Text

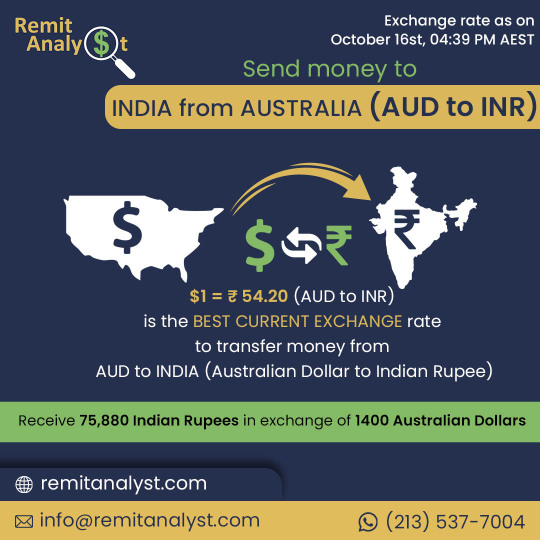

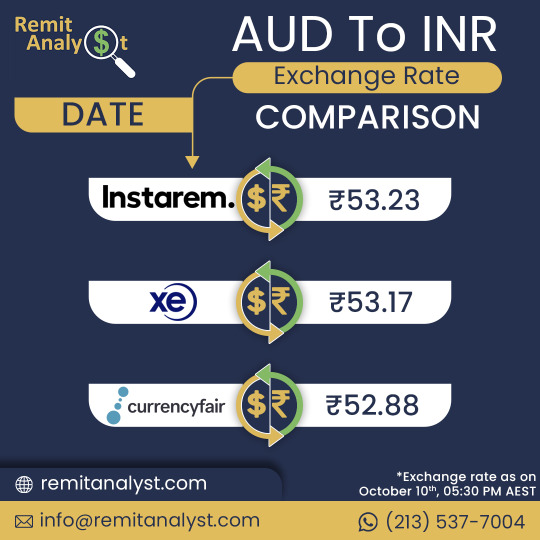

Exchange rate for transferring money from Australia (AUD) to India (INR)

RemitAnalyst:

RemitAnalyst is a platform or service that helps individuals compare various remittance options to find the most suitable and cost-effective way to send money from Australia to India. It provides insights, rates, fees, and features of different remittance providers, allowing you to make an informed decision.

Compare to Save More:

When transferring money from Australia to India, it's essential to compare different remittance options to ensure you get the best exchange rate and save on fees. Comparing rates and fees can help you maximize the amount of money your recipient receives in Indian Rupees (INR).

AUD to INR Exchange Rate:

The AUD to INR exchange rate refers to the current value of one Australian Dollar (AUD) in Indian Rupees (INR). This rate fluctuates based on various economic factors and market conditions. To get the most up-to-date exchange rate, you can check reliable financial news websites, banks, or currency converter apps.

Sending Money from Australia to India:

To send money from Australia to India, you can use various channels such as banks, money transfer operators (MTOs), online platforms, or wire transfers. Each option may have different exchange rates, fees, and processing times. It's advisable to compare these options to find the one that offers the best exchange rate and lowest fees.

To find the best current exchange rate for transferring money from Australia to India, consider comparing rates offered by different banks, remittance providers, and online platforms. Additionally, keep an eye on any promotions or special offers that may provide you with a better rate for your currency exchange.

#Remittance#MoneyTransfer#AUDtoINR#ExchangeRate#SendMoney#AustraliaToIndia#CurrencyExchange#RemitAnalyst#CompareRates#SaveOnFees

