#smefinance

Text

0 notes

Text

Empower Your Business Growth: Unveiling the Top 6 Collateral Options for SME Loans in Cambodia. Secure Your Financial Future Today! 💼🌐

0 notes

Text

Business Accounting: A Comprehensive Guide

Introduction

Welcome to the fascinating realm of business accounting. In this article, we will delve deep into the intricacies of managing finances, tracking expenses, and ensuring the financial health of your business. Whether you're a seasoned entrepreneur or just starting your business journey, understanding Business Accounting is essential for making informed financial decisions. Let's embark on this informative journey together.

Business Accounting Basics

What Is Business Accounting?

Business Accounting refers to the systematic process of recording, analyzing, and interpreting financial transactions within a business entity. It provides a clear picture of a company's financial health, facilitating decision-making and compliance with financial regulations.

The Importance of Accurate Accounting

Accurate accounting is the bedrock of a successful business. It enables you to monitor cash flow, make informed investment decisions, and fulfill tax obligations promptly. Without it, businesses may face financial instability and legal consequences.

Different Types of Business Accounting

There are various approaches to business accounting, including cash accounting and accrual accounting. Each method has its advantages and disadvantages, and choosing the right one depends on your business's size and financial goals.

Managing Financial Statements

Balance Sheets

Balance sheets provide a snapshot of a company's financial position at a specific point in time. They list assets, liabilities, and shareholders' equity, helping you assess your company's net worth.

Income Statements

Income statements, also known as profit and loss statements, detail a company's revenue and expenses over a specific period. They reveal profitability and indicate areas where cost optimization is necessary.

Cash Flow Statements

Cash flow statements track the flow of money in and out of your business. Understanding cash flow is crucial for managing day-to-day operations and planning for future investments.

Accounting Software Solutions

Streamlining with Accounting Software

Modern businesses leverage accounting software to simplify record-keeping, automate calculations, and generate financial reports efficiently. Popular choices include QuickBooks, Xero, and FreshBooks.

Choosing the Right Accounting Software

Selecting the most suitable accounting software depends on factors like business size, industry, and specific accounting needs. Research and compare options to find the perfect fit.

Taxation and Compliance

Tax Planning Strategies

Effective tax planning can significantly reduce a business's tax burden. Explore deductions, credits, and strategies to optimize your tax position legally.

Staying Compliant

Navigating the complex landscape of tax laws and regulations is a must for businesses. Compliance ensures you avoid penalties and maintain a good standing with tax authorities.

Frequently Asked Questions (FAQs)

What are the key differences between cash and accrual accounting?

Cash accounting records transactions when money changes hands, while accrual accounting recognizes transactions when they occur, regardless of when money is exchanged.

How often should I update my financial statements?

Regular updates, such as monthly or quarterly, are recommended. This helps you stay informed about your financial status and make timely adjustments.

Can I handle business accounting without software?

While possible, manual accounting is time-consuming and prone to errors. Utilizing accounting software is advisable for accuracy and efficiency.

What is the purpose of a trial balance?

A trial balance ensures that debits and credits in your accounting records are equal, helping to identify errors before financial statements are prepared.

Are there any tax advantages to incorporating my business?

Incorporating can offer tax benefits like lower tax rates and deductions, but it also involves additional compliance requirements.

How can I improve my business's cash flow?

Managing receivables, controlling expenses, and optimizing inventory turnover are effective ways to enhance cash flow.

Conclusion

In conclusion, Business Accounting is the lifeblood of any successful enterprise. It empowers you to make informed financial decisions, ensure compliance with tax laws, and drive the growth of your business. Whether you're a sole proprietor or a large corporation, mastering the art of business accounting is essential for long-term success. So, dive in, explore, and take control of your financial future.

#BusinessAccounting#FinancialManagement#SmallBusinessFinances#TaxPlanning#AccountingSoftware#FinancialStatements#CashFlowManagement#TaxCompliance#Entrepreneurship#FinancialPlanning#Bookkeeping#BusinessTips#TaxStrategy#SMEFinance#ProfitAndLoss#Budgeting#FinancialEducation#MoneyManagement#BusinessSuccess#FinancialAdvice#Toronto#Canada

0 notes

Photo

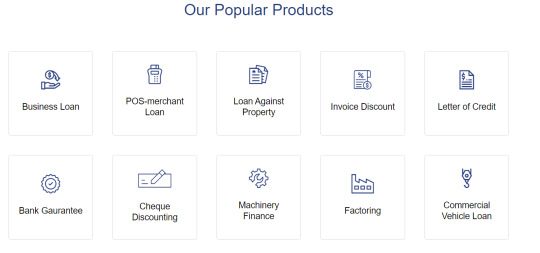

Don't let a lack of funding hold you back from reaching your full potential. Contact us today to learn more about our business loan options and take the first step toward a brighter future for your business.

