#best bookkeeping app for small business

Text

Best Accounting Software for Small Business

Best Accounting Software for Small Business:- In today’s digital era, having reliable accounting software is essential for small businesses. With the right accounting software, small business owners can streamline their financial processes, track expenses, manage invoices, and make informed decisions. However, with numerous options available in the market, choosing the best accounting software…

View On WordPress

#accounting app for small business#accounting packages for small businesses#accounting programs for small business#accounting software for businesses#accounting software for self employed#accounting software for small business#accounting software for small construction business#accounting software with payroll for small business#accounting systems for small business#accounts payable software small business#basic accounting software for small business#best accounting app for small business#best accounting for small business#Best Accounting Software for Small Business#best accounting software for sole trader#best app for business accounting#best bookkeeping software for small business#best business accounting software#best free accounting software#best free accounting software for small business#best online accounting software#best online accounting software for small business#best self employed accounting software#best small business accountant#cheap accounting software#cheap accounting software for small business#cloud based accounting software for small business#easy accounting software for small business#free accounting app for small business#free accounting software for self employed

0 notes

Text

You’ve Got Me Hooked - Chapter 5

Pairing: Captain Syverson x OFC (Riley McKenzie)

Word count: 2.5k

Warnings: Sex work, stripper, OnlyFans, Mentioned Online Harassment

Catch up: Series Masterlist

Taglist: @amberangel112 @utterlyhopeful-fics @marantha @kebabgirl67 @littleone65 @omgkatinka @luclittlepond @marytudorbrandon @foxyjwls007 @peaches1958 @identity2212 @summersong69 @liecastillo @islacharlotte

A/N: If you want to be added or removed from my taglist, let me know!

Please consider giving me a reblog because dumblr is censoring these posts so badly that I struggle to find my own chapters on my blog.

Masterlist

Sy

As soon as my boss got to the garage this morning, I asked him about hiring Riley to help with advertising. He’s known me my whole life so when I told him I knew someone willing to help us out, he didn’t ask for more information, he just took down her number. He opened this small shop a few years before I was born and I know it would be devastating for him to have to close it down.

I don't know much about running a business. Sure, I can run a team and keep track of costs and inventory, but I didn't have to deal with suppliers, banks and customers. I sure as hell can't manage a web page or anything like that.

After I found out about Riley, I checked out "Razzy's" profiles. Not her Onlyfans — that is a line I'm determined not to cross — but I looked at her TikTok and her Instagram. She's good at what she does. She has a big follower count by my uneducated standards and lots of likes and comments. I also made the mistake of reading some of the things people said about her and had to close the app before I did something stupid like march into her room and confiscate her laptop and her phone.

Some people just say how hot they think she is. Lots of them share all the fucked up shit they want to do to her. I’m no saint, I like it rough as much as the next guy, but I don’t plaster my desires across the Internet. Those weren’t the bad ones though. They were fucking nice compared to what I saw next.

I scrolled through dozens of comments from other girls calling her a skank or guys saying how she should be ashamed to do those kinds of things for money. So many people were lashing out at her from completely anonymous profiles, each one worse than the last. How does she manage to read that every day? No wonder that poor girl doesn’t feel safe enough to wear anything other than pants and hoodies in front of me.

Despite all that, I have to say, I can see her talent and skill showing even if it has nothing to do with the typical corporate bullshit. The colors and tones of the videos are consistent throughout the posts and they always compliment that bright pink hair that I assume is a wig since Riley's blond locks don’t look like they’ve ever been colored.

I text Riley a quick heads-up to expect a call then put my phone back in my locker. Aika is asleep under a nearby table, knowing well enough to stay away from the lifts and other tools and machinery. She’s content just being near me and the loud noises are nothing compared to the sound of bombs and gunfire she was trained to endure.

I’m the first one here every morning. Sometimes I go to the gym first but I still make it in by 8 am to open up. More often than not, I wrap up whatever job the other guys don’t quite finish or I do the final checks before returning a car to a customer.

My boss, Don, handles all the bookkeeping and most of the administrative work with the help of his wife since his arthritis made him incapable of working on the cars. They had a pretty good business going for the best part of the last forty years until all the larger chains started undercutting his prices. A few of the other mechanics had to leave and find better paying jobs elsewhere because there wasn’t enough work here to go around.

It doesn’t help business that the building is falling apart on the outside. The parking lot is in such dire need of being repaved that I’ve become an expert at maneuvering cars around the pot holes and deep cracks. It looks nothing like it did back before I enlisted.

It used to be that the garage ran off word-of-mouth alone with most of the locals adopting the garage because it was just that — local. But now, no one could blame customers for taking their business somewhere cheaper or somewhere they deem more reliable even if it is a half hour drive away from town. A lot of the old clientele have either retired or moved away since the garage was started, meaning there is no inherent loyalty from the townspeople. It’s just how things work these days.

I’m busy doing an oil change when I hear a car pull into the lot. In fact, I heard it approaching from the main road long before it ever reached the turn off. That car sounds like a bunch of bolts in a garbage disposal even over the loud music and the various power tools the other guys are using.

I roll out from under the car, expecting to greet a potential customer but instead I’m surprised to see Riley stepping out of the vehicle. I’ve noticed before that her car doesn’t look in great shape but I always assumed it was mostly aesthetic. If I had realized how bad it is I would’ve offered to take a look at it a long time ago.

I exit through the open workshop door with Aika trailing close behind. As soon as she sees her approaching, a wide smile spreads over Riley’s face. She bends down, burying both hands in Aika’s fur.

“Hey, sweet girl.”

“I take it Don called ya?”

“He did.” Riley stands, catching my gaze but as soon as she does, she turns her eyes towards the ground. She tries to play it off by wiping the dust from the knees but I know that she is just that shy.

She isn’t wearing her typical sweatshirt and leggings, instead opting for a cream blouse and fitted black pants that show off her beautiful figure. She looks every bit the professional put together woman I know she strives to be. She obviously put some thought into what she wore, because it’s not so fancy that she’d appear stuck up to a bunch of guys literally covered from head to toe in oil and grease on a day to day basis. It’s perfect.

"I'll show you to the office,” I say, pointing over my shoulder.

I lead Riley inside, being mindful not to get grease on anything, and knock on Don's door frame. The door was taken off its hinges long before I started working here. Part of the reason is so he can keep an eye on the work floor and be available if we need him. The other half of it is because he makes sure to say "hi" to every person that comes in even if they don't need his help.

