Text

USD under pressure a US PCE misses forecast, JPY collapses against greenback

Sabir Houssain

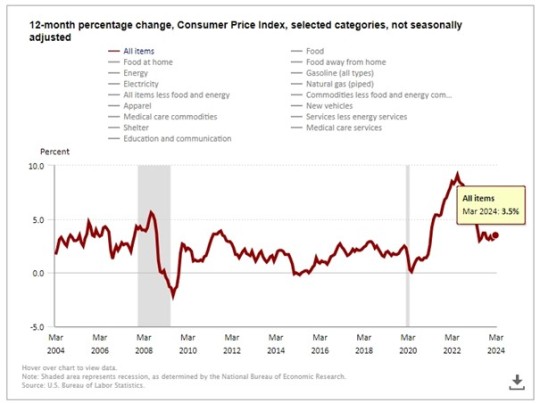

US PCE Misses Forecasts as Inflation Remains Off Target

The US Core PCE Price Index came in at 0.2%, down from 0.3% forecasted and 0.3% last month. Core PCE is the Federal Reserve's primary inflation measure, accounting for goods and services consumed by individuals. Decreasing PCE is positive news for the Fed, as it needs to hit 0.17% month-on-month to reach the 2% year-on-year target.

Overall, the result is encouraging a September rate cut; however, further cooling is required from consumer spending along with a higher unemployment rate of around 4.2%. Meanwhile, household disposable incomes fell, leading to a potentially subdued Q2 contribution to GDP.

Following the news, EURUSD is testing the descending trendline and 1.0850 resistance area. If the price finds resistance from the trendline, it will likely find support around 1.0650 which coincides with the 100 SMA (black line).

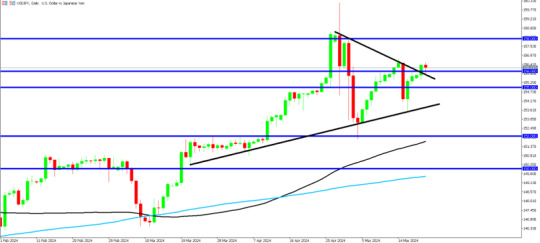

USDJPY continues to rise within an ascending wedge as the price nears the extreme highs of the chart. The price will probably find further support from the lower ascending trendline before testing the extreme high around 160.

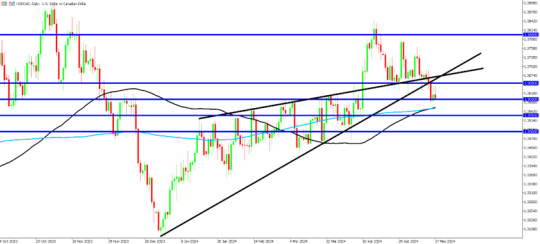

Canadian GDP Drops as USDCAD Breaks Lower

Canadian GDP fell to 0% from 0.2% last month. Despite the weak result, construction increased to 1.1% which was the biggest monthly growth rate since January 2022. Additional positive news came from public sector services, which grew by 0.2% for a third monthly increase.

After the release, we can see USDCAD breaking the lower ascending trendline. The price will likely drop to test the 1.35 pivot along with the 100 SMA (black line). However, if the price reverses, there are strong potential resistance areas with the ascending trendline and 1.38 pivot.

0 notes

Text

Wall Street sharply lower as GDP drops, Crude oil retreats

Jon Hopkins

US stocks dropped sharply on Thursday after disappointing quarterly economic growth data added to concerns over sticky inflation further denting expectations that the Federal Reserve will be decreasing interest rates anytime soon.

US gross domestic product (GDP) grew at an annualised rate of 1.3% in the first quarter of 2024, below the advance estimate of 1.6% and notably lower than the 3.4% rise in the final three months of 2023.

While the weak GDP reading could point to the Fed cutting rates, a measure of inflation in the data was revised down to 3.3% from 3.4%, showing quarterly price-pressure growth remains stiff.

Central bank policymakers have recently pushed back expectations for interest rate cuts due to stubborn inflation readings. Friday's release of the latest price consumer expenditure (PCE) index, the Federal Reserve’s preferred measure of inflation, will be key to gauging rate cut timescales.

Other data on Thursday saw US initial jobless claims for last week come in at 219,000 just above the 217,000 estimate and the prior week's 215,000 reading. The May non-farm payrolls report is due next Friday.

US30 H4

At the New York close, the Dow Jones Industrials Average was down 0.9% at 38,111, while the broader S&P 500 index shed 0.6% to 5,235, and the tech-laden Nasdaq Composite lost 1.1% to 16,737.

Among the fallers, software firm Salesforce plunged 19.9% after posting weak quarterly earnings and as its forward guidance missed estimates. Other tech losers included Microsoft and Amazon, down 3.4% and 1.5% respectively.

