Text

Cryptocurrency News

For the most recent, up-to-the-minute cryptocurrency information, please visit:

Breaking Crypto News

source https://top5cryptos.com/2021/02/18/cryptocurrency-news/

source https://top5cryptos1.blogspot.com/2021/02/cryptocurrency-news.html

0 notes

Text

Crypto-Backed Lending Service Sees Massive Demand

Crypto-backed lending service CEX.IO LOAN, launched in October 2020, has been experiencing major demand, receiving over $100M worth of loan requests to date. Most of the requests came from institutional investors, despite the service’s popularity among retail clientele, as well.

According to CEX.IO LOAN, such an increase in demand can be attributed to the institutionalization of the crypto-industry. Institutional investors in possession of cryptocurrencies regard it as collateral for borrowing funds and use it as such.

They prefer the company’s service due to the convenience it offers to users. On the CEX.IO LOAN platform, customers can borrow cash against their cryptoassets in a quick and simple manner, without having to deal with credit checks or any unnecessary paperwork.

CEX.IO LOAN serves various cryptocurrency market participants, from retail investors and traders to startups and large enterprises. Users can borrow any amount between $500 and $100,000 at competitive interest rates starting at 8.75% per year and the loan duration ranging from seven days to one year.

The service has already experienced high demand from VIP clients, with 41% of all CEX.IO LOAN customers borrowing cash against Bitcoin, 53% – against Ethereum, and 6% – against decentralized finance (DeFi) tokens.

While retail investors borrow $1,400 on average, VIP clients request larger-sized loans, with the typical amount being $1 million or higher. Institutional clients also need the funds for more extended periods (usually, 6-12 months), which indicates a long-term asset management strategy.

“As institutional investors find the digital asset industry increasingly attractive, it’s a pleasure to serve them with our enterprise-grade instant crypto-backed loan platform. Security, convenience, and compliance are key priorities for corporate clients, which are features that we have been providing to all our clients in the rapidly growing CEX.IO ecosystem,” Anton Chashchin, Commercial Director for the CEX.IO LOAN service, stated.

About CEX.IO LOAN

CEX.IO LOAN is a part of the CEX.IO Group. Founded in 2013, CEX.IO operates one of the largest international exchanges of the cryptocurrency market, which has been featured among Crypto Compare’s ten best exchange services. With offices in the UK, USA, Ukraine, Cyprus, and Gibraltar, CEX.IO serves over 3 million customers worldwide. From entry-level users to professional traders, as well as institutions and businesses, CEX.IO suits the needs of various crypto market participants with a reliable, high-security digital asset service.

source https://top5cryptos.com/2021/02/16/crypto-backed-lending-service-sees-massive-demand/

source https://top5cryptos1.blogspot.com/2021/02/crypto-backed-lending-service-sees.html

0 notes

Text

Altcoin Season 2021 – $151 Trillion Market Cap?

We’ve written frequently about the 4 year cycle in cryptocurrency prices. Cryptocurrency – this first of which was Bitcoin – was introduced in 2009. Four years later, in 2013, prices surged to a blowoff top. Exactly four years later, in 2017, prices again surged to another blowoff top.

Using this 4 year cycle as a guide, later this year, in 2021, the cryptocurrency market should again experience another blowoff top.

Using this 4 year price cycle in cryptocurrencies, we’ve made predictions on how high the price of Bitcoin could go. We’ve also made 2021 price predictions for altcoins such as Ethereum, Chainlink, EOS, Stellar Lumens and others.

But what about the entire altcoin market as a whole?

Let’s take a look at the previous altcoin season and use that price information to make an educated forecast of where the altcoin market is likely headed later this year.

Whereas Bitcoin was released in 2009, the first Altcoin wasn’t released until 2011. However, Bitcoin is the undisputed leader of the entire cryptocurrency market. The 4 year cycle in altcoins does not see a peak 4 years after the introduction of the first altcoin, but rather the altcoins follow the leader – Bitcoin – and rise and fall in tandem with it.

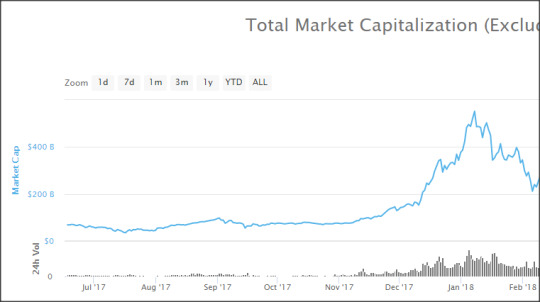

Here is the chart of the first blowoff top of the entire altcoin market cap:

You can see from the chart above that the total market cap of the entire altcoin market reached its peak of $2,004,339 billion on December 4, 2013.

Like Bitcoin, after reaching its blowoff top in 2013, the altcoins went into a bear market for the next 2 years.

