#Finance & Accounting BPO Market Sales

Text

Finance & Accounting BPO Market Size To Reach $110.74 Billion By 2030

Finance & Accounting BPO Market Growth & Trends

The global financial and accounting business process outsourcing market size is expected to reach 110.74 billion by 2030, expanding at a CAGR of 9.1% from 2023 to 2030, according to the recent reports of Grand View Research, Inc. Innovation, global competition, and new technologies are the key driving factors behind the expansion and growth of the finance & accounting business process outsourcing (BPO) industry. Technologies such as robotic process automation (RPA) that have emerged over the past few years have influenced the BPO industry.

RPA with its speed, efficiency, and cost savings abilities is slowly making its way into all industries and all types of business processes. Robotic process automation has also emerged as the fastest-growing trend in finance & accounting BPO, particularly in the management sector, providing high-value creation with fast time-to-value and notable cost savings. These developments would further drive the market’s growth during the forecast period.

Earlier, the customer service industry was entirely reliant upon Interactive Voice Response (IVR) and websites for transferring a call to the correct representative. However, now a day’s most of the population has at least one social media account, resulting in a significant shift in consumer behavior. Social media browsing has recently become the third most popular online activity. Companies have now realized the importance of social media as it provides consumer data and feedback that can enhance a company’s ability to analyze impending trends and innovate.

Enterprises are aggressively investing in real-time customer engagement instead of call center software programs, which will allow them to procure first-hand product insights and turn concerns into new solutions or products that will address the upcoming challenges. This change in customer management is considered a huge opportunity by the finance & accounting business process outsourcing service providers.

Leading vendors such as Tech Mahindra, Wipro, Infosys Ltd, and TCS are increasingly incorporating AI and blockchain technologies to provide a differentiated offering to their clients. Favorable government initiatives are also paving the way for the growth of the overall outsourcing market in India.

For instance, in May 2020, the Government of India under the Ministry of Electronics and Information Technology (MeitY) launched the MeitY Startup Hub (MSH) portal that aims to encourage technological innovation, startups, and the development of intellectual properties. Similarly, in the Philippines, lower labor costs, competitive IT infrastructure, a highly educated and skilled workforce, and favorable tax incentives are some of the factors driving the growth of the financial and accounting (F&A) business process outsourcing (BPO) industry.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/finance-accounting-business-process-outsourcing-market-report

Finance And Accounting Business Process Outsourcing Market Report Highlights

The record-to-pay segment is anticipated to observe a CAGR of 12.2% during the forecast period. A number of providers such as Accenture and KPMG are building up Centers of Excellence (CoE) to progress R2R process expertise. These service providers are also forging technology partnerships to get access to tools beyond the general ledger and recognition. For instance, reporting solutions and asset management solutions

The large enterprise segment is anticipated to observe a CAGR of 9.3% during the forecast period. Large enterprises are adopting new business strategies to capture a huge chunk of buyers and retain their position in the finance and accounting BPO market

The IT & telecommunications segment is anticipated to observe a CAGR of 10.2% during the forecast period. Financial and accounting outsourcing is being used by telecommunications companies all over the world to reduce overall capital expenditure (CAPEX). F&A outsourcing solutions assist telecom companies in developing a flexible strategy for optimizing current investments, managing cost pressures, acquiring and retaining more customers, and gaining access to specialized resources

North American finance & accounting BPO market is expected to reach USD 38.88 billion by 2030. The growth is ascribed to the increasing adoption of cloud enablement and digital-related services that requires frequent assistance and maintenance for business operations

Financial And Accounting Business Process Outsourcing Market Segmentation

Grand View Research has segmented the global finance and accounting business process outsourcing market based on service, enterprise size, vertical, and region:

Financial & Accounting Business Process Outsourcing Service Outlook (Revenue, USD Billion, 2018 - 2030)

Order-to-cash

Procure-to-pay

Record-to-report

Source-to-pay

Multi Processed

Financial & Accounting Business Process Outsourcing Enterprise-size Outlook (Revenue, USD Billion, 2018 - 2030)

Small & Medium Enterprises (SMEs)

Large Enterprises

Financial & Accounting Business Process Outsourcing Vertical Outlook (Revenue, USD Billion; 2018 - 2030)

BFSI

Healthcare

Manufacturing

Energy & Utilities

Travel & Logistics

IT & Telecommunications

Media & Entertainment

Retail

Others

Financial & Accounting Business Process Outsourcing Regional Outlook (Revenue, USD Billion; 2018 - 2030)

North America

U.S.

Canada

Europe

U.K.

Germany

France

Asia Pacific

China

India

Japan

Singapore

Malaysia

Philippines

Indonesia

Thailand

Latin America

Brazil

Mexico

MEA

List of Key Players in the Finance And Accounting Business Process Outsourcing Market

Accenture

Infosys Limited (Infosys BPM)

HCL Technologies Limited

Wipro Limited

Capgemini

Sutherland

IBM Corporation

Tata Consultancy Services Limited

Genpact

Fiserv, Inc.

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/finance-accounting-business-process-outsourcing-market-report

#Finance & Accounting BPO Market#Finance & Accounting BPO Market Size#Finance & Accounting BPO Market Trends#Finance & Accounting BPO Market Growth#Finance & Accounting BPO Market Sales

0 notes

Text

Business Process Outsourcing (BPO) Market Trends and Forecast to 2030

Business Process Outsourcing (BPO) Market analysis report is sure to help boost sales and improve return on investment (ROI). The research and analysis carried out in this Business Process Outsourcing (BPO) Market report assists clients to forecast investment in an emerging market, expansion of market share or success of a new product with the help of global market research analysis. Market drivers and market restraints assessed in this Business Process Outsourcing (BPO) Market report makes attentive about how the product is getting utilized in the recent market environment and also provide estimations about the future usage. This industry report includes market analysis based on regional as well as global level.

Request For Free Sample Report at: https://www.delvens.com/get-free-sample/business-process-outsourcing-bpo-market

Business Process Outsourcing (BPO) Market, by Service Type (Finance & Accounting, Human Resource, KPO, Procurement & Supply Chain, Customer Services, Others), End-use (BFSI, Healthcare, Manufacturing, IT & Telecommunications, Retail, Others), Outsourcing Type (Offshore, Nearshore, and Onshore), region (North America, Europe, Asia-Pacific, Middle East and Africa and South America). The Business Process Outsourcing (BPO) Market size was estimated at USD 285.86 billion in 2023 and is projected to reach USD 527.63 billion in 2030 at a CAGR of 9.15% during the forecast period 2023-2030.

Business Process Outsourcing (BPO) Market Competitive Landscape:

Accenture

ADP, Inc.

Aidey

ALAC ETOILE

AMDOCS

Capgemini

CBRE

Cognizant

Concentrix Corporation

Conduent, Inc.

eNoah

ExlService Holdings, Inc. and Affiliates.

Genpact

H2A

HCL Technologies Limited

Helpware

Humania BPO

IBM Corporation

Infosys Limited

INTERSA

Intetics Inc.

Invensis Technologies Pvt. Ltd.

NCR Corporation

NTT DATA, Inc.

Octopus Tech

OUTSOURCIA GROUP

Plaxonic Technologies

Sodexo

SunTec Web Services Pvt. Ltd.