"Hey boss, Riley's here to see ya."

"Miss McKenzie, how wonderful to meet you." He stands, shaking Riley's hand.

"The pleasure is mine, Sir."

"Oh, none of that, call me Don. Please, sit."

I take that as my cue to leave, going back to my work. I glance towards the office every so often and every time, Riley has a smile on her face. She takes notes of whatever Don is saying, nodding along.

It's funny how different this Riley is to the girl I've come to know. Instead of making herself as small as possible, she's sitting straight with her head up and shoulders back, meeting Don's gaze as they talk over their ideas.

Over an hour later, she stands and shakes Don's hand again. She walks out through the office door and makes her way to her car with a small wave my way.

When my day is over, I go to the office to drop off my day's paperwork then poke my head in to say goodbye to Don.

"I'm headin' out."

Don lifts his head from the stack of invoices he's reviewing.

"Alright, Son, thank you."

I don't want to meddle but I can't help myself from asking about how the meeting went.

"So, umm, what didja think of Riley?"

He crosses his arms over the desk, leaning closer.

"Oh she is just lovely, Sy. Smart and beautiful, you've got yourself a real catch there."

Something in my chest warms at the praise but I have to remind myself that she is not mine to be proud of and never will be. When Sam said she filmed videos with other girls I figured he was just making it up to try and catch my interest but I’d seen enough on “Razzy’s” profiles to know he’d been telling the truth.

"Actually, we're just friends. Barely know her if I'm being honest."

Don's eyes go wide. "My apologies, I thought she said something about you two living together."

I guess he would have assumed that. Not many people in his day believed in living together out of wedlock so us living as roommates must be strange.

"We do. But we didn't know each other before I moved in. We both know I don't make enough to pay for my own place right now and there aren't a lot of men my age looking for roommates."

Like that, any remnants of a smile is completely wiped from Don's face. "I know, Sy, but I really can't —"

I stop him immediately because I have no intention of trying to guilt him into paying me more.

"I didn't mean it like that, Don. I just meant sharing with Riley might not be a conventional choice but it works out well for the both of us."

He nods in understanding.

"That car of hers sounds like a real piece of work."

"You can say that again," I say, sinking into the chair opposite him. This is shaping up to be a long conversation so I might as well get comfortable.

"She's refusing to let me pay for her work until she has proof that it helped us bring in more business."

I scoff, shaking my head. "That sounds like her alright."

She rarely stands up for herself but if ya offer to pay something of hers, she gets as stubborn as a mule.

"She also said the money would be better invested elsewhere."

"I doubt gettin' the the lot paved costs the same as a couple hours of her time."

"No, you're right about that." He pauses, looking down at the invoices on his desk. He pulls open the bottom drawer of his desk, taking out two glasses and a bottle of something that looks an awful lot like whiskey. He pours us both a generous amount and slides mine across the desk. "But if she comes back after crunching the numbers and tells me what I've been thinking for a while, I'll take out a second mortgage on the house."

"What?" Now I know why he pulled out the liquor. "No, I'm not lettin' ya do that Don."

The last thing any man his age needs is another loan to pay off. If he's even mentioning it to me it means he's already talked it over with his wife and that she’s agreed. He’s serious about this.

"If it means saving this place and keeping it going then, yes, I am. Your father and I worked too damn hard on this place to see it go down. I don't have any kids of my own but as far as I'm concerned, half of this place is yours and you deserve to have yourself a stable income to provide for your own family some day."

His words cause my throat to tighten up and I have to swallow down a gulp of whiskey before I can respond.

"Well, just know that I will be by your side every step even if we do have to shut this place down."

He takes a sip of his own drink.

"You're a good man, Sy. Your daddy would be proud."

Fuck, this has really turned into a liquor kind of conversation. I simply nod, looking over his shoulder at the framed picture on the wall behind him. My pop and a much younger Don smile back at me, my pregnant mama on one side and Charlotte, Don's wife, laughing brightly on the other.

"I'll see ya tomorrow, Don."

“Get home safe.”

Those are always Don’s parting words. I never took them seriously until the first time I shipped out. Then they got a whole new meaning after my parents were killed in that car wreck.

I shoot the remaining whiskey from my rocks glass, focusing on the slight burn down the back of my throat then get to my feet. “Will do, Don.”

For the second day in a row, Riley is at the island when I get home. She has a set of colored pencils spread out around her computer and sheets of paper strewn from one end of the counter to the other.

“You know, Don doesn't expect you to get back to him tomorrow.”

She doesn’t look up or move from her spot. She just keeps coloring with her head tilted to the side and worrying her bottom lip between her teeth.

“I know, but I want to brainstorm while the ideas are still fresh.”

Fuck, she is adorable. All I want is to go up behind her and wrap my arms around her waist. I’d rest my chin over her head and look at all the ideas she’s put on paper. I’d tell her how much it means to me that she’s doing this for my godfather.

“Have ya eaten?”

“I have stew simmering on the stove. Should be ready in about an hour. I got bread from the bakery on the way home and —” Her sentence is cut off when her eyes land on me. “Sy, why are you green?”

“Aika and I went to the park.”

She gives me one of those cute little giggles that she always hides by putting her hand over her mouth or making her hair fall in front of her face.

“You know, normally, the dog is supposed to be the one rolling in the grass.”

I finally get my boots off and step further into the apartment. “Where’s the fun in that?”

She shakes her head at me and waves me off. “Alright, shoo. You’re trailing grass and mud everywhere and in all honesty, I can smell you from here.”

I give her a mock salute. “Yes ma’am. I’ll let ya get back to work.”

I take my shirt off, leaving it inside out in an attempt to keep at least some of the dirt contained. Riley immediately turns away but not before I spot how her eyes trail over my chest. Maybe she isn't completely uninterested after all.

Chapter 6

#captain syverson#captain syverson fic#captain syverson fanfiction#captain syverson fanfic#captain syverson x ofc#cpt syverson fic#cpt syverson x ofc#cpt syverson fanfiction#cpt syverson#cpt syverson fanfic#henry cavill

110 notes

·

View notes

Text

FreshBooks vs Xero: Which Online Accounting Software is Best for Your Business?

Are you tired of the hassle that comes with traditional accounting methods? It's no secret that manual bookkeeping can be a daunting task for business owners. Fortunately, in today's digital age, there are online accounting software options available to help simplify your financial management. Two popular choices are FreshBooks and Xero. Both offer innovative features to streamline your accounting processes, but which one is the best fit for your business?

