Text

Highlights of the DeFi Deep Dive Event

Fan 10, 2022

Brú Finance

Hello! Brú Finance Community!!

We are excited to share the success story of our event “DeFi Deep Dive” which was live on our Discord server and LinkedIn on 5th Feb 22 at 4 PM IST

In this event, the founders of Brú Finance interacted with community members.

First of all, thanks for your enthusiasm and engagement during the event.

Let us now move forward to learn more about this enriching event.

After a warm welcome and brief introduction of our founders, Ashish Anand, Abhishek Bhattacharya, and Falguni Pandit, we started our event.

Ashish Anand delivered an insightful session on DeFi, how its emergence is changing the finance ecosystem globally.

Ashish went through the financial crisis in 2008, which led to lowering the trust in banks, government, and media. Even though institutions in the social sector were trustworthy, they did not manage the finance sector.

Then, in 2009, the world witnessed the birth of the first cryptocurrency, Bitcoin. The main reason for the rise in the popularity of cryptocurrencies is that these currencies are programmable money based on code.

The need for programmable money has led to decentralized finance, where all assets can be used for earning passive income. Earlier, even if a borrower holds Ethereum, Bitcoin, etc. they could not earn passive income from it. But in the DeFi system, we can use cryptocurrencies for earning passive income.

The first revolution in DeFi 1.0 is the introduction of stable coins pegged with the dollar. Whereas, the second revolution witnessed decentralized money markets or automated exchanges.

Ashish highlighted the role of Brú Finance in DeFi 2.0 and how we are strengthening the real economy. We are connecting TradFi and DeFi worlds by using real-world assets like agri-products as collateral.

On blockchain-based Brú Finance lending and borrowing platform, borrowers can use agri-commodities as collateral. We issue NFTs to the borrowers against their collateral.

Then, Ashish handed over the mic to Abhishek for throwing light on the journey of Brú Finance.

Abhishek informed the audience that Brú Finance has tokenized assets worth USD 500 million and has an association with over 1400 asset custodians. On the technology side, we use Proof of Reserve for bridging the on-chain network and DeFi. He also gave information about the token utility and roadmap of Brú Finance.

Towards the end of the event, there was a question-answer session. While answering the questions from participants, Ashish told participants about how the real-world assets are collateralized, the process of the private sale of tokens, interest rates on the platform, etc.

To know more details about the event, please visit our YouTube channel:https://www.youtube.com/watch?v=loYnv_YOW10

Join our community on Discordhttps://discord.gg/8C9SZXDy2r

Stay updated with the latest news about Brú Finance. Follow us on.Twitter — https://twitter.com/bru_finance

LinkedIn — https://www.linkedin.com/company/bru-finance/

0 notes

Text

DeFi lending platforms

Brú Finance offers real-world asset-backed loans, allowing borrowers to use assets like #agricultural products or #livestock as collateral. This opens up opportunities for #financialinclusion and empowers people to access capital for business growth and better livelihoods.

One of the key advantages of Brú Finance's #defi platform is the reduction in the cost of capital for borrowers. By eliminating intermediaries like banks, Brú Finance makes loans more affordable, ensuring that individuals can secure the necessary funds to develop their businesses and improve their lives.

Transparency is a core principle of Brú Finance's DeFi platform. Both #borrowers and #lenders can view all loan terms before entering into an agreement. This fosters trust and minimizes the risk of fraud, creating a fair and accountable financial ecosystem.

0 notes

Text

Brú Finance: NFTs backed by Commodities — A Global First

Mar 01, 2022

Brú Finance

Many Web3 organizations have been trying to adopt and bring real world assets on-chain since 2017–18. But success has been far and few.

We, at Brú Finance, realized that digitization of the existing paper documents is not an appropriate way of tokenization. The tokenization of the real world assets should take place either at source or under a custody of a decentralized third party.

Significance of NFTs backed by RWAs

The tokenization could be done either at the time of the issuance by the issuer. We can take the example of gold. Miners should do the process of tokenization and create tokens for the gold produced at the mine. Tokens could be created in the form of the gold bars and authenticated using some unique number printed on the bars which cannot be altered. The entire journey of the gold bar could be captured.

Another point of tokenization is possible when the assets are in the possession of the custodians. Tokenization of the real world assets can solve the existing problems like ownership, IP records, duplicacy of the tokens, etc.

To solve the above-mentioned problems, Brú Finance has adopted the tokenization of real-world assets like agri-commodities when they are in the custody of a warehouse. We have onboarded more than 1400 custodian warehouses in India and the number is growing continuously. We create tokens in the form of NFTs when the goods are stored in the custody of the warehouses. These NFTs are then used to provide collateral to lenders for borrowing against commodity NFTs.

As the tokens created by Brú Finance are backed with real world assets stored with custodians, they are more reliable in terms of quality/quantity and are free from volatility risk. This makes them excellent collateral for financing.

How does Brú Finance convert RWA to NFTs?

We are focused on commodities and commodities finance. The farmers and other supply chain players like traders, processing mills etc. deposit their agri-commodities like rice, wheat, sugar, etc. in the warehouses.

The third party decentralized verification agencies record and audit the information like quality and quantity of the goods stored in the warehouse. This data is recorded on our Blockchain protocol. On a daily basis, all the stakeholders can determine the most accurate last traded price on regional and national exchanges and markets. This price information is used for issuance of Non-Fungible Tokens (NFTs) against the warehouse receipts (WHRs).

For lending, our partners use these commodities as collateral for loans. In this way, Brú Finance is connecting real economy with decentralized world using the NFTs supported by RWAs.

Brú Finance Journey

Since launching the platform in early 2020, we have already tokenized assets worth more than $500 million. We are the largest blockchain fintech company using the RWA as collateral for NFTs. Using these NFTs, the platform provides loans to Indian farmers, thus creating a social impact. We have witnessed the rise in the income level by 30 to 40% of the Indian farmers. 85% of these farmer borrowers have land holding less than 4 acres thereby creating grassroot social impact.

Efforts of Brú Finance are recognized and supported by Indian government entities, banks, non-bank organizations, thousands of platform users, and prestigious institutions like MAssChallenge, UNDP’s SDGia, ETHDenver, Microsoft, University of Toronto’s CDL, etc.

