#naffziger

Text

Showa Squad showing up at your door

628 notes

·

View notes

Text

Building at 5654 Delmar Boulevard, St. Louis, Missouri, USA

Photos by Chris Naffziger

88 notes

·

View notes

Text

Bonus Kaijumas post!

As seen in the video, here are the extra photos I took for "Five Sofubi" and the "Christmas Gigan" that pops up in the last verse.

For the record, I can't take full credit for Gigan. Friend and fellow kaiju fan and artist Lisa Naffziger did a candy cane Gigan while I was still editing the video, and that inspired me to do this palette swap at the last second. :)

youtube

19 notes

·

View notes

Link

Egor Redin has found a Russian Baptist community in the Seattle area, where he and his family have settled as they await their asylum hearings. He is surprised by the level of religious freedom in the United States. In Russia, pastors have to watch what they say in the pulpit; here, the idea that security services would eavesdrop on sermons seems unthinkable. Even nature seems less afraid here, he says: he’s seen more wild animals than he ever did in Russia. And he is deeply grateful for the “incredible amount of mutual assistance” in his church, and the support of state social services of Washington State. He thanks God for the opportunity to start a new life in a democratic country.

He also isn’t blind to the problems of his new home: he is troubled by the number of unhoused people he sees and wants to help. For now, though, he is focused on helping others who, like him, are seeking asylum from persecution abroad. Recently, he helped start a program through his church to match asylum seekers with guarantors. Guarantors agree to provide an address for important documents to go to and to help asylum seekers adjust to life in the United States. Having a guarantor can help asylum seekers avoid extended detention or immediate deportation, since immigration authorities want to be able to find them easily. Egor recently received his work permit and plans to begin practicing as a lawyer as soon as he can pass an American bar exam, so that he can help others seeking asylum. At present, he does what he can: he publishes information about seeking asylum via a Telegram channel of his own in the United States.

1 note

·

View note

Text

A Russian Christian Speaks Out by Rachel Cañon Naffziger

The Russian Orthodox Church is not entirely united behind Kirill: over 150 priests signed a letter protesting the war in March 2022, calling for “reconciliation and an immediate ceasefire.” But at the highest level, the church is wedded to political power. One prominent Orthodox television channel owner went so far as to say that Putin was sent by God.

Source: A Russian Christian Speaks Out by…

View On WordPress

0 notes

Text

AMD claims “a big lead” versus Nvidia with Radeon GPU chiplets

AMD claims “a big lead” versus Nvidia with Radeon GPU chiplets

Both AMD and Nvida set to release new contenders for the title of best graphics card later this year, but team red claims that its new approach to GPU design gives the company a big lead versus its competitors. It all comes down to chiplets, which could replace the monolithic dies we’ve become accustomed to.

Samuel Naffziger, AMD senior vice president, corporate fellow, and product technology…

View On WordPress

0 notes

Text

AMD, RDNA 3 series power consumption is quite high

AMD has increased power consumption with new generation graphics cards. AMD's latest graphics cards have been criticized for high power consumption by users.

Not much, just a few years ago a good computer could run with a 500W power supply. As time progressed, technology improved, and as performance increased, the power requirement naturally increased. The last point of the graphics cards is the increase in the bill visibly. According to published reports, AMD will consume very high power with the RDNA 3 series.

The future of the new generation with no less power requirements was already evident. However, there is also a competition between Nvidia and AMD in terms of power consumption. In the next generation, users will also consider the wattage spent when choosing between the two brands. Therefore, the power consumption of these cards is of greater importance.

AMD RDNA 3 can reach 450W power consumption

While 450W power supply can be enough to feed a mid-level computer, it is not so when we go to the upper segment. While Nvidia's current generation flagship RTX 3090 consumes 300-400W of power, we will see AMD reach 450W with the new generation. However, this is not surprising, because similar power consumption values are expected from the RTX 40 series, which Nvidia will introduce this year. However, we can see slight differences between the two manufacturers.

