#kimberly dow

Text

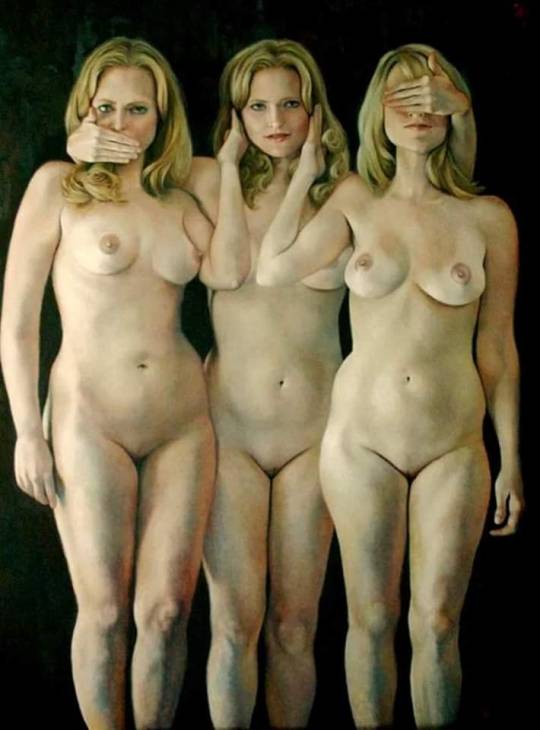

"No Evil", Kimberly Dow art

432 notes

·

View notes

Text

ARTIST: Kimberly Dow

132 notes

·

View notes

Photo

Kimberly Dow.

Alluring realist figurative works by artist Kimberly Dow.

Kimberly says of her paintings, “often my themes are women’s lives, secrets and empowerment. I love to celebrate people, but women especially – and do it with playful exuberance. I will also occasionally tackle a social issue, but most often it is deeply personal stories I am attempting to convey.”

See more on Artsy.

#art#painting#kimberly dow#figurative art#sponsored#female artists#fine art painting#feminism#33contemporary

100 notes

·

View notes

Photo

Kimberly Dow (Born 1968) American

“Unveiled”

https://www.kimberlydow.com/about

228 notes

·

View notes

Text

Unfettered by painter Kimberly Dow after a Leonard Nimoy photography

328 notes

·

View notes

Photo

Check out Kimberly Dow, Sitting Pretty (2023), From 33 Contemporary

3 notes

·

View notes

Photo

Ascolta come mi batte forte il tuo cuore.

Wislawa Szymborska

Kimberly Dow.

11 notes

·

View notes

Text

Blind Faith, 2019-2022

Oil on panel, 40.6 × 61 cm

Kimberly Dow (b. 1968, US)

0 notes

Text

Jail docket: Brookhaven man arrested for animal cruelty - Daily Leader

New Post has been published on https://petn.ws/hi8Kk

Jail docket: Brookhaven man arrested for animal cruelty - Daily Leader

Jail docket: Brookhaven man arrested for animal cruelty Published 5:00 pm Tuesday, April 4, 2023 METRO / Jail docket Lincoln County Jail docket, Monday, April 3, 2023 Kimberly Gayten, 05/18/1961, 804 Dow St. — arrested, charged with simple assault domestic violence, burglary/breaking and entering dwelling/inner door, by Brookhaven Police Department. Abe G. Blue Jr., […]

See full article at https://petn.ws/hi8Kk

#PetInsuranceNews

0 notes

Text

Industrial and Institutional Cleaning Chemicals Market Size, Share, Demand, Growth & Trends by 2032

The global industrial & institutional cleaning chemicals market is set to witness an impressive growth rate of 7.3% over the forecasted years of 2022 to 2032. The industrial & institutional cleaning chemicals market size is anticipated to reach a valuation of around US$ 144.35 Billion by the end of year 2032 from the current valuation of US$ 71.35 Billion in 2022.

Their widespread use in cleaning stubborn soil stains, oily stains, hard-floor surfaces, and more is what accounts for the significant industrial and institutional cleaning chemicals market share in the present times. All-purpose cleansers and a range of disinfectants and sanitizing chemicals are needed in retail stores, department stores, different public institutions including colleges, recreational areas, courts that has surged the demand for industrial and institutional cleaning chemicals.

The industrial and institutional cleaning chemicals market size is primarily impacted by the growing sales of the commercial end-use segment. Demand for is rising, particularly in the foodservice and healthcare sectors, which must adhere to strict hygiene requirements. On the other hand, disinfectants and sanitizers have emerged to be a crucial type of product and are extensively used in cleaning industry solutions.

Get Your 30% Discount Now! Access Sample Copy @

https://www.futuremarketinsights.com/reports/sample/rep-gb-1088

The global industrial and institutional cleaning chemicals market has benefited from the increased demand for the solvent sector from various industries as it substantially adds to the industry’s development and revenue. As it is yet another very basic ingredient used in the creation of chemical cleansers that is observed to have augmented the emerging trends in industrial and institutional cleaning chemicals in the present market.