In India’s most prestigious business school IIM-Ahmedabad, our success story in social impact finance to Indian’s farmers using Blockchain is being taught.

We have won accolades across the globe from organizations like Indian Bank’s association, DCB bank, Polygon, Indian Merchant’s Chamber for innovative usage of blockchain technology in facilitating lending against commodities backed by NFTs.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter: https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

0 notes

Text

Benefits of diversifying portfolio with commodities

☘ Green is the New Gold: Brú Finance ESG Bonds for a Sustainable Future

ESG Bonds are a responsible #investment option that finances projects and companies committed to prioritizing #environmental , #social , and #governance issues. This approach to 💸 investing is gaining popularity as more individuals seek to align their values with their investments.

By subscribing to Brú Finance ESG Bonds, you can support initiatives that tackle climate change, promote diversity and inclusion, and enhance transparency. Not only does this investment provide a positive impact, but it also offers 💰 financial returns.

What's more, Brú Finance's emerging asset-backed ESG bonds are leading the way and can help mitigate high net worth volatility risk.

As the demand for impact investing continues to rise, ESG Bonds are becoming a more mainstream investment option for those who want to make a difference.

🤝 Join the movement towards a sustainable future by subscribing to Brú Finance ESG Bonds. Let's make a positive impact in the world together.

0 notes

Text

Product Unveiling!

May 28, 2022

Brú Finance

One Step Closer!

Having started our Blockchain CeFi journey two years back to create last mile financial connectivity to the farmers of India, Brú finance is pleased to announce that our attempt to create a CeFi-DeFi Web3 bridge is one step closer to its destination.

Financial inclusion is the key driver of economic welfare and social upliftment. Defi has emerged as a powerful technology with the potential to create last-mile financial connectivity if we build on it with the right objectives and focus on the vulnerable sections of society that have traditionally been left high and dry by the TradFi institutions.

Matt Homer of the New York State Department of Financial Services explains,

“We’re finally starting to see use cases emerge that could help crypto and blockchain live up to the financial inclusion hype it initially generated a decade ago. The credit space is an example of that..”

Brú Finance’s journey started two years back to create a financially inclusive ecosystem and provide easy-to-access financial services to 1.7 billion unbanked and underbanked population across the globe. We started this mission with the farmer community in India and launched a Blockchain-based Cefi platform to connect farmers with the Banking ecosystem. The blockchain-based Cefi platform tokenizes Agri-commodities stored in a decentralized network of custodian warehouses and allows farmers to be part of mainstream financialization by allowing them to use their harvest as collateral.

First time in the world, Brú Finance brought farmers (as borrowers), warehouses (as custodians), and banks (as lenders) on a single blockchain Cefi platform. Brú finance has become the world’s largest token issuer in this pursuit, having tokenized agri-commodities worth USD 600 million, 1400 warehouses registered as custodians on the blockchain, and 2 million metric tons of Agri-commodities stored in the warehouses.

To fulfil the mission of financial inclusion and democratizing financial services, it is crucial to harness the power of Defi and connect it with the existing Cefi platform. The Defi protocol will connect farmers with a global capital pool and provide them with a swift and sustainable source of credit against their tokenized Agri-commodities.

The team has worked relentlessly to develop this Defi protocol in the past few months. We are super excited to announce that we have achieved an important milestone in this journey.

Brú Finance unveils “Emerging Market Asset Backed Bonds” on Polygon Testnet

Polygon was a clear choice due to the low transaction fee and superior security of the Ethereum blockchain. We are working for financial inclusion, and many of the transactions are low ticket size; hence to make it user-friendly, it is vital to keep the transaction cost in check, and Polygon is best suited for this requirement.

Real-World Assets (RWA) are the physical assets that carry an inherent value because of their attributes; these include precious metals, infrastructure assets, land, commodities, etc. By introducing RWA on DeFi, Brú Finance opens up a significantly more enormous market for the DeFi ecosystem, connecting 1.70 billion unbanked/underbanked people to a new source of financial capital.

Brú Finance surmounts these obstacles faced by Decentralised Finance by creating a bridged ecosystem of DeFi and TradFi, facilitating lending against tokenized, on-chain Real-World Assets.

We invite the community to be a part of this journey. Please test the protocol, do the test transactions, and share your ideas and feedback.

Test URL: https://v2.bru.finance

Product Demo URL: https://bit.ly/bru-product-demo

Steps to test the protocol

Prerequisite:

1. Install Metamask:- https://metamask.io/

2. Once you install Metamask, connect your metamask to the following sites: Brú.Finance, Polygon, RPC-Mumbai

3. Once all these are connected, we are ready to start testing!.

Users can be lenders or borrowers when interacting with the Brú Finance platform.

On clicking the “i” (information icon), besides both the options, you can read — what being a lender and a borrower on our platform means.

Borrowers are the commodity/asset holders who have stored these assets in the physical warehouses in India, get tokenized, and reflect on the blockchain as NFTS.

On this page, the user mimics the behaviour of an actual farmer.

For Borrowing and Repayment:

Choose the “Borrow” option on the home page to test.

Find the option to Deposit Commodity. This option mints a dummy asset on which Borrow and Repayment can be tested.

There are one thousand NFTs to mint against for the test, and more are coming soon.

Following Minting, find the option to “Borrow” against the same asset.

Enter an amount to borrow.

Find the Repay option for the asset you’ve already borrowed against.

Enter the amount you want to repay and test.

As lenders, users can invest their stable coins to buy bonds from the platform. These bonds are backed 140% by high-yield emerging market assets (RWAs) and are over-collateralized.

For Buying Bonds and Withdrawal:

1. Choose the “Buy Bonds” option on the home page to test from the drop-down on the Header. The user can also go back to the home page and select the “Borrow” option.

2. On the Buy Bond page, find the “Add Test USDT to Metamask” option in the drop-down list under “Test.

3. Use the “Get Test USDT” option to receive test USDT in your wallet.

4. Three option tabs are visible: “Pools,” “Withdraw,” and “My Wallet.”

5. Under the “Pools” tab, choose any pool for lending USDT to the pool. Interest rates and other details would be subsequently shown.

