Text

Make An Extra $1000 A Month With Buildbox

Buildbox is a powerful game development engine that allows you to build mobile games without coding. Founded by Trey Smith in 2014, Buildbox aims to simplify the process of game development. It achieves this by offering a simple drag-and-drop user interface, making it easy for anyone with no programming experience to use.

It’s also worth noting that Buildbox can easily export a game to multiple platforms, including; Android, Mac, Apple TV, Windows and iOS devices. This means that your game will work on most major platforms, exponentially increasing your revenue.

Table of Contents

- How exactly does Buildbox work?

- Do I need to be skilled to use Buildbox?

- How do you make money with Buildbox?

- How much money can you make with Buildbox?

- Pricing

- Where can I get assets for my projects?

- How do I publish to the play store?

- How do I publish to the iOS app store?

-

Are there any other stores you can post to?

- Are there any alternatives to Buildbox?

- Is Buildbox worth it?

How exactly does Buildbox work?

There are many different types of game engines out there and each one has its own way of working. In this section, we’ll go through the basics of how to use Buildbox and what you need to know before you start.

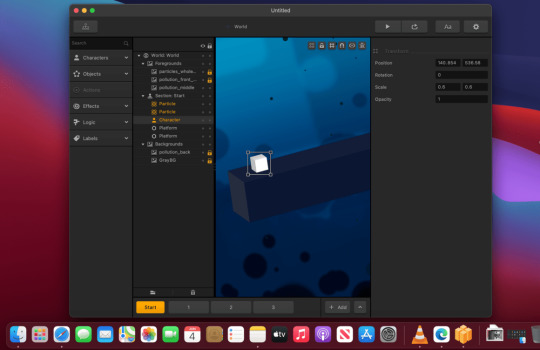

- First and foremost, head over to Buildbox.com and download the software. Buildbox offers 2 different versions; 2D classic and 3D. The version you'll pick will depend on the type of game you're interested in making. I personally love using Buildbox 2D classic because it allows me to build simple addictive 2-dimensional mobile games. I also find it easier to use and faster at deploying ideas and games.

On the other hand, Buidlbox 3D is extremely powerful. You can create immersive 3-dimensional games without any programming knowledge. (Note: Whichever version you choose, Buildbox offers a similar experience, with a robust UI)

- Once the website opens, click get started on the top, and select either Buildbox 3D or 2D Classic. Choose the free version so you can first try out the software.

- Buildbox is available on both Mac and Windows, so make sure to select the right version.

- Once the software finishes downloading, open it and sign in using your Gmail account.

- Take a few seconds to familiarise with the UI.

Do I need to be skilled to use Buildbox?

Simply no. Buildbox has a very easy learning curve. The platform also has an active community with tutorials to help you when you're stuck. In addition, Buildbox has a plethora of tools and templates that you can use to design your game. If you don't want to start from scratch, these templates present you with the option of selecting a game that you can tweak, add art, levels and create something of your own.

Before using Buildbox, I would recommend you watch all tutorial videos, as this will benefit you in the long run. Click this link to see all tutorials.

How do you make money with Buildbox?

Like any other app on the AppStore, Buildbox easily allows you to integrate Google Ads and add in-app purchases for upgrades, levels or anything you see fit. Or you can simply just sell the games you make. However, most people usually prefer to place ads and offer in-app purchases.

How much money can you make with Buildbox?

The potential is unlimited but there are many caveats. If you create a smashing hit, something like Flappy Bird with millions of downloads, that is obviously life-changing. However, realistically speaking, the mobile gaming industry is competitive, and it will all boil down to what you create. But don't be discouraged, if this is an avenue you want to test, it's absolutely worth trying. A lot of people make money doing this, and $1000 a month in revenue is easily doable if you put in the work.

(Note: In the world of App development, $1000/month in revenue is actually considered low. Try to aim higher by setting yourself quarterly goals)

Pricing

- Buildbox 2D Classic has 3 pricing tiers. A free version, a plus version for $9.99 a month (or $89.99 annually) and a Pro version for $224.99 per year.

- Buidlbox 3D also has 3 pricing tiers. A free version, a plus version for $19.99 (or $189.99 annually) and a Pro version for $499.99 per year.

(Note: these prices are relevant to the time of writing. Click this link to see updated prices and features of each tier)

Where can I get assets for my projects?

Game assets are anything you use to create your game. They can be as simple as a character sprite or as complex as a full 3D model of a house.

The most common types of game assets include:

- Art Assets: Art assets are visual elements that go into making your game, such as backgrounds, characters, sprites and other things. These are usually drawn by hand or generated by software such as Photoshop. There are also countless resources to buy or download game assets for free.

- Sound Assets: Sound effects and music make up the audio side of your game, so they're also an important part of creating your game. You can create these yourself using tools like GarageBand or Audacity, or purchase them from websites like AudioJungle.

-

Samsung Galaxy Tab S8

Hands down the best Android Tablet. Paired with an S-Pen, this tablet was built for art. You can definitely use this to create game assets for your Buildbox projects.

Buy

-

iPad Pro M1

If you're in the Apple ecosystem, no tablet can rival this beast. It's arguably the best tablet money can buy. Not to mention, the Apple pencil 2 is amazing. It's totally worth considering if you'll be making your own assets.

