#douyu

Text

Douyu CEO Chen Shaojie Allegedly Arrested in China

On Tuesday (November 21), the Chinese video live streaming platform Douyu (斗鱼) issued an announcement stating that the company’s CEO Chen Shaojie (陳少傑) was arrested by Chengdu police around November 16. The company added that it had not received any official notification about Chen’s investigation or the reasons for his arrest.

As Deutsche Welle reported, Douyu also stated that Chen’s continued…

View On WordPress

0 notes

Text

Sounds like they just announced a preview of the third beta on the 11th?

""Persona: Phantom of the Night" "Heart Stealing Test" preview program will be officially broadcast on all platforms at 19:00 on January 11. In this three-test preview special program, we will work together with producers Lao V and Moyu Office to bring captains a preview of the content of the "Heart-stealing Test" version and an explanation of the actual trial. design concept? More information on the third test? Subsequent commercialization? For more content, please make a reservation and lock in the P5X official live broadcast room!"

▶Live broadcast time: 19:00 on January 11

◆Live broadcast platform information: B station room number: 31538431 / Douyin live broadcast: 59584731425 / Huya room number: 29561641 / Douyu room number: 11948363 / WeChat live broadcast: search the video number to enter /TapTap live broadcast: search the game name to enter the live broadcast

Considering that's 3 AM in my time zone, I probably won't be able to make it, but I'm expecting a recording of it will probably get uploaded somewhere afterward, so I'll keep an eye out for that. Not sure what, exactly, they'll be showing, but if it's anything new you know I'll be posting (/reblogging) it here!

#third beta#if anyone seeing this manages to attend and record it + send it in that'd also be super appreciated!

5 notes

·

View notes

Text

i don't even know why i type hateful TikTok shit it's like who are you gonna be mad at, I see this all the time. TikTok? Douyu? For what? Giving the masses what they want? (thoughtless consumable and recyclable content)

7 notes

·

View notes

Text

2 notes

·

View notes

Note

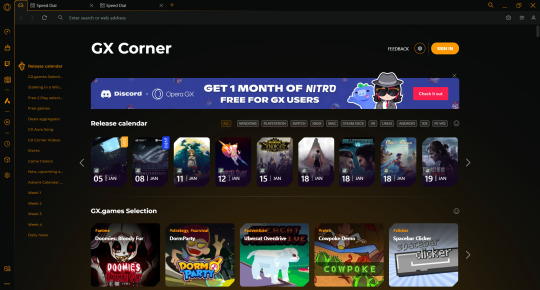

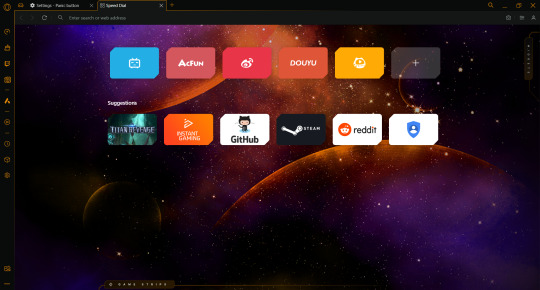

Would you be willing to install and try Opera GX browser for its panic button feature?

I just installed it & also took screenshots to document the process! Looks like Opera GX is marketed as a "gaming browser", but I'll keep it on my laptop anyway even though I don't play games.

After installation, Opera GX chose dark mode by default before giving me the 9-step tutorial. For the theme, I couldn't decide but ultimately went for Lambda (because I was watching Hyp Mic earlier & thought of Ramuda). I have no idea what Nitro is (told you I'm not a gaming person), so I skipped that. ⬇️

After Step 9 was the speed dial page, which (by pure coincidence?) had only CHINESE websites for some reason. I do watch stuff on BiliBili & AcFun often. I know what Weibo is but don't use it because only registered users can view posts, but registration is complicated (don't ask). Douyu & Huya are for live streaming, which doesn't pertain to me. Hitting CTRL+1 takes me to the GX Corner, which is self-explanatory after reading the side bar headings. ⬇️

Then I went to the panic button settings & found some default "safe websites" that Opera GX pulls up after hitting the panic button (F12). I tried it a few times, & whichever safe website that shows up is pretty random (but can be customized). Because I viewed the random safe websites, my speed dial page now has extra recommendations. ⬇️

That's it for this tutorial! Now I go back to writing fanfics!

1 note

·

View note

Note

does 臭鱼烂虾 have a specific meaning or is it just a general insult?

No, it's basically what it says on the tin!

Stinky fish and rotten shrimp. Aka trash, good for nothing, etc.

The origins as a popular insult is generally attributed to the danmu/comment section of a popular DouYu livestreamer where someone said "臭鱼烂虾, 滚出克 (滚出去 with an accent))".

33 notes

·

View notes

Text

DOYU Stock Earnings: DouYu Intl Hldgs Beats Revenue for Q4 2023 [ Nasdaq ]

DOYU Stock Earnings: DouYu Intl Hldgs Beats Revenue for Q4 2023 [News Summary]

InvestorPlace Earnings is a project that leverages data from TradeSmith to

automate coverage of quarterly earnings reports.

DouYu International’s (DOYU) fourth-quarter performance is likely to have

benefited from a focus on innovation, regulatory compliance and…

Douyu International Holdings Ltd (DOYU) reported better…

View On WordPress

0 notes

Text

WEEK 9: China's Booming Gaming Livestreams: A Culture All Its Own

"Video Game makers, audiences, and intermediaries do not simply constitute an industry; they constitute a cultural field – an internally structured space of positions and dispositions given shape by a distribution of various forms of capital and power..." (Bourdieu 1983; Keogh 2019).