Since we can see power consumptions of up to 450W from both brands, the factor we will determine when choosing is performance. AMD's senior manager, Sam Naffziger, used the expressions "Performance is king" when it comes to energy efficiency in an interview he attended. In addition, claiming that the AMD RDNA 3 architecture is the leader in performance per Watt, the manager pointed out that the main point is performance.

Later this year, both Nvidia and AMD will introduce new generation graphics cards. It is certain that these have the power to raise the bill, and the next thing we will pay attention to is how much performance they can give despite the energy they consume. In the system where a video card consumes 450W of power, a huge power supply such as 1000W will be needed. In other words, if you are going to assemble a high-end computer in the near future, it is useful to calculate the power consumption.

We hope to have more information about the AMD RDNA 3 architecture in the near future. Which would you choose between Nvidia and AMD?

Read the full article

0 notes

Text

AMD's President Talks GPU Efficiency, Power Targets, Chiplets, Cache & How NVIDIA & Intel Stack Up To Them, Says Raja Koduri Is A Visonary

AMD’s President Talks GPU Efficiency, Power Targets, Chiplets, Cache & How NVIDIA & Intel Stack Up To Them, Says Raja Koduri Is A Visonary

AMD’s Senior Vice President, Sam Naffziger, had a lot to talk about regarding GPU efficiency, power numbers, chiplets, cache, and how their competitors stack up to them in an interview with Venture Beat.

AMD President & Tech Architect Talks Energy-Efficient Computing, GPUs, Chiplets & How They Are Addressing The Competition

Sam Naffziger has been at AMD for 16 years and currently has the role of…

View On WordPress

0 notes

Photo

Lisa Naffziger turned her kaiju illustrations into T-shirts with all-over prints. Hedorah, Gigan, Destoroyah, and Gamera are available for $38 each on Society6, along with other goodies.

#godzilla#godzilla king of the monsters#godzilla: king of the monsters#gamera#hedorah#gigan#destoroyah#kaiju#daikaiju#godzilla vs hedorah#godzilla vs gigan#godzilla vs destoroyah#godzilla vs. hedorah#godzilla vs. gigan#godzilla vs. destoroyah#lisa naffziger#shrit#gift

59 notes

·

View notes

Text

I like my legendary goji LIME GREEN OK

575 notes

·

View notes

Text

If you’re not checking out @takingbacktoku then what the hell are you doing, it’s a delightful, relatable indie comic dramedy about struggling in a creative job with cool monsters - and it’s free on the internet.

17 notes

·

View notes

Link

Order placed! Excite!!

1 note

·

View note

Text

Pharaoh of Eels: The Audio Experience is

“a thrill to listen to.” (-Lisa Naffziger @rugops )

Out now (link)

13 notes

·

View notes

Text

Talking Sense About Bitcoin Electricity Use

There’s been a lot written over the past couple of years about the electricity used to mine Bitcoin, the most prominent of many cryptocurrencies. I can best summarize the credibility and tone of that coverage with the following headline from Newsweek:

Bitcoin Mining On Track To Consume All Of The World’s Energy By 2020

This kind of headline makes me cringe, because it’s

1) an invalid extrapolation of oversimplified calculations that are no better than guesses that may mislead investors into taking rash actions; and (less importantly)

2) Bitcoin mining uses electricity, not (usually) other forms of energy.

I’ve been studying the electricity used by computing equipment for more than two decades, so I have some things to say about this latest outbreak of people taking leave of their critical faculties.

I’m also the author of an award winning book on critical thinking skills (among many other books and articles), recently out in its 3rd edition (Turning Numbers into Knowledge: Mastering the Art of Problem Solving, October 1, 2017).

In this post, I lay out my thoughts about how sensible people can avoid being misled by the hype machine on Bitcoin electricity use. I created a blog page that lists the recent links I’ve been able to find on this topic, which you can find here.

I’m making no judgment here about whether Bitcoin is something that society shouldbe doing, just focusing on the narrow question of what we know about the estimates of electricity used by Bitcoin currently making the rounds.