Buy

Visit kenyonndez.com to read more

Read the full article

0 notes

Text

How To Monetize Your Blog In 2022

So you started a blog – congratulations! You’ve taken the first step towards sharing your ideas with the world. Maybe you’re doing it for fun or to share information with friends. Or maybe you’re trying to build a personal brand and even start a business.Whatever your goal is, blogging is one of the best ways to reach an audience, and there are plenty of ways to make money with a blog once you know what you’re doing.This guide will help you learn many ways of monetizing a blog, as well as some tips to keep your audience engaged. Keep in mind that some of these strategies require more traffic than others.Let's look at some of the most popular ways bloggers make money and explore what they are — and how you can use them to monetize your blog.There are several ways to make money from blogging. There are also a lot of scams out there, so you have to be careful. (To learn how to start a blog, click this link to read our previous post.) Table of Contents - 1. Affiliate Marketing - 2. Sponsored posts- 3. Advertisements - 4. Sell your own products - 5. Sell courses on your blog- Improve SEO to increase traffic- Understand your expenses- Quick Summary (how to monetize your blog) 1. Affiliate MarketingInstead of promoting your own products, you can sell affiliate products to your audience. For example, if your blog was about Apple devices, you could promote the latest iPhone accessories to your audience and make a good commission for each sale.Affiliate marketing is a great way to monetize your site because of how simple it is. All you have to do is include affiliate links, provided by an affiliate network, such as Amazon in your posts. When a sale is made, the merchant will handle the rest. But it takes time to build trust with an audience before anyone buys something from you. Remember- blogging is not a get-rich-quick scheme. Always recommend products that you actually use or have knowledge of. Building trust is the key to affiliate marketing. This type of monetization usually makes the most money for many bloggers. The pros are you won't run out of content as there are millions of products and services to recommend, and there is basically no risk as you're not the one shipping products or dealing with customers; but you have to be very selective on what you want your brand to represent. (Note: You don't need a blog to be a successful affiliate marketer. Some of the most successful affiliate marketers use TikTok, Facebook, YouTube, Instagram and Pinterest to promote products.)Below are some of the best affiliate networks to join. - Amazon associates. This platform needs no introduction. Amazon is one of the best affiliate networks. It has almost any product you can think of. - Clickbank. Similar to Amazon marketplace, Clickbank offers a collection of products to promote. - Refersion. Connects Ecommerce businesses with affiliate marketers. - eBay Partner Network. Promote products from eBay. Though eBay has amazing deals, the only caveat is that auctioned products can sell quickly and as a result, your links can lead potential customers to expired items. - Nord VPN. VPN's are very popular with tech blogs. Most of these affiliate programs pay well, averaging around $50 a sale. - Fiverr Affiliate program. Get paid to promote Fivver and receive a commission for every qualified purchase. - Envato. Envato is the go-to marketplace for web designers, bloggers and anyone who needs digital assets. They sell themes, plugins, art, templates and more. As an Envato affiliate marketer, you could focus on premium WordPress themes and plugins because you're likely using WordPress.This is just the tip of the iceberg. There are many more affiliate networks that can represent your niche. Take time to research and narrow it down.2. Sponsored postsGetting sponsors is a great way to make money on your blog. But how exactly do you find sponsors and what do you do when they come knocking?A sponsor pays you to test and review their product or service in exchange for promoting their company on your blog. This is an effective method of monetizing your blog and engaging with your audience by providing recommendations for new products and services. Different companies will present different terms on how they want you to feature their products, so it's important to review their terms and see if they align with your interests. Pay is also a factor, but that will mostly be determined by how much traffic you get.Don't be scared to reach out to companies for sponsorships. Some of them will be willing to work with you, even if you're a smaller blogger. The key is to have rich content and a blog that is geared towards a mutual audience. Here's how you can get sponsored by a top-notch brand: - 1. Research Your Target Market. First things first, before approaching a company with a sponsorship offer, do your research! Find brands you think you'd like to collaborate with. Look at the niche that your blog covers and find out what brands would contribute positively to your readers' experience. - 2. Contact Companies With Offers To Sponsor Content. Once you have a list of companies that are relevant to your niche, contact them with an offer to become a sponsor on your blog. Do not ask them for money directly (i.e., "I'll promote your product if you give me $300"). Instead, ask if they'd be interested in sponsoring content on your website (i.e., "Would you be interested in sponsoring an infographic I created about electric cars?"). This approach reduces their expectations and allows them to see the value of your content.If you're looking for sponsorship opportunities, I'd recommend starting with a site like lookingforsponsors.com, which is an awesome resource for bloggers (and advertisers) alike looking for free and paid sponsorships.Lookingforsponsors gives you access to the sponsorships & promotions forum where people post blogging opportunities that they're seeking sponsors for. It's pretty easy to use; just look through the forums and see if any posts interest you. There are also opportunities available on SponsorFind's Job Board, which is like an online classified ad section.3. AdvertisementsThe most common method of making money through a blog is through advertising, either through pay-per-click (PPC) ads or banner ads. One of the most popular ad networks is Google Adsense. Once signed up, Google will review your website, and if it gets approved, you can successfully show ads on your site. To show ads, Google will provide a code that you can embed in any location of your site. Don't freak out, it's easier than it sounds. There are many tools, guides and plugins that can help with ad management. (Google has also made it quite easy to add ads to your website through automatic ads. To read more about Google Auto Ads, read our article here.)Check out these Google Adsense alternatives below - Media.net - PropellerAds - Ezoic - Mediavine - Amazon Native Shopping Ads - Adversal - Skimlinks - Monumetric - InfoLinks - ylliX - Evadav - PopCash4. Sell your own productsIf you have a product or service that you want to sell, create a store section in your blog or set up an account with Amazon so that people can purchase directly from there. You can also sell digital products such as art, music files, software and ebooks.If you're a WordPress user, install the WooCommerce plugin and transform your blog into a fully-fledged store. WooCommerce is extremely powerful and a must-have tool for any seller.These are some of the most popular things that people sell on their blogs - Ebooks. A lot of seasoned bloggers have written ebooks that sell for less than $5. These short-form ebooks can cover anything from blogging, and affiliate marketing to cooking guides. If you do decide to make an ebook, make sure it's priced right and offers value to the reader. - Software - Art - Crafts - Apparel - AppliancesIf you do decide to sell your own products, just make sure that these products align with your audience's interests.5. Sell courses on your blogIf you're particularly good at something, consider using your skillset to sell courses to your audience. It can be anything from (but not limited to) "Coding for Beginners", "How to file taxes", "Social Media Marketing", or even "How to be a better cook"! You'd be surprised how many people are willing to pay to learn a new skill.Tailoring your content and pricing appropriately is also important. While it can be tempting to just start with a one-size-fits-all price, consider what real value means for your customers. If you're not sure what's right for your audience, test different prices and see what people are willing to pay.Improve SEO to increase trafficSearch engine optimization (SEO) is the technique of growing the quality and quantity of website traffic, by increasing the visibility of a website or a web page to users of a web search engine. The more exposure your blog gets, the more revenue the site will generate. To learn more about SEO, read our article here.Understand your expensesMonetization Goals: - Increase income. - Decrease expenses. It's important to think about the cost of running a website. With growth and development, at some point, the site will pay for itself. Selecting a good host with good performance at an affordable price is crucial. One of the best hosts is Bluehost which only costs .../month. To learn more about Bluehost, click here. - Improve user experience. Your audience should be able to easily navigate and find posts. Having a good user interface can really enhance the overall reading experience, thus boosting sales and content engagement.Quick Summary (how to monetize your blog) - Display ads - Affiliate marketing - Making an e-book - Writing sponsored posts - Sell physical goods - Sell digital goods - Collaborate with influencers and brands - Do paid reviews - Sell courses - Host paid events on your blog - Get sponsors for your content - Offer membership and subscriptions - Join Patreon - Rent out ad space - Accept guest posts on your blog - Host webinars and workshops - Offer one-on-one services

Read the full article

0 notes

Text

The Complete Guide to TFSAs and RRSPs

With the future being unpredictable, Canadians are wondering whether they should be opening a Tax-Free Savings Account (TFSA) or a Registered Retirement Savings Plan (RRSP) account. The answer to that question depends on several factors, including your age, income and financial goals.

What is an RRSP?

A Registered Retirement Savings Plan (RRSP) is a type of financial account that is registered with the Canadian federal government. It offers tax advantages to individuals who contribute and provides you with a safety net after retirement. In Canada, you can open an RRSP through a financial institution like a bank, credit union, or trust company.

Contributions to an RRSP are deducted from taxable income, which means that if you make $100,000 and contribute $10,000 to your RRSP, you'll pay tax on $90,000 instead of $100,000. This means that your taxes will be lower in the present year than if you didn't contribute.

With an RRSP, you don't have to use 100% of your contribution room each year, but you can't carry forward unused contributions indefinitely. Any unused contribution room will be lost on December 31 of the year you turn 71 years old when you must close your RRSP and convert it into an income stream (such as an RRIF).

To learn more about RRSPs, checkout our article here.

Learn more about RRSPs

What is a TFSA account?

The TFSA was introduced in 2009 as a way to help Canadians save money and invest in various assets without having to pay taxes on growth. An individual can contribute up to $6,000 per year to their TFSA account and carry any unused amount to the following year. (Note: Earnings from investments do not affect contribution room)

With a TFSA, the contribution room carries over to the next year if you don't use it all, but is temporarily lost if you withdraw funds from your TFSA in the current year. For example, if your contribution room for the year 2022 is $6,000 and you contributed $4000, your remaining contribution for the year 2022 will be $2000. However, if you decide to withdraw that $4000 that you contributed, the overall contribution room won't go back to $6,000 until the year ends.

(Note: withdrawn amounts are added back to your contribution room in the following year.)

To learn more about TFSAs click this link.

Learn more about TFSA

TFSA VS RRSP

Primary use

- TFSA. This account is flexible, as money can be withdrawn without penalties. It can be used to build long-term and short-term savings, investments and emergency funds.

- RRSP. An RRSP account was created to help people with retirement and it's not meant to be withdrawn before its maturity date. For anyone who makes income, it's a valuable option as it deducts and defers taxes on contributions.

Who is eligible to open?

- TFSA. If you are 18 years of age or older and have a valid SIN number, you can open a TFSA account.

