#Authorised Capital Increase Fees

Link

The following fees are assessed for the increased authorised capital in the event that the private limited company needs it:

0 notes

Text

Exploring Medical Education in Romania: Your Roadmap to Pursuing an MBBS Degree

Hey dear visitors, respecting your online navigation, the page brings before you an expert guide for pursuing MBBS in Romania.

Studies show that there is a steady increase in the number of students aspiring to study MBBS in Romania. Though many foreign countries are extending all the desirable supports to international students for studying MBBS, MBBS in Romania is a popular choice of many international students. It offers MBBS program at a reasonable price but never compromise in imparting quality education. All Indian medical students can pursue an MBBS in Romania due to the reasonably priced tuition. In addition to charging exorbitant annual fees, private medical colleges in India also need substantial donations or capitations in order to provide admission through management quotas. For an MBBS seat in India, the majority of candidates are unable to pay the hefty payment that private colleges demand. Under these conditions, international medical schools present an excellent choice for Indian medical students. The MBBS and other medical programmes are not inexpensively offered by Indian medical institutes, unlike many other universities around the world. One of the most popular MBBS study abroad options for prospective medical students in the nation is Romania.

Significant Draw for MBBS Students from Romania:

The fact that there is no admission exam necessary is one of the reasons why a large number of Indian students enrol in MBBS programmes in Romanian medical universities.

The admissions process is simple and easy to understand.

All the necessary paperwork should be ready when you apply for MBBS in Romania.

Why Do Indian Medical Students Choose Romanian MBBS Programmes?

The MBBS in Romania is quite well-liked by Indian students.

Obtaining an MBBS degree in Romania is a highly recommended and reasonably priced alternative.

Furthermore, the World Health Organisation (WHO) and NMC have authorised the majority of Romania's institutions.

Romanian medical universities do not require any admission exams.

For those who wish to study from Romania, there is now a cheap MBBS tuition cost available at a well-regarded medical university.

The cost is less at some of Romania's best medical colleges than it is at Indian ones.

Romania is proud of its equitable educational system, which is reinforced by regulations that support free elementary education, give out free books to those in need, and promote national cohesion. In addition to official education, private systems and unofficial tutoring help achieve educational parity. Indian students are becoming more and more interested in MBBS programmes offered by Romanian institutions because of their excellent quality and reasonable costs. These colleges provide instruction in English, which makes it easier for applicants from other countries to understand. Students are better able to understand difficult topics when they have a strong foundation in a variety of areas. For individuals looking for a top-notch education in a welcoming setting, studying an MBBS in Romania is an appealing option because of these many qualities together.

Ria Overseas is a leading consultant agency offering you the best platform for studying MBBS in Romania.

Contact soon to grab the opportunity!

0 notes

Link

0 notes

Text

[ad_1]

A number of buyers are flocking to a distressed workplace constructing in Uptown Dallas in hopes of snagging it a candy low cost.

Three presents are on the desk for Uptown Tower, a 12-story workplace property, at 4144 North Central Expressway, that entered chapter and was foreclosed on final 12 months, the Dallas Morning Information reported.

The proprietor, a Houston-based actual property funding belief, defaulted on a greater than $14 million that matured Oct. 1. The lender, Morgan Stanley Mortgage Capital Holdings, financed the 253,000-square-foot constructing with a $16.5 million mortgage in 2013.

The constructing’s future was mentioned at a listening to earlier this week in U.S. Chapter Court docket for the Northern District of Texas, together with buy presents, a swap of itemizing brokers, the addition of particular counsel and approval to retain a mediator for a charge, the outlet mentioned.

A $26 million bid by Dallas-based Dogwood Industrial was the best supply, barely decrease than the property’s appraised worth of $27.6 million. The opposite two entities that inquired haven't been disclosed.

The Uptown Tower landlord additionally desires to change the itemizing agent from Marcus & Millichap to Dallas-based Weitzman, which obtained conditional approval. Decide Michelle V. Larson thought switching brokerages was infeasible, calling it “an alligator pit I don’t wish to leap in” because the courtroom beforehand authorised a six-month settlement with Marcus & Millichap, the outlet reported.

Considerations had been raised through the listening to concerning potential double charges and the strategic course for advertising and marketing the property. Marcus & Millichap would take a 3 % fee of the sale value, whereas Weitzman’s fee can be 2 %.

Advertising and marketing Uptown Tower as an workplace constructing can be most popular over exploring residential conversion alternatives, citing latest leasing momentum, mentioned Joyce W. Lindauer, the proprietor’s lawyer.

The constructing is simply 57.7 % leased, however a legislation agency that’s in talks to lease a whole flooring might increase its occupancy significantly. Alternatives for renewed leases, lease extensions and new leases for Radford & Associates and Westside Contracting Group had been additionally on the docket.

—Quinn Donoghue

Learn extra

[ad_2]

Supply hyperlink

0 notes

Text

VAT Ai: What are the benefits and drawbacks of starting an Amazon FBA business?

Benefits of FBA

Access to Prime shipping labels boosts visibility and sales

Automated fulfillment handles logistics drudgery

Sellers capitalize on Amazon’s wide customer base

Shipping discounts and savings vs going it alone

24/7 customer support is outsourced to Amazon

Drawbacks of FBA

Fees can add up significantly for some products

Branding visibility is reduced on outbound packaging

Sellers lose control over fulfillment operations

Increased return rates occur due to an open return policy

If you are an Amazon FBA seller looking for a complete compliance solution (EORI, VAT, EPR, Authorised Representative, etc) in the EU&UK market, contact VAT Ai today for more information.

0 notes

Text

Bitcoin briefly soared towards $30,000 following a false spot Bitcoin ETF approval info earlier than swiftly retreating to the $28,000 degree. However an precise approval might add $1 trillion to the crypto market, in accordance with the newest report by CryptoQuant.

The subsequent wave of Bitcoin institutional adoption seems to be advancing within the type of monetary establishments providing entry to the flagship cryptocurrency investing to their shoppers by way of spot Bitcoin ETFs.

$1 Trillion Market Cap Increase

A number of corporations, corresponding to BlackRock, Bitwise, VanEck, Constancy, and Valkyrie, amongst others, have utilized to launch spot Bitcoin Change Traded Funds (ETFs). Whereas these aren't anticipated to get approvals this yr, business consultants imagine inexperienced lights might be on the horizon, doubtlessly as early as March 2024.

On this case, Bitcoin might witness inflows of $155 billion. The entry of recent cash might additional increase Bitcoin’s market cap by $450-$900 billion, CryptoQuant stated in its newest report.

“We might anticipate $155 billion will stream into the Bitcoin market as soon as these ETFs are authorised. The whole Belongings Below Administration (AUM) of those corporations are round $15.6 trillion. In the event that they have been to place 1% of their AUM into these Bitcoin ETFs, the whole US greenback quantity that may enter the Bitcoin market can be ~$155 Billion. To place it in context, these quantities signify virtually a 3rd of the present market capitalization of Bitcoin.”

In previous bull markets, Bitcoin’s market capitalization has sometimes expanded at a fee of three to five instances larger than its realized capitalization. This suggests that for every further greenback coming into the Bitcoin market, the market capitalization might doubtlessly develop by 3x to 5x, CryptoQuant defined.

Moreover, the anticipated capital inflow from spot ETFs is poised to surpass the funds that flowed into the Grayscale Bitcoin Belief (GBTC) throughout the earlier bull market cycle. Operated by Digital Forex Group (DCG), GBTC is presently the world’s largest cryptocurrency fund, managing over 620k BTC holdings.

Ferver Surrounding Spot Bitcoin ETF

Deceptive experiences regarding BlackRock’s spot ETF approval created a stir within the cryptocurrency market earlier this week. However the total sentiment stays robust.

