#BillPayment

Text

Recharge your FASTag online with abhieo and enjoy hassle-free toll payments without any extra fee

#abhieo#finance#fintech#recharge#rechargeapp#mobilerecharge#payment#fastag#fastagrecharge#billpayment#paymentapp#bbps#tolltax#tollpayment#tollplaza

2 notes

·

View notes

Text

Electronic bill payment is made simply with OnlineCheckWriter.com - powered by Zil Money. You can create bills with payee details and send them instantly. Sign up now.

Learn more: https://onlinecheckwriter.com/bill-payment

0 notes

Text

💻 Need to pay your landline bill online? Look no further than Gotraav's website! 📞💳

👉 Skip the hassle of traditional payment methods and conveniently settle your landline bill with just a few clicks on Gotraav's user-friendly platform. www.gotraav.com

🌟 Secure, reliable, and hassle-free payment experience awaits you at Gotraav. Say goodbye to long queues and hello to convenience!

💻 Visit Gotraav's website today to make your payment and enjoy peace of mind. #OnlinePayment #LandlineBill #Convenience #EasyPayment #Gotraav #SecurePayment #HassleFree #DigitalPayment #BillingSolution #UtilityPayment #QuickPayment #UserFriendly #OnlineTransaction #SaveTime #PayWithEase #TechSavvy #DigitalAge #StayConnected #BillPayment #SmoothExperience #Effortless #OnlineConvenience

#GotraavExperience #DigitalSolution #PaymentPortal #StayConnected #CustomerSatisfaction #TechInnovation #DigitalTransformation #UtilityBills #ConvenientPayment #EasyBilling #EfficientService #TimeSaving

#EasyPayment#Gotraav#SecurePayment#HassleFree#DigitalPayment#BillingSolution#UtilityPayment#QuickPayment#UserFriendly#OnlineTransaction#SaveTime#PayWithEase#TechSavvy#DigitalAge#StayConnected#BillPayment#SmoothExperience#Effortless#OnlineConvenience#GotraavExperience#DigitalSolution#PaymentPortal#CustomerSatisfaction#TechInnovation#DigitalTransformation#UtilityBills#ConvenientPayment#EasyBilling#EfficientService#TimeSaving

0 notes

Text

Going Digital: The Future of Bill Payment

Financial transactions, particularly bill payments, have changed dramatically in this age of rapid technology growth. Digital technology has replaced check writing and mailing. Online banking, mobile apps, and digital payment platforms are driving online bill pay’s future. This change has made managing financial commitments easier, faster, and safer. Digital channels allow users to pay bills anytime, anyplace. This revolution marks a paradigm shift in how people handle their finances, reflecting technology's persistent pursuit of a more connected and efficient future.

Convenience and Accessibility

Digital bill payment is transforming how people handle their financial commitments by providing an unparalleled level of convenience. Writing checks, packing envelopes, and waiting for mail delivery are gone. Instead, use a smartphone and a few taps or clicks to pay bills quickly from anywhere. Secure online banking and simple smartphone apps make managing and paying credit card bills, internet subscriptions, and utility bills easy.

Beyond convenience, the digitalization of bill payment procedures also has other advantages. Through lowering the amount of paper used and the carbon emissions related to regular letter delivery, it supports environmental sustainability. Furthermore, digital platforms frequently include functions like bill tracking and automated reminders, which support customers in staying organized and preventing late payments, protecting their credit scores.

Automation and Timely Payments

Digital bill payment allows consumers to automate regular bill payments. By linking bank accounts or credit cards to billers, people can ensure monthly payments without manual intervention. This prevents late payments and fines and helps maintain a good credit score. The ability to schedule payments in advance adds security, ensuring expenses are paid even during busy schedules or vacations. The simplified procedure improves financial organization and reduces the stress of remembering several due dates, making life easier.

Enhanced Security Measures

Security concerns have often slowed digital payment acceptance. However, technical advances have created a new era of secure financial data protection. Digital banking platforms increasingly use encryption, multi-factor authentication, and biometric verification. These features protect transactions from unauthorised access.

