Text

CPEC PROJECT CONTRIBUTING TO INCREASING PRIVATE INVESTMENT IN PAKISTAN

CPEC PROJECT CONTRIBUTING TO INCREASING PRIVATE INVESTMENT IN PAKISTAN

The China-Pakistan Economic Corridor framework ventures and a stable macroeconomic condition is adding to an expansion in private interest & Investment in Pakistan, a most recent World Bank report stated, determining the economic development to stay solid.

As indicated by the World Bank’s June 2017 Global Economic Prospects, favorable weather and increased cotton prices are supporting agriculture production, and the CPEC framework extends and in addition stable macroeconomic condition is adding to an expansion in private speculation. Agriculture yield bounced back after the finish of a dry season, while the fruitful culmination of an IMF-upheld program improved macroeconomic conditions and outside direct venture, the report note. Investment in Pakistan

The World Bank report said Pakistan’s development is relied upon to increment to 5.2 percent in the current budgetary year and stay solid over the estimate skyline, mirroring an upturn in private venture, increased vitality supply an enhance security.

In the South Asian area in general, yield expanded by an expected 6.7 percent in 2016. All in all, the report stated, South Asian economies profited from a change in fares, low oil prices, foundation spending, and strong macroeconomic strategies a year ago. A pickup in territorial development is in progress in 2017. Investment in Pakistan

Development in South Asia stays solid, with local yield anticipated to develop by 6.8 percent in 2017 and a normal of 7.2 percent in 2018-19. Barring India, development is anticipated to normal 5.8 percent in 2017-2019, with some crosscountry variety. The report said that swelling has stayed generous, drifting underneath focus in Bangladesh, Pakistan, and India while favorable weather in Pakistan and India and lower oil prices have kept expansion low, and in this manner made conceivable an accommodative money related strategy. Investment in Pakistan

Regardless of blended advance with financial solidification in the area, deficiencies for the most part declined, the report stated, including that an unexpected market reassessment about U.S. money related arrangement fixing could prompt more tightly residential monetary conditions, which have been considerate generally. In spite of advance in financial combination, open obligation stays high over the area.

Global development is anticipated to quicken to 2.7 percent in 2017, up from a post-emergency low of 2.4 percent in 2016, preceding reinforcing further to 2.9 percent in 2018-19, extensively in accordance with January projections.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

http://crowncitygwadar.pk/gwadar/cpec-project-contributing-to-increasing-private-investment-in-pakistan/

0 notes

Photo

Cemetery of 140 Chinese workers & engineers who lost their lives during the construction of Karakoram highway, in Gilgit, Pakistan. #CPEC #Gwadar #OBOR

0 notes

Photo

Sahiwal is 5th energy project completed under #CPEC. Others are 3 wind farms in Sindh, Sachal, Dawood & UEP, Phase 1 of solar plant in Punjab.#Gwadar #OBOR

0 notes

Text

Gwadar will be the economic funnel for the region

Gwadar will be the economic funnel for the region

The Pakistan port, operated by China, will also benefit countries in Central Asia and the Middle East as it helps unhindered flow of energy and goods. Pakistan’s deep-sea port Gwadar, which the Chinese manufactured and are presently working under a 40-year understanding, remains a subject of extensive enthusiasm for a great part of the world. The port, 605km east of the world’s greatest vitality stifle point — Straits of Hormuz, has a significantly greater key measurement than prior envisioned. Almost 20 for each penny of the world’s exchanged oil and 77 for each penny headed towards Asia-Pacific go through the Straits ordinary. Pakistan’s previous president General Pervez Musharraf had portrayed Gwadar as the “economic channel for the entire locale”. Gwadar abbreviates China’s course to the world by a huge number of kilometers. Gwadar will be the economic funnel for the region.

Gwadar’s significance expanded complex after China’s declaration of China-Pakistan Economic Corridor (CPEC) by President Xi Jinping in 2015 at an expected cost of $45 billion (Dh165.51 billion). Extra undertakings have now raised the investment volume to $54 billion. As the southern terminal of the CPEC, near the Straits of Hormuz, Gwadar expect imposing significance in the high-stakes control amusement for key control of the Indian Ocean district. Gwadar will be the economic funnel for the region.

Regardless of beginning difficulties, there is significant positive thinking in its future in light of the fact that right off the bat the Chinese go full-steam once they go up against a venture. Furthermore, Gwadar being a key machine gear-piece in the CPEC, China or Pakistan can’t bear the cost of its disappointment. The anticipated advancement of street, rail joins, with oil and gas pipelines will change over Gwadar into a trans-shipment port for China and the Central Asian area. Gwadar will be the economic funnel for the region.

Unverified reports show that after senior Russian authorities went to Gwadar, Pakistan has likewise assented to Russia’s enthusiasm for utilizing the port. Moscow’s progressive defrost towards Pakistan may likewise be a result of this common intrigue.

