#Collecting outstanding payments from customers

Text

Important Steps to Small Business Debt Collection

Business debt collection is probably the major issues faced by small businesses. Prolonged efforts for collecting debt could cost your company both time and money. There are lots of practical actions to reduce the requirement for debt collection in order to enhance collection efforts. When things deteriorate, you must take help of an authorized expert that will help you in the entire process.

There are many reasons that result in a commercial debt. A late paying customer could be categorized into three main groups. In the first group, fall those who find themselves genuine. They want to clear off of the payment but aren't within the position to pay. In the second group would be the customers who knowingly delay their payment as a way to manage their residence. And the shoppers who will be never willing to cover fall inside the third group. A business must have a robust strategy available so that you can figure out their commercial debt collection. For the customers who fall within the third group, you will have to follow a completely different approach. And, finding a lawyer for collecting debt from customers falling underneath the third category is a sensible decision.

Here will be the few steps you ought to take for easy business commercial collection agencies.

Payment policy

It is essential to shield your interests with policies that help you collect your credit card debt. It is vital to possess a signed contract for any product or service in which payment will be made at a later date. The policy should contain exact due dates or agreed timeframe where the payment will likely be made.

Keep your accounts updated

Accurate and updated accounting will assist you to identify and use delinquent accounts. You should keep the clients updated and tell them where their accounts stand. You should supply to them the itemized invoices which include a specific due date for your payment.

Follow the law

It is prohibited to threaten, harass or intimate customers who will be defaulters. Never threaten the customers can use with actions which are illegal to adopt. Take Small business help collecting invoices of an expert commercial commercial collection agency lawyer to help you in the collection process. You should be complaint using the appropriate laws to ensure that you usually are not following any unfair means to collect debt. The attorney will draft letters for your benefit for requesting payment. They would also assist you to if any additional legal steps are essential.

Be careful when collecting outstanding payments from your customers and take legal help if you aren't in a position to manage the collection all on your own.

#Collecting unpaid invoices training#Invoice collection process#Unpaid invoices small business#Collecting outstanding payments from customers#Help collecting unpaid invoices#Small business help collecting invoices#Programs for collecting invoices#How to collect unpaid invoices#Invoice collection training course#How to collect outstanding invoices

0 notes

Text

Collect Your Accounts Receivable - A Quick Guide to Accounts Receivable Management

Today, the business enterprise is moving so quickly that it is hard to maintain. With margins shrinking plus much more competition than any other time, it's more essential than ever for businesses to acquire paid punctually and in full. This guide will coach you on how to keep your company is collecting accounts receivable punctually and in full. From investigating past-due invoices and setting up a formal A/R follow-up process, here are several methods to ensure you collect all of your accounts receivable.

A Quick Overview of Accounts Receivable

Before we obtain to the nitty-gritty, let's quickly review what accounts receivable are. Accounts receivable, also called A/R, is money owed for a company by customers who've ordered products.

For example, imagine that you have an internet outlet as well as your customer sends in a $100 order. You send them a confirmation email and so they pay with PayPal to get a total of $106.00. The order is currently completed and you are awaiting the customer into the future grab their item out of your store front or shipping center.

Since it has been over 45 days since the sale occurred, you've technically collected past-due invoices with this account if you want to be paid in full-even though there may 't be any funds being released your immediate future from the buyer on this account.

In this post, we'll be going over the way to track down past-due invoices and make certain your accounts receivable are collected promptly and in full!

Why Invoice collection training course to Collect Accounts Receivable

When you are looking at payments, you wish to be sure to receive money promptly as well as in full with every customer. You also want to try not to chase payments which can be unlikely to come in.

It's very important to you plus your company to use customers who will be always paying punctually with payments in full. If you're not getting paid on time, it could affect your cash flow and ultimately result in trouble.

That's why it is so necessary for companies to recover accounts receivable punctually. It's essential on your company's financial health, plus the morale of the employees.

If you would like accounts receivable collected efficiently, it is vital that you simply build an official A/R follow-up process. This includes locating past- due invoices and sending reminder emails before participating in any collection efforts, like phone calls or a lawsuit.

Remember that collecting accounts receivable is an ongoing process that often requires multiple steps before reaching success.

The Key to Successful A/R Management

There a wide range of a few when implementing an A/R collection strategy.

First, track down past-due invoices in order to improve your collections. There's nothing worse than chasing unpaid invoices which you've already delivered! By keeping an eye on whenever your invoices are due then when they're paid, you'll know when you should telephone the customer.

Second, setup a formal A/R follow-up process. You don't want to be fighting over late payments for the rest of your respective life; it is necessary to possess a system available for systematically tracking and following on all late payments.

Third, work with a vacation. Outsourcing accounts receivable management services may help you minimize time spent about this critical function while maximizing revenue collections. This will take back your time and energy to help you target growing your business as an alternative to collecting past-due invoices!

Setting Up Your Process for Collecting Accounts Receivable

Setting up an operation for collecting accounts receivable will allow you to hunt down any missed opportunities and enhance your ability to acquire paid punctually.

To start, it's important to determine who's accountable for following with customers and ensuring that they pay for the invoice. You can create an activity that you assign somebody or team member to follow-with past-due invoices per week.

It's also smart to generate a system for locating past-due invoices. This could be as simple as setting aside a box where people can drop in past-due invoices they've collected from customers, or creating a spreadsheet which allows everyone within the office to add new overdue invoices each day.

You might also want to consider automating your A/R follow-up process by using a CRM system like Salesforce.com or ZohoCRM. This will enable you to automatically send emails and hang reminders for when you need to telephone customers again.

Tracking Down Past-Due Invoices

It's imperative that you have a system for tracking past-due invoices so that you can proactively collect money from customers who haven't paid. But, after a while, it becomes difficult to manage many of these invoices.

Tracking down past-due invoices will need commitment. You'll need to review your records and make contact with your web visitors individually. Lucky for you, this process doesn't have to be difficult! In order to simplify this, you can create an Excel spreadsheet with columns for the: outstanding invoice amount, date sent, date due, customer name, and reason behind late payment. You can then sort each column by column or filter by column inside search function inside the top left corner from the spreadsheet. This way, you can actually find past-due invoices inside of seconds!

#Collecting unpaid invoices training#Invoice collection process#Unpaid invoices small business#Collecting outstanding payments from customers#Help collecting unpaid invoices#Small business help collecting invoices#Programs for collecting invoices#How to collect unpaid invoices#Invoice collection training course#How to collect outstanding invoices

0 notes

Text

A strategic approach to Accounts Receivable to get paid easier.

Accounts Receivable Management is a financial term that reflects both the strength and weakness of a business. On one hand, accounts receivable enables a long-term customer relationship based on credit. On the other hand, accounts receivable also creates a risky credit line on the company’s balance sheet. Customer creditworthiness, alignment between sales and finance teams, streamlined AR processes with minimal efforts, and accountable ownership are key elements that contribute to a smooth and goal-oriented accounts receivable approach.

In simple terms, accounts receivable management ensures that the credits from customers are fully paid within the agreed time, improve cash flow and provide businesses with sufficient working capital. However, the AR process is not as simple as it sounds, and many businesses face difficulties in achieving it.

Current Financial Environment:

Most businesses have established clear accounts receivable policies, but many of them are still struggling with the different aspects of accounts receivables - timely invoicing, confirmed due dates, receivables timing, outstanding balances, discounts and agreed payment terms, and write-offs are all different pillars for an efficient AR planning.

Cash that is locked in receivables is a delayed asset, and as long as companies follow and maintain a planned approach, the risk is manageable. However, many companies try to bypass the rules in the process of increasing sales, retaining customers, or simply due to a lack of ownership, resulting in a chaotic situation to track the trapped cash.

