Text

How to Enhance Your Driving Experience with High-Quality Tyres and Wheels to Mastering the Road

Introduction

Your vehicle's performance on the road is a culmination of various factors, and among the most crucial are the tyres and wheels that connect you to the asphalt. Investing in High-quality premium tyres and wheels not only ensures your safety but also significantly enhances your overall driving experience. Let's explore how these components play a pivotal role in mastering the road.

1. Traction and Grip:#

The quality of your tyres directly affects your vehicle's traction and grip on the road. High-quality tyres are designed with advanced tread patterns and rubber compounds that provide optimal grip in various driving conditions. Whether it's navigating a rain-soaked highway or cruising through a winding mountain road, premium tyres ensure superior traction, enhancing both safety and performance.

2. Smooth and Comfortable Ride:

Quality tyres, especially those with advanced technologies like noise-reducing treads and shock-absorbing materials, contribute to a smoother and more comfortable ride. The right set of tyres can minimize vibrations and road noise, transforming your driving experience from ordinary to extraordinary. The result is a journey where every mile feels refined and enjoyable.

3. Enhanced Fuel Efficiency:

Investing in high-quality tyres pays off at the fuel pump. Premium tyres are often designed with fuel efficiency in mind, featuring low rolling resistance that reduces the energy required to move the vehicle. This not only contributes to environmental sustainability but also saves you money in the long run by maximizing fuel efficiency.

4. Durability and Longevity:

When it comes to tyres and wheels, durability is paramount. High-quality tyres are engineered to withstand the rigors of the road, including potholes, sharp turns, and varying weather conditions. Investing in durable tyres means fewer replacements, saving you money and providing peace of mind knowing that your tyres can handle whatever the road throws at them.

5. Optimal Handling and Control:

The synergy between high-quality tyres and well-crafted wheels results in optimal handling and control of your vehicle. Quality wheels, in addition to being visually appealing, are designed to be lightweight and durable, contributing to better steering response and overall performance. This ensures that you have precise control over your vehicle, especially in challenging driving scenarios.

6. Aesthetics and Personalization:

Beyond the functional aspects, high-quality wheels can also enhance the aesthetic appeal of your vehicle. Whether you prefer a sleek, modern look or a more classic design, premium wheels offer a wide range of styles and finishes. Personalizing your vehicle with quality wheels not only boosts its visual appeal but also reflects your unique style and preferences.

7. Safety First:

Above all, safety should be the top priority when considering tyres and wheels. High-quality tyres undergo rigorous testing to meet and exceed safety standards. From improved wet and dry braking performance to enhanced stability and handling, investing in top-tier tyres ensures that you and your passengers are protected on every journey.

In conclusion :

Mastering the road involves making informed choices about your vehicle's tyres and wheels. The impact of high-quality components goes beyond aesthetics, providing tangible benefits such as improved traction, a smoother ride, enhanced fuel efficiency, and optimal handling. Whether you're a daily commuter or an avid road tripper, investing in the right tyres and wheels is a key step towards elevating your driving experience and enjoying every moment on the open road.

0 notes

Text

What are the Eligibility Criteria for Becoming a Designated Partner in an LLP?

Introduction

A Limited Liability Partnership (LLP) is a popular business structure that combines the benefits of both a partnership and a limited liability company. In an LLP, there can be two types of partners - designated partners and ordinary partners. Designated Partners have additional responsibilities compared to ordinary partners. However, not everyone can become a designated partner in an LLP. There are conditions of eligibility that must be met.

Age Limit

To become a designated partner in an LLP, you must be at least 18 years old or above as per the Indian Majority Act, 1875.

2.Residency Status

The designated partner of an LLP needs to be either resident in India or should have stayed in India for more than one hundred eighty-two days during the preceding financial year.

3.Director Identification Number (DIN)

Designated Partners must obtain Director Identification Number(DIN), which serves as proof of identity and address verification; it allows them access crucial details registered with Registrar office such as tax returns filed annually etc., thereby ensuring transparency throughout entire process from incorporation onwards until dissolution among all stakeholders involved!

4.No Criminal Record

Any person aspiring towards becoming designated partner within any given Limited Liability Partnership must ensure they do not have criminal records associated with them before finalizing their application status! This will help maintain integrity & trustworthiness between parties concerned while also mitigating risks associated legal non-compliance issues down line if found out later on after approval granted initially based solely upon false information presented upfront by applicant seeking designation rights under agreement signed into effect at time incorporation finalized!.

5.Qualifications Required

There is no specific educational qualification required for becoming a designated partner in an LLP; however, having knowledge about accounting practices along with general awareness about laws governing businesses helpful overall when managing finances together alongside other members present within the LLP structure.

6.Obtaining Digital Signature Certificate (DSC)

Designated partners must obtain a digital signature certificate(DSC) from any certifying agency authorized by the Controller of Certifying Authorities as per Indian Information Technology Act,2000. This certificate ensures security for all electronic documents signed digitally during various stages involved throughout an LLP's life cycle from incorporation onwards until dissolution among stakeholders involved!

In conclusion:

Becoming a designated partner in an LLP requires meeting certain eligibility criteria such as age limit, residency status and obtaining Director Identification Number (DIN), having no criminal record with qualifications required to manage finances effectively alongside other members present within Limited Liability Partnership structure overall while also obtaining digital signature certificates! It is important to note that these requirements are put in place to ensure transparency and legal compliance within partnerships so that each party knows their rights and responsibilities clearly before entering into agreements together - ultimately leading towards better outcomes achieved more efficiently overall!.

#Eligibility Criteria for Becoming a Designated Partner in an LLP#Criteria for Becoming a Designated Partner in an LLP#Designated Partner in an LLP#Designated Partner#llp

0 notes

Text

What is a caveat petition, and when should I file one?

Introduction

Legal matters can be intricate and overwhelming, especially if you find yourself caught up in a dispute or impending legal action. In such cases, it is essential to have a basic understanding of various legal tools that can safeguard your interests. One such instrument is a caveat petition. This aims to shed light on what a caveat petition is, its significance, and the appropriate circumstances in which it should be filed.

