Text

Metaverse Alternatives: These Important Platforms Are Shaping The Sector

There are so many people who are excited about Metaverse, the hype may develop the platform. In this respect let us have a look at some of the Metaverse alternatives that are existing in this space.

Read complete article from: cryptoventurenews.com

#metaverse#crypto#cryptocurrency#augmented reality#virtual reality#metaverse platform#decentraland#crypto news#blockchain

0 notes

Text

The non-fungible tokens or NFTs are currently an important investment option for both the investors and the players despite the fact that they possess potential risks.

1 note

·

View note

Text

Custodial Vs Non Custodial Wallets: Which One To Go For?

Cryptocurrency is a significant genre in itself, and there is no such “one size fits all” approach in it. The segment is highly customizable depending on the preference of the users. The users can enjoy various options when it comes to choosing the type of cryptos. They may go for mining or staking or even trading crypto. With all of these going around, there is still one essential topic that people are often confused about. This is especially the new ones who are trying to gain their place in the crypto field. There has been a confusion between whether to opt for the custodial wallets or the non-custodial wallet of Bitcoin. This calls for an immediate comparison of the Custodial Vs Non Custodial Wallets.

The new crypto enthusiasts are often confused about which one would be better for them. Both the bitcoin wallets have their individual benefits and disadvantages. Thus, before opening a Bitcoin account, you need to consider everything about Custodial Vs. Non-Custodial Wallets. In this article, we are going to let you know everything about both these wallets. It becomes a lot easier for you to decide which wallet you would want to go for.

What Does A Custodial Bitcoin Wallet Mean?

The primary concept of a custodial bitcoin wallet is that a third party will control the private keys. This means the users are placing their trust in a different entity, usually the cryptocurrency exchange platforms. Many of the newest Bitcoin investors have depended on a custodial wallet at some point in their crypto journey. If you create an account with reputed exchanges such as Gemini or Coinbase, you will have the opportunity to use a custodial wallet, and it is all part of their service.

These platforms want to protect the users’ funds and will make an effort to do so. It is because they have their interest in it as well. The users often term the custodial crypto wallets as hosted wallets. Without any doubt, the custodial wallets remove the users from their personal responsibility for their funds. This might be a plus point to some users, while others might perceive it as a significant red flag. Additionally, the custodial wallets are typically web-based applications, unlike the hardware wallets that require a constant internet connection.

Advantages Of The Custodial BTC Wallet

The BTC custodial wallets do not hold the best reputation in cryptocurrency community. This is not because they are considered unsafe. Fact is that the user doesn’t hold their private keys, and they are not in charge of their entire funds. Some believe that the lack of this control is unacceptable. But for the others, this is the only reason for appreciating the custodial wallets.

The private key serves as the only path to access the money that the users earn. But what will happen if you cannot remember the private key? This means that all your Bitcoin (BTC) is lost forever. This does not occur with the custodial wallets, as the exchanges take certain precautions for ensuring that you always have access to your funds.

Generally speaking, custodial wallets are also a safer option as they offer better security against phishing scams and malware when web-based wallets come into consideration. However, there are a couple of downsides that you need to focus on as well. The first is that some of the exchanges would require you to use their wallets. In this case, as you do not hold the private keys to your wallet, it could mean that they might take your assets if they would want to, and you will have nothing to do about it.

What Does A Non-Custodial Bitcoin Wallet Mean?

The non-custodial BTC wallet is just the opposite of the custodial wallet. With this kind of wallet, the users possess complete control of their funds and private keys. Usually, when the users accumulate considerable amounts of bitcoin in their exchange accounts, they would like to open a BTC account of their own. It is a fact that the presence of a third party that controls your wallet and the funds is pretty cumbersome. It is better to move out when you become savvy of Bitcoin and how to hold it. However, in comparison to the custodial wallets (you have to trust the platform that offers them), with the non-custodial wallets, you will have to keep faith in yourself to keep your funds and the private keys safe.

If you are using hot wallets or web-based wallets, you need to be mindful of the security of your internet connection as well as the health of your devices. In this situation, you will have to use a VPN service or choose to backup your wallet with a recovery phrase or the “seed phrase.”

Advantages Of The Non-Custodial BTC Wallet

The most striking reason for the non-custodial wallets being so popular is that they offer the users complete freedom to choose the wallet they wish for and total control over their funds. This is, however, not an insignificant advantage as the appeal of the cryptos moves around the fact that they are decentralized and that no third party is ever involved. Additionally, the non-custodial wallets are not exclusively based on the internet.

If you are focusing on better security and managing your BTC wallet in the offline format, you can do so by choosing the hardware wallets over the software wallets. If you are selecting a hardware wallet, this would mean that you are having complete access to staking rewards from your holdings.