6. On clicking the “Buy” option, the user gets to buy the bonds by filling in the required details.

7. On clicking the “Show bonds” option, the user gets to know about their “Active bonds” and “Mature bonds.” This will help the user know if they can withdraw from a particular bond or not.

8. Switch to the “Withdraw” tab to test the Withdrawal functionality. This will depend upon the lock-in period, which is 180 seconds (for test purposes).

9. Switch to the “My Wallet” tab to view wallet and token details.

There are two types of Bonds:

1. Active bonds -> Active bonds are the bonds with holding period maturity period. The bond buyers can’t withdraw their principal before maturity but can trade these bonds for early liquidity.

2. Mature bonds -> These are the bonds that have completed the maturity period and the bond buyers can withdraw their principal.

Every borrower has a repayment period, and every lender has a maturity period.

On this occasion, our CEO, Ashish Anand, has a message for the community. Ashish said,

“Given the latest event in the Defi environment, it is high time to bring real-world assets to Defi for long-term sustainability and avoid risks for lenders and borrowers alike. The algorithmic degen box DeFi has proven to be an unsustainable business model. To avoid such risky events and to make large-scale adoption of crypto, Defi must move to the real world, and that’s what our effort is focused upon. We aim to connect unbanked and underbanked such as farmers, medium and small businesses across emerging markets in the global south who are always looking for capital accessibility with a global pool of capital through Defi.”

We are just getting started with the Polygon testnet launch. We are working non-stop to build a financially inclusive ecosystem powered by real-world assets on Defi. Watch this space for more updates and be a part of our journey as we prepare ourselves to launch on mainnet.

Experience our protocol and share your valuable feedback and suggestions here -> Feedback Form

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter: https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

0 notes

Text

Brú Finance: NFTs backed by Commodities — A Global First

Mar 01, 2022

Brú Finance

Many Web3 organizations have been trying to adopt and bring real world assets on-chain since 2017–18. But success has been far and few.

We, at Brú Finance, realized that digitization of the existing paper documents is not an appropriate way of tokenization. The tokenization of the real world assets should take place either at source or under a custody of a decentralized third party.

Significance of NFTs backed by RWAs

The tokenization could be done either at the time of the issuance by the issuer. We can take the example of gold. Miners should do the process of tokenization and create tokens for the gold produced at the mine. Tokens could be created in the form of the gold bars and authenticated using some unique number printed on the bars which cannot be altered. The entire journey of the gold bar could be captured.

Another point of tokenization is possible when the assets are in the possession of the custodians. Tokenization of the real world assets can solve the existing problems like ownership, IP records, duplicacy of the tokens, etc.

To solve the above-mentioned problems, Brú Finance has adopted the tokenization of real-world assets like agri-commodities when they are in the custody of a warehouse. We have onboarded more than 1400 custodian warehouses in India and the number is growing continuously. We create tokens in the form of NFTs when the goods are stored in the custody of the warehouses. These NFTs are then used to provide collateral to lenders for borrowing against commodity NFTs.

As the tokens created by Brú Finance are backed with real world assets stored with custodians, they are more reliable in terms of quality/quantity and are free from volatility risk. This makes them excellent collateral for financing.

How does Brú Finance convert RWA to NFTs?

We are focused on commodities and commodities finance. The farmers and other supply chain players like traders, processing mills etc. deposit their agri-commodities like rice, wheat, sugar, etc. in the warehouses.

The third party decentralized verification agencies record and audit the information like quality and quantity of the goods stored in the warehouse. This data is recorded on our Blockchain protocol. On a daily basis, all the stakeholders can determine the most accurate last traded price on regional and national exchanges and markets. This price information is used for issuance of Non-Fungible Tokens (NFTs) against the warehouse receipts (WHRs).

For lending, our partners use these commodities as collateral for loans. In this way, Brú Finance is connecting real economy with decentralized world using the NFTs supported by RWAs.

Brú Finance Journey

Since launching the platform in early 2020, we have already tokenized assets worth more than $500 million. We are the largest blockchain fintech company using the RWA as collateral for NFTs. Using these NFTs, the platform provides loans to Indian farmers, thus creating a social impact. We have witnessed the rise in the income level by 30 to 40% of the Indian farmers. 85% of these farmer borrowers have land holding less than 4 acres thereby creating grassroot social impact.

Efforts of Brú Finance are recognized and supported by Indian government entities, banks, non-bank organizations, thousands of platform users, and prestigious institutions like MAssChallenge, UNDP’s SDGia, ETHDenver, Microsoft, University of Toronto’s CDL, etc.

In India’s most prestigious business school IIM-Ahmedabad, our success story in social impact finance to Indian’s farmers using Blockchain is being taught.

We have won accolades across the globe from organizations like Indian Bank’s association, DCB bank, Polygon, Indian Merchant’s Chamber for innovative usage of blockchain technology in facilitating lending against commodities backed by NFTs.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter: https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

0 notes

Text

Brú Finance Ambassador Program — Season 1

Apr 23, 2022

Brú Finance

Are you a Designer, Tech Content Creator, Influencer, or just passionate about Blockchain or DeFi projects? Are you interested in being at the forefront of the World’s Largest Tokenization Platform? Then we have a lot of things for you!!!

Globally the largest issuer of tokenized real-world assets, Brú Finance is a DeFi lending protocol connecting decentralized lending to the real economy. In addition, we are launching our Brú Finance Ambassador Program, allowing you to use your creative skills and influencer connections to spread the word about Brú Finance.

Apply now and help us grow the next wave of DeFi while earning exciting rewards!!

Types of Ambassador Engagement:

1. Brú Video Creators

Post Eligibility:

500+ followers or subscribers on any of your preferred social media platforms (YouTube/ Twitter/ Reddit) to qualify for rewards

Minimum: 50 views + 10 engagements ( Comments ) across any aforementioned platforms.

Requirements:

Post original short videos per week (minimum 30 sec, maximum 10 min)

Videos can be on any topic related to Brú Finance platform that will announce weekly during the Ambassadors Meetup.