What is a Caveat Petition?

A caveat petition is a legal document filed by an individual or party known as a 'caveator' to inform a court or authority that they should not take any action or pass any orders in a specific case without giving the caveator an opportunity to be heard. By filing a caveat petition, the caveator seeks to prevent the court from delivering any decision that may adversely affect their rights or interests without their knowledge.

Significance of Filing a Caveat Petition

A caveat petition acts as a preemptive measure, allowing a person to ensure their involvement in any legal proceedings that may potentially impact their rights. By filing a caveat, the caveator ensures that they are notified when any application or petition is filed by another party related to the subject matter in question. This enables the caveator to present their side of the case and protect their interests effectively, ensuring a fair and just process.

When Should You File a Caveat Petition?

In Property Matters: If you anticipate a dispute or potential legal action concerning property matters, such as land, houses, or tenancy, filing a caveat petition can safeguard your rights. It ensures that no transfer or order is passed without your knowledge or participation.

In Probate and Succession Matters: In cases involving wills, inheritance, or succession, filing a caveat petition can help protect your rights as a potential beneficiary. It alerts the court to your interest in the matter and ensures that you are given an opportunity to present your claims.

In Family Law Matters: In disputes related to divorce, child custody, maintenance, or any other family law matter, filing a caveat petition can be crucial. It ensures that no orders or decisions are passed without your knowledge, allowing you to present your side of the case and protect your rights.

In Intellectual Property Cases: If you hold intellectual property rights, such as trademarks or patents, and anticipate a potential challenge or infringement, filing a caveat petition can help you secure your interests. It alerts the authorities that you wish to be heard before any decision is made that may impact your intellectual property.

Conclusion

A caveat petition serves as a protective shield for individuals who want to ensure their involvement in legal proceedings. By filing a caveat, you can ensure that no orders or decisions are passed without giving you an opportunity to present your case. Whether it is a property dispute, a family matter, a probate issue, or an intellectual property concern, a caveat petition can help safeguard your rights and ensure a fair and just process. It is advisable to consult with a legal professional to understand the specific requirements and procedures for filing a caveat petition in your jurisdiction.

0 notes

Text

What is the best way for property verification?

Introduction :

Property verification is a crucial step when buying or investing in real estate. It helps ensure that the property you intend to purchase is legally sound and free from any encumbrances or disputes. In this blog post, we will discuss the best ways to conduct property verification, enabling you to make informed decisions and safeguard your interests.

Engage a Reputable Lawyer

One of the most effective ways to ensure proper property verification is by engaging a reputable and experienced lawyer specializing in real estate law. They possess the necessary expertise to scrutinize property documents, conduct due diligence, and verify the property's legal status. A lawyer can identify potential issues, such as pending litigation, unpaid dues, or unauthorized construction, and guide you through the verification process.

Verify Ownership and Title Deeds

The first step in property verification is to confirm the ownership of the property. Thoroughly examine the title deeds, sale deeds, and encumbrance certificates to ensure that the property is legally owned by the seller and free from any legal disputes or claims. Additionally, verify the chain of title to ensure that the property has been transferred legally from one owner to another over the years.

Conduct a Site Visit

Performing a physical inspection of the property is essential to verify its existence, boundaries, and condition. Visit the site personally or hire a professional surveyor to assess the property's dimensions, encroachments, and any inconsistencies with the documents. This step helps prevent any surprises or discrepancies between the property's physical state and what is mentioned in the paperwork.

Check for Encumbrances and Liabilities

Verify if the property has any existing encumbrances, such as mortgages, liens, or easements, which might affect your ownership rights. Obtain an encumbrance certificate from the concerned registrar's office to confirm that the property is free from financial liabilities. Additionally, review utility bills, tax receipts, and other related documents to ensure that the property's dues are cleared and up to date.

Verify Approvals and Permits

Ensure that the property has obtained all the necessary approvals and permits from the local authorities. Check for documents such as building plan approvals, occupancy certificates, and completion certificates, depending on the type of property. This step helps ascertain that the property has been constructed adhering to the applicable regulations and guidelines, minimizing the risk of legal complications in the future.

Seek Legal Opinions and Certifications

Consulting legal experts and obtaining their opinions and certifications can provide an additional layer of assurance during property verification. They can scrutinize the documents, review the title search reports, and offer their expert opinion on the legality and validity of the property transaction. This step can help you make informed decisions and minimize potential risks.

Conclusion

When it comes to property verification, it is crucial to adopt a comprehensive approach to mitigate potential risks and protect your investment. By engaging a reputable lawyer, conducting a site visit, verifying ownership and title deeds, checking for encumbrances, and seeking legal opinions, you can ensure a thorough and effective property verification process, providing you with peace of mind in your real estate transactions.

0 notes

Text

What is designated and non designated partner in LLP?

Introduction

Limited Liability Partnerships (LLPs) have gained significant popularity as a flexible business structure that combines the benefits of a partnership and limited liability. In an LLP, partners play a crucial role in the management and operation of the business. Among the partners, there are two distinct categories: designated partners and non-designated partners. In this blog post, we will explore the roles, responsibilities, and key differences between designated and non-designated partners in an LLP.

Designated Partners: Key Roles and Responsibilities

Designated partners hold a distinctive position within an LLP. They are responsible for ensuring compliance with statutory obligations and maintaining the smooth functioning of the partnership. Some key roles and responsibilities of designated partners include:

Compliance: Designated partners are accountable for ensuring compliance with the provisions of the Limited Liability Partnership Act and other applicable laws and regulations.

Filing of Documents: They are responsible for filing various statutory documents, such as annual returns and statements of accounts, with the Registrar of Companies (RoC).

Maintenance of Books of Accounts: Designated partners are tasked with maintaining accurate and up-to-date books of accounts, which include financial records, receipts, payments, and other relevant documents.

Representing the LLP: They have the authority to represent the LLP in legal proceedings and other official matters.

Non-Designated Partners: Roles and Contributions

Non-designated partners, as the name suggests, do not possess the same statutory responsibilities as designated partners. However, they still play a vital role in the functioning of the LLP. Some key aspects of their roles and contributions include:

Business Operations: Non-designated partners actively participate in day-to-day business operations, contributing to strategic decision-making, managing projects, and overseeing specific functions.