PRELIMINARIES

Bitcoin is what’s called a “cryptocurrency”, which is a digital medium of exchange and a store of value under decentralized control (unlike traditional currencies that are created and regulated by governments). The technology underlying Bitcoin and other cryptocurrencies is what’s called “block chain”, which is a decentralized way to establish and maintain trust among people interacting with each other.

Bitcoin is a public, permissionless block chain that uses what’s called “proof of work” to establish this trust. There are other types of block chains, and in some cases these can be designed to be less computationally and energy intensive than Bitcoin. I’ll explore the implications of this fact below.

There are at least a couple of credible academic studies of Bitcoin electricity use (O’Dwyer and Malone 2014 and Vrankan 2017), but things change so fast in this field that estimates become outdated in weeks or months.

BRANDOLINI’S LAW GOVERNS

In 2014, and Italian software developer named Alberto Brandolini made the following trenchant observation, which has come to be known as Brandolini’s law, or the BS asymmetry principle (where BS stands for bull manure in polite company):

The amount of energy needed to refute BS is an order of magnitude bigger than to produce it.

This “law” encapsulates one important reality of living in the digital age: it’s easier to create ostensibly accurate but incorrect numbers than it is to demonstrate why such numbers are invalid. That is the nature of careful analysis, but people have come to expect instant answers on new topics, even when there isn’t any real data or research. That’s the case for Bitcoin electricity use, which has emerged as a topic of wide public interest only in the past couple of years.

My corollary to Brandolini’s law is that

In fast changing fields, like information technology, BS refutations lag BS production more strongly than in fields with less rapid change.

This corollary places special obligations on media producers and consumers (Koomey 2014).

KNOW YOUR HISTORY

Information technology changes at a much more rapid pace than many other technologies (Nordhaus 2007, Koomey et al. 2011, Koomey et al. 2013, Koomey and Naffziger 2016). Unfortunately, innumerate observers love to mindlessly extrapolate rapid exponential growth rates to create “clickbait” headlines like the one in Newsweek I cited above. There’s also a tendency to assume that because information technology is economically important that it also must use a lot of electricity, but that’s just not the case.

Here are a couple of historical examples.

In 2003, writing in IEEE Spectrum, I cited an anecdote from Andrew Odlyzko, formerly at AT&T, now at the University of Minnesota (Koomey 2003). Odlyzko documented the genesis of a familiar “factoid” from the mid-1990s (“the Internet doubles every 100 days”) that led to a substantial overinvestment in the fiber optic network. This misconception

was based on data reported by UUNet, the first commercial Internet service provider, in the mid-1990s. In those days, at least for a brief time, such growth rates actually prevailed. But for almost all the rest of the 1990s, data flows were doubling only every year or so, as documented by Kerry Coffman and Andrew Odlyzko of AT&T Corp. and reported by The Wall Street Journal in 2002.

The difference between the two growth rates is huge: because of the magic of compounding, a doubling of traffic every 100 days translates into growth of about 1000 percent a year, rather than the 100 percent-a-year growth represented by an annual doubling.

During the dot-com boom, industry leaders, investment analysts, and the popular press repeated that gross overestimate of the growth of Internet data flow. The bogus figures helped justify dubious investments in network infrastructure and contributed greatly to overcapacity in the telecommunications and networking industries. Only a tiny fraction of this network capacity is now [circa 2003] being used, and billions of dollars [were] squandered because of blind acceptance of flawed conventional wisdom.

Misleading factoids about information technology electricity use emerged from coal-industry funded studies around the year 2000, at the time of the first dot com bubble and the California electricity crisis. They popped up again, from the same authors and funders, in 2005and 2013. The claims were reported in every major newspaper, cited by investment banking reports and politicians of both political parties, and avidly promoted by people and companies who should have known better.

The authors claimed that the Internet used 8% of US electricity in 2000, that all computers (including the Internet) used 13%, and that the total would grow to 50% of US electricity in 10 years. The authors also claimed that a wireless Palm VII used as much electricity as a refrigerator (later updated to an iPhone using as much electricity as TWO refrigerators) for the networking to support its data flows.

