Text

Emoneywallets: Your Trusted eWallet Application Development Company in France

Introduction:-In an era where digital transactions are becoming increasingly popular, having a robust and user-friendly eWallet application is essential for businesses to thrive. If you're searching for a reliable and expert eWallet Aapplication Development Company in France, look no further than Emoneywallets. With their extensive experience and innovative solutions, Emoneywallets stands out as a leading provider of top-quality eWallet application development services in the country.

Extensive Expertise:-Emoneywallets boasts a team of highly skilled professionals with deep expertise in eWallet application development. With years of experience in the industry, they have successfully delivered numerous projects for clients ranging from startups to established enterprises. Emoneywallets possesses comprehensive knowledge of the latest technologies, security protocols, and industry trends, ensuring that they provide cutting-edge solutions tailored to your business requirements.

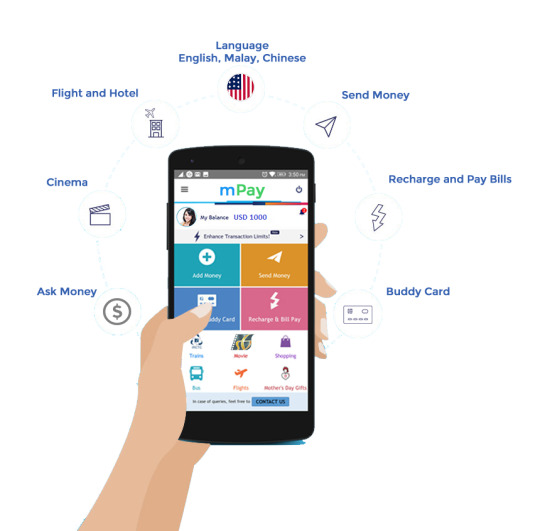

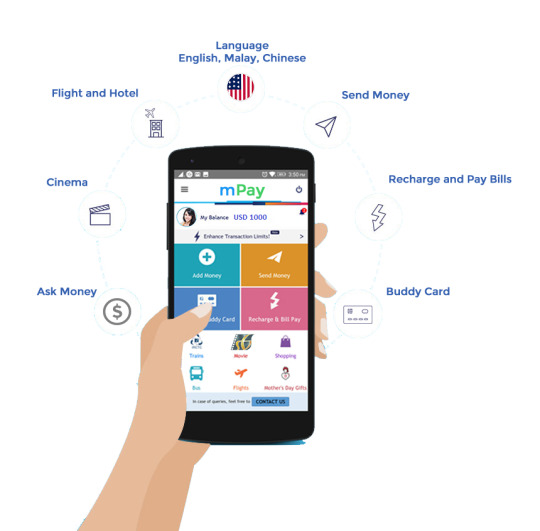

Customized Development:-At Emoneywallets, they understand that each business has unique needs and goals. That's why they offer customized eWallet application development services. Their team takes the time to understand your business objectives, target audience, and desired features to create a tailored solution that aligns with your brand identity. Whether you need a standalone eWallet app or integration with existing systems, Emoneywallets can deliver a personalized application that meets your specific requirements.

User-Centric Design:-User experience is at the forefront of successful eWallet applications. Emoneywallets follows a user-centric approach to design, ensuring that the interface is intuitive, visually appealing, and easy to navigate. They conduct thorough user research, usability testing, and UI/UX optimization to create an engaging and seamless experience for your app users. By prioritizing user satisfaction, Emoneywallets develops eWallet applications that drive customer engagement and loyalty.

Robust Security Measures:-Security is of utmost importance in eWallet applications, given the sensitive nature of financial transactions. Emoneywallets prioritizes the implementation of robust security measures to protect user data and transactions. They employ industry-standard encryption protocols, two-factor authentication, and advanced security features to ensure the utmost protection of sensitive information. Emoneywallets takes the necessary steps to comply with data privacy regulations, providing peace of mind to both users and businesses.