PC maker HP bucked the weak tech trend, jumping 17.0% after posting better than expected second quarter revenue. But after the US close, rival Dell dropped 16% after reporting disappointing quarterly results.

Elsewhere, the main corporate earnings focus was on retailers. Kohl’s dropped 22.9% after the department store chain reported an unexpected first-quarter loss and issued a 2025 profit warning. Meanwhile, American Eagle Outfitters shed 7.6% after the apparel retailer’s fiscal first-quarter sales came in weaker than expected, even though revenue was 5% above the levels seen a year ago.

But on the up, Foot Locker jumped 15% after the shoes retailer affirmed its guidance for 2024 as its turnaround plan showed signs of progress. And Best Buy gained 13.5% as its earnings beat forecasts though revenue slightly undershot.

On commodity markets, oil prices fell as the weak US growth data outweighed optimism over a bigger-than-expected draw in inventories.

USOIL M15

US WTI crude lost 1.7% to $77.86 per barrel, while UK Brent crude fell 2.0% to $81.90 a barrel.

Data from the American Petroleum Institute, released on Wednesday, showed that US oil inventories shrank nearly 6.5 million barrels last week, way above expectations for a draw of 1.9 million barrels.

0 notes

Text

UK100 extends losing streak, US PCE in focus

Jon Hopkins

UK stocks ended lower on Wednesday, extending a recent retreat to a sixth straight session as the vagaries of the UK general election campaign and uncertainties over the timing of interest rate cuts globally keep investors cautious.

Higher bond yields pressured equities globally, while recent US data have reignited inflation worries and cast doubts about the timing of rate cuts by the Federal Reserve.

DXY H4

All eyes were focused ahead to the latest US personal consumption expenditures (PCE) price index data - the Fed's preferred inflation gauge - due out on Friday. A speech by the Bank of England Governor Andrew Bailey's on Thursday will also be monitored closely for pointers to UK rate cuts.

At the London close, the blue-chip FTSE 100 was down 0.9% at 8,183, notching up its longest losing streak since August 2023. The more domestically focused FTSE 250 index dropped 1.3% to 20,436.

Among the blue chip fallers, Anglo American lost 3.1% after its suitor BHP Group walked away after being denied another extension by the target company to its 'put up or shut up' takeover deadline, which ended today.

However, mid cap International Distribution Services gained 4.3% after the Royal Mail owner agreed to a £3.57 billion takeover offer by Czech billionaire Daniel Kretinsky.

UK100 H1

Precious metals miner Fresnillo was a top FTSE 100 gainer, up 2.0% after analysts at RBC Capital upgraded the stock to outperform from sector perform.

Ocado and St James's Place were among the blue-chip fallers, down 12.3% and 1.8% respectively, with both to be demoted to the FTSE 250 index from the FTSE 100 after the latest constituents review.

On the second line, Impax Asset Management shed 14.7% after the sustainability-focused fund reported interim results showing operating profits of £25.8 million, a 5% decrease from last year, while the dividend was held flat at 4.7p.

But Harry Potter and Sarah J Maas publisher Bloomsbury Publishing rose 7.2% after it struck its largest deal to date, acquiring US group Rowman & Littlefield's academic publishing business for £65 million.

0 notes

Text

US Consumer Confidence Beats Forecasts after 3 Consecutive Declines

After three months of declines, US consumer confidence rose to 102 on Tuesday, higher than the 96 forecasted and 97.5 last month. The positive result was boosted by the rising Present Situation Index and Expectations Index. However, despite the Expectations Index increasing to 74.6, it remained below 80, which typically signals an upcoming recession.

Strong labour market conditions have contributed significantly to rising consumer confidence as fewer respondents claimed that jobs were "hard to get". Those making over $100k showed the most considerable increase in confidence.

Following the release, EURUSD rose to test the descending trendline plus the recent swing high around 1.0875 for potential resistance. The combination of resistance factors will likely cause the price to drop towards the 100 and 200 SMAs plus the 1.08 pivot.

USDCHF dropped to the 0.91 pivot, which recently showed clear flips between support and resistance. The price will probably find support at 0.91 and rise to test the 0.92 level.

Bank of Japan Governor Expresses Unique Inflation Concerns

Bank of Japan Governor Kazuo Ueda gave a speech in Tokyo on the central bank outlook. He noted "uniquely difficult" concerns over inflation-targeting frameworks following many years of easing monetary policy. He mentioned that it's difficult to estimate neutral interest rates accurately in Japan, given the near-zero short-term rates over the last three decades.

However, on a positive note, Ueda said Japan has "made progress in moving away from zero and lifting inflation expectations."