All of these claims turned out to be bunk, but it took years of creating peer reviewed research to prove it. We found that the Internet (defined as those authors defined it) used only 1% of US electricity in 2000, all computers used 3%, the total would never grow to half of all electricity use, and that the factoid about the wireless Palm VII overestimated networking electricity by a factor of 2000. In virtually every case, we found that those authors had overestimated electricity used by computing equipment. For a summary of these claims and a review of their effects on investors, see the Epilogue to the 3rd Edition of Turning Numbers into Knowledge.

These examples came to mind when I first heard about recent claims about Bitcoin electricity use, but the Bitcoin issue has some unique features.

BEWARE OF HAND WAVING ESTIMATES

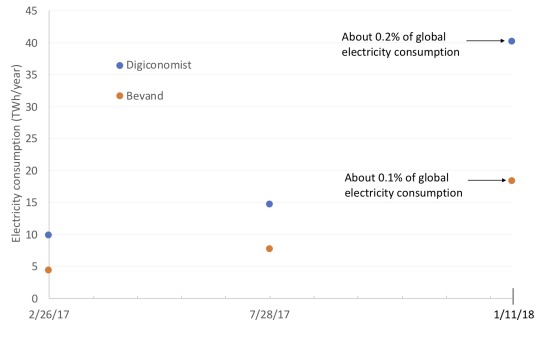

The web site Digiconomist is the source for many media estimates of Bitcoin electricity use. The site is the creation of Alex de Vries, an economist in the Netherlands, and he summarizes his estimates in the form of his “Bitcoin consumption index”. Figure 1 is a screen shot of that index for roughly the past 16 months, showing TWh (terawatt-hours or billion kWh) on the Y-axis and time on the X-axis:

One important feature of cryptocurrency electricity use is that you need to specify the exact day to which your estimate applies. That’s because Bitcoin mining is increasing rapidly over time, so generating a monthly or annual average isn’t accurate enough. Such growth makes estimates from only a couple of years back less useful for estimating current day Bitcoin electricity use than you might expect.

De Vries recently published a commentary article in the journal Joule, in which he summarized the method for generating the Bitcoin consumption index. De Vries is able to create a time series day by day because he generates the index using following data:

1) the price of bitcoin over some time period (it was about $6300 as of today, October 29, 2018);

2) the number of Bitcoins mined over that same time period;

3) an assumption about the percentage of the bitcoin price that is electricity (60%), which would include both direct electrcity use for bitcoin mining rigs and the supporting infrastructure electricity(cooling, fans, pumps, power conversion, etc); and

4) an assumption about the price of electricity (5¢ US/kWh)

Figure 1: Digiconomist Bitcoin Energy Consumption Index

The price of bitcoin over some time period times the number of Bitcoins mined in that period (plus transaction fees) gives total revenues, which are multiplied by 60% to get electricity expenditures. Those expenditures are divided by the assumed electricity price to get electricity consumption of the network in TWh.

The calculation has the advantage of being tractable using available data, but it relies on assumptions about economic parameters and Bitcoin miner behavior (e.g., optimal allocation of mining resources) to estimate physical characteristics of a technological system.

Calculations like these set off alarm bells for me. Economic parameters (like Bitcoin prices) are volatile, and are at best imperfectly correlated with electricity use. In real economic systems, there may be a tendency towards optimality, but they often don’t get close because of transaction costs, cognitive failures, and other imperfections in people and institutions. In addition, the assumptions used by Digiconomist are so simplistic as to make any credible analyst wary.

DOING IT RIGHT

The more direct way to estimate electricity used by equipment is to understand the characteristics of the underlying computing, cooling, and power distribution equipment using field data (as we did for our most recent data center report). Unfortunately, aside from a few anecdotes in the trade and popular press, there’s little information on Bitcoin mining operations.

The servers used for Bitcoin mining are nowadays customized for just that application, and they bear little resemblance to standard server hardware installed in corporate or hyperscale data centers. Because these custom servers have not been tracked by the big data providers (like IDC and Gartner), we have only guesses/estimates as to how many are being built. We know almost nothing about where they’re being installed. And our knowledge of the power systems and cooling equipment in these facilities is virtually nil.