Should post a minimum of one video in a week to continue with the program.

Rewards:

Reward CriteriaBru Points50 to 100 views + 10 Engagements20101 to 1000 views + 15 Engagements401001 to 3000 views + 25 Engagements803001 to 5000 views + 45 Engagements160

2. Brú Twitter Influencers

Post Eligibility:

500+ followers on Twitter

Minimum: 10 engagements per thread ( 10 RT/ Comments )

Requirements:

Post original Twitter Threads per week

1 Twitter Thread should comprise five or more Tweets

Tweets can be on any topic related to Brú Finance platform that will announce weekly during the Ambassadors Meetup.

Should do a minimum 1 Twitter threads per week to continue with the Ambassador Program

Rewards:Reward CriteriaBru Points10-20 Engagements /Thread521-30 Engagements /Thread1031-40 Engagements /Thread2041-50 Engagements /Thread4050 Engagements /Thread80

How to get started?

Step 1: Fill out the details in the application form

Step 2: Wait for confirmation from our official handles. You will get confirmation from the following handles-Official Twitter handle — @bru_financeOfficial Telegram Id — https://t.me/bruofficialOfficial Discord server — https://discord.gg/cnYxzGEqHX

Step 3: Become a Brú Ambassador & you are good to go!

How to fetch your rewards?

Step 1. Fill out the Task Submission Form

Step 2. The team will be reviewing the tasks, and rewards will be distributed monthly based on the quality & engagement.

Total Reward Pool of $2000

10 Brú Point = 1 USD

Guidelines:

All the ambassadors will have to follow Brú Finance’s Social Media platforms. Like, Retweet, and share our updates.

Join all the events (e.g., AMA’s) organized by the Brú Finance team.

The Brú Finance team will be holding weekly meetings on Fridays to announce the theme for the next week.

All the selected Ambassadors need to join weekly meetings mandatorily to understand the weekly theme and get clarity directly from the founding team.

The Brú Finance team will provide resources related to the weekly theme.

Ambassadors will create content based on the weekly theme provided by the team and include specific Hashtags and Taglines in the content. Brú Finance team will provide the Hashtags and Taglines.

Tag Brú Finance’s official handles on all the posts made.

We will share shortlisted posts & creatives across the Brú Finance SM platforms.

We reward only high-quality and factually correct content (videos/threads) based on the resources provided on the company’s official handles and documents.

Brú Finance holds the right to use the contents created by our ambassadors for future purposes.

Brú Finance team reserves the right to choose high-quality content and the final decision would be of the Brú Finance team

Brú Finance team reserves the right to update/make changes in the program without prior notice.

Brú Finance reserves the right to terminate the candidate/ambassador from the program if they violate the community guidelines.

Contents that don’t adhere to the weekly theme won’t consider for rewards.

Contents should be unique/original and must not be copied from other sources.

The Brú Finance team won’t be considering the contents of those ambassadors who don’t attend the weekly meeting.

Can report feedback or comments to [email protected]

0 notes

Text

The importance of transparency in ESG bond reporting

Meet Mr. Shyamsundar Balaji Bhatarkar from Yavatmal, Maharashtra, who found invaluable support from Brú Finance. By choosing to secure a #loan through Bru Finance, Mr. Shyamsundar reaped significant benefits from their remarkably lower #interestrates , unlike the high rates imposed by private banks.

Brú Finance stands out by offering loans with lower interest charges, making it highly advantageous for #farmers like Mr. Shyamsundar. Within a mere 24 hours, he received the loan amount from Bru Finance, showcasing their efficient and reliable services.

This success story exemplifies the visionary approach of Bru Finance and its transformative impact on the lives of countless farmers.

Mr. Shyamsundar's journey serves as a testament to the remarkable resilience of farmers and highlights Bru Finance's life-changing influence within the #agricultural community, empowering them to achieve greater levels of success.

0 notes

Text

The role of governance in ESG bond investments

invest in a Sustainable Future: ESG Bonds with Brú Finance

Brú Finance offers a transformative opportunity to #invest in ESG Bonds, empowering individuals to support projects and companies that prioritize Environmental, Social, and Governance concerns. This #investment approach not only generates #positiveimpact but also delivers promising financial returns.

As the demand for responsible investments rises, #ESGBonds have gained immense popularity. With these #bonds , #investors can align their financial choices with their values, actively contributing to crucial causes like climate change, diversity, inclusion, and transparency.

Brú Finance takes it a step further by introducing asset-backed ESG bonds in emerging markets, providing stability and reducing volatility for high net worth individuals. This initiative amplifies the impact of #esg investments on a global scale.

Embrace a Sustainable Future with Brú Finance

Learn more about the potential of ESG Bonds by visiting Brú Finance now

Make a meaningful difference and be part of the positive change our world needs.

0 notes

Text

ESG bond portfolio for impact investing

SRI has become increasingly popular in recent years. A 2021 study by the Global Sustainable Investment Alliance found that #global sustainable assets reached $35.3 trillion in 2020, up from $22.9 trillion in 2016.

There are a number of reasons why #investors are choosing SRI.

Some investors believe that SRI can help them to achieve better #financial returns. Others believe that SRI is a way to make a #positiveimpact on the world. Still others believe that SRI is simply the right thing to do.

Socially responsible investing (SRI) is an investment approach that seeks to combine financial returns with social and #environmentalimpact . SRI investors consider #environmental , #social , and #governance (#esg ) factors when making investment decisions.

There are many different ways to implement SRI. Some investors focus on investing in companies that have strong ESG ratings, while others focus on avoiding companies that have poor ESG ratings. There are also a number of specific SRI strategies, such as investing in ethical #funds , impact investing, and #shareholder activism.

0 notes

Text

The role of technology in ESG bond investing

Looking to make a difference with your #investments ?

Brú Finance ESG Bonds are the way to go !

These bonds allow you to #invest in projects and companies that care about the #environment , #society , and #goodgovernance .

And the best part ? You not only generate #financial returns but also create a #positiveimpact !

Nowadays, more and more people want their investments to align with their values. That's where ESG Bonds come in. By choosing these #bonds , you actively support initiatives that tackle #climatechange , promote diversity and inclusion, and foster transparency.