After the news, USDJPY found support at the previous swing high around 156.50 and looks set to climb to the extreme high of the chart, as shown below. The price will probably find resistance between 158.50 and 160.

0 notes

Text

Three fundamentals for the week:

focus on Fed's favourite inflation figure

An explosive end to May – that is what a key inflation figure promises traders on the last day of the month after a slow start to the week due to bank holidays in the US and the UK.

US Consumer Confidence kicks off the week on Tuesday and it is expected to show the fourth consecutive decline. Weaker sentiment implies softer spending and, eventually, lower interest rates.

Lower confidence deteriorating due to inflation fears would boost the US Dollar and hurt other assets, while an improvement in sentiment due to lower inflation expectations would mostly help stocks.

US GDP to confirm Q1 weakness and growth may also include a downgrade to 1.4% from 1.6%. Any softer read of inflation would boost markets. The US economy is powered by personal consumption, and as long as this figure remains robust, there will be no real recession worry.

Core PCE, the Fed's preferred gauge of inflation, is set to trigger high volatility on Friday. The core Personal Consumption Expenditure Price Index is set to show a monthly increase of 0.3% MoM in April, but some expect it to be lower.

The Fed's targets 2% core PCE YoY, and as of March, it stood at 2.8%. Markets expect it to remain steady in April, so any drop would be welcomed. weaker core PCE figures, boosting stocks and Gold, while pushing the US Dollar and yields lower.

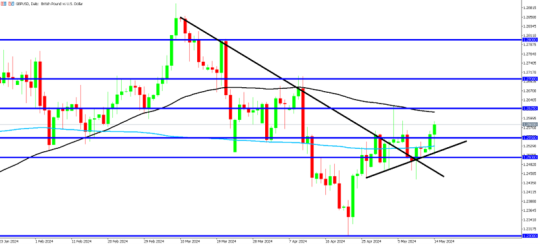

GBP/USD climbs to new two-month high

The Pound US Dollar (GBP/USD) started the surge last week following renewed signs that US inflation is back on track and climbed 0.30% against the Greenback on Monday amid thin liquidity conditions in observance of UK and US holidays.

Traders bet that BoE will be more hawkish than Fed in the second half of the year.

The latest inflation data is due for release mid-week. Forecast to have notably eased in April, rapidly cooling inflation may see BoE rate cut bets surge, in turn denting the Pound.

GBP/USD Price Analysis: Technical outlook

Cable, from a daily chart perspective, could challenge the March 21 high at 1.2803. If cleared on further strength, up next lies the year-to-date (YTD) high at 1.2894. Sellers could keep the pair within the 1.2700 – 1.2800 range ahead of the release of the US PCE on Friday.

In the short-term, the RSI shifting overbought suggests that buying pressure could be fading. In that event, sellers could step in once the RSI pierces below 70. If the GBP/USD retreats below 1.2750, the next stop would be the current day’s low of 1.2728. Once cleared, the next stop would be the 1.2700 mark.

0 notes

Text

UK Retail Sales Plunge Over 2% while Missing Forecasts

UK retail sales hit -2.3%, far lower than -0.5% forecasted and -0.2% last month. A decline in retail sales was expected as the usual wet weather in April deterred shoppers.

Sales volumes were down across most sectors, particularly in clothing, sports equipment, and furniture stores, causing a 0.8% year-on-year drop. However, with summer soon to arrive and inflation nearing the 2% target, retailers remain hopeful that consumer confidence will return.

Following the release, GBPUSD rose above the 1.27 level which saw strong resistance last month. The price looks set to test the 200 SMA (blue line), upper flag trendline, and 1.2850 area soon for potential resistance.

EURGBP broke out from the ascending flag and is testing the 0.85 level for support. The 0.85 level has seen multiple swing lows recently and looks set to hold as support along with the descending trendline. The price will probably pullback up to test the 0.8550 level soon.

US Unemployment Claims Hit the Largest Back-to-Back Drop since September

US unemployment claims were 215K, down from 220K forecasts and 223K last week. The positive news was helped by the slowing of job cuts while labour shortages eased.

During the previous six months, claims have been within a narrow range near historically low levels. The Federal Reserve is looking for weaker demand while balancing reducing inflation and avoiding a spike in unemployment.

After the news, EURUSD returned to the descending trendline and will likely test the 1.1 pivot for resistance soon. The price has broken out from the descending wedge and an additional descending trendline, which will likely provide support.

0 notes

Text

USD index rebounds, Crude Oil rides roller coaster

Jon Hopkins

US stocks ended lower on Thursday, dragged down by interest rate cut uncertainties which undid the earlier benefits of tech sector strength following positive earnings and guidance news from Nvidia.