- RRSP. There's no age limit to opening an RRSP account, as long as you have employment income and filed a tax return.

Contribution limits

- TFSA. The 2022 contribution limit for a TFSA is $6,000. Unused amounts will be carried forward. To learn more about TFSA contributions, click this link.

- RRSP. 2021 RRSP contribution limit is 18% of your earned income reported on your 2020 tax return or $27,830 – whichever is lower, subject to certain adjustments. Unused contributions will be carried forward. To learn more about RRSP contributions, click this link.

Contribution penalties

- TFSA. For overcontribution, you will pay a tax equal to 1% for each month that the excess amount stays in your account.

- RRSP. For excess contributions exceeding the RRSP deduction limit by $2,000, you will have to pay 1% tax every month for that excess.

Spousal Plan

- TFSA. There are no spousal TFSAs.

- RRSP. You can contribute towards your spousal RRSP if they are younger than 71 years of age.

Withdrawals

- TFSA. Withdrawals can be made at any time and are tax-free.

- RRSP. The account needs to mature (when you are 71 years of age) before withdrawals are made. In addition, withdrawals are also taxable.

Key points

- The main benefit of the TFSA over the RRSP is that you don't have to pay taxes on income earned in the account - not even on earnings from interest or dividends. On the other hand, withdrawals from an RRSP are taxable at your marginal rate.

- An RRSP is designed to help people save for retirement, it's designed to deduct and defer taxes when a contribution is made.

- A TFSA is better suited for those who have little or no taxable income, but most people usually utilize both accounts.

- An RRSP is beneficial if you have income because of its significant tax deductions. The downside is, money is not easily accessible if you haven't turned 71.

- A TFSA enables you to earn investment income, such as interest, dividends and capital gains, that is not taxed and can be withdrawn at any time.

- An RRSP allows your investments to grow tax-free within the plan but you pay tax when you withdraw funds.

Which account should you open?

Most people utilize both accounts. If you've maxed out your RRSP contribution for the year, it would be wise to also take advantage of the tax-free benefits of a TFSA account. A TFSA account also allows you to withdraw money anytime without restrictions. This comes in handy during emergencies.

For anyone who is employed (especially people with higher income), an RRSP will lower your income tax by the amount you contribute. Not only will you be preparing for retirement, but you may receive a tax refund every time you make an RRSP contribution. The refund can be as much as 50% of every dollar contributed, depending on your personal tax rate.

-

Start A Blog Today With Bluehost

Subscribe to Bluehost and easily create a website like this one. Generate leads and make passive income for only $2.95 a month

Sign Up

Read the full article

0 notes

Text

All You Need To Know About An RRSP Account

What is an RRSP account?

A Registered Retirement Savings Plan (RRSP) is a type of financial account that is registered with the Canadian federal government. It offers tax advantages to individuals who contribute and provides you with a safety net after retirement. In Canada, you can open an RRSP through a financial institution like a bank, credit union, or trust company.

How to contribute towards an RRSP?

It's important to understand the rules before making contributions, to avoid penalties. For excess contributions exceeding the RRSP deduction limit by $2,000, you will have to pay 1% tax every month for that excess. You can avoid this by withdrawing the excess amount or transferring it to a qualifying group plan.

RRSP accounts can hold different investments such as; Cash, bonds, stocks, mutual funds, ETFs, options, treasury bills and guaranteed investment certificates (GICs).

How are contributions calculated?

The contribution you make to your RRSP is based on a percentage of your earned income, plus previously unused contribution room less any pension adjustments. Your maximum RRSP contribution limit is 18% of your annual earned income or $27,880 (whichever is lower) from the previous year.

The biggest advantage of an RRSP

Contributions are tax-deductible in the year they are made. This means that when you contribute to an RRSP, you are reducing your taxable income for the year by the amount of your contribution. For example, if you earn $90,000 in 2022 and contribute $10,000 to your RRSP, then your 2022 income would be taxed as if you only earned $80,000.

Additionally, contributions made to an RRSP are tax-deferred and will be taxed on withdrawal at the marginal tax rate. In simpler terms, the underlying investment income earned within an RRSP is sheltered from taxes until funds are withdrawn (interest earned on GICs, dividends paid on stocks, or any investment gains held within an RRSP, are not taxed until withdrawn).

How long can you make contributions?

You can invest in an RRSP until December 31 the year you turn 71. After this date, you can contribute up to your RRSP deduction limit to a spousal RRSP or common-law partner RRSP if your spouse or common-law partner is 71 or younger.

When an RRSP matures, there are three options to access funds

- Lump sum withdrawal. A withholding tax will be placed immediately and paid to the government. The withdrawn amount also needs to be added as income when filing for taxes.

- Convert RRSP to Annuity. An annuity is a financial product that provides you with a guaranteed regular income. You can buy an annuity with a lump sum or through multiple payments over time. There are different types of annuities such as life, term-certain and variable annuities. Each type has its advantages and disadvantages, however, what is common is; All annuities don't have a withholding tax. However, each payment received will be subject to income tax. To learn more about annuities, click this link.

- Convert RRSP to RRIF. An RRSP can be converted to a Registered Retirement Income Fund (RRIF). The amount of money you have in your RRSP at the time you convert it to an RRIF will determine how much you will receive each year. This payout is taxable income.

What's the fuss about RRSP during tax season?

At the start of every year, you’re allowed to make contributions to your RRSP during the first 60 days and claim it as a deduction in your income tax return for the previous year. For people who haven't used their contributions from previous years, there is more room for contribution.

The contributed amount will be deducted from your taxable income, thus reducing your taxes owing in any given year. Because your contributions are tax-deductible, you may receive a tax refund every time you make an RRSP contribution. The refund can be as much as 50% of every dollar contributed, depending on your personal tax rate.

You can also use an RRSP to split income with your spouse or common-law partner. For example, if one spouse or common-law partner has a significantly higher income than the other, he or she may be able to contribute to an RRSP for the other and deduct that amount from his or her income. (Note: Contributions to your own plan and your partners can’t exceed your allowable maximum contribution.)

Why you should consider opening an RRSP

- RRSPs get you money back. You get a tax deduction when you put money in RRSPs, and you may receive a tax refund.

- RRSP contributions can grow tax-free. As long as you don't withdraw, tax is deferred.

- Income in retirement. Once you retire, your RRSP withdrawals are taxed at a lower rate than your income when you were working.

- It's easy to make RRSP contributions. There are lots of choices for making your contributions: payroll deductions, online banking and automatic payments from your bank account are just a few examples of the ways you can contribute to your RRSPs regularly.

- Tax-deferral on investments. As well as helping you save taxes, RRSPs give your investments a chance to grow on a tax-deferred basis. That means any interest, dividends and capital gains they earn aren't taxed until they're withdrawn. So your investments have more money working for them and you end up with more money in your RRSP account when it's time to retire.

To learn more about other registered accounts, such as a tax-free savings account (TFSA), click here.

Read the full article

0 notes

Text

Learn How To Save And Build An Emergency Fund

Building savings is equally as vital as learning to invest. Investing is a sure way to plan for a comfortable future, but having savings gives you the necessary safety net in the event of a financial emergency. Luckily, you don’t need to have high a high income to build emergency savings. There are ways to plan for the unexpected, even on a small budget. Here are some “do-able” tips to reassess your budget and to help you kickstart an emergency savings:

- Set automatic deposits. The easiest way to save is to set up an automatic transfer from your checking account into a savings account after you get paid. Not only does this ensure that you don't see the money, but it also means you're growing your savings at a steady rate.

- Divide your income. The amount you should be saving will depend on your budget and your goals, but a good rule of thumb is to try to save 20% of your income every month, whether or not you're also trying to pay off debt. This will leave enough room for other expenses, while also ensuring that you grow your savings consistently.

- Try to live on last month's income. It's important to have at least 3 months of expenses, including rent. This will ensure that everything will be alright if an emergency occurs.

