violation of the CGST Act, the IGST Act, 2017, or any other applicable law are disqualified from submitting a GST LUT. In this case, they would have to offer an export bond. According to the CGST Rules, 2017, any registered person may submit an export bond or LUT under GST RFD 11 without having to pay the integrated tax. They could apply for LUT if:

They want to offer goods or services to India, other nations, or SEZs (Special Economic Zones) and have registered for GST.

They wish to avoid paying the integrated tax when they sell goods.

What is the process of filing LUT under GST?

The following is the process of filing LUT under GST:

Navigate to the GST Portal and sign in using your authorized credentials.

The “USER SERVICES” drop-down menu under “SERVICE TAB” offers the option to furnish a Letter of Undertaking (LETTER OF UNDERTAKING (LUT).

You must next choose the financial year for which you want to file the letter of undertaking after choosing this option.

Next, attach a PDF of the LUT from the previous financial year, if applicable.

Next, include two witnesses’ names, addresses, and occupations.

The next step is to fill in the filing location. You can view a preview of the form after this process is finished.

The application can be signed using an electronic verification code or a recognized digital signature certificate. On the form, both options are present. The form cannot be changed after it has been signed and submitted.

What are the documents required for filing LUT?

The following documents are required for filing LUT under GST:

PAN Card of the Company

Authorized Person’s KYC

Certificate of IEC Code

Form GST RFD 11

LUT Cover Letter with an official signature serving as an acceptance request

Returned/ Canceled Cheque

How will the GST Letter of Undertaking help exporters?

The following are the benefits of GST LUT for exporters:

Regular exporters gain a lot by filing LUT electronically because doing so saves time compared to the alternative.

The applicant does not have to show up in person for approval in front of the officials. The entire process can be finished more quickly and easily.

An exporter may export products or services tax-free if they submit a LUT under the GST.

The Letter of Undertaking is effective for the whole financial year for which it was submitted.

GST filing charges are the fees incurred when individuals or businesses file their Goods and Services Tax (GST) returns with tax authorities. These charges vary based on tax laws, filing frequency, and transaction complexity, covering preparation, verification, and submission of GST returns, along with any professional services fees if needed. Staying informed and seeking professional guidance can aid in a smooth and accurate GST filing process.

Summary

LUT is necessary if you want to export goods, services, or both without paying IGST. If exporters fail to provide the LUT, they must pay IGST or release an export bond. Previously, LUT could only be delivered in person to the appropriate GST office. But in order to make the process simpler, the government has made LUT filing available online.

0 notes

Text

Navigating the Complexities of GST Refunds for Exports

Are you an exporter looking to stay competitive in the global market?

With the implementation of the Goods and Services Tax (GST) in India since July 2017, navigating the export landscape has become more complex.

How can you ensure that your business meets all necessary compliance requirements, including laws and regulations, tax and duty payments, and quality and safety standards?

For those opting for the Letter of Undertaking (LUT) scheme, the GST refund process may seem daunting.

Therefore, this article offers valuable insights into the potential challenges and pitfalls during the GST refund process and highlights reasons why the tax department might not process Input Tax Credit (ITC) refund applications.

Get ready to discover key strategies for streamlining your GST refund experience and ensuring a successful outcome!

Reasons Why Applications May Not Process

Let's explore some of the common reasons why applications for refunds of ITC do not get processed in the tax department.

1. Discrepancies in GST Returns for the Relevant Period

One of the common reasons why GST return applications for exports may not be processed in the department is due to a failure to reconcile GST returns for the concerned period.

* GSTR-1 with GSTR-3B: Reconciling GSTR-1 with GSTR-3B is important. Failing to do so can result in a show-cause notice from the GST authorities and create difficulties in processing of GST refund applications. Therefore, it is crucial for exporters to perform reconciliation from time to time to avoid any discrepancies.

* GSTR-2A with GSTR-3B: Another crucial step in the GST return process for exports is the reconciliation of ITC claimed in GSTR-3B with one reflecting in GSTR-2A. This exercise enables businesses to claim the full Input Tax Credit (ITC) and rectify any excess ITC claimed. By performing reconciliation before filing GSTR-3B, exporters can avoid any potential demand notices from the tax authorities, thereby making it an essential step to easy processing of refunds.

2. Mismatched Details in Shipping Bill and Invoice

It is crucial for exporters to ensure that the details in the shipping bill align with those in the invoice to avoid any issues with refunds. If there are discrepancies between the two, the refund may be withheld by the department.

