#Application for Registration of Firm

Text

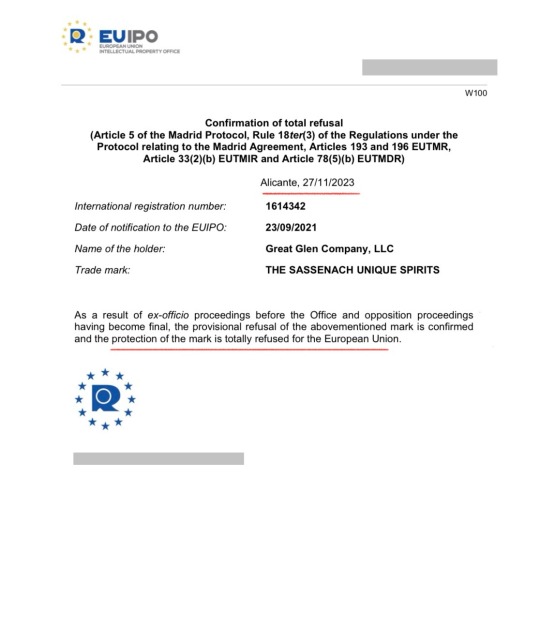

Sam Heughan’s Sassenach whisky brand loses the final legal fight in a trademark dispute in the European Union 🇪🇺

Sam Heughan launched his whisky brand "The Sassenach" in 2020, nickname his character uses for his on-screen love interest in the time travel drama "Outlander". Since 2021, Heughan has been embroiled in a legal battle with "Sasse" a German distillery over the name of his whisky brand, arguing that the Sassenach whisky would confuse customers who might think he is linked to them.

The European Union Intellectual Property Office (EUIPO), which resolves trademark disputes, ruled in favour of the German company and issued a decision upholding the opposition saying The Sassenach could not use the name as a whisky brand. After losing the initial decision at the Fifth Board of Appeals in 2021, Heughan's legal team appealed in 2022 to overturn the decision.

His legal team said there was no risk of confusion as Outlander was popular in Germany. Lawyers for the Sasse distillery, however, said: "The television series may be as popular as the other side claims, which we deny, nonetheless it is not sufficient to assume that the average consumer knows the meaning of that term. Both parties in litigation were given time to present evidence and arguments in their defence and after the Examination period, the Opposition Division’s decision was taken this year 2023.

Great Glen Company or its representative never commented on the EU decisions until last October, in New York when Sam Heughan was asked about Sassenach whisky situation in the European Union in a chat with Mark Gillespie at the Whisky Cast podcast and Heughan's response was very limited, deflecting the question talking about the name in dispute but not the EUIPO's decision, regarding Sassenach whisky that was supposedly aware of the official communication from the European Union Intellectual Property Office - Opposition Division- sent to Great Glen Company in July 2023, which considered that the disputed trademark 'The Sassenach' must be rejected for all the contested goods.

It's a bit curious that after the EUIPO decision, Sam Heughan appeared on a surprise visit to New Orleans, which included podcasts, and events with @sgwinespirits on Tales of the cocktail with an unscheduled tasting of his drinks at the Ritz-Carlton in Nola. Later on, he began his Sassenach sales tour around the United States last summer. If these people had known what had happened with his Sassenach brand in the EU would be different?