In addition, the need for disinfectants and sanitizers has skyrocketed ever since outbreak of the Covid-19 epidemic overtook with a greater need for proper cleaning, appropriate hygiene requirements, and preventative measures to limit the virus from spreading. These factors together have contributed to the global expansion of the industrial and institutional cleaning chemicals market opportunities in general and disinfectants and sanitizers products in particular.

Key Takeaways from Market Study

The overall growth of the global industrial & institutional cleaning chemicals market is estimated to be absolutely US$ 73 Billion over the next ten years by following the average CAGR of 7.3%.

A little under 33% of the market for industrial & institutional cleaning chemicals comes from the general purpose cleaning category.

Globally North America is the dominant region for the industrial & institutional cleaning chemicals market by the presence of prominent market players

Asia Pacific promises a lucrative growth for the industrial & institutional cleaning chemicals market share during the forecast years of 2022 to 2032.

Competitive Landscape

Some of the well-known industrial & institutional cleaning chemicals market players are Procter & Gamble, BASF SE, Clariant, The Clorox Company, Inc., Henkel AG & Co. KGaA, 3M, Kimberly-Clark Corporation, Reckitt Benckiser Group plc, Croda International PLC, Albemarle Corporation, Eastman Chemical Corporation, Huntsman International LLC, STEPAN Company, Westlake Chemicals Corporation, SOLVAY, Dow, and Sasol among others.

Recent Developments in the Global Industrial & Institutional Cleaning Chemicals Market:

Tasman Chemicals, a supplier of sanitary and cleaning additives for several industries, including institutional and others, was acquired by Diversey Holdings Ltd in August 2021, according to a press release.

Azelis said in April 2021 that it has signed a contract to buy the distribution assets of Nortons Exim Private Limited and Spectrum Chemicals, two Indian businesses that provide a range of cleaning chemicals for industrial purposes. This acquisition is therefore expected to help Azelis grow its cleaning agent chemical operations.

Industrial & Institutional Cleaning Chemicals Market By Segmentation

By Raw Material:

Chlor-alkali

Surfactant

Solvents

Phosphates

Biocides

Others

By Product Type:

General Purpose Cleaners

Disinfectants and Sanitizers

Laundry Care Products

Vehicle Wash Products

By End Use Verticals:

Commercial

Manufacturing

Browse Full Report: https://www.futuremarketinsights.com/reports/industrial-institutional-cleaning-chemicals-market

0 notes

Text

Top 5 Worst Stock Market Crashes

The Five Worst Stock Market Crashes In The History Of The USA

Below are details about the worst stock market crashes in the USA’s history.

2020: The COVID-19 Crash

Market loss: 34%

Time to recover: 33 days

The recent crash still on many investors’ minds is the one caused by the COVID-19 pandemic. Because of the virus, global governments shut down entire economies to lessen the spread, causing an economic shock that rattled investors.

Unlike the other crashes on this list, this one hit surprisingly fast and recovered quickly. The stock market decreased by 34% but regained its peak in only 33 days, a historically fast turnaround. The journey to the bottom and subsequent recovery was slower than in previous crashes.

The US government partially reacted by injecting trillions of dollars into the US economy. It was the most cash added to the circulation between printing money and stimulus payments since 1945.

Despite the terrible human costs of the pandemic & the financial suffering felt by millions, what followed was a surprising upward run in the market. Companies reported record profits, and valuations soared. For a while, the market reacted as though the crash had never occurred.

Read More @ https://businesschiefsinsight.com/stock-market-crashes/

2008: The Subprime Mortgage Crisis

S&P 500 loss: 57%

Time to recover: 17 months

Linda García, the founder of In Luz We Trust, a financial coaching business, explains that the cause of this crash was banks’ loose lending practices for mortgages (particularly subprime mortgages), which had a ripple effect in the entire economy, resulting in the worst crash since the Great Depression. It was a very specific trigger. There were terrible loans in the housing market.

Kimberly R. Nelson, the advisor at Coastal Bridge Advisors, adds that the S&P 500 fell around 57% from its peak and took global markets down with it. Valuations of homes were not good, and prices were through the roof.

Recovery came from government bailouts, fresh cash injections into the economy, and interest rates cut down to historically low levels.

It took nearly 17 months for the market to recover. When it did, one of the longest and most profitable bull runs in history began in 2009 and lasted to 2020 – the start of the COVID-19 pandemic. During bull markets, market confidence is high, and investors are eager to buy stocks.

2000: The Dotcom Bubble

Nasdaq loss: 77%

Time to recover: 15 years

When the 21st century rolled around, the stock market was reeling from the “dot-com bubble” aftermath caused by the major overvaluation of tech companies in the late 1990s. A bubble is caused by valuations that don’t match a company’s financial stability and are often spurred by eager investors trying to chase the next big thing – even if a company doesn’t have revenue. It was the case with many of these tech companies.