Therefore, it is important for taxpayers to enter correct details such as Shipping Bill number, Shipping Bill date, Port Code, etc., and file them in their subsequent Form GSTR-1.

3. GST Officer's Field Visit

Business owners should not take a field visit by a GST officer lightly and should ensure that someone from the company is present at the premises during the visit.

The officer may ask for documents related to the business, such as sale invoices, purchase invoices, bank statements, and details of goods. Therefore, it is crucial for exporters to have proper documents readily available to show the officer during the visit.

The officer's primary objective is to verify that the business premises are actually functioning and in compliance with GST regulations. Being prepared with the necessary documents can help ensure a smooth and hassle-free field visit, making it easier to process refunds.

4. Ineligible ITC Claims on Capital Goods

It is important for exporters to note that capital goods are not eligible for ITC claims if exports are made through LUT, and their claim may be denied in the GST refund. Despite this, many exporters file GST return applications to claim refunds against ITC of these goods.

Therefore, it is essential for exporters to exclude these goods before filing their applications to avoid any issues with the processing of their refunds.

By excluding these goods, exporters can ensure that their claims for eligible goods are processed quickly and without any issues.

5. Inconsistent Monitoring of Refund Status

Exporters should regularly check the status of their refunds to ensure that the process is moving smoothly. In some cases, the tax department may issue deficiency memos or show cause notices against the refund application if they find any discrepancies or issues.

Therefore, it is crucial for exporters to monitor the status of their refunds regularly and address any issues promptly to avoid any potential delays or complications in the process.

By staying on top of their refund status, exporters can ensure that they receive their refunds in a timely and hassle-free manner.

6. Unclaimable ITC Due to Vendor's Cancelled GSTIN

Exporters must be aware that if the tax department cancels a vendor's GSTIN, the exporter cannot claim ITC on purchases made from that vendor. Therefore, it is essential for exporters to identify such vendors and avoid claiming ITC credit for their purchases.

This is because the tax department will not provide a credit or refund for purchases made from vendors with cancelled GSTINs.

By being proactive in identifying such vendors and avoiding ITC claims, exporters can ensure that their GST refund applications are processed quickly and without any issues.

7. Late Filing of GST Refund Applications

Exporters should be aware that there is a time limit for filing GST refund applications. The relevant date for determining the time limit is the date on which the taxpayer exports the goods or delivers the services.

The application for a refund must be filed within two years from the relevant date. Exporters who miss the deadline to file their refund applications risk having their applications rejected by the tax department.

Therefore, it is crucial to ensure that the refund application is filed within the designated time frame to avoid any delays or rejections.

8. BRC/FIRC Amount Discrepancies or their non-avalability

Exporters must ensure that they obtain the Bank Realization Certificate (BRC) and Foreign Inward Remittance Certificate (FIRC) for the full value of the exported goods or services.

These certificates serve as proof of payment for the goods or services exported and are essential for claiming the GST refund.

Therefore, it is important to ensure that the BRC and FIRC received from the bank match the invoice amount and payment received. In case of any discrepancies, the exporter must take corrective action with the bank and obtain the correct certificates before filing the refund application.

This will ensure that the tax department does not reject the refund application due to missing or incorrect BRC/FIRC.

9. Inaccurate HSN Codes on Invoices and Annexure B

Correct invoicing is crucial for claiming GST refunds, and the HSN code on the invoice must match with Annexure B. Any discrepancies or mismatches can result in the rejection of the GST refund application.

Therefore, it is important to ensure that the HSN code mentioned in the invoice is accurately reflected in Annexure B, which is a statement of inward supplies filed by registered taxpayers. This can help avoid any unnecessary delays or rejections in the GST refund process.

10. Ineffective Coordination with GST Officer

When it comes to GST refunds, a lack of coordination with the GST officer can cause delays or even rejections.

While the process of filing for a refund is primarily online, the process of verifying and approving the refund is often manual and requires coordination with the GST officer.

This means that if there is a lack of coordination between the taxpayer and the officer, it can lead to misunderstandings and delays in the refund process.

It is important for taxpayers to communicate clearly and provide all necessary information to the officer in a timely manner so that the officer can process the refund application efficiently.

11. Unfiled GST Returns for the Relevant Period

In order to claim a GST refund for a particular period, it is mandatory to file the GST returns for that period. If the returns are not filed, refund application could not be filed and obviously there will be delays and in GST refund.