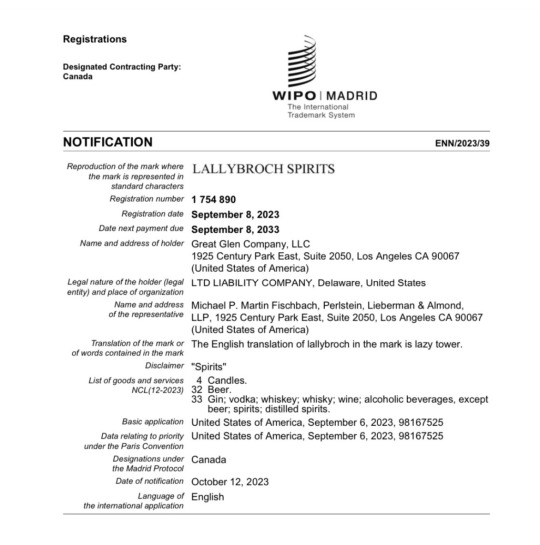

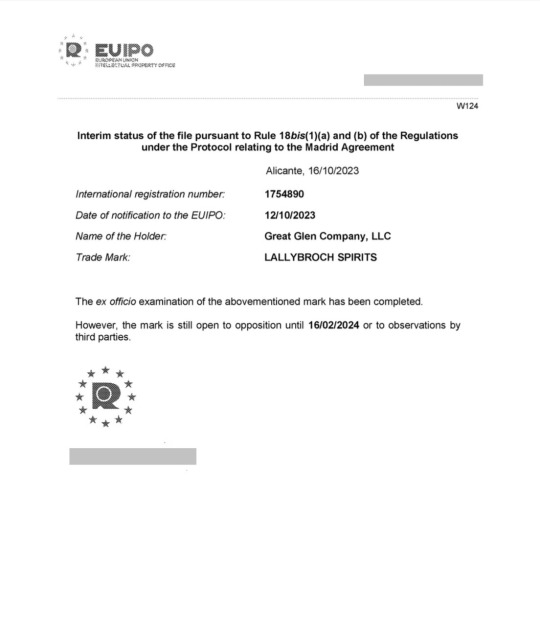

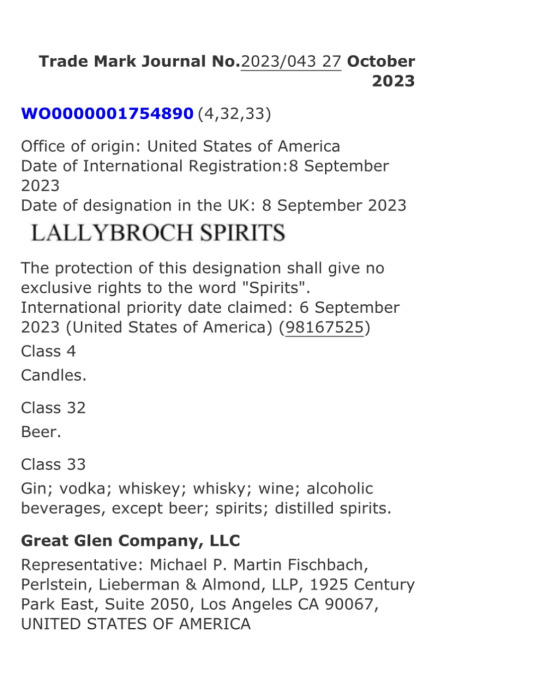

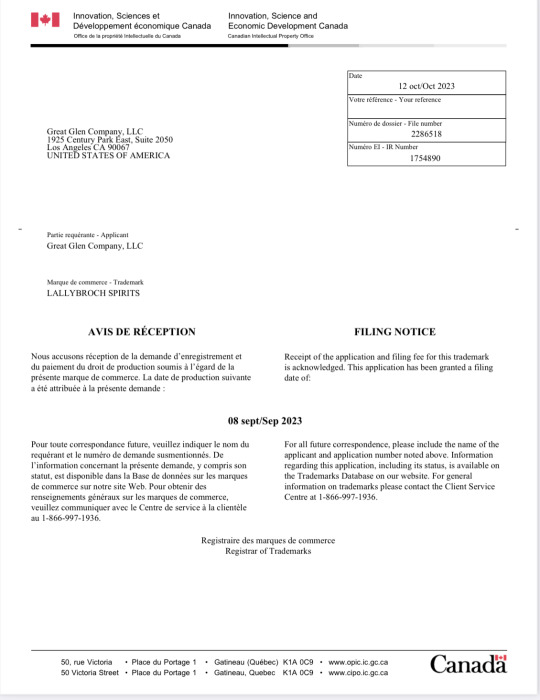

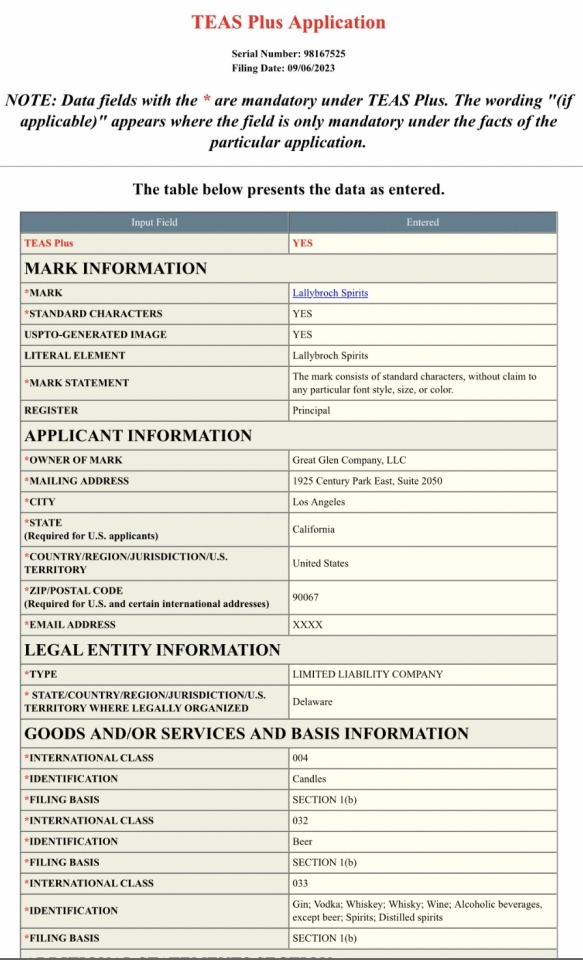

In addition, Great Glen Company (GGC) applied to register a new trademark with the World Intellectual Property Organisation (WIPO) and the EU, following the EUIPO decision, following its earlier idea to build on all the Outlander ideas, the new trademark is called "LALLYBROCH SPIRITS" (Lallybroch means "lazy tower" in Gaelic). It will not use Midhope/Lallybroch as a distillery. This new trademark has nothing to do with or relate to the grounds of Midhope Castle, the site of a new whisky distillery with a different brand and ownership. Its new application is already registered in the United States.

It's pending resolution in the EU, Canada and the United Kingdom where Heughan requested its registration.

WIPO

EUIPO

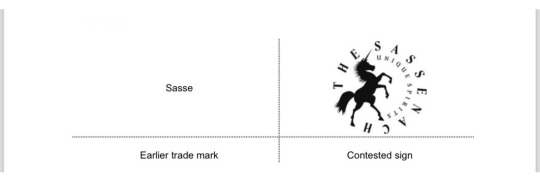

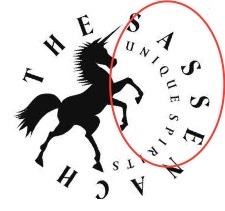

THE SASSENACH UNIQUE SPIRITS

The Great Glen Company, Sam Heughan’s firm, applied to register the brand name Scotch whisky THE SASSENACH UNIQUE SPIRITS as a future trademark to sell the whisky across Europe, but Theo Sasse e.K brand distillery in Schöppingen-Germany, objected claiming the name was too close to its trademarked name, which it uses to sell whiskies and brandies spirits.

On 20th July 2023 the Opposition Division takes the following:

DECISION

1. Opposition is upheld for all the contested goods.

2. International registration is entirely refused protection in respect of the European Union.

REASONS

On 24th November 2021 the opponent Theo Sasse e.K filed an opposition against all the goods (Class 33) of international registration designating the European Union. The opposition is based on, inter alia, German trademark registration ‘Sasse’ (word mark). Also, the opponent invoked Article 8(1)(b) EUTMR and Article 8(4) EUTMR.

LIKELIHOOD OF CONFUSION — ARTICLE 8(1)(b) EUTMR

A likelihood of confusion exists if there is a risk that the public might believe that the goods or services in question, under the assumption that they bear the marks in question, come from the same undertaking or, as the case may be, from economically linked undertakings.

The opposition is based on more than one earlier trade mark. The Opposition Division finds it appropriate to first examine the opposition in relation to the opponent’s German trade mark registration.

a) The goods

The goods on which the opposition is based are, inter alia, the following:

Class 33: Alcoholic beverages, excluding beers. Alcoholic beverages, except beer are identically contained in both lists of goods (including synonyms).

b) Relevant public — degree of attention

The average consumer of the category of products concerned is deemed to be reasonably well informed and reasonably observant and circumspect. It should also be borne in mind that the average consumer’s degree of attention is likely to vary according to the category of goods or services in question. In the present case, the goods found to be identical are directed at the public at large.

c) The signs

The relevant territory is Germany.

Contested sign The global appreciation of the visual, aural or conceptual similarity of the marks in question must be based on the overall impression given by the marks, bearing in mind, in particular, their distinctive and dominant components. The earlier mark is the word mark ‘Sasse’. The protection of a word mark concerns the word as such and not the specific graphic or stylistic elements accompanying that mark.

The verbal element ‘SASSENACH’ of the contested mark has, contrary to the allegations of the holder, no meaning for the relevant public and is, therefore, distinctive. Likewise, the unicorn device of the contested sign has no particular meaning in relation to the goods and is distinctive.

THE SASSENACH’ in the contested sign are the dominant elements as they are the most eye-catching.

Visually, the signs coincide in ‘SASSE’, which represents the entire earlier mark. The signs differ in the representation of a unicorn and the additional letters ‘-NACH’ (after SASSE) and the non-distinctive elements ‘The’ as well as ‘UNIQUE SPIRITS’ in the contested mark. Thus, the single word element of the earlier mark is fully contained in the most distinctive verbal element of the contested mark. That fact alone is a clear indication of a visual similarity. Therefore, the signs are similar to a below-average degree.

Aurally, the signs coincide in the syllables ‘Sas-se’, which is the sole and distinctive element of the earlier mark and the beginning of the most important verbal element of the contested sign, ‘Sas-se-nach’. The signs differ in the last letters of this word (one syllable), ‘nach’, and in the first verbal element of the contested sign, ‘The’. The fact remains that the earlier mark is entirely included at the beginning of the most important verbal element of the contested sign.

Conceptually, the signs will always be dissimilar as the contested mark will be understood with at least one meaning, namely the unicorn in the contested mark. As the signs have been found similar in at least one aspect of the comparison, the examination of likelihood of confusion will proceed.

d) Distinctiveness of the earlier mark The distinctiveness of the earlier mark is one of the factors to be taken into account in the global assessment of likelihood of confusion. In the present case, the earlier trade mark as a whole has no meaning for any of the goods in question from the perspective of the public in the relevant territory. Therefore, the distinctiveness of the earlier mark must be seen as normal.

e) Global assessment, other arguments and conclusion The goods at issue are identical. They target the general public, who possesses an average degree of attention. The earlier mark has a normal degree of distinctiveness. The signs are visually similar to a below average degree and aurally similar to an average degree since the sole and distinctive element of the earlier mark, ‘Sasse’, is entirely reproduced at the beginning of the contested sign’s only fully distinctive verbal element, ‘Sassenach’. Evaluating the likelihood of confusion implies some interdependence between the relevant factors and, in particular, a similarity between the marks and between the goods or services.

Considering all the above, especially taking into account that the earlier mark is entirely reproduced in the contested sign and used for goods that are identical, the Opposition Division finds that there is a likelihood of confusion on the part of the public. Therefore, the opposition is well founded on the basis of the opponent’s German trade mark registration It follows that the contested trade mark must be rejected for all the contested goods. As the earlier right German trade mark registration leads to the success of the opposition and to the rejection of the contested trade mark The Sassenach for all the goods against which the opposition was directed.

The trademark status was "totally refused", meaning that THE SASSENACH UNIQUE SPIRITS trademark cannot be registered in the EU. If SH's trade mark application is refused, he can file an appeal. He must file his notice of appeal within 2 months from the date of the refusal decision (August-September) and the grounds of appeal must be filed within 4 months from the same date of notification (October-November). But, He did not appeal and last November the EUIPO confirmed by letter the provisional refusal of his trademark and refused its protection in the European Union. The final decision was published on 14 December 2023.