China's gamers are massive! With over 668 million players, it's the world's gaming champion (Li 2024). And here's the cool part: watching other people play is just as popular as playing yourself. Live streaming has become a huge part of Chinese gaming culture, creating a one-of-a-kind online space with its own stars, websites, and ways to make money. Let's jump in and see what makes it tick.

Homegrown Streaming Giants

Forget Twitch! In China, Douyu and Huya rule the livestreaming roost. These platforms are built specifically for Chinese gamers, making them feel more connected and specialized. Unlike Western streams with a mix of content, here it’s all about video games. The competition was fierce, but in 2020, Douyu and Huya joined forces (Chen 2020). Why? To avoid spending tons of money on grabbing new viewers and famous gamers (Frater 2020). This super-stream could take up a whopping 80% of China's livestreaming market (Frater 2020)! It shows how these platforms are becoming the go-to spot for Chinese gaming fans.

Making Money from Fans

One big way streamers in China make money is through virtual gifts. Viewers can buy these fancy animated presents or ones that look like real-world stuff. It’s a cool way to show appreciation for a streamer you like and chat with them at the same time. Furthermore, top streamers score deals with companies who want to reach China’s giant gaming audience. This can involve showing off products during streams, creating content together, or even getting paid to play a specific game.

More Than Just Gameplay

According to Keogh (2019), the video game field is not characterized by a uniformity of cultural, economic, and political values. On the contrary, it encompasses a diverse spectrum of practices, communities, aesthetics, and objectives. Even the most expensive perspectives on the “video game industry”, with its inherent focus on economic factors and globalization, fail to fully capture this rich tapestry.

For Suits (1978), gameplay is the pursuit of a predetermined goal within a rule-bound system. These rules intentionally restrict the most efficient methods, privileging those aligned with the game's structure. The core justification for these constraints lies in their ability to facilitate the very act of playing. Alternatively, the author proposes a more concise definition: playing a game is the voluntary act of overcoming self-imposed challenges.

Following these facts, Chinese game streaming isn’t just about watching someone else be good at a game. Streamers often show off their personalities, chat with viewers, and even sing or dance. It’s all about creating a fun and interactive experience. In addition, these platforms connect right to online stores, so you can buy the things streamers recommend without ever leaving the stream. It's a whole new way to shop!

In reality, emerging knowledge communities in gaming will be characterized by voluntary participation, impermanence, and a focus on achieving specific goals. Shared intellectual pursuits and a sense of emotional connection will serve as the primary unifying factors. Members will retain the flexibility to move between communities as their interests and requirements evolve, potentially belonging to multiple communities concurrently. However, the cornerstone of these communities will be the collaborative creation and reciprocal exchange of knowledge (Jenkins 2006).

Rules & Challenges

Things are a bit different in China compared to some Western countries. The government has stricter rules about what people can show online, especially when it comes to violence, gambling, or anything political. To be more specific, when following Cbiz, it is easy to come across the phrase "封杀 / 封殺" (fēng shā) expressing a ban or blockade to prevent people or things from existing in a certain area. Fēng (封) means closed, forbidden to use; shā (杀) is to kill or to kill. And this term applies to many different fields, not just the performing arts. This means streamers have to be careful about what they do and say. There’s also a lot of competition, with new livestreaming platforms popping up all the time. But like we saw before, the bigger players are starting to dominate the market.

The Future is Bright

China’s game streaming scene is only going to get bigger. With more people playing games, having more money to spend, and even cooler technology coming out, the future looks amazing. Platforms might even add features that let viewers play along with streamers, use virtual reality, or chat in even more ways. This will make things even more fun for both streamers and viewers!

As a follower of Chinese-biz, the special point that impressed me when mentioning Chinese gaming is the cooperation between reality shows about gaming for celebrities and professionals. They will be divided in teams with a professional mentor and the players in many rounds to find the winning team after the show.

"战至筋峰" - The winner of "We are the champions" season 2

So What?

The way China does game livestreaming is fascinating. It’s a mix of new technology, what Chinese gamers like, and the rules of the Chinese government. Understanding this unique culture is key if you want to be a part of this massive and ever-changing market.

Reference List

Chen, W 2020, ‘Huya-Douyu Merger Creates a Livestreaming Behemoth under the Control of Tencent’, KrASIA, viewed 21 March 2024, <https://kr-asia.com/huya-douyu-merger-creates-a-livestreaming-behemoth-under-the-control-of-tencent>.

Frater, P 2020, ‘China’s Games Streaming Giants Huya and DouYu to Merge’, Variety, viewed 21 March 2024, <https://variety.com/2020/gaming/asia/china-games-streaming-huya-and-douyu-to-merge-1234801202/>.

Jenkins, H 2006, ‘Interactive Audiences? The “Collective Intelligence” of Media Fans’, Fans, Bloggers, and Gamers, New York University Press.

Keogh, B 2020, ‘The Melbourne Indie Game scenes. Value Regimes in Localized Game Development’, Independent Video Games: Cultures, Networks, Techniques and Politics, Taylor & Francis Group, Milton, pp. 209–222, viewed 21 March 2024, <https://ebookcentral.proquest.com/lib/swin/detail.action?docID=6295925.>.

Li, X 2024, ‘China’s Online Gaming Industry Is Making Moves’, www.bjreview.com, Beijing Review, viewed 21 March 2024, <https://www.bjreview.com/China/202401/t20240102_800353352.html>.

Suits, B 1978, The Grasshopper: Games, life and utopia, Broadview Press.

#MDA20009 #Week9 #Gaming #Livestreaming #ChinaGamingLivestreaming

0 notes

Text

Gaming and Livestreaming Culture in China: A Booming Industry with Unique Characteristics

“To play a game is to attempt to achieve a specific state of affairs, using only means permitted by rules, where the rules prohibit use of more efficient in favour of less efficient means, and where the rules are accepted just because they make such activity possible. I also offer the following simpler, and, so to speak, more portable version of the above: playing a game is the voluntary attempt to overcome unnecessary obstacles.”

