#CoinDesk

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

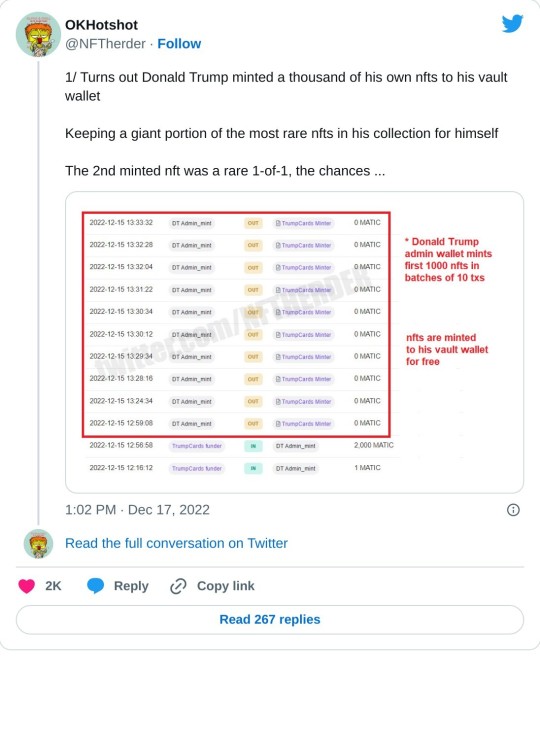

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

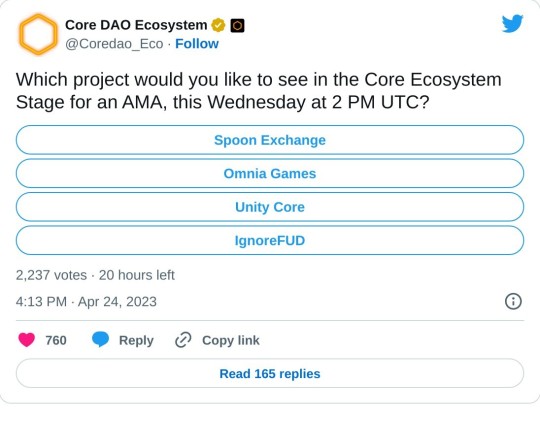

Attention Omniavores. It is rare that we are called upon to do anything in this community. We are pushing for exposure and mass adoption. Winning this poll will be a major step in the right direction as there are a ton of eyes on CoreDao with their recent partnership with Mexc and Bitget.

Everyone who votes and posts a screenshot in our telegram group will earn 1000 $Block on Core!

Do yourself a favor and vote for Omnia Games in this poll:

https://twitter.com/coredao_eco/status/1650533468676280320?s=46&t=DMk0ivuZNyhcnHfr08qBhQ

2 notes

·

View notes

Text

4

5

1

7

8

9

2

6

3

0

#the angel of the lord#catherine de valois#tw accidental drug use#higuruma hiromi#robin ii#a001#coindesk#festivals#htp art#suspiria 2018

1 note

·

View note

Text

Day Trading Academy: Complete Day Trading Guide for Beginners and Advanced Investors: Top Trading Strategies that Every Elite Trader is Using: Option and Stock Trading Advice.

Are you ready to make more money with your investments? Do you need a course to teach you everything you need to know about day trading?

The truth is, there are step to take about how day trading works. You just need to learn how it works to make a huge return on your investments when you get into shifting your fortune for profit. There are a few tried and true secrets, that you can learn from a us.

You learn this with us

The Best Options and Stock For You

When to Trade & When to Hold

The best investment

Top Trading Strategies the Elite Use to Stay Wealthy

Investing 101-499 From Beginner to Advanced Tactics

Stop spending your hard earned time and money on stuff that doesn't work when anything you really need to know about wealth building is here with us. Feel free to contact Here or Instagram @Jessicatraderofficia

#trader#investment#how to make money online#make money from home#how to earn money#bitcoin#how to mine bitcoin#new movie#xeno coining#coindesk#coinbase#binance#blockchain#and more…high quality original t shirts. digital printing in the usa.#made in usa#asia#japan#vietnam#livemusic

5 notes

·

View notes

Text

Bitcoin Cash Rally Led CoinDesk 20 Gainers Last Week: CoinDesk Indices Market Update

CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI).

