Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

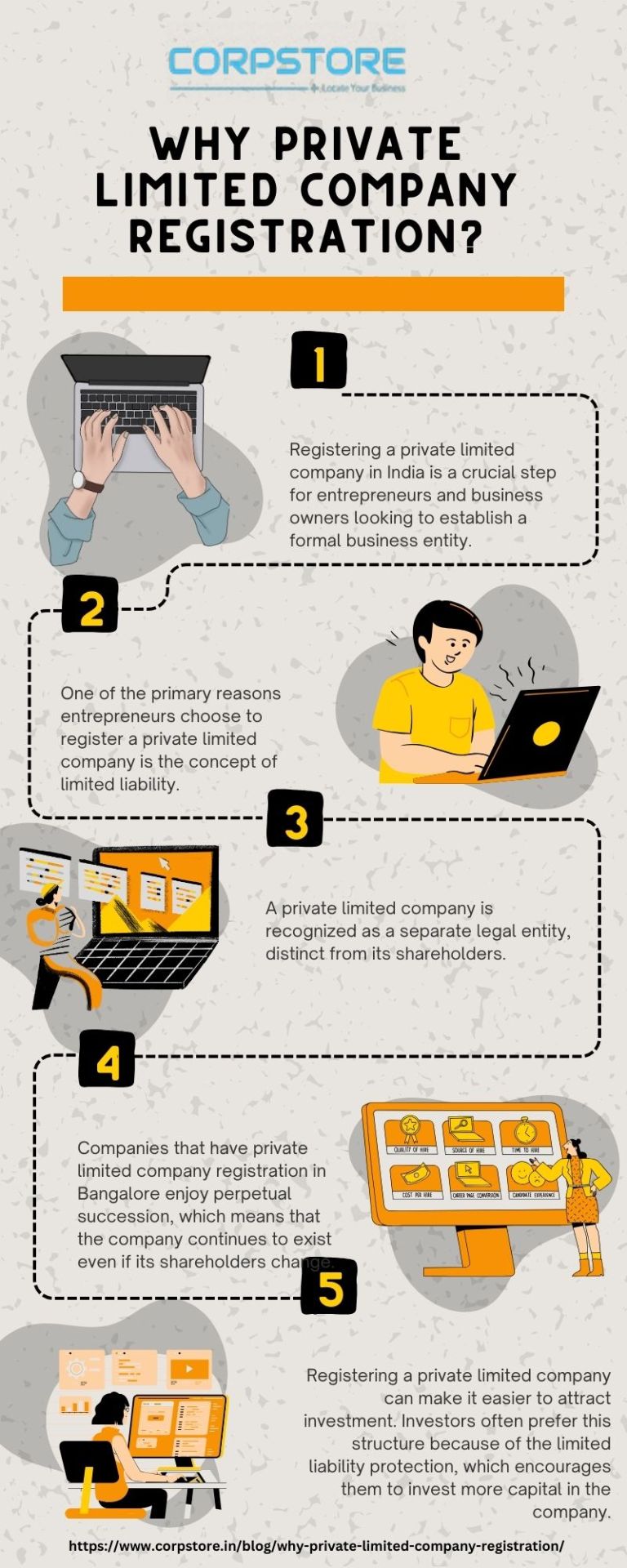

Private limited company registration in Bangalore

Registering a Private Limited Company in India involves a set of legal and procedural steps that enable entrepreneurs to establish a separate legal entity for their business.

This form of business structure offers limited liability to its shareholders and is governed by the Companies Act, 2013.

Registration process

Choose a Unique Name:

The first step is selecting a unique name for your company. Ensure that the chosen name is not already registered and adheres to the naming guidelines provided by the Ministry of Corporate Affairs (MCA).

Obtain Digital Signatures (DSC):

The directors and shareholders must obtain digital signatures. These are required for digitally signing documents filed with the Registrar of Companies (ROC).

Director Identification Number (DIN):

Each director must obtain a DIN by filing Form DIR-3. This unique number is essential for directors to operate as company officials.

Memorandum and Articles of Association:

Draft the MOA and AOA of the company that needs Private limited company registration in Bangalore. These documents outline the company's objectives, rules, and regulations governing its operations.

Register on the MCA Portal:

Create an account on the MCA portal and apply for the company's registration by filing Form SPICe (Simplified Proforma for Incorporating Company Electronically).

Who is eligible for Pvt Ltd?

Eligibility for having Private limited company registration in Bangalore and establishing is determined by the country's regulatory framework, specifically the Companies Act, 2013.

This business structure is popular among entrepreneurs and investors due to its advantages, such as limited liability, ease of raising capital, and enhanced credibility.

