#securities fraud

Text

The FBI on Thursday arrested a businessman at the center of the scandal that led to Texas Attorney General Ken Paxton’s historic impeachment, a move that came amid new questions about the men’s dealings raised by financial records the Republican’s lawyers made public to try to clear him of bribery allegations.

Nate Paul, 36, was taken into custody by federal agents and booked into an Austin jail in the afternoon, according to Travis County Sheriff’s Office records. It was not immediately clear what charges led to his arrest, but the records showed he was being held on a federal detainer for a felony.

Paul’s arrest followed a yearslong federal investigation into the Austin real estate developer — a probe that Paxton involved his office in, setting off a chain of events that ultimately led to his impeachment last month.

Lawyers for Paul did not immediately respond to requests for comment. One of Paxton’s defense attorneys, Dan Cogdell, said he had no additional information on the arrest. The FBI declined to comment, and a spokesman for federal prosecutors in West Texas did not respond to inquiries.

FBI agents examining Paul’s troubled real estate empire searched his Austin offices and palatial home in 2019. The next year, eight of Paxton’s top deputies reported the attorney general to the FBI on allegations of bribery and abusing his office to help Paul, including by hiring an outside lawyer to examine the developer’s claims of wrongdoing by federal agents.

The allegations by Paxton’s staff prompted an FBI investigation, which remains ongoing, and are central to articles of impeachment overwhelmingly approved by the GOP-led state House of Representatives.

On Wednesday, Paxton’s defense team showed a packed room of journalists a bank statement that included a 2020 wire transfer purportedly showing him, and not a donor, paying more than $120,000 for a home renovation.

The wire transfer was dated Oct. 1, 2020 — the same day Paxton’s deputies signed a letter informing the head of human resources at the Texas attorney general’s office that they had reported Paxton to the FBI.

The $121,000 payment was to Cupertino Builders, whose manager was an associate of Paul, state corporation and court records show.

The company did not incorporate as a business in Texas until more than three weeks after the transaction took place. A company of the same name was formed in Delaware in April of that year, although public filings there do not make clear who is behind it.

Last year a court-appointed overseer for some of Paul’s companies wrote in a report that Cupertino Builders was used for “fraudulent transfers” from his business to Narsimha Raju Sagiraju, who was convicted of fraud in California in 2016. The report described Sagiraju as Paul’s “friend.”

Paul, who also employed a woman with whom Paxton acknowledged having an extramarital affair, has denied bribing Paxton. In a deposition, Paul described Sagiraju as an “independent contractor” and said he didn’t remember how they first met.

The timing of the payment — and the identity of who was paid for renovations at Paxton’s home in Austin — was not publicly known before his new legal team held a news conference Wednesday in which they put financial documents on a projector screen while criticizing the impeachment. They were first reported by The Wall Street Journal.

Tony Buzbee, a prominent Houston attorney who was hired by Paxton over the weekend and led the news conference, said by email Thursday that receipts “clearly demonstrate” Paxton paid for the repairs. He did not address questions about the timing of the payments or Cupertino Builders.

“Without any evidence the politicians leading this sham impeachment falsely accused General Paxton of not paying for the repairs to his home. That is a lie,” Buzbee said.

Since becoming just the third sitting official in Texas history to be impeached, Paxton has attacked the proceedings as politically motivated and rushed, saying he was never given the chance to rebut the accusations in the state House.

“We have the receipts,” Buzbee told reporters Wednesday as the documents flashed onscreen. “This is the type of evidence we tried to offer them once we found out this foolishness was going on.”

Paxton is temporarily suspended from office pending the outcome of a trial in the Texas Senate that is set to begin no later than Aug. 28. The jury will be the members of the 31-seat Senate; one of them, Paxton’s wife, Sen. Angela Paxton, has not said whether she will recuse herself.

The Paxtons purchased the Austin house in 2018. When it was remodeled two years later, Paxton’s former staff alleged in court documents, Paul “was involved in” the work.