(Suits 1978, p.41)

China is the epicenter of online gaming globally and has the world's largest gaming population, estimated at over 668 million in 2023, data from a Statista report (Thomala, 2024). Live streaming has become a deeply integrated aspect of this thriving gaming culture, creating a unique ecosystem with its own trends, platforms, and monetization methods. Let's delve into the key features of this dynamic landscape.

Dominant Live Streaming Platforms

Unlike the West where Twitch and YouTube Gaming dominate the livestreaming landscape for games, China boasts its own homegrown giants: Douyu and Huya. These platforms cater specifically to the Chinese audience, fostering a more specialized and engaged community. Here, viewers primarily engage with video game streaming. Recognizing the intense competition within the market, Douyu and Huya, the two top players, merged in 2020 (Chen, 2020) to reduce the massive marketing costs associated with attracting star gamers and acquiring new users (Frater, 2020). This strategic move allowed the combined entity to potentially capture a staggering 80% of the Chinese live streaming market share (Frater, 2020). The merger signifies the consolidation trend within the Chinese game streaming industry, highlighting the dominance of these platforms and their focus on creating a thriving ecosystem specifically for video game enthusiasts.

Monetization Strategies

A prominent feature in China's livestreaming scene is the virtual gift system. Viewers can purchase and send virtual gifts to streamers, generating a significant source of revenue. These gifts can be animated or represent real-world items, offering viewers a way to interact and show appreciation for their favorite streamers. Additionally, popular streamers attract sponsorships and brand deals from companies seeking to tap into the vast gaming audience. This can involve product placements, sponsored streams, or even co-created content.

Cultural Aspects and the Effect of Regulations and Challenges

Entertainment takes center stage in Chinese game streaming alongside gameplay. Streamers often showcase their personalities, interact with viewers through chat functionalities, and even perform talents like singing or dancing. This creates a more engaging and interactive experience for viewers. Furthermore, livestreaming platforms seamlessly integrate with e-commerce, allowing viewers to purchase products directly from the stream. This fosters a unique shopping experience influenced by the streamer's recommendations.

On the other hand, the Chinese government maintains stricter control over content compared to some Western countries. Livestreaming platforms face regulations concerning violence, gambling, and politically sensitive topics. This necessitates careful navigation of content creation and moderation. Additionally, the Chinese livestreaming market is highly competitive, with a constant influx of new platforms vying for viewers' attention. However, recent years have seen consolidation, with the larger players like Douyu and Huya dominating the market, as mentioned above.

Looking Forward

The future of game streaming in China looks bright. With a growing user base, rising disposable income, and continuous technological advancements, the industry is poised for further expansion. Platforms may explore new features like interactive gameplay elements, virtual reality integration, and enhanced social interaction tools to further engage viewers and streamers alike.

So…

The game and livestreaming culture in China is a fascinating phenomenon, shaped by a unique combination of technological innovation, cultural preferences, and government regulations. Understanding these characteristics is crucial for anyone wanting to tap into this vast and dynamic market.

References:

Chen, W 2020, Huya-Douyu merger creates a livestreaming behemoth under the control of Tencent | KrASIA, KrASIA, KrASIA, viewed 17 March 2024, <https://kr-asia.com/huya-douyu-merger-creates-a-livestreaming-behemoth-under-the-control-of-tencent>.

Frater, P 2020, China’s Games Streaming Giants Huya and DouYu to Merge, Variety, viewed 17 March 2024, <https://variety.com/2020/gaming/asia/china-games-streaming-huya-and-douyu-to-merge-1234801202/>.

Suits, B 1978, The Grasshopper: Games, life and utopia, Broadview Press.

Thomala, LL 2024, Total number of game users in China from 2013 to 2023, Statista, viewed 17 March 2024, <https://www.statista.com/statistics/870620/china-number-of-game-users/>.

0 notes

Text

Ma Huateng wants to make peace with Zhang Yiming, but where is Wang Xing?

Tencent has fully opened the live broadcast rights of "Honor of Kings" to Douyin, and may become the "successor" of Byte Games, which HE Tuber means that the process of China's Internet transformation has accelerated: the infinite war between giants is being replaced by a new competition and cooperation relationship.

On January 13, the official Weibo of "Honor of Kings" announced that Douyin live broadcast will be fully open from January 21. By then, anchors big and small will be able to live broadcast "Honor of Kings" on Douyin without having to worry about infringement issues. Zhang Daxian and other top anchors who have just started to shake up will be the first to benefit.

Tencent has always attached great importance to the live broadcast copyright of "

Honor of Kings". Previously, it only authorized it to "direct descendants" such as Douyu and Huya. It also launched a large number of lawsuits against pirated broadcasts on ByteDate platforms such as Douyin and Xigua Video, and achieved some victories.

However, these lawsuits failed to fundamentally put an end to piracy; until now, it is still very common for Douyin anchors to covertly broadcast "Honor of Kings".

Now, Tencent has granted the live broadcast rights of "Honor of Kings" to Douyin, and the two giants have taken a big step towards reconciliation.

Earlier, many of Tencent's games have resumed streaming on Douyin. Especially for the just-released party mobile game "Yuanmeng Star", nearly 40% of the advertising materials went to Byte's advertising platform "Pangolin" in the first month of its launch, while only 12% went to Tencent's own "Youlianghui". Douyin did not stop these actions.