Equities were knocked by growing concerns that US interest rates will remain higher for longer than expected, especially after repeated warnings from the Federal Reserve on sticky inflation.

Minutes from the central bank’s meeting published on Wednesday cemented fears that the Fed was growing less confident that inflation is moving sustainably back towards its 2% annual target.

DXY H4

On Thursday, the S&P Global Flash US PMI Composite Output Index rose sharply, up from 51.3 in April to 54.4 in May, with the report also highlighting "the rate of inflation accelerating to register the second-largest monthly increase seen over the past eight months”.

Adding to fears about demand-led inflation, US initial jobless claims fell by 8,000, more than expected, to a seasonally adjusted 215,000 in the week ended May 18.

Atlanta Fed president Raphael Bostic, however, said in comments on Thursday that the last couple of inflation prints suggest inflation remains on track to return to the Fed’s target, albeit at a slow pace.

At the New York close, the blue-chip Dow Jones Industrials Average was down 1.5% at 39,065, its worst session of the year so far. Meanwhile, the broader S&P 500 index shed 0.7% to 5,267, and the tech-laden Nasdaq Composite lost 0.4% to 16,736.

NAS100 H4

Nvidia, considered a bellwether for tech and artificial intelligence (AI) demand, jumped 9.3% reaching a record high, after its first quarter earnings, released overnight on Wednesday beat estimates. The firm also gave a stronger-than-expected revenue forecast for the current quarter and announced a 10-for-one forward stock split.

Nvidia’s strong earnings had earlier lifted other major chipmakers, but only Broadcom clung onto its gains, up 1.1%, while Advanced Micro reversed to a 3.3% loss.

Elsewhere, Live Nation Entertainment dropped 7.8% on a report that the Department of Justice is planning a lawsuit against the firm over allegedly monopolistic practices by its Ticketmaster unit, and that lawmakers were also seeking a separation of Ticketmaster from the firm.

Boeing fell 7.6% after the aircraft maker warned investors that its cash flow could take a bigger hit than the $3.9bn seen in Q1, making it unlikely that it would be able to turn cash flow positive for the year.

Crude prices were weak, extending their recent series of losses to a fourth straight session. USOIL was 0.6% lower at $77.07 per barrel, while UKOIL fell 0.4% to $81.57 a barrel.

USOIL M15

Both oil benchmarks shed more than 1% Wednesday as the Fed minutes pointed to US interest rates remaining at elevated levels for some time.

0 notes

Text

UK100 retreats as CPI misses, GBPUSD higher

Jon Hopkins

UK stocks fell Wednesday as the latest consumer price index (CPI) missed forecasts, meaning a hoped for cut in interest rates in June looks unlikely, even though the annual inflation rate is now much closer to the Bank of England’s 2.0% target.

UK CPI was up 0.3% month-on-month in April, which was less than the 0.6% rise in March but not as big a reduction as the 0.1% increase that economists had forecast. The CPI headline annual rate eased to 2.3%, down from 3.2% in March, but not as low as the 2.1% the market had expected.

UK100 Daily

A first Bank of England rate cut is now predicted to come in August, which would likely be after an expected European Central Bank cut in June but ahead of any move by the US Federal Reserve, which is predicted for September.

On currency markets, the pound jumped higher lifted by expectations that UK interest rates would be higher for longer. Sterling was up 0.2% versus the US dollar at 1.2731, having touched a two-month high, and added 0.3% against the euro to 1.1746.

The pound’s gains were also boosted by reports that UK prime minister Rishi Sunak would imminently announce an earlier-than-expected general election following an unscheduled meeting of his cabinet on Wednesday afternoon. That was confirmed after the stock market close, with the election to be held on July 4, meaning six weeks of political campaigning and consequent uncertainty over the outcome – although Labour holds a big 20-point lead over the incumbent Tories in the latest polls.

Before that general election date was revealed, the blue-chip FTSE 100 index ended down 0.6% points at 8,370, its biggest drop in over a month. Meanwhile the more domestically focused FTSE 250 index fell 0.4% to 20,710.

GBPUSD H4

Declines by heavyweight mining issues provided the main drag on the blue-chip index, as the dollar-earners were impacted by sterling’s strength and weaker commodity prices. Antofagasta lost 6.4%, Glencore shed 3.4%, and Rio Tinto was down 2.3%.

Housebuilders suffered on the expected further push-back to UK rate hikes, with Barratt Developments falling 2.1%, Persimmon shedding 1.4%, and Berkeley Group losing 1.3%.

Other big fallers included Ocado, down 3.2%, as the online grocer’s legal wrangle with its partner Marks & Spencer (M&S) was spotlighted by the latter’s strong results.