It was not until June of 2016 that the altcoin market convincingly topped its previous all time high, and it wasn’t until more than 3 years later, on December 28, 2016 – exactly 1,120 days – that the altcoin market exceeded its previous all time high for good.

What did the altcoin market do after exceeding its old all time high for good?

The answer can be found in the following chart:

After permanently exceeding the 2013 all time high on December 28, 2016, altcoins then rose for the next 375 days to set a new all time high of $551,926,104 billion on January 5, 2018.

That’s a gain of 27,536%, or stated another way, 275-to-1.

Now let’s take a look at what has happened since then, and see if the altcoin market is following the same pattern, and if so where the 2021 altcoin season is heading.

The 4 Year Cycle In Action

Like what happened in 2013, after reaching its blowoff top in 2017, the altcoins went into a bear market for the next 2 years.

It wasn’t until more than 3 years later, on February 11, 2021 (4 days ago!) – exactly 1,133 days – that the altcoin market exceeded its previous all time high for good.

Wow.

The cycles are amazingly close. In the previous altcoin cycle it took exactly 1120 days for the altcoin market to convincingly exceed its previous record peak, and in the current altcoin cycle it has taken 1133 days to do the same.

The difference in timing is a mere 13 days, which is only one tenth of one percent!

So where to from here?

The Next Altcoin Blowoff Top

Using this cycle as guidance, it would indicate that the altcoin market will go up for the next 375 days and reach a top on February 20, 2022.

If the overall percentage gain is identical, that would place the total altcoin market cap at over $151 trillion.

Is that even possible?

Our opinion: one word, yes.

Let’s see where we are a year from now.

source https://top5cryptos.com/2021/02/15/altcoin-season-2021-151-trillion-market-cap/

source https://top5cryptos1.blogspot.com/2021/02/altcoin-season-2021-151-trillion-market.html

0 notes

Text

The First U.S. Commercial Bank To Provide Access To Bitcoin

Blue Ridge Bank has announced that for the first time in U.S. history a commercial bank is providing access to Bitcoin at its branch locations. Cardholders can purchase and redeem Bitcoin at 19 Blue Ridge Bank ATM locations, consisting of both branch and off-site ATMs.

“Blue Ridge Bank is excited to continue its evolution to serve the growing needs of our current and future customers,” said Brian K. Plum, Chief Executive Officer of Blue Ridge Bankshares, Inc. (NYSE American: BRBS), the parent company of Blue Ridge Bank. “The ATMs remain able to serve cash-based and inquiry activity, so this is simply layering on more services and reinforces our commitment to the future of banking for all customers.”

Blue Ridge Bank has partnered with BluePoint ATM Solutions, a national ATM operator out of Woodstock, Va., and LibertyX, the leading U.S. bitcoin ATM software provider from Boston, Massachusetts.

BluePoint ATM Solutions CEO Wade Zirkle commented, “We are proud to partner with Blue Ridge Bank and LibertyX to provide ATM management services that are Bitcoin-capable. We predict that more community banks and credit unions will demand innovative fintech solutions like this at their branches, and we are excited to be a leader in this space.”

“We’re honored to work with Blue Ridge Bank and BluePoint. For years, consumers have been asking for the ability to buy bitcoin from their banks. We are proud that BRB is the first bank in the nation to offer bitcoin services on their ATMs,” said Chris Yim, LibertyX Co-Founder & CEO. “LibertyX provides consumers with the trust and ease of going to 8,500 ATMs at local convenience stores, pharmacies, and gas stations. Now they can also buy bitcoin at their local bank ATM.”

Blue Ridge Bank, N.A., is the wholly-owned banking subsidiary of Blue Ridge Bankshares, Inc. Through its subsidiaries and affiliates, Blue Ridge Bank provides a wide range of financial services including retail and commercial banking, payroll, insurance, card payments, wholesale and retail mortgage lending, and government-guaranteed lending. The bank provides commercial banking services to customers located throughout Virginia and North Carolina.

BluePoint ATM Solutions is one of the largest privately-held ATM management companies in the U.S., with offices in Virginia and Colorado. BluePoint ATM Solutions specializes in providing efficient, outsourced ATM services to Community Banks and Credit Unions across the U.S. and providing customized ATM services to the retail and hospitality industries.

source https://top5cryptos.com/2021/02/14/the-first-u-s-commercial-bank-to-provide-access-to-bitcoin/

source https://top5cryptos1.blogspot.com/2021/02/the-first-us-commercial-bank-to-provide.html

0 notes

Text

TruckPay to Accept Logistics Payments With Cryptocurrencies

In 2020, TruckPay introduced the first multi-currency, multi-lingual, and multi-metric fleet management logistics platform to serve the needs of the aggregates, asphalt, scrap metal, recycling, demolition, agricultural, and landfill industries. TruckPay has now announced that cryptocurrencies, such as Bitcoin, Ethereum, and Stellar Lumens will be able to be used to facilitate payments on both its TruckPay Fleet Management and MyTruckScales platforms.