These data issues make it hard to create accurate estimates of electricity used by Bitcoin mining in the aggregate. This is probably why de Vries used his simplified economic approach to generate his index, but that doesn’t mean this method is a reliable indicator of Bitcoin electricity use.

Marc Bevand, an “analyst and crypto[currency] entrepreneur”, critiqued the Digiconomist estimates on February 1, 2017. Most importantly, he expressed concern over the arbitrary choice of 60% of revenues being electricity, and showed a range in his data (based on real equipment) of between 6.3% and 38.6%. Using a more refined approach and more detailed information about the characteristics of Bitcoin mining rigs over time, he estimated Bitcoin electricity use for February 26, 2017, July 28, 2017, and January 11, 2018. Figure 2 compares the Bevand and Digiconomist estimates for those three days.

Bevand did not generate day by day estimates for the intervening periods as Digiconomist does, but these three data points are enough to teach some important lessons. Both sources show growth of about fourfold between February 26, 2017 and January 11th, 2018. That’s rapid growth compared to conventional end-uses, so it’s not surprising that Bitcoin is getting more attention. The big difference is in the absolute electricity consumption. Bevand’s estimates are less than half of the Digiconomist estimates. They also are far more technically detailed and less dependent on high level arbitrary assumptions, which makes them more trustworthy, in my view.

Another important finding from this graph is the relative scale. The world used 21,200 TWh/year in 2016, the latest year for which I could find historical data, and this number increases by only a few percent a year, if history is any guide. This means that on January 11, 2018, Bitcoin accounted for about 0.1% of global electricity if Bevand’s numbers are correct.

Figure 2: Comparison of Digiconomist and Bevand Estimates of Bitcoin Electricity Use

IT’S NOT A CRISIS, BUT MORE RESEARCH IS NEEDED

According to the International Energy Agency, data centers and global networking equipment each accounted for about 1% of global electricity use in 2014, for a total of 2% (IEA 2017). In addition, growth in electricity use for data centers appears to have slowed substantially in recent years, as is also true for the US (Shehabi et al. 2016). Because of inefficiencies in current corporate data centers, little if any growth is expected for electricity use of data centers as a whole over the next couple of years.

Mining Bitcoin accounts for about 0.1% of global electricity use if Bevand’s estimates are correct, implying that total data center electricity use is about 5% bigger than what IEA estimates (Bitcoin isn’t included in those figures). Without better data, it’s hard to be any more precise than that.

Recent growth rates for Bitcoin mining are substantial, and if that growth continues at anywhere near current rates, Bitcoin electricity use will become more important soon. Continued growth in Bitcoin mining electricity use depends on the price of bitcoin, the difficulty of mining Bitcoin (which goes up as mining speed goes up), and the rate of efficency improvements in Bitcoin mining rigs. It also depends on electricity prices, the cost of mining equipment, and the continued laissez-faire attitude many governments have about Bitcoin (which could change quickly, but no one can predict if or when that might happen).

One thing we should NOT do is recklessly extrapolate recent growth rates for Bitcoin into the future, as the Nature Climate Change article coming out today appears to do (Mora et al. 2018). I cannot emphasize enough how dangerous, irresponsible, and misleading such extrapolations can be, and no credible analyst should ever extrapolate in this manner, nor should readers of reports on this topic fall for this well-known mistake.

Another big uncertainty is that we know even less about other cryptocurrencies than about Bitcoin, so more research is clearly needed there. The electricity use for non-Bitcoin cryptocurrencies should be tallied, both because the total is important and because these other cryptocurrencies (which can be MUCH more energy efficient than Bitcoin) may represent competition to Bitcoin if the electricity demands of Bitcoin become unmanageable.

We urgently need measured data about Bitcoin mining facilities in the field, including characteristics of Bitcoin mining rigs and the power and cooling infrastructure needed to support them. The Digiconomist estimate uses very high level assumptions and data to estimate electricity use, while Bevand creates a more detailed technical estimate, but neither includes much if any field data on actual equipment in real facilities. If we’re to get a better handle on Bitcoin electricity use, such field studies and data are vital.

