#450 crore investment)

Text

Investments to create job opportunities for over 27k people in the state: chief minister Siddaramaiah

Bengaluru, 08 March 2024: The 63rd State High-Level Clearance Committee (SHLCC), headed by Hon’ble Chief Minister Shri Siddaramaiah, today approved six new projects and eight additional investment proposals worth INR 17,835.9 crore, with the potential to create 27,000 jobs across the state. SHLCC received a nod for six new projects worth INR 8,220.05 crore, and eight additional investment…

View On WordPress

#"S" (Secular) needs to be removed from JDS party: It won’t be surprising even if JDS merges with BJP: CM Siddaramaiah#&039;Don&039;t stop traffic for me&039; - Siddaramaiah#"Can Siddaramaiah deny his role in the collapse of Congress-JDS coalition government" - Dr Sudhakar#078 crore investment)#095 crore and providing employment to 21#352.3 crore investment)#3rd meeting of the SHLCC held at Hon’ble Chief Minister’s Home office “Krishna”. SHLCC approved Wistron’s proposal to invest INR 2#450 crore investment)#63rd State High-Level Clearance Committee (SHLCC)#723 in the state. Other major proposals that received the government’s green signal are Air India Limited (INR 1#750 crore investment)#Chief Minister Siddaramaiah#Chief Minister SiddaramaiahChief Minister Siddaramaiah#Clearance Committee#ICT Service Management Solutions (India) Private Limited (INR 1#Indian Cane Power Limited (INR 1#Investments to create job opportunities for over 27k people in the state: chief minister Siddaramaiah#STT Global Data Centres India Private Limited (INR 1

0 notes

Text

Revolutionary Move: Royal Enfield to Launch Its First Electric Motorcycle in Collaboration with Stark Future

Royal Enfield's iconic 'thump' is about to get electrified! The company has announced that it's working on an electric motorcycle in collaboration with Stark Future, with an investment of almost Rs 450 crores. #RoyalEnfieldElectric #FutureOfPropulsion

Royal Enfield’s Managing Director has confirmed the company is developing an electric motorcycle in collaboration with Stark Future, with an investment of almost Rs 450 crores.

The electric motorcycle is anticipated to make its public appearance within the next two years and is expected to mark Royal Enfield’s entry into the future of propulsion technology.

image source:…

View On WordPress

#2025#electric motorcycle#Electric Vehicles#INDIA#Royal Enfield#royal enfield electric#royal enfield electric bike#upcoming royal enfield

4 notes

·

View notes

Text

BPCL to Offer 80 Lakh Shares in Block Deal

State-owned Bharat Petroleum Corporation Ltd (BPCL) is set to offer approximately 80 lakh shares worth an estimated ₹450-500 crore through a block deal, according to a recent report by CNBC Awaaz. This strategic move by BPCL involves the BPCL Trust for Investment divesting a portion of its shares through this transaction. The final decision regarding the size and price of the block deal will be…

View On WordPress

0 notes

Text

A Look at Mohan Meakin's Share Price and Future Prospects

Mohan Meakin Limited, the legendary Indian liquor giant synonymous with the iconic "Old Monk" rum, holds a unique position in the beverage industry. While its name has resonated for generations, its shares remain firmly within the confines of the unlisted market, leaving investors thirsty for insights into Mohan Meakin Share Price and future trajectory.

This article delves into the intricacies of Mohan Meakin unlisted status, explores the factors influencing its potential share price, and examines the whispers of a possible Mohan Meakin IPO. So, raise a glass of curiosity and join us as we dissect the mysteries surrounding this venerable player in the Indian liquor landscape.

Unlisted but Unwavering: A Glimpse into Mohan Meakin's Private Market Journey

Unlike many established companies, Mohan Meakin, founded in 1855, thrives in the private market. Its shares aren't readily traded on public exchanges like the BSE or NSE, making traditional methods of gauging its financial health and investment potential somewhat opaque.

However, whispers of Mohan Meakin Share Price circulate within the unlisted market space. Platforms like LetsExchange and Stockify offer glimpses into its private valuation. As of January 2024, estimates suggest a share price hovering around ₹450, with a market capitalization exceeding ₹800 crore.

This valuation reflects the company's robust performance despite the complexities of the unlisted market. Key factors driving this impressive trajectory include:

Enduring Legacy: Mohan Meakin's "Old Monk" brand enjoys near-religious devotion among loyal consumers, securing a solid market share within the rum segment.