Bitcoin Cash (BCH) (+6.6%) and Internet Computer (ICP) (+4.6) is the only members of the CoinDesk 20 to close Thursday with positive returns on the week.

Several cryptos that have led the index of…

View On WordPress

0 notes

Text

Former NYSE Executive Acquires CoinDesk, Leading Cryptocurrency News Site, for $50M

#BarrySilbert #CoinDesk #cryptocurrencynews #digitalassetmarket #ThomasFarley

0 notes

Text

CoinDesk's CEO Shake-up: New Leadership Signals Bold Changes

Key Points:

Leadership Transition: Sara Stratoberdha takes the helm as CEO, replacing Kevin Worth, in CoinDesk’s restructuring.

Organizational Changes: Departures of key executives and integration of functions with Bullish mark the strategic shift.

Commitment to Independence: CoinDesk reaffirms its dedication to journalistic integrity and editorial independence under new leadership.

CoinDesk, a…

View On WordPress

0 notes

Text

Village Protocol Review: January 18, 2024

Matter Labs and iCandy Unveil zkCandy - A Strategic Digital State

In the latest Village Protocol review by CoinDesk on January 18, 2024, several startups captured attention, with Matter Labs and iCandy founders announcing a groundbreaking initiative—a "strategic digital state" incorporating collaborative integrity and resource allocation. This venture will lead to the development of zkCandy, a specialized hyper-network focusing on gaming and artificial intelligence within the decentralized infrastructure. The hyper-chain is poised to offer comprehensive tools for gaming, machine learning, decentralized infrastructure, developer resources, and a unique ecosystem.

Safary's Triumph in Pre-Seed Round

Safary, self-described as an "alternative team to Web3 Google Analytics," joyfully shared news of successfully closing a $2.4 million pre-seed round, led by Lemniscap. Other participants include Arca, SevenX, Big Brain Holdings, Saison Capital, Diaspora Ventures, and 20 business angels. The funding will expedite the development of Safary's platform marketing attribution, enabling the analysis of Web3 marketing CAC, investment profitability in the channel, and customer LTV. Safary's free solution unlocks research and monitoring capabilities for Web3, incorporating code onto websites, tracking wallets, displaying conversions, and links to any network activities.

Minima's Decentralized Milestone

In a significant move, Minima has "disabled all 24 centralized servers—16 network relay nodes and 8 archival. The network now operates entirely through 25,000–50,000 independent nodes that remain active." According to Luke Edwards, Head of Communications, "We now function solely through user bases," marking a transformative shift for Minima.

Read the full article

#CoinDesk#CryptoProtocols#decentralization#DecentralizedInfrastructure#Hyper-Network#iCandy#Lemniscap#MarketingAttribution#MatterLabs#Minima#Pre-SeedRound#Safary#VillageProtocol#Web3GoogleAnalytics#zkCandy

0 notes

Text

Aeternus Blockchain is On Its way!😍 Soon you can join the hands of the most powerful tech of the era!😀

Stay tuned with us for more updates! AeternusBlockchainComingSoon

Trade Live now - https://bitmart.com/trade/en-US?symbol=ATRNO_USDT

VISIT WEBSITE NOW: https://aeternus.foundation/

👉 Follow Us on Twitter: https://twitter.com/AeternusF

Follow us for more details -

Facebook - https://bit.ly/46mVAt2

Instagram - https://bit.ly/3PNgn1F

0 notes

Text

XRP Chartanalyse: Technische Analyse für Investoren und Trader

XRP, das digitale Asset von Ripple, steht im Fokus einer detaillierten Chartanalyse, um sowohl kurz- als auch mittelfristige Potenziale aufzudecken. Ripple als Projekt hat sich darauf spezialisiert, innovative Lösungen für Cross-Border-Payments anzubieten, insbesondere im Kontext mit Zentralbanken. In diesem Blogartikel werden wir uns intensiv mit dem XRP-Kurs auseinandersetzen, beginnend mit einer tiefgehenden Betrachtung des Tagescharts, gefolgt von einer Analyse des Wochencharts.