0 notes

Text

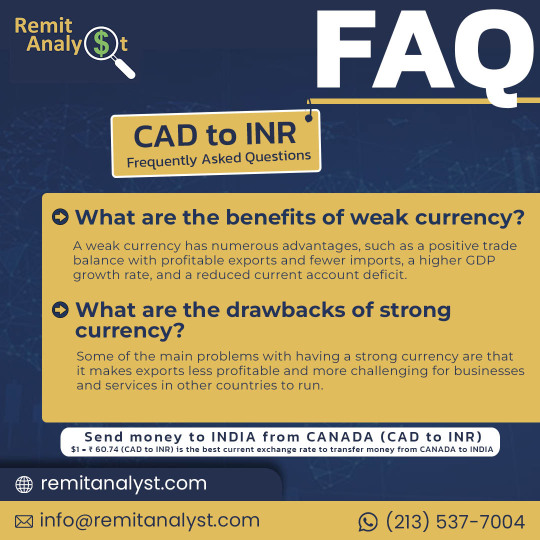

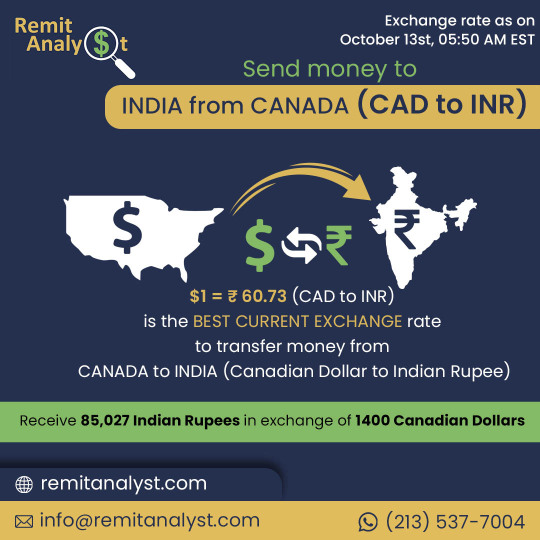

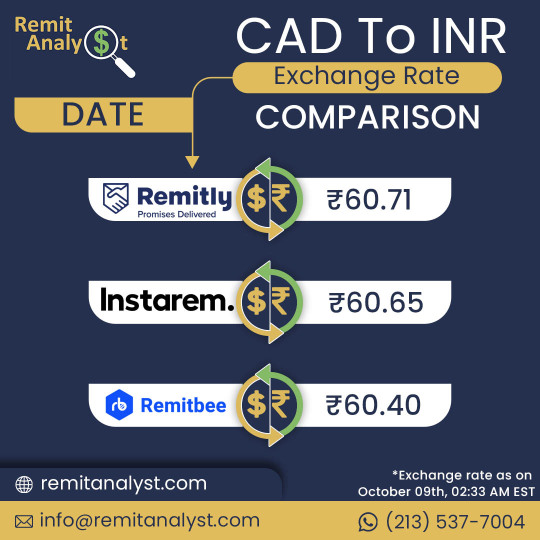

Unlocking the Best Exchange Rates: A Comprehensive Guide from CAD to INR

In today's interconnected world, the need to send money across borders has become increasingly common. For individuals in Canada looking to send funds to India, finding the best exchange rates is of paramount importance. In this comprehensive guide, we will delve into understanding the dynamics of CAD to INR conversions, identifying the optimal exchange rates, and providing insightful forecasts for better financial decisions.

Understanding the Basics: CAD to INR Exchange

Before diving into the complexities, let's get a grasp of the basics. CAD refers to the Canadian Dollar, the official currency of Canada, while INR represents the Indian Rupee, the legal tender in India. The exchange rate between CAD and INR determines how much one currency is worth in terms of the other.

Seeking the Best Exchange Rates

Sending money from Canada to India involves currency conversion, and the exchange rate plays a crucial role in determining the value of the transferred funds. To ensure you get the best deal, consider the following factors:

Market Trends:

Regularly monitor the market trends for CAD to INR conversions. Staying informed about the prevailing rates will enable you to make an informed decision on the optimal time to transfer money.

Exchange Platforms:

Leverage the services of reliable online exchange platforms. These platforms often provide competitive exchange rates and minimal fees, resulting in more money reaching your intended recipient in India.

Compare and Contrast:

Exercise due diligence by comparing the exchange rates offered by various financial institutions and platforms. Comparing the rates will empower you to choose the most favorable one.

Timely Transactions:

Timing is critical. Conduct your transactions during the weekdays as weekends or public holidays may have slightly unfavorable exchange rates due to lower market activity.

Forecasting CAD to INR Exchange Rate

Predicting the future exchange rate accurately is complex, but experts utilize various methods to forecast. While forecasts are speculative, they can guide your decisions. Keep an eye on financial news, economic indicators, and expert analyses for a well-rounded perspective.

Conclusion

Sending money from Canada to India at the best exchange rates involves careful consideration and staying informed about market dynamics. Utilize online platforms, compare rates, and be strategic in your timing to ensure your funds reach India with maximum value. Stay informed, choose wisely, and make the most of your international transactions from CAD to INR.

#CADtoINR#CurrencyExchange#SendMoneyToIndia#ExchangeRate#FinancialTips#InternationalTransactions#MoneyTransfer#Forex#RemitAnalyst#FinancialInsights

0 notes

Text

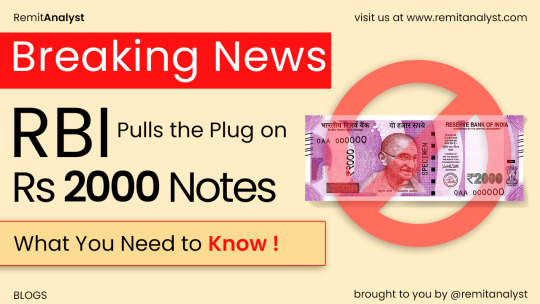

Breaking News: RBI Pulls the Plug on Rs 2000 Notes - What You Need to Know!

Key Points:

RBI decided to cancel Rs 2000 denomination notes on May 19, 2023, prompting speculation regarding motives and consequences.

Possible reasons: discourage hoarding, curb black money, and counter counterfeit currency.

Individuals can deposit Rs 2000 notes in their bank accounts until September 30, 2023.