For Pakistan, Gwadar, with its industrial free zone is conceivably the economic motor that can help shore up its wavering economy. The 923 hectares zone will produce hinterland for the Gwadar Port and will profit nations of South Asia, Central Asia and the Middle East. Gwadar’s area 460km west of Karachi declines Pakistan’s powerlessness against India in the event of another round of dangers between the two neighbors. Alongside the maritime base at Ormara 349km west of Karachi, Pakistan will have an upgraded capacity to spy on India’s maritime moves in the Arabian Sea. Gwadar will be the economic funnel for the region.

Hidden China’s need is the reality the Gulf Cooperation Council (GCC) nations together record for 60 for each penny of China’s vitality supplies. About 75 for each penny of China’s vitality supplies go through the Straits of Malacca. The US naval force and its partners have a summoning nearness in both the locales and can piece China’s provisions. Beijing for the present is by all accounts creating Gwadar to be a terminal of Iranian, GCC and African oil, which leaves open the likelihood of Chinese maritime units watching the zones around. While this might be the apparent intrigue, it is likely that Iran’s gas and oil pipelines will reach out to Gwadar through overland course to give more noteworthy security to its provisions from the Gulf. Gwadar will be the economic funnel for the region.

Gwadar’s significance to CPEC is coherent — once created, it will help goad economic development in China’s western locale through considerably shorter vitality supply course and for fares from China through Gwadar into the Middle East and past.

Gwadar’s key importance is best comprehended as a major aspect of a developing Chinese securing of port offices, regularly portrayed as the “pearl necklace” in the Indian Ocean locale. Gwadar took after Chinese nearness in Myanmar, Bangladesh, Seychelles and Sri Lanka, and will soon include Djibouti where a Chinese-fabricated maritime base is nearing culmination.

The US and India are just about the main critical nations taking a gander at the Chinese OBOR/CPEC activity with wariness. They trust that the twin activity is implied more to secure China’s geo-vital points with political and security suggestions for them. Gwadar is in this manner, saw contrastingly by either side.

Regardless of a few Chinese suggestions to join the CPEC, India trusts that the activity, of which Gwadar is a key segment, is intended for vital enclosure of India. The US is additionally careful about China supplanting American authority around the globe.

In this round of energy, the reality remains that the US, through its territory and ocean based arrangements, overwhelmingly commands the oil-delivering Middle East area and the ocean paths. No quickly rising force can acknowledge to remain a prisoner to such military strength. Consequently the Chinese endeavors to break out of the US-forced request.

Gwadar and the CPEC extend offer a few chances to the GCC nations. From almost 15,000km separation between the UAE ports to Xingjiang in China, the Gwadar course will bring the delivery remove down to pretty much 2,500km. At the point when the street, rail and vitality pipelines are set up, Gwadar will offer the most limited and more secure course for the transportation of Gulf oil to China and merchandise in any case, wiping out any risk of chocking at Malacca.

Gwadar in this way, offers a one of a kind open door for China and Pakistan, as well as straightforwardly advantage nations in Central Asia and the Middle East. The unhindered and effective stream of vitality and products will convey points of interest of relationship prompting peace and more noteworthy success to the district.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk/pakistan-property/gwadar-will-be-the-economic-funnel-for-the-region/

0 notes

Photo

#CPEC as flagship of China's Belt and Road project, helped rapidly convert #Pakistan into an Asian "emerging market."

#GWADAR #Crowncitygwadar #Investment #Property #Commercial #Residential #plots #realestate #OBOR

0 notes

Photo

#CPEC will bring progress and development for the entire region: President Mamnoon Hussain.

#GWADAR #Crowncitygwadar #Investment #Property #Commercial #Residential #plots #realestate #OBOR

0 notes

Text

CPEC Hope for Tomorrow

CPEC Hope for Tomorrow

It will be a misrepresentation to state that present period is of geo-economics, best case scenario geo-economics are endeavoring to discover a sensibly safe section through planet’s excessively geo-politicized and securitized scene. Despite the fact that one wishes that geo-economics overshadow geo-governmental issues, imperative procedures have far to go. One belt one Road(OBOR) is attempting to discover its approach to imagined goals. An early operationalization of China-Pakistan Economic Corridor (CPEC) a year ago, a leader venture of OBOR, has given boost to early fruition of residual OBOR, which is a multi-trillion dollar program spread over, might be, a century. Yes CPEC Hope for tomorrow.

.

Some Western representatives have communicated unease as they see the activity as a dare to advance Chinese impact universally. It has been accounted for that presumably participation by Russian President Putin and some different pioneers whose nations have a poor human rights track record, similar to the Philippines and Central Asian States, may have incited hesitance among pioneers from the Western nations to avoid the occasion. China has rejected these perspectives, saying the plan is “interested in all, is a win-win, and pointed just at advancing flourishing”. “We won’t send out our arrangement of society and advancement display, and significantly more won’t force our perspectives on others,” President Xi said. “What we plan to make is a major group of concordant conjunction,” he included. Yes CPEC Hope for tomorrow.