Timely Delivery and Support:-Emoneywallets understands the importance of timely project delivery. They follow efficient development processes and maintain clear communication throughout the development lifecycle, ensuring that your eWallet application is delivered on schedule. Moreover, their commitment to customer satisfaction extends beyond the launch of the app. Emoneywallets provides reliable post-development support, addressing any issues or updates promptly to ensure your application continues to perform optimally.

Conclusion:-Emoneywallets is your trusted partner for top-quality eWallet application development services in France. With their extensive expertise, customized development approach, user-centric design, robust security measures, and commitment to timely delivery and support, Emoneywallets ensures the success of your eWallet application project. Whether you need an eWallet app for retail, finance, or any other industry, Emoneywallets has the skills and experience to bring your vision to life. Contact Emoneywallets today to discuss your eWallet application development needs and unlock the potential for digital transformation and growth in the French market.

#ewallet Application Development Company in Paris#ewallet Application Development Company in France#ewallet Application Development Company in Italy#ewallet Application Development Company in Birmingham

0 notes

Text

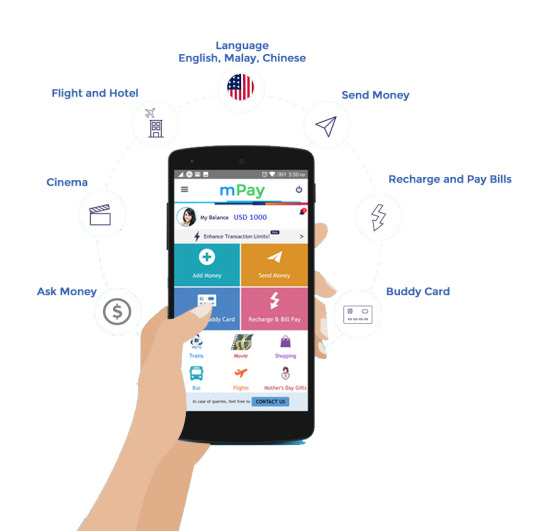

Emoneywallets offers a complete Mobile Banking Solution Provider in Malta. which is our mobile payment sale switch, it provides an interoperable structure for banks to offer real- time plutocrat transfers to guests through the mobile banking channel. It makes transferring and entering plutocrat immediate, accessible, usable and transmittable.

The banks can give a host of other services – Account related services like Balance Enquiry, Mini Statement, Generate OTP, Change OTP; position grounded services like ATM Locator, Branch Locator and Card affiliated services like disbenefit / Credit Card Request, Block & Replace Requests, which can enhance the overall banking experience of a client.

0 notes

Text

Best Banking Service Provider in Malta

Malta has become a hub for banking service providers in recent years, attracting a wide range of financial institutions to the island. One such provider that has made a name for itself in the Maltese financial sector is E money wallets. E money wallets is a leading digital wallet and payment solution provider that offers a wide range of banking services to its customers. In this blog post, we will discuss the benefits of banking with E money wallets in Malta and why it's an excellent choice for those looking for reliable banking solutions.

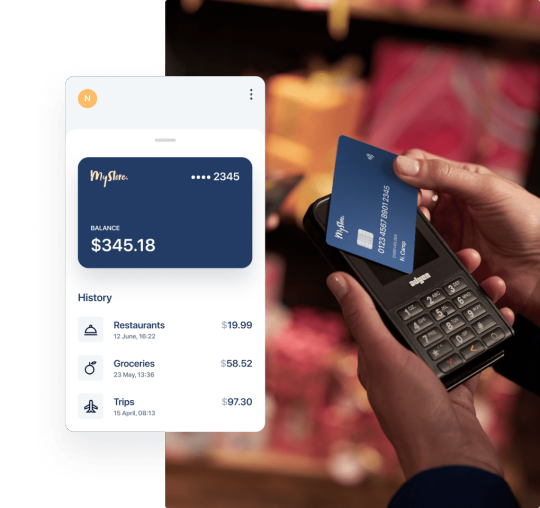

Firstly, E money wallets offers a wide range of banking services, including digital wallets, online payments, international money transfers, and more. These services are designed to cater to the needs of individuals, small businesses, and large corporations alike. With E money wallets, customers can easily manage their finances and conduct transactions securely and efficiently.

