Text

Pa. lawmaker seeks co-sponsors for 'any willing insurer' legislation to push Highmark, UPMC together

The “any willing insurer” law is something that has been used in other states to avoid provider disputes like we are currently witnessing with Highmark and UPMC. While it is unlikely to work again this time, as was the case in 2013, it is a legislative way to try and solve the issue.

Pa. lawmaker seeks co-sponsors for 'any willing insurer' legislation to push Highmark, UPMC together

by Steve Twedt

Senate Minority Leader Jay Costa, D-Forest Hills, is seeking co-sponsors on legislation which “would require UPMC and Highmark to either contract with each other for services or enter mandatory arbitration,” according to a release circulated Wednesday.

While not even in bill form yet, the move is another sign of growing interest from Harrisburg as the Pittsburgh region moves into the final months of a five-year agreement that has allowed some Highmark Medicare Advantage members and others continued in-network access to UPMC hospitals.

That agreement between the two Pittsburgh health giants expires June 30.

Mr. Costa’s proposed legislation would apply to all statewide integrated delivery networks -– entities such as Highmark and UPMC that provide both care and sell health insurance -– that would require those hospitals and physicians to contract with all insurers.

The release notes, “This issue is particularly problematic in southwestern Pennsylvania given the ongoing dispute between UPMC and Highmark.”

If enacted, “Consumers will not be denied care, or worse abandoned mid-treatment, simply because they hold one type of insurance over another.”

The legislation also intends to block any dominant health system “from demanding unreasonable rates for services from insurers, and in turn raising the overall cost of health care because they are in the ‘must have’ system in that area.”

Similar legislation proposed in 2013 easily passed in the House but died in the Senate.

0 notes

Text

UPMC: We are going to court over consent decrees

This should come as no surprise, but the UPMC perspective on the Shapiro lawsuit is one of defiance.

UPMC: We are going to court over consent decrees

by David Bruce

Pennsylvania Attorney General Josh Shapiro left the door open even as he announced that his office was filing a petition in state Commonwealth Court that would force modifications to the UPMC-Highmark consent decrees.

Shapiro on Thursday said he would welcome UPMC back to the negotiation table after the Pittsburgh-based health system rejected the changes, which would extend UPMC consent decrees with Highmark and continue accepting its competitor’s subscribers as in-network patients at UPMC hospitals and medical offices.

UPMC on Friday said it is closing that door.

“We’re going to litigate,” UPMC spokesman Paul Wood said. “We’re going to go to court and we will see.”

Shapiro’s office filed a petition because, Shapiro said, UPMC is violating the state’s charity laws. Shapiro went to court after two years of negotiations with UPMC and Highmark to modify the consent decrees they signed in 2014 that are set to expire June 30.

“As attorney general, it is incumbent on me to ensure UPMC lives up to its end of the bargain,” Shapiro said during a news conference Thursday in Pittsburgh. “Right now, it is clearly not.”

The modifications include:

‒ Enabling open and affordable access to UPMC’s and Highmark’s health-care services and products through negotiated contracts with any health plan.

‒ Requiring last, best-offer arbitration when contract negotiations between insurers and providers fail.

‒ Protect against unjust enrichment by prohibiting excessive and unreasonable billing practices inconsistent with a nonprofit charity providing health care to the public.

“Significantly, Highmark did agree to the terms, provided UPMC would be subject to those same terms,” the attorney general’s office said in the petition. “However, UPMC was unwilling to agree to these same modifications.”

If a Commonwealth Court judge agrees to the modifications, UPMC and Highmark would almost assuredly reach agreements so that patients with Highmark insurance would have in-network access to UPMC hospitals and medical offices, and those with UPMC Health Plan insurance would have access to Allegheny Health Network hospitals and medical offices.

UPMC would also be prohibited from its plan to require patients with out-of-network insurance plans to pay the entire cost of their visit, procedure or surgery ahead of time and make the patient seek reimbursement from their insurer, Shapiro said.

Wood declined to say why UPMC rejected the modifications and would not return to the negotiation table, but said knowing the consent decrees will end has improved the health-insurance market in western Pennsylvania.

“The market has changed in western Pennsylvania and it has changed for the better,” Wood said. “Probably every business in western Pennsylvania now offers plans other than Highmark plans, so there are multiple options to get to UPMC.”

However, the premiums for many of those plans have continued to increase over the past five years and also include higher out-of-pocket expenses — like co-insurance — even though the plans won’t be accepted at as many hospitals and medical offices after June 30.

Wood countered that those increases would have been higher without UPMC and Highmark agreeing to go their separate ways.

“Ten years ago, we were seeing double-digit price increases every year,” Wood said. “Now we see single-digit increases and, in some cases, decreases.”

Highmark Health CEO David Holmberg said Highmark agreed to the modifications because they are in the best interests of the communities it serves.

“We have long held to the truths that vital community assets must be available for the public good and that nonprofit and charitable organizations exist for the benefit of the community,” Holmberg said Thursday.

“We’ve always believed that a level playing field should exist among health-insurance companies and health-care providers. We believe that all health plans and health systems should compete based on their value to the consumer. We welcome working with all health-care providers.”

The issues between Highmark and UPMC started in 2011. UPMC officials said problems began when Highmark announced a $475 million takeover of the West Penn Allegheny Health System, UPMC’s primary competitor in Pittsburgh.

Highmark officials said they were forced to buy the financially-troubled health system because of UPMC’s rapidly increasing medical costs and a concern that Pittsburgh would turn into a single health-system town.

Contract talks stagnated because UPMC came to view Highmark’s new Allegheny Health Network as a competitor. Then-Gov. Tom Corbett was able to convince the two sides to extend UPMC’s contract with Highmark until the end of 2014.

State officials then brokered a deal in June 2014 between the two health-care giants where they signed five-year consent decrees that gave Highmark subscribers in-network access to Hamot and “rural” hospitals in western Pennsylvania.

Both UPMC and Highmark officials have said there will not be another extension to the consent decrees after they expire.

