Text

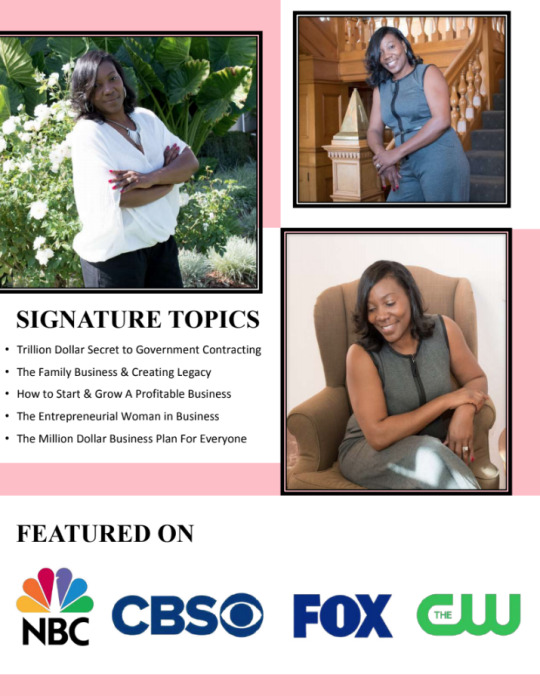

Meet Karwanna Dyson, CEO Of She’s Got Goals, LLC. Helping Women Learn About The TRILLION Dollar Secret...

She's Got Goals, LLC is a company built on empowering women & minority small business owners by teaching them how to grow their businesses with government contracts so they can have consistent sustainable income for their business future and beyond.

LEARN MORE ABOUT MS. KARWANNA & HER RESOURCES

Official Website:

https://www.QualifyForGovernmentContracts.com

https://www.shesgotgoals.com

Social Media:

Facebook.com/KarwannaDyson

Instagram.com/ShesGotGoals247

Youtube.com/KarwannaD

Contact # 1-888-694-6446

#government contracts#small business bosses#women in business#entrepreneurship#female entrepreneurs#top female black entrepreneurs#trillion dollar business#small business consulting#business secrets#mentorship#business education

3 notes

·

View notes

Photo

HOW TO MAKE YOUR OWN HAND SANITIZER

Homemade hand sanitizer is easy to make with just a few ingredients that you may already have in your kitchen. Use rubbing alcohol, aloe vera gel to make a simple gel sanitizer that can help protect your family from getting sick and from germs.

***This post contains affiliate links to products we love.

Before we begin, the number one thing you can do to help protect your family from germs is to wash your hands up to your elbows with warm soap and water. But if soap and water are not available the CDC recommends using an alcohol-based hand sanitizer that is at least 60% alcohol.

If you’re looking for a medical grade soap to keep your family protected we suggest purchasing DEFENSE. It keeps my hands from getting too dry and smells great. Highly recommend. I do wish I could find in our local stores, but Amazon seems to be the only place I can get it.

Feeling under the weather? My favorite ginger lemon tea will help both boost your immune system and make a cough feel better. You should also try some Apple Cider Vinegar by Braggs, it is like the cure for everything from your skin to within.

Not all homemade hand sanitizers are created equal. Here are a few tips that can help you make the best hand sanitizer for your family.

Use 90-99% rubbing alcohol– This is really important to make sure your hand sanitizer has a high enough concentration to kill most germs. Don’t use other types of alcohol (like methanol, butanol) as they can be toxic.

Use Aloe Vera Gel– Using aloe vera gel helps protect your skin so it doesn’t dry out too much.

INSTRUCTIONS

In a measuring cup measure your aloe vera gel and rubbing alcohol.

With a whisk or spoon, mix together the aloe vera and rubbing alcohol until combined.

Add a 3-4 drops of essential oil and mix well. This is an optional step.

Using the funnel, pour the hand sanitizer in your small container.

NOTES

Use alcohol that is either 90 or 99% to make an effective hand sanitizer.

Essential oils can be added for scent if you'd like but isn't needed.

1 note

·

View note

Photo

They say it’s love in the air when he buy you some flowers, they say he showing you support when he keep you showered, but the gifts aren’t necessary, I’d rather he invest. I’m a business woman baby, those coins can be flipped. I appreciate the flowers and all the nice things, but I’m focused on this empire and my generational needs. www.shesgotherown.com

1 note

·

View note

Photo

They’re making money. #Influencer Performing animals who star in print and TV ads, movies and TV shows, or critters making you money by being social media influencers (like these beauties below from Luxury Bulldogs), could also qualify for deductions since they are making their owners enough money to be taxable income. “If your dog is an Instagram star, that’s your business, that would be reported as self-employed income,” so the IRS would look at it as a business, and then look at what business expenses are associated.” So transporting your pet to shoots, feeding them, grooming, etc., can be deducted as business expenses. #Shesgotherownnetwork #Assets #Frenchbulldogs Check out Luxury Bulldogs On Facebook