Secondly, E money wallets is fully licensed and regulated by the Malta Financial Services Authority (MFSA), ensuring that its services are compliant with local and international banking regulations. This means that customers can trust E money wallets to handle their financial transactions with the utmost care and security.

Another significant advantage of banking with E money wallets in Malta is the ease of access to its services. E money wallets has a user-friendly online platform that allows customers to manage their accounts and conduct transactions from anywhere in the world. Additionally, E money wallets has a mobile app that is available for download on both iOS and Android devices, making banking on the go effortless and convenient.

E money wallets also offers competitive fees and exchange rates, ensuring that customers get the best value for their money. Whether it's international money transfers or online payments, E money wallets provides cost-effective solutions that help customers save money on banking fees.

In conclusion, E money wallets is a leading Banking Service Provider in Malta that offers a wide range of reliable and secure banking services to its customers. With its user-friendly online platform, mobile app, and competitive fees and exchange rates, E money wallets is an excellent choice for those looking for an easy and efficient way to manage their finances. Stability and Security: Malta has a stable and secure banking system that is regulated by the Malta Financial Services Authority (MFSA). This ensures that banks operate with integrity and in compliance with regulatory standards.

Accessibility: Malta has a range of banking institutions, including international banks, which offer a wide range of financial services. This makes it easy for individuals and businesses to find a banking service provider that suits their needs.

Efficient Payment Processing: Banking service providers in Malta offer efficient payment processing services, which is particularly beneficial for E money wallets. This means that transactions can be processed quickly and securely, which can help to reduce transaction costs and improve the overall user experience.

Diversified Investment Opportunities: Malta's banking system offers a range of investment opportunities, including stocks, bonds, and mutual funds. This can help E money wallets to diversify their investments and potentially earn higher returns.

Access to International Markets: Malta's banking system is well connected to international financial markets, which can provide E money wallets with access to a wider range of investment opportunities and facilitate international trade and commerce.

Overall, using a banking service provider in Malta can provide E money wallets with a stable, secure, and efficient financial system, as well as access to a range of investment opportunities and international markets.

#Banking Service Provider in Malta#Banking Service Provider in Netherlands#Banking Service Provider in Spain

0 notes

Text

A Comprehensive Guide For E Wallet Application Development

We’re living in the digital period! Consumers are exercising a variety of ultramodern ways to ameliorate their standard of living. Technology advancements have redounded in the creation of IoT- enabled widgets and a variety of pall- grounded systems. During the last many times, the cashless assiduity has seen tremendous expansion. E Wallets will be a digital volition to traditional payment options similar as credit or disbenefit cards and digital currencies by 2021.

Mobile operation payment systems have progressed to a new position, perfecting their capability to deliver further trust ability and security while doing online payments. The convenience of digital deals has boosted ewallet Application Development Company in Spain to be one of the trendiest businesses of the ultramodern period.

What Are E Wallet Mobile Apps?

While a conventional portmanteau may include several cards and cash, e-wallets function as a result by allowing druggies to store their card information and make deals snappily by surveying a QR law or inputting the payee’s number. The finances are taken incontinently from their accounts and transferred to the payee’s bank accounts. It not only has simplified deals but also increased people’s effectiveness in transferring plutocrat snappily.

the system was lengthy, taking us to input multitudinous credentials about the payee, constantly enter OTP figures, and stay an hour or so before initiating any transfer to that existent. Indeed, the current circumstance is no longer the same, since payments may be completed in a matter of seconds with only a many clicks.

The progress of eCommerce has been remarkable, paving the door for the development of e Wallet mobile operations. These two generalities are inextricably linked. However, now is the time to do it, If you ’ve been considering erecting an e Wallet app for your business.