It is crucial for exporters to be aware of the filing deadlines and ensure the timely submission of returns to avoid delays in receiving refunds. Additionally, proper documentation and accurate information are key factors in facilitating a smooth refund process.

12. Non-compliance with Circular 125

Circular 125, issued by the GST authorities, provides guidelines and clarifications on the GST refund process. It is important to comply with the circular while filing the GST refund application, as it specifies the necessary documents and information that need to be submitted.

Non-compliance with the circular may lead to the rejection of the refund application. Therefore, businesses should carefully review the circular and ensure that all the requirements are met before filing the GST refund application.

13. Inappropriate Shipping Methods

Proper shipping of goods is crucial for successful exports. It is important to ensure that the goods are shipped thorough proper channel under custom authorities. It is not advisable to ship through private courier companies. These modes do not qualify for taking GST refunds from the department.

Final Thoughts

Navigating the GST refund process for exports can be complex due to various compliance requirements and potential issues.

Some common reasons for unprocessed refund applications include unreconciled GST returns, discrepancies in shipping bills and invoices, ineligible ITC claims, and lack of coordination with the GST officer.

To ensure a smooth refund process, it's crucial to maintain accurate documentation, regularly check refund status, adhere to compliance guidelines, and maintain open communication with the GST officer.

For professional assistance in managing your GST refund process, don't hesitate to reach out to a qualified expert who can guide you through the intricacies and ensure timely and hassle-free refunds.

Source: https://www.manishanilgupta.com/blog-details/navigating-the-complexities-of-gst-refunds-for-exports

0 notes

Text

GST LUT filing is a procedure under which businesses can claim exemption from paying taxes on the export of goods. A LUT is a document in which a business undertakes to pay all its GST liabilities on time.

0 notes

Text

What is LUT in GST? A Detailed Guide | eAuditor Office

Exports are one of the few situations whereby the taxpayer is allowed to claim a refund under GST. When it comes to the export of goods, GST law permits two options to the exporters i.e., ‘export with payment of tax’ or ‘export without payment of tax’. In the case of the former, the exporter needs to discharge the output tax liability in cash after adjusting the ITC. The exporter can then claim a refund for the same.

However, in the case of the latter, the exporter can claim a refund of ITC lying in the electronic credit ledger provided he exports the goods under a bond or Letter of Undertaking (LUT). What is LUT under GST and why is it important? Let’s find out!

What is LUT Under GST?

All the registered taxpayers who opt for exporting without payment of tax are required to furnish a Letter of Undertaking in Form GST RFD-11 in the GST portal. It ensures that the exporters agree to the terms and conditions for export without payment of tax.

How to File LUT Under GST?

Following is the process to apply for LUT in GST under Form GST RFD-11:

Login to the GST portal

Navigate as follows: Services >> User Services >> Furnish Letter of Undertaking (LUT)

The dashboard for LUT will appear on the screen. Select the financial year for which you are willing to furnish LUT.

In case you have already furnished LUT for any of the previous periods, then you shall upload the same after selecting the financial year. It should be in JPEG or PDF format and the maximum file size should be 2 MB.

Fill in all the necessary details as required in the form.

Tick on the self-declaration boxes. By ticking, the exporter agrees with the following conditions:

The export of goods or services will be completed within a period of 3 months from the date of issue of the export invoice or such further period as allowed by the Commissioner

To abide by the GST law with respect to exports

To pay IGST along with interest if you fail to export

The interest shall be paid at the rate of 18% per annum from the date of issue of the export invoice up to the date of payment of IGST.

You need to provide the name, occupation and address details of two independent witnesses. Witnesses declared in the LUT under GST shall be the ones declared in the bank guarantee or the bond.

Enter the place of filing the form and save the information. Preview the form to verify for correctness before submitting the form.

The authorized signatory shall sign the form. The LUT form can be submitted using the Digital Signature Certificate of the authorized signatory or through the EVC that will be sent to the registered mobile number or email ID. In the case of companies or LLPs, LUT in GST can be submitted only through DSC.

Once the LUT form is submitted, ARN will be generated and sent to the email and mobile number of the taxpayer. Click on the ‘Download’ button to save the acknowledgement.

In case you want to view the LUT form you submitted, then navigate as follows:

Services >> User Services >> View My Submitted LUTs

Select the period for which you want to view the LUT and click on view.