Diversification Play: The company isn't just a one-trick pony. Its portfolio boasts established brands like Golden Eagle Beer and Solan No. 1 Whisky, catering to diverse palates.

Strategic Expansion: Forward-thinking ventures like the Solan Gold Indian Single Malt Whisky showcase Mohan Meakin's adaptability and willingness to tap into premium segments.

Resilient Performance: Even with challenges like state-imposed liquor bans, the company has demonstrated an ability to navigate regulatory hurdles and maintain profitability.

Bullish Brew or Bearish Bite? Examining Potential Upsides and Downsides for Mohan Meakin's Share Price

While Mohan Meakin Share Price paints a promising picture, investors require a holistic understanding of the potential upsides and downsides:

Bullish Factors:

Booming Liquor Market: India's liquor market is projected to reach a staggering ₹80,000 crore by 2026, offering immense growth potential for Mohan Meakin.

Premiumization Trend: Consumers are increasingly opting for premium liquor brands, aligning perfectly with Mohan Meakin's strategic offerings.

Robust Distribution Network: The company boasts a widespread distribution network across India, ensuring product accessibility and market penetration.

Potential IPO Buzz: Rumors of a potential Mohan Meakin IPO in the near future have piqued investor interest and could unlock significant liquidity.

Bearish Factors:

Unlisted Market Volatility: The unlisted market inherently carries higher risks and uncertainties compared to publicly traded securities.

Regulation Risks: Evolving liquor regulations and potential policy changes can impact the industry and affect Mohan Meakin's performance.

Intensified Competition: The liquor market is fiercely competitive, with established players and emerging brands vying for market share.

Profitability Concerns: While Mohan Meakin has shown progress, concerns regarding consistent profitability could dampen investor sentiment.

Beyond the Share Price: Intangibles Shaping Mohan Meakin's Value Proposition

A comprehensive assessment of Mohan Meakin SharePrice goes beyond mere financial metrics. The company's intangible assets also play a crucial role:

Unmatched Brand Equity: The "Old Monk" brand enjoys unparalleled heritage and brand loyalty, offering a distinct competitive advantage.

Proven Innovation: Mohan Meakin's ability to adapt and experiment with new products and market trends demonstrates agility and growth potential.

Sustainable Practices: The company's commitment to environmentally conscious processes resonates with modern consumers and investors.

Experienced Leadership: Mohan Meakin boasts a dedicated and experienced leadership team with a deep understanding of the Indian market.

The Mohan Meakin Mystery: IPO Whispers and Future ForecastThe whispers of a potential Mohan Meakin IPO have sent ripples through the investment community. While the company hasn't officially confirmed plans, the possibility of its shares entering the public domain holds immense potential.

0 notes

Text

Vehicle Scrappage Policy

The Vehicle Scrappage Policy, launched on August 13, 2021, is a government-funded programme to replace old vehicles with modern & new vehicles on Indian roads. The policy is expected to reduce pollution, create job opportunities and boost demand for new vehicles. Several countries including the US, Germany, Canada and China have introduced vehicle scrappage policies to boost their respective automotive industries and curtail vehicular pollution. Large automakers are onboarding this policy by launching scrappage centres including CERO by Mahindra & Mahindra (2018) and Maruti Suzuki Toyotsu by Maruti Suzuki and Toyota (2019). This policy also supports India’s ‘Green India’ mission, as it creates space for a cleaner fleet of vehicles.

Register Now: https://bit.ly/3RrDnEq

According to the new policy, commercial vehicles aged >15 years and passenger vehicles aged >20 years will have to be mandatorily scrapped if they do not pass the fitness and emission tests. The policy does not treat a vehicle as scrap just because of its age, but considers other factors such as quality of brakes, engine performance and others. The objective is to phase out old cars, reduce urban pollution levels and stimulate automotive sales, which continues to record slowdown amid India’s post-COVID recovery phase. Additionally, the vehicle scrappage policy is also said to be a part of a larger stimulus package majorly requested by original equipment manufacturers (OEMs) to stir their demand.

Under the policy, automated testing stations and scrapping facilities will be set up in phases. Currently, 75 stations are proposed under Phase 1; this count will gradually scale up to 450–500 stations across the country. The government has also welcomed private players to invest in setting up such stations through partnership with the state governments. The government also plans to set up 50–70 facilities for scrapping vehicles in the next 4–5 years. An automobile industry body—the Society of Indian Automobile Manufacturers (SIAM)—has urged the government to allow dealer workshops to function as inspection and certification stations, as establishing new ones may not be commercially viable and delay the policy developments and implementation.