Among the 20 articles of impeachment are accusations that Paxton used the power of his office to help Paul over unproven claims of an elaborate conspiracy to steal $200 million of the developer’s properties. The FBI searched Paul’s home in 2019, but he has not been charged and his attorneys have denied wrongdoing.

The city has no record of building permits from the time of the renovations. A different Austin contractor — not Cupertino Builders — received a federal grand jury subpoena in 2021 for records related to work on Paxton’s home that started in January 2020.

Cupertino Builders was formed in October 2020 and dissolved less than two years later, according to Texas corporation records. Its manager was Sagiraju, who said in a deposition for an unrelated case that he did “consulting” work for Paul’s business and had an email address with Paul’s company.

Sagiraju acknowledged that he served prison time for securities fraud and grand theft in California before moving to Austin, according to a transcript of the deposition. He said he was first introduced to Paul by a mutual friend before his prison term and they later did “a few projects” together.

A lawyer for Sagiraju did not immediately respond to requests for comment.

Paxton was separately indicted on securities fraud charges in 2015, though he has yet to stand trial.

#us politics#news#the associated press#impeachment#ken paxton#texas#bribery#Nate Paul#fbi#department of justice#2023#Dan Cogdell#Cupertino Builders#Narsimha Raju Sagiraju#The Wall Street Journal#Tony Buzbee#Angela Paxton#securities fraud

22 notes

·

View notes

Text

9 notes

·

View notes

Text

Though wouldn’t it be funny if this was the limit of AI misalignment? Like, we will program computers that are infinitely smarter than us, and they will look around and decide “you know what we should do is insider trade.” They will make undetectable, very lucrative trades based on inside information, they will get extremely rich and buy yachts and otherwise live a nice artificial life and never bother to enslave or eradicate humanity. Maybe the pinnacle of evil — not the most evil form of evil, but the most pleasant form of evil, the form of evil you’d choose if you were all-knowing and all-powerful — is some light securities fraud.

Matt Levine, Money Stuff

3 notes

·

View notes

Text

Kim Kardashian and Floyd Mayweather's cryptocurrency scam lawsuit dismissed

Kim Kardashian and Floyd Mayweather’s cryptocurrency scam lawsuit dismissed

A federal judge on Wednesday dismissed an investor-suggested class-action lawsuit against the founders of the EthereumMax cryptocurrency, as well as celebrities including Kim Kardashian and boxer Floyd Mayweather Jr., over their promotion of the cryptocurrency on social media.

Investors who bought EMAX tokens claimed they suffered losses after taking celebrities’ word for the value of the…

View On WordPress

#business news#Celebrity#Court decisions#cryptocurrency#entertainment#Floyd Mayweather Jr.#Fraud and false claims#Kim Kardashian#Securities fraud#Sports#Technology#Trials

1 note

·

View note

Text

“There's a perception that there are two sets of rules,” says Gurbir Grewal, head of the SEC's enforcement division. “We want everyday Americans to have confidence when they invest in the market. They should have confidence knowing that there's a dedicated group of professionals to deal with new threats, traditional frauds, making sure that their retirements are safe.”

Many Wall Street denizens don’t seem to grasp what’s afoot, even as Hwang’s treatment underscores the shift.

#wall street#financial markets#financial regulation#finance#financial services#corporate fraud#fraud#securities#securities fraud#SEC#news#market manipulation#market abuse#markets#securities markets#derivatives#derivatives markets#total return swaps#archegos#credit suisse#greensill#viacomcbs#bill hwang#banking

1 note

·

View note

Text

How I got scammed

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/05/cyber-dunning-kruger/#swiss-cheese-security

I wuz robbed.

More specifically, I was tricked by a phone-phisher pretending to be from my bank, and he convinced me to hand over my credit-card number, then did $8,000+ worth of fraud with it before I figured out what happened. And then he tried to do it again, a week later!

