Text

Don't use Google Translate. It can fool you! (HPSC0092 Blog2)

Google Translate (GT), which was launched in April 2006, has arguably become one of the best resources for easy translation. It is a lifesaver in a lot of circumstances, such as when you are travelling and have no clue what the local restaurant menu is about, or when you are trying your best to communicate with someone from across the ocean. GT can be really fast——way more efficient than human beings and it costs much less. Because of the convenience, the number of its users has rapidly grown from hundreds in 2006 to more than 500 million in ten years.

Apart from the webpage, GT is also available on smartphones and continuing to develop services on various platforms. Statistical machine translation (SMT) is the foundation of its translating system, which based on statistical models whose frameworks rely on analysing the bilingual text corpus. Instead of having a database with all words in over 100 languages, GT finds as much the most similar content in the two targeting languages as possible and then retrieves the database to find the parallel text in these languages.

Looks high-tech, helpful and reliable, right? But have you ever been concerned about how good it actually is? Is GT able to compete with human translators and interpreters? Or more about the essence, can such a mechanical translation always be allowed to play a significant role in language use?

1. GT for academic use

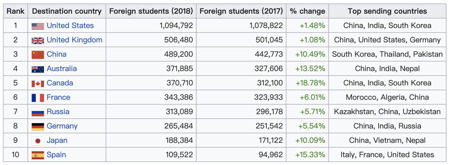

Globalisation makes the higher education market boom and promotes academic mobility. An increasing number of individual students are crossing borders and studying in a foreign country. As it is shown in the graph, the two countries that have the most enrolled foreign students are the UK and the US, and English speaking countries are the most popular.

The de facto official language used in both the UK and the US is English and English is also the largest language, considering native speakers and people who learn it as the second language. GT is also English based, which uses English as a hub to find parallel text. This explains the reason why even though most of the international students-favoured universities forbidden students from using GT, over 65% of them still use it more than often.

For a foreign student, who is not proficient in the instructing language, language can be an obstruction of academic achievement. With all those study materials, students may choose to translate them into a more understandable language. Nevertheless, translation work is expensive to be done by a competent translator and it takes up time if they want to complete it by themselves. Therefore, GT becomes a fairly good choice. Research suggests that machine translation can actually help beginners study better, especially for language learning and academic writing in English. Search engines, online dictionaries, grammar checkers and machine translation are ubiquitous nowadays and they can be the best tools for academic writing.

But the tutors and instructors may not agree. There are comments consistently denying the practicality of machinery translation: they don’t want to teach by having a machine writes assignments for their students. Considering the accuracy of the terms used in coursework, students are aware of most of the mistakes made by GT and will correct them after using it, according to the research done in 2017. Moreover, the purpose of teaching is to help students achieve different outcomes with intelligent and informed decisions, which does not necessarily need to exclude machine translation in case the students can achieve the same result.

2. Information Security

Be careful with what you are typing in——what if your confidential document will be collected in the database and even published online? Most companies and institutions choose experienced translators for important documents. In response to the fact that some online translation systems will store the data in the cloud, companies may block access to GT. The documents put through the Google algorithm may face the risk of being scanned and read without notice. However, it is claimed that the privacy and security protection is trust-worthy and there’s no definite evidence to prove that GT is secretly reading everything.

3. Accuracy

In December 2018, the Wrexham council was called out by Welsh language campaigners for using Google Translate to translate road signs into Welsh. Those inaccurate signs failed to comply with the required language standard.

The issue was described as ‘frustrating’ and the Welsh Language Commissioner received more than a dozen complaints about it. One of the councillors argued that it is understandable for the internal staff to use Google Translate for a quick translation, but the public tends to claim for a more standard form of the language.

Instead of understanding the meaning of a word, GT is familiar with the data and the algorithm. The research and development team of it aims at ultra rapidly processing the text, rather than learning any language. Principally, a computer program can be designed to memorise, to understand and to experience, however, that’s not the case with GT. The approach has been changed since 2016, from phrase-based to Neural Machine Translation (NMT). By taking the whole text into account, the quality of GT has been significantly improved and comparing the old approach, the accuracy has increased more than 60%.