Tata Consultancy Services Limited

Tech Mahindra Limited

Triniter

TTEC

Unity Communications

Wipro Limited

WNS (Holdings) Ltd.

Business Process Outsourcing (BPO) Market Recent Developments:

In June 2023, the TTEC Digital Innovation Studio has opened in Hyderabad, according to a statement from TTEC Holdings. With the help of prominent CX technology platforms like Amazon, Microsoft, and Google, among others, this development is anticipated to increase TTEC's capacity to provide better customer experiences around the globe.

In June 2023, in order to emphasize the company's dedication on investing and growing its footprint in the nation, Wipro Limited officially opened its new office at Sable Park in Cape Town, South Africa. This is anticipated to hasten the job and skill-development prospects for the rapidly expanding BPO industry in Cape Town, which considerably boosts the local economy, in the near future.

For Purchase Enquiry at: https://www.delvens.com/Inquire-before-buying/business-process-outsourcing-bpo-market

Business Process Outsourcing (BPO) Market Key Findings:

Based on service type, the market is segmented into finance & accounting, human resource, kpo, procurement & supply chain, customer services, others. The customer services segment dominated the market in this segment. The increase in service centers that require offline and online technical help can be ascribed to this category. Businesses that focus on providing customer service are experts at managing requests and questions from customers that come in via social media platforms, chats, phone calls, emails, and other channels. Additionally, the majority of them offer self-service assistance, allowing clients to get answers to their questions whenever they need to.

Based on end-use, the market is segmented into bfsi, healthcare, manufacturing, it & telecommunications, retail, others. The IT and telecommunications segment dominated the market in this segment. A few of the causes driving up demand for business process services among IT and telecommunication organizations include the rise in the number of IT enterprises and the rising industrialization of the world. IT and telecom BPO services meet the rising need for connection, deal with security concerns, and develop fresh products for the newest gadgets and technological advancements.

Based on outsourcing type, the market is bifurcated into offshore, nearshore, and onshore. The offshore BPO dominated the market in this segment. This is due to increasing globalization of businesses and growing demand for BPO services from small and medium-sized businesses.

The market is also divided into various regions such as North America, Europe, Asia-Pacific, South America, and Middle East and Africa. North America is estimated to account for the largest market share during the forecast period. Due to the increasing demand for business process outsourcing services from various regional IT behemoths, the area is predicted to maintain its dominance. Regional expansion is also anticipated to be supported by the customization of service offerings to better fit individual demands and the rising demand for cloud computing.

Business Process Outsourcing (BPO) Market Regional Analysis:

North America to Dominate the Market

North America is estimated to account for the largest market share during the forecast period because of the increasing demand for business process outsourcing services from various regional IT behemoths.

Moreover, the customization of service offerings to better fit individual demands and the rising demand for cloud computing is expected to drive the growth of the market during the forecast period.

Frequently Asked Questions:

What are the years considered to study Business Process Outsourcing (BPO) Market?

What is the compound annual growth rate (CAGR) of the Business Process Outsourcing (BPO) Market?

Which region holds the largest market share in Business Process Outsourcing (BPO) Market?

Which region is the fastest growing in Business Process Outsourcing (BPO) Market?

Who are the major players in Business Process Outsourcing (BPO) Market?

The market for business process outsourcing (BPO) is expanding as a result of factors such as businesses' increasing emphasis on enhancing productivity and organizational agility, cutting costs, and accelerating key capabilities to survive the rapidly changing business dynamics. Additionally, a lot of businesses are concentrating on lowering their operating expenses so they can access global resources to satisfy the rising market needs. These factors have promoted the use of market services by a number of companies that concentrate on utilizing technical developments like cloud computing and Artificial Intelligence (AI) to increase corporate productivity.

In the projected term, security and intellectual property rights worries are anticipated to limit market expansion. The need to lower operating costs drives the outsourcer to locations without a legislative framework in place to guard against confidentiality breaches and infringement of intellectual property rights. Because even a tiny mistake can result in a permanent loss for the company's market position, outsourcing organizations are frequently concerned about how they outsource and handle the information supplied.

Get Direct Order of this Report at: https://www.delvens.com/checkout/business-process-outsourcing-bpo-market

Explore More Reports:

Oil and Gas Process Simulation Software Market

Sports Betting Market

Data Center Construction Market

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-3290-6466

#Business Process Outsourcing (BPO) Market#Business Process Outsourcing Market#Business Process Outsourcing#BPO#BPO Market#consulting company#strategic advisory firm#best market reports#market analysis reports#trending reports#syndicated reports#IT & Telecom

0 notes

Text

Back Office Outsourcing For Staffing & Recruitment Corporations

During this time, Mr. Hersh was answerable for the launch of three new authorized databases tracking thousands of information points within publicly filed M&A and business financing agreements. A back office in most corporations is the place work that helps entrance office work is done. The front office is the "face" of the company and is all of the resources of the company which may be used to make gross sales and interact with prospects and clients. Broadly talking, back paperwork contains roles that affect the prices facet of a enterprise's buying and selling statement and entrance office work contains roles that affect the earnings aspect of a enterprise's buying and selling statement. Customer experiences, from marketing to sales and repair, at the moment are reflections of the model.

back office services

Apart from saving costs, corporations have been capable of enhance their bottom line. Outsourcing human assets enable businesses to achieve more optimized processes and the highest level of team satisfaction. Throughout the years, it has helped many firms not solely free up time but in addition create higher and more practical HR methods. These methods embody depart administration, compensation, worker screening and hiring, efficiency administration, employee retention, performing audits, and constructing an overall better workflow and process.

You can generate a finances report to see whether you were near the finances you set or not. You can generate financial reviews corresponding to ratio evaluation, revenue and loss statement, stability sheet, and trial steadiness. If you need inventory-related stories, then you presumably can generate these too with ease.

Regardless of the cost incurred by the back office, it's critical to your total business operations. Your front office, for example, won't function properly to generate revenue if HR and payroll are problematic or your IT service just isn't responsive. Outsourcing administrative features have turn out to be popular amongst all enterprise varieties as a end result of back-office work can turn out to be overwhelming as a company scales up. The bottleneck in the back office can cost companies 20% to 30% of their annual revenue. Depending on the difficulty of the duty and the availability of assets, STAFFVIRTUAL can frequently begin working on a brand new project inside a few days.

So by outsourcing back office actions to a BPO agency, western companies can cut back on employee hiring and training prices. IT support is crucial in working many important operations of an organization. For instance, you have to guarantee post-sales technical support like a help desk or real-time on-line support service to reinforce buyer expertise and satisfaction. For instance, Wagepoint (a payroll software program company) states that companies spend round 10 hours a month processing payroll manually. Outsourcing payroll can save a company’s time, stop miscalculations, and keep away from compliance issues. Back office capabilities like knowledge administration, payroll processing, HR administration, and so on., play an important function in a company’s scalability and productiveness.