Conclusion

The EUIPO’s decision of the Board of Appeals, regarding its whisky has a “displacement” because Sassenach whisky cannot be registered as a trademark in the EU, the Sassenach trademark was refused. SH must be aware the significance of the total refusal decision regarding its whisky brand. If he was planning to recover from a legal dispute by putting his gin on an impromptu Sassenach tour around US last summer, proving that his recent EU legal battle was a mere bump in the road, he should have thought twice. He lost a legal battle to register his Sassenach whisky brand as a European Community trademark ® in 27 states. It is a big difference. It seems that if Heughan wants to continue selling its whisky, it will have to change the name.

LALLYBROCH SPIRITS registration:

United Kingdom

Canada

USA

26 notes

·

View notes

Text

Unlock the Secrets of Udyam Registration for Partnership Firms

The Udyam Registration, previously known as Udyog Aadhaar Memorandum (UAM), has been a transformative initiative by the Indian government to support and empower micro, small, and medium-sized enterprises (MSMEs). For partnership firms, this registration offers a host of benefits and opportunities.

Update Udyam Certificate: One of the key advantages of Udyam Registration is the ability to Update Udyam Registration online. Business details may change over time, and this feature allows you to keep your registration accurate and up-to-date, reflecting the current state of your partnership firm.

Apply Online for Udyam Partnership Firm: The online application process for partnership firms is user-friendly and efficient. You can easily submit the necessary documents and information online, reducing the time and effort required for registration.

Online Enquiry for Udyam: The digital platform has simplified the process of making inquiries related to Udyam Registration. You can get information, clarification, and assistance regarding the registration process, making it easier to navigate.

Print UAM Registration Online: Once your partnership firm's Udyam Registration is approved, you can conveniently print your Udyam Certificate online. This certificate is not just a document; it's your ticket to a plethora of benefits and opportunities reserved for MSMEs.

Print Udyam Certificate: After successfully obtaining your Udyam Registration, you can print the Udyam Certificate, which serves as proof of your registration. Displaying this certificate can build trust among clients and partners, enhancing your firm's credibility.

Access to Government Schemes: Udyam Registration opens the door to various government schemes and incentives specifically designed for MSMEs. These schemes can provide financial assistance, subsidies, and priority in procurement, giving your partnership firm a competitive edge.

Financial Benefits: Banks and financial institutions often offer preferential treatment to Udyam-registered businesses. This includes easier access to credit facilities and lower interest rates, which can be advantageous for managing finances and expansion.

Global Opportunities: Udyam Registration can also pave the way for international collaborations and exports. Many foreign companies prefer to engage with Udyam-registered Indian businesses, offering the potential for global growth.

Simplified Compliance: Udyam Registration streamlines the compliance process by consolidating various government-related registrations into one. This reduces the administrative burden on your partnership firm.

Competitive Advantage: Displaying your Udyam Certificate on your website and marketing materials can enhance your firm's reputation and attract clients who prefer working with registered MSMEs.

Conclusion

Udyam Registration is a game-changer for partnership firms in India. It offers numerous benefits, ranging from financial advantages to global opportunities. By utilizing online services such as updating your Udyam Certificate, applying online, making online inquiries, and printing your Udyam Certificate, you can unlock the full potential of this registration and take your partnership firm to new heights of success. Don't miss out on the secrets of Udyam Registration; embrace them and witness the transformation in your business.

2 notes

·

View notes

Text

Required Summer Reading From The IRS: Transfer And Elective Payment Tax Rules

Portrait of a young brunette relaxing on the beach, reading a book

getty

Treasury and the IRS promised to release guidance on direct pay and transferability “before summer,” and with proposed regs (REG-101610-23) issued June 14, they met their deadline admirably. Announcing a precise time frame for when proposed rules will be released is less important than their substance, but it’s still a practice that the IRS and Treasury should continue.

It’s painful to hear government officials intone the refrain that “guidance should be coming soon.” Let’s have more dates to put on the calendar.

Clarification of the rules under sections 6417 and 6418 is what taxpayers wanted in the proposed regulations, and that’s what they deliver — for the most part. They are less generous than some commentators had hoped. The market for credit transfers will be less expansive than it might have been had the passive activity rules been swept away.

At least for now, the proposed regulations don’t allow an applicable entity to purchase a credit and then seek an elective payment for the credit, although the preamble indicates that the IRS and Treasury will entertain possible exceptions. The registration process still has large open questions, but the transferee gross income exclusion is a welcome clarification for potential buyers.

The proposed regulations add necessary details to the new regime and include policy decisions. The elective payment rules appear to be intended to enable the use of elective payment, said Adam Cohen of Holland & Hart. Cohen pointed out that instrumentalities and agencies of state and local governments, as well as U.S. territories, are included within the definition of applicable entities in the proposed section 6417 rules.

The exclusion of partnerships seems incongruous, but the complexity of applying sections 6417 and 6418 may explain it. “From a tax logic perspective, they found the right balance, particularly in the section 6418 regulations,” said Chaim Stern of Schulte Roth & Zabel LLP.

MORE FROMFORBES ADVISOR

Combining Transfers and Elective Payment?

The answer to whether an applicable entity could purchase credits under section 6418(a) and make an elective payment election is proposed to be no – but not a completely firm no. The preamble to the section 6417 rules says that its conclusion that “sections 6417 and 6418 are best interpreted to not allow an applicable entity under section 6417 to make an elective payment election for a transferred credit under section 6418” was informed by administrative and practical reasons given by commentators.

The preamble also connects its conclusion to the text of section 6417(a). Treasury and the IRS explained that they believe that transferred credits are not “determined with respect to” an applicable entity, as required by section 6417(a).

That is because the credit is not determined with respect to underlying applicable credit property owned by the applicable entity or electing taxpayer, or activities otherwise conducted by the entity or taxpayer under section 6417(a).

And the proposed section 6418 regulations say that transferees are not considered to have owned an interest in the underlying credit property or to have otherwise conducted any of the activities that give rise to the credit. That isn’t a statutory reason to disallow chaining, but doing so maintains consistency between the two sets of proposed regs.

The preamble invites comments on possible exceptions to the proposed bar on chaining, indicating a surprising flexibility that is tempered by the specificity that’s also requested. Suggested limitations to any exceptions include the type of applicable entity that may be allowed to make a direct payment election for credits transferred to it — government entities are offered as an example — and the transferee taxpayer’s involvement in the project’s development.

The other possible considerations are more difficult to distinguish from other types of transfers. They include the transferee’s due diligence, the fact that the transferee pays close to the face value of the credit, and the lack of other special financial arrangements between the parties. Transferees of all types should be expected to do due diligence, and they’ll likely all pay about 93% to 98% of the credit.

The outlined considerations suggest that Treasury and the IRS might provide exceptions if they are satisfied that they won’t be opening the transfer and elective payment regimes up for fraud or abuse. Commentators will almost certainly advocate for exceptions.

Registration

In order to claim the benefits provided by section 6417 or 6418, taxpayers must complete prefiling registration requirements in accordance with temp. reg. sections 1.6417-5T or 1.6418-4T. The online registration portal isn’t ready yet, but the preamble to the temporary regs says its opening deadline of fall 2023 is one justification for putting out temporary regs instead of proposed rules.

Transferees and elective payment claimants will need to reference their registration number when claiming their credits, which raises the question of how long it will take the IRS to review pre-registrations. The FAQs warn taxpayers to leave enough time to obtain a registration number, Cohen noted, but it isn’t clear what that means. It may depend on the depth of the IRS’s review, another open question.

Seth Feuerstein of Atheva, a marketplace for IRA credits, said it would be helpful if the IRS offered the timeline it expects to follow for assigning registration numbers to taxpayers. “It could create a problem if the IRS says they’re not able to review a pre-registration in time and the transferee can’t take the credit,” he noted.

It also isn’t clear whether the review will be substantive or focused on limited items intended to prevent fraud. Feuerstein said it should be the latter. “It’s not clear why a substantive review of a transferred credit would be more critical than a substantive position any taxpayer is taking,” he said.

