Link

7 notes

·

View notes

Text

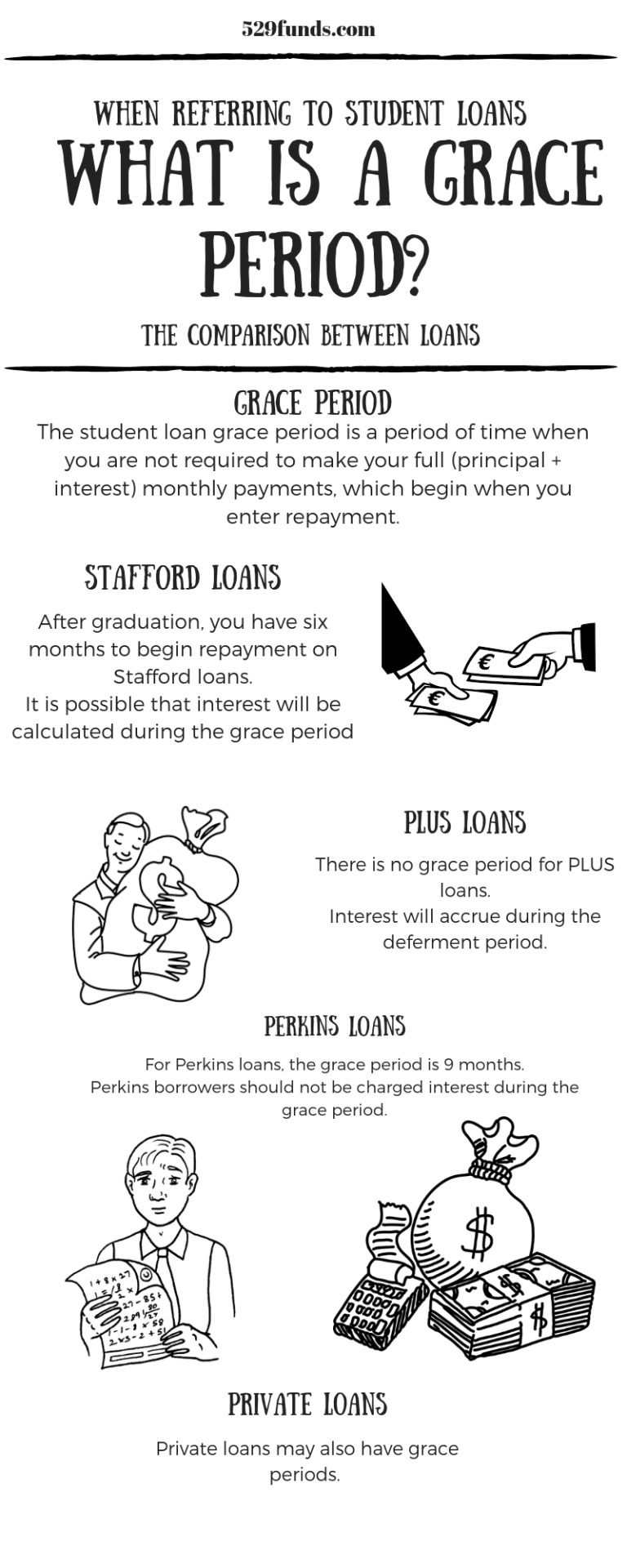

When referring to student loans, what is a grace period?

What exactly is a student loan grace period?

Read the full article

#whenreferringtostudentloanswhatisagraceperiod#studentloangraceperiod#graceperiod#studentloan#529funds.com

1 note

·

View note

Text

What is a Direct Subsidized Loan?

The Direct Subsidized Loan is a federal student loan available to students with demonstrated financial need. It's one of the least expensive loan options for students. The cheapest because the federal government pays the interest while:

The student is attending college on at least a half-time During other periods of authorized deferment.