Impact: cash-dependent sectors affected, potential for temporary cash shortages and public inconvenience.

Opportunity: may boost digital transactions and align with the government's less-cash economy vision.

Vital aspects for smooth transition: effective communication, digital infrastructure support, and streamlined cash exchange procedures.

In a surprising move, the Reserve Bank of India (RBI) has recently announced the cancellation of the Rs 2000 denomination notes. On May 19, 2023, the chief general manager of RBI, Yogesh Dayal released a press statement on the cancellation and withdrawal of Rs 2000 notes. This decision has sparked widespread speculation and debate regarding the motives behind it, its impact on the economy, and its implications for the general public. In this comprehensive blog, we will delve into the details of RBI's decision, explore the potential reasons behind it, and examine the possible consequences for various stakeholders.

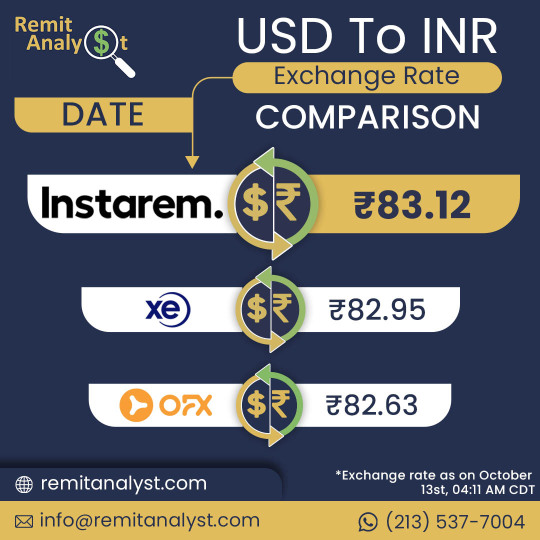

Are you looking to make the most out of your USD to INR transactions? Look no further! RemitAnalyst is here to help you compare and save on USD to INR exchange rates, ensuring you get the best value for your money.

Compare to Save More: Make Informed Choices

Make smarter financial decisions by comparing exchange rates for USD to INR with RemitAnalyst. Our easy-to-use platform empowers you to find the most favorable rates and save on every transfer.

Unlock the Best USD to INR Exchange Rates

Don't settle for less when you can get more! Discover competitive USD to INR exchange rates with RemitAnalyst and optimize your currency transfers. Start saving today and get the most out of your hard-earned money. Visit our website now!

#Demonetization#Blackmoney#Counterfeitcurrency#Digitaltransactions#Rs2000Notes#ReserveBankofIndia#remitanalyst

0 notes

Text

Sending money from Canada to India is now easier than ever, thanks to various options available to remit funds. If you're looking for cost-effective and efficient ways to transfer money in October 2023, this guide will provide you with the best options.

CAD to INR Conversion

One of the fundamental steps in sending money to India is converting Canadian dollars to Indian Rupees (CAD to INR). Ensure you check the current exchange rates to get the most value out of your Canadian dollars.

Wire Transfer from Canada to India

Sending money through a wire transfer is a reliable and secure method. It allows for a direct transfer of funds from your Canadian bank account to the recipient's bank account in India. This method is known for its efficiency and safety.

RemitAnalyst for Hassle-Free Transactions

Consider using RemitAnalyst, a trusted platform for sending money from Canada to India. They offer competitive rates and ensure a smooth transaction process, making it one of the best options available.

Lowest Cost Transfers

If cost-effectiveness is a priority, explore options that provide the lowest transfer fees and favorable exchange rates. Compare various providers to find the most economical solution for transferring money to India.

Best Options for Sending Money

Research and identify the best options available for sending money to India from Canada. Look for reputable financial institutions or online platforms that offer competitive rates, low fees, and a convenient transfer process.

In conclusion, when it comes to sending money from Canada to India, it's essential to choose the most suitable option that aligns with your preferences and requirements. Whether you prioritize low costs, efficient transfers, or reputable platforms, the key is to research and select the best method for your specific needs. Stay updated on the latest exchange rates and make an informed decision to ensure a seamless money transfer experience.❤️❤️❤️

#MoneyTransfer#Remittance#SendMoney#CADtoINR#WireTransfer#RemitAnalyst#CurrencyExchange#FinancialTransfers#CostEffectiveRemittance

0 notes

Text

RemitAnalyst: Your Gateway to Lowest Cost USD to INR Money Transfers!

Looking for the best options to send money from the United States to India? RemitAnalyst has got you covered! Discover the lowest cost money transfer services, compare live USD to INR exchange rates, and find the ideal way to convert your dollars to Indian rupees. Simplify your international transactions and send money effortlessly to India with RemitAnalyst.

Are you looking for the best options to send money from the United States to India at the lowest cost with the best exchange rates? Look no further than RemitAnalyst!