The Vehicle Scrappage Policy extends many obvious benefits, besides pollution control and improved road safety factor. Union Minister Mr. Nitin Gadkari has highlighted that raw materials derived from scrapped vehicles such as copper, rubber, steel, aluminium and plastic can be reused in new vehicles, which can help reduce the price of new vehicles and subsequently, boost sales.

Some incentives for scrapping old vehicles and buying new ones are as follows:

Manufacturers can give up to 5% discount for buying new vehicles

Zero registration fee for new vehicle purchase

Owners can receive scrap value equivalent of 4–6% of ex-showroom price of new vehicles

States can give up to 25% and 15% rebate on road tax for personal and commercial vehicles, respectively

According to the Ministry of Road Transport and Highways (MORTH), India is home to 2.1 crore vehicles that are older than 20 years, with the highest number in Karnataka (39.4 lakh), followed by Delhi (36.1 lakh), Uttar Pradesh (26.2 lakh), Kerala (20.6 lakh), Tamil Nadu (15.9 lakh) and Punjab (15.3 lakh). The policy will likely result in the following projected gains:

30% boost for the Indian automobile industry, from the current Rs. 4.5 lakh crore (US$ 61.46 billion) turnover to Rs. 10 lakh crore (US$ 136.59 billion) over the coming years

Export component of Rs. 1.45 lakh crore (US$ 19.81 billion) in the current turnover is likely to go up to Rs. 3 lakh crore (US$ 40.98 billion)

Decrease India’s huge Rs. 10 lakh crore (US$ 136.59 billion) crude import bill

Attract new investments of ~Rs. 10,000 crore (US$ 1.37 billion) and create as many as 35,000 jobs

The Vehicle Scrappage Policy has been welcomed by most states. Most car dealers in Gujarat have expressed optimism at the new policy enforcements. Mr. Pranav Shah, Chairman, Federation of Automobile Dealers Associations (FADA) in Gujarat, believes that the scrappage policy will boost sales of new vehicles on the back of proposed discounts on new car purchases against vehicle scrappage certificates. Other experts in the industry have stated that the turnaround time of cars will reduce, generating more demand for new cars. The state of Maharashtra is outlining SOPs (that will be soon rolled out) for setting up digitised scrapping centers. The Delhi Government issued a public notice prohibiting plying of over 15-year-old petrol vehicles and over 10-year-old diesel vehicles. The owners of such vehicles have been advised to get their vehicles scrapped through authorized facilities at the earliest, failing which the vehicles can be impounded.

The Tamil Nadu govt. has reported mixed responses towards the scrappage policy, raising concerns of owners of second-hand or third-hand cars as they may have a tough time finding potential buyers. Additionally, some stakeholders from the state also believe that a well-maintained car fetches a good price irrespective of its age. Mr. Wilson Joseph of BRK Automobiles, who owns a used cars business in Chennai, expressed doubts over how the policy will cater to the second-hand cars market. The policy has received a similar response from lorry/truck owners in the state.

However, at a broader level, the policy has a good mix of incentives for new vehicle buyers and automotive dealers and hence, is anticipated to generate positive results in the near future. This will also pave the way for a whole new business segment—‘Scrappage Facility’—which will flourish in a well-organised manner. Additionally, the policy addresses the intent of all stakeholders from exporters, importers, car dealers, micro, small & medium enterprises (MSMEs), original equipment manufacturers (OEMs) and end consumers. Prime Minister Mr. Narendra Modi, while introducing the policy stated, “The policy is an important link to achieve the circular economy of waste to wealth. It will also energise India's auto sector and metal sector under the principles of reuse, recycle and recover.” The Vehicle Scrappage Policy is expected to truly touch every aspect of the automobile industry in India, the result of which is expected to churn in the years to come.

0 notes

Photo

Tata Coffee To Invest Rs 450 Crore To Produce Extra 5500-Tonne Freeze-Dried Coffee In Vietnam

0 notes

Text

Northern Hills: 5 Top Reasons Why These Flats in Dahisar East Are a Good Investment

For many aspiring homeowners, it is a dream to purchase a flat in Mumbai, and if that home blends convenience, comfort, and natural beauty, there is nothing better. If you are in the market for properties in Dahisar, Northern Hills by N.Rose Developers in Dahisar East check all of the above boxes and more.