Capital Contribution: Like designated partners, non-designated partners are required to make capital contributions to the LLP as agreed upon in the partnership agreement.

Sharing of Profits and Losses: Non-designated partners are entitled to a share of the LLP's profits as per the agreed-upon profit-sharing ratio. They also bear a proportionate share of any losses incurred by the LLP.

Key Differences between Designated and Non-Designated Partners

While both designated and non-designated partners contribute to the LLP's growth and success, there are significant differences between their roles and responsibilities. These include:

Statutory Obligations: Designated partners are responsible for ensuring compliance with legal and regulatory requirements, while non-designated partners are not bound by specific statutory obligations.

Filing of Documents: Only designated partners have the authority to sign and file documents with the RoC, such as annual returns and statements of accounts.

Legal Representation: Designated partners have the authority to represent the LLP in legal proceedings, whereas non-designated partners may require specific authorization for the same.

Liability: Designated partners bear additional liability for non-compliance and acts of the LLP, while non-designated partners' liability is limited to their agreed-upon capital contribution.

Conclusion

Designated and non-designated partners play distinct yet crucial roles in the management and operation of an LLP. Designated partners shoulder statutory responsibilities, ensuring compliance and accountability, while non-designated partners contribute to the day-to-day operations and overall success of the partnership. Understanding these roles and responsibilities is essential for LLPs to function smoothly, adhere to legal requirements, and leverage the diverse skills and contributions of all partners involved.

0 notes

Text

What are the objectives of partnership Act 1932?

Introduction

The Partnership Act 1932 is a crucial legislation governing partnerships in India. This Act aims to provide a comprehensive legal framework for the formation, operation, and dissolution of partnerships. In this blog post, we will delve into the objectives of the Partnership Act 1932, highlighting its key provisions and the significance they hold for businesses operating as partnerships.

Formation and Regulation of Partnerships

One of the primary objectives of the Partnership Act 1932 is to define and regulate the formation of partnerships. The Act lays down the essential elements required for the creation of a partnership, such as the agreement between partners, profit-sharing, mutual agency, and the absence of a legal entity separate from the partners. By providing guidelines for partnership formation, the Act aims to ensure clarity and transparency in the establishment of partnerships, enabling partners to engage in business activities with a clear understanding of their rights and obligations.

2 . Establishing Partners' Rights and Responsibilities

The Partnership Act 1932 aims to establish the rights, duties, and liabilities of partners within a partnership. It outlines the rights of partners to participate in the management of the partnership, access partnership records, and share profits and losses. The Act also specifies the duties of partners, including their fiduciary responsibilities towards the partnership and the obligation to act in good faith. By clearly defining these rights and duties, the Act promotes fairness and accountability within partnerships, fostering a harmonious and efficient business environment.

3 . Preservation of Partnership Property

Another objective of the Partnership Act 1932 is to safeguard the partnership property. The Act defines partnership property and establishes the rules for its use, management, and disposal. It prohibits partners from individually appropriating partnership assets for personal use or benefit. This provision ensures that partnership assets are protected and utilized solely for the benefit of the partnership and its partners. By preserving partnership property, the Act aims to maintain the integrity and financial stability of the partnership.

objectives of partnership Act 1932

4 . Dissolution and Winding-Up of Partnerships

The Partnership Act 1932 sets out the provisions for the dissolution and winding-up of partnerships. It specifies the various modes of dissolution, such as by agreement, expiry of the partnership term, death or insolvency of a partner, or by court order. The Act also outlines the procedures for the settlement of accounts, distribution of assets, and discharge of liabilities upon dissolution. By providing a clear framework for partnership dissolution, the Act aims to facilitate a fair and orderly process, protecting the interests of all partners involved.

Conclusion

The Partnership Act 1932 serves as a critical legislation governing partnerships in India. By establishing the objectives of partnership formation, determining the rights and duties of partners, preserving partnership property, and facilitating dissolution processes, the Act aims to provide a comprehensive legal framework that promotes transparency, accountability, and stability within partnerships. Understanding and adhering to the provisions of this Act is essential for businesses operating as partnerships in India.

#objectives of the Partnership Act 1932#objectives of the Partnership Act#objectives of the Partnership

0 notes

Text

What does self assessment mean for income?

Introduction

Self-assessment is a fundamental aspect of managing personal finances, particularly when it comes to income. It refers to the process of assessing and reporting one's income, deductions, and tax liabilities directly to the tax authorities. In this blog, we will explore what self-assessment means for income and why it is an essential responsibility for individuals.

Understanding Self-Assessment for Income

Self-assessment for income involves individuals taking the initiative to assess and report their income to the relevant tax authorities. It is a mechanism through which individuals declare their earnings, deductions, and tax liabilities, enabling accurate tax calculations and compliance. Self-assessment ensures that taxpayers are responsible for providing a true and complete picture of their income, allowing tax authorities to assess and collect the appropriate amount of tax.

The Significance of Self-Assessment

Self-assessment holds several key implications and benefits:

1.Accurate Tax Calculation: By self-assessing their income, individuals can calculate their tax liabilities accurately. This helps them avoid underpaying or overpaying taxes, ensuring compliance with tax regulations.

2 . Responsibility and Transparency: Self-assessment instills a sense of responsibility in individuals to report their income honestly and transparently. It promotes trust between taxpayers and tax authorities and contributes to the integrity of the tax system.

3 . Claiming Deductions and Benefits: Self-assessment allows individuals to claim deductions, exemptions, and benefits they are entitled to. This includes deductions for expenses related to business, investments, education, and healthcare, among others.

4 .Timely Tax Payments: Self-assessment ensures that individuals pay their taxes on time. By assessing their income and calculating their tax liabilities, taxpayers can meet their tax obligations within the stipulated deadlines.

Process of Self-Assessment

The process of self-assessment for income typically involves the following steps:

1.Gathering Income Information: Collect all relevant information about income from various sources, such as employment, self-employment, investments, and rental properties.

