#money and finances

Text

Can anyone spare a few bucks?

I found out I'm suddenly $100 overdrawn in my bank >_<

I have PayPal and Venmo both are [email protected] / shippyprincess

Any little bit helps ;-;

#help#financial aid#financial hardship#financial help#money and finances#money aid#money help#signal boost#signal b00st#signalboost#reblog#please reblog#paypal#paypal help#donate to my venmo#donate#donations#donate if you can#please donate#donate to my paypal#venmo me#venmo

141 notes

·

View notes

Text

Are you in the USA? I cannot stress this enough: search your state's unclaimed property site to see if there is anything in your name.

I just got a check for nearly $900 that I didn't know about. Apparently it was sent to me at the end of 2019 and I never got it, so it was sent on to Unclaimed Property.

My friend checked the state he used to live in. He didn't have any unclaimed property of his own. But his dad, who died 20 years ago, had over $10,000 in unclaimed property. My friend is the heir, so he gets that money.

It involves a little paperwork to get the money but it's so worth it!

You can search ALL states using MissingMoney.com. And I recommend that you search ALL states - sometimes you might get a surprise about post property in another state (as my friend did with his dad!)

25K notes

·

View notes

Text

on ao3's current fundraiser

apparently it’s time for ao3’s biannual donation drive, which means it’s time for me to remind you all, that regardless of how much you love ao3, you shouldn’t donate to them because they HAVE TOO MUCH MONEY AND NO IDEA WHAT TO DO WITH IT.

we’ve known for years that ao3 – or, more specifically, the organization for transformative works (@transformativeworks on tumblr), or otw, who runs ao3 and other fandom projects – has a lot of money in their “reserves” that they had no plans for. but in 2023, @manogirl and i did some research on this, and now, after looking at their more recent financial statements, i’ve determined that at the beginning of 2024, they had almost $2.8 MILLION US DOLLARS IN SURPLUS.

our full post last year goes over the principles of how we determined this, even though the numbers are for 2023, but the key points still stand (with the updated numbers):

when we say “surplus”, we are not including money that they estimate they need to spend in 2024 for their regular expenses. just the extra that they have no plan for

yes, nonprofits do need to keep some money in reserves for emergencies; typically, nonprofits registered in the u.s. tend to keep enough to cover between six months and two years of their regular operating expenses (meaning, the rough amount they need each month to keep their services going). $2.8 million USD is enough to keep otw running for almost FIVE YEARS WITHOUT NEW DONATIONS

they always overshoot their fundraisers: as i’m posting this, they’ve already raised $104,751.62 USD from their current donation drive, which is over double what they’ve asked for! on day two of the fundraiser!!

no, we are not trying to claim they are embezzling this money or that it is a scam. we believe they are just super incompetent with their money. case in point: that surplus that they have? only earned them $146 USD in interest in 2022, because only about $10,000 USD of their money invested in an interest-bearing account. that’s the interest they earn off of MILLIONS. at the very least they should be using this extra money to generate new revenue – which would also help with their long-term financial security – but they can’t even do that

no, they do not need this money to use if they are sued. you can read more about this in the full post, but essentially, they get most of their legal services donated, and they have not, themselves, said this money is for that purpose

i'm not going to go through my process for determining the updated 2024 numbers because i want to get this post out quickly, and otw actually had not updated the sources i needed to get these numbers until the last couple days (seriously, i've been checking), but you can easily recreate the process that @manogirl and i outlined last year with these documents:

otw’s 2022 audited financial statement, to determine how much money they had at the end of 2022

otw’s 2024 budget spreadsheet, to determine their net income in 2023 and how much they transferred to and from reserves at the beginning of 2024

otw’s 2022 form 990 (also available on propublica), which is a tax document, and shows how much interest they earned in 2022 (search “interest” and you’ll find it in several places)

also, otw has not been accountable to answering questions about their surplus. typically, they hold a public meeting with their finance committee every year in september or october so people can ask questions directly to their treasurer and other committee members; as you can imagine, after doing this deep dive last summer, i was looking forward to getting some answers at that meeting!