Nestled amidst the lush greenery and natural beauty of the Sanjay Gandhi National Park which encompasses Dahisar East, the spacious 2 BHK and 3 BHK flats of Northern Hills capture the essence of peaceful living while ensuring seamless connectivity to the heart of Mumbai thanks to metro connectivity and the Western Express Highway

This project is one of the tallest in the vicinity, giving you amazing views of the surrounding area due to its thoughtfully designed architecture.

The ample use of glass and open spaces help to maximize natural light and ventilation so that you can relax and enjoy the magnificent views of the nearby Yeoor Hills.

Besides its convenient location, Northern Hills offers a variety of amenities and security features.

Investing in Northern Hills comes with the added assurance of MahaRERA registration, providing transparency and quality assurance for your peace of mind.

In this article, we will take a closer look into Northern Hills, revealing hidden gems that make it a dream home selection.

Site Address:- Northern Hills, Bharucha Rd, Hyland Park, Dahisar East, Mumbai, Maharashtra 400068.

Project Details:

Project Size- 1.29 acres, 841 units

Configurations- 2 BHK (701.01 sqft) 2 BHK (636.88 sqft ), 2 BHK (622.89 sqft), 3 BHK (1100.51 sq ft)

Price- Starts from INR 1.43 crores

Project Possession: December 2026

No of Floors in Tower: 66

Reason 1: Location of Northern Hills in Dahisar East

Situated in the serene and picturesque neighborhood of Dahisar East, Northern Hills enjoys the best of both worlds - it offers a peaceful ambiance away from the bustling city while ensuring effortless connectivity to key areas of Mumbai.

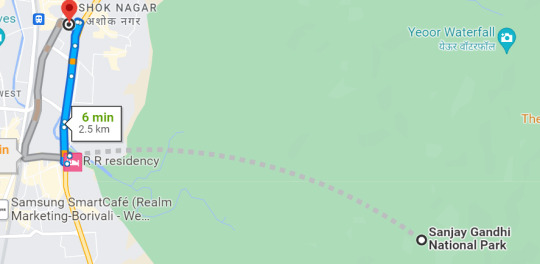

As it is certain from the map above, Northern Hills is well situated. Western Express Highway is just 210 m from the gate of the project, while another significant road is SV Road which is about 130 m from the project. And if you are someone who would also like to rely on public transportation, then Ovaripada Metro Station is just 800m, a stone’s throw away from Northern Hills.

Aside from the convenience of seamless connectivity, the area is surrounded by the Sanjay Gandhi National Park, approximately 9 minutes away, which guarantees fresh air and stunning views for a lifetime.

S V Road: 130 m

W E H: 210 m

Ovaripada Metro Station: 800 m

Dahisar Station East: 450 m

D Mart Link Road: 1.9 km

Sanjay Gandhi National Park: 2.4 km

Entertainment, Hospitals and Schools Near Northern Hills

Thakur Mall: 2.2 km

Metro Mall: 5.2 km

Pulse Diagnostic Centre: 20 m

Universal High School: 1.5 km

Rustomjee Cambridge School: 2.4 km

Reason 2: A Wide Range of Project Features in Northern Hills

Architecture and Design of the project

Soaring 733 ft. into the sky with 66 floors, Northern Hills stands tall as an architectural marvel in

the heart of Dahisar East. The project offers 2 BHK and 3 BHK homes in Mumbai with Sky and Podium amenities. The aesthetics of the project perfectly complement the surrounding landscape, and the strategic placement of each building ensures ample natural light and cross ventilation. While the project is developed in a modern style, special focus has been on making it sustainable too, making the project eco-friendly and energy efficient.

Amenities:

What truly sets Northern Hills apart is its impressive range of 25 plus amenities that cater to residents every need and desire.

The list of amenities that Northern Hills boasts of are

Fitness Zone

Terrace Movie Lounge

Podium Turf

Multipurpose Lawn

Infinity Pool

Kid's Play Area

Multipurpose Hall

Jogging Track

Toddler's Cycle TracK

Gymnasium

Outdoor Lap Swimming Pool

Skating Rink

Multi-Purpose Court

Children’s Play Area

Table Tennis

Indoor Games Area

Snooker & Billiards

Yoga/Dance Room

Business Centre

Creche

Amphitheatre

Library / Reading Lounge

Security Features:

The safety and security of the residents are paramount at Northern Hills. The project is equipped with state-of-the-art security measures, including 24/7 CCTV surveillance, manned entry points, and intercom systems, ensuring complete peace of mind for all residents.