Tageschartanalyse

Am 07.01.2024 notiert der XRP-Kurs bei etwa 0,5660 Dollar. Der Tageschart (Abbildung 1) zeigt, dass der Kurs sowohl unter dem 10er EMA (0,5920 Dollar, blaue Markierung) als auch dem 50er EMA (ca. 0,61 Cent, orange Markierung) liegt. Nach dem letzten Höchststand von 0,70 Dollar am 09.12.2023 verzeichnete XRP einen Rückgang von fast 28%, erreichte am 03.01.2023 einen Tiefstand von 0,50 Cent und generierte ein negatives Sell-Signal im EMA.

Die Konsolidierung erfolgt aktuell leicht unter dem 200er EMA (rote Markierungslinie im Chart bei EMA200, 0,57 Dollar). Ein nachhaltiges Überwinden dieses Niveaus könnte die bärische Situation weiter verschärfen. Trotz positiver Marktbedingungen hat XRP Schwierigkeiten, die angekündigten Kursgewinne zu realisieren. Mit einem RSI von 34 befindet sich der Markt in einem überverkauften Bereich, während der RSI MA bei 46,11 liegt. Die Aussichten auf steigende Kurse sind vorhanden, doch aufgrund des bärischen Gesamtbildes weniger realistisch.

Ein nachhaltiges Überwinden des 200er EMA und die Umwandlung in eine Unterstützung würden die nächsten Widerstandsniveaus bei 0,64 Dollar und erneut bei 0,71 Dollar in den Fokus rücken. Aktuell wird ein Einstieg in Long/Short-Positionen nicht empfohlen, bis der Kurs eine klare Richtung eingeschlagen hat. Die Kreuzung des RSI mit dem RSI MA am 02.01.2024 deutet auf eine mögliche bärische Divergenz hin.

Wochenchartanalyse

Der Wochenchart gibt einen langfristigeren Ausblick auf die Kursentwicklung von XRP. Seit Anfang Januar durchläuft XRP eine Korrekturbewegung, die bei 0,6155 Dollar begann und vorläufig bei 0,50 Dollar endete. Der 10er EMA (blau markiert) notiert derzeit bei 0,6020 Dollar, der 50er EMA (orange markiert) bei 0,5472 Dollar und der 200er EMA bei 0,4955 Dollar.

Die Korrektur stoppte knapp über dem EMA, und der Kurs konsolidiert zwischen dem 10er und 50er EMA. Um von einer Erholung sprechen zu können, bedarf es einer nachhaltigen Schließung einer Wochenkerze über dem Wert des 10er EMA. Die nächste bedeutende Marke wäre ein Wochenschluss oberhalb von 0,701Dollar. Im Wochenchart liegt der RSI bei etwa 49, während der RSI MA 55,79 beträgt.

Schlussfolgerung und Ausblick

Zusammenfassend lässt sich sagen, dass das Gesamtbild derzeit eher negativ und bärisch ist. Ein Einstieg in Long-Positionen könnte in Betracht gezogen werden, wenn der Kurs nachhaltig den 10er oder 50er EMA auf Tagesebene überwindet. Eine solche Position sollte jedoch eng abgesichert und gering gehebelt werden. Die Entwicklung des RSI und die mögliche bärische Divergenz am 02.01.2024 geben Anlass zur Vorsicht. Von einer Bullischen Entwicklung kann erst gesprochen werden, wenn es gelingt den Wert von 0,71 Dollar nachhaltig zu überschreiten. Die fortlaufende Beobachtung des Marktes ist unerlässlich, um fundierte Entscheidungen zu treffen und auf potenzielle Wendepunkte vorbereitet zu sein.

Quellennachweis und Vertiefungen für XRP-Chartanalyse:

TradingView – Charts und Analysen:

Link: TradingView

Beschreibung: TradingView ist eine umfassende Plattform für Finanz-Charts und Analysen. Hier können aktuelle Entwicklungen auf den Märkten verfolgt und fundierte technische Analysen erstellt werden, speziell angepasst auf XRP.