In addition, Byte is considering selling many games, and Tencent is one of the potential buyers. Byte has previously invested tens of billions in the gaming sector, but has never achieved the desired results; if it is sold to Tencent, Byte will no longer directly pose a threat to Tencent Games.

Ma Huateng made peace with Zhang Yiming, where is Wang Xing?

During its rise, Byte once competed with almost all major domestic Internet companies. But today, giants such as Tencent and Alibaba have eased relations with Douyin and even reached cooperation; Meituan may be the only major company that still has a relatively rigid relationship with Byte. Meituan and Douyin had a brief honeymoon period.

In 2018, Douyin, which aims to become a "universal entrance", launched cooperation with Meituan, Ctrip, etc. in the area of wine and travel to divert traffic for the latter. But soon after, Douyin began to directly contact wine and travel businesses, bypassing OTAs and starting a new business, constantly eroding the market of old players such as Meituan. The collaboration between Meituan and Douyin has come to an end.

Since 2022, Meituan and Douyin have been engaged in a fierce battle around local life, while simultaneously focusing on short videos and live broadcasts to penetrate into the hinterland of Douyin. In addition, Meituan continues to compete with companies such as Ele.me, Pinduoduo, JD.com, Didi, and Hello in sectors such as food delivery, instant retail, and travel. Meituan is not the largest, but now it has become the largest Internet company with the longest front line.

However, the external strategy of far more competition than cooperation is not the best choice for Meituan.

According to Wang Xing’s vision, Meituan needs to play an “infinite game” and continuously expand its business boundaries. To advance this game, Meituan needs to continuously add traffic fuel to drive the wheels of various businesses forward.

But as an aggregation trading platform, Meituan is not known for its traffic. According to data from market research organization QuestMobile, Meituan’s DAU (daily active users) was approximately 120 million in June 2023. Among other transaction-based apps, Taobao has more than 400 million DAU, Pinduoduo has more than 300 million, and even Amap has 130 million.

Meituan's internal traffic sources mainly come from high-frequency services such as food delivery, shared bicycles, and instant retail. In the third quarter of last year, Meituan's food delivery, instant delivery and other businesses still maintained rapid growth. However, since the industry structure of these businesses is basically stable and the user volume is already very large, subsequent growth will gradually slow down as the industry enters a mature stage.

Next, Meituan needs to find more traffic engines outside of the ecosystem.

Currently, Meituan’s external traffic pool is mainly WeChat.

Tencent took a stake in Meituan in 2014, and has since continued to invest more and opened multiple traffic scenarios on WeChat to Meituan. It also gave Meituan takeout and Meituan special price fixed display space on the WeChat service page. As a result, Meituan received a strong injection of traffic, defeating Ele.me in one fell swoop and firmly taking the top spot in local life.

But now, WeChat user penetration rate is extremely high, and the traffic pool has been basically stable. In addition to continuing to dig deep into the gold mine of WeChat, Meituan is also worthy of looking for user growth in Douyin, which has 700 million DAU. Byte's move to consider selling the game to Tencent reflects its change of mentality that it is willing to share benefits and jointly make the pie bigger; Meituan has no chance of turning an enemy into a friend.

At present, Meituan needs to spend huge sums of money every year to attract traffic from online and offline scenes. Many of the marketing expenses go to content communities such as Bilibili, Zhihu, Weibo, and Xiaohongshu, including advertising on the platform and making V videos with experts. Cooperation. In the third quarter of last year, Meituan’s sales and marketing expenses increased by 55% year-on-year to 16.9 billion yuan, and its revenue share increased from 17.4% to 22.1%. During the same period, Meituan’s revenue increased by 33% year-on-year to 76.5 billion yuan.

But compared with Douyin, these communities are much smaller; Meituan may wish to cooperate with Douyin to completely open the traffic valve outside its own system.

It is true that Douyin, which has launched an onslaught in the local life field, still threatens Meituan’s home base. However, judging from past history, Douyin has to not only sell traffic to other platforms, but also personally participate in the competition and have direct contact with merchants, consumers and other market entities. This has become an irresistible practice for partners.

Faced with Douyin, which has the second largest traffic pool in the entire network, most companies have to accept Douyin’s “need and want”. If Meituan wants Douyin’s traffic, it can only abide by Douyin’s rules. .

The competitive landscape of the Internet has undergone profound changes. The partial settlement between Byte and Tencent once again proves that no matter how fierce the fight between big companies is, there is always huge room for cooperation.

Before 2023, large companies such as Byte, Tencent, Alibaba, Baidu, and Meituan are trying their best to expand their business scope and start fierce battles at the intersection. In the same track, multiple companies often appear at the same time. From information and search to live streaming and short videos, from games and e-commerce to entertainment, travel and real-time retail, large companies are fighting hand-to-hand at all costs. Competition far outweighs cooperation. Even if they are far behind the leaders, the input-output ratio is not cost-effective. , but also to keep a chess piece that can charge into battle at any time.

But with Byte and Tencent frequently joining hands, the all-round confrontation that has lasted for many years is passing into history. The ice-breaking between Byte and Tencent is a symbolic event that accelerates the process of this historical turning point. Of course, users still cannot share Douyin videos directly on WeChat, which means that there is still a long way to go before the two parties are completely "interconnected."

New BAT took the initiative to extend an olive branch, and the scope of cooperation became larger and larger. Competition and cooperation have replaced zero-sum game and become the new development tone of the Internet industry.

As early as 2017, Wang Xing publicly announced to Didi Cheng Wei, "Everyone must accept that competition and cooperation are the new normal in the future." But since then, Meituan has focused its main energy on "competition" and "cooperation". Quite lacking. Today, local life and even China’s Internet environment have undergone fundamental changes; Meituan might as well pick up its original aspirations, follow in the footsteps of Tencent and Alibaba, and shift from confrontation to cooperation with Douyin, or both competition and cooperation.

