#How to Do a Partnership Company Registration in India

Text

Unburden Your Business with Expert Accounting Services in India

Navigating the ever-evolving financial landscape in India can be daunting, especially for businesses juggling growth and compliance. That's where MASLLP, a leading provider of accounting services in India, steps in.

Who is MASLLP?

Established in 2000, MASLLP is a trusted partner for businesses of all sizes, from ambitious startups to established corporations. Their team of experienced chartered accountants, financial advisors, and tax consultants brings a wealth of expertise to the table, ensuring your financial needs are met with precision and efficiency.

What Services Do They Offer?

MASLLP goes beyond basic bookkeeping, offering a comprehensive range of services to empower your business:

Accounting Outsourcing & Bookkeeping: Free yourself from time-consuming tasks like maintaining statutory books, generating reports, and managing inventory.

Financial Reporting & Analysis: Gain valuable insights into your financial health with accurate reports and insightful analysis, allowing you to make informed decisions.

Tax Consulting & Compliance: Stay compliant with ever-changing tax regulations with their expert guidance and assistance.

Company Registration & Formation: Streamline your business launch with their assistance in company registration and legal formalities.

Payroll Processing: Ensure timely and accurate payroll management for your employees.

And more! They offer a variety of additional services to cater to your specific needs.

Why Choose MASLLP For Accounting Services in India?

Experienced & Qualified Team: Their team boasts professionals with proven track records and certifications, ensuring the highest quality service.

Tailored Solutions: They understand that every business is unique, and their services are customized to your specific requirements and industry.

Technology-Driven Approach: They leverage advanced technology to streamline processes and ensure data security.

Cost-Effective Services: They offer competitive rates, allowing you to access top-notch accounting expertise without breaking the bank.

Strong Client Relationships: They believe in building long-term partnerships with their clients, offering ongoing support and guidance.

Ready to Simplify Your Finances?

Accounting services in India

If you're seeking reliable and professional accounting services in India, look no further than MASLLP. Contact them today for a free consultation and discover how they can help your business thrive.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Accounting services in India

3 notes

·

View notes

Text

A Guide To Registration Of Limited Liability Partnerships (LLPs) in India

As The Ministry of Corporate Affairs (MCA) has announced that LLP incorporation has moved to the web, just like SPICE+, as a result of the second amendment to the Limited Liability Partnership (Second Amendment) Rules, 2022. The incorporation document must be electronically filed with the Registrar in the form FiLLiP (Form for incorporation of Limited Liability Partnership) with the Registrar with jurisdiction over the registered office.

How Do You Form A Limited Liability Partnership (LLP)

LLPs combine the features of a corporation and a partnership in one business structure. They are a combination of corporations and partnerships. A small business in India often chooses an LLP Incorporation because of its low registration fees and easy maintenance.

Overview Of The Limited Liability Partnership (Second Amendment) Rules, 2022

A The LLP (Second Amendment) Rules, 2022 have undergone a few changes since they were announced on the 04th March 2022. These changes are as follows:

The number of designated partners at incorporation can be as many as five (without DIN numbers).

A PAN and TAN will be assigned as part of the LLP incorporation or registration process.

Incorporating an LLP through the web is similar to SPICE+.

It is also recommended to disclose contingent liabilities on Form 8 (Statement of Solvency) and Annual Return.

As a result, all LLP forms, including Form 9 - Consent of Partners, will be web-based, requiring all Designated Partners to sign digitally.

Incorporating A Limited Liability Company: Step-By-Step Guide

Name Reservation:

To incorporate an LLP, the first step involves reserving the name of the partnership. The applicant must fill out E-Form 1, which confirms availability.

Forming a Limited Liability Partnership (LLP):

If you wish to incorporate a Limited Liability Partnership (LLP), you must file FiLLiP after reserving a name. FiLLiP contains information about the LLP being formed, the partners/designated partners, and their consent to act as partners/ designated partners.

Agreement for Limited Liability Partnership:

A Within 30 days of LLP incorporation, the LLP Agreement must be executed and filed in E-Form 3. In LLP, mutual rights and duties are governed by an agreement between the partners or between the partners and the LLP, depending on the case. However, the LLP is still liable for its other obligations.

LLPs are incorporated using a Web-Based Process, which is as follows:

The LLP Incorporation (FiLLiP Form) is now available online as a result of the Limited Liability Partnership (Second Amendment) Rules, 2022. An DIN or DPIN applications are required along with name reservations, LLP incorporations, and/or new LLP incorporations under FiLLiP.

The eForm must include all supporting documentation, such as the names of designated partners and partners, etc. Once processed and found complete, an LLPIN is assigned.

A DIN/DPIN must also be issued to proposed designated partners/nominees of body corporate designated partners without valid DINs/DPINs.

When incorporating an LLP using this integrated form, the DIN/DPIN can be allocated to no more than five designated partners.

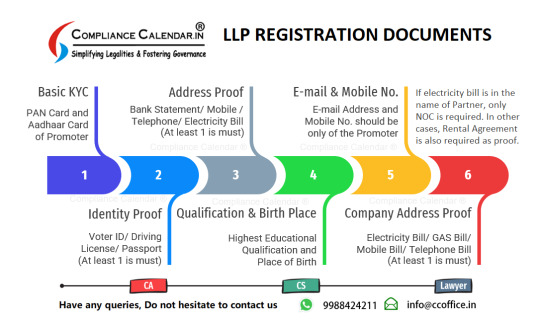

Document Requirements:

Documents required for the FiLLiP Form include:

It is required to submit the resolution on the letterhead of the body corporate being appointed a partner.

On the letterhead of that body corporate, an authorization/resolution naming the nominee/designated partner nominated to represent the company.

Document proving the address of a Limited Liability Partnership's Registered Office.

Subscriber consent form.

Regulatory authorities must approve the proposed name in principle before the attachment can be submitted.

Provide detail about the partnership/designated partnership(s) and/or company(s) in which the partner/designated partner is a director/ partner.

Owners or applicants of trademarks must approve trademark registration applications.

Any words or expressions in the proposed name that require approval from the Central Government.

The competent authority must approve collaboration and connection with a foreign country or place.

A copy of the Board Resolution of the existing company or the consent of the existing LLP is proof of no objection.

The advantages of LLP:

A Limited Liability Partnership is a type of business model that is

Based on an agreement, it is arranged and operated.

Provides flexibility without imposing detailed legal and procedural requirements.

Enables professional/technical expertise and initiative to interact with financial.

Thank you for giving your valuable time for reading this write-up, if still, you have any doubts regarding LLP Registration in India then please connect to our team at [email protected] or call us at 9988424211.

0 notes

Text

How do I start a microfinance company in Ghaziabad?

Starting a Section 8 microfinance company in Ghaziabad, or anywhere in India, involves several steps and requires compliance with regulatory requirements. Here’s a general guide to help you get started:

Market Research:

Conduct thorough market research to understand the demand for microfinance services in Ghaziabad.

Identify your target customers, their needs, and the competition in the area.

Business Plan:

Develop a detailed business plan outlining your company’s objectives, target market, financial projections, and operational strategies.

Include information on how you plan to manage risks associated with microfinance lending.

Legal Structure:

Decide on the legal structure of your company (e.g., partnership, private limited company).

Consult with a legal advisor to understand the regulatory requirements and compliance needed for setting up a microfinance company in India.

Registration and Licensing:

Register your company with the Registrar of Companies (ROC) under the Companies Act, 2013.

Obtain necessary licenses and approvals from the Reserve Bank of India (RBI) and other relevant regulatory bodies like the National Housing Bank (NHB) if you plan to offer housing microfinance.

