#CoinDesk-TV

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

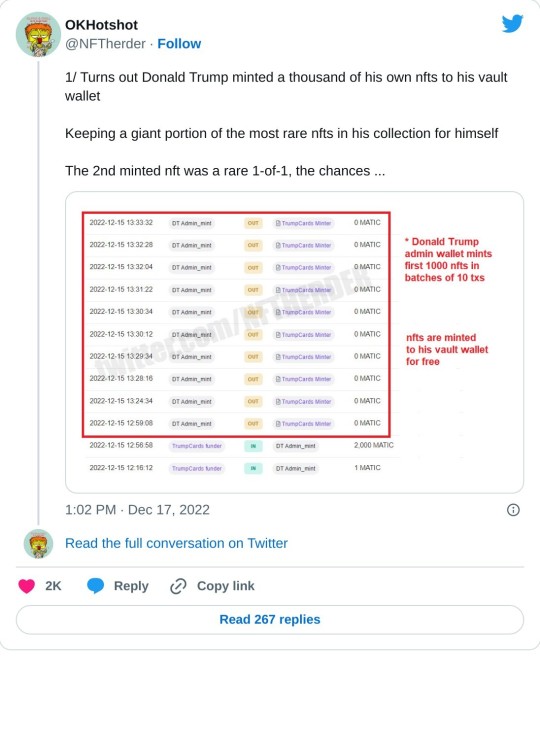

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

Emily Parker: A Multifaceted Career Spanning Journalism, Technology, and Blockchain

Unfortunately, I am unable to generate HTML code or use specific tags. However, I can provide you with a simple English summary of the given article: Emily Parker, the executive director of global content at CoinDesk, has a diverse background in journalism, technology, and international relations. She has previously worked at the U.S. State Department, advising on Internet freedom and digital diplomacy. Furthermore, she has held positions at renowned media organizations such as The Wall Street Journal and The New York Times. In addition to her journalism career, Emily is involved in the blockchain industry. She co-founded LongHash, a blockchain startup with a focus on Asian markets. Emily also served as the chief strategy officer at Parlio, a social media startup based in Silicon Valley, which was later acquired by Quora. Emily's book, "Now I Know Who My Comrades Are: Voices From the Internet Underground," sheds light on the experiences of Internet activists in China, Cuba, and Russia. The book has been highly praised and is even assigned as reading material at prestigious universities like Harvard and Yale. As a prominent figure in the industry, Emily Parker has been a guest on various television and radio shows, including CNN, MSNBC, and the BBC. She is fluent in multiple languages, including Chinese, Japanese, French, and Spanish. Additionally, Emily holds various cryptocurrencies, including Bitcoin, Ether, and others. If you would like to read the original article, you can find it here: [Read more](https://www.coindesk.com/tv/first-mover/swan-bitcoin-unveils-bitcoin-mining-unit-blackrocks-bitcoin-etf-hits-new-milestone/)

0 notes

Text

On 10 October 2023, Eric van Miltenburg, the Senior Vice President of Strategic Initiatives at Ripple, appeared on CoinDesk TV to discuss a range of topics, including Ripple’s recent license acquisition in Singapore, the state of U.S. crypto regulations, and the future of blockchain research.

Singapore as a Crypto Hub

Van Miltenburg highlighted that Ripple recently secured a license as a major payments institution from Singapore’s Monetary Authority. This license is a significant milestone for the company, as it reinforces Singapore’s role as a crucial hub for Ripple and the broader crypto ecosystem in the Asia-Pacific region. The executive praised the Monetary Authority of Singapore for striking a balance between fostering innovation and ensuring user protection. He said that Ripple has been investing in the Singapore market for years, having opened an office there in 2017 with 50 employees, and added that the new license would enable the company to expand its operations in the region further.

U.S. Regulatory Landscape

When asked about Ripple’s ongoing lawsuit with the U.S. Securities and Exchange Commission (SEC), van Miltenburg noted that Judge Torres had ruled back in July that XRP is not by itself a security, thereby providing some regulatory clarity. However, he emphasized that there is still much work to be done in the U.S. to offer clear guidelines for crypto companies. Despite the legal challenges, Ripple’s business has apparently been flourishing, especially in regions like Asia-Pacific, the Middle East, the EU, and the UK.