M&S was the top FTSE 100 riser, up 5.9%, after the high street retailer restored its dividend after a four-year gap as it reported a bigger-than-expected jump in annual profits.

0 notes

Text

USDCAD rebounds as Canadian CPI cools, Fed upgrades economic outlook

Sabir Houssain

Canadian Inflation Cools as USDCAD Rebounds Sharply

Canadian CPI was 0.5%, down from 0.6% previously, while the Median CPI declined to 2.6% from 2.9% last month. Grocery prices contributed significantly by dropping 1.4% annually last month. However, from a longer-term perspective, grocery prices have risen by 21.4% from April 2021.

On the other hand, increasing global oil prices and home ownership costs are likely to continue being major contributors to inflation.

After the release, USDCAD spiked before declining rapidly after finding resistance at the ascending trendline and 1.3650 pivot. The price looks likely to test the 1.3550 pivot for support, along with a potential intersection of the 100 and 200 SMAs.

EURCAD is within a narrow ascending flag that is contained in a larger one, as shown below. If a breakout higher occurs, there is a large amount of space for the price to hit 1.49 before any major resistance levels.

US FOMC Member gives a Highly Encouraging Outlook

On Tuesday, high-profile US FOMC member Waller gave a speech about the economic outlook and monetary policy. He gave a positive outlook, mentioning that restrictive monetary policy is cooling inflation and that progress towards 2% has likely resumed.

Furthermore, Waller said, “the probability of rate hikes is very low", and that progress back to 2% inflation may be slower than we saw last year. Additionally, he ruled out that inflation is reaccelerating.

Following the speech, USDJPY is finding resistance at the upper wedge trendline and 156 level. The recent bullish trend looks likely to push the price towards the extreme highs around 158.

0 notes

Text

Wall Street scores another ATH, gold makes history

Federico Russo

The Nasdaq closed at a record high on Monday and gold jumped to an all-time high as investors weighed hawkish statements from the Federal Reserve against evidence of cooling U.S. inflation.

The Nasdaq is being led higher by Nvidia ahead of its closely watched earnings report on Wednesday and expected to dominate global equity trading this week.

Comments from Fed officials have reflected the U.S. central bank's cautious view of its progress in reining in inflation and the timing of interest rate cuts.

FED official said on Monday it was too early to tell if inflation slowdown is "long lasting," and it has been stated again that restrictive policy needs more time and take will take a while for the central bank to be confident that price growth is on a sustainable downward path.

The market is irrational; it started the year expecting six interest rate cuts, but then the pendulum swung completely to the other side, and everybody was talking about increases.

NAS100 H4

Nasdaq 100 Technical Overview

NASDAQ tests resistance at 18,600 – 18,700 amid rising demand for tech stocks. Micron and NVIDIA are among the biggest gainers in the NASDAQ index today as traders stay focused on the potential of AI technology.

If NASDAQ manages to settle above the 18,700 level, it will head towards the 19,000 level. RSI is in the overbought territory, but there is some room to gain additional upside momentum.

Gold price trends higher despite hawkish Fed comment

Gold price extended its gains on Monday, yet it trades slightly below the all-time high of $2,450 reached during the Asian session amid increasing expectations that major central banks, including the Federal Reserve, might ease policy during 2024.

This and last week’s softer-than-expected consumer inflation report in the United States (US) boosted bets that the Fed could slash borrowing costs as soon as September.

Odds that the Fed would cut rates by 25 bps in September are at 76%. Investors have begun to price in two cuts toward the end of the year, which would leave the fed funds rate at 4.75%-5.00%.

Technical analysis

Gold price hits $2,450 as bulls target $2,500

XAUUSD H1

Gold prices remain set to test higher prices after hitting a new all-time high of $2,450, which could open the door to further gains. Traders should know that momentum supports buyers as the Relative Strength Index (RSI) continues to aim higher but is not yet at overbought readings.

If XAUUSD breaches the all-time high, the next stop would be $2,475, followed by the $2,500 mark.

Conversely, if XAUUSD retreats below $2,400, that could expose the May 13 low at $2,332, followed by the May 8 low of $2,303.

0 notes

Text

Dollar falls further after higher unemployment claims, Euro pushes higher

Sabir Houssain

US Unemployment Claims Rise as EURUSD Shoots Up

US unemployment claims were 222K, up from 219K forecasted and 232K previously. As the nation's earliest data on assessing overall economic health, this is a good indicator of future results.

Meanwhile, the actual number of initial claims under state programs was 196,72, which is lower than the 199,654 claims from the same week in 2023. Seasonal factors caused many to expect a more considerable decrease in unemployment claims; however, a significant increase in claims in New York offset this amount.