Capital Requirement:

Determine the capital requirement for your microfinance company. RBI has prescribed minimum capital requirements for non-banking financial companies (NBFCs) engaged in microfinance.

Arrange the necessary capital through equity, debt, or a combination of both.

Operational Setup:

Set up your office with the required infrastructure, including technology platforms for loan processing, credit assessment, and customer management.

Hire qualified staff with experience in microfinance, credit assessment, and customer service.

Risk Management:

Develop robust risk management policies and procedures to assess and mitigate the risks associated with microfinance lending.

Implement proper systems for loan monitoring, repayment tracking, and collection.

Compliance and Reporting:

Ensure ongoing compliance with regulatory requirements and reporting obligations as prescribed by RBI and other regulatory bodies.

Maintain accurate records and financial statements to facilitate regulatory audits and inspections.

Marketing and Outreach:

Develop a marketing strategy to promote your microfinance services and reach out to potential customers.

Build partnerships with local organizations, community groups, and government agencies to expand your outreach and promote financial inclusion.

Launch and Operations:

Once all regulatory approvals are in place, launch your microfinance operations in Ghaziabad.

Monitor the performance of your portfolio, manage customer relationships, and continuously refine your business strategies based on market feedback and operational insights.

Why Choose Vakilkaro for Section 8 microfinance company registration?

Looking to register a Section 8 microfinance company? Choose Vakilkaro for hassle-free and expert assistance. With our experienced team, we ensure a smooth registration process tailored to your needs. Trust Vakilkaro for reliable and efficient Section 8 microfinance company registration. Reach out to us today on this number: 9828123489!

#microfinance company#what is the job of field officer in microfinance company#best microfinance company#microfinance loan process#how to start microfinance business#microfinance job in bihar#microfinance job in mp#microfinance in india#best software company ghaziabad#microfinance kya hai#microfinance in hindi#nidhi company ghaziabad#microfinance company me field officer ka kam kya hota h#microfinance business model in india#nidhi software in ghaziabad

0 notes

Text

Registering a Business in India: A Step-by-Step Guide

India, the land of diversity and opportunity, has emerged as one of the world’s most promising business destinations. With a burgeoning middle class, a tech-savvy workforce, and a growing entrepreneurial spirit, India offers a fertile ground for business ventures. However, before you embark on your entrepreneurial journey in this vibrant nation, it’s essential to understand the intricacies of registering a business in India. In this comprehensive guide, we will walk you through the step-by-step process of company registration in India, shed light on some exciting business opportunities, and provide insights into how to navigate the labyrinth of Indian bureaucracy.

The Indian Business Landscape: A Land of Promise

India’s economic landscape boasts a thriving startup ecosystem, a burgeoning e-commerce market, and a robust manufacturing sector. The ‘Make in India’ initiative has further cemented the country’s position as a global manufacturing hub. The Indian government’s emphasis on ease of doing business and digital initiatives has created a conducive environment for entrepreneurs. So, if you’re pondering over which business to start in India, rest assured that the opportunities are boundless.

The Significance of Business Registration

Before delving into the specifics of starting a business in India, it’s crucial to emphasize the importance of proper registration. Registering your business not only ensures legal compliance but also provides a host of benefits:

1. Legal Recognition: Registering your business entity confers legal status upon it. This recognition is essential for engaging in various activities, including contracts, partnerships, and raising capital.

2. Access to Government Schemes: Registered businesses are often eligible for government incentives, grants, and subsidies aimed at fostering economic growth and entrepreneurship.

3. Credibility: A registered business carries more credibility in the eyes of customers, investors, and partners. It signals your commitment to transparency and compliance.

4. Protection of Personal Assets: Certain business structures, like Limited Liability Partnerships (LLPs) and Private Limited Companies, offer limited liability, protecting your personal assets from business debts.

5. Tax Benefits: Properly registered businesses can avail of tax benefits and exemptions, reducing the tax burden on the business.

Step 1: Choosing the Right Business Idea-

The foundation of any successful business venture is a well-chosen business idea. India offers a diverse market with opportunities spanning various sectors. To decide on the right business, conduct thorough market research. Analyze industry trends and competition. This research will guide you in selecting a business idea with growth potential.

Step 2: Selecting the Appropriate Business Structure-

Once you have a clear business idea, the next crucial step is selecting the right business structure. India offers several options, including Sole Proprietorship, Partnership, Limited Liability Partnership (LLP), Private Limited Company, and more. Each structure has its advantages and disadvantages in terms of liability, compliance, and taxation. Make an informed choice based on your business goals and long-term plans.

Step 3: Legal Requirements and Documentation–

Before diving into the registration process, gather the necessary documentation. Common documents include identity and address proof, PAN card, Aadhar card, and passport-sized photographs. For different business structures, additional documents may be required, such as partnership deeds, MOAs, and AOA for companies. Ensure all documents are complete and accurate.

Step 4: Company Name Registration–

Your business’s name is its identity. To avoid any legal complications, ensure your chosen name is unique and doesn’t infringe on any existing trademarks. You can check name availability on the Ministry of Corporate Affairs (MCA) website. Once you’ve selected a unique name, reserve it through the Name Reservation process.

Step 5: Getting the Necessary Permits and Licenses-

Depending on the type of business and its location, you may need various permits and licenses. Common licenses include GST registration, trade licenses, environmental clearances, and industry-specific permits. Research the specific licenses required for your business and apply for them. Non-compliance with licensing requirements can lead to legal issues down the road.

Step 6: Registration Process-

The registration process can vary based on your chosen business structure. Here’s a simplified overview:

● Sole Proprietorship/Partnership: You can start your business immediately by obtaining the necessary licenses and permits. However, it’s advisable to open a business bank account in your business name for financial clarity.

● LLP/Company Registration: The process involves obtaining a Digital Signature Certificate (DSC) and Director Identification Number (DIN) for directors or partners, filing the incorporation documents, and obtaining the Certificate of Incorporation. Consult a legal expert or a chartered accountant for guidance through this process.

Step 7: Taxation and Compliance-

Understanding India’s taxation system is crucial for business owners. Register for Goods and Services Tax (GST) if your turnover exceeds the prescribed limit. Maintain proper accounting records and comply with tax filing deadlines. Consult with a tax advisor to optimize your tax strategy and ensure compliance with all applicable laws.

Step 8: Post-Registration Obligations-

After registering your business, ensure you fulfill post-registration obligations such as annual filings, conducting board meetings, and adhering to corporate governance norms for companies. Compliance is an ongoing process that ensures the sustainability and legality of your business operations.

By following these steps diligently, you can navigate the process of registering a business in India successfully. Keep in mind that seeking professional advice from chartered accountants, company secretaries, and legal experts can simplify the registration process and ensure compliance with all regulations.

In the vast tapestry of India’s business landscape, the process of registering a business serves as the crucial first stitch that holds it all together. We’ve embarked on a journey through the intricacies of company registration in India, discussing everything from selecting the right business idea to complying with tax regulations. As we draw the curtain on this guide, let’s reflect on the significance of these steps and the boundless opportunities that await those who dare to venture into the Indian entrepreneurial realm.

The Entrepreneurial Dream: Alive and Thriving

India’s entrepreneurial spirit is akin to the mighty Ganges, flowing strong and deep through the hearts and minds of its people. It’s a nation where dreams take flight, where ideas find fertile soil to grow into groundbreaking ventures. Whether you’re an aspiring startup founder or a seasoned businessperson looking to expand to India, this land offers a canvas where you can paint your vision.