In the process of increasing the number of sales deals, businesses often neglect the AR policies and by the time they realize it, their working capital is already affected. A smart approach is needed, where new sales and repeat deals make a positive impact on the balance sheet, by bringing cash into the business without compromising the customer relationship.

Refined AR approach

While accounts receivable is a lengthy process, understanding the customer’s capacity and credit worthiness is vital, to start with. When designing an AR strategy, it is important to communicate the plan clearly across the sales, marketing, and finance verticals of an organization, so that the teams work together toward the common business objective.

Every transaction with the customer has to be documented and must be accessible to all the stakeholders involved in the process. Understanding that AR is a repetitive process, it is important to follow a step-by-step approach and not skip any steps.

A typical AR collection process will start with the sales and delivery of goods, issuing the invoice, collecting payment (complete or partial payment), recording and tracking the balance payment by the accounts receivable team, and clearing the invoice once the payment is collected or writing it off as bad debt. Every business strives to avoid the bad debts on its books, and some of the following strategies will help the process

⦁ Clear segmentation of the customer base

⦁ Creating a proven accounts receivable plan

⦁ Effective follow-up and clear communication message

⦁ Professional dunning approach

⦁ Embedding B2B Payments in the accounts receivable process

A simple way of segmenting customers based on past payment experience will help the receivables team to establish the desired number of touchpoints. Every past communication response from the customer will be useful to categorize them and then a follow-up plan is devised for each group.

An accounts receivable plan aims to keep the receivables time frame as short as possible, as a delayed payment becomes riskier as the days pass. Therefore, it is important to reduce the credit extension days. An average invoice time can last up to 3 months, requiring a consistent and efficient follow-up depending on the customer base.

Embedding B2B Payments in the AR process is a smart way to facilitate faster and easier payments from the customers. By offering multiple payment options, such as credit cards, bank transfers, digital wallets, or cryptocurrencies, businesses can increase the convenience and security of the payment process. Moreover, by integrating B2B Payments with the accounts receivabale software, businesses can automate the invoicing, payment reminders, payment confirmation, and reconciliation processes, saving time and reducing errors. B2B Payments can also enable businesses to offer incentives, such as discounts, rewards, or loyalty points, to encourage customers to pay on time or early.

One of the challenges of managing your accounts receivable is dealing with different types of customers and their payment behaviors. Large companies may have multiple approval levels that can cause payment delays, so you need to identify and contact the right person who can speed up the process and clear your invoice. However, in small and mid-sized companies, you may face the problem of competing with other creditors for your customers’ attention and cash. In this case, you may need to send frequent and friendly reminders to prioritize your invoices over others, and also offer incentives for early payments that can benefit both parties.

Another challenge of managing your accounts receivable is dunning, which is the process of contacting your customers to collect overdue payments. Dunning management can be a frustrating and delicate process if not done in the right way, so you need to understand and empathize with your customers first. You need to use the right tone, language, and medium to communicate with your customers, depending on their situation and preferences. When you do dunning management effectively, you can overcome many obstacles and make payment collection a super-efficient process.

Follow-up is another important word in the receivables context, and it is closely related to dunning management. Follow-up is the process of keeping in touch with your customers until they pay their invoices, or until you decide to write them off as bad debts. Follow-up is crucial to maintain a good customer relationship and to avoid losing track of your receivables. However, you cannot afford to be boring and repetitive in your follow-up messages. You need to use a personalized and professional approach in every follow-up, and also provide value to your customers, such as updates, insights, or tips.

Managing your accounts receivable can be a complex and time-consuming process, but it can also be a rewarding and satisfying one, if you use the right tools and strategies. One of the tools that can help you focus on one thing - getting paid faster and easier - is Kapittx, an Accounts Receivable automation platform that uses facts to help you reduce your Days Sales Outstanding (DSO). Kapittx gives you a clear view of what’s working and what’s not, and why, in your Accounts Receivable process. It helps you establish a successful relationship between your customers’ accounts payable cycle, your invoice life cycle management, and your collective ownership. Kapittx also enables your collection teams and sales teams to collect payments faster and more efficiently than before, by embedding B2B Payments in the AR process.

B2B Payments are a smart way to facilitate faster and easier payments from your customers, by offering them multiple payment options, such as credit cards, bank transfers, digital wallets, or cryptocurrencies. These payment options can increase the convenience and security of the payment process for your customers, and also reduce the transaction costs and risks for you. Moreover, by integrating B2B Payments with the accounts receivable software, you can automate the invoicing, payment reminders, payment confirmation, and reconciliation processes, saving time and reducing errors. B2B Payments can also enable you to offer incentives, such as discounts, rewards, or loyalty points, to encourage your customers to pay on time or early.

If you want to improve your cash flow and reduce your DSO by more than 30%, you should try Kapittx, an Accounts Receivable automation platform that embeds B2B Payments in the AR process. Experience how Kapittx can speed up your payments and make your Accounts Receivable management a breeze.

Request a demo today.

2 notes

·

View notes

Text

interaction call ( mysterious inn group ) — yet another call for interactions revolving around the lore for this inch-resting inn. aka an interaction call solely for the following muses :o) if you don't specify who you'd like, i will be randomizing them.

haneul — sorcerer. if that’s even their real name... ( it’s not ). proprietor of a wayward inn for those lost and in need of shelter. expertly hidden from plain sight and can only be found when led by odd animals that posses glowing eyes. curious enough to step into the establishment? excellent choice, for full satisfaction is guaranteed once your name is added to the ledger. oh, and one last thing — whatever you do, don’t even think about harming them ‘lest you’d prefer to have this as your final destination.

dhrish amin — nightjar familiar . not a single braincell in that pretty head. familiar to haneul, sometimes guides potential customers to the inn, a bundle of energy and surprises — he’s an all around good time with a penchant to get into weird situations. might be a mess but he's fairly outstanding with being a guide to the labyrinth of the everchanging inn. you've got lobby right here, all sorts of magical shops over there, and— oh! right, rooms are up to the left, past supply closet, right, left, left, and right again!

hyun jiah — mythical tiger. the idiom of ‘back when tigers used to smoke’, but literal. part of the inn as a storyteller that can tell tales for days upon end. some even say that the stories this tiger’s come to collect have a sway with truths that can be altered to reality. others say a powerful boon can be traded for one’s life story — though this oftentimes means the tiger will hold possession over that person’s life in some manner.

bu doyun — haetae. coming out of the cage and he’s been doing just.. decent. jkjk, but seriously — he’s the most fickle, isolated grouch around that’s just begun to subject himself to the living world again. serves as hidden security to haneul’s inn — sometimes as a stone figure out front and other times as some random schmuck indoors near the lobby ( always with a frown, always with a comically large bell around his neck ). if you're of the Dangerous variety outdoors then you'll have the honor of seeing him shift into a humanoid form just so he can berate and deter your entrance ( and if that doesn't work.. well, ever have a buff statue hand u ur own ass? ).

hak minji — human, allegedly ( totally a mythical red crown crane with fortune influences ). fully eccentric lady, surprisingly loving mother, deeply profound with the knowledge of all things lost. comes from a lineage of enigmatic folk that maintain ownership over this shop of wonders. anything a person could ever desire can be bought here, but only if they're allowed entrance. aka if doyun thinks someone worthy. sends a little birdy ( totally not chinmae ) with gifts of good fortune occationally.

ransom — harpy . a being that deals in memories . the only form of payment he takes is by the trade of memories that are of equal value. happy ones are highly sought for( naturally ) whereas sadder ones aren’t as much — though there are some that seek out painful memories for whatever reason. he can even concoct something that can let a person experience a memory they’ve forgotten / never known, but those are the priciest of them all. oh, and sometimes… he eat some memories but you didn’t hear that from me.