- Set a savings goal. It's hard to save unless you have something specific to work towards. Whether it's an emergency fund, down payment on a house or just enough to get you through the holiday season, having a goal in mind makes it easier to put money away.

- Keep track of your spending. If you're not sure where your money is going or what your budget should look like, write down all your expenses and review the numbers at the end of each week. This will help you see where your budget needs improvement and make any necessary adjustments.

- Keep track of bank fees. Bank fees can pile up quite quickly. Try to avoid NSF fees (non-sufficient funds) and any other related bank charges that can be avoided.

- Watch out for convenience fees. It's tempting to use an ATM that isn't part of your bank's network when cash is needed right away — but convenience fees add up fast. Try to avoid these fees

- Keep track of your bills. Paying your bills will give you oversight on how much you really have.

- Set up a budget. It's important to pay yourself and set aside disposable income. Without budgeting, it's hard to avoid sporadic spending. You can use Microsoft Excel or download any budgeting app to get started.

- Be realistic. Set realistic expectations and have your goals in mind. Don't starve yourself or hinder your health for the sake of saving money. Be strategic and always follow the plan.

- Stay consistent. Whether you're saving $10 a month or $300, the key to successfully saving is to be consistent.

- Live within your means. We all want the best things in life, but it's okay if you don't have that shiny new Tesla, or the latest PS5 console. Social pressures can push people to spend more than they need or to buy things they can't afford. We all feel this pressure but you don't need to prove anything to anyone. The best way to get the things you want is to assess your income, debts and other expenses before making big purchases.

- Set up a joint account. If you're living with someone you share expenses with, setting up a joint account can help with budgeting.

- Keep track of your subscriptions. Almost every streaming platform charges in the form of monthly or yearly subscriptions. From Netflix, Hulu, Disney+ to Spotify, it's easy to subscribe to them all. However, the cost adds up a lot when you have multiple subscriptions. To stay ahead, cancel and re-subscribe platforms that have content that you only watch seasonally, such as sports. Also, try to avoid duplicate subscriptions such as having Apple Music and Spotify, which in a sense do the same thing.

Should you save or Invest?

The answer is to do both. Investing money is the best way to build wealth in the long run. The average annual rate of return for investments is 10% which is way more than the interest rate of any savings account. Saving on the other hand is also important, especially for emergency funds and immediate cash. To learn more about investing, check out our article here.

Read the full article

0 notes

Text

How To Invest In The Stock Market With Little Money In 2022

The stock market is a system for buying and selling shares of publicly traded companies. Shares represent pieces of ownership in a company, and the price of a share is determined by supply and demand.

When you buy shares in a company, you are buying an ownership stake in that company. You are entitled to vote on how the company is run and any profit it makes (dividends). The price of your shares can go up or down depending on how the company performs.

Why you should invest

The stock market has historically achieved an average return of 10% annually which by itself proves to be better than saving money in a bank. Banks used to be the main place people would go set up a savings fund, but the interest paid on bank accounts has fallen dramatically since 2008. In addition, you usually need to have a large amount of money saved to receive any sort of decent return on your account. However, unlike a savings account, investing in stocks comes with some risks, which is why you should always educate yourself before you start using your hard-earned cash.

(Note: There is nothing wrong with saving money. It's actually important to have an emergency fund that can cover 2-3 months of expenses in case something happens. Nevertheless, if the end goal is to build wealth, investing your money will always yield a better return in the long run)

How much do you need to Invest?

If you're new to investing, the stock market can be a scary place. But there are steps you can take to make the process less intimidating and help yourself become a confident investor.

Numerous individuals think that investing requires a lot of money, but in reality, you don't need to be a millionaire to get the ball rolling. In fact, it's possible to start investing with very little money. Whether you want to invest $100 or $500, here are some tips on how to invest in the stock market with little money.

Open a brokerage account

Brokerage accounts are investment accounts that allow you to buy and sell various types of investments. These include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and index funds. An account can be opened by yourself or with the help of an investment professional, such as a broker or financial advisor. You can also open an account at a bank or credit union. The benefits of investing in a brokerage account include access to professionally managed portfolios, retirement planning and research tools for analyzing stocks.

Ready to build your portfolio? Here's what you need to know about opening and funding a brokerage account

- The stock market consists of exchanges, or markets, where these shares can be bought and sold. Each exchange has a different focus. For example, some exchanges are focused on companies from a specific country or region of the world while other exchanges are focused on companies from around the world. Examples of exchanges include NASDAQ, NYSE, NSE and many more.

- Some brokerages have high fees and a minimum balance. It's wise to keep your costs low by picking a brokerage with low fees. One of the easiest ways to start investing in Canada is through Wealthsimple, by downloading their trading app. All you need to do is fund your account and start trading. They also have a Robo advisor (money will be invested automatically, all you have to do is choose a risk factor) and cryptocurrency investing.

- Place some of your investments on a registered non-taxable account such as a TFSA (Tax-Free Savings Account) or an RRSP. Signing up with any brokerage will allow you to choose a preferred account. To read more on TFSAs and RRSPs accounts, click here. Nonetheless, why do people still use non-registered cash accounts for investments? Non-registered accounts are more flexible when it comes to withdrawing, have no funding restrictions and are good for day trading, therefore, its good to have both (Note: Income earned from your investments will be taxed on a non-registered account)

What is the best portfolio for a beginner?

A diversified balanced portfolio is always safer than investing in only one company. It's important to spread your money with different companies. If picking individual stocks is not for you, consider using a Robo-Advisor or a financial advisor. You can also invest in index funds and mutual funds to accomplish this. (Mutual funds and Index funds hold a variety of securities such as, stocks and bonds in one portfolio.)

Check out these 5 trading platforms

- Wealthsimple Invest. Possibly the easiest way to invest in Canada. Wealthsimple invest is a Robo advisor that does it all. Money will automatically be invested for you. All you need to do is create an account, decide on a risk portfolio, fund the account and you're good to go. There's also no minimum balance, making this a great platform for beginners. To learn more about Wealthsimple Invest, read our article here.

- Wealthsimple Trade. Is the only commission-free trading solution for investors in Canada. There is no minimum balance and account creation takes less than a minute if you already use other Wealthsimple products. You can also trade stocks and cryptocurrencies within the same app, which is quite impressive. The Wealthsimple brand is heavily geared towards Gen Z's and millennials, therefore expect the interface to be easy to use and friendly. To learn more about Wealthsimple Trade, checkout this article.

- Questrade. Offers competitive fees, great customer service and free ETF purchases.

- TD Direct Investing (Formerly known as TD Waterhouse). Known to have amazing research tools, TD Direct investing has a robust platform that seasonal investors will love, however, it has high trading fees.

- CIBC Investor's Edge. Though the interface looks quite outdated, Investor's Edge offers low trading fees and a no minimum balance to start. If you already have a CIBC account, moving money between accounts is easy and all in one place.

Are there any other investments other than stocks?

- Mutual funds & Index funds

- Real estate

- Bonds

- Commodities (precious metals, Currencies)

- Crypto Currencies & NFTs (It's important to do your research when looking into these. It's very easy to get caught with the hype.)

Summary: 8 Simple Steps To Getting Started With Investing

Investing in stocks is a great way to grow your money. But, it can also be an overwhelming process if you don't know what you're doing.

- Find a broker that fits your needs and budget.

- Research individual companies before investing in them. Invest in stocks that you know and understand (Research is crucial.)

- Decide how much money to invest and set a schedule for regular investments.

- Create a long-term plan for your investments.

- Stay disciplined and focused on your goals.

- Stay invested for the long term. (Re-invest dividends)

- Diversify your portfolio.

- Keep costs low.