Reason 3: Superior Buid Quality of 2 and 3 BHK Flats In Northern Hills

The apartments at Northern Hills are a testament to luxury and elegance. The meticulously designed living spaces have an exterior made of an RCC frame, that gives strong protection from earthquakes, while the walls are Gypsum finished with low Volatile Organic Compound (VOC) paint.

These 2 BHK and 3 BHK flats in Dahisar East come equipped with air-conditioned living, dining, and bedroom spaces with split units. Large formal flooring with vitrified tiles is used throughout the house, which is an excellent choice, particularly for areas that see frequent movements like kitchens, bathrooms, and hallways. Along with being durable, this kind of flooring is quite easy to maintain too. False Ceilings with lighting are also present at certain locations in the flats. Special care has been taken to ensure good planning of the electrical layout and the usage of modular electrical switches.

The bathrooms in the homes are designed with utmost care and attention to detail. They feature anti-skid flooring to ensure safety and prevent slipping accidents. The bathrooms also come equipped with premium sanitary fittings and water, providing functionality and durability. Additionally, a geyser is installed to provide hot water whenever needed, offering a comfortable and convenient bathing experience.

Reason 4: Developer With A Trusted Legacy

The reputable developer behind Northern Hills has a proven track record of delivering high-quality projects. Their commitment to excellence and timely delivery instills confidence in homebuyers and adds to the allure of Northern Hills.

N Rose Developers Private Ltd. (NRDPL) is a renowned real estate company that was established in 2004 by Late Shri Parshuram Shinde.

Since its inception, NRDPL has been dedicated to creating luxurious living spaces with an unwavering commitment to excellence and customer satisfaction.

With a wealth of experience spanning over two decades, N Rose Developers' portfolio boasts an impressive array of completed projects, each exemplifying the hallmarks of quality, innovation, and attention to detail. From commercial complexes to residential towers

Here are some of the other 3 BHK homes in Mumbai by N Rose Developers

Reason 5: Price Trend in Dahisar East Dahisar East has witnessed significant real estate price appreciation due to its improved infrastructure, strong connectivity due to the Western Express Highway, SV Road, and metro connectivity. The area's proximity to major commercial centers, along with its access to green spaces and recreational areas, has made it a sought-after destination for both homebuyers and developers alike. Steady development by reputable real estate companies has further boosted the area's popularity, offering high-quality residential projects that cater to modern homebuyers seeking luxury and convenience. This makes Dahisar East an attractive investment option in Mumbai's competitive real estate market.

In conclusion, Northern Hills is a haven of luxury, comfort, and tranquility that offers a lifestyle unlike any other in Dahisar East. Whether you seek a family-friendly environment or a peaceful retreat to call home, this project with its well-planned amenities, breathtaking views, and attention to detail undoubtedly sets a new benchmark for real estate projects in Dahisar East.

If you need more information about the project, call us at (022) 6849 3649 or visit dwello.in

FAQs

Is Dahisar East a good place to live?

Dahisar, a charming neighborhood in the northern Mumbai Suburbs, has become a top choice for homebuyers. Thanks to its excellent road and rail connections and well-established social amenities, it offers a desirable and convenient living experience.

What is the RERA number for Northern Hills Dahisar?

The RERA number for Northern Hills Dahisar is P51800020350

0 notes

Text

Cuttack Railway Station To Be Redeveloped With Rs 303 Crore Investment: Ashwini Vaishnaw

Railway Minister Ashwini Vaishnaw also said this year that railways have constructed 450 km of new rail line in the state this year which is a record, reports PTI.

source https://zeenews.india.com/railways/cuttack-railway-station-to-be-redeveloped-with-rs-303-crore-investment-ashwini-vaishnaw-2589616.html

View On WordPress

0 notes

Text

Interest rate on PF deposits may be near 8% for FY23

New Delhi: The government may peg the interest rate on provident fund deposits at nearly 8% for 2022-23, almost at the same level as in the previous fiscal, people familiar with the matter told ET.They said the earnings of the Employees' Provident Fund Organisation were being worked out but 8% was doable considering higher returns on investments this year."Return on EPFO investments this year have been strong with reduced withdrawals on account of Covid-19 pandemic. Even investments in equity are expected to fetch better returns than last year, making a clear case of either retaining the interest rate at 8.1% or bringing it a tad lower to 8%," a senior government official said on the condition of anonymity.