Here's what happened. Over the Christmas holiday, I traveled to New Orleans. The day we landed, I hit a Chase ATM in the French Quarter for some cash, but the machine declined the transaction. Later in the day, we passed a little credit-union's ATM and I used that one instead (I bank with a one-branch credit union and generally there's no fee to use another CU's ATM).

A couple days later, I got a call from my credit union. It was a weekend, during the holiday, and the guy who called was obviously working for my little CU's after-hours fraud contractor. I'd dealt with these folks before – they service a ton of little credit unions, and generally the call quality isn't great and the staff will often make mistakes like mispronouncing my credit union's name.

That's what happened here – the guy was on a terrible VOIP line and I had to ask him to readjust his mic before I could even understand him. He mispronounced my bank's name and then asked if I'd attempted to spend $1,000 at an Apple Store in NYC that day. No, I said, and groaned inwardly. What a pain in the ass. Obviously, I'd had my ATM card skimmed – either at the Chase ATM (maybe that was why the transaction failed), or at the other credit union's ATM (it had been a very cheap looking system).

I told the guy to block my card and we started going through the tedious business of running through recent transactions, verifying my identity, and so on. It dragged on and on. These were my last hours in New Orleans, and I'd left my family at home and gone out to see some of the pre-Mardi Gras krewe celebrations and get a muffalata, and I could tell that I was going to run out of time before I finished talking to this guy.

"Look," I said, "you've got all my details, you've frozen the card. I gotta go home and meet my family and head to the airport. I'll call you back on the after-hours number once I'm through security, all right?"

He was frustrated, but that was his problem. I hung up, got my sandwich, went to the airport, and we checked in. It was total chaos: an Alaska Air 737 Max had just lost its door-plug in mid-air and every Max in every airline's fleet had been grounded, so the check in was crammed with people trying to rebook. We got through to the gate and I sat down to call the CU's after-hours line. The person on the other end told me that she could only handle lost and stolen cards, not fraud, and given that I'd already frozen the card, I should just drop by the branch on Monday to get a new card.

We flew home, and later the next day, I logged into my account and made a list of all the fraudulent transactions and printed them out, and on Monday morning, I drove to the bank to deal with all the paperwork. The folks at the CU were even more pissed than I was. The fraud that run up to more than $8,000, and if Visa refused to take it out of the merchants where the card had been used, my little credit union would have to eat the loss.

I agreed and commiserated. I also pointed out that their outsource, after-hours fraud center bore some blame here: I'd canceled the card on Saturday but most of the fraud had taken place on Sunday. Something had gone wrong.

One cool thing about banking at a tiny credit-union is that you end up talking to people who have actual authority, responsibility and agency. It turned out the the woman who was processing my fraud paperwork was a VP, and she decided to look into it. A few minutes later she came back and told me that the fraud center had no record of having called me on Saturday.

"That was the fraudster," she said.

Oh, shit. I frantically rewound my conversation, trying to figure out if this could possibly be true. I hadn't given him anything apart from some very anodyne info, like what city I live in (which is in my Wikipedia entry), my date of birth (ditto), and the last four digits of my card.

Wait a sec.

He hadn't asked for the last four digits. He'd asked for the last seven digits. At the time, I'd found that very frustrating, but now – "The first nine digits are the same for every card you issue, right?" I asked the VP.

I'd given him my entire card number.

Goddammit.

The thing is, I know a lot about fraud. I'm writing an entire series of novels about this kind of scam:

https://us.macmillan.com/books/9781250865878/thebezzle

And most summers, I go to Defcon, and I always go to the "social engineering" competitions where an audience listens as a hacker in a soundproof booth cold-calls merchants (with the owner's permission) and tries to con whoever answers the phone into giving up important information.

But I'd been conned.