but they cancelled that meeting in 2023, and instead asked people to write to the finance committee through their contact us form online. fun fact: i wrote a one-line message to the finance committee on may 11, 2023 through that form, when @manogirl and i were doing this research, asking them for clarification on how much they have in their reserves. i have still not received a response.

so yeah. please spend your money on people who actually need it, like on mutual aid requests! anyone who wants to share their mutual aid requests, please do so in the replies and i’ll share them out – i didn’t want to link directly to individual requests without permission in case this leads to anyone getting harassed, but i would love to share your requests. to start with, here's operation olive branch and their ongoing spreadsheet sharing palestinian folks who need money to escape genocide.

oh, and if you want to write to otw and tell them why you are not donating, i'm not sure it’ll get any results, but it can’t hurt lol. here's their contact us form – just don’t expect a response! ¯\_(ツ)_/¯

#ao3#otw#archive of our own#organization for transformative works#ao3 is not your savior#and they don't need your money#otw finances

3K notes

·

View notes

Text

Paying consumer debts is basically optional in the United States

The vast majority of America's debt collection targets $500-2,000 credit card debts. It is a filthy business, operated by lawless firms who hire unskilled workers drawn from the same economic background as their targets, who routinely and grotesquely flout the law, but only when it comes to the people with the least ability to pay.

America has fairly robust laws to protect debtors from sleazy debt-collection practices, notably the Fair Debt Collection Practices Act (FDCPA), which has been on the books since 1978. The FDCPA puts strict limits on the conduct of debt collectors, and offers real remedies to debtors when they are abused.

But for FDPCA provisions to be honored, they must be understood. The people who collect these debts are almost entirely untrained. The people they collected the debts from are likewise in the dark. The only specialized expertise debt-collection firms concern themselves with are a series of gotcha tricks and semi-automated legal shenanigans that let them take money they don't deserve from people who can't afford to pay it.

There's no better person to explain this dynamic than Patrick McKenzie, a finance and technology expert whose Bits About Money newsletter is absolutely essential reading. No one breaks down the internal operations of the finance sector like McKenzie. His latest edition, "Credit card debt collection," is a fantastic read:

https://www.bitsaboutmoney.com/archive/the-waste-stream-of-consumer-finance/

McKenzie describes how a debt collector who mistook him for a different PJ McKenzie and tried to shake him down for a couple hundred bucks, and how this launched him into a life as a volunteer advocate for debtors who were less equipped to defend themselves from collectors than he was.

McKenzie's conclusion is that "paying consumer debts is basically optional in the United States." If you stand on your rights (which requires that you know your rights), then you will quickly discover that debt collectors don't have – and can't get – the documentation needed to collect on whatever debts they think you owe (even if you really owe them).

The credit card companies are fully aware of this, and bank (literally) on the fact that "the vast majority of consumers, including those with the socioeconomic wherewithal to walk away from their debts, feel themselves morally bound and pay as agreed."

If you find yourself on the business end of a debt collector's harassment campaign, you can generally make it end simply by "carefully sending a series of letters invoking [your] rights under the FDCPA." The debt collector who receives these letters will have bought your debt at five cents on the dollar, and will simply write it off.

By contrast, the mere act of paying anything marks you out as substantially more likely to pay than nearly everyone else on their hit-list. Paying anything doesn't trigger forbearance, it invites a flood of harassing calls and letters, because you've demonstrated that you can be coerced into paying.

But while learning FDCPA rules isn't overly difficult, it's also beyond the wherewithal of the most distressed debtors (and people falsely accused of being debtors). McKenzie recounts that many of the people he helped were living under chaotic circumstances that put seemingly simple things "like writing letters and counting to 30 days" beyond their needs.

This means that the people best able to defend themselves against illegal shakedowns are less likely to be targeted. Instead, debt collectors husband their resources so they can use them "to do abusive and frequently illegal shakedowns of the people the legislation was meant to benefit."

Here's how this debt market works. If you become delinquent in meeting your credit card payments ("delinquent" has a flexible meaning that varies with each issuer), then your debt will be sold to a collector. It is packaged in part of a large spreadsheet – a CSV file – and likely sold to one of 10 large firms that control 75% of the industry.