Brú Finance is taking things further by introducing asset-backed Fractional ESG bonds in #emergingmarkets . This approach helps reduce the ups and downs experienced in a volatile market, making it a smart choice for those who want stability.

The demand for impact #financing is growing rapidly, and ESG Bonds are becoming the go-to option for individuals who want to make a meaningful difference.

Join the movement towards a #sustainablefuture and contribute to a positive global impact.

Let's make our investments count for a better world !

#Privacy · Terms · Advertising · Ad choices · Cookies · · Meta © 2023#Posts#Bru Finance#13 h ·#Meet Mr. Shyamsundar Balaji Bhatarkar from Yavatmal#Maharashtra#who found invaluable support from Brú Finance. By choosing to secure a 💸#loan through Bru Finance#Mr. Shyamsundar reaped significant benefits from their remarkably lower#interestrates#unlike the high rates imposed by private banks.#Brú Finance stands out by offering loans with lower interest charges#making it highly advantageous for 👨🌾#farmers like Mr. Shyamsundar. Within a mere 24 hours#he received t… See more#1 d#·#Meet Mr. Sudam Gyanba Mule#a 👨🌾#farmer hailing from Dondbujruk#Hingoli#who experienced invaluable support from Anndhan. By opting for a loan through Anndhan#Mr. Sudam benefited significantly from the stark difference in interest rates compared to those offered by private banks.#Anndhan provides 💸#loans with lower interest charges#in stark contrast to other lenders who impose higher rates#thus proving highly advantageous for#farmers like Mr. Sudam.#Ann… See more#0:00 / 1:38

2 notes

·

View notes

Text

The importance of transparency in ESG bond reporting

Brú Finance: Early Community Member Pass (ECMP)

Base Tier

Brú Finance

We, at Brú Finance, are happy to share our Early Community Member Pass (ECMP) details with you. This giveaway will be offered to 100 early supporters of Brú Finance. With this giveaway, we invite new members to join our server and remain active in raising awareness about the project.

The giveaway is divided into 3 parts. The basic prize will be available for all and the highest price will be allocated for major contributors.

How will ECMPs Work?

The total number of passes is fixed at 100. All the 100 early members will initially be given 1 base tier pass for each person. Once someone moves up the ladder to Mid-Tier level, they will swap their base tier pass for the mid-tier pass, and the base tier pass will be burnt. Similarly, those moving to Top Tier will swap their mid-tier card with top-tier card and the mid-tier card will be burnt. This way, the total supply will be always limited to 100.

The 3 tiers of the Giveaway are-

● Base tier

● Mid-tier

● Top tier

The criteria for Base Tier is

1. Follow Brú Finance on Twitter

2. Invite 3 interested friends on the Discord server

3. Remain at least level 1 on the Discord server

Our Early community members who are in Base Tier will get

1. Early community member Pass in the form of a tradable NFT

2. Early member T1 role

3. $50 worth Brú Tokens on IDO launch

Mid-Tier

The criteria for Mid-tier is-

● Follow Brú.finance on Twitter

● Invite 7 interested friends on the Discord server

● Be at least level 2 on the Discord server

● Base Tier Benefits +

● Access to special giveaways and whitelist

● No gas fee for 1 month(except transaction on Ethereum network)

● $100 worth Brú tokens on IDO launch

● Follow Brú.finance on Twitter

● Invite 15 interested friends on the Discord server and Twitter

● Be at least level 3 on the server(don’t grind)

Top-Tier

The Top tier prize includes-

● Mid-Tier Benefits +

● Early member T3 role

● Special access to private sale and whitelist

● Special airdrops

● 1 special limited edition Brú NFT

And the best news, all the ECMP passes will be tradeable NFT, and don’t forget the top tier ECMP holders will also be entitled to one more NFT (To be unveiled later.)

How to apply?

● Make sure you come under the required criteria

● Fill out the Google form once you become community member on our Discord server

Please note-

1. Do not invite bots on the server, we have measures to detect them.

2. Invite only interested people into the server, we are trying to build a close-knit community.

3. Successful referral will only be counted if the person stays till the distribution of the giveaway.

4. All the eligible winners will get the NFT first with the utility being the prizes, and these utilities can be redeemed after token and platform launch

5. NFTs will be distributed on OpenSea

Please note: Round 1 of the ECMP NFT giveaway is over

30/100 of the ECMPs are claimed.

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord: https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

Twitter: https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

0 notes

Text

Socially responsible investing

Despite a brutal #bearmarket , DeFi’s resilience has been incredible to watch throughout 2022. Paradoxically, this year saw a #defi growth while simultaneously witnessing more users adopting it .

0 notes

Text

Socially responsible investing

What is Brú Tokenomics

Brú Finance

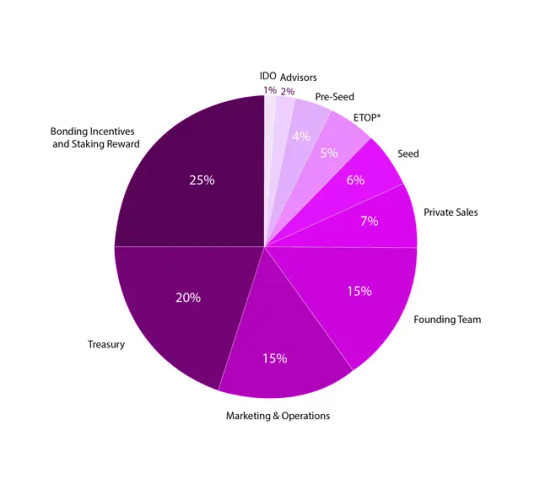

Today we are sharing our Tokenomics for Brú Tokens. Brú Token is a governance token that gives the rights to the community to make proposals for protocol governance, vote on them and set the direction of the protocol.

Brú token also gives the token holders rights in cash flow of the protocol.

We are presenting our Brú Tokenomics for our investors, partners, and community members.

Issuance & Burn Mechanism of New Brú Tokens

In our Initial Token Supply, we will issue 250 M. This number is in direct proportion to Total Real World Assets worth 500 Trillion and Token supply to Global RWA Ratio will be 1:2 million.