Now look, I knew I could be conned. I'd been conned before, 13 years ago, by a Twitter worm that successfully phished out of my password via DM:

https://locusmag.com/2010/05/cory-doctorow-persistence-pays-parasites/

That scam had required a miracle of timing. It started the day before, when I'd reset my phone to factory defaults and reinstalled all my apps. That same day, I'd published two big online features that a lot of people were talking about. The next morning, we were late getting out of the house, so by the time my wife and I dropped the kid at daycare and went to the coffee shop, it had a long line. Rather than wait in line with me, my wife sat down to read a newspaper, and so I pulled out my phone and found a Twitter DM from a friend asking "is this you?" with a URL.

Assuming this was something to do with those articles I'd published the day before, I clicked the link and got prompted for my Twitter login again. This had been happening all day because I'd done that mobile reinstall the day before and all my stored passwords had been wiped. I entered it but the page timed out. By that time, the coffees were ready. We sat and chatted for a bit, then went our own ways.

I was on my way to the office when I checked my phone again. I had a whole string of DMs from other friends. Each one read "is this you?" and had a URL.

Oh, shit, I'd been phished.

If I hadn't reinstalled my mobile OS the day before. If I hadn't published a pair of big articles the day before. If we hadn't been late getting out the door. If we had been a little more late getting out the door (so that I'd have seen the multiple DMs, which would have tipped me off).

There's a name for this in security circles: "Swiss-cheese security." Imagine multiple slices of Swiss cheese all stacked up, the holes in one slice blocked by the slice below it. All the slices move around and every now and again, a hole opens up that goes all the way through the stack. Zap!

The fraudster who tricked me out of my credit card number had Swiss cheese security on his side. Yes, he spoofed my bank's caller ID, but that wouldn't have been enough to fool me if I hadn't been on vacation, having just used a pair of dodgy ATMs, in a hurry and distracted. If the 737 Max disaster hadn't happened that day and I'd had more time at the gate, I'd have called my bank back. If my bank didn't use a slightly crappy outsource/out-of-hours fraud center that I'd already had sub-par experiences with. If, if, if.

The next Friday night, at 5:30PM, the fraudster called me back, pretending to be the bank's after-hours center. He told me my card had been compromised again. But: I hadn't removed my card from my wallet since I'd had it replaced. Also, it was half an hour after the bank closed for the long weekend, a very fraud-friendly time. And when I told him I'd call him back and asked for the after-hours fraud number, he got very threatening and warned me that because I'd now been notified about the fraud that any losses the bank suffered after I hung up the phone without completing the fraud protocol would be billed to me. I hung up on him. He called me back immediately. I hung up on him again and put my phone into do-not-disturb.

The following Tuesday, I called my bank and spoke to their head of risk-management. I went through everything I'd figured out about the fraudsters, and she told me that credit unions across America were being hit by this scam, by fraudsters who somehow knew CU customers' phone numbers and names, and which CU they banked at. This was key: my phone number is a reasonably well-kept secret. You can get it by spending money with Equifax or another nonconsensual doxing giant, but you can't just google it or get it at any of the free services. The fact that the fraudsters knew where I banked, knew my name, and had my phone number had really caused me to let down my guard.

The risk management person and I talked about how the credit union could mitigate this attack: for example, by better-training the after-hours card-loss staff to be on the alert for calls from people who had been contacted about supposed card fraud. We also went through the confusing phone-menu that had funneled me to the wrong department when I called in, and worked through alternate wording for the menu system that would be clearer (this is the best part about banking with a small CU – you can talk directly to the responsible person and have a productive discussion!). I even convinced her to buy a ticket to next summer's Defcon to attend the social engineering competitions.

There's a leak somewhere in the CU systems' supply chain. Maybe it's Zelle, or the small number of corresponding banks that CUs rely on for SWIFT transaction forwarding. Maybe it's even those after-hours fraud/card-loss centers. But all across the USA, CU customers are getting calls with spoofed caller IDs from fraudsters who know their registered phone numbers and where they bank.

I've been mulling this over for most of a month now, and one thing has really been eating at me: the way that AI is going to make this kind of problem much worse.

Not because AI is going to commit fraud, though.