Wang Xing and Zhang Yiming are fellow villagers and former colleagues. After they each grew up to be Internet giants, they once cherished each other. Nowadays, the two cannot really defeat each other in the local life circuit; it is in the long-term interests of both companies to make peace when the battle reaches a stalemate.

01

At present, Meituan's two major traffic sources - high-frequency services such as food delivery and bicycle sharing, as well as the WeChat ecosystem - are facing the challenge of slowing growth and approaching the ceiling.

How to open a new traffic faucet is related to the upper limit of Meituan.

Internally, Meituan is trying to copy Day's path and open the traffic valve by cultivating the content ecosystem.

Meituan started out as a community group buying company and is not known for its content.

At the end of 2015, Meituan acquired Dianping. It originally had the opportunity to enter the short video era based on the graphic and text ecology, and use the graphic and text + video content ecology to build barriers for users' minds and usage habits, but it failed to fully grasp it. Seize the opportunity and shift strategic focus elsewhere.

According to China Business News, after the merger with Meituan, Dianping received less attention within the company. After several revisions, it has not found an effective content direction, and its daily active users have remained at around 15 million. At the beginning of 2023, Dianping proposed to achieve 25 million daily active users by the end of the year.

This shows from the side that in the eight years since it was merged with Meituan, Dianping’s user base has not improved significantly, and it has not been able to become the content traffic pool of the entire Meituan.

Meituan is trying to start a new business.

In the past few years, its live broadcast and short video sectors have achieved some results, with Meituan Live’s single-month GMV exceeding 2 billion yuan. However, these businesses are still in the early stages of development and are mainly traffic receivers rather than creators; Meituan still has a long way to go before it can develop a prosperous content production and consumption ecosystem.

Externally, in addition to purchasing traffic from multiple content communities, Meituan is also trying to join hands with Kuaishou to obtain content traffic from the latter.

At the end of 2021, Meituan announced a strategic cooperation with Kuaishou on interconnection. Users can purchase coupons and more through the Meituan Kuaishou mini program. But Kuaishou not only has a smaller traffic pool than Douyin, but its users are also concentrated in lower-tier cities, while Meituan is better at operating in high-tier cities. There is a certain degree of mismatch between the two.

In the past two years, the marriage between Meituan and Kuaishou has not brought about eye-catching results, but Douyin has been pressing harder.

In this case, obtaining traffic from Douyin is a more reasonable choice for Meituan.

After the Internet demographic dividend disappears, how to achieve user growth at a reasonable cost is a difficult problem for all Internet companies.

Douyin, which holds one of the two largest traffic pools in the entire network, has become a rich mine for all companies trying to find gold, and it has also become the "banker" of Internet mahjong games.

Neither Alibaba nor Tencent are willing to leave Douyin's traffic game and will not hesitate to make concessions. However, Meituan seems to be a bit maverick. After briefly joining hands with Douyin, it fell into a long-term tit-for-tat confrontation.

Under the influence of various factors, Meituan used a series of tactical actions to contain Douyin's attack, but it did not achieve a decisive strategic victory. In early January, Zhang Chuan, president of Meituan’s in-store business group, admitted in an internal letter that “it is difficult to summarize 2023 in terms of success and failure”; Meituan is facing a long-term battle.

Douyin carries its traffic with great success and is invincible; other giants, no matter whether they are willing to do so or not, are worthy of establishing a competitive and cooperative relationship with Douyin in the face of surging traffic. As a trading platform, Meituan should follow the example of Alibaba and Tencent and establish an interest exchange mechanism with Douyin; it may not be wise to actively isolate itself from the second largest traffic pool in the entire network.

In addition, the cooperation between Meituan and Douyin will also help prevent Douyin from completely "falling" into Ele.me.

Since Douyin and Ele.me reached a strategic cooperation in 2021, rumors that Ele.me will be acquired have often surfaced, but they have never come to fruition. But every time the news comes out, Meituan’s stock price always plummets, which is enough to reflect the value of Ele.me to Douyin.

So far, Douyin has always denied that it will acquire Ele.me. But Douyin needs to find a changing scenario for local life traffic, and the possibility of taking over Ele.me still exists. But if Meituan, which is much larger than Ele.me, offers an olive branch, it will be much less necessary for Douyin to end its own business, and naturally it will not buy Ele.me.

In the secondary market, Douyin’s acquisition of Ele.me has always been one of Meituan’s biggest negatives. If this black swan can be completely eliminated, Meituan will benefit in the long term even if it temporarily bows to Douyin.

0 notes

Text

The Game Awards 2023 revela sus nominados.

Publicado por SrepGames

The Game Awards, la celebración de fin de año de la industria del videojuego, ha revelado hoy sus nominados para 2023, con Alan Wake 2 y Baldur's Gate 3 a la cabeza con 8 nominaciones cada uno. La impresionante lista de nominados de la edición de este año, que celebra los juegos, estudios y creativos más innovadores de la industria del videojuego de 2023, incluye 112 juegos, personalidades, equipos y eventos diferentes que abarcan multitud de géneros y plataformas.

Los nominados a Juego del Año de este año son Alan Wake 2 de Remedy Entertainment, Baldur's Gate 3 de Larian Studios, Marvel's Spider-Man 2 de Insomniac Games, Resident Evil 4 de Capcom, Super Mario Bros. Wonder de Nintendo y The Legend of Zelda: Tears of the Kingdom de Nintendo.

Tras la introducción de la categoría de Mejor Adaptación en 2022, el cruce entre juegos y cine/tv sigue profundizando. Este año están nominadas a Mejor Adaptación las siguientes películas y programas de streaming: Castlevania: Nocturne (Netflix), Gran Turismo (Sony Pictures), The Last of Us (HBO), The Super Mario Bros. Movie (Illumination/Universal Pictures) y Twisted Metal (Peacock).

