#overtime pay

Text

Democrats deliver.

#overtime pay#salaried workers to get overtime#Biden administration expands overtime pay to millions#Democrats deliver#democrats help the common man#republicans serve the rich#republican assholes#never trump

78 notes

·

View notes

Text

128 notes

·

View notes

Text

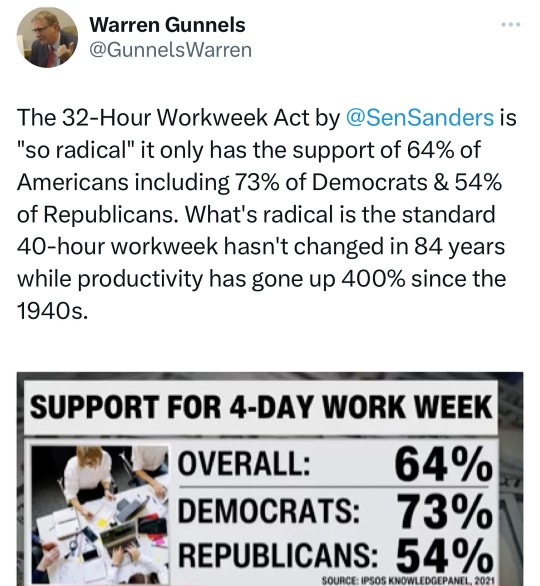

#bernie sanders#work week reduction#32-hour work week#overtime pay#productivity#technology#fair labor standards act#international examples#france#norway#denmark#germany#well-being#stress#fatigue#republican senator bill cassidy#small enterprises#job losses#consumer prices#japan#economic output#labor dynamics#artificial intelligence#automation#workforce composition

63 notes

·

View notes

Text

Dave Jamieson at HuffPost:

A new federal rule to expand overtime protections to millions of workers now excluded under current law has been finalized, the Biden administration said Tuesday.

The Labor Department’s regulation would ensure that salaried workers who earn less than $58,656 per year would automatically be entitled to overtime pay when they work more than 40 hours in a week, starting in 2025. What’s known as the “overtime salary threshold” would then be updated every three years, starting in 2027, to account for inflation.

The agency estimated that the change would extend the overtime law’s coverage to an additional four million workers, meaning they couldn’t be forced to work extra hours without their employers paying a premium.

Julie Su, the Labor Department’s acting secretary, said updating the regulation was about basic fairness.

[...]

Most hourly workers are entitled to time-and-a-half pay when they log over 40 hours, which discourages employers from working them too much. But whether salaried workers can get overtime pay depends on how much they earn and what their job duties are. Employers have an incentive to pile work onto those without overtime protections, since the extra work is done essentially for free.

[...]

The current overtime salary threshold is just $35,568, set by the administration of former President Donald Trump. Salaried workers, such as retail store managers, must earn less than that amount to automatically be entitled to any additional pay when they work more than 40 hours.

Progressives have fought for years to increase the salary threshold in order to restore the share of the U.S. workforce that gets paid overtime. An effort by former President Barack Obama was blocked in federal court in 2017. His successor, Trump, released a watered-down version of the reform that covered fewer workers than Obama’s version would have.

Last year the Biden administration said it planned to raise the threshold to a little over $55,000. It ultimately hiked that figure to $58,656 to account for newer wage data.

Great news for workers: more workers could be eligible for overtime pay under a new rule from the Biden Administration.

4 notes

·

View notes

Text

@octoblinoctober, Day 4: Overtime Pay

Otto and Norman spend a lot of time at Oscorp afterhours and sometimes Norman rewards his lapdog for all his hard work ;)

#octogoblin october#octogoblin#norman osborn#otto octavius#art challenge#overtime pay#artist on tumblr#digital art#sparkles art

60 notes

·

View notes

Text

#dept of labor#please sign and share#petition#petitions#please sign this petition#please share#please sign#hot labor summer#fight for 15#department of labor#overtime pay

2 notes

·

View notes

Text

What is Overtime Pay in California?

In the state of California, nonexempt employees are entitled to overtime pay of:

5 times their normal rate of pay for each extra hour worked over 8 hours in a day or more than 40 hours in a week.

2 times their normal rate of pay for hours worked over 12 hours in a day or if they work seven days straight and work more than 8 hours on the seventh day.