The bullish outlook can be evident within the ongoing discount of the discount on Grayscale Bitcoin Belief (GBTC), which hit its lowest level in 22 months final Friday. The narrowing low cost has ignited optimism as spot Bitcoin ETFs in america edge nearer to turning into a actuality.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).PrimeXBT Particular Provide: Use this link to register & enter CRYPTOPOTATO50 code to obtain as much as $7,000 in your deposits.

0 notes

Text

Net zero by 2070: India’s shift to e-mobility

30 September, 2022

WOCE Team

By committing an economy to a 1 billion tonne reduction in predicted carbon emissions by 2030, India’s net zero objective for 2070 demonstrates the intention to undertake decarbonization. The inter-sectoral contributions of states, industries and companies will be essential in accomplishing this aim, even though this lays out a clear path for India to take.

In India, the transportation sector is one of the major emitters. India must prioritise this area if it is to reach the net zero goal. Without quick electrification of vehicle fleets, emissions associated with transportation will soar by 2050, significantly hastening climate change. Critical actions, such as the following, are urgently needed to create an EV ecosystem in India.

Infrastructure fees for business parks and public roads

Medium and long-haul freight as well as the electrification of last-mile delivery, powered by renewable energy

Government at work: Strengthening policy backing

The Indian government has created the conditions for quick uptake of electric mobility. To support reaching the target of 30% EVs by 2030, a clever combination of purchase reductions across a variety of vehicle categories, lower road taxes, and scrapping and retrofit incentives is needed. The cost of oil imports, rising pollution, and India’s international responsibilities to combating climate change are the driving forces behind its recent measures to quicken the transition to e-mobility.

1. Demand incentives for Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME II)

Around 160,000 EVs had received demand incentives totaling $75 million USD under FAME II as of November 2021. More than 6,300 e-buses, 2,870+ EV charging stations in 68 cities, and 1,576 charging stations on nine expressways and 16 motorways have all been approved by the incentive programme. All this could hasten the adoption of electric two-wheelers, three-wheelers, and e-buses throughout the nation.

2. Production-linked Incentive (PLI) Programme

The Indian government launched a 2.4 billion USD PLI project for ACC storage manufacture in May 2021 to build a local manufacturing capacity of 50 GWh of ACC and 5 GWh of “niche” ACC capacity. This would increase capacity, localise the EV supply chain, and reduce dependency on imports. Reliance, Hyundai, Ola, and M&M are just a few of the well-known Indian companies that have submitted bids totaling roughly 130 GWh.

To promote the production of electric and hydrogen fuel cell vehicles, the central government also authorised 3.4 billion USD for automobiles and automobile components in September 2021.

3. State policies on EV

EV-specific policies have been enacted by several states. Incentives on the supply side include:

Subsidy for a capital interest

Refunds for stamp duties

Tax exempt status

Refund for state goods and services tax (SGST)

Offering interest-free loans will encourage EV manufacturers.

There are financial incentives, exemptions from road tax, and registration fee reductions on the demand side.

The governments of Delhi and Maharashtra have made announcements about initiatives to hasten the adoption of EVs. By 2024, EVs in Delhi are expected to account for 25% of all new vehicle registrations. By 2025, 10% of all new vehicle registrations in Maharashtra will be electric vehicles.

Companies setting the bar high: Ambition and action

Exide and Amara Raja Batteries, two well-known producers of automotive lead-acid batteries, are pioneers in focusing fresh investments on environmentally friendly technologies like lithium-ion batteries. In response to the opportunity offered by India’s EV industry, business leaders like OLA Electric, Ather Energy, and Mahindra Electric are rapidly growing their market presence.

Due to soaring demand, Ather Energy plans to produce 1 million electric scooters annually.

A 2 billion USD investment was made by Ola’s “Future Factory” to produce 10 million electric scooters annually.

TPEML, a recently established EV subsidiary of Tata Motors, was created to manufacture, design, and develop EV-related services.

Together with Mahindra Group, Hero Electric produces more than 1 million electric two-wheelers annually.

In addition, EV100 members, who are dedicated to a 100% switch to EVs by 2030, are setting the demand side

To hasten the switch to electric vehicles in the last-mile delivery sector, Flipkart has teamed with Hero Electric, Mahindra Electric, and Piaggio.

Initiated by Dalmia Cement, the e-trucks initiative aims to deploy 22 electric trucks by 2022.

The JSW Group has a new EV policy that enables incentives for employees to buy electric two-wheelers or four-wheelers up to $300,000.

Even though the government and private sector are now aware of the enormous benefits of EV adoption, more work needs to be done to accelerate the switch to EVs in India. The demand for the uptake of sustainable transportation must be fueled by the Indian corporate sector. They can also effectively transform outmoded processes by inspiring fresh business concepts.

By increasing EV demand, influencing legislation, and promoting mainstream adoption to make electric transport the new normal by 2030, initiatives like EV100 are extending the frontiers to create a conducive climate for the transition to e-mobility. The ability of EVs to reduce emissions will continue to increase as India’s energy infrastructure becomes more environmentally friendly and new ways to obtain clean electricity surface.

#net zero emissions#carbon footprint#co2 emissions#sustainability reporting#carbon credit price today in india#Carbon footprint calculation#10 simple ways to reduce your carbon footprint

1 note

·

View note

Text

PRESS RELEASERevealed April 8, 2023

Market Overview:

The automotive Finance Market was valued at USD 1.60 trillion in 2021 and is predicted to succeed in USD 3.60 trillion by the yr 2028, at a CAGR of 12.3%.

Finance firms or specialised auto producers are typically those who supply automotive financing. It incorporates a spread of economic merchandise that enable prospects to purchase automobiles, like loans and leases. The first distributors of auto finance services and products embrace unique tools producers (OEMs), banks, credit score unions, brokers, and different monetary organizations. Moreover, auto or vehicle financing is a program that permits debtors to buy automobiles with out making a whole upfront fee. Nonetheless, automotive finance firms use technology to ship value-added providers to their prospects. Prospects from main rising and established economies choose authorised monetary establishments for Automobile finance to remove any danger issue or inconsistency within the transaction course of, so creating economies current substantial alternatives for automotive finance suppliers to develop their firms.

The Report Will Embody A Main Chapter

Patent Evaluation

Regulatory Framework

Expertise Roadmap

BCG Matrix

Warmth Map Evaluation

Value Development Evaluation

Purchase PDF Pattern Report + All Associated thorough TOC, Graphs and Tables of World automotive Finance Market Now:

https://introspectivemarketresearch.com/request/14696

Are Involved about the opportunity of an financial recession and uncertain how to adapt to the present social and financial local weather? Contemplating the present financial state of affairs, it's essential to conduct market analysis to guage the forthcoming alternatives and threats. Introspective Market Analysis is right here to help you in overcoming these threats and seizing the alternatives that can quickly turn into out there. Don't worry concerning the market research and evaluation; we'll help you by offering probably the most up-to-date market analysis reviews on the most reasonably priced costs.

Market Dynamics and Components:

Elevated world demand for brand new automotive fashions and branded automobiles has emerged as one of many key market improvement drivers. The demand for automotive financing & loans is anticipated to extend and is predicted to take care of its dominance available in the market as client traits & preferences towards automotive purchases have elevated immensely. Consequently, the common value of automobiles has elevated globally together with the rise in want for cars. Consequently, the dramatic enhance in automobile costs is pushing prospects to make use of auto or automotive financing as a substitute of creating direct purchases.

Automobile finance suppliers are targeted to supply value-added providers to their prospects, increasing present product & service choices by implementing applied sciences resembling artificial intelligence, enterprise analytics, and blockchain are anticipated to assist enhance the standard of providers and enhance the extent of buyer satisfaction. Moreover, these applied sciences enable firms to construction new and used auto loans extra precisely. Subsequently, the enlargement of present merchandise & providers via the implementation of latest applied sciences is predicted to supply profitable alternatives for automotive finance suppliers within the upcoming years.