Under the temporary regs, taxpayers will register eligible credit property and the registration number will apply to all the credits associated with that property. For production tax credits, that might lead to some tracking and accounting challenges.

Because the registration number will refer to the underlying property rather than the unit of production, if a taxpayer sells production tax credits from a single facility to multiple buyers, those amounts will all have to be added up and accounted for under a single registration number.

Stern said a better idea would be to register each unit of production as it is produced. “If a solar facility that is producing electricity has a single registration number for its production and sales to various buyers over the course of a number of years, it becomes very hard to track the total credit amount,” he said.

That increases the risk of double counting. A separate registration number for each unit would make the tracking simpler for taxpayers and the IRS.

Gross Income Exclusion

The proposed section 6418 regulations give many commentators what they sought regarding how to treat the difference between the amount a buyer pays for a credit and the amount of the credit that the buyer claims. Affirming what some congressional staffers indicated, that amount is excluded from taxable income under the proposed regs.

The rationale for the transferee gross income exclusion is that under section 6418(a), the transferee is treated as the taxpayer for purposes of title 26 concerning a transferred eligible credit. The preamble explains that an eligible taxpayer wouldn’t have gross income from claiming the credit, and the transferee shouldn’t either.

But the statute doesn’t say that the transferee is treated as the eligible taxpayer, merely that the transferee is treated “as the taxpayer.” That language is how the transferee gains the ability to apply the credit to its own tax liability, but it doesn’t expressly address the transfer’s tax effects, or lack thereof, on the transferee. It only describes the treatment of the transferee after the transfer.

Congress should have more clearly excluded the delta of the purchase price of the credit and the claimed amount of the credit from the buyer’s gross income. A technical correction was never very likely, and it won’t happen now in light of the proposed regulations.

The practical effect of including the difference in gross income would be that transferees would pay less for credits to account for the tax they owe. Notably, in 2011, the IRS’s conclusion concerning transferable state credits contradicted the rule prescribed in the proposed regulations (CCA 201147024).

Monte A. Jackel of Jackel Tax Law said that the proposed exclusion is solely a creature of the proposed regulations, not the statute, since section 6418(b) is silent on the treatment of the transferee’s income, if any, because of the discount — section 6418(b)(3) says only that the consideration the transferee pays is not deductible.

Read more here https://au3.s3-web.ca-tor.cloud-object-storage.appdomain.cloud/Taxation-Insider/US-Tax/US-Tax-Service-for-Americans-in-Portugal-Simplifying-Tax-Compliance-for-Expats-in-Portugal.html

2 notes

·

View notes

Text

How to Establish Travel Services Business in Vietnam?

How to Establish Travel Services Business in Vietnam?

Because passenger transportation is one of the investment areas subject to restrictions for foreign investors in Vietnam, a foreign investor can only form a joint venture with a travel agency in Vietnam to establish a travel services business there.

It is impossible to deny the significant impact that information technology has had on the travel services industry. The utilization of booking reservation framework application on cell phone and web are inescapable that make travel has never been more straightforward. The travel services market would be interesting for a foreign investor to explore. Nonetheless, 100 % foreign owned company is not allowed to set-up travel services business in Vietnam. Due to the conditionality of this investment area, a Vietnam-based law firm should be consulted to ensure compliance with local regulations.

The application process and documents requirements to establish travel business in Vietnam are briefly

1.Required documents to establish travel business in Vietnam

-Application for the International Travel Business License (form);

-Certificate of business registration (copy – certified)

-Business plan for the international travel agency;

-Tour schedule

-Proof of at least 4 years of experience in international travel business operations

-Certified copies of the tourist guides’ cards whereby at least 3 international tourist guides are required

-Confirmation of bank deposit (as per regulations);

-Proof of offi

2. Business License Application Procedure to establish business in Vietnam

-Submitting the required documents to the appropriate authority (the province or city's Department of Culture, Sports, and Tourism).

-Within 10 working days of receiving a valid application, the province or city's Department of Tourism completes the appraisal records and sends a written request along with the agency's records to Vietnam's Ministry of Culture, Sports, and Tourism. At the point when cases are not qualified for the proposed grant to the state organizations, the commonplace the travel industry office will refer to the particular purposes behind refusal.

Within ten working days of receiving the file and written request from the state agency of tourism in the province, the international travel business must be reviewed and licensed by the state management agency of tourism (VNAT – Ministry of Culture, Sports, and Tourism). In the event of refusal, the service will express the particular motivations to the state and commonplace the travel industry specialists.

3. Number of records

-Submission to the Department of Culture, Sports and Tourism: 01

– Tourism Authority Filed in: 01

ANT Lawyers – a law firm in Vietnam will always follow up with authorities for legal update on matters relevant to investment registration or business registering in Vietnam.

2 notes

·

View notes

Text

Top 6 Benefits of Hiring PRO Services in Dubai

What is PRO Services?

In the United Arab Emirates, all businesses express the need to hire a Government Liaison Officer, often known as a Public Relations Officer or PRO. Dubai is currently the best place for people from different parts of the world to explore diverse business opportunities. However, UAE is also known for strict regulations, especially when it comes to accepting ex-pats to set up their business. Many businesses need to hire a government associate Officer, often known as a Public Relations Officer or PRO, to pass through strict screening processes and documentation with several authorities. PRO services are something that refers to all activities related to processing governmental documents and paperwork, such as visa applications, labor cards, and company trade licensing documentation and approvals.

In this article, we’ll take a closer look at the top six benefits of hiring PRO services in Dubai, and how they can help businesses thrive in this competitive environment.

6 Benefits of Hiring PRO Services

1. Saves Time and Effort

Through a PRO service in UAE, a business is able to save time as experts will handle the time-consuming tasks, legal processes, and permissions, and validations, which can be done quickly with qualified professionals’ help. So you can get additional time to target your business instead of queuing up before government departments.

2. Expertise and Knowledge of Local Laws and Regulations

It is ok if you are not an expert in labor law in the UAE. Similarly, you may not be an expert to coordinate, responding to the ongoing changing policies and laws of the country. Thus, this lack of role will harm the output of the company; but it will also lead to fines and delays.

3. Cost-Effective

Hiring PRO services in Dubai is an investment for your organization. It enables you to save the unnecessary cost of hiring full-time employees. Once you find a suitable Business Setup Consultant in Dubai, you can take the services of their team when it is required. Besides helping you set up your

company quickly and efficiently, they also help you manage any legal requirement that emerges in Dubai and the UAE.

Outsourcing PRO services in Dubai also save you money by avoiding fines and penalties. Businesses in Dubai have to be diligent about implementing any new government policies to avoid delays and hefty fines. A dedicated PRO helps you avoid this and run your business without restriction.

4. Timely Processing of Documents

Working with a firm that offers the best pro services relieves company owners of time-consuming legal processes and permissions and validations. The professional services provider ensures that you finish on time when it comes to legal activities. As a result, it facilitates you to concentrate more on your business and less on bureaucracy

A professional Business Service provider can handle all the hustle and bustle of a variety of issues:

Obtaining a visa

Assisting you in setting up your firm or extra branches in the first place

Approving and renewing trade licenses

Helping you with practical matters like setting up business bank accounts

Having legal papers notarized

Aiding you with the laws around trademarks and copyright

5. Streamlined Communication with Government Authorities

The majority of tasks that are under PRO services in UAE are targeted at helping businesses and staff members comply with legal requirements. A PRO service facilitates in complying with the processes required by government authorities and their timely completion in order to reduce the risks of acquiring any setbacks for the businesses or to avoid any unnecessary fines.

6. Reduced Risk of Fines and Penalties

professional PRO services in Dubai help businesses remain regularly updated with renewal terms for government licenses, as well as registration and visa policies. A business can easily become subject to hefty fines and penalties when they fail in operating in accordance with the rules and regulations of the UAE government.

Hiring PRO services in Dubai is essential for businesses and investors who want to establish their company in the city. PRO services providers simplify the process of setting up a business, save time and money, ensure compliance with legal requirements, provide expert guidance and support, handle document processing efficiently, and act as the official representative of the company. By outsourcing administrative tasks to PRO services providers, businesses can focus on their core activities and achieve their goals and objectives.