In this blog post, we'll compare FreshBooks vs Xero and help you determine which option is right for you!

What is FreshBooks?

FreshBooks is a cloud-based accounting software designed for small business owners who want to manage their finances efficiently. The platform offers features such as invoicing, time tracking, expense management, and project management all in one place.

One of the standout benefits of FreshBooks is its user-friendly interface. Even if you're not an accounting expert, you can easily navigate through the system without feeling overwhelmed. Another great feature is that it integrates seamlessly with other popular apps such as Stripe, PayPal, and G Suite.

Moreover, FreshBooks has an excellent invoicing system that allows users to create customized invoices quickly and effectively. You can send professional-looking invoices via email or snail mail and even set up recurring billing for your regular clients.

Another benefit of using FreshBooks is its mobile app compatibility. With just a few clicks on your smartphone or tablet screen, you can track your billable hours or expenses while on-the-go.

FreshBooks provides affordable pricing plans for small businesses seeking easy-to-use tools like time tracking and automated invoicing paired with strong customer support options including phone numbers available during extended hours which are key criteria areas when choosing an online accounting software.

What is Xero?

Xero is an online accounting software that was created to help small business owners manage their finances more easily. It was founded in New Zealand in 2006 and has since grown to become a popular choice for businesses around the world.

One of the main features of Xero is its cloud-based platform, which allows users to access their financial information from anywhere with an internet connection. This means that business owners can log in and check their accounts on-the-go or collaborate with team members remotely.

Another advantage of Xero is its user-friendly interface, which makes it easy for non-accountants to use. The software offers a range of tools and integrations designed specifically for small businesses, such as invoicing, expense tracking, payroll management and inventory management.

In addition, Xero provides real-time reporting and insights into your business's financial health. This enables you to make informed decisions based on up-to-date data.

Xero is a powerful tool for managing your business's finances efficiently while saving time and effort.

The Pros and Cons of FreshBooks

FreshBooks is an online accounting software designed for small businesses and freelancers. Here are the pros and cons of using FreshBooks.

Pros:

Firstly, FreshBooks offers a user-friendly interface that makes it easy to navigate through the different features of the platform. The dashboard provides a clear overview of your business finances with charts and graphs that show important financial data such as revenue, expenses, profit, and loss.

Secondly, FreshBooks allows you to create professional-looking invoices quickly without much effort. You can customize your invoice templates with your brand logo, colors, and messaging to match your company's branding.

Thirdly, FreshBooks integrates seamlessly with other applications like PayPal or Stripe which assists in making payments effortless. This integration saves time for users who don't want to manually input payments one by one into their system.

Cons:

One major disadvantage of using FreshBooks is its limited reporting options compared to other accounting software available on the market. Users have reported difficulties when trying to generate customized reports which limits analysis capabilities.

Secondly, while there are mobile apps available for both iOS and Android devices users complain about stability issues on older phones or tablets due to slow loading times or crashing problems during use

Lastly - pricing - some people may find that FreshBooks is more expensive than alternative solutions especially if they require multiple user accounts or plan add-ons such as payroll services etc

Despite these drawbacks many businesses still see positive results from implementing this solution depending on their specific needs so consider all factors before choosing what best suits yours!

The Pros and Cons of Xero

Xero is one of the most popular online accounting software for small businesses. It offers a wide range of features to manage finances, such as invoicing, inventory management, bank reconciliation and expense tracking. Here are some pros and cons of using Xero:

Pros:

User-friendly interface: Xero has an easy-to-use dashboard that displays all your financial information in one place.

Integration with third-party apps: You can integrate Xero with over 800 third-party apps including Shopify, PayPal and Stripe.

Mobile app: The mobile app allows you to access your financial data from anywhere at any time.

Cons:

Limited customer support options: Compared to other software providers, Xero's customer support options are limited.

Pricey plans for larger sized businesses: While the basic plan is affordable for small-sized businesses, the higher-tiered plans can be pricey for larger-sized businesses.

Limited customization options: Customization options on invoices and reports are limited compared to some competitors.

Xero is a great option for small businesses looking for an easy-to-use accounting software with strong integrations capabilities.

Which Online Accounting Software is Best for Your Business?

When it comes to choosing the best online accounting software for your business, there are a number of factors you should consider. Both FreshBooks and Xero offer unique features that can benefit different types of businesses.

For small businesses with basic accounting needs, FreshBooks may be the better option as it is easy to use and has a simple interface. However, if you need more advanced features such as inventory management or multi-currency support, then Xero may be the way to go.

In terms of pricing, both FreshBooks and Xero offer affordable options with various pricing plans depending on your business needs. It's important to compare these plans carefully before making a decision.

Another important factor is integrations - both FreshBooks and Xero integrate with many popular apps like PayPal and Shopify. However, if you already use other cloud-based software in your business operations, check which ones are compatible before making a final choice.

Ultimately, the best online accounting software for your business will depend on your unique needs and budget. Take time to research each option carefully before making an informed decision that suits your organization’s specific requirements.

Conclusion

After weighing the benefits and drawbacks of FreshBooks and Xero, it's clear that both online accounting software options have their strengths. FreshBooks is an excellent option for small business owners who prioritize ease-of-use and invoicing capabilities. Meanwhile, Xero offers more advanced features suitable for medium-sized businesses in need of more sophisticated bookkeeping tools.

Ultimately, the best choice depends on your specific business needs and priorities. Consider factors such as budget, company size, required features, industry-specific requirements when choosing between FreshBooks vs Xero online accounting platforms.

Regardless of which one you choose to implement into your business operations - either FreshBooks or Xero - rest assured knowing that both offer significant value to entrepreneurs seeking to manage their finances with ease while growing their companies at the same time!

3 notes

·

View notes

Text

Small Businesses Software

The best invoicing software for your small business depends on various factors, such as your business size and type and your needed pricing, ease of use, and features. For most businesses, we recommend choosing a solution that lets you create customizable invoices and has enhanced features, such as recurring invoices, payment links, billing realization tracking, and a mobile invoicing app - online restaurant management software.

Traditional invoicing software usually necessitates regular upkeep and updates, which might add to the general value burden for small businesses. These updates may require additional training or professional help, resulting in additional bills. Our invoicing options include turning quotes into invoices in a single click and automated alerts that inform you of any late payers. We also offer many other free bookkeeping templates, including cash e-book, petty cash, money flow, finances and business expenses.