Sometimes, workers who are nonexempt may be paid differently than an hourly wage and their overtime pay is calculated accordingly. Exempt workers are those to whom the overtime laws do not apply. There are also some special exceptions that have their own guidelines.

What is the Regular Rate of Pay?

An employee’s regular rate of pay is the way their compensation for their work is calculated. This could be by the hour, per year, by piecework, or on commission. Regardless of how the rate of pay is calculated, it can never be lower than the minimum wage. It can also never exceed an 8 hour workday or a 40 hour workweek. There is however a standard under Industrial Welfare Commission Wage Orders that allows for alternative workweek schedules consisting of either 4 days of 10 hour shifts or 3 days of 12 hour shifts. For these schedules, the rate of pay is based on the 40 hour workweek.

Some agreed upon schedules come out to less than 40 hours per workweek. Although a set agreed upon work week may total under 40 hours, the employer is not obligated to pay overtime until the employee works more than 8 hours in a workday or 40 hours within that workweek.

How Much is Overtime Pay in California?

In order to qualify for overtime, the following parameters must be met:

Hours paid time and a half:

Over 8 and up to 12 hours per workday

Over 40 regular hours per workweek

The first 8 hours of the 7th day worked in a row per workweek

Hours paid double time:

Over 12 hours per workweek

Over 8 hours on the 7th day worked in a row per workweek

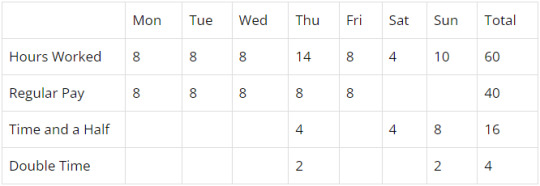

How to Calculate Overtime Pay in California

Step 1: Determine Workweek vs Workday

Workday – The default workday begins at 12:01 in the morning. However, employers are able to set their workday to be any block of 24 hours that begins at the same time every calendar day. If an employee works more than 8 hours in a workday, they are entitled to overtime pay for the extra hours worked. Employers are not permitted to average out hours across multiple days. If an employee works 6 hours one day and 10 hours the next, they receive 2 hours of overtime pay.

Workweek – A workweek is a set period of seven days that begins the same calendar day every week. While employees within the same company may have different workweek schedules, a workweek is set for each individual employee and can not be changed unless it is being permanently altered. If an employee works more than 40 hours within a workweek, they are entitled to overtime pay.

Step 2: Calculate Hours Worked

Employees must document the times that they punch in for work, out for break, back in from break, and out for the day. Most employers have a system for all employees to do this, so that the employer can then calculate the hours worked for each person.

Step 3: Determine Amount of Daily Overtime Hours

When calculating daily overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 8 and up to 12

Time and a half for the first 8 hours of the seventh day worked in a row

Double time for hours worked over 12

Double time for hours worked over 8 on the seventh day worked in a row

Step 4: Determine Amount of Weekly Overtime Hours

When calculating weekly overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 40

Step 5: Calculate Daily vs Weekly Overtime Hours

According to California state law, both daily and weekly overtime hours must be taken into account. The overtime hours themselves are only counted once, but they also do not negate each other. This is to protect workers in situations such as if someone works more than 8 hours a day, but they worked less than 40 hours that week. Determining overtime on both a daily and weekly basis ensures that employee gets paid properly. The way this works is:

When an employee’s daily overtime is the same or more than the employee’s weekly overtime, then they must be paid in accordance with daily overtime. In these cases, the weekly overtime is already included in the daily overtime.

When the employee’s daily overtime hours are less than the number of weekly overtime hours, then the remaining time must be accounted and compensated for.

Employers must also ensure that daily double time rules are being followed when calculating weekly overtime as well.

Employers can keep track of these hours by accounting for the hours worked and separating the regular rate of pay from the overtime. This ensures that all hours are accounted for and paid correctly.