The Power of a Well-Chosen Business Idea

The journey begins with a business idea, the North Star guiding your efforts. India’s diverse market is a playground for innovators and visionaries. From technology startups to traditional crafts, from e-commerce giants to sustainable agriculture initiatives, the range of possibilities is staggering. The success of your venture hinges on the depth of your understanding of this market, your ability to identify unmet needs, and your commitment to providing solutions.

The Critical Choice of Business Structure

As you lay the foundation of your business, the choice of business structure is paramount. Each structure comes with its unique set of benefits and challenges. Sole proprietorships offer simplicity but expose personal assets to business risks. Partnerships foster collaboration but require clear agreements. Limited Liability Partnerships (LLPs) provide protection but have compliance requirements. Private Limited Companies offer credibility but demand more stringent regulatory adherence. Making the right choice aligns your business with your goals and aspirations.

The Legal Landscape: Navigating with Prudence

India’s legal landscape can appear labyrinthine, but it’s essential to tread with prudence and compliance. Collecting the required documentation, reserving a unique business name, obtaining licenses, and adhering to post-registration obligations are steps that require diligence. By following the rules, you not only secure your business’s legal status but also lay the groundwork for credibility and trust among partners, customers, and investors.

The Importance of Taxation and Compliance

Taxes are the lifeblood of any nation’s growth, and India is no exception. Understanding the nuances of India’s taxation system, from GST to income tax, is vital for your business’s financial health. Compliance is not just a legal requirement; it’s a commitment to ethical business practices. Keeping your financial records in order, filing returns on time, and seeking professional guidance ensure that your business sails smoothly through the tides of taxation.

The Ongoing Journey of Post-Registration Obligations

Business registration isn’t a one-time affair; it’s the commencement of a lifelong journey. Post-registration obligations, such as annual filings, maintaining corporate governance norms, and fulfilling compliance requirements, keep your business in good stead. They reflect your dedication to transparency and corporate responsibility.

Embracing the Future: Challenges and Rewards

As you embark on your business journey in India, it’s essential to recognize the challenges that may arise. Competition can be fierce, regulatory changes may occur, and market dynamics may shift. However, it’s precisely these challenges that pave the way for innovation and growth. With the right mindset and adaptability, you can turn obstacles into opportunities.

The rewards of doing business in India are immeasurable. The nation’s vast consumer base, skilled workforce, and technological advancements offer a fertile ground for success. Moreover, India’s economic resilience and the government’s initiatives make it an attractive destination for investments and collaborations. Whether you’re an Indian entrepreneur with a local vision or a global business leader eyeing the Indian market, India’s doors are wide open.

Final Thoughts: The Tapestry of Your Business Story

In the grand tapestry of business, your venture is a unique thread contributing to the rich narrative of India’s economic growth. As you register your business and navigate the intricacies of the Indian entrepreneurial ecosystem, remember that every step you take is part of a larger story.

This story is one of ambition, innovation, and the pursuit of excellence. It’s a story of resilience in the face of challenges and a commitment to ethical business practices. It’s a story of creating not just profits but also positive impacts on society and the environment. Your business, whether a startup or an established enterprise, has the potential to be a beacon of change and progress in India’s evolving economic landscape.

So, as you embark on this journey, hold your head high, for you are not just registering a business in India; you are crafting a chapter in a story that spans generations. May your entrepreneurial spirit soar, and may your business thrive in the vibrant tapestry of India’s business landscape.

With these words, we conclude our step-by-step guide to registering a business in India. We wish you the utmost success in your entrepreneurial endeavors, and may your business journey be filled with growth, prosperity, and fulfillment.

This post was originally published on: Foxnangel

#foxnangel#new market entry#Business expansion#strategy consulting#Invest In India#Investment In India#fdi in india#foreign investment in india#invest in startups india#company registration in india#investment options in india#outsource to india#franchise in india

0 notes

Text

Apply LLP Registration in Bangalore

Introduction:

A Limited Liability Partnership (LLP) is a famous business structure that combines the benefits of a partnership and a corporation. LLP Registration in Bangalore follows a set process mandated by the Ministry of Corporate Affairs (MCA). LLPs offer limited liability protection to their partners while allowing flexibility in management and taxation benefits.

How do you apply for LLP Registration in Bangalore?

To apply for LLP registration in Bangalore, you need to follow these steps:

1. Obtain a Digital Signature Certificate (DSC): At least two designated partners must obtain a DSC, as all the documents for LLP registration are filed online and require digital signatures.

2. Obtain Director Identification Number (DIN): Each designated partner needs to obtain a DIN from the Ministry of Corporate Affairs (MCA). It can be done by filing Form DIR-3 online.

3. Name Reservation: Choose a unique name for your LLP and check its availability on the MCA website. You can file Form 1 for name reservation along with the required fee.

4. Prepare Documents: Prepare the necessary documents, including LLP agreement, consent of partners, address proof, identity proof, and other required documents.

5. File Form FiLLiP: This form incorporates a Limited Liability Partnership (LLP). It must be filed online with the Registrar of Companies (RoC) along with the required documents and fees.

6. Certificate of Incorporation: After verifying the documents and satisfying all requirements, the Registrar of Companies will issue the Certificate of Incorporation.

7. LLP Agreement: Once the Certificate of Incorporation is received, an LLP agreement must be drafted. This agreement defines the partners' roles, responsibilities, and rights. It should be filed using Form 3 within 30 days of incorporation.

8. PAN and TAN: After obtaining the Certificate of Incorporation, apply for PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) for the LLP.

9. Compliance: Ensure compliance with all regulatory requirements, such as GST registration and obtaining necessary licenses.

10. Post-Incorporation Formalities: Complete any other post-incorporation formalities that may be required based on your business activities.

It is advisable to seek professional assistance from a chartered accountant or a company secretary to ensure a smooth LLP registration process and compliance with all legal requirements.

Conclusion:

Limited Liability Partnership (LLP) registration in Bangalore follows a structured process mandated by the Ministry of Corporate Affairs (MCA), similar to the rest of India. LLPs provide partners with limited liability protection, flexibility in management, and tax advantages. To initiate LLP registration in Bangalore, one must diligently adhere to the outlined steps, which include obtaining necessary certificates, filing relevant forms, drafting agreements, and ensuring compliance with regulatory obligations. Seeking professional guidance from experts such as chartered accountants or company secretaries is recommended to navigate the complexities of the registration process and ensure adherence to legal requirements. By following these steps and seeking appropriate assistance, businesses can establish LLPs effectively in Bangalore and benefit from this business structure.

0 notes

Text

How do I register a company in T-Hub Hyderabad?

To register a company in T-Hub Hyderabad, you need to follow these steps:

First, you need to have a startup idea that is innovative, scalable, and has a potential market. You can check out the Startup Telangana portal for some inspiration and guidance on how to validate your idea and build a prototype.

Second, you need to apply for one of the startup programs offered by T-Hub, which is a Hyderabad-based startup ecosystem enabler1. T-Hub’s state-of-the-art startup programs are designed to foster a culture of innovation through access to cutting-edge technology and a network of corporates, mentors, investors, and government agencies2. You can choose from various programs depending on your stage of development, such as Lab32, T-Angel, T-Works, etc. You can find more details and application forms on the T-Hub website.

Third, if you are selected for a program, you will get access to the T-Hub facilities and services, such as co-working space, mentorship, workshops, events, funding opportunities, etc. You will also get to interact with other startups and ecosystem stakeholders, and learn from their experiences and feedback. You will also get exposure to the global market and potential customers through T-Hub’s partnerships with various corporates and governments3.