Below is an in-depth explanation of the eligibility criteria for forming a Private Limited Company in India, covering various aspects:

Number of Directors and Shareholders:

To set up a Private Limited Company, a minimum of two directors and two shareholders is required. The directors can also be shareholders, meaning a single individual can hold both positions. However, it's important to have at least two separate individuals/entities as shareholders and directors.

Resident Director:

At least one of the directors must be from India. A resident director is someone who has stayed in India for a total of 182 days or more during the previous calendar year. This requirement ensures a local presence for regulatory compliance.

Share Capital:

There is no specific minimum capital requirement for a Company with Private limited company registration in Bangalore. It can be registered with a nominal share capital, and there is no need to show proof of capital during registration. Entrepreneurs can decide on the capital structure based on their business needs.

Name Reservation:

Choosing a unique name for the company is essential. The name must not violate any trademark or intellectual property rights, and it should follow the naming guidelines provided by the Ministry of Corporate Affairs (MCA).

Object Clause:

The Memorandum of Association (MOA) should outline the company's objectives and activities. It is important to specify the main objects for which the company is incorporated. The MOA should also include any ancillary or related objects that the company may engage in.

Registered Office:

The company must have a registered office address within India from the date of incorporation. This address is used for official communication and must be accessible during normal business hours.

Digital Signatures:

Directors and subscribers to the Memorandum and Articles of Association must obtain Digital Signatures (DSC). DSCs are used for digitally signing documents filed with the Registrar of Companies (ROC).

Director Identification Number (DIN):

All directors must obtain a Director Identification Number (DIN) by submitting Form DIR-3. This unique identification number is essential for directors to operate as company officials.

Consent and Declarations:

Directors must provide their consent to act as directors, and subscribers to the MOA and AOA must declare their intention to become shareholders of the company that has Private limited company registration in Bangalore. These declarations are part of the incorporation process.

Documents Required:

During the registration process, various documents are required, including the MOA, AOA, address proof, identity proof, passport-sized photographs of directors and shareholders, and the registered office address proof.

ROC Registration:

After completing all the necessary paperwork and formalities, the company can be registered with the ROC. Once the ROC reviews and approves the application, a Certificate of Incorporation is issued, indicating the formation of the Private Limited Company.

Annual Compliance:

Once the company is registered, it must comply with various annual and periodic regulatory requirements, such as filing annual financial statements and returns, conducting an Annual General Meeting (AGM), and maintaining proper accounting records.

Benefits of Pvt Ltd Company

Taxation:

The Private Limited Company with Private limited company registration in Bangalore is subject to corporate income tax. It must obtain PAN and TAN. Additionally, it may need to register for Goods and Services Tax (GST) if its turnover exceeds the prescribed threshold.

Limited Liability:

One of the key advantages of a Private Limited Company is that the liability of its share-holders is limited to the extent of their shareholding. This means that personal assets of shareholders are protected in case of business debts or liabilities.

Raising Capital:

Private Limited Companies can raise capital. This structure is attractive to investors as it provides transparency and limited liability, making it easier to attract funding.

Enhanced Credibility:

A Private Limited Company often enjoys a higher level of credibility and trust among stakeholders, including customers, suppliers, and financial institutions, compared to other business structures like sole proprietorship or partnership.

Conclusion

In summary, eligibility for establishing a Private Limited Company in India is primarily based on having a minimum of two directors and two shareholders, with at least one director being a resident of India.

There is no strict minimum capital requirement, and the company must follow the guidelines provided by the MCA for name selection and object clause.

The company with Private limited company registration in Bangalore should maintain a registered office in India, and directors and subscribers must obtain DSCs and DINs. Once registered, the company must adhere to ongoing compliance and taxation requirements.

This business structure offers several benefits, including limited liability and the ability to raise capital, making it a popular choice for entrepreneurs and investors in India. Consulting with legal and financial professionals is advisable to ensure compliance with all regulatory requirements and to make informed decisions during the incorporation process.

#privatelimitedcompanyregistrationinbangalore

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

Partnership firm registration in Chennai

In India, registering a partnership firm is a relatively straightforward process, and it provides legal recognition and protection to the business entity. A partnership firm is a popular choice for small and medium-sized businesses where two or more individuals come together to carry out a business venture with shared responsibilities, profits, and losses.

What is the ITR form for partnership firm?

In India, partnership firms are required to file their income tax returns (ITR) using specific forms provided by the Income Tax Department. The choice of ITR form depends on the nature of income, the type of business, and the annual turnover of the partnership firm.

1. ITR-5:

ITR-5 is the most commonly used form for filing income tax returns by partnership firms. This form is meant for entities other than individuals, Hindu Undivided Families (HUFs), companies, and individuals who are filing ITR-7 (for trusts, political parties, etc.).