💰 Transfer Money - Lowest Cost in INDIA 🌏

At RemitAnalyst, we pride ourselves on offering the lowest cost for transferring money to India. We understand that every penny counts, and that's why we provide you with the most cost-effective solutions for your money transfer needs.

💱 Convert USD to INR with Ease 📈

With RemitAnalyst, converting your US Dollars to Indian Rupees has never been easier. Our user-friendly platform ensures a hassle-free experience, so you can get your funds to your loved ones in India without any complications.

🇺🇸 Money Transfer to India from the US 🇮🇳

Sending money to India from the United States has never been more convenient. RemitAnalyst offers a seamless and secure way to transfer your funds, ensuring that your money reaches its destination promptly and safely.

📊 Best USD to INR Exchange Rates Compared Live 💹

We know how important exchange rates are when it comes to international money transfers. At RemitAnalyst, we compare live exchange rates to ensure that you get the best deal. Our transparent approach helps you make informed decisions.

Choose RemitAnalyst for the most efficient, cost-effective, and reliable money transfer services from the United States to India. Join our community of satisfied customers who trust us for their financial needs.

#RemitAnalyst#USDtoINR#MoneyTransfer#LowestCost#ConvertUSDtoINR#SendMoneytoIndia#BestExchangeRates#MoneyRemittance

0 notes

Text

Effortless Money Transfers: Convert CAD to INR at the Best Rates!

Explore the best options to convert Canadian Dollar (CAD) to Indian Rupee (INR) and send money conveniently from Canada to India. Find the lowest cost for money transfers and get the best exchange rates to make your transactions seamless.

Looking for a hassle-free way to convert Canadian Dollar (CAD) to Indian Rupee (INR) and send money to your loved ones in India? RemitAnalyst has you covered! We offer a quick and efficient platform for transferring money from Canada to India, ensuring you get the best current exchange rate and the lowest transfer costs.

At RemitAnalyst, we understand the importance of finding the right exchange rate when transferring money internationally. We strive to provide you with the most competitive CAD to INR exchange rates, making it cost-effective to send money to India from Canada.

Our platform allows you to transfer money from Canada to India seamlessly through wire transfers. Whether you're residing in Canada or the USA, you can use our online service to send money to India with ease. Trust us to deliver a secure and reliable money transfer experience.

Key Features:

Best Exchange Rates: Discover the best current exchange rates to transfer money from Canada to India.

Lowest Transfer Costs: Save on transfer fees and get the most value out of your money when sending funds to India.

Secure Transactions: Rest assured that your money transfers are safe and secure through our trusted platform.

Convenient Online Process: Easily send money to India from the comfort of your home or office using our user-friendly online portal.

Swift Wire Transfers: Experience quick and efficient wire transfers for timely delivery of funds to your recipients in India.

Make your money transfers from Canada to India a breeze with RemitAnalyst. Join us today and enjoy a seamless process, unbeatable exchange rates, and low transfer costs!

#CADtoINR#CurrencyExchange#MoneyTransfer#RemitAnalyst#SendMoneyToIndia#BestExchangeRate#CanadaToIndia#WireTransfer#LowestTransferCosts#OnlineMoneyTransfer

0 notes

Text

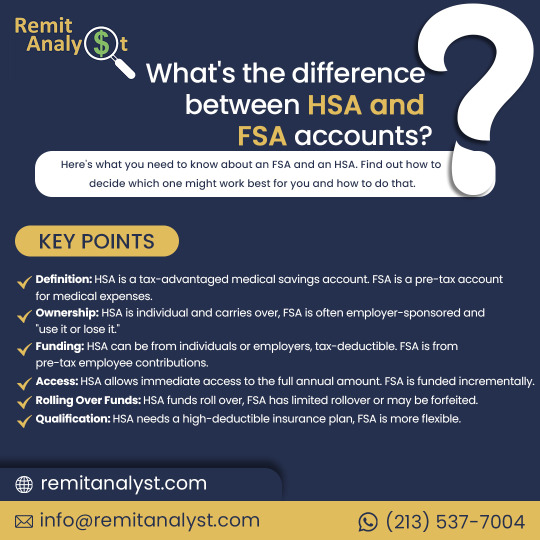

What's the difference between HSA and FSA accounts?

HSA (Health Savings Account) and FSA (Flexible Spending Account). Let's break down the differences between these options and help you make informed choices!

Health Savings Account (HSA)

🔹 Imagine it like a healthcare piggy bank - money goes in tax-free!

🔹 You control it, and it stays with you, even if you change jobs or health plans.

🔹 Contributions are tax-deductible, which is like giving yourself a little financial boost.

🔹 The funds in your HSA can grow over time, providing a nest egg for future medical expenses.

🔹 You need a high-deductible health plan (HDHP) to be eligible for an HSA.

Flexible Spending Account (FSA)

🔸 Think of it as a yearly budget for medical expenses - you plan ahead.

🔸 Funded by pre-tax dollars from your paycheck, reducing your taxable income.

🔸 Use it or lose it - generally, you need to spend the funds within the plan year or a grace period.