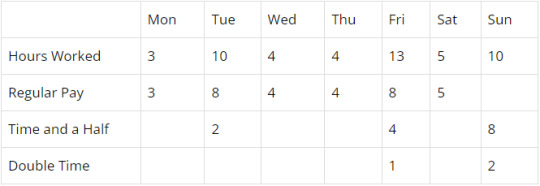

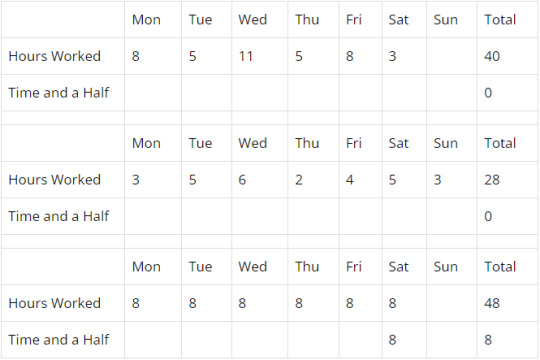

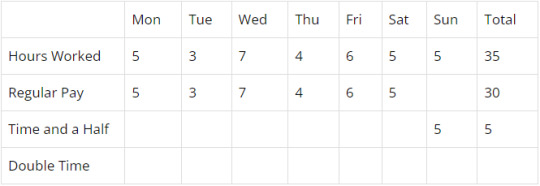

No weekly overtime, but time and a half daily overtime for the seventh day in a row worked:

No daily overtime, but time and a half weekly overtime paid for hours worked over 40 in the workweek:

Both daily and weekly overtime:

Time and a half for daily hours worked over 8 up to 12

Time and a half for the first 8 hours of seventh day worked in a row

Double time for hours worked over 12

Double time for hours over 8 on seventh day worked in a row

Time and a half for weekly overtime hours over 40

Step 6: Determine Base Rate of Hourly Pay

Since overtime is 1.5 or 2 times the employee’s regular rate of pay, it is important to figure out what that is. An employee’s regular rate of pay is generally the amount of money earned by the employee each hour generally calculated by dividing the total compensation for the workweek by the hours worked. There are many different ways in which employers pay out their employees’ compensation, and so different ways for the regular rate of pay to be calculated.

Hourly Non-Exempt Employees

The regular rate of pay for hourly employees is the amount of money they earn each hour. If they also receive bonuses or commissions, those are divided by the number of hours worked.

So, if an employee makes $20 an hour, then their overtime pay would be $30 an hour or $40 an hour for double time.

Sometimes, employees are paid different rates within the same workweek. In these cases, the regular rate of pay is calculated by dividing all earnings throughout the week by all of the hours worked. The overtime premiums are then added to the applicable overtime hours afterwards. So, if an employee works 20 hours at $10 an hour and 30 hours at $15 an hour, their total earnings would be $650 which would be divided by 50 for a regular rate of $13. $6.5 would be added to every overtime hour that earned time and a half, and $13 would be added to every overtime hour that earned double time.

Sometimes, employees also earn flat-sum bonuses on top of their hourly rates. When this happens, the bonus is divided by the amount of non-overtime hours they worked, and then that amount is added to the hourly rate. The final sum is the number used to determine the overtime rate of pay. So, if an employee works 45 hours in a workweek at $10 with a weekly bonus of $100, the $100 would be divided by 40 making $2.5 which would make the regular rate of pay $12.5 which would be used to calculate the applicable overtime.

Piece Rate or Commission Employees

There are several different methods that can be used to calculate regular rate of pay for employees who are compensated by piece or commission:

The rate that the employee is paid by piece or commission is considered the regular rate, and that number is multiplied by 1.5 for hours worked over 8 up to 12 in a workday and multiplied by 2 for hours worked over 12 per workday.

The total amount of money earned for the workweek is divided by the total hours worked for the workweek. The overtime premium of that number is then added to the applicable overtime hours.

For group rates, the amount of pieces the group produced during the workweek is divided by the amount of people in the group. Each member of the group is paid accordingly, and that amount is then divided by the hours worked.

Salaried Non-Exempt Employees

When a salaried employee is nonexempt, their salary only covers regular hours worked. In these situations, those employees are entitled to overtime pay. To determine the regular rate of pay for a full time employee, the weekly salary is divided by 40. If the employee is paid monthly, the monthly rate is multiplied by 12 months in a year, then that number is divided by 52 weeks in year, then that number is divided by 40 hours in a week.

Are Salaried Employees Entitled to Overtime?

Some salaried employees may be exempt from overtime pay for many reasons:

Federal law

State Law

California Labor Code Provision

Industrial Welfare Commission Wage Orders

If the salaried employe does not meet the requirements for exemption status, then the employer must pay them overtime rates when overtime hours are worked.