2 notes

·

View notes

Video

youtube

Guide to Singapore Employment Pass: Application Requirements and Procedure

First time to apply for an employment pass for your company? Find out the requirements and the application procedure when applying for an employment pass through this video.

The processing time of your application may vary by several days or weeks. It is best to seek assistance from a professional firm to ensure that all documents are complete and accurate to avoid delays and maximise approval. Corporate Services Singapore gives the best advise on pre-application requirements for the various work visas. It also provides comprehensive company registration solutions, serving over 400 companies in the last ten years. It also offers add-on services including company secretarial services and accounting services.

Source: https://www.corporateservicessingapore.com/guide-to-singapore-employment-pass-application-requirements-and-procedure/

#company secretarial services#corporate secretarial services#corporate secretarial services Singapore#corporate secretary services#corporate secretary services Singapore#company secretary services Singapore#company secretarial services Singapore

4 notes

·

View notes

Text

What Important Step-by-Step Guide to Establish Company in Vietnam?

When foreign investors invest in Vietnam, they could establish company in Vietnam. Foreign investors have the right to choose the appropriate forms of enterprise such as a limited liability company, joint stock company, etc. with specific steps are as follows:

How to establish company in Vietnam?

Step 1: Register the investment project

Investors submit an investment project registration file to the Business Registration office of the province or city or the management board of an industrial zone, an export processing zone or a high-tech zone for the approval of an investment project during the period within 15 days (without time for clarification).

Step 2: Apply for Certificate of investment registration

After approval of the investment project, investors submit a valid record to the Department of Planning and Investment within 10 days to apply for a business registration certificate.

Step 3: Apply for the certificate of business registration

After obtaining the business registration certificate, the investor shall submit the application for enterprise registration certificate to the enterprise registration office within 3 days.

Step 4: Publish the content of the business registration

After being granted the certificate of enterprise registration, the investor shall disclose information about the enterprise on the national enterprise registration portal within 30 days, including the following information:

i, Business lines;

ii, List of founding shareholders and shareholders being foreign investors for joint-stock companies.

Step 5: Registered business stamp

The enterprise has the right to decide on the form, quantity and contents of the stamp of the enterprise. The content of the stamp must show the following information:

-Company’s name;

-Business code.

After receiving the legal entity stamp and before using the business stamp, the enterprise must send a notice on the stamp of the enterprise to the business registration office for publication in the National Information Portal on the business registration.

Step 6: Notice of use of stamp:

After having stamp made, investors submit notices on use of stamp forms to the Investment registration agency. After receiving the record, the Investment registration agency issues a receipt for the enterprise, publishes the notice of the enterprise on the National Business Information Portal and issues a notice of the posting, stamp samples of enterprises, branches and representative offices for enterprises.

Step 7: Open bank account:

Investors need to open two types of bank accounts, namely the investment capital account to receive the investment amount and the transaction account for conducting daily transaction in Vietnam.

Step 8: The post licensing procedures:

For the conditional business lines:

Investors investing in conditional businesses lines as regulated in Appendix 4 of the Investment Law 2014 must apply certificate of business qualification, practicing certificates, professional liability insurance, legal capital requirements, etc. before conducting business in Vietnam.

With highly professional staff and great experience in foreign investment, ANT Lawyers would like to support you in establishing company in Vietnam.

ANT Lawyers - a Law firm in Vietnam with international standard, local expertise and strong international network. We focus on customers’ needs and provide clients with a high quality legal advice and services. For advice or service request, please contact us via email [email protected], or call us +84 24 730 86 529.

Source ANTLawyers: https://antlawyers.vn/library/what-important-step-by-step-guide-to-establish-company-in-vietnam.html

2 notes

·

View notes

Text

What Important Step-by-Step Guide to Establish Company in Vietnam?

When foreign investors invest in Vietnam, they could establish company in Vietnam. Foreign investors have the right to choose the appropriate forms of enterprise such as a limited liability company, joint stock company, etc. with specific steps are as follows:

How to establish company in Vietnam?

Step 1: Register the investment project

Investors submit an investment project registration file to the Business Registration office of the province or city or the management board of an industrial zone, an export processing zone or a high-tech zone for the approval of an investment project during the period within 15 days (without time for clarification).

Step 2: Apply for Certificate of investment registration

After approval of the investment project, investors submit a valid record to the Department of Planning and Investment within 10 days to apply for a business registration certificate.

Step 3: Apply for the certificate of business registration

After obtaining the business registration certificate, the investor shall submit the application for enterprise registration certificate to the enterprise registration office within 3 days.

Step 4: Publish the content of the business registration

After being granted the certificate of enterprise registration, the investor shall disclose information about the enterprise on the national enterprise registration portal within 30 days, including the following information:

i, Business lines;

ii, List of founding shareholders and shareholders being foreign investors for joint-stock companies.

Step 5: Registered business stamp

The enterprise has the right to decide on the form, quantity and contents of the stamp of the enterprise. The content of the stamp must show the following information:

-Company’s name;

-Business code.

After receiving the legal entity stamp and before using the business stamp, the enterprise must send a notice on the stamp of the enterprise to the business registration office for publication in the National Information Portal on the business registration.

Step 6: Notice of use of stamp:

After having stamp made, investors submit notices on use of stamp forms to the Investment registration agency. After receiving the record, the Investment registration agency issues a receipt for the enterprise, publishes the notice of the enterprise on the National Business Information Portal and issues a notice of the posting, stamp samples of enterprises, branches and representative offices for enterprises.

Step 7: Open bank account:

Investors need to open two types of bank accounts, namely the investment capital account to receive the investment amount and the transaction account for conducting daily transaction in Vietnam.

Step 8: The post licensing procedures:

For the conditional business lines:

Investors investing in conditional businesses lines as regulated in Appendix 4 of the Investment Law 2014 must apply certificate of business qualification, practicing certificates, professional liability insurance, legal capital requirements, etc. before conducting business in Vietnam.

With highly professional staff and great experience in foreign investment, ANT Lawyers would like to support you in establishing company in Vietnam.

ANT Lawyers - a Law firm in Vietnam with international standard, local expertise and strong international network. We focus on customers’ needs and provide clients with a high quality legal advice and services. For advice or service request, please contact us via email [email protected], or call us +84 24 730 86 529.

Source ANTLawyers: https://antlawyers.vn/library/what-important-step-by-step-guide-to-establish-company-in-vietnam.html

2 notes

·

View notes

Text

What is a Crypto Exchange Platform and How Does It Work?

Crypto Exchange Platform encourages crypto trading in return for digital assets or traditional currencies. They act as a median between a buyer and seller with a commission charge or transaction fee. UnoCoin, CoinSwitch, CoinDCX, and Kuber are a few examples of operational online exchanges in India.

Besides trading digital currencies for other cryptocurrencies, an investor can exchange them for fiat currencies or traditional money( dollars, euros, or rupees) through an online exchange. They can transfer that amount to their bank account and withdraw them later from their local bank.

Work of Crypto Exchange

As already discussed above, crypto exchanges are like brokerage firms that act as a central entity between a buyer and seller during the crypto trading process. It lets the traders transfer their money using various means like debit/credit cards, bank transfer or UPI, etc. Although it charges some amount as a commission fee for every successful transaction with their services.

First things first, a buyer or an investor needs to choose the right exchange platform for themselves. This process will need research work about that chosen platform like its profile, history, credibility, etc., and things that benefit it will help your trading journey.

The next step is fairly simple which is trading account registration setup. Go to the selected Crypto Exchange Platform’s website or download their Android/iOS application (if they have any) for account creation. You would need your email address, phone number along with a security password for that purpose.

After that, you would receive an email verification request to that address and ask for KYC details. Click on that verification email link to complete the KYC process. Set a password and you are ready for trading in the crypto market. Also, make sure to not lose any login credentials like account name or password as it might never get recovered.

You can learn more about various Crypto Exchange Platform types, and their work process from reputable Crypto Exchange Development Company. We will help you decide which platform to get started with for crypto trading.

2 notes

·

View notes

Text

What Important Step-by-Step Guide to Establish Company in Vietnam?

