#Forexstrategy

Text

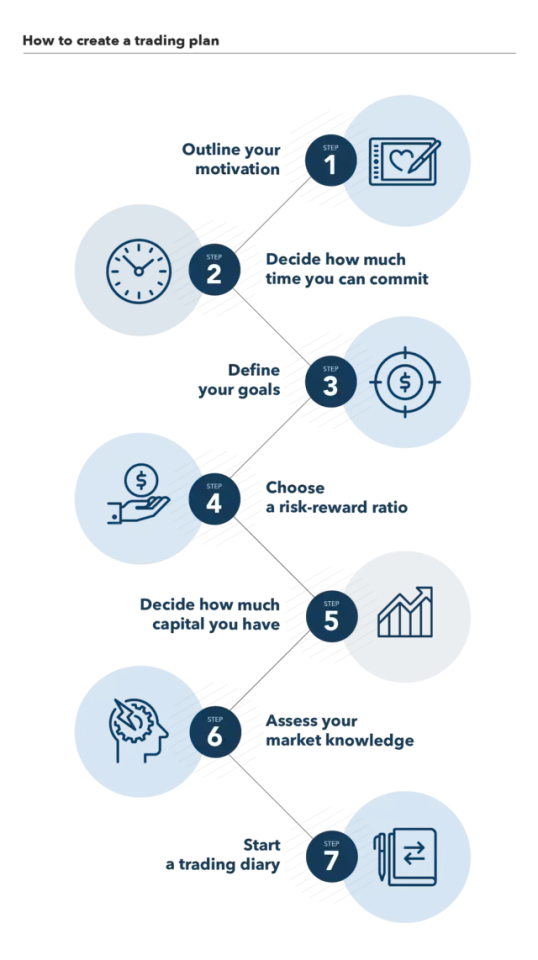

Successful Forex Trading Plan:

Outline your motivation.

Decide how much time you can commit to trading.

Define your goals.

Choose a risk-reward ratio.

Decide how much capital you have for trading.

Assess your market knowledge.

Start a trading diary.

#forex#forextrading#forexsignals#forexstrategy#trade#planning#grow#learn#experience#reason#following#everyone

4 notes

·

View notes

Text

Time to take this office apart ft my needy little helper I won't miss much about this office, but I will definitely miss the stunning view and the breathtaking sunrises I had every morning. I haven't decided whereabouts my office will be going in my new house yet but I'm looking forward to switching things up and creating my brand new trading den ⚫.

#forexmarket#forextrading#forexstrategy#forex#bitcoin#free usdt#cryptocurrency#cryptonews#crypto#stock market#stock trading#investment#learnsomethingneweveryday#learn forex trading

2 notes

·

View notes

Text

Crypto and mindset videos to help honest people Win

2 notes

·

View notes

Text

You can learn about my work and contact me from my linktree!

Hello everyone, I am the business manager from vantage, my name is Dora Wong, I am new to using Tumble, I am mainly looking for excellent traders for long-term affiliate cooperation - Introducing Broker and CPA affiliate Programs, of course the cooperation is It is global in nature. If you become my partner, you will get sustainable and considerable commission reports with my help. The author is an official cooperation. If you are interested, please feel free to contact us!

Love everyone and good luck to everyone in 2024!

#forex #forextrading #investmoney #affiliateprograms #forextrader #forextrading #forexmarkets #xauusd #trader

#forextrading#forexsignals#how to trade forex#investment#forexsuccess#forextips#forexprofit#forexscalping#for example#forexstrategy

6 notes

·

View notes

Text

É com essa foto que eu vou presentear com a minha mentoria de Forex a pessoa que mais interagir hoje aqui comigo!! E ah!! Vai ter vídeo novo essa semana! 🔥

#forex#forextrading#forexmarket#forexstrategy#forex education#forexsignals#forexsuccess#forexscalping#brazilian boys#braziliansource#online earning#portugal#uss enterprise#enterpreneur#indain

3 notes

·

View notes

Text

Forex trading Auto bot for trading synthetic indices and all assets available at affordable prices. £200

Daily profits assured tested and proven.