Know More Visit - https://creditmoney.co.in/

Mail us - [email protected]

#BusinessLoans#SmallBusinessFunding#EntrepreneurialFinance#creditmoney#creditmoney11#WorkingCapital#money#Credit#BusinessExpansion#CapitalInvestment#CommercialLoans#BusinessGrowth#FinancialSupport#BusinessOpportunities#LoanOptions#SMEFinance#BusinessFinancing#BusinessLending#LoanPrograms#BusinessDevelopment

0 notes

Text

Steering through the horizon! 🌟 As we set sail into the new year, let's chart the anticipated economic and financing changes that could impact small businesses. Stay tuned as we unpack insights and strategies to navigate these waters effectively. Keep an eye on our page for updates!

youtube

Contact Us:

🌐 Visit our website: https://cgfsllc.com/

📞 Contact us: 1-307-456-1226

📧 Email us: [email protected]

#SmallBusinesses #EconomicChanges #FinancingStrategies #BusinessForecast #SMEFinance #AdaptingToChange #EntrepreneurshipJourney #FinancialAdvisory #BusinessStrategy #FutureOfFinance #AdaptiveBusiness #MarketTrends #SmallBizFinance #EconomicShifts #FinancialResilience #SmallBizStrategy #FinancingChallenges #BusinessAdaptability #EconomicForecasting #NavigatingChange @highlight

0 notes

Text

Navigating the CGTMSE Government Scheme maze so you don't have to! Consult with us to secure your business's future.

#CGTMSE #GovernmentScheme #BusinessSupport #SmallBusiness #CreditGuarantee #MSMEs #Entrepreneurship #FinancialSecurity #BusinessLoan #Startups #SMEFinance #CreditGuaranteeScheme #BusinessDevelopment #EconomicGrowth #SmallBizSupport #CGTMSERegistration #SMEsInIndia #StartupIndia #EntrepreneurSupport #FinancialInclusion

0 notes

Photo

For SME-Business Owners SowtexConnect brings to you a purposeful LIVE discussion on managing your risks during pandemic both personally and professionally. Join us for our Knowledge Session coming week on Thursday: Topic - Managing key organisational risks during pandemic Date: 24th June 2021 Time: 5:00-6:00 PM IST (11:30 UTC) Panelist - Puneet Oberoi, Senior Risk Analyst & Advisor. What to expect from the session: 💰How to mitigate risks against your assets in a business? 💰How to safeguard your Working capital? 💰How to prevent paying millions on liabilities? 💰How to safeguard your teams from unexpected liabilities? 💰How to safeguard personal finances from organisational liabilities? Pre-registration is must if you are not a part of SowtexConnect Community: https://event.sowtex.com/finadwise For any support call, Team Sowtex 📲 +91-9818355715 +91-9643201856 #textileindustry #smefinance #financialplanning #businessowners #insurance #riskmanagement #smallbusiness #sowtex #SowtexConnect #growyourbusiness https://www.instagram.com/p/CQS6SxBJ0Tv/?utm_medium=tumblr

#textileindustry#smefinance#financialplanning#businessowners#insurance#riskmanagement#smallbusiness#sowtex#sowtexconnect#growyourbusiness

0 notes

Photo

Happy New Year Friends..Growth is The Key, Looking To Serve Our Clients Better In These Difficult Times..Raj Sukheja # #businessfinance #businesslending #smefinance #businessloans #sme #loans #smefunding #msmesector #startupindia #advisory #startupcommunity #entrepreneurindia #smallbusinesses #equityfunding #businessadvisor #venturefunding #consultingservices #acquisitions #valuations #debtfunds #venturecapitalists #acquisition #businessadvice #consultingfirms #growingyourbusiness #debts #npas #mergersandacquisitions #venturecapital https://www.instagram.com/p/CJfh2Q5jFIv/?igshid=mzbgn937pfr3

#businessfinance#businesslending#smefinance#businessloans#sme#loans#smefunding#msmesector#startupindia#advisory#startupcommunity#entrepreneurindia#smallbusinesses#equityfunding#businessadvisor#venturefunding#consultingservices#acquisitions#valuations#debtfunds#venturecapitalists#acquisition#businessadvice#consultingfirms#growingyourbusiness#debts#npas#mergersandacquisitions#venturecapital