Read the full article

0 notes

Text

The Ultimate Guide To Improve SEO Rankings In 2022

Search engine optimization (SEO) is the technique of growing the quality and quantity of website traffic, by increasing the visibility of a website or a web page to users of a web search engine. SEO targets organic traffic and excludes paid placements (such as traffic driven from ads)

SEO may target different kinds of searches; including image search, local search, video search, products, news and industry-specific topics. It is a vital element for internet marketing strategies. SEO also assesses how search engines work; the computer-programmed algorithms that dictate search engine behaviour, what people search for, the actual search terms or keywords typed into search engines, and which search engines are preferred by their targeted audience. The higher a website ranks, the easier it is to convert visitors to potential customers.

How to improve SEO

- Use focused keywords. The use of proper keywords helps search engines match your business or blog with searches. Keep reading to learn more about keywords.

- Improve user interface. A well-structured website will rank better with Google's search engine. All elements of a site need to be cohesive, easy to navigate and mobile optimized.

- Share on social media. The more you share, the more chances that people will discover your site. If new visitors share your links in return, SEO ranking will improve. There are many WordPress plugins and tools that easily automate sharing of posts.

- Write original high-quality content. Search engines love new content. The more often you update your site with new information, the better chance it has of ranking well in search results. This doesn't mean that you should be constantly updating old posts or posts with irrelevant information just for the sake of doing so.

- Improve website speed. According to research from Google, visitors will abandon a page that takes too long to load (try to aim for 2 seconds or less of load time). Don't be alarmed if you don't understand any of the terms below. If WordPress is the platform in use, there will usually be a plugin that can help optimize speed. To optimize site speed, compress images (preferably to Webp), cache all pages, minify code, lazy load images, install gzip compression and most importantly, make sure the server has enough resources to support the site. (Shared hosting packages can hinder site speed and that needs to be taken into account.)

Why keywords are the key to success

Keywords are words or phrases (sometimes single words are referred to as keywords) that describe your business. The use of proper keywords helps search engines match your business or blog with searches. Your goal is to put yourself in front of as many people as possible who are searching for the things that you offer.- Keyword Research: Start your keyword research by brainstorming terms related to your business. If you sell clothes online, start with words like "clothing" or "online store." You can then use tools in Google AdWords Keyword Planner to see how popular keywords are.

- Create Content Based on Keywords: Now that you know what keywords you want to target, it's time to create content around them. Think about ways people might search for your products and services and include those terms in places such as page titles, in content or even in the images you use. Get creative!

To help boost your rankings, here are six free SEO tools

- Google Trends. Google Trends is a go-to keyword tool. You can see how a list of keywords is trending over time which can help you determine if a particular keyword is worth targeting or not.

- Keywordtool.io. This free tool gives you up to 750 keyword ideas (and more if you upgrade to the paid version). You can filter your results by country and language which is useful if your target audience is international.

- Ubersuggest. Keyword Tool takes keywords you enter and finds other relevant keywords that people are searching for on Google.

- Answer the Public. Answer the Public takes a search term and provides questions and other related searches that people are asking around that topic.

- Yoast SEO Plugin (WordPress). If you have a WordPress site, this plugin is a must-have for any small business owner trying to optimize their website for search engines. The Yoast plugin helps guide you through optimizing each post and page on your site for specific keywords.

- Google Analytics. Google Analytics allows you to monitor traffic on your website over time, along with other helpful data like where your website traffic comes from, how long people stay and what content performs best.

What more can be done?

SEO optimization is an ever-growing learning curve. There is always more that can be done to improve content quality, keywords research and user interface.- Always find ways to improve meta descriptions and titles.

- Use tools like Grammarly to improve content quality.

- Reach out to other bloggers and build reputable backlinks.

- Create social media accounts for your blog or business and share, share, share!

- Open a Youtube channel and recycle content from your website. Make sure to add links back to your site for reference.If you're interested in starting a blog, checkout this article here.

-

Start A Blog Today With Bluehost

Bluehost is one of the best hosts for hosting any type of website for an affordable price. Get a discount when you sign up today!

Sign Up

Read the full article

0 notes

Text

It's Not Too Late To Change Careers

The pandemic has had colossal effects on the economy, the travel industry, the office environment and most importantly, the way we perceive work. Due to lockdowns and stay-at-home mandates, a lot of people have gotten the time to reassess what they really want in life. Whether it's to pursue a higher-paying job or to focus more on family time, it's clear that no one wants to settle for less.

Why are people resigning?

You've probably seen the news with the headline, "the great resignation." Workers have been quitting jobs at historic rates, to a point where there is a shortage of employees in some industries. It's no secret that a lot of people were unhappy and some decided to try out new careers. Nonetheless, there's no better time than now to make a career shift.

Why Change Careers?

- Money and stability. Some jobs pay better than others, especially in the tech industry. That's more than enough reason for people to change careers. There's an interesting story about Oil and Gas workers in Newfoundland who are changing careers to work in the tech sector. Some of these people are old but they've taken the initiative to self-teach themselves how to code. Check out this article to see how they made a career shift.

- Work culture. Some companies don't treat their employees with respect. That and many other things can make someone quit. Work culture can also be prevalent in the type of job. For instance, a sales environment will be fast and performance-based. Some people are just not cut out for that.

- Interest. Maybe you're not passionate about your current job; every day feels like a drag and a never-ending cycle. Lack of interest can lead to poor performance, low morale and stress, thus affecting the quality of life. Try to do something you love.

- Stress. Some jobs are more stressful than others. It took the pandemic for people to think about the mental effects of stress in the work environment. A job that is more flexible with good working conditions is more desirable.

- Challenge. Different individuals expect different outcomes in life. This also applies to the challenges they face. Maybe the job you're in is not challenging enough and you feel overqualified. Getting something that can keep up with your skills will be a good move for career advancement.

- Growth. Do you feel stuck in the same job without any career advancement? Working in a company that has a clear growth path is more sustainable in the long run. This also applies to the type of job. If you don't have enough skills to advance, take some courses and make yourself more marketable. There's always room to grow.

- Happiness. People just work better when they're happy.

How to advance your career?

There are many platforms, resources and programs that can help you advance your career or make a complete shift. Take a look.

- Go back to school. Enroll in any college or University. It doesn't matter if it's a community college or a prestigious institution. After all, you have to factor in how much money you're willing to spend.

- Tuition-free options. There are many free resources on the internet that can further advance your career. A basic Google search can guide you. Take a look at this US-accredited, tuition-free university called the University of The People.

- Work opportunities and scholarships. Depending on where you work. Your job might have free courses or educational opportunities that you can take advantage of. Take a look at Walmart's tuition-free program. There are also various scholarships that you may be eligible for.

- Learn a new skill. Take the initiative and checkout platforms like Coursera, Udemy, Edx, Skillshare and Codeacademy. Note, a lot of jobs in the tech sector are more lenient on the type of education you have. What matters is your knowledge, and a portfolio showcasing your skills.

- Take a career Bootcamp. Some courses are tailored to help you start a new position in a specific job. The most popular boot camps are for coding or tech-related jobs. Find your interest.

- Apply to new jobs. Sometimes that's all you need to do to start a new career.

- Have a plan and execute it. Don't quit without starting a new job or having an alternative source of income. Don't do it because everyone is doing it. Do it because you see a brighter better future for yourself.

- Online opportunities. There are plenty of jobs and online opportunities that can easily transform someone's life. From blogging to owning a successful business, it can be done. Checkout this article to learn more.

There are also numerous examples of people who have transitioned to owning successful online businesses. Take a look at this 24 year old who now makes $8600 a month online, after loosing her waitress job.

Read the full article

0 notes

Text

Beer Money Guide For Canadians: Make An Extra $100 A Day

The term "beer-money" might raise some eyebrows. The meaning has less to do with beer but more with money. It's simply the craft of making extra cash doing minimal tasks on various online websites.

Setting expectations.