🔸 Great for predictable, planned medical expenses like copayments, deductibles, or prescriptions.

🔸 Typically, your employer offers FSA options as part of your benefits package.

difference between HSA and FSA accounts depends on your health needs and financial situation. If you anticipate high medical expenses, an HSA could be a great long-term savings tool. If you have predictable costs and want to save on taxes, an FSA might be your best bet!

Remember, it's your healthcare and your money - understanding these options can put you in the driver's seat. Choose wisely and stay financially healthy! 💪🏥

Discover the Best Rates! Send money to India hassle-free from the USA with RemitAnalyst. Get the top exchange rates and seamless online money transfers.

Convert USD to INR effortlessly. Start saving on every transfer now!

#HealthcareSavings#FinancialWellness#HSAExplained#FSAInsights#MoneyMatters#MedicalExpenses#BudgetingTips#HealthcareEducation#SaveSmart#EmpowerYourWallet#HSA#FSA#HealthcareFinance101

0 notes

Text

🇬🇧✨ Ready to explore the UK like a local? 🚗💨 Discover essential apps tailored for UK immigrants:

📊 RemitAnalyst: Compare top remittance providers hassle-free for the best money transfer rates.

🚇 Station Master: Dive into London's underground with fun facts and insider insights.

🔑 Virtuo: Unlock the freedom to explore with easy mobile car rentals.

🚖 Citymapper: Navigate London seamlessly and find the best transportation options.

🚲 Santander Cycles: Explore the city on two wheels with smart bike borrowing features.

☕ Best Coffee Guide: For coffee enthusiasts, uncover the finest independent cafes.

🍽️ Qkr!: Simplify group dining and split bills effortlessly at 1000+ restaurants. 💳

Engage with your new adventures! Which app caught your eye? Comment below! 👇

Read More : https://remitanalyst.com/blogs/57-seven-must-have-apps-and-online-tools-for-immigrants-in-uk/

#UKTravel#Immigrants#ExploreLondon#MobileApps#TravelSmart#CityExploration#TechForLife#LondonTransport#DiscoverUK

0 notes

Text

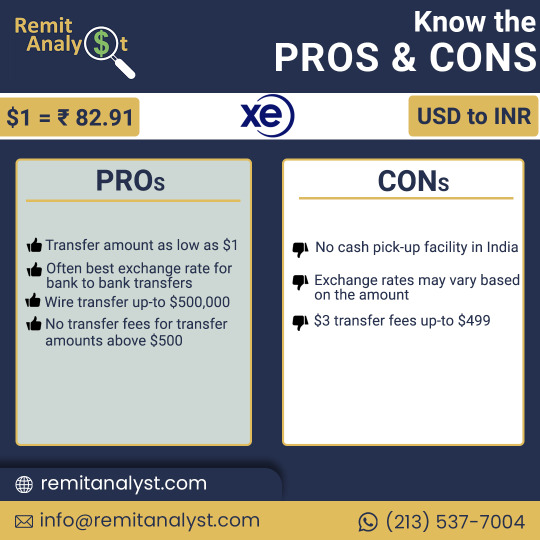

Are you looking to send money from the USA to India and searching for the best exchange rates? Look no further! RemitAnalyst is here to help you find the most competitive USD to INR rates in the market, ensuring that you save more with every transfer.

Why Choose RemitAnalyst?

RemitAnalyst is committed to providing you with a seamless and reliable remittance experience. Our goal is to empower you to make informed decisions when sending money to India, maximizing the value of your transfers.

Trusted Worldwide Service Provider:

RemitAnalyst collaborates with XE Money, a renowned and trustworthy remittance service provider with a global footprint. Trust and reliability are at the core of our services.

Best USD to INR Exchange Rates:

We understand the importance of getting the best value for your money. Our platform allows you to compare USD to INR exchange rates from various providers to ensure you secure the most favorable rate available.

Save More with Every Transfer:

Comparing exchange rates through RemitAnalyst allows you to identify the best current rates for transferring money from the USA to India. Saving on exchange rates means more funds reaching your loved ones back home

How to Get Started:

Visit RemitAnalyst:

Navigate to our user-friendly website at www.remitanalyst.com .

Select Your Transfer Details:

Input the amount you wish to send and choose the currency pair (USD to INR).

Compare Rates:

View and compare the current exchange rates offered by various service providers to find the best deal.

Choose Your Provider:

Select the remittance service provider offering the most attractive rates and services for your transfer.

Initiate the Transfer:

Follow the steps to initiate your transfer securely and conveniently.

RemitAnalyst is here to simplify your remittance process and help you save more on your USD to INR transfers. Compare rates, choose wisely, and send money to your loved ones in India with confidence and savings.

Disclaimer: Exchange rates may vary and are subject to change. Please refer to the respective remittance service provider for the most up-to-date rates.