CSB Group's comprehensive accounting and payroll services staff supports shoppers who may lack full in-house sources for accounting and back office services. As Malta Corporate Accounting Specialists and Independent members of EuraAudit International, we provide professional outsourced Accounting Services in Malta. Like the manufacturing and distribution sector, automotive firms outsource to keep away from wasting on costs. 2020 and 2021 have been a battle for many corporations because of the Covid-19 pandemic. When you add to that the strain of managing name centers and back-office IT services, the problem turns into too tough. In 2021, it's the proper time to modify to outsourcing instead of toiling with in-house support.

Conflicts inside a enterprise or between clients and an organization are unavoidable. As such, dispute resolution is an essential part of back-office administration. This service is anxious with helping both events discover a resolution that may work for them, whether via mediation, arbitration, or litigation.

The reporting denotes every provider’s efficiency in relation to the minimal score required by the consumer and to the stream (the common of all provider scores). Lenders rely on back office support services from in-house and/or BPO teams to execute the IPV and loan doc evaluate processes and maximize their win rates. Teams should execute these processes at a degree of accuracy and velocity that satisfies the client, dealer, and lender. They have been very happy with the 15+ year relationship and the constructive outcomes iQor has delivered in different areas of their enterprise as a trusted CX solutions outsourcing partner. So, they partnered with us for outsourced back office services to assist them obtain the four outcomes described above.

Serious knowledge breaches can affect your sales as prospects and workers prefer firms with good knowledge security. Meanwhile, back office BPO companies have already got a professional employees prepared at hand. So by partnering with a back office BPO firm, companies can keep away from spending time and assets on the lookout for the best worker. Creating a digital copy of your firm’s data helps employees access crucial company information rapidly. In this article, we’ll discuss what back office BPO is, together with its pros, cons, and 5 in style back office capabilities. We’ll also try three prime BPO service suppliers that will assist you outsource your back office operations.

1 note

·

View note

Text

Jobs in Bhubaneswar: Check Latest job Vacancies available in bhubaneswar

The city of Bhubaneswar is known throughout the country as a historical, cultural and religious tourist center - enriched with many ancient temples distinguished by indigenous sculpture, art and architecture. Bhubaneswar is the capital of the state of Odisha. Although the city's economy is largely dependent on agriculture, farming, IT services and horticulture, other industries such as agricultural products, engineering, metal and mineral sectors also contribute significantly to the city's economy and provide ample employment. These industries have evolved over the past decade and created an ecosystem for the development of other ancillary industries such as banking, healthcare, electrical and fire protection services. All these sectors create many job opportunities every year. The city is also an important Buddhist and Hindu pilgrimage center where tourists from all over the world come to capture the cultural heritage of India, and as more people visit the city every year, it brings with it many job opportunities. There are several latest jobs in Bhubaneswar based on your skills and experience. Like most major cities, freshers and seasoned professionals can find different things in Bhubaneswar.

Learn more about career opportunities in Bhubaneswar.

What are the latest vacancies in 2022?Bhubaneswar, the land of opportunities, has already achieved enviable achievements in IT exports, attracting IT professionals, setting up IT infrastructure etc. Bhubaneswar is slowly becoming the destination of choice for many IT and ITES companies as already set by many big players its operations in Bhubaneswar. The IT industry scenario in Bhubaneswar seems to be finally changing for the better. This trend is sure to benefit the city's young engineering graduates who had no choice but to leave the state and move to other IT hubs like Bengaluru, Hyderabad and Pune in search of jobs and better transport options. These young professionals can finally hope to realize their dream of working for world-class companies in their home country. Part time job opportunities in Bhubaneswar include: Teacher Telephone caller Insurance agent Delivery partners Sales and Marketing Manager

Housewives and students trying to support their families should look for such jobs. Part time jobs in Bhubaneswar are available for women in various fields like HR Manager, Back Office Manager, Receptionist, Beautician, Insurance Sales Manager, BPO Caller, Office Assistant, Tele-Sales, Recruiter, Consultant and many more.

Bhubaneswar also has various 10th pass and 12th pass jobs for skilled and unskilled work. Delivery partners, logistics agents, data entry operators, hospitality workers and technicians are just a few examples of common and readily available jobs.

What are the best jobs in Bhubaneswar? Bhubaneswar is a bustling metropolis. There are various job opportunities in Bhubaneswar. Bhubaneswar is not just a city of one industry. Bhubaneswar's tourism industry, on the other hand, is booming. Bhubaneswar is a popular pilgrimage destination. Every year thousands of people visit the city which offers several new job opportunities in Bhubaneswar.

Here are some of the most common jobs in Bhubaneswar: Courier Sales (field work) Machine operator Guard The driver Accounts / Finance Telephone Operator / BPO Housekeeping

In addition to the roles mentioned above. There are other career opportunities for Bhubaneswar job seekers such as Office Assistant, Back Office Manager, Cashier, Tradesman, Interior Designer, Administrative Assistant, Warehouse Manager and Computer Technician.

What are the best rental companies in Bhubaneswar? Many large companies in Bhubaneswar employ a large number of people and contribute to the economic prosperity of the city. If you are looking for jobs in Bhubaneswar, you can narrow down your search to industries that match your qualifications and skills.

Some of the best companies in Bhubaneswar are: Infosys TCS The technologies of An Fortune Towers Accenture To Capgemini Maximum life insurance Wipro Technical Mahindra Deloitte

Cognizant Technology Solutions

There are many local companies and startups in Bhubaneshwar that can help you advance your career in Bhubaneshwar. What are popular Homework? The pandemic has increased interest in Home Work jobs because they are more flexible. There are several jobs available for those who want to work from home in Bhubaneswar. Some of the most common domestic jobs in Bhubaneswar are: BPO Mr User support Telephone caller Marketing manager Telemarketing Data entry operator Online tutor

The increased amount of housekeeping in Bhubaneswar has also opened up new income opportunities for women, who can now maintain a work-life balance and work in a way that suits them best.

What are the best jobs in Bhubaneswar? Bhubaneswar has a major advantage over other IT centers which is the transport system.The city has an extensive public transport system that connects all important points in the city. Bhubaneswar is slowly becoming the preferred destination for many IT and ITES companies as many major players have already set up their operations in Bhubaneswar. Some of the best jobs in Bhubaneswar are: Acharya Vihar Saheed Nagar Rasulgarh Patia G Colony Chandrasekharpur Nayapalli Khandagiri Baramunda Ashok Nagar

How to start searching and applying for jobs in Bhubaneswar? If you are looking for a job in Bhubaneswar, is the easiest and most effective way. Download Apna app to find and apply latest jobs in Bhubaneswar. For 10th, 12th pass, home work, fresher and experienced people, the app facilitates work in more than 70 categories.

Start applying for jobs in Bhubaneswar. Jobs Classified is fast, easy and efficient. It is a one-stop solution for jobs, skill development, professional networking and all other aspects of career development.

#advertising arts and media jobs in bhubaneswar#trainer jobs in bhubaneswar#farming animals conservation jobs in bhubaneswar

0 notes

Text

India's Top 5 Call Centers - Excellence in Customer Service

Is your company struggling to handle all customer inquiries? Don’t let your customer satisfaction affect due to insufficient in-house resources. You can outsource your customer service to call centers — and let them take care of your customers.

Furthermore, these companies have evolved greatly and are not limited to providing customer support services, lead generation and market research etc.