You won't make a living or get rich from doing this. In truth, most people might find these websites exhausting and unrewarding, especially if you don't have a main job. Nonetheless, a few bucks (even 100$ a day) can be made daily if you have the time.

Ledger Opinion (LEO)

Get paid to do surveys and earn points (LEO points) that can be redeemed as cash through PayPal, cheque or gift cards. The website also has an intuitive mobile app that comes in handy when you feel like doing a couple of surveys in your spare time.

Sign Up

Qmee

Survey-paying website that has gained popularity throughout the years. The company has a site and a mobile app that can be used for cashback deals, and paid surveys. Qmee has no minimum cashout when using PayPal.

Sign Up

Prolific

Is another famous survey-paying website that is based in the UK. Its main focus is connecting researchers and people. Surveys tend to pay well; According to Prolifics website, "studies pay a minimum of $6.50 per hour". In addition, they only pay in £GBP (British Pounds) that gets converted to your currency when you use Paypal.

Sign Up

Usertesting

Earn extra money by testing websites and apps. All you'll need is a headset with a built-in microphone and an opinion. Expect to earn $4 for every 5-minute test, $10 USD for every 20-minute test and between $30 USD to $120 USD for live interviews. Payout will be through Paypal.

Sign Up

Amazon Mturk

One of the best crowdsourcing marketplace with a wide range of tasks such as; Data validation, research, surveys, AI training, content moderation and more.

Workers with good accuracy and approval rates get higher-paying HITs that can boost income. Some people even decide to work full time as there is no limit on how many tasks they can work on. However, most of the work is repetitive and low in pay for anyone outside the US.

For those interested, the only way Mturk can yield an acceptable payout is by using scripts and plugins that can track and accept high-paying hits for you. To start, head on to the Google Chrome web store and install Mturk suite. This extension will maximize your earnings and alert you if there are high-paying HITs. The program runs in the browser's background, therefore allowing you to work on other important projects.

In Canada, Mturk pays through direct deposit or Amazon gift cards (The gift card can only be used on the Amazon US website). To set up direct deposit, you will need to open a US bank account with a routing number. Check out this CIBC US smart account or WISE account to open a US account in Canada. If you opt for the bank option, you can set payment every 3 days, weekly or monthly.

Sign Up

Usercrowd

Formerly known as UsabilityHub, Usercrowd is another testing site that allows users to give feedback on different products, websites and apps. The only downside is, there is few tasks for new users. The minimum cash out is $10 through Paypal.

Sign Up

Clickworker

Similar to Mturk, Clickworker is another crowdsourcing website that pays for small tasks such as writing, translating, researching, and data processing. The platform has both a website and an app. To qualify for higher-paying jobs complete available assessments. Like most of these sites, payment is made via Paypal.

Sign Up

GG2U

Is a rewards program that allows you to earn GG2U coins by playing games, taking surveys, and completing offers from advertisers. Minimum payout is $7 through Paypal or to a Bitcoin wallet at Coinbase.

Sign Up

Swagbucks

Earn rewards, gift cards, deals and promotions by completing tasks. All payments can be redeemed for cash or gift cards.

Sign Up

dscout

Give companies feedback about their brand and products, and get paid in return. To get started click the link below.

Sign Up

wecheckservice

Become a mystery shopper and get paid to give feedback on a store. Payout is every 30 days through PayPal. The biggest downside is you will need to use your own money to complete assignments and get reimbursed. Note: Watch out for scammers and fake websites that claim to be wecheckservice.

Sign Up

Other user testing sites (Get paid to give feedback and test products.)

- Validately

- UserTesting

- WhatUsersDo

- UserFeel

- Userlytics

- Playtest Cloud

Are there any real jobs and opportunities online?

None of the sites mentioned in this article can replace a real job. They are meant to supplement income. However, If you would like to see lucrative sustainable ways of making money online, check out this article.

Read the full article

0 notes

Text

Struggling To Pay For Tuition? Let Walmart Pay For It

The cost of post-secondary education is higher than it's ever been. According to CNBC, the cost of college has gone up 169% since 1980. More and more people are taking on student debt without the certainty of a better future. But what if I told you that if you worked for Walmart, you could go to school...for free. Unbelievable right?

Walmart, the World's largest retailer, has pledged to invest nearly $1 billion over the next five years to train, towards the development and career-driven training of their associates. Whether full-time or part-time, Walmart will fully fund an associate's education. You'll be debt-free by the time you finish your program!

So what's in it for you?

- The program offers impressive degrees, including Business Management/Administration, Supply Chain and IT.

- They're not just offering Bachelors's degrees, you can also finish a high school diploma, a skilled trade certificate and other certifications, free of charge.

- All the participating academic institutions are accredited.

- Enrolling in the program builds your skills and provides an opportunity to advance. Walmart has a plethora of high-paying corporate jobs, between 70-150k per year. Walmart wants to take care of their own, so associates have a chance to move up as an associate.

- The best part is, it's completely free.

What's the catch?

- The most obvious thing is you have to be a Walmart associate.

- Most countries are not included in this program.

- You can only apply to colleges that are included in the Live Better U education program.

- They might not have a degree/ program you're interested in. Most programs are technical, business-related or skilled trades.

Is it worth it?

Absolutely! If you don't already have an academic certification, or you've been thinking about college, this might be an option for you. Elevating your educational background can boost your career path.

Whether you decide to stay with Walmart after your education or not, now you have an arsenal of skills that make you more marketable or allow you to venture into your desired career.

So if you don't mind working with Walmart, and, you're looking for a way to save loads on school, this program might be valuable to you.

Read the full article

0 notes

Text

Read This Before You Buy NFTs

Nonfungible tokens, popularly known as NFTs are the new hot topic of our generation. You've probably heard the news of how lucrative they can be; like Beeple's art that sold for $68 million, or a cat meme that sold for six figures. Yes, you read that right, a cat meme. However, is the hype worth your while?

What are NFTs and why are they important?

The simplest way to understand an NFT is to think of it as a unique identifier associated with a digital or physical asset. This identity can not be replicated or copied, therefore showing proof of authenticity or ownership. This unique data is stored in the blockchain and can be accessed to verify ownership.

What's stopping someone from making a copy of a digital asset?

Nothing is stopping anyone, though potential buyers only care about authenticity and proof of ownership. For instance, no one is willing to pay millions of dollars for a fake Mona Lisa painting that any artist can replicate. Yet the original artwork costs over $800 million today (adjusted for inflation). Nonetheless, if a person creates an NFT to sell someone else's art without their permission, this is considered infringement and can result in a lawsuit.

Why you should think twice before buying NFTs

Before jumping on the hype bandwagon, try to analyze the value of any NFT before making a purchase. Try to assess digital assets the same way you would treat physical ones. Would you randomly go out and buy a 2001 car from the junkyard? Or would you hold back and get something worth your money? The same concept applies to digital assets. Countless individuals are creating random NFTs that have no value whatsoever, and people buy them for crazy prices without considering a long-term selling strategy. When the hype dies, you don't want to be left with a worthless asset that has no value or demand. Ask yourself, will the next person buy this? (Check out this link to see the most expensive NTFs ever sold)

Tips to get NFT'S that are worth your money

- NFTs sold by famous people and celebrities might be worth buying because of the demand they hold. Whether it's a music album or art, it helps when it comes from a reputable source.

- Avoid pump and dump schemes or purchasing random assets because of hype. Remember, you'll only be able to sell if the asset means something to the people. The market will always speak for itself.

- If you identify an NFT that is in high demand, or projects future demand, and in your reach; It might be worth your while. Nevertheless, don't gamble your life savings in the hope of a hefty return.

How are NTFs changing the world?

Blockchain technology is truly the future. But other than memes and art, are there any world scenarios that NFTs can be helpful?- Security. NFTs verify ownership and are tamper-resistant as no one can fabricate a token. This makes the whole process of buying and selling efficient and exclusive. This technology will also reduce art piracy for work posted online.