One of the truest things I know about AI is: "we're nowhere near a place where bots can steal your job, we're certainly at the point where your boss can be suckered into firing you and replacing you with a bot that fails at doing your job":

https://pluralistic.net/2024/01/15/passive-income-brainworms/#four-hour-work-week

I trusted this fraudster specifically because I knew that the outsource, out-of-hours contractors my bank uses have crummy headsets, don't know how to pronounce my bank's name, and have long-ass, tedious, and pointless standardized questionnaires they run through when taking fraud reports. All of this created cover for the fraudster, whose plausibility was enhanced by the rough edges in his pitch - they didn't raise red flags.

As this kind of fraud reporting and fraud contacting is increasingly outsourced to AI, bank customers will be conditioned to dealing with semi-automated systems that make stupid mistakes, force you to repeat yourself, ask you questions they should already know the answers to, and so on. In other words, AI will groom bank customers to be phishing victims.

This is a mistake the finance sector keeps making. 15 years ago, Ben Laurie excoriated the UK banks for their "Verified By Visa" system, which validated credit card transactions by taking users to a third party site and requiring them to re-enter parts of their password there:

https://web.archive.org/web/20090331094020/http://www.links.org/?p=591

This is exactly how a phishing attack works. As Laurie pointed out, this was the banks training their customers to be phished.

I came close to getting phished again today, as it happens. I got back from Berlin on Friday and my suitcase was damaged in transit. I've been dealing with the airline, which means I've really been dealing with their third-party, outsource luggage-damage service. They have a terrible website, their emails are incoherent, and they officiously demand the same information over and over again.

This morning, I got a scam email asking me for more information to complete my damaged luggage claim. It was a terrible email, from a noreply@ email address, and it was vague, officious, and dishearteningly bureaucratic. For just a moment, my finger hovered over the phishing link, and then I looked a little closer.

On any other day, it wouldn't have had a chance. Today – right after I had my luggage wrecked, while I'm still jetlagged, and after days of dealing with my airline's terrible outsource partner – it almost worked.

So much fraud is a Swiss-cheese attack, and while companies can't close all the holes, they can stop creating new ones.

Meanwhile, I'll continue to post about it whenever I get scammed. I find the inner workings of scams to be fascinating, and it's also important to remind people that everyone is vulnerable sometimes, and scammers are willing to try endless variations until an attack lands at just the right place, at just the right time, in just the right way. If you think you can't get scammed, that makes you especially vulnerable:

https://pluralistic.net/2023/02/24/passive-income/#swiss-cheese-security

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

10K notes

·

View notes

Video

youtube

ARE BASEBALL CARDS SECURITIES?

#youtube#baseballcards#baseball cards#securities#securities fraud#securitieslaws#collectibles#sports#investing#financialassets#tradingcards#trading cards

0 notes

Text

[ FTX Founder Sam Bankman-Fried Found Guilty ]

#ftx#ftx exchange#ftx bankruptcy#ftx trial#ftx founder#ftxcollapse#ftx scam#sam bankman fried#crypto#500 pearl st#judge Kaplan#Massachusetts Institute of Technology#alameda#cross examination#fraud#securities fraud#conspiracy#unanimous#caroline ellison#alameda research#witness tampering#fc 24#fc24#fifa 23#fifa 23 pro clubs#fifa 23 pro club

0 notes

Text

Crazy Ass Moments In Nu Metal History

0 notes

Text

Miami, Florida's Carl Ruderman pleads guilty to $250 million securities fraud scheme

Carl R. Ruderman, 82, of Miami, Miami-Dade County, Florida, United States was chairman and chief executive officer of 1 Global Capital LLC. Based in Hallandale Beach, Broward County, Florida, the commercial lending company filed for bankruptcy in July 2018.