Joined Nations General Assembly received the 2030 Agenda for Sustainable Development; Sustainable Development Goal 9 (SDG 9) expects to “fabricate strong framework, advance comprehensive and economical industrialization and cultivate advancement.” OBOR–CPEC consolidate is in accordance with this objective, driving towards joint collaboration. While going to the OBOR summit, Prime Minister Nawaz Sharif said on May 14 that the CPEC under the OBOR was interested in all nations in the area that the venture “must not be politicized.” “Given me a chance to make it clear that CPEC is an economic undertaking open to all nations in the district. It has no land limits. It must not be politicized.” Yes CPEC Hope for tomorrow.

Be that as it may, geopolitical aplenty, India boycotted the worldwide occasion referring to reservations on the CPEC course going through Gilgit-Baltistan, India cases to be a questioned domain. The Prime Minister’s announcement was clearly a reaction to Indian concerns and restriction. Occasion was gone to by 29 heads of state and government and also more than 1500 representatives partook. Yes CPEC Hope for tomorrow.

Peace and advancement go as an inseparable unit, and economic improvement encourages peace and security through multilateral and multidimensional collaboration. OBOR-CPEC would be a vital procedure driving towards a win-win circumstance for all members. In any case, this indicate is not home India since its China and Pakistan arrangements are depended on zero-total analytics. What’s more, for this India is as a rule abundantly compensated by America and its partners in light of the fact that their discernments are driven by geo-political contemplation. Yes CPEC Hope for tomorrow.

OBOR would advance “incorporation and resilience” and have positive effect on way of life of poor and impeded fragments of social orders of three landmasses that OBOR imagines to associate, as a reward point it would weaken the radical and psychological militant propensities. Unfurling of the program has as of now emanated the message of consideration, resistance and acknowledgment. CPEC intends to interface the catchment territories of South Asia, West Asia and Central Asia. Furthermore, if India goes along with it then East Asia would, too, have the opportunity to associate. Pakistan is ready to wind up plainly a pass route and in addition goal for cross-territorial, a prospect which is difficult for India to process. As indicated by the Director General of United Nations Industrial Development Organization (UNIDO), Li Yong, the Belt and Road Initiative is the most noteworthy improvement venture of the century, making huge potential for joint collaboration amongst China and the United Nations. The activity “plans to construct groups of political shared trust, economic mix and culturally diverse convenience through quiet and dynamic improvement and collective economic associations along the Belt and Road,” Li said in a meeting. The activity mirrors the “mainstays of comprehensive and reasonable improvement and assumes a critical part in advancing the construction of foundation”, Li included. Yes CPEC Hope for tomorrow.

Effort of Belt and Road activity traverses around 65 nations speaking to 60 percent of the total populace and around 33% of worldwide total national output. It is a vehicle for advancing industrialization in creating and slightest created nations through universal industrial capacity participation. Its key elements are: taking care of the issue of financing framework and mirroring the soul of comprehensive and maintainable advancement. Pakistan respects China’s vision and inventiveness in creating corridors crosswise over areas. Yes CPEC Hope for tomorrow.

Foundation improvement requires considerable capital investment. Asian Infrastructure Investment Bank, Silk Road Fund and BRICS Development Bank and so forth have as of now demonstrated their readiness for adequate money related undertaking. What’s more, amid the summit, President of China Xi Jinping submitted US $124 billion for the OBOR. He likewise reported extra 100 billion Yuan for “Silk Road Fund“, close by Yuan 380 billion credit from two Chinese banks, in addition to 60 billion Yuan in-help to “creating nations and universal establishments in new Silk Road nations”. He additionally swore Yuan 300 billion to empower money related organizations to “extend their abroad Yuan finance businesses“. China will dispatch 100 “cheerful home” tasks, 100 destitution mitigation activities and 100 medicinal services and recovery extends in nations along the Belt and Road. For smooth treatment of CPEC related budgetary matters, Bank of China is setting up its initially branch in Pakistan. Yes CPEC Hope for tomorrow.

While the things are advancing great as to forward development of CPEC program, the troubling point is slow backslide of Balochistan into CPEC related viciousness. Late inhumane murder of workers working for Gwadar port venture demonstrate that outside supported subversive components keep on having the ability of completing such assaults, all the more captivating were the current remarks by Daniel Coats, Director of National Intelligence amid his Congressional declaration: “The rising China-Pakistan Economic Corridor will most likely offer activists and psychological militants extra targets.”

A Chinese man and his wife who show Chinese at a neighborhood dialect focus were snatched from Quetta. It demonstrates that even Chinese faculty not identified with center CPEC ventures stand powerless for kidnapping to make weight indicates and send over a message of weakness to Chinese government and individuals. A year ago, a Chinese designer was harmed in a bomb assault in southern Pakistan and a separatist gathering, the Sindhudesh Revolutionary Army, guaranteed duty regarding the assault, saying they were focusing on the CPEC. Pakistani government has conveyed 15,000 military work force to CPEC related exercises. The CPEC resembles each other investment program where openings and dangers coincide.