The Brú token is a deflationary token set with rate of inflation or deflation set to the After TVL crosses $50M, we will issue new tokens in the ratio of quarterly TVL growth rate.

Initial Token Distribution

The total supply of Brú Token is about 250 million, out of which

20 % reserved for Treasury/Future Growth Reserve

25% reserved for Bonding Incentives and Staking Rewards

15% for the Marketing and Operations

15% for the Founding team

Other fractions are

Pre-seed 4%

Seed 6%

Private 7%

IDO 1%

Advisors 2%

ETOPs 5%

Risk Management through Capital Adequacy Norms

Brú Finance follows Basel III capital adequacy norms voluntarily to manage its risk. We have issued Treasury Tokens and Funding Tokens as Tier 1 capital with a minimum capital adequacy ratio (CAR) of 6%. We will consider Staked tokens as Tier II Capital. Our total capital and CAR would consist of Tier I and Tier II and be maintained at an 8% minimum. Except for Perpetual Bonds issued by us, TVL will be treated as Debt and will not be treated as Capital.

Risk Management through Capital Adequacy Norms

Risk Management through Capital Adequacy Norms

Burn Mechanism

If borrowers hold Brú Tokens, they would get

1. Staking rewards

2. Higher cashback with higher loan eligibility at the low-interest rate.

3. Karma Tokens, which are Social impact funding to LP

Brú Token Supply and Distribution

For more updates and latest news about Brú Finance, please join our Twitter Channel, Discord server, LinkedIn, Telegram at

Please join our Discord events and Twitter AMAs to connect directly with our founders and ask your queries.

Discord : https://discord.gg/8C9SZXDy2r

Telegram Channel : https://t.me/bruofficial

witter:T https://twitter.com/bru_finance

LinkedIn : https://www.linkedin.com/company/bru-finance/

0 notes

Text

Green is the New Gold: Brú Finance ESG Bonds for a Sustainable Future

0 notes

Text

The role of technology in ESG bond investing

rú Finance is proud to be at the forefront of this revolution, empowering individuals and institutions alike to participate in a #defi platform that is dedicated to ESG Bonds. By embracing these #bonds we can collectively bring about positive change in the world.

0 notes

Text

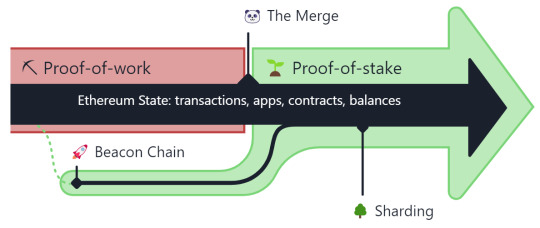

How will ETH Merge affect the DeFi ecosystem?

Brú Finance

Ethereum, The World’s Largest Programmable Blockchain And 2nd Largest Crypto Project Just After BTC, Is The Foundation For The Future Of The Internet (Web3) And The Future Of Finance, I.E., Decentralized Finance (DeFi). Despite The Market Volatility And Macroeconomic Uncertainty Since Its Genesis, Ethereum’s Founder Vitalik Buterin Was Always Looking For Growth As He Focused On The Long-Term Building Of The ETH Network.

For This Reason, The Merge Of The ETH Network Was Executed Last Month. This Merge Will Eventually Open The Doors For The DeFi To The World.

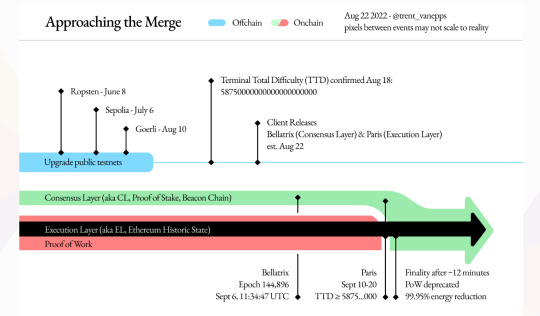

Before Understanding The Effects Of The Merge On DeFi, Let’s First Look At The Working Of ETH And The Change In The ETH Network After The Merge.

Ethereum Has Been Working On Proof Of Work Since Its Inception In July 2015. However, On December 1, 2020, A New, Separate Consensus Proof-Of-Stake Layer Called Beacon Chain Was Created From The Existing Mainnet.

The Ethereum Mainnet Usually Runs For All Accounts And Applications And In Parallel With The PoW With The Beacon Layer Following PoS. Therefore, The Beacon Chain Worked Side-By-Side With Testing And Processing With Active Validators Without Impacting The PoW Mainnet.

After A Successful Check, The Merge Took Place On September 15, 2022.

As A Result, The Beacon Chain Running In PoS Has Become A Run-Level Consensus Mechanism As A Single Chain Handling All Accounts, User Data, And Transactions.

The Ethereum Merge Refers To Merging Ethereum’s Mainnet (The Execution Layer Currently Protected By The Energy-Intensive Proof-Of-Work System) And Another Consensus Layer, The Beacon Chain, Based On The Proof-Of-Stake Mechanism. Once Complete, Transaction Blocks Are Added To The Ethereum Blockchain Via Proof-Of-Stake Verification Only, Eliminating The Role Of Ethereum Miners And Their Heavy Carbon Footprint.

Currently, In The Move To Proof Of Stake, Validators Are In Charge Of The Verification Process Without The Need To Mine Blocks And Verify Blocks, Which Consumes High Computational Power.

As Ethereum Moves To Proof Of Stake, It Will Use Tokens To Rely On Validators To Validate Transactions And Add New Blocks To The Chain. Ethereum Stakers Must Deposit 32 ETH On The Beacon Chain, Also Known As The Consensus Layer, To Run Validator Nodes. Alternatively, You Can Deposit A Small Amount Of ETH Into A Staking Pool.

Now, Let Us Look At The Effects Of The Merge On DeFi.