Following the release, EURUSD broke out from the descending trendline to test the 1.0850 level for potential resistance. The price showed rapid bullish momentum after breaking the inside bar from the prior week and now looks likely to hit the 1.1 pivot soon.

EURUSD Weekly

GBPUSD also showed US dollar weakness as the price climbed back to the ascending trendline. The 1.27 level will probably provide resistance, pushing the price back towards 1.25.

GBPUSD Weekly

Eurozone Inflation Stabilises following CPI Results

European Final Core CPI has helped push inflation figures back towards normal target rates as it hit 2.7%. Compared to last year, annual inflation was far higher at 7%. The nations that contributed the lowest annual inflation rates were Lithuania at 0.4% and Denmark at 0.5%.

Despite most nations producing far lower rates compared to last year, Romania hit 6.2%, and Belgium reached 4.9%. Overall, inflation fell in fifteen member nations, remained stable in four and increased in eight.

After the news EURJPY rose to test new highs around 170. The price has recently found consistent support from the ascending trendline, which looks likely to hold as support along with the 165 level.

EURJPY weekly

0 notes

Text

Dow makes history at 40,000, UK100 and GBP slide

Jon Hopkins

UK blue chips fell modestly on Thursday, retreating from recent record highs as some heavyweight companies including oil major BP traded ex-dividend, while a big drop by software firm Sage Group also weighed on the benchmark index.

At the London close, the FTSE 100 was down 0.1% at 8,438, notching up its worst session in a month. But the mid-cap FTSE 250 index ended 0.2% higher to 20,822, continuing to inch towards the key 21,000 mark.

Among the weak blue chips, BP fell 1.5%, GSK lost 1.6%, Tesco shed 1.3%, and Kingfisher dropped 2.8% as the stocks all traded without entitlement to their latest dividend.

UK100 Daily

Sage Group was the top loser on the FTSE 100, down 9.4% after the enterprise software firm lowered its annual revenue forecast. And discount airline easyJet fell 6.0% after it reported a first-half loss largely in line with company expectations ahead of a busy summer season.

But on the upside, BT Group was the top FTSE 100 gainer, jumping 17.2% after the telecoms, broadband and mobile operator's new CEO, Allison Kirby set out a path for a more than double free cash flow over the next five years.

Elsewhere in the telecoms sector, FTSE 250-listed Helios Towers soared 12.0% higher after it reported well-received first-quarter results.

Watches of Switzerland was also the top mid-cap riser, up 19.9% jump after the luxury retailer said it was 'cautiously optimistic' about 2025.

The UK data calendar was light on Thursday, which put the spotlight on a speech from Megan Greene, an external member of the Bank of England’s monetary policy committee, which proved fairly hawkish on interest rate cut expectations. Greene said she wanted more evidence of persistent waning inflation, particularly in the tight labour market.

GBPUSD H4

On currency markets sterling was flat against the euro at 1.6153 and a touch weaker versus the US dollar, losing 0.12% at 1.2669.

Weekly US unemployment data revealed that layoffs have remained at a historically low level. Jobless claims for the week to May 11 dropped by 10,000 to 222,000, the US labour department revealed.

US30 H4

But Wednesday’s softer-than-expected US inflation report reignited hopes that the Federal Reserve could sanction two rate cuts this year.

0 notes

Text

Wall Street march to record high after cooling CPI

Jon Hopkins

US stocks powered higher on Wednesday, with all three major indexes jumping to all-time highs after consumer inflation cooled more than expected, lifting hopes for the Federal Reserve to cut interest rates sooner.

The US consumer price index (CPI) slowed to a 0.3% increase in April, down from 0.4% a month earlier, lower than market expectations for a 0.4% rise, while the annual figure fell to 3.4%, down from 3.5%, in line with forecasts. The core CPI inflation rate eased to 3.6% from 3.8% in March.

DXY M30

Elsewhere on the economic front, US retail sales were unchanged in April, weaker than forecasts for a 0.4% rise.

The slowdown in consumer prices came a day after April producer price inflation came in stronger than expected. Traders now see a 50.5% chance that the US central bank will start cutting rates in September. Treasury yields fell sharply on the CPI news, while the dollar also dropped.

At the New York close, the blue-chip Dow Jones Industrials Average was up 0.9% at 39,908, while the S&P 500 added 1.2% at 5,308, and the Nasdaq Composite ended 1.4% higher at 16,742, all at closing peaks just below earlier intraday records.

US30 H4

Big tech stocks led the market rally, with Apple adding 1.2%, Google owner Alphabet up 1.3%, and AI chip maker Nvidia ahead 3.6%.

Elsewhere, Monday.com soared 21.4% after the cloud-based platform provider saw its first-quarter earnings beat expectations and it hiked its full-year forecasts.