A colleague (Professor Eric Masanet) and I have secured a small amount of funding to investigate the implications of block chains for electricity use, and that project begins in November 2018. To do such analyses properly (as we did in 2007, 2008, 2011, 2013, and again in 2016 for US data center electricity use) takes teams of scientists and hundreds of thousands of dollars, so it’s no surprise this emergent issue hasn’t yet been carefully studied (EPA 2007, Koomey 2008, Masanet et al. 2011, Masanet et al. 2013, Shehabi et al. 2016). Policy makers naturally want answers quickly, but until more research is funded, there’s not a whole lot more we can say about this issue.

OTHER LESSONS

While I encourage everyone in the electricity sector to track Bitcoin as a potential source of new load growth, please use caution and avoid being misled by the hype. Breathless media coverage papers over the uncertainties in the underlying data, and makes it seem like Bitcoin is taking over the world, but in fact it’s likely only 0.1% of global electricity consumption, and it is unlikely to continue growing at recent historical rates.

Because the rate of change in Bitcoin electricity use can be rapid, it is critically important that no estimates of electricity use be cited or reported unless the day to which that estimate applies is also reported. It is not sufficient to report the year in which an estimate applies, because things change so fast.

If there are many mining facilities proposed in a utility service territory, I suggest that they be charged the full cost of transmission and distribution infrastructure investments up front. Bitcoin mining can disappear just as fast as it rose to prominence, and you don’t want ratepayers to be left holding the bag. I’m not predicting that outcome, just pointing it out as a possibility with real risks to utility ratepayers.

If Bitcoin electricity use becomes more important, we’re likely to face questions about whether to allocate limited zero emissions generation resources to power it. If we use it for Bitcoin, we can’t use it elsewhere, so we’ll have to choose. This concern should factor into the needed societal conversation about whether cryptocurrencies are something we should as a society encourage.

The method for ascertaining trust for Bitcoin is needlessly computationally intensive, and other cryptocurrencies have taken a different tack. Resource intensity can be reduced substantially (i.e., by orders of magnitude) with software and protocol redesign, so it’s not just a question of hardware efficiency. As use cases for cryptocurrencies emerge, we’ll need to confront the possibility that more efficient cryptocurrency designs may be a better fit than Bitcoin for a low emissions world.

CONCLUSIONS

It’s still early days for cryptocurrency and the data on its electricity use are still too poor to derive firm conclusions. The issue bears watching, but caution is indicated, particularly when large investments are involved (like for transmission lines and distribution transformers for new bitcoin mining facilities). Media observers should beware of mindless extrapolations of recent trends, as such simpleminded methods can lead to consequential mistakes. At this point (as of January 11, 2018), Bitcoin mining accounts for about 0.1% of global electricity use, but recent growth has been rapid. What happens next is up to us.

ACKNOWLEDGMENTS

Professor Harald Vrankan of the Open University of the Netherlands and Jens Malmodin of Ericsson gave comments on an earlier version of this blog post. The author is responsible for the blog post itself and any errors contained herein.

REFERENCES

IEA. 2017. Digitalization and Energy. Paris, France: International Energy Agency. [https://www.iea.org/digital/]

Koomey, Jonathan. 2003. "Sorry, Wrong Number: Separating Fact from Fiction in the Information Age." In IEEE Spectrum. June. pp. 11-12. [http://ieeexplore.ieee.org/xpls/abs_all.jsp?arnumber=1203076&tag=1]

Koomey, Jonathan. 2008. "Worldwide electricity used in data centers." Environmental Research Letters. vol. 3, no. 034008. September 23. [http://stacks.iop.org/1748-9326/3/034008]

Koomey, Jonathan G., Stephen Berard, Marla Sanchez, and Henry Wong. 2011. "Implications of Historical Trends in The Electrical Efficiency of Computing." IEEE Annals of the History of Computing. vol. 33, no. 3. July-September. pp. 46-54. [http://doi.ieeecomputersociety.org/10.1109/MAHC.2010.28]