Another official said raising the interest rate beyond 8.1% will widen the difference between PF rates and rates on public provident fund (PPF) and general provident fund (GPF) which stands at 7.1%."The government will stick to around 8% to avoid any political backlash as it heads into key state assembly elections this year, followed by general elections next year," the second official added.The central board of trustees of EPFO is expected to meet later this month or in early March to decide on the interest rate that will be recommended by its Finance Investment and Audit committee based on the earnings for 2022-23.

The retirement fund body had announced the interest rate of 8.1% for 2021-22, which was the lowest in four decades and was significantly lower than 8.5% credited in the preceding year. This was on an estimated income of ₹76,768 crore with ₹450 crore as surplus.

Exchange Traded Fund

The CBT is also expected to take a call on the threshold on redemption of exchange traded funds at its upcoming meeting.It had in its last meeting in October 2022, proposed fixing a threshold on ETF redemption to ensure minimum returns and better payout to its subscribers. EPFO started investing in equities in 2015-16, starting with 5% in the first year, 10% in the second year and 15% in the subsequent years.

Source link

https://www.infinitycompliance.in/product/online-company-registration-in-india/

Read the full article

0 notes

Text

ITC opens up food manufacturing & logistics unit in Telangana

ITC opens up food manufacturing & logistics unit in Telangana

Hyderabad, Jan 31 (KNN) The FMCG giant ITC Ltd. has set up an integrated food manufacturing and logistics facility at Toopran in the Medak district of Telangana.

Spread over nearly 59 acres of land, the food processing facility, with a built-up area of 6.5 lakh sq ft, entails an initial investment outlay of Rs 450 crore. The facility…

View On WordPress

0 notes

Text

Japanese Company Daifuku To Invest 450 Crore In Telangana! Read Govt's Plan

Japanese Company Daifuku To Invest 450 Crore In Telangana! Read Govt’s Plan

The Japanese material-handling equipment company, Daifuku recently made headlines after the company announced to make a total of 450 crores investment in Telangana. According to the reports, the Telangana govt has signed a bond with the Computer manufacturing company followed by which the brand is now setting up a new manufacturing facility in the state. Well, no doubt this investment will not…

View On WordPress

0 notes

Text

PhonePe Reportedly in Talks to Raise Funds in Round Led by General Atlantic at $12 Billion Valuation

PhonePe Reportedly in Talks to Raise Funds in Round Led by General Atlantic at $12 Billion Valuation

Indian digital payments firm PhonePe is in talks to raise funds in a round led by General Atlantic at a valuation of $12 billion (roughly Rs. 99,300 crore), financial news website Moneycontrol reported on Friday, citing people aware of the matter.

US private equity group General Atlantic is likely to lead the round with an investment of $450 million (roughly Rs. 3,720 crore) to $500 million…

View On WordPress

0 notes

Text

PhonePe Reportedly in Talks to Raise Funds at $12 Billion Valuation

PhonePe Reportedly in Talks to Raise Funds at $12 Billion Valuation

Indian digital payments firm PhonePe is in talks to raise funds in a round led by General Atlantic at a valuation of $12 billion (roughly Rs. 99,300 crore), financial news website Moneycontrol reported on Friday, citing people aware of the matter.

US private equity group General Atlantic is likely to lead the round with an investment of $450 million (roughly Rs. 3,720 crore) to $500 million…

View On WordPress

0 notes

Text

Ather Energy Share Price: Future Outlook for Ather Stock

Ather Energy has carved a niche in the Indian electric vehicle (EV) market, capturing the imagination of riders and investors alike. But who owns this cutting-edge company, how do their scooters perform, and what's the buzz around their stock? Buckle up, as we dive into the dynamic world of Ather Energy. Get in depth information on Ather Energy Share Price.

Ather Energy Ownership: A Vision Realized

The brainchild of Tarun Mehta and Swapnil Jain, Ather Energy was born in 2013 with a vision to revolutionize urban mobility. Today, the company remains firmly under the leadership of its co-founders. Mehta, an IIT Bombay graduate with experience at Motorola and Hero MotoCorp, serves as CEO, while Jain, an IIM Bangalore alumnus, helms the role of CTO. Their deep understanding of technology and the Indian market has been instrumental in Ather Energy success.