The attorney general’s office is asking the court to modify the consent decrees and extend them. Shapiro did not mention any effort to revoke UPMC’s tax-exempt status, though he listed — in great detail — the health system’s finances.

They included UPMC receiving $1.27 billion in public and private contributions between 2005 and 2017 in support of its charitable health-care, education and research missions. It also has received hundreds of millions of dollars worth of city, county, state and federal tax exemptions since its inception.

In Erie County, UPMC Hamot has entered agreements to make payments in lieu of taxes. It pays half of the property taxes, about $1.3 million a year, on what Hamot would owe if it were fully taxable. Saint Vincent Hospital, which is part of the Allegheny Health Network, pays $749,000 a year under its P.I.L.O.T. deal.

“UPMC does more than $1 billion per year in ... community benefit, far more than any other nonprofit hospital in Pennsylvania,” Wood said. “I’d say it’s far more than any other nonprofit hospital in the entire nation.”

Shapiro also described ways in which UPMC was running afoul of the consent decrees by engaging in conduct that violates its charitable obligations. They include:

‒ Refusing to negotiate reasonable payment terms with self-insured employers, resulting in UPMC’s “unjust enrichment through excess reimbursements for the value of its services.”

‒ Withholding access to doctors for patients in Williamsport whose employers have contracts with a competing health plan. It forces patients to travel more than an hour to seek medical care, Shapiro said.

Standing in a cramped conference room Thursday, surrounded by patients, business and labor leaders demanding better access to UPMC hospitals and medical offices, Shapiro said filing the petition was the last, best chance to make UPMC listen.

“These people followed the law, they pay their taxes, they subsidize what UPMC does,” Shapiro said. “UPMC has an obligation to them as well.”

0 notes

Text

UPMC vs. Highmark: How we got here

UPMC vs. Highmark: How we got here

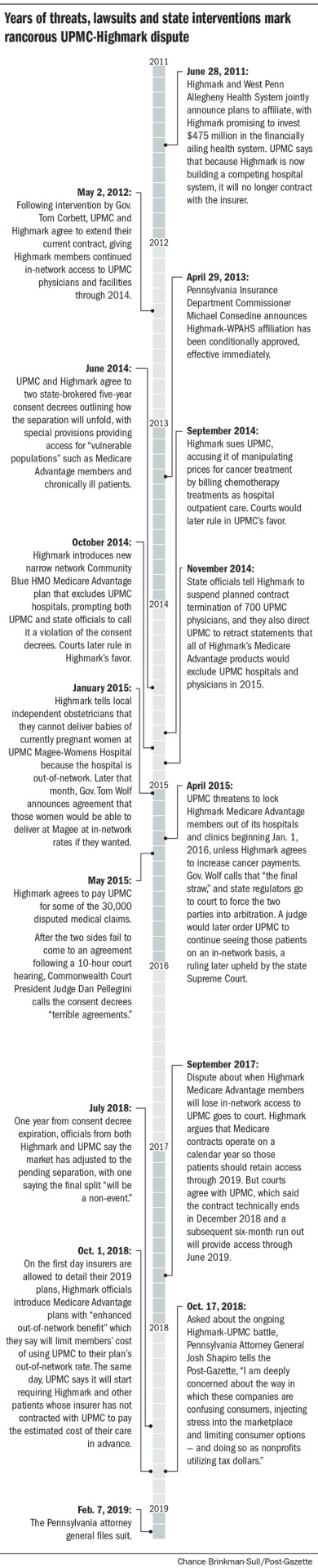

For nearly a decade, officials at Pittsburgh-based health giants Highmark and UPMC have been at loggerheads over reimbursements, network access and market share, with patients at times feeling like collateral damage.

The battles have been fought in courts and on the airwaves, interrupted only by the occasional intervention by state officials trying to broker a peace between UPMC, the region’s largest health system, and Highmark, historically the dominant local insurer.

Here are some of the notable mileposts:

0 notes

Text

Supreme Court gives teeth to delegation clauses in arbitration provisions

While employment contracts aren’t really in our wheelhouse, this article is interesting from the perspective that the Supreme Court has weighed in on how to improve upon these often contentious, yet extremely important, documents.

Supreme Court gives teeth to delegation clauses in arbitration provisions

by Kendall Waters

Taking the time to include a well-crafted arbitration agreement in your employment contracts sometimes feels like a moot point, but a recent unanimous U.S. Supreme Court opinion in Henry Schein, Inc. v. Archer & White Sales, Inc. should inspire some confidence in the enforcement of arbitration.

The story is a familiar one—an employee who signed an agreement sues their employer, the employer tries to invoke the agreement’s arbitration clause, and both parties spend countless time and money arguing over who should decide whether the dispute is subject to arbitration: the judge or an arbitrator?

To cut off such fights, some employers put “delegation clauses” in their arbitration agreements. A delegation clause states that it is the arbitrator who decides whether the dispute is fit for arbitration. Even with such language in agreements, delegation clauses have been fiercely contested and courts could determine that they and not the arbitrator should hear the case because the assertion of arbitrability was “wholly groundless.”

The Henry Schein case, issued on Jan. 8, 2019, clarifies some of this madness and gives teeth to delegation clauses.

The contract in Henry Schein did not contain a specific delegation clause, but did incorporate the rules of the American Arbitration Association (AAA). Because the AAA rules give arbitrators authority to decide their own jurisdiction, Henry Schein argued that their incorporation in the contract amounted to a delegation clause and that an arbitrator should determine whether the case was fit for arbitration. The district court rejected this argument, and the Fifth Circuit Court of Appeals agreed. The appeals court said that the underlying argument for arbitration was “wholly groundless” and thus the court should not delegate the issue to an arbitrator.

In a unanimous decision, the Supreme Court reversed the appeals court and rejected the “wholly groundless” exception to delegation clauses. It held that where parties agree to delegate arbitrability, a court must give effect to that intent and cannot override delegation to an arbitrator even if the court believes the answer is obvious.