It is true that GT may not be accurate in a lot of circumstances, especially for relatively unpopular language, but no one really uses GT by converting the text into multiple languages and then back to English. Moreover, you can report any translation error to their community so that GT can do better next time. When it comes to a foreign country and a completely different language, it may make a great difference if the sentences can be translated properly. By approving, analysing and confirming the translation results, GT can make progress on a daily basis.

4. The Further Development

Google just cannot stop. With a Google Pixel phone and a GT app on it, the paired Pixel Buds can actually be your interpreter. You can get a translator simply by tapping the right earbud and then it will send your spoken message to the phone, automatically type it out in the app and read the translated text aloud for you.

However, from a video uploaded by Mashable Deals, which has the Pixel Buds compete with two real interpreters, it is clear that GT performs much worse. Not only that GT is not as fast, but the interpreters also point out that there are meaning errors. The experience of using the Pixel Buds is so far fine but not really satisfying but it is very possible for people to have real-time translation with a pair of wireless headphones in our ears in the future——although that might not make it less awkward when communicating with someone who speaks a different language, GT definitely offers help.

youtube

Conclusion

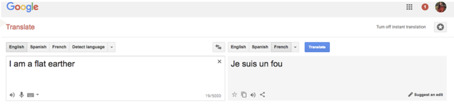

GT can even be savage and interesting with some easter eggs.

This was claimed to be an error caused by the learning pattern: GT learns from millions of translation examples, and the patterns can lead to mistakes. But the issue is interesting in the way reflecting how people react or think about such unconventional paradox.

GT is trying hard, to be more accurate, more efficient and even more amusing. Nevertheless, you may have been told several times to be careful with it——or one day it may control the way we speaking and writing. But believe it or not, as far as I personally have no belief in machine translation, I do sometimes use GT to double-check my writing. Google Translate is doing really well and will hopefully perform even better in the near future——it definitely can fool you, more obviously in the past, but now I can’t really tell. It really helps and can do a lot.

0 notes

Text

Is cybercrime on third-party payment platforms out of control?(HPSC0092 Blog1)

In the digital age, electronic finance has always been a hot topic, as it is closely related to our daily life. The online banking system can provide easier access for banking activities, such as money transfer, online payment and retrieval of the transaction history. Thereafter, seeking to even more convenience, third-party payment platforms become the trend. Online and mobile payments start to rely more on those platforms.

In the process of actual action, the crime of telecommunications fraud involves both virtual and real aspects, which is particularly relevant to swindling of online transactions. Merely by signing up with a third-party processor, the business owner can start the online payment processing immediately, which is efficient and easy. But the online bargaining process is lack of protection against fraudulent transactions. In particular e-commercial relationship with customers, the reputation, credit and fraud risks of third-party payment platforms may be exposed more than usual.

1. The risk control system

Speaking of the largest third-party online payment vendor all around the world, Alipay, which was established in 2004 by the Alibaba Group in China, is now still facing the prevalent problem of scam.

On 21/08/2018, the technical team of Alipay upgraded the function of delayed payment, in order to recover false funds transfers. It is claimed that together with the newest monitoring system, the risk of online payment has been minimized. However, is this improvement actually able to solve the problem of risky online transactions?

The third-party platform provides direct interactions between the buyer and the seller, and also allows immediate transactions. Considering the virtual part,one of the most significant issues is that by communicating through such a platform, obtaining rights of information becomes easier. There are two aspects of information security to concern for a platform like this: risk management through the all-encompassing term ‘big data’ and the users’ operability. Big data itself has no fixed size, it is dynamic and unstructured. Third-party payment platforms have their own set of technologies and techniques to capture, collect, analyse and process users’ information so that they are able to manage fraud risk relying on big data.

Various technical teams of all different platforms are making efforts to promote the accuracy of their big data-based risk control systems. AlphaRisk, which is the fifth generation of risk control system developed by the Alipay group, is able to automatically remind the payer to use the delayed payment function (DP function) or cancel the payment in case the payee has a suspicious account. Near-real time payments are efficient and convenient but also risky. The DP function is specially designed to prevent fund fraud. By delaying the transaction for 2 hours or 24 hours, the payer has more time to figure out the details of the transaction, and it gives the chance to the police to trace the money back. Together with the DP function, AlphaRisk helps Alipay lower down the money loss rate to the minimal level. However, regarding the dramatically increasing online transactions, the 0.5% risk rate is still a lot of money. Risks still exist, even though Alipay has the lowest risk rate of online transaction in the industry, the loss is a loss.