It was the first big crash for tech stocks that make up the Nasdaq Composite Index. Between 1995 & 2000, the Nasdaq rose over 500%. By 2002, the index fell nearly 77% and wouldn’t reach its former peak again for almost 15 years.

1973: The Oil Crisis and Economic Recession

Market loss: 48%

Time to recover: 21 months

This crash was the worst since the Great Depression at that time. There was not only one event that caused the crash, but a series of events.

First, several financial reforms, including de-pegging or unlinking the dollar from gold, undermined the dollar’s stability and contributed to runaway inflation. Parallelly, there was an economic recession, then the 1973 oil crisis, in which the price of oil approximately quadrupled and sped up inflation much faster.

All combined, these events created a crash that saw the market decline by 48%, taking about 21 months to recover.

1929: The Worst Crash in History

Dow loss: 89%

Time to recover: 25 years

The stock market crash of 1929 was the end of the Roaring 20s and started the Great Depression. It was one of the worst stock market crashes. The stock market contracted so much that it would take until 1954 to regain its pre-crash value fully.

Stocks began dipping in September of that year, but two consecutive days in late October, the 28th and 29th, saw a nearly 13% decrease and another 12% dip, respectively. These days are now known as Black Monday and Black Tuesday, the biggest two-day loss in history. It was enough to bounce investors into panic selling.

A couple of weeks later, the Dow lost half its value (the S&P 500 and Nasdaq were not used as markers then) and entered a long bear market. In 1932, the market found its ultimate bottom at a staggering 89% below its peak.

This period was tumultuous, with the Great Depression, Dust Bowl, World War II, and other distressing international events. Hundreds of companies filed for bankruptcy.

0 notes

Text

Stock crack of 1929

Stock crack of 1929 registration#

Stock crack of 1929 series#

It was more than the total cost of World War I. The 1929 stock market crash lost the equivalent of $396 billion today. The Dow Jones Industrial Average dropped 25 percent. The stock market crash of 1929 was a four-day collapse of stock prices that began on October 24, 1929. In many cases, federal law preempts state blue sky laws, requiring investors to sue in federal court and under federal law.BY KIMBERLY AMADEO Updated January 21, 2019 In New York, individual investors must bring private suits for common-law fraud law in order to recover. For example, New York's securities law, the Martin Act, permits only the Attorney General to bring a suit for violations.

Stock crack of 1929 registration#

Key differences are: (1) the kinds of products and transactions covered by the laws (2) the registration requirements for brokers, dealers, and issuers and (3) the breadth and causes of action available under anti-fraud provisions. State laws can be very different from state-to-state, and from federal law. Although there is some overlap, state law may provide for causes of action unavailable under federal law and vice-versa. State law and federal law do not, however, correspond perfectly. In interpreting the federal securities laws, courts often reach back into relevant state law to interpret definitions or concepts that Congress used when drafting federal law. Congress drafted the federal securities laws against the backdrop of pre-existing state regulation. Long before Congress enacted the federal laws, most states also had their own securities laws, which today are known as blue sky laws. Under the Exchange Act, the SEC has the authority to register, regulate and discipline broker-dealers, regulate the securities exchanges, and review actions of the securities exchanges' self-regulatory organizations (SROs). The SEC has power to promulgate rules pursuant to the federal securities acts, and to enforce federal law and its own rules. The Exchange Act created the Securities and Exchange Commission(SEC), a federal agency with the authority to regulate the securities industry. The Securities Act and the Exchange Act are federal laws that provide for private causes of actions under which investors may recover for fraud and certain violations of the registration and disclosure processes mandated by the federal securities laws. Congress intended to ensure that investors had access to balanced, non-fraudulent information. The efficacy of these disclosure requirements is backed up by extensive liability for fraud under the Securities Act and the Exchange Act for both issuers and sellers of securities. Federal securities laws primarily accomplish this by requiring companies to disclose information about themselves and the securities they issue. The Securities Act and Exchange Act give investors access to information about the securities they buy and the companies that issue those securities. The key theme of the federal securities law is disclosure.

Stock crack of 1929 series#

After a series of hearings that brought to light the severity of the abuses leading to the crash of 1929, Congress enacted the Securities Act of 1933 (the "Securities Act"), and the Securities Exchange Act of 1934 (the "Exchange Act"). In response to this calamity and at President Franklin Roosevelt's instigation, Congress enacted laws to prevent speculative frenzies like those in the 1920s. With thousands of investors buying up stock in hopes of huge profits, the market was in a state of speculative frenzy that ended in October 1929, when the market crashed as panicky investors sold off their investments en masse. In many cases, the promises made by companies and brokers had little or no substantive basis, or were wholly fraudulent. Brokers in turn sold this stock to investors based on promises of large profits but with little disclosure of relevant information about the company. In the period leading up to the stock market crash, companies issued stock and enthusiastically promoted the value of their company to induce investors to purchase those securities. The development of federal securities law was spurred by the stock market crash of 1929, and the resulting Great Depression.

0 notes