Prime Key Gamers Coated In The Automobile Finance Market:

Financial institution of America (US)

Volkswagen Finance Personal Restricted (India)

Hitachi Capital Company (Japan)

Ford Motor Credit score (US)

Toyota Monetary Providers (Japan)

Ally Monetary (US)

BNP Paribas (France)

Capital One (US)

HSBC (UK)

JPMorgan Chase & Co. (US), and Different Main Gamers.

Automobile Finance Market Report Spotlight:

By Sort, the OEM section is anticipated to guide the expansion of the Automobile Finance market within the forecasted timeframe. Automotive OEMs present higher

after-sales providers because of the availability of equivalent vehicle components, like that of the automobile financed, for restore or alternative. Additionally, OEMs are thought-about the way forward for mobility, owing to their constructive influence on new enterprise fashions.

By Car Age, the New Car section is predicted to have the best share of the Automobile Finance market over the projected interval. The penetration of automotive finance is greater in new automotive gross sales, and there's a excessive desire for loans/leases amongst customers. Used automotive financing is gaining reputation and its share is predicted to rise in the course of the forecast interval.

By Software, the Industrial Car section is ready to develop on the highest CAGR in the course of the forecasted timeframe. business automobiles are costly compared to different automobiles, quite a few banks, and monetary establishments have launched cheap mortgage schemes, which embrace easy phrases and circumstances. Furthermore, the processing time wanted to approve business automobile loans is much less compared to passenger automobiles.

The North American area is predicted to have the best share of the Automobile Finance market over the projected interval. The presence of outstanding key gamers, in addition to a rise in technological development, are the primary elements driving the event of the market on this area.

Personalized Report:

https://introspectivemarketresearch.com/custom-research/14696

Key Trade Growth:

In October 2021, Volkswagen Monetary Providers have based a three way partnership in Brazil with the fleet and mobility supplier LM FROTAS. The goal is to develop the fleet enterprise collectively to ascertain the brand new enterprise as one of many high gamers available in the market

In April 2022, Ally and NASCAR Legend Dale Earnhardt Jr. Announce New Partnership, Collaboration will deal with intensifying and increasing NASCAR fan engagement via unique content material, occasions, and mortgage.

Automobile Finance Market Segmentation:

By Sort

OEMs

Banks

Financing establishment

By Car Age

New Autos

Used Autos

By Software

Private Autos

Industrial Autos

Inquiry For This Report : –

https://introspectivemarketresearch.com/inquiry/14696

Desk Of Content material

Chapter 1: Introduction

1.1 Analysis Targets

1.2 Analysis Methodology

1.3 Analysis Course of

1.4 Scope and Protection

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Govt Abstract

Chapter 3:Progress Alternatives By Section

3.1 By Sort

3.2 By Car Age

3.3 By Software

Chapter 4: Market Panorama

4.1 Porter’s 5 Forces Evaluation

4.1.1 Bargaining Energy of Provider

4.1.2 Risk of New Entrants

4.1.3 Risk of Substitutes

4.1.4 Aggressive Rivalry

4.1.5 Bargaining Energy Amongst Consumers

4.2 Trade Worth Chain Evaluation

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Alternatives

4.5.4 Challenges

4.4 Pestle Evaluation

4.5 Technological Roadmap

4.6 Regulatory Panorama

4.7 SWOT Evaluation

4.8 Value Development Evaluation

4.9 Patent Evaluation

4.10 Evaluation of the Impression of Covid-19

4.10.1 Impression on the Total Market

4.10.2 Impression on the Provide Chain

4.10.3 Impression on the Key Producers

4.10.4 Impression on the Pricing

Moreover, we're providing firm profiles for all the main key firms. Please take the time to go to our firm profiles. If you wish to do any personalized profiling for the businesses do tell us.

Chapter 5: Automobile Finance Market by Sort

5.1 Automobile Finance Market Overview Snapshot and Progress Engine

5.2 Automobile Finance Market Overview

5.3 OEMs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Measurement (2016-2028F)

5.3.3 Key Market Traits, Progress Components and Alternatives

5.3.4 OEMs: Grographic Segmentation

5.4 Banks

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Measurement (2016-2028F)

5.4.3 Key Market Traits, Progress Components and Alternatives

5.4.4 Banks: Grographic Segmentation

5.5 Financing Establishments

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Measurement (2016-2028F)

5.5.3 Key Market Traits, Progress Components and Alternatives

5.5.4 Financing Establishments: Grographic Segmentation

Chapter 6: Automobile Finance Market by Car Age

To Be Continued…

For this report, Introspective Market Analysis has segmented the Automobile Finance Market based mostly on area:

Regional Outlook (Income in USD Million; Quantity in Items, 2022-2028)

North America

Europe

Germany

UK

France

Italy

Russia

Spain

Relaxation Of Europe

Asia Pacific

China

India

Japan

Singapore

Australia

New-Zealand

Remainder of APAC

Center East & Africa

Turkey

Saudi Arabia

Qatar

UAE

Israel

South Africa

South America

Brazil

Argentina

Remainder of SA

Purchase the Report:

https://introspectivemarketresearch.com/checkout/?consumer=1&_sid=14696

Scope of the Report:

The newest analysis on the Automobile Finance market gives a complete overview of the marketplace for the years 2022 to 2028. It offers a complete image of the worldwide Automobile Finance trade, contemplating all important trade traits, market dynamics, aggressive panorama, and market evaluation instruments resembling Porter’s 5 forces evaluation, Trade Worth chain evaluation, and PESTEL evaluation of the Automobile Finance market. Furthermore, the report consists of important chapters resembling Patent Evaluation, Regulatory Framework, Expertise Roadmap, BCG Matrix, Warmth Map Evaluation, Value Development Evaluation, and Funding Evaluation which assist to grasp the market route and motion within the present and upcoming years. The report is designed to assist readers discover info and make choices that can assist them develop their companies. The research is written with a particular objective in thoughts to offer enterprise insights and consultancy to assist prospects make sensible enterprise choices and obtain long-term success of their explicit market areas.

For Extra Associated Experiences Click on Right here:

https://introspectivemarketresearch.com/reviews/iot-for-finance-market/

https://introspectivemarketresearch.com/reviews/personal-finance-software-market/

https://introspectivemarketresearch.com/reviews/remote-car-parking-locks-market/

About us:

Introspective Market Analysis (introspectivemarketresearch.com) is a visionary analysis consulting agency devoted to help our shoppers develop and have a profitable influence in the marketplace. Our workforce at IMR is able to help our shoppers flourish their enterprise by providing methods to realize success and monopoly of their respective fields. We're a world market analysis firm, specialised in utilizing large knowledge and superior analytics to point out the larger image of the market traits. We assist our shoppers to assume in a different way and construct higher tomorrow for all of us. We're a technology-driven analysis firm, we analyze extraordinarily giant units of knowledge to find deeper insights and supply conclusive consulting. We not solely present intelligence options, however we assist our shoppers in how they'll obtain their objectives.

Contact us:

Introspective Market Analysis

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1 773 382 1049

E mail : [email protected]

Linkedin | Twitter | Facebook

This Press Launch has been written with the intention of offering correct market info which is able to allow our readers to make knowledgeable strategic funding choices. For those who discover any downside with this content material, please be at liberty to succeed in us on [email protected]XheraldXherald is keen about providing in depth protection of worldwide business news. Devoted to creating each participant's notification, it reaches its personal reader. Day by day our consultants supply contemporary related info relating to what is definitely occurring in Markets in addition to Enterprise. Our headlines are literally swiftly paced and in depth.

Our distributor listing connects you with model new services or products and its market state of affairs from the simplest firms across the planet. Xherald is pushed by its 500+ contributors coming from all over the world. Xherald gives native in addition to world market intelligence info protection in sectors starting from healthcare, IOT, chemical compounds and 17 extra sectors. Our updates are shortly paced and detailed. The information we current is definitely a mixture of genuine content material, group contributions and curated headlines bulletins. All the updates our firm provides should move a strict criterion of genuineness, relevance and significance to our readers.