Fourth, you need to register your company as a legal entity in India, and comply with the relevant laws and regulations. You can choose from various types of company structures, such as sole proprietorship, partnership, limited liability partnership, private limited company, etc. You can consult a legal expert or use online platforms to help you with the registration process. You will also need to obtain a PAN card, a GST number, a bank account, and other documents for your company.

Fifth, you need to grow your business by developing your product or service, acquiring customers, generating revenue, and scaling up. You can leverage the T-Hub network and resources to help you with your growth strategy and challenges. You can also apply for more advanced programs or incubation support from T-Hub or other partners, such as T-Hub – Invest Telangana, which provides incentives and benefits for startups in Telangana.

I hope this answer helps you understand how to register a company in T-Hub Hyderabad. If you want to learn more, you can listen to this podcast RawTalks with T-HUB CEO MSR | Startups | Telugu Business

0 notes

Text

In the realm of business financing, unsecured business loans stand out as a strategic and flexible option for entrepreneurs. Offered by various banks and non-banking financial companies (NBFCs), these loans are granted without the need for collateral, making them an attractive choice for running, expanding, or starting a business. Often referred to as signature loans, unsecured business loan from My Mudra come with minimal documentation, ensuring a hassle-free application process.

Benefits of Unsecured Business Loan

Unsecured business loans, in essence, are financial instruments that do not require collateral for approval. Unlike secured loans, which are backed by assets, unsecured loans provide a quick and straightforward solution for businesses in need of capital.

Easy Application Process:

Apply unsecured business loan online at www.mymudra.com with basic details for a straightforward application process

Minimal Documentation: Submit KYC documents, company financial details, and registration details for quick processing.

No Collateral Required: Enjoy the freedom of a collateral-free loan, eliminating the need for additional security.

Shorter Tenure and Flexible Repayment: Benefit from a shorter tenure compared to other loans, coupled with flexible repayment options.

Fast Amount Disbursal: Experience quick disbursal of the loan amount within a day, ensuring timely financial support.

How to Apply for an Unsecured Business Loan

Applying for an unsecured loan for business with My Mudra is a simple three-step process:

Apply Online: Visit www.mymudra.com and click to initiate the application process.

Document Verification: Complete necessary documentation within a day for a speedy approval process.

Quick Disbursal: Receive the approved loan amount in your account within a day.

Documents Required for Unsecured Business Loan

To facilitate a swift approval process, My Mudra requires minimal documentation. Applicants need to provide the following:

Identity Proof:

PAN Card (for Company/Firm/Individual)

Aadhaar Card

Passport

Voter's ID Card

Driving Licence

Address Proof:

Aadhaar Card

Passport

Voter's ID Card

Driving Licence

Additional Documents:

Bank statement of the previous 6 months

Latest ITR along with computation of income, Balance Sheet, and Profit & Loss account for the previous 2 years (CA Certified/Audited)

Proof of continuation (ITR/Trade licence/Establishment/Sales Tax Certificate)

Other Mandatory Documents (Sole Prop. Declaration, Certified Copy of Partnership Deed, Certified true copy of Memorandum & Articles of Association, Board resolution)

Interest Rate and Charges

My Mudra is committed to transparency, with no hidden charges for Unsecured business loan in india. The interest rate and charges are as follows:

Unsecured Business Loan Interest Rate: 15%

Business Loan Processing Fee: 1-2%

Other Charges: NIL

Conclusion:

In conclusion, My Mudra serves as a one-stop solution for diverse financial needs. This article sheds light on the advantages of unsecured business loans, emphasising the seamless application process and quick disbursal offered by My Mudra. Transform your perspective on business loans, overcome financial hurdles, and propel your business towards success. Apply for a My Mudra Business Loan today to experience swift approval and disbursal within a day.

#unsecured business loan#unsecured loan for business#unsecured business loan in india#unsecured business loan online#unsecured business loan india

0 notes

Text

Registering a Business in India: A Step-by-Step Guide by Fox&Angel

India, the land of diversity and opportunity, has emerged as one of the world’s most promising business destinations. With a burgeoning middle class, a tech-savvy workforce, and a growing entrepreneurial spirit, India offers a fertile ground for business ventures. However, before you embark on your entrepreneurial journey in this vibrant nation, it’s essential to understand the intricacies of registering a business in India. In this comprehensive guide, we will walk you through the step-by-step process of company registration in India, shed light on some exciting business opportunities, and provide insights into how to navigate the labyrinth of Indian bureaucracy.

The Indian Business Landscape: A Land of Promise

India’s economic landscape boasts a thriving startup ecosystem, a burgeoning e-commerce market, and a robust manufacturing sector. The ‘Make in India’ initiative has further cemented the country’s position as a global manufacturing hub. The Indian government’s emphasis on ease of doing business and digital initiatives has created a conducive environment for entrepreneurs. So, if you’re pondering over which business to start in India, rest assured that the opportunities are boundless.

The Significance of Business Registration

Before delving into the specifics of starting a business in India, it’s crucial to emphasize the importance of proper registration. Registering your business not only ensures legal compliance but also provides a host of benefits:

Legal Recognition: Registering your business entity confers legal status upon it. This recognition is essential for engaging in various activities, including contracts, partnerships, and raising capital.

Access to Government Schemes: Registered businesses are often eligible for government incentives, grants, and subsidies aimed at fostering economic growth and entrepreneurship.

Credibility: A registered business carries more credibility in the eyes of customers, investors, and partners. It signals your commitment to transparency and compliance.

Protection of Personal Assets: Certain business structures, like Limited Liability Partnerships (LLPs) and Private Limited Companies, offer limited liability, protecting your personal assets from business debts.

Tax Benefits: Properly registered businesses can avail of tax benefits and exemptions, reducing the tax burden on the business.

Step 1: Choosing the Right Business Idea-

The foundation of any successful business venture is a well-chosen business idea. India offers a diverse market with opportunities spanning various sectors. To decide on the right business, conduct thorough market research. Analyze industry trends and competition. This research will guide you in selecting a business idea with growth potential.

Step 2: Selecting the Appropriate Business Structure-

Once you have a clear business idea, the next crucial step is selecting the right business structure. India offers several options, including Sole Proprietorship, Partnership, Limited Liability Partnership (LLP), Private Limited Company, and more. Each structure has its advantages and disadvantages in terms of liability, compliance, and taxation. Make an informed choice based on your business goals and long-term plans.

Step 3: Legal Requirements and Documentation–

Before diving into the registration process, gather the necessary documentation. Common documents include identity and address proof, PAN card, Aadhar card, and passport-sized photographs. For different business structures, additional documents may be required, such as partnership deeds, MOAs, and AOA for companies. Ensure all documents are complete and accurate.

Step 4: Company Name Registration–

Your business’s name is its identity. To avoid any legal complications, ensure your chosen name is unique and doesn’t infringe on any existing trademarks. You can check name availability on the Ministry of Corporate Affairs (MCA) website. Once you’ve selected a unique name, reserve it through the Name Reservation process.

Step 5: Getting the Necessary Permits and Licenses-

Depending on the type of business and its location, you may need various permits and licenses. Common licenses include GST registration, trade licenses, environmental clearances, and industry-specific permits. Research the specific licenses required for your business and apply for them. Non-compliance with licensing requirements can lead to legal issues down the road.

Step 6: Registration Process-

The registration process can vary based on your chosen business structure. Here’s a simplified overview:

Sole Proprietorship/Partnership: You can start your business immediately by obtaining the necessary licenses and permits. However, it’s advisable to open a business bank account in your business name for financial clarity.