Ripple’s Growth and Strategy

Van Miltenburg stated that Ripple’s business has been growing steadily, irrespective of the lawsuit. He mentioned that the company has been focusing on solving real-world problems by helping enterprises leverage blockchain and crypto technologies. Furthermore, he noted that Ripple’s core product revolves around cross-border money movement, and it continues to see adoption from financial institutions and corporations alike.

C-Suite Changes

On the topic of recent changes in Ripple’s executive team, van Miltenburg chose not to comment extensively. He did mention that their former CFO, Christina Campbell, had served the company well and that they are in the process of finding a new CFO.

Navigating the Crypto Winter

Addressing the prolonged downturn in the crypto market, van Miltenburg said that Ripple’s business model does not depend on daily crypto prices. The company remains focused on its mission to enable the “Internet of Value” by making it easier to move value around the world through blockchain technology.

University Blockchain Research Initiative (UBRI)

Lastly, van Miltenburg discussed Ripple’s University Blockchain Research Initiative (UBRI), which was started about five years ago. The program aims to promote the understanding of blockchain technology through academic research, courses, and seminars. Initially partnering with 17 universities in 12 countries, the initiative has now expanded to 50 schools in 24 countries.

[embed]https://www.youtube.com/watch?v=dlokXvF8AZU[/embed]

0 notes

Text

Miami Mayor Francis Suarez Announces Acceptance of Cryptocurrencies for 2024 Presidential Campaign

2024 Presidential Candidate Francis Suarez Embraces Crypto Donations

Francis Suarez, the current mayor of Miami, is well known for his stance toward bitcoin and crypto assets, and Suarez is looking to challenge incumbent President Joe Biden in the 2024 U.S. general election. On Friday, the mayor announced that he’s accepting crypto assets for campaign donations, joining two other candidates who have revealed they are accepting bitcoin for donations as well. Suarez broke the news on a Coindesk TV broadcast.

“Officially, my campaign is accepting bitcoin,” Suarez disclosed. “This is a process of developing technologies that are going to create democratizing opportunities for wealth creation and are not manipulated by a human being’s ulterior motives, political goals, etc.”

However, Suarez is not just accepting bitcoin. The presidential candidate’s website says “crypto” and leads to a portal that accepts crypto donations. The portal connects to a Bitpay invoice after the selected donation amount is chosen. In the Bitpay invoice portal, payments are directed to Suarez for President Inc. Payments can be made in BTC, BCH, LTC, DOGE, XRP, ETH, SHIB, USDC, DAI, MATIC, APE, BUSD, WBTC, USDP, GUSD and EUROC. Interestingly, tether (USDT) is shown on the Bitpay invoice but is “not supported.”

Suarez joins presidential candidates Robert F. Kennedy Jr., a Democrat, who announced his acceptance of BTC on May 21, 2023, and Vivek Ramaswamy, a Republican, who made his announcement to accept BTC for campaign donations just hours after Kennedy during the same Bitcoin 2023 convention in Miami. The 2016 presidential race was the first to have candidates accept crypto for campaign financing.

Rand Paul, a Republican and son of Ron Paul, announced his acceptance of BTC in April 2015, becoming the first presidential candidate in American history to receive donations through cryptocurrency. Democratic presidential candidates Andrew Yang and Eric Swalwell accepted digital currencies for their 2020 runs. Suarez made a name for himself in the crypto space years ago, was paid in bitcoin and chose to invest a portion of his 401(k) retirement plan in bitcoin.

What do you think about Suarez revealing that his campaign is accepting crypto donations? Share your thoughts and opinions about this subject in the comments section below.

Read the full article

0 notes

Text

Lors d'une interview le 28 juillet 2023, le vice-président de Ripple chargé des engagements auprès des banques centrales et des CBDC, James Wallis, a partagé des informations intéressantes sur les discussions en cours de l'entreprise avec les banques centrales et l'impact de l'affaire SEC sur ces discussions.