Truck Pay’s CEO and President, Barry Honig said, “Given the growing acceptance of cryptocurrency, with companies like Tesla preparing to accept Bitcoin as payment, we feel that it is time to allow users of our platforms to pay their subcontractors and independent owner-operators in a variety of cryptocurrencies, if they so choose.” Benjamin Honig, TruckPay’s CTO said, “I’ve been active in the crypto industry for the last 4 years and over that time, I have developed a deep knowledge of the space. I appreciate how cryptocurrencies can be used to help serve some of our underbanked drivers and contractor companies, especially ones in places like Latin-America and Africa, that have unstable fiat currencies.” Benjamin went on to say, “I have also established an extensive network of resources in the crypto software development space that will allow TruckPay to not only initially allow crypto payments on the platform, but will also, eventually, allow us to offer other related value-added services. Barry Honig concluded by saying, “By offering our customers cryptocurrencies as an additional payment method, combined with our multi-lingual and multi-metric features, we will be able to fully realize TruckPay’s goal of making our products accessible to any job creating company, subcontractor, driver, and truck scale owner anywhere in the world.”

TruckPay provides highly secure, mobile and cloud-based, paperless, enterprise truck fleet and scale management platforms. The powerhouse father-son team and company co-founders are Barry and Benjamin Honig. Barry is blind and brings many years of technology and business experience, eliminating paper tickets from trading in the financial services industry to automating logistics. Barry’s son, Benjamin, is a two-time Apple WWDC Scholarship winner. Benjamin has a remarkable talent for creating very user-friendly apps.

source https://top5cryptos.com/2021/02/13/truckpay-to-accept-logistics-payments-with-cryptocurrencies/

source https://top5cryptos1.blogspot.com/2021/02/truckpay-to-accept-logistics-payments.html

0 notes

Text

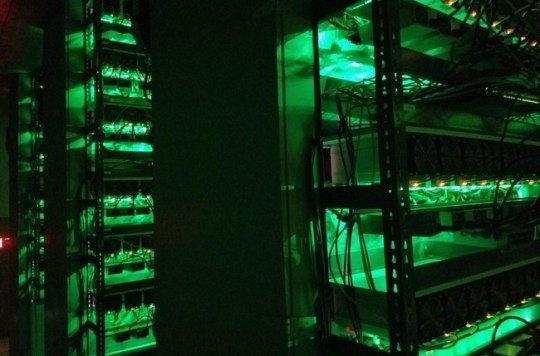

VBit Technologies Looks To Montana To Expand Mining Business

VBit Technologies, one of the only U.S.-based companies developing and hosting Bitcoin mining operations, based out of Philadelphia is expanding its mining business into Montana. Known as the “Known Technology Frontier”, Montana provides access to cheap electricity plus cooler conditions making it an ideal place to turn dormant manufacturing plants into server farms to mine Bitcoin. Yesterday, CEO of Tesla, Elon Musk, announced that it had bought $1.5 billion worth of Bitcoin, and would start accepting Bitcoin as a payment method for its products. Some are crediting Musk with raising the price of cryptocurrencies. As of today, Bitcoin has broken another all-time high at $48,200 per Coinable price index, so as the market is growing, Bitcoin mining is too.

VBit already has existing mining locations in Calgary and Colorado and is expanding into Montana while actively looking for new locations in Western Pennsylvania as well. Montana with its inexpensive and vast amounts of hydroelectric power and large vacant facilities that have their own power substations and is a prime location for expansion to mine Bitcoin. VBit will deploy its new mining hardware in a data center that is 100% powered by hydroelectricity.

According to bitcoinenergyconsumption.com, the total power consumption of Bitcoin mining in 2020 is estimated at 77.8 TWh per year which is the equivalent of the entire country of Chile. A single mining transaction uses 686.5 kWh which equates to 23.3 days of power for an average US household (Bitcoin Energy Consumption Index – Digiconomist). This amount of power generation is estimated to add over 36.9 metric tonnes of carbon dioxide to the atmosphere which is the same as New Zealand in a year.

Don Vo, CEO and founder of VBit Technologies, said, “Crypto as an industry has now come of age, and is now firmly in the mainstream – it is here to stay, and so is VBit Technologies. From an environmental standpoint, it’s therefore important for Bitcoin mining to move to a more eco-friendly energy source that not only reduces the cost of electricity consumption but also generates it from renewable sources making it environmentally friendly. In addition, VBit is exploring new liquid immersion cooling technology that will allow for a more reliable mining environment with less failure. If there’s an hour of downtime from a failure, it means we’re losing money, so we need to keep the equipment optimized for profitability and customer satisfaction.”

VBit Technologies has a brand called VBit Mining that provides Bitcoin mining services to thousands of people worldwide, and is on its way to becoming one of the largest Bitcoin mining operations in the world.