Digital bill payment security has surpassed older techniques. Digital transactions are more secure than checks. Cutting-edge encryption protects sensitive data, giving users peace of mind. Multi-factor authentication adds another degree of protection by forcing users to verify their identity several times. This reduces the risk of unauthorized access and boosts digital payment system trust. Modern security techniques like biometric verification use fingerprints or facial recognition to authenticate transactions. Since biometric data is hard to fake, this biologically-derived authentication mechanism reduces fraud.

Adoption Challenges and Digital Divide

Digital bill payment has evident benefits, but its widespread adoption faces challenges. Not everyone has internet access or the skills to use online banking. Digital disparity disproportionately affects marginalized people, possibly denying them digital financial services. To close this divide, governments, financial institutions, and technology companies must collaborate to provide affordable internet access, digital literacy education, and intuitive user interfaces. Our collaborative efforts can ensure that everyone may benefit from digital financial services, regardless of background or circumstances.

Digitalization will transform bill payment, offering unparalleled convenience, efficiency, and security. Online banking, mobile apps, and digital payment platforms let consumers simplify financial transactions, automate bill payments, and eliminate paper use. However, to ensure that no group is excluded from the digital future, we must address the barriers to general adoption and prioritize inclusivity. As technology progresses, the bill payment landscape will change, altering how we navigate and manage our finances and shaping financial management for the future.

0 notes

Text

Boosting Efficiency and Convenience: The Advantages of Upgrading to Online Recharge Portal Software

In today's fast-paced digital era, where convenience and efficiency are paramount, businesses are continually seeking ways to streamline their processes. One crucial aspect that demands attention is payment systems. If you haven't already upgraded to online recharge portal software, now is the time to do so. This technological solution offers a myriad of advantages that can significantly enhance your business operations.

The Evolution of Payment Systems

Traditionally, businesses relied on manual methods for recharging services or making payments. Whether it was through cash transactions, checks, or physical recharge cards, the process was time-consuming and prone to errors. The advent of online recharge portal software revolutionized this landscape, offering a seamless and automated approach to handling transactions.

Enhanced Efficiency

One of the primary benefits of adopting online recharge portal software is the significant boost in efficiency. Manual processes often involve a series of steps, paperwork, and potential delays. With an online recharge portal, the entire process is streamlined, reducing the time and effort required for recharging services. Customers can quickly and easily top up their accounts or make payments with just a few clicks, leading to a more efficient operation for both businesses and consumers.

Accessibility Anytime, Anywhere

Online recharge portal software enables customers to access the platform from the comfort of their homes or on the go. This level of accessibility is crucial in today's digital landscape, where consumers expect the convenience of handling transactions whenever and wherever they need to. By offering a 24/7 online recharge portal, businesses can cater to the diverse schedules of their customers, leading to increased customer satisfaction and loyalty.

Streamlined Record-Keeping

Traditional payment methods often result in a trail of paperwork that can be cumbersome to manage and prone to errors. Online recharge portal software automates the record-keeping process, maintaining accurate and easily accessible transaction histories. This not only reduces the risk of errors but also simplifies the reconciliation process for businesses, saving time and resources that can be better utilized elsewhere.

Secure Transactions

Security is a top priority for both businesses and consumers when it comes to financial transactions. Online recharge portal software is designed with robust security features, ensuring that sensitive information is protected. Advanced encryption and secure payment gateways safeguard against potential threats, instilling confidence in customers and maintaining the integrity of the payment system.

Customization and Integration

The flexibility of online recharge portal software allows businesses to customize the platform to their specific needs. Whether it's branding, user interface, or functionality, businesses can tailor the portal to create a seamless and branded experience for their customers. Additionally, these systems often integrate with other business applications, such as accounting software or customer relationship management (CRM) tools, creating a unified and efficient ecosystem.

Cost Savings

While the initial investment in online recharge portal software may seem significant, the long-term cost savings cannot be overstated. Automated processes reduce the need for manual intervention, minimizing the risk of errors and the associated costs of rectifying them. The efficiency gained through automation also allows businesses to allocate resources more effectively, leading to overall cost reductions.