When foreign investors invest in Vietnam, they could establish company in Vietnam. Foreign investors have the right to choose the appropriate forms of enterprise such as a limited liability company, joint stock company, etc. with specific steps are as follows:

How to establish company in Vietnam?

Step 1: Register the investment project

Investors submit an investment project registration file to the Business Registration office of the province or city or the management board of an industrial zone, an export processing zone or a high-tech zone for the approval of an investment project during the period within 15 days (without time for clarification).

Step 2: Apply for Certificate of investment registration

After approval of the investment project, investors submit a valid record to the Department of Planning and Investment within 10 days to apply for a business registration certificate.

Step 3: Apply for the certificate of business registration

After obtaining the business registration certificate, the investor shall submit the application for enterprise registration certificate to the enterprise registration office within 3 days.

Step 4: Publish the content of the business registration

After being granted the certificate of enterprise registration, the investor shall disclose information about the enterprise on the national enterprise registration portal within 30 days, including the following information:

i, Business lines;

ii, List of founding shareholders and shareholders being foreign investors for joint-stock companies.

Step 5: Registered business stamp

The enterprise has the right to decide on the form, quantity and contents of the stamp of the enterprise. The content of the stamp must show the following information:

-Company’s name;

-Business code.

After receiving the legal entity stamp and before using the business stamp, the enterprise must send a notice on the stamp of the enterprise to the business registration office for publication in the National Information Portal on the business registration.

Step 6: Notice of use of stamp:

After having stamp made, investors submit notices on use of stamp forms to the Investment registration agency. After receiving the record, the Investment registration agency issues a receipt for the enterprise, publishes the notice of the enterprise on the National Business Information Portal and issues a notice of the posting, stamp samples of enterprises, branches and representative offices for enterprises.

Step 7: Open bank account:

Investors need to open two types of bank accounts, namely the investment capital account to receive the investment amount and the transaction account for conducting daily transaction in Vietnam.

Step 8: The post licensing procedures:

For the conditional business lines:

Investors investing in conditional businesses lines as regulated in Appendix 4 of the Investment Law 2014 must apply certificate of business qualification, practicing certificates, professional liability insurance, legal capital requirements, etc. before conducting business in Vietnam.

ANT Lawyers - a Law firm in Vietnam with international standard, local expertise and strong international network. We focus on customers’ needs and provide clients with a high quality legal advice and services. For advice or service request, please contact us via email [email protected], or call us +84 24 730 86 529.

Source ANTLawyers: https://antlawyers.vn/library/what-important-step-by-step-guide-to-establish-company-in-vietnam.html

2 notes

·

View notes

Text

About me

Hello, my name is Tyler Ellis. I am a betting enthusiast and love sports. I've had many questions what to look for in a reliable office for betting on sports, how to win the bet, and how do you withdraw your winnings, and many other issues. Here are seven basic criteria that are important when choosing a bookmaker, and a complete list of the best bookmakers for 2022 is available at best online bookmakers.

If you are looking for the best bookmaker for betting it is essential to determine the legal status of betting in your nation. It is preferential to choose legally licensed bookmakers that operate within the local legislation.

There are risks to betting on bookmakers that are offshore. The reliability of offshore bookmakers is not affected since they're usually in business for longer time periods as UK legally licensed bookmakers. The risks stem from the legal requirements.

As online betting becomes more commonplace, the number of casinos that are based in the land is declining every year. Additionally, in addition to betting from the PC, it's possible to bet from the mobile phone. You may also bet using a smartphone or tablet through downloading a mobile app or the mobile-friendly site.

A phone-based betting option is more convenient, since smartphones are always row-based, unlike a computer or laptop. When you are choosing mobile betting options be sure to look at the functionality of the app as well as the website.

Withdrawal of earnings is an issue that should be considered in depth. It is not enough just to pick a bookmaker's address and research the possibilities for making a deposit and withdrawal of funds. Legal and offshore bookmakers allow withdrawals using e-wallets, credit card mobile phone, accounts with banks.

When selecting a bookmaker, look at the possibility of commission and the conditions for transfer of money from the game to the current account.

Bookmaker's offices have a bonus policy that aims at attracting new customers as well as to encourage existing customers.

Bonuses allow being rewarded for registration, the installation of an application, as well as the first bet. You should always read the conditions and terms of each bonus as they may have wagering requirements. Don't forget that bonus money cannot be withdrawn from the account, they are available only to be used for wagering, however the winnings on them can already be taken out.

Pick a bookmaker firm for sports betting with a wide range of aspects. But the reliability of the bookmaker's rating are the main factors to consider.

6 notes

·

View notes

Text

Cryptocurrency Exchange Development Company In India

How Crypto Exchange Platform Works?

Crypto trading is booming at an exponential rate, and more and more people are getting eager to participate in the bandwagon. Crypto Exchange Platform in simpler terms enables the investors to buy and sell cryptocurrencies in return for fiat money or other assets. You need to use a crypto exchange platform in order to trade cryptocurrencies as of now due to the lesser traditional investment firms offering crypto.

Cryptocurrency Exchanges software are generally of three types which are, Centralized Exchange, Decentralized Exchange (DEX), and Hybrid Exchange. Besides these exchanges, there are other ways of trading cryptocurrencies like P2P (peer-to-peer) platforms and investing applications for crypto buying and selling.

What is a Crypto Exchange Platform?

Crypto Exchange Platform encourages crypto trading in return for digital assets or traditional currencies. They act as a median between a buyer and seller with a commission charge or transaction fee. UnoCoin, CoinSwitch, CoinDCX, and Kuber are a few examples of operational online exchanges in India.

Besides trading digital currencies for other cryptocurrencies, an investor can exchange them for fiat currencies or traditional money( dollars, euros, or rupees) through an online exchange. They can transfer that amount to their bank account and withdraw them later from their local bank.

How Does It Work?

As already discussed above, crypto exchanges are like brokerage firms that act as a central entity between a buyer and seller during the crypto trading process. It lets the traders transfer their money using various means like debit/credit cards, bank transfer or UPI, etc. Although it charges some amount as a commission fee for every successful transaction with their services.

First things first, a buyer or an investor needs to choose the right exchange platform for themselves. This process will need research work about that chosen platform like its profile, history, credibility, etc., and things that benefit it will help your trading journey.

The next step is fairly simple which is trading account registration setup. Go to the selected Crypto Exchange Platform’s website or download their Android/iOS application (if they have any) for account creation. You would need your email address, phone number along with a security password for that purpose.

After that, you would receive an email verification request to that address and ask for KYC details. Click on that verification email link to complete the KYC process. Set a password and you are ready for trading in the crypto market. Also, make sure to not lose any login credentials like account name or password as it might never get recovered.

You can learn more about various Crypto Exchange Platform types, and their work process from LBM Blockchain Solutions which is based in Mohali, India. We will help you decide which platform to get started with for crypto trading.

Thanks For Reading This Blog

LBM Blockchain Solutions

3 notes

·

View notes

Text

How to Establish a Joint-Stock Company in Vietnam?

How to Establish a Joint-Stock Company in Vietnam?

In addition to limited liability companies, partnerships, and private enterprises, joint-stock companies are recognized by Vietnamese law. When a Vietnam authority issues a Certificate of Business Registration, a joint-stock company gains legal status. Consult with corporate lawyers in Vietnam to learn about the advantages of various company formations in Vietnam for the owner's efficient management and goals.

As per the meaning of the Law on Undertakings, a business entity is a venture whose sanction capital is separated into two halves called shares. A joint-stock company can have individuals or organizations as its shareholders; the minimum number of shareholders is three. Since there is no maximum number of shareholders, the company will be able to easily expand its operations on a larger scale. In addition, shareholders will only be responsible for the company's debts and other property obligations up to the amount of capital contributed. Due to the level of risk that shareholders must bear, this is an advantage of this type of business. Specifically, business entities reserve the privilege to give offers, bonds and different protections to raise capital, which is a component that different kinds of organizations don't have.