Koomey, Jonathan G., H. Scott Matthews, and Eric Williams. 2013. "Smart Everything: Will Intelligent Systems Reduce Resource Use?" The Annual Review of Environment and Resources. vol. 38, October. pp. 311-343. [http://arjournals.annualreviews.org/eprint/wjniAGGzj2i9X7i3kqWx/full/10.1146/annurev-environ-021512-110549]

Koomey, Jonathan. 2014. "Separating Fact from Fiction: A Challenge For The Media." In IEEE Consumer Electronics Magazine. January. pp. 9-11. [http://ieeexplore.ieee.org/xpl/articleDetails.jsp?arnumber=6685864]

Koomey, Jonathan, and Samuel Naffziger. 2016. "Energy efficiency of computing: What's next?" In Electronic Design. November 28. [http://electronicdesign.com/microprocessors/energy-efficiency-computing-what-s-next]

Masanet, Eric R., Richard E. Brown, Arman Shehabi, Jonathan G. Koomey, and Bruce Nordman. 2011. "Estimating the Energy Use and Efficiency Potential of U.S. Data Centers." Proceedings of the IEEE. vol. 99, no. 8. August. [https://eta.lbl.gov/sites/all/files/publications/lbnl_version_procieee_embargoed-1-1.pdf]

Masanet, Eric, Arman Shehabi, and Jonathan Koomey. 2013. "Characteristics of Low-Carbon Data Centers." Nature Climate Change. vol. 3, no. 7. July. pp. 627-630. [http://dx.doi.org/10.1038/nclimate1786]

Mora, Camilo, Randi Rollins, Katie Taladay, Michael B. Kantar, Mason K. Chock, Mio Shimada, and Erik C. Franklin. 2018. "Bitcoin emissions alone could push global warming above 2°C." Nature Climate Change. October 29. [https://doi.org/10.1038/s41558-018-0321-8]

Nordhaus, William D. 2007. "Two Centuries of Productivity Growth in Computing." The Journal of Economic History. vol. 67, no. 1. March. pp. 128-159. [http://www.econ.yale.edu/~nordhaus/homepage/homepage/nordhaus_computers_jeh_2007.pdf]

O’Dwyer, Karl J., and David Malone. 2014. Bitcoin Mining and its Energy Footprint. Proceedings of the ISSC 2014/CIICT 2014 Conference. Limerick, Ireland: June 26-27. [http://eprints.maynoothuniversity.ie/6009/1/DM-Bitcoin.pdf]

Shehabi, Arman, Sarah Josephine Smith, Dale A. Sartor, Richard E. Brown, Magnus Herrlin, Jonathan G. Koomey, Eric R. Masanet, Nathaniel Horner, Inês Lima Azevedo, and William Lintner. 2016. United States Data Center Energy Usage Report. Berkeley, CA: Lawrence Berkeley National Laboratory. LBNL-1005775. June. [https://eta.lbl.gov/publications/united-states-data-center-energy]

US EPA. 2007. Report to Congress on Server and Data Center Energy Efficiency, Public Law 109-431. Prepared for the U.S. Environmental Protection Agency, ENERGY STAR Program, by Lawrence Berkeley National Laboratory. LBNL-363E. August 2. [http://www.energystar.gov/datacenters]

Vranken, Harald. 2017. "Sustainability of bitcoin and blockchains." Current Opinion in Environmental Sustainability. vol. 28, no. Supplement C. 2017/10/01/. pp. 1-9. [http://www.sciencedirect.com/science/article/pii/S1877343517300015]

2 notes

·

View notes

Text

a very long thought

Dear Ross,

It's been a while since I've sent you an email. Life has been moving fast this week. In my impatience to leave NM, the days can't pass swiftly enough, but on the other side of things it's become increasingly difficult to savor well the season of advent. Much like lent, I am finding this season is revealing of my ineptitude at grasping and practicing regular observance; and simultaneously, there is this begrudging realization that this season still bears a great capacity for grace towards others and ourselves.

