#Foreign company registration

Text

HOW TO SETUP BUSINESS IN INDIA

BUSINESS SETUP IN INDIA

In February 2023, I happened to visit my uncle who was based in Australia, for attending a marriage ceremony in his family. It was a grandeur event attended by almost 200 peoples including 50 odd local Australians. During the function, one of my uncle’s friends who were an Australian started discussing about Indian economy, industries and what the opportunities for business setup in India are.

I asked him to meet next day after the marriage in a coffee shop, so that I may explain him in detail about the process of business setup in India.

We met in Starbucks and He was accompanied by another Australian guy. He introduced the guy as his friend and partner in his business. Actually, they both were running a business of manufacturing and trading of beers and hard drinks in Australia.

They were very excited to know about the process of foreign company registration in India as they wanted to open an Indian company with same brand as they were using in Australia but they have fair share of doubts in their mind about Indian market.

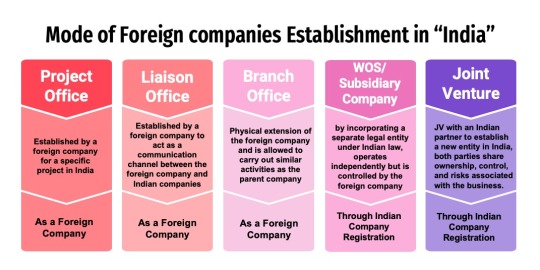

I advised them in brief that there are many options of setting up business in India like liaison office, branch office, wholly owned subsidiary and limited liability partnerships. I also informed them about various features of each type of entities and their pros and cons.

They informed me that initially, they want to do survey of Indian markets before going for full scale business operations. They were even planning to set up manufacturing unit in India but not initially. I asked them to initially set up a liaison office in India and do water testing and if they have confidence in Indian market, they may start full-fledged operations in India by opting for subsidiary company registration in India.

For liaison office registration in India, it was important that parent company must be profitable for last 3 years and have minimum net worth of USD 50,000 in home country. Also, these are sort of representative offices in India which cannot do any commercial activities in India but only act as channel of communication between parent company and Indian customers. Accordingly, liaison office may conduct the market survey, talk with potential Indian buyers and pass on information to the parent company.

They also asked for the procedure of subsidiary company registration. I informed them that for the same, minimum 2 directors and 2 shareholders are required. Also, at least one director must be an Indian Resident. Local office address will also be required. Further, sufficient capital must be required. Although there is no minimum amount required for company registration but for setting up factory, substantial amount of capital will be required. Also, ROC incorporation fee will depend upon amount of share capital.

I also briefed them about the entire process of subsidiary company registration as well as what types of compliances to be done once company is incorporated in India.

They also share information about various options of doing business in Australia. They were very happy to know that there are so many options of foreign company registration in India.

They informed that they are planning to visit India in the month of April and will finally decide about type of entity for business setup in India. Also, thanked me for providing a brief overview of entire process of business setup in India.

0 notes

Text

Describe The Process Of Foreign Company Registration In India

Once the Certificate of Incorporation has been obtained, the next step is to obtain approvals and registrations from various government agencies. This includes obtaining a Foreign Investment Promotion Board approval, as well as registering with the Reserve Bank of India.

A company providing application services such as company Registration, ISO Certification, Trademark Registration,Import Export Registration, Fss ai License etc.

For know more information visit here : https://efilingcompany.com/company-registration-in-india-by-foreign-national/

0 notes

Link

For MNCs and Global Businesses, At Tax Shooter, we offer assistance at every step and assure seamless solutions. Contact us today to know more.

0 notes

Photo

Foreign company registration in India - Do you wish to setting up Branch Office in India? Our team of experts will ensure a smooth process flow in opening the Branch Office of Foreign Entities in India. Email us at [email protected] or visit www.knmindia.com for more information.

#foreign company registration in India#foreign company registration#company registration#india market entry#india market entry strategy#investment in india#business in india#investment#business#registration#foreign company#finance#growth#solution#advisory solutions#knm#knm india

0 notes

Text

Streamlining Success: Formation and Incorporation of Company with Mas LLP

In the vibrant landscape of business, laying the groundwork for your company's success begins with a strategic approach to formation and incorporation. At Mas LLP, we understand the intricacies involved in this pivotal process, and we offer comprehensive solutions tailored to simplify the Formation and incorporation of company of your company. Let's explore why Mas LLP stands out as your premier choice for company formation and incorporation services.