Before outsourcing your customer service, it’s important to ensure that the company you hire is reliable enough to handle your customers. To help you pick the right one, we’ve reviewed a few leading call center companies and chosen the top options for you.

1. Call2Customers:

Call2Customers is the first in the list of call centers in India. It specializes in providing services such as inbound/outbound call centers, customer care service, B2B/B2C lead generation, and technical customer support.

Call2Customers can be a reliable outsourcing partner for organizations seeking to hire an agent specializing in these services.

Visit https://www.call2customers.com/ to learn more about their offerings.

2. Zrima:

Zrima is an outsourcing services company that provides state-of-the-art applications and high-quality standards to achieve seamless processes for business.

This firm company delivers high-quality BPO solutions for clients through Inbound Call Center, Outbound Call Center, Customer Support and Telemarketing. Zrima employs top-notch ideal solutions to help scale up businesses on a global scale.

Visit https://www.zrima.in/ to learn more about their offerings.

3.Votiko:

Votiko is a Call Center firm that provides a wide array of value-added services that helps clients meet their telemarketing needs and solutions.

With over seven years of experience, Votiko offers custom contact center solutions to small and medium-sized businesses.

Part of the company’s services includes a call center, telecom solution, CRM, BPO, finance and accounting, e-commerce and technical support.

Visit https://votiko.com/ to learn more about their offerings.

4. Fusion BPO Services :

Fusion BPO Services is a global business process outsourcing firm headquartered in Montreal, Canada, that was established in 2004. Their team of over 1000 employees offers voice BPO, non-voice BPO, and transcription services.

Fusion BPO Services is providing call center services for a hospitality company. They consider the client’s technical and commercial needs when hiring resources.

Visit https://www.fusionbposervices.com to learn more about their offerings.

5. Vsynergize:

Vsynergize is a global sales and marketing service provider that has offices in San Francisco, Westborough and Pune, India. Founded in 2001, Vsynergize's team of about 300 employees has nearly two decades of experience specializing in call center services.

The firm also extends back-office services to its clients in the financial services, telecommunications, and healthcare industries.

VSynergize offered sales and marketing support, including creating messaging for an email campaign, researching a target market, as well as conducting calls and scheduling appointments with a list of contacts.

Visit https://vsynergize.com/ to learn more about their offerings.

1 note

·

View note

Text

Business Process Outsourcing.

What is Business Process Outsourcing?

Business Process Outsourcing (BPO) is the practice of contracting out specific business functions or processes to a third-party service provider. This allows organizations to focus on their core competencies while outsourcing other tasks such as customer service, finance and accounting, human resources, or IT services to specialized service providers.

BPO services can be classified into two types: back office outsourcing and front office outsourcing. Back office outsourcing involves non-customer facing tasks such as data entry, data processing, accounting, or logistics. Front office outsourcing involves customer-facing tasks such as customer service, technical support, sales, or marketing.

BPO can provide several benefits to organizations, such as cost savings, increased efficiency, access to specialized skills and technology, and flexibility in scaling up or down as business needs change. It can also help organizations to focus on their core business activities, while leaving non-core activities to specialized service providers.

However, BPO also has some potential drawbacks, such as a loss of control over outsourced processes, potential risks to data security and privacy, and communication and cultural barriers between the organization and service provider. Therefore, it is important for organizations to carefully evaluate their BPO needs, choose the right service provider, and establish clear communication and performance metrics to ensure a successful outsourcing relationship.

1 note

·

View note

Link

0 notes

Text

Understanding Business Process Outsourcing Solutions: Benefits and Best Practices

Business process outsourcing (BPO) is the practice of contracting out specific business processes to third-party service providers. Business process outsourcing solutions can help organizations streamline their operations, reduce costs, and improve efficiency. Here's a guide to understanding BPO solutions, their benefits, and best practices:

Benefits of BPO Solutions: BPO solutions offer numerous benefits to organizations, including cost savings, improved efficiency, access to specialized expertise, and flexibility to scale up or down as needed. By outsourcing non-core processes, organizations can focus on their core competencies and strategic initiatives, improving their overall competitiveness.

Types of BPO Solutions: There are two main types of BPO solutions: back-office and front-office outsourcing. Back-office outsourcing includes processes such as accounting, finance, human resources, and supply chain management, while front-office outsourcing includes processes such as customer service, sales, and marketing.

Best Practices for BPO Solutions: When outsourcing business processes, it's important to follow best practices to ensure successful outcomes. These include clearly defining the scope of work, selecting the right service provider, establishing clear communication channels, and implementing effective performance metrics to track progress and ensure accountability.

Common Challenges with BPO Solutions: While BPO solutions offer numerous benefits, they can also present some challenges. These include communication and cultural differences with the service provider, maintaining data security and privacy, and ensuring compliance with regulatory requirements.

Factors to Consider when Selecting a BPO Provider: When selecting a BPO provider, it's important to consider factors such as the provider's expertise, track record, pricing, and scalability. It's also important to conduct due diligence and establish clear service level agreements (SLAs) to ensure expectations are met.

In conclusion, Unity communication's business process outsourcing solutions can offer numerous benefits to organizations, including cost savings, improved efficiency, and access to specialized expertise. However, to ensure successful outcomes, it's important to follow best practices, consider common challenges, and carefully select the right service provider. By doing so, organizations can streamline their operations and focus on their core competencies, improving their overall competitiveness.

0 notes

Text

Business Process Outsourcing (BPO) Market Size, Share, Trends and Analysis by Region, Service

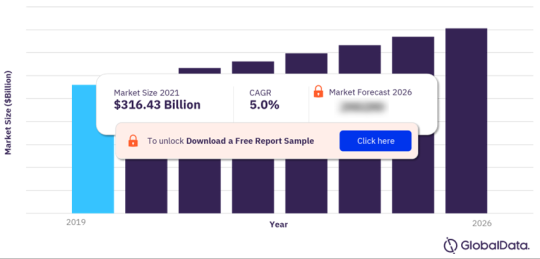

The business process outsourcing market size was valued at US$ 316.43 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% during 2022-2026. Outsourcing of business functions such as bookkeeping, HR activities, finance and accounting, research, sales, and marketing allows businesses to focus on core business activities essential for the growth of the organization. Additionally, outsourcing enables businesses to cut operational costs, gain access to skilled resources, enables diversification, and provide access to innovation, technology, and more, which is anticipated to drive the BPO market. The above-mentioned benefits have increased the demand for BPO services across various end-use industries, including BFSI, IT and telecom, healthcare and pharmaceuticals, manufacturing, and retail, among others.

0 notes

Text

Functions Commonly Outsourced By Banks And Financial Institutions

Functions Commonly Outsourced By Banks And Financial Institutions

Customer Support, Financial Outsourcing, Payroll Outsourcing

Eyeing the increasing competition, consumer demands and expectations of shareholders for cogency, today, BPO or

Business Process Outsourcing has become a common practice in many sectors. Like others, the banking sector outsources multiple services to external agencies or call centers to ensure timely delivery of quality outputs, cost-effectiveness, access to the latest technology and maximum reach. Financial organizations, these days, tie-up with finance outsourcing BPO service providers to meet the growing customer care requirements. To offer better sales support to both the valued and potential customers, banks often reach out to call centers, which are usually equipped with a skilled workforce, and modern technologies and are capable of providing 24-hour support along with multilingual assistance.