LLP/Company Registration: The process involves obtaining a Digital Signature Certificate (DSC) and Director Identification Number (DIN) for directors or partners, filing the incorporation documents, and obtaining the Certificate of Incorporation. Consult a legal expert or a chartered accountant for guidance through this process.

Step 7: Taxation and Compliance-

Understanding India’s taxation system is crucial for business owners. Register for Goods and Services Tax (GST) if your turnover exceeds the prescribed limit. Maintain proper accounting records and comply with tax filing deadlines. Consult with a tax advisor to optimize your tax strategy and ensure compliance with all applicable laws.

Step 8: Post-Registration Obligations-

After registering your business, ensure you fulfill post-registration obligations such as annual filings, conducting board meetings, and adhering to corporate governance norms for companies. Compliance is an ongoing process that ensures the sustainability and legality of your business operations.

By following these steps diligently, you can navigate the process of registering a business in India successfully. Keep in mind that seeking professional advice from chartered accountants, company secretaries, and legal experts can simplify the registration process and ensure compliance with all regulations.

The Entrepreneurial Dream: Alive and Thriving

India’s entrepreneurial spirit is akin to the mighty Ganges, flowing strong and deep through the hearts and minds of its people. It’s a nation where dreams take flight, where ideas find fertile soil to grow into groundbreaking ventures. Whether you’re an aspiring startup founder or a seasoned businessperson looking to expand to India, this land offers a canvas where you can paint your vision.

The Power of a Well-Chosen Business Idea

The journey begins with a business idea, the North Star guiding your efforts. India’s diverse market is a playground for innovators and visionaries. From technology startups to traditional crafts, from e-commerce giants to sustainable agriculture initiatives, the range of possibilities is staggering. The success of your venture hinges on the depth of your understanding of this market, your ability to identify unmet needs, and your commitment to providing solutions.

The Critical Choice of Business Structure

As you lay the foundation of your business, the choice of business structure is paramount. Each structure comes with its unique set of benefits and challenges. Sole proprietorships offer simplicity but expose personal assets to business risks. Partnerships foster collaboration but require clear agreements. Limited Liability Partnerships (LLPs) provide protection but have compliance requirements. Private Limited Companies offer credibility but demand more stringent regulatory adherence. Making the right choice aligns your business with your goals and aspirations.

The Legal Landscape: Navigating with Prudence

India’s legal landscape can appear labyrinthine, but it’s essential to tread with prudence and compliance. Collecting the required documentation, reserving a unique business name, obtaining licenses, and adhering to post-registration obligations are steps that require diligence. By following the rules, you not only secure your business’s legal status but also lay the groundwork for credibility and trust among partners, customers, and investors.

The Importance of Taxation and Compliance

Taxes are the lifeblood of any nation’s growth, and India is no exception. Understanding the nuances of India’s taxation system, from GST to income tax, is vital for your business’s financial health. Compliance is not just a legal requirement; it’s a commitment to ethical business practices. Keeping your financial records in order, filing returns on time, and seeking professional guidance ensure that your business sails smoothly through the tides of taxation.

The Ongoing Journey of Post-Registration Obligations

Business registration isn’t a one-time affair; it’s the commencement of a lifelong journey. Post-registration obligations, such as annual filings, maintaining corporate governance norms, and fulfilling compliance requirements, keep your business in good stead. They reflect your dedication to transparency and corporate responsibility.

Embracing the Future: Challenges and Rewards

As you embark on your business journey in India, it’s essential to recognize the challenges that may arise. Competition can be fierce, regulatory changes may occur, and market dynamics may shift. However, it’s precisely these challenges that pave the way for innovation and growth. With the right mindset and adaptability, you can turn obstacles into opportunities.

The rewards of doing business in India are immeasurable. The nation’s vast consumer base, skilled workforce, and technological advancements offer a fertile ground for success. Moreover, India’s economic resilience and the government’s initiatives make it an attractive destination for investments and collaborations. Whether you’re an Indian entrepreneur with a local vision or a global business leader eyeing the Indian market, India’s doors are wide open.

Final Thoughts: The Tapestry of Your Business Story

In the grand tapestry of business, your venture is a unique thread contributing to the rich narrative of India’s economic growth. As you register your business and navigate the intricacies of the Indian entrepreneurial ecosystem, remember that every step you take is part of a larger story.

This story is one of ambition, innovation, and the pursuit of excellence. It’s a story of resilience in the face of challenges and a commitment to ethical business practices. It’s a story of creating not just profits but also positive impacts on society and the environment. Your business, whether a startup or an established enterprise, has the potential to be a beacon of change and progress in India’s evolving economic landscape.

So, as you embark on this journey, hold your head high, for you are not just registering a business in India; you are crafting a chapter in a story that spans generations. May your entrepreneurial spirit soar, and may your business thrive in the vibrant tapestry of India’s business landscape.

With these words, we conclude our step-by-step guide to registering a business in India. We wish you the utmost success in your entrepreneurial endeavors, and may your business journey be filled with growth, prosperity, and fulfillment.

Also Visit- Fox&Angel- Your Global Expansion Partner

#business expansion#india market entry#foxnangel#business registration#Register business in india#how to register business in india

0 notes

Text

Complete Guidance :How To Start An Organic Food Business In India

You know the vital rule of starting your business and making it successful? the need or requirement. If you're solving any drastic problem or fulfilling any requirement, your business is definitely going to be one of the best and thriving businesses just like how you imagined. And in this blog we'll talk about the crucial pointers before you start your organic food business in India. From location selection to expanding your business to new heights from dealing the finest organic agro food suppliers in Andhra Pradesh to being one of the finest organic agro food distributors in India. we cover all the edges to give you the complete coverage of starting any organic food business.

Location Selection: Before starting your business you have to do one of the crucial thing for your business and that is the Location selection. If you ever did research you'll find that all organic food distributors and exporters in India made sure to establish their business where target audience were. You're solving and fulfilling the requirement so be very specific when you're deciding your location. Your location should not have any food stores or food joints nearby, and especially it should be a place where a lot of people are coming but have no choice of any food.

Required Registration & Documents: Starting food business requires many registrations and food certifications. Here's what you need to do:

Business Registration: Register your organic food business as a legal entity. This can be a sole proprietorship, partnership, limited liability partnership (LLP), or a private limited company. Consult with a legal expert to choose the most suitable structure for your business.

Licenses and Permits: Obtain the required licenses and permits to operate a food business in India. This includes a food license, GST registration, and any other local permits mandated by your state or municipality.

FSSAI Certification: The Food Safety and Standards Authority of India (FSSAI) certification is mandatory for businesses involved in food production and distribution. Ensure compliance with FSSAI regulations.

Product Selection:

Your product selection plays a pivotal role in the success of your organic food business. Consider the following:

Market Research: Conduct thorough market research to identify the demand for specific organic food products in your target area. Understand consumer preferences and trends.

Diverse Product Range: Offer a diverse range of organic products, including fresh produce, packaged goods, dairy, and more. Cater to various dietary preferences and requirements.

Local Sourcing: Whenever possible, source organic products locally. Deal with organic food manufacturers in Andhra Pradesh. Promote the use of locally grown and sustainable produce, which can resonate with environmentally conscious consumers."

Setting Captivating Pricing: Pricing your organic products competitively while maintaining profitability is a delicate balance. Consider these pricing strategies:

Cost Analysis: Calculate the cost of sourcing, production, and overheads. Ensure that your prices cover these expenses while providing a reasonable profit margin.