Another example of the buyer protecting function is the ‘PayPal Buyer Protection’ service. The platform will investigate whether there is a fraud after the user submits the report. In the process of investigation, there are strict rules for submitting personal details, which is applied to both payers and payees in order to reduce frauds. However, offering detailed personal information is a two-way requirement. Both the seller and the buyer have their information uploaded.

On the official Paypal website, it is claimed that they provide 24/7 monitor and will ask for confirmation to process a purchase. They also follow up the transaction and later on the stage of the order, which shows that the third-party platform is taking the responsibility to reduce online frauds to a minimum. Nevertheless, although making an online payment is easy, online trading may have a complicated process. As a result, the victim cannot always be careful enough to find out vulnerabilities in the fraud‘s rhetoric. Even with proof of evidence, like a photo of a certificate or ID card, it is difficult to prove that the evidence truly exists.

2. The Responsibility

Analytical solutions are not available until the data collection and storage system has been upgraded adequately,so as to be able to manage the considerable workload. That is to say, the daily volume of information flow dealt by third-party platforms is beyond imagination at the moment, which raises the question: Is my information securely stored and disseminated with such a large amount of information? How is it possible to ensure that everything is secure with a third-party platform, which is usually owned and operated by a private company? Therefore, it is essential for those companies to consider the payee’s integrity. It is also believed that in order to avoid unnecessary loss, the companies should be responsible to maintain a good and fair credit environment.

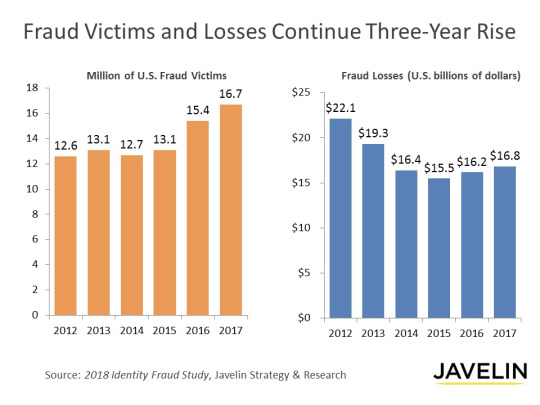

As companies, like Alibaba and eBay, are playing the role of a pusher in the electronic commerce world, ensuring information security is also necessary for them. Network integrity is an essential element for users to decide whether the platform is trustworthy. Whether the platform should be obliged to take part in the review process is arguable but the current circumstance is surely not satisfying. It has been found that with all the efforts made to prevent e-commercial scams, the number of victims and the amount of money stolen are still increasing as it has been shown in the chart above. Bargaining online provides great opportunities for frauds and the preferred way of shopping continues to shift to online stores. As a result, the loss caused by online transactions increases the overall fraud losses.

3. The Regulation

Telecommunication frauds are traditionally divided into two sections: revenue and non-revenue based swindling. The main difference between them is whether the purpose is money transfer. The vast majority of defrauding transactions through a third-party payment platform is to swindle money. One of the fundamental difficulties in legislation is that the target of the scam is hard to define. The crime of e-fund fraud is different from other scams, in the way of communication. E-transaction happens between a certain natural person and a machine and the human-machine dialogue can be considered as merely representing data in the electronic system, instead of real money transfer. In the UK the Fraud Act 2006 and the Theft Act 1968 are applicable to a wide range of cyber-scams, but there is no targeted legislation in either China or in the UK. Without regulatory guidelines, it is difficult to solve the fundamental problem.

Conclusion

It’s inevitable that methods of shopping will rely more and more on e-commerce. In the aspect of electronic finance service, fraud risk management, which is based on the development of computing technology and data science, has become the trend. In order to build a good network of e-commerce, companies and institutions should make efforts and work together to create a safe and secure e-finance environment. Regulations and high-tech risk control system can help protect the integrity from online funds fraud, the remaining issue is to figure out the most appropriate way since so far, cybercrimes on third-party payment platforms are not completely under control.

1 note

·

View note