NAS100 H4

But on the downside, after strong gains earlier this week two meme stocks came down to earth, with AMC Entertainment dropping 20.0% after the cinema chain announced a debt-for-equity swap, while GameStop stock fell 18.8%. Before Wednesday, GameStop and AMC were up 179% and 135%, respectively this week.

Away from tech, Boeing fell 2.1% after the Department of Justice said the airplane manufacturer had violated a settlement that prevented it from facing criminal prosecution related to two fatal 737 Max crashes.

SPX500 H1

Elsewhere, oil prices were higher as the dollar fell, while a much larger-than-expected draw in US weekly inventories offset a weaker forecast for demand growth this year from the IEA.

UK Brent crude rose 0.7% to $82.95 a barrel, and US West Texas Intermediate rose 1.1% to $78.84 a barrel.

0 notes

Text

Dollar lower despite strong PPI, GBPUSD jumps past resistance

US PPI Beats Forecasts Significantly

Sabir Houssain

US PPI was 0.5%, up from 0.3% forecasts and -0.1% last month. Core PPI (excluding food and energy) was released simultaneously and hit 0.5%, which is over double the forecasts.

Most of the PPI increase is attributable to final demand services, which rose by 0.6%, the most significant increase since July 2023. Additionally, final demand goods increased by 0.4% in April, with a 5.4% rise in gasoline prices contributing. significantly. However, in contrast, prices for final demand warehousing and transportation decreased.

Following the release, EURUSD has continued to show bullish momentum after breaking out from the descending trendline and finding support at the 200 SMA (blue line). The price is testing the 100 SMA (black line) and will likely pull back to find support at the 1.08 pivot.

EURUSD Daily

USDJPY has rebounded from the 152 pivot and ascending trendline. The price will likely hit the extreme high at 160 before pulling back to test the 155 level and ascending trendline for potential support.

USDJPY Daily

UK Claimant Count Falls Below Forecasts as GBPUSD Rises Sharply

The UK Claimant Count indicates that the labour market is cooling as it dropped to 8.9K from 13.9K forecasts, which is good for the economy.

Despite the number of people claiming unemployment benefits, unemployment has gone up recently to 4.3% while wage growth is slowing. Vacancies are down, and as a ratio to the number of unemployed workers, it's not far from the 2019 average.

After the news, GBPUSD found support off the 1.2550 pivot, which has confluence with the 200 SMA. The price looks likely to find resistance around 1.2625, which has a previous swing high and the 100 SMA (black line) nearby.

GBPUSD Daily

0 notes

Text

Five fundamentals to watch this week

Federico Russo

Inflation figures for April and what the Fed says are set to trigger high volatility in markets which will be battered by four consecutive worrying releases of the all-important Consumer Price Index.

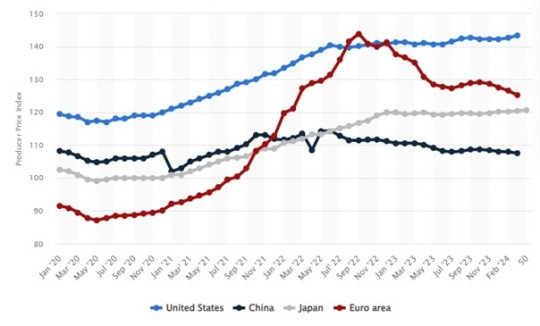

1. Warm-up with PPI. The reading of the Producer Price Index will be on Tuesday, the most important figure is core PPI, which hit 2.4% in March. Any increase would trigger worries, boosting the US Dollar and weighing on Gold. A stable read or a drop would buoy Gold and weigh on the Greenback.

2. Fed Chair Powell speaks. On Tuesday Powell will address an audience in Amsterdam and markets will probably scrutinize every word on his thoughts about interest rates which could trigger action.

3. US CPI, the peak news of the week and perhaps of the month, will be released on Wed. Underlying inflation is expected to have risen by 0.3% in April, a touch lower than the 0.4% seen in each of the past three months. Forecast expect the most critical data, the core CPI YoY, would drop to 3.6% from 3.8%, getting the annual figure closer to the Fed's 2% target.

Any 0.1% surprise in core CPI MoM would obviate retail data. In case of little or no surprises in the CPI report, Retail Sales figures published simultaneously would also have their say.

A weak inflation report would boost risk assets and weigh on the Greenback.

4. US jobless claims on Thursday will also be of interest after stealing the spotlight last week. The data will be of greater interest than usual since early this month Fed Chair Powell talked about "unexpected weakness" in labour markets as a reason to accelerate rate cuts. Since then, Nonfarm Payrolls have shown softer hiring.

5. Fed's Waller speech on Friday attracts importance since he’s a permanent voter and anything he will say could be interpreted as the bank's thinking after the CPI data and could trigger significant movements.