Expert Guidance: With Mas LLP, you're not just navigating the formation and incorporation process alone. Our team of seasoned professionals brings years of experience and expertise to the table. From choosing the right business structure to navigating legal requirements, we provide expert guidance and support every step of the way.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of services designed to streamline the formation and incorporation process. Whether you're starting a new venture or expanding your existing business, we handle every aspect of company formation and incorporation, ensuring compliance with regulatory requirements and minimizing administrative burdens.

Tailored Approach: We understand that every business is unique, with its own goals, objectives, and challenges. That's why we take a personalized approach to company formation and incorporation, offering tailored solutions that align with your specific needs and aspirations. Whether you're a small startup or a large corporation, we have the expertise and resources to support you on your journey.

Transparency and Efficiency: Transparency and efficiency are at the core of everything we do at Mas LLP. We believe in keeping our clients informed and empowered throughout the formation and incorporation process, providing regular updates, clear communication, and transparent pricing. Our streamlined approach minimizes bureaucratic hurdles and accelerates the process, allowing you to focus on building and growing your business.

Compliance Assurance: Staying compliant with regulatory requirements is essential for maintaining the legal and financial integrity of your company. Mas LLP helps clients navigate the complexities of company formation and incorporation, ensuring adherence to all applicable laws, rules, and regulations. With our proactive approach to compliance, you can minimize potential liabilities and focus on achieving your business goals.

Dedicated Support: At Mas LLP, we're committed to providing exceptional service and support to our clients. Our dedicated team of professionals is here to answer your questions, address your concerns, and provide expert guidance every step of the way. With personalized attention and responsive support, you can trust Mas LLP to be your reliable partner in company formation and incorporation.

In the competitive business landscape, the Formation and incorporation of company of your company are critical steps towards achieving your entrepreneurial dreams. With Mas LLP as your trusted partner, you can navigate these processes with confidence and clarity.

Contact us today to learn more about our Formation and incorporation of company services and take the first step towards building a successful and sustainable business.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

youtube

How to Successfully Set Up a Medical Business in Thailand

In this video, we will guide you through the process of setting up a successful medical business in the vibrant country of Thailand. Whether you are a healthcare professional looking to expand your practice or an entrepreneur interested in the booming healthcare industry, we've got you covered.

At Reliance Consulting, we are experts in providing support to businesses in Thailand company registration. Feel free to get in touch with us to explore the various ways in which we can assist you in navigating the thriving Thai healthcare market. Take the first step towards your journey to success, register a Thai company today! We also offer other business services such as withholding tax Thailand and payroll services.

#register a thai company#company registration in thailand for foreign#thailand company registration#medicalbusiness#Youtube

4 notes

·

View notes

Text

Exploring Investment in India: Meaning, Significance, and Opportunities

Investment in India embodies the allocation of financial resources with the aim of generating returns, fostering growth, and contributing to the economic development of the country. It encompasses various forms, including foreign direct investment (FDI), domestic investments in sectors like infrastructure, manufacturing, technology, and financial markets, among others. The significance of investment in India extends beyond mere financial transactions; it serves as a catalyst for economic progress, job creation, innovation, and the overall enhancement of living standards.

One of the primary reasons investment in India holds immense importance is its role in driving economic growth. Foreign investors recognize India's vast market potential, growing middle-class population, and skilled workforce as lucrative opportunities. FDI, in particular, contributes to job creation, facilitates technology transfer, and enhances infrastructure development, thereby bolstering the economy.

Moreover, investments in India spur innovation and technological advancements. Various sectors, especially technology and startups, have witnessed substantial inflows of investments, fostering an entrepreneurial ecosystem. This influx of capital often leads to the development of new technologies, services, and products, positioning India as a hub for innovation and fostering global competitiveness.

The significance of investment in India also lies in its contribution to infrastructure development. Investments in sectors like transportation, energy, telecommunications, and urban development play a crucial role in building a robust infrastructure backbone. Improved infrastructure not only attracts further investments but also enhances the ease of doing business, facilitating smoother operations for both domestic and foreign companies.