0 notes

Text

Asset Liability Management

5. DEBT SECURITIES

5.1 Overview

5.1.1 What this module covers

· Debt securities are debt instruments (i.e. contracts) that can be bought or sold between two parties.

· They have agreed terms such as interest and maturity date

· A debt is created when the security is issued, whereby the issuer (or borrower) owes an agreed set of payments (how interest calculated and capital payment at maturity and when to pay them and its timing) to the investor in the debt security.

· Risk of debt security -> possibility that the agreed payment terms are not fulfilled -> borrower defaults on repayments of interest or principal payments

· Debt can take different forms:

o Defined in terms of a local or foreign currency or by reference to an index such as a CPI

o Can have fixed or variable rate of interest

o Can be repayable at a fixed date or perpetual debt with no fixed term for repayment

o May be tradeable on an exchange (or any organised market) to be sold before the maturity date

5.1.2 Setting the scene

· Global bond (debt) markets far outweigh global equity markets in both market value and annual issuance.

· Bond market is a key source of capital for business and gov’ts -> investment opportunity for institutions as well as individuals

· Investors are attracted to investment in debt securities -> compared with equity or property debt securities offer (near) certainty of the agreed payments, which usually include interest payments and the return of capital at a set point or points in time.

o Enables them to arrange their financial affairs to meet their liabilities with more certainty

o Trade-off for less uncertainty -> accepting a lower long-term return on debt securities compared to equity or property.

5.2 Main types

5.2.1 Overview

Well-known types of debt securities

Examples

Deposit

Cash, term deposit

Money market security

Certificate of deposit; Bill of exchange (including bank bill); Promissory note; Treasury note; Repurchase agreement

Debt market security

Government bond; Corporate bond; Floating rate note; Inflation-linked bond

· Cash instruments in money market (<1 year maturity) and debt capital market (>1 year).

· Debt securities are used to build derivative investment products:

o Mortgage-backed security (MBS)

o Collateralised debt obligation (CDO)

o Credit default swap (CDS)

5.2.2 System T

· Characteristics that influence the risk and return expectations of the asset class or security under consideration:

o Security (i.e. default risk where agreed payments of interest or capital are not made)

o Yield (i.e. real/nominal, expected return/running yield relative to other assets)

o Spread (i.e. expressed as a required margin of yield over government securities of the same term to compensate for increased risk of default)

o Term (i.e. short, medium, or long, expressed in remaining years to maturity)

o Expenses (i.e. dealing and management) or Exchange rate (i.e. currency risk)

o Marketability (i.e. tradeable on an exchange or market, liquidity related to volume traded, or non-tradeable, or illiquid

o Tax

5.3 Deposit securities

· Are debt that arises by an investor placing (deposit) their money with a bank (or any building society or credit union) and receiving interest on the amount deposited.

· Deposit taker in Australia must be an authorised deposit-taking institution (ADI) -> bank, credit union or building society under the supervision of the regulator -> APRA

· They are either at-call deposits -> investor can have access to the deposit at any time or term deposits -> investor cannot access their account for an agreed period.

5.3.1 At-call deposits

· Depositor/ investor has instant access to withdraw the deposit or required to provide a very short notice period before withdrawing their capital.

· Fees maybe charged or adjusted with interest payable to cover expense recovery and profit margin.

· Cash deposits often called sight deposits or call deposits

Return

· No capital gain and investment returns are interest paid by issuer of the security (deposit taker). Interest can be:

o Fixed for the duration of the deposit

o Fixed for an initial period and then varied

o Variable day on day

o Higher or bonus rate paid if certain conditions are met e.g. no withdrawal

· Cash rates are usually linked to central bank’s cash rate (used to achieve target inflation).

· In Australia, over long-term, cash rates have been higher than inflation -> good real return for the investor. But at times, with negative real return (e.g. COvid-19 where cash rate was 0.25% and inflation was 1.8% with real return of 1.55% p.a.)

Risk

· Well-regulated economy -> lower likelihood of failure of cash deposit taker (except during GFC).

· Gov’ts introduced a guarantee to reassure investors that their cash was ‘safe’ in local banks -> to prevent a run on banks’ capital.

· E.g. Australia -> Financial Claims Scheme (FCS) -> protections to deposits in ADIs and to policies with general insurers if their fail (up to $250,000 per account holder).

5.3.2 Term deposits

· Varying terms and conditions

· Investor has no access to the capital before the end of the agreed period of time.

· Can gain access to the funds earlier than the original term under certain conditions -> investor may be penalised e.g. loss of interest or payment of exit fees

· It will also affect the expected return the investor will receive in order to compensate for the ‘loss of access’ -> issuer will likely to price deposit to balance for their need for capital now and expectations of future cash rates failing/rising (making it cheaper/more expensive to raise capital in the future).

· Suits investors with known liabilities that require funding at a known future date or those with no specific liability but a strong aversion to loss.

Return

· At-call deposits -> no capital gain and the return is interest paid by issuer of the security

· Term deposit rates are quoted daily -> secure deposit to issue loans to customers

· Factors affect term deposit interest rates set by banks:

o Cash rates set by the central bank (RBA)

o Market competition between banks for deposits

o Banking regulations

· Ex 5.1: Research the relationships between cash rates set by the RBA and the inflation rate.

What are your observations on the cash rate and inflation rate?

By what theoretical mechanism does the cash rate influence the inflation rate?

Is there evidence of this relationship?

o The cash rate has essentially trended down since 1990 from 17.5% to 0.25%. For a reasonable period, it ranged between 5% and 7% pa; however, since the GFC (dropped) and recovery (rose) it has gradually been reduced to 0.25%.

o The inflation rate has been more volatile and has remained within a smaller band (1% to 5% pa).

o Economic growth tends to fluctuate around a long-term trend. When the economy grows too slowly because of weak demand, the RBA can lower interest rates to stimulate economic growth and employment. On the other hand, when the economy grows too quickly because of excessively strong demand, the RBA can raise interest rates to dampen economic activity and contain inflation.

o It is important to remember that monetary policy is a tool used to smooth fluctuations in the business cycle. While it can help support long-term economic growth by avoiding costly recessions or financial crises, it cannot create long-term economic growth by permanently stimulating demand. Any attempt to do so results in higher inflation. Long-term economic growth is ultimately determined by the availability and productivity of an economy’s resources such as labour, land, and capital.

o In May 2020 (cash rate 0.25%, inflation 2.2%) the RBA had no plans for further lowering cash rates with the most recent minute noting ‘The yield target [0.25% pa for 3 year bonds] was expected to remain in place until progress was made towards the goals for full employment and inflation’.

· Interest rates for term deposits vary based on:

o Term

o Amount invested

o Interest payment frequency

o Early exit fees/penalties

· Investor benefits if market rates declining during the term -> as they will be paid at the higher rate. But these expectations about the future will drive both investors and deposit takers when a new term deposit is issued.

· Investors expecting a fall in cash rates -> seek longer term to lock in current higher rate for longer period. So banks offer lower rate for longer-term deposits.

· Ex 5.2 Select one Australian ADI and obtain their term sheet. Figure 5.3: ANZ Term Sheet is an example of the ANZ Bank term deposit rates on 17 April 2020. What factors influence the rates being offered?

o Term of deposit (longer term earns slightly higher rate)

o Amount of deposit (higher amount earns slightly higher rate)

o Cash rate — Small/short-term approaching cash rate plus a margin

o Bond rates — Large/long-term approaching 10-year bond rate

o Bank margins — All deposit rates are below the corresponding mortgage or business loan rate being offered to customers, to ensure a margin for the bank

Risk

· Failure of a term deposit taker is very low in markets if the banking sector is regulated and supervised (similar to cash on deposit). But possible -> guarantee schemes by FCS apply to term deposits.