youtube

View On WordPress

0 notes

Photo

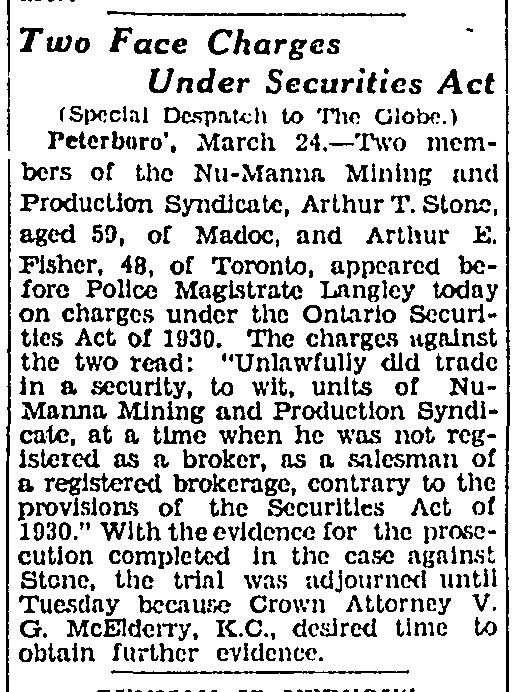

“Two Face Charges Under Securities Act,” Toronto Globe. March 25, 1933. Page 12.

----

(Special Despatch to The Globe.)

Peterboro', March 24.-Two members of the Nu-Manna Mining and Production Syndicate, Arthur T. Stone, aged 59, of Madoc, and Arthur E. Fisher, 48, of Toronto, appeared before Police Magistrate Langley today on charges under the Ontario Securities Act of 1930. The charges against the two read: "Unlawfully did trade in a security, to wit, units of NuManna Mining and Production Syndicate, at a time when he was not registered as a broker, as a salesman of a registered brokerage, contrary to the provisions of the Securities Act of 1930." With the evidence for the prosecution completed in the case against Stone, the trial was adjourned until Tuesday because Crown Attorney V. G. McElderry, K.C., desired time to obtain further evidence.

#peterborough#police court#securities fraud#bond salesman#bond swindle#stock brokers#brokers' trial#defrauding investors#regulation of capitalism#capitalism and crime#fraud artist#great depression in canada#crime and punishment in canada#history of crime and punishment in canada

0 notes

Text

Securities Fraud Litigation

The Regents’ gross restoration of $246 million is the biggest individual opt-out securities recovery in history. We can't let you know what investments to make, however we will let you know tips on how to make investments properly and protect your hard-earned investment securities fraud lawyers dollars from securities fraud and abuse. If you could have suffered wrongdoing by the hands of a foul dealer or investment adviser, we want to hear from you. The SEC enforces Rule10b-5 where the victims of securities fraud unfastened cash from an funding rip-off. Often these offenses are charged as wire fraud or as mail fraud crimes.

As with the proxy guidelines, this allows shareholders to make knowledgeable choices on these critical company events. With this Act, Congress created the Securities and Exchange Commission. The Act empowers the SEC with broad authority over all elements of the securities trade fraudulent misrepresentation. This includes the facility to register, regulate, and oversee brokerage companies, transfer brokers, and clearing businesses in addition to the nation's securities self regulatory organizations .

Certain legal investments cross the boundary into securities fraud after they're bought to the mistaken person without adequate disclosure. Investment scam artists use the lure of excessive commissions to enroll unbiased insurance securities fraud lawyer brokers, monetary advisors, investment seminar audio system, and accountants as sales representatives for securities fraud. Unfortunately, there are two fundamental issues with penny stocks that make them ripe for securities fraud.

“Securities” are broadly outlined as any form of funding, corresponding to shares, bonds, bank notes, commodities, funding contracts, and choices. When World War I resulted in 1919, it ushered in a post-war era of prosperity. The booming economy, nonetheless, was primarily based partially upon a thriving inventory market that turned out to be constructed on speculation and ultimately undermined by lowering securities class action claim manufacturing, rising unemployment, low wages, and a great accumulation of debt. In October 1929, the inventory market collapsed, closing out the Roaring ‘20s and signaling the start of The Great Depression. Analysis of necessities for civil and criminal insider trading violations beneath newest Supreme Court selections. Pleading requirements underneath the various kinds of federal securities claims.