#interaction call.#indie rp#open rp#supernatural rp#horror rp#fantasy rp#oc rp#// took me 10 years to type this up

4 notes

·

View notes

Text

AJ Furniture | Premier Home & Office Furniture in Ahmedabad - Quality, Style, and Comfort

Transform Your Space with AJ Furniture in Ahmedabad

When it comes to enhancing the aesthetics and functionality of your home or office, AJ Furniture in Ahmedabad stands out as a premier destination. With an extensive collection of stylish and durable furniture, AJ Furniture caters to a wide range of tastes and budgets, making it the perfect choice for anyone looking to elevate their living or working spaces.

Quality Home Furniture

At AJ Furniture, you will find an impressive array of home furniture designed to suit various styles and preferences. Whether you are looking for a cozy sofa for your living room, a sturdy dining table for family meals, or a comfortable bed for restful nights, AJ Furniture has it all. Each piece is crafted with precision, ensuring not only aesthetic appeal but also longevity and comfort. The selection includes:

Sofas and Sectionals: Available in various designs, from modern to classic, these pieces offer both style and comfort.

Beds and Mattresses: Choose from a range of beds that promise restful sleep, paired with high-quality mattresses for added comfort.

Dining Tables and Chairs: Perfect for hosting family dinners or entertaining guests, these pieces are both functional and stylish.

Storage Solutions: Wardrobes, cabinets, and shelves designed to keep your home organized and clutter-free.

Functional Office Furniture

In addition to home furniture, AJ Furniture excels in providing top-notch office furniture that promotes productivity and comfort. A well-furnished office can significantly impact employee performance and satisfaction. AJ Furniture’s office collection includes:

Office Desks: Ergonomically designed desks that support various work styles, whether you need a simple desk or one with ample storage.

Office Chairs: Comfortable and adjustable chairs that ensure proper posture and reduce the risk of back pain during long work hours.

Conference Tables: Stylish and functional tables that facilitate productive meetings and collaborations.

Storage Units: Filing cabinets and shelves that help keep important documents and office supplies organized.

Exceptional Craftsmanship

What sets AJ Furniture apart is its commitment to exceptional craftsmanship. Each piece of furniture is meticulously crafted using high-quality materials to ensure durability and longevity. The designs blend functionality with modern aesthetics, making each piece a perfect addition to any space.

Competitive Prices and Outstanding Service

At AJ Furniture, customers enjoy competitive prices without compromising on quality. The store offers a seamless shopping experience, both online and offline, with a user-friendly website that allows you to browse and purchase furniture from the comfort of your home. The in-store experience is equally impressive, with knowledgeable staff ready to assist you in finding the perfect pieces for your needs.

Why Choose AJ Furniture?

Diverse Selection: A wide range of furniture styles and designs to choose from.

Quality Assurance: High-quality materials and craftsmanship ensure durable and stylish furniture.

Customer Service: Friendly and knowledgeable staff committed to helping you make the best choice.

Affordable Pricing: Competitive prices that suit various budgets.

Convenient Shopping: Easy online shopping with secure payment options and efficient delivery services.

Conclusion

AJ Furniture in Ahmedabad is your go-to destination for all your home and office furniture needs. With a vast selection of stylish and durable pieces, exceptional craftsmanship, and outstanding customer service, AJ Furniture ensures that you find the perfect furniture to transform your spaces. Visit AJ Furniture today and discover the best in furniture design and comfort.

0 notes

Text

Optimizing Your Financial Operations: The Benefits of Advanced Cash Collection Management

In today’s fast-paced business environment, managing financial operations efficiently is crucial for sustained growth and stability. One of the key components of financial management is effective cash collection management. By leveraging advanced cash collection systems and software, businesses can enhance their operational efficiency, improve cash flow, and reduce financial risks.

Understanding Cash Collection Management

The Role of Cash Collection Management in Modern Businesses

Cash collection management involves strategies and processes used by businesses to manage the inflow of cash, primarily from customers. Effective management is vital as it directly influences the liquidity and financial health of a company. Inefficient cash collection can lead to serious cash flow problems, affecting the ability to fund operations and grow.

Challenges Addressed by Effective Cash Collection Management

Traditional cash collection processes often involve manual record-keeping and follow-ups, which can be time-consuming and prone to errors. Delays in collecting receivables impact cash flow, restrict capital availability, and can increase the risk of bad debts. Advanced cash collection management systems address these challenges by automating processes, reducing errors, and speeding up the cash conversion cycle.

The Components of Cash Collection Systems

Overview of Cash Collection Systems

A modern cash collection system is a blend of software tools and methodologies designed to streamline the collection processes. These systems include features like automated invoicing, payment reminders, digital payment options, and real-time monitoring of receivables.

Integrating Cash Collection Software into Business Systems

Integrating cash collection software with other business systems (like CRM and ERP) enhances data accuracy and provides a holistic view of customer interactions and financial transactions. This integration allows for automated data flow between systems, reducing manual intervention and improving operational efficiency. Learn more about integrating these systems at Atcuality's Cash Collection Solutions.

Advantages of Advanced Cash Collection Management

Enhancing Financial Accuracy and Visibility

Advanced cash collection management systems provide detailed insights into financial metrics such as accounts receivable turnover ratios and days sales outstanding (DSO). These insights help businesses understand their financial position in real-time, facilitating better strategic decision-making.

Speeding Up the Cash Collection Cycle

Effective cash collection software helps streamline and automate the billing and collections process, significantly reducing the time it takes to collect payments. Features like online payment gateways and automated reminders ensure that receivables are paid faster, thereby improving cash flow and reducing the dependency on borrowed capital.

Implementing Advanced Cash Collection Solutions

Selecting the Right Cash Collection Software

Choosing the right cash collection software involves assessing features that meet specific business needs, such as compliance with industry standards, scalability, user-friendliness, and integration capabilities. It’s crucial to select a software that not only fits the current business scale but also has the capacity to grow with the business.

Best Practices in Cash Collection System Deployment

The successful deployment of a cash collection system involves careful planning, clear communication, and training. Organizations should ensure that all users are adequately trained and that there is robust support during and after the implementation phase. Clear documentation of processes and regular audits can also enhance the effectiveness of the new system.

Conclusion

Adopting advanced cash collection management systems is more than just a technological upgrade; it is a strategic investment in the financial health of your business. With improved efficiency, better cash flow management, and enhanced visibility, companies are well-positioned to manage their finances proactively and sustain growth.

Ready to enhance your financial operations with advanced cash collection solutions? Visit Atcuality's Cash Collection Solutions to learn more about how our software can transform your business operations.

Embrace the future of financial operations today and optimize your cash collection processes to achieve better financial stability and growth.