Competitive Pricing: Research your competitors' pricing and offer competitive rates. Highlight the quality and benefits of your organic products to justify the pricing. For more quality, always stay in touch with the organic agro food dealers in Andhra Pradesh.

Value Proposition: Communicate the value of organic food to your customers. Emphasize the health benefits, environmental impact, and quality of your products."

Managing The Store:

Hiring Manpower: Recruit experienced staff who share your passion for organic food. Trained employees can provide valuable assistance in customer service and product knowledge.

Marketing Strategies: Develop a robust marketing plan to create awareness and attract customers. Utilize both online and offline channels, including social media, local events, and collaborations

Investment and Budgeting: Carefully manage your initial investment and ongoing expenses. Create a detailed budget that accounts for rent, utilities, marketing, and employee salaries.

Financing Options For Food Business

Funding is often a significant concern when starting a business. Explore various financing options:

Personal Savings: Utilize your personal savings to kickstart your organic food business. This reduces the need for external funding.

Business Loans: Consider taking a business loan from banks or financial institutions. Look for loans specifically tailored for food businesses.

Government Schemes: Investigate government schemes and subsidies available for food-related startups. Some programs offer financial assistance and support.

In conclusion, starting an organic food business in India is an exciting journey filled with opportunities for growth and success. By carefully selecting your location, ensuring legal compliance, offering the right products, setting competitive prices, managing your store effectively, and exploring financing options, you can turn your passion for organic food into a thriving business venture that contributes to a healthier and more sustainable future. Good luck on your entrepreneurial journey!

If you want to start your own food business then you can connect with leading organic food suppliers in India for fulfill your agro- food requirements.

1 note

·

View note

Text

Understanding Recruitment Agency Terms and Conditions in India

In today's competitive job market, both job seekers and employers often turn to recruitment agencies to streamline the hiring process. These agencies play a crucial role in connecting the right candidates with the right job opportunities. However, to ensure a fair and transparent partnership between all parties involved, it's essential to understand the recruitment agency terms and conditions in India. In this blog, we'll delve into the key aspects of these terms and conditions and how they impact job seekers, employers, and recruitment agencies.

Registration and Fees

One of the fundamental aspects of recruitment agency terms and conditions in India is the registration process and associated fees. Recruitment agencies typically require job seekers to register with them, which may involve submitting their resumes and other relevant documents. Employers may also need to register with an agency to avail of their services.

Job seekers should be aware that legitimate recruitment agencies in India do not charge candidates for finding them job opportunities. Instead, they earn their fees from the employers when a successful placement is made. Be cautious of agencies that demand money from job seekers upfront.

Confidentiality and Data Protection

Recruitment agencies handle sensitive personal and professional information about job seekers and employers. It's crucial for both parties to understand the terms and conditions related to data protection and confidentiality.

Job seekers should ensure that the agency they work with has strict policies in place to protect their personal information and that their data is not shared without their consent. Similarly, employers should expect recruitment agencies to maintain confidentiality about their hiring needs and not disclose sensitive information to third parties.

Terms of Engagement

Recruitment agencies typically outline the terms of their engagement with job seekers and employers in their contracts. These terms may include the duration of the agreement, the specific services provided, and any fees or commissions involved.

Job seekers should carefully review these terms to understand how the agency will represent them in the job market and whether they have any obligations during the engagement. Employers should also be clear about the agency's responsibilities in sourcing and presenting suitable candidates.

Payment Terms

Payment terms are a critical aspect of recruitment agency terms and conditions in India. Employers typically agree to pay a fee or commission to the agency upon successful placement of a candidate. These payment terms may vary from one agency to another.

Both employers and agencies should be transparent about the fee structure and when payments are due. It's essential for employers to understand how fees are calculated and budget accordingly.

Termination and Refund Policies

In the event that the recruitment agency fails to meet its obligations or if either party wishes to terminate the engagement, the terms and conditions should outline the process for termination and any applicable refund policies.

Job seekers should be aware of any conditions that might require them to repay fees if they withdraw from the recruitment process after accepting an offer. Employers should also understand the agency's policy regarding refunds in case the hired candidate leaves the company within a specified period.

Conclusion

Understanding recruitment agency terms and conditions in India is essential for job seekers and employers alike. It ensures a fair and transparent hiring process while protecting the interests of all parties involved. When engaging with a recruitment agency, it's advisable to carefully review and discuss the terms and conditions to avoid any misunderstandings and facilitate a successful partnership in the pursuit of job opportunities and talent acquisition.

0 notes

Text

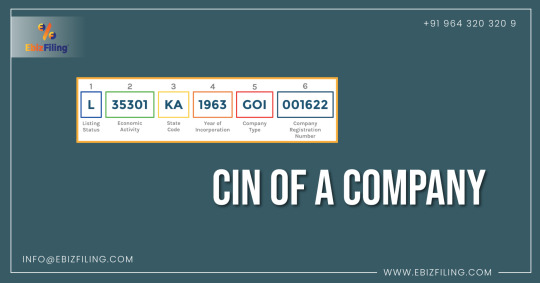

What is Corporate Identification Number (CIN)?

Introduction

This blog includes information on the corporate identification number (CIN), covering information on the CIN for companies, what it is, how to check it, and other related information. The Registrar of Companies (ROC) assigns each company incorporated in India with a unique identification number known as a Corporate Identification Number (CIN). After receiving their Registration Certificate, companies are granted their CIN by the ROC. The CIN is significant because every business is required to include this specific number on all documents submitted to the MCA, such as audits and other reports.

What is CIN Number?

The Ministry of Corporate Affairs issues the Corporate Identification Number (CIN), a 21-digit alpha-numeric identifier, to businesses that are formed in India after they have registered with the ROC in various states across the country.

All businesses that register in India are issued a CIN; examples are listed below.

One Person Company (OPC)

Nidhi Company

Limited Liability Company

State-owned enterprises

The company from Section 8 and others

On the other hand, Limited Liability Partnerships (LLP) registered in India do not acquire a CIN. LLPs are given a special 7-digit identifying number called the LLPIN (Limited Liability Partnership Identifying Number) by the ROC.

Description of the 21-digit of CIN

Section 1

The first character of a CIN shows whether a company is “Listed” or “Unlisted” on the Indian stock exchange. So, the first character indicates if the company is a stock market listed company. The CIN of a company will start with the letter “L” if it is listed, and with the letter “U” if it is not.

Section 2

The next five numeric digits classify a company’s economic activity or the industry to which it belongs. This categorization is based on the kind of economic activity that a facility like that would carry out. The MCA (Ministry of Corporate Affairs) has issued numbers to each category and industry.

Section 3

The next two letters represent the Indian state where the company is registered. As an illustration, GJ signifies Gujarat, MH signifies Maharashtra, KA signifies Karnataka, and so on. It works in the same way that a vehicle registration number does.

Section 4

The next four digits in a CIN number represent the year in which the company was created.

Section 5

The next three letters stand for the company class. These three letters indicate whether a company is a public limited or private limited company. If the CIN number is FTC, it means the business is a subsidiary of a foreign corporation, whereas the Government of India means the business is owned by the Indian government.

Section 6

The final six numerical digits represent the registration number provided by the concerned ROC (Registrar of Companies).

The importance of a company’s CIN number

The 21-digit CIN has a unique importance that is easy to understand and simplifies the identification of important corporate data.

It is used to obtain the fundamental data on businesses that are registered in the nation with the MCA (Ministry of Corporate Affairs).