As a small enterprise creating and tracking invoices could be time-consuming and expensive should you get it mistaken. Invoice Ninja allows small companies to optimize their invoicing process. A key characteristic of Invoice Ninja is that customers can arrange recurring payments for purchasers. Products classified in the overall Billing category are similar in many regards and help companies of all sizes solve their business problems. However, small business features, pricing, setup, and installation differ from businesses of other sizes, which is why we match buyers to the right Small Business Billing to fit their needs - free restaurant billing software.

We present completely different ranges of assistance for purchasers who use totally different features and providers. The best restaurant point-of-sale software program helps eating places improve their day-by-day operations, which instantly impacts income and customer support satisfaction. The restaurant point-of-sale software program is an end-to- end solution, which simplifies the administration of restaurant operations. The software program routinely generates accurate monetary statements, making it simpler for you to analyze your restaurant’s performance. This is a restaurant management app and EPOS system that harnesses the facility of mobile to speed up restaurant providers. Expect all the essential contains a restaurant, catering business, brewery, or event venue. For more information, please visit our site https://billingsoftwareindia.in/restaurant-billing-software/

0 notes

Text

Why Flowace Reigns Supreme as the Best QuickBooks Alternative

As businesses strive to streamline their operations and maximize productivity, the right software solutions can make all the difference. Enter Flowace – the ultimate QuickBooks alternative that is revolutionizing the way businesses manage their finances. In this comprehensive guide, we'll explore the key features and benefits of Flowace, and why it stands head and shoulders above QuickBooks as the preferred choice for modern businesses.

1. Streamlined Financial Management: Flowace offers a comprehensive suite of financial management tools designed to simplify the complexities of accounting and bookkeeping. From invoicing and expense tracking to budgeting and reporting, Flowace provides everything businesses need to stay on top of their finances. With its intuitive interface and user-friendly features, Flowace makes it easy for businesses of all sizes to manage their finances effectively and efficiently.

2. Seamless Integration: One of the standout features of Flowace is its seamless integration capabilities. Unlike QuickBooks, which may require additional plugins or third-party apps to achieve full integration with other business systems, Flowace offers native integrations with a wide range of popular platforms. Whether you're using project management software, CRM tools, or e-commerce platforms, Flowace seamlessly integrates with your existing systems to streamline your workflow and eliminate data silos.

3. Advanced Reporting and Analytics: In addition to its robust financial management features, Flowace also offers advanced reporting and analytics capabilities. With customizable reports and real-time insights, businesses can gain a deeper understanding of their financial performance and make data-driven decisions to drive growth and profitability. Whether you're analyzing sales trends, monitoring expenses, or forecasting cash flow, Flowace empowers you with the tools you need to make informed decisions and stay ahead of the competition.

4. Cost-Effective Solution: Flowace offers a cost-effective alternative to QuickBooks, with pricing plans tailored to suit businesses of all sizes and budgets. Unlike QuickBooks, which may charge hefty fees for additional features or user licenses, Flowace offers transparent pricing with no hidden costs or surprises. With Flowace, businesses can access all the features they need at a fraction of the cost, making it the smart choice for budget-conscious organizations.

5. Exceptional Customer Support: Last but not least, Flowace prides itself on providing exceptional customer support to its users. Whether you're a small business owner or a large enterprise, our dedicated support team is here to assist you every step of the way. From setup and implementation to troubleshooting and ongoing support, we're committed to ensuring that you get the most out of your Flowace experience.

Conclusion: In conclusion, Flowace is the ultimate QuickBooks alternative for businesses looking to streamline their financial management processes and boost efficiency. With its intuitive interface, seamless integration capabilities, advanced reporting tools, and cost-effective pricing, Flowace ticks all the boxes for modern businesses. So why settle for mediocrity when you can unleash efficiency with Flowace? Make the switch today and experience the difference for yourself

#quickbooks alternative#Best quickbooks alternative#quickbooks alternatives#Best quickbooks alternatives#quickbooks pricing#quickbooks online pricing

0 notes

Text

Maximizing Efficiency: Why Businesses Are Turning To Accounting Outsourcing Companies In UK

Many small and mid-sized companies hesitate to hire outsiders for their accounting functions. We would say that outsourcing is the most beneficial, strategic and efficient method. They can handle your financial statements, bank account operations and plan outgoing invoices at a competitive pricing range. So, consider the best accounting outsourcing companies in UK to scale up.

This is why many businesses in the UK are turning to professional accounting outsourcing companies to maximize efficiency. They have a team of qualified accountants and CA/ACCAs that specializes in providing bookkeeping & accounting outsourcing services in UK. They are highly capable and dedicated to their work. It brings various benefits, given below-

Why Expert Accounting Outsourcing Companies In The UK?

Allows Focusing On Your Business-

Managing finances requires skills and knowledge. It is indeed a time-consuming task for a business owner. By hiring an accounting outsourcing company, you can pay attention to areas where you excel. In this competitive business environment, everyone is seeking to fast-track their growth so new practices are entering the market. This is where outsourcing your accounting tasks to a professional team can be a smart choice.

Reduce Overhead Costs-

Outsourcing accounting functions can reduce overhead costs. Many small business owners can’t afford in-house accountants. Now, you can pay for the services you need and when you need them. Part-time personnel with vast experience and skills can handle this job efficiently. It helps businesses save money.

Access To Advanced Technology-

This is another reason for hiring expert accounting outsourcing companies. You don’t need to buy any latest software or technology to train your in-house staff. Outsourcing companies use advanced accounting software and tools. They can set up the right processes. They can help you understand and set up the right processes and app stack and streamline the processes. It can enhance your accuracy, efficiency and decision-making abilities.

Mitigate Risks-

Accounting outsourcing companies understand the ever-changing legal landscape. They can easily handle legal responsibilities and you will remain compliant at all times. It can minimize the risk of costly errors, penalties and audits.

Indeed, accounting outsourcing companies offer numerous benefits. However, you should carefully evaluate a service provider that best suits your accounting needs. They can provide you with superior experience, efficiency, and impartial advice.

Searching for one of the best accounting outsourcing companies in UK? Welcome to the forefront of financial excellence! Our top-notch accounting outsourcing firms in UK provide supreme support for your business. Tribocon brings a comprehensive range of accounting outsourcing services for your organization that can easily deal with your laborious accounting functions. We offer tailored solutions for different Payroll, yearly accounting, account management, self assessment, VAT, CIS, corporate tax, company secretarial and Liquidation processes and so on. Visit www.tribocon.com today!