WhatsApp +254705143733

Email [email protected]

Serious business

28 notes

·

View notes

Text

Possible scenario in NFP💹🇺🇸

1)If NFP is coming more than the Forecast number (187K), This will be positive for the USD and Negative for the Gold📉, Then Gold can test the 2030 Level

2)If NFP is coming less than forecast number (187K) This will be negative for the USD and Positive for the Gold📈, Then Gold can test the 2080 level

Join now for todays NFP trades : https://t.me/+dhwEscK8ANs5YTc1

#forex#forexmarket#forexstrategy#forextips#forexprofit#forexmentor#forex education#forexsignals#forextrading#gold trading#nfp

2 notes

·

View notes

Text

#forexnews#forextrading#forextips#forexsuccess#forexstrategy#forexscalping#forexprofit#forexmoney#forexsignals#for example#forex#forex analysis#forex education#forexindicator#forexlifestyle#how to trade forex

2 notes

·

View notes

Text

Understanding the Working Model of Forex Prop Trading Firms

Most of the passionate people in trading know prop businesses but may need to learn exactly what they do. Property trading firms, or prop firms for short, are niche businesses that invite experienced traders to use their trading abilities on behalf of the company. Prop trading is distinguished from traditional trading by this special structure, which gives traders several benefits and chances in the financial sector.

Essentially, a prop trading company is a financial marketplace that provides funds to knowledgeable traders to trade stocks, commodities, and currencies, among other financial instruments. Through this extract, we intend to clear up the mystery surrounding prop trading and offer a thorough grasp of how it operates within the dynamic context of financial markets.

Business Model of Forex Prop Trading Firms

Capital Allocation and Proprietary Trading Desk:

Forex Prop Trading Companies differentiate themselves from one another based on the capital they offer their dealers. Capital allocation, which allows traders to profit from huge amounts of money above their own capital, is the cornerstone of their business plan. The best forex prop trading firms thoroughly assess risk before disbursing cash to traders.

These assessments consider the trader's approach, prior performance, and additional variables. Based on this evaluation, the company determines how much cash to provide each trader, ensuring that the strategy remains balanced and risk-controlled. Prop trading firms use the profit-sharing model in return for the provided funds. Traders do this by contributing a percentage of their profits to the business.

Trading Strategies and Risk Management:

Exclusive Trading in Forex Businesses uses a wide variety of trading techniques to take advantage of the existing market opportunities and turn it into a profit. Some of the most important trading tactics and risk management techniques these organizations use are statistical arbitrage, high-frequency trading, algorithmic trading, and quantitative strategies. Using sophisticated algorithms and fast data feeds, high-frequency trading allows for the execution of several deals in a matter of milliseconds. Using predefined algorithms to carry out trading strategies is known as algorithmic trading.

These algorithms can examine market data, spot trends, and automatically execute trades by preset parameters. Statistical analysis and mathematical frameworks are used to find trading opportunities in the quantitative trading process. Finding and taking advantage of arithmetic correlations between various financial instruments is the process of statistical arbitrage. By employing this tactic, traders hope to profit from transient disparities in price or mispricing among connected assets. You can control your earnings and losses more with a very successful risk management strategy.

Technology and Tools:

The capacity of Forex Prop Trading Organizations to utilize advanced technologies and apply skillful instruments to maneuver through the intricacies of the financial markets is critical to their success. Discover in this article how these companies' operations rely heavily on technology such as data analytics, trading algorithms, direct market access (DMA), etc. Large volumes of market data are processed in real-time by these companies using sophisticated analytics techniques.

Traders can obtain important insights that guide their trading methods by looking at past data and detecting patterns. Prop businesses use several trading tactics, one of which is algorithmic trading. These systems automate the execution of trades based on predefined conditions using intricate algorithms. A "direct market access" technique enables traders to communicate with financial markets directly and eliminates the need for middlemen. Forex Prop Trading Firms use DMA to provide quick and effective order execution by executing transactions with the least delay.