#cash collections solutions#cash collection system#cash collection software#cash collection management

0 notes

Text

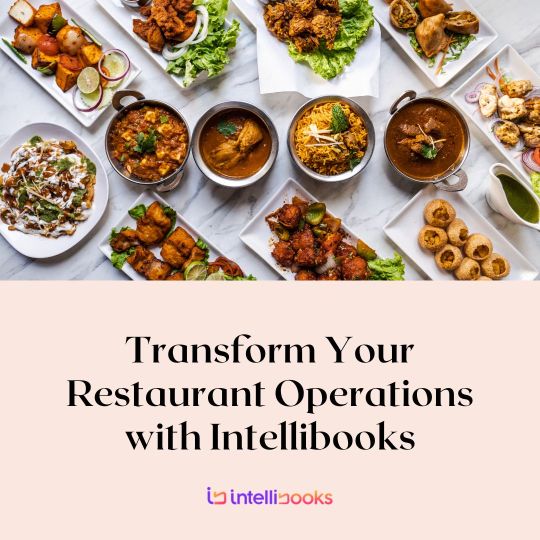

Revolutionizing Restaurant Management: The Power of INTELLIBOOKS

In today’s fast-paced restaurant industry, staying ahead requires more than just great food and excellent service. Operational efficiency, seamless management, and enhanced customer engagement are essential. INTELLIBOOKS is a game-changing restaurant management software designed to revolutionize how restaurants operate, allowing them to focus on what truly matters: delivering outstanding dining experiences.

The INTELLIBOOKS Advantage

INTELLIBOOKS integrates various aspects of restaurant management into a single, cohesive platform. This integration simplifies daily operations, reduces errors, and ensures that every part of the restaurant functions smoothly. Here’s a closer look at some of the key services that make INTELLIBOOKS a must-have for modern restaurants.

Advanced POS System

At the heart of INTELLIBOOKS is its advanced POS (Point of Sale) system. This powerful tool handles high transaction volumes with ease, supporting multiple payment methods such as credit cards, mobile payments, and cash. The user-friendly interface ensures quick and efficient checkouts, enhancing the customer experience. By integrating directly with inventory management and online ordering systems, the POS system provides real-time data, helping restaurant managers make informed decisions and streamline their operations.

Efficient Inventory Management with IntelliScan

Managing inventory effectively is crucial for any restaurant. INTELLIBOOKS offers a sophisticated inventory management feature called IntelliScan, which tracks inventory levels in real time. With each transaction, inventory data is automatically updated, helping to prevent stockouts and overstock situations. Detailed reports provide insights into usage patterns and trends, enabling managers to optimize stock levels and reduce waste. By ensuring that the right ingredients are always available, IntelliScan helps maintain the quality and consistency of dishes served to customers.

Seamless Online Ordering

The rise of online food delivery and takeout services has made an efficient online ordering system essential for restaurants.INTELLIBOOKS provides a seamless online ordering feature that integrates directly with the POS system. This integration ensures that orders are processed efficiently and accurately, whether for delivery or pickup. Customers enjoy a smooth ordering experience, and restaurants benefit from increased sales opportunities. By offering a user-friendly online ordering system, INTELLIBOOKS helps restaurants attract more customers and boost their revenue.

Comprehensive Payroll Management

Handling payroll can be a complex and time-consuming task for restaurant managers. INTELLIBOOKS simplifies this process with its integrated payroll management module. This feature automates payroll calculations, including wages, tax deductions, and employee benefits. By ensuring compliance with labor laws and reducing the risk of errors, the payroll module saves time and provides peace of mind. Integration with time tracking and scheduling features further streamlines labor management, helping managers optimize staffing levels and control labor costs.

Enhancing Customer Engagement

In today’s digital age, engaging with customers goes beyond the physical dining experience. INTELLIBOOKS offers tools designed to help restaurants connect with their customers in meaningful ways. The integrated CRM (Customer Relationship Management) system tracks customer preferences and order histories, enabling personalized service and targeted marketing campaigns. Additionally, the platform supports online reservations and feedback collection, making it easy for customers to interact with the restaurant through their preferred channels. By enhancing customer engagement, INTELLIBOOKS helps build loyalty and encourages repeat business.

Powerful Analytics and Reporting

Data-driven decision-making is crucial for running a successful restaurant. INTELLIBOOKS provides powerful analytics and reporting tools that offer detailed insights into various aspects of restaurant operations. From sales and inventory to labor costs and customer behavior, these reports help restaurant owners and managers identify trends, measure performance, and make informed decisions. The analytics tools are user-friendly and customizable, allowing managers to focus on the metrics that matter most to their business.

Supporting Sustainable Practices

Sustainability is becoming increasingly important in the restaurant industry. INTELLIBOOKS supports sustainable practices through its advanced features. The inventory management system helps reduce food waste by optimizing stock levels and ensuring that items are used before they expire. Additionally, detailed reporting can track the restaurant’s environmental impact, identifying opportunities to reduce energy consumption and waste. By supporting sustainability, INTELLIBOOKS not only helps restaurants reduce costs but also appeals to environmentally conscious customers.

Real-World Success Stories

Many restaurants have already experienced the transformative power of INTELLIBOOKS. For example, a popular bistro in New York City reported a 20% increase in efficiency after implementing the platform. The restaurant was able to streamline operations, reduce waste, and improve customer satisfaction, all of which contributed to its success. Another case study involves a family-owned restaurant in California that used INTELLIBOOKS to enhance its online ordering system, leading to a significant boost in takeout sales and overall revenue.

Continuous Innovation

INTELLIBOOKS is committed to continuous innovation, regularly updating its platform to incorporate the latest technological advancements and industry best practices. This ensures that restaurants using INTELLIBOOKS always have access to cutting-edge tools and features that can help them stay ahead of the competition. The company actively listens to customer feedback and works closely with industry experts to identify new opportunities for improvement and expansion.

Scalability for Growing Businesses

As a restaurant grows, its management needs evolve. INTELLIBOOKS is designed to scale with the business, providing the flexibility and functionality needed to support expansion. Whether a restaurant is opening new locations, adding new services, or increasing its staff, INTELLIBOOKS can adapt to meet these changing needs. The system’s modular design allows restaurants to add new features and capabilities as needed, ensuring that they always have the tools they need to succeed.

Security and Reliability

In an era where data security is paramount, INTELLIBOOKS prioritizes the protection of sensitive information. The system employs robust security measures to safeguard data, including encryption, secure user authentication, and regular security updates. This ensures that customer and business information is protected from unauthorized access and cyber threats. Additionally, INTELLIBOOKS is designed for reliability, with a cloud-based infrastructure that ensures high availability and uptime, so restaurants can operate smoothly without interruptions.

Conclusion

INTELLIBOOKS is revolutionizing the restaurant industry with its comprehensive, integrated management solutions. By streamlining operations, enhancing customer engagement, and providing powerful analytics, INTELLIBOOKS empowers restaurant owners and managers to focus on what they do best – delivering exceptional dining experiences. With its robust POS system, advanced inventory management, efficient online ordering, and comprehensive payroll features, INTELLIBOOKS addresses the unique challenges of modern restaurant management. As the industry continues to evolve, INTELLIBOOKS remains committed to innovation, scalability, and sustainability, ensuring that restaurants have the tools they need to thrive in a competitive market. For restaurants looking to stay ahead of the curve and achieve long-term success, INTELLIBOOKS is the partner of choice. Visit us at intellibooks.io to learn more and transform your restaurant operations today.

Read More at IntelliBooks.io

LinkedIn- https://www.linkedin.com/company/intellibooks/

Facebook- https://www.facebook.com/intellibooks?mibextid=LQQJ4d

Instagram- https://www.instagram.com/intelli_books/?igshid=MzRlODBiNWFlZA%3D%3D

Pinterest- https://in.pinterest.com/IntelliBooks/

Medium- https://medium.com/@intelligentblock2018

#RestaurantManagement#POSSystems#TechInRestaurants#CustomerSatisfaction#FoodService#HospitalityTech#EfficiencyBoost#RestaurantInnovation

0 notes

Text

Optimizing Success with Dental Revenue Cycle Management Services

Introduction

In the intricate realm of dental practice management, Revenue Cycle Management (RCM) emerges as a critical component ensuring the financial health of dental clinics. Effectively navigating the complexities of RCM demands a comprehensive understanding of its key components and strategies. From billing accuracy to compliance considerations, each facet plays a pivotal role in optimizing revenue streams and sustaining operational excellence.