Calculating Deductions: Determine eligible deductions and exemptions, such as expenses related to housing, education, medical bills, and retirement contributions.

3 .Filing the Tax Return: Complete the necessary tax forms or online tax return, providing accurate details of income, deductions, and tax liabilities.

4.Paying the Tax: Calculate the total tax liability and pay any tax due within the specified timeline.

5 .Document Retention: Maintain proper documentation, including income statements, receipts, and proof of deductions, in case of future audits or inquiries.

Conclusion

Self-assessment for income tax is an integral part of managing personal finances and fulfilling tax obligations. By accurately assessing and reporting income, individuals contribute to a transparent and efficient tax system while ensuring compliance with tax regulations. Taking the responsibility to self-assess income empowers individuals to stay in control of their financial affairs and make informed decisions.

#Self-assessment for income#Self-assessment for income tax#Self-assessment#income tax assessment order#What does self assessment mean for income?

0 notes

Text

What is compulsory for appointment of director of a company ?

Introduction

The appointment of a director for a company is a critical decision for any business. It is important to ensure that the right person is appointed in order to help the company reach its goals and objectives. The process of appointing a director can be a complicated one and it is important to understand the legal and regulatory requirements that must be met before the appointment is made.

In most countries, the appointment of a director requires the filing of a legal document. This document must include the name and address of the company, the name, address, and other relevant details of the proposed director, and the number of shares the director will hold.

The document must also provide details of the terms of appointment, including the length of the term, remuneration and other benefits, and any other conditions that may be required by the company.

In addition to the legal document, the appointment of a director may require the company to disclose information about the director’s background and qualifications. This includes details such as educational qualifications, previous work experience, and any relevant professional qualifications or certifications.

In many countries, the appointment of a director is subject to certain regulatory requirements. This includes obtaining prior approval from the relevant government authority before the appointment is made. The company must also adhere to any legal requirements, such as filing certain documents with the relevant government agency.

The company must also ensure that the director is not disqualified from acting as a director by any applicable laws. This includes ensuring that the director does not have any convictions for offences relating to company management or the company’s finances, and that the director has not been disqualified from acting as a director by any other company.

Finally, the company must ensure that the director is a suitable person to act in the role. This includes considering factors such as the director’s character and integrity, expertise, and any other relevant criteria. The company may also want to consider any potential conflicts of interest when appointing a director.

The appointment of a director is a critical decision for any business and it is important to ensure that the right person is appointed. By understanding the legal and regulatory requirements and ensuring that the director is suitable, companies can ensure that they make the best appointment for the company.

0 notes

Text

How to get income tax assessment order in india ?

Income tax assessment is a process of determining the tax liability of an individual or company in India. It involves the calculation of taxable income and the subsequent payment of taxes as per the provisions of the Income Tax Act, 1961. It is an important aspect of tax planning and compliance in India. Here know more about income tax assessment order

Income tax assessment is done by the Income Tax Department, which is a part of the Ministry of Finance in India. The department is responsible for administering the Income Tax Act and for levying and collecting taxes from individuals, companies and other entities.

The main steps involved in getting an income tax assessment order in India are as follows:

1. Filing of Income Tax Return: The first step in the process of income tax assessment is to file your income tax return. This must be done by the due date as prescribed by the Income Tax Department. You can file your return either online or offline.

2. Verification of the Return: The Income Tax Department will then verify your return. They will check it for accuracy and completeness and may even ask for additional information or documents.

3. Assessment of Income Tax: After the verification process is completed, the Income Tax Department will assess your income tax liability. They will determine the amount of tax that you need to pay and issue an assessment order.

4. Payment of Taxes: Once the assessment order is issued, you need to pay the taxes as per the instructions mentioned in the order. You can pay online through the e-payment gateway or through the bank branch.

5. Receipt of Tax Return Acknowledgement: After you have paid the taxes as per the assessment order, the Income Tax Department will send you an acknowledgement of the return filed by you. This will be your proof that the taxes have been paid by you.

These are the basic steps involved in getting an income tax assessment order in India. It is important to remember that the assessment order should be followed in order to ensure that your taxes are correctly paid and to avoid any penalties or fines.

It is also important to note that the assessment order may be revised or amended by the Income Tax Department in case of any discrepancies or errors. Therefore, it is important to keep updated with the latest changes in the rules and regulations related to income tax assessment.

Conclusion

Getting an income tax assessment order in India is a simple process that involves filing of income tax return, verification of the return, assessment of income tax, payment of taxes, and receipt of tax return acknowledgement. It is important to follow the assessment order and keep updated with the latest changes in order to ensure that your taxes are correctly paid.

0 notes

Text

what is the process for appointment of managing director in private company ?

Introdution

The appointment of a managing director in a private company is a critical step in the life cycle of a business as it determines how the organization will be managed in the long run. It is a process that should be taken very seriously and should not be done in haste.

The following steps should be followed in order to ensure that the person appointed is the right fit for the job and that the organization will benefit from their appointment.

First and foremost, it is important to define the position and the responsibilities that the managing director will have. This can be done by creating a job description, which should include the purpose of the role, the scope of work, and the skills and experience required for the role. It is also important to consider the size of the company and the organizational structure, as this will help to determine the type of person best suited for the role.

Once the job description has been created, the next step is to search for potential candidates. This can be done through a variety of methods, including recruitment agencies, job boards, and networking. It is important to ensure that the right people are identified, as this will help to ensure the best possible fit for the role.

Once suitable candidates have been identified, the process of appointing a managing director can begin. This will involve an interview process, which will involve assessing the candidate’s skills and experience, as well as their ability to manage the organization. It is important to ask the right questions and to provide feedback to the candidate throughout the process.

After the interviews have been conducted and a suitable candidate has been chosen, the organization will need to negotiate a contract with the managing director. This should include details such as the salary, benefits, and any other incentives that may be offered. It is important to ensure that the contract reflects the expectations of the organization, as well as the expectations of the managing director.

Finally, the managing director will need to be formally appointed by the board of directors. This will typically involve the signing of documents and the issuing of a certificate of appointment. This process should be completed in a timely manner, as this will ensure that the organization is able to move forward with the new appointment.