The Supreme Court also wrote that to allow courts to take the case is both “inconsistent with the text of the [Federal Arbitration Act] (FAA) and with precedent.” The employee in Henry Schein who did not want to go to arbitration supported its position by arguing that it was a waste of resources and money to send the issue to an arbitrator if the basis for arbitration was wholly groundless.

Not only did the Supreme Court reject that argument, it also raised concerns about a “time-consuming sideshow” of collateral litigation to determine whether an argument was wholly groundless or merely groundless. Where a demand for arbitration is truly meritless, “[a]rbitrators are already capable of efficiently disposing of frivolous cases.” The opinion further challenged whether the question of arbitrability would indeed be obvious, noting that the arbitrator may reach a different conclusion.

The Court stopped short of deciding whether incorporation of the American Arbitration Association rules is, by itself, an ‘effective, clear and unmistakable’ delegation clause. The impact of Henry Schein is limited to invalidating the “wholly groundless” exception where the court has either inferred delegation, such as from the incorporation of AAA rules, or where the contract has an express delegation clause.

Employers favoring arbitration and wishing to soften the time and expense of litigation should consider adding delegation clauses to arbitration provisions in employment agreements as well as other contracts. In light of this recent decision, it will be much more difficult for employees to avoid arbitration where the agreement they signed has a properly drafted arbitration provision and delegation clause.

0 notes

Text

Experience Justifies a 1331% Increase in an LTCI Block's Rates: Actuaries

Think a 247% rate increase is bad? Well, it is, but compared to the original increase of over 1000%, it might not seem so bad. Just another example of the wild world of Long-Term Care insurance.

Experience Justifies a 1331% Increase in an LTCI Block's Rates: Actuaries

by Allison Bell

Actuaries for Blue Cross Blue Shield of Nebraska say a block of 2,880 long-term care insurance (LTCI) policies the company sold from 1998 through 2004 has performed so poorly that, if the company were seeking to achieve a loss ratio of 60%, it could justify a request for a 1331% rate increase.

Increasing the premiums by 1331% would mean that premiums would be about 14 times higher than they are today.

Instead, Nebraska Blue asked for increases that could average about 247% for the 1,853 people who still have their coverage in force, according to a rate increase application cover letter signed by Matthew Morton, an actuary at LTCG.

Increases could average 168% for 546 holders of one LTCI policy form who chose limited benefits, 243% for 628 holders of that form who chose lifetime benefits, 227% for 254 holders of another form who chose limited benefits, and 347% for 407 holders of the second form who chose limited benefits, according to an actuarial memorandum.

The original memorandum shows the original rate proposal would, for example, have increased the rates for the 546 holders of the one form, with limited benefits, to $3,281 per year, from $1,224 per year today. The 628 holders of a version of that form with lifetime benefits could have seen their premiums increase to $4,791, from $1,397.

The annual premiums for the holders of a second form, with limited benefits, could increase to $4,585, from $1,402. For holders with lifetime benefits, premiums could increase to $7,071, from $1,582.

Actuarial exhibits show the actual loss ratios have been more twice as high each year as originally expected. The actuaries are projecting the issuer could be a significant amount of claims well into the 2050s.

The Nebraska Department of Insurance has posted the cover letter and other increase application documents in its section of the System for Electronic Rates & Form Filing (SERFF) system.

The department approved Genworth’s rate increase request in December.

A unit of Genworth Financial Inc. serves as the administrator of the LTCI block. The unit has told agents that it expects to phase in actual increases of 223% for holders of the first form who have limited benefits, 285% for holders of the first form with lifetime benefits, 309% for the holders of the second form with limited benefits, and 426% for the holders of the second form with lifetime benefits.

0 notes

Text

Employers offer high-deductible plans, but workers are cautious about them

Given that Jason Seltzer was featured in this article, we will let his contribution speak for itself. But, as the title indicates, we are attempting to peel back the layers on HSAs and their true effectiveness.

Employers offer high-deductible plans, but workers are cautious about them

by Steve Twedt

Are high-deductible health plans and health savings accounts, two recent darlings of the health insurance world, about to lose some of their luster?

Early signs of that may be surfacing, even as a recent Pittsburgh Business Group on Health survey shows more major employers in the region are offering the plans.

High-deductible health plans “never had the adoption rates in our region the way they did in other parts of the country” and health savings accounts meant to help employees prepare for medical expenses aren’t generating the desired savings, says Jason Seltzer of J. Seltzer Associates brokers in Mt. Lebanon.

“The main issue that is driving up costs of [such health plans] is that the ‘consumerism’ that they were supposed to promote doesn’t happen.”

A 2017 survey in the journal Health Affairs bears this out — of the nearly 3,000 adults responding, just 13 percent said they’d tried to get cost information before receiving care and only 3 percent compared costs from different providers ahead of time.

“In addition,” says Mr. Seltzer, “employees can’t afford to fund the HSA and avoid getting care due to the cost. So when they do get care, it is much more expensive, which drives claims costs up, rather than down.”

For now, employers — both locally and nationally — continue to offer the plans, usually as one of multiple plan options that employees can choose.

In the Pittsburgh Business Group on Health survey of major local employers, 73 percent said they offered employees a high-deductible, or consumer-driven, plan among their offerings. That’s up from 65 percent in 2017 and 55 percent in 2014.

Recent action at the federal level seemingly would make high-deductible health plans and HSAs more appealing, too.

The 40 percent excise “Cadillac” tax on high-cost health insurance plans — which had prompted some employers to shift to lower-cost high-deductible health plans and health savings accounts — has been pushed back two years to 2022. President Donald Trump also has signed an executive order that would widen access to HSAs.

But “availability doesn’t necessarily equate to greater participation,” said Brian Breisinger, president of MediConnect Insurance brokerage in Kennedy.

“We have seen a number of folks enrolling in these plans, but not at a level that I believe would move the needle significantly.”

The two types of plans are linked: Individuals must have a health insurance plan that carries a minimum deductible of $1,350 ($2,700 for a family) to qualify for the tax advantages a health savings account offers.