Nintendo es el publisher más nominado en The Game Awards en 2023, con 15 nominaciones en toda su cartera combinada, seguido de Sony Interactive Entertainment/PlayStation, con 13 nominaciones, Xbox (incluidas Bethesda y Blizzard), con 10, y Epic Games, el publisher third party más nominado, con 9. Los nominados a The Game Awards son seleccionados por un jurado global de más de 100 medios de comunicación e influencers de todo el mundo.

En 2022, The Game Awards registró la cifra récord de 103 millones de retransmisiones en directo. The Game Awards 2023, la décima celebración mundial anual de la industria de los videojuegos, se transmitirá en directo de forma gratuita a través de más de 30 plataformas digitales de vídeo diferentes, como YouTube, Twitch, Steam, Facebook, TikTok Live, X, WeChat Bilibili, Huya, DouYu, Xiaohongshu e Instagram Live.

Por segundo año consecutivo, los espectadores podrán participar del show a través del servidor oficial de Discord, lo que incluye la posibilidad de votar por los nominados a The Game Awards 2023 en las semanas previas a la gala. Además, los miembros de Discord pueden unirse a la watch party en directo el 7 de diciembre para ver el show y reaccionar a los ganadores en tiempo real.

A partir de hoy y hasta el 6 de diciembre a las 18.00 hs (horario del Pacifico), los aficionados podrán ayudar a elegir a los ganadores de todas las categorías a través de una votación en la página oficial y en el servidor oficial Discord de The Game Awards. En China, los fans pueden votar por sus favoritos en Bilibili, WeChat y Xiaohongshu.

La producción ejecutiva de The Game Awards corre a cargo de Geoff Marcon Keighley y Kimmie Kim. LeRoy Bennett es director creativo y Richard Preuss, director.

Aquí la lista completa de nominados:

Juego del año:

・Alan Wake 2 (Remedy Entertainment / Epic Games)

・Baldur’s Gate 3 (Larian Studios)

・Marvel’s Spider-Man 2 (Insomniac Games / Sony Interactive Entertainment)

・Resident Evil 4 (Capcom)

・Super Mario Bros. Wonder (Nintendo)

・The Legend of Zelda: Tears of the Kingdom (Nintendo)

Mejor dirección:

・Alan Wake 2 (Remedy Entertainment / Epic Games)

・Baldur’s Gate 3 (Larian Studios)

・Marvel’s Spider-Man 2 (Insomniac Games / Sony Interactive Entertainment)

・Super Mario Bros. Wonder (Nintendo)

・The Legend of Zelda: Tears of the Kingdom (Nintendo)

Mejor adaptación:

・Castlevania: Nocturne (Powerhouse Animation / Netflix)

・Gran Turismo (Sony Pictures)

・The Last of Us (HBO)

・Super Mario Bros. Movie (Illumination / Universal Pictures)

・Twisted Metal (Peacock)

Mejor narrativa:

・Alan Wake 2 (Remedy Entertainment / Epic Games)

・Baldur’s Gate 3 (Larian Studios)

・Cyberpunk 2077: Phantom Liberty (CD Projekt Red)

・Final Fantasy XVI (Square Enix)

・Marvel’s Spider-Man 2 (Insomniac Games / Sony Interactive Entertainment)

Mejor dirección de arte:

・Alan Wake 2 (Remedy Entertainment / Epic Games)

・Hi-Fi Rush (Tango Gameworks / Bethesda)

・Lies of P (Round8 / Neowiz)

・Super Mario Bros. Wonder (Nintendo)

・The Legend of Zelda: Tears of the Kingdom (Nintendo)

Mejor partitura y música:

・Petri Alanko (Alan Wake 2)

・Borislav Slavov (Baldur’s Gate 3)

・Masayoshi Soken (Final Fantasy XVI)

・Shuichi Kobori (Hi-Fi Rush)

・Manaka Kataoka (The Legend of Zelda: Tears of the Kingdom)

Mejor diseño de sonido:

・Alan Wake 2 (Remedy Entertainment / Epic Games)

・Dead Space (Motive Studio / EA)

・Hi-Fi Rush (Tango Gameworks / Bethesda)

・Marvel’s Spider-Man 2 (Insomniac Games / Sony Interactive Entertainment)

・Resident Evil 4 (Capcom)

Mejor actuación:

・Ben Starr (Final Fantasy XVI)

・Cameron Monaghan (Star Wars Jedi: Survivor)

・Idris Elba (Cyberpunk 2077: Phantom Liberty)

・Melanie Liburd (Alan Wake 2)

・Neil Newbon (Baldur’s Gate 3)

・Yuri Lowenthal (Marvel’s Spider-Man 2)

Innovación en accesibilidad:

・Diablo IV (Blizzard Entertainment)

・Forza Motorsport (Turn 10 Studios / Xbox Game Studios)

・Hi-Fi Rush (Tango Gameworks / Bethesda)

・Marvel’s Spider-Man 2 (Insomniac Games / Sony Interactive Entertainment)

・Mortal Kombat 1 (NetherRealm Studios / WB Games)

・Street Fighter 6 (Capcom)

Juegos de impacto:

・A Space for the Unbound (Mojiken Studio / Toge Productions)

・Chants of Sennaar (Rundisc / Focus Entertainment)

・Goodbye Volcano High (KO_OP)

・Tchia (Awaceb / Kepler Interactive)

・Terra Nil (Free Lives / Devolver Digital)

・Venba (Visai Games)

Mejor juego en curso:

・Apex Legends (Respawn Entertainment / EA)