In the in the interim, Beijing on May 25 expelled an UN body’s report which cautioned that the CPEC could make strain with India and fuel political insecurity. China said the report by Economic and Social Commission for Asia-Pacific (ESCAP), an improvement arm of the United Nations (UN), wasn’t particularly on the CPEC and had assessed the BRI in an exceptionally positive manner. The report has said that CPEC could prompt “further political flimsiness” in the district and “make geo-political pressure with India” as it goes through PoK. India avoided the Belt and Road Forum in Beijing two weeks prior basically as a result of “sway” issues over CPEC going through PoK. Remote Ministry representative Lu Kang expelled the UN’s worries. “With respect to CPEC going through the disputable domain, I have said this multiple occassions, it is an economic activity and it won’t influence our position on the Kashmir issue,” Lu said. Despite the fact that Prime Minister’s investment in the summit nearby four boss minsters is an encouraging signs demonstrating that at the residential level contrast stand settled, the outside cynics haven’t surrendered nor are they liable to surrender at any point in the near future. There is have to deny the space for neighborhood apparatuses of outside saboteurs.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

http://crowncitygwadar.pk/gwadar/cpec-hope-for-tomorrow/

0 notes

Photo

Chinese company plans bus manufacturing plant in #Pakistan.

KARACHI: The China-Pakistan Economic Corridor (CPEC) has indeed opened several avenues for business ventures that were previously unexplored between Pakistan and China.

In one such development, a renowned Chinese company – Yutong Bus – has expressed interest in investing in inter-city and intra-city bus services in Sindh.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

#GWADAR #Crowncitygwadar #Investment #Property #Commercial #Residential #plots #realestate #OBOR#CPEC #CHINA

0 notes

Text

Investing in Pakistan and Gwadar Real Estate

Investing in Pakistan

With 200 million individuals and 60 million white collar class customers, Pakistan is a quickly developing market. An expansive trainable workforce, combined with great socioeconomics and rising residential utilization, give a scope of convincing foundation and corporate open doors in Pakistan. In any case, the development and return potential in Pakistan presently can’t seem to be opened by household and global financial specialists. Investing in Pakistan is big opportunity for all investors.

Pakistan has significant requirement for capital investment, given its colossal foundation prerequisites and unexploited potential in for all intents and purposes each real division. Given political solidness, protection from outer turbulence and the correct full scale monetary condition, Pakistan can enroll a drawn out time of locally determined development.

Capital investing in Pakistan can enter a managed and remunerating stage.

Pakistan’s administrative condition is among the most financial specialist amicable on the planet. There are no confinements on outside possession (dissimilar to India and most other developing markets); remote trade change, repatriation of profits or contracting of ostracizes. Pakistan offers low corporate expense rates and assessment motivating forces for vital investments. Generally, outside investment returns in Pakistan have been high. Investing in Pakistan is big opportunity for all investors.

Today, in Pakistan, there are generous open doors in underestimated resources and organizations, a dynamic privatization activity, extensive foundation related investment ventures (particularly under the China-Pakistan Economic Corridor), development in nearby utilization and a generally undiscovered fare potential. With a monstrous diaspora of exceptionally qualified Pakistani administrators and an expansive save of residential ability, capital investing in Pakistan can enter a managed and compensating stage. Investing in Pakistan is big opportunity for all investors.

It is not hard to recognize a portion of the significant open doors and in addition the hindrances to investment. Among these, the most obvious open doors are the real street and rail and pipeline extends under CPEC. These will be actualized at the administration to-government level. Be that as it may, these ventures will yield auxiliary monetary action and extra investment open doors for the private segment.

The 10 control ventures included under the CPEC umbrella are fundamental and pressing to meet the nation’s energy needs. There are a few inquiries, notwithstanding, regardless of whether these ventures have been very much arranged and arranged by the private gatherings who have won their advancement rights. Some may confront financing and usage troubles therefore. There ought to be instrument to audit and supplant lacking gatherings where required. Investing in Pakistan is big opportunity for all investors.

Given the moderate misuse of Thar coal, conceivable troubles in financing coal-based power plants, and the time-slack in laying the Iran-Pakistan gas pipeline, the choice to enable the private area to set up LNG import terminals is sensible. It is disturbing, be that as it may, that the principal terminal has turned into the subject of contention. Such discussions are a noteworthy demoralization to investment. It appears to be basic to make an unbiased system to address and resolve grumblings rapidly, straightforwardly and decently.

With the decrease in oil and gas costs, wind and sun powered vitality may require bigger endowments at present. In any case, over the more drawn out term, the cost of sun oriented power is probably going to decrease facilitate, particularly for family unit utilize. Sunlight based power must turn into a developing some portion of the national vitality lattice.

Shopper merchandise creation is additionally a conceivably vast development area that is being kept down because of the scarcity of nearby financing for the little and medium ventures which are the primary speculators in this space. A financing office and some type of investment protection may give an answer. An audit of duty security and control of carrying are other basic parts of an answer. Investing in Pakistan is big opportunity for all investors.

Nourishment handling is another underutilized investment segment. A vast rate of organic product, vegetables and fish creation is squandered in Pakistan because of insufficient stockpiling and handling offices. Here as well, access to financing and most recent advances is the significant deterrent.

With suitable administration and financing, Pakistan’s farming creation can extend exponentially. Expansive, modern size cultivating may bode well in some meagerly populated ranges. However, the most noteworthy development can originate from giving sufficient credit, advances and protection scope to little and medium-sized cultivating and disposal of exploitative go between from the market.