Employees That Are Paid Different Rates Within the Same Job

When employees are paid two or more different rates at the same job within the same workweek, the weighted average is found by dividing the total amount of money earned by the total number of hours worked. So, if an employee worked 20 hours at $10 an hour, 20 hours at $12 an hour, and 10 hours at $14, the weighted average would be $580 divided by 50 hours, totaling $11.6 an hour.

Employees that Receive Bonuses

Nondiscretionary bonuses are included when calculating an employee’s regular rate of pay for the sake of overtime if that bonus is for how many hours they worked, a reward for high performance, or an incentive to stay with the employer.

When calculating regular rate of pay on a flat sum bonus for the sake of overtime, the amount of the bonus is divided by the number of regular hours the employee worked. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours.

When calculating regular rate of pay on a production bonus, the amount of the bonus is divided by the number of hours the employee worked during the bonus period. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours in the bonus period.

Bonuses that are not factored into overtime pay are discretionary bonuses such as holiday gifts or special rewards.

Who Is Exempt from California Overtime Laws?

The most notable exempt workers are those who earn a fixed salary that is equal to or greater than double the minimum wage.

There are specific salaried job categories that are generally exempt such as:

Normally Exempt Roles

These requirements reduce the likelihood that high salaried professionals are not able to enjoy the benefits of overtime pay. However, these roles are often rewarded in amounts of compensation that far exceed the need for overtime pay.

Executives

Administration

Professional Employees

Outside Salespeople

The requirements for being classified as an exempt outside salesperson are:

18 years old or older

51% or more of their work is conducted away from the business

They sell products, contracts, the performance of services, and/or the use of facilities

Unionized Employees

Not all union workers are exempt. Exemption for unionized workers requires:

That the collective bargaining agreement explicitly provides for wages and working hours and conditions

That the collective bargaining agreement explicitly provides for regular rate of pay and premium overtime rates that are 30% or higher than state minimum wage

Job Specific Exceptions

The California Industrial Welfare Commission outlines certain job specific exceptions to overtime laws such as:

Agricultural workers

Ambulance workers

Camp Counselors

Live-in household workers

Retirement home managers

Personal attendants

Some 24-hour residential childcare providers

The parents, spouse, and children of the employer

Independent Contractors

The requirements for being an independent contractor are:

Someone who is contracted to perform a specific service for a specific amount of pay

Someone who has complete control over when and how the service is completed

Alternative Schedules

Sometimes, employees may agree to alternative schedules such as working a 40 hour workweek as 4 days of 10 hour shifts. These schedules are not bound by overtime laws. A valid alternative workweek schedule must be:

Voted on via secret ballot by the affected employees

Approved by a two-thirds majority

Reported within 30 days by the employer to the Division of Labor Standards Enforcement

Employers are not permitted to retaliate against any employees for their stance on alternative schedules. Employees working an alternative schedule are still entitled to overtime pay when:

They work more than the daily agreed upon hours

They work more than 40 hours in a workweek

Nonresidents

In the state of California, all nonexempt workers are protected by the state’s overtime laws, including those who are not residents of the state or citizens of the country. There is some back and forth about whether workers who work in the state for less than a day at a time should also be protected by those same laws.

Step 7: Calculate Total Overtime and Pay Balance

According to Labor Code Section 204, overtime in California must be paid by the payday for the next payroll period. The regular hours for that pay period must be paid on time, only the overtime pay may be paid the following payday.

Are Any Amounts Excluded from Overtime Pay?

There are some types of payments and compensation that may not be included when calculating overtime in California such as:

Discretionary Bonuses

Expenses

Gifts

Holiday Pay

Paid Time Off

Can Overtime Be Waived?

In the state of California, all nonexempt employees must be compensated for any overtime worked. If an employer has an employee sign an agreement waiving their right to overtime pay, that waiver is unenforceable, and the employee is still entitled to their overtime pay.

Can an Employer Require Overtime?

In most cases, employers in California are allowed to require their employees to work overtime. One big exception is that employers are not permitted to require employees to work seven consecutive days in a row with no day off for rest. Employees are however able to waive their rest day provided they are aware of their right to take it if they choose.