Technische Analyse (Chartanalyse) – Wikipedia:

Link: Technische Analyse – Wikipedia

Beschreibung: Der Wikipedia-Artikel zur Technischen Analyse bietet weiterführende Informationen zu den Grundlagen und Prinzipien dieser Analysemethode, insbesondere im Kontext von XRP.

XRP-Charts und Marktdaten – CoinMarketCap:

Link: CoinMarketCap – XRP

Beschreibung: CoinMarketCap bietet aktuelle XRP-Charts und Marktdaten. Eine zuverlässige Quelle, um den aktuellen Kurs, Volumen und andere relevante Daten von XRP zu verfolgen.

Krypto-Nachrichten und Analysen – CoinDesk:

Link: CoinDesk

Beschreibung: CoinDesk ist eine angesehene Plattform für Krypto-Nachrichten und Analysen. Hier finden sich aktuelle Nachrichten, Expertenmeinungen und Marktkommentare, die für eine umfassende Analyse von XRP relevant sind.

Disclaimer: Diese Analyse dient ausschließlich Informationszwecken und stellt keine finanzielle Beratung dar. Jegliche Handelsentscheidungen, die auf den in dieser Analyse präsentierten Informationen basieren, liegen in der alleinigen Verantwortung des Lesers. Es wird dringend empfohlen, sich bei Bedarf von einem qualifizierten Finanzberater beraten zu lassen.

#Chartanalyse#CoinDesk#CoinMarketCap#Finanzmärkte#KryptoAnalyse#Kryptowährung#TechnischeAnalyse#TradingView#XRP#XRPCharts

1 note

·

View note

Text

Bullish Makes Headlines with CoinDesk Acquisition Deal

0 notes

Text

CoinDesk Retracts Essays Critical of Chainalysis, Justin Sun

Popular crypto industry news outlet CoinDesk has retracted a pair of opinion articles criticizing the founder of the cryptocurrency TRON and the head of US investigations at Chainalysis, a company specializing in financial analysis and forensics of crypto. CoinDesk claims the articles were removed because they contained “personal attacks” lodged against the two, but one of the authors tells…

View On WordPress

#Blockchains#Chainalysis#CoinDesk#Corporate crime#Cryptocurrencies#Culture#Digital Currency Group#Elizabeth#Elizabeth Bisbee#Entertainment#FTX#Gizmodo#Justin Sun#Kwon#Michael Casey#Retraction#Roman Sterlingov#Sam Bankman-Fried#Tron

1 note

·

View note

Text

Piyasa analizi: Ayı görünümü kripto para piyasalarını etkilerken Bitcoin fiyatı 26 bin doların altına düştü!

Bir analist, fiyat grafiklerini inceleyerek büyük yatırımcıların Bitcoin varlıklarına ekleme yaparken bile BTC fiyatının daha fazla düşüşe işaret ettiğini söyledi.

Bitcoin (BTC), kripto tüccarları arasında genel olarak düşüş eğiliminin etkisi ve piyasaları toparlayacak yeni katalizörlerin eksikliği nedeniyle pazartesi günü sabah saatlerinde 26.000 doların altına düştü. CoinGecko verilerine göre…

View On WordPress

0 notes

Text

Bitcoin Cash's 29% Advance Led CoinDesk 20 Gainers Last Week: CoinDesk Indices Market Update

CoinDesk Indices (CDI) presents its bi-weekly market update, highlighting the performance of leaders and laggards in the benchmark CoinDesk 20 Index (CD20) and the broad CoinDesk Market Index (CMI).

Only three assets in the CoinDesk 20 closed higher compared to one week ago: bitcoin cash (BCH) up 29%, dogecoin (DOGE) up 9% and litecoin (LTC) up 0.5%. Bitcoin cash has gained more than 4x…

View On WordPress

0 notes

Text

Former NYSE Executive Acquires CoinDesk, Leading Cryptocurrency News Site, for $50M

#BarrySilbert #CoinDesk #cryptocurrencynews #digitalassetmarket #ThomasFarley

0 notes