Here are some key points about ITR-5 for partnership firms:

A. Eligibility:

Firms with Partnership firm registration in Chennai, including Limited Liability Partnerships (LLPs), can use ITR-5.

It is suitable for firms with business income, such as trading, manufacturing, or providing services.

ITR-5 can be used by firms irrespective of their turnover.

B. Income Sources:

Partnership firms should report income from business or profession, capital gains, income from other sources, and income from investments in this form.

It is essential to provide details of income, such as interest income, rental income, etc.

C. Computation of Income:

Partnership firms need to calculate their total income, deductions, and exemptions as per the provisions of the Income Tax Act.

The firm should provide a balance sheet and profit and loss account, which is audited by a Chartered Accountant, along with the return.

D. Audit Requirement:

If the annual turnover of the partnership firm exceeds Rs. 1 crore (or Rs. 25 lakhs for professionals), it is mandatory to get the accounts audited under Section 44AB of the Income Tax Act. In such cases, the audit report in Form 3CA/3CB and the tax audit report in Form 3CD should be submitted along with the ITR.

E. Due Date for Filing:

The due date for filing ITR-5 for a company with Partnership firm registration in Chennai is usually July 31st of the assessment year. However, it may get extended by the Income Tax Department.

F. Mode of Filing:

ITR-5 can be filed online on the Income Tax Department's e-filing portal.

G. Consequences of Non-Filing:

Failure to file ITR-5 or filing it after the due date can lead to penalties and interest charges.

2. ITR-3:

ITR-3 is another form that can be used by partnership firms, especially if the firm includes individual partners who have income from the business.

Here are some key points about ITR-3 for partnership firms:

A. Eligibility:

ITR-3 is meant for individuals and Hindu Undivided Families (HUFs) who have income from a proprietary business or profession.

It can be used by a partnership firm if it has individual partners who are liable to pay tax on their share of income from the firm.

B. Income Sources:

Firms with Partnership firm registration in Chennai filing ITR-3 should report their business income, income from profession, capital gains, income from other sources, and income from investments.

Individual partners must report their share of income from the partnership firm.

C. Computation of Income:

The partnership firm should calculate its total income, deductions, and exemptions, similar to ITR-5.

Individual partners need to include their share of partnership income in their individual returns.

D. Audit Requirement:

The audit requirement for partnership firms under ITR-3 is the same as that for ITR-5. If the annual turnover exceeds Rs. 1 crore (or Rs. 25 lakhs for professionals), a tax audit is mandatory.

E. Due Date for Filing:

The due date for filing ITR-3 is also typically July 31st of the assessment year.

F. Mode of Filing:

ITR-3 can be filed online on the Income Tax Department's e-filing portal.

G. Consequences of Non-Filing:

Non-filing or late filing of ITR-3 can result in penalties and interest charges, similar to ITR-5.

3. ITR-4:

ITR-4 is primarily meant for individuals and Hindu Undivided Families (HUFs) who have income from a proprietary business or profession.

However, it may be relevant for certain partnership firms, specifically those with a presumptive income scheme.

Here are some key points about ITR-4 for firms with Partnership firm registration in Chennai:

A. Eligibility:

ITR-4 is designed for individuals, HUFs, and firms who have opted for the presumptive income scheme under Section 44AD, 44ADA, or 44AE of the Income Tax Act.

Partnership firms that have opted for presumptive taxation can use this form.

B. Income Sources:

ITR-4 covers income from business, profession, and income from other sources, but it is primarily intended for businesses with presumptive income.

C. Computation of Income:

Under the presumptive income scheme, the firm's income is presumed to be a certain percentage of its gross receipts. Partnerships opting for this scheme do not need to maintain detailed books of accounts.

D. Audit Requirement:

Partnership firms with Partnership firm registration in Chennai under the presumptive income scheme are not required to get their accounts audited unless their total income exceeds the maximum amount not chargeable to tax. In such cases, the audit report in Form 3CD is required.

E. Due Date for Filing:

The due date for filing ITR-4 is typically July 31st of the assessment year.

F. Mode of Filing:

ITR-4 can be filed online on the Income Tax Department's e-filing portal.

G. Consequences of Non-Filing:

Similar to other forms, non-filing or late filing of ITR-4 can result in penalties and interest charges.

In conclusion, the choice of ITR form for a firm with Partnership firm registration in Chennai depends on factors such as the nature of income, turnover, and whether individual partners are involved.

Partnership firms should carefully assess their tax situation, maintain proper records, and consult with a qualified Chartered Accountant to ensure compliance with the applicable ITR form and other tax-related requirements.

0 notes