The world is currently witnessing a digital revolution, where social media platforms like Facebook, Twitter, and Instagram have become one of the primary mediums for communication. Apart from solving queries over phone calls, BPO service providers make sure that the customers, trying to reach out through social media, chats, emails and messaging apps, are instantly attended to. Besides, call centers also offer various requirement-specific packaged services to different customers.

Top 5 Benefits Of Outsourcing Financial Services, For The BFSI Industry:

Saves Times

Back office activities and lead generation are time-consuming activities. Hence, outsourcing these functions to a service provider or call center saves a lot of time. Reputed outsourcing providers make sure the banks can invest more time into other core banking activities.

Gives Access To The Latest Technologies And Expertise

Call centers are generally rigged with modern technologies and a team of skilled professionals, who are aware of the current market trends, policies and regulations. Hence, outsourcing financial services enables a BFSI company to retain old customers and build new ones by offering efficient customer support.

Saves Overhead Costs

Hiring and training customer support, back-office and lead- generating staff often turn out to be a costly affair. Besides, in- house staffs need to be offered employee benefits, like incentives, medical insurance etc., along with fixed monthly remunerations. Hence, outsourcing financial services is quite beneficial. It enables the companies to save overhead costs while ensuring optimum revenue along with customer retention.

Reduces Hardware And Software Costs

Hardware and software required for accounting are quite expensive. Therefore, instead of spending money for acquiring these, it is always beneficial for banks to outsource the accounting activity to finance outsourcing companies, who already have access to the latest software to churn out outputs of optimum quality.

Lowers Risk

The risk of internal theft or security breaches can be eliminated by outsourcing financial services to a third party. Banks can check the references and history to make sure the outsourcing partner meets all the basic security standards. The encryption method used by the outsourcing partners is often considered and the actions they take are observed by the banks, to monitor data and location.

Commonly Outsourced Financial Services:

Lead Generation

Outsourcing lead generation offers a better turnaround time for identifying, delving into qualified leads and scheduling meetings with clients.

Payroll Processing

Outsourcing payroll processing fetches a bank ample time to put on the core banking activities and saves a lot of energy, time as well as money.

Customer Support

Customer support is one of the critical activities, commonly outsourced by banks and financial service providers. For the BFSI sector, customer support plays a vital role. When it comes to

choosing banks, customers often get skeptical, as it is about the safety of their hard-earned money. To thrive in the competitive industry, banks need to offer proper guidance on choosing the right financial services, through efficient customer support. Hence, outsourcing customer support exposes banks to skilled professionals who are capable of understanding the psychology and requirements of the customers and guiding them accordingly.

Back Office

In the BFSI sector, data management and CRM(customer relationship management) activities are often considered secondary. However, these activities are crucial, like the others. Effective data management and CRM can ensure transparency in banks and financial service-providing companies. Therefore, financial firms can consider outsourcing back-office activities to make sure the job is done by experts and with maximum diligence.

#outsourcing financial accounting services outsourcing of finance and accounting services#outsourcing financial accounting#finance#merchant finance cash#merchant

0 notes

Text

Benefits of Using Reappropriated Accounts Payable in Private Businesses and Lager

Each individual keeping a business should be freed from the obligation to pay cash to anyone, immediately. Lender liabilities unequivocally suggest the money a business owes to dealers of things and organizations they have bought on loan. Accepting you are showing trying to screen the number of its records payable. This is the perfect strategy for dealing with this condition.

While keeping a business, checking and the leading body of things like records payable can be very hard and wild. Loan boss liabilities offer organization to clients all around the planet. Regardless, this is a critical component of any business connection and prerequisites do and takes time. Organizations reexamining loan boss liabilities are given by numerous associations that orchestrate cash and accounting reconsidering.

Leaser liabilities processes have huge contact with the installment of an association. The associations use colossal proportions of money consistently to deal with sales, completely get the matching of solicitations, the failure to address and respond to requests from merchants. If the records payable system isn't capable, an association needs to allow the additional cost of late portion results, missed limits, a portion of the increase, and indeed piece. With a wide method for managing cost diminishes and more conspicuous monetary organization, pioneer administrative gatherings are figuring out the benefits of a productive course of records payable.

Reevaluating lender liabilities appreciate many advantages. One of the essential advantages is that you can save a colossal proportion of pay through the re-appropriating of work. The work is for the most part moved to countries whenever there is a ton of work. This, therefore, suggests that your occupation reexamining lender liabilities will be ready by specialists at a very humble expense. The benefit to being saved in this approach is the benefit to your business. On account of globalization itself, the resistance close to the end makes all associations attempting to persevere through better ways to deal with assembling quality and lower costs and in this manner be more forceful.

The Internet from the impressively unrivaled correspondences between associations, inciting associations to make closer ties of affiliation working in various kinds of re-appropriating, making it logically more specific associations exist immense market strengths. Then as shown formally Reconsidering.

At the same time, I find new reexamining organizations, including Re-appropriating of varieties, work environments, call centers, finance, bargains (I sell and a financial master liable for finance), processes by and large (BPO or Business Cycle Rethinking) including the chiefs of arrangements, purchases, and patterns of each and every business or organization.

For More Info:-

personalized virtual bookkeeping services

quickbooks online setup services usa

0 notes

Text

Best Software Outsourcing Companies

Best Software Outsourcing Companies

The Best Outsourcing Companies In The World

Now that you know how outsourcing can take your business to the next level, how do you choose the right outsourcing company?

This can be a problem as there are thousands of outsourcing companies across the world in 2022!

1. Wipro

Wipro is an India-based outsourcing company that provides IT, consulting as well as business process outsourcing services. They work with clients across several industries, from banking and communication to insurance and oil.

Major clients: Airbus, Telenor, Swiss Pharmaceutical

Outsourcing Services

Artificial intelligence

Cloud and infrastructure

Customer service management

Supply chain planning

Digital marketing

2. AppTechub

Apptechub is an industry leader yet affordable software outsourcing company. Their services include web app development, mobile app development and customer software development. They have been awarded as the top software development company by reputed review firms like Clutch.

Major clients: Fortune 500 companies

Outsourcing Services

Mobile App development

Web development

UI/UX Design

DevOps services

3. K.K Tech IT Solution

KK Tech design and develop web and mobile applications for our clients worldwide.

Kk tech have rich experience of 3+ years in offering Website Design, Web Development, CMS, Ecommerce Solutions, Mobile Apps and Digital Marketing Services to business of all statures whether you are a small business or a corporate company. Our team of young and skilled developers have expertise to deliver the perfect web and mobile apps solutions.

KK Tech offers experienced and comprehensive help for a wide range of business needs and can help you to work smarter and reach your goals. Have a look at the professional services KK Tech offers, and let’s talk.

Major clients: F.D Education, Blaze Investigation and many more

Outsourcing Services

Mobile App development

Web development

UI/UX Design

Customer service management

Digital marketing

Software development & IT

4. TrinityWired

TrinityWired is one of the top IT solutions companies in the world. It offers variety of high quality and dependable IT solutions. They work with banking, financial, healthcare, retail, marketing, advertising, telecommunications, education, logistics and oil and gas industries.