Competitive Edge

In a competitive market, staying ahead of the curve is crucial for business success. By adopting online recharge portal software, businesses demonstrate their commitment to embracing technological advancements and meeting the evolving needs of their customers. This not only attracts new customers but also helps retain existing ones, positioning the business as a leader in the industry.

Conclusion

In conclusion, upgrading to online recharge portal software is a strategic move that offers numerous advantages for businesses looking to enhance efficiency, security, and customer satisfaction. The digital transformation of payment systems is not just a trend but a necessity in today's dynamic business landscape. Embracing this technology not only streamlines operations but also positions businesses for sustained success in an increasingly digital world. If you haven't made the switch yet, now is the time to take the leap into the future of payment systems.

#mobilerecharge#recharge#moneytransfer#aeps#bbps#dthrecharge#india#cashback#airtel#bkash#instagram#allservices#microatm#billpayment#domesticmoneytransfer#instagood#bills#business#offer#digitalindia#jio#atm#dmt#smartserve#money#insurance#b#onlinemobilerecharge#transfermoney#mobile

0 notes

Text

Bharat Bill Payment System - BBPS

Bharat Bill Payment System (BBPS) simplifies the bill payment process and improves payment security and speed. This service is available in various payment modes, online and through a network of agents. Instant approval is generated for bill payments. BBPS will convert society from cash to electronic payment system and become cashless. Now you can pay Utilities (Gas, Electricity, Water, DTH) and Telecom Bills.

0 notes

Text

Making Financial Transactions Effortless and Smart

From seeking quick loans to making international money transfers or even paying utility bills, these transactions have become an integral part of our routine. But what if there was a way to simplify these processes, making them not just effortless but also smart? Enter Muthoot FinCorp ONE, an all-in-one digital financial platform designed to revolutionize the way you handle your finances.

The Convenience You Deserve

At Muthoot FinCorp ONE, convenience isn’t just a promise; it's a commitment we live by. Muthoot FinCorp ONE gives you the ability to secure a Gold Loan swiftly, without any hassle, and from anywhere you prefer, be it the comfort of your home or at any of our 3600+ branches across India. With our quick doorstep service, you can have your Gold Loan sanctioned in as little as 30 minutes*. Plus, we offer competitive interest rates as low as 0.83%* per month and, as a cherry on top, a zero* processing fee. You can avail the Gold Loan at offered gold rates up to ₹4200/gm, making it a lucrative and hassle-free option for your financial needs.

Digital Gold and Beyond

We understand the importance of diversifying your portfolio, which is why we offer the opportunity to invest in Digital Gold. With an entry point as low as Re. 1, you can start your journey into gold investment, secured at 99.99% purity, and trade it at market prices, all stored safely and securely.

NCDs for a Secure Investment Future

For those seeking stability and high returns, our Non-Convertible Debentures (NCDs) present an excellent opportunity to build a robust investment portfolio. Starting with just Rs. 10,000, enjoy returns of up to 9.43%* with fast-tracked investments, high-yield, low-risk opportunities, and flexible tenure durations to suit your needs.

Simplified Forex Transactions

Navigating the complexities of foreign exchange transactions can be daunting, but not with Muthoot FinCorp ONE. Enjoy secure and reliable forex services with competitive exchange rates and guaranteed 24-hour* transfers. We also provide a buy-back guarantee, ensuring your peace of mind throughout the process.

Seamlessly Handle Payments and Recharges

From bill payments to recharges, Muthoot FinCorp ONE simplifies it all. Recharge your DTH or prepaid mobile, pay electricity, internet, or LPG gas cylinder bills instantly, or manage your financial services and taxes hassle-free—all with a few taps on our app. Moreover, pay your rent or vendors effortlessly, making the entire process quick, secure, and available 24x7.

Our commitment to making your financial life easier continues with the Muthoot FinCorp ONE app. It’s your gateway to effortless Gold Loans, Digital Gold investments, Forex transactions, and more, available whenever and wherever you need it. Expect regular updates, enhanced services, and an unwavering dedication to simplifying your financial journey.