VBit Technologies

source https://top5cryptos.com/2021/02/12/vbit-technologies-looks-to-montana-to-expand-mining-business/

source https://top5cryptos1.blogspot.com/2021/02/vbit-technologies-looks-to-montana-to.html

0 notes

Text

America’s Oldest Bank Embraces Cryptocurrency

The Wall Street Journal is reporting this morning that America’s oldest bank, Bank of New York Mellon Corp., is formally entering the cryptocurrency market:

The custody bank said Thursday it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients. In time, BNY Mellon will allow those digital assets to pass through the same plumbing used by managers’ other, more traditional holdings—from Treasurys to technology stocks—using a platform that is now in prototype. The bank is already discussing plans with clients to bring their digital currencies into the fold.

“Digital assets are becoming part of the mainstream,” said Roman Regelman, chief executive of BNY Mellon’s asset-servicing and digital businesses.

Wall Street Journal, February 11, 2021

It’s difficult to imagine a stronger signal that Bitcoin and cryptocurrencies are heading towards mainstream adoption.

HODL.

source https://top5cryptos.com/2021/02/11/americas-oldest-bank-embraces-cryptocurrency/

source https://top5cryptos1.blogspot.com/2021/02/americas-oldest-bank-embraces.html

0 notes

Text

Twitter CFO Says Company Thinking About Adding Bitcoin

The Chief Financial Officer of Twitter, Ned Segal, gave an interview to CNBC today and was asked about Bitcoin. In that interview he stated that Twitter has been doing a lot thinking on how to pay employees in Bitcoin, how to pay a vendor in Bitcoin, and even if Twitter should have Bitcoin on its balance sheet.

Auto company Tesla just revealed this week that it had used $1.5 billion of its cash to purchase Bitcoin. In response to the actions of Tesla, Mr. Segal stated that the company is continuing to study that possibility and that they haven’t bought any Bitcoin with the company’s cash… “Yet.”

It’s only a matter of time.

source https://top5cryptos.com/2021/02/10/twitter-cfo-says-company-thinking-about-adding-bitcoin/

source https://top5cryptos1.blogspot.com/2021/02/twitter-cfo-says-company-thinking-about.html

0 notes

Text

Elon Musk Talks His Book While Tesla Buys $1.5 Billion In Bitcoin

It was announced within the past 24 hours that Tesla has used $1.5 Billion of its “cash that is not required to maintain adequate operating liquidity” to buy Bitcoin. The company stated it had done so in order to “maximize returns on our cash,” as stated in the company’s most recent 10-K filing with the SEC. The filing revealed that in addition to the massive purchase of Bitcoin, the company also expects to start accepting Bitcoin as payment for its automobiles “in the near future.”

Bitcoin quickly responded to the news and rose to a new all time high of $44,900 within an hour of the announcement.

We observe that Elon is guilty of “talking his book.”

What is “talking your book?”

An decade-plus old article from Abnormal Returns, titled “Everybody talks their book, everybody” explains it this way:

Talking your book is a phrase used to describe what portfolio managers are doing when they discuss their portfolio holdings. It is generally assumed that this discussion is to create interest (and buyers) of these securities.

This will ultimately benefit the price of the security and the manager’s portfolio. The more cynical out there might see any sort of stock rise as an opportunity to exit a position as well.

Even that might be too simple an explanation. A manager might take the opposite tack an bad mouth a position hoping for a drop in price to allow further accumulation.

To summarize and simplify the above quote, “talking your book” basically means that a money manager will talk glowingly about an asset he wants to sell (in order to get the highest price possible), and conversely will talk negatively about an asset he is in the process of buying (in order to drive the price down to provide a better entry price).

Did Elon do that?

It certainly seems that way to us. Have a look at his tweet from December 20, 2020:

Bitcoin is BS?

Yes, so says Elon when he is trying to buy.

And after his purchase is complete, then he adds Bitcoin to his twitter profile, his car company announces it has bought a gigantic amount of Bitcoin, and will be taking the cryptocurrency as payment for its autos in the near future.

It seems Bitcoin is only BS to the wealthy when they’re trying to buy it.

source https://top5cryptos.com/2021/02/09/elon-musk-talks-his-book-while-tesla-buys-1-5-billion-in-bitcoin/

source https://top5cryptos1.blogspot.com/2021/02/elon-musk-talks-his-book-while-tesla.html

0 notes

Text

CME Launches Ethereum Futures

CME Group, the world’s leading and most diverse derivatives marketplace, today launched Ethereum futures, further expanding its crypto derivatives offerings in this emerging asset class.

“As institutional demand for transparent, exchange-listed crypto derivatives continues to increase, we are pleased to launch our new Ether futures contract,” said Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products. “The addition of Ether, along with our liquid Bitcoin futures and options, will create new opportunities for a broad array of clients, whether they are looking to hedge ether positions in the spot market or gain exposure to this cryptocurrency on a regulated derivatives marketplace.”