0 notes

Photo

𝗗𝗘𝗩𝗜𝗦𝗜𝗡𝗚 𝗧𝗥𝗔𝗡𝗦𝗙𝗢𝗥𝗠𝗔𝗧𝗜𝗢𝗡𝗔𝗟 𝗦𝗧𝗥𝗔𝗧𝗘𝗚𝗜𝗘𝗦 𝗙𝗢𝗥 𝗧𝗛𝗘 𝗡𝗘𝗪 𝗡𝗢𝗥𝗠𝗔𝗟 🇰🇪🇺🇬🇹🇿🇪🇹🇷🇼🇿🇼🇸🇴🇸🇨🇩🇯🇲🇼🇲🇬 Get ready for #Finnovex EastAfrica 2021 to get inspired by visionary trailblazing speakers and witnessed the thought-provoking content , debates, demos,discussion and insight into the opportunities and challenges financial institution face as they enter new normal to recover from the aftereffects of the pandemic and emerge stronger, to not just achieve the expected levels of innovation and excellence, but to supersede them. We’ve structured Finnovex EastAfrica to make it easy for you to connect with a global audience of innovators from the comfort of your own home or office. With lots of dedicated networking time built into the agenda, our networking platform makes it easy to start conversations with the right people. 🎟️Banks and FI’s Register & Claim your💯% FREE Registration: ea.finnovex.com ☎️For sponsorships and partnerships 📩[email protected] #fintech #finance #digitalbanking #innovation #digitaleconomy #mobilebanking #blockchain #retailbanking #financialservices #digitaltransformation #Exibex #Africa #financialinclusion #smefinance #automation #ecosystem #financetransformation #robotics https://www.instagram.com/p/CIXSSTvAYTf/?igshid=1l2agbm35b4bz

#finnovex#fintech#finance#digitalbanking#innovation#digitaleconomy#mobilebanking#blockchain#retailbanking#financialservices#digitaltransformation#exibex#africa#financialinclusion#smefinance#automation#ecosystem#financetransformation#robotics

0 notes

Link

Find Best Business Loan Dubai Offers and Lenders across UAE, Grow your Business faster with Business Finance. Get SME finance and SME loan. SMEFin help is to find the right options for you.

1 note

·

View note

Text

Unlocking Success: Dodge These Top 5 Mistakes When Applying for SME Loans in Cambodia. Learn, Apply, Succeed! 💼💡

0 notes

Text

Khannan Finserv Pvt Ltd process #Agro Product #Finance Service Chennai. www.khannanfinserv.com | 9841822558

* #unsecured #finance on #AgroProduct Stocks & #warehouse .

* Upto 95% Finance on Sales Invoice Value

* Plant , Machinery & Working Capital upto 150% on Asset Value.

#businessandfinance #workingcapitalloans #businessloans #financeadvice #financeconsulting #loan #khannanfinserv #loanagainstproperty #msme #smefinance #investment #entrepreneur

0 notes

Text

Get Online commercial vehicle loan in Dubai

Comprehensive facilities can meet your short-term liquidity requirements by discounting future posted checks (PDC). Our cheque discounting service provides instant access to liquidity by discounting checks and simultaneously crediting your account. The check discount product is a circular financing mechanism that reduces the company's cash conversion cycle and improves liquidity throughout the year.

Features of Cheque Discounting

Offered to UAE registered businesses and UAE Nationals

Competitive Revolving facility which reduces the company's cash conversion cycle, and improves liquidity.

High Facility limits

Flexible tenors ranging between 30 days to 120 days for discounting

Low Interest rates

Low Cheque Discounting Commission per cheque

Low Processing Fees

A letter of credit is a financial document used in international trade. This is the payment guarantee provided by the bank to the commodity supplier. If the buyer does not pay, the "letter of credit" issued by the bank is a promise to the seller. The letter of credit in Dubai is called "the lifeblood of international trade."

Commercial Vehicle Loan Dubai

In Dubai, the price of a new car can range from several thousand to several million, depending on the make or model. Of course, not everyone can make the full payment. If you do not have the necessary funds, or prefer to use the remaining cash for other expenses, you can apply for a car loan in Dubai at any time. But first, you need to understand how the process works in the UAE. Depending on your situation and financial situation, the "automatic loan eligibility requirements" are different. Whether you're looking for a commercial vehicle loan in Dubai or want to finance a new wheelset Smefin will help you.

When the business expands, it generally requires investments in equipment, machinery equipment loan UAE, vehicle equipment, and other business assets. Solutions provided by CBD Commercial Bank can meet business asset or equipment purchase requirements. The product package provided includes different types of equipment, such as construction equipment, medical equipment, and professional equipment. The structure of these offers allows clients to choose to use their assets as funds for purchase transactions. If you need loans against construction equipment loan finance.