I had a wonderful call with a former NM colleague of mine, who left NM several months ago in a rather dramatic way, and has served as an invaluable sounding board as I process the systemic misogyny, racism, and ethical dilemmas that NM is fraught with. I am coming to see that: the type of woman who lasts the longest at a firm like this is submissive, a follower, steady and reliable, patient, and a professional who doesn't have idealistic career aspirations. I don't fit, and I never did, and that's more than okay.

I've noticed that my voice has become quieter in this last year and a half, I've stopped speaking up and interrupting as much, I've been more hesitant to take initiative on projects because I know they'll get assigned entirely to me if I show the least amount of interest, I've begun to automatically defer to the men in the room, to adopt a submissive posture. It's taken my involvement with the endowment project and the leadership cohorts to realize that I've been cloaking my true self in favor of a more palatable, amiable version of my working self. It's what I did at moody to survive, and what I felt I had to do in this space in order to not be labeled as an emotional or immature millennial.

With these realizations have come bitterness, that I've become complacent in letting myself stagnate in my professional development in these ways. But then I am reminded that no work experience is wasted, and that I've learned so many things of what not to do when I finally achieve a management position, or end up in a hiring role, or lead a team. So in that sense, my education here at NM has been constructively helpful. Even as I have limited myself, I've also grown in my understanding of how corporate systems work, and how my ethical framework ought impact the spaces I exist in.

I deeply respect the co-workers who comprise my team, who have been supportive and encouraging and who have trained me from the ground up. But I also know that my existing in this space long-term was never going to be worth it. Justifying my staying by highlighting my role on the team as needful was just a construct to make getting through the week a little easier. But no job is worth a psychiatrist, four anxiety and anti-depression medications, aggravated PTSD, and the suicidal hole I existed in for most of this year. It took a long time to realize this.

I know that at one point, somewhere on the future trajectory, there exists a reality where work will be fulfilling and good, as I believe God has created work to be. And I am daring to hope in that direction.

The last two years have been a halting lament of losing parts of myself along the way, but I'm coming to realize those parts were never really who I was, they were just facades I created to fit the environment I was in. Assimilation is deadly and subtle, and I wrestle with the reality that this is most often my default posture.

_

I've begun mentoring a girl at her request, did I tell you that? She's from Moody, and is currently in an intensive agricultural internship in Florida learning how to sustainably grow food with hopes of teaching students in CPS as a community organizer when she returns back to Chicago. Anyway, it's been a good exercise in deconstructing the stays of purity culture with her and identifying casual gnosticism and discussing a more holistic theology of body which contains a framework of how we ought consider the purpose of our beauty. The whole relationship dynamic has been challenging in the best way and I feel unqualified and incredibly blessed.

One of my former roommates used to ask often, what is the purpose of beauty for the single person? And I always felt that question was inherently flawed, because I don't think whatever purpose of beauty exists or stewardship thereof then changes functionally when the individual becomes married. I want to hear your thoughts on this. You know I obviously have a very complicated relationship with beauty, and I tend to reject more easily its influence on self-image than make myself wrestle with the implications of if it were to hold a role.

_

There is a good chance that Fancy the Sqrl will become a book, though I have no idea what the premise would be. Emily is out of town again so we roasted a bunch of fish and vegetables last night and it was delightful, and today we're making poppyseed chicken with gluten free breadcrumb topping. Our friend Rachel Naffziger from moody will be staying with us this week, so you may see her on Thursday and Saturday. Lizzy bought a new velvet chair for our living room, and it is velvet, and solidifies everyone's opinion that we can absolutely take NO MORE FURNITURE in this tiny apartment, but the chair is loved by all and I'm really enjoying lounging on it upside down.

Right now, the goal is to army crawl my way to Friday, and gain a few days of reprieve before launching into another grueling week of training next week. That sounds dramatic, because it is.

I am going to go buy my brother a japanese kitchen knife for Christmas now. I hope your Wednesday is going swimmingly.

Yrs,

S

0 notes