Text

Residence Equity Loans And Also Credit Report Lines

House Equity Funding Calculator

And also, she'll pay a cash-out surcharge upfront of around.375 percent ($ 840). This is a reasonably reduced amount because her equilibrium is so low and her credit report is excellent.

Do you have to pay taxes on home equity loan?

youtube

There are two ways to borrow against your home equity. With a home equity loan, you're given the money as one lump sum and make fixed monthly payments over the life of the loan to repay what you borrowed. A home equity line of credit (HELOC) works more like a credit card.

Why Is A Home Equity Loan A Bad Suggestion?

The graph below programs instances in which it makes good sense to pick a cash-out re-finance home loan. This assumes you have a reduced present very first home loan rate than is readily available currently.

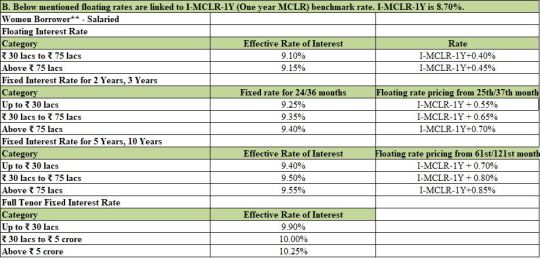

Taken Care Of Or Variable Interest Rate?

So if a new mortgage rate is similar to your current rate, as well as you do not wish to obtain a great deal of added cash, a residence equity car loan is probably your best bet.

Since a HELOC is a line of credit, you make payments just on the amount you actually borrow, not the full amount readily available.

Usually, house equity financings as well as lines included greater interest rates than cash-out refinances.

A residence equity credit line-- additionally known as a HELOC-- is a rotating credit line, just like a charge card.

You can obtain as long as you require, any time you need it, by composing a check or using a bank card linked to the account.

Credit report is a system financial institutions make use of to aid determine whether to give you credit report. Lenders contrast this details to the credit score performance of individuals with similar profiles.

Can I use home equity to pay off debt?

Debt consolidation

A HELOC or home equity loan can be used to consolidate high-interest debt at a lower interest rate. Homeowners sometimes use home equity to pay off other personal debts, such as a car loan or a credit card.

Qualifying For A Home Equity Line Of Credit

How hard is it to get a home equity loan?

As a rule of thumb, lenders will generally allow you to borrow up to 75-90 percent of your available equity, depending on the lender and your credit and income. So in the example above, you'd be able to establish a line of credit of up to $80,000-$90,000 with a home equity line of credit.

The underwriting is not as stringent just like a very first home mortgage, yet you still require to have a solid credit rating, reduced financial obligation, and also high income. Have you ever before took into consideration considering the pros and cons of a home equity loan? One of the largest difficulties numerous beginner real estate investors and also prospective property owners face is where to discover capital. That does not indicate you'll have the ability to obtain approximately $100,000, however.

0 notes