Druggies can make payments indeed if they aren’t having their e Wallet

or if customer forget their cards at home. Nothing can stop people from shopping if their smartphones and e Wallet operations are running. The maturity of outlets, shops, and businesses now accept payments using any of the digital payment operations rather than just accepting cash.

E Wallet Mobile Application

Styles Of Payment In A Digital Payments operation

Since eCommerce has established itself as a champion in all circumstances and people’s reliance on it for window shopping and ordering diurnal musts has grown to an unapologetically high position, it has spawned e-Wallets as well. currently, there are a variety of options for making online payments. Let us bandy these approaches in detail

1 NFC (Near Field Communication)

This is a completely contactless payment system that utilizes a chip. In this approach, the stoner doesn’t need to touch another device; he only needs to be close enough for his device to be scrutinized by the receiver’s pay panel. Payments may be reused within a 3- 4inch range.

While this invention isn’t yet accessible on aged smartphones, it’s being enforced into all new phones in order to exclude any contact between druggies and merchandisers in the coming months.

2 UPI

UPI is a kind of universal payment system that enables any consumer with a bank account to transfer plutocrat via a UPI- enabled operation. The service enables druggies to connect several bank accounts to a UPI app on their smartphone, enabling them to painlessly initiate cash transfers and collect payments 24 × 7.

The crucial advantage of UPI is that it permits druggies to shoot and admit plutocrat without taking them to have a bank account number or an IFSC number. You only bear a Virtual Payment Address (VPA). There are several UPI operations available on the request, and they’re compatible with both iOS and Android.

To use UPI, you must have a licit bank account and a vindicated mobile phone number associated with the same bank account. There are still no sale freights associated with UPI. This enables guests to transfer finances as well as check their account balances.

3 styles Of Payment Using Sound swells

Giving precedence to contactless payment is a revolutionary way of payment that enables one to conduct a sale using sound swells generated by a smartphone. This functionality is compatible with a wide variety of bias, including smartphones and card swipe machines.

4 Internet Banking

The alternate stage is for them to admit a one- time word (OTP) on their phones, which enables them to add the devisee. Also they must stay a many twinkles or indeed days for the individual to be included in their devisee list and also conduct any deals.

5 Mobile e Wallet

As the name implies, mobile e Wallet

6 Direct Billing To The Carrier

Generally employed by residers in underdeveloped areas where multitudinous means of online payment are still unapproachable, this type of payment is also rather simple to complete. One could order products and request that the seller adds the assessed quantum straight to their yearly phone bills.

Types of Mobile e Wallet Applications

Closed E Wallets

You ’ve presumably come across Walmart Pay and seen that you can use the mobile portmanteau to make purchases only if you buy particulars through the operation. Indeed though the association has been in operation for a long period of time, the e Wallet payment option was added latterly. As a result, digital e Wallet are limited to a single app and can not be used to make other electronic payments.

Semi-Closed E Wallets

This bone gives you lesser influence than unrestricted e Wallets. druggies can make payments with these e Wallet at merchandisers that have inked contracts with the e Wallet establishment. This function is only available in some of stores. As a result, they’re appertained to as semi-closed e Wallets.

Open E Wallets

These are the most popular e Wallets, and you can snappily install them on Android or iOS bias. These are simple to use and able of doing an horizonless number of deals. created e Wallets account include Paytm and GPay.

Why Should You Invest In The Development Of An E Wallet Application?

The assiduity has seen a dramatic increase in the use of digital payment apps that enable contactless deals. Encyclopedically, the digital portmanteau assiduity is read to grow from$1.35 billion in 2019 to$7.96 billion in 2027. It’ll climb at a stunning30.1 percent emulsion periodic growth rate. Piecemeal from its ease, inflexibility, and security, the following are the top reasons to develop an e Wallet operation for your business

Increased Conversion Rate

Are your guests queuing to pay their bills? Allow them to make purchases on the move and expedite the shopping experience with an e Wallet operation. This will have a direct effect on their purchasing geste , performing in raised income.