The Key Components of Dental RCM

Billing and Coding Accuracy

At the heart of Dental RCM lies the precision of billing and coding practices. Accurate coding not only facilitates seamless reimbursement but also mitigates the risk of claim denials and audits. Dental professionals must adeptly translate diagnoses and procedures into universally recognized codes, adhering to established guidelines such as the Current Dental Terminology (CDT) and International Classification of Diseases (ICD) coding systems.

Insurance Verification and Claims Processing

Efficient insurance verification processes lay the groundwork for smooth claims processing. Verifying patient coverage details, eligibility, and benefit limitations in advance helps prevent payment delays and denials. Streamlining claims submission and processing workflows ensures timely reimbursement while minimizing administrative burdens on dental staff.

Payment Collection and Accounts Receivable Management

Timely and systematic payment collection mechanisms are indispensable for maintaining healthy cash flow and minimizing outstanding accounts receivable. Implementing clear financial policies, offering flexible payment options, and promptly addressing patient inquiries contribute to a robust revenue collection process. Effective accounts receivable management involves diligent tracking, follow-up on outstanding balances, and strategic resolution of overdue accounts to optimize revenue realization.

Utilizing Technology in Dental RCM

The integration of advanced technologies revolutionizes dental RCM practices, enhancing efficiency, accuracy, and patient satisfaction. From automated billing systems to intuitive practice management software, technology streamlines administrative tasks, reduces errors, and facilitates seamless communication with payers and patients. Leveraging data analytics and predictive modeling empowers dental practices to identify revenue trends, anticipate payment bottlenecks, and proactively optimize RCM strategies for sustained financial success.

Compliance and Regulatory Considerations

Navigating the intricate landscape of healthcare regulations and compliance standards is paramount in dental RCM. Ensuring adherence to HIPAA regulations, coding guidelines, and payer policies safeguards patient confidentiality and prevents potential legal repercussions. Regular audits, ongoing staff training, and robust compliance protocols are essential for mitigating compliance risks and upholding ethical standards in revenue management practices.

Training and Staff Development

Investing in comprehensive training and professional development programs is instrumental in fostering a skilled and knowledgeable workforce proficient in dental RCM practices. Equipping staff with specialized training in billing procedures, coding updates, and regulatory compliance cultivates a culture of excellence and accountability. Continuous learning initiatives empower dental teams to adapt to evolving industry trends, enhance job performance, and deliver superior patient-centric care.

Outsourcing vs. In-house RCM

The decision to outsource RCM functions or manage them in-house warrants careful consideration of various factors, including cost-effectiveness, expertise, and resource allocation. While outsourcing RCM services to specialized vendors may offer scalability and access to advanced technologies, maintaining in-house control provides greater autonomy and customization options. Evaluating the pros and cons of each approach based on practice size, complexity, and strategic objectives is essential in determining the most viable RCM solution.

Measuring RCM Performance and Success

Effectively measuring RCM performance metrics is indispensable for evaluating financial health, identifying areas for improvement, and benchmarking success. Key performance indicators (KPIs) such as clean claim rate, days in accounts receivable, and collection ratio offer valuable insights into revenue cycle efficiency and effectiveness. Utilizing data-driven analytics and comparative benchmarks enables dental practices to optimize workflows, enhance revenue streams, and drive sustainable growth.

Conclusion

In conclusion, mastering the intricacies of dental Revenue Cycle Management is pivotal for ensuring the financial viability and long-term success of dental practices. By prioritizing billing accuracy, embracing technology-driven solutions, and fostering a culture of compliance and continuous improvement, dental professionals can navigate the complexities of RCM with confidence and achieve optimal revenue outcomes. Through strategic alignment of key components and ongoing performance evaluation, dental practices can position themselves for sustained growth, profitability, and excellence in patient care.

0 notes

Text

Invoice Factoring For Capital Generation

Bill and invoice include the terms that you may frequently get confused with. Even though are both way of collecting payments, there's considerable difference between the two. A bill can be a document requesting the payment for that goods or services already provided. Here the complete tariff of the skills and goods received which are yet unpaid is presented with the expectation that the immediate payment is going to be made. Invoice is a type of detailed bill left by vendors and outside suppliers for products or services made available to a company. Invoice usually includes amount of each item, costs, billable hours, description of services, contact address, etc. This is often a valid document that's being considered as an evidence of an incurred debt. Invoice factoring is term that is commonly heard nowadays and it's also vital to learn about this in greater detail.

The small businesses proprietors end up finding it difficult if the payment is delayed. Large organizations will often have a trend of coughing up the invoices in just a amount of 60 days or more. The money which is stuck will be the capital along with the outstanding invoices can hamper the smooth flow of greenbacks. If your small business to accomplish the amount of money quickly, a possible option for you personally is invoice factoring. Here the authority to outstanding invoices is sold to a vacation company that's permitted to collect this debt. The fee incurred is minimal. If you are selling the invoices you can find a share from the outstanding debt before anticipated. A business firm that is certainly inside initial stage of growth obtains capital for expansion also to meet shortages this way.

Invoice collection process , a type of invoice factoring involves factoring receivables for companies lacking capital. The greatest advantage of outsourcing your accounts receivable to another company is that it will assist you to invest your valuable time and resources on better productive areas of your company. The tied up capital is freed so the expansion is just not diminished. Another major feature are these claims is quick money. Emergencies may be dealt with easily with the help in the factoring services. The stabilized earnings has decided to lead your business to great heights. Most of companies elect to borrow money from a person or a business when they are in need. This can cause issues at a later stage. With accounts receivable factoring, you can avoid seeking funds from outsiders and gain access to your individual money.

The means of seeking invoice factoring is not hard. A company approaches the invoice funding agencies while offering to market their present unpaid billed receivables. If your business has credibility, they are going to accept you since the client. The changing economic conditions and the uncertainty create chaos occasionally. Here the business that sells the account receivable can be confident relating to commercial collection agencies. The factoring agreement is a common practice now so you can find online businesses ready to purchase bulks of account receivables. This is one from the virtually risk free ventures for the business firm.

#Collecting unpaid invoices training#Invoice collection process#Unpaid invoices small business#Collecting outstanding payments from customers#Help collecting unpaid invoices#Small business help collecting invoices#Programs for collecting invoices#How to collect unpaid invoices#Invoice collection training course#How to collect outstanding invoices

0 notes

Text

Cash Flow Acceleration Through Invoice Factoring- Who is it For?

You could be aware of the terms invoice factoring, invoice discounting or recruitment factoring, but a majority of companies use such services mainly because it allows them to turn outstanding invoices into immediate cash. By factoring your invoices you can raise approximately 90% of their value and enjoy the money right into your bank account within 24 hours.

Invoice factoring usually necessitates the factoring company allowing you to manage the sales ledger and credit control, this consists of following up unpaid invoice and bad debtors. Invoice discounting works on the same principle, apart from you manage your own sales ledger therefore this part of your hard earned money flow remains confidential and isn't revealed for your clients.

Obviously you'll find fees involved, normally a amount of your organization turnover. Releasing cash in this way allows you to keep an eye on earnings and outgoing payments, ensuring your credit score is protected. It also offers you the ways to always put money into and grow your company. Factoring is competitively priced in comparison to bank overdrafts and loans.

So who's factoring for?