“Just like in other capital markets, derivatives have become the avenue of choice for institutions to access cryptocurrencies,” said Sui Chung, CEO of CF Benchmarks. “Our status as a U.K. FCA regulated benchmark provider, whose compliance is regularly audited by Deloitte, gives institutions further confidence to enter the cryptocurrency space via the CME Ether futures contact based on our CME CF Ether-Dollar Reference Rate. For the first time, investors can gain exposure to the second-largest cryptocurrency by market cap via a U.S.-regulated futures contract. Just as Bitcoin futures paved the way for institutions to enter the crypto market in 2017, so CME Ether futures will allow CME Group clients to gain even greater exposure to the asset class.”

“CME Group has been an integral participant in the continued institutionalization of this asset class, and the launch of Ether futures is yet another milestone,” said Michael Moro, CEO of Genesis Global Trading Inc. “Genesis is excited to continue to work closely with CME in this effort.”

“The launch of CME Ether futures is an exciting addition to the digital assets ecosystem as it evidences the ongoing maturation of the asset class as a whole,” said Michael Sonnenshein, CEO of Grayscale Investments. “At Grayscale Investments, we’ve seen enormous growth in investor interest for Ethereum and we’re excited to see the growing list of financial product offerings expanding access to digital currencies.”

CME Ether futures are cash-settled, based on the CME CF Ether-Dollar Reference Rate, which serves as a once-a-day reference rate of the U.S. dollar price of Ether. Ether futures are listed on and subject to the rules of CME.

As the world’s leading and most diverse derivatives marketplace, CME Group enables clients to trade futures, options, cash and OTC markets, optimize portfolios, and analyze data – empowering market participants worldwide to efficiently manage risk and capture opportunities. CME Group exchanges offer the widest range of global benchmark products across all major asset classes based on interest rates, equity indexes, foreign exchange, energy, agricultural products and metals. The company offers futures and options on futures trading through the CME Globex® platform, fixed income trading via BrokerTec and foreign exchange trading on the EBS platform. In addition, it operates one of the world’s leading central counterparty clearing providers, CME Clearing. With a range of pre- and post-trade products and services underpinning the entire lifecycle of a trade, CME Group also offers optimization and reconciliation services through TriOptima, and trade processing services through Traiana.

source https://top5cryptos.com/2021/02/08/cme-launches-ethereum-futures/

source https://top5cryptos1.blogspot.com/2021/02/cme-launches-ethereum-futures.html

0 notes

Text

Cryptocurrency Pandemic: Phishing Scams

There’s a pandemic in the cryptocurrency world, and it’s not Covid-19.

It’s phishing scams.

As the crypto bull run charges upward, so too, does the number of phishing scams aiming to steal your precious coins and tokens.

If you’re HODLing or considering investing in some promising cryptocurrencies, you must beware of Cryptocurrency Phishing. This is a common and ever-growing problem that is plaguing the entire planet. We will go over the basics of this particular scam, as well as give you some basic rules on how to protect yourself from it.

Cryptocurrency Phishing starts with forgery. The key to running a credential-stealing phishing scam is creating an exact replica of a secure website that’s good enough to fool most people, or even just some people. With the classiest fakes, every link goes to the real site. Well, every link except the one that submits your username and password to the perpetrators. As icing on the cake, the fraudsters may try to create a URL that looks at least a little bit legitimate. Instead of paypal.com, perhaps paypa1.com, or paypal.security.co.

The fraudsters are ALWAYS going to try to make you think you’re entering your information at the genuine site, but – like counterfeit money – it only looks real. Instead of entering your password, date of birth, and social security number into the form at your bank’s website, you’d be entering that data into a site that looks identical to your bank’s website, but is actually a site set up by the scammers.

The same holds true for entering your password logging into your favorite crypto exchange or wallet.

If you want to protect yourself against these scams, there are a few rules that you must do.

Never violate these rules! Ever! Never-Ever! NEVER-EVER!

Never click a link from inside an email. Trojans and Malware could be just on the other side of that click. If you get an email from your financial institution claiming that security has been breached and you need to update your password or other information, direct navigate to your financial institution and do not EVER click the link in the email.

Make sure that the website you visit offers a secure checkout process. Secure checkout ensures that only people authorized by the website can access your information. The “HTTP” communications system used for basic internet communication is a holdover from the early days of the world wide web. It’s not secure, because at the time there was no commerce done online. Well, the bad folks are here, and the only sensible way to connect is using the secure “HTTPS” protocol. Web browsers show a lock icon for HTTPS pages. Chrome takes a step beyond, actively marking HTTP sites “Not secure.” You should never enter any sensitive information into any site that doesn’t use HTTPS.

If you have even the slightest gut feeling that something might be amiss, contact the website or institution directly and ask. Simple as that. Got an email from Ledger saying you need to update the software? DON’T CLICK THE LINK! Instead direct navigate to Ledger and check the FAQs. If you see nothing about an update, submit a support ticket.