A company’s CIN (Corporate Identification Number) must be submitted on all transactions with the relevant ROC (Registrar of Companies), and it is used to track all of its activities beginning with the time the ROC first established the company.

CIN numbers can be used to identify or track organizations for various levels of information maintained by MCA/ROC. The CIN provides details about the Registrar of Companies (ROC) as well as the identification of the company.

How to obtain a CIN number for your company?

Once you have chosen the type of business you want to establish, the steps to obtaining a CIN are as follows.

Get a DSC (Digital Signature Certificate).

Obtain a DIN (Director Identification Number).

The new user registration process must be finished.

After completing this, complete the company incorporation process.

Incorporate the Company

After receiving the company’s incorporation papers, the MCA (Ministry of Corporate Affairs) will evaluate and approve the application. After all of the application’s data has been verified, the CIN is assigned.

“Effortlessly meet compliance with our comprehensive LLP Annual Return Filing services. Expert assistance for seamless filings, ensuring your business stays on track. Stay focused on growth while we handle the paperwork.”

Summary

A business registration number, also referred as a CIN (Corporate Identification Number), a special identification number issued by the ROC (Registrar of Companies). In simple terms, a CIN is a special code that includes both the company’s identification number and extra details about how it operates.

0 notes

Text

How do Section 8 companies raise funds?

Introduction:

In the realm of socially conscious business entities, Section 8 companies play a pivotal role in fostering positive change. Specifically designed for non-profit purposes, Section 8 companies, also known as Section 8 microfinance institutions, focus on activities that promote social welfare and development. One crucial aspect of their operations is fundraising, which ensures their sustainability and ability to make a lasting impact. In this article, we delve into the process of Section 8 microfinance company registration and explore effective strategies for raising funds, How do Section 8 companies raise funds.

Section 8 Microfinance Company Registration:

Before diving into fundraising strategies, let's first understand the essential steps involved in Section 8 microfinance company registration:

Incorporation: The process begins with the incorporation of the company as a Section 8 entity under the Companies Act. This involves submitting the necessary documents, such as the memorandum of association and articles of association, to the Registrar of Companies.

Objective Declaration: A Section 8 company must clearly declare its objectives, emphasizing the promotion of commerce, art, science, sports, education, research, social welfare, religion, charity, protection of the environment, or any other beneficial purpose.

Board Approval: The proposed company's board must approve the application for Section 8 status, ensuring that the objectives align with the criteria specified in the Companies Act.

Licenses and Approvals: Obtain the necessary licenses and approvals from regulatory bodies, such as the Reserve Bank of India (RBI) for microfinance activities.

Fundraising Strategies for Section 8 Microfinance Companies:

Once registered, Section 8 microfinance companies can explore various strategies to raise funds sustainably:

Grants and Donations: Seek grants and donations from government agencies, international organizations, philanthropic foundations, and individuals interested in supporting social causes.

Social Impact Investments: Attract socially responsible investors who are willing to invest in organizations with a dual focus on financial returns and positive social impact.

Partnerships with Financial Institutions: Collaborate with banks and financial institutions to access capital, leverage financial expertise, and expand the reach of microfinance services.

Crowdfunding Campaigns: Harness the power of online platforms to run crowdfunding campaigns, engaging a wider audience to contribute towards the organization's goals.

Corporate Social Responsibility (CSR) Initiatives: Build partnerships with corporate entities looking to fulfill their CSR obligations by supporting initiatives aligned with social welfare and development.

Microfinance Networks and Associations: Join microfinance networks and associations to connect with like-minded organizations, share best practices, and explore opportunities for collective fundraising efforts.

Conclusion:

In conclusion, the journey of Section 8 microfinance companies involves not only the meticulous process of registration but also the strategic pursuit of funds to fulfill their noble objectives. By adopting a diverse range of fundraising strategies, these organizations can enhance their financial sustainability and contribute significantly to the betterment of society. Whether through grants, investments, or strategic partnerships, Section 8 microfinance company can pave the way for inclusive development and positive societal impact.

#section 8#section 8 housing#section 8 landlord#section 8 tenants#section 8 investing#section 8 company#section 8 real estate investing#section 8 rental property#section 8 tenant#section 8 housing for landlords#section 8 company registration process#what is section 8#section 8 landlord tips#section 8 company benefits#section 8 company registration#section 8 company compliances#section 8 housing investment#section 8 companies act

0 notes

Text

How to Register a Singapore Company in India?

Introduction

A variety of laws and regulations must be followed by owners of foreign firms doing business in India. The Companies (Registration of Foreign Companies) Rules, 2014, which also control the registration of foreign companies in India, contain these conditions. These regulations outline procedures for providing the Registrar with information about directors and secretaries. It is crucial that business owners keep up with these requirements in order to preserve compliance and avoid fines. The information on “How to Register a Singapore Company in India?”, “Documents Required for Singapore Company Registration in India,” and “Advantages of Company Registration in India” will be covered in this article.

Learn the steps and requirements for company registration in India. Learn insightful information on business formats, taxation, and legal requirements to start your own prosperous venture in India. With the help of our thorough guide on forming a company in India, be informed and make effective choices.

Various business structures for Singapore company registration in India

Private Limited Company

The quickest and easiest way to enter India for foreign nationals and businesses is through the incorporation of a private limited company. By using the automatic method, which exempts such investments from Central Government clearance, a Private Limited Company may take up to 100% in foreign direct investment.

Limited Liability Partnership

Given that 100 percent FDI in LLPs is allowed, forming a Limited Liability Partnership (LLP) is another foreign national’s or foreign citizen’s entry method into India. An LLP is a great option for investment vehicles and professional firms because it cannot have shareholders and must be represented by partners.

Partnership Firm or Proprietorship Firm

Ownership and partnership firms, which are generally used by very tiny businesses or unorganized actors, are the most basic kind of business forms. Foreign investment in partnerships or sole proprietorships must have prior RBI (Reserve Bank of India) approval.

Project Office, Branch Office or Liaison Office

Registration of a branch office, liaison office, or project office is subject to RBI and/or governmental permission. Therefore, it will be more expensive and take longer to register a branch office, liaison office, or project office for a foreign corporation than it would to establish a private limited company.

Benefits of registering a company in India

One of the main benefits of beginning a business in India is the enormous population and large market without borders with typically established logistics to conduct business.

With India, there is a vast network of tax treaties. Additionally, in order to make doing business easier, the Direct Taxes Code and the Goods and Service Tax (GST) have recently updated the Indian tax structure.

India’s financial system is well-regulated, has access to mature markets worldwide, and can be funded from a variety of sources subject to certain RBI laws and regulations, etc.

Documents needed to register a Singapore business in India

All foreign directors and shareholders have notarized identification documents.

Proof of address for foreign directors and shareholders, notarized

Notarized Address verification for the parent company’s registered office

A picture of each shareholder and director

A notarized copy of the parent company’s certificate of incorporation

A registered office address for the subsidiary company in India

Specific Conditions

The utility bill must be sent to the ROC (Registrar of Companies) as proof of address.

A company must have a registered office in India.

A letter of consent from the landlord is necessary for the use of a rental office as a corporation’s registered office.

Utility bills and bank statements must be no more than two months old.

How can I register a Singapore company in India?

The process for establishing a Singapore company is the same as the process for establishing an Indian subsidiary. The applying company must be informed of the procedures needed to incorporate a business as specified by the authority (MCA). The Company Registrar must have the business registered.

To be incorporated, SPICE+ needs to be registered. There are two parts to SPICE+ FORM:

Part A:

Name reservations

Part B:

Additional steps for incorporation. It contains the entire application for incorporation, including the name reservation.