#RemitAnalyst#USDtoINR#MoneyTransfer#Remittance#XEMoney#SendMoneyToIndia#ExchangeRates#SaveMore#CurrencyExchange#InternationalTransfers

0 notes

Text

If you're looking to send money from Australia to India, look no further than RemitAnalyst! We're here to help you compare and find the best current exchange rates to transfer your Australian Dollars (AUD) to Indian Rupees (INR).

Whether you're a frequent remitter or sending funds for personal reasons, it's crucial to stay updated on the AUD to INR exchange rate. At RemitAnalyst, we make it easy for you to track the latest exchange rates and convert your Australian Dollar to Indian Rupee swiftly and efficiently.

Our platform offers a reliable AUD to INR exchange rate and a convenient currency converter tool to ensure you're getting the most value for your money. We understand that every cent counts, and finding the best rate can make a significant difference in your savings.

Stay informed about the Australian Dollar buying rate today in India and make well-informed decisions when transferring your funds. Trust RemitAnalyst to provide you with today's best Australian Dollar to Indian Rupees exchange rate, giving you the most bang for your buck!

Compare to save more with RemitAnalyst - your trusted partner for AUD to INR transfers.

#RemitAnalyst#Compare#Save#Money transfer#India#Australia#Exchange rate#AUD to INR#Australian Dollar#Indian Rupee#Currency converter

0 notes

Text

Looking for the best way to send money to India from the USA (USD to INR)? Look no further than RemitAnalyst! We understand the importance of a quick and hassle-free money transfer experience, especially when it comes to sending funds to your loved ones in India.

At RemitAnalyst, we pride ourselves on providing a seamless and efficient platform for sending money to India. We know that finding the best current exchange rate is crucial to ensuring your funds reach their destination with maximum value. With our user-friendly interface, you can easily compare exchange rates and choose the one that works best for you.

Sending money to India has never been this easy. Our website, https://remitanalyst.com, is designed to be simple and straightforward, allowing you to initiate a transfer within just a few clicks. Whether it's for family support, education, investments, or any other purpose, we've got you covered.

Why choose RemitAnalyst for your money transfer needs?

Swift and Easy Process: Our platform offers a quick and straightforward process for sending money to India, ensuring your funds reach their destination in no time.

Best Exchange Rates: We help you find the best current exchange rates so that you can maximize the value of your transfer and save on unnecessary fees.

Transparent Fees: With RemitAnalyst, you'll always know what fees you're paying upfront. We believe in transparency and honesty in all our transactions.

Secure and Reliable: Your security is our priority. Rest assured that your money transfer is safe and secure with RemitAnalyst.

24/7 Customer Support: Have a question or need assistance? Our dedicated customer support team is available 24/7 to assist you.

Sending money to India from the USA is now simpler than ever with RemitAnalyst. Join our satisfied customers and experience a hassle-free money transfer service.

Visit our website now at https://remitanalyst.com/send-money-to-india-usd-to-inr/ to start your money transfer journey!

#RemitAnalyst#SendMoneyToIndia#MoneyTransfer#USDtoINR#ExchangeRate#MoneyTransferService#IndiaMoneyTransfer#SecureTransfer#QuickTransfer#InternationalMoneyTransfer

0 notes

Text

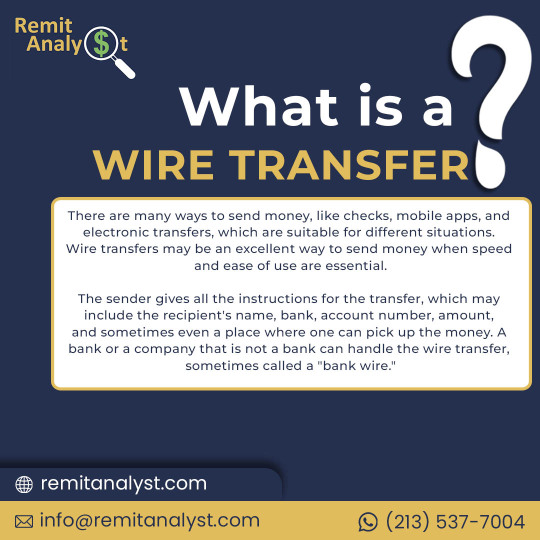

What is a Wire Transfer?

Sending money has evolved significantly with the advent of technology, offering a variety of methods such as checks, mobile apps, and electronic transfers. However, when speed and ease of use are paramount, wire transfers emerge as a top choice. This article delves into the world of wire transfers, shedding light on when to use them, where they can be sent, and how to efficiently send money through various methods.

What is a Wire Transfer?

A wire transfer is an electronic method of transferring money from one person or business to another. Unlike cash transactions, no physical currency is exchanged. The sender provides instructions, including recipient details, amount, and sometimes pickup location. Both banks and non-bank entities can facilitate wire transfers, often referred to as "bank wires."

1.1 When to Use Wire Transfers:

Wire transfers are ideal in situations where immediate money transfer is necessary. They are commonly utilized for both domestic and international transfers, particularly for larger sums of money, making them ideal for bill payments, family support, or real estate transactions.