TrinityWired is one of the most reputed IT solutions in the industry.

Major clients: Fortune 500 companies

Outsourcing Services

Mobile App development

Web development

Design

IoT solutions

DevOps services

Artificial intelligence and machine learning

Quality Assurance and Testing

5. 1840 & Company

1840 & Company is a US based BPO company with service delivery facilities in the Philippines, India, Ukraine, South Africa and Argentina. They work with companies of all sizes across numerous industries to help them build remote teams that quickly scale to accelerate growth. In addition to outsourcing, 1840 also provides freelance talent and a founder’s club with market resources and insights.

Major clients: Groupon, Instacart, HomeLight and LearnZillion

Outsourcing Services

Artificial intelligence

Customer service

Technical support

Business/sales development

Back-office support

Software development & IT

Digital marketing

Recruitment process outsourcing

6. Capgemini

Capgemini is a consulting, technology and outsourcing service provider with headquarters in Paris, France. They focus on application development and digital product development along with providing a host of other technology solutions.

Major clients: Armstrong, Bluescope Steel

Outsourcing services

Digital manufacturing

Customer experience

Customer operations management

Finance and accounting

7. Sciencesoft

Sciencesoft is an IT consulting services and custom software development provider. They are based in the USA and cater to mid-sized and large businesses internationally.

Sciencesoft is known for its web application and mobile development services.

Major Clients: IBM, Walmart, eBay, Salesforce and Nestle.

Outsourcing services

IT help desk outsourcing

Software development

IT strategy

Crisis management

Quality assurance

8. Arka Softwares

Arka Softwares is an ISO 9001:2015 certified and industry-leading web and mobile development solution provider company with 100+ passionate developers and designers, based in Jaipur, India, having offices in, USA, UK, and Australia. They have been helping consumer-oriented clients to drive business with its innovation-driven and contemporary web and mobile app solutions since its establishment in 2010.

Major clients: Recursando, DialUsafi, Top Team 11, Archithrones

Outsourcing services

Mobile App Development

Web Development

iOS App Development

Salesforce development

9. Cognizant

Based in New Jersey, USA, Cognizant offers digital solutions involving IT, business operations and consulting.

Cognizant is more than just a software development company since web design and software development services are a small part of their business model. They also focus on more advanced services like AI and digital engineering.

Major clients: ING, JP Morgan Chase and Wells Fargo.

Outsourcing services

Cloud enablement

Digital strategy

Artificial intelligence

Wealth and asset risk assessment

Contact center support

10. Belitsoft

Belitsoft is a custom software development company. They are a reliable partner for clients in the United States, the UK, European countries, and Israel, including both small businesses and companies with thousands of employees.

Founded in 2004, this team of 370+ software development experts provide full-cycle software development services and staff augmentation. They manage everything from project and product perspective and platform design, to all front- and backend development, including database design and all of the system architecture as well as software testing, maintenance, and setting up successful dedicated teams.

Major clients: Technicolor SA, ElearningForce, Insly, IDT Corporation, CRIMSON, NEDAP, Berkeley University, Aalborg University, Ticken.nl.

Outsourcing Services

Outsourcing custom software development

Outsourcing developers

Software product development outsourcing

Outsource web development

Mobile development outsourcing

IT infrastructure outsourcing

IT Stuff augmentation outsourcing

Software testing outsourcing

Customer support outsourcing

#kktechsolution#it comapny#it comes full circle#outsourcing#appdevelopment#websitedevelopment#webdesign#software#digital marketing

1 note

·

View note

Text

3 career possibilities for MBA graduates

Career After MBA:

Our blog is intended to assist you to reduce your options based on your interests and the MBA specialties if you’re still undecided about the career you should follow. So, before you leap, consider some of the popular MBA concentrations and features. Learn MBA from The Best MBA colleges in Bangalore.

Possibilities for Jobs Following an MBA in Specific Fields

Candidates for an MBA should be well-aware of their work options after receiving their degrees. As we examine the many MBA degree specialties, let’s determine which MBA specialization and job profile are suitable for you based on your skills and knowledge. Let’s look at some of the more popular MBA specializations and career choices.

#1 Opportunities for Graduates of the MBA in Finance

The MBA in Finance covers all management, analytical, and financial aspects of any business, financial, or corporate subject. You can enter the finance, banking, and investment sectors of corporations or government departments thanks to the large variety of jobs available in this field. Accounting, corporate finance, banking, portfolio management, international finance, capital venture, private equity, and other careers are available to students who receive an MBA in finance.

The position description for MBA finance

Financial Analyst

Manager or analyst of finance

Accounting Supervisor

Manager of Risk and Insurance

Treasurer

Manager of Finance

Legal Financial Consultant

Cash Manager

Degrees with MBA specializations

Finance Administration

Financial and marketing

Worldwide Finance

Finance and Management

Management of Banking and Finance

Finance Strategy Management

Finance and HR Management

Major Firms

Goldman Sachs

Bank of India State

HDFC

KPMG

Bain & Co.

#2 Career Possibilities for Marketing MBA Graduates

An MBA in marketing focuses primarily on the study of business and marketing. The major goal is to teach students the fundamentals of marketing by providing them with a thorough understanding of the subject and any pertinent essential concepts. With an MBA in marketing, you have a wide range of career options, and the curriculum includes all of the necessary subjects, such as brand marketing, techniques, leadership, sales, responsibilities, management skills, product branding and management, marketing research, consumer behavior, and others. The success of any brand’s marketing initiatives depends on its ability to increase sales and the market value of its unique products or services.

Job Profiles in MBA Marketing

#3 Career Possibilities for Human Resource Management MBA Graduates

Candidates with an MBA in HRM (Human Resource Management) can work as HRs in a number of organizations for a wide range of firms. The human resources division serves as a conduit between management and the workforce. The HR division is in charge of keeping an eye on employee performance and recruiting new hires for the company.

With a degree in HR management, a student can work as an HR executive or manager in a range of sectors, including manufacturing, BPO, IT, services, corporate, government, banking, finance, education, and more. A company’s or organization’s hiring, orientation, training, event planning, and other office-related responsibilities are all highly influenced by the HR professional.

MBA Human Resource Management Job Profiles (HRM)

Human Resource Manager.

Human Resource Consultant

International Human resource professional.

Human Resource Generalist.

Human Resource Specialist IT.

Employee Education Consultant.

Director of HR Training and Development.

Staffing Directo

Degrees with MBA specializations

HR Management

Marketing and HR Management

Strategic HR Management

HRM and Finance Management

Top Companies

Reliance

KPMG ( Klynveld Peat Marwick Goerdeler)

WIPRO

Deutsche Bank

PepsiCo

Infosys

Makemytrip

Aditya Birla Group

Why Should People Choose MBA?

No one is permitted to sign up for any of the courses if they have no valid cause. Many businesspeople or working professionals desire prominent and profitable MBA degrees. There are various MBA specialties and related career trajectories. It’s crucial to understand the advantages of obtaining an MBA through conventional, online, or remote learning modes before reading the rest of the text.

The best way to develop the skills required to begin a higher-level firm with all the required management, administrative, and financial skills, according to the current situation, is through an MBA program.