The "mom and pops" who have the other quarter of the industry might also get your debt, but it's more likely that they'll buy it as a kind of tailings from one of the big guys, who package up the debts they couldn't collect on and sell them at even deeper discounts.

The people who make the calls are often barely better off than the people they're calling. They're minimally trained and required to work at a breakneck pace. Employee turnover is 75-100% annually: imagine the worst call center job in the world, and then make it worse, and make "success" into a moral injury, and you've got the debt-collector rank-and-file.

To improve the yield on this awful process, debt collection companies start by purging these spreadsheets of likely duds: dead people, people with very low credit-scores, and people who appear on a list of debtors who know their rights and are likely to stand on them (that's right, merely insisting on your rights can ensure that the entire debt-collection industry leaves you alone, forever).

The FDPCA gives you rights: for example, you have the right to verify the debt and see the contract you signed when you took it on. The debt collector who calls you almost certainly does not have that contract and can't get it. Your original lender might, but they stopped caring about your debt the minute they sold it to a debt-collector. Their own IT systems are baling-wire-and-spit Rube Goldberg machines that glue together the wheezing computers of all the companies they've bought over the last 25 years. Retrieving your paperwork is a nontrivial task, and the lender doesn't have any reason to perform it.

Debt collectors are bottom feeders. They are buying delinquent debts at 5 cents on the dollar and hoping to recover 8 percent of them; at 7 percent, they're losing money. They aren't "large, nationally scaled, hypercompetent operators" – they're shoestring operations that can only be viable if they hire unskilled workers and fail to train them.

They are subject to automatic damages for illegal behavior, but they still break the law all the time. As McKenzie writes, a debt collector will "commit three federal torts in a few minutes of talking to a debtor then follow up with a confirmation of the same in writing." A statement like "if you don’t pay me I will sue you and then Immigration will take notice of that and yank your green card" makes the requisite three violations: a false threat of legal action, a false statement of affiliation with a federal agency, and "a false alleged consequence for debt nonpayment not provided for in law."

If you know this, you can likely end the process right there. If you don't, buckle in. The one area that debt collectors invest heavily in is the automation that allows them to engage in high-intensity harassment. They use "predictive dialers" to make multiple calls at once, only connecting the collector to the calls that pick up. They will call you repeatedly. They'll call your family, something they're legally prohibited from doing except to get your contact info, but they'll do it anyway, betting that you'll scrape up $250 to keep them from harassing your mother.

These dialing systems are far better organized than any of the company's record keeping about what you owe. A company may sell your debt on and fail to keep track of it, with the effect that multiple collectors will call you about the same debt, and even paying off one of them will not stop the other.

Talking to these people is a bad idea, because the one area where collectors get sophisticated training is in emptying your bank account. If you consent to a "payment plan," they will use your account and routing info to start whacking your bank account, and your bank will let them do it, because the one part of your conversation they reliably record is this payment plan rigamarole. Sending a check won't help – they'll use the account info on the front of your check to undertake "demand debits" from your account, and backstop it with that recorded call.

Any agreement on your part to get on a payment plan transforms the old, low-value debt you incurred with your credit card into a brand new, high value debt that you owe to the bill collector. There's a good chance they'll sell this debt to another collector and take the lump sum – and then the new collector will commence a fresh round of harassment.

McKenzie says you should never talk to a debt collector. Make them put everything in writing. They are almost certain to lie to you and violate your rights, and a written record will help you prove it later. What's more, debt collection agencies just don't have the capacity or competence to engage in written correspondence. Tell them to put it in writing and there's a good chance they'll just give up and move on, hunting softer targets.

One other thing debt collectors due is robo-sue their targets, bulk-filing boilerplate suits against debtors, real and imaginary. If you don't show up for court (which is what usually happens), they'll get a default judgment, and with it, the legal right to raid your bank account and your paycheck. That, in turn, is an asset that, once again, the debt collector can sell to an even scummier bottom-feeder, pocketing a lump sum.