This interest subsidy effectively gives the loan a zero percent interest rate during the in-school and other deferment periods. On the other hand, on unsubsidized Federal Stafford loans, the government does not pay the interest.

Direct Subsidized Loan Quick Facts

Interest is subsidized while the borrower is in school Eligibility is based on financial need, as determined by the FAFSA Cumulative loan limit of $23,000 A low origination fee of about 1% How Subsidized Loans Work

Generally, direct subsidized loans, are available to borrowers who can show financial need. The borrower does not have to pay interest on the debt, at least temporarily. That makes subsidized loans less expensive to borrow.

So how subsidized loans work?

When you raise a loan, you expect to pay interest, for example at the monthly or annual base. But if your interest costs are subsidized, you will not have to pay this cost either in the form of higher monthly payments in the future or as a monthly payment to cover the interest charges.

Who Provides the Money

That depends on the type of loan, but generally, any part can subsidize a loan. That can be a government organization, a charity, or some other group.

Definitely, among the most common types of loans that receive subsidies are student loans. For certain students, beneficiaries of these subsidies, the US Government will pay interest costs. So, for example, students with subsidized Stafford Loans enjoy interest-free borrowing while they stay enrolled in school.

How You Qualify for Direct Subsidized Loan

How You Qualify

The direct subsidized loan is not for everyone. Usually, it offered only to those who qualified. If you want to apply for a subsidized loan you need to demonstrate financial need or meet other criteria because there are annual and lifetime limits on how much you can borrow.

Other restrictions might include the need for a purchased home to meet health and safety standards, and the need to limit the profits you can earn on the sale of your home.

Subsidized Student Loans

As a user of the subsidized loan, you will have no interest charged as long as you demonstrate financial need. As long as you show the financial need and you meet the requirements, you will be able to be the beneficiary of this loan.

Requirements:

You are enrolled in a qualified educational program at least half-time, orYou are in a six-month grace period after graduation, orYour loans are in deferment.

To apply for these loans you need to fill FAFSA form. In the application, you need to indicate the amount of money you need. The amount of money you need must be greater than the one you have at your disposal (your funds). Your direct subsidized loan will be limited based on the cost of attendance at your school.

Indeed, the best option for you is to receive a subsidized loan, if possible. In case you need more money, you can choose the unsubsidized loan. It is important to borrow as much as you need because after you finish school, you’ll have to pay it all back.

NOTE: This relates only to undergraduate students. Graduated students and professionals have to pay interest on everything they borrow because they can’t get subsidized loans.

Options for Unsubsidized Loans

If you have an unsubsidized loan, you have the option of choosing how to handle the interest to minimize it. It is necessary to find the best opportunity to reduce the amount you will pay over time. Possible options are:

Pay as you go: If you can afford it, this is the best option, is to pay interest charges as they get assessed. This approach allows you to reduce the total debt as well as the amount you’ll have to pay every month for years to come. In the end, it will result in a reduction in the total amount you would pay in interest on your education debt.

Capitalize interest: This option allows you to add interest charges on your loan balance. In this case, instead of making payments to cover the costs as they come up, you “borrow” more each time interest is charged.

This will lead to an increase in the balance of your loan. Even though you will not receive more money, unpaid interest will be added to your balance, and the balance will increase. Also with this option, you will have higher costs and therefore higher monthly payments in the future.

Read the full article

0 notes

Text

When referring to student loans, what is a grace period?

What exactly is a student loan grace period?

Read the full article

0 notes

Text

What Are 529 Plan Rules?

We will all agree that the 529 plan represents one of the better ways to save for education. However, what exactly are the rules that distinguish this plan? We know that unlike with several investments accounts, the federal governments allow that 529 plan earnings to grow tax-free. Also, if you use that money for qualified higher education expenses, your withdrawals will be tax-free also.

However, how do all this work and what are the rules, and what are the deviations? Below we will explain this in more detail and show you how to take advantage of the most significant benefits of this plan.