· Investor accepts the risk of market interest rate increase during the term -> will not be passed onto existing term deposits. But can be broken (with penalty) to rest the interest rate.

· Ex 5.3: How do the cash flows differ, in terms of timing and amount, between a fixed rate term deposit at a fixed interest rate and an instant access cash account with a variable interest rate?

o All the cash flows are known in advance at the point of purchase in terms of timing and amounts for a fixed term deposit at a fixed interest rate.

o The actual cash flows are:

§ One deposit

§ Repayment of capital at agreed time with accrued interest at agreed rate on amount deposited.

o Contrary to this, the amounts and timing of cash flows are unknown at the point of purchase for an instant access account with variable interest.

o The actual cash flows are:

§ Deposits and withdrawals by investor at any time, any amount

§ Credit of interest at the end of each agreed period (e.g. monthly) at the interest rate for that period applied to the daily account balance for that period.

5.4 Money market securities

5.4.1 General background

· Basic structure -> an investor lends capital to a borrower for a short period (<1 year) at an agreed rate of interest (margin above reference rate). Then the investor receives capital + interest earned at the end of period.

· Money market securities are issued at a discount to the maturity value (par), to reflect interest and then redeemed at par -> discount securities (return is earned due to the amortisation of the discount b/w time of issue and maturity date -> interest).

· Short term (overnight or up to 365 days)

· Money markets -> transactions in money market securities

· Dominated by banks over other financial and non-financial institutions who manage their own liquidity -> issue if they need short-term capital or purchase if they have excess short-term liquid funds.

· Central banks -> act as lenders of last resort to provide liquidity or use money market to establish short-term interest rates (via sale or purchase of certain money market securities and subsequent repurchase or sale at agreed price – repurchase agreements)

Return

· Short-term interest rates (money market rate or Treasury bill rate) -> rate for short-term borrowings between financial institutions or rate at which short-term government paper is issued or traded in the market.

o They are average of daily rates (as %).

o They are based on 3-month money market rates

· Investors use interest rate benchmarks -> assess current pricing for ST money market securities and observe historical experience.

o Also used in corporate borrowing rates and in financial contracts (derivatives and asset-based securities)

· Interbank rates have been the most common benchmark for short-term interest rates.

· The RBA cash rate and BBSW (bank bill swap rate) continue as Australia’s key short-term interest rate benchmarks.

Risk

· Money market securities can be attractive to risk-averse investors -> due to stability of capital values.

· Over the long-term money market, securities are expected to provide a lower return than riskier or less liquid investments.

· All securities in this market are short term, do not pay interest during the term, and have a fixed maturity date.

· The key distinguishing characteristic between the types is the credit risk.

Types

· 5 types of money market instruments:

o Certificate of deposit

o Promissory note

o Bills of exchange

o Treasury notes/ bills

o Repurchase agreements

5.4.2 Certificate of deposit (CD)

· Is a term deposit that is traded between investors (cash term deposits are not tradeable)

· Duration is usually 7-365 days

· Features:

o The ‘certificate’ acts as an acknowledgement for money that has been deposited with a bank — therefore, it is issued by a bank

o CDs are freely negotiable — the initial investor can sell their certificate to another investor, who then has the right to receive the interest and capital from the bank

o CDs are only issued if the amount is sizeable

o CDs are issued at a discount to par, where the investor deposits say $0.95m and receives back $1m a year later, where the $0.05m difference is the interest payment

5.4.3 Promissory note

· A written promise for the amount owed to a specified counterparty at a specified time or on demand.

· Settled through the payment of the amount owed by the borrower (maker of the note) to the lender (the payee, or the bearer of the note).

· Banks may issue promissory notes, these debt instruments allow funding from non-bank sources.

· They are usually:

o issued for relatively short terms, say 185 days or less

o must be signed by the party making the promise

o must be for a specific sum of money; must specify the time for repayment

o must be in bearer form

o are transferable by delivery without endorsement

o are issued and traded at a discount

o are redeemable at maturity

· If it is unconditional and readily saleable -> negotiable instrument

· Difference b/w an unsecured and a secured promissory note -> secured note is guaranteed by a certain asset (e.g. property or vehicle), whereas an unsecured note does not have any collateral associated with it.

· Credit or default risk -> credit risk of the issuer as well as the value of the secured asset (if any).

· Commercial paper -> an unsecured promissory note with a fixed maturity of < 270 days.

o Is issued by companies for the purpose of raising capital directly from the market.

o Returns are as good as treasury bills due to low security offered.

5.4.4 Bills of exchange

· An unconditional order in writing, addressed by one person to another, signed by the person giving it (the maker or borrower), requiring the person to whom it is addressed (the acceptor -> usually bank) to pay on demand or at a fixed or determinable future time, a sum certain in money or to the order of a specified person (the bearer).

· Negotiable instrument maturing within 6 months sold at discount (redeemed at faced value).

· Can be also redeemed at another bank or broker at a discount.

· If bank is the acceptor -> accepted bill of exchange or bank bill

· The bank has endorsed the bill on the back, either through buying the bill in the market or for a fee to raise the bill’s status -> bank endorsed bill

· Bank accepted bills -> Carries negligible risk of default -> highly marketable

5.4.5 Treasury notes

· Many central governments offer short-term debt securities that are guaranteed by that government and usually assumed by investors to be free of default risk (but not always).

· Australian Treasury notes are a short-term discount security redeemable at face value on maturity. Terms are less than 12 months. Treasury notes are issued to assist with the Australian Government's within-year financing task -> low risk and secure investments.

· Ex 5.4 In Australia, the most important types of discount securities are Treasury notes and bank accepted bills of exchange (bank bills). Determine the current value of these securities on the Australian short-term money market.

o Two useful resource sites that will help are: https://www.aofm.gov.au/securities/treasurynotes and https://afma.com.au/

5.4.6 Repurchase agreements

· Where the party willing to buy the underlying security provides the party selling the asset with temporary capital in exchange for the underlying security as collateral.

· Very short term borrowing or lending (overnight)

· Then the party selling the asset has an obligation to repurchase the asset at an agreed price (hence the term ‘repo’).

· Important to maintain liquidity in the secondary market.

· In Australia, each bank holds an exchange settlement (ES) balance with the RBA -> an at-call cash deposit, must be positive at all times. If not, they may need to borrow temporarily from another bank to provide cash for the ES balance to the RBA.

· There are transactions between the government (RBA is the banker) and the commercial world (commercial banks) daily that change the ES balances via repurchase agreements.

· To inject ES balances, the RBA provides cash to a bank and the bank provides eligible debt securities as collateral to the RBA. This protects the RBA from counterparty default losses by the bank. Then the next day, bank returns the ES balance and RBA returns the securities to the bank.

· Therefore, the underlying debt securities do not have to be sold to any other market participant to obtain the required cash.

· Ex 5.5 Provide an example of when a reverse repo is likely to occur.

o A central bank can use reverse repos as part of implementing their monetary policy. In doing so, the central bank would borrow money from banks to control the money supply in the country.

5.5 Bonds

5.5.1 General background

· Entity require longer-term capital -> equity or debt

· To raise debt -> entity creates and sells (issues) a debt security.

o In return they pay interest to the purchaser and repay the principal at the end of the term of the security.

· Bonds -> longer-term debt securities (>365 days).

· Coupon or coupon payment -> annual interest rate paid on a bond, expressed as a % of the face value and paid from issue date until maturity.

o Coupon rate -> (sum of coupons paid in a year)/(FV of the bond)

· Bond investor has an initial –ve cash outflow, followed by small known +ve CFs and a final amount at specified future dates known in advance.

o They can sell the bond before the end date -> actual yield will be different to expected.

o When holding long-term securities, pricing fluctuations each day might be significant short term -> which can be higher or lower than cash rate or inflation and may even be negative -> difference between return and current yield to maturity (gross redemption yield)

· CFs of bonds is known in advance in absolute terms or by reference to some benchmark or event (in monetary terms) at the point of entering the agreement.

o Conventional bonds -> payments fixed in monetary terms.

o Bonds can be linked to inflation or short-term cash rates.