However, there is a notable downside to it. The trading will be a lot slower as the funds would first require to reach the exchange. Furthermore, the user interfaces are a lot less user-friendly.

Custodial Vs. Non-Custodial Wallets: Do You Prefer To Give Up Your Control Or Not?

There remains a pile of arguments on why custodial wallets are the sensible choice, especially if you have just started with Bitcoin or are pretty much newer to the crypto space. But as you become more savvy with the Bitcoin and the crypto space, you are more likely to incline towards the non-custodial wallets. Some of the users might also like a helping hand offered by the custodial wallets that are from a third party, while the others just oppose the fact altogether.

Considering the cryptocurrency space, there is really no uniformity in the approach. There is not a thing that the custodial bitcoin wallet is better than the non-custodial bitcoin wallet and vice versa. After discussing on the Custodial Vs Non Custodial wallets in details, we can conclude that both are simply options that you can choose based on your preference.

0 notes

Text

#Cryptotrading#Bearmarket#Cryptoinvestment#Cryptomarkets#investment#crypto#cryptocurrency#crypto investment

0 notes

Text

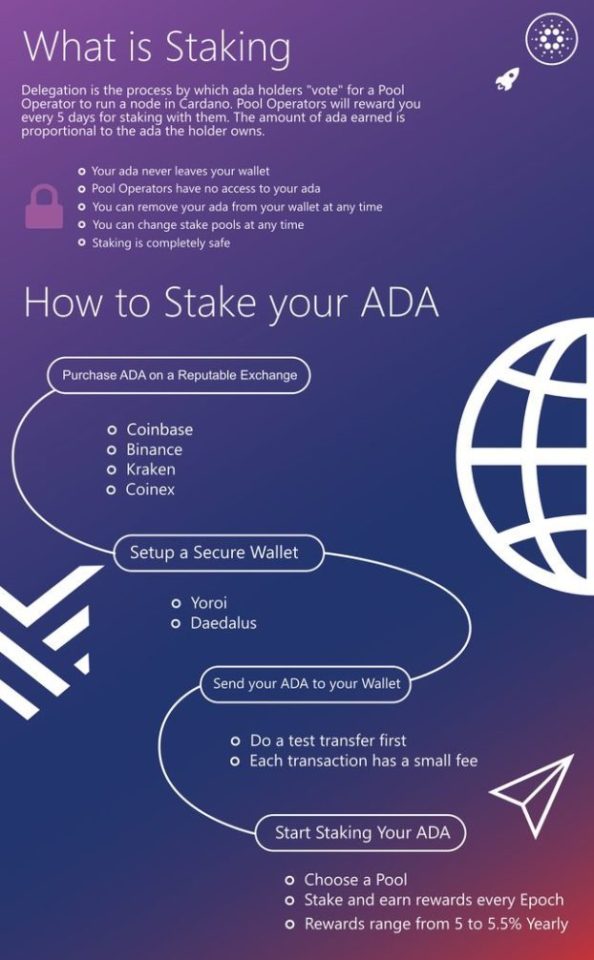

Best Cardano ADA Stake Pool Operator For 2021 And Beyond

A staking pool can be considered as a place where multiple stakeholders can continue their computation resources for increasing their chances of receiving a reward. In simple terms, it can be stated that staking pools offer the stakeholders an opportunity to reunite their staking power in the process of verifying as well as validating the new blocks. This increases the probability of earning the block rewards. Simultaneously, a pool operator manages the staking pool where the stakeholders joining the pool lock their digital assets in a specific blockchain address or digital wallet.

It is also important to note that the number of the rewards that are paid out to the stakeholders depends on the size of the stake in a given pool. For instance, a staking pool having a more significant stake of over one million might produce one block every five days, called an epoch, and offer the stakeholders consistent rewards. On the contrary, staking pools with a very small amount will rarely produce any blocks.

If you want to be on the safe side, you are required to decentralize your stake in the multiple pools as it will garner even more value apart from the staking reward. The staking pools are pretty similar to the mining pools. However, they provide more frequent staking rewards and are predictable. Owing to the charged fees, you might have to face some of the deductions on your staking rewards. Almost all of the staking pools have fees levied for the users, and with this, they tend to reduce the final payout.

This being the reason, staking pools are ways for the stakeholders to earn passive income without much hassle of the technical implementation and the maintenance of setting up and running a validating node while paying for the rendered service.

Before we jump into the staking pools and the best cardano staking platforms, you need to know what some of the factors are that you need to consider before getting into staking pools.

Server Uptime: If the servers of the stake pool are not online when they have been scheduled to mint a block, you will be missing out on the rewards. In this case, you can see if a stake pool has missed the blocks by analyzing its luck metric over time.