Housing needs are tremendous and becoming quickly because of populace development and urbanization. Real estate advancements have so far concentrated on the high end of the market. The center and low-pay housing market is possibly substantially bigger and can yield alluring returns if the administration makes a generally accessible home loan back framework. Investing in Pakistan is big opportunity for all investors.

Investment in instruction is as of now demonstrated lucrative for schools and universities for higher salary gatherings. There is still space to expand such investment. It can be stretched out, with advancements, to the lower-salary gatherings, particularly in organization with the legislature and not-revenue driven wellsprings of capital. Well being has likewise demonstrated profitable for keen financial specialists and administrators. Be that as it may, to give wellbeing scope to the masses, an organization will be required between the administration and private financial specialists, including medical coverage scope at reasonable rates.

The IT sector in Pakistan has grown for all intents and purposes without authority bolster. There is immense, undiscovered ability in Pakistan which requires money related, authoritative and marketing bolster which can be given by investment from inside and outside the nation. Development in materials has been hindered by the imposing business model of spinners and yarn creators who have blocked esteem expansion. This test requires a strong political arrangement. Investing in Pakistan is big opportunity for all investors.

Pakistan’s whole assembling part has been hindered in light of the fact that, under outer weight, Pakistan has for all intents and purposes disassembled the levy and non-tax insurances which are basic to empowering beginning national enterprises to accomplish aggressive status. The administration must survey and reestablish such exchange assurances to support investment and extension in assembling for the local and fare market.

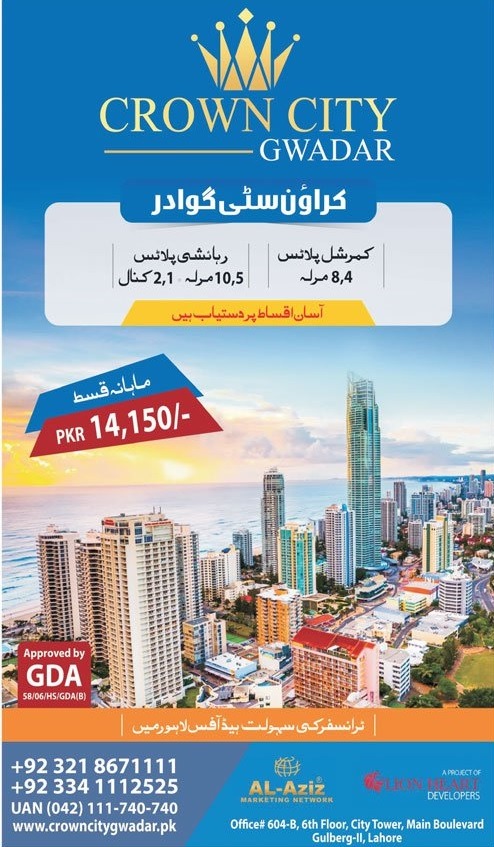

Gwadar Real Estate sector is another opportunity for investing in Pakistan. with low investing will gain high profit in real estate sector in Pakistan. you can buy residential or commercial plot in any good housing society in gwadar like Crown City Gwadar who offers commercial plots in Gwadar and residential plots in Gwadar on easy 3 years Installments with low booking only 20% advance.

There are, obviously, a few other real approach issues which the administration must deliver with a specific end goal to open Pakistan’s financial and investment potential. To start with to fund advancement programs, assess incomes should be multiplied from the present 9pc of GDP. Second, the endemic defilement in officialdom must be heartlessly dispensed with. Finishing friend capitalism must be a piece of this crusade. Last, Pakistan needs to make a significantly bigger capital market, through such measures as the “financialization” of home loans and protection and formation of obligation instruments, to produce sufficient and expansive based investment and riches creation.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

http://crowncitygwadar.pk/real-estate/investing-in-pakistan/

0 notes

Text

Initial approval for 300 MW #CPEC power plant in Gwadar, taking city towards energy-sufficiency.

ISLAMABAD: A Chinese company has got initial approval for setting up a 300-megawatt imported coal-based power plant in Gwadar, which is part of the $57 billion China-Pakistan Economic Corridor (CPEC) comprising scores of energy and infrastructure projects.

The Private Power and Infrastructure Board (PPIB) has issued a Letter of Interest to China Communications Construction Company (CCCC) for developing the power project in the port city of Balochistan.

In this regard, PPIB Managing Director Shah Jahan Mirza and CCCC Vice President Xu Jun signed a document.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

#GWADAR #Crowncitygwadar #Investment #Property #Commercial #Residential #plots #realestate #OBOR

0 notes

Text

GWADAR INVESTMENT OPPORTUNITY

GWADAR INVESTMENT OPPORTUNITY

Any one confounded how he/she can contribute being far and what is the peace circumstance at there. I as of now said that all Makran Area is especially secured then any piece of Pakistan. All locals of this territory are great individuals and wrongdoing proportion in those individuals is near zero. In the event that some scoundrel from outside make issues then it’s another matter, yet as far nearby populace is concerned they are exceptionally peace-adoring occupants. GWADAR INVESTMENT OPPORTUNITY.