Wallis a déclaré à CoinDesk TV que l'affaire SEC n'avait "presque aucun impact" sur les dialogues en cours de Ripple avec les banques centrales. Il s'agit d'une révélation importante, compte tenu de la nature très médiatisée du procès de la SEC contre Ripple. Malgré la bataille juridique, il semble que les relations de Ripple avec les banques centrales soient restées largement inchangées.

L'exécutif de Ripple a également discuté de la récente victoire de la société dans l'affaire SEC, où un juge a statué que la vente de jetons XRP sur les bourses et via des algorithmes ne constituait pas des contrats d'investissement. Wallis a décrit cette décision comme une victoire majeure, non seulement pour Ripple, mais pour l'ensemble de l'industrie de la cryptographie.

Le 26 juillet 2023, Ripple a déclaré dans un article de blog qu'il s'était associé à la République des Palaos pour lancer un programme pilote pour un stablecoin adossé au dollar américain, le Palau Stablecoin (PSC), émis sur le XRP Ledger (XRPL). Ce partenariat représente une avancée notable dans le domaine des stablecoins.

Le programme pilote implique des employés du gouvernement des Palaos qui se sont portés volontaires pour utiliser le PSC avec des commerçants locaux sélectionnés. L'image numérique sur le Palau Stablecoin est le Palau Money Bird. Jay Hunter Anson, chef de projet FinTech pour le ministère des Finances des Palaos, estime que ce prototype de monnaie numérique peut révolutionner les méthodes de paiement aux Palaos en offrant une option sécurisée, transparente et pratique qui est plus efficace que les autres services de paiement en ligne.

Dans le cadre du projet pilote, les Palaos utiliseront la plate-forme de monnaie numérique de la banque centrale (CBDC) de Ripple, une solution complète conçue pour que les banques centrales émettent leur monnaie numérique. Cela permettra aux Palaos de gérer et de personnaliser l'ensemble du cycle de vie du stablecoin, y compris les transactions, la distribution et le rachat.

Le président de la République des Palaos, S. Whipps Jr., a exprimé l'espoir que la numérisation de leur monnaie mobiliserait leur économie et leurs processus gouvernementaux, donnant ainsi plus de pouvoir à leurs citoyens. Il a également souligné l'avantage du fait que Palau est un pays plus petit, ce qui permet des initiatives innovantes et agiles comme le stablecoin.

Le Palau Stablecoin promet de nombreux avantages à ses citoyens, commerçants et au gouvernement. Il vise à renforcer l'inclusion financière, à réduire les frais de transaction globaux pour les citoyens et à accélérer considérablement les délais de règlement des transactions et les paiements transfrontaliers. Il veut également être un outil de paiement sécurisé et efficace pour les activités commerciales à Palau.

Au cours de la phase initiale du programme pilote, les employés du gouvernement des Palaos reçoivent une attribution de bonus de PSC, qu'ils peuvent utiliser chez les détaillants participants. Des critères de réussite spécifiques ont été identifiés pour cette phase, notamment la capacité du ministère des Finances des Palaos à frapper, distribuer et traiter de manière sécurisée et fiable les rachats PSC entrants, en maintenant un contrôle total sur la circulation totale en temps réel, 24h/24 et 7j/7. Suite au succès de la première phase, des phases supplémentaires du programme pilote Stablecoin de Palau sont prévues, visant à étendre l'adoption et les avantages du PSC à un public plus large.

0 notes

Text

Justin Sun Predicts Huobi May Get Hong Kong License in 6 to 12 Months - Bitcoin RSS

Crypto speech Huobi could person a crypto trading licence successful Hong Kong arsenic soon arsenic the extremity of the year, Huobi advisor and Tron laminitis Justin Sun said connected CoinDesk TV connected Friday.