The owner of a business in Vietnam has the option of submitting a set of documents to the Business Registration Office where the intended head office is located on their own or by authorizing another individual, organization, or law firm in Vietnam to do so. These documents include:

1.An application for enterprise registration;

2.The company’s charter;

3.List of founding shareholders and list of shareholders being foreign investors;

4.Copies of the following papers:

a) Legal papers of the individual for the legal representative of the enterprise;

b) Personal legal papers for company members, founding shareholders, shareholders being foreign investors who are individuals; Legal papers of the organization for members, founding shareholders, shareholders being foreign investors being organizations; Legal documents of individuals for authorized representatives of members, founding shareholders, shareholders being foreign investors being organizations and documents on appointment of authorized representatives.

For individuals and investors being unfamiliar associations, duplicates of lawful papers of the association should be authenticated and consularly sanctioned in Vietnam; The owner of a business in Vietnam has the option of submitting a set of documents to the Business Registration Office where the intended head office is located on their own or by authorizing another individual, organization, or law firm to do so. These documents include:

c)Investment registration certificate, in case the enterprise is established or participated in the establishment by a foreign investor or a foreign-invested economic organization in accordance with the provisions of the Investment Law and other legal documents; implementation manual.

The Business Registration Office will process the application within three working days of receiving it.

ANT Lawyers could assist you in establishing a joint-stock company in Vietnam with their highly skilled staff and extensive experience in foreign investment.

2 notes

·

View notes

Text

Visitor Visas For Taiwan

I went to Xi’an and Beijing last November for 9 days and I only spent about 600 dollars for every little thing including airfare from Manila. I know someone who solely have about a thousand dollars in his checking account and obtained accredited. Confirmed round-trip tickets will really assist you to boost your application approval as a end result of it gives them assure that the customer will return.

Taiwan Visitor Visa, which is mostly referred to as a Taiwan Tourist Visa, issued for stays of up to 90 days. Upon receiving your info, we are going to fax you your tour confirmation letter on our official stationery with our company seal. 1.Have a passport valid for a minimum of 6 months from the date of journey.

When travelling to Tibet you want a Tibetan Permit prematurely. If you are booked on our Group Tour Take me to Tibet, we will arrange this for you. It must be utilized for one month upfront and we'd like a copy of your Chinese visa in order to acquire this.

You may submit the applying to the Visa Office at Chinese embassies or consulates, or China Visa Application Service Centers if they are operating in your nation. Maximum validity refers to the period over which you are allowed to enter a given country. Validity of visa begins from the date of issuance of visa.

Visa Utility Type Of The Peoples Republic Of China Editorial Photography

Such utility is to be made at the customer support places of work of the National Immigration Agency located in the respective cities/counties during which the scholars are residing. Before official registration, the related authority will issue students with an ARC permitting residency rights for an appropriate period. After official registration, students are requested to make use of their student cross to extend the validity of their ARC. Holders of Z Visa shall, inside 30 days from the date of their entry, apply to the exit/entry administrations of public safety organs beneath native folks's governments at or above the county degree within the proposed places of residence for foreigners' residence permits. Holders of X1 Visa shall, within 30 days from the date of their entry, apply to the exit/entry administrations of public safety organs beneath native people's governments at or above the county degree in the proposed places of residence for foreigners' residence permits.

Treasury is also taking motion in opposition to firms in Russia’s digital forex mining trade. By working huge server farms that sell virtual foreign money mining capacity internationally, these companies assist Russia monetize its pure assets. Russia has a comparative benefit in crypto mining due to energy assets and a chilly local weather.

All guests should hold a passport valid for 6 months . Online applications can only be made by persons holding legitimate common passports. Persons holding temporary, emergency, or informal passports, or travel documents other than a passport, can't submit online functions.

7 Causes Scholar Visas Are Rejected In Australia

In most instances, to enter the United States, you should have a passport that is legitimate for a minimum of six months after the date you enter or re-enter. If you're from a visa exempt country, you don't need a visa to reenter the United States from the western hemisphere, however just keep in mind to current your I-20 to be admitted as an F-1 scholar and never a visitor. If the college is operating one hundred pc on-line, faculty officials usually are not allowed to issue a Form I-20 for a student in new or preliminary standing who's outside of the United States. Department of Homeland Security makes use of to maintain info on SEVP-certified colleges, F-1 and M-1 college students who come to the United States to attend these colleges, according to the ICE web site. You could additionally be requested to offer police certificates for each country you've lived in for 12+ months over the previous 10 years .

This is particularly true the place the applicant appears directionless — perhaps engaged on a third Ph. D. Dependents Applying Separately from the F-1 Student. For a pupil visa applicant who had previously labored illegally within the US it is a no-brainer for the consul.

Something so easy as forgetting a well being clearance document, or as little as forgetting to include a policy code, could make or break your visa software. Provinces that don't offer health coverage should purchase private health insurance. All Canadian faculties supply medical well being insurance plans for international college students. McGill has an international status for excellence. It's no wonder it has a inhabitants of greater than 12,000 worldwide college students.

China Visa Utility Necessities For Filipinos

To achieve a Chinese visa, the method normally takes round a week, however can be longer relying on the nation you might be from and the documentation you provide. Once you receive your visa, you may have a specific time frame to enter the nation, so time your software accordingly. It will depend on the visa that the consular office will concern to you; however often, a multiple-entry visa can last for six months or 1 12 months. Whereas a single-entry or double-entry visa typically lasts for 14 days only. — especially if it’s affixed to your old passport, you must submit it to the embassy.Submit a photocopy of your old/previous china visa web page as nicely.

As lengthy as there are cheap causes, pressing processing will usually be granted, though it's necessary to pay an extra charge. At the moment, only a few Chinese embassies have set up online appointment services for visa purposes. Therefore, it is normally necessary to contact the related consulate directly to set up an interview. Please browse the boxes below for extra information about tourist visa necessities for China in your nationality.

List of international residents who require visa for entry into Sweden, Government of Sweden. "The Agreement between the Government of the Republic of Serbia and the Government of the People's Republic of China on mutual visa exemption for holders of strange passports". Australian residents and permanent residents can visit, work and reside in New Zealand. You do not need a visa earlier than you journey to New Zealand. Several nations mandate that each one travellers, or all overseas travellers, be fingerprinted on arrival and will refuse admission to or even arrest travellers who refuse to comply.

Chinese Visa Application Service Center

1 – excluding type FL, X and P visas, and resident playing cards with "foreign laborer" as the purpose of residence. Macau residents using a Portuguese passport may enter visa-free for ninety days, like some other Portuguese passport holder, and don't want to use for a permit beforehand. Permanent residents of Hong Kong and/or Macau, may be eligible for an Exit & Entry Permit upon arrival for NT$300 or might apply for an Entry Permit online without charge to visit Taiwan for less than 30 days.

Philippine travelers will not be eligible for different visa-relaxation measures formally accorded once the visa-free trial is launched on November 1. There are various time durations a enterprise visa may be granted for, depending on the needs of the applicant and the character of the enterprise. The commonest sort of China enterprise visa granted within the country is legitimate for 90 days, with the permitted length of keep being 30 days . China business visa fees are the identical as that of vacationer visas. The applicant’s nationality and variety of entries make a difference. In international locations where there are CVASC, you have to pay both the Chinese M visa fee and the service payment to the center.

As of right now there isn't any centralized national coverage offering foreignersEntrepreneurship Visain Mainland China. The arrangement for entrepreneurs differ from metropolis to city, and will evolve sooner or later. Individual situations shall be assessed on a case-by-case foundation.

The Method To Get A Visa For Enterprise Travel To China

Your software might be declined otherwise you may be refused entry permission to China should you offered inaccurate, false or deceptive data. Copy of Registration Certificate of Resident Representative Offices of enterprises of foreign nations issued by Chinese authorities of business and business administration. A photocopy of the inviting individual's passport and residence permit. Information concerning the visit (the purpose of go to, arrival and departure dates, place to be visited, relations between the applicant and the inviting individual, financial source for expenditures, and so forth.).