Minimize Abandoned Wagons

The primary benefit for merchandisers is a reduction in abandoned wagons. eWallets streamline and expedite the purchasing process, adding the chance of guests who finish their deals.

Low sale Costs

In comparison to credit cards’ grandly- interest rates, eCommerce platforms charge significantly cheaper sale freights. merchandisers can also issue their own payment cards. It can serve also to a gift card, removing the bank from the sale and significantly dwindling sale freights.

Order Cancellations And Returns Are ineluctable

Order canceling and returns are necessary aspects of the retail assiduity. still, with the help of an e Wallet system, you may transfigure them into a pleasurable customer experience. It enables consumers to admit refunds snappily and fluently. This also implies that your consumers now have available finances in their app, which they may use to buy further.

In just a many clicks, eCommerce possessors can also effectively target these consumers with product advertising, encouraging them to make further purchases.

Increased profit

merchandisers may give acclimatized offers with pasteboard canons to retain consumers. This may be done on a periodic base to enhance deals possibilities over time.

Increase client Base

Digital payment services allow banks and fiscal institutions to fleetly communicate with prospective consumers. Contactless payment systems that are well- designed and include sophisticated features increase a bank’s credibility and help company possessors see it as reliable and secure.

Encyclopedically, people prefer a digital portmanteau. They will incontinently move over to you due to your comprehensive security features, leaving your competition before.

The diligence Fueling The Growth Of E Wallet App

Food And Grocery Delivery

Without a mistrustfulness, the grocery and mess delivery diligence have made tremendous strides in recent times. individualities prefer to pay online due to the ease of having demanded inventories delivered directly to their frontal doors. It would be easier for consumers to pay and produce further profit if these delivery operations included e Wallet capabilities.

ECommerce Assiduity

Now days smart phone is a importent part of life. With just a many clicks, you may have everything packed to your home. lately, the eCommerce business has grown in fashion ability, bringing merchandisers and buyers closer together.

Due to the preface of e Wallet operations, start- ups and small businesses have increased their speed and trust ability. eCommerce and payment processing have grown safer and more accessible as a result of the growth of e Wallet operations.

Hack reserving

reserving a hack or hack and paying with cash? To be honest, this script has come fairly old and isn’t common in the maturity of cases. Since people’s precedences have converted, with their health taken first, they’ve also begun using e-wallets to make payments in this situation.

To begin, it promotes translucency between guests and operation possessors; also, it’s the simplest and most effective system of doing a sale.

Payment Of Bills Online

guests appreciate this e Wallet functionality a lot. The days of visiting an electric force office to pay the electricity bills are over. Not only has this point simplified payments, but it has also backed consumers in making timely payments

all most e-wallets enable druggies to pay all of their once-due bills directly from the Application. This includes, but isn’t limited to, the phone bill, the water bill, and the power bill.

Ticketing And Reservations

Another significant sector that has contributed immensely to icing the success of e-wallets is the tickets and reservation assiduity. druggies may now make the utmost of their time by reserving airline, machine, and rail tickets at blinked rates online. They may also use it to book pictures and musicales.

Worldwide operation Mobile Wallets

E Wallets have been a disclosure, and their use is adding encyclopedically. Unexpectedly, it was the most favored payment system the time before, counting for roughly 26 of all worldwide sale payments. disbenefit cards and credit cards reckoned for 22 and 13 of the request , independently.

#ewallet Application Development Company in Spain#ewallet Application Development Company in Manchester#ewallet Application Development Company in Birmingham

0 notes

Text

How Digital Banking Services Make Your Life Easy?

The banking assiduity has experienced a dramatic metamorphosis during the former decade. With the arrival of digital banking came the worlds of online bill payments, phone banking, digital check deposits, person- to- person deals, electronic portmanteau, and other services. These Banking software provider in United Kingdom are all designed to make your life easier.