Regulatory Framework:

Similar to other financial operations, prop trading is subject to several laws and rules that are designed to maintain market stability, equitable treatment, and transparency. Prop trading rules differ from nation to nation, but they are always intended to balance encouraging financial innovation with discouraging actions that would endanger the system. For instance, the US Dodd-Frank Act has placed several limitations on prop trading, especially for commercial banks. The purpose of these restrictions is to restrict trading activity that carries a high risk of destabilizing the financial system.

The minimum capital requirements for forex prop trading firms are frequently outlined in regulations. Regulators seek to improve the overall stability of the financial system and lower the danger of insolvency by setting minimum capital limits. Regulations also require prop trading companies to use effective risk management techniques, such as defining profit goals and using complex techniques like volatility/merger arbitrage to reduce risk. The execution of trading methods by forex proprietary trading firms is mostly dependent on prop traders. It is essential for a prop trader to be be clear about the legal and regulatory landscape in which they operate.

Success Factors and Challenges

The best Forex prop firms rely on a number of variables to be successful, including personnel management, technology, technological adaptation, good risk management, and strategic alliances. Prop businesses must address the difficulties of market saturation, liquidity constraints, technology risks, market volatility, talent retention, and regulatory compliance to succeed in the competitive and constantly changing world of forex trading.

The reason being that forex markets are dynamic, there is a chance that prices would observe fluctuations quickly and unexpectedly. In order to overcome increased volatility, best prop firms for forex need to have strong risk management methods. Businesses that rely heavily on technology run the risk of experiencing cybersecurity attacks and system malfunctions. Strong cybersecurity safeguards, regular monitoring, and upgrades are necessary to mitigate these dangers.

Conclusion

Navigating the intricacies of financial markets requires a thorough understanding of the Forex Proprietary Trading Firms operating model. It involves more than just making profitable trades; it also involves understanding the bigger picture, including subtle regulatory differences, new technological developments, and risk management techniques.

Prop traders need to be aware of the legal and regulatory landscape, the value of utilizing technology, and the crucial role they play in the success of their companies, regardless of their level of experience. The robustness and success of the larger financial ecosystem are strengthened by ongoing education and interaction with the complex components of Forex Proprietary Trading Firms.

2 notes

·

View notes

Text

Forex Trading Plan.

Evaluate yourself

Choose your trading style

Pay attention to trading times

Use stops and limits

Identify currency pairs to trade

Plan for rollover rates

Readjust your trading plan?

Know the regulations where you trade

Take care of the details

2 notes

·

View notes

Text

My View this week on #USD and #JPY pair,

Before taking any trade there confirmation and other confluence behind, so before taking this trade look for confirmation, if u don’t see anything please don’t trade u gonna lose money

if u wanna now more DM is open,

Forex is all about logic, not always going to work but, we look for higher possibility to work

Let’s win together

#forextips#forexsignals#forexmoney#forex#foryou#forexeducation#forexstrategy#education#usdollar#usd / jpy#gold#xauusd

13 notes

·

View notes

Text

"Unlock Your Potential: Explore the World of Forex Trading"

#knowledgeempowerment#chartingplatforms#communitysupport#freedaytradingeducation#fastpacedtrading#learnfromexperts#aspiringtraders#tradingstrategies#tenchoeducation#continuouslearning#forexprofit#forexmarket#forexstrategy

3 notes

·

View notes

Text

#alternative#rap#hip hop#soundcloud#music#UndergroundmUsic#r&b/rap#Spotify#rare#repost#fire#cloud rap#phonk music#Throwedsuprramcyclick#forexbroker#forextrading#forexstrategy#forex online trading#forexsignals#forextips#sauce

3 notes

·

View notes

Text

Hi friends! My name is Antonia Dogaru, I’m 23 years old and I've successfully established various online income streams despite having no prior experience. My diverse income sources include affiliate marketing, trading, investing using artificial intelligence and more. If you're curious about my methods and how you can start your journey, feel free to send me a message and we can schedule a 1-1 call.🖤

#artists on tumblr#network marketing#socialist#make moeny online#how to earn money#make money from home#digital marketing#entrepreneur#digital entrepreneur#forextrading#forexstrategy#forexmentor#mentor#stocks#nft crypto

3 notes

·

View notes

Text

Forex For Dummies: A Hobbyist’s Guide to Currency Trading

Hello there, fellow traders and aspiring enthusiasts! I’ve been navigating the fascinating world of Forex trading as a hobby for a good few years now. If you’re considering diving into this exhilarating pastime, you’ve come to the right place. This article will serve as your introduction to Forex trading, breaking down the key terms, concepts, and processes you’ll need to know.