1 note

·

View note

Photo

49% OFF on GST Registration Now Only at Kanakkupillai

Special Offer: 49% OFF on GST Registration Now Only at Kanakkupillai !

We can help you with the Goods and Services Tax (GST) in India. GST Return Filing, GST LUT Filing, GST Registration Cancellation, GST Advisory Services, GST Annual Return Filing & more.

https://www.kanakkupillai.com/online-gst-registration

0 notes

Text

Entrust your GST LUT filing to us for peace of mind. With our expertise, timely filing, and competitive pricing, focus on your business while we ensure compliance. Read our blog for more insights.

#GST#LUTFiling#TaxCompliance#PeaceOfMind#BusinessServices#Taxation#Exporters#BusinessGrowth#Consultancy#ExpertAssistance#TaxExperts#Compliance#GSTRegistration#SmallBusiness#MSMEs

0 notes

Text

Import Export Code (IEC) Online Registration

The import and Export Code is a 10 digit unique number issued by the Directorate General of Foreign Trade (DGFT) to a business entity for import and export in India. The Import and Export Code helps the business to grow in the global market. In order to clear customs duties, the trader must ensure that the importing entity has an IE code and GST registration before commencing the import of the goods.

If an importer does not have both an IE code and a GST registration, the goods will be stuck at the port and start paying demurrage or may get destroyed.

The IE code once issued is valid during the existence of the unit and there is no need to renew the code.

Importance of Import Export Code

International Market Unlocks: Since IE codes are a requirement for import and export business, they allow products to reach the international market. IE Code facilitates entry into Indian business internationally and opens doors for growth and expansion.

Online Registration: The process to find the IE Code is completely online and hassle-free with little document submission.

Less Document Requirement: Very few documents are required to get IE code in India. Here is the list of mandatory documents required to obtain the Import Export Code.

PAN of the applicant

Cancelled Cheque

Passport size photo of the applicant

Address proof of the applicant

Lifetime Validity: IE Code is a lifetime registration which is valid as long as the business is in existence. Hence, there is no problem in updating, filing and renewing the Import Export Code registration. IE registration is valid till the business ceases to exist or the registration is cancelled or surrendered.

Reduces Illegal Goods Transportation: The most basic requirement for an import-export code is that you need to provide authentic information. IE code cannot be obtained without providing proper information. This criterion makes the transportation of illegal goods impossible.

Benefits of the Schemes: IE code has huge benefits for both importers and exporters. Registered business entities will be able to get benefits in the form of subsidies from Customs, Export Promotion Council or other authorities. With LUT filing under GST, exporters can export without paying taxes. If the export is made with payment of tax, the exporter can claim a refund of the tax amount paid.

Compliance: Unlike other tax registrations, the person importing or exporting is not required to meet any specific compliance requirement such as annual filing or return filing.

Documents Required for IE Code Application

Proprietorship

Digital Photograph (3x3cms) of the Proprietor.

Copy of PAN card of the Proprietor.

Copy of Passport (first & last page)/Voter’s I-Card/ Driving Licence/UID (Aadhar card) (any one of these).

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case office is rented/ leased; or latest electricity /telephone bill.

Bank Certificate as per ANF 2A(I)/ Cancelled Cheque bearing preprinted name of applicant and A/C No.

Partnership firm

Digital Photograph (3x3cms) of the Managing Partner.

Copy of PAN card of the applicant entity.

Copy of Passport (first & last page)/Voter’s I-Card /UID (Aadhar Card) /Driving Licence/PAN (any one of these) of the Managing Partner signing the application.

Copy of Partnership Deed.

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case office is rented/ leased; or latest electricity /telephone bill.

Bank Certificate as per ANF 2A (I)/Cancelled Cheque bearing preprinted name of the applicant entity and A/C No.

LLP or Private Limited Company or Section 8 Company

Digital Photograph (3x3cms) of the Designated Partner/Director of the Company signing the application.

Copy of PAN card of the applicant entity.

Copy of Passport (first & last page)/Voter’s I-Card /UID (Aadhar Card) /Driving Licence/ PAN (any one of these) of the Managing Partner/Director signing the application.

Certificate of incorporation as issued by the RoC

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case office is rented/ leased; or latest electricity or telephone bill.

Bank Certificate as per ANF 2 A(I)/Cancelled Cheque bearing preprinted name of the company and A/C No.

Society or Trust

Digital Photograph (3x3cms) of the signatory applicant/Secretary or Chief Executive.