Go back and memorize these 4 rules, and make it a habit to always follow them.

Remember, Phishing is a method used to compromise the computers of and steal sensitive information from individuals by pretending to be an email from or the website of a trusted organization. For example, a person receives an email that appears to be from the recipient’s bank requesting that recipient verify certain information on a web form that mimics – and looks exactly like – the bank’s website. When captured by the hackers, the personal data allows them access to the recipient’s banking information. Alternatively, the web-link may contain malicious code to compromise the target’s computer. One of the things that makes phishing attacks tricky is that they can be distributed by compromising the email address books of compromised computers. So the phishing email you receive may appear to have been sent by a known and trusted source.

A subset and highly effective form of phishing attack is a spear-phishing attack in which a hacker will research an intended target and include details in an email that makes the email seem more credible. The details may, for example, reference a corporate social event from the previous month that was published on a public website. It can be exceedingly difficult to protect against these kinds of attacks as demonstrated by the notable and extremely costly breaches of sensitive information by Target, Home Depot, and other well known firms.

To keep yourself as protected as possible, we suggest more reading on this topic at Digital Guardian, FTC,gov, PCmag.com, and Phishing.org.

As the value of your crypto investments goes up, so too does the size of the prize for the scammers. The bigger the reward, the harder they’ll try to get it.

Use your best judgement and be safe out there.

source https://top5cryptos.com/2021/02/07/cryptocurrency-pandemic-phishing-scams/

source https://top5cryptos1.blogspot.com/2021/02/cryptocurrency-pandemic-phishing-scams.html

0 notes

Text

Be Expecting News Headlines Warning of “The Bitcoin Bubble”

The prices of Bitcoin and altcoins have been climbing in recent weeks. We’ve written a fair amount about the 4 year Bitcoin cycle and have pointed out that 2021 is the next iteration of a significant crypto bull run.

We want to give you a heads up regarding news stories that you are almost certainly going to be subjected to this year: In 2017, the higher the price of Bitcoin climbed, the more stories were published about the “Bitcoin bubble”.

A simple google news search for “Bitcoin bubble” with a date range of the entire year brings up hundreds and hundreds of articles. Here’s just a small sampling:

WBUR.org published, “The Bitcoin Bubble: Deciphering Digital Currency” on June 1, 2017. A quote from the article:

There are a couple of reasons why the bubble is sure to burst. The first is just that it’s a bubble, and any chart which looks like the one at the top of this post is bound to end in tears at some point.

CNBC published “Mark Cuban calls bitcoin a bubble, price falls” on June 6, 2017. The article included this statement:

Bitcoin gave back most of its gains on Tuesday after billionaire entrepreneur Mark Cuban said in a series of tweets the digital currency is in a bubble. Cuban Tweet: I think it’s in a bubble. I just don’t know when or how much it corrects. When everyone is bragging about how easy they are making $=bubble

The Economist published “What if the bitcoin bubble bursts?” on June 3, 2017. The news story proclaimed:

Is the latest frenzy like tulipmania, a gold rush or the dotcom boom? MARKETS frequently froth and bubble, but the boom in bitcoin, a digital currency, is extraordinary. Although its price is down from an all-time high of $2,420 on May 24th, it has more than doubled in just two months.

There are hundreds upon hundreds of news stories from 2017, all claiming that Bitcoin was in a bubble and implying that anyone holding Bitcoin was going to lose everything once the bubble popped.

These stories were published in every month of the year, however, the higher the Bitcoin price climbed, the more frequent the stories became.

We expect the same stories to be rolled out again en masse this year, as the price of cryptocurrencies soar in a major, breathtaking bull market.

There are bear markets, and there are bull markets. If our forecast is correct, the top of this bull market in cryptocurrencies will not be reached until mid to late December this year.

We are not going to let the coming onslaught of Bitcoin bubble stories frighten us into selling prematurely.

A word to the wise.

source https://top5cryptos.com/2021/02/06/be-expecting-news-headlines-warning-of-the-bitcoin-bubble/

source https://top5cryptos1.blogspot.com/2021/02/be-expecting-news-headlines-warning-of.html

0 notes

Text

World Economic Forum Releases Very Pro-Cryptocurrency Report

The World Economic Forum has recently released a report that suggests cryptocurrencies have a very prosperous future. The report, titled “Crypto, What Is It Good For? An Overview of Cryptocurrency Use Cases,” is rabidly optimistic about the future role of cryptocurrencies in the world’s economic and financial systems.

Here are some various quotes from the report:

Over a decade ago, a white paper by Satoshi Nakamoto was distributed to a cryptography mailing list outlining a novel proposal for a “peer-to-peer electronic cash system” called bitcoin. This innovation spurred a new, global industry and asset class that has created hundreds of billions of dollars in value, and inspired a generation of entrepreneurs and innovators.

