#Attorney Overview in Texas U.S 2023

Text

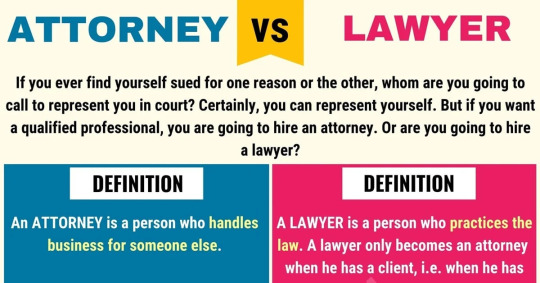

Attorney vs lawyer | Overview in Texas U.S 2023

The terms “attorney” and “lawyer” are often used interchangeably, but they are not exactly the same. An attorney is a person who is authorized to practice law and give legal advice. An attorney can represent clients in court, draft legal documents, and handle other legal matters.

A lawyer is a more general term that refers to anyone who is trained and licensed to practice law. A lawyer may be an…

View On WordPress

#Attorney#Attorney Overview in Texas U.S 2023#Attorney vs lawyer#Attorney vs lawyer | Overview in Texas U.S 2023#lawyer#lawyer Overview in Texas U.S 2023#Overview in Texas U.S 2023

0 notes

Text

SteelPath July MLP updates and news

June MLP performance seemed to reflect a reversal of sentiment as COVID-19 cases returned in certain regions. That likely influenced the near-term trajectory of what appeared to be improving energy consumption. Despite a softer market, some midstream companies advanced new projects and completed corporate simplification transactions.

MLP market overview

Midstream MLPs, as measured by the Alerian MLP Index (AMZ), ended June down 7.9% on a price and total return basis. The AMZ results underperformed the S&P 500 Index’s 2.0% total return for the month. The best performing midstream subsector for June was the Compression group, while the Diversified subsector underperformed, on average.

For the year through June, the AMZ is down 39.0% on a price basis, resulting in a 35.7% loss once distributions were considered. This trails the S&P 500 Index’s 4.1% and 3.1% price and total return losses, respectively. The Propane group has produced the best average total return year-to-date, while the Gathering and Processing subsector has lagged.

MLP yield spreads, as measured by the AMZ yield relative to the 10-Year U.S. Treasury Bond, widened by 108 basis points (bps) over the month, exiting the period at 1,122 bps. This compares to the trailing five-year average spread of 630 bps and the average spread since 2000 of approximately 402 bps. The AMZ indicated distribution yield at month-end was 11.9%.

Midstream MLPs and affiliates raised $800 millionin new marketed equity (common or preferred, excluding at-the-market programs) and $2.9 billion in debt during the month. No new asset acquisitions were announced during June.

Spot West Texas Intermediate (WTI) crude oil exited the month at $39.27 per barrel, up 10.7% over the period and 32.8% lower year-over-year. Spot natural gas prices ended June at $1.64 per million British thermal units (MMbtu), down 3.5% over the month and 32.2% lower than June 2019. Natural gas liquids (NGL) pricing at Mont Belvieu exited the month at $17.05 per barrel, 0.1% lower than the end of May and 12.4% lower than the year-ago period.

News

EPD inks supply agreement for PDH 2. Enterprise Products Partners (NYSE: EPD) announced the execution of a long-term agreement to supply propylene to Marubeni Corp from EPD’s second propane dehydrogenation plant (PDH). The plant is currently under construction and expected to be put into service in 2023. EPD also announced stronger than expected operating results from its ethylene export terminal at Morgan’s Point, Texas while advancing its expansion via ongoing construction of storage and additional supply connections.

Line 5 temporarily shut. A Michigan Circuit Court granted Michigan Attorney General Dana Nessel’s motion for a temporary restraining order requiring Enbridge (NYSE: ENB) to cease all transport operations of its Line 5 and disclose additional information following the discovery of damage to an anchor support.

ETRN closes acquisition of EQM. Equitrans Midstream Corporation (NYSE: ETRN) closed the acquisition of EQM Midstream Partners (NYSE: EQM); the final meaningful step in the companies’ simplification process.