Anybody intrigued to Invest in Gwadar ought to go there and before going there ought to stamp the range to visit and not relying upon merchant since they will take you all alone intrigue regions. After through going by, one will come at choice end it is possible that he/she need to contribute here or not, if so in which regions will be the best for investment. At that point request that the merchant discover the land in the range of his/her decision. Typically individuals straightforwardly approach the merchant at Gwadar or whatever other parts of the nation and at there they get the value substantially higher than of its esteem. At here one question emerges that how he/she could get the genuine cost. I recommend going to at the remarkable site identified with Gwadar and there is part of material alongside most recent costs. It will help them out to buy the place that is known for their decision at market rate and of its genuine esteem.For the most part, when market is quiet and there are couple of purchasers in the market, individuals believe that there is some problem. Actually the things dislike that but rather what occurred in Gwadar, a colossal deal/buy was made in Gwadar amid the months from Oct 2004 to Feb 2005. Costs were ascended 10 times in this period. Numerous merchants, dealers assumed the part at there. GWADAR INVESTMENT OPPORTUNITY.

It is intriguing to quote that amid this period, each local of Gwadar and any single merchant from all over Pakistan was doing the property business. Bank exchanges demonstrate it. These are the ground substances when exchanging occurred at such a substantial scale then it is hard to look after it. Thats why costs descended and recently there was no purchaser in the market. Presently issues are for the general population who purchase the land at high cost couldn’t get purchaser at this cost. In this manner I propose them to sit tight for next two years to get the benefit. What’s more, for purchasers get the land subsequent to doing home works. I will post the genuine rate at crowncitygwadar.pk soon; it will help the general population while making the buy. GWADAR INVESTMENT OPPORTUNITY.

Much obliged to all of you for being understanding. We will continue buckling down and keep on updating every one of you the individuals who are occupied with Gwadar’s advancement and Pakistan’s economic strength best is Crown City Gwadar. GWADAR INVESTMENT OPPORTUNITY.

Crown City Gwadar UAN : +92-42-111-740-740

Cell: +92 321 8671111 http://crowncitygwadar.pk

http://crowncitygwadar.pk/pakistan-property/gwadar-investment-opportunity/

0 notes

Photo

‘Huashang’ first-ever Chinese language newspaper of #Pakistan.

ISLAMABAD: Huashang, is the first-ever Chinese language weekly newspaper launched in Pakistan along with its English version. It is mainly targeted towards Chinese embassy staff, Chinese nationals living in Pakistan and those working in Chinese companies.

According to BBC Urdu, the newspaper Huashang, with its head office located in Islamabad, publishes 5000 copies every week. The Chinese weekly hit 60,000 readers. This week, it was Huashang’s 21 edition in Pakistan.

The entire environment of Huashang’s office, situated at Islamabad’s busy market, reflects the atmosphere of Beijing.

In Chinese language ‘Hua’ means flower and ‘Shang’ means business, therefore, the literally meaning of Huashang is business of flower, but here it means “Pure Business”.

According to Facebook page of the newspaper, Huashang was launched in response to the Chinese "One Belt One Road" initiative to better promote enterprise-depth cooperation between China and Pakistan under the "China-Pakistan Economic Corridor".

Talking to BBC Urd, newspapers Chinese national Chief Editor said Huashang is particularly working on business in Pakistan and China.

The editorial policy of the newspapers is also to give importance to the news stories related to culture, tourism and recreational activities in both countries.

The publication outlet is willing to give status of daily newspaper to its weekly Huashang. They also see bright future of Chinese language journalism in Pakistan in near future.

#CPEC #Gwadar #OBOR #chiness #newspaper #published

0 notes

Text

Crown City Gwadar 5 Marla Residential Plot Is Available on Installments

Crown City Housing Scheme Is The Ongoing Residential & Commercial Project In Gwadar. offering 5, 10, 20 & 40 Marla Residential Plot File. Residential Plots in Crown City can be booked on cash payment and also on easy installments. It is one of the top housing developments of Gwadar due to state of the art planning, top location and provision of all general amenities. Crown City is ideal for living and property investment in Gwadar, it is located on Airport Road, costal highway, Gwadar. A project of al aziz marketing networks.

APPROVED BY GDA 58/06/HS/GDA.

Pre Launch LIMITED Inventory

Located MAIN Makran Coastal Highway

Mauza 'CHATI SHUMALI'

Total Land 155 Acres

16 Acre Front On Both Sides Main Makran Coastal Highway.

Amenities

State of the art planning, Wide roads with green belts, Modern sewerage system, High security, Parks & grounds, Children Play area, Mosque.

Payment Plan

Residential

5 Marla

Down payment 170,000

Monthly installment 14,150

Total 850,000

Contact us for more details.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

0 notes

Text

Energy Returns as Gwadar Injects Force into Property Market

Gwadar appears to have been a key fixing in the patterns experienced by most urban communities amid Q1 2017. While the city did not appear like quite a bit of a speculator most loved when the year started, it made its nearness felt amid February by drawing in financial specialists far from Karachi. Amid March, comparable patterns were seen at the end of the day in Karachi, alongside Lahore and Islamabad. Energy returns as Gwadar injects force into property market.