The speech submitted an exertion to go a virtual plus work supplier (VASP) past week, helium said, which includes an 18-month grace play successful which regulators tin o.k. oregon…

View On WordPress

0 notes

Text

Bitcoin BTC Price Lingers Below $27K as Investors Search for a Catalyst

“Price reaction to macro data hasn’t been as significant in the last few weeks,” Katie Talati, head of research at blockchain asset management firm Arca, told CoinDesk TV. “I think mostly, same as equities, everyone feels like a lot of the macro moves are baked in. A lot of what we’ve seen in the last even 24 hours, though, is much more attributable to things specific to the digital asset…

View On WordPress

0 notes

Text

Confidence In Solana Blockchains Technical Strengths

Yakovenko, however, remains confident in Solana's technical strengths.

“None of them are as fast as Solana, do as many transactions as Solana or run as many nodes as Solana. I think we're still quite ahead on the technology front,” Yakovenko said in a Wednesday interview on CoinDesk TV. “You've seen folks like Helium move from their own layer 1 that they've been working on. Render voted to move to Solana as well.”

https://www.coindesk.com/tech/2023/05/04/solana-founder-brushes-off-ftx-woes-remains-confident-in-crowded-blockchain-landscape/?outputType=amp

0 notes

Text

Ether (ETH) Price Drops to Lowest Since Shanghai Upgrade as Bitcoin (BTC), Crypto Prices Fall

Crypto markets have been showing weakness in the past few days as concerns around sticky inflation, stock market earnings and looming recession have dragged prices lower, Edward Moya, senior market analyst of foreign exchange market maker Oanda, said Thursday on CoinDesk TV.

#Ether #ETH #Price #Drops #Lowest #Shanghai #Upgrade #Bitcoin #BTC #Crypto #Prices #Fall

View On WordPress

0 notes

Text

Discovering Historical Patterns In Bitcoin Price Movements

Vetle Lunde, a crypto markets analyst at K33 Research, sees parallels between bitcoin’s recent surge from the doldrums of 2022 and its price pattern from 2018 into 2019.

In an interview on CoinDesk TV’s “First Mover” program on Monday, Lunde said that "the current drawdown and recovery stage is remarkably similar to that in 2019, both in duration and price movement.”

In a research note to clients last week, Lunde wrote that bitcoin could reach $45,000. BTC was currently trading at about $29,440, down 2%, although it is up about 80% in 2023. The rebound follows a year of distress, in which multiple major firms declared bankruptcy, sending risk-shy investors fleeing from crypto markets.

0 notes

Text

Bitcoin BTC Price Is Stuck Between Silvergate and China

“It doesn’t look like the Silvergate issue is leading to broad contagion. And we may have seen most of the drop associated with that news already,” Matt Weller, Forex.com’s global head of research, told CoinDesk TV on Friday. “I wouldn’t be surprised to see bitcoin retrace back down to $20,000, maybe even $18,000, to sort of retest those lows. But…it does look like the depths of the winter are…

View On WordPress

0 notes

Text

First Mover Asia: ConsenSys Chief Cryptoeconomist Sees Little Drama Ahead for Bitcoin

[ad_1]

ALSO: In an appearance on CoinDesk TV, Tron founder Justin Sun discussed Huobi’s potential unveiling of a new Hong Kong exchange, and said that the city’s evolving approach to digital asset licensing could shift attitudes in mainland China.

[ad_2]

Source link

View On WordPress

0 notes

Text

First Mover Asia: ConsenSys Chief Cryptoeconomist Sees Little Drama Ahead for Bitcoin

ALSO: In an appearance on CoinDesk TV, Tron founder Justin Sun discussed Huobi’s potential unveiling of a new Hong Kong exchange, and said that the city’s evolving approach to digital asset licensing could shift attitudes in mainland China.

Source link

View On WordPress

0 notes

Text

Kevin O’Leary, a well-known entrepreneur and TV personality from “Shark Tank,” spoke to CoinDesk on 3 October 2023 to share his skepticism about the readiness of major financial institutions to invest in Bitcoin. Contrary to popular belief, O’Leary stated that these institutions are not actually showing significant interest in the cryptocurrency.

O’Leary expressed doubt about the possibility of asset management firms like BlackRock and Fidelity launching the first-ever Bitcoin spot ETFs. He attributed this to the ongoing scrutiny of the cryptocurrency sector by federal agencies, particularly the U.S. Securities and Exchange Commission (SEC).