The idea behind consumer-driven plans is to shift more costs to consumers and incentivize them to save, so they become smarter shoppers, and HSA money used for health care costs is not subject to federal tax. The high deductibles, though, may simply be making people more cautious.

The California-based Kaiser Family Foundation’s 2018 survey on employer health benefits reported that 29 percent of insured workers are in a high-deductible or similar plan that will lower premiums.

As one example, the foundation has reported that yearly premiums for family coverage in a typical high-deductible plan would be $16,737, compared with $19,003 for a more traditional PPO plan. But the high deductible also means that those families will pay more of the cost for using those services.

The Kaiser Family Foundation found the average annual deductible in high-deductible plans was just under $2,500 for an individual and approaching $5,000 for families.

And nearly one-fourth of the families had deductibles of at least $6,000 -– which, barring major illness or injury, means they may be paying out of pocket every time they need care without their coverage ever kicking in.

Adam Bick, an executive with America’s Health Insurance Plans, a Washington, D.C., trade group, said in a phone interview last week that rising deductibles in these plans is “extremely problematic for us.”

“We don’t want folks to feel as though they only have one option based on sticker price, simply because they can’t afford the coverage that may be better suited to their overall needs.”

But he also said there are fans. “A lot of people like the HDHPs” — particularly if they are not anticipating many medical claims. “We think HSAs are a great option for many, many people.”

0 notes

Text

Why voluntary benefits are good for employers

Voluntary (worksite) benefits have been growing exponentially in the past several years as health care costs have eroded the ability of many employers to provide comprehensive non-medical benefits. At the same time, it has allowed employers to provide a more robust offering that allows employees to choose what works best for them. And the notion that Aflac is the only game in town is definitely not the case as many different providers offer many different options.

Why voluntary benefits are good for employers

by Andy Glaub

Following eight years of job growth, the U.S. unemployment rate hit a nearly five-decade low in September, according to a recent U.S. Department of Labor jobs report. While this is good news for the U.S. economy, it suggests there is a smaller pool of active job-seekers and a high demand for workers.

As a result, companies are facing fierce competition when it comes to winning over new talent. While some companies are raising wages to woo job candidates, many companies cannot afford to do so. However, boosting benefits is another effective strategy for not only winning new talent, but keeping talent around. In fact, 55 percent of the 2,000 employees surveyed for the 2018 Aflac WorkForces Report said they would be at least somewhat likely to accept a job offer with slightly lower compensation but better benefits options. Additionally, more than one-third of employees said an improved benefits package would help keep them in their current job.

Of course, every employer situation is different. This article is for informational purposes only and is not intended as a solicitation.

You have to counsel each employer client separately, and encourage each to seek any relevant accounting and legal advice.

But, by some estimates, the financial impact of losing an employee can range from tens of thousands of dollars to twice the employee’s annual salary —and the impact is especially felt in a tight labor market where replacing talent often takes some time. These numbers may not be surprising considering the costs associated with hiring, onboarding, training, learning and development. Losing experienced workers only amplifies the financial drain.

As you counsel clients, discuss the role benefits play in attracting and retaining employees. Employers do not always consider how major medical benefits and voluntary insurance can factor in employee retention, thus saving money. Bringing this concept to the forefront will likely provide them with a new perspective on maintaining a well-run workforce and, in turn, a positive bottom line.

Voluntary insurance and cost containment

Brokers and agents have an opportunity to remind decision-makers that one low-cost way to improve a benefits package and boost employee morale is by adding voluntary insurance options, such as vision and dental as well as accident, critical illness and hospital indemnity insurance.

Because voluntary benefits are paid directly to policyholders, unless otherwise assigned, they can be used to help pay housing costs, utility bills, car payments, deductibles, and co-payments in the event of illness or injury. This gives advisors room to explain that a robust health benefits package can act as a financial safety net for employees and help relieve some of their financial stress. With 45% of employees stating that they are more likely to buy insurance if it is recommended by a benefits professional, advisors can use this opportunity to their advantage, as well. And when employees feel prepared for the future, they can focus more on their day-to-day responsibilities.

Voluntary insurance goes a long way toward meeting employee needs and expectations, and often costs businesses little or nothing to add to their benefits package. Furthermore, by offering employees voluntary benefits options, clients can potentially contain or save costs through reduced turnover and happier employees. And when employees’ needs and expectations are met, they are more likely to be satisfied with their jobs, more engaged and more productive. But most importantly, they are less likely to look for a new job.

0 notes

Text

Study shows impact of urgent care centers on nonemergent ED usage

While the headline of this article isn’t likely to surprise many, the details are particularly interesting. As we have moved to try and reduce emergency room utilization over the years for non-emergency conditions, urgent care facilities have helped greatly with that end in mind. But, as this article shows, specifically in more rural areas, one urgent care won’t have much impact. In addition, it is important to remember that urgent cares, while less costly than emergency rooms, are significantly more expensive than a PCP visit.

Study shows impact of urgent care centers on nonemergent ED usage

by Meg Bryant

A new study suggests urgent care centers are impacting the use of emergency departments for minor illnesses and injuries, but only in locations with multiple UCCs.

The multistate study by the National Bureau of Economic Research compared nonemergent ED use when UCCs were open and closed. The results showed a 1.4% uptick in ED visits after the last center in an area closed for the day — or about 2.4 million ED visits annually. The effect was limited to privately insured patients, the primary targets of UCCs.

The study — the first to measure the effect of UCCs on ED use, according to the researchers — could inform strategies to reduce use of expensive ED services and help rein in costs.

The findings come as hospitals and health systems are struggling with smaller patient volumes and lower reimbursements and looking to diversify their services and bolster financials. The shift to value-based care has helped to drive growth in the $18 billion urgent care industry, a mix of for-profit freestanding centers and health system-owned facilities.

In 2017, Dignity Health and Select Medical merged their urgent care businesses, citing the potential to increase patient access and standardize best practices.

More recently, two Arizona-based urgent care companies — FastMed Urgent Care and NextCare Holdings of America — announced a definitive agreement to merge. The combined company will have 251 clinics in 10 states.