・Cyberpunk 2077 (CD Projekt Red)

・Final Fantasy XIV (Square Enix)

・Fortnite (Epic Games)

・Genshin Impact (HoYoverse)

Mejor soporte de comunidad:

・Baldur’s Gate 3 (Larian Studios)

・Cyberpunk 2077 (CD Projekt Red)

・Destiny 2 (Bungie)

・Final Fantasy XIV (Square Enix)

・No Man’s Sky (Hello Games)

Mejor juego independiente:

・Cocoon (Geometric Interactive / Annapurna Interactive)

・Dave the Diver (MINTROCKET)

・Dredge (Black Salt Games / Team 17)

・Sea of Stars (Sabotage Studio)

・Viewfinder (Sad Owl Studios / Thunderful)

Mejor nuevo juego independiente:

・Cocoon (Geometric Interactive / Annapurna Interactive)

・Dredge (Black Salt Games / Team 17)

・Pizza Tower (Tour de Pizza)

・Venba (Visai Games)

・Viewfinder (Sad Owl Studios / Thunderful)

Mejor juego para móviles:

・Final Fantasy VII: Ever Crisis (Applibot / Square Enix)

・Honkai: Star Rail (HoYoverse)

・Hello Kitty Island Adventure (Sunblink Entertainment)

・Monster Hunter Now (Niantic / Capcom)

・Terra Nil (Free Lives / Devolver Digital)

Mejor juego de VR/AR:

・Gran Turismo 7 (Polyphony Digital / Sony Interactive Entertainment)

・Humanity (Enhance Games)

・Horizon Call of the Mountain (Guerrilla Games / Sony Interactive Entertainment)

・Resident Evil Village VR Mode (Capcom)

・Synapse (nDreams)

Mejor juego de acción:

・Armored Core VI: Fires of Rubicon (FromSoftware / Bandai Namco)

・Dead Island 2 (Dambuster Studios / Deep Silver)

・Ghostrunner 2 (One More Level / 505 Games)

・Hi-Fi Rush (Tango Gameworks / Bethesda)

・Remnant 2 (Gunfire Games / Gearbox)

Mejor juego de aventura:

・Alan Wake 2 (Remedy Entertainment / Epic Games)

・Marvel’s Spider-Man 2 (Insomniac Games / Sony Interactive Entertainment)

・Resident Evil 4 (Capcom)

・Star Wars Jedi: Survivor (Respawn Entertainment / EA)

・The Legend of Zelda: Tears of the Kingdom (Nintendo)

Mejor RPG:

・Baldur’s Gate 3 (Larian Studios)

・Final Fantasy XVI (Square Enix)

・Lies of P (Round8 / Neowiz)

・Sea of Stars (Sabotage Studio)

・Starfield (Bethesda Game Studios / Bethesda)

Mejor juego de peleas:

・God of Rock (Modus Games)

・Mortal Kombat 1 (NetherRealm Studios / WB Games)

・Nickelodeon All-Star Brawl 2 (Ludosity / GameMill Entertainment)

・Pocket Bravery (Statera Studio / PQube)

・Street Fighter 6 (Capcom)

Mejor juego familiar:

・Disney Illusion Island (Dlala Studios / Disney)

・Party Animals (Recreate Games)

・Pikmin 4 (Nintendo)

・Sonic Superstars (Sonic Team / Sega)

・Super Mario Bros. Wonder (Nintendo)

Mejor juego de simulación/estrategia:

・Advance Wars 1+2: Re-Boot Camp (WayForward / Nintendo)

・Cities: Skylines II (Colossal Order / Paradox Interactive)

・Company of Heroes 3 (Relic Entertainment / Sega)

・Fire Emblem Engage (Intelligent Systems / Nintendo)

・Pikmin 4 (Nintendo)

Mejor juego de deportes/carreras:

・EA Sports FC 24 (EA Sports)

・F1 23 (Codemasters / EA Sports)

・Forza Motorsport (Turn 10 Studios / Xbox Game Studios)

・Hot Wheels Unleashed 2: Turbocharged (Milestone)

・The Crew Motorfest ( Ivory Tower / Ubisoft)

Mejor multijugador:

・Baldur’s Gate 3 (Larian Studios)

・Diablo IV (Blizzard Entertainment)

・Party Animals (Recreate Games)

・Street Fighter 6 (Capcom)

・Super Mario Bros. Wonder (Nintendo)

Juego más anticipado:

・Final Fantasy VII Rebirth (Square Enix)

・Hades II (Supergiant Games)

・Like A Dragon: Infinite Wealth (Ryu Ga Gotoku Studio / Sega)

・Star Wars Outlaws (Massive Entertainment / Ubisoft)

・Tekken 8 (Bandai Namco)

Creador de contenido del año:

・IronMouse

・PeopleMakeGames

・Quackity

・Spreen

・SypherPK

Mejor juego de esports:

・Counter-Strike 2 (Valve)

・Dota 2 (Valve)

・League of Legends (Riot Games)

・PUBG Mobile (LightSpeed Studios / Tencent Games)

・Valorant (Riot Games)

Mejor jugador de esports:

・Lee “Faker” Sang-hyeok (League of Legends)

・Mathieu “ZywOo” Herbaut (CS:GO)

・Max “Demon1” Mazanov (Valorant)

・Paco “HyDra” Rusiewiez (Call of Duty)

・Park “Ruler” Jae-hyuk (League of Legends)

・Phillip ”ImperialHal” Dosen (Apex Legends)

Mejor equipo de esports:

・Evil Geniuses (Valorant)

・Fnatic (Valorant)

・Gaimin Gladiators (Dota 2)

・JD Gaming (League of Legends)

・Team Vitality (Counter-Strike)

Mejor entrenador de esports:

・Christine “potter” Chi (Evil Geniuses - Valorant)

・Danny “zonic” Sorensen (Team Falcons - Counter-Strike)

・Jordan “Gunba” Graham (Florida Mayhem - Overwatch)

・Remy “XTQZZZ” Quoniam (Team Vitality - Counter-Strike)

・Yoon “Homme” Sung-young (JD Gaming - League of Legends)

Mejor evento de esports:

・2023 League of Legends World Championship

・Blast.tv Paris Major 2023

・EVO 2023

・The International Dota 2 Championships 2023

・VALORANT Champions 2023

youtube

0 notes

Link

They include a streaming app founder and an executive referred to as China's Warren Buffett.