In order to develop their knowledge or abilities in the professional environment of their specialized field, expert candidates or specialists register in MBA programs.

A candidate with a degree from this accredited MBA school can easily advance in their current position within the corporate world.

Because of their MBA degrees or their areas of concentration, a fresher or more experienced CV has better value and eligibility.

With an MBA, you may expand both your technical and non-technical knowledge and skills, which will improve your professional competence.

Conclusion

I hope this article has allayed your worries and given you a broad notion of the kind of work you ought to be able to get after receiving an MBA from any reputable or approved college or university. Candidates should seek an MBA since it is a lucrative and respectable sector if they are keen to advance their careers in management, finance, administration, or other monetary disciplines.

From my point of view The Soundarya Institute of Management Science (SIMS) Bangalore is one of The Best MBA colleges in Bangalore.

0 notes

Text

Employment Agency For Remote Work - Employ Remote

We deliver world-class extended back-office support and dedicated BPO services with flexible and scalable web-based solutions. Employ Remote gives companies an unfair competitive advantage by providing cost-effective, world-class remote employee solutions.

How We Work - Employ Remote :

Every potential client comes to us with an idea or problem in mind. But in order to be efficient in making that idea into reality or providing innovative solutions to the client, we’re constantly refining our processes. We think it’s important for us to be clear with you about how we work, so we are all on the same page, working together productively.

We deliver business and technology transformation from start to finish, leveraging various methodologies, industry best practices, proven customer collaboration frameworks, engineering excellence tools and hybrid teams. We work on a wide variety of projects; we know each project will be different so we approach each project with an open mind. Here is how we work with you to get your project from stage A to stage B.

1. ESTABLISH CONTACT

You fill the inquiry form

The sales team calls or emails you

2. REQUIREMENT ANALYSIS

High-level understanding of requirements

Ballpark estimate (where possible)

Approval to go-ahead

Detailed understanding of your requirements

Execute a pilot project (if required

3. PRICING & CONTRACTING

Confirm pricing

Proposal where required

Contracting & SLA sign-off

What Services Do We Offer?

We provide specialised BPO services and world-class extended back-office support using adaptable and scalable web-based solutions. Employ Remote provides world-class, affordable solutions for remote employees, giving businesses an unfair competitive advantage.

Call Center Services

Give your enterprise a winning edge and enhance your business’s operational proficiency by hiring an extended Call Center.

Software Development Services

Bring new tools and technologies to your business by developing smart, robust, agile, and scalable software solutions.

Finance and Accounting Services

Get rid of tiring and the iterative task of finance and accounting and spend quality time focusing on core business operations.

Data Entry Service

Outsourcing data management services to Employremote will ensure highly professional and mission-critical data at your disposal.

Technical Support Services

Manage your valued customers by offering professionally managed technical support and helpdesk solutions that yield results.

Sales and Marketing

Expand the horizon of your products and services by leveraging the most advanced and result-oriented sales and marketing solutions.

Contact us :

Facebook : https://www.facebook.com/EmployRemotePtyLtd

Twitter : https://twitter.com/Employ_Remote

Linkedin : https://www.linkedin.com/company/employ-remote-pty-ltd

Instagram : https://www.instagram.com/EmployRemote/

Website : http://employremote.com.au/

tel : +61 02 8733 5229

1 note

·

View note

Text

FinTech: Is This Set To Poise As A Neo-Banking Or Is Only The Noise?

Guess everyone knows by now – what is FinTech?

FinTech is a buzzword that has been constantly making the right noise in technology, investments and start-up circles since last two decades. Investors across the globe are following it close on their heels. We have extreme views of experts believing that this would put an end to the traditional banking on one hand to forming a new tech bubble on the other! However, given the adoption of FinTech services globally and the investments being pumped up by global firms, instil a huge confidence in the potential prospect of this industry & its applications. FinTech has given rise to a start-up scene of over 4,000 firms with business models that span across lending, payments, personal finance, remittance, investments, securities trading and savings. Its importance was reinforced during the global financial crisis of 2008 that highlighted the inefficiencies in the banking system and prodded the tech industry to understand and take advantage of the numerous opportunities presented by the financial world. FinTech has helped digitize the financial sector, reshaping businesses and transforming the way consumers use and manage money. Prominent FinTech brands in the industry include Bitcoin, LendingCLub, PayPal, Tencent, Check, OnDeck, Future Advisor, FundBox and Kreditech, among others.

What is the investment outlook by 2020? Currently, who are the leading investors?

According to Goldman Sachs, the FinTech sector promises a pot of revenues to the tune of US$4.7 tn that investors across the globe are hitting on. Investors are pouring in billions of dollars into financial start-ups across the globe and have in fact quintupled their investments, from US$4 bn in 2013 to US$20 bn in 2015; and are expected to grow to US$46 bn by 2020, on the back of further advancements in technology and innovative financial products. Investor groups, across segments, have exhibited interest in the sector, with venture capital firms contributing 24% to the total investments, private equity firms 15%, angel investors 12% and corporate & other investors 49%. Few investors (and their investments) that have hit the spotlight include SoftBank (SoFi), Baseline ventures (Millenial Personal Finance), Alibaba (PayTm), General Atlantic (Avant), Google (Symphony), Intel (IntelSee), Salesforce (SalesForce Financial Services Cloud), JP Morgan Chase (Bunker), Master Card (Pinpoint-loyalty provider) and Pingan (Lufax). The frontrunners in attracting these investments, as of Jan 2016, were payments/loyalty/Ecommerce firms (51%), followed by Banking/Lending firms (41%). The remaining share of investments (8%) has been made in securities/capital markets, wealth management, financial BPOs, financial management, insurance technology, and FinHCIT companies.

But what has convinced so many investors for betting their money in FinTech firms?

The emergence of new technologies such as Blockchain (public ledger account for Bitcoin transactions), Internet of Things (IoT), machine learning or artificial intelligence (AI), cloud-based solutions, Big-data and the increased coverage expansion of mobile apps has turned the traditional model of financing on the head and is driving financial innovation. It has eased monetary transactions, ensured faster processing, reduced documentation requirements, improved risk management, made investments easier and reduced the cost of financial services. The internet savvy young population has supported greater usage of card payment methods, higher smartphone penetration, online payments and at the Point of sale terminals transactions. Such a change in consumer behaviour is driving a myriad of advancements in FinTech.

Another key driver for FinTech start-ups is the rise of Small & Medium Enterprises (SMEs), which are constantly in search for adequate low-cost funds and need customized solutions for processing merchant card payments, supply chain financing, and credit & expense management. The lower interest rates charged by the online lending platforms such as Peer to Peer lending and CrowdFunding, has made it attractive for SMEs to borrow money from these platforms. The lower cost and higher returns offered by FinTech services is due to absence of significant hurdles and overhead costs that traditional banks are subject to. For instance, Prosper, a P2P lending platform offers average returns of ~7%, while it is only ~1-2% for deposit holders in a traditional US bank.