DIN application.

EPFO, ESIC, and professional tax registration must all be issued (in Maharashtra) notwithstanding the PAN and TAN issue.

Account at the bank of the business.

GSTIN allocation

Incorporation requires obtaining a Digital Signature Certificate from the Certifying Authority.

DSC guarantees the validity of the document.

Conclusion

A business can be registered in India easily and online. India is a nation with endless opportunities and skilled labor, as many people would agree. In India, investing and launching a business have never been simpler, more affordable, or quicker. Anywhere in India may be used to establish a totally owned Indian subsidiary. There are no state-specific business registration regulations in India. In all of India, the Indian Subsidiary Establishment is governed by a single single law.

#company registration in india#open a company in india#register a company#company registration#register company in india

0 notes

Text

Gumasta License Consultant in Wagle Estate, Thane

Are you opening a business in India? If so, you must know the need for a Gumasta License. The Municipal Corporation of an area grants this license mandatory for all individuals willing to start an enterprise in India. Tax compliance and registrations with different statutory legal entities are also essential. This blog post discusses all you need to know about Gumasta licenses, including the different types, requirements, and how to apply for one.

What is a Gumasta License?

A Gumasta license is a government-issued document used as a form of identification by small businesses to show that they are legitimate and follow all tax regulations and other laws. It is also mandatory for companies o apply for GST registration. The Gumasta License also serves as a certificate of merit and recognition for an enterprise.

What are the types of Gumasta licenses?

A Gumasta License can be classified into two categories:

1. General Gumasta License: This type of license applies to small proprietors and business enterprises run on a small scale. This also applies to the areas or cities where the municipality issues the licenses.

2. Specific Gumasta License: This type of license applies to companies that have gained recognition from the Indian Government. These are usually issued by either the Government of India or involved government agencies such as those in tax compliance.

What are the requirements for obtaining a Gumasta License?

To obtain a Gumasta license, an individual must fulfill specific requirements. The individual must satisfy the following criteria:

• A valid ID proof of the owner of the business

• Address proof of the business address

• A copy of the rental agreement or any other proof of the establishment in which the business is registered

• A No Objection Certificate from the landlord or owner of the premise in which the business will take place

• A plan of the premise in which the business is being set up

• A proof of the trade name

• A Certificate of Incorporation or a Partnership Deed

• A Memorandum of Association

• Proof of a bank account.

How to apply for a Gumasta License?

The application for a Gumasta License can be made online and through the Municipal Corporation, depending on the license type.

1. Online Application: An individual can apply for a Gumasta license online by visiting the official website of the respective government organization or agency. The process involves filling in the required documents, uploading the necessary certificates, photographs, and other information, and paying the applicable fees. After applying, the individual will be notified about the acceptance of the license.

2. Application through the Municipal Corporation: An individual willing to apply for a Gumasta license through the Municipal Corporation can do so by visiting the office in person. After verifying all the documents, the application form, photographs, and other necessary information should be submitted along with a demand draft of the applicable fee.

Conclusion

A Gumasta License is an essential document for any enterprise in India. An individual must know the two types of licenses and the requirements to obtain one. An individual can apply for a Gumasta license either online or through the office of the Municipal Corporation. Knowing the importance of a request and how to obtain one to run a business efficiently while following all the laws and regulations is essential.

0 notes

Text

How to do LLP registration in India

Online registration LLP facility is available in India. You must, therefore, electronically approve the documents required for LLP registration online. With a digital signature, you can authenticate any documents that you upload online. Since the process is online, you must visit an LLP portal and register as a new user. The Form 1 application for LLP registration in India is used to reserve the LLP's name. Form 2 is used for the LLP's incorporation and subscriber statement. After the ministry has approved both forms, you have 30 days from the date of LLP registration to file the initial LLP agreement. It has to be delivered utilising Form 3. As soon as your Online LLP Registration has been formally registered, you can start running your business.

LLP Registration Online process:

An LLP's name must be distinct and cannot be identical to or misleadingly similar to the name of any other registered or unregistered company, LLP, or trademark. The partners' liability in an LLP is limited to the amount of their investment.

Since it is a distinct legal entity and juristic person, an LLP can sue and be sued separately from its partners. Even after a partner dies, the LLP continues to operate. Furthermore, an LLP's ownership can be easily transferred to a different party; however, the recipient must be admitted as an LLP-designated partner.

To do LLP Company Registration, the enterprise must be a separate legal entity and body corporate from its partners. It will continue indefinitely. The LLP form is a type of business model that is organised and operates on the basis of an agreement, allowing for flexibility without imposing detailed legal and procedural requirements. Furthermore, LLP Registration Online enables professional expertise and initiative to be combined with risk-taking financial capacity in a novel and efficient manner.

Documents required for online LLP registration in India

The Partners' PAN cards

The Partners' Identification proof

Address proof of all the partners

Ids with the partners' photos

The partners' passports (if the partners are either foreign nationals or (NRIs)

Evidence of the registered office's address

DSC (Digital Signature Certificate)

Online LLP registration for a Business

2008 saw the start of LLP registration in India. This has quickly gained popularity among small businesses because it has a lower registration fee and some compliance requirements than a private limited company. Prior to November 2015, LLP registration and investment in India were time-consuming processes. As a result, NRIs and foreign nationals preferred company formation over LLP formation. However, since the November 2015 relaxation of FDI regulations, NRIs and foreign nationals can now easily do online LLP Registration. It is regarded as the best investment strategy for starting a small business in India, according to the FDI policy.

Since an LLP registration in India contains elements of both a "corporate structure" and a "partnership firm structure," it is referred to as a "hybrid" between a company and a partnership. The duties and mutual rights of the partners in an LLP are governed by an agreement among the partners or between the partners and the LLP, as the case may be. The LLP Company Registration, on the other hand, is not released from liability for its other obligations as a separate entity.

Changes in partners won't stop the Limited Liability Partnership (LLP) from continuing to exist. It has the legal authority to hold property in its own name and to enter into contracts. Even though the LLP is a distinct legal entity and is accountable for all of its assets, the partners' liability is only as great as their agreed-upon share of the LLP's assets. Additionally, no partner is responsible for the independent or unauthorised actions of other partners; as a result, each partner is exempt from joint liability resulting from the bad judgment or misconduct of another partner.

Foreign Limited Liability Partnership structure

Various Gulf nations, Australia, Singapore, the United Kingdom, and the United States of America all offer the Limited Liability Partnership (LLP) structure. The LLP Act is largely based on the UK LLP Act 2000 and Singapore LLP Act 2005, according to experts who have researched LLP laws in various nations. Both of these Acts permit the formation of LLPs in the corporate body form, that is, as a distinct legal entity from its partners or members.

The distinction between a Traditional Partnership Firm and an LLP

Every partner in a "traditional partnership firm" is responsible for the firm's actions, both jointly and severally, with the other partners. At the same time, the liability of a partner is capped by his agreed-upon contribution in a Limited Liability Partnership (LLP) structure. Additionally, no partner is responsible for the independent or unauthorized actions of other partners, protecting each partner from joint liability brought on by the wrongdoing or misconduct of another partner.

The distinction between a LLP and a Company

The internal administrative structure of a company is governed by statute (i.e., the Companies Act, 1956), whereas a Limited Liability Partnership (LLP) would be by a deal agreement between partners. This is a fundamental distinction between an LLP and a joint stock company.

A firm that has done Online LLP Registration will be subject to fewer compliance requirements than companies.