Are Employers Responsible for Paying Unapproved Overtime?

In the state of California, all nonexempt employees must be paid overtime pay for all overtime hours worked regardless of managerial approval. While employers are permitted to discipline employees who work unapproved overtime, they can not refuse to pay them. In accordance with California law, employees must be paid for whatever time they were suffered or permitted to work. This means that the employer is responsible for any compensation owed for hours worked that they knew about or should have known about.

What Can an Individual Do if Overtime Isn’t Paid?

If an employee was not paid properly for overtime hour worked, they can contact the Department of Labor, file a claim with the Division of Labor Standards Enforcement, or file a lawsuit to sue for the money. When suing a former employer, they can also file a claim for a waiting time penalty in accordance with Labor Code Section 203.

What is the Wage Claim Filing Process?

After an employe files a claim with the Division of Labor Standards Enforcement, that claim is then assigned to a Deputy Labor Commissioner. They will then decide whether to:

Refer the matter to a conference – The parties involved are brought together to meet and attempt to resolve the issue out of court.

Refer the matter to a hearing – The parties involved will testify under oath during a recorded hearing. Afterwards, the Labor Commissioner will serve an Order, Decision, or Award (ODA) to the parties.

Dismiss the matter

The ODA may be appealed by either party. The matter will then be sent to trial where the parties involved will present their cases again, without the initial hearing bearing primary weight on the court’s final decision. IF the employer is the one appealing the ODA and the employee can not afford legal representation, the DLSE may opt to represent them.

What Do I Do If I Win an Overtime Pay Claim But the Employer Fails to Pay?

Sometimes, an Order, Decision, or Award will be in the employee’s favor and the employer will not appeal but will refuse to pay. In this instance, the Division of Labor Standards Enforcement will request that the ODA be entered as a court judgement.

Contact Mesriani Law Group if You Are Owed Overtime Pay

In the state of California, employers are legally required to pay all nonexempt employees 1.5 times their regular rate of pay for hours worked over 8 and up to 12 in a work day, hours over 40 in a work week, and the first 8 hours of the seventh day worked in a row in a workweek. They are also legally required to pay 2 times their regular rate of pay for hours worked over 12 in a workday, and hours over 8 on the seventh day worked in a row. Unfortunately, not all employers properly pay their employees. If you believe your employer has not paid you properly, call Mesriani Law Group today.

Overtime Pay FAQs

How does overtime work?

In the state of California, if an employee works more than 8 hours and up to 12 hours in a workday, those hours are compensated at 1.5 times their normal rate of pay. Also compensated at time and a half are hours worked over 40 in a workweek and the first 8 hours worked on the seventh consecutive day in a row. Hours over 12 on a workday and hours over 8 on the seventh day in a row are compensated at 2 times the normal rate of pay.

Do overtime hours count towards 40 hours in California?

All hours count towards total hours worked. Hours worked over 8 in a workday are daily overtime. Hours worked over 40 in a workweek are weekly overtime. If hours count as both daily and weekly overtime, they are only counted once.

Is 7th day double time in California?

According to California state labor laws, the first 8 hours worked on the seventh consecutive day in a row worked in a workweek are paid at time and a half. Any hours worked after those first 8 hours are paid at double time.

#California Employment Laws#Overtime#Overtime Pay#Wage and Hour Violations#Employment Law#Employment Lawyers#California Attorneys#Workplace Discrimination#Workplace Retaliation

0 notes

Text

Dear Labor Department,

It's nice to want.

Affectionately,

A Dissatisfied Customer

#In the Words of My Father#And please note that this is just a joke#Mostly based on my own place of work#Work#Jobs#Labor#Mycki's Working Life#Mycki Jokes#Funny Shit#Pay Scales#Overtime Pay

0 notes

Text

120 notes

·

View notes

Text

Overtime Pay: How Is It Beneficial?

Nowadays, most firms expect their employees to work extra than their regular official hours. Some employers consider their additional work seriously enough to calculate their salaries, while some do not.

For those who sacrifice their time with family and friends to complete their tasks, it's obvious for you to demand extra pay. The term for this is overtime payment. As per the latest employment research, if your working hours exceed 40 hours of total work per week, you are eligible for overtime pay.

Let's know more about it in detail:

What Is Overtime Pay?