The Rise Of Digital Banking

Online banking results, believe this or not, dates back to the early 1980s, albeit the technology’s sweats during that period were at best introductory. But it wasn't until the 1990s that so numerous banks began offering online banking services to their guests, and it was n’t until the 2000s that the preface of mobile phones with online banking software truly came a practical choice for numerous people. Throughout this timeframe, online banking has grown in terms of service immolations.

druggies, for illustration, have successfully been suitable to log in to their bank accounts, examine figures, transfer finances between accounts, and arrange tab or credit card deals. fresh services, similar as remote payments, have just lately come possible with the preface of cell phones( and phone cameras).

Online banking is n’t technically the “ norm ” — at least, it was n’t before COVID- 19 — but it’s well on its way towards getting similar. nearly all banking results now not only have doors designed to make internet banking simple and intuitive but also phone operations that put the maturity of those services right on their guests ’ mobiles in a secure manner, no lower.

The Benefits Of Online Banking

The advantages of online banking software are the same whether you name their internet banking, phone banking, or online banking. Among the numerous advantages are

An online banking result system enables you to assess fiscal accounts with a many mouse clicks or keyboard inputs, which is significantly more effective than checking your original bank services.

When opposed to the commitment of travelling to the bank, standing in a line, and having a banker perform the transfer for you, digital and mobile banking makes transferring plutocrat between fiscal accounts a matter of seconds.

Mobile banking operations include a tool that helps you to deposit checks into your portmanteau using only your phone’s camera, sparing you a trip to the bank and immolation you a speedier option to have your checks deposited so you can recoup your cash.

Digital banking makes it simple to view old deals, which streamlines expenditure operation, cheque book balancing, and covering for questionable or fraudulent bills.

The Digital Banking Options

Internet And Mobile Banking internet banking refers to getting some banking installations like transferring plutocrat and accounts opening and closing online.

Immediate Payment Service( IMPS) Immediate Payment Service is an instant payment interbank electronic finances transfer system. The payment service allowsinter-bank electronic fund transfer service on mobile phones. IMPS is available 24 × 7 365 days including bank leaves.

Unified Payments Interface( UPI) At the moment, UPI is the most popular kind of online banking. UPI employs a digital payment address to allow druggies to shoot and admit plutocrat without inputting their bank account information or IFSC law.

Mobile Wallets Mobile holdalls

have fully removed the need to study four- number card watchwords, submit CVV information, or carry loose plutocrat.

Conclusion

In moment’s world, your cell phone serves as your virtual frontal door to the world of finance. Bankers are now trying to move down from traditional concrete block systems by spending heavily on fiscal invention.

Digital banking services indicate personalised interfaces, heightened security, superior and broader range of services; this is fantastic for client relations.

While fintech companies and banks probe the possibilities of AI in the fiscal sector, online banking systems may deliver further comprehensive services in the future.

#Banking Transfer Provider solution in London#Banking Transfer Provider solution in Manchester#Banking Transfer Provider solution in Birmingham#Banking Transfer Provider solution Italy#Banking Transfer Provider solution in France#Banking Transfer Provider solution in Paris#Banking Transfer Provider solution in Germany#Banking Transfer Provider solution in Berlin#Banking Transfer Provider solution in Haiti#Banking Transfer Provider solution in Caribbean Island

0 notes

Text

How can mobile banking apps help serve Fintech?

The Finance Industry and banking sector are among the top most heirs of digitalisation. The preface of Banking software provider in Lithuania has added further inflexibility and availability to banking.

The ultramodern mobile banking system has changed the hand of Fintech.

It has revolutionised the operation of the finance assiduity by reducing overhead costs and enhancing client experience. Then are some of the points that state how can mobile banking apps help serve Fintech

Mobile Banking Apps give flawless relations And amicable Deals

Mobile banking services have brought a significant shift in the way individualities can handle their finances. It has handed great ease and convenience by allowing easy access from anywhere. Mobile banking software loaded with stoner-friendly features facilitates amicable finance deals.