McKenzie doesn't know what will fix this. But Michael Hudson, a renowned scholar of the debt practices of antiquity, has some ideas. Hudson has written eloquently and persuasively about the longstanding practice of jubilee, in which all debts were periodically wiped clean (say, whenever a new king took the throne, or once per generation):

https://pluralistic.net/2020/03/24/grandparents-optional-party/#jubilee

Hudson's core maxim is that "debt's that can't be paid won't be paid." The productive economy will have need for credit to secure the inputs to their processes. Farmers need to borrow every year for labor, seed and fertilizer. If all goes according to plan, the producer pays off the lender after the production is done and the goods are sold.

But even the most competent producer will eventually find themselves unable to pay. The best-prepared farmer can't save every harvest from blight, hailstorms or fire. When the producer can't pay the creditor, they go a little deeper into debt. That debt accumulates, getting worse with interest and with each bad beat.

Run this process long enough and the entire productive economy will be captive to lenders, who will be able to direct production for follies and fripperies. Farmers stop producing the food the people need so they can devote their land to ornamental flowers for creditors' tables. Left to themselves, credit markets produce hereditary castes of lenders and debtors, with lenders exercising ever-more power over debtors.

This is socially destabilizing; you can feel it in McKenzie's eloquent, barely controlled rage at the hopeless structural knot that produces the abusive and predatory debt industry. Hudson's claim is that the rulers of antiquity knew this – and that we forgot it. Jubilee was key to producing long term political stability. Take away Jubilee and civilizations collapse:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

Debts that can't be paid won't be paid. Debt collectors know this. It's irrefutable. The point of debt markets isn't to ensure that debts are discharged – it's to ensure that every penny the hereditary debtor class has is transferred to the creditor class, at the hands of their fellow debtors.

In her 2021 Paris Review article "America's Dead Souls," Molly McGhee gives a haunting, wrenching account of the debts her parents incurred and the harassment they endured:

https://www.theparisreview.org/blog/2021/05/17/americas-dead-souls/

After I published on it, many readers wrote in disbelief, insisting that the debt collection practices McGhee described were illegal:

https://pluralistic.net/2021/05/19/zombie-debt/#damnation

And they are illegal. But debt collection is a trade founded on lawlessness, and its core competence is to identify and target people who can't invoke the law in their own defense.

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” today (Aug 12) at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/12/do-not-pay/#fair-debt-collection-practices-act

#pluralistic#jubilee#debts that cant be paid wont be paid#Patrick McKenzie#patio11#bits about money#debt#debt collection#do not pay#bottom feeders#Fair Debt Collection Practices Act#fdcpa#finance#armbreakers

11K notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#miscellaneous polls#submitted nov 28#finances#personal finance#money

4K notes

·

View notes

Text

with the end of the month slowly coming up again i am once again unfortunately already broke again and still somewhat in debt, really hoping to get out of that and get a stable enough income to allow me to stay out of debt for the future (i currently make about 1k a month which is very very little for trying to survive in switzerland esp as i currently support myself and a roommate pretty much alone (and currently leaves me somewhat financially dependent on my parents as well which im not gonna be able to be forever), goal for the end of this year is a stable 2k) anything really helps, but the subscription option helps me the most with stability and ability to budget (also i'll hopefully soon manage to give my subscribers actual special benefits).

i hate asking for money so often especially as i haven't put out a new article in quite a while now, but that will change again soon (i have various things in my pipeline and also non text content coming up soon!), and it is the supporters on ko-fi that let me do all the work i do <3

#maia arson crimew#donations#fundraiser#mutual aid#im so sorry#personal finances#also paypal option is disabled as i currently have no way of getting#paypal money to my bank account

2K notes

·

View notes

Text

Basic Financial Rules To Live By 💰✨

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don't spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don't forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you're older and don't work anymore. Use retirement accounts to help with this.

Think before you buy things. Don't buy something just because you want it; think if it's necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance#investing#money#girl math#wealth#level up journey#it girl#dream girl#dream girl guide#dream girl tips#dream girl journey#that girl#becoming that girl#educate yourself#wealth mindset#growth mindset#success mindset

3K notes

·

View notes

Text

#animal crossing#new horizons#acnh#switch#nintendo#nintendo switch#tom nook#finance#money#mortgage#dogs#cute#funny#lol#humor#meme#gaming#video games#villagers#animal crossing new horizons#ac

1K notes

·

View notes

Text

This summer will be a financially satisfying time for you. You won't have to worry about not having enough money. You will have more than enough money to enjoy your desired experiences. You will be able to see new and beautiful places without the burden of stressing over money. You will eat the foods you want to eat and go on all the adventures that call out to you. You will enjoy all the luxuries this summer has to offer you, and money will never be a factor. Claim it.