An analysis of claims data from Aetna from 2008 to 2015 found ED visits per enrollee for low-acuity conditions like respiratory infections and sprains dropped 36% over that time period, while use of non-ED settings like urgent cares and retail clinics rose 140%.

This study suggests urgent cares could play a larger role in reducing overall healthcare costs. With a nonemergent case costing about $414 more in an ED versus UCC, the effect of 2.4 million fewer ED visits translates to about $1 billion in savings per year, the researchers say.

That effect was only evident, however, in areas with multiple UCCs. "Since urgent care centers are smaller than EDs, it is unlikely that a single urgent care center will drive meaningful change in nearby ED use," the researchers said.

The potential to reduce healthcare costs by substituting UCCs for EDs in nonemergent cases may have its limits as well, they add, noting the 7,600 existing urgent cares were likely placed in areas with high privately insured patient demand. "As the market matures, there may be diminishing returns to opening new clinics," the researchers note.

They also point out that the evening spike in ED visits occurred at a time of day when such visits are normally higher. There may not be as many low-acuity ED visits for UCCs to impact during their operating hours.

Still, given that just about 5% of sampled ZIP codes had more than one UCC, "urgent care companies may be incentivized to increase their supply in certain areas, which would bolster their impact," the researchers said.

0 notes

Text

People Still Need a Way to Pay for Long-Term Care: Idea File

Long-term care is the black box of financial planning. Most, if not all, people need it yet most people cannot afford it or can’t get access to it, as it is becoming increasingly difficult to purchase LTC. But carriers have made strides over the past several years developing hybrid products that help ease the sting of the LTC purchase. Now, actuaries are looking at new ways to buy LTC, rather than just how to sell it.

People Still Need a Way to Pay for Long-Term Care: Idea File

by Allison Bell

Most life insurers are now scared to death of writing stand-alone long-term care insurance.

Millions of aging, non-poor, cash-strapped Americans are getting older.

Vince Bodnar, the chair of the Long Term Care Think Tank at the Society of Actuaries, has this idea: Someone ought to figure out more ways insurers can help people protect themselves against long-term care (LTC) risk.

Life insurers are selling annuities and life insurance policies with features that can help people pay LTC bills. But some have argued that people still need arrangements that do more to maximize the amount of resources available for people who end up need LTC services for many years.

Bodnar said in an interview that the SOA Long Term Care Think Tank has helped to develop two LTC finance concepts that appear to have broad appeal.

One is the “life stage” concept. A life stage product would term life coverage when an insured was young, then provide long-term care coverage when the insured was older.

The second is the 401(k) LTC benefits concept. Advocates of this proposal would let workers use some of the assets in a 401(k) plan, or a similar plan, to pay for LTC coverage.

Here are seven things to know about the concepts.

1. Young (and Not So Young) Invincibles

The life stage and 401(k) LTC concepts could overcome two major obstacles for stand-alone LTCI issuers: Consumers’ need to pay bills now, and those consumers’ resistance to thinking about long-term care.

“They can’t envision themselves needing it” Bodnar said.

One solution might be to attach LTC benefits to some other product that consumers already like, Bodnar said.

If the arrangement could pay cash to the heirs of people who get through life without ever needing LTC services, that would be even better, Bodnar said.

In that scenario, “you wouldn’t have the use-it-or-use-it characteristic,” Bodnar said.

2. Actuarial Analysis

Actuaries assumed, as a given, that consumers would have to go through underwriting to buy the life stage or 401(k) LTC product, and that the consumers would have to pay for the products themselves.

Even under those assumptions, actuarial analysis suggested that both the life stage approach and the 401(k) LTC benefits approach could lead to viable products, Bodnar said.

“They both have quite a bit of appeal,” Bodnar said.

Having the government cover most or all of the costs for all could decrease the per-person cost, by putting healthier people in the risk pool.

3. Timing

An insurer could probably create a life stage plan today and get it into the field in about two years, Bodnar said.

“There’s not really a lot of regulatory barriers to it,” Bodnar said. “A lot of the work has been done already.”

Setting up a 401(k) LTC program with favorable tax treatment would take help from the federal government, Bodnar said.

4. Tax Break

One obstacle is the idea that the government could lose some tax revenue, Bodnar said.

Bodnar said the supporters could benefit if they can show the program would cut Medicaid nursing home benefits spending.

If insurers wanted to get a new tax break for life stage policy purchasers, they would have to go through a similar process, of showing that Medicaid program savings and other government program savings would outweigh the anticipated reduction in federal income tax revenue, Bodnar said.

5. Washington

The Congressional Budget Office and Joint Committee on Taxation have looked at LTC finance issues in the past, but, since 2010, up till now, efforts to shore up or replace the Affordable Care Act individual major medical framework have crowded out most LTC financing discussions, Bodnar said.

“It’s difficult for this issue to break through,” Bodnar said.

The SOA, for example, is good at doing analysis, but it does not promote policy proposals in Washington, Bodnar said.

Bodnar said he’s happy to see Scott Cipinko’s efforts to up a new LTC financing policy “do tank,” or entity that would try to get LTC financing proposals through Congress, or through state legislatures.

6. Insurer Interest

Long-term care insurance issuers have had their hands full in recent years with the effects of low interest rates, inaccurate claim projections, and rating agency, investor and regulatory agency scrutiny.

Bodnar said he has not yet seen much interest from current LTCI issuers in offering either a life stage product or a 401(k) LTC.

Other insurers are showing some interest in the life stage LTC concept.

At this point, insurers seem to like the idea of 401(k) LTC options, but no one is calling him up about that.

“Tax law has to change first,” Bodnar said.

On the bright side: Bodnar hasn’t yet seen opposition to either the life stage concept or the 401(k) LTC concept.

“It’s just going to take time to develop it,” Bodnar said of the main barrier to the birth of a new type of LTC financing vehicle. “Anything new just takes time.”

7. Resources

Links to LTC Think Tank materials that discuss the concepts in more detail are available here.