Copy of PAN card of the applicant entity.

Copy of Passport (first & last page)/Voter’s I-Card /UID (Aadhar Card) /Driving Licence/ PAN (any one of these) of the Secretary or Chief Executive/ Managing Trustee signing the application.

Sale deed in case business premise is self-owned; or Rental/Lease Agreement, in case office is rented/ leased; or latest electricity /telephone bill.

Registration Certificate of the Society / Copy of the Trust Deed

Bank Certificate as per ANF 2A(I)/Cancelled Cheque bearing preprinted name of the Registered Society or Trust and A/C No.

HUF

Digital Photograph (3x3cms) of the Karta.

Copy of PAN card of the Karta.

Copy of Passport (first & last page)/Voter’s I-Card/ UID (Aadhar card)/ Driving Licence (any one of these) of the Karta.

Sale deed in case business premise is self-owned or Rental/Lease Agreement, in case office is rented/ leased or latest electricity /telephone bill.

Bank Certificate as per ANF 2A(I)/ Cancelled Cheque bearing preprinted name of applicant and A/C No.

Procedure for obtaining Import and Export Code

Exporters/importers shall file an online application in form ANF 2A.

The applicant is required to submit only two documents one is the address proof and the other is the pre-printed cheque or bank certificate.

Once the online application is submitted, along with appropriate fees and requisite documents, IEC will be auto-generated.

Intimation regarding allotment of IEC will be sent to an applicant via SMS and E-mail along with a hyperlink through which the e-IEC can be downloaded and printed.

Regional Authority would conduct post-verification of the online IEC as per the guidelines. In case there is any wrong/incomplete information being furnished, the applicant would be liable for penal/criminal activity and in such case, IEC would be either suspended or cancelled.

An e-IEC holder needs to update his profile immediately after the issuance of the e-IEC.

ANF-1 of the Handbook of Procedure contains the profile of the importer/ exporter.

Every IEC holder is responsible for updating his profile, immediately. Further, in case of any change in IEC or in any other case, the profile Updation needs to be done at least once a year.

Documents Required For Importer Exporter Code

Pan Card

Aadhaar Card

Incorporation Certificate

Cancelled Bank Cheque

Electricity Bill

Rental Agreement

CONTACT US : +91 9911235662

www.services.edu-visor.in

CLICK HERE TO APPLY NOW https://services.edu-visor.in/contact.php

0 notes

Text

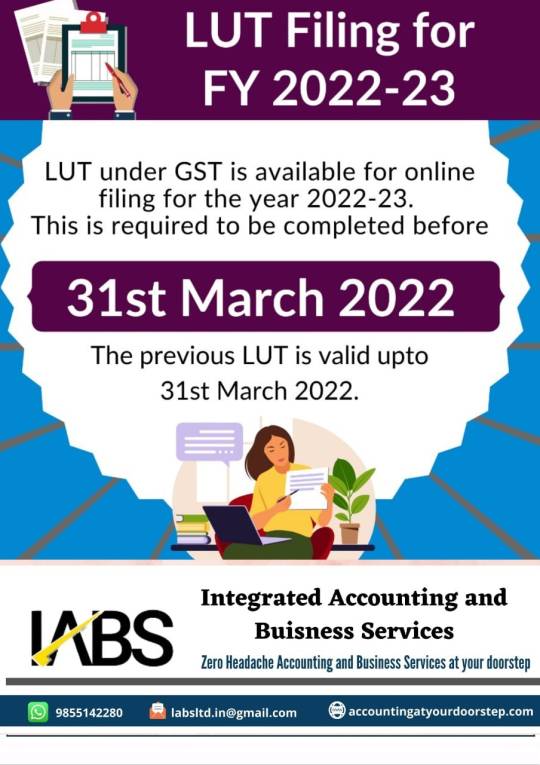

𝐋𝐔𝐓(𝐋𝐞𝐭𝐭𝐞𝐫 𝐨𝐟 𝐔𝐧𝐝𝐞𝐫𝐭𝐚𝐤𝐢𝐧𝐠) 𝐅𝐢𝐥𝐢𝐧𝐠 𝐟𝐨𝐫 𝐅𝐘 𝟐𝟎𝟐𝟐-𝟐𝟎𝟐𝟑

LUT under GST is available for online filing for the year 2022-2023.This is required to be completed before 31st March 2022. The Previous LUT is valid upto 31st March 2022.