Chart of the month: Associated gas, once a drag, may now begin to help natural gas prices

Pricing for natural gas has been challenged for many years as supply growth has exceeded demand growth. Unbeknownst to some, the robust supply of natural gas is the direct result of increased oil production. Most oil wells also produce some natural gas, and production of this “associated gas” has been rising substantially alongside the growth of crude oil produced from shale. However, the sharp decline in the rig count of primary crude oil shale plays in recent months has likely changed the trajectory of associated gas production and may benefit natural gas pricing, and production from dry gas basins, in the years ahead. The situation is similar for natural gas liquids.

Figure 1: Drilling activity and production of natural gas from key US oil basins

Sources: Energy Information Administration, Drilling Productivity Report (June 15, 2020), Baker Hughes North American Rig Count (June 26, 2020), and Invesco SteelPath calculations

Important Information

Blog Header Image : Matthias Kulka / Getty

Before investing, investors should carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund(s), investors should ask a financial professional for a prospectus/summary prospectus or visit invesco.com.

The opinions referenced above are those of the author as of July 1, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Energy infrastructure MLPs are subject to a variety of industry specific risk factors that may adversely affect their business or operations, including those due to commodity production, volumes, commodity prices, weather conditions, terrorist attacks, etc. They are also subject to significant federal, state and local government regulation.

The mention of specific companies, industries, sectors, or issuers does not constitute a recommendation by Invesco Distributors, Inc.

The S&P 500 Index is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

The Alerian MLP Index is a float-adjusted, capitalization-weighted index measuring master limited partnerships, whose constituents represent approximately 85% of total float-adjusted market capitalization. Indices are unmanaged and cannot be purchased directly by investors. Index performance is shown for illustrative purposes only and does not predict or depict the performance of any investment. Past performance does not guarantee future results.

A yield spread is the difference between yields on differing debt instruments of varying maturities, credit ratings, issuer, or risk level, calculated by deducting the yield of one instrument from the other.

Investing in MLPs involves additional risks as compared to the risks of investing in common stock, including risks related to cash flow, dilution and voting rights. Energy infrastructure companies are subject to risks specific to the industry such as fluctuations in commodity prices, reduced volumes of natural gas or other energy commodities, environmental hazards, changes in the macroeconomic or the regulatory environment or extreme weather. MLPs may trade less frequently than larger companies due to their smaller capitalizations which may result in erratic price movement or difficulty in buying or selling. Additional management fees and other expenses are associated with investing in MLP funds. Diversification does not guarantee profit or protect against loss.

The opinions expressed are those of Invesco SteelPath, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/steelpath-july-mlp-updates-and-news/?utm_source=rss&utm_medium=rss&utm_campaign=steelpath-july-mlp-updates-and-news

0 notes

Text

It’s a Full Slate for the FTC

It appears increasingly likely that for probably the first time since the FTC was established, we will have five new Commissioners in the same calendar year. Just to quickly recap, the FTC has five seats, only two of which are currently filled. Commissioner McSweeny’s term has already expired, while Acting Chairman Ohlhausen has been nominated for a position on the federal bench. Commissioners are nominated by the President and confirmed by the Senate for a term of seven years, subject to the rule that no more than three Commissioners may be from the same political party. The President also designates who is to serve as Chairman. Note that the seven-year terms are set rather than running from when an individual is confirmed so that some of the nominees will fill remaining shorter terms.

Four individuals have been nominated and voted out of Committee while the Trump administration just announced its intent to nominate the fifth Commissioner. We provide a brief overview of each of the nominees below. As the overview indicates, it seems likely that the new Commissioners will bring little in the way of past consumer protection experience.

Christine Wilson has been nominated to fill the remainder of Ms. Ohlhausen’s term, and Ms. McSweeny’s term expired last year, but she has stayed on in the position until a replacement is confirmed. Her seat will be filled by Chairman nominee Joseph Simons. The Senate Commerce Committee will likely begin processing the current nominees in February, according to Chairman John Thune. When a fifth member will be nominated to the Commission is currently unclear.

Joseph Simons (R)

Joseph Simons is President Trump’s nominee for Chairman of the FTC. He has been nominated to take the seat currently held by Commissioner McSweeny, whose term expires in 2024. Mr. Simons is a highly regarded antitrust lawyer and has worked in this for most of his professional career. Before that, Mr. Simons served at the FTC as the Director of the Bureau of Competition from June 2001 to August 2003. In this role, he was the head of the FTC’s antitrust enforcement. During his tenure the Commission was active in both merger and non-merger enforcements. Prior to heading the Bureau of Competition, he was a partner at law firm Clifford Chance, and earlier in his career he was the Bureau of Competition’s Associate Director for Mergers and Assistant Director of Evaluation. Mr. Simons’ is generally regarded as having a strong interest in bringing economic analysis to bear on antitrust law and his published articles, which include “The 2010 Merger Guidelines, Critical Loss, and Linear Demand” as well as “In Defense of Market Definition,” reflect this. He is not believed to have much in the way of consumer protection experience.