0 notes

Text

Tally Accounting Software - Tally Prime & Tally On Cloud Services

We Provide Best Tally Prime Software Services and give many facility and features to tally prime software . Tally on Cloud it’s a solution for easy, economical, efficient and with securely to use Tally from anywhere, anytime and from any devices with the help on just an internet connection. Tally Prime is a rearranged arrangement that runs the unpredictable parts of your business, for example, bookkeeping, busy software team chat messaging apps accounting marg accounting software consistence and procedures out of sight. Count is anything but difficult to learn and can with least assets.

Where is tally software used -

Tally software is used for storing all the business transactions of each account in detail. Tally has made calculations simple. Tally Software has become part of all businesses. Small scale enterprises believe that Tally software carries out efficient business transactions, provides accuracy, and saves a lot of time Ds Software giving you more facility and features buy now tally software .

0 notes

Text

Announcing BizStack Solopreneur Community — Limited Founding Member Offer!

Unlock your potential with exclusive content, special perks, and a vibrant solopreneur community. The first 50 members enjoy a special rate!

Exciting news, everyone! 🎉 We’re thrilled to announce the launch of the BizStack Solopreneur Community!

It’s more than just a community; it’s a movement for solopreneurs like you who are eager to explore, grow, and transform the digital landscape.

I’m even more thrilled to share that Saul de Jesus has joined Cagri Sarigoz LLC as the Community Manager for the BizStack Solopreneur Community. With his wealth of experience in engagement strategy and community building, Saul will be instrumental in onboarding new members and ensuring you have the best experience possible. Connect with Saul on LinkedIn and welcome him to our vibrant community!

🎬️ New Solopreneur Spotlight Interviews

Vaibhav Dwivedi’s Journey in Educating Minds with Writing and Coding

Vaibhav, founder of The Brain Psych, blends technology with psychology to make learning fun. Discover his innovative approach to entrepreneurship and how he balances creativity and discipline in his work.

Read Vaibhav’s Solopreneur Story»

Vanjela Bellovoda: Psychologist turned Social Media Strategist

Vanjela uses her psychology expertise to craft compelling social media strategies that captivate and engage. Learn about her transition from psychology to digital marketing and the tools she uses to stay ahead.

Read Vanjela’s Solopreneur Story »

Are you a solopreneur? Fill out this solopreneur spotlight survey to get your story featured on BizStack.

🌍 Join the BizStack Solopreneur Community

Our Discord server is your gateway to exclusive content, discussions, and a platform to share your wins and ideas. Plus, you’ll gain access to special benefits, including:

50% Off On Growth Strategy 1:1 Session: Personalized guidance from me, Cagri Sarigoz, at a special rate.

✨ Solopreneur Spotlight Interview: An exclusive chance to share your journey and inspire others.

And much more!

Become a Founding Member Now — Just $2.99/Month

This special rate, including a 7-day free trial, is only available to the first 50 founding members. Hurry, as spots are filling up fast!

We’re committed to making the BizStack Solopreneur Community the ultimate resource for you to thrive. Join us today and be part of a community that celebrates your entrepreneurial spirit and drive.

Looking forward to welcoming you!

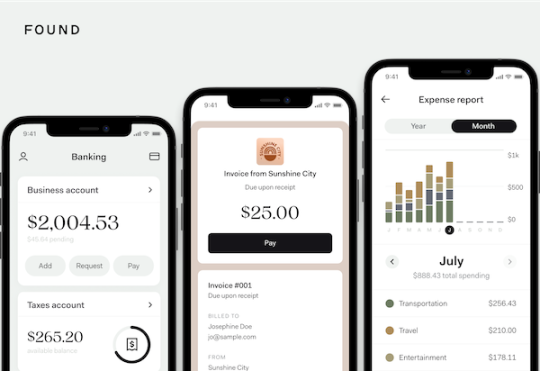

BANKING APP FOR SOLOPRENEURS

Manage Your Solopreneur Finances Without the Hassle with Found Banking App!

I recently encountered a banking solution built explicitly for solopreneurs like me: Found Banking App.

Found is an all-in-one banking solution tailor-made for the self-employed. It combines the functionality of a business checking account with comprehensive bookkeeping, tax tools, and much more, all designed to support the growth of your business.

Here’s what makes Found stand out:

Simplicity: Sign up is free, online, and takes less than 5 minutes. Plus, no credit check or opening deposit is required.

Functionality: Enjoy a free business checking account, a Mastercard debit card, and access to helpful tax savings tools and bookkeeping support.

Value: Found, the basic plan is free to use. Found Plus, the paid plan, offers exclusive features, including earning 1.5% APY on balances up to $20K for just $19.99/month or $149.99/year, effectively $12.5/mo.

Whether freelancing, running a small business, or working as a gig worker, Found offers the financial tools you need without the traditional banking fees.

Check out Found and see how it can support your solopreneur journey. 👇

Explore the Found Banking App »

Disclaimer: Found is a financial technology company, not a bank. Business banking services are provided by Piermont Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. The Found Mastercard Business debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted. Found’s core features are free. They also offer a paid product, Found Plus.

🛠️ My Top Business Stack Recommendations

Pipedream: Automate API connections seamlessly.

Superhuman: Revolutionize your inbox management. (One month free through my invite link. 👆)

Jotform — Typeform + Docusign + much more in a single app (Free to start, 50% off on paid plans through my invite link 👆)

Setapp — a must-have app bundle for Mac users (Some of my favorite apps on Setapp: CleanMyMac, Numi, Receipts, Squash, Permute, and Bartender)

Beehiiv — The best ESP for newsletter growth (Easy-to-use, free to start, inexpensive as you grow + advanced growth features)

🔝 Reader Favorites: Past Highlights

Here are some of the most popular past issues:

🤖 Unlock Advanced AI Solutions with These Free Custom GPTs!

🧰 Steal My Content Distribution Machine

🔄 2024 Content Refresh: Easy Bulk Update from 2023 to 2024

And here are some of the timely posts from the BizStack website:

Global Solopreneur Statistics

The Ultimate Solopreneur Guide

14 AppSumo Alternatives to Find the Best SaaS Deals

Top 10 Solopreneur Business Ideas for 2024

Stay tuned for more insights and strategies for effectively navigating solopreneurship. Until next time, stay productive!