688 notes

·

View notes

Text

#campaign finance reform#oligarch dark money#Republican Nazi oligarchs#republican billionaires purchased the SCOTUS#illegitimate scotus#republican assholes#never trump#maga morons#traitor trump#crooked donald#republican hypocrisy#corporate greed#republican party#leonard leo#Harlan crow

458 notes

·

View notes

Text

Fictober23 Prompt: 29 - "That's all? Easy."

Fandom: DPxDC

Rating: G

Warnings: -

A/N: I sometimes like to headcannon that Danny is actually a rich kid that doesn't live the rich kid style cause his parents use their money for their research and like to live a simple life. He goes to galas Vlad or Sam drag him to as his parents representative.

Damian had been prepared for another boring Gala to go through. His elder siblings as well as Pennyworth had made sure to take away any sharp blade he had on him beforehand. With the blades gone Damian refused to socialize with high society. What was the point in enduring the torture of pinched cheeks and repeating comments with double meanings and hidden insults as well as the 'boot' lickers, as one of his brothers liked to put it, when he wasn't allowed to return the favor these people were giving him with a quick blade swipe.

So Damian was hanging back, retreating to the corners and shadows of the room where people aside from his family wouldn't notice him. But being there gave him the chance to notice something else. At first Damian didn't think much of it but with the minutes passing he noticed it more and more.

Small colorful page markers.

He started tracking them. Eyes going from person to person as he scanned them for these markers. Always in spots and placements oneself wouldn't notice them on their own as well as by others around them. Sometimes they were even Color matched with the person's outfit.

Damian scanned the hall and his eyes landed on a teenager, younger than Drake but older than him. The other boy was gliding through the people seemingly effortlessly and unnoticed towards the snack table. Once there the teen appeared to be interested in what sort of food the gala was offering.

His eyes narrowed as he eyed the people the teen had passed.

A blue marker by the belt loop of an older gentleman.

Red marker on the purse of the lady dressed in purple.

Green marker on another man's vest.

He was sure these markers weren't on them before. Interesting, he missed before moving towards the teenager by the snack table. The boy by now had piled up one of the small plates high with some of the overhead foods and Damian first felt reminded of everting Todd went to a gala and immediately would go for the foods.

"You are quite sneaky." He spoke up after waiting somewhat politely for the other to acknowledge his presence. Which never happened even after five minutes and Damian having clearly seen the other looking at him from his corner of the eye.

"Oh, what do you mean?" The teen then said after swallowing a bite of food.

"I presume the page markers are what you're doing?"

"Damit, not even an hour in and I am already busted." The teenager muttered and Damian arched an eyebrow. "Look, I don't know whose rich kid you are but will stop as long as you don't tell the fruitloop. I am here to represent my parents and if this fruitloop hears I am playing the game Sam invented for these galas he will-"

"I believe you misunderstood my intention." Damian smirked as he held out a hand. "My family found it adequate to take my blades. So I want in on this 'game' you are playing."

The teenager blinked at Damian before a grin spread across his face. He hurriedly placed his plate on the table before rummaging around in one of his pockets."Well that is a nice change! Your not a stuck up like the other kids here."

A block of green, red and blue page markers were then placed in Damians held out hand. "I am Danny Fenton by the way, representative of Fentonworks."

"Damian Wayne." He answered out of reflex as he inspected the page markers given to him, uncaring if the teen would now start fawning over his last name like he had seen others do before.

"Cool. So want to make it more interesting? This is more fun in a two player setting then one player." Damian inclined his head, not letting the surprise of the other teens lack of reaction towards his name show. Well it looked like Daniel, because what else got the name Danny stand for, would be nice company for this gala.

"Let's make specific targets for each other, maybe even placements. Sam always dares me to do specific things. If one of us gets caught is an automatic loss, the one with the highest successful placements at the end of this gala is the winner."