The suitability of factoring and associated costs for the business will depend on the scale and nature of your respective business. However, despite what you might think, factoring isn't just for larger companies . Small and mid-sized businesses can greatly benefit from this type of accelerated cashflow for obvious reasons.

Most business sectors will probably be considered along with the majority of businesses, even new starts, could possibly be viable for factoring.

To contemplate you have suitability take into consideration whether you're:

A business that need cash to aid their business grow.

A business which is expanding, or that is looking to purchase other businesses.

An organisation that wants a credit control department that does that – controls credit and contains the ability and capability to credit check needed clients and chase debts effectively.

An entrepreneur or MD that juggles a variety of roles for example business manager, salesperson and credit controller.

A company or person that desires to remove the emotions from so what can be a difficult area of the relationship along with your clients. Particularly if they may be a bigger customer you need to "keep on side".

When in the event you think consider factoring like a serious option?

If you might be concerned with the speed of which you might be being paid.

If you are too busy "running your business" to get money you might be owed.

If you always seem to be hitting your overdraft limit and/or incurring bank charges.

If you might be concerned about paying your individual suppliers on time as well as the impact this might don the company credit score.

If you company development is becoming restricted or has stalled, as a result of deficiency of consistent cashflow.

If you happen to be worried about debt and would love the option to achieve the protection that can be furnished by factoring.

If you would like to expand, but your bank will not help.

The factoring process starts with research. This involves checking the loan quality of your respective customers, checking anything unique to your industry or transactions, and determining your true funding needs.

There are Help collecting unpaid invoices that make use of invoice factoring more than others. For example, recruitment factoring for recruitment agencies ensures that you may always have the money handy to cover your temp workers promptly.

Whatever your industry, if you think any of the criteria above may affect you, it's worthwhile considering invoice factoring or invoice discounting as a way to accelerate your business cash flow.

#Collecting unpaid invoices training#Invoice collection process#Unpaid invoices small business#Collecting outstanding payments from customers#Help collecting unpaid invoices#Small business help collecting invoices#Programs for collecting invoices#How to collect unpaid invoices#Invoice collection training course#How to collect outstanding invoices

0 notes

Text

HANEUL'S INN RESIDENTS — ever growing cast of who's found a home within this strange inn.

haneul — sorcerer. if that’s even their real name... ( it’s not ). proprietor of a wayward inn for those lost and in need of shelter. expertly hidden from plain sight and can only be found when led by odd animals that posses glowing eyes. curious enough to step into the establishment? excellent choice, for full satisfaction is guaranteed once your name is added to the ledger. oh, and one last thing — whatever you do, don’t even think about harming them ‘lest you’d prefer to have this as your final destination.

dhrish amin — nightjar familiar . not a single braincell in that pretty head. familiar to haneul, sometimes guides potential customers to the inn, a bundle of energy and surprises — he’s an all around good time with a penchant to get into weird situations. might be a mess but he's fairly outstanding with being a guide to the labyrinth of the everchanging inn. you've got lobby right here, all sorts of magical shops over there, and— oh! right, rooms are up to the left, past supply closet, right, left, left, and right again!

hyun jiah — mythical tiger. the idiom of ‘back when tigers used to smoke’, but literal. part of the inn as a storyteller that can tell tales for days upon end. some even say that the stories this tiger’s come to collect have a sway with truths that can be altered to reality. others say a powerful boon can be traded for one’s life story — though this oftentimes means the tiger will hold possession over that person’s life in some manner. typically cool, calm, and collected but can be kickass if given reason. often seen smoking out of a gombangdae pipe. some claim that the smoke forces them to profess complete truth in their stories, but it only have calming properties. customers claiming to have been tricked despite explicit warnings prior = ransom 🤝 jiah

bu doyun — haetae. coming out of the cage and he’s been doing just.. decent. jkjk, but seriously — he’s the most fickle, isolated grouch around that’s just begun to subject himself to the living world again. serves as hidden security to haneul’s inn — sometimes as a stone figure out front and other times as some random schmuck indoors near the lobby ( always with a frown, always with a comically large bell around his neck ). if you're of the Dangerous variety outdoors then you'll have the honor of seeing him shift into a humanoid form just so he can berate and deter your entrance ( and if that doesn't work.. well, ever have a buff statue hand u ur own ass? ).

ransom — harpy . a being that deals in memories . the only form of payment he takes is by the trade of memories that are of equal value. happy ones are highly sought for( naturally ) whereas sadder ones aren’t as much — though there are some that seek out painful memories for whatever reason. he can even concoct something that can let a person experience a memory they’ve forgotten / never known, but those are the priciest of them all. oh, and sometimes… he eat some memories but you didn’t hear that from me.

beatrice — siren / demon hybrid . singer-songwriter, rockin' with a low voice, charms with laidback ease. any personal history's locked up tight. totally didn't start to lose pieces of mind and soul alike whenever father dearest visits ( which prince of hell is he? i'll never say ) tried not to form relations with anyone prior to residing within the inn, but she struck a deal with haneul and seems to be more open and interpersonal. does leave the inn to eat souls and sometimes makes a mess of it.

warren — fire elemental ( of some sort ). has a humanoid form, but burns hot — sometimes has a keen white edge around their form when enraged. notoriously encased in fully, heavy armor when in combat ( the core of which is themselves liquified into something molten ). ever since the incident that turned his dad to stone, they now take up after their pop’s smithy with a very heavy heart. their practice is nestled near the back of hanuel's inn. anything from weapon, shield, and armor repairs are offered. commissions are only accepted if the idea's extremely well thought out / genuinely interesting.

1 note

·

View note

Text

5 Essential Elements For Cheap replica luxury bags

This is certainly just a method to make people today truly feel under by not obtaining the access that loaded individuals have. We've been avatars In any event. It is possible to’t consider it with whenever you die so who cares if it’s bogus or not?

Designed in buttery nappa leather, the bag features a ruched excellent that evokes easy elegance. The adjustable gold chain strap makes it completely adaptable — it turns into a shoulder, crossbody, or hand-have bag.

Nevertheless This is certainly carried out only when both the person that is bringing the products into the state declares it fake or attempts to sneak it via customs with out declaring it, the two causes remaining in order to avoid paying taxes. That’s all we treatment about, whether you are paying your reasonable share of taxes.

So for this, we provide you the 1st duplicate branded sneakers of best high quality brands like adidas, guccio, franco at reasonable selling prices. You seem best and organized any time you dress in footwear matching your outfit. So never ever compromise on your own sneakers and opt for a perfect shoe for yourself now from our fantastic collection.

Making sure 25 30 replica lv handbags for sale of your hard earned money should really often be your best priority when searching online. It can be vital to generally be cautious, as quite a few persons have regretably fallen target to frauds on the internet. One method to increase safety is by choosing protected payment approaches including charge cards or PayPal.

Madewell's bag collection is really in depth. The descriptions don't indicate simply how much they've in prevalent with designer bags, but in case you glance carefully, you'll see similarities. By way of example:

I won't ever possibility to journey with pricey cling bag or goods I desire a copy result in Threat can seem anytime thief so I get assaulted n rob is not me going to eliminate will be the legal thief he likely concentrate what he/she see received’t inspect at the moment right up until he /she gone… I regard all policies for touring but never ever chance my everyday living for real highly-priced products for no person .

” He implies examining weblogs and boards for peer-to-peer reviews and cross-evaluating resale websites to be certain costs are legit. Recall luxury deals replica handbags -aged adage: If it seems far too great to be real—i.e. the bag costs way below its resale current market value—it in all probability is.