Investment in India acts as a catalyst for job creation, addressing the pressing issue of unemployment. With substantial investments pouring into various sectors, job opportunities arise, providing employment to a significant portion of the population. This not only improves livelihoods but also contributes to social and economic stability.

Furthermore, the investment climate in India has been continually evolving, with the government introducing various reforms and initiatives to ease regulations, simplify processes, and attract more investments. Initiatives like Make in India, Digital India, and Atmanirbhar Bharat have been instrumental in showcasing India as an attractive destination for investors.

In conclusion, investment in India holds multifaceted significance in fostering economic growth, driving innovation, creating job opportunities, and enhancing infrastructure. The inflow of investments, both domestic and foreign, plays a pivotal role in shaping India's economic trajectory, enabling the country to emerge as a global economic powerhouse. As India continues to showcase its potential across diverse sectors, investing in the country remains a strategic decision for individuals and entities looking to participate in and benefit from its dynamic growth story.

This post was originally published on: Foxnangel

#foreign direct investment#fdi investment#fdi in india#foreign invest in india#investment in india#investing in india#company registration in india#investment options in india#foxnangel

0 notes

Text

What Are the Legal Requirements for Foreigners to Start a Business in Singapore

Starting a business in Singapore as a foreigner involves understanding and complying with the country's laws and regulations. By fulfilling these legal requirements, foreigners can establish and operate a business in Singapore smoothly and in accordance with the country's laws and regulations.

#starting a business in singapore#company registration consultants#starting a business in Singapore as a foreigner#singapore permanent resident#singapore one pass visa#opening a business in singapore#dependent pass singapore#one pass singapore#how to incorporate a company in singapore#business license singapore

0 notes

Text

Navigating the Indian Business Landscape: Tips for a Smooth Business Setup

Creating a company in India is a lucrative but complex process that requires thoughtful preparation and calculated execution, particularly when utilizing Bandraz’s services as your reliable business solutions partner.

Without further ado, let’s check out some acing tips that can help you in navigating the Indian Business Landscape through Bandraz!

Thorough Market Research: Start your Indian business adventure by collaborating with Bandraz for in-depth market research. Gain from their understanding of target demographics, competitive landscape research, and your product or service demand. Your business plan will be guided by Bandraz’s data-driven approach to ensure it meets the target market’s demands.

Regulatory Compliance: With Bandraz, you can easily navigate India’s regulatory landscape. Please use their knowledge to comprehend compliance guidelines, legal requirements, and the subtleties of labor and tax legislation. To guarantee that your company runs in compliance with Indian laws, Bandraz can help with the licensing procedure.

Local Partnerships: With Bandraz’s assistance, build solid local alliances. Work with regional companies or develop joint ventures, using Bandraz’s network to build credibility and learn about the Indian industry. With so many contacts, Bandraz can help create valuable alliances that will pay off in the long run.

Cultural Sensitivity: Follow Bandraz’s advice to ensure cultural sensitivity in your commercial dealings. Their understanding of Indian culture will guide you through the country’s terrain and promote successful relationship- and communication-building. The favorable brand image of Bandraz in the culturally diverse Indian market results from their comprehension of local customs and traditions.

Technological Integration: With Bandraz’s help, smoothly embrace technology. Utilize their knowledge to combine technology for efficient corporate procedures, web presence creation, and successful digital marketing tactics. With Bandraz, your company may be more visible in the Indian market and remain at the forefront of the digital revolution.

Talent Acquisition: Use Bandraz’s resources to acquire talent. Please take advantage of their understanding of the Indian talent market and, with Bandraz’s help, establish a welcoming workplace environment. Developing a trained and driven team with the help of Bandraz is crucial to reaching your company goals in India.

Scalability Planning: Bandraz helps you with your first scalability planning. Count on their experience to create a thorough strategy that considers infrastructure, supply chain management, and logistics to support your company’s expansion in the fast-paced Indian market.

With the help of Bandraz’s extensive business solutions, you may set up your Indian business with confidence and success. Navigating the Indian business scene becomes collaborative and fulfilling when you have Bandraz as your trusted partner.