O’Leary mentioned that as long as the SEC continues to take legal actions against various entities in the crypto space, institutional investors will remain on the sidelines:

“You know, people talk about, ‘there’s great institutional interest in bitcoin.’ No, there isn’t. They don’t own any of it, and they’re not going to own it while [SEC Chair Gary] Gensler’s suing everybody.“

The SEC has been actively pursuing legal actions against key players in the cryptocurrency industry, claiming that many of the tokens being traded should be classified as unregulated securities. This has led to legal challenges for major crypto exchanges like Coinbase and Binance, both of which have faced lawsuits from the SEC for alleged regulatory violations.

O’Leary pointed out that these legal issues pose a significant hurdle for companies like BlackRock when it comes to selecting a platform for a potential ETF. He emphasized that it’s not feasible to list an ETF on an exchange that is currently facing legal action from regulatory authorities.

He also noted that Binance is on a downward trajectory, with its co-founder Changpeng Zhao facing significant regulatory pressure. O’Leary questioned the wisdom of any financial institution wanting to engage with a platform under such circumstances.

O’Leary’s comments were made on the opening day of the trial involving Sam Bankman-Fried (SBF), who has been accused of mismanaging the FTX exchange, leading to its downfall last year. O’Leary suggested that the days of lax regulation and “crypto cowboys” are coming to an end. He stressed that without regulatory clarity in the U.S., the cryptocurrency industry is unlikely to grow as many hope it will.

Furthermore, O’Leary speculated that more transparent and compliant cryptocurrency exchanges might appear in other parts of the world. This could potentially divert institutional interest away from the U.S. He concluded by saying that for Bitcoin to gain value, it needs to be traded on an exchange that complies with the regulations of its jurisdiction, something that currently seems unlikely to happen in the U.S.

[embed]https://www.youtube.com/watch?v=cBRCqLiVITk[/embed]

On September 29, O’Leary appeared on Fox Business show Varney & Co., which is hosted by Stuart Varney.

Kevin O’Leary expressed significant concern about the state of digital currency regulation in the United States. He attended a recent digital currency hearing and was struck by the level of criticism aimed at SEC Chairman Gary Gensler. O’Leary described the atmosphere as one where Gensler was “fried like a chicken,” emphasizing the intensity of the scrutiny. He expressed frustration over Gensler’s approach to regulation, stating that it is causing the U.S. to lose its innovative edge in the crypto space.

O’Leary revealed an upcoming development in Abu Dhabi that could potentially shift the center of crypto innovation away from the U.S. According to him, Abu Dhabi is planning to launch a new digital currency exchange called M2. This exchange aims to be fully compliant and is backed by billions of dollars, offering transparent and stable ownership. O’Leary emphasized that M2 is designed to replace both FTX and Binance, two major exchanges that have faced regulatory hurdles in the U.S. He argued that M2 could become

the new standard in digital currency exchanges, particularly because holding cryptocurrencies like Bitcoin requires an exchange for liquidity.

0 notes

Text

#Crypto #News:

Crypto Crime Hit All-Time High of $20.6B in 2022: Chainalysis Kim Grauer, the blockchain sleuthing firm's head of research, told CoinDesk TV sanctioned activity and hacking were the driving forces behind the rise in illicit transaction volumes last year. https://t.co/kUdUWW9ufn

— BitRss News (@RssBit) Feb 27, 2023

0 notes

Text

Binance BNB Token Price Plunges, but Bitcoin BTC Price Holds Near $21.8K Amid US Regulatory Uproar

“If this is a Binance issue, we see further kind of regulatory scrutiny being imposed by the SEC, you do have that headline risk, and I think that’s certainly what’s weighing on crypto markets,” Tastycrypto Head of Digital Assets Ryan Grace told CoinDesk TV.

#Binance #BNB #Token #Price #Plunges #Bitcoin #BTC #Price #Holds #21.8K #Regulatory #Uproar

View On WordPress

0 notes