In Lahore’s realty segment Bahria Orchard emerged by demonstrating noteworthy development amid the main quarter of the year. Different ranges that ordinarily draw in financial specialist consideration either displayed direct development or stayed stable, including DHA Lahore and LDA Avenue I, meaning a move in speculator intrigue.

The capital city has been seeing land action politeness honest to goodness purchasers that are dynamic in the market. Investment levels never truly come back to ordinary contrasted with the pretax situation, and tasks that seemed like financial specialist top choices, i.e. DHA Islamabad, are currently observing plunges in costs, conceivably in light of Gwadar. Part B-17 experienced sharp value rises on account of its continuous advancement work. Energy returns as Gwadar injects force into property market.

Additionally, Gulberg Residencia likewise experienced sharp ascents amid Q1. The initial three months have regarded Bahria Town Islamabad/Rawalpindi, which has figured out how to remain on top of things by shooting up on the value list with a 9.57% climb in the costs of 1-kanal plots, and another 11.29% ascent in the costs of 10-marla plots. Its quick advancement has been a key reason that it has kept on performing admirably, and a comparatively fast pace of improvement has additionally helped activities, for example, Bahria Town Karachi (BTK) emerge in Karachi. Energy returns as Gwadar injects force into property market.

The city by the ocean begun the principal quarter by indicating great development in costs in general. Nonetheless, the last 66% of the principal quarter had Gwadar gobbling up speculators left, right and focus. Both DHA Karachi and DHA City Karachi (DCK) felt the effect.

In the mean time, BTK figured out how to move itself onto new statures amid Q1. The area saw costs truly shoot up 17.24% and 24.08% for 500-yard2 and 250-yard2 plots. The quick pace of improvement is continually bringing on value surges, and it doesn’t appear like the venture will back off at any point in the near future.

In Gujranwala, the market saw DHA Gujranwala ascend as a substantial contender that caught financial specialist premium immediately. While it’s steady right now, in its short history the venture has seen a few sharp ascents in costs. It encountered gigantic climbs in February, and direct development in January. Energy returns as Gwadar injects force into property market.

On the other side, DC Colony sunk somewhat additionally down on the value outlines with 12.81% and 17.40% drops in the costs of 1-kanal and 10-marla plots, individually.

LAHORE

Speculators in Lahore were circumspectly re-entering the market post a year ago’s expense execution. In any case, Q1 2017 finished on a fascinating note for Lahore, with numerous speculators looking towards Gwadar for better returns.

DHA Lahore Phases I to VI saw direct development in the primary quarter. The immersion levels here have an expansive part to play. Financial specialists had been dynamic in Phases VII to IX, yet many moved concentration to Gwadar towards the finish of Q1. The whole of DHA Lahore experienced direct development. Note that costs in Phase VIII dropped in light of the fact that its unique ascent has been unnatural.

Wapda Town remained stable for 1-kanal plots with 0.67% development, and enlisted a 1.83% ascent in costs of 10-marla plots.

Bahria Town experienced direct development generally speaking, while Bahria Orchard emerged with its sharp value climbs of 6.20% and 6.39% for 1-kanal and 10-marla plots, individually. Property in Orchard is moderately less expensive when contrasted with Bahria Town itself which is the reason more purchasers have been dynamic here.

LDA Avenue I appreciated direct development in general in Q1 with costs for 1-kanal plots creeping up by 2.69% and costs for 10-marla plots moving upwards by 2.84%. The market has been moderate, which implies relatively few financial specialists are dynamic in this area. Energy returns as Gwadar injects force into property market.

ISLAMABAD

Islamabad’s land showcase has been chugging alongside the assistance of authentic purchasers as far back as a year ago’s expenses hit. Also, a few hotbeds for investment are currently being to some degree sidelined as a result of Gwadar’s rising notoriety. DHA Islamabad saw direct drops in property costs amid Q1 2017; 10-marla plots falling 3.40%, while costs for 1-kanal plots stayed stable with a 0.36% ascent. Financial specialists that were taking some enthusiasm here have now discovered new property alternatives to play inside Gwadar.

Bahria Town reliably performed well with sharp ascents of 9.57% for 1-kanal plots, and 11.29% for 1 0-marla plots amid the principal quarter of 20 17.

Improvement proceeded at a decent pace in m any squares. In March alone, Sector N performed well, while Sector J introduced itself as a decent spot for financial specialists searching for enormous returns. Business action in the last will bring about property costs to further shoot up in the coming months. Bahria’s development can likewise be ascribed to the improvement that has been occurring in Bahria Enclave.

Area B-17 enlisted sharp climbs of 6.33 % and 5.25% for 1-kanal and 10-marla plots, individually. Advancement work that has been continuous amid the principal quarter is generally the explanation behind the region ‘s positive development patterns.

Despite the fact that Gulberg Residencia detailed sharp ascents in property costs, it ought to be noticed that these are in contrast with the end rates in December 2 016. In actuality, the general public pretty much stayed stable all through Q1.