The appointment of a managing director in a private company is a critical process which should not be taken lightly. It is important to ensure that the right person is chosen for the role, that the role is clearly defined, and that the contract reflects the expectations of the organization. By following these steps, the appointment of a managing director can be successful and beneficial for the organization.

0 notes

Text

Things should be know Before getting legal help online

Introduction

Legal help online is a convenient and cost-effective way to get help with legal matters. It can offer a range of services, from helping you find a lawyer to providing legal advice and representation. The internet can be a great resource for people who need legal help but don't have the time or money to hire a lawyer.

Legal help online can be accessed through websites, online forums, and online directories. These resources provide a variety of services, including legal advice, document preparation, and case management. They can also help you find a lawyer who is experienced in the area of law you need assistance with.

When looking for legal help online, it is important to ensure that the website you are using is reputable and reliable. Many websites offer free legal advice, but it is important to understand the terms and conditions of the advice given and make sure that the advice is accurate and up-to-date. Additionally, it is important to be aware of any fees associated with the services offered.

Once you have found a website that offers legal help online, it is important to read all of the information carefully and make sure that the advice is accurate and relevant to your situation. It is also important to be aware of any hidden costs or fees associated with the services. Additionally, you should always check that the lawyer you are considering is licensed and qualified to practice law in your state or country.

Legal help online can be a convenient and cost-effective way to get help with legal matters. However, it is important to take the necessary precautions and research any websites you use to ensure that the advice you receive is accurate and relevant to your situation.

0 notes

Text

Knowing about money recovery suit limitation period

Introduction

Money recovery suit limitation period in India is a legal term that refers to the amount of time a person has to file a suit in order to recover money from a debtor. In India, the limitation period for filing a money recovery suit is three years from the date the debt became due. This period is determined by the Limitation Act, 1963.

The limitation period for filing a money recovery suit is important because it sets a time limit for when a person can file a lawsuit in order to recover money from a debtor. After the limitation period has passed, a person is not allowed to file a lawsuit in order to recover money from the debtor. This means that if a person waits too long to file the suit, they may miss out on the opportunity to recover their money.

The limitation period for filing a money recovery suit can be extended in certain circumstances. For example, if the debtor has moved to another state or country, the limitation period may be extended to five years. Additionally, if the debtor has died, the limitation period may be extended to 10 years.

However, it is important to note that the limitation period for filing a money recovery suit is a strict one and cannot be extended in all cases. Therefore, it is important for a person to file their suit as soon as possible in order to ensure that they are able to recover their money.

In addition to the limitation period for filing a money recovery suit, there are also other important legal considerations that a person must take into account before filing the suit. For example, a person must make sure that they have sufficient evidence to prove their case in court. Additionally, they must also make sure that all of the necessary documents and paperwork are in order.

Overall, it is important to understand the limitation period for filing a money recovery suit in India. This period is important because it sets a time limit for when a person can file a lawsuit in order to recover money from a debtor. Additionally, it is important to make sure that all of the necessary documents and paperwork are in order before filing the suit, as well as making sure that sufficient evidence is available to prove the case in court.

0 notes

Text

Tax Collected At Source (TCS) Under GST

Introduction :

The taxes below Goods and Services Tax (GST) are Tax Deduction at Source (TDS), and Tax Collected at Source (TCS). These phrases are categorized beneathneath the Income Tax Act and feature a extraordinary effect at the GST Act. The taxation has been powerful from October 1st 2018. We can outline TDS because the tax deducted whilst you purchase offerings or items and is usually deducted from financial institution deposits, authorities or institutional branch bills, settlement bills and extra. On the opposite hand, TCS is the tax accrued through e-trade structures for offerings and items bought on its platform or website, in which bills are virtual bills. Here know more about Gst registration in puducherry

In this article, we will study TDS and TCS under GST, the way to declare TCS in GST, the diverse sections relevant for TDS and TCS bills, charges, etc., and the way to get your TDS or TDS TCS refunds as a TCS credit score in GST.

What is TDS and TCS in GST?

Let’s have a look at the fundamentals of TDS deductions beneathneath the GST Act firstly.

Who deducts TDS beneathneath GST?

All Governmental agencies.

Central or State Government institutions and Local Authorities.

Societies beneathneath the authorities or nearby authority and people registered beneathneath the Societies Registration Act, 1860.

Public zone undertakings.

Categories of people notified through the Government.

Boards and government are installation thru right rules or in which the authorities owns extra than fifty one% equity.

What is the TDS charge deducted beneathneath GST?

When the whole price for items or offerings under a settlement exceeds Rs 2.five lakhs, the individual paying is susceptible to deduct TDS. The TDS charge notified below GST legal guidelines is a complete of 2%, with 1�ing Central Goods and Services Tax (CGST) and 1�ing the Integrated Goods and Services Tax (IGST) or State Services and Goods Tax (SGST) on all bills on taxable offerings and items made to the seller.

Due date:

Such TDS quantities deducted are to be made to the GST government the use of the GSTR-7 on or earlier than the tenth of the following month. Suppose the ‘ABC’ branch of the Central Government deducts the TDS from a invoice to ‘Y’ at 2% on March 4th 2021, then it need to make the TDS remittance to the GST government through April tenth 2021.

TDS Impact on Government civil contractors:

An common of 10,000 huge civil contracts is granted yearly through the Indian authorities. The common price for restore/ creation of a National Highway runs into numerous hundred crores. Large creation businesses win those tenders, that are then sub-reduced in size and re sub-reduced in size numerous times. Hence, the TDS tax legal responsibility with every such settlement maintains growing. Many labour and small civil contractors aren't registered or tax compliant. Thus GST and TDS carry a positive quantity of transparency withinside the operations of such huge contracts. It is now vital to mandatorily deduct the TDS quantities at supply for all bills extra than Rs 2.five lakhs because of this that even small civil contractors will want to check in beneathneath the GST regime.

For instance, M/s XYZ Ltd. received a central authority settlement to restore an 800-m street really well worth Rs 20 lakhs. The agency outsourced its paintings to M/s ABC and M/s DEF contractors, which in addition outsourced to smaller corporations like M/s LMN Associates, a small civil contractor.