0 notes

Video

They’re making money. #Influencer Performing animals who star in print and TV ads, movies and TV shows, or critters making you money by being social media influencers (like these beauties below from Luxury Bulldogs), could also qualify for deductions since they are making their owners enough money to be taxable income. “If your dog is an Instagram star, that’s your business, that would be reported as self-employed income,” so the IRS would look at it as a business, and then look at what business expenses are associated.” So transporting your pet to shoots, feeding them, grooming, etc., can be deducted as business expenses. #Shesgotherownnetwork #Assets #Frenchbulldogs Check out Luxury Bulldogs On Facebook

1 note

·

View note

Photo

Spending time on content that you don’t plan on advertising and marketing is a waste of time and money. Developing content is meant to help with closing your deals and creating more sales. Holding on to your content or waiting for the right time will never bring your business the income it needs to succeed. Learn how to use the content you have to generate more sales for your business by joining www.shesgotherown.com/enrollment

1 note

·

View note

Photo

It’s always good to go back and reevaluate your business plan, your goals and your dreams. Check the traction of your business and figure out where your business is really taking you. Identify your strengths, your challenges and your weaknesses. Learn from them and use that to help strengthen your business and skills. Business is constantly growing and evolving, no matter what industry you’re in. As the boss it’s up to you to stay on top of things and know where your business is taking you. RESOURCES FOR YOU: #NetworkandSupport www.shesgotherown.com #Credit Credit Solutions Network #Beauty Ethnicity Cosmetics

1 note

·

View note

Video

This was such a wonderful quick encounter. The salesperson made his way over to talk to me about his company WHILE I was talking to another company lol. I posted this because he showed me that no matter what the competition, you take your shot and INTRODUCE YOUR BUSINESS AND BRAND! Never wait around. Needless to say I have him as one of my new vendors for my company!! Wooohoo. Never be afraid to SPEAK UP! Shake a hand and meet a new friend. #shesgotherownnetwork . . . #whitelabelexpo #lasvegas #lasvegasboss #businesscoachforwomen #smallbusiness #thoughtsofarealwoman #thoughtsofaceo (at Las Vegas, Nevada) https://www.instagram.com/p/B9PTUPYA0t2/?igshid=11ys9jijp94hn

#shesgotherownnetwork#whitelabelexpo#lasvegas#lasvegasboss#businesscoachforwomen#smallbusiness#thoughtsofarealwoman#thoughtsofaceo

1 note

·

View note

Video

We are women focused on the development of micro and small business sustainability for women of color. Starting a business is already hard enough but being a woman of color and starting a business is even harder. We are focused and dedicated to helping provide a platform that allows women of color in business the opportunity to expand their brands build their empires and gain the leverage they need for sustainability in both business and life. She’s Got Her OWN Network is consumer focused and ready for change. ❤️🦈 #shesgotherownnetwork #businesscoachforwomen #marcyventurepartners #smallbusiness #memes #microbusiness #beatpoverty #findsolutions #businessfunding #startupfunding #funding #angelinvestor #angelinvestors #womeninspiringwomen #shesgotherownnetwork #ceomindset (at Bear's Best Golf Course) https://www.instagram.com/p/B9PQ03AgcTQ/?igshid=1o0yyq3ghz85g

#shesgotherownnetwork#businesscoachforwomen#marcyventurepartners#smallbusiness#memes#microbusiness#beatpoverty#findsolutions#businessfunding#startupfunding#funding#angelinvestor#angelinvestors#womeninspiringwomen#ceomindset

1 note

·

View note

Photo

Section 179 of the United States Internal Revenue Code (26 U.S.C. § 179), allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated. Soooo this means that this nice GWagon I’m sitting in can be written off as a small business expense. WOOOO HOOOOO!!🦈🙋🏽♀️ As the code states...vehicles can be new or used, and must be financed and placed in service (meaning used by the business). To qualify for Section 179 deduction, the asset must be: Tangible; Purchased, not leased, for use in your trade or business; ... Placed in service (purchased, acquired, or converted to business use) during the current tax year. Ask your small business CPA about tax code 179 if you use your vehicle for business transportation. Respectfully She’s Got Her OWN Network www.shesgotherown.com

1 note

·

View note

Photo

Section 179 of the United States Internal Revenue Code (26 U.S.C. § 179), allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated. Soooo this means that this nice GWagon I’m sitting in can be written off as a small business expense. WOOOO HOOOOO!!🦈🙋🏽♀️ As the code states...vehicles can be new or used, and must be financed and placed in service (meaning used by the business). To qualify for Section 179 deduction, the asset must be: Tangible; Purchased, not leased, for use in your trade or business; ... Placed in service (purchased, acquired, or converted to business use) during the current tax year. Ask your small business CPA about tax code 179 if you use your vehicle for business transportation. Respectfully She’s Got Her OWN Network www.shesgotherown.com

1 note

·

View note

Photo

How To Earn $3000 In Only 5 Days! An easy strategy that you can use to earn $3000 or more in 5 days. Earning income is about strategy, planning, and taking action. She’s Got Her OWN Network provides women with the resources, tools, and strategies to help them win in both business and life.

1 note

·

View note