0 notes

Text

China detains DouYu founder, investment guru - reports

They include a streaming app founder and an executive referred to as China’s Warren Buffett.

from BBC News – World https://ift.tt/jeh2ncq

via IFTTT

View On WordPress

0 notes

Text

Live Streaming Platform Market Opportunities and Landscape [2023-2031]

Global Live Streaming Platform Market (2023-2031) latest research report, analyses several areas such as drivers, challenges, opportunities, and threats to provide an in-depth assessment of the market. It contains growth, trends, competitive landscape research, and significant region expansion status. The research includes numerical industry analysis and statistics for developing strategies to boost market growth and success. Live Streaming Platform Market organizes data into segments based on type, application, and region. Market investment scenario by market share and market growth (value and volume) are stated in the Live Streaming Platform Market research.

This report is the result of extensive primary and secondary research into the Live Streaming Platform market. It offers an in-depth assessment of the market's current and future objectives, along with an industry competitive analysis broken down by application, type, and regional trends.

Who are the leading players in the Live Streaming Platform market?

Kuaishou

YY

Twitch

Tencent Music Entertainment (TME)

Momo

Douyu

ByteDance

YouTube

Inke

Huajiao

Yizhibo (Weibo)

Twitter (Periscope)

Brightcove (Ooyala)

Uplive

Mixer

Facebook

Instagram

Snapchat

Vimeo (Livestream)

IBM Cloud Video (formerly Ustream)

Dacast

Smashcast (Azubu)

StreamShark

Regional Segment of Live Streaming Platform Market:

Geographically, the report includes research on production, consumption, revenue, market share, and growth rate, and forecast of the following regions:

- North America (United States, Canada, and Mexico)

- Europe (Germany, UK, France, Italy, Russia, Turkey, etc.)

- Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia, and Vietnam)

- South America (Brazil, Argentina, Columbia, etc.)

- Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa)

The Study Objectives of This Report:

The study objectives of this report are to analyze the global Live Streaming Platform market, understand its demand drivers, evaluate its growth rate, assess production and production value, identify key producers, and analyze the growth factors driving market demand. Additionally, the report aims to examine market trends, challenges, and opportunities, provide insights into market segmentation and competitive landscape, assess pricing trends, explore market opportunities, forecast future prospects, study regulatory frameworks, and understand environmental considerations in the Live Streaming Platform industry. These objectives aim to provide a comprehensive understanding for industry stakeholders and guide decision-making processes.

Key Questions Answered In the Live Streaming Platform Market Report:

What are the major trends influencing the global Live Streaming Platform market?

What are the key challenges faced by the Live Streaming Platform market?

What are the different types of Live Streaming Platforms prevalent in the market?

What is the market share of different Live Streaming Platform types?

What is the geographical distribution of the Live Streaming Platform market?

Who are the key customers/end-users of Live Streaming Platform products?

What are the pricing trends in the Live Streaming Platform market?

What are the emerging technologies affecting the Live Streaming Platform market?

What are the regulatory frameworks affecting the Live Streaming Platform market?

What is the competitive landscape of the Live Streaming Platform market?

What are the key strategies adopted by leading companies in the Live Streaming Platform market?

What are the market opportunities and potential growth areas in the Live Streaming Platform market?

What is the market forecast for the Live Streaming Platform industry in the next five years?

Browse More Details On This Report at - https://www.businessresearchinsights.com/market-reports/live-streaming-platform-market-102147

Contact Us:

Business Research Insights

Phone:

US: (+1) 424 253 0807

UK: (+44) 203 239 8187

Our Other New Reports are Below:

Peony Market Revenue

Digital Mapping Cameras (DMC) Market Size

Chlorotoluene Industry Growth Report

Biosimilar Insulin Market Size and Share Estimation

IoT Platforms Software Market Forecast Report

Brik Shape Aseptic Packaging Market Trends

Animal Placental Protein Industry Size

Outdoor Power Supply Industry Revenue

Garden Handheld Power Equipment Market

Metal Seals Market Forecast

Zebrafish Market Statistics

Luxury Swimwear Market Share

Media Based Water Filters Industry Growth

Ovarian Cancer Market Revenue

Cloud Infrastructure Services Market Size

Commercial Ice Cream Freezers Industry Growth Report

Quinacridone Pigments Market Size and Share Estimation

Clean Energy Technology Market Forecast Report

Disposable Plastic Spoon and Fork Market Trends

Soft Touch Lamination Films Industry Size

0 notes

Text

ROSEN, SKILLED INVESTOR COUNSEL, Encourages DouYu International Holdings Limited Investors to Secure Counsel Before Important Deadline in the Securities Class Action Commenced by the Firm – DOYU

http://dlvr.it/Sr6Kp7

0 notes

Text

ROSEN, A TOP RANKED LAW FIRM, Encourages DouYu International Holdings Limited Investors to Secure Counsel Before Important Deadline in the Securities Class Action Commenced by the Firm – DOYU

http://dlvr.it/SqqkJz

0 notes