Whether it's allocating finance in finances, pullout of finances, or transfer of plutocrat, any type of finance sale fleetly. Also, the increase in operation of Money Transfer Software Provider in Netherlands deals has shown a growth of around 64.

Mobile Banking Apps Will Help Target Your followership And Ameliorate Services

Banking and Finance is a customer- driven assiduity. Experience and commerce play an essential part. fiscal institutions and banks constantly are contending with each other and using client service as a great differentiator.

The mobile banking system has opened doors of openings for these institutions. It has eased better connections with guests. The finance institutions can efficiently reach the target followership and communicate about finance products.

likewise, mobile banking services play an essential part in gathering client perceptivity for service enhancement.The data attained from mobile banking apps give precious information to offer customised services to the target followership.

structure Mobile Banking Apps Can Reduce Cost And Ameliorate perimeters

Fiscal institutions are utilising the power of the mobile banking system to convert branch guests to mobile banking guests.

Thereby reducing their cost and perfecting perimeters. The finance institution sees guests saving moment as a prospect for outspoken investment in the future.

Mobile Banking Apps Present New openings in the Lending Space

Mobile banking apps give believable information and client data to fiscal institutions. It's upgrading the functionality of fiscal institutions.The integration of Fintech has opened new avenues to detect new implicit guests. figure Mobile Banking Apps To Serve Underbanked Populations

A significant quantum of the underbanked population still doesn't comprehend the banking system.

The preface of mobile banking services and systems is bridging this gap. guests are more likely to use their mobile phones to carry out fiscal deals.

Mobile banking apps are stimulating the growth of fintech by enabling them to explore untapped areas.

THE BOTTOM LINE

Without a doubt, Mobile banking services are the future of finance. They are changing the overall functioning and operations of the finance sector.

Its impact on the customers and target audience is humungous. Hence, modern banks must unfold the fintech trends and incorporate mobile banking services strategically to boost their growth and development.

#Ebanking Solution Provider in London#Banking software provider in Malta#Emoney solution Provider in Malta#Virtual Card Provider in Malta#Card program provide in Birmingham#Co Branding card provider in Netherlands#White Label IBAN account in Italy#Mastercard Provider in Netherlands#Money Transfer Sofware Provider in Malta#ewallet Application Development Company in Estonia

0 notes

Text

Money Transfer Software Provider in United Kingdom

#Money Transfer Software Provider in United Kingdom#ewallet Application Development Company in France#Money Transfer Sofware Provider in Haiti#Mastercard Provider in Berlin#Mastercard Provider in Estonia#White Label IBAN account in Berlin#IBAN account provider in Haiti#Co Branding card provider in Italy#Card program provide in Paris#Virtual Card Provider in Birmingham#Emoney solution Provider in United Kingdom#Banking Transfer Provider solution in Haiti#Ebanking Solution Provider in Paris

0 notes

Text

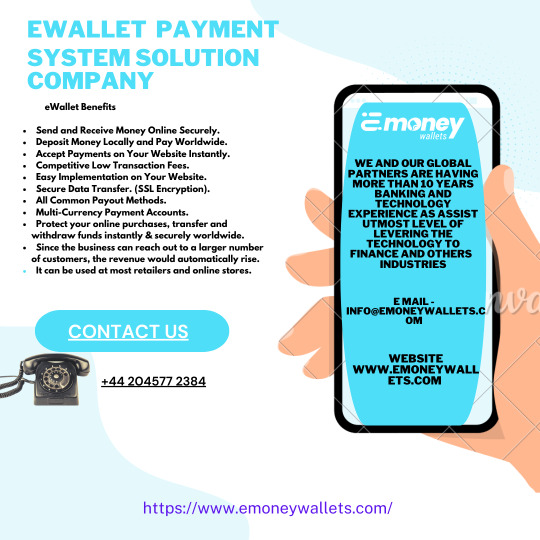

Ewallet Payment System Solution Company

Best Ewallet Payment Solution and Development Services Company in USA, Europe, Asia, UK, Latin America, UAE. Hire Best digital wallet system provider agency