Each of the sub-segments of FinTech has shown exponential growth in the past few years. According to a global survey conducted by Business.com in 2015, nearly 30% individuals with smartphones prefer using mobile payment services over cash or card transactions. Bitcoin, another major sub-segment of FinTech is changing the way we use currency. As of 2015, nearly 6 million people across the globe used Bitcoin for various transactions for its faster processing and higher security associated with its usage. Similarly, other segments like payments, money lending, roboadvisors etc. offer unmatched opportunity for investors. We will be discussing more on each of these sub-segments in this blog series. We leave you with a quick list of services or sub-segments of FinTech. Watch out for our next post!

Source: ValueAdd

This article is authored by Girish Bhise (Founder & CEO of ValueAdd)

About The Author:

Girish has over 15 years of research experience across investment banking, equity research, fixed income and credit research, and business strategy research for large global clients including asset management firms, investment banks, brokerage firms, corporations, private equity & venture capital firms. Has extensive experience in successfully managing large-scale research right-shoring transitions across multiple regions. Is a thought-leader in the global research & technology industry. He is an MBA with specialization in Finance from the University of Pune, and Bachelor in Commerce from the University of Mumbai.

Please share your feedback/comments/thoughts on [email protected]. Thank you for time.

", "wordcount": "919", "publisher": { "@type": "Organization", "name": "ValueAdd Research and Analytics Solutions ", "logo": { "@type": "ImageObject", "url": "https://www.valueadd-research.com/wp-content/uploads/2016/04/FinTech.png", "width": 600, "height": 60 } }, "url": "https://www.valueadd-research.com/fintech-set-poise-neo-banking-noise/", "datePublished": "2016-04-23", "dateCreated": "2016-04-23", "dateModified": "2016-04-23", "articleBody": " Guess everyone knows by now – what is FinTech?

FinTech is a buzzword that has been constantly making the right noise in technology, investments and start-up circles since last two decades. Investors across the globe are following it close on their heels. We have extreme views of experts believing that this would put an end to the traditional banking on one hand to forming a new tech bubble on the other! However, given the adoption of FinTech services globally and the investments being pumped up by global firms, instil a huge confidence in the potential prospect of this industry & its applications. FinTech has given rise to a start-up scene of over 4,000 firms with business models that span across lending, payments, personal finance, remittance, investments, securities trading and savings. Its importance was reinforced during the global financial crisis of 2008 that highlighted the inefficiencies in the banking system and prodded the tech industry to understand and take advantage of the numerous opportunities presented by the financial world. FinTech has helped digitize the financial sector, reshaping businesses and transforming the way consumers use and manage money. Prominent FinTech brands in the industry include Bitcoin, LendingCLub, PayPal, Tencent, Check, OnDeck, Future Advisor, FundBox and Kreditech, among others.

What is the investment outlook by 2020? Currently, who are the leading investors?

According to Goldman Sachs, the FinTech sector promises a pot of revenues to the tune of US$4.7 tn that investors across the globe are hitting on. Investors are pouring in billions of dollars into financial start-ups across the globe and have in fact quintupled their investments, from US$4 bn in 2013 to US$20 bn in 2015; and are expected to grow to US$46 bn by 2020, on the back of further advancements in technology and innovative financial products. Investor groups, across segments, have exhibited interest in the sector, with venture capital firms contributing 24% to the total investments, private equity firms 15%, angel investors 12% and corporate & other investors 49%. Few investors (and their investments) that have hit the spotlight include SoftBank (SoFi), Baseline ventures (Millenial Personal Finance), Alibaba (PayTm), General Atlantic (Avant), Google (Symphony), Intel (IntelSee), Salesforce (SalesForce Financial Services Cloud), JP Morgan Chase (Bunker), Master Card (Pinpoint-loyalty provider) and Pingan (Lufax). The frontrunners in attracting these investments, as of Jan 2016, were payments/loyalty/Ecommerce firms (51%), followed by Banking/Lending firms (41%). The remaining share of investments (8%) has been made in securities/capital markets, wealth management, financial BPOs, financial management, insurance technology, and FinHCIT companies.

FinTech Chart

But what has convinced so many investors for betting their money in FinTech firms?

The emergence of new technologies such as Blockchain (public ledger account for Bitcoin transactions), Internet of Things (IoT), machine learning or artificial intelligence (AI), cloud-based solutions, Big-data and the increased coverage expansion of mobile apps has turned the traditional model of financing on the head and is driving financial innovation. It has eased monetary transactions, ensured faster processing, reduced documentation requirements, improved risk management, made investments easier and reduced the cost of financial services. The internet savvy young population has supported greater usage of card payment methods, higher smartphone penetration, online payments and at the Point of sale terminals transactions. Such a change in consumer behaviour is driving a myriad of advancements in FinTech.

Another key driver for FinTech start-ups is the rise of Small & Medium Enterprises (SMEs), which are constantly in search for adequate low-cost funds and need customized solutions for processing merchant card payments, supply chain financing, and credit & expense management. The lower interest rates charged by the online lending platforms such as Peer to Peer lending and CrowdFunding, has made it attractive for SMEs to borrow money from these platforms. The lower cost and higher returns offered by FinTech services is due to absence of significant hurdles and overhead costs that traditional banks are subject to. For instance, Prosper, a P2P lending platform offers average returns of ~7%, while it is only ~1-2% for deposit holders in a traditional US bank.

Each of the sub-segments of FinTech has shown exponential growth in the past few years. According to a global survey conducted by Business.com in 2015, nearly 30% individuals with smartphones prefer using mobile payment services over cash or card transactions. Bitcoin, another major sub-segment of FinTech is changing the way we use currency. As of 2015, nearly 6 million people across the globe used Bitcoin for various transactions for its faster processing and higher security associated with its usage. Similarly, other segments like payments, money lending, roboadvisors etc. offer unmatched opportunity for investors. We will be discussing more on each of these sub-segments in this blog series. We leave you with a quick list of services or sub-segments of FinTech. Watch out for our next post!

Fintech Subseg new (3) Source: ValueAdd

This article is authored by Girish Bhise (Founder & CEO of ValueAdd) About The Author: Girish has over 15 years of research experience across investment banking, equity research, fixed income and credit research, and business strategy research for large global clients including asset management firms, investment banks, brokerage firms, corporations, private equity & venture capital firms. Has extensive experience in successfully managing large-scale research right-shoring transitions across multiple regions. Is a thought-leader in the global research & technology industry. He is an MBA with specialization in Finance from the University of Pune, and Bachelor in Commerce from the University of Mumbai.

Please share your feedback/comments/thoughts on [email protected]. Thank you for time.

", "author": { "@type": "Person", "name": "ValueAdd Research and Analytics Solutions Editorial team" } }

0 notes

Text

Business Process Outsourcing Market Size, Share, Trends and Analysis by Region, Service and Segment Forecast

The business process outsourcing market size was valued at US$ 316.43 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% during 2022-2026. Outsourcing of business functions such as bookkeeping, HR activities, finance and accounting, research, sales, and marketing allows businesses to focus on core business activities essential for the growth of the organization. Additionally, outsourcing enables businesses to cut operational costs, gain access to skilled resources, enables diversification, and provide access to innovation, technology, and more, which is anticipated to drive the BPO market. The above-mentioned benefits have increased the demand for BPO services across various end-use industries, including BFSI, IT and telecom, healthcare and pharmaceuticals, manufacturing, and retail, among others.

0 notes