Low Fees: Two types of fees are prevalent, viz., fixed price and margin. The lowest possible margin is 0%. Thus, it would be best to choose a pool with the lowest possible fees. Some of the staking pools might increase their fees later without you knowing.

Low Saturation: The ADA amount that can be staked to any pool is limited. When the maximum is reached, it is termed as saturated. This offers lower rewards. Thus, it would be best if you avoided overly saturated pools.

High Pledge: The pledge of a stake pool is considered the amount of ADA they lock while staking their pool. This is important if they are pledging a large amount and then make mistakes resulting in the loss of significant funds. It is best to pledge on pools over 1,500,000 ADA.

There are a couple of best Cardano (ADA) staking pool operators, and knowing which is the best depends on the requirements of the stakeholders. Here are some of the best in the lot:

Adavault

This staking pool consolidates its place on the first one in the list as it offers its delegators with reliable rewards of over 5% for the fixed fee of 340A per epoch. Adavault provides its delegators a continuous return on their ADA investments. Additionally, it planned to waive the variable fee for both the existing and new delegators until the 30th of September 2021, returning to 0.99%. It offers an average stake pool return of ~6%.

Cardanode

The platform boasts of a 0% fee, and they are not willing to change it. Cardanode does not focus on profits as it benefits from its staking rewards and the compulsory minimum fee of Cardano. The platform does not miss a single block as it checks for the nodes every 10 seconds alongside possesses a 24*7*365 monitoring capabilities. The uptime is also 100%. Furthermore, it ensures rapid block propagation having five relays connecting to 30 different nodes on three continents.

AzureADA

This platform is one of the best options as it has a large pledge amount that depicts how strongly they take the success of their pools and continuously work to improve it. AzureADA also makes the best of the Azure cloud platforms that are the most feature-rich cloud platforms globally. The platform is also backed by multiple professionals that are involved in Cardano that indicates a proven level of the competency for the delegators.

Staking247

The platform mainly focuses on maximizing the stakeholders’ rewards, although it charges a petite margin fee of 0.5% for keeping its infrastructure running efficiently. Staking247 bears a software experienced team that offers one of the most reliable staking pools. The platform serves its delegators with transparency and lets them monitor the real-time node status on their respective dashboards.

Flowr

The Flowr staking pools bear three dedicated servers in various data centers across the globe. It levies a 2% fee for improving its infrastructure. The platform offers redundancy since it entirely runs on the new hardware or the bare metal servers having an optimistic view on the future. While considering the essential factors such as safety and reliability on the staking pools, it becomes transparent why the Flowr staking pool takes up a place in the list.

1 note

·

View note

Text

RBIS Price Rise By 350%: Is The New Coin Surpassing Bitcoin?

There is a nearly 350% RBIS price rise that has shaken the crypto space and everybody now is talking about this crypto. But what is this crypto? How did it get a high price?

cryptoventurenews.com News: https://l.linklyhq.com/l/cRod

September 30, 2021, Crypto Venture News By Linda Lopez

1 note

·

View note

Text

It is being employed in healthcare technology, industries, logistics, supply chain, and in many other technological fields. In this article, we will see a list of blockchain platforms that will allow you to create your own decentralized platform. As per the experts, the market size of blockchain technology is expected to increase by 39.7 billion USD by the end of 2025. This tremendous increase calls for the requirements of blockchain platforms. Here is a list of all the top blockchain platforms 2021.

#technology#blockchain#Blockchain network#blockchain platform#blockchain technology#Digital transformation

0 notes

Text

You may wonder if the Pi Network scam is true. But to your knowledge, it is not true. PI Cryptocurrency is a genuine effort to create the first digital currency that can be mined by only using your mobile phone. Today we will be discussing the Pi Network and its possibilities of being a scam or not in order to derive an answer to this question. This article is obvious compared to the rising altcoin scams happening in the crypto market.

1 note

·

View note

Text

Now once we are talking about investment, let us do a comparison on two investment prospects: Gold vs Bitcoin and help you make a firm decision on what to invest.

0 notes

Text

Blockchain technology has received immense attention over the last decade, driving beyond the appreciation of niche Bitcoin enthusiasts and into the hardcore conversation of investors and banking experts. Digital currency is transforming everything from payment to investment options. Crypto solves bank failures and reaches out to all the consumers where traditional banks fail to. Here are all the ways in which cryptocurrencies do it.

0 notes

Text

In the past few years, the popularity of cryptocurrency has been reaching new heights. It has attracted millions of investors globally. The present success of digital currencies in the world market has convinced even more people to invest in digital assets. As cryptocurrency is welcoming more users, there has been an increase in crypto accelerated cybercrime.

0 notes

Text

WHY IS THE BITCOIN DEPTH CHART IMPORTANT FOR TRADING?