#Best Ewallet Software Developer in Europe#Online Payment System Software Provider in Europe#Payment System Software Provider in USA#Ewallet Payment System Solution Company in USA#Ewallet Payment System Solution Company

0 notes

Text

Payment and Banking Solution Company in USA

E-Money Wallets Company offers Mobile Banking & International eWallet payment solution with Debit/Prepaid integration services. A White Label virtual banking approach with hundreds of eBanking open API included Web and Mobile platform.We are best Payment and Banking Solution Provider Company in Australia, USA, UAE, Europe, Thailand and Philippines.

0 notes

Text

Role of Ebanking Solution Provider

Banking software provider in Netherlands banks with rich end- to- end capability and functionality to streamline their operations. They enable them to give individualized top- notch services to guests. Backed up with innovative robotization services and passionate expert advisers ; no bank will ever be packed out of business.

Emoneywallets of the banking system

Ebanking Solution Provider in London enable fiscal institutions to manage their own finances and indeed give convenience to their guests. utmost inventors have created platforms that distribute digital and supported data across all channels. The software gives banks unlimited reach to guests moment, hereafter and indeed in the future. This helps them to understand client requirements indeed before they state them, and come up with the stylish way to meet them. Online banking results are substantially characterized by their capability to do further of the following;

1. confining Digital Fraud Best Practices

Banks face challenges to manage both impalpable and palpable means, security protocols are of great significance. While watchwords have been used for a long time to cover important information, some banks have fallen victims of attacks executed by cyber culprits who use crucial logging ways, sophisticated technology and phishing to compromise the bank’s systems.

moment, Banking software provider in Estonia are gaining fashionability as a result to guarding banking systems. So, what's banking security software? The software controls access to any system by matching the behavioural and physiological characteristics of an individual to database information.

Banking software has been designed to ameliorate functional effectiveness by barring tedious executive processes involved with maintaining access

cards, watchwords and leg figures. This technology has the capability to cover, track and report attendance situations and access to outfit.

As a supplement to conventional word access, banks that want to beef up security can incorporate a combination of biometric procedures and digital access. In fact, numerous companies use this online banking result moment.

2. The Rise In requirements Processing – Merchant Services

The failure and success of any bank depend on its client’s fiscal operation. But finance operation can be veritably grueling in moment’s terrain. Online banking results can be veritably helpful for digital banking, the leading Financial Apps Development Company in UK have worked with hundreds of guests in website design, strategy, marketing and data operation. They help banks to get good control over guests ’ finance operation.

A banking software is used by colorful banking companies to govern their income, lending, recessions, deposits, administration and much further. It helps maximize gains and ensures sustainability. Every bank should have good online banking results to face the challenge of administration services and operation of client finances.

3. Overview Of Motivation Credit

At present, electronic credits are the norm across the globe. Banks need a point that manages online banking results,e.g., credit cards, disbenefit cards,e-wallets and a range of systems. Thanks to digital banking software inventors, banks can cipher all credits fleetly and with a dropped liability of mortal- grounded crimes.

Conclusion

Banks should look for digital banking software inventors that can offer good fiscal operation at cost effective value. A good banking software can keep track of arrears, keep records streamlined, minimize paperwork, insure data integrity and security, balance several client accounts, coordinate balance wastes, income statements and indeed charges, keep all deals transparent and much further.

#Ebanking Solution Provider in London#Banking software provider in United Kingdom#Emoney solution Provider in Netherlands#Virtual Card Provider in Malta#Card program provide in France#Co Branding card provider in Spain#IBAN account provider in Manchester#IBAN account provider in Italy#White Label IBAN account in Italy#Mastercard Provider in Estonia#Money Transfer Sofware Provider in Haiti#ewallet Application Development Company in France

0 notes