He smirked. Daniel had no chance, a game like this was easy for him. This was going to be an easy win. His league training as well as the training his father had made him go through was going to give him a clear advantage. He was playing with the thought of giving Daniel a chance by not using certain skills but after the first three targets, Damian decided that that would be unnecessary.

The gala went by faster, the two pointing out specific people or placements of the marketers to each other. They both had surprisingly their fair share of failures as well as success. In the end they both had a draw and were on their last page marker to place.

"This is going to be the final decision between, win, loss or draw." Daniel hyped up the game and Damian shook his head lightly at the others foolishness that reminded him of Jon.

"Well then, it would be only right to select the most difficult targets for each other."

"Well if that's the case, see the guy over there, the one with gray hair and a ponytail? That's the fruitloop. Place your last marker right to the left on his lower back, where his jacket covers over his belt."

Damian arched an eyebrow but the teen only grinned. He smirked if the other wanted to make it apparently difficult then Damian could provide him with a real challenge. "For you target, my father is currently talking to this 'fruitloop' as you call him. Place the marker on his back on his left shoulder blade."

Daniel would not be able to so, his father was vigilant and despite his act, very aware of his surroundings. His newly made gala acquaintance would fail and Damian would be the winner of this game.

"That's all? Easy."

The two boy's started to move towards the two adults. They shared one last glance before splitting up slightly in two different directions to approach their targets. Damian was close, his steps silent as he neared his target the 'fruitloop'. The page marker was tagged to the tip of one of his fingers. Once he was close enough he would be able to place it without even having to get too close.

His father noticed him and Damian gave him a polite smile as he moved like he was going to pass the man in his way towards his father. He did however not anticipate for his target to place his hand on the hip obscuring his target placement. Damian's hand instantly hid his hand behind his back transferring the page tag to his other hand and unconsciously clicked his tongue. He would have to try again.

"Fruitloop! Who are you talking to?!" He heard Daniel shout out of nowhere suddenly, his head wiping around to see the other clapping his hand on his fathers shoulder. The shoulder where he had told the other to place the marker. Damian ground his teeth. He was not going to accept a loss here.

"Daniel! Where are your manners?! This is Bruce Wayne. CEO of Wayne Enterprise. I am so sorry Mr.Wayne."

"No worries Mr.Masters. He is just like how my sons were at his age. It is good for teens to be so full of energy."

Damian narrowed his eyes as the other teen gave him a peace sign and mouthed the words 'I won.' As the adults returned to their discussion Damian glared at Daniel, his last page tag crumpled in his hand, he switched to stand on his fathers other side so that he was next to the teen now.

"I demand a rematch." He hissed agitated, to which Daniel only grinned wider. "Sure. The next time we see each other at a gala again. I will have two packs ready for our rematch."

Later that night when Damian had returned home from the Gala, he took off his jacket only to notice something green peaking through the folds of it. As he lifted it to inspect where the Color on it game from his eyes narrowed and his grip on the jacket tightened. On his jacked he found several green page markers tagged on it one of them even had a little ghost drawn on it. "Well played Fenton, well played."

#fictober23#danny fenton#dp x dc#danny phantom#dpxdc#crossover#dcxdp#damian wayne#Vlad masters#bruce wayne#Danny and Sam play a game with page markers during galas#Danny was playing it alone#until Damian noticed and wanted in on it#if he can't stab rude people#then he can at least tag them with page markers#headcannon that Danny is a rich kid too#he just lives simpler than Sam#his parents have to have some money to finance their research#Damian and Danny are just having some fun during the gala#gala shenanigans#Bruce knows Danny placed something on his should he just can't react on it for his Brucie act#Vlad was just in the middle of explaining something when he placed his hand on the hip#he had no idea that Danny was playing that game again#Damian now wants a rematch#the next gala they meet on is going to be fun