1.2 Where Can Wire Transfers Be Sent:

Wire transfers can be sent domestically within a country or internationally to recipients in other countries. The fees associated with wire transfers vary based on the service provider, destination, and the amount of money being transferred.

1.3 Security Measures:

In terms of security, wire transfers through banks or authorized non-bank providers offer similar levels of security, ensuring the safe transfer of funds.

Sending Wire Transfers Internationally: Methods and Procedures

Sending a wire transfer internationally can be done through multiple methods, including using online banking services, visiting a bank branch in person, making a phone call to the bank, or utilizing specialized money transfer services.

#WireTransfers#MoneyTransfers#ElectronicPayments#SecureTransfers#InternationalMoneyTransfer#DomesticTransfers#Banking#FinancialServices#CurrencyExchange#TransferFees#OnlineBanking#FinancialSecurity#PaymentMethods#TransferProcess#FundsTransfer

0 notes

Text

Are you looking for a seamless and cost-effective way to send money from Canada to India? RemitAnalyst has got you covered! We understand the importance of finding the best current exchange rates and ensuring a swift and secure transfer process.

Send Money to India Online

With RemitAnalyst, sending money to India is as easy as a few clicks. Our online platform provides a user-friendly experience that allows you to initiate transfers from the comfort of your home. Say goodbye to long queues and complicated processes—sending money to India has never been more convenient!

Best Current Exchange Rate to Transfer Money

We strive to offer you the most competitive exchange rates available, ensuring that you get the most value out of your transfer. At RemitAnalyst, we constantly monitor the market to provide you with the best rates, saving you money on every transaction.

Send Money to India Fast at Competitive Rates

Need to transfer funds urgently? Rest assured, our platform prioritizes speed and efficiency. When you send money through RemitAnalyst, you can expect a fast and secure transfer without compromising on competitive rates. Your loved ones in India will receive the funds promptly and hassle-free.

Cheapest Way to Transfer Money from India to Canada

We understand the importance of keeping transaction costs low. RemitAnalyst offers one of the most affordable options for transferring money from India to Canada. Our transparent fee structure ensures that you get the most value for your money, making us the cheapest and most reliable choice for your international transfers.

Experience a seamless and cost-effective way to send money from Canada to India with RemitAnalyst. Join our satisfied customers who trust us for their international money transfer needs. Try us today and enjoy a hassle-free money transfer experience!

#RemitAnalyst#MoneyTransfer#CanadaToIndia#SendMoneyOnline#BestExchangeRate#FastTransfer#CostEffective#HassleFree#Remittance#InternationalMoneyTransfer#Finance#Savings#CurrencyExchange

0 notes

Text

Is Your Money at Risk? Safeguard Your Global Finances with Secure Online International Money Transfers

Sending money internationally online is a convenient and efficient way to transfer funds, but it's essential to ensure that the process is safe and secure. This guide will give you a full rundown of the safety and security measures for sending money online and tips for keeping yourself safe from fraud. We will also include some facts and data better to understand the current state of online money transfers.

What are The Security Measures for Money Transfers?

First, let's talk about the security measures for online money transfers. Most banks and money transfer companies use encryption technology to protect their customers' personal and financial information. This technology ensures that the data is scrambled and can only be decrypted by authorized parties. A study by the Aite Group, a financial services research and advisory firm, found that 80% of consumers think encryption is the most crucial online transaction security feature. Additionally, many of these institutions also use multi-factor authentication, which requires customers to provide multiple forms of identification before they can access their accounts.

Another essential safety measure is using secure servers to store customer information. Many banks and money transfer companies use servers located in safe, off-site locations and protected by firewalls and other security measures. This ensures that customer information is protected from unauthorized access or hacking attempts. A study by the Ponemon Institute, a research firm focusing on data protection, found that a data breach costs a company an average of $3.86 million. This shows how important it is to keep customer information safe.

#OnlineMoneyTransfers#InternationalTransfers#MoneyTransferSafetyMeasures#CybersecurityTips#SecureTransactions#FraudPrevention#PaymentSecurity

0 notes

Text

Looking for the best current exchange rates to transfer money from the United Kingdom to India? Explore your options with RemitAnalyst and find the most efficient and cost-effective ways to send money to India from the UK (GBP to INR).

If you're looking to send money from the United Kingdom to India, finding the best exchange rate is crucial to ensure you get the most value for your transfer. At RemitAnalyst, we specialize in comparing various remittance options to help you save more on your money transfers.

Finding the Best Exchange Rates

When sending money to India, it's essential to compare the current exchange rates offered by different remittance services. Exchange rates can vary, and even a small difference can have a significant impact on the amount your recipient receives. RemitAnalyst helps you easily compare these rates to make an informed decision.

Money Transfer Options

RemitAnalyst provides an array of money transfer options tailored to your needs. From traditional bank transfers to specialized online platforms, we've got you covered. Explore these options and choose the one that suits your preferences in terms of speed, fees, and exchange rates.