Overtime payment is the compensation an employee receives for working beyond their regular employment hours. If you feel you are eligible for overtime pay and your standard workweek is 30 hours, then working 40 hours will be considered overtime. Hence, you will be eligible to get extra compensation for the additional 10 hours you work.

The exempted employees for extra time payment are:

Executive

Administrative

Computer

Highly-compensated

Outside Sales

Whereas the non-exempted employees for extra time payment are:

Production roles

Police officers

Administrative assistants

Manufacturing roles

Construction roles

Contractors

Firefighters

Retail associates

Paramedics

Now, let's look at:

Types Of Overtime Pay:

There are numerous types of overtime payment:

Time Off In Lieu (TOIL):

Certain employers offer their workers extra time off in return for working extended hours. The employer and the employee collaborate to arrange the schedule for this leave.

Voluntary Overtime:

It pertains to the optional overtime work your employers provide, which you can choose to agree to or refuse without any negative consequences. Workers who agree to it earn additional compensation in the form of overtime pay for the extra hours they put in by tracking overtime.

Non Guaranteed Overtime:

It describes the possibility of your employer offering overtime work, which is not certain. In the event that overtime is offered, you are obligated to work the specified hours as stated in your employment agreement.

Compulsory Overtime:

Mandatory overtime, also known as compulsory overtime, is included in the conditions of your employment agreement. Even though it is outlined in the contract, employers still adhere to overtime laws to ensure compliance.

How To Calculate Overtime Pay?

Check Your Exemption:

Before you demand overtime payment from your employer, make sure to check whether your employment category falls into exempted or non-exempted as per FLSA. If you still feel exempt, talk to your employer to pay you for the extra time.

Research:

Although many employers pay their employees one and a half times their regular rate for working overtime, there are some who offer a rate of double time or a distinct rate that is at least one and a half times their usual rate. Additionally, state regulations may also specify the amount of overtime pay that workers are entitled to. If you are unaware of your employer's overtime pay rate, you can consult your contract or employee statement of work, which usually contains this information.

Determine Weekly Hours:

You should record the number of hours you work every week, particularly if you have an unpredictable or divided work schedule. Keeping a timesheet to report your hours to your employer will make it simpler for you to keep track of your hours compared to tracking your pay on a weekly basis.

Calculate Your Pay:

Once you have assessed the number of overtime hours you have completed during a particular week and your company's corresponding overtime pay rate, you can compute your overtime wages for a designated duration. To determine your overall overtime earnings, multiply the total overtime hours worked by the overtime rate. This calculation will provide you with an estimate of the amount of overtime pay you will receive.

You can also watch: EmpMonitor: Best Time Tracking Software

youtube

Wrapping Up:

So we hope our readers have got prior knowledge of how overtime pay is beneficial for employees. We have also listed some information about the types and ways to calculate the same.

0 notes

Text

Supreme Court Takes Up FLSA High Earners Exemption

Supreme Court Takes Up FLSA High Earners Exemption

On October 12, 2022, the U.S. Supreme Court heard oral arguments in a case that considers whether a supervisor who earned over $200,000 annually may still be eligible for overtime pay under the Fair Labor Standards Act (FLSA). The case centers on the interpretation of the regulatory scheme surrounding highly compensated employees and their exemption status under the FLSA.

The Plaintiff in the…

View On WordPress

#Fair Labor Standards Act#fair pay#FLSA#FLSA exemption#Overtime Pay#SCOTUS#U.S. Supreme Court#wage law

0 notes

Text

How to compute the overtime pay of government employees (with actual computation)

How to compute the overtime pay of government employees (with actual computation)

Legal Basis

CSC-DBM Joint Circular No. 1, s. 2015 — Policies and Guidelines on Overtime Services and Overtime Pay for Government Employees, dated November 25, 2015

Forums

Overtime pay if overtime services fall on a work day

Overtime pay if overtime services fall on rest day or scheduled day off, holiday, or special non-working day.

View On WordPress

0 notes

Text

Employment Law Case Reviews - Overtime Pay Violation

Employment Law Case Reviews – Overtime Pay Violation

(more…)

View On WordPress

#career#career advise#career change#Department of Labor Cases#DOL#DOL cases#not getting paid for overtime#overtime pay#overtime pay violations#reporting overtime violations

0 notes