Muthoot FinCorp ONE is not just about transactions; it's about transforming the way you interact with your finances. Experience ease, convenience, and reliability—all in one place.

At Muthoot FinCorp ONE, we're not just simplifying financial transactions; we are empowering you to make smarter choices, effortlessly. Join us and witness a new era of financial convenience and intelligence.

About Muthoot FinCorp ONE

Muthoot FinCorp ONE is an all-in-one digital financial platform that makes getting an MSME & a Gold Loan, investing in Digital gold & NCDs, making payments & remittances, buying insurance & exchanging forex, simple and convenient.

As an SBU of Muthoot FinCorp Limited, Muthoot FinCorp ONE is backed by a legacy stretching back over 135 years, and the trust of more than 1 crore customers and is building a holistic financial ecosystem using the latest digital products for lending, investing, protection and payments.

Muthoot FinCorp ONE continues to uphold the values of the parent, the Muthoot Pappachan Group (Muthoot Blue) by providing its customers with easily accessible services, replete with unmistakable quality. The Muthoot Pappachan Group is among India’s most reputed names in the financial services industry, with customers in diverse segments like Automotive industry, Financial Services, Hospitality, Alternate Energy, Real Estate, and Precious Metals.

So what are you waiting for? Head to the Play Store and download the Muthoot FinCorp ONE app. You can also visit the website today to know more.

Alternatively, you can also follow us on Facebook, Instagram, Twitter or LinkedIn to stay tuned to our latest offerings.

Chat on Whatsapp | Branch Locator | Email us - [email protected] | Download App

0 notes

Text

Panashi’s bill payment kiosk

Experience the convenience of paying your bills without waiting in long queues using Panashi’s bill payment kiosk

Click to know more: https://panashi.ae/bill-payment-kiosk.html

It's fast, secure, and available 24/7. Our user-friendly interface is fully customizable and offers multilingual support. It also accepts cash in any denomination and offers a variety of payment options, including cardless payments.

#billpayment#kiosk#EasyPayments#SecureTransactions#CashOrCard#cardlesspayments#innovation#self service kiosks#technology#kiosks#self service kiosk

0 notes

Text

Rockspay.com is digital payment solution that provide a secure platform for processing online payments

1 note

·

View note

Text

Need help in paying your bill without any queue? Get in touch with nearby Soulpay Retailers to pay all your bills! The Retailer Bill Pay Service is a solution for retailers with large volumes of invoice and statement data that need to be managed in an automated way. When choosing a bill payment service for retailers should consider factors such as transaction fees, security, ease of use, and customer support. It's also important to ensure that the service integrates well with its existing systems and workflows. Soulpay Bill Payment Service allows you to pay your customer's bills instantly.

For more details, visit our website.

#Soulpay#digitalvypari#fintech service#business ideas#bill payment services for retailers#billpayment

0 notes

Text

Get Upto ₹50 Cashback On Mobile Recharge

#abhieooffers#abhieo#recharge#abhieonews#finance#fintech#rechargeapp#mobilerecharge#paymentapp#rechargeoffers#billpayment#payment#airtelrecharge#airtel#AIRTEL RECHARGE OFFER#VI#vodafone#jiorecharge#JIO#JIO RECHARGE OFFER#BSNL#bsnlrecharge#BSNL OFFER#ONLINE RECHARGE OFFER#cashback offer#discounts#deals

2 notes

·

View notes

Text

OnlineCheckWriter.com- powered by Zil Money makes bill payment simple. You can also create bills with payee details and send them instantly.

Learn more: https://onlinecheckwriter.com/bill-payment

0 notes

Text

💸 Say goodbye to queues and hello to convenience! 💻🌐 Pay your bills hassle-free with Gotraav! 💳✨

🔗 Why Gotraav? ✅ Fast and Secure Transactions ✅ Wide Range of Bill Payment Options ✅ 24/7 Accessibility ✅ User-Friendly Interface

💡 How It Works: 1️⃣ Log in to Gotraav 2️⃣ Select your Biller 3️⃣ Enter Bill Details 4️⃣ Pay Easily and Swiftly

🎁 Exclusive Offer: Use code "GOTRAAVPAY" for a special discount on your first bill payment! 🌟