Sending Money to India Made Easy

Our platform simplifies the process of sending money to India from the UK. With just a few clicks, you can find the best ways to transfer money, ensuring a smooth and hassle-free transaction. Rest assured, your money will reach your loved ones securely and promptly.

Remittance Services at a Glance

We present an overview of various remittance services that facilitate sending money from the UK to India. Compare their features, fees, and rates to identify the most suitable service for your specific requirements. Make an informed choice and optimize your funds sent to India.

In conclusion, at RemitAnalyst, we emphasize the importance of comparing your options when it comes to sending money from the United Kingdom to India. By doing so, you can secure the best exchange rates and save more on your transfers. Explore our platform to find the ideal way to send money to India and stay informed about the latest remittance trends and offers. Compare to save and make your money transfer experience seamless and cost-effective.

#RemitAnalyst#MoneyTransfer#SendMoney#UKtoIndia#ExchangeRates#RemittanceServices#SavingOnTransfers#BestRates#MoneyTransferIndia#CurrencyExchange#RemitUK#SendMoneyAbroad#ComparingTransfers#FinancialSavings#InternationalRemittance

0 notes

Text

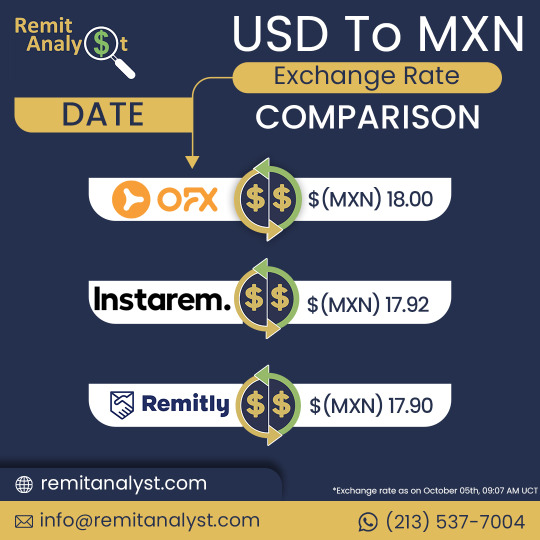

Sending Money to Mexico from the USA? Discover the Best Options with RemitAnalyst

If you're in the USA and need to send money to Mexico, you've come to the right place! RemitAnalyst is here to help you navigate the various options available and ensure you get the best value for your transfer.

💸 Best Exchange Rate: Currently, the exchange rate is $1 = $19.29 MXN (USD to MXN), making it an optimal time to transfer your funds.

🇲🇽 Send Money Securely: There are several reliable ways to send money to Mexico from the US, including bank transfers, money transfer services like Western Union or MoneyGram, online payment platforms like PayPal or TransferWise (Wise), and even cryptocurrency transfers through platforms like Coinbase or Bitso.

🔍 Compare and Choose Wisely: It's important to compare the fees, exchange rates, processing times, and convenience of different methods before making a decision. RemitAnalyst can assist you in making an informed choice that aligns with your needs.

🌐 Sending Money Online: Sending money online has never been easier! Explore secure online platforms that offer a seamless experience to send funds to Mexico.

Feel free to share your experiences or ask any questions about sending money to Mexico. Let's help each other make the best decisions when it comes to international money transfers! 💰✨

0 notes

Text

RemitAnalyst: Secure Money Transfers from Australia to India at Best Exchange Rates

Are you looking to transfer money from Australia to India? Look no further than RemitAnalyst, your trusted platform for secure and efficient money transfers. With our expertise, we ensure you get the best exchange rates for your AUD to INR transactions.

Exchange Rate Update:

As of the latest update, the best current exchange rate for transferring money from Australia to India is $1 = ₹54.20 (AUD to INR). This competitive rate allows you to maximize the value of your transfer and ensures that your recipient in India receives more rupees for every Australian dollar you send.

Why Choose RemitAnalyst for Money Transfers to India?

Competitive Exchange Rates: We constantly monitor the market to offer you the most favorable exchange rates, allowing you to save on transfer fees and get more value for your money.

Secure and Reliable: Your financial security is our top priority. Rest assured, our platform employs state-of-the-art security measures to safeguard your transactions and personal information.

Transparent Transactions: We believe in complete transparency. You will always know the exchange rate and any applicable fees before confirming your transfer, ensuring no hidden surprises.

Effortless Process: Our user-friendly platform makes the money transfer process simple and quick. You can initiate your transaction in just a few easy steps.

Customer Support: Our dedicated customer support team is available to assist you at every stage of the transfer, addressing any queries or concerns you may have.

Make the smart choice and choose RemitAnalyst for seamless and cost-effective money transfers from Australia to India. Send money worry-free, knowing that you are getting the best exchange rate in the market. Start your transaction today and provide financial support to your loved ones in India hassle-free.

0 notes