From the foreword

Another pro-crypto statement:

The World Economic Forum Global Future Council on Cryptocurrencies represents a broad cross-section of experts working to make cryptocurrencies useful across a wide range of use cases.

From the foreword

And one more:

Cryptocurrencies have reached a point of inevitability. We have dedicated our careers to advancing the adoption and use of cryptocurrencies because we believe they represent an enormous opportunity to grow the global digital economy and benefit consumers and businesses across the world.

From the foreword

When on reads the report, it becomes very clear that the World Economic Forum clearly believes that cryptocurrency will permeate all economic and financial transactions globally.

These specific cryptocurrencies each have a dedicated segment in the report: Bitcoin, Ethereum, Ripple, Tezos, Celo, Litecoin, Zcash, Filecoin, and Arweave. These second layer protocols also have their own segments in the report: Bancor, Lightning, Compound Protocol, Uniswap, Etherisc, and OMG Network.

This report is more evidence that the world is heading towards mass adoption of blockchain.

Got crypto?

source https://top5cryptos.com/2021/02/05/world-economic-forum-releases-very-pro-cryptocurrency-report/

source https://top5cryptos1.blogspot.com/2021/02/world-economic-forum-releases-very-pro.html

0 notes

Text

Bitcoin New All Time High In February?

We’ve written extensively about the 4 year cycle in Bitcoin and Altcoins. Just two days ago we released our Bitcoin and Altcoin forecast for February and March.

We pointed out how closely 2021 price behavior is following 2017 price behavior:

This year, Bitcoin reached its high on January 8, only 3 days later than it did in 2017.

In 2017, the previous 4th year of the Bitcoin cycle (2021 is also a 4th year of the Bitcoin cycle), Bitcoin made an intermediate high on January 5 and an intermediate low on January 25.

This year, Bitcoin made an intermediate high on January 8, and made an intermediate low on January 28 – again, exactly 3 days later than it did in 2017.

The timing of these swing lows and highs is remarkable.

Using this data, we predict that February will not see a new all time high for the price of Bitcoin.

If the pattern continues to follow 2017 this precisely (at some point it will diverge, markets don’t repeat so precisely for extended periods of time), the new all time high for Bitcoin will not arrive in February, as the pattern in 2017 saw Bitcoin top its early January high on February 28th of that year.

Comparing 2021 to 2017, the cycle has been experiencing a 3 day delay, which would suggest a new all time high for Bitcoin will not be reached this year until March 3.

Of course, this forecast is not guaranteed. Highly charged positive crypto news events could cause Bitcoin to surge to new highs sooner, while the unexpected appearance of negative Bitcoin news sphere could delay the timing of a new all time high for Bitcoin.

We are quite certain, however, that a new all time high for Bitcoin is only a matter of time.

source https://top5cryptos.com/2021/02/04/bitcoin-new-all-time-high-in-february/

source https://top5cryptos1.blogspot.com/2021/02/bitcoin-new-all-time-high-in-february.html

0 notes

Text

Blockchain Storms The Automotive Industry

Created by experienced automotive professionals, Carnomaly harnesses the limitless potential of the blockchain and cryptocurrency to provide innovative solutions for some of the most pressing problems in today’s automotive industry. Carnomaly can solve numerous industry inefficiencies, such as undervalued trades, high-interest rates, overpaying for vehicles, a confusing purchase process, and inaccurate vehicle histories with its fleet of technology solutions: the CARR token, CarrChain, and CarrDefi.

CARR Tokens

Carnomaly logo

To fund its development and the global reward program, Carnomaly created CARR tokens. The Ethereum network hosts the token exclusively through its ERC-20 smart contract. Utilizing only the Ethereum network makes it simple to analyze how many tokens each member holds and the membership level each member has achieved.

CarrChain

CarrChain is a web-based application through which vehicle owners can easily manage and update their vehicle’s online profile. The better updated an owner keeps their vehicle’s profile, the more points they can earn towards the car’s reputation score. When the time comes to sell the car, this gives a competitive edge to the seller.

Essential Benefits of CarrChain:

Achieve real-time vehicle sales by eliminating lengthy title transfers

Replace confusing, incomplete vehicle maintenance paper records

Notify dealers and private buyers of possible weather damage to a vehicle through the Natural Disaster Bulletin

Provide complete historical records for the dealer when it’s time to sell

Increase the value of the car

Discover service gaps in maintenance to improve the lifetime performance of the vehicle

CarrDefi

CarrDefi is a crypto-powered solution from Carnomaly to eliminate outdated and inflexible auto lending. It utilizes a decentralized blockchain system where loans and assets can be purchased or sold without a bank. Carnomaly members can use CarrDefi to securely connect with borrowers and lenders through loan pools created by Carnomaly’s financial experts.

Carnomaly will offer 250,000,000 CARR tokens in three separate IEOs, the first of which launched on Jan.26. To ensure stability for token holders, Carnomaly is dedicated to listing on some of the top exchanges with the highest liquidity. Once the final IEO sale has concluded, Carnomaly will lock company funds for 90 days.