Trade and Working capital financing is commercial financing intended to increase the company's available working capital. It is usually used for specific growth projects, such as signing larger contracts or investing in new markets. Develop businesses, which will recover in the short and medium term.

Asset financing means using assets from the balance sheet, inventory, short-term investments, etc. from the business to obtain loans or borrow money. The company that borrows these funds must provide the lender with a collateral on the assets. Asset financing allows companies to buy equipment, such as machinery, vehicles, or almost any equipment that helps strengthen their business. This also helps free up cash from the value of assets the business already owns. Asset financing Dubai is a form of financing that applies to the purchase of tangible and intangible assets.

0 notes

Text

Unlock your business's potential with an A/R line of credit from CGFS LLC! Say goodbye to cash flow constraints and hello to flexibility. Learn how our financing solutions can empower your company today.

Join us in exploring the world of small-cap investments!

🌐 Visit our website: https://cgfsllc.com/

📞 Contact us: 1-307-456-1226

📧 Email us: [email protected]

Follow us on social media for daily financial tips and insights:

📷 Instagram: https://www.instagram.com/cgfsllc/

🐦 Twitter: https://twitter.com/CgfSllc

#CashFlow #ARLineOfCredit #BusinessFinance #CashFlowBoost #ARFinancing #WorkingCapitalSolution #BusinessFunding #FinancialFreedom #InvoiceFinancing #SmallBusinessGrowth #UnlockCashFlow #SMEFinance #FundingSolutions #BusinessCredit #AccelerateGrowth #InvoiceFactoring

0 notes

Photo

Find Best Business Credit Card Offers and Lenders across UAE, Grow your Business Globally with Business Credit Card, SMEFin help's to find the right options for you.

0 notes

Photo

여성들의 프랜차이징 웨비나 – 여기서 보실 수 있습니다, https://www.youtube.com/watch?v=2TqBUr16o28 프랜차이즈 비즈니스모델의 기초를 이해하고 어성기업가들을에게 힘을 실어 주어서 프랜차이징에서의 역할을 스스로 찾아내고 프랜차이징에서 계속해서 튀어나오는 위험요소(비즈니스를 수행할 때 발생하는, 하지만 견딜만한, 견뎌야만 하는 것들)을 다루면서 자신감을 누적시키기, 여성들의 비즈니스성장과 확장을 목적으로 하는 프랜차이즈 전략을 수립하기, 마치 수학공식처럼. Women in Franchising Webinar - View-in-Demand Video Understand the foundation of a franchise business model. Realize the role of franchising in empowering female entrepreneurs. Build their confidence in franchising as a sustainable risk-tolerant means of doing business. Consider formulating a franchise strategy for their business growth and expansion. https://lnkd.in/eAS55t7 https://lnkd.in/dFgBjz7 [email protected] #thefranchisetrainer #Women_in_Franchising_Initiative #diversityinfranchising #entrepreneur #entrepreneurship #familybusiness #franchise #franchisebusiness #franchisedevelopment #franchisee #franchiseinfo #franchiseinterview #franchisemarketing #franchisenews #franchiserecruitment #franchiseresale #franchisewatch #franchising #franchising_for_DWBC #microbusinesses #sme #smefinance #smefunding #startups #womenbusinessowners #womenempowerment2021 #womenentrepreneurs #womenexecutives #WomeninFranchising Women Owned Business 여성의 비즈니스 오너가 법적으로 51% 이상의 지분을 소유하거나, 또는 매일매일의 회사운영에서 많은 부분을 지배.통제하는 경우에: 법적으로의 지배구조와 비즈니스운영의 통제.지배를 살펴볼 목적으로, 어딘가의(누군가의) 나라의 政府들은 특정한 프로그램을 제공해서 여성 비즈니스 오너들을 북돋워 주고 권한을 부여한다. https://www.instagram.com/p/CNQq87_pWl5/?igshid=xd6pxy0rrnsx

#thefranchisetrainer#women_in_franchising_initiative#diversityinfranchising#entrepreneur#entrepreneurship#familybusiness#franchise#franchisebusiness#franchisedevelopment#franchisee#franchiseinfo#franchiseinterview#franchisemarketing#franchisenews#franchiserecruitment#franchiseresale#franchisewatch#franchising#franchising_for_dwbc#microbusinesses#sme#smefinance#smefunding#startups#womenbusinessowners#womenempowerment2021#womenentrepreneurs#womenexecutives#womeninfranchising

0 notes