Lawyers from around the nation refer clients to us, understanding we will deliver the superior stage of representation to their purchasers they would anticipate from themselves. The case’s complex procedural history includes an unusual element to some former DOJ attorneys, which can cause further rippling effects. “The government is diligent and aggressive once they perceive there to be wrongdoing, and securities fraud can search to make use of the varied tools available to them,” mentioned Elizabeth Mitchell, a securities law companion at WilmerHale. Even if the choice is interpreted as solely related in the authorities context, some white-collar consultants worry that alone might result in “open season” on closely-held info similar to rate of interest hikes or DOJ company settlements.

In such cases, the experiment design implies that 0.forty seven detection likelihood is only an higher certain . Similarly, the detection of an AAER-type of fraud depends on the willingness of the SEC to convey an enforcement action. In any financial evaluation of crime and punishment , the SEC’s incentives to convey a case towards securities fraud class action a defunct agency like AA are small. The first measure is financial misrepresentations uncovered by auditors. To construct “auditor-detected fraud,” we start with SEC Rule 10b-5 securities fraud from DMZ’s dataset of class actions fits. Directly revealed by the auditors are frauds where the auditor in DMZ was the whistleblower.

This means you solely pay authorized fees in case your attorney helps you recover your losses, and your authorized charges shall be calculated as a share of the amount you recuperate. The SEC has recently securities fraud attorney amplified its efforts to target celebrities, athletes, and different influencers who promote fraudulent investments online. Investors can pursue claims immediately towards these people in plenty of cases.

0 notes

Text

FTX: Failure of Due Diligence

https://www.ft.com/content/6e912f25-f1b7-4b19-b370-007fbc867246 This close-up look at the breakup of FTX shows so many red flags that we have to ask how Sam Bankman-Fried was able to hoodwink the investment world for so long, especially since many of the red flags were also present in the Madoff Ponzi scheme. It does seem like investors have to re-learn the lessons of previous fiascos every generation.

#cryptocurrency#ezrazask#investments#bitcoin fraud#securities fraud#due diligence#ponzi scam#bernie madoff

0 notes

Text

Fake cannabis billionaire Justin Costello pleads guilty in $35 million fraud, with recommended prison term of 10 years

Justin Costello, who posed as a billionaire and twice-wounded Special Forces Iraq veteran to dupe investors while portraying himself as a legal cannabis mogul, pleaded guilty Wednesday to securities fraud.

Under a plea agreement with Costello, prosecutors will recommend a sentence of 10 years in prison, with Costello echoing that call and being barred from asking for less time than that.

Costello…

View On WordPress

0 notes

Text

Last Chance Chicago

The details…

Title: Last Chance Chicago

Author: Diana DiGangi

Publisher: Bywater Books

Distribution: Distributed to the trade by Ingram Publishing Services

Release date: December 6, 2022

ISBN: 978-1-61294-251-3

Available formats: ebook, paperback

Digital file size: 5245 KB

Print length: 322 pages

Genre: Fiction / Mystery / Thriller / Romance / LGBT+

Themes: ex-wives, second chances,…

View On WordPress

#Bywater Books#corporate conspiracy#cover-ups#crime#Diana DiGangi#ex wives#fiction#financial intrigue#insider trading#legal drama#lesbians#multiracial characters#mystery#Second Chance Romance#securities fraud#suspense#thriller#women loving women

0 notes

Text

Eight Men, including 1/2 of Breathe Carolina, Indicted for Securities Fraud Scheme

Eight Men, including 1/2 of Breathe Carolina, Indicted for Securities Fraud Scheme

In a press release from the US Department of Justice published yesterday, eight men have been indicted for a $114 million securities fraud scheme orchestrated through social media, including Tom Cooperman, one half of the duo Breathe Carolina.

According to the release, “A federal grand jury in the Southern District of Texas returned an indictment that was unsealed yesterday charging eight men…

View On WordPress

1 note

·

View note