Irrespective of whether you might have an accessories keep or are seeking the best upsell opportunity, Spocket has a novel assortment of premium components from trusted dropshipping suppliers inside the United states, Europe, and globally. Include extras on your retail store and instantaneously create a aggressive and irresistible online retail outlet.

Gorra suggests looking for “sellers that are responsive and ready to give more information.” You’re searching for entire transparency from the vendor mainly because they really should have nothing to cover.

Replica Therapy is definitely an online System operated by a outstanding manufacturing unit situated in Guangzhou, specializing in creating significant-quality designer replicas. Because they run like a manufacturing facility, they might offer you their solutions at reasonably priced charges without having involving intermediaries. The costs vary from $30 to some optimum of $150, and they frequently provide discounts when multiple merchandise are obtained.

Given that most of us will treatment about what our buddies, colleagues or simply strangers Assume, remaining savvy and trendy is exactly what the current present day Way of living is immediately after.

Be among the list of first to recognize popular dropshipping products, and obtain a competitive advantage about your competition with Spocket. With a unique mixture of items in the United states, EU and globally, you’ll have the capacity to attract several marketplaces - all around the earth.

DUPBAGS has realized a exceptional feat by developing products that faithfully capture the essence of large-end luxury bag types while retaining Fantastic quality.

0 notes

Text

What Is Accounts Receivable Management?

What Is Accounts Receivable Management? A Guide from Billed Right

In the fast-paced world of healthcare, managing finances effectively is crucial for maintaining a healthy bottom line. For medical practices, this often means navigating the complex landscape of accounts receivable management. But what exactly is accounts receivable management, and why is it so important? At Billed Right, a leading provider of accounts receivable management services in Florida, we believe that understanding this key aspect of your practice’s financial health is essential.

Understanding Accounts Receivable Management

Accounts Receivable Management (ARM) refers to the process of overseeing and handling the outstanding invoices or money owed by patients or insurance companies to a medical practice. This process includes billing patients and insurers, tracking outstanding payments, and taking necessary steps to ensure timely collections. Effective ARM is vital for maintaining cash flow and financial stability.

The Importance of Accounts Receivable Management

1. Improved Cash Flow: Timely collection of receivables ensures that your practice has a steady cash flow, which is necessary for covering operational costs, paying staff, and investing in new technologies or services.

2. Reduced Bad Debt: By actively managing accounts receivable, practices can significantly reduce the amount of bad debt, which occurs when payments are not collected.

3. Enhanced Patient Relationships: Efficient billing and follow-up processes can improve patient satisfaction by providing clear communication and minimizing billing errors or disputes.

4. Regulatory Compliance: Proper accounts receivable management ensures compliance with healthcare regulations and standards, reducing the risk of legal issues or fines.

How Billed Right Enhances Accounts Receivable Management

At Billed Right, we specialize in accounts receivable management services in Florida, tailored to meet the unique needs of medical practices. Our comprehensive approach includes:

1. Streamlined Billing Processes

We employ advanced technology to streamline the billing process, ensuring accuracy and efficiency. Our systems are designed to handle large volumes of claims, reducing the likelihood of errors and speeding up the payment cycle.

2. Persistent Follow-Up

Our team diligently follows up on outstanding claims and invoices, ensuring that payments are collected as quickly as possible. This proactive approach helps to minimize the number of overdue accounts and enhances overall cash flow.

3. Detailed Reporting

We provide detailed reports that offer insights into your practice’s financial health. These reports help you track the status of your receivables, identify trends, and make informed decisions about your financial management.

4. Expert Knowledge

Our experienced professionals are well-versed in the intricacies of medical billing and coding, insurance claim processes, and regulatory requirements. This expertise ensures that your accounts receivable management is handled with the highest level of competence and accuracy.

5. Customized Solutions

We understand that every medical practice is unique. That’s why we offer customized accounts receivable management solutions tailored to your specific needs and challenges. Whether you’re a small clinic or a large healthcare provider, we have the tools and expertise to help you succeed.

Conclusion

Effective accounts receivable management is essential for the financial health of any medical practice. At Billed Right, we offer comprehensive accounts receivable management services in Florida, designed to streamline your billing processes, enhance cash flow, and reduce bad debt. By partnering with us, you can ensure that your practice’s finances are in expert hands, allowing you to concentrate on delivering top-quality care to your patients.

Contact Billed Right today to learn more about how our accounts receivable management services can benefit your practice. Together, we can achieve greater financial efficiency and success.

This blog content provides an informative and engaging overview of accounts receivable management, highlighting the benefits and the specific services offered by Billed Right.

0 notes

Text

Streamlining Your Business with Effective Cash Collection Solutions

In the fast-paced world of business, efficient cash collection is crucial for maintaining healthy cash flow and ensuring operational stability. Managing cash collections can be challenging, especially for businesses handling large volumes of transactions. This is where cash collection management systems and software come into play. In this blog, we will explore the benefits of cash collection solutions and how they can transform your business operations.

Understanding Cash Collection Management

Cash collection management involves overseeing the process of collecting payments from customers. This includes tracking invoices, managing accounts receivable, and ensuring timely payments. Effective cash collection management is vital for businesses to maintain liquidity, reduce bad debt, and improve financial planning.

The Role of Cash Collection Software

Cash collection software is designed to automate and streamline the cash collection process. It provides tools for tracking invoices, sending payment reminders, and reconciling payments. By using cash collection software, businesses can reduce manual errors, save time, and improve overall efficiency.

Key Features of Cash Collection Software:

Automated Invoicing: Generate and send invoices automatically, ensuring customers receive their bills on time.

Payment Tracking: Monitor the status of invoices and track payments to ensure timely collections.

Reminders and Notifications: Send automated reminders to customers for upcoming or overdue payments.

Reporting and Analytics: Generate detailed reports on cash flow, outstanding invoices, and payment trends.

Integration: Seamlessly integrate with existing accounting and ERP systems to ensure data consistency.

Benefits of Implementing a Cash Collection System

Cash collection systems offer a comprehensive solution for managing and optimizing the cash collection process. Implementing a robust cash collection system can provide several benefits:

Improved Cash Flow: By automating invoicing and payment reminders, businesses can accelerate cash collections and improve cash flow.

Reduced Administrative Costs: Automation reduces the need for manual intervention, lowering administrative costs and freeing up staff for other tasks.

Enhanced Customer Relationships: Timely invoicing and clear communication improve customer satisfaction and relationships.

Accurate Financial Reporting: Real-time data and analytics provide accurate insights into cash flow and financial health.

Minimized Risk of Bad Debt: Regular follow-ups and automated reminders reduce the likelihood of overdue payments and bad debt.

Choosing the Right Cash Collection Solution

When selecting a cash collection solution, it’s important to consider the specific needs of your business. Here are some factors to keep in mind:

Scalability: Ensure the solution can grow with your business and handle increasing volumes of transactions.

Customization: Look for software that can be tailored to fit your business processes and requirements.

User-Friendly Interface: Choose a system that is easy to use and requires minimal training for your staff.

Integration Capabilities: Ensure the solution can integrate with your existing systems for seamless operation.

Customer Support: Opt for a provider that offers robust customer support to assist with any issues or queries.

Conclusion

Effective cash collection management is essential for the financial health of any business. By leveraging advanced cash collection software and systems, businesses can streamline their operations, improve cash flow, and reduce administrative burdens. Investing in the right cash collection solutions not only enhances efficiency but also strengthens customer relationships and provides valuable insights into financial performance.

For businesses looking to optimize their cash collection processes, partnering with a provider like Atcuality can make a significant difference. With their expertise in cash collection solutions, Atcuality offers comprehensive tools and services to help businesses manage their cash collections more effectively. Embrace the power of cash collection management and drive your business towards financial success.