GST Department asks for the LUT in case you want to Export without payment of taxes. If LUT for that period is not filed then the GST Department might charge Taxes on exports.

Contact with us Today+91 98551 42280

Email: [email protected]

Get more Information here: https://accountingatyourdoorstep.com/

0 notes

Text

GST LUT Filing

LUT stands for Letter of Undertaking. According to the CGST Act, 2017, it is the document that is required to be filed by exporters to export goods or services such that they don’t have to pay the taxes. All exports are a subject to IGST under the new GST system, in which it can be reclaimed later by a refund against the paid tax. Having difficulties faced by exporters in processing tax refunds, an alternative option of LUT eases their efforts by eliminating blocking of funds.

0 notes

Text

GST Refund For Exporters

GST is an indirect tax that eventually serves the revenue of the government when the product and service are consumed by the end buyer. The government enables the GST refund to facilitate the exports and to make Indian exporters competent to the international market.

So, except for some exceptional circumstances, a GST refund applies to the exports.Any qualified GST registered individual can refer for the GST refund as per the provided timelines through the GST Portal online along with benefiting documents.

The refund process for exporters

The export supply under the GST legislation is also called a zero-rated supply. As the percentage of tax on export stocks is planned to effectively be zero. The considered exports are also zero-rated stocks. The process of the statement of exports varies under each procedure.

What is the GST refund process for exports under the present return filing?

1) The Export with the expense of IGST:

Exporters can allege the compensation of the IGST spent at the period of export. The GST refund procedure for exports in the case of goods and services starts with carrying a source to a preliminary statement known as the shipping law.

The shipping law or bill and extra export-related certificates should be documented on the Indian Customs Electronic Commerce Gateway (ICEGATE).

The GSTR-1: GST refund procedure for exports proceeds on the GST opening in the form GSTR-1. The elements are declared in the GSTR-1 under Table 6A – Exports Invoices. The details expected are as follows:

● Invoice date

● Port code

● Shipping bill no./bill of export no.

● Shipping bill date/bill of export date

● Total invoice value and taxable value

● GST payment With Payment of Tax needs to be clicked

● Whether the allowance is capable of tax at a different proportion, as instructed by the administration

● The tax amount is auto-populated but can be edited

All the details declared at this point must match with the related details declared in the shipping law or bill.

For assumed exports, the statement will be uploaded as an ordinary B2B invoice in Tables 4A, 4B, 4C, 6B, 6C – B2B invoices. When joining invoice details, the checkbox for Deemed exports, SEZ Supplies without expenditure, or Sale from tied warehouse may be assigned, as acceptable.

The GSTR-3B: The GST refund procedure for exports will affect the statement in the GSTR 3B. The related amount needs to be filled up in Outward taxable supplies (zero-rated).

The IGST amount typed, should be either identical to or bigger than the total IGST restored in Table 6A of the related GSTR-1.

Form GST RFD-01/RFD-01A: GST refund procedure for exports will require the filing of a form RFD-01 which is completely online or RFD-01A which is manual, in particular cases only.

(A) Export of Goods: The export of welfare with the expenditure of rate, there is no different compensation petition expected as the shipping bill or law, itself will be dealt with as the refund petition.

The details entered in Form GSTR-1 will be corresponded with the facts cited in the shipping bill as documented with ICEGATE. The ICEGATE will filter the refund and value the same to the bank account as spoken of by the taxpayer on its outlet.

(B) The Export of Services: A different refund petition in RFD-01A is compelled. Such as,

● the taxpayer has to login to the GST portal

● Select Services Refunds

● Application for Refund

● Export of Services with payment of tax

● RFD-01A

The elements associating with the export of employment are required to be uploaded using the offline method. The quantity of compensation and the bank account digit in which the refund is to be charged will also need to be delivered.

On successful filing, an Application Reference Number (ARN) will be developed, which can be used to trace the importance of the refund petition.

1) Export without payment of IGST:

The GST refund procedure for exports, in this lawsuit, implicates a different statement. The option to export goods and services without the expenditure of tax can either be utilized under the cover of a Letter of Undertaking (LUT) or a bond.

In that case, any ITC accumulated on inputs services unused will be accessible for reimbursement.

The choice of LUT is accessible only for a select quantity of exporters fulfilling a prescribed standard. The protocol is identical to the export of services.