Ather Energy Electric Scooters: Performance Packed

Ather's flagship scooters, the 450X and 450S, are more than just EVs; they're testaments to cutting-edge engineering. Boasting a powerful AC PMSM motor, these scooters deliver exhilarating acceleration and a top speed of 80-90 km/h. But performance isn't just about speed. Ather's focus on safety is evident in its robust chassis, advanced braking system, and a 7-inch touchscreen dashboard packed with ride information and diagnostics.

Ather Energy Share Price: Buzzing with Potential

In June 2023, Ather Energy made a remarkable debut on the Indian stock market, generating much excitement among investors. With Ather Energy IPO being oversubscribed by nearly 6 times, the company raised over ₹628 crore. Since then, Ather's share price has seen some fluctuations, reflecting the evolving EV market and broader economic factors. However, analysts remain optimistic about the company's long-term prospects, citing its strong brand identity, technological prowess, and expanding fast-charging network.

Ather Energy has become a hot topic in the Indian stock market, with its innovative electric scooters and rapid growth capturing the attention of investors. To help you navigate the buzzing world of Ather Energy Share Price, here are some insightful blogs delving into different aspects:

1. Riding the Electric Revolution: Analyzing Ather Energy Share Price

This comprehensive blog dives deep into the factors influencing Ather Energy Share Price. It explores market sentiment, the burgeoning EV industry, Ather's product innovation, sales performance, and expansion plans. It also provides a historical overview of the company's journey and offers an optimistic outlook for future growth.

2. Ather Energy Ltd Share Price - Technical Analysis and Future Predictions (Planify)

This blog takes a more technical approach, analyzing Ather Energy Share Price through charts and graphs. It examines various technical indicators like P/E Ratio, Market Cap, and EV/EBITDA, providing insights for seasoned investors. The blog also offers potential future predictions based on technical analysis, although it emphasizes the inherent risks and uncertainties involved.

3. Can Ather Energy's Stock Outpace Hero MotoCorp? (Moneycontrol)

This blog takes a comparative approach, analyzing Ather Energy Share Price alongside the established player Hero MotoCorp. It highlights the difference in their business models, market segments, and growth potential. The blog offers valuable insights for investors looking to diversify their portfolios with a mix of traditional and emerging players in the automotive sector.

4. Is Ather Energy Stock Overvalued? Examining Risks and Rewards (Seeking Alpha)

This blog takes a cautious approach, exploring the potential risks associated with investing in Ather Energy. It examines the company's profitability, competition, and valuation concerns. While acknowledging the company's strong potential, the blog encourages investors to carefully consider the risks before making a decision.

5. The Ather Community: A Platform for Share Price Discussions and EV Enthusiasm (Ather Forum)

The Ather community forum isn't just for tech enthusiasts and scooter owners. It also has a dedicated section for discussing the company's share price. Here, you can find insightful threads analyzing market trends, sharing investment strategies, and discussing news impacting Ather's stock performance. Remember, these discussions are for informational purposes and shouldn't be considered financial advice

0 notes

Text

PhonePe Reportedly in Talks to Raise Funds at $12 Billion Valuation

PhonePe Reportedly in Talks to Raise Funds at $12 Billion Valuation

Indian digital payments firm PhonePe is in talks to raise funds in a round led by General Atlantic at a valuation of $12 billion (roughly Rs. 99,300 crore), financial news website Moneycontrol reported on Friday, citing people aware of the matter.

US private equity group General Atlantic is likely to lead the round with an investment of $450 million (roughly Rs. 3,720 crore) to $500 million…

View On WordPress

0 notes

Text

Samsung to Invest $356 Billion by 2026 to Accelerate Growth in Chip Sector, Biopharma, Next-Gen Technology

Samsung to Invest $356 Billion by 2026 to Accelerate Growth in Chip Sector, Biopharma, Next-Gen Technology

Samsung Group will invest KRW 450 trillion (roughly Rs. 27,60,920 crore) in the next five years to accelerate growth in semiconductors, biopharmaceutical, and other next-generation technologies, Samsung Electronics said.

South Korea’s top conglomerate said on Tuesday the investments through 2026 are expected to help Samsung drive long-term growth in strategic areas such as the chip sector, while…

View On WordPress

0 notes