- Real estate

- Identification and databases

- Trading cards and collectibles

- Supply chain and logistics

How to create, purchase and sell NTFs

The Verge has a great article explaining the whole process. Click this link to read more.(Disclaimer: This is my personal opinion and I encourage everyone to research thoroughly before investing in any product covered in this article.)

Read the full article

0 notes

Text

Wise Review: Multiple Currencies, One Bank Account

Wise, formerly known as Transferwise, is a London-based fintech company that offers multi-currency accounts capable of sending and receiving money.

Wise accounts can hold and convert money in 54 currencies, allowing the account holder to create "artificial" bank accounts for various countries. Imagine the flexibility of having a US, Euro, Canadian, and countless regional bank details in one account.

Features

- Get bank details for these currencies: the British Pound, Euro, US dollar, Australian dollar, New Zealand dollar, Singapore dollar, Romanian Iei, Canadian dollar, and Hungarian forint.

- US account details include a routing number and all the necessary information. This is beneficial to anyone who receives payments from US-based companies.

- Having a multicurrency account comes in handy when moving countries. Exchanging money and adjusting financially is a breeze.

- Get account details for different currencies to receive money from around the globe. Send money to family and friends globally at affordable rates.

- The account comes with a debit card that can be used for physical and online purchases (This debit card is not currently available in Canada)

- When making a purchase online, Wise automatically converts your money to the currency of the country you're buying from. If that currency is unavailable, wise will convert to the cheapest available balance.

- Money can easily be converted into 54 currencies.

Pricing

- It's free to create a wise account. There are no monthly fees or minimum balances -There is a 0.40% annual fee if you hold more than €15,000

- Receive and send wire transfers for 7.50 USD

- No rate markups

Is it safe to use Wise

Wise is regulated by FINTRAC which is an agency that is responsible for facilitating the detection, prevention, and deterrence of money laundering, terrorist activity financing, and other threats.

However, Wise is not a bank, therefore your money is not financially protected by schemes such as the CDIC, FDIC, and FSCS, that insure your money if something happens to Wise. Without this protection, there is a possibility that you won't get your money back if Wise closes. (Although there is a very low chance of this happening).

On the other hand, Wise safeguards your money by depositing funds at banking institutions. Overall, Wise is a trusted company that has been around for 11 years. The company is transparent and serves a large customer base. Here is a quote from their website regarding this issue.

What would happen if Wise became insolvent? The protections afforded by safeguarding stay in place even in the unlikely event that Wise were to become insolvent. However, if this happens, some of this money might be used by an insolvency administrator to pay for their own costs. This means the money returned to you could be lower than the total amount you had in your account. It might also take some time for that insolvency administrator to return the rest of your money back to you.

WISE

Competitors

- Paypal

- Remitly

- OFX

- World Remit

- Western Union

- MoneyGram

Who is this for?

Wise is a great financial tool for anyone looking to send, receive, and convert money at affordable rates. Bundled with a multicurrency account, Wise comes in handy for a frequent traveler, contractor, seasonal employee, or anyone looking to have international bank accounts. It's genius.

Read the full article

0 notes

Text

Sezzle Review: Buy Now Pay later

Buy now, pay later has gotten popular during the pandemic. More consumers are using this form of payment to make occasional purchases. One of the most popular platforms is Sezzle, a payment solution that allows you to pay in 4 interest-free payments.

How Sezzle works

Sezzle can be used with any store offered in their catalog. The buying process is the same as any website, with Sezzle being a payment option on checkout.

I discovered Sezzle when I was buying car parts for my Acura MDX on Partsavatar and decided to try it on checkout. The whole process was seamless and account creation took less than 5 minutes. To no surprise, $476 was split into four interest-free payments of $119. Each payment was due bi-weekly (14 days apart). You can add a debit card, credit card, or bank account as your form of payment.

Sezzle also has an app that allows you to check and manage upcoming payments. The app is well designed, simple, and intuitive. My favorite feature on the app is the ability to postpone payments if you need more time. It's crucial to make payments on time; missing payments can result in a permanent ban or an account hold. I urge you to make a budget and plan ahead of time.

Why use Sezzle?

It depends, everyone has different reasons. It might be a big Christmas purchase; possibly waiting for payday, or other responsibilities take precedence, and you prefer paying in installments. Whatever the reasons, it's important to be responsible as this can easily turn into a financial burden. It might be wise to avoid buy now, pay later platforms if you don't have any form of recurring income.

Sign up for Sezzle and get 5$ off your next order.

Click here

Are you declined?

Sezzle's verification process is a mystery, but their site mentions that they only run a soft credit check. Double-check and use the correct address, name, and birthdate when you sign up to avoid errors. If all your information is correct and it's still declined, try to order something small to build trust.

Can you build a credit score with Sezzle?

Sezzle can be used to build credit score if you upgrade your account to Sezzle Up. This allows Sezzle to report your payment history to the credit bureaus (TransUnion and Equifax). If you opt for this option, each payment will affect your credit score. To learn more about credit scores, click this link.

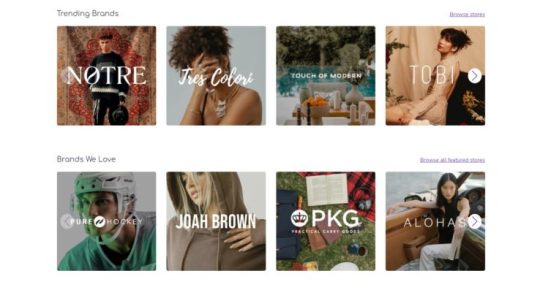

Offered stores.

There are more than 20,000 active stores in selection. From fashion brands, beauty shops to electronics, there is something for everyone. My favorite stores are Partsavatar (especially when I need emergency car parts) and Swiftronics (they sell good electronics). To check out Sezzle's catalog of stores, click this link.

Shoppers who have repaid 4 orders of $30 or more, will have access to exclusive merchants, that allow you to purchase a gift card that can be used in-store or online. One of these exclusive merchants is Bestbuy and Walmart. This is great news to anyone who loves tech and wants a simple interest-free buying solution. To buy from best buy, log in to Sezzle, click Best Buy, choose in-store or online and enter the amount you need for your purchase. You can also sign up for a Sezzle virtual card at select stores.

How does Sezzle make money?

Sezzle makes money via merchant fees (6% transaction fees), late payment fees, and interchange fees. However, the bulk of their revenue comes from merchant fees.

Pros

- Simple intuitive app

- Great selection of stores

- 4 interest-free payments

- Access to virtual cards

- Can purchase gift cards

- Payments can be delayed

- Local stores are featured

Cons

- Can become overwhelming for anyone who is not responsible with money

- Few electronic stores

Alternatives

- Afterpay

- Paybright

- Klarna

To learn more about Sezzle, here is a link to their FAQ page.

Read the full article

0 notes

Text

CIBC US Smart Account: A Travel Companion

CIBC offers cross-border US accounts that make it easy to save and transfer US dollars between a Canadian and a US account. One of the best chequing accounts is the CIBC USA smart account. This account is different from the CIBC US Personal Account, as it's registered as a real US account (with a routing number) and affiliated with CIBC US.

Who is this account for?

- If you frequently travel to the US or partially live there, the CIBC US Smart account will be a valuable option. It's a proper US registered account, affiliated with CIBC USA. It might be easy to confuse it with a Canadian US dollar account that allows you to deposit and save US dollars. An easy way to distinguish the two is, the CIBC US Smart Account will have a routing number.

- If an employer or contractor only deposits paychecks in US accounts, opening a CIBC US Smart account will solve this issue. A perfect example would be for individuals who use Amazon Mturk, which only allows payments to a US account. Also, if you already have a CIBC account, transferring money to your Canadian account is instant.