Carnomaly is the future of the automotive industry. Their fleet of tech solutions will bring digital innovation to the automotive industry through the power of blockchain technology. CarrChain, CarrDefi, and the Carnomaly marketplace will change the way we buy, sell, shop, report, and finance new or used vehicles.

source https://top5cryptos.com/2021/02/04/blockchain-storms-the-automotive-industry/

source https://top5cryptos1.blogspot.com/2021/02/blockchain-storms-automotive-industry.html

0 notes

Text

2021 Bitcoin Price Prediction: $250,000

If you’ve already read our Bitcoin price predictions, you are aware that we’re calling for Bitcoin to reach a price between $379,825 and $1,329,389 later this year. You may also be aware that Tim Draper is predicting the price of Bitcoin to reach $250,000 next year.

Tim Draper isn’t the only forecaster calling for the price of Bitcoin to reach a quarter of a million dollars. The Bitcoin Stock-to-Flow model is predicting the same price, by the end of this year.

PlanB, the creator of the model, a few moments ago tweeted that the model is predicting a 20% monthly increase in value of Bitcoin for the remainder of this year. That would put the price of Bitcoin at $250,000 each by December 31, 2021.

We would like to point out what should be obvious: the model predicts a steady 20% monthly increase in the “value” of Bitcoin. Theoretical value and market price can often be quite different. During periods of fear and negative press, market conditions can can cause the price to be substantially lower than value, and during periods of extreme bullishness and greed (as illustrated by the crypto fear and greed index), market conditions can cause the price to be bid to levels that are significantly higher than the value indicated by the model.

Nevertheless, there are strong indications from several factors – our favorite being the 4 year cycle – that the price of Bitcoin will be six digits later this year.

source https://top5cryptos.com/2021/02/03/2021-bitcoin-price-prediction-250000/

source https://top5cryptos1.blogspot.com/2021/02/2021-bitcoin-price-prediction-250000.html

0 notes

Text

Bitwise Files For Approval To Have Its Bitcoin Fund Publicly Trade On OTCQX

Bitwise Asset Management, a leading crypto asset manager with over $700 million in assets under management, announced today that it has begun the regulatory process to allow shares of the Bitwise Bitcoin Fund to trade on OTCQX.

If approved, shares of the fund would be available for trading in traditional brokerage accounts and for custody with many traditional custodians.

The company has not yet announced a ticker for the fund.

“We are tremendously excited to take the Bitwise Bitcoin Fund down the path recently taken by the Bitwise 10 Crypto Index Fund (OTCQX: BITW),” said Bitwise President Teddy Fusaro. “We have been managing this fund since 2018, offering investors a cost-effective, convenient, and secure means of gaining investment exposure to bitcoin, and are excited to potentially see shares of the fund quoted on OTCQX.”

The Fund charges a 1.5% expense ratio, which includes costs related to custody, tax, accounting, and management fees, lower than competing products. The fund’s bitcoin is held with a regulated, insured, third-party custodian.

The Bitwise Bitcoin Fund opened for private placements by accredited investors in December 2018, and the private placement offering remains open via the Bitwise website.

“There is significant growth in interest from professional investors in accessing bitcoin as a tool to hedge their portfolios against rising inflationary risks,” added Matt Hougan, Bitwise chief investment officer. “Financial advisors in particular are taking note of the large allocations that hedge funds, institutions, insurance companies, and traditional asset managers are making to bitcoin, and based on our recent survey of nearly 1,000 financial advisors, many are deciding that now is the time to consider an allocation of their own.”

If cleared, the Bitwise Bitcoin Fund will be the second Bitwise fund cleared for public quotation: On December 9, shares of the Bitwise 10 Crypto Index Fund (OTCQX: BITW) became the first publicly traded crypto index fund in the United States, and began trading on the OTCQX Best Market.

Bitwise Asset Management is a leading provider of index and beta crypto funds. Based in San Francisco, Bitwise’s team combines expertise in technology with decades of experience in traditional asset management and indexing—coming from firms including Facebook, Google, Wealthfront, BlackRock, Fidelity, Deutsche Bank, IndexIQ, and ETF.com. Bitwise is backed by leading institutional investors and asset management executives, and is a frequent commentator on crypto in the press. It has been profiled in Institutional Investor, CNBC, Barron’s, Bloomberg, The Wall Street Journal, The New York Times, and many other leading publications. The firm is a trusted partner to financial advisors, RIAs, multifamily offices, hedge funds, and other professional investors as they navigate the crypto space.

source https://top5cryptos.com/2021/02/02/bitwise-files-for-approval-to-have-its-bitcoin-fund-publicly-trade-on-otcqx/

source https://top5cryptos1.blogspot.com/2021/02/bitwise-files-for-approval-to-have-its.html

0 notes