529 Plan Tax Rules

If you don’t use 529 plan money on qualified expenses, you’re making a nonqualified withdrawal. In this case, you will face with federal income tax at your bracket plus a 10% penalty. Also, in addition to state income tax on the earnings portion of your withdrawal, The IRS may also require you to pay back any previously claimed tax deductions on your contributions.

How does your earnings portion break down? It depends on the size of your account at the time you made the nonqualified withdrawal.

This largely depends on the laws in the state you pay your taxes. So, concerning unqualified cash withdrawals, it is best for you to consult with your financial advisor or certified public accountant (CPA) in your state to measure the ultimate impact of a nonqualified withdrawal. However, no matter of a percent of the penalty or final cost, this will reduce your savings, which should be invested into your or your child educational future.

529 Plan Rules by State

Most people think it’s possible to open a 529 plan only in the country where they live. That is confusion. Even your child does not have to enroll in a college in the state in which the 529 plan was opened. He can freely choose the college that best suits him. It's is just one of the many benefits of this savings plan.

529 account can open any U.S citizen or resident alien with a valid Social Security number or tax identification number. You can open a 529 saving account in New York, for someone who lives in Florida and ends up going to school in California.

Indeed, there are some limits, and they vary from state to state. Therefore, you need to be adequately informed when choosing and opening your 529 accounts. For example, every state that sponsors the 529 plan set their contribution limits. These limits vary across the country, but you can expect that they usually stech from about $350,000 to $500,0000.

The exception to this is the 529 prepaid plan. As the name implies allows you to prepaid tuition at an in-state public college. You have to be careful with this plan because it makes sense only if you are sure that your child will attend an in-state, public school.

529 Plans and Gift Tax Rules

People often hesitate to open a 529 plan because they don’t understand how all that works or they don’t understand some terms. As for the withdrawal of funds, most do not follow a “qualified higher education expenses” term. That part seems like an intricate part of the tax code to understand, but it’s not at all.

So what are qualified higher education expenses? What counts under them? Well, qualified education expenses are all tuition and mandatory fees at an eligible school, room, and board expenses, off-campus room, book, and school supplies, etc.

You can find all qualified higher education expenses listed on IRS report: Eligible expenses aren’t:

Transportation to and from campus College insurance policies Medical expenses incurred at college Campus health club memberships The fees offered to school-sponsored clubs even if they’re educational in nature.

Also, to determine the expenses, you’d need to cover for a given academic year, and whether they’re qualified, you should reach out to the financial aid office, at the school your child is enrolled.

NOTICE: If you have any 529 plan activity like transactions and withdrawals, you need to fill the form 1099-Q and report it to the IRS.

529 Plan Contribution Rules

The federal government treats 529 plan contributions as gifts toward the beneficiary for tax purposes. However, since 2018, if you contribute more than $15,000 to an individual in a year, you’d trigger a gift tax. The same applies to a married couple filing jointly that contributes more than $30,000.

However, 529 plans offer a kind of exception. Individuals can contribute $75,000, and married couples can transfer up to $150,000 per year toward a 529 plan, as long as contributions are paused throughout the next five years. This rule stretches out the gift tax exclusion throughout five years. So say you contribute $50,000 one year. The IRS treats it as $10,000 contributed through five years. For the next four years, you could contribute up to $25,000 without incurring a gift tax.

Also, if a donor dies within those five years, a portion of the contribution will be included in his or her estate for estate tax purposes. Because all this it will be smart to consider to have a qualified tax advisor.

529 Plan And Scholarship Rules

If your child receives a scholarship, you don’t need to worry that the scholarship will jeopardize your 529 savings. In this case, you can make a nonqualified withdrawal in the amount of the tax-free scholarship while avoiding the 10% penalty.

If your child attends a U.S military academy, the IRS will waive the 10%penalty. But, keep in mind that you still owe federal income tax and possibly state income tax on the earnings portion of the withdrawal.