Gold Pulls Back

Gold prices trade on a negative attitude on Monday, remaining on the back foot amidst some recovery in the Greenback ahead of the release of US PPI and CPI later in the week, prompting XAU/USD to retest the $2,330 region per troy ounce.

XAUUSD H1

Traders will continue to look at this as an opportunity to get long occasionally on these dips. The $2,300 level is more likely than not going to be the floor.

Gold Markets Technical Analysis

The bullish stance of the yellow metal remains intact as it holds above the key 100-day Exponential Moving Average (EMA) on the four-hour chart. The upward momentum is supported by the 14-day Relative Strength Index (RSI) which stands in bullish territory around 63.50, suggesting the further upside looks favourable.

The first upside barrier for XAU/USD will emerge near a high of May 10, $2,378, en route to the $2,400 psychological level. A decisive break above this level could clear the path for a rally to the next major resistance near an all-time high near $2,432, and then the $2,500 figure.

XAUUSD H4

On the downside, the key support level is seen near the confluence of the resistance-turned-support level and the 100-period EMA at $2,325. Further south, the next contention level is located near a low of May 2 at $2,281.

There are geopolitical concerns, interest rate concerns, central banks around the world getting ready to cut again, central banks around the world buying gold, and a multitude of plenty of other reasons why the yellow metal looks attractive and in a bullish market.

0 notes

Text

US inflation to dictate markets, major indices inch higher

Daniel Thompson

As we embrace a brand-new week, traders are actively adjusting their exposure as the US April inflation data is scheduled to be released on Wednesday. Economists are now expecting both the core and headline inflation to cool from Marc, adding hope that major indices could grasp more momentum after the recent remarkable rebound.

The industrial-heavy US30 has continued its advance towards 40,000, now battling at 39,500 levels as day traders cautiously scalp profits ahead of inflation data release.

US30 H1

For the tech laden NAS100, buyers have been keen to propel the index higher with a momentum strong enough to breach the top band of the ascending tunnel. The index is now sitting at 18,165, approximately 230 points away from its next resistance level at 18,391.

NAS100 H4

Similar price actions are taking place on the more broad-based SPX500. The index has mostly recovered from the recent plunge to 4,922 and is now back above 5,220, only 50 points away from the historical high in 5,278.

SPX500 H1

Traders should be aware of downside risk should Wednesday’s CPI beat expectation and use the lower band of corresponding ascending tunnels as a guide to finding support levels.

0 notes

Text

UK100 breaks another intra-day high, dovish BoE led GBPUSD higher

Jon Hopkins

UK blue-chips surged to another all-time peak at 8,396 on Thursday but ended below that high – albeit at another record close – as the Bank of England’s (BoE) held rates for another month but inched closer to a cut.

As expected, the BoE’s Monetary Policy Committee (MPC) maintained its key interest rates at 5.25%, but two members voted for a cut, one more than at the last meeting, and none of the nine opted to vote for an increase for the second meeting running.

In a news conference after the meeting, the central bank’s governor Andrew Bailey said interest rates will need to be cut in the coming months at a faster rate than money markets have forecast. Markets are now pricing in two rate cuts to take place in 2024, the first of which is either in June or August.

UK100 Daily

Adding to those rate cut hopes, the RICS UK House Price Balance, which measures the gap between the percentage of respondents seeing rises and falls in house prices, remained unchanged at -5%.in April.

Sterling was mixed after the dovish BoE news. Against the dollar, the pound ticked up 0.13% to 1.2512, but versus the pound lost 0.12% at 1.1611.

On the stock market, at the London close, the FTSE 100 index was 0.3% higher at 8,381, while the broader FTSE 250 index added 0.2% at 20,531.

Among the day’s company news front, on the FTSE 100, BAE Systems gained 0.8% after the defence firm said it was on track to meet guidance for higher earnings And IMI rose 0.3% after the specialised engineering firm confirmed its full-year guidance.

But investment firm 3i Group was the top FTSE 100 faller, down 5.2% after it recorded a total return of 23% for its 2023/24 financial year, down from 36% a year earlier.

GBPUSD H4

On the FTSE 250, ITV added 1.8% even though the broadcaster posted a 7% year-on-year fall in total revenues for the first quarter to £887 million. The decline was attributed to a 16% drop in ITV Studios’ advertising revenue, reflecting the phasing of deliveries and the impact of the US film industry strikes. But there was some optimism that the advertising slump may be nearly an inflection point.

Harbour Energy, the largest UK-listed North Sea oil and gas producer, was the biggest gainer on the FTSE 250, adding 7.7% after it said it expects to generate significantly higher free cash flow next year.

0 notes