· But there is still uncertainty on credit risk of the issuer -> probability that the issuer will default on some or all of agreed interest or capital payments at maturity.

· Bond investor has provided a leverage to the bond seller -> borrowing will increase the leverage of the borrower -> greater risk of default.

o Bond investor receives at most what has been contractually agreed.

o If seller invests the loan in a business venture and is successful, the profit is not shared with the investor.

· Bond is issued in primary market and traded in secondary market. Can be traded through bond markets, stock exchanges or via private placements.

· Quoted prices in the secondary market excludes next coupon payment -> flat price or clean price. Purchaser pays flat price + accrued interest at the settlement date.

o Dirty price -> sum of clean price + accrued interest

· Three options:

o Callable bonds (redeemable bond)

§ Issuer may redeem before it reaches the stated maturity date

§ Allows issuing company to pay off their debt early

§ May happen if interest rates move lower -> allows the business to re-borrow at a more beneficial rate

§ Has more attractive interest rate or coupon rate -> to compensate investors for the risk of redeemed at a time unfavourable to them

o Puttable bonds

§ A debt instrument with an embedded option that gives bondholders the right to demand early repayment of the principal from the issuer.

§ Incentive for investors to buy a bond that has a lower return

§ Can be exercised upon the occurrence of specified events or conditions or at a certain time or times

o Convertible bonds

§ Corporate debt security that yields interest payments but can be converted into a pre-determined number of common stock or equity shares.

§ Conversion can be done at certain times at the discretion of the bondholder.

§ Hybrid security -> price is sensitive to changes in interest rates, price of the underlying equity stock and the issuer’s credit rating.

5.5.2 Bond returns

· In general,

o returns to the investor come from the contracted cash flows or the sale of the securities.

o if the issuer (borrower) gets into financial difficulties and cannot pay the contracted cash flows, the investor (lender) may be left with nothing, even though their investment ranks ahead of equity investors

o there is no upside for the investor in terms of bonus payments or profit share if the issuer does well financially, only the contracted payments

o Therefore, the certainty of receiving the payments (i.e. the quality of the credit) is the most crucial factor in assessing the risk of a debt security.

· The country of issuer, listing or purchaser might affect legal action to enforce payment.

· For a specific bond,

o Return is determined by the value and timing of the future cash flows over the remaining life of the security to maturity

o Risk is predominantly measured as the expected loss in the event of cash flows not being received as promised or anticipated at the time of the investment.

· Investor can buy a debt security and either:

o Hold the security to maturity receiving all coupons and the principal; or

o Sell the security prior to maturity receiving none or some coupons and the sale price.

· Returns may be different as the market price of security may change over time (unlike principal).

· Yield to maturity or gross redemption yield -> IRR that results in sum of PVs of the CFs, discounted at this rate = current market price of the bond (if held to maturity).

o There is a clear relationship b/w market price and market rate of return (or yield to maturity)

· Yield to maturity is based on the following assumptions:

1. The bond is held to maturity

2. The issuer does not default on any of the payments -> all coupons and principal payments are received as per the original agreed dates

3. Coupon payments can be reinvested at the same rate

· In reality, insurers don’t hold bonds till maturity.

· Valuation of debt securities depends on 3 factors:

o The amounts of CFs and their timing prescribed in the contract

o The probability of the CFs occurring -> requires credit analysis

o The appropriate rate of interest to use to calculate PV of the CFs as determined by market forces (yield to maturity can change at any time)

· Factors that affect the yield to maturity on bonds include:

o Supply of bonds (gov’t bonds) -> relates to govt’s fiscal policy.

§ If governments fund fiscal deficits through the issuance of bonds, then bond yields at those targeted durations will rise as prices will need to fall to tempt buyers (increase supply to lower the price)

§ E.g. gov’t decides to switch to issuing inflation-linked bonds -> decrease in supply of conventional bonds -> price increases -> yields will fall

o Demand for bonds -> arises from private and institutional investors

§ Institutional demand may change depending on savings patterns as a result of gov’t policy

§ E.g. 2020 early withdrawal of super -> superfunds selling more liquid assets such as bonds, increasing supply to the secondary market.

§ gov’t relaxes the need for insurance companies to hold bonds -> demand may fall.

§ Gov’t imposes compulsory annuitisation on work-based pension savings -> increase demand for gov’t issued bonds and high-credit-rated bonds.

o Issuing organisation

§ Each have different credit ratings -> affects the demand for these bonds due to marketability or liquidity of an issue.

§ Credit risk (probability of payment) and liquidity risk (difficulty of selling before maturity) changes by organisation.

§ E.g. credit risk -> default by issuer where sovereign governments have been known to default on government bonds from time to time.

§ Use credit ratings to place a value on the risk of default.

§ Lower the credit rating -> investor would expect a higher margin over the risk free rate -> devalues the security.

§ Credit spread -> the difference in yield between two securities of the same maturity but different credit quality.

· Credit quality assessed against that of a flagship government security (e.g. US treasure bond) which is risk free.

· The difference in yield is quoted in basis points (1% is 100 basis points).

· It indicates the additional return that the buyer is seeking in compensation for the credit risk assessment of the issuer.

o Expected inflation

§ Conventional bonds are exposed to this

§ Past data show long periods where interest rates are above inflation.

§ They set an expected margin for risk-free interest rates above price inflation.

o Uncertainty of inflation

§ Investors add margin to reflect the uncertainty.

o Exchange rate

§ In the long run, changes in the price level in one country will cause changes in nominal exchange rates, thus keeping the real exchange rate constant. This suggests a link between long-term bond yields across similarly rated countries.

o Taxation

§ Taxation of bonds will affect demand.

§ E.g. coupons taxed as income and proceeds taxed as capital gains/losses. If the tax rates between income tax and CGT are different -> it will affect the demand for high or low coupon bonds.

o Return on US bonds

§ This is due to the size of US market -> all bonds are priced in relation to them

§ Pricing model is a 2 staged process:

1. The risk-free real rate in the US Treasury market reflects the supply and demand of global capital.

2. The nominal risk-free government rate in other countries is priced off the US rate plus local factors of exchange rates, inflation expectations, economic factors, and political stability.

3. Credit assessment of the various issuers (both government and non-government) leads to various appropriate credit risk premiums, defined as a percentage per annum additional to the yield on the risk-free (US) government bond of a similar maturity.

§ Global rate is long-term rate -> local central bank has little control of

§ Floating exchange rate -> If the local central bank sets the cash rate too high (in the eyes of the global market), then foreign investors will demand more local currency and the exchange rate will appreciate, reducing international competitiveness. The reverse applies for a cash rate that is too low.

§ Nominal interest rates are driven by inflation and growth expectations (short and long ends of the yield curve).

§ Assume that observable gov’t bond yields are a proxy for the unobservable risk-free rates.

§ Nominal risk free yield = risk free real yield + expected future inflation + inflation risk premium

§ Short end -> local CB changes the cash rate affecting its monetary policy -> it will lift rates if the economy is expanding too quickly and lower if it is too sluggish.

§ Long end -> erosion of purchasing power (inflation). A fixed interest investor receiving fixed coupons and principal in the future has lower real cash flows if inflation should increase. Then the other investors will try to push yields up to compensate for this erosion of purchasing power. Long-term yields are very sensitive to inflationary expectations.

Interest rate risk

· Quantitative measures of interest rate risk: Duration and Convexity

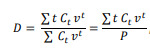

· Duration:

o Measures the weighted average time to receipt of cash flows, the weights being the present value of cash flows.