Segment E-11 stayed stable through Q1 for 1-kana l plots, while costs for 10-marla plots saw direct plunges. So also, F 1 stayed stable for 1-kanal plots, and experienced direct drops of 3.40% for 10-marla plots. Energy returns as Gwadar injects force into property market.

KARACHI

Pakistan’s business center point began the year on a decent note with sharp ascents in huge undertakings, for example, DCK and BTK. Property estimations even crept up for generally stagnating territories, for example, Gulshan-e-Iqbal. Nonetheless, this development chilled for a few zones off amid the most recent two months of Q1 2017.

DHA Karachi’s immersion levels, joined with the charm of Gwadar’s huge returns, prompted a plunge in its numbers amid February and March. Costs for 500-yard2 and 250-yard2 plots figured out how to remain stable with mellow 1.00% and 0.20% drops separately, amid the main quarter.

DCK also enlisted drops in both February and March, taking after the sharp ascent in its costs amid January. Gwadar pulled financial specialists away abandoning it with a general direct development of 1.38% for 500-yard2 plots, and sharp ascent of 7.00% for

250-yard2 plots in Q1 2017. The positive numbers can be credited to its development in January, combined with much a littler shutting normal sticker price in December 2016.

BTK appears to have reliably disregarded any plunges and falls different parts of the city’s realty segment experienced. It posted a sharp ascent of 17.24% for 500-yard2 plots, and another 24.08% for 250-yard2 plots amid this period. The venture has developed reliably all through Q1. Speculators are taking an additional intrigue on account of the speed at which BTK plots are evolving hands. The quick pace of improvement in the general public has made it unimaginable for financial specialists to occupy consideration, it appears. Gulshan-e-Iqbal has figured out how to stick sensibly to its soundness all through February and March. Its Q1 direct development is partially the consequence of the value climbs it encountered in January. Energy returns as Gwadar injects force into property market.

GUJRANWALA

Gujranwala’s realty showcase had an intriguing first quarter. A few social orders stayed predictable in their soundness and some in their decay.

DHA Gujranwala was the most flighty and had its own patterns to report each month. While it saw direct development in January, costs shot up amid February on account of buzz around other DHA extends in the nation. Then again, March saw costs cool into strength. The general public saw a noteworthy general sharp ascent of 10.38% for 1-kanal plots and 10.39% for 10-marla plots amid 2017’s first quarter.

Citi Housing experienced drops of 1.24% and 1.55% for 1-kanal and 10-marla plots separately. Ace City remained stable with a 0.65% ascent for 10-marla plots, and experienced direct development of 1.21% at 1-kanal plot costs.

DC Colony did not do too well amid the initial three months of 2017. The general public enlisted sharp drops for both 1-kanal and 10-marla plots at 12.81% and 17.40%, individually. A month ago we announced that costs were falling on the grounds that it goes under the Cantt Board which has pretty much made exchanges unimaginable, a circumstance that is yet to change. Deal buy action kept on dropping, and may do as such in the coming months also. Energy returns as Gwadar injects force into property market.

LAST ANALYSIS

The current year’s initially quarter has seen the property showcase returned to fairly its unique shape. Numerous zones have seen promising value climbs, and these patterns are relied upon to proceed as huge framework extends in numerous urban communities advance towards consummation. Remarkable among these eventual the new improvements on Lahore Ring Road and Islamabad’s new air terminal. Energy returns as Gwadar injects force into property market.

It was additionally intriguing to take note of the effect that Gwadar had available towards the finish of February, and amid the vast majority of March. The three noteworthy urban areas highlighted in this Market Report, i.e. Lahore, Karachi and Islamabad, have all lost some of their financial specialists to Gwadar. The city’s ascent has not been inadvertent, and as advancement develops it might proceed.

“Financial specialists who had taken a rearward sitting arrangement after the execution of the new assessment administration a year ago appear to have discovered inspiration to return, so in actuality I would state that Gwadar’s ascent is something worth being thankful for. Our scan patterns for the city have seen spikes of 235.72% for plots, 291.42% for houses, and 243.61% for business property in the most recent year. Energy returns as Gwadar injects force into property market.

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

http://crowncitygwadar.pk/real-estate/energy-returns-as-gwadar-injects-force-into-property-market/

0 notes

Photo

Pakistan has allocated Rs.180 Billion to the development of International Airport, 200 Bed Hospital & 200 MW Power Plant in #Gwadar #CPEC

0 notes

Photo

PM Nawaz Sharif governor punjab & other offering dua after unveiling the inaugural plaque of sahiwal power protect first unit(660MW)

#GWADAR #Investment #Property #plots #OBOR #CPEC #Sahiwal #power#plant #pm #nawaz

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

0 notes

Photo

#CPEC entails benefits not only for #Pakistan and #China but the entire #region: Zakariya

#GWADAR #Crowncitygwadar #Investment #Property #Commercial #Residential #plots #realestate #OBOR

Crown City Gwadar

UAN : +92-42-111-740-740

Cell: +92 321 8671111

http://crowncitygwadar.pk

0 notes