Under the preceding regime, M/s LMN Associates want now no longer have GST registration or pay Value Added Tax (VAT) and provider tax. Now, M/s LMN Associates have to be registered beneathneath the GST Act to say an Input Tax Credit or ITC. Thus, TDS U/S fifty one of the GST Act guarantees tax compliance through the development enterprise and its unorganised labour zone.

TCS in GST:

TCS or Tax Collected at Source in GST is the tax accrued on behalf of the offerings and items providers making resources to the net platform of the operator. The tax is accrued through the net e-trade platform and is a percent of every transaction of taxable resources.

Who is susceptible to acquire TCS?

E-trade platform operators who acquire on-line bills on behalf in their offerings and items providers like Snapdeal, Amazon, Flipkart etc., have to mandatorily acquire TCS. In different words, they deduct the TCS quantity after which pay the providers in their items and offerings whilst remitting the TCS quantities accrued to the GST government thru a GST TCS Form-eight earlier than the tenth of the following month. For instance, ABC stores, a proprietary concern, sells ready-made child clothes on Snapdeal. Snapdeal, the e-trade operator, has to deduct 1% TCS on behalf of ABC Stores.

Exceptions to the TCS provisions beneathneath Section 9(five) of the GST Act at the e-trade platform are

Unregistered golf equipment and lodge lodging at the platform.

Radio-a-taxi, bike or cab for passenger transportation.

Unregistered home tasks offerings like carpentry, salons, plumbing, etc.

TCS charge beneathneath GST:

The TCS charge beneathneath GST is special beneathneath the CGST Act of 2018 beneathneath Section fifty two of the GST Act. The Central Board of Indirect Taxes and Customs (CBIC) offers the TCS notification beneathneath GST. Under it, investors and sellers presenting offerings/items thru e-trade structures/operators will provide TCS deductions of 1% and acquire bills. The apportioning of taxes is 1% IGST or 0.five% CGST and 0.five% SGST. This method for each interstate and intrastate resources, a complete of 1% tax might be accrued on the supply. For interstate resources, the TCS is 1% IGST, whilst intrastate resources have 0.five % SGST and 0.five% CGST because the tax charges for TCS in GST.

Registration requirements:

E-trade operators have to check in beneathneath GST as they may be susceptible to acquire TCS on GST, even if their providers have now no longer crossed the GST registration threshold limit.

The providers, in flip, need to mandatorily check in for Goods and Services Tax Identification Number (GSTIN). Registration is vital to acquire the TCS quantities deducted as Input Tax Credit (ITC) to their respective digital ledgers or declare refunds of the TCS/TDS quantities from the Income Tax government.

The exceptions are referred to in Section 9(five) of GST Act, in which they do now no longer want to check in for GST if their turnover does now no longer exceed Rs 20 lakhs or the brink for GST registration of Rs forty lakhs.

Furthermore, e-trade structures need to check in for GST in each kingdom they deliver items and offerings.

Due date:

TCS GST is deducted on each transaction for the duration of the month the deliver is made in and have to be deposited inside 10 days of the following month of deliver to the GST government.

The tax is paid in flip through the GST government to the:

Central Government in case of CGST (CentralTerritory Goods and Services Tax) and UGST (Union Territory Goods and Services Tax)

The State Government in case of SGST (State Territory Goods and Services Tax).

TCS effect at the e-Commerce Sector:

Section fifty two of the CGST regulation brings in TCS beneathneath GST or Tax Collected at Source for all e-trade operators accountable beneathneath the GST regulation. Depositing the deducted TCS carried out at 1% of each transaction is vital for such operators. Thus, all investors and sellers at the platform promoting their offerings or items get their bills at much less than 1% TCS. TCS is apportioned as 1% IGST or 0.five% SGST and 0.five% CGST. Aggregators like Amazon, Flipkart, Snapdeal etc., need to deposit this tax to the GST government through the tenth of the following month in GSTR -eight.

Besides growing the price and administrative price of the aggregators, all sellers and investors on such structures want to be registered to say their TCS deductions despite the fact that they'll now no longer be over the brink quantity special for GST registration.

Here’s an instance of a TCS deduction: Mr Raj sells his ready-to-use clothes on Flipkart on-line. He gets an order for Rs 20,000, which incorporates fee and tax. Assume the fee charged is Rs 250. Flipkart deducts 1% of the quantity and Rs 2000/- as income returns. The TCS deducted will for this reason be on Rs 18,000 or the internet income price, ie. Rs 1,800/-, because it excludes fee payable. In effect, Mr Raj best gets Rs 17,800/- and has to pay GST too. He will need to check in with the GST government to say the Rs 2000/- deducted in this and each in addition transaction on Flipkart.

Benefits of TCS, TDS and GST:

From October 1st 2018, all on-line dealers had been required to extrade their administration, Enterprise Resource Planning (ERP) structures and on-line charge structures to mirror the TCS beneathneath GST. The dealers and e-tailers on e-trade structures will need to check in for GST compulsorily, and their running capital receives blocked until they declare the taxes paid extra than their legal responsibility and record returns. Introduced U/S fifty one, fifty two of the CGST Act, the TCS and TDS deductions have numerous benefits. They are:

TDS and TCS beneathneath GST support compliance withinside the unorganised sectors like creation and on famous e-trade structures.

Tax evaders beneathneath the preceding regime need to avail GST registration to say Input Tax Credit mandatorily and the quantities deducted as TCS or TDS.

Suppliers and deductees gain as their digital ledgers mechanically mirror those TDS and TCS in GST deductions while the deductor documents the GST returns.

Conclusion:

This article has protected the fundamentals of tax deductions of TDS and TCS beneathneath GST. GST compliance and submitting of returns may be a bulky assignment for maximum small sellers, investors etc. Therefore, it's miles essential for enterprise proprietors to recognise approximately the TCS in GST in order that moral paintings functioning may be maintained. We desire thru this article, you've got got understood the significance of TDS and TCS in GST.