DeFi market after Merge

Over The Past Two Years, ETH Network Adoption And Usage Have Skyrocketed, Sending A Strong Signal Of Network Maturity. Today, Over Half Of The Entire DeFi Ecosystem Run, Works, And Builds On The Ethereum Network. For Example, AAVE And Uniswap Are The Two Largest DeFi Platforms Built On Ethereum. Since The ETH Network Moved From POW To POS, It Will Lead To Some Significant Technological Upgrades In The DeFi And Web 3.0 Ecosystem Seen In Recent History. This Upgrade Not Only Benefits The Environment But Also Network Adoption And Growth. Businesses Can Build More Easily And Confidently On The Ethereum Network Without Worrying About Power Consumption Or Sustainability Regulations. The Transaction Will Be Smooth And Fast As Compared To Before. More DApps Can Be Built Easily And Efficiently. You May Have Seen It Widely Covered By All Web 3.0 Publications, Projects, Influencers, And Traditional Media Sources On The Internet.

DeFi market after Merge

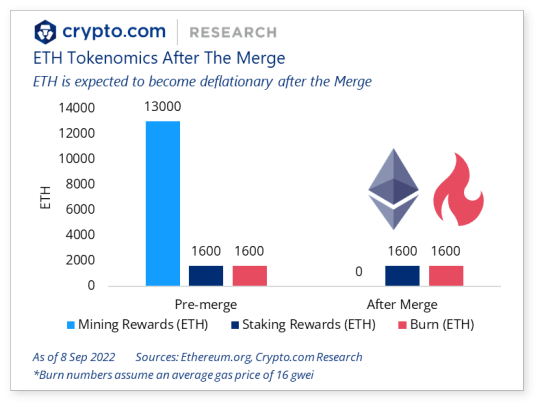

The Changes Can Be Seen In The ETH Network System. The ETH Network Formally Abandoned The Energy-Intensive Miner-Based System, Which Was Previously Used To Handle Distributed Ledger Updates. By Removing Compute-Intensive Proof-Of-Work Mining From Ethereum, The Merge Helps Reduce The Overall Network Power Consumption By More Than 99%.

By Moving From Proof Of Work (PoW) To Proof Of Stake (PoS) Consensus Mechanisms, The Merge Will Change How Value Is Accumulated Across The Ethereum Network. Validators Are Rewarded 5.5–13.2% For Validating Transactions And Adding Them To Blocks, While Token Holders Are Rewarded Through The Token-Burning Mechanism.

This Merge Will Further Deflate Ethereum Supply As It Will Be Issued Less. Currently, ETH Is Issued At The Execution Level As A Reward To Miners And At The Consensus Level As A Reward To Validators. After The Integration, Issuance Will Stop At The Run Level, Reducing New ETH Issuance By Almost 90%.

Let Us Understand How The Move From PoW To PoS Will Affect The ETH Issuance Rate.

Now, The Ethereum Transactions Are Not Validated By Miners Doing The Math But By Validators Who Stake Their Own Money (In The Form Of ETH) As Collateral To Ensure They Are Diligent And Honest In Their Validation. In Return, Validators Who Successfully Add Blocks To The Blockchain Receive A Monetary Reward For Their Work. In The Context Of Ethereum, The Validator Would Have To Stake 32 ETH (At The Current Price Of 1558$, As Marked On 27th Oct 2022, It Is Around $50,000) To Run A Validator Node.

This New System, Therefore, Creates The Potential To Generate Direct And Secure Income From ETH Holdings. This Is A Great Deal For Investors, Especially In The DeFi World, And Could Prove Attractive To Money Managers Whose Primary Concern Is To Generate Stable Returns With High Upside Potential.

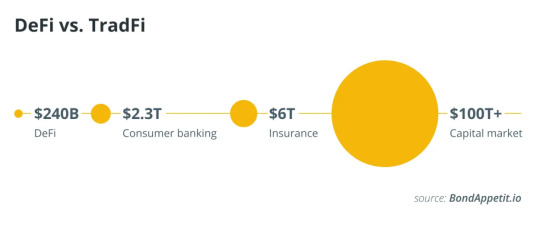

Moreover, ETH Staking Will Also Boost The Entire Decentralized Finance (DeFi) Space. The Size And Reliability Of The Ethereum Network Make It Roughly Equivalent To The US Treasury Bond Market In The Crypto World.

ETH Staking Has Become The De-Facto “Risk-Free” Rate For Cryptocurrencies And Serves As The Base Rate Against Which All Kinds Of Revenue-Generating DeFi Projects Can Be Benchmarked.

The Ethereum Merge And Future Ethereum Upgrades, Coupled With The Development Of A Layer 2 Blockchain That Allows For Massive Scaling While Inheriting The Security Guarantees Of The Base Layer, Will Create A New Proof-Of-Stake-Based Infrastructure Built On Ethereum. As A Result, It Leads To A Sharp Increase In The Users Rushing Into The DeFi System.

Based On The Combination Of All These Factors, It’s No Wonder Many Are Bullish On Ethereum, Its Ecosystem, And DeFi. This Merge Was About Long-Term Value, Not Short-Term Price Appreciation. The Ethereum Ecosystem Is Built Over Time. Despite Current Geopolitical And Macroeconomic Factors And Recent Market Volatility, The Community Continues To Develop Innovative Products And Systems, And Institutions Desire Institutions To Participate.

Financial Institutions And Investment Banks Such As Goldman Sachs And Barclays, A16z, Hedge Funds Such As Citadel Securities And Point72 Ventures, And Retail Banks Such As Banco Santander And Itau Unibanco — Invest Their Funds In Cryptocurrencies And Offer Their Clients Cryptocurrency Investment Opportunities Through Defi Are Now Working On Plans To Provide Options To Their Users.

For A Long Time, The Debate Revolved Around Institutional Investment In Crypto Rather Than Traditional Finance (TradFi) Vs. DeFi. The Growing Popularity Of DeFi Is Often Seen As The Death Knell For TradFi. However, The Digital Asset Management Strategies Of Many TradFi Companies During The Recession Show That TradFi And DeFi Have Complemented Each Other. This Trend Will Likely Increase Post-Merge As Institutional Investors Perceive It’s All A Long Game.

As The Merge Will Make The Ethereum Network More Secure And Set It Up For Future Scalability, It Is Expected That The Institutions Will Become Increasingly Interested In Engaging With The DeFi Ecosystem.