💬 Join the Gotraav community and simplify your bill payment experience! 💬

🌐 Visit our website: [www.gotraav.com]

#Gotraav#OnlinePayments#BillPayment#Convenience#EasyPayments#DigitalWallet#SaveTime#TechSavvy#ExclusiveOffer#DigitalTransformation

0 notes

Text

Maximizing Cash Flow: Strategies for Effective Bill Payment App Utilization

Managing personal finances efficiently is crucial for achieving financial goals and maintaining a healthy cash flow. One powerful tool that has emerged to simplify the process is bill payment apps. These applications offer convenience, automation, and organization, making it easier for users to stay on top of their financial responsibilities.

Consolidation and Organization

One of the primary advantages of bill payment apps is the ability to consolidate various bills and financial obligations in one centralized platform. To maximize cash flow, users should take advantage of this feature by linking all their accounts, subscriptions, and regular bills to the app. This consolidation not only simplifies the payment process but also provides a comprehensive view of upcoming expenses, allowing for better financial planning.

Automation for Timely Payments

Late fees and interest charges can quickly erode cash flow. Bill payment apps offer automation features that allow users to schedule payments in advance. By setting up automatic payments for recurring bills, users can ensure that payments are made on time, avoiding unnecessary fees and preserving cash flow. This automation also minimizes the risk of forgetting a due date, providing peace of mind and financial stability.

Cash Flow Forecasting

Effective cash flow management involves not just paying bills on time but also planning for future expenses. Some bill payment apps come equipped with cash flow forecasting tools that analyze spending patterns and predict upcoming financial obligations. By leveraging these features, users can anticipate cash flow gaps and proactively adjust their budget or savings strategy, ensuring a more stable financial future.

Discounts and Rewards

Certain bill payment apps offer incentives such as discounts, cashback, or reward points for using their platform. Maximizing cash flow goes beyond paying bills; it involves optimizing every aspect of financial transactions. Users should explore apps that provide these additional benefits and choose payment methods that offer the most advantageous rewards. This way, users can save money or earn rewards while meeting their financial obligations.

Budgeting Integration

To truly maximize cash flow, bill payment apps should be integrated with budgeting tools. This integration allows users to track their spending, set financial goals, and identify areas where expenses can be reduced. By combining bill payments with comprehensive budgeting, users can make informed decisions to optimize their cash flow and allocate funds more efficiently.

Security and Fraud Protection

Ensuring the security of financial transactions is important. Users should choose bill payment apps that prioritize security and offer robust fraud protection features. A secure app not only safeguards personal information but also prevents unauthorized transactions that could negatively impact cash flow. Regularly monitoring accounts and configuring security settings enhances the overall financial safety net.

In the digital age, utilizing bill payment apps is a smart and efficient way to maximize cash flow. By consolidating bills, automating payments, forecasting cash flow, and integrating budgeting tools, users can achieve greater financial control and stability. Additionally, taking advantage of discounts, and rewards, and prioritizing security further enhances the benefits of these apps. Embracing these strategies allows individuals to navigate their financial responsibilities with ease, ultimately leading to a healthier and more secure cash flow.

0 notes

Text

Why is Integration Capability Crucial for Retailers Using a Recharge Money Transfer Portal?

In the rapidly evolving landscape of financial technology, retailers are increasingly turning to recharge money transfer portals to offer convenient and efficient services to their customers. These portals serve as a bridge between retailers and financial transactions, enabling seamless recharge money transfer portal for retailers. However, the success of retailers in leveraging these portals depends significantly on their integration capabilities. In this article, we will delve into the reasons why integration capability is crucial for retailers using a recharge money transfer portal.

Enhanced Customer Experience:

Integration capability plays a pivotal role in enhancing the overall customer experience for retailers using a recharge money transfer portal. Seamless integration with existing point-of-sale (POS) systems and other retail platforms ensures a smooth and hassle-free transaction process for customers. Retailers can offer a one-stop solution for mobile recharges and money transfers, leading to increased customer satisfaction and loyalty.