Noah Phillips (R)

Noah Phillips will come to the FTC from the Senate, where he is Chief Counsel for Texas Republican John Cornyn at the Senate Judiciary Committee. He has been nominated to fill a seat for a term that expires in 2023. Mr. Phillips has been at the Senate since 2011, and his work in that role has touched on issues related to the FTC, including antitrust matters and oversight of the agency. Earlier in his career, Mr. Phillips clerked on the 5th Circuit before practicing in the private sector at Cravath, Swaine and Moore and later at Steptoe and Johnson. The website for the Federalist Society, an organization that advocates conservative principles in the legal profession, lists Mr. Phillips as a “contributor.”

Christine Wilson (R)

Christine Wilson is currently a Senior Vice President at Delta Air Lines. She has been nominated for a term that expires in 2025. Her role at Delta involves leading the legal and regulatory teams, but Ms. Wilson has self-described her specialty as antitrust law. She has been recognized by publications such as Chambers USA and Euromoney as a leading antitrust attorney, reflecting her experience in the field. Before becoming an executive at Delta, Ms. Wilson was a partner at the Kirkland and Ellis and prior to that at O’Melveny and Myers, where she counseled clients on antitrust and consumer protection issues. Ms. Wilson also served as the Chief of Staff to FTC Chairman Tim Muris from 2001 to 2002 where she would have dealt with a wide range of consumer protection issues. Ms. Wilson also co-founded The Grapevine, an organization that seeks to connect women practicing antitrust and consumer protection law in Washington, D.C.

Rohit Chopra (D)

Rohit Chopra is one of two Democratic nominees and is nominated for a term that expires in 2019. In contrast to the other nominees, Mr. Chopra is not a lawyer. His relevant consumer protection experience has focused primarily on student loan issues. From 2010 to 2015, he worked at the Consumer Financial Protection Bureau, where he served as Assistant Director and Student Loan Ombudsman. After the CFPB Mr. Chopra was Special Advisor to the Secretary of the U.S. Department of Education. In that role, he again focused on student loan servicers and providers, similar to his work at the CFPB. Currently, Mr. Chopra is a senior fellow at the non-profit Consumer Federation of America, and previously he held the same title at the Center for American Progress. In an article last year on fine print in consumer agreements, Mr. Chopra was quoted as saying “fine print is often a way to give companies plausible deniability that they aren’t breaking the law.” Mr. Chopra received his M.B.A from The Wharton School at the University of Pennsylvania and then worked for two years at McKinsey, a management consulting company.

Rebecca Slaughter (D)

Late last month the administration also announced its intent to nominate Rebecca Slaughter for the last remaining FTC seat. She would take over a term that expires in 2022. Currently, Ms. Slaughter serves as Chief Counsel to Senate Minority Leader Chuck Schumer. Prior to that, she was counsel to Senator Schumer on the Senate Judiciary Committee and also had a brief stint (9 months) at Sidley& Austin after graduating from Yale law school.

It’s a Full Slate for the FTC syndicated from https://ronenkurzfeldweb.wordpress.com/

0 notes

Text

It’s a Full Slate for the FTC

It appears increasingly likely that for probably the first time since the FTC was established, we will have five new Commissioners in the same calendar year. Just to quickly recap, the FTC has five seats, only two of which are currently filled. Commissioner McSweeny’s term has already expired, while Acting Chairman Ohlhausen has been nominated for a position on the federal bench. Commissioners are nominated by the President and confirmed by the Senate for a term of seven years, subject to the rule that no more than three Commissioners may be from the same political party. The President also designates who is to serve as Chairman. Note that the seven-year terms are set rather than running from when an individual is confirmed so that some of the nominees will fill remaining shorter terms.

Four individuals have been nominated and voted out of Committee while the Trump administration just announced its intent to nominate the fifth Commissioner. We provide a brief overview of each of the nominees below. As the overview indicates, it seems likely that the new Commissioners will bring little in the way of past consumer protection experience.