As more and more technical guys and common people enter into the domain of Bitcoin compared to traditional traders, the terminologies and the concepts should be revisited for a better understanding of these common people. So to do that there is a need for a Bitcoin depth chart. So let us look at the concept of this chart in detail.

How Is The Bitcoin Depth Chart Important?

Many times individuals prefer either holding Bitcoin for a long term investment or put them in trading. A depth chart is an important tool that allows us to understand and evaluate the demand and supply of Bitcoin at any specified range of value. It can be said as a visual representation of any order book that is the outstanding sell or buys of any asset at various levels of prices. For people who are wishing to invest Bitcoin in trading, it is very crucial for them to know the way of reading the Bitcoin depth chart for a better understanding of the market.

Essential Elements Of A Bitcoin Depth Chart

In order to know how to read a depth chart, it is very important that you know the various elements of the free market depth chart. While depth charts can vary across exchanges like that of Bitcoin depth chart Binance, Bitcoin depth chart Coinbase, etc. a standard Bitcoin depth chart has few very important components.

Bid Line: The bid line portrays the accumulated value of the bid at any provided price point of Bitcoin. It is shown by a green line that is sloping negatively from left to right. Here buy orders are placed in fiat currencies like dollars.

Ask Line: The ask line portrays the accumulative value of the sell, or ask orders at every price point. It is represented by a sloping red line from right to left.

Horizontal Axis: This is the point of the price where they sell and buy orders are placed.

Vertical Axis: It is the tidal dollar value in terms of the Bitcoin orders that are placed. The total value in dollars of all the Bitcoins is shown in the left vertical axis.

Now you may wonder what does a good depth chart looks like? Most depth charts that are provided by the digital currency exchanges hover over any point on the ask line or the bid and see the number of sells or buy orders that are placed at that particular price point.

What Is Represented By A Depth Chart?

In a Bitcoin depth chart, the cumulative value of the sell orders is extended to respond to the dollar values on the left axis. However, the values of the x-axis, while valued in the same currency, do not always portray the same values. The difference in the values on the x-axis provides an investor or trader insight into the liquidity and the fluctuations of the asset.

If supply and demand for the asset are approximately equal, then the x-axis should be closely the same in value. If the asset is very liquid, which implies more market participants are wanting to sell the asset than are in the need to buy, the volume will be slanted to the right, formulating a large sell wall. If the asset is not liquid, in which there is greater demand for the asset than traders are willing to provide, the chart will be inclined to the left, formulating a buy wall.

What Is A Buy Wall?

The more unnoticed buy orders prevail at a given price, the greater the buy wall. A high buy wall can mean that traders believe the value will not fall below a marked price. A large buy wall stops bitcoin prices from falling rapidly because it formulates a large number of buy orders at a single price. In the time of a bearish market cycle, buy wall orders may be filled more quickly than during bullish market cycles due to hiked market liquidity. The formulation and increase of a buy wall can be affected by market psychology. If traders see a large or increasing buy wall, they may think that the asset price will increase, affecting them to sell and build immediate profit or buy and understand greater long-term profits.

What Is A Sell Wall?

The more unnoticed sell orders prevail at a given price, the higher the sell wall. A high sell wall can show that there are many traders who do not believe that an asset will cross a given price, while a low sell wall may indicate that the asset price may increase. A large sell wall protects bitcoin prices from increasing rapidly because it formulates a large number of sell orders at one price. If traders see a big or increasing sell wall, they may think that the price of assets will fall, which will influence them to avoid and sell greater losses.

Conclusion

The bid and ask line shows the accumulative valuation of all sell and buy orders at a provided price. So this can be concluded that a good Bitcoin depth chart provides a good view into the demand-supply of Bitcoin in the current time. When you are reading a depth chart it is important that you consider price liquidity as well. The Ethereum depth chart serves the same purpose in terms of Ether. But the Bitcoin Depth chart is one of the best crypto depth charts.

Frequently Asked Questions On Bitcoin Depth Chart:

1. How do you read the Bitcoin depth chart?

From left to right is the USD price, bottom to top is the quantity of USDT. The red sloping line (left) is “buy” orders for USDT when the dollar price goes down very far, and the black sloping line (right) is “sell” orders for when it goes up very far. The bottom chart is the orders; the top chart is the accumulated value.

2. What does a depth chart tell you?

A depth chart represents the buy and sells of orders for a specific asset at various prices in a graphical image. A depth chart shows both sides of demand and supply to illustrate how much of an asset can be sold at a specified price point. It is also arranged across the bottom by price.

3. What is depth of Binance chart?

A depth of Binance chart is a tool to evaluate the demand and supply of any crypto at any given moment for a specified price range.

This article was originally published here: https://cryptoventurenews.com/bitcoin-depth-chart-importance/

1 note

·

View note