Using visa businesses is just elective for the visa processing but not a requirement. Visa processing time and service fees are subjected to change during pandemic period. Foreigners touring to Hong Kong or Macao with ordinary passports of nations which have established diplomatic relations with China can enter the Pearl River Delta area of Guangdong with no visa, if traveling with a tour firm legally registered in Hong Kong and Macau. The stay granted to visa-exempt nationals who wish to enter the People’s Republic of China varies between 15, 30, 60 or ninety days, depending on their nationality. If you need your Chinese visa to be processed urgently, please inform embassy officials when submitting your software at an embassy. As 台胞證 as there are reasonable reasons, urgent processing will often be granted, though it is essential to pay an extra fee.

Meanwhile, an official of the Vancouver consulate acknowledged the coverage and said it has been in drive since 1996. The 5-year allow, which also serves because the de facto ID card in Mainland China, may be utilized from journey businesses in Taiwan and CTS in Hong Kong or Macau. Holders of the allow are allowed to enter Mainland China for any objective and stay in Mainland China until the expiration date of the permit .

Nonimmigrant Visas

These fees apply to varied classes of visas and differ by nationality and the number of years the visa is legitimate for. Please signal on the Confirmation Page and the 8th Page of the visa utility type. A complete visa utility form is at least 9 pages together with the Confirmation Page. The best approach to estimate wait instances for a U.S. visa appointment is to visit the State Department website. Select the city the place you plan to use for the visa. You’ll get an approximate U.S. visa appointment wait time.

Supply the rationale for the trip, the Main Member country (The nation within the Schengen Zone by which you’ll spend essentially the most days), and your first port of entry. On this web page, you have the choice of both making an appointment and submitting your application in individual, or you could proceed together with your application and return to make an appointment to submit your software if that’s wanted. We recommend you select “Online Application” as it's going to enable you to finish your complete software earlier than making an appointment. The Turkish Consulate in London has made adjustments to the work visa utility course of because it seeks to handle a backlog of purposes.

The major objective for offering on this kind is to schedule an appointment with a USCIS workplace. USCIS may contact you thru email to complete a voluntary survey or take part in a voluntary focus group about your customer service experiences. Check the submitting instructions for the shape you want to undergo see if you can file it in individual.

On the next page, you’ll need to finish all your passport data, as well as your personal home tackle. At the bottom left a half of the web page, you’ll see a section titled “Residence Regulations Of The Applicant.” If you are a legal resident of a rustic apart from your country of nationality, choose “Yes”. Fill in your residence permit quantity and the date till it's legitimate and proceed by deciding on subsequent. Foreign nationals should complete the required pre-application on-line before emailing the consulate e-book an appointment. Applicants shouldn't try and guide an appointment on the London consulate through the Turkish Visa Application website.

Contact Us_embassy Of The People's Republic Of China In The United States Of America

The EVUS Call Center number is based in Washington, DC, USA. The EVUS Call Center also supplies help by email at A good friend, relative, travel industry professional, or one other third celebration could submit the required information to EVUS in your behalf. You are liable for the truthfulness and accuracy of all info submitted in your behalf. All passengers who check adverse for COVID-19 might be required to continuously adhere to COVID-19 security protocols and will receive regular info on COVID-19 inside five days of arrival in Ghana. Airlines who board passengers with out proof of cost for the COVID-19 check and would/could NOT pay for the test in Ghana, shall be fined US$3,500 per passenger.

Apply for Employment AuthorizationYou wouldn't have to pay the SEVIS I-901 payment again when applying for employment authorization of any kind. If you are a scholar who has been out of status for more than 5 months, pay the SEVIS I-901 payment earlier than you file for reinstatement. If you may be scholar who has been out of standing for less than five months, do not pay the SEVIS I-901 charge. If you're a M-3 pupil who wishes to alter standing to an M-1, do not pay the SEVIS I-901 charge.

If so, please ensure you staple the verify or cash order to the suitable Form I-901. If you do pay for a bunch utilizing one check, we recommend that you calculate the charge very fastidiously. You could want to file on-line as a end result of this will help prevent information entry errors. For extra info, see the section on cost by verify or money order. You can complete the form on-line at or on paper. The part, Where can I get a duplicate of the Form I-901?

Turkey can acquire a visa on arrival to Taiwan without cost for a keep of up to 30 days. Documentation identifying the character of the non-public affairs ought to be supplied as required by the consular officer. Please signal the printed kind and affirmation web page and write down the appointment quantity on the upper right nook of the appliance kind. The applicant could also be required to furnish extra documents and information every time necessary. The above-said landing visa can't be transformed to customer or resident visa beneath regular circumstances.

1 note

·

View note

Text

Rapid Surge Projected: Communications Platform as a Service (CPaaS) Market to Reach US$120.996 Billion by 2034

The global Communications Platform as a Service (CPaaS) market exhibited robust growth in 2021, with total revenue reaching approximately US$ 5,296.6 million. This growth trajectory is projected to continue, as the CPaaS market is expected to soar to an estimated US$ 59,362.1 million by 2032, marking a staggering CAGR of 25.0% during the forecast period of 2022-2032.

Communications platform as a service or CPaaS solutions are referred to as cloud solutions which enable organizations to add real-time communication features onto business applications. These solutions are adaptable, scalable, and unite latest integrated communication services into a single offering.

Request a Sample of this Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-12953

Communications platform as a service brings together several types of communications, including calls, emails, and SMS for enhanced customer engagement. Emergence of omni channel methods for customer management is set to increase the demand for CPaaS solutions in the banking and financial sector. Insurance firms, banks, and payment providers require a secure platform for providing rapid and dependable services to customers while preventing fraud. CPaaS solutions have proved to be a secure real-time communication platform across the BFSI industry.

CPaaS solutions are becoming more popular, especially in the banking sector as these provide personalized offerings. CPaaS services, on the other hand, deliver onboarding features and text reminders to customers, thereby reducing delinquency risk with compliance and security.

Furthermore, implementation of CPaaS solutions results in the early fraud detection with outbound IVR facility. These facilities come along with additional options for immediate transfer to agents offering secure environments to customers for financial transactions. Such wide adoption is opening new opportunities for key players in the CPaaS market.

Key Takeaways: Communications Platform as a Service Market

By solution, the CPaaS software segment is predicted to lead the global communications platform as a service market with a CAGR of 2% during the forecast period.

By enterprise size, the large enterprises segment is set to dominate with a CAGR of nearly 23% between 2022 and 2032.

By industry, the healthcare segment is anticipated to exhibit an astonishing CAGR of 31% in the forthcoming years.

By geography, North America had the largest market share of about 2% in the CPaaS industry in 2021.

The South Asia & Pacific region is expected to witness the highest growth rate of around 7% throughout the forecast period of 2022-2032.

“Growing demand for customer communication and customer engagement across the BFSI and retail industries is expected to drive the global communications platform as a service market growth,” says a FMI analyst.

Ask An Analyst:

https://www.futuremarketinsights.com/ask-the-analyst/rep-gb-12953

Increasing Demand for CPaaS in Retail Industry to Drive the Market

Retail firms are utilizing CPaaS solutions to adapt to the hybrid environment of modern day purchase requirements. Large-scale retail and consumer enterprises with multiple locations add cloud-based call routing solutions to ensure accurate routing of calls and SMS depending on location, time, and need.

Several brick and mortar, as well as online merchants utilize CPaaS solutions as the preferred business software. Such software solutions can circulate customized information, initiate in-store event registrations, offer segmented discount codes, and send sales alerts. Also, the addition of SMS with voice to the communication strategy is ensuring increased footprint of products onto consumers.

Up-to-date and flexible real-time integrated communication services enable small- and large-scale retail business to embrace the rapidly evolving cloud communications market. Thus, increasing adoption in retail industry is fueling the market growth and is anticipated to continue its supremacy in the near future.

Communications Platform as a Service Outlook by Category

By Solution:

Communications Platform as a Service (CPaaS) Software

Services

Professional Services

Integration & Implementation

Consulting

Support & Maintenance

Managed Services

By Enterprise Size:

Small & Medium Enterprises (SMEs)

Large Enterprises

By Industry:

IT & Telecom

BFSI

Manufacturing

Healthcare

Retail & CPG

Others

By Region:

North America

Latin America

Europe

East Asia

South Asia & Pacific

Middle East and Africa (MEA)

0 notes