Quick Plug: Hey, I’m Ingrid Olsen, dabbling in Forex trading whenever I get a chance. I’ve been using decodefx.com (by Decode Global) for my trades and seriously, it’s a game-changer. User-friendly, secure, and filled with useful features — it’s got everything you need for a smooth trading experience. Give it a go, and you’ll see what I mean!

The ABCs of Forex

Forex — short for foreign exchange — is all about trading one currency for another. It’s the world’s most liquid financial market, with daily trading volumes exceeding a staggering $5 trillion. What’s unique about Forex is that it’s decentralized — there’s no central exchange, and trades happen directly between two parties, round the clock, five days a week.

Let’s Talk Pairs

In the Forex market, currencies are traded in pairs, like EUR/USD (Euro/US Dollar). The first currency listed (EUR) is known as the ‘base’ currency, and the second one (USD) is the ‘quote’ or ‘counter’ currency. The value of a currency pair indicates how much of the quote currency it takes to buy one unit of the base currency. So, if EUR/USD is trading at 1.20, it means you need 1.20 US dollars to buy 1 Euro.

Interpreting Forex Quotes

When you see a Forex quote, you’ll notice two prices: the ‘bid’ and ‘ask’ price. The ‘bid’ is the price you can sell the base currency for, while the ‘ask’ is the price you can buy it. The difference between these two prices is the ‘spread’ — which is essentially your broker’s commission for the trade.

Going Long or Short

In Forex trading, you can ‘go long’ or ‘go short’. Going long means you’re buying the base currency because you believe it will increase in value against the quote currency. Conversely, going short means you’re selling the base currency as you think its value will decrease.

The Power of Leverage

One distinctive aspect of Forex trading is the use of ‘leverage’. Leverage is like a loan from your broker, allowing you to control a much larger amount than your actual investment. For instance, with 100:1 leverage, you can control $100,000 with just a $1,000 investment. But be careful — while leverage can amplify your gains, it can also magnify your losses.

The Art of Analysis

Successful Forex trading involves market analysis. This usually involves:

Fundamental Analysis: Examining economic data, political events, and social factors that could affect currency values. These can range from policy changes to economic reports and global events.

Technical Analysis: Using charts and statistical indicators to predict future price movements. Techniques might include analyzing trend lines, support and resistance levels, and using mathematical indicators.

Minimizing Risk

Forex trading, like any investment, carries risk. It’s crucial to manage this risk by setting stop-loss orders to limit potential losses, never risking more than a small percentage of your trading capital on a single trade, and keeping emotions out of trading decisions.

Finding a Broker

To start trading Forex, you’ll need to open an account with a Forex broker. Look for a regulated broker with a user-friendly platform, competitive spreads, good customer service, and hassle-free deposit and withdrawal options.

Final Thoughts

Forex trading can be a thrilling hobby, but it’s important to understand the basics before jumping in. Take the time to learn and practice (many brokers offer demo accounts), and don’t be afraid to ask for advice. Remember, the aim is not just to make profits, but also to enjoy the journey of becoming a savvy Forex trader. Happy trading!

Ingrid Olsen

3 notes

·

View notes

Text

Forex Trading Signals

Buy #xauusd 1826.00

slp 1831.00

Tp1 1821.00

Tp2 1816.00

Free Telegram Channel : https://t.me/FOREXRESEARCHGAIN

Official Telegram ID: https://t.me/FXGAINADMIN

#forex#forexprofit#forexstrategy#forexmentor#forexsignals#investment#stock market#currency#dollar#us dollar#gbpusd#xauusd#forexnews#trader

4 notes

·

View notes