Christine Wilson has been nominated to fill the remainder of Ms. Ohlhausen’s term, and Ms. McSweeny’s term expired last year, but she has stayed on in the position until a replacement is confirmed. Her seat will be filled by Chairman nominee Joseph Simons. The Senate Commerce Committee will likely begin processing the current nominees in February, according to Chairman John Thune. When a fifth member will be nominated to the Commission is currently unclear.

Joseph Simons (R)

Joseph Simons is President Trump’s nominee for Chairman of the FTC. He has been nominated to take the seat currently held by Commissioner McSweeny, whose term expires in 2024. Mr. Simons is a highly regarded antitrust lawyer and has worked in this for most of his professional career. Before that, Mr. Simons served at the FTC as the Director of the Bureau of Competition from June 2001 to August 2003. In this role, he was the head of the FTC’s antitrust enforcement. During his tenure the Commission was active in both merger and non-merger enforcements. Prior to heading the Bureau of Competition, he was a partner at law firm Clifford Chance, and earlier in his career he was the Bureau of Competition’s Associate Director for Mergers and Assistant Director of Evaluation. Mr. Simons’ is generally regarded as having a strong interest in bringing economic analysis to bear on antitrust law and his published articles, which include “The 2010 Merger Guidelines, Critical Loss, and Linear Demand” as well as “In Defense of Market Definition,” reflect this. He is not believed to have much in the way of consumer protection experience.

Noah Phillips (R)

Noah Phillips will come to the FTC from the Senate, where he is Chief Counsel for Texas Republican John Cornyn at the Senate Judiciary Committee. He has been nominated to fill a seat for a term that expires in 2023. Mr. Phillips has been at the Senate since 2011, and his work in that role has touched on issues related to the FTC, including antitrust matters and oversight of the agency. Earlier in his career, Mr. Phillips clerked on the 5th Circuit before practicing in the private sector at Cravath, Swaine and Moore and later at Steptoe and Johnson. The website for the Federalist Society, an organization that advocates conservative principles in the legal profession, lists Mr. Phillips as a “contributor.”

Christine Wilson (R)

Christine Wilson is currently a Senior Vice President at Delta Air Lines. She has been nominated for a term that expires in 2025. Her role at Delta involves leading the legal and regulatory teams, but Ms. Wilson has self-described her specialty as antitrust law. She has been recognized by publications such as Chambers USA and Euromoney as a leading antitrust attorney, reflecting her experience in the field. Before becoming an executive at Delta, Ms. Wilson was a partner at the Kirkland and Ellis and prior to that at O’Melveny and Myers, where she counseled clients on antitrust and consumer protection issues. Ms. Wilson also served as the Chief of Staff to FTC Chairman Tim Muris from 2001 to 2002 where she would have dealt with a wide range of consumer protection issues. Ms. Wilson also co-founded The Grapevine, an organization that seeks to connect women practicing antitrust and consumer protection law in Washington, D.C.

Rohit Chopra (D)

Rohit Chopra is one of two Democratic nominees and is nominated for a term that expires in 2019. In contrast to the other nominees, Mr. Chopra is not a lawyer. His relevant consumer protection experience has focused primarily on student loan issues. From 2010 to 2015, he worked at the Consumer Financial Protection Bureau, where he served as Assistant Director and Student Loan Ombudsman. After the CFPB Mr. Chopra was Special Advisor to the Secretary of the U.S. Department of Education. In that role, he again focused on student loan servicers and providers, similar to his work at the CFPB. Currently, Mr. Chopra is a senior fellow at the non-profit Consumer Federation of America, and previously he held the same title at the Center for American Progress. In an article last year on fine print in consumer agreements, Mr. Chopra was quoted as saying “fine print is often a way to give companies plausible deniability that they aren’t breaking the law.” Mr. Chopra received his M.B.A from The Wharton School at the University of Pennsylvania and then worked for two years at McKinsey, a management consulting company.

Rebecca Slaughter (D)

Late last month the administration also announced its intent to nominate Rebecca Slaughter for the last remaining FTC seat. She would take over a term that expires in 2022. Currently, Ms. Slaughter serves as Chief Counsel to Senate Minority Leader Chuck Schumer. Prior to that, she was counsel to Senator Schumer on the Senate Judiciary Committee and also had a brief stint (9 months) at Sidley& Austin after graduating from Yale law school.

It’s a Full Slate for the FTC published first on http://simonconsultancypage.tumblr.com/

0 notes