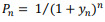

o The duration, D, say, of a cash flow sequence {Ct}, using a constant rate of interest i, say, is:

where v = 1/(1+i) and P represents the price of the CFs.

o The modified duration, D*, say, is:

-> measure of the sensitivity of the price of the security to a change in interest rates.

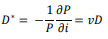

· Convexity

o Proportional second derivative of price with respect to yield.

o Combining duration and convexity -> good approximation of the price-yield relationship.

o Convexity is a measure of the curvature, or the degree of the curve, in the relationship b/w bond prices and bond yields.

o Shows that duration of bond changes as the interest rate changes -> convex

o Used by portfolio manager to measure and manage the portfolio’s exposure to interest rate risk.

· Taylor’s theorem -> show how convexity aids duration.

o Let P(i) denote the price of bond at rate i.

o For small, or sudden, changes in interest rates, duration will indicate how bond prices will change.

o Convexity is a better measure for assessing the impact on bond prices when there are large fluctuations in interest rate

· Duration and convexity have their limitations as risk measures, due to:

o The inherent assumptions about the yield curve shape and yield changes;

o The features of particular debt securities, including embedded options and interest sensitive cash flows.

· Duration and convexity are measures of sensitivity of bond prices to shifts in yield, rather than measures of the probability of loss.

Relationship between characteristics and price

· Price of a fixed rate bond will change whenever the assumed yield changes.

· Relationship between the price of an instrument and the yield:

o Price is inversely related to the yield. As the yield increases, the price will decrease and vice versa

o Given the same coupon rate and time to maturity, the absolute change in price is greater when the yield decreases compared to when it increases — the convexity effect

o Given the same time to maturity, the absolute change in price is greater for a bond with a lower coupon than a bond with a higher coupon when the yields change by the same amount — the coupon effect

o For bonds with the same coupon rate, a longer-term bond has a greater absolute change in price than a shorter-term bond for the same change in yield — also known as the duration or maturity effect).

5.5.3 Conventional government bonds

· Sovereign gov’ts issue a variety of conventional bonds with different redemption dates and coupon rates.

· Conventional -> refers to payments in nominal terms (monetary terms)

[SYSTEM T] used to determine the risk and return characteristics.

· Security:

o Often has very small or negligible risk of default for bonds issued by major sovereign gov’ts -> risk is nil if it controls fiat money.

o Security in monetary terms is usually high.

o But sovereign gov’ts can default

· Yield:

o Known at outset in monetary terms (if it is held till redemption and all coupons are reinvested at expected rate)

o Inflation adjusted return (real return) is unknown at outset as rate of inflation is unknown.

o Running yield = expected income over 1 yr/ current price -> difficult to compare against equities in recent years because of significant market swings.

o Total return is secure in nominal returns and this may lead to the conclusion that it should be lower than more risky investments -> but nominal return has a risk of inflation and consequent erosion of real return.

· Ex 5.6 Describe two scenarios where conventional bonds perform well in terms of the return achieved for the risk that is borne.

o When yields reduce, as prices will increase

o When inflation was lower than anticipated

o When other asset classes perform poorly.

· Spread

o Affected by supply and demand factors

o Spread (compensation for credit risk) is small for gov’t bonds.

· Term of government bonds

o Varies from one year to undated bonds (perpetual bonds).

o Varies by market

· Expenses

o Very low

· Exchange-rate risk -> only if the loan is not in the investor’s domestic currency

· Marketability and liquidity

o Excellent for gov’t bonds

o Low dealing costs

o Large volumes of bonds held and traded by institutional investors

o Liquidity -> assisted by an active market in derivatives based on bonds and by a market that decomposes a bond to its components (STRIPS)

o STRIPS -> Separate Trading of Registered Interest and Principal of Securities.

§ Zero coupon bonds -> pay no interest or coupon

§ Created when a bond’s coupons are separated from the bond

§ Then the bond is sold to an investor at a discount price with no coupons (no need to reinvest the coupons at a lower rate)

§ Each coupon payments also become a zero coupon bonds that can be sold separately

5.5.4 Corporate bonds

· Issued by corporations to raise capital.

· But to trade in capital market -> should meet minimum capital requirement and credit assessment.

· Corporate bonds may be secured (debentures -> unsecured) against assets of the corporation or unsecured.

· Conventional debt ranks ahead of shareholder equity.

· Some debt securities have options that allow borrower to convert it to shareholder equity rather than repay the principal.

· Corporate bonds have higher yield compared to gov’t bonds -> for additional credit risk and lower liquidity (marketability).

· Yield to maturity for corporate bonds:

o Yield = required risk free real yield + expected inflation + bond risk premium

o Bond risk premium’s main components:

§ Inflation risk premium -> additional compensation for uncertainty in the risk of future inflation

§ Credit default premium -> for risks that the bond issuer will default on payments

§ Marketability premium -> for the risk the bond can’t be resold before maturity

· Ex 5.7: Use SYSTEM T to detail the investment and risk characteristics of:

o Money market instruments

§ Security. This will depend on the issuer — for example, investing in a short-term government instrument will generally be more secure than a short-term loan to a manufacturing company. However, short-time frames often suggest that the security would be good.

§ Yield — real versus nominal. Money market instruments tend to have rates similar to official rates set by monetary authorities. These amounts will vary over time, with some instruments providing a known nominal return, such as a bill offered at a discount to face value, and other instruments having returns linked to inflation. Investors will mostly expect to achieve a positive real return, although this is not always true (e.g. during the 70s). In order to achieve positive real returns, short-term rates tend to rise with inflation.

§ Yield — expected return relative to other assets. Money market instruments are close to risk free as they tend to have a low risk of default. As a result, the expected returns will have a negligible risk premium and generally offer lower returns compared with other asset classes.

§ Spread — volatility of capital values. Due to the short-term nature and fixed nominal returns, these instruments tend to have low levels of volatility, with no volatility for cash deposits.

§ Term. The term for these instruments is usually less than one year, with the majority being very short, such as overnight deposits.

§ Expenses. Expenses are relatively minimal for these types of transactions.

§ Exchange rate. Money market instruments are available in most currencies and will introduce exchange-rate risk if it is bought in a foreign currency. Theoretically, movements in exchange rates are expected to compensate for interest rate differentials; however, in practice, realised exchange-rate movements can be unpredictable and very volatile.

§ Marketability. This depends on the instrument with some instruments not being marketable, for example call and term deposits. Other instruments can be highly marketable, but these tend to be through the interbank money market.

§ Tax. Common practice is to treat the total return as income for tax purposes.

o Corporate bonds

§ Corporate bonds have generally the same characteristics as government bonds, with the exception that they have:

· generally, lower levels of security, the extent of which will depend on the issuer

· lower marketability as issue size tends to be significantly lower

· higher yields to allow for marketability and default risk.

§ Conventional government bonds recap:

§ Security. The closest to being risk free for developed countries and where the government is highly rated.

§ Yields. Income streams from these bonds are flat and capital gains are limited (if the bonds are held to maturity). For this reason, income levels tend to be higher, compared with equities or property.

§ Yields — real versus nominal. If the bonds are held to maturity, then the expected nominal return is known in advance. However, uncertainty remains for the following reasons:

· reinvestment of coupons will be at an unknown rate, unless they are used to meet liabilities as and when they are received

· if the bonds are sold before maturity, the yield achieved will not be known in advance

· real yields depend on future inflation and as this is unknown in advance the real yield will be unknown in advance.

§ Yield — relative return. The lower risk implies a lower return; however, this ignores inflation risk. When inflation is uncertain or high, history suggests higher nominal returns. Over long periods, returns are generally lower than equities.

§ Spread — volatility of capital values. Changes in supply or demand will affect market values; however, volatility tends to much lower compared with equities.