0 notes

Text

Why employers should take offboarding more seriously

In our current world, where online reputation management is essential for everyone - from restaurants to nail salons to employers - understanding why employees are leaving your company is essential. As the Benjamin Franklin put it, “an ounce of prevention is worth a pound of cure”.

Why employers should take offboarding more seriously

by Lana Mellis

When it comes to layoffs in today’s online world, companies must focus on providing the best experience possible for departing employees, not only because it’s the right way to treat these individuals, but also because it can have a direct effect on the company’s public reputation.

Websites like Glassdoor, Fairy God Boss and Indeed provide a public stage for employees to rate and review their current and former employers. A whopping 79% of job seekers use sites like these during their job search, according to a recent Glassdoor study. Reviews can come in the form of happy employees who cheerlead and promote their employer, as well as disgruntled employees who take the opportunity to air out their employer’s dirty laundry.

In an economy with nearly full employment, where disgruntled employees can and do turn to public online review sites where prospective employees are sure to visit before an interview, organizations cannot afford to take their separation and off-boarding processes lightly.

Reviews by exiting employees have the potential to be very damaging to an employer’s reputation and deter prospective employees from even applying for potential jobs. This kind of transparency also offers a lot of benefit to job seekers; prospective employees can get a better idea of what it would be like to work for a particular company and have greater ability to select a company whose culture and values match their own. In fact, Glassdoor’s study found that 69% of job seekers would not take a job with a company that has a bad reputation – even if unemployed.

One theme that repeatedly appears in negative reviews centers around the topic of layoffs, including write-ups of various HR blunders made throughout the process, inadequate communication, and a lack of empathy and respect toward the departing employees.

While much consideration is given to the onboarding and retention phases of the relationship between employee and employer, the separation phase is often given far less attention. Whether due to a layoff, reduction in force, performance termination, or some other event, managing employee separations can be challenging and can easily turn for the worse, leaving the employee with a negative perception of the company – and an axe to grind on social media.

To address the organizational need for reputation management during a reorganization, many companies work with a third-party specialist to guide them through the necessary steps to maintain employee good-will and satisfaction. A consultative partner can offer added benefit by bringing a fresh perspective and specialized experience to a delicate situation.

For companies committed to attracting new talent, maintaining a strong online reputation should be a priority. Whether you choose to work with a partner-firm or not, ensuring that offboarding is carefully planned and managed will help your organization be more prepared and better equipped to manage a layoff action skillfully, in a way that leaves people feeling heard, cared for and appreciated.

0 notes

Text

Convenience more important to patients than quality of care, survey finds

As the healthcare world continues to push the quality and cost narrative as a way to keep costs low, study after study shows that the message just isn’t resonating with patients. Convenience is king, and that is unlikely to change until the convenience, quality and cost all line up in a way that is easy to access and digest at the member level.

Convenience more important to patients than quality of care, survey finds

by Les Masterson

People want convenience, whether that's from their mechanic, retailer or provider. NRC Health's Market Insights surveyed more than 223,000 healthcare consumers and found that 51% said convenience and access to care are the most important factors in their decision-making. That's above insurance coverage (46%), doctor/nurse conduct (44%), brand reputation (40%) and quality of care (35%).

The need for convenience is one factor in the growth of retail clinics and telehealth services. The report found that retail clinics grew 500% since 2006. Nearly one-third of patients have used retail clinics for primary care. A recent PwC Health Research Institute report also referenced how retail clinics' convenience make them an alternative to traditional providers.

"There's no reason to believe that these trends will slow down, as consumers continue to expect ever-more convenient access to care," NRC Health said.

The survey of patients found that they're largely satisfied with their providers. They also appreciate respect and communication from doctors and nurses.

There is room to grow in other areas, though. The survey discovered that patients don't believe their providers have a proper understanding of their health history. Only slightly more than a quarter of respondents were satisfied with their provider's knowledge of their past.

Respondents also spoke negatively about wait times and dealings with non-clinical staff. About two-thirds said administrative and support staff didn't treat them with respect.

Problems with support staff also involve billing and insurance, which about one-third of respondents complained about. The report warned these non-clinical issues can affect a patient's perception of a practice. One way to help with this issue is to improve cost transparency.

In response to the findings, NRC Health offered five recommendations: prioritize human innovation and improve relationships, improve ease-of-use, cultivate continuous relationships rather than focusing on episodic care and return time to clinicians through reduced documentation and rebuilt EHR systems.

Health system executives understand the end to improve customer experience. A recent Kaufman Hall survey of 200 hospitals and healthcare executives found that 90% of respondents said improving customer experience is a high priority. That was up from just 30% a year prior.

Few systems have actually done anything about it so far, though. A recent study from Chicago-based Prophet charged that consumerism for providers, payers and pharmaceutical companies is lacking.

0 notes

Text

Look ahead: 5 health care story lines we'll be watching in 2019

As we kick off 2019, here are 5 local stories for the Western PA market that we will all be keeping an eye on.

Look ahead: 5 health care story lines we'll be watching in 2019

by Paul J. Gough

Even before the year gets too much under its belt, there’s one thing for certain: 2019 is going to be a big year in health care in the Pittsburgh region. June 30 will see the end of the UPMC-Highmark consent decree, which will be the culmination of the brokered settlement between the two health care giants. And just as 2018 turned out to be a year when a lot of attention was paid at the national level to health care, it’s likely to play out even more in 2019 as the presidential election season heats up.

Here are five story lines we’ll be watching in 2019:

The end of the consent decree

It has been several years in the making, but July 1, 2019, will be the moment we’ve been awaiting since UPMC and Highmark entered into an agreement in 2014. By now most companies and consumers have made their choices, and a court ruling earlier in 2018 helped spell out what coverage was going to continue and what would end. But a major question mark remains Medicare Advantage, although when the numbers are tallied in late January, it’s likely to become a little clearer.