— Cagri Sarigoz

P.S. Some links are affiliate/referral links, helping me out at no extra cost to you. Thanks for your support! 🙏

1 note

·

View note

Text

Brendon Pack | 1-800Accountant Named BigCommerce Certified Partner

1-800Accountant today announced it has been named a BigCommerce Certified Technology Partner, providing approximately 60,000 BigCommerce merchants access to 1-800Accountant's comprehensive suite of business accounting, tax planning and bookkeeping services. Beginning today, BigCommerce merchants can schedule a free consultation with one of 1-800Accountant's small business experts through the BigCommerce App Marketplace.

"This partnership between 1-800Accountant and BigCommerce is a natural fit because both companies offer services that allow our clients to spend their time running their business," said Brendon Pack, chief executive officer at 1-800Accountant. "There are a lot of moving parts in running a business and, by utilizing the services offered by BigCommerce and 1-800Accountant, small business owners can free up more of their day for what really matters — their customers."

1-800Accountant supports small businesses at every stage. From developing an idea and making it official to turning it into a money-making business, its services have clients covered. The company's use of technology to expedite processes ensures accuracy and allows its CPAs to focus on the details of each client's specific situation and needs, and to identify hidden savings. 1-800Accountant continues to define the new accounting services model for success in today's economy, offering several subscription-based plans that cover a wide range of business accounting and tax planning services. Brendon Pack

"Our partnership with 1-800Accountant further illustrates our commitment to providing merchants access to the highest-caliber technologies and service providers available in the industry," said Russell Klein, chief commercial officer for BigCommerce. "1-800Accountant shares our desire to help merchants sell more and grow faster to maximize success, and we look forward to working together to mutually support customers." Brendon Pack

BigCommerce Certified Technology Partners are selected for offering best-in-class technologies, value and superior customer service. For more information, visit https://www.bigcommerce.com/dm/1800accountant/.

About 1-800Accountant

1-800Accountant's mix of dedicated human CPAs and technology allows the fastest, most comprehensive service available for SMBs today. With expertise across all 50 states and every industry, the company provides business owners the services, solutions, and support necessary to manage and grow their businesses while saving time and eliminating stress. Learn more at 1800accountant.com.

About BigCommerce

BigCommerce (Nasdaq: BIGC) is a leading open software-as-a-service (SaaS) ecommerce platform that empowers merchants of all sizes to build, innovate and grow their businesses online. BigCommerce provides merchants with sophisticated enterprise-grade functionality, customization and performance with simplicity and ease of use. Tens of thousands of B2C and B2B companies across 150 countries and numerous industries use BigCommerce to create beautiful, engaging online stores, including Ben & Jerry's, Molton Brown, S.C. Johnson, Skullcandy, SoloStove and Vodafone. Headquartered in Austin, Texas, BigCommerce has offices in London, Kyiv, San Francisco, and Sydney. For more information, please visit www.bigcommerce.com

Source:- 1-800Accountant Named BigCommerce Certified Partner

0 notes

Text

What Are The Key Features Offered By Free Accounting Software?

Keeping track of your finances can be uncomplicated and inexpensive. Free accounting software provides all the basic features you need to manage your money without the hefty price tag. Whether you're a freelancer, small business owner, or just trying to get a handle on your finances, free options offer a cost-effective solution.

Core Features

Free accounting software includes the essential tools for monitoring your finances:

Income and expense tracking - Easily enter income and expenses. Categorize transactions to see where your money comes from and goes.

Invoicing - Generate professional invoices to bill clients and customers. Send invoices and track payments.

Bank reconciliation - Connect bank accounts to match transactions and ensure balances match.

Basic reporting - Generate financial statements like profit and loss, balance sheets, and cash flow reports.

Transaction categorization - Organize transactions using preset or customizable categories and tags.

Additional Functions

While core features are covered, free accounting software can also offer other functionalities:

Project management - Track time and expenses on projects. Manage project budgets and profitability.

Inventory - Maintain inventory quantities and values. Track inventory costs and sales.

Tax estimates - Estimate taxes owed based on income and expenses.

Mobile access - Manage finances on the go through Android and iOS apps.

Collaboration - Share access and work with bookkeepers, accountants, or business partners.

The Benefits of Going Free

Deciding to use free accounting software offers many advantages:

Saves money - Avoid the cost of paid subscription software. Free meets basic financial needs.

Easy to use - Intuitive and simple interfaces catered to non-accountants. Easy to learn and use without training.

Increased organization - Systematically categorize transactions and generate reports. Stay on top of finances in real time.

Time savings - Avoid manual bookkeeping and paperwork. Accounting tasks take minutes instead of hours.

Insights - Reporting provides insights into profitability, cash flow, spending patterns, etc. Make data-driven decisions.

Considerations When Choosing Free Accounting Software

While free software is a great starting point, there are some limitations to be aware of:

Transaction limits - Caps on some monthly transactions could be restrictive depending on business needs.

Limited functionality - Advanced features like payroll or inventory costing methods are not included.

Support - Phone and email support may be limited compared to paid plans. Reliance on self-service resources.

Privacy - Review privacy policies and data practices carefully before choosing platforms.

Streamline Your Business Finances With Jaz

Free accounting software makes it simple to take control of your finances. Before choosing a platform, evaluate your needs and shortlist options that best fit. When managing your financial data, these free tools can save you time, money, and headaches. The benefits outweigh the limitations for most individuals and small businesses.

Jaz is the all-in-one accounting solution built to simplify and automate your most complex accounting tasks like invoices, bills, bank reconciliations, payments, and more so you can get back to growing your business or serving more clients.

Get Started for free and take control of your financial operations with Jaz.