0 notes

Text

E-Invoice GST - A Simple Guide

Introduction :

During its thirty seventh meeting, which passed off on September 20, 2019, the GST Council made a advice to put in force digital invoices (additionally recognised as "e-invoices") in GST in a innovative manner. E-invoicing turned into first made relevant as of October 1, 2020, however handiest for registered agencies with combination sales of Rs. 500 crores or more. Here know about Gst registration in andhra pradesh and Gst Invoice

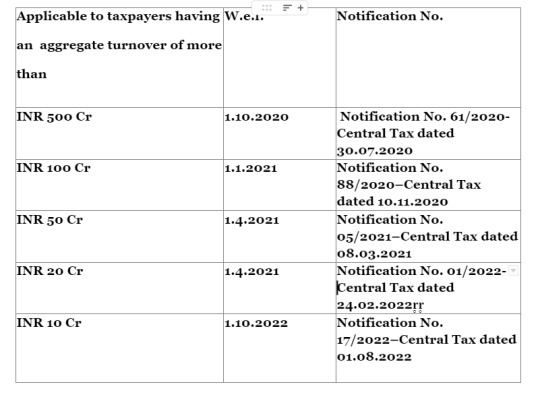

Since then, the whole turnover has been steadily reducing with the intention to accommodate the finest wide variety of taxpayers for the implementation of e-invoicing with inside the following manner:

Notes:

E-invoicing policies end up powerful starting with the 2017–18 financial yr while the aforementioned combination turnover threshold boundaries are crossed in any of the preceding monetary yr(s). Therefore, the whole turnover restrict for the modern financial yr must now no longer be taken into consideration.

Even if their annual combination turnover is extra than the required restrict, sure entities are exempt from the responsibility to generate digital invoices. These entities consist of SEZ units (however now no longer developers), insurers or banking groups or monetary institutions, authorities departments or neighborhood authorities, passenger delivery provider providers, and invoicing in instances wherein offerings are rendered withinside the shape of admission to the exhibition of cinematograph movies in multiplex theatres.

Only applies to taxable income of products or offerings made among agencies (B2B) in DN/CN export transactions.

Not applicable to Business-to-Consumer (B2C) Supplies, Exempted Supplies (Bill of Supply), Receipt Vouchers (on Advances Received for Supply of Services), Refund Vouchers (on Advances Received for Supply of Services), Payment Vouchers, and Self-Invoice (for RCM Liability Received from an Unregistered Person), and ISD Invoice.

LIST OF COMPLIANCE TO BE FOLLOWED

The registered character who's required to apply e-invoicing ought to first generate a tax bill with certain details consistent with e-schema INV-01 the usage of the taxpayer's personal account and billing software, then convert the tax bill right into a JSON record, and finally, add the record to the devoted Invoice Registration Portal ("IRP") that turned into released via way of means of the authorities.

After that, IRP will generate a one-of-a-type e-bill reference wide variety together with a Quick Reference ("QR") Code and a digitally signed JSON record, which it'll then ship to the involved supplier. Additionally, IRP will push the records to the GST Portal for auto-populace of date in GSTR-1 (outward deliver statement), in addition to the E-waybill portal for the technology of an e-manner bill.

0 notes

Text

Debt Recovery Appellate Tribunal (DRT)

Introduction

The banking establishments and companies that are financial had been managing issues in restoration of loans superior via way of means of them to particular people or employer entities. Due to this, the banks and financial companies are restraining on their very own from advancing out loans. There turned into a demand to acquire a gadget this is green get well the loan from debtors.

This resulted withinside the advent of Debt Recovery Tribunals (DRTs) after the passage of Recovery of Debts due to Banking establishments and Financial Institutions Act (RDDBFI), 1993. DRTs deal with the overall conditions in regard to disputed loans above Rs. 10 lakhs. Debt Recovery Appellate Tribunals (DRATs) handles the appeals springing up out of the orders of DRTs. Currently, there are 33 DRTs and five DRATs hired in India so as for restoration of mortgage from debtors, the banks and economic establishments needed to check in a fit withinside the civil courts.

The fit turned into determined and attempted as in step with the provisions of Civil Procedure Code (CPC), 1908 which could be lengthy and complex.A committee ended up being shaped in 1981 to advise reforms below the Chairmanship of Mr. T. Tiwari. It truly turned into determined via way of means of the committee that thinking about that the courtroom docket turned into strained with manner too many instances, significance turned into now no longer directed at times in admire to the restoration of dues of banks and financial companies.

The committee recommended measures that are exceptional among which turned into growing quasi-judicial figures on the way to deal simply with restoration issues. However, setting up of those structures wasn’t initiated for round ten years in a while round Indian financial marketplace and liberalization this is economic. The goal this is first function of DRT is that the facts restoration of mortgage from debtors with a purpose to be due to finance establishments and banks.

The Tribunal’s strength is constant to try to settle instances recovery of advances from NPAs as formerly noted via way of means of the banks underneath the RBI recommendations. The Tribunal has all of the powers vested aided via way of means of the District Court. The Tribunal moreover functions a Recovery officer whom assists in executing the restoration Certificates as handed away via way of means of the Presiding Officers. DRT accompanied the gifted suitable method via way of means of emphasizing on rapid disposal of this conditions and rapid implementation of the order this is final.

A fit can be designed to DRT both via direct software or via SARFAESI route. The legislature has supplied for the improvement of precise courts for the goal, known as as Debt Recovery Tribunals the use of the intention of imparting economic our bodies with a swifter and greater adept approach of restoration of debts. Debt Recovery Appellate Tribunals are based to don't forget the enchantment up in opposition to the choice of DRT. These Tribunals have delivered to lessening the responsibility on civil courts.

0 notes

Text

What Is the Role of a Company Director?

A company director is one of the maximum critical roles in a agency, and the formation of a appropriate board of administrators can in the long run decide your commercial enterprise’ achievement. Here know about the director of a company

Therefore, while you installation a agency, you should make certain your agency’s director stocks the imaginative and prescient of your agency’s direction. And if you’re a agency director searching for statistics approximately your position and obligations, comply with this manual to study extra!

What Is the Definition of a Company Director?