Form GST RFD-11:

● The LUT can be filed in Form GST RFD-11 on the common portal by accessing the Services

● User Services

● Furnish Letter of Undertaking (LUT)

The essential elements are restored and uploaded with the digital impression as per the LUT filing method. The GST refund procedure for exports will not be detailed without this filing.

In case of a contract or bond, it must be committed manually on an authorization paper, approved, and delivered to the jurisdictional Deputy or Assistant Commissioner with the relevant documents like Form RFD-11. With the envelopes of the taxpayer, bank warranty, council letter, etc.

The Jurisdictional Deputy or Assistant Commissioner, after inspection of the statements delivered, will issue an approved letter admitting the same.

Form GST RFD-01/ RFD-01A: Similar to the GST refund procedure for exports in case of tax payment, taxpayers should use this form. The details about ITC attributable to zero-rated supply need to be entered and submitted on RFD-01 is ( online method or RFD-01A is done manually.

The taxpayer should confirm if RFD-11 is filed. Upload relevant documents and affix the digital signature to submit the form and an ARN gets generated for tracking.

The procedure of proclamation of invoices in the Form GSTR-1 is exact except that in the GST Payment field, Without payment of tax needs to be selected.

What is the GST refund process for exports under the new return filing?

The GST refund procedure for exports and compensation petitions in RFD-01A and RFD-11 will stay exact under the new GST return policy. There is a modification in the reporting of export conditions in the return.

Below mentioned points are the forms used to report refund circumstances on exports:

Form ANX-1: The GST refund procedure for exports under new GST returns will begin with ANX-1.

In this form, the invoice circumstances of the exports are to be uploaded in Table 3C – Exports with payment of tax and Table 3D – Exports without payment of tax relying on the IGST is spent or not in appreciation of the allowance.

For a tax interval, all such export statements must be documented on which the shipping law or bill of export are accessible till the date of documenting the GST returns. Which is on the 20th of the following month for monthly filers or the 25th of the month following the quarter for quarterly filers. The rest will be documented in the second tax duration.

The factors expected in this area are as follows:

● Document components (statement, credit and debit statement, consecutive quantity, duration, value)

● HSN law (which is at the six-digit level)

● Tax rate and taxable value

● Related tax quantities, in a lawsuit the export is earned with the expenditure of tax

● Shipping bill/bill of export (no. and date)

Once the council starts up, various functional will soon be accessible for updation of circumstances of shipping law or bill of export just after the duration of documenting the return of the similar tax duration. It will then automate the GST repayment protocol for exports to a huge extent.

FORM RET-1: GST refund procedure for exports under the new GST returns system will continue with the declaration in RET-1. Therefore, the taxpayer requires to ascertain the exact and not re-enter the circumstances.

The New Amendment Return Introduced: The modification to the export circumstances whether or not with expenditure of the IGST, can be done in ANX-1A that will modify the new annexure ANX-1 introduced for a tax interval, either monthly or quarterly.

It can be done by about the recent details. These will be auto-populated to RET-1A.

Note that the modification is not authorized on the export manuscripts on which refund is already successfully claimed. On the other hand, those export invoice details omitted to declare in prior duration can be reported in the recent period’s AND-1 itself.

source

gst refund calculation for export|gst refund for export of services without payment of tax|refund of igst paid on export of services|refund under gst| refund of input tax credit under gst in case of export|gst refund procedure|refund of itc on export with payment of

2 notes

·

View notes

Text

The filing of RFD-01 will occur only in certain cases such as:

The filing of RFD-01 will occur only in certain cases such as:

Only if the export of goods with payment of tax, no separate return/refund application is needed due to all the details present on the shilling bill. However, when filling out the GSTR-1 make sure all the details match with the shopping bill filled with ICEGATE that you are using as proof.

When a separate return/refund application is needed. The filing of RFD-01 along with details of the export of services is required to upload with an offline utility. A reference number will be generated to track the status of the application.

Export of Goods without payment of tax or IGST

Under this different documents are required as shipping bills cannot be used as an application for a refund. Exporters must fill RFD-01 with GST portals. This option can be used under a bond or Letter of Undertaking (LUT). Any ITC accumulated services are available for funds. However, LUT is only applicable to selected services. Under the export of goods without payment of tax or IGST, exporters have to provide a turnover of zero-rated supplies. Along with adjusted total turnover of the refund period to get a refund. At the time of filing the GST return without payment of tax, the exporter must have all the applications and documents ready for the filing process. You have to fill out forms under CGST rules and circulars.

0 notes