0 notes

Text

Best Bookkeeping App for Small Businesses

As of my last knowledge update in January 2022, there is no specific information available about a company named "businessclasso" or their insights into the Best Bookkeeping App for Small Businesses. However, I can create a fictional overview for you:In the ever-evolving landscape of small business management, effective bookkeeping stands as a cornerstone for financial success. Recognizing the vital role that technology plays in this process, businessclasso, a pioneering tech company, has meticulously researched and compiled a list of the Best Bookkeeping App for Small Businesses. This curated selection is designed to cater specifically to the unique needs and challenges faced by small enterprises in maintaining accurate and streamlined financial records.At the forefront of this list is an intuitive and user-friendly bookkeeping app that seamlessly integrates with various accounting systems. The recommended app is tailored for small businesses, providing features such as expense tracking, income recording, and invoice management, all within a user-friendly interface. It caters to businesses with limited accounting knowledge, offering simplified yet comprehensive tools to manage financial transactions effortlessly.Businessclasso places a strong emphasis on cloud-based bookkeeping solutions in its recommendations. This approach ensures that small business owners can access their financial data securely from anywhere, fostering flexibility and adaptability, crucial in the dynamic landscape of entrepreneurship. Moreover, the app seamlessly integrates with other business tools and banking systems, reducing the manual effort required for data entry and reconciliation.Automation features are a key criterion in the selection process, with the recommended app streamlining repetitive tasks like categorizing transactions and generating financial reports. This not only saves valuable time for small business owners but also minimizes the risk of errors associated with manual bookkeeping.Security and compliance are paramount, and the Best Bookkeeping App endorsed by businessclasso prioritizes data security, employing encryption and secure authentication methods to safeguard sensitive financial information. Additionally, it assists businesses in staying compliant with tax regulations, avoiding penalties and ensuring a smooth financial audit process.

0 notes

Text

Best accounting and bookkeeping app

Business Classo stands out as the best accounting and bookkeeping app in the market, offering a comprehensive suite of features that cater to the diverse needs of businesses. This app has garnered praise for its user-friendly interface and robust functionality, making it an indispensable tool for entrepreneurs, small business owners, and accounting professionals alike. One of the standout features of Business Classo is its seamless integration with various financial institutions, allowing users to effortlessly import and reconcile transactions. The app's real-time collaboration feature enables multiple team members to work on financial data simultaneously, promoting efficiency and accuracy in record-keeping. The powerful reporting tools within Business Classo empower users to generate insightful financial reports with just a few clicks, providing a clear and detailed overview of their business's financial health. Automation is at the core of Business Classo's functionality, streamlining repetitive tasks such as invoice generation, expense tracking, and payroll management. The app's intelligent algorithms learn from user behavior, adapting to individual preferences and simplifying the overall accounting process. Security is a top priority for Business Classo, with advanced encryption protocols safeguarding sensitive financial data. The app's cloud-based infrastructure ensures that users can access their financial information securely from anywhere, promoting flexibility and remote collaboration. Customer support is another area where Business Classo excels, with a responsive team ready to assist users with any queries or challenges they may encounter. In conclusion, Business Classo stands as the epitome of excellence in the realm of accounting and bookkeeping apps, providing a comprehensive and intuitive solution that empowers businesses to manage their finances with precision and ease.

0 notes

Link

0 notes

Text

The Ultimate Comparison of Zoho Books and QuickBooks for Small Business Owners

Introduction

Running a small business is no easy feat. From managing finances to handling client relationships, the responsibilities can be overwhelming. However, with the right tools in hand, you can streamline your operations and simplify your workload significantly. Two of the most popular accounting software options for small businesses are Zoho Books and QuickBooks. But which one should you choose?

In this ultimate comparison guide of Zoho Books vs QuickBooks, we'll take a deep dive into both platforms' pros and cons so that you can make an informed decision on what's best for your business needs!

What is Zoho Books?

Zoho Books is an easy-to-use cloud-based accounting software designed specifically for small business owners. It offers a range of features to help manage finances, including invoicing, expense tracking, inventory management and time-tracking.

One of the best things about Zoho Books is its user-friendly interface. Even if you have no prior experience with accounting software, you can easily navigate through the platform and get started in no time.

Another noteworthy feature of Zoho Books is its automation capabilities. You can set up recurring invoices or automatic payment reminders to save yourself time on manual tasks. Additionally, Zoho Books integrates seamlessly with other apps within the Zoho suite and third-party applications like Stripe and PayPal.

Zoho Books provides a cost-effective solution for small businesses looking to streamline their financial operations without sacrificing functionality or ease-of-use.

What is QuickBooks?

QuickBooks is an accounting software that targets small and medium-sized businesses. It was developed by Intuit, a well-known financial software company based in Mountain View, California. QuickBooks offers a range of features such as bookkeeping, invoicing, payroll management, and inventory tracking.

One of the key features of QuickBooks is its user-friendly interface which makes it easy for non-accountants to use. The software also integrates with various third-party applications like PayPal and Shopify to provide users with more functionality.

Moreover, QuickBooks comes in both desktop and online versions meaning you can choose the one that suits your business needs. Desktop version requires installation on your computer while the online version allows you to access the app from anywhere provided you have internet connection.

QuickBooks is ideal for small business owners who need basic accounting tools without spending too much time learning complex financial jargon.

The Pros and Cons of Zoho Books

Zoho Books is a cloud-based accounting software designed for small businesses. It offers many features that can help business owners manage their finances effectively.

One of the pros of Zoho Books is its affordability. The pricing plans are reasonable and offer great value for money, especially when compared to other accounting software on the market.

Another advantage of Zoho Books is its user-friendly interface. Even if you're not an accounting expert, you can easily navigate through the software with ease.

Furthermore, Zoho Books also allows users to customize invoices and reports which can be helpful in branding your business identity as well as presenting financial data more professionally.

On the downside, some users have reported glitches with certain features like inventory management and bank reconciliation. Also, customer support may take longer than usual to respond sometimes leaving users waiting for hours or days before getting assistance.

Zoho books offer a wide range of benefits at an affordable price point but it’s important to consider the potential drawbacks too before making a final decision about whether this solution will meet your needs and expectations.

The Pros and Cons of QuickBooks

QuickBooks is a popular accounting software that has been around for decades. It offers a variety of features to help small business owners manage their finances effectively. Here are some pros and cons of using QuickBooks.

Pros:

One of the biggest advantages of QuickBooks is its user-friendly interface, which makes it easy to navigate and use even for non-accountants. The software also offers a wide range of features such as invoicing, expense tracking, inventory management, and payroll processing.

Another benefit of using QuickBooks is its integration with other applications like Microsoft Excel, TurboTax, and Salesforce. This allows you to import data from other sources into QuickBooks seamlessly.

Moreover, QuickBooks provides excellent customer support through phone or chat services and has an extensive knowledge base that can answer most common questions.

Cons:

One major drawback of using QuickBooks is its high cost compared to other accounting solutions in the market. Additionally, some users have reported glitches or difficulties when attempting to run certain functions within the software.

Furthermore, while it does offer many features that are helpful for small businesses operations; however this may be overwhelming for some users who only require basic functionalities but still need to pay the full price for all options provided by the software.