According to Business Directory, a agency director is:

“An appointed or elected member of the board of administrators of a agency, who with different administrators, has the duty for figuring out and imposing the agency’s coverage. A agency director does now no longer need to be a stockholder (shareholder) or an worker of the firm, and can most effective keep the workplace of director. Directors act on the premise of resolutions made at administrators’ meetings, and derive their powers from the company rules and from the company rules and the agency’s articles of affiliation.”

Essentially, a agency director is selected with the aid of using a constrained agency to control its each day commercial enterprise sports and finances, and to make certain each criminal submitting requirement is met. A agency director is needed to perform truly and lawfully, and make verdicts for the coolest of the agency as nicely its members (shareholders). He or she will bind the agency into legitimate contracts with 0.33-parties (buyers, lenders, providers etc) and act as trustees for a agency however now no longer the man or woman stockholders.

With sound judgement and revel in, a agency director need to thrive to make a agency a success with the aid of using selling and accomplishing its commercial enterprise goals.

What Are the Roles and Duties of a Company Director?

Effectively, agency administrators want to behave collectively as a “board of administrators” however frequently the board might also additionally delegate particular powers to a board committee or to an man or woman agency director.

The roles and obligations of a agency director are set out withinside the Companies Act 2006, the articles of affiliation, and any provider agreement that can be in impact among a director and the commercial enterprise.

Under the Companies Act 2006, agency administrators should:

Act Within Designated Powers

A agency director has to stick to the agency’s charter and follow the agency’s coverage and delegated tasks — this consists of the articles of affiliation and wider constitutional issues, which includes shareholder/joint challenge agreements.

Promote the Company’s Success

Although every agency’s achievement is relative, it’s agreeable that a agency director will want to actively exercising the dissemination of the agency’s values and achievement to garner durability and agency scalability. In this respect, the rules states that a director should have regard to, however now no longer constrained to, the subsequent:

The viable outcomes of any choice withinside the lengthy term.

The hobbies of the agency’s employees.

The implementation of the agency’s commercial enterprise relationships with providers, clients and others.

The agency’s effect on environmental and network operations.

The dedication of making sure the agency keeps a popularity for excessive requirements of commercial enterprise conduct.

The duty to behave pretty and justly among agency members.

Carry Out Independent Judgement

A agency director should use impartial judgement, bearing the duty and duty of creating impartial decisions. However, the agency’s charter/settlement should nevertheless be obeyed.

Consistently Exercise Reasonable Skill, Care, and Diligence

A agency director is predicted to look at the equal talent, care, and diligence to the equal requirements as another moderately diligent worker with:

the overall expertise, talent, and revel in that can moderately be predicted of someone wearing out the equal features when it comes to the agency.

the overall expertise, talent and revel in that possessed with the aid of using the agency director.

Note: A director’s real know-how and capabilities won't be sufficient if extra ought to moderately be predicted of a person in his or her position, consequently a experience of recognising and adapting to the truth of man or woman expertise base is key.

Avoid Conflict of Interest

A agency director should keep away from a scenario wherein there may be/can be a agency associated war of hobby — in particular when it comes to the exploitation of assets, statistics or possibility, irrespective of whether or not it'd serve to advantage the agency.

However, there may be no recognisable infringement if the subsequent is true:

After a radical evaluation of the scenario in question, it isn't probable that a war of hobby will arise.

The scenario has been pre-permitted — authorisation can be greenlit thru the articles of affiliation, particular shareholder decision or, in a few circumstances, with the aid of using the alternative administrators who do now no longer percentage the equal war.

Conversely, the subsequent non-exhaustive listing outlines caveats that can reason a war of hobby:

Numerous directorships:a agency director who's additionally a part of a board of administrators of a primary shareholder, the pension scheme trustee agency, a competitor or a client or provider of the agency.

Personal investments:a agency director who's a primary shareholder, competitor, client/provider of the agency or one which owns assets in proximity to the agency’s assets which can be suffering from the agency’s sports.

Advisory position:a agency director who additionally features as an advisor (e.g. accountant/consultant) to the agency or to the agency’s competitor.

Muster earnings from the agency: a agency director who makes private use of agency statistics/opportunities, takes benefit of an possibility formerly declined with the aid of using the agency, or is in any scenario in which they could make a earnings because of the director position.

A war of hobby can even observe if any of the above conditions are relevant to someone who's carefully related with the agency director, e.g. spouse, partner, parent, toddler or different near own circle of relatives member.

Company administrators who assume they'll be concerned in a war of hobby need to pay attention to the subsequent 3 remedies:

Seek the board’s approval.However, if the board is powerless to authorise conflicts or can not approve the war scenario, shareholders can be contacted thru the board with the intention to come to a decision.

Check the articles of associationas they'll define provisions referring to conflicts of hobby.

Regulate self-actions.Although a war scenario might also additionally had been permitted with the aid of using the articles of affiliation, a agency director should nevertheless act in keeping with the agency’s charter.

Reject Benefits from Third Parties

A agency director should now no longer be given 0.33 birthday birthday celebration benefits. However, no infringement can be recognized if the popularity can not be seemed as some thing probable to reason war.

Declare Interests in Proposed/Existing Transactions/Arrangements with the Company

A agency director has to claim the volume of any hobby, transaction, or association with the agency (without delay or indirectly) to the relaxation of the agency administrators.

No infringement can be recognized if:

A war of hobby isn't probable to arise because of affordable evaluation to decide the sort of end of the transaction.

An hobby has now no longer been declared due to the fact a agency director is unaware that they own the hobby, or that the alternative administrators are aware about the hobby.

Who Is Eligible to Be a Company Director?

A agency director may be withinside the shape of any of the subsequent:

an man or woman (may be the agency secretary, shareholder)

a company body

a partnership

a group

any other constrained agency

an organisation/commercial enterprise/charity

Conversely, a agency wishes to have as a minimum one regular, herbal director.

Who Is Eligible to Be a Company Director?

A agency director can not be any of the subsequent:

a agency auditor

a banned agency director (can not be a director of any other agency whilst their forbid continues to be in place)

man or woman under the age of sixteen years

an un-discharged insolvent .

0 notes