If your child receives a full-ride scholarship, don’t worry, you don’t have to give up your savings. In this case, you will have several options for disposing of. Your child will be able to use funds for qualified expenses in future education. Also, you can switch the beneficiary to anyone in your child’s immediate family without penalty.

Also, you can raise funds, but in this case, you are faced with penalties for raising money for unqualified costs.

529 Plan Rules And Financial Aid

Having a 529 plan may affect your child’s eligibility for federal financial aid. Generally, the impact is minor and depends on several factors such as the identity of the account holder.

It’s crucial to understand the nuances of 529 plan rules on this front. When the student fills out a Free Application for Federal Student Aid (FAFSA), in case that the parents are the account holders, the government will treat the 529 plan as a parental asset. However, only a maximum of 5.64% of the account value will be factored into the student’s Expected Family Contribution (EFC).

U.S Department of Education uses this formula to determine a student’s federal financial aid eligibility.

In case student savings for college is the account holder, the government will treat the 529 plan as his or her assets.

Up to 20% of the money on the account will be included in the EFC student. Of course, the number of maximums that will be included in EFC depends on other factors. Some of them are external assets and income of the household.

In case that your grandparents, ants or other relatives other relative or anyone else besides a dependent student or one of their parents will not affect the student’s FAFSA because the balance of the plan will not be counted as an asset at all.

To conclude, the federal government treats different assets and incomes depending on the sources from which they come from. Because of this approach, students with a similar financial situation but a different relationship to the people who opened 529 plans for them could get drastically different financial aid packages

Distributions for qualified higher education expenses will be considered the student’s untaxed income when he or she fills out additional FAFSAs.

529 plan will have a minor dent on the beneficiary financial aid eligibility when the custodial parent opens the account. On that plan family and friends can contribute to the plan as well. Some states even allow them to make a tax-deductible contribution.

529 Plans and K-12 Rules

According to Trump’s tax plan you can use up to $10,000 in a 529 plan to fund tuition and private religion and even public K-12 School per year. Many lawmakers are analyzing how to treat this withdrawal for state tax purposes. Be careful check how laws in your state regarding 529 plan rules.

Also, check which state offer 529 plans tax breaks for K-12 savers? Because, some states do not provide state income tax deductions or tax credits for K-12 tuition, but distributions for K-12 tuition are state-tax free.

The Takeaway

Let’s be honest 529 plans offer many benefits, but you need to follow the rules. How to make the most out of tax perks, it will be smart to use 529 plans only qualified education expenses. As long as you play by the rules the IRS we let you enjoy all the benefits of 529 plans. On the other hand, if you don’t follow the rules you can expect some penalties.

Tips on Following 529 Plan Rules

If you can find a financial advisor to be sure that you will follow the 529 plan rules and make the most out of your savings. Pure research and try to be informed about the last low changes and all 529 plan rules.

If you don’t know what qualified expenses are you can visit the IRS website to find out. Also, you can contact ( if you have) a financial advisor or a representative at the school’s office of financial aid assistance. They can help you determine what your 529 plan investment does and doesn’t cover tax-free.

You can use money from a 529 saving plan to cover tuition at certain K-12 schools. You can cover up to $10,000 in tuition. However, these are qualified at the federal level. Lawmakers are still working out how to treat these withdrawals for state tax purposes.

As we mention, it is essential to follow all laws and news regarding 529 plans.

Read the full article

0 notes

Photo

https://529funds.com/529-plans-faq/

Everything you need to know about 529 plan

#529plan, #529planfaq

0 notes

Photo

https://529funds.com/pros-and-cons-student-loan-consolidation/

0 notes

Photo

https://529funds.com/when-referring-to-student-loans-what-is-a-grace-period/

0 notes

Photo

https://529funds.com/when-referring-to-student-loans-what-is-a-grace-period/

0 notes