Affordable Care Act’s uncertain future

A mid-December ruling by a federal judge striking down the Affordable Care Act all but assures that the debate on the ACA will spill over into 2019 and become a major issue in the 2020 presidential campaign. That will have an impact on the state and federal level, at a time when the premiums — and the cost to insurers — seems to have stabilized in Pennsylvania. What impact it will have on providers and big insurers like Highmark and UPMC Health Plan have yet to be determined.

The neighborhood hospital will arrive in Pittsburgh

These small “micro hospitals” are new to Pennsylvania, but operating full-scale emergency departments and 10 observation beds in a single facility are nothing new to Allegheny Health Network’s joint venture partner, Emerus. They’ve been a pioneer in these micro hospitals, particularly in the West. How will they play out in Pittsburgh?

UPMC specialty hospitals get going

With the architects picked and the designs rendered, construction will begin in 2019 on the first of UPMC’s three specialty hospitals that UPMC will build in Pittsburgh over the next five years. That first hospital will be the UPMC Vision and Rehabilitation Hospital, which will be built on the campus of UPMC Mercy in Uptown Pittsburgh. But work will likely progress on the other two, the UPMC Heart and Transplant Hospital and the UPMC Hillman Cancer Hospital.

Jefferson Hills’ big decision

UPMC’s plans to build a hospital in the South Hills led it first to South Fayette, then to Pleasant Hills, and now, Jefferson Hills. But the proposed UPMC South ran into community opposition and, in December, it wasn’t clear if neighbors’ efforts to limit hospital development would go through.

0 notes

Text

This local hospital has a financial tool to get at the true costs of procedures for patients — and it's not chargemaster

For those of us in the South Hills of Pittsburgh, it is not news that St. Clair Hospital is excellent. And with the new requirements surrounding the publishing of the chargemaster, St. Clair has gone a step further to create their own portal that claims to show costs inclusive of health insurance discounts. While we cannot personally speak to how accurate this site is, the fact that it exists is a great step in the right direction toward better transparency in health care.

This local hospital has a financial tool to get at the true costs of procedures for patients — and it's not chargemaster

by Paul J. Gough

While new federal regulations required all hospitals to publish online a list of charges for procedures, supplies and drugs, no one thinks the move goes far enough to help get at the true cost to patients. But one local hospital has been doing just that for the past three years.

St. Clair Hospital in February 2016 rolled out its financial tools webpage that provides patients with an estimate of out-of-pocket costs for common hospital procedures, including surgery, colonoscopy, CT scans and sleep studies.

"A lot of patients are really price sensitive, especially patients who have a higher deductible, who know they will be responsible for a larger part of health care expenses," said Beth Pittman, VP and COO of St. Clair Medical Services.

The real-time estimates tool works for insured and uninsured patients, takes in specific health insurance policies and then provides deductibles, copays and coinsurance the patient will have to pay after insurance. That's in direct contrast to the now-required chargemaster data, which provides the cost of individual procedures and supplies but not how they might fit together into a typical bill.

Other hospitals, including Monongahela Valley Hospital and Uniontown Hospital, have cost estimators on their website. All hospitals provide individual counseling through patient navigators to discuss costs. But it's hard for a one-size-fits-all solution to hospital health care costs, not only because of the type of insurance, but also because of the variables between hospitals and doctors, said Denis Lukes, CFO of the Healthcare Council of Western Pennsylvania.

Lukes pointed to St. Clair's financial tool as a best-practice.

"They have gotten some national notoriety from that," Lukes said.

But the transparency doesn't come easy. St. Clair's SVP and CFO Rick Chesnossaid the first launch of the financial tools in February 2016 came after about nine months of hard work with its technology partner, Experian, and feedback from patient focus groups and individual patient groups. The tool has grown to 114 separate procedures.

"We continue to see a lot of activity, about 50 patients a week accessing our site to look for the cost of our services," Chesnos said.

And it's not just the hospital services. Pittman said the tool can be used by medical office staff to estimate costs as well.

"It's real-time and accurate so there are no surprises," Pittman said.

Allegheny Health Network also is working to increase its cost-estimation tools, acknowledging the limitations of the chargemaster publishing.

"The chargemaster in and of itself in the current environment has little to do with what insurance companies or individuals pay to a hospital," AHN CFO Jeff Crudele said. "It's one element of the process of developing a bill, but it's not the only determinant." For people who are insured by Medicare, Medicaid or a commercial insurer, it's often a predetermined fee schedule.

AHN already has tools and services to help with how much procedures will cost. One tool is through the Epic electronic health records system, Crudele said.

Crudele said it's important for patients to seek personalized health support, which includes an AHN telephone number.

"We really pride ourselves on spending time with our patients so they get the personalized service to fully understand this in a more comprehensive way," Crudele said.

0 notes

Text

Hospitals provide charges on website, but it's not as useful as you might think

The big news last week was the effective date of the law requiring hospitals to make their chargemaster public. But, as the article illustrates, this means next to nothing to patients as the costs of care are entirely dependent on the negotiated rates of their provider and the plan design of their specific health plan.

Hospitals provide charges on website, but it's not as useful as you might think

by Paul J. Gough

The region’s hospitals have uploaded to their websites a list of charges for services, supplies and medications, as required Tuesday by the federal government. But it’s an open question about whether the data will be useful on its own for patients and businesses who crave pricing and transparency in health care.

The Centers for Medicare & Medicaid Services mandated all hospitals provide their standard pricing online beginning Jan. 1 in a bid to increase transparency in health care. Some in the region, including Mon Valley Hospital and Uniontown Hospital, had already offered some level of pricing data online. But now all hospitals must provide a detailed list of charges, called a chargemaster, and there has been a flurry of activity in recent days on hospital websites.

Most of the hospitals in the region met the Jan. 1 deadline, although UPMC hospitals' data were still being uploaded Wednesday. It wasn't immediately clear when the UPMC hospitals would have all the information available. Some of the hospitals, including UPMC Susquehanna, were already online and the others were being put online Wednesday.

The chargemaster is considered the starting point for the cost of hospital procedures, supplies and medication, but experts say it's more of a guide and how much what someone with insurance would pay.