Features

- No minimum deposit.

- Transfer money easily between your CIBC Canadian accounts with your US account.

- The account comes with a Mastercard Debit that will work with online or physical purchases.

- Pay no monthly fee for one year with unlimited transactions.

- Pay US bills, write USD checks and set up direct deposits for US dollar payroll checks from US-based companies.

- No exchange rate fees

- Real-time transfers

- 2 people can open a joint account.

Open Account

Fees

- Monthly maintenance fees sit at $4.95 a month.

- If you decide to close the account within 90 days of opening, you will not be charged.

- Stop payment will cost you $30 per check.

Requirements to open this account.

- You need to be a CIBC client with a personal account or line of credit.

- Have access to online banking

- Be at least 18 years old and have a valid ID.

Alternatives

In addition: TD, RBC, BMO, and Scotiabank also offer great cross-border banking solutions for Canadians. Make sure to research the different types of accounts before starting an application.

Read the full article

0 notes

Text

Owning An EV In Newfoundland: The Complete Guide

Electrical vehicles have reimagined the concepts of the automotive industry. Packed with technology, performance, and style, these vehicles are paving the way to a greener brighter future.If you live in Newfoundland, you might notice a few EV's here and there. Compared to other provinces, Newfoundland is still developing the infrastructure to fully support a community of EV owners. Read this guide to get you started!

Why should you buy an Electric vehicle in NL

Gone are the days where electric vehicles were seen as boring. Companies like Tesla have changed the narrative by creating amazing vehicles with great performance and battery life. Did I mention that some of these vehicles are capable of autonomous driving?Let's say you're not a tech geek and you only need a reliable car. You feel like electric vehicles are overhyped and unnecessary, a biased narrative to get rid of gasoline cars. A lot of people think the same way until they test-drive a Model 3. If you have time to spare, watch some informative youtube videos and test drive one. Below are some of the benefits that come with owning an EV.- Government Rebates. The government of Canada provides incentives of $2,500 to $5000 for consumers who buy or lease an electric vehicle. That's a huge chunk of savings, considering how expensive EVs are. A car that costs $40,000 can easily be bought for $35,000.

- Expense. The cost of ownership for EVs is considerably lower than that of gasoline vehicles. Electricity costs less than gas and there are charging stations that offer free service. In addition, EVs don't have a complex engine and a fuel system that can break at any moment. You'll save quite a lot on repairs and maintenance. Of course, there will always be the usual tire change and brakes repair, but overall, EVs are more reliable than gas vehicles.

- Environment. Electric vehicles reduce carbon emissions by offering a cleaner alternative to fossil fuels. EVs are also cost-effective and efficient compared to gas cars. (Note: It's not all rainbows and roses. The production of EV batteries also creates upstream emissions. However, EV cars are considered cleaner throughout their entire life cycle.) Click this link to learn about EVs and their impact on the environment.

- Performance and features. Electric Vehicles are dominating when it comes to performance. Check out the specs of the new Tesla Model S Plaid, and your jaw will drop. 0-60 MPH in 1.98 seconds (0-100 km/h in 2.1 seconds). If that still doesn't amaze you, this family sedan is the quickest production car that you can buy.

Electric vehicles also offer an array of features, such as; Regular software updates, autonomous driving, instant torque, more storage (since there is no engine), innovation, and the latest tech.

Where to buy electric vehicles in NL

- Dealership. The first EV dealership in Newfoundland, ALL EV CANADA, officially opened shop in St. John's and Corner Brook. They carry different vehicles in varying price points; such as the popular Tesla cars to budget-friendly vehicles like the Chevy Bolt. They also sell bikes and charging accessories for electric vehicles. Check their website by clicking this link.

- Buy online. You read that right, companies like Tesla allow you to buy a vehicle the same way you'd buy groceries from Amazon. All you have to do is pick a vehicle, add to cart, choose a payment option and the vehicle will be shipped to your location. This is convenient, especially if you want to customize your car. If a manufacture doesn't offer this option, you can import EVs from other provinces.

Reasons not to buy an electric vehicle in Newfoundland

- Road trips. If you're a person who takes a lot of road trips in Newfoundland, an Electric vehicle might not be the best option. There are few charging stations, especially in remote locations. Range anxiety will be the least of your problems if your car dies out in the middle of nowhere. I'm sure the government and automotive companies have plans to expand the charging infrastructure. But for now, city driving might be the best way to enjoy your EV.

Five years ago today, this wonderful couple of Rolf Oetter, Silke Sommerfeld and their lovely dog Kye showed you could drive across Canada not just in an EV, but towing a trailer to boot. They are some of the best friends we have made during our discovery and enjoyment of driving electric cars.

When you see trips like this, long before there were fast chargers anywhere in Atlantic Canada, you can really get a perspective of how far we have come.

- JON SEARY, Tesla Owner

Facebook has a growing community of EV owners in Newfoundland. Make sure to follow their page for updates and information.

-

The winter cold. Electric vehicles are notorious for losing range in cold weather. The colder the temperatures, the reduction in range. However, this really shouldn't be a deciding factor if you are interested in buying an EV. If you commute to work and back, range should be more than enough to accommodate your transport needs. It just sucks when you compare to the range you get during warmer weather. To read more on this, check out this site.

-

Repairs. Good news is that Newfoundland has an electric dealership. They should be able to sort out any repairs and maintenance. However, there may be a lack of options when you want to fix your car. In comparison, you can take your gas car to different shops and get a suitable quote.

If you buy a Tesla, you'll receive repair service through their warranty program. Since Tesla doesn't have a store in Newfoundland, someone will be sent to your house for repairs. Regardless, I hope to see EV garages popping in the future.

How to set up your house for EV charging.

Newfoundland doesn't have many charging stations. Setting up your house for home charging is the next big move. To install a high-speed charger, you'll need the assistance of an electrician. Check this article to learn about the different types of chargers you can buy.

What vehicles should you consider buying

- Tesla Model 3, Model Y, Model X, Model S

- Hyundai Kona EV, Ioniq

- Chevrolet Bolt EV

- Ford Mach-E

- Mini Cooper Electric

- Toyota RAV4 Prime (One of the best hybrids you can buy)

- Nissan Leaf.There are also upcoming EVs that you should keep an eye on such as; The Rivian truck, Tesla's Cybetruck, Lucid Air, Hummer EV, and many more.

Newfoundland's EV future

There is a growing number of people who are showing interest in driving EVs. Newfoundland isn't an exception. The world is shifting to a new age and eventually, this will be the new normal. The future is here!

Read the full article

0 notes

Text

What Is A TFSA

TFSA stands for "Tax-Free Saving Account." The TFSA program was introduced in 2009 by the Canadian government to encourage individuals to save money. As the acronym states, your money will not be taxed, regardless of how much you make with interest or investments. This will heavily benefit individuals who save money on a TFSA high-interest account or a TFSA investment account. Any gains made from these accounts will not be taxed. Imagine how good it will feel when all the income you made from your stocks is tax-free.

How does it work

Unlike a regular savings account, there are limits governing how much you can put in and take out of a TFSA. This is known as the contribution limit and it varies from year to year. Overcontribution will lead to a penalty that taxes 1% of the excess money every month until it is withdrawn. The current 2019 lifetime contribution limit for someone who has never had a TFSA is $63,500. If you've deposited money throughout the years, subtract that number from $63,500 and you will have your maximum contribution limit.

Why you should open one

TFSA accounts are amazing for investing. You can invest in stocks, bonds, real estate, mutual funds, and more. All gains that you make from your Tax-free investment account will not be subject to any taxes. This is incredible for people who would like to make long term investments. TFSA accounts are also quite flexible and accessible whenever you need to withdraw money. This will benefit individuals who might want to save for a short-term goal such as buying a car or an emergency fund.

Where can you open a TFSA