§ Term

· Short-dated (less than 5 years)

· Medium-dated (5–15 years)

· Long-dated (> 15 years)

· Undated (i.e. irredeemable)

§ Expenses. Transaction costs are relatively low compared with other asset classes due to high levels of liquidity and marketability.

§ Marketability. Marketability is usually very good with relatively large quantities transacted with little impact on price. Low dealing costs, large quotation sizes, a developed derivatives market, and the STRIPS market all assist with marketability.

§ Tax. Tax treatment varies between countries and is country-specific.

5.5.5 Inflation-linked securities

· Has coupon set as a margin over a specific index, typically CPI.

· This margin is referred to as real return or real yield -> specified in the contract

· E.g. Australian gov’t issued inflation-linked bonds -> nominal amount of security is adjusted for CPI each quarter. Lagged by one quarter based on average of previous two.

· Interest based on the adjusted nominal FV (indexed value) x fixed coupon (margin) and is normally paid quarterly. On redemption, adjusted capital value (indexed) is paid.

· Calculation is complicated. Investors assume income and maturity payments are adjusted for inflation.

· Indexed bonds are traded on ‘real’ yield (return above inflation) basis, convertible quarterly -> formula similar to fixed coupon.

· Real return is known (if held to maturity) and is valuated based on the assumptions that the reinvested rate has the same margin as the coupon rate, but inflation index returns are not known in advance.

· No lags between coupon payments and underlying inflation index. But in practice there is -> it limits an index-linked security’s ability to hedge inflation risk as the CFs do not related to the inflation index at the time of payment due to delays in calculating the index. Also sometimes the issuer wants to know the payments in advance too -> end up using index from earlier period.

· Purchasing power diminishes over time due to inflation -> investors are attracted to a security with interest and capital that are not fixed but linked to index.

· Real yield on bonds is used as a benchmark for equities.

5.5.6 Floating rate notes

· Is a non-conventional bond -> known as floating rate bond or adjustable rate bond.

· Pays a coupon that is determined as a reference rate + specified margin. Interest paid quarterly.

· E.g. bank bill rate + 1.5% pa. In AU -> margin is over the bank bill swap rate (BBSW)

· The margin is set by the issuer (in response to market appetite reflecting credit risk) at the time of issue and is not changed. Lower margin -> lower risk (stronger credit assessment).

· Interest is not adjusted in accordance with market movements of the reference rate (usually cash rate), the capital is not as sensitive to overall movements in interest rates as a fixed coupon bond.

· Adjustable rate bond with a longer term to maturity may be sensitive to movements in the market’s expectation of an appropriate margin over the reference rate.

· Factors affecting pricing:

o Demand for funds

o Changes in Credit quality assessment

o Short term rate movements -> due to the reset mechanism on the payment dates, FRNs will pay a fixed rate until the next coupon reset date. Therefore, an investor is locked in at the current rate until it resets at the next reset date.

o Accrued interest -> as a note gets closer to the interest payment date, it builds up more accrued interest and its price, all other things being equal, will rise. When the interest is paid, the price will fall by the amount of the payment and will again start to accrue interest on a daily basis until it is paid on the next payment date. The same is true of fixed rate bonds.

· Because of the way they are structured, FRNs typically protect a portfolio when interest rates are rising -> central bank increase cash rate to slow growth in an economy, FRN income will also increase with the cash rate. Hence, FRNs are less exposed to a decline in price than fixed rate bonds under those economic conditions.

5.6 Term structure of interest rates

5.6.1 Spot and forward rates

· Bonds are often more straightforward than equities because of the relative ease of valuing the securities.

· The yield to maturity for a bond represents a single statistic that belies the underlying complexity of yields to different points in time. The phrase “term structure” is reference to any summary of this complexity that conveys how interest rates vary by term.

· Yield curve -> curve fitted to plot yield to maturity against term to maturity for similar credit rates securities.

o E.g. one may construct a yield curve from yield to maturity for the various government bonds in issue in a country. The curve is smoothed so that an individual bond’s yield to maturity is unlikely to lie exactly on the yield curve.

o Yield curve is not static and changes in response to market conditions.

o The shape of the yield curve -> represents term structure of interest rates

· Theoretically, the yield curve should be analysed bonds with same properties such as currency, credit risk, liquidity, tax status (other than time to maturity -> only reason for difference in yield) and same coupon (same reinvestment risk).

o Annual rates -> quoted for same periodicity (freq of coupons).

· These assumptions rarely hold in practice.

· Calculate the price of a bond based on a sequence of yields (spot rates) that corresponds to CFs dates -> assesses yields and reflects inherent risk and uncertainty with each CF.

o Spot rate today for a specified period = yield to maturity expected to be earned with zero-coupon bond of that period (no-arbitrage value approach) -> reflects the term structure of interest rates.

· If the price at which the bond is trading is different from no-arbitrage value -> a trading opportunity exists as it is (theoretically) possible to construct the same cash flows using zero- coupon bonds, which will have a different price (ignoring transaction costs).

· Spot yield curve -> data sets of yields to maturity for a series of zero-coupon government bonds, with a range of maturities, can be used to demonstrate the term structure.

· The spot curve (or zero or strip curve) is a sequence of yields to maturity on zero-coupon bonds.

· Gov’t bond spot rates are interpreted as the risk-free yields (default risk). There are also inflation and liquidity risk to the investor.

The observed

spot rate yield

from today (t=0) for a period of n years from now (t=n) as

yn

. The corresponding

price Pn

, say, is:

· We can observe spot rates today but not those that apply in future times. E.g. one-year spot rate is y1 but one-year spot rate in one year’s time is unknown.

· The future (unknown) one-year spot rate from time t= s-1 to time t = s as rs. Apart from r1, which equals y1, rs is unknown today as future interest rates are uncertain.

o Forward rates are derived from spot rates as the break-even reinvestment rate. They bridge the return on an investment in a shorter-term zero-coupon bond to the return on an investment in a longer-term zero-coupon bond.

Denote the forward rate in the period from time t = n-1 to time t = n as

fn, then:

· Compare f2 with r2 by considering an investor who has a one-year time horizon who can receive guaranteed 1-year yield of y1.

o Alternatively, they could buy 2-year guaranteed yield of y2 and sell at the end of year 1. If the one-year spot rate at the end of the year coincides with the expected value of r2, then the return over the first year must be y1.

o However, there is a non-zero chance that the actual value of r2 ≥ its expected value. The one-year horizon investor would need to be tempted into the strategy of buying the two-year bond and selling it at the end of the first year. This would force up y2. A consequence is that the forward rate, f2, would then exceed the expected future spot rate, r2. Therefore, .

o Under these conditions, the market is dominated by short-term investors, However, if the market is dominated by long-term investors, then the opposite conclusion would be drawn —that there is a relationship between forward rates and future spot rates: where liquidity premium may be +ve or –ve.

· You can only infer the future spot rates from the current spot rates when there is no interest rate uncertainty. If there is uncertainty, the forward rates do not inform you of likely future spot rates.

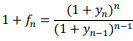

5.6.2 Yield curve shapes

· Common yield curve features:

o upward slope

o a concave shape — steeply upwardly sloping, then levelling out to become almost flat at longer durations.

· Short rates are more volatile than longer-term interest rates, as the longer-term spot rates are averages of the one-year spot and forwards.

· Shapes the yield curve can take include:

o Upward sloping or normal

o Flat

o Downward sloping or inverted

o Humped

· Longer-dated gov’t bonds tend to have higher yield compared to shorter-dated gov’t bonds under normal market conditions.

· Inverted yield curve – shorter dates gov’t bonds have yields higher than longer-dated ones (spot curve is downward sloping).

· Market conditions, changing expectations, or supply and demand for particular terms to maturity can all affect the shape of the curve. E.g.

o Regulator requirement to hold long-term bonds by insurers when they are low on supply -> increases demand -> lower yields for long-term bonds but no impact on shorter-term yields -> humped curve