It's not easy to find on most hospital websites. (Try searching "chargemaster.") And the data isn’t user-friendly, and doesn’t provide reasons for a wide variation in pricing between hospitals and sometimes within hospitals. The Allegheny Health Network chargemaster, for instance, provides costs for 160,000 procedures, diagnostic tests, drugs and supplies that isn’t what it ends up costing due to insurer contracts, Medicare and Medicaid, and others.

“The chargemaster is generally not a factor in determining the patient’s portion of payment when third-party insurance coverage is available,” AHN spokesman Dan Laurent said.

Hospitals on their websites provide the information but said that the standard charges don’t mean that’s what patients will pay.

“It is highly unlikely that this will provide any meaningful information that would be useful for patients. It is important to understand that the standard charge is not the amount that a patient is expected to pay for receiving healthcare services. A patient’s financial obligation is determined by many factors, including insurance coverage and benefit plan limits,” UPMC spokesman Susan Manko said.

Said AHN's Laurent: “Without context, the chargemaster prices may be of limited value to patients."

Uniontown Hospital has had standard charges on its website for a while but uploaded more information to comply with the rule in late December.

“The prices contained in the chargemaster cover so many items and so many things, there really isn’t a one-stop location to gain an understanding of how they are made,” said Joshua Krysak, a spokesman for Uniontown Hospital.

0 notes

Text

Strategies to help employers minimize ADA missteps

While we don’t wade into “legal” areas very much, sometimes certain issues tie into benefits programs, and this is one of those areas.

Strategies to help employers minimize ADA missteps

by Jeffrey Kopp

Handling ADA accommodation requests is tricky. But having a good ADA policy, making sure employees acknowledge receipt of the policy, and properly instructing managers how to deal with requests are essential tools to help prevent unforeseen disability discrimination claims.

Take this scenario.

In a conversation about his tardy attendance, an employee tells his manager he is having difficulty arriving to work because his sleep apnea interferes with his rest and prevents him from waking up on time. He adds that he is being evaluated for drugs that could potentially help him. Is this a request for an accommodation under the ADA?

In general, the answer is probably yes, and the employer could face a potential disability discrimination claim if the request is ignored.

Title I of the ADA requires employers to provide reasonable accommodations to qualified individuals with disabilities. Failure to provide an accommodation is a form of disability discrimination. The employee’s request for an accommodation triggers an “interactive process” to determine what accommodation might be reasonable.

To trigger the interactive process, the employee does not even have to specifically mention the ADA or state that he is requesting a “reasonable accommodation.” Thus, if such a statement made to a manager could be considered a request for an ADA accommodation, how can an employer possibly monitor these types of employee requests and comply with the ADA?

Realistically, there are two ways an employer can minimize ADA missteps in this scenario.

First, the employer should review and make sure that its ADA policy includes a definitive procedure for how an employee should request an ADA accommodation. An increasing number of courts are holding that even though an accommodation request may be informal, it does not necessarily excuse an employee’s failure to use the correct procedure, provided the procedure is clear and disseminated in advance. So once an employer has established a fixed set of procedures to request accommodations, an employee’s failure to follow this procedure could preclude a claim for failure to accommodate.

In one recent case, for example, an employer required employees to make all accommodation requests though it’s leave of absence administrator, a position it created specifically to deal with employee leave requests. The court held that the employee’s failure to use that specific procedure precluded her failure-to-accommodate claim. Thus, having a clear procedure that tells employees how, and to whom, they should direct their accommodation requests is essential to mitigating risk for failure to accommodate claims.

Second, even if an employer has a policy limiting the methods for accommodation requests, it also should inform managers and supervisors that when an employee who is trying to justify performance issues makes comments about his or her medical condition, such comments are potentially an accommodation request. The employer should direct supervisors and managers to immediately refer any such circumstance to human resources, in order to handle the interactive process.

0 notes

Text

How the CVS-Aetna merger could lower healthcare costs

And story #2: perhaps a much larger, more impactful initiative, but the CVS - Aetna merger will bring primary care to the storefront, making it more accessible to the masses.

How the CVS-Aetna merger could lower healthcare costs

by Craig Hasday

Healthcare in the United States is a mess and confuses even savvy professionals. With this complexity and significant increases in cost sharing, it’s no wonder many Americans have no primary care doctor and almost half are dissatisfied with the cost of care they get.

Chronic care costs about 80%–90% of the country's annual healthcare expenditures, and some estimate that as much as 25% of those costs are duplicative, wasteful or avoidable.

So what can CVS-Aetna do about this?

The retailer has a lot of clinical resources. Opening up the MinuteClinic model will provide an easy-to-access, front door portal to cost-effective care for acute and chronic conditions — which can help simplify care. I especially like the pharmacist’s role in this model since prescriptions are the most frequent access point to care. Integrating the pharmacist into care triage to aid in steerage to a primary care provider is a low-hanging fruit solution — and allowing that pharmacist to provide needed advice and follow-up on chronic-care treatment can only serve to lower those costs.

CVS-Aetna will have better data available to arm these clinicians with timely care considerations, helping Aetna members take what CVS-Aetna calls the “next best action” in healthcare. And it’s easy to see that this can be supported by seamless electronic medical records.

The MinuteClinic can also provide a lower-cost care setting for things like infusion therapy. This is a hot topic in cost savings — moving from the highest-cost inpatient setting, the clinic setting seems like a logical stopping point for many who are uncomfortable with performing self-infusion at home. Also, integrating the availability of often-fragile specialty medication, which may need refrigeration or other special handling, will no doubt create efficiencies and lower costs.

These clinics can also save money on the estimated 30% steerable emergency room visits. And post-surgical care coordination might be efficiently and effectively delivered by a local pharmacy supported by their clinical team.

No doubt healthcare is about to embark on the type of change, facilitated by access and digital tools, which has swept much of our economy. I expect that we are just a few years away from lower costs and greater efficiency in healthcare delivery. This transaction will prove to be a big catalyst for change.

0 notes