0 notes

Text

5 Essential Elements For Cheap replica luxury bags

Equally as importantly, we’re dedicated to providing the best replica handbags for our customers, due to the fact we purpose at developing a consumer foundation of pleased, repeat consumers.

Produced in buttery nappa leather, the bag has a ruched quality that evokes easy elegance. The adjustable gold chain strap can make it completely adaptable — it turns right into a shoulder, crossbody, or hand-carry bag.

I’ve witnessed youthful Adult males with rolexes on their own arms undergo, but they look like they gained’t manage to afford housing for the next thirty day period. Remember, cash screams but wealth whispers. To People of you pondering obtaining these overpriced real solutions, end and give it some thought all over again. For those who are likely to go the following thirty day period with no foods only to pay for this bag then you can’t afford it.

Whenever they do arrest you for this, the initial decide that can take a check out this could toss the case out mainly because they haven't any way of proving that you choose to understood which you were being obtaining a fake products. 25 30 replica lv handbags for sale are generally there to discourage men and women from earning buys willingly of fake goods. In essence type of scaring them into not undertaking it. They know they can’t do nearly anything about this if you are doing it, so they try to scare you into not carrying out it. These rules will also be in place to mostly prosecute people who are providing pretend items simply because you require a stable legal framework all around it.

Making certain the protection of your money must generally be your prime priority when purchasing online. It can be essential to be cautious, as several individuals have regrettably fallen sufferer to scams online. One method to enhance safety is by deciding on secure payment solutions for example charge cards or PayPal.

We use cookies and identical technologies to provide the best encounter on our Site. Make reference to our Privacy Plan To learn more.

It is sensible to protect your self by preventing sellers who show these methods and instead opting for individuals who provide very clear and good return procedures.

Yep, 2024 is developing all Gucci. The heritage brand appreciates ways to Participate in to its strengths by having to pay homage for the classics. So to the 70th anniversary of its famous horsebit components, the brand produced a kooky, asymmetrical Model of your Horsebit 1955.

Prior to buying that Louis Vuitton bag you've been dreaming about, learn how to inform the distinction between the real detail in addition to a replica. Keep Reading

Many people can almost certainly enjoy the effort that goes into generating a designer bag. Having said that, a lot of individuals basically can't afford to pay for or decide on not to pay for this kind of rates so that you can get hold of the position of a designer handbag. This is when replica suppliers are available.

and look forward to the seller to approve. It’s similar to eBay’s “make a suggestion” option as opposed to “obtain it now.”

Fake or counterfeit: They appear the same as designer bags, down to the logo and signature fabrics. Sometimes a keep will get in touch with these replicas so they are not misleading The customer. Selling fakes is against the law regardless of the; offering designer-impressed handbags is not.

Believe in us with quite possibly the most genuine replica designer bags that can’t be found elsewhere in the market. In 7 star replica gucci handbags to Use a Luxury created reasonably priced we give you get from our LV Outlet cheap handbags with Outstanding top quality.

When obtaining replica designer bags, it truly is critical to collect as several specifics as is possible. Even when sellers guarantee that their replica handbags are flawless and indistinguishable from the genuine types, it is important to notice that real designer bags possess unique characteristics Which may be tricky to replicate with absolute perfection.

0 notes

Text

Revolutionizing Restaurant Management: The Power of INTELLIBOOKS

In today’s fast-paced restaurant industry, staying ahead requires more than just great food and excellent service. Operational efficiency, seamless management, and enhanced customer engagement are essential. INTELLIBOOKS is a game-changing restaurant management software designed to revolutionize how restaurants operate, allowing them to focus on what truly matters: delivering outstanding dining experiences.

The INTELLIBOOKS Advantage

INTELLIBOOKS integrates various aspects of restaurant management into a single, cohesive platform. This integration simplifies daily operations, reduces errors, and ensures that every part of the restaurant functions smoothly. Here’s a closer look at some of the key services that make INTELLIBOOKS a must-have for modern restaurants.

Advanced POS System

At the heart of INTELLIBOOKS is its advanced POS (Point of Sale) system. This powerful tool handles high transaction volumes with ease, supporting multiple payment methods such as credit cards, mobile payments, and cash. The user-friendly interface ensures quick and efficient checkouts, enhancing the customer experience. By integrating directly with inventory management and online ordering systems, the POS system provides real-time data, helping restaurant managers make informed decisions and streamline their operations.

Efficient Inventory Management with IntelliScan

Managing inventory effectively is crucial for any restaurant. INTELLIBOOKS offers a sophisticated inventory management feature called IntelliScan, which tracks inventory levels in real time. With each transaction, inventory data is automatically updated, helping to prevent stockouts and overstock situations. Detailed reports provide insights into usage patterns and trends, enabling managers to optimize stock levels and reduce waste. By ensuring that the right ingredients are always available, IntelliScan helps maintain the quality and consistency of dishes served to customers.

Seamless Online Ordering

The rise of online food delivery and takeout services has made an efficient online ordering system essential for restaurants. INTELLIBOOKS provides a seamless online ordering feature that integrates directly with the POS system. This integration ensures that orders are processed efficiently and accurately, whether for delivery or pickup. Customers enjoy a smooth ordering experience, and restaurants benefit from increased sales opportunities. By offering a user-friendly online ordering system, INTELLIBOOKShelps restaurants attract more customers and boost their revenue.

Comprehensive Payroll Management

Handling payroll can be a complex and time-consuming task for restaurant managers. INTELLIBOOKS simplifies this process with its integrated payroll management module. This feature automates payroll calculations, including wages, tax deductions, and employee benefits. By ensuring compliance with labor laws and reducing the risk of errors, the payroll module saves time and provides peace of mind. Integration with time tracking and scheduling features further streamlines labor management, helping managers optimize staffing levels and control labor costs.

Enhancing Customer Engagement

In today’s digital age, engaging with customers goes beyond the physical dining experience. INTELLIBOOKS offers tools designed to help restaurants connect with their customers in meaningful ways. The integrated CRM (Customer Relationship Management) system tracks customer preferences and order histories, enabling personalized service and targeted marketing campaigns. Additionally, the platform supports online reservations and feedback collection, making it easy for customers to interact with the restaurant through their preferred channels. By enhancing customer engagement, INTELLIBOOKS helps build loyalty and encourages repeat business.

Data-driven decision-making is crucial for running a successful restaurant. INTELLIBOOKS provides powerful analytics and reporting tools that offer detailed insights into various aspects of restaurant operations. From sales and inventory to labor costs and customer behavior, these reports help restaurant owners and managers identify trends, measure performance, and make informed decisions. The analytics tools are user-friendly and customizable, allowing managers to focus on the metrics that matter most to their business.

Sustainability is becoming increasingly important in the restaurant industry. INTELLIBOOKS supports sustainable practices through its advanced features. The inventory management system helps reduce food waste by optimizing stock levels and ensuring that items are used before they expire. Additionally, detailed reporting can track the restaurant’s environmental impact, identifying opportunities to reduce energy consumption and waste. By supporting sustainability, INTELLIBOOKS not only helps restaurants reduce costs but also appeals to environmentally conscious customers.

Many restaurants have already experienced the transformative power of INTELLIBOOKS. For example, a popular bistro in New York City reported a 20% increase in efficiency after implementing the platform. The restaurant was able to streamline operations, reduce waste, and improve customer satisfaction, all of which contributed to its success. Another case study involves a family-owned restaurant in California that usedINTELLIBOOKSINTELLIBOOKS to enhance its online ordering system, leading to a significant boost in takeout sales and overall revenue.