Efficient Operations and Workflow:

Retailers dealing with a high volume of transactions need efficient operations and streamlined workflows. Integration capability allows the recharge money transfer portal to sync seamlessly with the retailer's backend systems, reducing manual efforts and minimizing the chances of errors. This results in faster transaction processing, improved operational efficiency, and ultimately, a more productive retail environment.

Real-time Transaction Monitoring:

For retailers, real-time visibility into transactions is crucial for monitoring and managing their financial activities effectively. Integration capability enables retailers to track transactions in real-time, providing instant updates on mobile recharges and money transfers. This transparency not only enhances trust between retailers and customers but also allows retailers to address any issues promptly, ensuring a reliable and secure transaction experience.

Diverse Payment Options:

The ability to integrate with various payment methods is a key factor in the success of recharge money transfer portals for retailers. Integration allows retailers to accept payments through credit/debit cards, mobile wallets, and other popular payment channels. This flexibility caters to a wider audience, accommodating diverse customer preferences and increasing the likelihood of completing successful transactions.

Inventory Management:

Retailers operating through recharge money transfer portals often deal with prepaid recharge cards and vouchers. Integration capability aids in effective inventory management by syncing real-time sales data with the portal. Retailers can effortlessly track stock levels, identify popular products, and replenish inventory as needed. This not only prevents stockouts but also helps retailers optimize their product offerings based on customer demand.

Seamless Loyalty Programs:

Integration capabilities allow retailers to seamlessly integrate loyalty programs with the recharge money transfer portal. This enables retailers to reward customers for their repeat business, encouraging brand loyalty. Whether through discounts, cashback, or other incentives, a well-integrated loyalty program can significantly boost customer retention and attract new business.

Compliance and Security:

Integration with regulatory and security protocols is imperative for retailers operating in the financial services sector. Compliance with industry standards and security measures is essential to protect both retailers and customers from fraudulent activities. An integrated recharge money transfer portal ensures that retailers can implement the necessary security features and adhere to regulatory requirements, safeguarding the integrity of financial transactions.

Conclusion:

In conclusion, the integration capability of recharge money transfer portal for retailers is a crucial factor that determines the success and efficiency of retailers operating in the financial services space. From enhancing customer experience and optimizing operations to ensuring compliance and security, integration plays a multifaceted role in the seamless functioning of these portals. Retailers looking to thrive in the competitive landscape must prioritize integration capabilities to provide a robust and user-friendly experience for their customers while staying ahead of technological advancements in the financial technology sector.

#mobilerecharge#recharge#moneytransfer#aeps#bbps#dthrecharge#india#cashback#airtel#bkash#instagram#allservices#microatm#billpayment#domesticmoneytransfer#instagood#bills#business#offer#digitalindia#jio#atm#dmt#smartserve#money#insurance#b#onlinemobilerecharge#transfermoney#mobile

0 notes

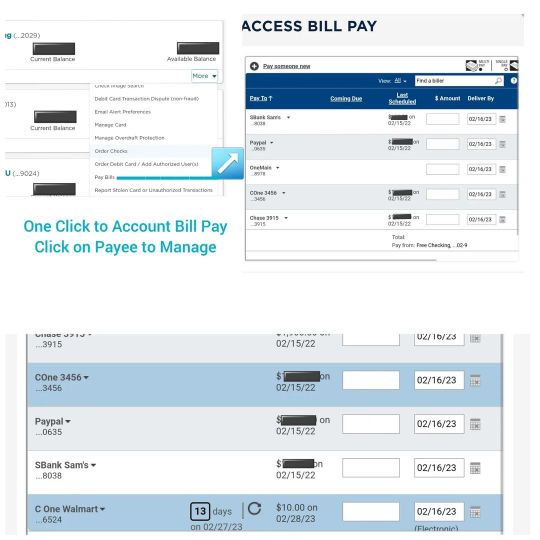

Photo

Streamlined Bill Pay instead of new, clunky, multiple steps @firstcommunity #creditunion #billPayment app (at St. Louis, Missouri) https://www.instagram.com/p/CoqR4nWvCVr/?igshid=NGJjMDIxMWI=

0 notes