Over The Past Two Years, DeFi Innovation Has Created The Infrastructure And Tools Necessary For The Institutional Adoption Of DeFi. As A Result, More And More Institution-Focused Projects Are Hitting The Market, From Approved Credit Pools That Only Guarantee KYC Participants, To On-Chain Asset Management, To MEV-Resistant Best Execution Protocols, To Decentralized Identities.

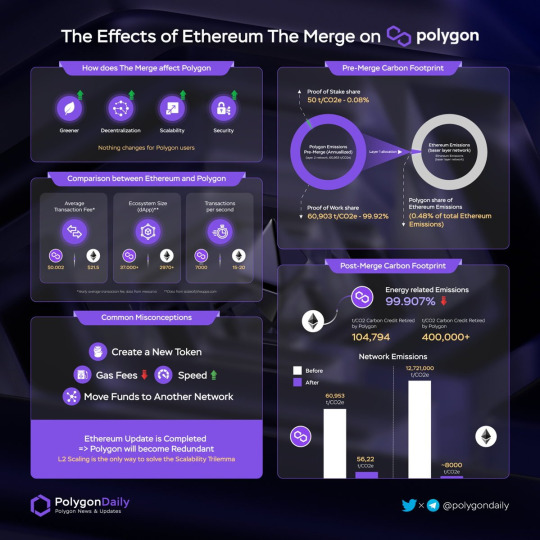

It Can Also Be Seen That The Layer -2 Projects Such As Optimism, Polygon, And Arbitrum Are Achieving Enough Of The DeFi Volume For Yield Farming. Further, More Institution-Focused Projects Will Hit The Market As Post-Merge Layer 2 Scaling Accelerates.

It Is A Common Misconception That Ethereum Scaling Solutions Will Eventually Make Layer 2 Solutions Redundant, But Most Layer 2 Solutions, Like Polygon, Said That Even If The Ethereum Consensus Changes, It Does Not Reduce The Need For A Scaling Solution.

The ETH Merge Paves The Way For Sharding, But This Upgrade Is Not Enough To Scale Ethereum. Nevertheless, The Polygon Will Benefit From It And Improve The Performance Of Scaling Solutions. This Merge Is Expected To Make Layer 2 More Environment-Friendly. Polygon Claims It Will Reduce Carbon Emissions By 60,000 Tons, Or 99.91% Of Its Current Value.

Built To Help Ethereum Scale, Layer 2 Will Move Along With The Ethereum Merge. So, For Example, If Arbitrum Is Faster Than Ethereum Before The Merge And The Layer 1 Itself Becomes Faster, Then Arbitrum Essentially Scales In Speed As Well. As A Result, User And Developer Experience With Layer 2s Will Improve In Tandem With How Ethereum Improves Over Time.

Both Optimistic And Zero-Knowledge Rollups Will Benefit Greatly From Sharding After The Merge, Even In Its Most Primitive Form, Which Is Only Useful For Storing Data With Guaranteed Availability.

Many Industry Insiders Have Hinted That No Matter How Scalable The Network Becomes, Layer 2 Will Continue To Thrive And Be Able To Gain A Foothold On The Ethereum Blockchain. After All The Phases Are Completed On The Ethereum Mainnet, L2s Will Continue To Be The Execution Layer.

Opportunities after the ETH Merge

The Move To PoS Has Created Attractive Reward Opportunities For Institutions. For Example, The 4.06% Annual Returns On ETH Positions As Major ETH Holders, Including Crypto Exchanges, Funds, And Custodians, Have Already Realized That Holding ETH Gives Them A Strong Position Within The DeFi Ecosystem.

For Institutions, The DeFi Opportunities Are Enormous, And Mergers Will Only Help The Market Mature And Create Opportunities For Investors Seeking Returns In A Riskier Space. In Addition, Institutional Investors Who May Have Previously Been Skeptical Of DeFi’s Investment Opportunities Have Found The Growth Of The DeFi-Powered Web3 And Other Related Financial Products Inevitable. They May Still Need To Understand The Dynamics Behind DeFi Or Web3 Fully, But They Have Learned That Digital Asset Classes Must Be Addressed.

The DeFi Ecosystem Will Change Forever When People Who Stake ETH On The Beacon Chain Start Receiving Staking Rewards. The Search For The ETH Killer Coin Has Forced The Ethereum Foundation To Take This Step Of The Merge.

Building DApps Using Smart Contract Applications Have Revolutionized The Cryptocurrency Industry, And Mining ETH Has Made Many Fortunes. This New Generation Of DApps Deployed On Beacon Chain Contracts Makes It Easier For Developers To Deploy The APIs. The Boom In New DeFi Projects Is Based On Ethereum, The Second-Largest Crypto Asset By Market Capitalization.

When You Invest Your ETH Into A Staking Pool, Your Stored ETH Instantly Becomes A Time Deposit, With Estimated Returns Of Up To 10%. The Cryptocurrency Community Hopes This Will Attract More People To ETH, Further Boosting Web 3.0 And DeFi Adoption.

Conclusion

Ethereum’s Proof Of Stake Integration Has The Potential To Transform The Network And Establish Ethereum For Long-Term Sustainability And Scalability. Given The Significant Role Ethereum Plays In Both DeFi And NFTs, This Should Benefit The Entire Crypto Ecosystem.

About Brú Finance

Brú Finance Is Creating A New Paradigm Of DeFi 2.5, Bringing Emerging Market Asset-Backed Bonds To Decentralized Finance. Brú Finance Is The Largest Issuer Of Tokenized Real-World Assets (RWA). Brú Finance Connects Decentralized Lending To The Real Economy, Serving The Un/Underbanked Population Of 1.70 Billion In The Global South.

For More Industry Updates And The Latest News About Brú Finance, Please Join Us On:

Discord: Https://Discord.Gg/8C9SZXDy2r

Telegram Channel : Https://T.Me/Bruofficial

Twitter: Https://Twitter.Com/Bru_finance

LinkedIn : Https://Www.Linkedin.Com/Company/Bru-Finance/

0 notes