Which One is Right for You?

Choosing between Zoho Books and QuickBooks can be a tough decision, as both offer unique features to small business owners. To determine which one is right for you, there are a few factors to consider.

Firstly, the size of your business plays an important role in choosing between the two platforms. If you're running a smaller operation with fewer employees and transactions, then Zoho Books might be the way to go due to its affordability and ease of use. However, if your business has more complex accounting needs or multiple users that need access to financial information, QuickBooks may be better suited for you.

Another factor to consider is what type of industry your business operates in. QuickBooks offers more specialized versions geared towards specific industries such as construction or nonprofit organizations. On the other hand, Zoho Books caters more towards service-based businesses like consulting firms or marketing agencies.

It's worth considering whether integration with other software programs is important for your business operations. QuickBooks has been around longer and therefore may have stronger integrations with other common software systems like Microsoft Office Suite or Salesforce.

Ultimately, choosing between Zoho Books vs QuickBooks comes down to individual needs and preferences based on these various factors mentioned above - ensuring that you pick an accounting platform tailored specifically for your unique requirements will make all the difference in managing finances effectively!

Conclusion

After comparing Zoho Books vs QuickBooks, it's clear that both accounting software packages have their strengths and weaknesses. Ultimately, the decision on which one to use will depend on your specific business needs.

If you're a small business owner who is looking for an affordable solution with excellent invoicing capabilities, then Zoho Books may be the right choice for you. However, if you require more advanced accounting features or a system that integrates with other applications seamlessly, then QuickBooks may be the better option.

Regardless of which platform you choose, make sure to do your research thoroughly before committing to any particular accounting software. By taking the time to carefully evaluate each package's pros and cons in light of your company's unique requirements, you'll ensure that you end up with an ideal solution that helps streamline your operations while providing accurate financial data at all times.

3 notes

·

View notes

Text

How To Separate Your Personal & Business Finances

Now that we understand the importance of dividing between personal and business finances from our last article (read here), let’s get started on how to separate your finances from your business finances.

Determine How To Structure Your Business

The first step, if you are a new business or have yet to legally register your business, is to establish a legal structure for your business. This is the most important step to take in separating your finances. The legal structure of your business will dictate your risk and liability, and how the IRS will receive your business taxes. Some structures include sole proprietors, partnerships, LLCs, corporations, and small business corporations.

Depending on the corporate setup of your business, you can be held personally responsible for company debts, including seizing assets to satisfy creditors. To make the best decision, take the time to discuss your options with an attorney, CPA, and financial planner.

Maintain Separate Accounts

The ability to distinguish between personal and business finances is critically important. Creating an individual account for your business will help to tell the difference between personal and business expenses, as well as assist your case if the IRS ever questions the legitimacy of your business.

Pay Yourself A Salary

Paying yourself a regular salary can help business owners isolate the line between business and personal profits, instead of randomly pulling money from their business. Providing yourself with a regular paycheck will not only better the chances of your business succeeding, but keeping you on your budget.

Track Shared Expenses

The best way to steer clear of being audited is to track shared expenses. Separating receipts for your business expenses is vitally important when running a business, as co-mingling has the potential for dire tax consequences. The most efficient way to track expenses is to use separate credit cards and checking accounts.

For business expenditures use your business credit or debit card or checks, while personal expenses should be taken care of through your personal banking account. There are several apps and programs that help track expenses and keep digital receipts.

Dividing personal and business finances is the first step to transforming a business idea into reality. Once your company becomes a registered entity, your idea of owning a business becomes a reality — and separating finances will help to ensure it grows and succeeds.read more

0 notes

Text

5 Small Business Tax Tips to Less Stressful Tax Time

Tax season can be a daunting time for small business owners, with the pressure of ensuring accurate financial reporting and meeting deadlines. However, there are proactive measures that entrepreneurs can take to make this period less stressful and more manageable. Following are, five strategies to ease the tax season burden for business owners:

Organize Your Financial Records Throughout the Year

One of the most effective ways to alleviate tax season stress is to maintain organized financial records throughout the year. Implementing a robust accounting system and diligently recording income, expenses, and receipts on a regular basis will save you from the last-minute scramble. Consider using accounting software or hiring a professional bookkeeper to streamline the process. When tax season arrives, you’ll be grateful for the comprehensive and well-organized documentation that allows for a smoother filing experience.

Stay Informed about Tax Regulations and Deductions

Tax laws and regulations are subject to change, and staying informed about these updates is crucial for business owners. Deductions, credits, and exemptions can significantly impact your tax liability. Regularly consult with a tax professional to ensure you are aware of any changes that may affect your business. By staying informed, you can take advantage of available opportunities to reduce your tax burden and optimize your financial position.

Make Quarterly Estimated Tax Payments:

Avoid the shock of a hefty tax bill by planning for estimated tax payments throughout the year. Business owners, especially those with irregular income, can benefit from making quarterly estimated tax payments to the Internal Revenue Service (IRS). This approach helps distribute the financial burden and prevents the accumulation of a large tax liability. Work closely with your accountant to determine the appropriate amount for each quarterly payment based on your projected income.

Engage a Tax Planner/Tax Preparer:

A tax planner can reduce tax liability significantly by utilizing the most tax-efficient tax structure, recommending effective retirement and investment strategies, navigating complex state and local tax laws, and maximizing deductions. Tax laws are complex and can be overwhelming, but professionals are trained to navigate these intricacies. Additionally, having a professional review your financial records throughout the year can identify potential issues before they become significant problems.

Leverage technology to streamline your tax-related processes:

Cloud-based accounting software, expense tracking apps, and electronic document management systems can simplify record-keeping and make it easier to access and share financial information. Automating repetitive tasks not only saves time but also reduces the risk of errors. Explore available tools and integrate them into your business operations to enhance efficiency and accuracy.

Tax season doesn’t have to be a source of stress for business owners. By adopting these proactive strategies, you can navigate this annual challenge with confidence and ease. Remember to stay organized, stay informed, plan ahead, seek professional assistance when needed, and leverage technology to streamline your financial processes. Taking these steps will not only make tax season less stressful but also contribute to the overall financial health and success of your business.

For more information about Best Tax Accountant NYC, visit our website: https://stepanchukcpa.com/

Reference: https://stepanchukcpa.com/5-small-business-tax-tips-to-less-stressful-tax-time/

0 notes