969 notes

·

View notes

Text

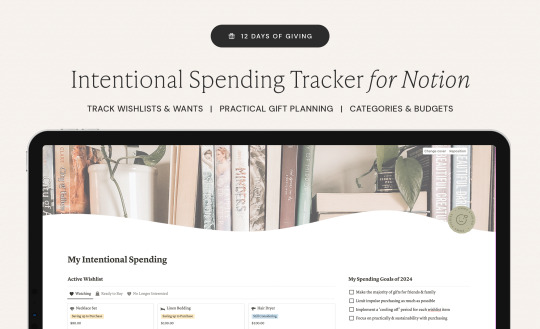

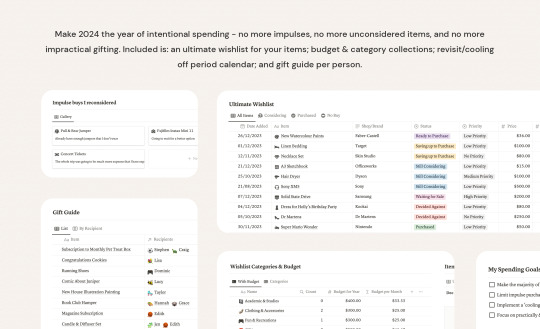

Free Intentional Spending Tracker for Notion

It's Day 8 of the 12 Days of Giving!

Track your wishlist and fill in details to help make more informed decisions regarding your purchases. Comes with an comprehensive way to categorise your wants & seeing the impact on your budgets. Whilst this has budgeting features, it's more about how you're spending and making sure those purchases are considered.

Features include:

spending goals for 2024

active wishlist & watching space

detailed digital wishlist and budget impact

wishlist categorises & year budgeting

pre-populated dates with calendar view for revisiting items after "cool off period"

gift gifting ideas (by idea, rather than recipient for more intentional gifting!)

recipient database

Download Free Here

Check back in each day for a new free item! Hopefully they're all useful and a fun way to end the year 🥰🎁

#download#free#wallpaper#studyspo#studyblr#emmastudies#studying#freebie#notion#notion template#spending#money#finances#old money#intentional spending#intentional living#gift guide

426 notes

·

View notes

Text

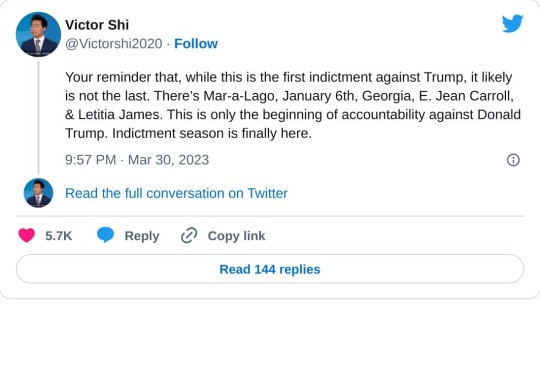

#us politics#news#twitter#tweet#republicans#conservatives#donald trump#gop#indictment#trump scandals#john fugelsang#@victorshi2020#hush money#campaign finance law#stormy daniels#classified documents probe#capitol riot investigation#georgia election investigation#e. jean carroll#letitia james#alvin bragg#fani willis#2023

3K notes

·

View notes

Text

#Three Reasons Why You Shouldn’t Give Money to Ghosts (And One Why You Should)#ghost#ghosts#pony rides#money#money management#finance#unreality

183 notes

·

View notes

Text

We ask your questions so you don’t have to! Submit your questions to have them posted anonymously as polls.

#polls#incognito polls#anonymous#tumblr polls#tumblr users#questions#miscellaneous polls#submitted nov 21#money#finances#financial#credit score#personal finance

254 notes

·

View notes

Text

i know vet prices are out of control expensive but it's because the world is expensive, not greed, and so every time i encounter someone complaining about it in bad faith i want to grab them by the hands with shaking, sweaty desperation and say "on average human nurses are paid 30-50 dollars an hour. vet techs, who are nurses of every department and every specialty and also janitors and mma fighters, are lucky to break minimum wage."

#my conviction has changed the hearts of at least 3 finance bros over the years#I'm always like. eye contact. this is how hard i work every single day and this is how much money i make. make it make sense#and nobody can#m2a#vet tech#work stuff#nurses of course deserve higher wages too we should all be fucking stacked I'm just saying people don't think of us the same way

156 notes

·

View notes