For a hassle free approach to open a Business in India, contact Bandraz today!

#Business in India for Foreigners#Start a new Business in India#Registration of foreign companies in India#Business Setup Services#Business Setup Consultants

0 notes

Text

#company registration#foreign companies#indians#foreign company registration#law firm in india#ksandk#lawyer

0 notes

Text

Simple Steps Incorporation of Foreign Subsidiary in India at VenturEasy

Thanks to VenturEasy's knowledge, you may go on your Indian business journey with confidence. We provide end-to-end solutions for a successful introduction into the Indian market, from simple Incorporation of Foreign Subsidiary in India to overcoming compliance complexities.

More Info: https://ventureasy.com/blog/incorporation-foreign-subsidiary-india/

#Incorporation of Foreign Subsidiary in India#Foreign Subsidiary in India#Subsidiary in India#Company registration in India

1 note

·

View note

Link

For MNCs and Global Businesses, At Tax Shooter, we offer assistance at every step and assure seamless solutions. Contact us today to know more.

0 notes

Text

#law firm#legal service#saudi arabia#business#contract lawyer#company registration service#foreign investment#intellectual property#commercial lawyer#Arbitration and Mediation

0 notes

Text

Unlocking GST Success: Your Guide to Finding the Right GST Expert in India from Mas LLP

In the dynamic world of Indian taxation, Goods and Services Tax (GST) has revolutionized the way businesses operate and comply with tax regulations. Navigating the complexities of GST requires expert guidance and support from seasoned professionals who understand the intricacies of the tax system. At Mas LLP, we pride ourselves on being leading GST expert in India, offering comprehensive solutions tailored to meet the diverse needs of businesses across the country. Let's delve into why Mas LLP is your go-to partner for GST success.

Unparalleled Expertise: With extensive experience and a team of seasoned professionals, Mas LLP brings unparalleled expertise to the table. Our GST expert in India have in-depth knowledge of GST laws, rules, and compliance requirements, enabling us to provide expert guidance and support across a wide range of GST-related matters.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of GST services designed to address the diverse needs of businesses in India. Whether you're a small startup, a mid-sized enterprise, or a multinational corporation, we have the expertise and resources to support you at every stage of your GST journey. From GST registration and compliance to filing returns and managing audits, we handle every aspect of GST with precision and professionalism.

Tailored Approach: We understand that every business is unique, with its own set of goals, objectives, and challenges. That's why we take a tailored approach to GST consulting, offering customized solutions that align with your specific needs and aspirations. Whether you're looking to optimize your GST strategy, mitigate risks, or resolve compliance issues, we work closely with you to develop tailored solutions that deliver results.

Transparency and Trust: At Mas LLP, transparency and trust are at the core of everything we do. We believe in building long-term relationships with our clients based on honesty, integrity, and reliability. Our transparent pricing, clear communication, and ethical business practices ensure that you always know where you stand and can trust us to act in your best interests.

Client-Centric Focus: We're committed to providing exceptional service and support to our clients. Our dedicated team of GST expert in India is here to answer your questions, address your concerns, and provide expert guidance every step of the way. Whether you need assistance with GST planning, compliance, or dispute resolution, we're here to help you achieve your GST goals.

In the competitive landscape of Indian business, having the right GST expert in India by your side can make all the difference. With Mas LLP as your trusted partner, you can navigate the complexities of GST with confidence and clarity. Contact us today to learn more about our GST services in India and take the first step towards GST success.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

youtube

Knowing the Rights of Minority Shareholders in Thailand

This video provides an overview of the rights of minority shareholders in Thailand.

Minority shareholders have important legal rights that protect them from being unfairly treated by majority shareholders or company management.

Planning to invest or register a thai company in Thailand? Get a professional advise from corporate services firm like Reliance Consulting. The firm is specialized in providing business services which includes auditing, accounting services, withhold tax, company registration in Thailand for foreign and local, payroll outsourcing and other business-related services.

Source: https://www.relianceconsulting.co.th/knowing-the-rights-of-minority-shareholders-in-thai-companies/

#company registration in thailand for foreign#register a thai company#thailand company registration#company registration#Youtube

2 notes

·

View notes